Investment Objectives, Policies and Risks

(continued)

Investment Objectives and Policies

(continued)

A call option written by the Trust on a security is “covered” if the Trust owns the security underlying the call or has an absolute and immediate right to acquire that security without additional cash consideration (or, if additional cash consideration is required, the Trust’s custodian segregates sufficient cash or other assets determined to be liquid by the Advisors (in accordance with procedures established by the Board of Trustees (the “Board”))) upon conversion or exchange of other securities held by the Trust. A call option is also covered if the Trust holds a call on the same security as the call written where the exercise price of the call held is (i) equal to or less than the exercise price of the call written or (ii) greater than the exercise price of the call written, provided the difference is maintained by the Trust in segregated assets determined to be liquid by the Advisors as described above.

A put option written by the Trust on a security is “covered” if the Trust segregates assets determined to be liquid by the Advisors (in accordance with procedures established by the Board) equal to the exercise price. A put option is also covered if the Trust holds a put on the same security as the put written where the exercise price of the put held is (i) equal to or greater than the exercise price of the put written or (ii) less than the exercise price of the put written, provided the difference is maintained by the Trust in segregated assets determined to be liquid by the Advisors as described above.

An index- or sector-oriented option is considered “covered” if the Trust maintains with its custodian assets determined to be liquid in an amount equal to the contract value of the applicable basket of securities. An index or sector call option also is covered if the Trust holds a call on the same basket of securities as the call written where the exercise price of the call held is (i) equal to or less than the exercise price of the call written or (ii) greater than the exercise price of the call written, provided the difference is maintained by the Trust in segregated assets determined to be liquid. An index or sector put option also is covered if the Trust holds a put on the same basket of securities as the put written where the exercise price of the put held is (i) equal to or more than the exercise price of the put written or (ii) less than the exercise price of the put written, provided the difference is maintained by the Trust in segregated assets determined to be liquid. Because index and sector options both refer to options on baskets of securities and generally have similar characteristics, we refer to these types of options collectively as “index options.”

The Trust generally intends to write covered put and call options with respect to approximately 30% to 45% of its total assets, although this percentage may vary from time to time with market conditions. As the Trust writes covered calls over more of its portfolio, its ability to benefit from capital appreciation becomes more limited.

The Trust may hold or have exposure to equity securities of issuers of any size, including small and medium capitalization companies, and to issuers in any industry or sector. The Trust will not invest 25% or more of its total assets in securities of issuers in any single industry.

The Trust may invest in the securities of smaller, less seasoned companies. The Trust also may engage in short sales of securities and may lend its portfolio securities to banks or dealers which meet the creditworthiness standards established by the Board.

Although not intended to be a significant element in the Trust’s investment strategy, from time to time the Trust may purchase and sell derivative instruments such as exchange-listed and over-the-counter put and call options on securities, financial futures, equity indices and other financial instruments, purchase and sell financial futures contracts and options thereon, engage in swaps and purchase derivative instruments that combine features of these instruments for hedging and risk management purposes or to enhance total return. The percentage limitations set herein apply at the time of investment, and the Trust will not be required to sell securities because of subsequent changes in market values.

Although the Agreement and Declaration of Trust of the Trust provides that the Board of the Trust may authorize the Trust to issue preferred shares or incur indebtedness, the Trust currently does not intend to issue preferred shares or incur indebtedness for investment purposes.

The Trust may enter into derivative transactions that have leverage embedded in them.

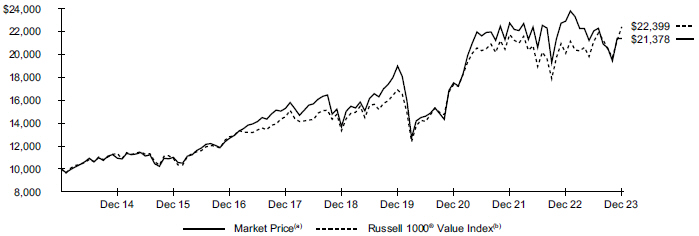

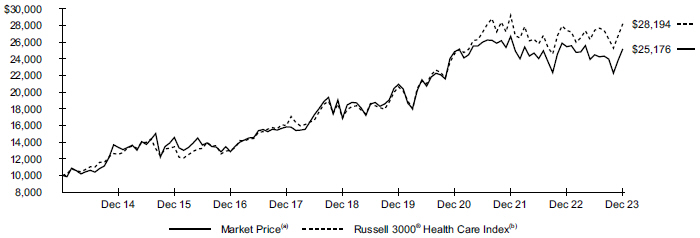

BlackRock Health Sciences Trust (BME)

The Trust’s investment objective is to provide total return through a combination of current income, current gains and long-term capital appreciation. The Trust seeks to achieve its investment objective by investing, under normal market conditions, at least 80% of its total assets in equity securities of companies engaged in the health sciences and related industries and equity derivatives with exposure to the health sciences industry. Equity derivatives in which the Trust invests as part of this non-fundamental investment policy include purchased and sold (written) call and put options on equity securities of companies in the health sciences and related industries.

The Trust’s investment objective may be changed by the Board of Trustees without prior shareholder approval; however, the Trust will not change its policy of investing, under normal market conditions, at least 80% of its total assets in equity securities of companies engaged in the health sciences and related industries and equity derivatives with exposure to the health sciences industry unless it provides shareholders with notice at least 60 days prior to changing this non-fundamental policy, or unless such change was previously approved by shareholders.

Companies in the health sciences industry include health care providers as well as businesses involved in researching, developing, producing, distributing or delivering medical, dental, optical, pharmaceutical or biotechnology products, supplies, equipment or services or that provide support services to these companies. These companies also include those that own or operate health facilities and hospitals or provide related administrative, management or financial support. Other health sciences industries in which the Trust may invest include: clinical testing laboratories; diagnostics; hospital, laboratory or physician ancillary products and support services; rehabilitation services; employer health insurance management services; and vendors of goods and services specifically to companies engaged in the health sciences. BlackRock Advisors, LLC (the “Manager”) determines, in its discretion, whether a company is engaged in the health sciences and related industries.

While the Trust will invest primarily in companies providing products and services for human health, it may also invest in companies whose products or services relate to the growth or survival of animals and plants. Non-human health sciences industries include companies engaged in the development, production or distribution of products or services that: increase crop, animal and animal product yields by enhancing growth or increasing disease resistance, improve agricultural product characteristics, such as taste, appearance, nutritional content and shelf life; reduce the cost of producing agricultural products; or improve pet health.

| | |

I N V E S T M E N T O B J E C T I V E S , P O L I C I E S A N D R I S K S | | 185 |

Investment Objectives, Policies and Risks

(continued)

Investment Objectives and Policies

(continued)

The Trust will consider a company to be principally engaged in a health sciences or related industry if 50% or more of its revenues are derived from, or 50% or more of its assets are related to, its health sciences business. Although the Trust generally will invest in companies included in the Russell 3000

®

Index, the Trust may invest in equity securities of health sciences companies with any size market capitalization, including small and mid-cap health sciences companies and companies that are not included in the Russell 3000

®

Index.

