UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number: 811-21784

| Name of Fund: | BlackRock Enhanced Equity Dividend Trust (BDJ) |

| Fund Address: | 100 Bellevue Parkway, Wilmington, DE 19809 |

Name and address of agent for service: John M. Perlowski, Chief Executive Officer, BlackRock Enhanced Equity Dividend Trust, 55 East 52nd Street, New York, NY 10055

Registrant’s telephone number, including area code: (800) 882-0052, Option 4

Date of fiscal year end: 12/31/2021

Date of reporting period: 06/30/2021

| Item 1 – | Report to Stockholders |

(a) The Report to Shareholders is attached herewith.

| JUNE 30, 2021 |

2021 Semi-Annual Report (Unaudited)

| ||

BlackRock Energy and Resources Trust (BGR)

BlackRock Enhanced Capital and Income Fund, Inc. (CII)

BlackRock Enhanced Equity Dividend Trust (BDJ)

BlackRock Enhanced Global Dividend Trust (BOE)

BlackRock Enhanced International Dividend Trust (BGY)

BlackRock Health Sciences Trust (BME)

BlackRock Health Sciences Trust II (BMEZ)

BlackRock Innovation and Growth Trust (BIGZ)

BlackRock Resources & Commodities Strategy Trust (BCX)

BlackRock Science and Technology Trust (BST)

BlackRock Science and Technology Trust II (BSTZ)

BlackRock Utilities, Infrastructure & Power Opportunities Trust (BUI)

| Not FDIC Insured • May Lose Value • No Bank Guarantee |

Supplemental Information (unaudited)

Section 19(a) Notices

BlackRock Energy and Resources Trust’s (BGR), BlackRock Enhanced Capital and Income Fund, Inc.’s (CII), BlackRock Enhanced Equity Dividend Trust’s (BDJ), BlackRock Enhanced Global Dividend Trust’s (BOE), BlackRock Enhanced International Dividend Trust’s (BGY), BlackRock Health Sciences Trust’s (BME), BlackRock Health Sciences Trust II’s (BMEZ), BlackRock Innovation and Growth Trust’s (BIGZ), BlackRock Resources & Commodities Strategy Trust’s (BCX), BlackRock Science and Technology Trust’s (BST), BlackRock Science and Technology Trust II’s (BSTZ) and BlackRock Utilities, Infrastructure & Power Opportunities Trust’s (BUI) (collectively, the “Trusts”, or individually a “Trust”) amounts and sources of distributions reported are estimates and are being provided to you pursuant to regulatory requirements and are not being provided for tax reporting purposes. The actual amounts and sources for tax reporting purposes will depend upon each Trust’s investment experience during the remainder of its fiscal year and may be subject to changes based on tax regulations. Each Trust will provide a Form 1099-DIV each calendar year that will tell you how to report these distributions for U.S. federal income tax purposes.

June 30, 2021

| Total Cumulative Distributions for the Fiscal Period | % Breakdown of the Total Cumulative Distributions for the Fiscal Period | |||||||||||||||||||||||||||||||||||||||

Trust Name | | Net Income |

| | Net Realized Capital Gains Short-Term | | | Net Realized Capital Gains Long-Term | | | Return of Capital | (a) | | Total Per Common Share | | | Net Income | | | Net Realized Capital Gains Short-Term | | | Net Realized Capital Gains Long-Term | | | Return of Capital | | | Total Per Common Share | | ||||||||||

BGR | $ | 0.153140 | $ | — | $ | — | $ | 0.071860 | $ | 0.225000 | | 68 | % | — | % | — | % | 32 | % | 100 | % | |||||||||||||||||||

CII | 0.029888 | — | 0.495112 | — | 0.525000 | 6 | — | 94 | — | 100 | ||||||||||||||||||||||||||||||

BDJ | 0.229141 | — | 0.070859 | — | 0.300000 | 76 | — | 24 | — | 100 | ||||||||||||||||||||||||||||||

BOE | 0.117999 | 0.017791 | 0.242210 | — | 0.378000 | 31 | 5 | 64 | — | 100 | ||||||||||||||||||||||||||||||

BGY | 0.101324 | — | 0.101476 | — | 0.202800 | 50 | — | 50 | — | 100 | ||||||||||||||||||||||||||||||

BME | 0.005112 | 0.042915 | 1.151973 | — | 1.200000 | — | 4 | 96 | — | 100 | ||||||||||||||||||||||||||||||

BMEZ | — | 0.780000 | — | — | 0.780000 | — | 100 | — | — | 100 | ||||||||||||||||||||||||||||||

BIGZ | — | — | — | 0.100000 | 0.100000 | — | — | — | 100 | 100 | ||||||||||||||||||||||||||||||

BCX | 0.116959 | — | — | 0.123041 | 0.240000 | 49 | — | — | 51 | 100 | ||||||||||||||||||||||||||||||

BST | — | 0.064543 | 1.213457 | — | 1.278000 | — | 5 | 95 | — | 100 | ||||||||||||||||||||||||||||||

BSTZ | — | 0.508730 | 0.405270 | — | 0.914000 | — | 56 | 44 | — | 100 | ||||||||||||||||||||||||||||||

BUI | 0.219802 | — | 0.150526 | 0.355672 | 0.726000 | 30 | — | 21 | 49 | 100 | ||||||||||||||||||||||||||||||

| (a) | Each Trust estimates that it has distributed more than its net income and net realized capital gains; therefore, a portion of the distribution may be a return of capital. A return of capital may occur, for example, when some or all of the shareholder’s investment in a Trust is returned to the shareholder. A return of capital does not necessarily reflect a Trust’s investment performance and should not be confused with “yield” or “income.” When distributions exceed total return performance, the difference will reduce a Trust’s net asset value per share. |

Section 19(a) notices for the Trusts, as applicable, are available on the BlackRock website at blackrock.com.

Section 19(b) Disclosure

The Trusts, acting pursuant to a U.S. Securities and Exchange Commission (“SEC”) exemptive order and with the approval of each Trust’s Board of Trustees (the “Board”), each have adopted a managed distribution plan, consistent with its investment objectives and policies to support a level distribution of income, capital gains and/or return of capital (the “Plan”). In accordance with the Plans, the Trusts currently distribute the following fixed amounts per share on a monthly basis:

| Exchange Symbol | Amount Per Common Share | |||

BGR | $ | 0.0375 | ||

CII | 0.0875 | |||

BDJ | 0.0500 | |||

BOE | 0.0630 | |||

BGY | 0.0338 | |||

BME | 0.2000 | |||

BMEZ | 0.1450 | |||

BIGZ | 0.1000 | |||

BCX | 0.0400 | |||

BST | 0.2260 | |||

BSTZ | 0.1710 | |||

BUI | 0.1210 | |||

The fixed amounts distributed per share are subject to change at the discretion of each Trust’s Board. Under its Plan, each Trust will distribute all available net income to its shareholders as required by the Internal Revenue Code of 1986, as amended (the “Code”). If sufficient income (inclusive of net income and short-term capital gains) is not earned on a monthly basis, the Trusts will distribute long-term capital gains and/or return of capital to shareholders in order to maintain a level distribution. Each monthly distribution to shareholders is expected to be at the fixed amount established by the Board; however, each Trust may make additional distributions from time to time, including additional capital gain distributions at the end of the taxable year, if required to meet requirements imposed by the Code and/or the Investment Company Act of 1940, as amended (the “1940 Act”).

Shareholders should not draw any conclusions about each Trust’s investment performance from the amount of these distributions or from the terms of the Plan. Each Trust’s total return performance is presented in its financial highlights table.

| 2 | 2 0 2 1 BLACK ROCK SEMI - ANNUAL REPORT TO SHAREHOLDERS |

Supplemental Information (unaudited) (continued)

The Board may amend, suspend or terminate a Trust’s Plan at any time without prior notice to the Trust’s shareholders if it deems such actions to be in the best interests of the Trust or its shareholders. The suspension or termination of the Plan could have the effect of creating a trading discount (if the Trust’s stock is trading at or above net asset value) or widening an existing trading discount. The Trusts are subject to risks that could have an adverse impact on their ability to maintain level distributions. Examples of potential risks include, but are not limited to, economic downturns impacting the markets, changes in interest rates, decreased market volatility, companies suspending or decreasing corporate dividend distributions and changes in the Code. Please refer to BME, BST and BUI’s prospectuses for a more complete description of each Trust’s risks.

S U P P L E M E N T A L I N F O R M A T I O N | 3 |

Dear Shareholder,

The 12-month reporting period as of June 30, 2021 was a remarkable period of adaptation and recovery, as the global economy dealt with the implications of the coronavirus (or “COVID-19”) pandemic. The United States, along with most of the world, began the reporting period emerging from a severe recession, prompted by pandemic-related restrictions that disrupted many aspects of daily life. However, easing restrictions and robust government intervention led to a strong rebound, and the economy grew at a significant pace for the reporting period, recovering much of the output lost at the beginning of the pandemic.

