Exhibit 99.2 Supplemental Information 2nd Quarter 2020

Table of Contents COVID-19 Financial Impact 4 Overview 5 Segment Overview 8 Senior Housing 9 Health Care Services 14 G&A Expense 15 Capital Expenditures 16 Cash Facility Lease Payments 17 Capital Structure 18 Definitions 19 Appendices: Pro-Forma Financial Information 22 2019 Lease Accounting Standard (ASC 842) Impact 26 Non-GAAP Financial Measures 27 2

SAFE HARBOR Certain statements in this Supplemental Information may constitute forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. These forward-looking statements are subject to various risks and uncertainties and include all statements regarding the Company’s intent, expectations and assumptions related to the various pending and expected transactions outlined herein and any other statements that are not historical statements of fact. Forward- looking statements are generally identifiable by use of forward-looking terminology such as "may," "will," "should," "could," "would," "potential," "intend," "expect," "endeavor," "seek," "anticipate," "estimate," "believe," "project," "predict," "continue," "plan," "target," or other similar words or expressions. These forward-looking statements are based on certain assumptions and expectations, and the Company's ability to predict results or the actual effect of future plans or strategies is inherently uncertain. Although the Company believes that expectations reflected in any forward-looking statements are based on reasonable assumptions, the Company can give no assurance that its assumptions or expectations will be attained, and actual results and performance could differ materially from those projected. Factors which could cause events or circumstances to differ from the forward-looking statements include, but are not limited to: the impacts of the COVID-19 pandemic, including the response efforts of federal, state, and local government authorities, businesses, individuals and the Company, on the Company's business, results of operations, cash flow, and liquidity, and strategic initiatives; the Company’s ability to complete pending or expected disposition, acquisition or other transactions on agreed upon terms or at all, including in respect of the satisfaction of closing conditions, the risk that regulatory approvals are not obtained or are subject to unanticipated conditions, and uncertainties as to the timing of closing, and the Company’s ability to identify and pursue any such opportunities in the future; delays in obtaining regulatory approvals; terminations, early or otherwise, or non-renewal of management agreements; regulatory changes in geographic areas where the Company is concentrated; disruptions in the financial markets, including those related to the pandemic, that affect the Company’s ability to obtain financing or extend or refinance debt as it matures and the Company’s financing costs; a decrease in the overall demand for senior housing, which may be adversely impacted by the pandemic; environmental contamination at any of the Company’s communities; failure to comply with existing environmental laws; unanticipated costs to comply with legislative or regulatory developments; as well as other risks detailed from time to time in the Company’s filings with the Securities and Exchange Commission, including those contained in the Company’s Annual Report on Form 10-K and Quarterly Reports on Form 10-Q. When considering forward-looking statements, you should keep in mind the risk factors and other cautionary statements in such SEC filings. Readers are cautioned not to place undue reliance on any of these forward-looking statements, which reflect management's views as of the date of this Supplemental Information. The Company cannot guarantee future results, levels of activity, performance or achievements, and, except as required by law, it expressly disclaims any obligation to release publicly any updates or revisions to any of these forward-looking statements to reflect any change in its expectations with regard thereto or change in events, conditions or circumstances on which any statement is based. 3