As part of its investment strategy, the Trust employs an option strategy of writing (selling) covered call options on common stocks in its portfolio, writing other call and put options on individual common stocks and, to a lesser extent, writing call and put options on indices of health sciences securities. The Trust seeks to generate current gains from options premiums and to enhance the Trust’s risk-adjusted returns. The Trust generally intends to write call and put options with respect to approximately 30% to 50% of its total assets, although this percentage may vary from time to time with market conditions.

The Trust invests primarily in equity securities, including common stocks, preferred stocks, convertible securities, warrants and depositary receipts, of issuers engaged in the health sciences or related industries and equity interests in real estate investment trusts (“REITs”) that own hospitals. The Trust may invest in companies of any size market capitalization.

The Trust may invest in preferred securities, including preferred securities that may be converted into common stock or other securities of the same or a different issuer. The types of preferred securities in which the Trust may invest include trust preferred securities.

The Trust may invest in convertible securities. A convertible security is a bond, debenture, note, preferred security or other security that may be converted into or exchanged for a prescribed amount of common stock or other equity security of the same or a different issuer within a particular period of time at a specified price or formula.

The Trust may purchase warrants, which are privileges issued by corporations enabling the owners to subscribe to and purchase a specified number of shares of the corporation at a specified price during a specified period of time.

The Trust may invest in sponsored and unsponsored American Depositary Receipts (“ADRs”), European Depositary Receipts (“EDRs”), Global Depositary Receipts (“GDRs”) and other similar global instruments.

The Trust may invest in equity interests of REITs. REITs possess certain risks which differ from an investment in common stocks. REITs are financial vehicles that pool investor’s capital to purchase or finance real estate. REITs may concentrate their investments in specific geographic areas or in specific property types (i.e., hotels, shopping malls, residential complexes and office buildings).

The Trust may invest without limitation in securities of U.S. issuers and non-U.S. issuers located in countries throughout the world, including in developed and emerging markets. Foreign securities in which the Trust may invest may be U.S. dollar-denominated or non-U.S. dollar-denominated. For purposes of the Trust, a company is deemed to be a non-U.S. company if it meets the following tests: (i) such company was not organized in the United States; (ii) such company’s primary business office is not in the United States; (iii) the principal trading market for such company’s securities is not located in the United States; (iv) less than 50% of such company’s assets are located in the United States; or (v) 50% or more of such issuer’s revenues are derived from outside the United States.

The Trust may invest up to 20% of its total assets in other investments. These investments may include equity and debt securities of companies not engaged in the health sciences industry. Fixed-income securities in which the Trust may invest include bonds or other debt securities issued by U.S. or foreign (non-U.S.) corporations or other business entities and U.S. Government and agency securities. The Trust has no set policy regarding portfolio maturity or duration of the fixed-income securities it may hold, and such securities may be of any maturity.

The Trust reserves the right to invest up to 10% of its total assets in securities rated, at the time of investment, below investment grade quality, such as those rated “Ba” or below by Moody’s Investors Service, Inc. and “BB” or below by S&P Global Ratings, or securities comparably rated by other rating agencies or in securities determined by the Manager to be of comparable quality. Such securities commonly are referred to as “high yield” or “junk” bonds.

The Trust may invest in registered investment companies in accordance with the Investment Company Act of 1940, as amended (the “Investment Company Act”). The Investment Company Act generally prohibits the Trust from investing more than 5% of its assets in any one other investment company or more than 10% of its assets in all other investment companies.

In addition to the option strategies discussed above, the Trust may engage in strategic transactions to facilitate portfolio management, mitigate risks and generate total return. The Trust may use a variety of other investment management techniques and instruments. The Trust may purchase and sell futures contracts, enter into various interest rate transactions such as swaps, caps, floors or collars, currency transactions such as currency forward contracts, currency futures contracts, currency swaps or options on currency or currency futures and swap contracts (including, but not limited to, credit default swaps) and may purchase and sell exchange-listed and over-the-counter put and call options on securities and swap contracts, financial indices and futures contracts and use other derivative instruments or management techniques. The Trust also may purchase derivative instruments that combine features of these instruments.

In connection with its hedging and other risk management strategies, the Trust may also enter into contracts for the purchase or sale for future delivery (“future contracts”) of securities, aggregates of securities, financial indices, and U.S. Government debt securities or options on the foregoing to hedge the value of its portfolio securities that might result from a change in interest rates or market movements. The Trust may engage in such transactions for bona fide hedging, risk management and other appropriate portfolio management purposes.

The Trust may enter into such transactions without limit for bona fide strategic purposes, including risk management and duration management and other portfolio strategies. The Trust may also engage in transactions in futures contracts or related options for non-strategic purposes to enhance income or gain provided that the Trust will not enter into a futures contract or related option (except for closing transactions) for purposes other than bona fide strategic purposes, or risk management including duration management unless it does so consistent with the rules of the Commodities Futures Trading Commission (the “CFTC”).

| | |

| 186 | | 2 0 2 3 B L A C K R O C K A N N U A L R E P O R T T O S H A R E H O L D E R S |

Investment Objectives, Policies and Risks

(continued)

Investment Objectives and Policies

(continued)

The Trust may engage in options and futures transactions on exchanges and options in the over-the-counter (“OTC”) markets.

The Trust intends to enter into options and futures transactions only with banks or dealers the Manager believes to be creditworthy at the time they enter into such transactions.

The CFTC subjects advisers to registered investment companies to regulation by the CFTC if a fund that is advised by the investment adviser either (i) invests, directly or indirectly, more than a prescribed level of its liquidation value in CFTC-regulated futures, options and swaps (“CFTC Derivatives”), or (ii) markets itself as providing investment exposure to such instruments. To the extent the Trust uses CFTC Derivatives, it intends to do so below such prescribed levels and will not market itself as a “commodity pool” or a vehicle for trading such instruments. Accordingly, the Manager has claimed an exclusion from the definition of the term “commodity pool operator” under the Commodity Exchange Act (“CEA”) pursuant to Rule 4.5 under the CEA. The Manager is not, therefore, subject to registration or regulation as a “commodity pool operator” under the CEA in respect of the Trust.

In order to enhance income or reduce fluctuations in net asset value, the Trust may sell or purchase call options on securities and indices based upon the prices of futures contracts and debt or equity securities that are traded on U.S. and non-U.S. securities exchanges and on the over-the-counter markets.