Equity prices rose with the broader economy, as investors became increasingly optimistic about the economic outlook. Stocks rose through the summer of 2020, fed by strong fiscal and monetary support and positive economic indicators. The implementation of mass vaccination campaigns and passage of an additional $1.9 trillion of fiscal stimulus further boosted stocks, and many equity indices neared or surpassed all-time highs late in the reporting period. In the United States, both large- and small-capitalization stocks posted a significant advance. International equities also gained, as both developed countries and emerging markets rebounded substantially.

The 10-year U.S. Treasury yield (which is inversely related to bond prices) had fallen sharply prior to the beginning of the reporting period, which meant bonds were priced for extreme risk avoidance and economic disruption. Despite expectations of doom and gloom, the economy expanded rapidly, stoking inflation concerns in early 2021, which led to higher yields and a negative overall return for most U.S. Treasuries. In the corporate bond market, support from the U.S. Federal Reserve (the “Fed”) assuaged credit concerns and led to substantial returns for high-yield corporate bonds, although investment-grade corporates declined slightly.

The Fed remained committed to accommodative monetary policy by maintaining near zero interest rates and by reiterating that inflation could exceed its 2% target for a sustained period without triggering a rate increase. Late in the period the Fed elaborated on their expected timeline, raising the likelihood of slower bond purchasing and the possibility of higher rates in 2023.

Looking ahead, while coronavirus-related disruptions have clearly hindered worldwide economic growth, we believe that the global expansion will continue to accelerate as vaccination efforts ramp up and pent-up consumer demand leads to higher spending. While we expect inflation to increase somewhat as the expansion continues, we believe the recent uptick owes more to temporary supply disruptions than a lasting change in fundamentals. The change in Fed policy also means that moderate inflation is less likely to be followed by interest rate hikes that could threaten the economic expansion.

Overall, we favor a moderately positive stance toward risk, with an overweight in equities. Sectors that are better poised to manage the transition to a lower-carbon world, such as technology and healthcare, are particularly attractive in the long-term. U.S. small-caps and European equities are likely to benefit from the continuing vaccine-led restart. We are underweight long-term on credit, but inflation-protected U.S. Treasuries, Asian fixed income, and Chinese government bonds offer potential opportunities. We believe that international diversification and a focus on sustainability can help provide portfolio resilience, and the disruption created by the coronavirus appears to be accelerating the shift toward sustainable investments.

In this environment, our view is that investors need to think globally, extend their scope across a broad array of asset classes, and be nimble as market conditions change. We encourage you to talk with your financial advisor and visit blackrock.com for further insight about investing in today’s markets.

Sincerely,

Rob Kapito

President, BlackRock Advisors, LLC

Rob Kapito

President, BlackRock Advisors, LLC

| Total Returns as of June 30, 2021 | ||||

| 6-Month | 12-Month | |||

U.S. large cap equities | 15.25% | 40.79% | ||

U.S. small cap equities | 17.54 | 62.03 | ||

International equities | 8.83 | 32.35 | ||

Emerging market equities | 7.45 | 40.90 | ||

3-month Treasury bills | 0.02 | 0.09 | ||

U.S. Treasury securities | (4.10) | (5.89) | ||

U.S. investment grade bonds | (1.60) | (0.33) | ||

Tax-exempt municipal bonds | 1.24 | 4.20 | ||

U.S. high yield bonds | 3.61 | 15.34 | ||

| Past performance is not an indication of future results. Index performance is shown for illustrative purposes only. You cannot invest directly in an index. | ||||

| 4 | THIS PAGE IS NOT PART OF YOUR FUND REPORT |

| Page | ||||

| 2 | ||||

| 4 | ||||

| 6 | ||||

| 6 | ||||

Semi-Annual Report: | ||||

| 7 | ||||

Financial Statements: | ||||

| 42 | ||||

| 138 | ||||

| 141 | ||||

| 144 | ||||

| 150 | ||||

| 153 | ||||

| 165 | ||||

Disclosure of Investment Advisory Agreements and Sub-Advisory Agreements | 178 | |||

| 183 | ||||

| 186 | ||||

| 189 | ||||

| 5 |

Overview

In general, the goal of each of the Trusts is to provide total return through a combination of current income and realized and unrealized gains (capital appreciation). The Trusts seek to pursue these goals primarily by investing in a portfolio of equity securities and also by employing a strategy of writing (selling) call and put options in an effort to generate current gains from option premiums and to enhance each Trust’s risk-adjusted return. Each Trust’s objectives cannot be achieved in all market conditions.

Each Trust primarily writes single stock covered call options, and may also from time to time write single stock put options. When writing (selling) a covered call option, a Trust holds an underlying equity security and enters into an option transaction which allows the counterparty to purchase the equity security at an agreed-upon price (“strike price”) within an agreed-upon time period. The Trust receives cash premiums from the counterparties upon writing (selling) the option, which along with net investment income and net realized gains, if any, are generally available to support current or future distributions paid by the Trust. During the option term, the counterparty may elect to exercise the option if the market value of the equity security rises above the strike price, and the Trust is obligated to sell the equity security to the counterparty at the strike price, realizing a gain or loss. Premiums received increase gains or reduce losses realized on the sale of the equity security. If the option remains unexercised upon its expiration, the Trust realizes gains equal to the premiums received. Alternatively, an option may be closed out by an offsetting purchase or sale of an option prior to expiration. The Trust realizes a capital gain from a closing purchase or sale transaction if the premium paid is less than the premium received from writing the option. The Trust realizes a capital loss from a closing purchase or sale transaction if the premium received is less than the premium paid to purchase the option.

Writing covered call options entails certain risks, which include, but are not limited to, the following: an increase in the value of the underlying equity security above the strike price can result in the exercise of a written option (sale by a Trust to the counterparty) when the Trust might not otherwise have sold the security; exercise of the option by the counterparty may result in a sale below the current market value and a gain or loss being realized by the Trust; and limiting the potential appreciation that could be realized on the underlying equity security to the extent of the strike price of the option. The premium that a Trust receives from writing a covered call option may not be sufficient to offset the potential appreciation on the underlying equity security above the strike price of the option that could have otherwise been realized by the Trust. As such, an option over-writing strategy may outperform the general equity market in flat or falling markets but underperform in rising markets.

Option Over-Writing Strategy Illustration

To illustrate these concepts, assume the following: (1) a common stock purchased at and currently trading at $37.15 per share; (2) a three-month call option is written by a Trust with a strike price of $40 (i.e., 7.7% higher than the current market price); and (3) the Trust receives $2.45, or 6.6% of the common stock’s value, as a premium. If the stock price remains unchanged, the option expires and there would be a 6.6% return for the three-month period. If the stock were to decline in price by 6.6% (i.e., decline to $34.70 per share), the option strategy would “break-even” from an economic perspective resulting in neither a gain nor a loss. If the stock were to climb to a price of $40 or above, the option would be exercised and the stock would return 7.7% coupled with the option premium received of 6.6% for a total return of 14.3%. Under this scenario, the Trust loses the benefit of any appreciation of the stock above $40, and thus is limited to a 14.3% total return. The premium from writing the call option serves to offset some of the unrealized loss on the stock in the event that the price of the stock declines, but if the stock were to decline more than 6.6% under this scenario, the Trust’s downside protection is eliminated and the stock could eventually become worthless.

Each Trust intends to write covered call and other options to varying degrees depending upon market conditions. Please refer to each Trust’s Schedule of Investments and the Notes to Financial Statements for details of written options.

Derivative Financial Instruments

The Trusts may invest in various derivative financial instruments. These instruments are used to obtain exposure to a security, commodity, index, market, and/or other assets without owning or taking physical custody of securities, commodities and/or other referenced assets or to manage market, equity, credit, interest rate, foreign currency exchange rate, commodity and/or other risks. Derivative financial instruments may give rise to a form of economic leverage and involve risks, including the imperfect correlation between the value of a derivative financial instrument and the underlying asset, possible default of the counterparty to the transaction or illiquidity of the instrument. The Trusts’ successful use of a derivative financial instrument depends on the investment adviser’s ability to predict pertinent market movements accurately, which cannot be assured. The use of these instruments may result in losses greater than if they had not been used, may limit the amount of appreciation a Trust can realize on an investment and/or may result in lower distributions paid to shareholders. The Trusts’ investments in these instruments, if any, are discussed in detail in the Notes to Financial Statements.

| 6 | 2 0 2 1 BLACK ROCK SEMI - ANNUAL REPORT TO SHAREHOLDERS |

| Trust Summary as of June 30, 2021 | BlackRock Energy and Resources Trust (BGR) |

Investment Objective

BlackRock Energy and Resources Trust’s (BGR) (the “Trust”) investment objective is to provide total return through a combination of current income and long-term capital appreciation. The Trust seeks to achieve its investment objective by investing, under normal market conditions, at least 80% of its total assets in equity securities of energy and natural resources companies and equity derivatives with exposure to the energy and natural resources industry. The Trust may invest directly in such securities or synthetically through the use of derivatives. The Trust seeks to pursue this goal primarily by investing in a portfolio of equity securities and also by employing a strategy of writing (selling) call and put options.

No assurance can be given that the Trust’s investment objective will be achieved.

