UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

AMENDMENT NO. 1 TO FORM SB-2

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933

RIVERBANK RESOURCES INC.

(Name of small business issuer in its charter)

| NEVADA | 1000 | 20-2551275 |

| State or jurisdiction of | Primary Standard Industrial | I.R.S. Employer Identification |

| incorporation or organization | Classification Code Number | No. |

Riverbank Resources Inc.

595 Howe Street, Suite 902, Box 12

Vancouver, B.C. V6C 2T5

Telephone: (604)-484-3701

Facsimile: (604)-484-3791

(Address and telephone number of principal executive offices)

Empire Stock Transfer Inc.

7251 West Lake Mead Blvd Suite 300

Las Vegas, NV 89128

Telephone: 702-562-4091

Facsimile: 702-562-4081

(Name, address and telephone number of agent for service)

Approximate date of proposed sale to the public: as soon as practicable after the effective date of this Registration Statement.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. x

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If delivery of the prospectus is expected to be made pursuant to Rule 434, check the following box . ¨

1

CALCULATION OF REGISTRATION FEE

| TITLE OF EACH | AMOUNT TO | PROPOSED | PROPOSED | AMOUNT OF |

| CLASS OF | BE | MAXIUM | MAXIMUM | REGISTRATION |

| SECURITIES TO | REGISTERED | OFFERING | AGGREGATE | FEE |

| BE | | PRICE PER | OFFERING | |

| REGISTERED | | SHARE (1) | PRICE (1) | |

| | | | | |

| Common Stock | 3,424,000 | $0.05 | $171,200 | $20.15 |

(1) The offering price has been estimated solely for the purpose of computing the amount of the registration fee in accordance with Rule 457(a). Our common stock is not traded and any national exchange and in accordance with Rule 457, the offering price was determined by the price our common stock was sold to our shareholders in a private placement memorandum. The price of $0.05 is a fixed price at which the selling security holders may sell their shares until our common stock is quoted on the OTC Bulletin Board at which time the shares may be sold at prevailing market prices or privately negotiated prices.

THE REGISTRANT HEREBY AMENDS THIS REGISTRATION STATEMENT ON SUCH DATE OR DATES AS MAY BE NECESSARY TO DELAY ITS EFFECTIVE DATE UNTIL THE REGISTRANT SHALL FILE A FURTHER AMENDMENT WHICH SPECIFICALLY STATES THAT THIS REGISTRATION STATEMENT SHALL THEREAFTER BECOME EFFECTIVE IN ACCORDANCE WITH SECTION 8(a) OF THE SECURITIES ACT OF 1933 OR UNTIL THE REGISTRATION STATEMENT SHALL BECOME EFFECTIVE ON SUCH DATE AS THE COMMISSION, ACTING PURSUANT TO SECTION 8(a), MAY DETERMINE.

SUBJECT TO COMPLETION, Dated August , 2005

2

PROSPECTUS

RIVERBANK RESOURCES INC.

3,424,000 SHARES

COMMON STOCK

----------------

The selling shareholders named in this prospectus are offering all of the shares of common stock offered through this prospectus.

Our common stock is presently not traded on any market or securities exchange.

----------------

The purchase of the securities offered through this prospectus involves a high degree of risk.

SEE SECTION ENTITLED “RISK FACTORS” ON PAGES 6-10

The information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

The selling shareholders will sell our shares at $0.05 per share until our shares are quoted on the OTC Bulletin Board, and thereafter at prevailing market prices or privately negotiated prices. We determined this offering price based upon the price of the last sale of our common stock to investors.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

----------------

The Date Of This Prospectus Is: August, 2005

3

Table Of Contents

| | | Page |

| Summary | 5 |

| Risk Factors | 6 |

| - | If we do not obtain additional financing, our business will fail | 6 |

| - | Because we have only recently commenced business operations, we face a high risk of business failure | 6 |

| - | Because of the speculative nature of exploration of mining properties, there is substantial risk that our business will fail | 7 |

| - | We need to continue as a going concern if our business is to succeed. Our independent auditor has raised doubt about our ability to continue as a going concern | 7 |

| - | Because of the inherent dangers involved in mineral exploration, there is a risk that we may incur liability or damages as we conduct our business | 7 |

| - | Even if we discover commercial reserves of precious metals on the Big Mike Property, we may not be able to successfully obtain commercial production | 7 |

| - | If we become subject to burdensome government regulation or other legal uncertainties, our business will be negatively affected | 7 |

| - | Because our directors owns 53.88% of our outstanding stock, they could control and make corporate decisions that may be disadvantageous to other minority stockholders | 8 |

| - | Because our president has other business interests, he may not be able or willing to devote a sufficient amount of time to our business operations, causing our business to fail | 8 |

| - | If a market for our common stock does not develop, shareholders may be unable to sell their shares | 8 |

| - | A purchaser is purchasing penny stock which limits the ability to sell stock | 8 |

| Use of Proceeds | 9 |

| Determination of Offering Price | 9 |

| Dilution | 9 |

| Selling Securityholders | 9 |

| Plan of Distribution | 12 |

| Legal Proceedings | 13 |

| Directors, Executive Officers, Promoters and Control Persons | 13 |

| Security Ownership of Certain Beneficial Owners and Management | 15 |

| Description of Securities | 15 |

| Interest of Named Experts and Counsel | 16 |

| Disclosure of Commission Position of Indemnification for Securities Act Liabilities | 16 |

| Organization Within Last Five Years | 17 |

| Description of Business | 17 |

| Plan of Operations | 22 |

| Description of Property | 22 |

| Certain Relationships and Related Transactions | 22 |

| Market for Common Equity and Related Stockholder Matters | 23 |

| Executive Compensation | 24 |

| Financial Statements | 25 |

| Changes in and Disagreements with Accountants on Accounting and Financial Disclosure | 26 |

4

Summary

Prospective investors are urged to read this prospectus in its entirety.