As with calls, the Trust may purchase put options on securities (whether or not it holds such securities in its portfolio), indices or future contracts. For the same purposes, the Trust may also sell puts on securities, indices or futures contracts on such securities if the Trust’s contingent obligations on such puts are secured by designating cash or liquid assets on its books and records having a value not less than the exercise price. The Trust will not sell puts if, as a result, more than 50% of the Trust’s assets would be required to be segregated on its books to cover its potential obligation under its hedging and other investment transactions.

The Trust may enter into interest rate swaps and the purchase or sale of interest rate caps and floors. The Trust expects to enter into these transactions primarily to preserve a return or spread on a particular investment or portion of its portfolio as a duration management technique or to protect against any increase in the price of securities the Trust anticipates purchasing at a later date. The Trust may enter into interest rate swaps, caps and floors on either an asset-based or liability-based basis.

The Trust intends to use these transactions for risk management purposes and not as a speculative investment. The Trust will not sell interest rate caps or floors that it does not own. The Trust will only enter into interest rate swap, cap or floor transactions with counterparties the Manager believes to be creditworthy at the time they enter into such transactions.

The Trust may engage in credit derivative transactions. There are two broad categories of credit derivatives: default price risk derivatives and market spread derivatives. Default price risk derivatives are linked to the price of reference securities or loans after a default by the issuer or borrower, respectively. Market spread derivatives are based on the risk that changes in market factors, such as credit spreads, can cause a decline in the value of a security, loan or index. There are three basic transactional forms for credit derivatives: swaps, options and structured instruments.

The Trust may enter into forward currency contracts to purchase or sell foreign currencies for a fixed amount of U.S. dollars or another foreign currency. A forward currency contract involves an obligation to purchase or sell a specific currency at a future date, which may be any fixed number of days (term) from the date of the forward currency contract agreed upon by the parties, at a price set at the time the forward currency contract is entered into. Forward currency contracts are traded directly between currency traders (usually large commercial banks) and their customers.

The Trust may make short sales of securities for risk management, in order to maintain portfolio flexibility or to enhance income or gain. The Trust will not make a short sale if, after giving effect to such sale, the market value of all securities sold short exceeds 25% of the value of its total assets or the Trust’s aggregate short sales of a particular class of securities exceeds 25% of the outstanding securities of that class. The Trust may also make short sales “against the box” without respect to such limitations. In this type of short sale, at the time of the sale, the Trust owns or has the immediate and unconditional right to acquire at no additional cost the identical security.

The Trust may invest in illiquid investments. Illiquid investments are subject to legal or contractual restrictions on disposition or lack an established secondary market. The sale of restricted and illiquid investments often requires more time and results in higher brokerage charges or dealer discounts and other selling expenses than does the sale of investments eligible for trading on national securities exchanges or in the over-the-counter markets. Restricted investments may sell at a price lower than similar investments that are not subject to restrictions on resale.

The Trust may purchase securities on a “when-issued” basis and may purchase or sell securities on a “forward commitment” basis in order to acquire the security or to hedge against anticipated changes in interest rates and prices. When-issued securities and forward commitments may be sold prior to the settlement date, but the Trust will enter into when-issued and forward commitments only with the intention of actually receiving or delivering the securities, as the case may be.

The Trust may lend securities with a value up to 33 1/3% of its total assets (including such loans) to banks, brokers and other financial institutions.

As temporary investments, the Trust may invest in repurchase agreements. The Trust will only enter into repurchase agreements with registered securities dealers or domestic banks that, in the opinion of the Manager, present minimal credit risk.

The Trust may deviate from its investment strategy and invest all or any portion of its assets in cash, cash equivalents or short-term debt securities when the Manager determines that it is temporarily unable to follow the Trust’s investment strategy or that it is impractical to do so or pending re-investment of proceeds received in connection with the sale of a security. The Trust may not achieve its investment objective when it does so. The Manager’s determination that it is temporarily unable to follow the Trust’s investment strategy or that it is impractical to do so will generally occur only in situations in which a market disruption event has occurred and where trading in the securities selected through application of the Trust’s investment strategy is extremely limited or absent. Short-term debt investments include U.S. Government securities, including bills, notes and bonds differing as to maturity and rates of interest that are either issued or guaranteed by the U.S. Treasury or by U.S. Government agencies or instrumentalities, certificates of deposit issued against funds deposited in a bank or a savings and loan association, repurchase agreements, which involve purchases of debt securities, and commercial paper, which consists of short-term unsecured promissory notes, including variable rate master demand notes issued by corporations to finance their current

| | |

I N V E S T M E N T O B J E C T I V E S , P O L I C I E S A N D R I S K S | | 187 |

Investment Objectives, Policies and Risks

(continued)

Investment Objectives and Policies

(continued)

operations. Investments in commercial paper will be limited to commercial paper rated in the highest categories by a major rating agency and which mature within one year of the date of purchase or carry a variable or floating rate of interest.

The Trust does not currently borrow money for investment purposes or have preferred shares outstanding, and has no present intention of borrowing money for investment purposes or issuing preferred shares in the future.

The Trust may enter into derivative transactions that have leverage embedded in them.

The Trust may enter into reverse repurchase agreements and “dollar roll” transactions.

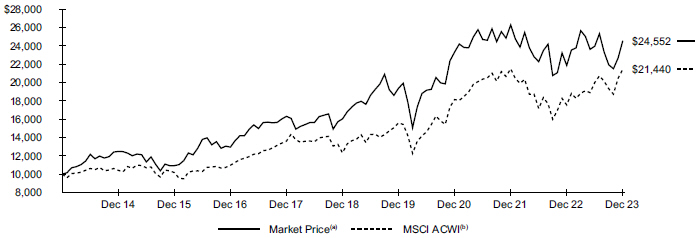

BlackRock Health Sciences Term Trust (BMEZ)

The Trust’s investment objectives are to provide total return and income through a combination of current income, current gains and long-term capital appreciation. The Trust’s investment objectives may be changed by the Board of Trustees of the Trust (the “Board”) without prior shareholder approval.

BlackRock Advisors, LLC (the “Manager”) believes that the knowledge and experience of its Health Sciences Team enable it to evaluate the macro environment and assess its impact on health sciences companies and the various sub-industries within the health sciences group of industries. Within this framework, the Manager identifies stocks with attractive characteristics, evaluates the use of options and provides ongoing portfolio risk management.

The top-down or macro component of the investment process is designed to assess the various interrelated macro variables affecting the health sciences group of industries as a whole. The Manager evaluates health sciences sub-industries (i.e., pharmaceuticals, biotechnology, medical devices, healthcare services, etc.). Selection of sub-industries within the health sciences group of industries is a result of both the Manager’s sub-industry analysis, as well as the Manager’s bottom-up fundamental company analysis. Risk/reward analysis is a key component of both top-down and bottom-up analysis.