Trust Information

Symbol on New York Stock Exchange | BGR | |

Initial Offering Date | December 29, 2004 | |

Current Distribution Rate on Closing Market Price as of June 30, 2021 ($9.81)(a) | 4.59% | |

Current Monthly Distribution per Common Share(b) | $0.0375 | |

Current Annualized Distribution per Common Share(b) | $0.4500 |

| (a) | Current distribution rate on closing market price is calculated by dividing the current annualized distribution per share by the closing market price. The current distribution rate may consist of income, net realized gains and/or a return of capital. Past performance is not an indication of future results. |

| (b) | The distribution rate is not constant and is subject to change. A portion of the distribution may be deemed a return of capital or net realized gain. |

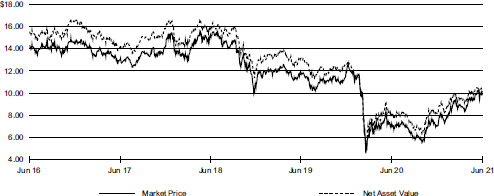

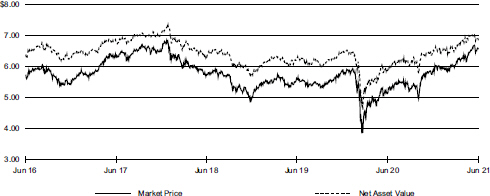

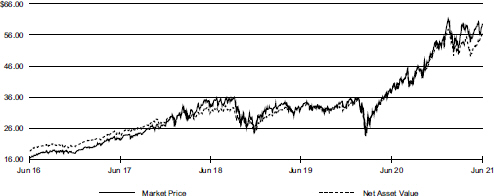

Market Price and Net Asset Value Per Share Summary

| 06/30/21 | 12/31/20 | Change | High | Low | ||||||||||||||||

Market Price | $ | 9.81 | $ | 7.10 | 38.17 | % | $ | 10.37 | $ | 7.02 | ||||||||||

Net Asset Value | 10.19 | 8.17 | 24.72 | 10.54 | 8.17 | |||||||||||||||

Market Price and Net Asset Value History for the Past Five Years

TRUST SUMMARY | 7 |

| Trust Summary as of June 30, 2021 (continued) | BlackRock Energy and Resources Trust (BGR) |

Performance and Portfolio Management Commentary

Returns for the six months ended June 30, 2021 were as follows:

| Returns Based On | ||||||||

| Market Price | NAV | |||||||

BGR(a)(b) | 41.66 | % | 27.87 | % | ||||

MSCI World Energy Call Overwrite Index(c) | N/A | 30.85 | ||||||

| (a) | All returns reflect reinvestment of dividends and/or distributions at actual reinvestment prices. |

| (b) | The Trust’s discount to NAV narrowed during the period, which accounts for the difference between performance based on market price and performance based on NAV. |

| (c) | MSCI World Energy Call Overwrite Index incorporates an option overlay component on the MSCI World Energy Index with a 33% overwrite level. |

N/A — Not applicable as the index does not have a market price.

Past performance is not an indication of future results.

Performance results may include adjustments made for financial reporting purposes in accordance with U.S. generally accepted accounting principles.

The following discussion relates to the Trust’s absolute performance based on NAV:

What factors influenced performance?

Energy stocks delivered strong returns in the past six months. The uptrend began in November 2020, prior to the beginning of the reporting period, when the release of a vaccine for the coronavirus provided a path to a re-opening of the global economy. Oil prices rallied on expectations of improving demand, leading to an impressive gain for the energy sector.

While the Trust produced a robust absolute return for the period, from an allocation standpoint, an underweight position in the integrated sub-sector detracted from performance. On the other hand, an overweight in the exploration and production (“E&P”) sub-sector contributed positively. Stock selection in the refining and marketing category was an additional contributor.

Among individual holdings, a position in the Brazilian state-owned integrated oil producer Petroleo Brasileiro SA, was the largest detractor from performance. The stock declined following an unexpected change in the company’s chief executive officer, which the market saw as the first step in deeper government influence in its longer-term strategy. An underweight in Exxon Mobil Corp., a large index component that outpaced its sector peers on the strength of improving earnings, also detracted.

An overweight position in the Canadian oil and gas producer Tourmaline Oil Corp. was a top contributor. The company announced the purchase of privately owned Black Swan Energy, a move that was well received by investors. An overweight in the exploration and production company Arc Resources, Ltd., which reported strong results, also contributed to returns. A zero weighting in the Finland-based refiner Neste oyj—which lagged after reporting weaker-than-expected guidance—was a further positive.

The Trust utilized an options overlay strategy in which calls are written on a portion of the portfolio’s holdings. The Trust’s options overlay strategy contributed positively to relative performance for the six-month period.

Describe recent portfolio activity.

The Trust selectively added to exploration & production companies, based on its view that global oil demand was steadily recovering. The Trust also rotated exposure in the integrated oil industry in an effort to capitalize on differences in relative performance. The investment adviser remains biased toward higher-quality oil producers, which it expects can benefit from continued strength in oil prices.

Describe portfolio positioning at period end.

The integrated energy sub-sector represented the Trust’s largest allocation, followed by the exploration & production, distribution, refining & marketing and oil services industries, respectively.

At period end, the Trust was overweight in the exploration & production industry. This positioning reflects the investment adviser’s tilt toward higher-quality producers. On the other hand, the Trust was underweight in distribution and oil services industries. The investment adviser believes many parts of the oil services sub-sector may continue to face headwinds due to the overcapacity built in the last upcycle.

As of June 30, 2021, the Trust had in place an option overwriting program whereby 34.4% of the underlying equities were overwritten with call options. These call options were typically written at prices above the prevailing market prices (estimated to be 3% out of the money) with an average time until expiration of 52 days.

The views expressed reflect the opinions of BlackRock as of the date of this report and are subject to change based on changes in market, economic or other conditions. These views are not intended to be a forecast of future events and are no guarantee of future results.

| 8 | 2 0 2 1 BLACK ROCK SEMI - ANNUAL REPORT TO SHAREHOLDERS |

| Trust Summary as of June 30, 2021 (continued) | BlackRock Energy and Resources Trust (BGR) |

Overview of the Trust’s Total Investments

TEN LARGEST HOLDINGS

| Security(a) | Percent of Total Investments | |||

Chevron Corp. | 13 | % | ||

Royal Dutch Shell PLC | 11 | |||

TotalEnergies SE | 8 | |||

ConocoPhillips | 7 | |||

Exxon Mobil Corp. | 7 | |||

Canadian Natural Resources Ltd. | 4 | |||

Suncor Energy, Inc. | 4 | |||

Pioneer Natural Resources Co. | 4 | |||

Hess Corp. | 4 | |||

Valero Energy Corp. | 3 | |||

INDUSTRY ALLOCATION

| Industry(a)(b) | 06/30/21 | 12/31/20 | ||||||

Oil, Gas & Consumable Fuels | 97 | % | 96 | % | ||||

Energy Equipment & Services | 2 | 4 | ||||||

Food Products | 1 | — | ||||||

| (a) | Excludes short-term securities and options written. |

| (b) | For Trust compliance purposes, the Trust’s industry classifications refer to one or more of the industry sub-classifications used by one or more widely recognized market indexes or ratings group indexes, and/or as defined by the investment adviser. These definitions may not apply for purposes of this report, which may combine such industry sub-classifications for reporting ease. |

TRUST SUMMARY | 9 |

| Trust Summary as of June 30, 2021 | BlackRock Enhanced Capital and Income Fund, Inc. (CII) |

Investment Objective

BlackRock Enhanced Capital and Income Fund, Inc.’s (CII) (the “Trust”) investment objective is to provide current income and capital appreciation. The Trust seeks to achieve its investment objective by investing in a portfolio of equity securities of U.S. and foreign issuers. The Trust may invest directly in such securities or synthetically through the use of derivatives. The Trust also seeks to achieve its investment objective by employing a strategy of writing (selling) call and put options.

No assurance can be given that the Trust’s investment objective will be achieved.