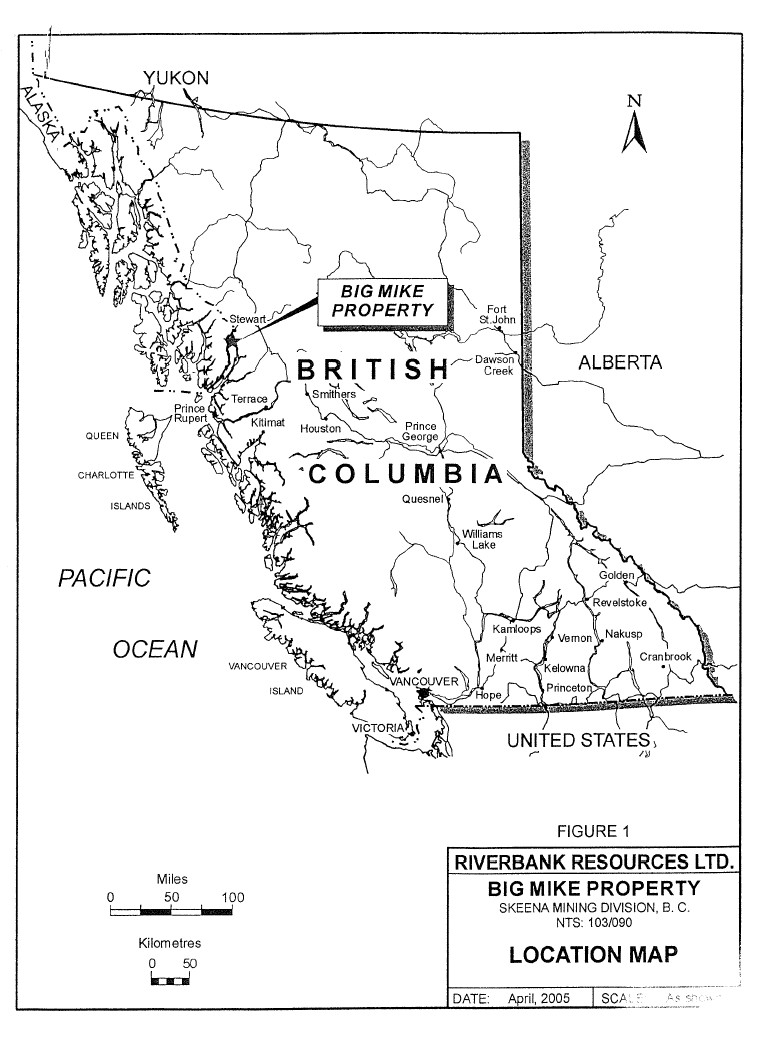

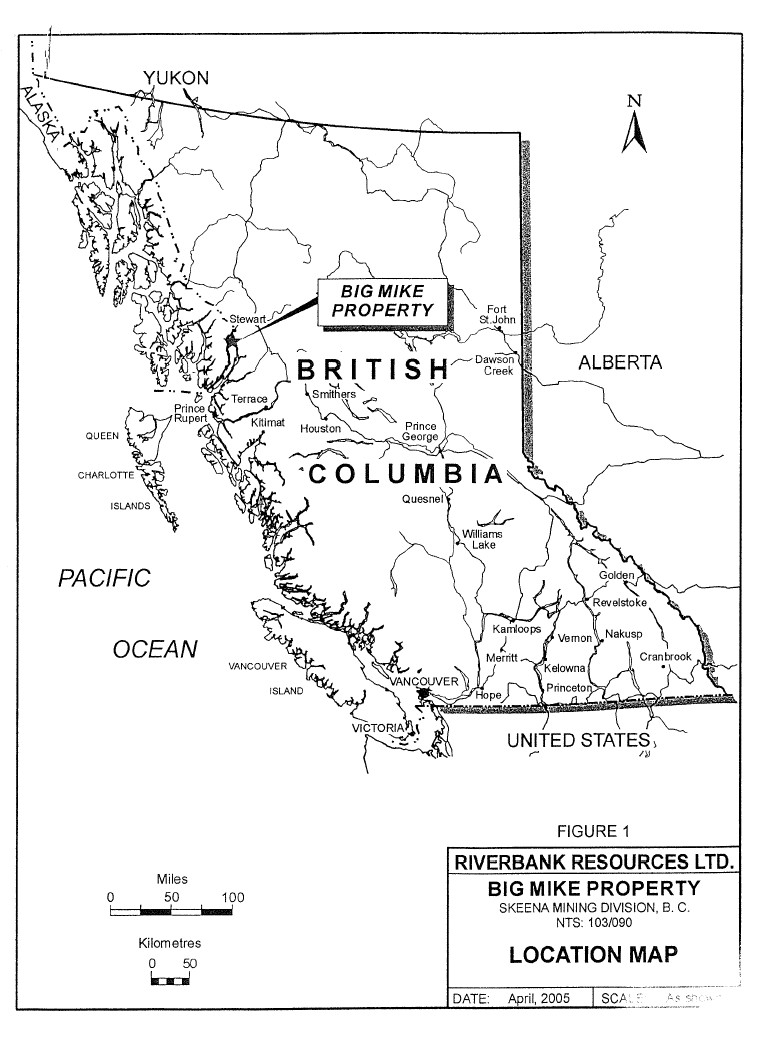

We are in the business of mineral property exploration. To date, we have only conducted initial exploration on our sole exploration property, known as the Big Mike property, which is located approximately six miles south of the town of Stewart, British Columbia and Hyder, Alaska, in the Skeena Mining Division in northern British Columbia, Canada. This initial exploration was comprised of the inspection conducted by Mr. Timmins for his report. We acquired a 100% interest in the Big Mike property from Gudmund Lovang of North Vancouver, British Columbia.

Our objective is to conduct mineral exploration activities on the Big Mike property in order to assess whether it possesses economic reserves of gold and silver. We have not yet identified any minerals on the Big Mike property. Our proposed exploration program is designed to search for an economically feasible mineral deposit.

The report of our independent accountant to our audited financial statements for the period ended April 30, 2005 indicates that there are a number of factors that raise substantial doubt about our ability to continue as a going concern. Our ability to continue as a going concern is dependent on our ability to raise additional capital during the next twelve months.

We were incorporated on February 9, 2005, under the laws of the state of Nevada. Our principal offices are located at 595 Howe Street, Suite 902, Vancouver, British Columbia Canada V6C 2T5. Our telephone number is (604) 484-3704.

The Offering:

| Securities Being Offered | Up to 3,424,000 shares of common stock. |

| | |

| Offering Price | The selling shareholders will sell our shares at $0.05 per share until our shares are quoted on the OTC Bulletin Board, and thereafter at prevailing market prices or privately negotiated prices. We determined this offering price based upon the price of the last sale of our common stock to investors. |

| | |

| Terms of the Offering | The selling shareholders will determine when and how they will sell the common stock offered in this prospectus. |

| | |

Securities Issued and to be

Issued | 7,424,000 shares of our common stock are issued and outstanding as of the date of this prospectus. All of the common stock to be sold under this prospectus will be sold by existing shareholders. |

| | |

| Use of Proceeds | We will not receive any proceeds from the sale of the common stock by the selling shareholders. |

5

Summary Financial Information

Balance Sheet

April 30, 2005

| Cash | $48,744 |

| Total Assets | $51,744 |

| Liabilities | $2,414 |

| Total Stockholders’ Equity | $49,330 |

Statement of Operations

From Incorporation on

February 9, 2005 to April 30, 2005

| Revenue | $0 | |

| Net Loss and Deficit | ($7,290 | ) |

Risk Factors

An investment in our common stock involves a high degree of risk. You should carefully consider the risks described below and the other information in this prospectus before investing in our common stock. If any of the following risks occur, our business, operating results and financial condition could be seriously harmed. The trading price of our common stock could decline due to any of these risks, and you may lose all or part of your investment.

IF WE DO NOT OBTAIN ADDITIONAL FINANCING, OUR BUSINESS WILL FAIL.

Our current operating funds are less than necessary to complete all intended exploration of the Big Mike property, and therefore we will need to obtain additional financing in order to complete our business plan. We recently commenced operations and we have no income. As well, we will not receive any funds from this registration.

Our business plan calls for significant expenses in connection with the exploration of the Big Mike property. As of July 31, 2005, we have $39,000 in cash. While we have sufficient funds to conduct the recommended phase one exploration program on the claim, which is estimated to cost $25,300, we will need additional funds to complete the phase two program, which is estimated to cost $70,950. Even after completing these two phases of exploration, we will not know if we have a commercially viable mineral deposit.

We will require additional financing to sustain our business operations if we are not successful in earning revenues once exploration is complete. We do not currently have any arrangements for financing and may not be able to find such financing if required.

BECAUSE WE HAVE ONLY RECENTLY COMMENCED BUSINESS OPERATIONS, WE FACE A HIGH RISK OF BUSINESS FAILURE.

We have only recently commenced exploration on the Big Mike property. Accordingly, we have no way to evaluate the likelihood that our business will be successful. We were incorporated on February 9, 2005 and to date have been involved primarily in organizational activities and the acquisition of the Big Mike property. We have not earned any revenues as of the date of this prospectus. Potential investors should be aware of the difficulties normally encountered by new mineral exploration companies and the high rate of failure of such enterprises. The likelihood of success must be considered in light of the problems, expenses, difficulties, complications and delays encountered in connection with the exploration of the mineral properties that we plan to

6

undertake. These potential problems include unanticipated problems relating to exploration as well as additional costs and expenses that may exceed current estimates.

Prior to completion of our exploration stage, we anticipate that we will incur increased operating expenses without realizing any revenues. We therefore expect to incur significant losses into the foreseeable future. We recognize that if we are unable to generate significant revenues from development of the Big Mike Property and the production of minerals from the claim, we will not be able to earn profits or continue operations.

There is no history upon which to base any assumption as to the likelihood that we will prove successful, and it is doubtful that we will generate any operating revenues or ever achieve profitable operations. If we are unsuccessful in addressing these risks, our business will most likely fail.

BECAUSE OF THE SPECULATIVE NATURE OF EXPLORATION OF MINING PROPERTIES, THERE IS A SUBSTANTIAL RISK THAT OUR BUSINESS WILL FAIL.

The search for valuable minerals as a business is extremely risky. In general, the probability that an individual prospect every having reserves that meet the requirements of Industry Guide 7 is extremely remote. Exploration for minerals is a speculative venture necessarily involving substantial risk. In all probability, the Big Mike property does not contain any reserves and funds that we spend on exploration will be lost. As well, problems such as unusual or unexpected formations and other conditions are involved in mineral exploration and often result in unsuccessful exploration efforts. In such a case, we would be unable to complete our business plan.

WE NEED TO CONTINUE AS A GOING CONCERN IF OUR BUSINESS IS TO SUCCEED. OUR INDEPENDENT AUDITOR HAS RAISED SUBSTANTIAL DOUBT ABOUT OUR ABILITY TO CONTINUE AS A GOING CONCERN.

The report of our independent accountant to our audited financial statements for the period ended April 30, 2005 indicates that there are a number of factors that raise substantial doubt about our ability to continue as a going concern. Such factors identified in the report are that we have no source of revenue and our dependence upon obtaining adequate financing. If we are not able to continue as a going concern, it is likely investors will lose all of their investment.

BECAUSE OF THE INHERENT DANGERS INVOLVED IN MINERAL EXPLORATION, THERE IS A RISK THAT WE MAY INCUR LIABILITY OR DAMAGES AS WE CONDUCT OUR BUSINESS.

The search for valuable minerals involves numerous hazards. As a result, we may become subject to liability for such hazards, including pollution, cave-ins and other hazards against which we cannot insure or against which we may elect not to insure. The payment of such liabilities may have a material adverse effect on our financial position.

EVEN IF WE DISCOVER COMMERCIAL RESERVES OF PRECIOUS METALS ON THE BIG MIKE PROPERTY, WE MAY NOT BE ABLE TO SUCCESSFULLY COMMENCE COMMERCIAL PRODUCTION.