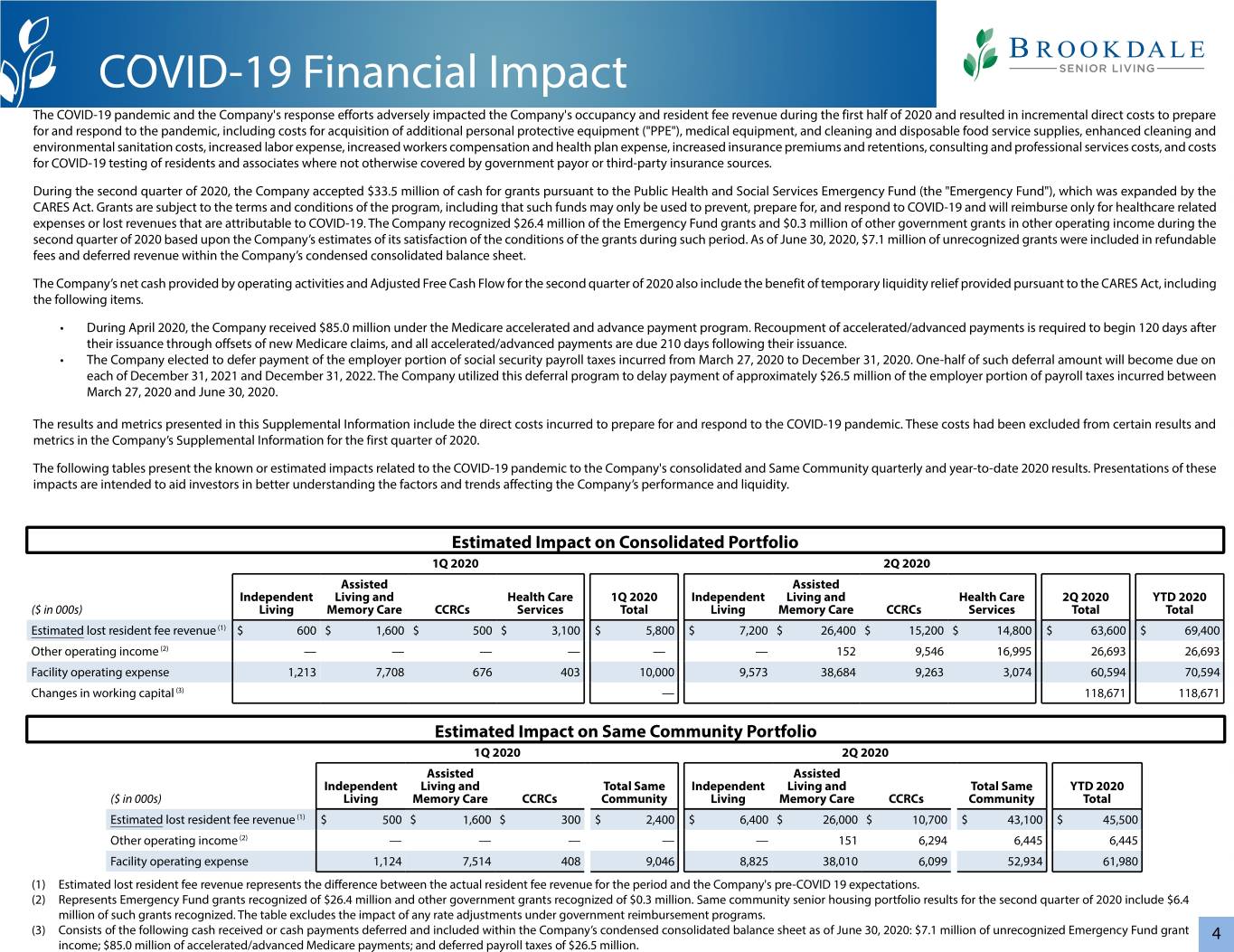

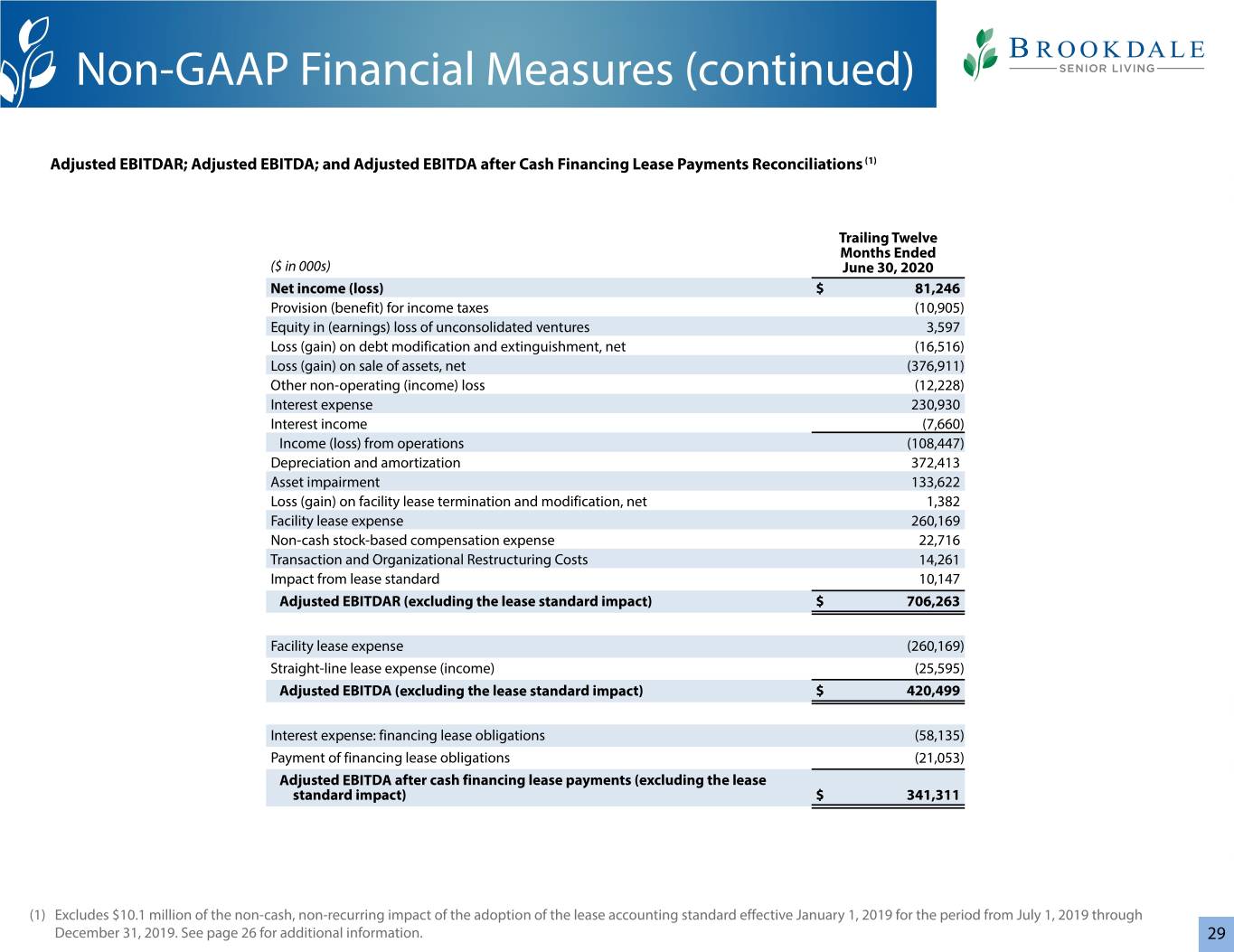

COVID-19 Financial Impact The COVID-19 pandemic and the Company's response efforts adversely impacted the Company's occupancy and resident fee revenue during the first half of 2020 and resulted in incremental direct costs to prepare for and respond to the pandemic, including costs for acquisition of additional personal protective equipment ("PPE"), medical equipment, and cleaning and disposable food service supplies, enhanced cleaning and environmental sanitation costs, increased labor expense, increased workers compensation and health plan expense, increased insurance premiums and retentions, consulting and professional services costs, and costs for COVID-19 testing of residents and associates where not otherwise covered by government payor or third-party insurance sources. During the second quarter of 2020, the Company accepted $33.5 million of cash for grants pursuant to the Public Health and Social Services Emergency Fund (the "Emergency Fund"), which was expanded by the CARES Act. Grants are subject to the terms and conditions of the program, including that such funds may only be used to prevent, prepare for, and respond to COVID-19 and will reimburse only for healthcare related expenses or lost revenues that are attributable to COVID-19. The Company recognized $26.4 million of the Emergency Fund grants and $0.3 million of other government grants in other operating income during the second quarter of 2020 based upon the Company’s estimates of its satisfaction of the conditions of the grants during such period. As of June 30, 2020, $7.1 million of unrecognized grants were included in refundable fees and deferred revenue within the Company’s condensed consolidated balance sheet. The Company’s net cash provided by operating activities and Adjusted Free Cash Flow for the second quarter of 2020 also include the benefit of temporary liquidity relief provided pursuant to the CARES Act, including the following items. • During April 2020, the Company received $85.0 million under the Medicare accelerated and advance payment program. Recoupment of accelerated/advanced payments is required to begin 120 days after their issuance through offsets of new Medicare claims, and all accelerated/advanced payments are due 210 days following their issuance. • The Company elected to defer payment of the employer portion of social security payroll taxes incurred from March 27, 2020 to December 31, 2020. One-half of such deferral amount will become due on each of December 31, 2021 and December 31, 2022. The Company utilized this deferral program to delay payment of approximately $26.5 million of the employer portion of payroll taxes incurred between March 27, 2020 and June 30, 2020. The results and metrics presented in this Supplemental Information include the direct costs incurred to prepare for and respond to the COVID-19 pandemic. These costs had been excluded from certain results and metrics in the Company’s Supplemental Information for the first quarter of 2020. The following tables present the known or estimated impacts related to the COVID-19 pandemic to the Company's consolidated and Same Community quarterly and year-to-date 2020 results. Presentations of these impacts are intended to aid investors in better understanding the factors and trends affecting the Company’s performance and liquidity. Estimated Impact on Consolidated Portfolio 1Q 2020 2Q 2020 Assisted Assisted Independent Living and Health Care 1Q 2020 Independent Living and Health Care 2Q 2020 YTD 2020 ($ in 000s) Living Memory Care CCRCs Services Total Living Memory Care CCRCs Services Total Total Estimated lost resident fee revenue (1) $ 600 $ 1,600 $ 500 $ 3,100 $ 5,800 $ 7,200 $ 26,400 $ 15,200 $ 14,800 $ 63,600 $ 69,400 Other operating income (2) — — — — — — 152 9,546 16,995 26,693 26,693 Facility operating expense 1,213 7,708 676 403 10,000 9,573 38,684 9,263 3,074 60,594 70,594 Changes in working capital (3) — 