Trust Information

Symbol on New York Stock Exchange | CII | |

Initial Offering Date | April 30, 2004 | |

Current Distribution Rate on Closing Market Price as of June 30, 2021 ($20.59)(a) | 5.10% | |

Current Monthly Distribution per Common Share(b) | $ 0.0875 | |

Current Annualized Distribution per Common Share(b) | $ 1.0500 |

| (a) | Current distribution rate on closing market price is calculated by dividing the current annualized distribution per share by the closing market price. Past performance is not an indication of future results. |

| (b) | The monthly distribution per Common Share, declared on July 1, 2021, was increased to $0.0930 per share. The yield on closing market price, tax equivalent yield, current monthly distribution per Common Share, and current annualized distribution per Common Share do not reflect the new distribution rate. The new distribution rate is not constant and is subject to change in the future. |

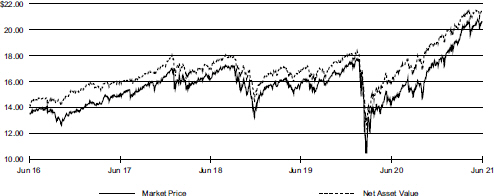

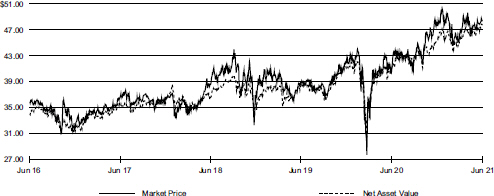

Market Price and Net Asset Value Per Share Summary

| 06/30/21 | 12/31/20 | Change | High | Low | ||||||||||||||||

Market Price | $ | 20.59 | $ | 17.40 | 18.33 | % | $ | 20.84 | $ | 17.14 | ||||||||||

Net Asset Value | 21.44 | 19.12 | 12.13 | 21.58 | 18.93 | |||||||||||||||

Market Price and Net Asset Value History for the Past Five Years

| 10 | 2 0 2 1 BLACK ROCK SEMI - ANNUAL REPORT TO SHAREHOLDERS |

| Trust Summary as of June 30, 2021 (continued) | BlackRock Enhanced Capital and Income Fund, Inc. (CII) |

Performance and Portfolio Management Commentary

Returns for the six months ended June 30, 2021 were as follows:

| Returns Based On | ||||||||

| Market Price | NAV | |||||||

CII(a)(b) | 21.54 | % | 15.17 | % | ||||

MSCI USA Call Overwrite Index(c) | N/A | 13.18 | ||||||

| (a) | All returns reflect reinvestment of dividends and/or distributions at actual reinvestment prices. |

| (b) | The Trust’s discount to NAV narrowed during the period, which accounts for the difference between performance based on market price and performance based on NAV. (c) MSCI USA Call Overwrite Index incorporates an option overlay component on the MSCI USA Index with a 55% overwrite level. |

N/A — Not applicable as the index does not have a market price.

Past performance is not an indication of future results.

Performance results may include adjustments made for financial reporting purposes in accordance with U.S. generally accepted accounting principles.

The following discussion relates to the Trust’s absolute performance based on NAV:

What factors influenced performance?

The largest contributor to the Trust’s performance was a combination of stock selection and an overweight allocation to the communication services sector. Most notably, stock selection and an overweight allocation to the interactive media & services industry proved beneficial. Stock selection and an underweight allocation to the entertainment industry and an underweight position in diversified telecommunication services companies also boosted performance in the sector. In financials, stock selection and an overweight allocation to the consumer finance industry boosted the Trust’s return. Other notable contributors during the period included stock selection in health care and an underweight allocation to the utilities sector.

The largest detractor from returns came from the Trust’s investment decisions in the consumer discretionary sector. Notably, stock selection in the multiline retail industry proved costly, as did stock selection and an overweight allocation to internet & direct marketing retail companies. Within materials, the Trust’s decision not to invest in the metals & mining industry weighed on from results. Other detractors at the industry level included stock selection within the information technology (“IT”) sector in IT services, as well as personal products companies within consumer staples.

The Trust utilized an options overlay strategy in which calls are written on a portion of the portfolio’s holdings. The Trust’s options overlay strategy detracted from relative performance for the six-month period.

Describe recent portfolio activity.

During the period, a combination of portfolio trading activity and market price changes resulted in the Trust adding exposure to the consumer discretionary, communication services, and energy sectors. The Trust reduced exposure to consumer staples, IT, and industrials.

Describe portfolio positioning at period end.

At period end, the Trust’s largest absolute allocations were to the IT, consumer discretionary, and communication services sectors. Relative to the benchmark, the Trust’s most significant overweight exposures were to the communication services, consumer discretionary, and financials sectors. The Trust maintained its most significant relative underweight sector exposures to consumer staples, utilities, and real estate.

As of June 30, 2021, the Trust had an options overwriting program in place whereby approximately 47% of the underlying equities were overwritten with call options. These call options were typically written at prices above prevailing market prices (estimated to be 2.8% out of the money) with an average time until expiration of 51 days.

The views expressed reflect the opinions of BlackRock as of the date of this report and are subject to change based on changes in market, economic or other conditions. These views are not intended to be a forecast of future events and are no guarantee of future results.

TRUST SUMMARY | 11 |

| Trust Summary as of June 30, 2021 (continued) | BlackRock Enhanced Capital and Income Fund, Inc. (CII) |

Overview of the Trust’s Total Investments

TEN LARGEST HOLDINGS

| Security(a) | Percent of Total Investments | |||

Microsoft Corp. | 7 | % | ||

Alphabet, Inc. | 6 | |||

Amazon.com, Inc. | 6 | |||

Apple, Inc. | 4 | |||

Facebook, Inc. | 4 | |||

Visa, Inc. | 3 | |||

UnitedHealth Group, Inc. | 3 | |||

Applied Materials, Inc. | 3 | |||

Comcast Corp. | 3 | |||

Berkshire Hathaway, Inc. | 2 | |||

SECTOR ALLOCATION

| Sector(a)(b) | 06/30/21 | 12/31/20 | ||||||

Information Technology | 27 | % | 29 | % | ||||

Consumer Discretionary. | 16 | 14 | ||||||

Communication Services | 15 | 14 | ||||||

Financials | 12 | 12 | ||||||

Health Care | 11 | 11 | ||||||

Industrials | 7 | 8 | ||||||

Materials | 4 | 3 | ||||||

Energy | 4 | 3 | ||||||

Consumer Staples | 3 | 5 | ||||||

Real Estate | 1 | 1 | ||||||

| (a) | Excludes short-term securities and options written. |

| (b) | For Trust compliance purposes, the Trust’s sector classifications refer to one or more of the sector sub-classifications used by one or more widely recognized market indexes or rating group indexes, and/or as defined by the investment adviser. These definitions may not apply for purposes of this report, which may combine such sector sub-classifications for reporting ease. |

| 12 | 2 0 2 1 BLACK ROCK SEMI - ANNUAL REPORT TO SHAREHOLDERS |

| Trust Summary as of June 30, 2021 | BlackRock Enhanced Equity Dividend Trust (BDJ) |

Investment Objective

BlackRock Enhanced Equity Dividend Trust’s (BDJ) (the “Trust”) primary investment objective is to provide current income and current gains, with a secondary investment objective of long-term capital appreciation. The Trust seeks to achieve its investment objectives by investing in common stocks that pay dividends and have the potential for capital appreciation and by employing a strategy of writing (selling) call and put options. The Trust invests, under normal market conditions, at least 80% of its total assets in dividend paying equities. The Trust may invest directly in such securities or synthetically through the use of derivatives.

No assurance can be given that the Trust’s investment objectives will be achieved.

Trust Information

Symbol on New York Stock Exchange | BDJ | |

Initial Offering Date | August 31, 2005 | |

Current Distribution Rate on Closing Market Price as of June 30, 2021 ($10.13)(a) | 5.92% | |

Current Monthly Distribution per Common Share(b) | $0.0500 | |

Current Annualized Distribution per Common Share(b) | $0.6000 |

| (a) | Current distribution rate on closing market price is calculated by dividing the current annualized distribution per share by the closing market price. Past performance is not an indication of future results. |

| (b) | The distribution rate is not constant and is subject to change. |

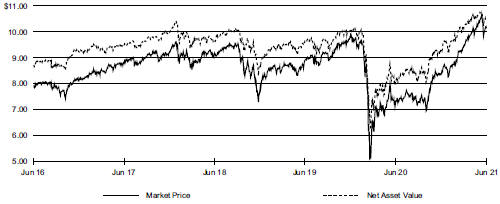

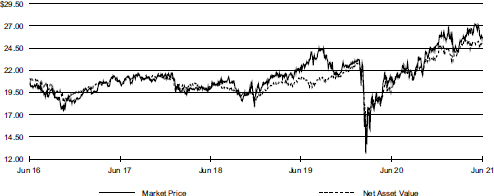

Market Price and Net Asset Value Per Share Summary

| 06/30/21 | 12/31/20 | Change | High | Low | ||||||||||||||||

Market Price | $ | 10.13 | $ | 8.47 | 19.60 | % | $ | 10.68 | $ | 8.22 | ||||||||||

Net Asset Value | 10.44 | 9.35 | 11.66 | 10.75 | 9.17 | |||||||||||||||

Market Price and Net Asset Value History for the Past Five Years

TRUST SUMMARY | 13 |

| Trust Summary as of June 30, 2021 (continued) | BlackRock Enhanced Equity Dividend Trust (BDJ) |

Performance and Portfolio Management Commentary

Returns for the six months ended June 30, 2021 were as follows:

| Returns Based On | ||||||||

| Market Price | NAV | |||||||

BDJ(a)(b) | 23.41 | % | 15.22 | % | ||||

MSCI USA Value Call Overwrite Index(c) | N/A | 15.09 | ||||||

| (a) | All returns reflect reinvestment of dividends and/or distributions at actual reinvestment prices. |

| (b) | The Trust’s discount to NAV narrowed during the period, which accounts for the difference between performance based on market price and performance based on NAV. |

| (c) | MSCI USA Value Call Overwrite Index incorporates an option overlay component on the MSCI USA Value Index with a 55% overwrite level. |

N/A — Not applicable as the index does not have a market price.

Past performance is not an indication of future results.

Performance results may include adjustments made for financial reporting purposes in accordance with U.S. generally accepted accounting principles.

The following discussion relates to the Trust’s absolute performance based on NAV:

What factors influenced performance?