The Big Mike property does not contain any known bodies of mineralization. If our exploration programs are successful in establishing gold and silver of commercial tonnage and grade, we will require additional funds in order to place the Big Mike property into commercial production. We may not be able to obtain such financing.

BECAUSE OUR DIRECTORS OWN 53.88% OF OUR OUTSTANDING COMMON STOCK, THEY COULD MAKE AND CONTROL CORPORATE DECISIONS THAT MAY BE DISADVANTAGEOUS TO OTHER MINORITY SHAREHOLDERS.

7

Our directors own approximately 53.88% of the outstanding shares of our common stock. Accordingly, they will have a significant influence in determining the outcome of all corporate transactions or other matters, including mergers, consolidations, and the sale of all or substantially all of our assets. They will also have the power to prevent or cause a change in control. The interests of our directors may differ from the interests of the other stockholders and thus result in corporate decisions that are disadvantageous to other shareholders.

BECAUSE BOTH OUR PRESIDENT AND CHIEF FINANCIAL OFFICE HAVE OTHER BUSINESS INTERESTS, THEY MAY NOT BE ABLE OR WILLING TO DEVOTE A SUFFICIENT AMOUNT OF TIME TO OUR BUSINESS OPERATIONS, CAUSING OUR BUSINESS TO FAIL.

Our president, Earl Hope, intends to devote approximately 15% of his business time providing his services to us and our Chief Financial Officer, Trevor Herbert, intends to devote approximately 10% of his business time providing his services to us.While both Mr. Hope and Mr. Herbert presently possess adequate time to attend to our interests, it is possible that the demands on Mr. Hope and Mr. Herbert from their other obligations could increase with the result that they would no longer be able to devote sufficient time to the management of our business.

BECAUSE MANAGEMENT HAS NO EXPERIENCE IN MINERAL EXPLORATION, OUR BUSINESS HAS A HIGH RISK OF FAILURE.

Our offices and a majority of our directors do not have any technical training in the field of geology and specifically in the areas of exploring for, starting and operating a mine. As a result, we may not be able to recognize and take advantage of potential acquisition and exploration opportunities in the sector. As well, with no direct training or experience, our management may not be fully aware of the specific requirements related to working in this industry. Their decisions and choices may not be well thought out and our operations, earnings and ultimate financial success may suffer irreparable harm as a result.

IF A MARKET FOR OUR COMMON STOCK DOES NOT DEVELOP, SHAREHOLDERS MAY BE UNABLE TO SELL THEIR SHARES.

There is currently no market for our common stock and no certainty that a market will develop. We currently plan find a market maker to apply for quotation of our common stock on the over the counter bulletin board upon the effectiveness of the registration statement, of which this prospectus forms a part. There can be no assurance that a market maker will agree to file the necessary documents with the National Association of Securities Dealers, which operates the OTC Electronic Bulletin Board, nor can there be any assurance that such an application for quotation will be approved or that a regular trading market will develop or that if developed, will be sustained. In the absence of a trading market, an investor may be unable to liquidate their investment.

SALES OF SHARES NOT REGISTERED IN THIS PROSPECTUS COULD HAVE A NEGATIVE IMPACT ON OUR STOCK PRICE.

In addition, to the shares being registered in this prospectus, there are an additional 4,000,000 million shares of our common stock outstanding. After April 26, 2005, these 4,000,000 shares will become available for resale to the public in accordance with the volume and trading limitations of Rule 144 of the Act. In general, under Rule 144 as currently in effect, a person who has beneficially owned shares of our common stock for at least one year is entitled to sell within any three month period a number of shares that does not exceed 1% of the number of shares of our common stock then outstanding which, in our case, will equal 72,440 shares as of the date of this prospectus. Sales of these shares by the shareholders owning these shares could have a negative impact on our stock price when and if our shares are approved to trade.

A PURCHASER IS PURCHASING PENNY STOCK WHICH LIMITS HIS OR HER ABILITY TO SELL THE STOCK.

The shares offered by this prospectus constitute penny stock under the Exchange Act. The shares will remain penny stock for the foreseeable future. The classification of penny stock makes it more difficult for a broker-dealer to sell the stock into a secondary market, thus limiting investment liquidity. Any broker-dealer engaged by the purchaser for the purpose of selling his or her shares in our company will be subject to rules 15g-1 through 15g-10 of the Exchange Act. Rather than creating a need to comply with those rules, some broker-dealers will refuse to attempt to sell penny stock.

Please refer to the “Plan of Distribution” section for a more detailed discussion of penny stock and related broker-dealer restrictions.

Forward-Looking Statements

8

This prospectus contains forward-looking statements that involve risks and uncertainties. We use words such as anticipate, believe, plan, expect, future, intend and similar expressions to identify such forward-looking statements. You should not place too much reliance on these forward-looking statements. Our actual results may differ materially from those anticipated in these forward-looking statements for many reasons, including the risks faced by us described in the “Risk Factors” section and elsewhere in this prospectus.

Use Of Proceeds

We will not receive any proceeds from the sale of the common stock offered through this prospectus by the selling shareholders.

Determination Of Offering Price

The selling shareholders will sell our shares at $0.05 per share until our shares are quoted on the OTC Bulletin Board, and thereafter at prevailing market prices or privately negotiated prices. We determined this offering price, based upon the price of the last sale of our common stock to investors.

Dilution

The common stock to be sold by the selling shareholders is common stock that is currently issued and outstanding. Accordingly, there will be no dilution to our existing shareholders.

Selling Securityholders

The selling shareholders named in this prospectus are offering all of the 3,424,000 shares of common stock offered through this prospectus. These shares were acquired from us in private placements that were exempt from registration under Regulation S of the Securities Act of 1933. The shares include the following:

| | 1. | 2,420,000 shares of our common stock that the selling shareholders acquired from us in an offering that was exempt from registration under Regulation S of the Securities Act of 1933 and was completed on April 16, 2005; |

| | | |

| | 2. | 1,004,000 shares of our common stock that the selling shareholders acquired from us in an offering that was exempt from registration under Regulation S of the Securities Act of 1933 and was completed on April 30, 2005; |

The following table provides as of the date of this prospectus, information regarding the beneficial ownership of our common stock held by each of the selling shareholders, including:

| | 1. | the number of shares owned by each prior to this offering; |

| |

| | 2. | the total number of shares that are to be offered for each; |

| |

| | 3. | the total number of shares that will be owned by each upon completion of the offering; and |