Bottom-up security selection is focused on identifying companies with the most attractive characteristics within each sub-industry of the health sciences group of industries. The Manager seeks to identify companies with strong product potential, solid earnings growth and/or earnings power which are under appreciated by investors, a quality management team and compelling relative and absolute valuation. The Manager believes that the knowledge and experience of its Health Sciences Team enables it to identify attractive health sciences securities.

The Manager intends to utilize option strategies that consist of writing (selling) call options on a portion of the common stocks in the Trust’s portfolio, as well as other option strategies such as writing other calls and puts or using options to manage risk. The portfolio management team will work closely to determine which option strategies to pursue to seek to generate current gains from options premiums and to enhance the Trust’s risk-adjusted returns.

Under normal market conditions, the Trust will invest at least 80% of its total assets in equity securities of companies principally engaged in the health sciences group of industries and equity derivatives with exposure to the health sciences group of industries. Equity derivatives in which the Trust invests as part of this non-fundamental investment policy include purchased and sold (written) call and put options on equity securities of companies in the health sciences group of industries.

The Trust will consider a company to be principally engaged in the health sciences group of industries if (i) it is classified in an industry within the health sciences group of industries by a third-party industry classification system or (ii) it is not classified in any industry by such third-party industry classification system and the Manager determines that the company is principally engaged in the health sciences group of industries.

Companies in the health sciences group of industries include health care providers as well as businesses involved in researching, developing, producing, distributing or delivering medical, dental, optical, pharmaceutical or biotechnology products, supplies, equipment or services or that provide support services to these companies. These companies also include those that own or operate health facilities and hospitals or provide related administrative, management or financial support. Other companies in the health sciences group of industries in which the Trust may invest include: clinical testing laboratories; diagnostics; hospital, laboratory or physician ancillary products and support services; rehabilitation services; employer health insurance management services; and vendors of goods and services specifically to companies engaged in the health sciences. The Trust will concentrate its investments in the health sciences group of industries.

While the Trust will invest primarily in companies providing products and services for human health, it may also invest in companies whose products or services relate to the growth or survival of animals and plants. Non-human health sciences companies include those engaged in the development, production or distribution of products or services that: increase crop, animal and animal product yields by enhancing growth or increasing disease resistance; improve agricultural product characteristics, such as taste, appearance, nutritional content and shelf life; reduce the cost of producing agricultural products; or improve pet health.

The Trust may invest in companies of any market capitalization located anywhere in the world, including companies located in emerging markets. The Trust will focus its investments in mid- and small-capitalization companies. Foreign securities in which the Trust may invest may be U.S. dollar-denominated or non-U.S. dollar-denominated.

The Trust invests primarily in equity securities, including common stocks, preferred stocks, convertible securities, warrants and depositary receipts, of health sciences companies and limited partnership interests in REITs that own hospitals.

The Trust may invest in shares of companies through IPOs. The Trust may also invest, without limit, in privately placed or restricted securities (including in Rule 144A securities, which are privately placed securities purchased by qualified institutional buyers), illiquid securities and securities in which no secondary market is readily available, including those of private companies. Issuers of these securities may not have a class of securities registered, and may not be subject to periodic reporting, pursuant to the Securities Exchange Act of 1934, as amended. The Trust intends to invest up to 25% of its total assets, measured at the time of investment, in illiquid privately placed or restricted securities. The Trust expects certain of such investments to be in “late-stage private securities,” which are securities of private companies that have demonstrated sustainable

| | |

| 188 | | 2 0 2 3 B L A C K R O C K A N N U A L R E P O R T T O S H A R E H O L D E R S |

Investment Objectives, Policies and Risks

(continued)

Investment Objectives and Policies

(continued)

business operations and generally have a well-known product or service with a strong market presence. Late-stage private companies have generally had large cash flows from their core business operations and are expanding into new markets with their products or services. Late-stage private companies may also be referred to as “pre-IPO companies.”

The Trust may invest up to 20% of its total assets in other investments, including equity securities issued by companies that are not principally engaged in the health sciences group of industries and debt securities issued by any issuer, including non-investment grade debt securities. The Trust’s investments in non-investment grade securities and those deemed to be of similar quality are considered speculative with respect to the issuer’s capacity to pay interest and repay principal and are commonly referred to as “junk” or “high yield” securities. The Trust has no set policy regarding portfolio maturity or duration of the fixed-income securities it may hold, and such securities may be of any maturity.

As part of its investment strategy, the Trust intends to employ a strategy of writing (selling) covered call options on a portion of the common stocks in its portfolio, writing (selling) other call and put options on individual common stocks, and, to a lesser extent, writing (selling) call and put index options. This options writing strategy is intended to generate current gains from options premiums and to enhance the Trust’s risk-adjusted returns. A substantial portion of the options written by the Trust may be over-the-counter (“OTC”) options.

During temporary defensive periods (i.e., in response to adverse market, economic or political conditions), the Trust may invest up to 100% of its total assets in liquid, short-term investments, including high quality, short-term securities. The Trust may not achieve its investment objectives under these circumstances. The Manager’s determination that it is temporarily unable to follow the Trust’s investment strategy or that it is impractical to do so will generally occur only in situations in which a market disruption event has occurred and where trading in the securities selected through application of the Trust’s investment strategy is extremely limited or absent.

The Trust may purchase and sell futures contracts, enter into various interest rate transactions such as swaps, caps, floors or collars, currency transactions such as currency forward contracts, currency futures contracts, currency swaps or options on currency or currency futures and swap contracts (including, but not limited to, credit default swaps) and may purchase and sell exchange-listed and OTC put and call options on securities and swap contracts, financial indices and futures contracts and use other derivative instruments or management techniques for duration management and other risk management purposes, including to attempt to protect against possible changes in the market value of the Trust’s portfolio resulting from trends in the securities markets and changes in interest rates or to protect the Trust’s unrealized gains in the value of its portfolio securities, to facilitate the sale of portfolio securities for investment purposes, to establish a position in the securities markets as a temporary substitute for purchasing particular securities or to enhance income or gain.

The Trust may also invest in securities of other open- or closed-end investment companies, including exchange-traded funds and business development companies, subject to applicable regulatory limits, that invest primarily in securities of the types in which the Trust may invest directly. The Trust classifies its investments in such investment companies as “equity securities” for purposes of its investment policies based upon such investment companies’ stated investment objectives, policies and restrictions.

The Trust may lend securities with a value of up to 33 1/3% of its total assets (including such loans) to financial institutions that provide cash or securities issued or guaranteed by the U.S. Government as collateral.