The largest contributor to the Trust’s performance was a combination of stock selection and an overweight allocation to financials. In particular, stock selection and overweight allocations to the banks and capital markets industries proved beneficial, as did stock selection in insurance. In energy, stock selection and an overweight allocation to the oil & gas refining & marketing sub-industry boosted the Trust’s return, as did an overweight position in companies engaged in the oil & gas storage & transportation and exploration & production businesses. Other modest contributors during the period included underweight allocations to the utilities and communication services sectors.

The largest detractor from returns came from the Trust’s stock selection in the information technology (“IT”) sector. Notably, stock selection decisions in the IT services and software industries weighed on performance, as did stock selection among technology hardware, storage & peripherals companies. In industrials, an underweight allocation to building products companies and investment decisions in the aerospace & defense, electrical equipment, and machinery industries all detracted from performance. Other detractors included the Trust’s lack of investment in the real estate sector, which was based on the view that valuations were unattractive, as well as stock selection among companies in the consumer discretionary sector.

The Trust utilized an options overlay strategy in which calls are written on a portion of the portfolio’s holdings. The Trust’s options overlay strategy detracted from relative performance for the six-month period.

Describe recent portfolio activity.

During the period, a combination of portfolio trading activity and market price changes resulted in the Trust adding exposure to the consumer discretionary, industrials, and health care sectors. The Trust reduced exposure to IT, consumer staples, and financials.

Describe portfolio positioning at period end.

At period end, the Trust’s largest absolute allocations were to the financials, health care, and IT sectors. Relative to the benchmark, the Trust’s most significant overweight exposures were to the financials, energy, and communication services sectors. The Trust maintained its most significant relative underweight sector exposures to real estate, industrials, and consumer staples.

As of June 30, 2021, the Trust had an options overwriting program in place whereby approximately 50% of the underlying equities were overwritten with call options. These call options were typically written at prices above prevailing market prices (estimated to be 2.3% out of the money) with an average time until expiration of 48 days.

The views expressed reflect the opinions of BlackRock as of the date of this report and are subject to change based on changes in market, economic or other conditions. These views are not intended to be a forecast of future events and are no guarantee of future results.

| 14 | 2 0 2 1 BLACK ROCK SEMI - ANNUAL REPORT TO SHAREHOLDERS |

| Trust Summary as of June 30, 2021 (continued) | BlackRock Enhanced Equity Dividend Trust (BDJ) |

Overview of the Trust’s Total Investments

TEN LARGEST HOLDINGS

| Security(a) | Percent of Total Investments | |||

Wells Fargo & Co. | 4 | % | ||

Citigroup, Inc. | 4 | |||

Anthem, Inc. | 3 | |||

American International Group, Inc. | 3 | |||

Bank of America Corp. | 3 | |||

Cisco Systems, Inc. | 3 | |||

Verizon Communications, Inc. | 2 | |||

Morgan Stanley | 2 | |||

General Motors Co. | 2 | |||

Comcast Corp. | 2 | |||

SECTOR ALLOCATION

| Sector(a)(b) | 06/30/21 | 12/31/20 | ||||||

Financials | 28 | % | 28 | % | ||||

Health Care | 19 | 18 | ||||||

Information Technology | 11 | 13 | ||||||

Industrials | 8 | 7 | ||||||

Consumer Discretionary | 7 | 5 | ||||||

Energy | 7 | 7 | ||||||

Consumer Staples | 7 | 9 | ||||||

Communication Services | 6 | 7 | ||||||

Utilities | 5 | 4 | ||||||

Materials | 2 | 2 | ||||||

| (a) | Excludes short-term securities and options written. |

| (b) | For Trust compliance purposes, the Trust’s sector classifications refer to one or more of the sector sub-classifications used by one or more widely recognized market indexes or rating group indexes, and/or as defined by the investment adviser. These definitions may not apply for purposes of this report, which may combine such sector sub-classifications for reporting ease. |

TRUST SUMMARY | 15 |

| Trust Summary as of June 30, 2021 | BlackRock Enhanced Global Dividend Trust (BOE) |

Investment Objective

BlackRock Enhanced Global Dividend Trust’s (BOE) (the “Trust”) primary investment objective is to provide current income and current gains, with a secondary investment objective of long-term capital appreciation. The Trust seeks to achieve its investment objectives by investing primarily in equity securities issued by companies located in countries throughout the world and by employing a strategy of writing (selling) call and put options. Under normal circumstances, the Trust invests at least 80% of its net assets in dividend-paying equity securities and at least 40% of its assets outside of the U.S. (unless market conditions are not deemed favorable by Trust management, in which case the Trust would invest at least 30% of its assets outside of the U.S.). The Trust may invest in securities of companies of any market capitalization, but intends to invest primarily in securities of large capitalization companies. The Trust may invest directly in such securities or synthetically through the use of derivatives.

No assurance can be given that the Trust’s investment objectives will be achieved.

Trust Information

Symbol on New York Stock Exchange | BOE | |

Initial Offering Date | May 31, 2005 | |

Current Distribution Rate on Closing Market Price as of June 30, 2021 ($12.55)(a) | 6.02% | |

Current Monthly Distribution per Common Share(b) | $0.0630 | |

Current Annualized Distribution per Common Share(b) | $0.7560 |

| (a) | Current distribution rate on closing market price is calculated by dividing the current annualized distribution per share by the closing market price. Past performance is not an indication of future results. |

| (b) | The distribution rate is not constant and is subject to change. |

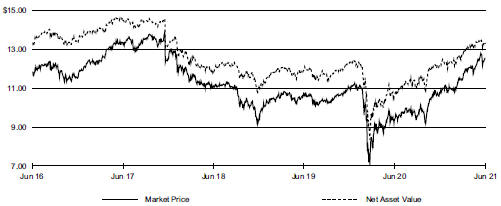

Market Price and Net Asset Value Per Share Summary

| 06/30/21 | 12/31/20 | Change | High | Low | ||||||||||||||||

Market Price | $ | 12.55 | $ | 10.91 | 15.03 | % | $ | 12.82 | $ | 10.66 | ||||||||||

Net Asset Value | 13.28 | 12.28 | 8.14 | 13.49 | 12.02 | |||||||||||||||

Market Price and Net Asset Value History for the Past Five Years

| 16 | 2 0 2 1 BLACK ROCK SEMI - ANNUAL REPORT TO SHAREHOLDERS |

| Trust Summary as of June 30, 2021 (continued) | BlackRock Enhanced Global Dividend Trust (BOE) |

Performance and Portfolio Management Commentary

Returns for the six months ended June 30, 2021 were as follows:

| Returns Based On | ||||||||

| Market Price | NAV | |||||||

BOE(a)(b) | 18.78 | % | 11.67 | % | ||||

MSCI ACWI Call Overwrite Index(c) | N/A | 11.92 | ||||||

| (a) | All returns reflect reinvestment of dividends and/or distributions at actual reinvestment prices. |

| (b) | The Trust’s discount to NAV narrowed during the period, which accounts for the difference between performance based on market price and performance based on NAV. |

| (c) | MSCI ACWI Call Overwrite Index incorporates an option overlay component on the MSCI ACWI Index with a 45% overwrite level. |

N/A — Not applicable as the index does not have a market price.

Past performance is not an indication of future results.

Performance results may include adjustments made for financial reporting purposes in accordance with U.S. generally accepted accounting principles.

The following discussion relates to the Trust’s absolute performance based on NAV:

What factors influenced performance?

Stock selection within the consumer discretionary sector was the largest contributor to the Trust’s performance, particularly within the textiles & apparel industry. Other contributors included the Trust’s underweight allocation to the utilities sector and stock selection within utilities and information technology (“IT”). At the individual stock level, financial software company Intuit Inc. was a top contributor, as the stock gained upward momentum during and after the U.S. tax reporting season. Regional bank Citizens Financial Group, Inc. also contributed as interested rates rose in the U.S., which boosted the bank’s net interest margin. Drug maker AstraZeneca PLC was also additive.

The largest detractor from performance came from the Trust’s overweight allocation to, and stock selection within, the consumer staples sector, most notably within the food products industry. Other detractors included an underweight position to energy and stock selection among financials. At the individual stock level, the Trust’s position in baby formula producer China Feihe Ltd. was the most substantial detractor amid concerns of the negative business impact of a potential drop in birth rates. Reckitt Benckiser Group PLC also detracted, as its health and nutrition divisions experienced declines in sales. The Trust’s position in Unilever NV also weighed on relative performance.

The Trust utilized an options overlay strategy in which calls are written on a portion of the portfolio’s holdings. The Trust’s options overlay strategy contributed positively to relative performance for the six-month period.

Describe recent portfolio activity.

During the period, the Trust added exposure to the financial sector, most notably within the capital markets industry. Exposure to the consumer discretionary sector also increased, especially within textiles, apparel & luxury goods. Conversely, the Trust reduced exposure to industrials, particularly within the aerospace & defense industry, and consumer staples, largely within tobacco.

Describe portfolio positioning at period end.