| |

| | 4. | the percentage owned by each upon completion of the offering. |

Name of Selling Stockholder

| Shares

Owned Prior

to this

Offering

| Total Number

of Shares to

be Offered for

Selling

Shareholders

Account | Total Shares

Owned Upon

Completion of

this Offering

| Percent

Owned Upon

Completion of

this Offering

|

Maxwell Ward

1179 Marine Dr.

West Vancouver, BC V7T 1B3 | 360,000 | 360,000 | Nil | Nil |

9

| Alfred Bleuler | | | | |

| 3422 West 20thAve. | 360,000 | 360,000 | Nil | Nil |

| Vancouver, BC V6S 1E4 | | | | |

| Don Charlton | | | | |

| C-2 Judson Site | 340,000 | 340,000 | Nil | Nil |

| Lone Butte, BC V0K 1X0 | | | | |

| Shane Goodenough | | | | |

| 592 St. Andrew Rd. | 340,000 | 340,000 | Nil | Nil |

| West Vancouver, BC V7S 1V4 | | | | |

| Moser F. Herbert | | | | |

| C-11 Blain Site RR 1 | 340,000 | 340,000 | Nil | Nil |

| Lone Butte, BC V0K 1X0 | | | | |

| Catherine Register | | | | |

| 201 Cayer St, Suite 45 | 340,000 | 340,000 | Nil | Nil |

| Coquitlam, BC V3K 5A9 | | | | |

| Jamie Viner | | | | |

| 13480 Crestwood Pl, Ste 140 | 340,000 | 340,000 | Nil | Nil |

| Richmond, BC V6V 2K1 | | | | |

| Jan Anderson | | | | |

| 2929 St. Johns St # 8 Box 3111 | 30,000 | 30,000 | Nil | Nil |

| Port Moody, BC V3H 4T4 | | | | |

| Gerald Atkinson | | | | |

| RR1 C100 Bell Rd. | 24,000 | 24,000 | Nil | Nil |

| Lone Butte, BC V0K 1X0 | | | | |

| Karin Bleuler | | | | |

| 3783 Riviere Place | 40,000 | 40,000 | Nil | Nil |

| North Vancouver, BC V7R 4E7 | | | | |

| Lidia Catalano | | | | |

| 302-4363 Halifax St. | 6,000 | 6,000 | Nil | Nil |

| Burnaby, BC V5C 5Z3 | | | | |

| Craig Charlton | | | | |

| Box10036 | 10,000 | 10,000 | Nil | Nil |

| 108 Mile Ranch, BC V0K 2Z0 | | | | |

| Tiffany Collick | | | | |

| 14284 Greencrest Dr. | 20,000 | 20,000 | Nil | Nil |

| Surrey, BC V4P 1L9 | | | | |

| Alfonso Ergas | | | | |

| West Va Point, PO Box 92061 | 4,000 | 4,000 | Nil | Nil |

| West Vancouver, BC V7V 4X4 | | | | |

| Emilia Finamore | | | | |

| 7171 121st, Suite 111 | 6,000 | 6,000 | Nil | Nil |

| Surrey, BC V3W 1G9 | | | | |

| Loredana Finamore | | | | |

| 4363 Halifax St., Suite 302 | 10,000 | 10,000 | Nil | Nil |

| Burnaby, BC V5C 5Z3 | | | | |

| Wendy Hershberg | | | | |

| 855 Fairmile Rd. | 4,000 | 4,000 | Nil | Nil |

| West Vancouver, BC V7S 1R4 | | | | |

| Erin Hindle | | | | |

| 175 4th St. East, Suite 313 | 20,000 | 20,000 | Nil | Nil |

| North Vancouver, BC V7L 2H8 | | | | |

| Inga Husar | | | | |

| RR1 C100 Bell Rd. | 10,000 | 10,000 | Nil | Nil |

| Lone Butte, BC V0K 1X0 | | | | |

| Frank Jacobs | | | | |

| 1500 Howe St., Suite 2404 | 10,000 | 10,000 | Nil | Nil |

| Vancouver, BC V6Z 2N1 | | | | |

| Cynthia Janzen | | | | |

| 5148 Galway Dr. | 10,000 | 10,000 | Nil | Nil |

| Delta, BC V4M 3R5 | | | | |

10

| Tobyn Kidd | | | | |

| 3371 Trumond Ave. | 30,000 | 30,000 | Nil | Nil |

| Richmond, BC V7E 1B4 | | | | |

| Ron Knoedler | | | | |

| 8167 14th Ave. | 20,000 | 20,000 | Nil | Nil |

| Burnaby, BC V3N 2B7 | | | | |

| James Kwan | | | | |

| 3098 East 8th Ave | 40,000 | 40,000 | Nil | Nil |

| Vancouver, BC V5M 1X3 | | | | |

| Yvette Lafreniere | | | | |

| 7040 Granville Ave., Suite 604 | 100,000 | 100,000 | Nil | Nil |

| Richmond, BC V6Y 3W5 | | | | |

| Mariko Lainas | | | | |

| 5860 Dover Cres, Suite 412 | 6,000 | 6,000 | Nil | Nil |

| Richmond, BC V7C 5S6 | | | | |

| Nicole LePage | | | | |

| 8740 Ash St. | 10,000 | 10,000 | Nil | Nil |

| Richmond, BC V6Y 2S3 | | | | |

| Susan Lewandoski | | | | |

| 2028 West 11th Ave, Suite 107 | 30,000 | 30,000 | Nil | Nil |

| Vancouver, BC V6J 2C9 | | | | |

| David MacKenzie | | | | |

| 2106 Anita Dr. | 30,000 | 30,000 | Nil | Nil |

| Port Coquitlam, BC V3C 1H3 | | | | |

| Susan MacKenzie | | | | |

| 990 Broughton St, Suite 205 | 80,000 | 80,000 | Nil | Nil |

| Vancouver, BC V6G 2A5 | | | | |

| Scott McArthur | | | | |

| 9680 River Rd. | 80,000 | 80,000 | Nil | Nil |

| Delta, BC V3H 1B5 | | | | |

| Frank Mueller | | | | |

| 8740 Ash St. | 100,000 | 100,000 | Nil | Nil |

| Richmond, BC V6Y 2S3 | | | | |

| George Ninkovich | | | | |

| 1680 Bayshorte Dr, Suite 1801 | 20,000 | 20,000 | Nil | Nil |

| Vancouver, BC V6G 3H6 | | | | |

| Saundra Salvone | | | | |

| 1599 Coast Meridian Rd. | 4,000 | 4,000 | Nil | Nil |

| Port Coquitlam, BC V3C 6R7 | | | | |

| Eleonor Sampert | | | | |

| 4706 53A St. | 6,000 | 6,000 | Nil | Nil |

| Delta, BC V4K 3V4 | | | | |

| Dimitrios Savvis | | | | |

| 3409 Pender St. E | 60,000 | 60,000 | Nil | Nil |

| Vancouver, BC V5K 2C9 | | | | |

| Nick Stathis | | | | |

| 4032 Mars Place | 20,000 | 20,000 | Nil | Nil |

| Port Coquitlam, BC V3B 6B9 | | | | |

| Laura Stefansson | | | | |

| 12367 189A St. | 20,000 | 20,000 | Nil | Nil |

| Pitt Meadows, BC V3Y 2H3 | | | | |

| Garry Swanson | | | | |

| 1599 Coast Meridian Rd | 4,000 | 4,000 | Nil | Nil |

| Port Coquitlam, BC V3C 6R7 | | | | |

| Glenda Tait | | | | |

| RR1 C35 Burgess Rd. | 30,000 | 30,000 | Nil | Nil |

| Lone Butte, BC V0K 1X0 | | | | |

| Peter Termansen | | | | |

| 131 West 3rd St. | 20,000 | 20,000 | Nil | Nil |

| North Vancouver, BC V7M 1E7 | | | | |

11

| Theresa Anne Walker | | | | |

| 9680 River Rd. | 40,000 | 40,000 | Nil | Nil |

| Delta, BC V4G 1B5 | | | | |

| Monica Weber | | | | |

| Box 10036 | 10,000 | 10,000 | Nil | Nil |

| 108 Mile Ranch, BC V0K 2Z0 | | | | |

| Peter Wilson | | | | |

| 527 Craigmohr Dr. | 40,000 | 40,000 | Nil | Nil |

| West Vancouver, BC V7S 1W8 | | | | |

Each of the above shareholders beneficially owns and has sole voting and investment over all shares or rights to the shares registered in his or her name. The numbers in this table assume that none of the selling shareholders sells shares of common stock not being offered in this prospectus or purchases additional shares of common stock, and assumes that all shares offered are sold. The percentages are based on 7,424,000 shares of common stock outstanding on the date of this prospectus.

None of the selling shareholders:

| | (1) | has had a material relationship with us other than as a shareholder at any time within the past three years; |

| |

| | (2) | has ever been one of our officers or directors; or |

| |

| | (3) | is a broker-dealer or affiliate of a broker dealer. |

Plan Of Distribution

The selling shareholders may sell some or all of their common stock in one or more transactions, including block transactions.

The selling shareholders will sell our shares at $0.05 per share until our shares are quoted on the OTC Bulletin Board, and thereafter at prevailing market prices or privately negotiated prices. We determined this offering price arbitrarily based upon the price of the last sale of our common stock to investors. The shares may also be sold in compliance with the Securities and Exchange Commission's Rule 144.

We are bearing all costs relating to the registration of the common stock which are estimated to be $12,500. The selling shareholders, however, will pay any commissions or other fees payable to brokers or dealers in connection with any sale of the common stock.

The selling shareholders must comply with the requirements of the Securities Act and the Exchange Act in the offer and sale of the common stock. In particular, during such times as the selling shareholders may be deemed to be engaged in a distribution of the common stock, and therefore be considered to be an underwriter, they must comply with applicable law and may, among other things:

| | 1. | Not engage in any stabilization activities in connection with our common stock; |

| |

| | 2. | Furnish each broker or dealer through which common stock may be offered, such copies of this prospectus, as amended from time to time, as may be required by such broker or dealer; and |

| |

| | 3. | Not bid for or purchase any of our securities or attempt to induce any person to purchase any of our securities other than as permitted under the Exchange Act. |

The Securities Exchange Commission has also adopted rules that regulate broker-dealer practices in connection with transactions in penny stocks. Penny stocks are generally equity

12

securities with a price of less than $5.00 (other than securities registered on certain national securities exchanges or quoted on the Nasdaq system, provided that current price and volume information with respect to transactions in such securities is provided by the exchange or system).