The Trust may also engage in short sales of securities. The Trust will not make a short sale if, after giving effect to such sale, the market value of all securities sold short exceeds 25% of the value of its Managed Assets or the Trust’s aggregate short sales of a particular class of securities exceeds 25% of the outstanding securities of that class. The Trust may make short sales “against the box” without respect to such limitations. In this type of short sale, at the time of the sale the Trust owns or has the immediate and unconditional right to acquire at no additional cost the identical security. “Managed Assets” means the total assets of the Trust (including any assets attributable to money borrowed for investment purposes) minus the sum of the Trust’s accrued liabilities (other than money borrowed for investment purposes).

Unless otherwise stated herein, the Trust’s investment policies are non-fundamental policies and may be changed by the Board without prior shareholder approval. The percentage limitations applicable to the Trust’s portfolio described herein apply only at the time of initial investment and the Trust will not be required to sell investments due to subsequent changes in the value of investments that it owns. The Trust’s investment objectives may be changed by the Board without prior shareholder approval; however, the Trust will not change its policy of investing, under normal market conditions, at least 80% of its total assets in equity securities of companies principally engaged in the health sciences group of industries and equity derivatives with exposure to the health sciences group of industries unless it provides shareholders at least 60 days’ written notice before implementation of the change in compliance with rules of the Securities and Exchange Commission.

The Trust currently does not intend to borrow money or issue debt securities or preferred shares. Although it has no present intention to do so, the Trust reserves the right to borrow money from banks or other financial institutions, or issue debt securities or preferred shares, in the future if it believes that market conditions would be conducive to the successful implementation of a leveraging strategy through borrowing money or issuing debt securities or preferred shares. Any such leveraging will not be fully achieved until the proceeds resulting from the use of leverage have been invested in accordance with the Trust’s investment objectives and policies.

The Trust may enter into reverse repurchase agreements with respect to its portfolio investments subject to certain investment restrictions.

The Trust may enter into “dollar roll” transactions.

The Trust may enter into derivative transactions that have leverage embedded in them.

The Trust may also borrow money as a temporary measure for extraordinary or emergency purposes, including the payment of dividends and the settlement of securities transactions which otherwise might require untimely dispositions of Trust securities.

| | |

I N V E S T M E N T O B J E C T I V E S , P O L I C I E S A N D R I S K S | | 189 |

Investment Objectives, Policies and Risks

(continued)

Investment Objectives and Policies

(continued)

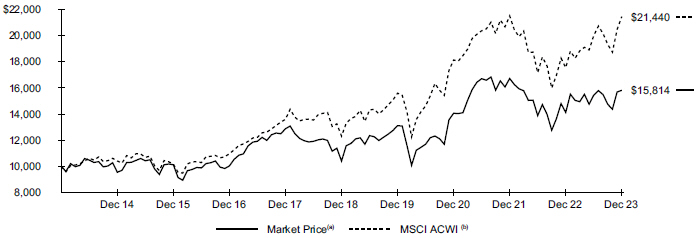

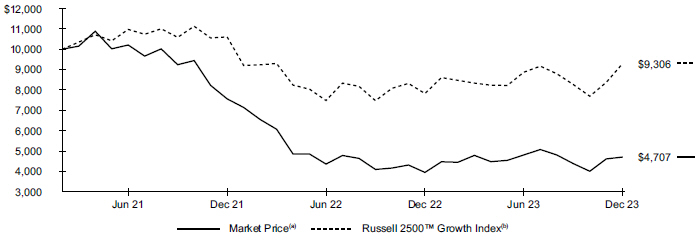

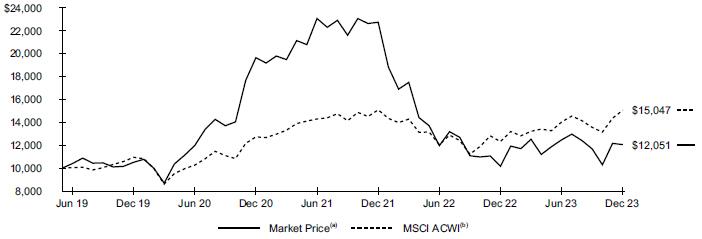

BlackRock Innovation and Growth Term Trust (BIGZ)

The Trust’s investment objectives are to provide total return and income through a combination of current income, current gains and long-term capital appreciation. The Trust is not intended as, and you should not construe it to be, a complete investment program. There can be no assurance that the Trust’s investment objectives will be achieved or that the Trust’s investment program will be successful. The Trust’s investment objectives may be changed by the Board of Trustees of the Trust (the “Board”) without prior shareholder approval.

In selecting investments for the Trust, BlackRock Advisors, LLC (the “Manager”) focuses on equity securities of mid- and small-capitalization growth companies that are “innovative.” These are companies that have introduced, or are seeking to introduce, a new product or service that potentially changes the marketplace. In evaluating innovative companies, the Manager seeks to identify, using its own internal research and analysis, companies capitalizing on innovation or that are enabling the further development of the theme of innovation in the markets in which they operate.

Among other things, common criteria for innovative companies across industries may include developing new products, selling in new markets or channels, applying a new or superior technology to legacy industries, refining existing processes for efficiency, changing or pivoting business model, or creating tools that empower new breakthroughs.

In addition, the Trust seeks to invest in companies where, in the opinion of the Manager, free cash flow is likely to grow for a sustained period. Factors considered in the Manager’s analysis of a company may include 1) a large and underpenetrated addressable market, 2) a technology or service model that creates recurring demand for product, and 3) a competitive landscape that allows for stable or expanding margins. The Manager’s outlook for a company based upon these and other factors is then compared to the outlook of the company implied in the current share price of the company. The Manager looks to invest in companies where its view of future cash flows is more favorable than that which it believes is reflected by the current price.

The Manager will identify trends that have ramifications for individual companies or entire industries. Risk/reward analysis is a key component of both top-down and bottom-up analysis.

Bottom-up security selection is focused on identifying innovative companies with the most attractive growth characteristics. The Manager seeks to identify companies with strong product potential, solid earnings growth and/or earnings power which are under appreciated by investors, a quality management team and compelling relative and absolute valuation. The Manager believes that the knowledge and experience of its investment team enables it to identify attractive innovative companies.

The Trust intends to utilize option strategies that consist of writing (selling) call options on a portion of the common stocks in its portfolio, as well as other option strategies such as writing other calls and puts or using options to manage risk. The portfolio management team will work closely to determine which option strategies to pursue to seek to generate current gains from options premiums and to enhance the Trust’s risk-adjusted returns.

The Trust will invest primarily in equity securities issued by mid- and small-capitalization companies that the Manager believes have above-average earnings growth potential.