At period end, the Trust’s largest sector exposures were in IT and health care, driven by holdings in the IT services and pharmaceuticals industries respectively. The Trust had no exposure to the energy or materials sectors. Regionally, the majority of the portfolio was listed in the United States or Europe, with significant exposure to the United Kingdom.

As of June 30, 2021, the Trust had an options overwriting program in place whereby approximately 45% of the underlying equities were overwritten with call options. These call options were typically written at prices above prevailing market prices (estimated to be 2.3% out of the money) with an average time until expiration of 49 days.

The views expressed reflect the opinions of BlackRock as of the date of this report and are subject to change based on changes in market, economic or other conditions. These views are not intended to be a forecast of future events and are no guarantee of future results.

TRUST SUMMARY | 17 |

| Trust Summary as of June 30, 2021 (continued) | BlackRock Enhanced Global Dividend Trust (BOE) |

Overview of the Trust’s Total Investments

TEN LARGEST HOLDINGS

| Security(a) | Percent of Total Investments | |||

Microsoft Corp. | 4 | % | ||

Sanofi | 4 | |||

Reckitt Benckiser Group PLC | 4 | |||

RELX PLC | 3 | |||

Taiwan Semiconductor Manufacturing Co. Ltd. | 3 | |||

Intercontinental Exchange, Inc. | 3 | |||

TELUS Corp. | 3 | |||

UnitedHealth Group, Inc. | 3 | |||

Fidelity National Information Services, Inc. | 3 | |||

Bristol-Myers Squibb Co. | 3 | |||

GEOGRAPHIC ALLOCATION

| Country/Geographic Region | 06/30/21 | 12/31/20 | ||||||

United States | 52 | % | 56 | % | ||||

United Kingdom | 20 | 18 | ||||||

France | 10 | 4 | ||||||

Taiwan | 3 | 2 | ||||||

Canada | 3 | 3 | ||||||

China | 3 | — | ||||||

Denmark | 2 | 1 | ||||||

Spain | 2 | 2 | ||||||

Netherlands | 1 | 2 | ||||||

Singapore | 1 | 3 | ||||||

Mexico | 1 | — | ||||||

Ireland | 1 | 1 | ||||||

Australia | 1 | 2 | ||||||

India | — | — | (b) | |||||

Germany | — | 1 | ||||||

Switzerland | — | 4 | ||||||

Finland | — | 1 | ||||||

(a) Excludes short-term securities and options written.

(b) Rounds to less than 1% of total investments.

| 18 | 2 0 2 1 BLACK ROCK SEMI - ANNUAL REPORT TO SHAREHOLDERS |

| Trust Summary as of June 30, 2021 | BlackRock Enhanced International Dividend Trust (BGY) |

Investment Objective

BlackRock Enhanced International Dividend Trust’s (BGY) (the “Trust”) primary investment objective is to provide current income and current gains, with a secondary objective of long-term capital appreciation. The Trust seeks to achieve its investment objectives by investing primarily in equity securities issued by companies of any market capitalization located in countries throughout the world and by employing a strategy of writing (selling) call and put options. The Trust invests, under normal circumstances, at least 80% of its net assets in dividend-paying equity securities issued by non-U.S. companies of any market capitalization, but intends to invest primarily in securities of large capitalization companies. The Trust may invest directly in such securities or synthetically through the use of derivatives.

No assurance can be given that the Trust’s investment objectives will be achieved.

Trust Information

Symbol on New York Stock Exchange | BGY | |

Initial Offering Date | May 30, 2007 | |

Current Distribution Rate on Closing Market Price as of June 30, 2021 ($6.55)(a) | 6.19% | |

Current Monthly Distribution per Common Share(b) | $0.0338 | |

Current Annualized Distribution per Common Share(b) | $0.4056 |

| (a) | Current distribution rate on closing market price is calculated by dividing the current annualized distribution per share by the closing market price. Past performance is not an indication of future results. |

| (b) | The distribution rate is not constant and is subject to change. |

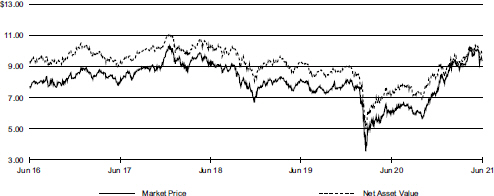

Market Price and Net Asset Value Per Share Summary

| 06/30/21 | 12/31/20 | Change | High | Low | ||||||||||||||||

Market Price | $ | 6.55 | $ | 5.87 | 11.58 | % | $ | 6.70 | $ | 5.75 | ||||||||||

Net Asset Value | 6.84 | 6.49 | 5.39 | 7.02 | 6.36 | |||||||||||||||

Market Price and Net Asset Value History for the Past Five Years

TRUST SUMMARY | 19 |

| Trust Summary as of June 30, 2021 (continued) | BlackRock Enhanced International Dividend Trust (BGY) |

Performance and Portfolio Management Commentary

Returns for the six months ended June 30, 2021 were as follows:

| Returns Based On | ||||||||

| Market Price | NAV | |||||||

BGY(a)(b) | 15.26 | % | 8.87 | % | ||||

MSCI ACWI ex USA Call Overwrite Index(c) | N/A | 9.49 | ||||||

| (a) | All returns reflect reinvestment of dividends and/or distributions at actual reinvestment prices. |

| (b) | The Trust’s discount to NAV narrowed during the period, which accounts for the difference between performance based on market price and performance based on NAV. |

| (c) | MSCI ACWI ex USA Call Overwrite Index incorporates an option overlay component on the MSCI ACWI ex USA Index with a 45% overwrite level. |

N/A — Not applicable as the index does not have a market price.

Past performance is not an indication of future results.

Performance results may include adjustments made for financial reporting purposes in accordance with U.S. generally accepted accounting principles.

The following discussion relates to the Trust’s absolute performance based on NAV:

What factors influenced performance?

From a sector perspective, the Trust’s exposure to the consumer discretionary, health care, and industrials sectors contributed the most to performance. The Trust’s underweight allocation to Japanese equities was the most significant contributor at the regional level. Among individual securities, luxury goods specialist LVMH Moet Hennessy SE, drug manufacturer AstraZeneca PLC, and beer, wine, and spirits producer Diageo PLC contributed the most to relative returns.

By contrast, the largest detractors from performance at the sector level resulted from the Trust’s exposure to financials, consumer staples, and materials. The Trust’s positions in North American-listed companies had the greatest negative impact on performance at the regional level. Among individual positions, the most significant detractors included baby formula producer China Feihe Ltd., consumer products giant Unilever NV, and health technology company Koninklijke Philips NV.

The Trust utilized an options overlay strategy in which calls are written on a portion of the portfolio’s holdings. The Trust’s options overlay strategy detracted from relative performance for the six-month period.

Describe recent portfolio activity.

During the period, the Trust increased its exposure to the consumer discretionary, financials, and utilities sectors. The Trust reduced exposure to health care, industrials, and materials. At the regional level, the Trust increased exposure to emerging market-listed companies, while reducing exposure to Europe ex-U.K.-listed companies

Describe portfolio positioning at period end.

At period end, the Trust had overweight allocations to consumer staples, health care, and industrials. It was underweight materials, financials, and consumer discretionary stocks.

As of June 30, 2021, the Trust had an option overwriting program in place whereby 42% of the underlying equities were overwritten with call options. These call options were typically written at prices above prevailing market prices (estimated to be 2.0% out of the money) with an average time until expiration of 48 days.

The views expressed reflect the opinions of BlackRock as of the date of this report and are subject to change based on changes in market, economic or other conditions. These views are not intended to be a forecast of future events and are no guarantee of future results.

| 20 | 2 0 2 1 BLACK ROCK SEMI - ANNUAL REPORT TO SHAREHOLDERS |

| Trust Summary as of June 30, 2021 (continued) | BlackRock Enhanced International Dividend Trust (BGY) |

Overview of the Trust’s Total Investments

TEN LARGEST HOLDINGS

| Security(a) | Percent of Total Investments | |||

Sanofi | 5 | % | ||

Reckitt Benckiser Group PLC | 5 | |||

Taiwan Semiconductor Manufacturing Co. Ltd. | 5 | |||

RELX PLC | 5 | |||

Ferguson PLC | 5 | |||

Diageo PLC | 5 | |||

TELUS Corp. | 5 | |||

AstraZeneca PLC | 4 | |||

Unilever PLC | 4 | |||

Prudential PLC | 4 | |||

GEOGRAPHIC ALLOCATION

| Country/Geographic Region | 06/30/21 | 12/31/20 | ||||||

United Kingdom | 35 | % | 35 | % | ||||

France | 17 | 9 | ||||||

United States | 10 | 4 | ||||||

China | 6 | 1 | ||||||

Spain | 5 | 6 | ||||||

Taiwan | 5 | 4 | ||||||

Canada | 4 | 5 | ||||||

Singapore | 4 | 5 | ||||||

Denmark | 4 | 3 | ||||||

India | 3 | 2 | ||||||

Netherlands | 3 | 6 | ||||||

Mexico | 2 | — | ||||||

Australia | 2 | 5 | ||||||

Germany | — | 3 | ||||||

Switzerland | — | 9 | ||||||

Finland | — | 3 | ||||||

(a) Excludes short-term securities and options written.