118,671 118,671 Estimated Impact on Same Community Portfolio 1Q 2020 2Q 2020 Assisted Assisted Independent Living and Total Same Independent Living and Total Same YTD 2020 ($ in 000s) Living Memory Care CCRCs Community Living Memory Care CCRCs Community Total Estimated lost resident fee revenue (1) $ 500 $ 1,600 $ 300 $ 2,400 $ 6,400 $ 26,000 $ 10,700 $ 43,100 $ 45,500 Other operating income (2) — — — — — 151 6,294 6,445 6,445 Facility operating expense 1,124 7,514 408 9,046 8,825 38,010 6,099 52,934 61,980 (1) Estimated lost resident fee revenue represents the difference between the actual resident fee revenue for the period and the Company's pre-COVID 19 expectations. (2) Represents Emergency Fund grants recognized of $26.4 million and other government grants recognized of $0.3 million. Same community senior housing portfolio results for the second quarter of 2020 include $6.4 million of such grants recognized. The table excludes the impact of any rate adjustments under government reimbursement programs. (3) Consists of the following cash received or cash payments deferred and included within the Company’s condensed consolidated balance sheet as of June 30, 2020: $7.1 million of unrecognized Emergency Fund grant 4 income; $85.0 million of accelerated/advanced Medicare payments; and deferred payroll taxes of $26.5 million.

Overview 2Q20 vs. YTD 2Q20 vs. 2019 2020 2Q19 YTD 2Q19 Better (B)/ ($ in 000s) 1Q 2Q 3Q 4Q Full Year 1Q 2Q (Worse) (W) B/(W) Resident fee revenue (1) $ 809,479 $ 801,863 $ 801,237 $ 797,352 $3,209,931 $ 782,707 $ 731,629 (8.8)% (6.0)% Management fee revenue $ 15,743 $ 15,449 $ 13,564 $ 12,352 $ 57,108 $ 108,715 $ 6,076 (60.7)% NM Other operating income $ — $ — $ — $ — $ — $ — $ 26,693 NM NM Net income (loss) (1) $ (42,606) $ (56,055) $ (78,508) $ (91,323) $ (268,492) $ 369,497 $(118,420) (111.3)% NM Net cash provided by (used in) operating activities $ (5,009) $ 64,128 $ 69,211 $ 88,082 $ 216,412 $ 57,479 $ 151,840 136.8 % NM Adjusted EBITDA(1) (2) $ 116,583 $ 104,036 $ 80,447 $ 100,103 $ 401,169 $ 185,069 $ 44,733 (57.0)% 4.2 % Adjusted EBITDA, excluding $100.0 million management termination fee $ 116,583 $ 104,036 $ 80,447 $ 100,103 $ 401,169 $ 85,069 $ 44,733 (57.0)% (41.2)% Adjusted Free Cash Flow $ (46,971) $ (16,369) $ (13,575) $ 511 $ (76,404) $ 5,182 $ 113,451 NM NM Period end consolidated number of units 55,948 55,209 55,262 54,181 54,181 54,037 54,019 (2.2)% (2.2)% Consolidated: As of June 30, 2020 Consolidated: 54,019 660 2Q 2020 weighted average occupancy (consolidated communities) Community % of Period End Occupancy Band Count Communities Leased: Greater than 95% 65 10% Leased: 21,538 90% > 95% 77 12% Owned: 305 85% > 90% 94 14% 737 Owned: 64,713 355 communities 32,481 units 80% > 85% 106 16% 75% > 80% 80 12% 70% > 75% 72 11% Less than 70% 166 25% Total 660 100% Managed: 10,694 Consolidated Portfolio Average Managed: 77 Asset Age ~ 23 years (1) The 2019 periods presented include the non-recurring, non-cash revenue and expense associated with the Company's adoption of the lease accounting standard effective January 1, 2019. See page 26 for additional information. (2) Adjusted EBITDA for the first quarter and year-to-date of 2020 includes the $100.0 million management agreement termination fee payment received from Healthpeak Properties Inc. ("Healthpeak") related to the sale of Brookdale’s interest in the entry fee CCRC venture, which closed on January 31, 2020. Adjusted EBITDA for the second quarter and year-to-date of 2020 includes $26.7 million of government grants recognized in other operating income during the second quarter of 2020. Important Note Regarding Non-GAAP Financial Measures • Adjusted EBITDA and Adjusted Free Cash Flow are financial measures that are not calculated in accordance with GAAP. See “Definitions” and “Non-GAAP Financial Measures” for the definitions of such measures and other important information regarding such measures, including reconciliations to the most comparable GAAP measures. 5