Equity securities include common stocks, preferred stocks, convertible securities, warrants and depositary receipts, though the Trust seeks to buy primarily common stock. Although universal definitions of mid-capitalization companies and small-capitalization companies do not exist, the Trust generally defines mid-capitalization and small-capitalization companies as those companies with market capitalizations, at the time of the Trust’s investment, comparable in size to the companies in the Russell 2500™ Growth Index (between $20.75 million and $20.98 billion as of December 31, 2023). In the future, the Trust may define mid- and small-capitalization companies using a different index or classification system.

The Trust may invest in shares of companies through IPOs. The Trust may also invest, without limit, in privately placed or restricted securities (including in Rule 144A securities, which are privately placed securities purchased by qualified institutional buyers), illiquid securities and securities in which no secondary market is readily available, including those of private companies. Issuers of these securities may not have a class of securities registered, and may not be subject to periodic reporting, pursuant to the Exchange Act. Under normal market conditions, the Trust currently intends to invest up to 25% of its total assets, measured at the time of investment, in illiquid privately placed or restricted securities. The Trust expects certain of such investments to be in “late-stage private securities,” which are securities of private companies that have demonstrated sustainable business operations and generally have a well-known product or service with a strong market presence. Late-stage private companies have generally had large cash flows from their core business operations and are expanding into new markets with their products or services. Late-stage private companies may also be referred to as “pre-IPO companies.”

The Trust may invest up to 25% of its assets in securities of foreign companies, including companies located in emerging markets. Foreign securities in which the Trust may invest may be U.S. dollar-denominated or non-U.S. dollar-denominated.

The Trust may also invest in securities of other open- or closed-end investment companies, including exchange-traded funds and business development companies, subject to applicable regulatory limits, that invest primarily in securities of the types in which the Trust may invest directly. The Trust classifies its investments in such investment companies as “equity securities” for purposes of its investment policies based upon such investment companies’ stated investment objectives, policies and restrictions.

As part of its investment strategy, the Trust intends to employ a strategy of writing (selling) covered call options on a portion of the common stocks in its portfolio, writing (selling) other call and put options on individual common stocks, including uncovered call and put options, and, to a lesser extent, writing (selling) covered and uncovered call and put index options. This options writing strategy is intended to generate current gains from options premiums and to enhance the Trust’s risk-adjusted returns. A substantial portion of the options written by the Trust may be over-the-counter options.

The Trust may also purchase and sell futures contracts, enter into various interest rate transactions such as swaps, caps, floors or collars, currency transactions such as currency forward contracts, currency futures contracts, currency swaps or options on currency or currency futures and swap contracts (including, but not limited to, credit default swaps) and may purchase and sell exchange-listed and over-the-counter (“OTC”) put and call options on securities and swap contracts, financial indices and futures contracts and use other derivative instruments or management techniques for duration management and other risk management purposes, including to attempt to protect

| | |

| 190 | | 2 0 2 3 B L A C K R O C K A N N U A L R E P O R T T O S H A R E H O L D E R S |

Investment Objectives, Policies and Risks

(continued)

Investment Objectives and Policies

(continued)

against possible changes in the market value of the Trust’s portfolio resulting from trends in the securities markets and changes in interest rates or to protect the Trust’s unrealized gains in the value of its portfolio securities, to facilitate the sale of portfolio securities for investment purposes, to establish a position in the securities markets as a temporary substitute for purchasing particular securities or to enhance income or gain.

During temporary defensive periods (i.e., in response to adverse market, economic or political conditions), the Trust may invest up to 100% of its total assets in liquid, short-term investments, including high quality, short-term securities. The Trust may not achieve its investment objectives under these circumstances. The Manager’s determination that it is temporarily unable to follow the Trust’s investment strategy or that it is impractical to do so will generally occur only in situations in which a market disruption event has occurred and where trading in the securities selected through application of the Trust’s investment strategy is extremely limited or absent.

The Trust may lend securities with a value of up to 33 1/3% of its total assets (including such loans) to financial institutions that provide cash or securities issued or guaranteed by the U.S. Government as collateral.

The Trust may engage in active and frequent trading of portfolio securities to achieve its investment objectives.

Unless otherwise stated herein, the Trust’s investment policies are non-fundamental policies and may be changed by the Board without prior shareholder approval. The percentage limitations applicable to the Trust’s portfolio described in this prospectus apply only at the time of initial investment and the Trust will not be required to sell investments due to subsequent changes in the value of investments that it owns. The Trust’s investment objectives may be changed by the Board without prior shareholder approval.

The Trust currently does not intend to borrow money or issue debt securities or preferred shares. The Trust is, however, permitted to borrow money or issue debt securities in an amount up to 33 1/3% of its Managed Assets (50% of its net assets), and issue preferred shares in an amount up to 50% of its Managed Assets (100% of its net assets). “Managed Assets” means the total assets of the Trust (including any assets attributable to money borrowed for investment purposes) minus the sum of the Trust’s accrued liabilities (other than money borrowed for investment purposes). Although it has no present intention to do so, the Trust reserves the right to borrow money from banks or other financial institutions, or issue debt securities or preferred shares, in the future if it believes that market conditions would be conducive to the successful implementation of a leveraging strategy through borrowing money or issuing debt securities or preferred shares.

The Trust is permitted to leverage its portfolio by entering into one or more credit facilities.

The Trust may enter into reverse repurchase agreements with respect to its portfolio investments subject to the Trust’s investment restrictions.

The Trust may enter into “dollar roll” transactions.

The Trust may enter into derivative transactions that have leverage embedded in them.

The Trust may also borrow money as a temporary measure for extraordinary or emergency purposes, including the payment of dividends and the settlement of securities transactions which otherwise might require untimely dispositions of Trust securities.

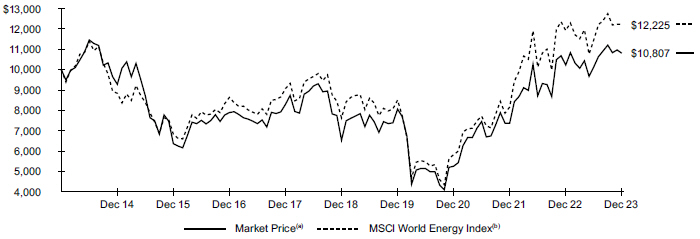

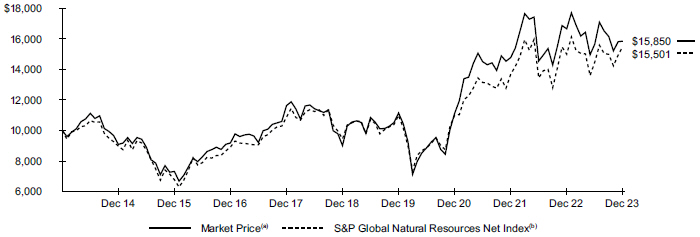

BlackRock Resources & Commodities Strategy Trust (BCX)

The Trust’s primary investment objective is to seek high current income and current gains, with a secondary objective of capital appreciation. The Trust will seek to achieve its objectives by investing substantially all of its assets in equity securities issued by commodity or natural resources companies, derivatives with exposure to commodity or natural resources companies or investments in securities and derivatives linked to the underlying price movement of commodities or natural resources, including commodity-linked derivatives such as commodity-linked notes, commodity futures, forward contracts and swaps and other similar derivative instruments and investment vehicles that invest in commodities, natural resources or commodity-linked derivatives. The Trust’s investment objectives are not fundamental and may be changed by the Board of Trustees of the Trust (the “Board”).