TRUST SUMMARY | 21 |

| Trust Summary as of June 30, 2021 | BlackRock Health Sciences Trust (BME) |

Investment Objective

BlackRock Health Sciences Trust’s (BME) (the “Trust”) investment objective is to provide total return through a combination of current income, current gains and long-term capital appreciation. The Trust seeks to achieve its investment objective by investing, under normal market conditions, at least 80% of its total assets in equity securities of companies engaged in the health sciences and related industries and equity derivatives with exposure to the health sciences industry. The Trust seeks to pursue this goal primarily by investing in a portfolio of equity securities and by employing a strategy of writing (selling) call and put options.

No assurance can be given that the Trust’s investment objective will be achieved.

Trust Information

Symbol on New York Stock Exchange | BME | |

Initial Offering Date | March 31, 2005 | |

Current Distribution Rate on Closing Market Price as of June 30, 2021 ($48.50)(a) | 4.95% | |

Current Monthly Distribution per Common Share(b) | $0.2000 | |

Current Annualized Distribution per Common Share(b) | $2.4000 |

| (a) | Current distribution rate on closing market price is calculated by dividing the current annualized distribution per share by the closing market price. Past performance is not an indication of future results. |

| (b) | The distribution rate is not constant and is subject to change. |

Market Price and Net Asset Value Per Share Summary

| 06/30/21 | 12/31/20 | Change | High | Low | ||||||||||||||||

Market Price | $ 48.50 | $ 47.59 | 1.91 | % | $ 50.54 | $ 44.15 | ||||||||||||||

Net Asset Value | 47.73 | 45.66 | 4.53 | 47.87 | 43.57 | |||||||||||||||

Market Price and Net Asset Value History for the Past Five Years

| 22 | 2 0 2 1 BLACK ROCK SEMI - ANNUAL REPORT TO SHAREHOLDERS |

| Trust Summary as of June 30, 2021 (continued) | BlackRock Health Sciences Trust (BME) |

Performance and Portfolio Management Commentary

Returns for the six months ended June 30, 2021 were as follows:

| Returns Based On | ||||||||

| Market Price | NAV | |||||||

BME(a)(b) | 4.60 | % | 7.29 | % | ||||

MSCI USA IMI Health Care Call Overwrite Index(c) | N/A | 10.67 | ||||||

| (a) | All returns reflect reinvestment of dividends and/or distributions at actual reinvestment prices. |

| (b) | The Trust’s premium to NAV narrowed during the period, which accounts for the difference between performance based on market price and performance based on NAV. |

| (c) | MSCI USA IMI Health Care Call Overwrite Index incorporates an option overlay component on the MSCI IMI Health Care Index with a 33% overwrite level. |

N/A — Not applicable as the index does not have a market price.

Past performance is not an indication of future results.

Performance results may include adjustments made for financial reporting purposes in accordance with U.S. generally accepted accounting principles.

The following discussion relates to the Trust’s absolute performance based on NAV:

What factors influenced performance?

Weakness in the biotechnology and health care providers & services sub-sectors was the primary cause of the Trust’s underperformance during the six-month period.

Among individual positions, an underweight in the biotechnology stock Moderna, Inc. was the largest detractor. The company received emergency use approval for its COVID-19 vaccine in the United States, United Kingdom and Europe, boosting its stock price. An overweight position in the biotechnology firm Seagen, Inc. also detracted. The company, which specializes in antibody drug conjugate treatments for cancer, experienced favorable clinical development that led to strong price appreciation in 2020. However, the stock lost ground in the first half of 2021 amid the broader rotation away from faster-growing companies.

On the positive side, stock selection in the pharmaceuticals sub-sector contributed to performance.

A private investment in the biotechnology company Acumen Pharmaceuticals, Inc., which underwent a successful initial public offering, was the largest contributor. An overweight position in the contract research and development company Wuxi AppTec Co., Ltd., which reported strong growth, was also helped results. An underweight in Merck & Co., Inc.—which suspended its COVID-19 vaccine development—was an additional contributor of note.

The Trust utilized an options overlay strategy in which calls are written on a portion of the portfolio’s holdings. The Trust’s option writing strategy detracted from relative performance for the six-month period.

Describe recent portfolio activity.

The Trust slightly reduced its weightings in the health care providers & services and medical devices & supplies sub-sectors, and it increased its allocations to biotechnology and pharmaceuticals.

Describe portfolio positioning at period end.

The investment adviser continued to monitor policy developments in the United States. Health care measures introduced by the Biden Administration have been limited in scope so far. While drug price reform is still a concern, it appears unlikely to have a significant long-term impact on the sector.

The investment adviser believes two key trends—aging demographics in both developed and developing countries, together with innovation in medical technology and biopharmaceutical drugs—remain the key drivers of performance in the health care sector. In the short term, the investment adviser is closely watching the ongoing developments related to COVID-19.

The Trust was overweight in the medical devices sector in anticipation of a recovery as economic conditions return to normal. Within the sector, the investment adviser was focused on companies pursuing minimally invasive surgical technologies on the belief they can improve patient outcomes and replace old standards of care. The Trust was also overweight in the biotechnology sub-sector, and it was underweight in pharmaceuticals and health care providers & services.

As of June 30, 2021, the Trust had an options overwriting program in place whereby 38% of the underlying equities were overwritten with call options. These options were typically written at prices above the prevailing market prices (estimated to be 4.9% out of the money) with an average time until expiration of 51 days.

The views expressed reflect the opinions of BlackRock as of the date of this report and are subject to change based on changes in market, economic or other conditions. These views are not intended to be a forecast of future events and are no guarantee of future results.

TRUST SUMMARY | 23 |

| Trust Summary as of June 30, 2021 (continued) | BlackRock Health Sciences Trust (BME) |

Overview of the Trust’s Total Investments

TEN LARGEST HOLDINGS

| Security(a) | Percent of Total Investments | |||

UnitedHealth Group, Inc. | 6 | % | ||

Abbott Laboratories | 5 | |||

Eli Lilly & Co. | 4 | |||

Thermo Fisher Scientific, Inc. | 4 | |||

Johnson & Johnson | 4 | |||

Medtronic PLC | 3 | |||

Pfizer, Inc. | 3 | |||

Humana, Inc. | 3 | |||

Intuitive Surgical, Inc. | 3 | |||

Amgen, Inc. | 3 | |||

INDUSTRY ALLOCATION

| Industry(a)(b) | 06/30/21 | 12/31/20 | ||||||

Health Care Equipment & Supplies | 27 | % | 30 | % | ||||

Biotechnology | 21 | 19 | ||||||

Health Care Providers & Services | 21 | 21 | ||||||

Pharmaceuticals | 20 | 19 | ||||||

Life Sciences Tools & Services | 10 | 9 | ||||||

Health Care Technology | 1 | 1 | ||||||

Diversified Financial Services | — | 1 | ||||||

Other* | — | (c) | — | (c) | ||||

| (a) | Excludes short-term securities and options written. |

| (b) | For Trust compliance purposes, the Trust’s industry classifications refer to one or more of the industry sub-classifications used by one or more widely recognized market indexes or ratings group indexes, and/or as defined by the investment adviser. These definitions may not apply for purposes of this report, which may combine such industry sub-classifications for reporting ease. |

| (c) | Rounds to less than 1% of total investments. |

| * | Includes one or more investment categories that individually represents less than 1% of the Trust’s total investments. Please refer to the Schedule of Investments for details. |

| 24 | 2 0 2 1 BLACK ROCK SEMI - ANNUAL REPORT TO SHAREHOLDERS |

| Trust Summary as of June 30, 2021 | BlackRock Health Sciences Trust II (BMEZ) |

Investment Objective

BlackRock Health Sciences Trust II’s (BMEZ) (the “Trust”) investment objective is to provide total return and income through a combination of current income, current gains and long-term capital appreciation. Under normal market conditions, the Trust will invest at least 80% of its total assets in equity securities of companies principally engaged in the health sciences group of industries and equity derivatives with exposure to the health sciences group of industries. Equity derivatives in which the Trust invests include purchased and sold (written) call and put options on equity securities of companies in the health sciences group of industries.

No assurance can be given that the Trust’s investment objective will be achieved.