Adjusted EBITDA and Adjusted Free Cash Flow 2Q20 vs. YTD 2Q20 vs. 2019 2020 2Q19 YTD 2Q19 ($ in 000s) 1Q 2Q 3Q 4Q Full Year 1Q 2Q B(W) B(W) Resident fee revenue $ 809,479 $ 801,863 $ 801,237 $ 797,352 $3,209,931 $ 782,707 $ 731,629 (8.8)% (6.0)% Management fee revenue 15,743 15,449 13,564 12,352 57,108 108,715 6,076 (60.7)% NM Other operating income — — — — — — 26,693 NM NM Facility operating expense (586,094) (590,246) (615,717) (598,438) (2,390,495) (588,482) (606,034) (2.7)% (1.5)% Combined Segment Operating Income 239,128 227,066 199,084 211,266 876,544 302,940 158,364 (30.3)% (1.0)% General and administrative expense (1) (49,494) (50,912) (46,570) (39,280) (186,256) (46,657) (43,031) 15.5 % 10.7 % Cash facility operating lease payments (see page 17) (73,051) (72,118) (72,067) (71,883) (289,119) (71,214) (70,600) 2.1 % 2.3 % Adjusted EBITDA (2) 116,583 104,036 80,447 100,103 401,169 185,069 44,733 (57.0)% 4.2 % $100.0 million management termination fee — — — — — (100,000) — NM NM Adjusted EBITDA, excluding $100.0 million management termination fee 116,583 104,036 80,447 100,103 401,169 85,069 44,733 (57.0)% (41.2)% $100.0 million management termination fee — — — — — 100,000 — NM NM Transaction and Organizational Restructuring Costs (461) (634) (3,910) (5,002) (10,007) (1,981) (3,368) NM NM Interest expense, net (see page 17) (59,302) (59,029) (58,749) (57,132) (234,212) (53,590) (48,623) 17.6 % 13.6 % Payment of financing lease obligations (5,453) (5,500) (5,549) (5,740) (22,242) (5,087) (4,677) 15.0 % 10.9 % Changes in working capital (3) (43,405) 9,620 31,439 20,410 18,064 (53,902) 149,055 NM NM Other (4) (331) 1,602 1,868 3,482 6,621 (4,771) (2,148) NM NM Non-Development Capital Expenditures, net (see page 16) (54,602) (66,464) (59,121) (55,610) (235,797) (60,556) (21,521) 67.6 % 32.2 % Adjusted Free Cash Flow (46,971) (16,369) (13,575) 511 (76,404) 5,182 113,451 NM NM (1) Excluding non-cash stock-based compensation expense and Transaction and Organizational Restructuring Costs, see page 15. (2) Adjusted EBITDA for the first quarter and year-to-date of 2020 includes the $100.0 million management agreement termination fee payment received from Healthpeak related to the sale of Brookdale’s interest in the entry fee CCRC venture, which closed on January 31, 2020. Adjusted EBITDA for the second quarter and year-to-date of 2020 includes $26.7 million of government grants recognized in other operating income during the second quarter 2020. (3) Excludes changes in prepaid insurance premiums financed with notes payable, changes in operating lease liability for lease termination and modification, and lessor capital expenditure reimbursements under operating leases and includes $118.7 million impact related to CARES Act programs for the second quarter and year-to-date of 2020. (4) Primarily consists of proceeds from property insurance and cash paid for state income taxes. 6

Adjusted EBITDA and Adjusted Free Cash Flow Distribution 2Q 2020 Senior Senior Housing Housing Owned Leased Health Care Management ($ in 000s) Total Portfolio Portfolio Services Services Other (1) Resident fee revenue $ 731,629 $ 376,140 $ 265,319 $ 90,170 $ — $ — Management fee revenue 6,076 — — — 6,076 — Other operating income 26,693 7,156 2,542 16,995 — — Facility operating expense (606,034) (301,459) (207,102) (97,473) — — Combined Segment Operating Income 158,364 81,837 60,759 9,692 6,076 — General and administrative expense (excluding non-cash stock-based compensation expense and transaction costs) (43,031) (18,336) (12,933) (5,355) (6,407) — Cash facility operating lease payments (70,600) — (69,216) — — (1,384) Adjusted EBITDA 44,733 63,501 (21,390) 4,337 (331) (1,384) Transaction and Organizational Restructuring Costs (3,368) — — — — (3,368) Interest expense, net (48,623) (38,974) (11,892) — — 2,243 Payment of financing lease obligations (4,677) — (4,515) — — (162) Changes in working capital (2) 149,055 — — — — 149,055 Other (2,148) (806) — — — (1,342) Non-Development Capital Expenditures, net (21,521) (12,011) (1,727) — — (7,783) Adjusted Free Cash Flow $ 113,451 $ 11,710 $ (39,524) $ 4,337 $ (331) $ 137,259 (1) Primarily consists of changes in working capital, corporate capital expenditures, Transaction and Organizational Restructuring Costs, interest income, lease payments for corporate offices and information technology systems and equipment, and cash paid for state income taxes. (2) Excludes changes in prepaid insurance premiums financed with notes payable and lessor capital expenditure reimbursements under operating leases. 7

Segment Overview 2Q20 vs. YTD 2Q20 vs. 2019 2020 2Q19 YTD 2Q19 ($ in 000s, except RevPAR and RevPOR) 1Q 2Q 3Q 4Q Full Year 1Q 2Q B(W) B(W) Total Senior Housing, Health Care Services, and Management Services Revenue (1) $825,222 $817,312 $814,801 $809,704 $3,267,039 $891,422 $737,705 (9.7)% (0.8)% Other operating income $ — $ — $ — $ — $ — $ — $ 26,693 NM NM Combined Segment Operating Income $239,128 $227,066 $199,084 $211,266 $ 876,544 $302,940 $158,364 (30.3)% (1.0)% Combined Segment Operating Margin (2) 29.0% 27.8% 24.4% 26.1% 26.8% 34.0 % 20.7% (710) bps (50) bps Senior Housing (see page 9) Revenue $697,947 $687,429 $689,452 $687,843 $2,762,671 $687,888 $641,459 (6.7)% (4.0)% Other operating income $ — $ — $ — $ — $ — $ — $ 9,698 NM NM Senior Housing Operating Income $215,212 $202,450 $180,742 $196,045 $ 794,449 $203,346 $142,596 (29.6)% (17.2)% Senior Housing Operating Margin (2) 30.8% 29.5% 26.2% 28.5% 28.8% 29.6 % 21.9% (760) bps (430) bps Number of communities (period end) 680 671 671 663 663 661 660 (1.6)% (1.6)% Period end number of units 55,948 55,209 55,262 54,181 54,181 54,037 54,019 (2.2)% (2.2)% Total Average Units 56,460 55,465 55,258 54,821 55,501 54,184 54,040 (2.6)% (3.3)% RevPAR $ 4,102 $ 4,097 $ 4,109 $ 4,116 $ 4,106 $ 4,229 $ 3,954 (3.5)% (0.2)% Weighted average unit occupancy 83.6% 83.5% 84.2% 84.5% 83.9% 83.2 % 78.7% (480) bps (250) bps RevPOR $ 4,909 $ 4,909 $ 4,880 $ 4,871 $ 4,893 $ 5,085 $ 5,022 2.3 % 3.0 % Health Care Services Segment (see page 14) Revenue $111,532 $114,434 $111,785 $109,509 $ 447,260 $ 94,819 $ 90,170 (21.2)% (18.1)% Other operating income $ — $ — $ — $ — $ — $ — $ 16,995 NM NM Segment Operating Income $ 8,173 $ 9,167 $ 4,778 $ 2,869 $ 24,987 $ (9,121) $ 9,692 5.7 % (96.7)% Segment Operating Margin (2) 7.3% 8.0% 4.3% 2.6% 5.6% (9.6)% 9.0% 100 bps (740) bps Management Services Segment Segment Operating Income (comprised solely of management fees) $ 15,743 $ 15,449 $ 13,564 $ 12,352 $ 57,108 $108,715 $ 6,076 (60.7)% NM Resident fee revenue under management (3) $321,952 $294,114 $275,796 $259,437 $1,151,299 $184,145 $131,558 (55.3)% (48.8)% Number of communities (period end) (3) 164 138 123 100 100 80 77 (44.2)% (44.2)% Period end number of units (3) 23,742 21,451 20,168 18,086 18,086 11,033 10,694 (50.1)% (50.1)% Total Average Units (3) 25,047 22,464 20,730 18,836 21,769 13,325 10,905 (51.5)% (49.0)% Weighted average unit occupancy (3) 82.9% 82.8% 83.4% 84.6% 83.3% 84.0 % 78.0% (480) bps (160) bps (1) Excludes reimbursed costs on behalf of managed communities. (2) For the second quarter of 2020, segment operating margin excluding other operating income was 17.8% for Total Senior Housing, Health Care Services, and Management Services; 20.7% for Senior Housing; and (8.1%) for Health Care Services. (3) Not included in consolidated reported amounts. 8