The penny stock rules require a broker-dealer, prior to a transaction in a penny stock not otherwise exempt from those rules, deliver a standardized risk disclosure document prepared by the Commission, which:

| | • | contains a description of the nature and level of risk in the market for penny stocks in both public offerings and secondary trading; |

| | • | contains a description of the broker's or dealer's duties to the customer and of the rights and remedies available to the customer with respect to a violation of such duties; |

| | • | contains a brief, clear, narrative description of a dealer market, including "bid" and "ask" prices for penny stocks and the significance of the spread between the bid and ask price; |

| | • | contains a toll-free telephone number for inquiries on disciplinary actions; |

| | • | defines significant terms in the disclosure document or in the conduct of trading penny stocks; and |

| | • | contains such other information and is in such form (including language, type, size, and format) as the Commission shall require by rule or regulation; |

The broker-dealer also must provide, prior to proceeding with any transaction in a penny stock, the customer:

| | • | with bid and offer quotations for the penny stock; |

| | • | details of the compensation of the broker-dealer and its salesperson in the transaction; |

| | • | the number of shares to which such bid and ask prices apply, or other comparable information relating to the depth and liquidity of the market for such stock; and |

| | • | monthly account statements showing the market value of each penny stock held in the customer's account. |

In addition, the penny stock rules require that prior to a transaction in a penny stock not otherwise exempt from those rules; the broker-dealer must make a special written determination that the penny stock is a suitable investment for the purchaser and receive the purchaser's written acknowledgment of the receipt of a risk disclosure statement, a written agreement to transactions involving penny stocks, and a signed and dated copy of a written suitability statement. These disclosure requirements will have the effect of reducing the trading activity in the secondary market for our stock because it will be subject to these penny stock rules. Therefore, stockholders may have difficulty selling those securities.

Legal Proceedings

We are not currently a party to any legal proceedings. Our address for service of process in Nevada is 7251 West Lake Mead Blvd., Suite 300, Las Vegas, NV 89128.

Directors, Executive Officers, Promoters And Control Persons

Our executive officers and directors and their age as of the date of this prospectus is as follows:

Directors:

| Name of Director | Age |

| Earl Hope | 66 |

| Trevor Herbert | 41 |

| L. J. (Lu) Manning | 78 |

13

Executive Officers:

| Name of Officer | Age | Office |

| Earl Hope | 66 | President and Chief Executive Officer |

| Trevor Herbert | 41 | Chief Financial Officer, Treasurer and Secretary |

Biographical Information

Set forth below is a brief description of the background and business experience of our executive officers and directors for the past five years.

Mr. Earl Hopehas acted as our President, Chief Executive Officer and as a member of our Board of Directors since our incorporation on February 9, 2005. Mr. Hope has provided consulting services to St. Elias Mines Ltd. in the areas of finance, as well as investor and shareholder relations since June 2000. Mr. Hope has experience with private and public traded companies. He spent 29 years as an Account Executive with several national and international securities firms such as Midland Walwyn Inc., West Coast Securities Ltd. and Canaccord Capital Inc. His duties and responsibilities in these capacities included: customer service, initial public offerings and market underwritings. Mr. Hope has completed the Canadian Securities Course, the Series 62 US Corporate Securities Limited Representative License and Series 63 Uniform Securities and Agent State Law Exam. From January 2002 to February 2004, Mr. Hope acted as a Director and Officer of Link Media Publishing Ltd. and acted as director of Infinex Ventures Inc. from November 2000 to June 2004. Both are US reporting Companies traded on the OTC Bulletin Board. Since February, 2005, he has been acting as Director and Officer of Greenwind Power Corp., a US non-reporting company involved in the development and marketing of wind generated electrical energy.

Mr. Hope does not have any professional training or technical credentials in the exploration, development and operation of mines.

Mr. Hope intends to devote approximately 15% of his business time to our affairs.

Mr.Trevor Herbert has acted as our Chief Financial Officer, secretary, Treasurer and as a member of our Board of Directors since our incorporation on February 9, 2005. Mr. Herbert has been involved in the business of restaurant and bar management for over eighteen years. Mr. Herbert currently manages The Gramercy Grill located in Vancouver. Other establishments he has managed includes The Sunset Grill Restaurant from May 1999 to March 2001, Malones Sports Grill from July 1996 to September 1999 and Monk McQueens restaurant December 1994 to June 1996, all of which are based in Vancouver.

Mr. Herbert does not have any professional training or technical credentials in the exploration, development and operation of mines.

Mr. Herbert intends to devote approximately 10% of his business time to our affairs.

Mr. Luard (LU) J. Manning has acted as a director since our incorporation on February 9, 2005. Mr. Manning is a member of the Canadian Institute of Mining and Metallurgy and of Life Member the British Columbia Professional Engineers. Mr. Manning has over 50 years mining experience, the last 37 of which has been as a mining consultant. He has experience in operating underground mines, as well as small open pit mines. In addition, he has supervised and critiqued engineering designs for both surface and underground deposits with emphasis on the effects of design on operating economics. He has work experience in Canada, Latin America, and the United States of America, and has examined properties in England and Australia. He is presently a director of Cusac Gold Mines Ltd., a Canadian reporting Company traded on the Toronto Stock Exchange and director and officer of Tyhee Development Corp., FM Resources Corp., Kimber Resources Inc., Nustar Resources Inc., LEH Ventures Ltd., Highbank Resources Ltd., Verona

14

Development Corp., all Canadian junior mineral exploration reporting Companies traded on the Vancouver Stock Exchange.

Mr. Manning intends to devote approximately 15% of his business time to our affairs.

Term of Office

Our directors are appointed for a one-year term to hold office until the next annual general meeting of our shareholders or until removed from office in accordance with our bylaws. Our officers are appointed by our board of directors and hold office until removed by the board.

Significant Employees

We have no significant employees other than the officers and directors described above.

Security Ownership Of Certain Beneficial Owners And Management

The following table provides the names and addresses of each person known to us to own more than 5% of our outstanding common stock as of the date of this prospectus, and by the officers and directors, individually and as a group. Except as otherwise indicated, all shares are owned directly.

| | | Amount of | |

| Title of Class | Name and address | beneficial | Percent of |

| | of beneficial owner | ownership | class |

| Common stock | Earl Hope | 2,300,000 | 30.98% |

| Common Stock | Trevor Herbert | 1,700,000 | 22.90% |

| Common Stock | L. J. (Lu) Manning | Nil | Nil |

| Common stock | All officers and directors as a group that consists | | |

| | of three people | 4,000,000 | 53.88% |

The percent of class is based on 7,424,000 shares of common stock issued and outstanding as of the date of this prospectus.

Description Of Securities

General

Our authorized capital stock consists of 69,000,000 shares of common stock at a par value of $0.001 per share and 1,000,000 shares of preferred stock at a par value of $0.001 per share.

Common Stock

As of August 22, 2005, there are 7,424,000 shares of our common stock issued and outstanding that are held by 46 stockholders of record. Holders of our common stock are entitled to one vote for each share on all matters submitted to a stockholder vote. Holders of common stock do not have cumulative voting rights. Therefore, holders of a majority of the shares of common stock voting for the election of directors can elect all of the directors.

Holders of common stock are entitled to share in all dividends that the board of directors, in its discretion, declares from legally available funds. In the event of a liquidation, dissolution or winding up, each outstanding share entitles its holder to participate pro rata in all assets that remain after payment of liabilities and after providing for each class of stock, if any, having preference over the common stock.

Holders of our common stock have no pre-emptive rights, no conversion rights and there are no redemption provisions applicable to our common stock.

15

Preferred Stock

We have authorized 1,000,000 shares of preferred stock at a par value of $0.001 per share. As of August 22, 2005 we have no shares of preferred stock outstanding.

Dividend Policy

We have never declared or paid any cash dividends on our common stock. We currently intend to retain future earnings, if any, to finance the expansion of our business. As a result, we do not anticipate paying any cash dividends in the foreseeable future.

Share Purchase Warrants

We have not issued and do not have outstanding any warrants to purchase shares of our common stock.

Options

We have not issued and do not have outstanding any options to purchase shares of our common stock.

Convertible Securities

We have not issued and do not have outstanding any securities convertible into shares of our common stock or any rights convertible or exchangeable into shares of our common stock.

Interests Of Named Experts And Counsel

No expert or counsel named in this prospectus as having prepared or certified any part of this prospectus or having given an opinion upon the validity of the securities being registered or upon other legal matters in connection with the registration or offering of the common stock was employed on a contingency basis, or had, or is to receive, in connection with the offering, a substantial interest, direct or indirect, in the registrant. Nor was any such person connected with the registrant as a promoter, managing or principal underwriter, voting trustee, director, officer, or employee.

Anslow & Jaclin, LLP, has provided an opinion on the validity of our common stock.

The financial statements included in this prospectus and the registration statement have been audited by Webb & Company, P.A.,Certified Public Accountants, to the extent and for the periods set forth in their report appearing elsewhere in this document and in the registration statement filed with the SEC, and are included in reliance upon such report given upon the authority of said firm as experts in auditing and accounting.

Disclosure Of Commission Position Of Indemnification For Securities Act Liabilities

Our directors and officers are indemnified as provided by the Nevada Revised Statutes and our Bylaws. These provisions provide that we shall indemnify a director or former director against all expenses incurred by him by reason of him acting in that position. The directors may also cause us to indemnify an officer, employee or agent in the same fashion.

We have been advised that in the opinion of the Securities and Exchange Commission indemnification for liabilities arising under the Securities Act is against public policy as expressed in the Securities Act, and is, therefore, unenforceable. In the event that a claim for indemnification

16

against such liabilities is asserted by one of our directors, officers, or controlling persons in connection with the securities being registered, we will, unless in the opinion of our legal counsel the matter has been settled by controlling precedent, submit the question of whether such indemnification is against public policy to a court of appropriate jurisdiction. We will then be governed by the court's decision.