The Trust will seek to achieve its investment objectives, under normal market conditions, by investing at least 80% of its total assets in equity securities issued by commodity or natural resources companies, derivatives with exposure to commodity or natural resources companies or investments in securities and derivatives linked to the underlying price movement of commodities or natural resources, including commodity-linked derivatives such as commodity-linked notes, commodity futures, forward contracts and swaps and other similar derivative instruments and investment vehicles that invest in commodities, natural resources or commodity-linked derivatives. Commodities and natural resources include, without limitation, minerals, metals (including precious, industrial and rare metals), steel, agricultural products and commodities, livestock, environmental commodities, wool, ethanol, chemicals, forest products (including wood, pulp and paper), plastic, rubber, sugar, cotton, cocoa, coffee, basic materials, building materials, water, oil, gas, consumable fuel, energy and other natural resources. Commodity and natural resources companies, include, but are not limited to, companies in commodities, natural resources and energy businesses and in associated businesses and companies that provide services or have exposure to such businesses (collectively, the “Commodities and Natural Resources Sector”). These companies include, without limitation, companies engaged in the exploration, ownership, production, refinement, processing, transportation, distribution or marketing of commodities or natural resources, companies that use commodities and natural resources extensively in their products, including companies that are engaged in businesses such as integrated oil, oil and gas exploration and production, gold, metals and minerals, steel and iron ore production, aluminum and related products, energy services, and technology, metal production, forest products, including timber and related wood and paper products, chemicals, fertilizer and agricultural chemicals, building materials, coal and other consumable fuel, alternative energy sources, environmental services and agricultural products (including crop growers, owners of plantations, and companies that produce and process foods), as well as related transportation companies and equipment manufacturers. The Trust will consider a company to be a commodity or natural resources company if: (i) at least 50% of the company’s assets, income, sales or profits are committed to or derived from the Commodities and Natural Resources Sector; or (ii) a third party classification (such as (a) Standard Industry Classifications and the North American Industry Classification

| | |

I N V E S T M E N T O B J E C T I V E S , P O L I C I E S A N D R I S K S | | 191 |

Investment Objectives, Policies and Risks

(continued)

Investment Objectives and Policies

(continued)

System, each of which is published by the Executive Office of the President, Office of Management and Budget and (b) classifications used by third party data providers including, without limitation, FactSet Research Systems Inc. and MSCI Barra), has given the company an industry or sector classification consistent with the Commodities and Natural Resources Sector.

Equity securities held by the Trust may include common stocks, preferred stocks, convertible securities, warrants, depositary receipts, equity interests in Canadian Royalty Trusts, and equity interests in master limited partnerships (“MLPs”). The Trust will not invest more than 25% of the value of its total assets in MLPs. The Trust’s economic exposure to securities and derivatives linked to the underlying price movements of commodities or natural resources, including commodity-linked derivatives such as commodity-linked notes, commodity futures, forward contracts and swaps and other similar derivative instruments and investment vehicles that invest in commodities, natural resources or commodity-linked derivatives (“Commodity-Related Instruments”) will not exceed 20% of its total assets. Commodity-Related Instruments may include, but will not be limited to, investments in structured notes, partnership interests, exchange-traded funds that make commodity-related or natural resources-related investments, mutual funds and strategic transactions, including futures contracts on commodities and natural resources, forward contracts on commodities and natural resources and swap contracts on commodities and natural resources.

The Trust may invest in such Commodity-Related Instruments either directly or indirectly through the BlackRock Cayman Resources & Commodities Strategy Fund, Ltd., a wholly-owned subsidiary of the Trust formed in the Cayman Islands (the “Subsidiary”). Investments in the Subsidiary are intended to provide the Trust with exposure to commodities market returns within the limitations of the federal tax requirements that apply to the Trust. The Trust may gain exposure to certain Commodity-Related Instruments and certain other commodity-related and natural resources-related investments that, if the Trust invested in such investments directly, would not produce qualifying income for purposes of the income tests applicable to regulated investment companies under the Internal Revenue Code of 1986, as amended, by investing in the Subsidiary. The Manager is the manager of the Subsidiary. The Subsidiary (unlike the Trust) may invest without limitation in commodity-related instruments.

The Subsidiary will be managed pursuant to compliance policies and procedures that are the same, in all material respects, as the policies and procedures adopted by the Trust. As a result, the Manager, in managing the Subsidiary’s portfolio, will be subject to the same investment policies and restrictions that apply to the management of the Trust, and, in particular, to the requirements relating to portfolio leverage, liquidity, brokerage, and the timing and method of the valuation of the Subsidiary’s portfolio investments and shares of the Subsidiary. The Trust’s Chief Compliance Officer will oversee implementation of the Subsidiary’s policies and procedures, and make periodic reports to the Board regarding the Subsidiary’s compliance with its policies and procedures. The Trust and Subsidiary will test for compliance with certain investment restrictions on a consolidated basis, except that with respect to the Subsidiary’s investments in certain securities that may involve leverage, the Subsidiary will comply with asset segregation requirements to the same extent as the Trust.

The Manager will provide investment management and other services to the Subsidiary pursuant to the investment management agreement among the Manager, the Trust and the Subsidiary. The Trust and the Subsidiary will pay the Manager based on the Trust’s assets (excluding the value of the Trust’s interest in the Subsidiary) and the Subsidiary’s assets, respectively. The Subsidiary has also entered into separate contracts for the provision of custody and audit services with the same or with affiliates of the same service providers that provide those services to the Trust. The financial statements of the Subsidiary are consolidated with the Trust’s financial statements in the Trust’s annul and semi-annual reports.

Although the Trust is permitted to invest up to 20% of its total assets in Commodity-Related Instruments, the Trust is not required to invest in Commodity-Related Instruments and does not currently expect to invest in securities and derivatives linked to the underlying price movement of commodities or natural resources. The Trust may invest in Commodity-Related Instruments (either directly or through the Subsidiary) when BlackRock Advisors, LLC (the “Manager”) or BlackRock International Limited (“BIL” and together with the Manager, the “Advisors”), the Trust’s sub-advisor, believes it is advantageous for the Trust to do so.