Senior Housing Segments 2Q20 vs. YTD 2Q20 vs. 2019 2020 2Q19 YTD 2Q19 ($ in 000s, except RevPAR and RevPOR) 1Q 2Q 3Q 4Q Full Year 1Q 2Q B(W) B(W) Independent Living Revenue $135,694 $135,951 $136,874 $136,039 $ 544,558 $135,862 $130,278 (4.2)% (2.0)% Other operating income $ — $ — $ — $ — $ — $ — $ — NM NM Segment Operating Income $ 52,876 $ 51,459 $ 49,414 $ 49,992 $ 203,741 $ 51,414 $ 41,038 (20.3)% (11.4)% Segment Operating Margin (1) 39.0% 37.9% 36.1% 36.7% 37.4% 37.8% 31.5% (640) bps (370) bps Number of communities (period end) 68 68 68 68 68 68 68 — % — % Period end number of units 12,430 12,460 12,511 12,514 12,514 12,537 12,534 0.6 % 0.6 % Total Average Units 12,430 12,440 12,511 12,514 12,474 12,529 12,534 0.8 % 0.8 % RevPAR $ 3,602 $ 3,592 $ 3,581 $ 3,545 $ 3,580 $ 3,615 $ 3,465 (3.5)% (1.6)% Weighted average unit occupancy 89.8% 89.1% 89.1% 88.7% 89.2% 87.1% 83.5% (560) bps (410) bps RevPOR $ 4,012 $ 4,033 $ 4,018 $ 3,994 $ 4,014 $ 4,151 $ 4,147 2.8 % 3.1 % Assisted Living and Memory Care Revenue $458,526 $450,225 $452,474 $454,713 $1,815,938 $457,479 $432,156 (4.0)% (2.1)% Other operating income $ — $ — $ — $ — $ — $ — $ 152 NM NM Segment Operating Income $140,699 $133,144 $116,856 $127,937 $ 518,636 $132,001 $ 87,708 (34.1)% (19.8)% Segment Operating Margin (1) 30.7% 29.6% 25.8% 28.1% 28.6% 28.9% 20.3% (930) bps (540) bps Number of communities (period end) 586 577 577 573 573 571 570 (1.2)% (1.2)% Period end number of units 36,944 36,175 36,177 35,956 35,956 35,789 35,744 (1.2)% (1.2)% Total Average Units 37,477 36,451 36,173 36,140 36,560 35,944 35,785 (1.8)% (3.0)% RevPAR $ 4,070 $ 4,092 $ 4,127 $ 4,135 $ 4,106 $ 4,242 $ 4,025 (1.6)% 1.3 % Weighted average unit occupancy 81.6% 82.1% 83.2% 83.6% 82.6% 81.9% 77.8% (430) bps (190) bps RevPOR $ 4,988 $ 4,987 $ 4,962 $ 4,948 $ 4,971 $ 5,178 $ 5,172 3.7 % 3.8 % CCRCs Revenue $103,727 $101,253 $100,104 $ 97,091 $ 402,175 $ 94,547 $ 79,025 (22.0)% (15.3)% Other operating income $ — $ — $ — $ — $ — $ — $ 9,546 NM NM Segment Operating Income $ 21,637 $ 17,847 $ 14,472 $ 18,116 $ 72,072 $ 19,931 $ 13,850 (22.4)% (14.4)% Segment Operating Margin (1) 20.9% 17.6% 14.5% 18.7% 17.9% 21.1% 15.6% (200) bps (90) bps Number of communities (period end) 26 26 26 22 22 22 22 (15.4)% (15.4)% Period end number of units 6,574 6,574 6,574 5,711 5,711 5,711 5,741 (12.7)% (12.7)% Total Average Units 6,553 6,574 6,574 6,167 6,467 5,711 5,721 (13.0)% (12.9)% RevPAR $ 5,232 $ 5,081 $ 5,012 $ 5,168 $ 5,123 $ 5,496 $ 4,572 (10.0)% (2.4)% Weighted average unit occupancy 82.9% 80.6% 80.4% 81.5% 81.3% 82.4% 74.0% (660) bps (350) bps RevPOR $ 6,312 $ 6,305 $ 6,234 $ 6,341 $ 6,298 $ 6,669 $ 6,181 (2.0)% 2.1 % (1) For the second quarter of 2020, segment operating margin excluding other operating income was 31.5% for Independent Living; 20.3% for Assisted Living and Memory Care; and 5.4% for CCRCs. 9

Senior Housing: Same Community(1) 2Q20 vs. YTD 2Q20 vs. 2019 2020 2Q19 YTD 2Q19 ($ in 000s, except RevPAR and RevPOR) 1Q 2Q 3Q 4Q Full Year 1Q 2Q B(W) B(W) Revenue $ 624,119 $ 619,285 $ 621,493 $ 622,064 $2,486,961 $ 637,054 $ 597,511 (3.5) % (0.7) % Other operating income — — — — — — 6,445 NM NM Revenue and other operating income $ 624,119 $ 619,285 $ 621,493 $ 622,064 $2,486,961 $ 637,054 $ 603,956 (2.5) % (0.2) % Community Labor Expenses (272,325) (275,356) (289,047) (287,776) (1,124,504) (287,992) (294,012) (6.8) % (6.3) % Other facility operating expenses (143,511) (145,287) (150,594) (141,167) (580,559) (157,627) (173,958) (19.7) % (14.8) % Facility operating expenses (2) (415,836) (420,643) (439,641) (428,943) (1,705,063) (445,619) (467,970) (11.3) % (9.2) % Same Community Operating Income $208,283 $198,642 $181,852 $193,121 $ 781,898 $191,435 $135,986 (31.5) % (19.5) % Same Community Operating Margin (3) 33.4% 32.1% 29.3% 31.0% 31.4% 30.1% 22.5% (960) bps (630) bps Total Average Units 50,092 50,101 50,111 50,114 50,105 50,114 50,107 — — RevPAR $ 4,153 $ 4,120 $ 4,134 $ 4,138 $ 4,136 $ 4,237 $ 3,975 (3.5 )% (0.7 )% Weighted average unit occupancy 84.4% 84.0% 84.8% 85.0% 84.6% 83.5% 79.2% (480) bps (280) bps RevPOR $ 4,922 $ 4,905 $ 4,876 $ 4,866 $ 4,892 $ 5,073 $ 5,020 2.3 % 2.7 % (2) Same Community Operating Income / Weighted Average Occupancy Same Community RevPAR 84.8% 85.0% 84.4% 84.0% 83.5% 79.2% $4,237 $208,283 $198,642 $193,121 $191,435 $4,153 $181,852 $4,120 $4,134 $4,138 $135,986 $3,975 1Q 2019 2Q 2019 3Q 2019 4Q 2019 1Q 2020 2Q 2020 1Q 2019 2Q 2019 3Q 2019 4Q 2019 1Q 2020 2Q 2020 (1) Same Community portfolio reflects 638 communities. (2) Excludes hurricane and natural disaster expense of $2.6 million for the full year 2019 and $1.1 million of related insurance recoveries year to date 2020. (3) For the second quarter of 2020, same community operating margin excluding other operating income was 21.7% for the same community portfolio. 10