Organization Within Last Five Years

We were incorporated on February 9, 2005 under the laws of the state of Nevada. On that date, Earl Hope, Trevor Herbert and L. J. (Lu) Manning were appointed as our directors. As well, Mr. Hope was appointed as our President and Chief Executive Officer and Mr. Herbert was appointed as our Secretary, Chief Financial Officer and Treasurer.

Description Of Business

In General

We are an exploration stage company. We are engaged in the acquisition and exploration of mineral properties with a view to exploiting any mineral deposits we discover. We own a 100% interest in one mineral claim known as the Big Mike property. There is no assurance that a commercially viable mineral deposit exists on the Big Mike property.

Mineral property exploration is typically conducted in phases. Each subsequent phase of exploration work is recommended by a geologist based on the results from the most recent phase of exploration. We have only recently commenced the initial recommended phase of exploration on the Big Mike property. Once we have completed each phase of exploration, we will make a decision as to whether or not we proceed with each successive phase based upon the analysis of the results of that program. Our directors will make these decisions based upon the recommendations of the independent geologist who oversees the program and records the results.

Our plan of operation is to conduct exploration work on the Big Mike property in order to ascertain whether it possesses economic quantities of gold and silver. There can be no assurance that an economic mineral deposit exists on the Big Mike property until appropriate exploration work is completed.

We currently have no equipment of infrastructure structure facilities on the property or any source of power. In addition, the property is currently without any known reserves. In the future we will contract for the necessary equipment or for generators if we cannot rely on the existing power lines. To date, the only exploration that has been conducted on the property is the work undertaken by the independent geologist in the preparation of his report.

Even if we complete our proposed exploration programs on the Big Mike property and we are successful in identifying a mineral deposit, we will have to spend substantial funds on further drilling and engineering studies before we will know if we have a commercially viable mineral deposit.

Big Mike Property Purchase Agreement

On April 26, 2005, we entered into a mineral purchase and sale agreement with Gudmund Lovang of North Vancouver, British Columbia, whereby he sold to us a 100% undivided right title and interest in one mineral claim located in the Skeena Mining Division of British Columbia, Canada. We acquired this interest in the Big Mike property by paying $3,000 to Mr. Lovang.

Description, Location and Access

The Big Mike property is located on the eastern shore of the Portland Canal, about six miles south of the towns of Stewart, British Columbia and Hyder, Alaska, in the Skeena Mining Division in northern British Columbia, Canada. It lies off a paved highway, approximately eight miles northeast of Hyder, Alaska, which is 40 miles to the west of Meziadin Junction, via the Village of Kitwanga, some 94 miles to the south. The Portland Canal lies in the boundary between British Columbia, Canada and the Alaskan Panhandle, near the Pacific Ocean. The property lies approximately

17

3,000 feet above sea level from the rocky eastern shore of the Portland Canal, in a heavily forested area.

Climate and Topography

The property lies in an area of coastal forest rising steeply from the rocky eastern shore of the Portland Canal from sea level to 3,000 feet above sea level.

The wet coastal climate is predominant with heavy rainfall during spring and fall and heavy snowfall during the winter months. Depths of tens of feet of snow can accumulate over the winter.

Dense vegetation consisting of cedar, fir, spruce and hemlock covers the property and alder, shrubs and mosses can make footing difficult.

The property totals 61 acres and is covered with dense vegetation consisting of a mix of cedar, fir, spruce and hemlock trees as well as alder, shrubs and mosses. The area’s wet coastal climate is predominant with heavy rainfall during spring and fall and heavy snowfall during the winter months. Depths of tens of feet of snow can accumulate over the winter.

Mineralization

Mineralization is the accumulation of high concentrations of valuable elements, such as gold, silver and copper, in rock and soil.

The property is underlain by the following rock types:

Diorite: dark, granite-textured, crystalline rocks rich in sodium and calcium aluminum, as well as small quantities of quartz

Granodioritic rocks: rocks containing a combination of acid and alkaline

Andesites: volcanic rocks characteristically medium dark in color and containing 54 to 62 percent silica and moderate amounts of iron and magnesium

Siltstone: a fine-grained standstone

Slate: a metamorphic rock that splits into thin, smooth-surfaced layers. Metaphoric rocks are rocks that haveundergone a transformation from its original state due to pressure and/or heat.

The area of the Big Mike property is mapped as being underlain by Jurassic Age volcanic rocks and sedimentary rocks, intruded by plutonic complex granitic rocks, all of which are intruded by igneous dikes and quartz veins. Jurassic Age volcanic rocks are rocks that vary from 146 to 200 million years old. Plutonic granitic rocks are created when a mass of molten rock cools below the earth’s surface.

The main adit found on the Big Mike property was developed along a quartz vein along an east-trending fault in metaphoric rocks. An adit is an opening driven horizontally into a side of a hill or mountain in order to access rock within. The south adit is some 850 feet south of the main adit. Both adits are underlain with various metaphoric and volcanic rocks.

18

Title to the Big Mike property

The Big Mike property consists of one mineral claim comprising 61 acres. A “mineral claim” refers to a specific section of land over which a title holder owns rights to explore the ground and subsurface, and extract minerals. Title to the Big Mike property is registered in the name of Gudmund Lovang. He has provided us with an absolute bill of sale with respect to the property. An absolute bill of sale is a legal document that transfers registered title to mineral property rights from one party to another unconditionally. Mr. Lovang holds these claims on our behalf, however, based on the absolute bill of sale, Mr. Lovang does not retain any right to the claims. There are no underlying interests or interests in the property.

Claim details are as follows:

| Claim Name | Record | Expiry Date |

| | Number | |

| Big Mike | 380857 | December 11, 2006 |

The claim was created on December 11, 2004 and is in good standing until December 11, 2006. This means that the claim will expire on December 11, 2006 unless we complete at least $100 worth of exploration work on the claim by that date. If this required exploration work is incurred, then the deadline is extended to December 11, 2007. In subsequent years, we must spend at least $200 on the claim to extend the expiry date by one year.

Exploration History

During 1925 and 1926, the Big Mike property was first staked and the main underground adit was excavated to a length of 115 feet along a quartz vein. Another underground adit of 100 feet long was excavated approximately 850 feet south of the main adit along a southeastern fault.

Mr. A.A. Davidson inspected the property in the 1920’s. Two samples taken from the vein along both adits contained some gold.

A program of geological, geophysical and geochemical surveying was carried out over a large area that included the Big Mike property during September and November 1986. Shangri-La Minerals Ltd. conducted the surveys for Alexa Ventures Inc. Results of the survey are not public.

Geological Report

We retained Mr. W. G. Timmins, a professional geologist, to complete an evaluation of the Big Mike property and to prepare a geology report on the claim.

Based on his review, Mr. Timmins concluded that the Big Mike property warrants further exploration due to the geochemistry and inferred geological continuity, as well as the lack of previous exploration.

Mr. Timmins recommends an initial exploration program consisting of two phases. The first phase would consist of staking additional mineral claims adjacent to the property in order to cover potential extensions of mineralization, trenching, stripping and sampling the open cut extension as well as clearing and rehabilitating the main underground adit. Trenching involves removing surface soil using a backhoe or bulldozer. Samples are then taken from the bedrock below and analysed for mineral content. Clearing an rehabilitating refers to removing rock and debris from an adit that has not been explored for some time.

The second phase would consist of drilling of the vein extension. Drilling involves extracting a long cylinder of rock from the ground to determine amounts of metals at different depths. Pieces of the rock obtained, known as drill core, are analysed for mineral content.

The first phase is estimated to cost $25,300 as described below. We anticipate the first phase of exploration will be complete in the autumn of 2005.

19

| Budget – Phase I | | |

| | Stake additional mineral claims | | $ 2,000 |

| | Trenching | | $ 6,000 |

| | Clear and rehabilitate main adit portal | | $10,000 |

| | Room and Board (2 men) | | $ 3,000 |

| | Transportation | | $ 2,000 |

| | | | |

| | | | $23,000 |

| | | | |

| | | Contingency | $ 2,300 |

| | | | |

| | | Total Cost Phase I: | $25,300 |

The second phase would consist of drilling of the vein extension as a precursor to the possibility of extending the adit. The second phase would cost approximately $70,950 as outlined below. We anticipate commencing the second phase of exploration in the spring of 2006. The program will take two months to complete.