While permitted, the Trust does not currently expect to invest in securities and derivatives linked to the underlying price movement of commodities or natural resources; therefore, the Trust does not currently intend to invest any assets in the Subsidiary.

The Commodity Futures Trading Commission (the “CFTC”) subjects advisers to registered investment companies to regulation by the CFTC if a fund that is advised by the investment adviser either (i) invests directly or indirectly more than a prescribed level of its liquidation value in CFTC-regulated futures, options and swaps (“CFTC Derivatives”), or (ii) markets itself as providing investment exposure to such instruments. To the extent the Trust uses CFTC Derivatives, it intends to do so below such prescribed levels and will not market itself as a “commodity pool” or a vehicle for trading such instruments. Accordingly, the Manager has claimed an exclusion from the definition of the term “commodity pool operator” under the Commodity Exchange Act (“CEA”) pursuant to Rule 4.5 under the CEA. The Manager is not, therefore, subject to registration or regulation as a “commodity pool operator” under the CEA in respect of the Trust.

The Trust may invest in companies of any market capitalization located anywhere in the world. The Trust expects to invest primarily in companies located in developed countries, but may invest in companies located in emerging markets.

The Trust may invest up to 20% of its total assets in debt securities issued by companies in the Commodities and Natural Resources Sector or any type of securities issued by companies that are not in the Commodities and Natural Resources Sector.

As part of its investment strategy, the Trust may employ a strategy of writing (selling) covered call options on a portion of the common stocks in its portfolio, writing (selling) covered put options and, to a lesser extent, writing (selling) covered call and put options on indices of securities and sectors of securities. This option strategy is intended to generate current gains from option premiums as a means to enhance distributions payable to the Trust’s shareholders.

In addition to the option strategies discussed above, the Trust may engage in strategic transactions for hedging purposes or to enhance total return. The Trust may also engage in short sales of securities.

The Trust may lend securities with a value up to 33 1/3% of its total assets (including such loans) to financial institutions that provide cash or securities issued or guaranteed by the U.S. Government as collateral.

| | |

| 192 | | 2 0 2 3 B L A C K R O C K A N N U A L R E P O R T T O S H A R E H O L D E R S |

Investment Objectives, Policies and Risks

(continued)

Investment Objectives and Policies

(continued)

The Trust may implement various temporary “defensive” strategies at times when the Advisors determine that conditions in the markets make pursuing the Trust’s basic investment strategy inconsistent with the best interests of its shareholders. These strategies may include investing all or a portion of the Trust’s assets in U.S. Government obligations and short-term debt securities that may be either tax-exempt or taxable.

Under current market conditions, the Trust currently does not intend to engage in short sales or incur indebtedness or issue preferred shares for investment purposes, except the Trust may engage for hedging purposes, risk management, or to enhance total return, including engaging in transactions, such as options, futures, swaps, foreign currency transactions, such as forward foreign currency contracts, currency swaps or options on currency and currency futures and other derivatives transactions , repurchase agreements, reverse repurchase agreements, when issued or forward commitment transactions and similar investment strategies, which may give rise to a form of leverage.

Unless otherwise stated herein, the Trust’s investment objectives and investment policies are non-fundamental policies and may be changed by the Board. In addition, the percentage limitations applicable to the Trust’s portfolio described herein apply only at the time of investment, and the Trust will not be required to sell investments due to subsequent changes in the value of investments that it owns.

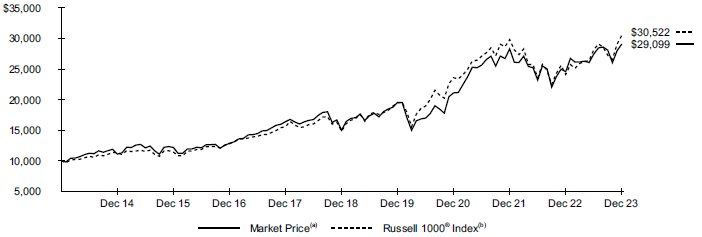

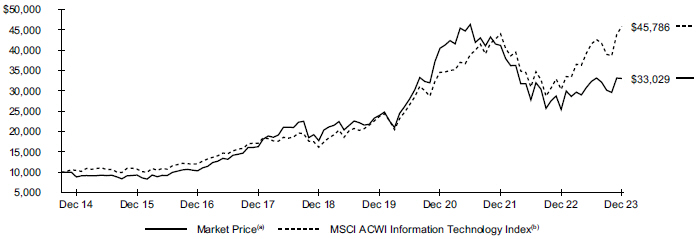

BlackRock Science and Technology Trust (BST)

The Trust’s investment objectives are to provide income and total return through a combination of current income, current gains and long-term capital appreciation. The Trust’s investment objectives may be changed by the Board of Trustees (the “Board”) without prior shareholder approval.

BlackRock Advisors, LLC (the “Manager”) may consider a variety of factors when choosing investments for the Trust, such as:

| | • | | selecting companies with the potential for rapid and sustainable growth from the development, advancement and use of science and/or technology (high growth science and technology stocks); and |

| | • | | identifying companies that have above-average return potential based on factors such as revenue and earnings growth, profitability, valuation and dividend yield (cyclical science and technology stocks. |

In addition, a variety of countries, including emerging market countries, and industries are likely to be represented in the Trust’s portfolio.

The Trust generally will sell a stock when, in the Manager’s opinion, the stock is fully valued, there is a need to rebalance the portfolio or there is a better opportunity elsewhere.

The Trust may engage in active and frequent trading of portfolio securities to seek to achieve its investment objectives.

Under normal market conditions, the Trust invests at least 80% of its total assets in equity securities issued by U.S. and non-U.S. science and technology companies in any market capitalization range, selected for their rapid and sustainable growth potential from the development, advancement and use of science and/or technology (high growth science and technology stocks), and/or potential to generate current income from advantageous dividend yields (cyclical science and technology stocks).

Science and technology companies are companies whose products, processes or services, in the Manager’s view, are being, or are expected to be, significantly benefited by the use or commercial application of scientific or technological developments or discoveries. These companies include companies that, in the Manager’s view, derive a competitive advantage by the application of scientific or technological developments or discoveries to grow their business or increase their competitive advantage, as well as companies that utilize science and/or technology as an agent of change to significantly enhance their business opportunities.

Science, technology and science- or technology-related companies may include companies operating in any industry, including, but not limited to software, internet software & services, IT services, hardware, communications equipment, semiconductors and semiconductor equipment, media, internet retail, consumer finance, life sciences tools & services, biotechnology, pharmaceuticals, energy, defense/aerospace, diversified telecom services and wireless telecom services. Examples of potential high growth companies include those operating in IT services, the internet, software and sciences; examples of potential cyclical companies include those operating in hardware, telecom, semiconductors and components. The Manager determines, in its discretion, whether a company is a science, technology or science- or technology-related company.