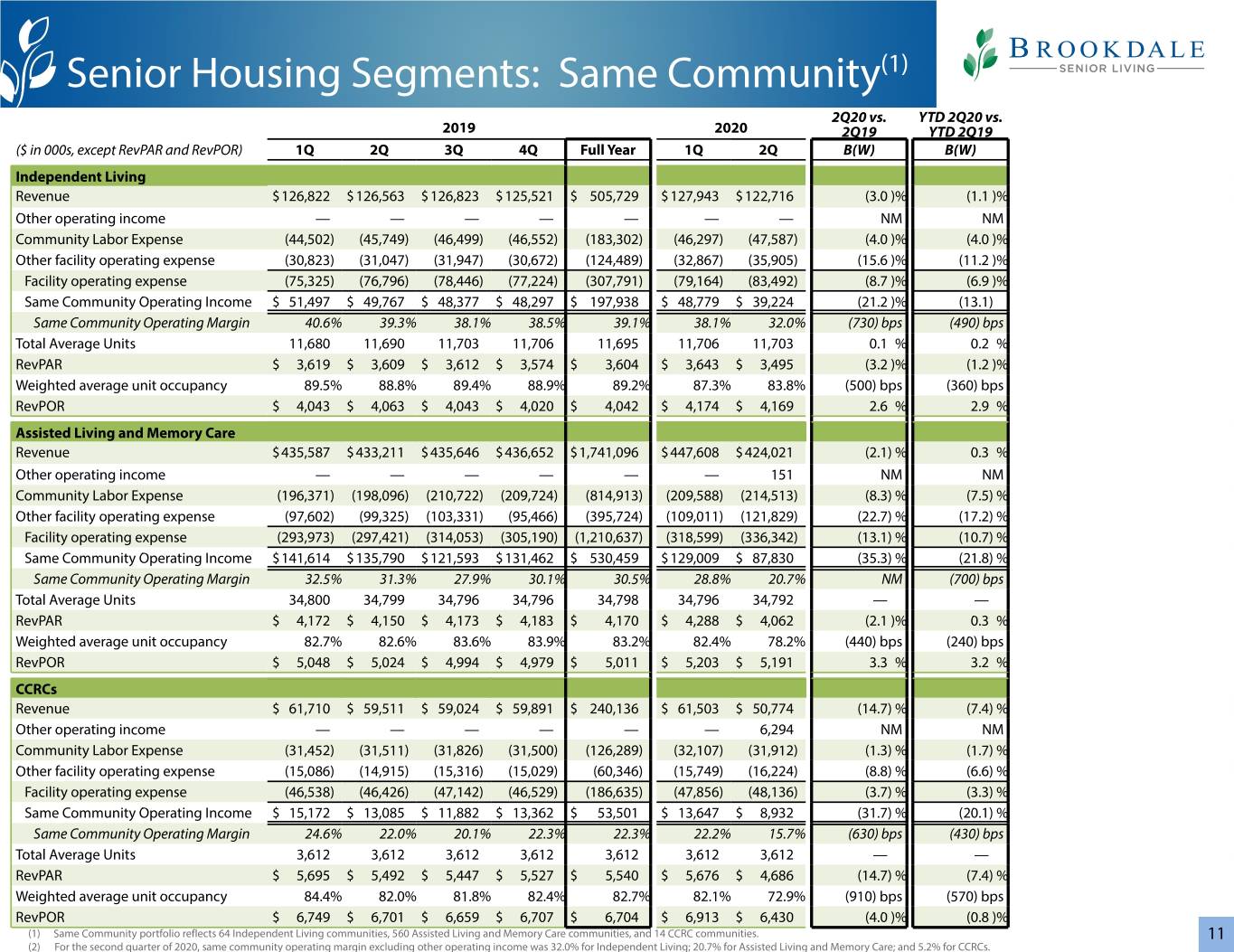

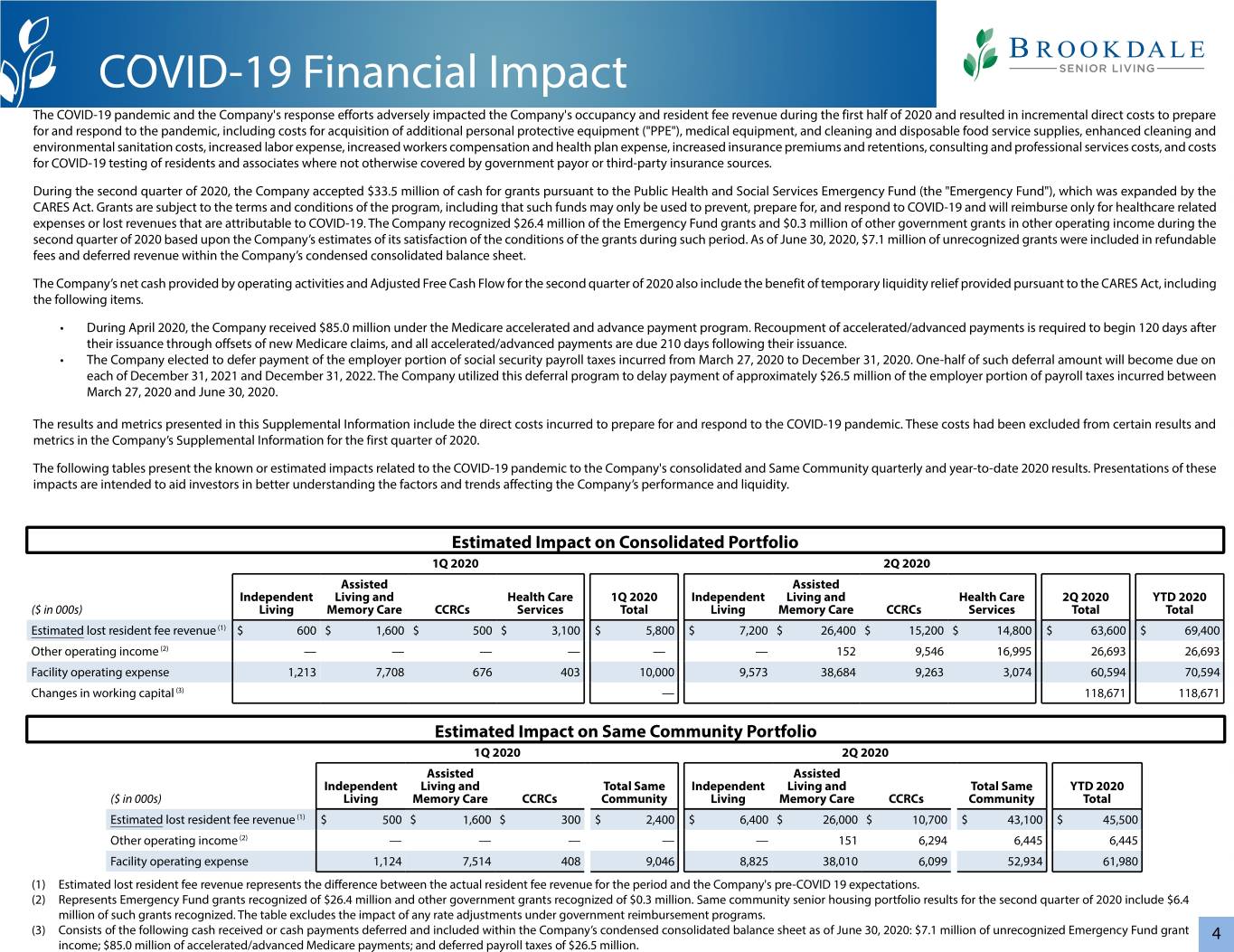

Senior Housing Segments: Same Community(1) 2Q20 vs. YTD 2Q20 vs. 2019 2020 2Q19 YTD 2Q19 ($ in 000s, except RevPAR and RevPOR) 1Q 2Q 3Q 4Q Full Year 1Q 2Q B(W) B(W) Independent Living Revenue $126,822 $126,563 $126,823 $125,521 $ 505,729 $127,943 $122,716 (3.0 )% (1.1 )% Other operating income — — — — — — — NM NM Community Labor Expense (44,502) (45,749) (46,499) (46,552) (183,302) (46,297) (47,587) (4.0 )% (4.0 )% Other facility operating expense (30,823) (31,047) (31,947) (30,672) (124,489) (32,867) (35,905) (15.6 )% (11.2 )% Facility operating expense (75,325) (76,796) (78,446) (77,224) (307,791) (79,164) (83,492) (8.7 )% (6.9 )% Same Community Operating Income $ 51,497 $ 49,767 $ 48,377 $ 48,297 $ 197,938 $ 48,779 $ 39,224 (21.2 )% (13.1) Same Community Operating Margin 40.6% 39.3% 38.1% 38.5% 39.1% 38.1% 32.0% (730) bps (490) bps Total Average Units 11,680 11,690 11,703 11,706 11,695 11,706 11,703 0.1 % 0.2 % RevPAR $ 3,619 $ 3,609 $ 3,612 $ 3,574 $ 3,604 $ 3,643 $ 3,495 (3.2 )% (1.2 )% Weighted average unit occupancy 89.5% 88.8% 89.4% 88.9% 89.2% 87.3% 83.8% (500) bps (360) bps RevPOR $ 4,043 $ 4,063 $ 4,043 $ 4,020 $ 4,042 $ 4,174 $ 4,169 2.6 % 2.9 % Assisted Living and Memory Care Revenue $435,587 $433,211 $435,646 $436,652 $1,741,096 $447,608 $424,021 (2.1) % 0.3 % Other operating income — — — — — — 151 NM NM Community Labor Expense (196,371) (198,096) (210,722) (209,724) (814,913) (209,588) (214,513) (8.3) % (7.5) % Other facility operating expense (97,602) (99,325) (103,331) (95,466) (395,724) (109,011) (121,829) (22.7) % (17.2) % Facility operating expense (293,973) (297,421) (314,053) (305,190) (1,210,637) (318,599) (336,342) (13.1) % (10.7) % Same Community Operating Income $141,614 $135,790 $121,593 $131,462 $ 530,459 $129,009 $ 87,830 (35.3) % (21.8) % Same Community Operating Margin 32.5% 31.3% 27.9% 30.1% 30.5% 28.8% 20.7% NM (700) bps Total Average Units 34,800 34,799 34,796 34,796 34,798 34,796 34,792 — — RevPAR $ 4,172 $ 4,150 $ 4,173 $ 4,183 $ 4,170 $ 4,288 $ 4,062 (2.1 )% 0.3 % Weighted average unit occupancy 82.7% 82.6% 83.6% 83.9% 83.2% 82.4% 78.2% (440) bps (240) bps RevPOR $ 5,048 $ 5,024 $ 4,994 $ 4,979 $ 5,011 $ 5,203 $ 5,191 3.3 % 3.2 % CCRCs Revenue $ 61,710 $ 59,511 $ 59,024 $ 59,891 $ 240,136 $ 61,503 $ 50,774 (14.7) % (7.4) % Other operating income — — — — — — 6,294 NM NM Community Labor Expense (31,452) (31,511) (31,826) (31,500) (126,289) (32,107) (31,912) (1.3) % (1.7) % Other facility operating expense (15,086) (14,915) (15,316) (15,029) (60,346) (15,749) (16,224) (8.8) % (6.6) % Facility operating expense (46,538) (46,426) (47,142) (46,529) (186,635) (47,856) (48,136) (3.7) % (3.3) % Same Community Operating Income $ 15,172 $ 13,085 $ 11,882 $ 13,362 $ 53,501 $ 13,647 $ 8,932 (31.7) % (20.1) % Same Community Operating Margin 24.6% 22.0% 20.1% 22.3% 22.3% 22.2% 15.7% (630) bps (430) bps Total Average Units 3,612 3,612 3,612 3,612 3,612 3,612 3,612 — — RevPAR $ 5,695 $ 5,492 $ 5,447 $ 5,527 $ 5,540 $ 5,676 $ 4,686 (14.7) % (7.4) % Weighted average unit occupancy 84.4% 82.0% 81.8% 82.4% 82.7% 82.1% 72.9% (910) bps (570) bps RevPOR $ 6,749 $ 6,701 $ 6,659 $ 6,707 $ 6,704 $ 6,913 $ 6,430 (4.0 )% (0.8 )% (1) Same Community portfolio reflects 64 Independent Living communities, 560 Assisted Living and Memory Care communities, and 14 CCRC communities. 11 (2) For the second quarter of 2020, same community operating margin excluding other operating income was 32.0% for Independent Living; 20.7% for Assisted Living and Memory Care; and 5.2% for CCRCs.