Budget – Phase II

| | Diamond Drilling @ $25/ft | | |

| | Estimated: 1,500 feet | | $ 37,500 |

| | Mobilization and demobilization | | $ 8,000 |

| | Assays and Analyses | | $ 4,000 |

| | Supervision, core logging, sampling, etc. | | $ 5,000 |

| | Room and Board | | $ 5,000 |

| | Transportation | | $ 5,000 |

| | | | |

| | | | $ 64,500 |

| | | | |

| | | Contingency | $ 6,450 |

| | | | |

| | | Total Cost Phase II: | $ 70,950 |

*Mobilization is the physical movement of exploration and mining equipment and personnel to the site of proposed exploration. Demobilization is the physical movement of equipment and mining equipment and personnel from the site of proposed exploration after work is completed.

Compliance with Government Regulation

We will be required to comply with all regulations, rules and directives of governmental authorities and agencies applicable to the exploration of minerals in Canada generally, and in British Columbia specifically.

We will have to sustain the cost of reclamation and environmental mediation for all exploration and development work undertaken. The amount of these costs is not known at this time as we do not know the extent of the exploration program that will be undertaken beyond completion of the currently planned work programs. Because there is presently no information on the size, tenor, or quality of any resource or reserve at this time, it is impossible to assess the impact of any capital expenditures on earnings or our competitive position in the event a potentially economic deposit is discovered.

If we enter into production, the cost of complying with permit and regulatory environment laws will be greater than in the exploration phases because the impact on the project area is greater. Permits and regulations will control all aspects of any production program if the project continues to that stage because of the potential impact on the environment. Examples of regulatory requirements include:

| | - | Water discharge will have to meet water standards; |

| |

| | - | Dust generation will have to be minimal or otherwise re-mediated; |

20

| | - | Dumping of material on the surface will have to be re-contoured and re- vegetated; |

| |

| | - | An assessment of all material to be left on the surface will need to be environmentally benign; |

| |

| | - | Ground water will have to be monitored for any potential contaminants; |

| |

| | - | The socio-economic impact of the project will have to be evaluated and if deemed negative, will have to be re-mediated; and |

| |

| | - | There will have to be an impact report of the work on the local fauna and flora. |

Employees

We have no employees as of the date of this prospectus other than our three directors.

Research and Development Expenditures

We have not incurred any other research or development expenditures since our incorporation.

Subsidiaries

We do not have any subsidiaries.

Patents and Trademarks

We do not own, either legally or beneficially, any patents or trademarks.

Reports to Security Holders

Although we are not required to deliver a copy of our annual report to our security holders, we will voluntarily send a copy of our annual report, including audited financial statements, to any registered shareholder who requests it. We will not be a reporting issuer with the Securities and Exchange Commission until our registration statement on Form SB-2 is declared effective.

We have filed a registration statement on Form SB-2, under the Securities Act of 1933, with the Securities and Exchange Commission with respect to the shares of our common stock offered through this prospectus. This prospectus is filed as a part of that registration statement, but does not contain all of the information contained in the registration statement and exhibits. Statements made in the registration statement are summaries of the material terms of the referenced contracts, agreements or documents of the company. We refer you to our registration statement and each exhibit attached to it for a more detailed description of matters involving the company, and the statements we have made in this prospectus are qualified in their entirety by reference to these additional materials. You may inspect the registration statement, exhibits and schedules filed with the Securities and Exchange Commission at the Commission's principal office in Washington, D.C. Copies of all or any part of the registration statement may be obtained from the Public Reference Section of the Securities and Exchange Commission, 100 F Street NE, Washington, D.C. 20002. Please call the Commission at 1-800-SEC-0330 for further information on the operation of the public reference rooms. The Securities and Exchange Commission also maintains a web site at http://www.sec.gov that contains reports, proxy statements and information regarding registrants that file electronically with the Commission. Our registration statement and the referenced exhibits can also be found on this site.

21

Plan Of Operations

Our plan of operation for the next twelve months is to complete the recommended phase one and two exploration programs on the Big Mike property consisting of trenching, stripping and geochemical sampling as well as diamond drilling of the second adit. We anticipate that these exploration programs will cost approximately $25,300 and $70,950 respectively.

We plan to commence the phase one exploration program on the Big Mike property in the late summer or fall of 2005. The program should take one to two months to complete. We will then undertake the phase two work program during the spring of 2006. This program will take approximately two months to complete. We do not have any verbal or written agreement regarding the retention of any qualified engineer or geologist for this exploration program.

As well, we anticipate spending an additional $20,000 on administrative fees, including fees payable in connection with the filing of this registration statement and complying with reporting obligations.

Total expenditures over the next 12 months are therefore expected to be $116,250.

While we have enough funds to cover the phase one exploration program and anticipated administrative fees, we will require additional funding in order to proceed with the phase two exploration program and any additional recommended exploration on the Big Mike property. We anticipate that additional funding will be in the form of equity financing from the sale of our common stock or from director loans. We do not have any arrangements in place for any future equity financing or loans.

We are not aware of any off-balance sheet arrangements which will have a current of future effect on our operations, financial conditions or capital expenditures or resources.

Results Of Operations For The Period From Inception Through April 30, 2005

We have not earned any revenues from our incorporation on February 9, 2005 to April 30, 2005. We do not anticipate earning revenues until we enter into commercial production on the Big Mike property. At this time there is substantial doubt about whether we will ever generate revenues from our operations. We have not completed the exploration stage of our business and can provide no assurance that we will discover economic mineralization on the Big Mike property, or if such minerals are discovered, that we will enter into commercial production.

We incurred operating expenses in the amount of $7,474 for the period from our inception on February 9, 2005 to April 30, 2005. These operating expenses were comprised of exploration costs and expenses of $4,750, professional fees of $2,413, listing and filing fees of $200 and general and administrative expenses of $111.

We have not attained profitable operations and are dependent upon obtaining financing to pursue exploration activities. For these reasons our auditors believe that there is substantial doubt that we will be able to continue as a going concern.

Description Of Property

We own the mineral exploration rights relating to the Big Mike mineral property. We do not own or lease any other property.

Certain Relationships And Related Transactions

None of the following parties has, since our date of incorporation, had any material interest, direct or indirect, in any transaction with us or in any presently proposed transaction that has or will materially affect us:

| * | Any of our directors or officers; |

22

| * | Any person proposed as a nominee for election as a director; |

| |

| * | Any person who beneficially owns, directly or indirectly, shares carrying more than 10% of the voting rights attached to our outstanding shares of common stock; |

| |

| * | Our promoters, Earl Hope and Trevor Herbert; |

| |

| * | Any member of the immediate family of any of the foregoing persons. |

Market For Common Equity And Related Stockholder Matters

No Public Market for Common Stock

There is presently no public market for our common stock. We anticipate applying for trading of our common stock on the over the counter bulletin board upon the effectiveness of the registration statement of which this prospectus forms a part. However, we can provide no assurance that our shares will be traded on the bulletin board or, if traded, that a public market will materialize.

Stockholders of Our Common Shares

As of the date of this registration statement, we have forty-six registered shareholders.

Rule 144 Shares

A total of 6,240,000 shares of our common stock are available for resale to the public after April 26, 2006 in accordance with the volume and trading limitations of Rule 144 of the Act. Of these 6,240,000 shares, a total of 2,240,000 shares are being registered pursuant to this prospectus and therefore will be eligible to be sold when this registration statement is deemed effective. In addition, after April 30, 2006, an additional 1,004,000 shares will become available for resale to the public in accordance with the volume and trading limitations of Rule 144 of the Act. All of these 1,004,000 shares are being registered pursuant to this prospectus and therefore will be eligible to be sold when this registration statement is deemed effective. In general, under Rule 144 as currently in effect, a person who has beneficially owned shares of our common stock for at least one year is entitled to sell within any three month period a number of shares that does not exceed 1% of the number of shares of our common stock then outstanding which, in our case, will equal 72,440 shares as of the date of this prospectus. The following sets forth a table disclosing the dates when of our common shares may be resold in accordance with Rule 144:

| # of Shareholders | Amount of Shares | Date Eligible to be resold pursuant to Rule 144 |

| | | |

| Ten | 6,240,000 shares | April 26, 2006 |

| Thirty-four | 1,004,000 shares | April 30, 2006 |

In general, under Rule 144 as currently in effect, a person who has beneficially owned shares of a company's common stock for at least one year is entitled to sell within any three month period a number of shares that does not exceed the greater of:

| | 1. | 1% of the number of shares of the company's common stock then outstanding which, in our case, will equal 74,240 shares as of the date of this prospectus; or |

| |

| | 2. | the average weekly trading volume of the company's common stock during the four calendar weeks preceding the filing of a notice on Form 144 with respect to the sale. |

Sales under Rule 144 are also subject to manner of sale provisions and notice requirements and to the availability of current public information about the company.

Under Rule 144(k), a person who is not one of the company's affiliates at any time during the three months preceding a sale, and who has beneficially owned the shares proposed to be sold

23

for at least two years, is entitled to sell shares without complying with the manner of sale, public information, volume limitation or notice provisions of Rule 144.

As of the date of this prospectus, persons who are our affiliates hold 4,000,000 shares.

Registration Rights

We have not granted registration rights to the selling shareholders or to any other persons.