Trust Information

Symbol on New York Stock Exchange | BMEZ | |

Initial Offering Date | January 30, 2020 | |

Current Distribution Rate on Closing Market Price as of June 30, 2021 ($28.92)(a) | 6.02% | |

Current Monthly Distribution per Common Share(b) | $0.1450 | |

Current Annualized Distribution per Common Share(b) | $1.7400 |

| (a) | Current distribution rate on closing market price is calculated by dividing the current annualized distribution per share by the closing market price. Past performance is not an indication of future results. |

| (b) | The distribution rate is not constant and is subject to change. |

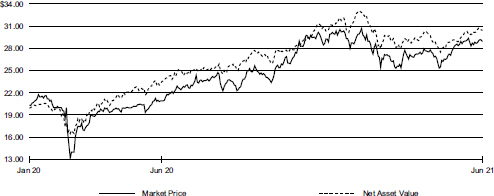

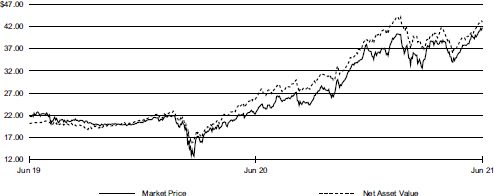

Market Price and Net Asset Value Per Share Summary

| 06/30/21 | 12/31/20 | Change | High | Low | ||||||||||||||||

Market Price | $ 28.92 | $ 28.65 | 0.94 | % | $ 30.94 | $ 25.10 | ||||||||||||||

Net Asset Value | 30.43 | 30.73 | (0.98) | 32.95 | 27.50 |

Market Price and Net Asset Value History Since Inception

TRUST SUMMARY | 25 |

| Trust Summary as of June 30, 2021 (continued) | BlackRock Health Sciences Trust II (BMEZ) |

Performance and Portfolio Management Commentary

Returns for the six months ended June 30, 2021 were as follows:

| Returns Based On | ||||||||

| Market Price | NAV | |||||||

BMEZ(a)(b) | 3.78 | % | 1.79 | % | ||||

MSCI ACWI 25% Call Overwrite Index(c) | N/A | 12.21 | ||||||

| (a) | All returns reflect reinvestment of dividends and/or distributions at actual reinvestment prices. |

| (b) | The Trust’s discount to NAV narrowed during the period, which accounts for the difference between performance based on market price and performance based on NAV. (c) MSCI ACWI 25% Call Overwrite Index incorporates an option overlay component on the MSCI ACWI Index with a 25% overwrite level. |

N/A — Not applicable as the index does not have a market price.

Past performance is not an indication of future results.

Performance results may include adjustments made for financial reporting purposes in accordance with U.S. generally accepted accounting principles.

The following discussion relates to the Trust’s absolute performance based on NAV:

What factors influenced performance?

The Trust focused on innovative, small- and mid-sized health care companies. The listed benchmark, which incorporates all sectors of the market and emphasizes large-cap stocks, is therefore used for reference purposes only.

At the sub-sector level, stock selection in the biotechnology and health care providers & services sub-sectors detracted from performance.

Among individual positions, the biotechnology firms Mersana Therapeutics, Inc. and Seagen, Inc. were the largest detractors. Both companies specialize in antibody drug conjugate treatments for cancer, and they experienced favorable clinical development that led to strong price appreciation in 2020. However, the stocks lost ground in the first quarter of 2021 amid the broader rotation away from faster-growing companies. A position in Sigilon Therapeutics, Inc., a biotechnology company focusing on rare chronic diseases, also detracted from results.

Positive stock selection within the pharmaceuticals and medical devices & supplies sub-sectors contributed to Trust performance.

A private investment in biotech company Design Therapeutics, Inc. was the largest contributor. The U.S.-based firm, which develops novel, small-molecule therapeutic candidates called gene targeted chimeras, went public during the period. Another private investment in a biotechnology company, Acumen Pharmaceuticals, Inc., also had a successful initial public offering and made a strong contribution to performance. The contract research organization PPD, Inc., which was acquired at a premium, was another key contributor.

The Trust utilized an options overlay strategy in which calls are written on a portion of the portfolio’s holdings. The Trust’s option overlay strategy contributed positively to relative performance for the period.

Describe recent portfolio activity.

The investment adviser continued to deploy capital in both public and private markets across the next-generation health science universe.

The Trust’s weighting in the biotechnology industry decreased during the period, while its allocation to health care providers & services increased. Its weightings in medical devices & supplies and pharmaceuticals remained the same.

More broadly speaking, the Trust reduced its weighting in companies with clinical development setbacks or competitive concerns. It added positions in innovative therapeutic companies with strong clinical pipelines, as well as innovative health care providers & services companies.

Describe portfolio positioning at period end.

The Trust held 35% of its assets in medical devices & supplies, 38% in biotechnology, 18% in health care providers & services, and 6% in the pharmaceuticals industry. These allocations were the result of bottom-up stock selection and not a top-down view.

The Trust held 25 private investments, comprising 7.5% of total assets for a total commitment of approximately $258 million. In addition, the Trust held approximately 2.5% of its assets in private investments of public equity, for additional private exposure across 10 different special purpose acquisition company entities.

As of June 30, 2021, the Trust had in place an option overwriting program whereby 22% of the underlying equities were overwritten with call options. These call options were typically written at prices above the prevailing market prices (estimated to be 8.1% out of the money) with an average time until expiration of 53 days.

The views expressed reflect the opinions of BlackRock as of the date of this report and are subject to change based on changes in market, economic or other conditions. These views are not intended to be a forecast of future events and are no guarantee of future results.

| 26 | 2 0 2 1 BLACK ROCK SEMI - ANNUAL REPORT TO SHAREHOLDERS |

| Trust Summary as of June 30, 2021 (continued) | BlackRock Health Sciences Trust II (BMEZ) |

Overview of the Trust’s Total Investments

TEN LARGEST HOLDINGS

| Security(a) | Percent of Total Investments | |||

Genmab A/S | 3 | % | ||

Seagen, Inc. | 3 | |||

Oak Street Health, Inc. | 2 | |||

Wuxi Biologics Cayman, Inc. | 2 | |||

Intuitive Surgical, Inc. | 2 | |||

WuXi AppTec Co. Ltd. | 2 | |||

Straumann Holding AG | 2 | |||

Teleflex, Inc. | 2 | |||

Amedisys, Inc. | 2 | |||

Alcon, Inc. | 2 | |||

INDUSTRY ALLOCATION

| Industry(a)(b) | 06/30/21 | 12/31/20 | ||||||

Biotechnology | 40 | % | 42 | % | ||||

Health Care Equipment & Supplies | 25 | 24 | ||||||

Health Care Providers & Services | 15 | 13 | ||||||

Life Sciences Tools & Services | 10 | 10 | ||||||

Pharmaceuticals | 5 | 6 | ||||||

Health Care Technology | 2 | 2 | ||||||

Diversified Financial Services | 1 | 2 | ||||||

Health Care Services | 1 | — | ||||||

Internet & Direct Marketing Retail | 1 | 1 | ||||||

Other* | — | — | (c) | |||||

| (a) | Excludes short-term securities and options written. |

| (b) | For Trust compliance purposes, the Trust’s industry classifications refer to one or more of the industry sub-classifications used by one or more widely recognized market indexes or ratings group indexes, and/or as defined by the investment adviser. These definitions may not apply for purposes of this report, which may combine such industry sub-classifications for reporting ease. |

| (c) | Rounds to less than 1% of total investments. |

| * | Includes one or more investment categories that individually represents less than 1% of the Trust’s total investments. Please refer to the Schedule of Investments for details. |

TRUST SUMMARY | 27 |

| Trust Summary as of June 30, 2021 | BlackRock Innovation and Growth Trust (BIGZ) |

Investment Objective

BlackRock Innovation and Growth Trust’s (BIGZ) (the “Trust”) investment objective is to provide total return and income through a combination of current income, current gains and long-term capital appreciation. The Trust will invest primarily in equity securities issued by mid- and small-capitalization companies that the Trust’s adviser believes have above-average earnings growth potential. In selecting investments for the Trust, the Trust’s adviser focuses on mid- and small-capitalization growth companies that are “innovative.” These are companies that have introduced, or are seeking to introduce, a new product or service that potentially changes the marketplace. The Trust utilizes an option writing (selling) strategy in an effort to generate current gains from options premiums and to enhance the Trust’s risk-adjusted returns.

No assurance can be given that the Trust’s investment objective will be achieved.

Trust Information

Symbol on New York Stock Exchange | BIGZ | |

Initial Offering Date | March 29, 2021 | |

Current Distribution Rate on Closing Market Price as of June 30, 2021 ($20.31)(a) | 5.91% | |

Current Monthly Distribution per Common Share(b) | $0.1000 | |

Current Annualized Distribution per Common Share(b) | $1.2000 |

| (a) | Current distribution rate on closing market price is calculated by dividing the current annualized distribution per share by the closing market price. The current distribution rate may consist of income, net realized gains and/or a return of capital. Past performance is not an indication of future results. |

| (b) | The distribution rate is not constant and is subject to change. A portion of the distribution may be deemed a return of capital or net realized gain. |

Net Asset Value Per Share Summary

| 06/30/21 | 03/29/21 | (a) | Change | High | Low | |||||||||||||||

Market Price | $ 20.31 | $ 20.00 | 1.55 | % | $ 23.05 | $ 18.61 | ||||||||||||||

Net Asset Value | 19.77 | 20.00 | (1.15) | 21.01 | 17.09 |

| (a) | Commencement of operations. |

| 28 | 2 0 2 1 BLACK ROCK SEMI - ANNUAL REPORT TO SHAREHOLDERS |

| Trust Summary as of June 30, 2021 (continued) | BlackRock Innovation and Growth Trust (BIGZ) |

Overview of the Trust’s Total Investments

TEN LARGEST HOLDINGS

| Security(a) | Percent of Total Investments | |||

Axon Enterprise, Inc. | 3 | % | ||

Amyris, Inc. | 3 | |||

Phreesia, Inc. | 3 | |||

Vroom Inc. | 3 | |||