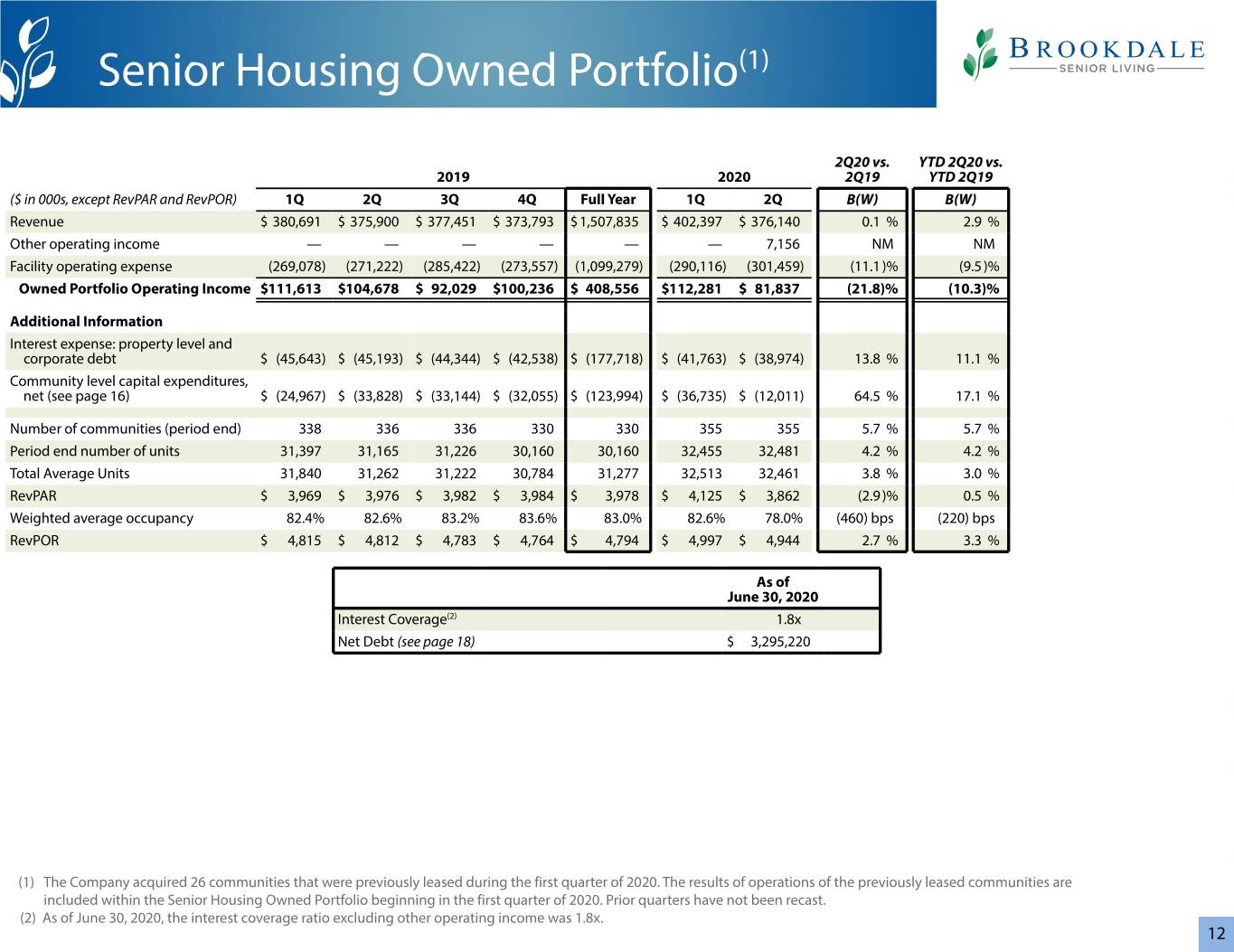

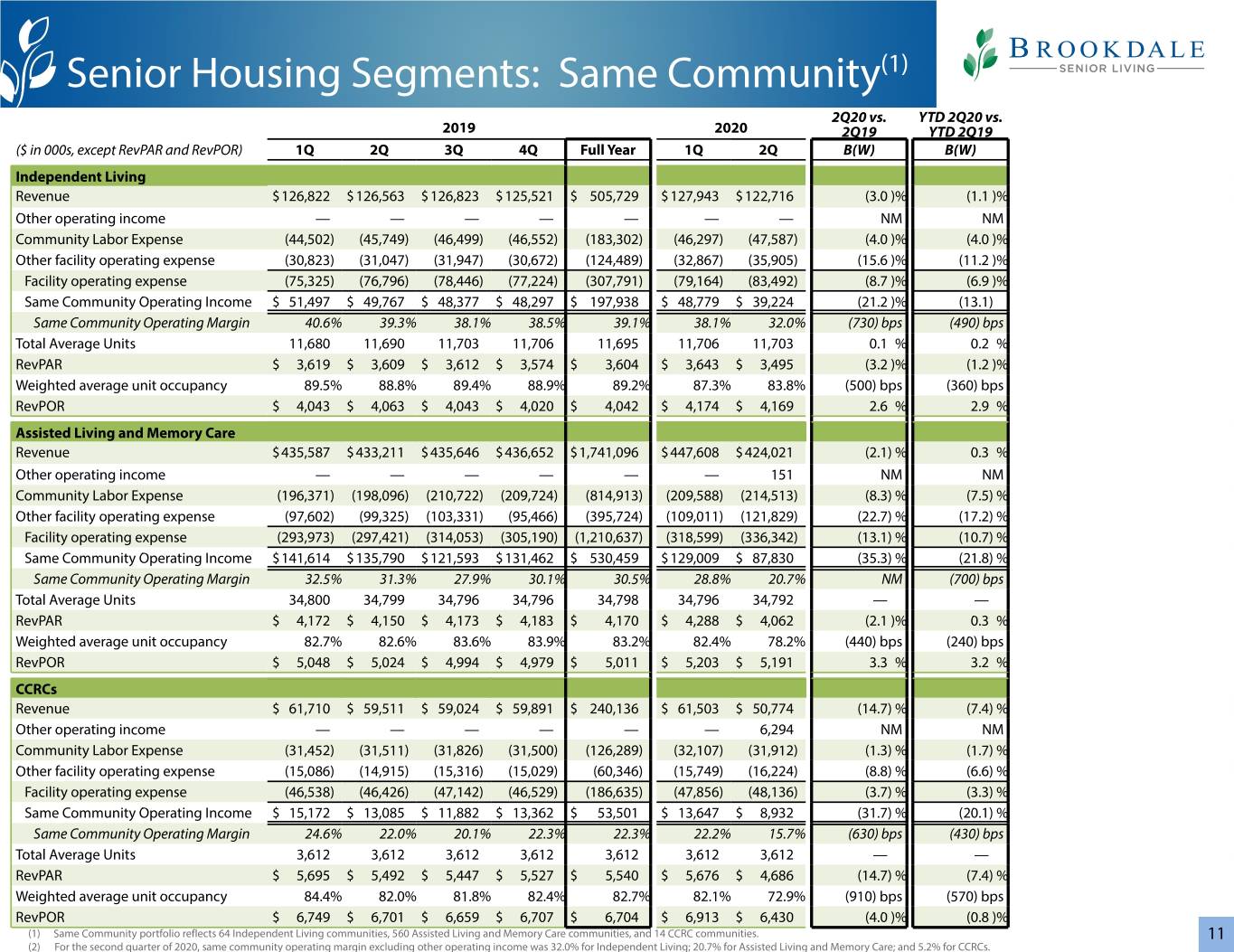

Senior Housing Owned Portfolio(1) 2Q20 vs. YTD 2Q20 vs. 2019 2020 2Q19 YTD 2Q19 ($ in 000s, except RevPAR and RevPOR) 1Q 2Q 3Q 4Q Full Year 1Q 2Q B(W) B(W) Revenue $ 380,691 $ 375,900 $ 377,451 $ 373,793 $1,507,835 $ 402,397 $ 376,140 0.1 % 2.9 % Other operating income — — — — — — 7,156 NM NM Facility operating expense (269,078) (271,222) (285,422) (273,557) (1,099,279) (290,116) (301,459) (11.1)% (9.5)% Owned Portfolio Operating Income $111,613 $104,678 $ 92,029 $100,236 $ 408,556 $112,281 $ 81,837 (21.8)% (10.3)% Additional Information Interest expense: property level and corporate debt $ (45,643) $ (45,193) $ (44,344) $ (42,538) $ (177,718) $ (41,763) $ (38,974) 13.8 % 11.1 % Community level capital expenditures, net (see page 16) $ (24,967) $ (33,828) $ (33,144) $ (32,055) $ (123,994) $ (36,735) $ (12,011) 64.5 % 17.1 % Number of communities (period end) 338 336 336 330 330 355 355 5.7 % 5.7 % Period end number of units 31,397 31,165 31,226 30,160 30,160 32,455 32,481 4.2 % 4.2 % Total Average Units 31,840 31,262 31,222 30,784 31,277 32,513 32,461 3.8 % 3.0 % RevPAR $ 3,969 $ 3,976 $ 3,982 $ 3,984 $ 3,978 $ 4,125 $ 3,862 (2.9)% 0.5 % Weighted average occupancy 82.4% 82.6% 83.2% 83.6% 83.0% 82.6% 78.0% (460) bps (220) bps RevPOR $ 4,815 $ 4,812 $ 4,783 $ 4,764 $ 4,794 $ 4,997 $ 4,944 2.7 % 3.3 % As of June 30, 2020 Interest Coverage(2) 1.8x Net Debt (see page 18) $ 3,295,220 (1) The Company acquired 26 communities that were previously leased during the first quarter of 2020. The results of operations of the previously leased communities are included within the Senior Housing Owned Portfolio beginning in the first quarter of 2020. Prior quarters have not been recast. (2) As of June 30, 2020, the interest coverage ratio excluding other operating income was 1.8x. 12