Dividends

There are no restrictions in our articles of incorporation or bylaws that prevent us from declaring dividends. The Nevada Revised Statutes, however, do prohibit us from declaring dividends where, after giving effect to the distribution of the dividend:

| | 1. | we would not be able to pay our debts as they become due in the usual course of business; or |

| |

| | 2. | our total assets would be less than the sum of our total liabilities plus the amount that would be needed to satisfy the rights of shareholders who have preferential rights superior to those receiving the distribution. |

We have not declared any dividends, and we do not plan to declare any dividends in the foreseeable future.

Executive Compensation

Summary Compensation Table

The table below summarizes all compensation awarded to, earned by, or paid to our executive officers by any person for all services rendered in all capacities to us for the fiscal period from our inception on February 9, 2005 to April 30, 2005 and the subsequent period to the date of this prospectus.

Annual Compensation

| | | | | | | Restr | Options/ | LTP |

| | | | | | Other | Stock | SARS (#) | payouts |

| Name | Title | Year | Salary | Bonus | Comp. | Awarded | | ($) |

| | President | | | | | | | |

| Earl Hope | CEO & | 2005 | $0 | $0 | $0 | $0 | $0 | $0 |

| | Director | | | | | | | |

| | Sec, | | | | | | | |

| Trevor Herbert | Treas. | 2005 | $0 | $0 | $0 | $0 | 0 | $0 |

| | CFO & | | | | | | | |

| | Director | | | | | | | |

Stock Option Grants

We have not granted any stock options to the executive officers since our inception.

Consulting Agreements

We do not have any employment or consulting agreements with our directors or officers. We do not pay Mr. Hope, Mr. Herbert or Mr. Manning any amount for acting as directors of the Company.

24

Financial Statements

Index to Financial Statements:

25

RIVERBANK RESOURCES INC.

(AN EXPLORATION STAGE COMPANY)

FINANCIAL STATEMENTS

AS OF APRIL 30, 2005

RIVERBANK RESOURCES INC.

(AN EXPLORATION STAGE COMPANY)

CONTENTS

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

To the Board of Directors of:

Riverbank Resources, Inc.

(A Exploration Stage Company)

We have audited the accompanying balance sheet of Riverbank Resources, Inc. (an exploration stage company) as of April 30, 2005 and the related statements of operations, changes in stockholders’ equity and cash flows for the period from February 9, 2005 (inception) to April 30, 2005. These financial statements are the responsibility of the Company’s management. Our responsibility is to express an opinion on these financial statements based on our audit.

We conducted our audit in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements. An audit also includes assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. We believe that our audit provides a reasonable basis for our opinion.

In our opinion, the financial statements referred to above present fairly in all material respects, the financial position of Riverbank Resources, Inc. (a exploration stage company) as of April 30, 2005 and the results of its operations and its cash flows for the period from February 9, 2005 (inception) to April 30, 2005 in conformity with accounting principles generally accepted in the United States of America.

The accompanying financial statements have been prepared assuming that the Company will continue as a going concern. As discussed in Note 4 to the financial statements, the Company is in the exploration stage with no operations and has a negative cash flow from operations of $4,876 from inception. These factors raise substantial doubt about its ability to continue as a going concern. Management’s plans concerning this matter are also described in Note 4. The accompanying financial statements do not include any adjustments that might result from the outcome of this uncertainty.

WEBB & COMPANY, P.A.

Boynton Beach, Florida

June 30, 2005

RIVERBANK RESOURCES INC.

(AN EXPLORATION STAGE COMPANY)

BALANCE SHEET

AS OF APRIL 30, 2005

| ASSETS | | | |

| | | | |

| CURRENT ASSETS | | | |

| Cash | $ | 48,744 | |

| Total Current Assets | | 48,744 | |

| | | | |

| MINERAL RIGHTS, NET | | 3,000 | |

| | | | |

| TOTAL ASSETS | $ | 51,744 | |

| | | | |

| | | | |

| LIABILITIES AND STOCKHOLDERS’ EQUITY | | | |

| | | | |

| CURRENT LIABILITIES | | | |

| Accounts payable and accrued expenses | $ | 2,414 | |

| | | | |

| TOTAL LIABILITIES | | 2,414 | |

| | | | |

| STOCKHOLDERS’ EQUITY | | | |

| Preferred stock, $0.001 par value, 1,000,000 shares authorized, | | | |

| none issued and outstanding | | | |

| Common stock, $0.001 par value, 69,000,000 shares authorized, | | | |

| 7,424,000 shares issued and outstanding | | 7,424 | |

| Additional paid in capital | | 49,196 | |

| Accumulated deficit during exploration stage | | (7,290 | ) |

| Total Stockholders’ Equity | | 49,330 | |

| | | | |

| TOTAL LIABILITIES AND STOCKHOLDERS’ EQUITY | $ | 51,744 | |

See accompanying notes to financial statements.

2

RIVERBANK RESOURCES INC.

(AN EXPLORATION STAGE COMPANY)

STATEMENT OF OPERATIONS

FOR THE PERIOD FROM FEBRUARY 9, 2005 (INCEPTION)

TO APRIL 30, 2005

| OPERATING EXPENSES | | | |

| Professional fees | $ | 2,413 | |

| Exploration costs and expenses | | 4,750 | |

| General and administrative | | 111 | |

| Listing and filing | | 200 | |

| Total Operating Expenses | | 7,474 | |

| | | | |

| LOSS FROM OPERATIONS | | (7,474 | ) |

| | | | |

| OTHER EXPENSE | | | |

| Foreign currency transaction gain | | 184 | |

| | | | |

| Provision for Income Taxes | | - | |

| | | | |

| NET LOSS | $ | (7,290 | ) |

| | | | |

| Net loss per share - basic and diluted | $ | (0.0001 | ) |

| | | | |

| Weighted average number of shares outstanding during the period - | | | |

| basic and diluted | $ | 1,351,550 | |

See accompanying notes to financial statements.

3

RIVERBANK RESOURCES INC.

(AN EXPLORATION STAGE COMPANY)

STATEMENT OF STOCKHOLDERS’EQUITY

FOR THE PERIOD FROM FEBRUARY 9, 2005 (INCEPTION)

TO APRIL 30, 2005

| | | | | | | | | | Accumulated | | | | |

| | | | | | | | | | Deficit | | | | |

| | | | | | | Additional | | | During | | | | |

| Common Stock | | | Paid-In | | | Exploration | | | | |

| Shares | | | Amount | | | Capital | | | Stage | | | Total | |

| | | | | | | | | | | | | | | |

| Common stock issued to founders for cash | | | | | | | | | | | | | | |

| ($0.001 per share) | 6,420,000 | | $ | 6,420 | | $ | - | | $ | - | | $ | 6,420 | |

| | | | | | | | | | | | | | | |

| Common stock issued for cash ($0.05 per share) | 1,004,000 | | | 1,004 | | | 49,196 | | | - | | | 50,200 | |

| | | | | | | | | | | | | | | |

| Net loss for the period from February 9, 2005 | | | | | | | | | | | | | | |

| (inception) to April 30, 2005 | - | | | - | | | - | | | (7,290 | ) | | (7,290 | ) |

| | | | | | | | | | | | | | | |

| BALANCE, APRIL 30, 2005 | 7,424,000 | | $ | 7,424 | | $ | 49,196 | | $ | (7,290 | ) | $ | 49,330 | |

See accompanying notes to financial statements.

4

RIVERBANK RESOURCES INC.

(AN EXPLORATION STAGE COMPANY)

STATEMENTS OF CASH FLOWS

FOR THE PERIOD FROM FEBRUARY 9, 2005 (INCEPTION)

TO APRIL 30, 2005

| CASH FLOWS FROM OPERATING ACTIVITIES: | | | |

| Net loss | $ | (7,290 | ) |

| Adjustments to reconcile net loss to net cash used in operating activities: | | | |

| Changes in operating assets and liabilities: | | | |

| Accounts payable | | 2,414 | |

| Net Cash Used In Operating Activities | | (4,876 | ) |

| | | | |

| CASH FLOWS FROM INVESTING ACTIVITIES | | | |

| Purchase of mineral rights | | (3,000 | ) |

| Net Cash Used In Investing Activities | | (3,000 | ) |

| | | | |

| CASH FLOWS FROM FINANCING ACTIVITIES | | | |

| Proceeds from issuance of common stock | | 56,620 | |

| Net Cash Provided By Financing Activities | | 56,620 | |

| | | | |

| NET INCREASE IN CASH | | 48,744 | |

| | | | |

| CASH AND CASH EQUIVALENTS AT BEGINNING OF PERIOD | | - | |

| | | | |

| CASH AND CASH EQUIVALENTS AT END OF PERIOD | $ | 48,744 | |

See accompanying notes to financial statements.

5

RIVERBANK RESOURCES INC.

(AN EXPLORATION STAGE COMPANY)

NOTES TO FINANCIAL STATEMENTS

AS OF APRIL 30, 2005