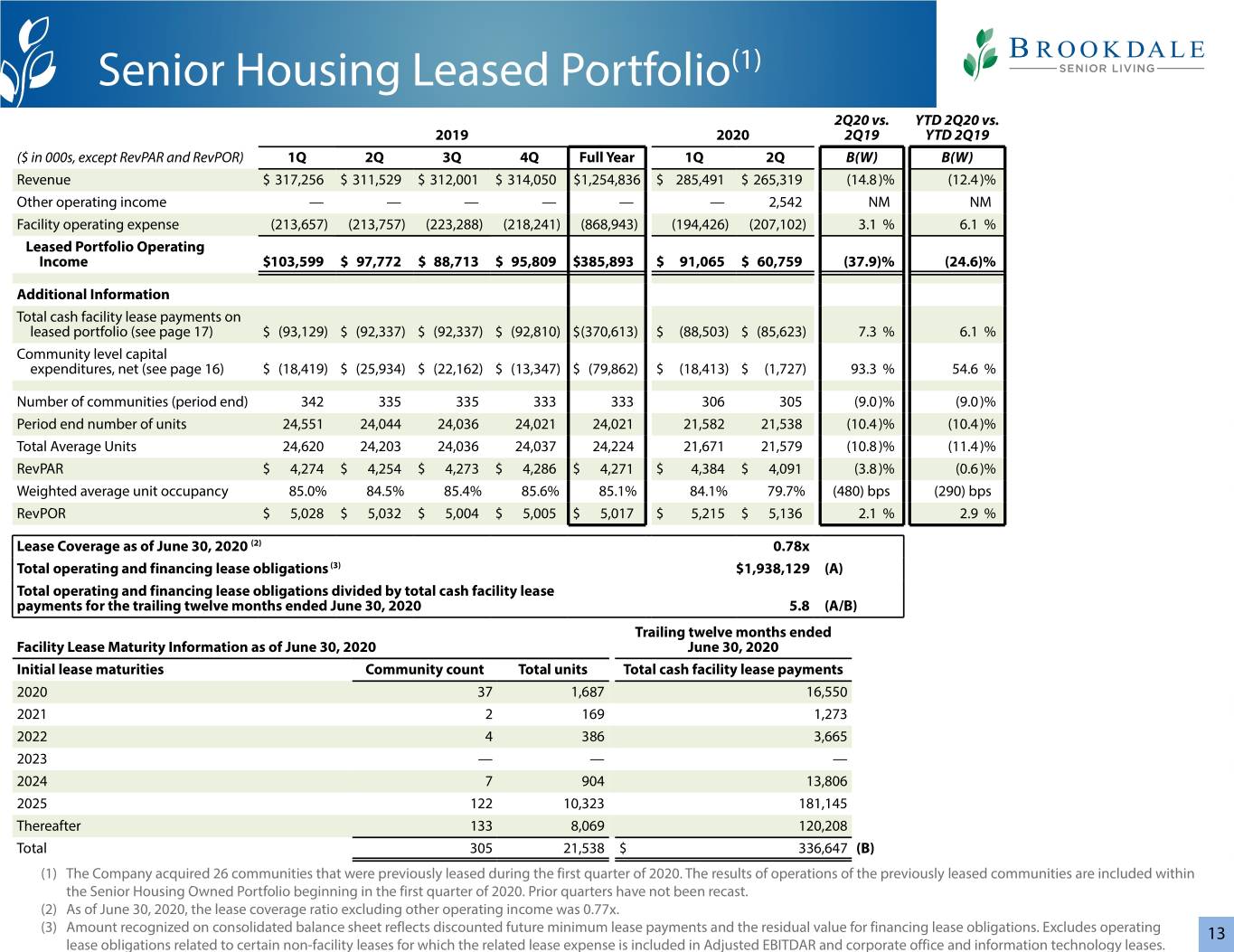

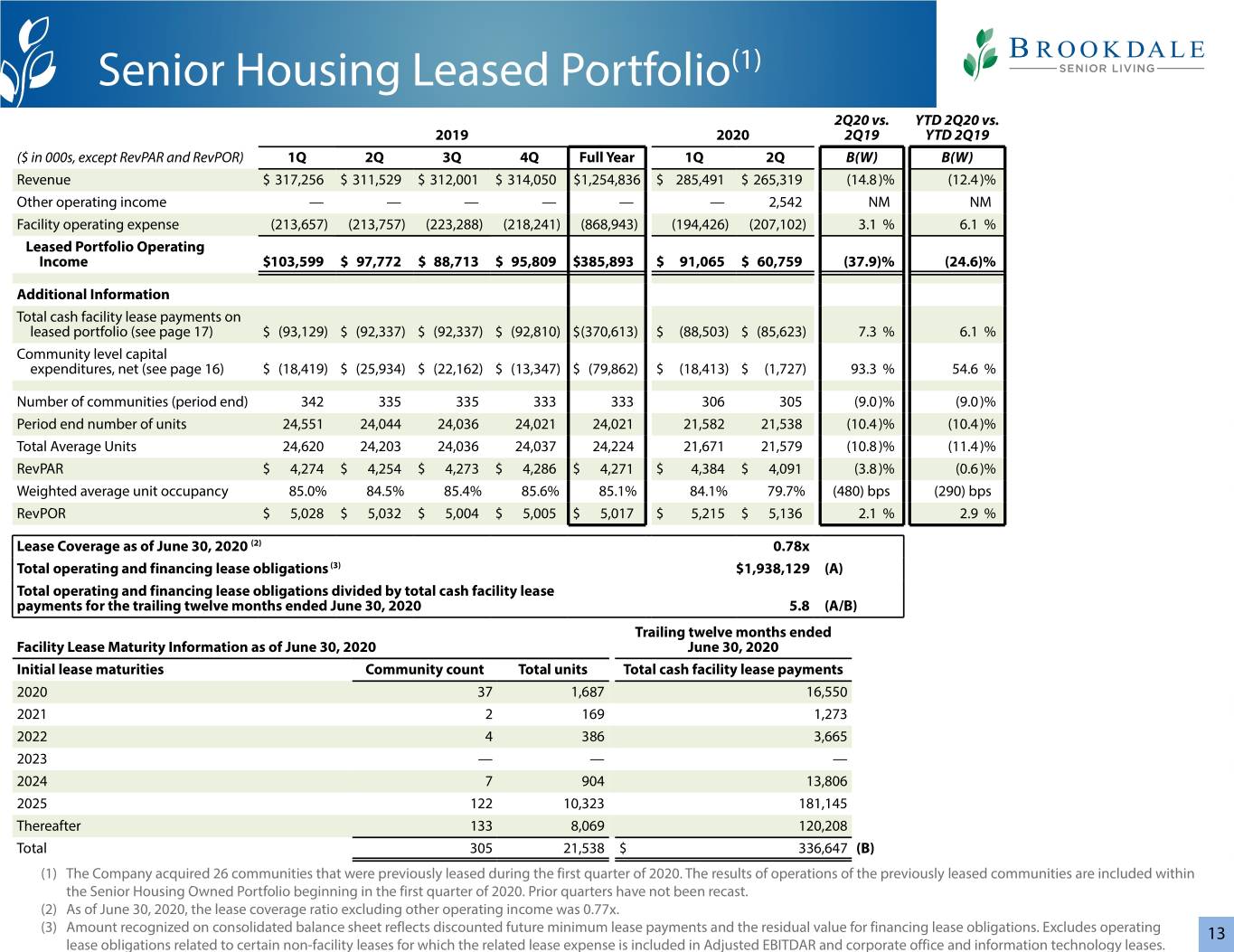

Senior Housing Leased Portfolio(1) 2Q20 vs. YTD 2Q20 vs. 2019 2020 2Q19 YTD 2Q19 ($ in 000s, except RevPAR and RevPOR) 1Q 2Q 3Q 4Q Full Year 1Q 2Q B(W) B(W) Revenue $ 317,256 $ 311,529 $ 312,001 $ 314,050 $1,254,836 $ 285,491 $ 265,319 (14.8)% (12.4)% Other operating income — — — — — — 2,542 NM NM Facility operating expense (213,657) (213,757) (223,288) (218,241) (868,943) (194,426) (207,102) 3.1 % 6.1 % Leased Portfolio Operating Income $103,599 $ 97,772 $ 88,713 $ 95,809 $385,893 $ 91,065 $ 60,759 (37.9)% (24.6)% Additional Information Total cash facility lease payments on leased portfolio (see page 17) $ (93,129) $ (92,337) $ (92,337) $ (92,810) $(370,613) $ (88,503) $ (85,623) 7.3 % 6.1 % Community level capital expenditures, net (see page 16) $ (18,419) $ (25,934) $ (22,162) $ (13,347) $ (79,862) $ (18,413) $ (1,727) 93.3 % 54.6 % Number of communities (period end) 342 335 335 333 333 306 305 (9.0)% (9.0)% Period end number of units 24,551 24,044 24,036 24,021 24,021 21,582 21,538 (10.4)% (10.4)% Total Average Units 24,620 24,203 24,036 24,037 24,224 21,671 21,579 (10.8)% (11.4)% RevPAR $ 4,274 $ 4,254 $ 4,273 $ 4,286 $ 4,271 $ 4,384 $ 4,091 (3.8)% (0.6)% Weighted average unit occupancy 85.0% 84.5% 85.4% 85.6% 85.1% 84.1% 79.7% (480) bps (290) bps RevPOR $ 5,028 $ 5,032 $ 5,004 $ 5,005 $ 5,017 $ 5,215 $ 5,136 2.1 % 2.9 % Lease Coverage as of June 30, 2020 (2) 0.78x Total operating and financing lease obligations (3) $1,938,129 (A) Total operating and financing lease obligations divided by total cash facility lease payments for the trailing twelve months ended June 30, 2020 5.8 (A/B) Trailing twelve months ended Facility Lease Maturity Information as of June 30, 2020 June 30, 2020 Initial lease maturities Community count Total units Total cash facility lease payments 2020 37 1,687 16,550 2021 2 169 1,273 2022 4 386 3,665 2023 — — — 2024 7 904 13,806 2025 122 10,323 181,145 Thereafter 133 8,069 120,208 Total 305 21,538 $ 336,647 (B) (1) The Company acquired 26 communities that were previously leased during the first quarter of 2020. The results of operations of the previously leased communities are included within the Senior Housing Owned Portfolio beginning in the first quarter of 2020. Prior quarters have not been recast. (2) As of June 30, 2020, the lease coverage ratio excluding other operating income was 0.77x. (3) Amount recognized on consolidated balance sheet reflects discounted future minimum lease payments and the residual value for financing lease obligations. Excludes operating 13 lease obligations related to certain non-facility leases for which the related lease expense is included in Adjusted EBITDAR and corporate office and information technology leases.

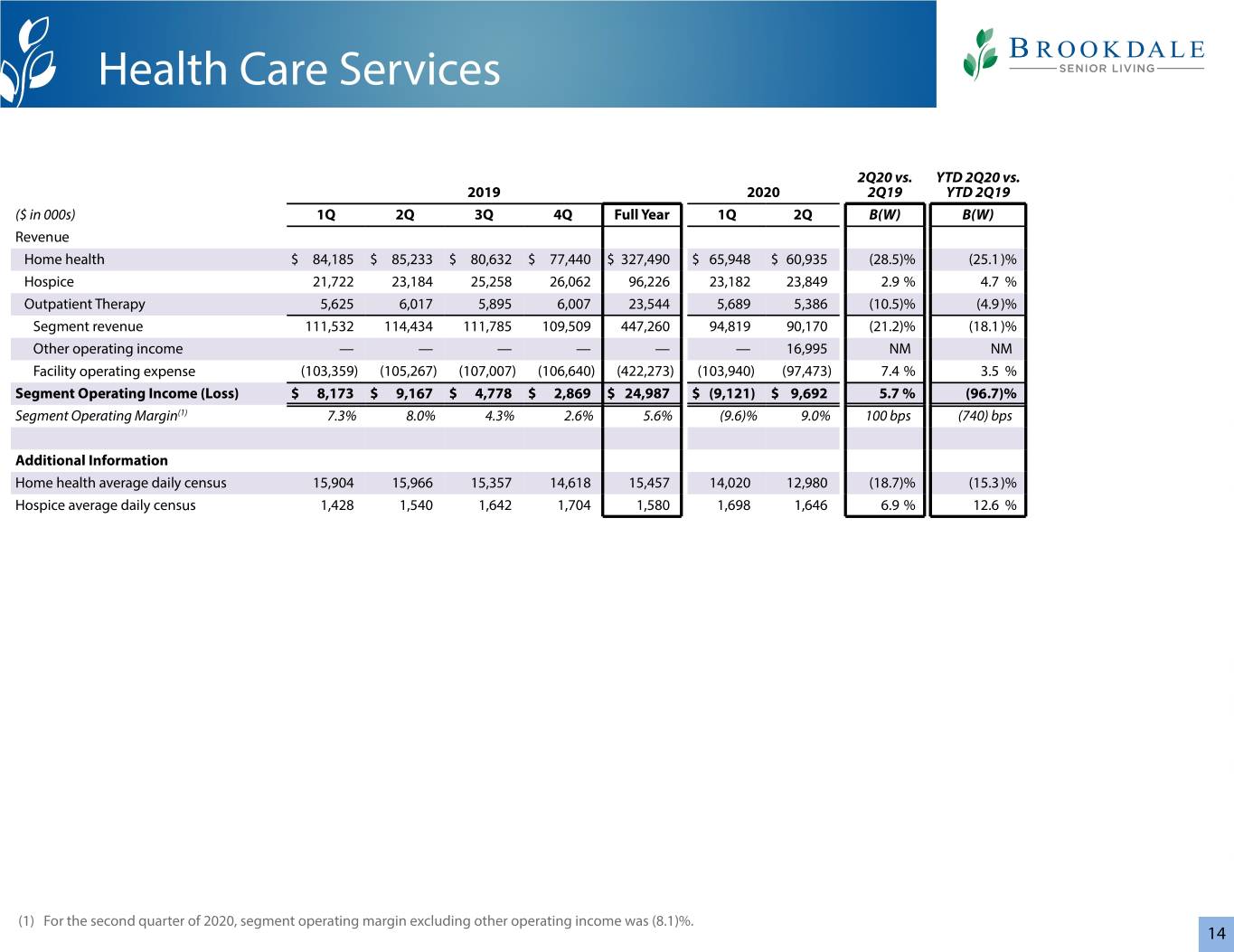

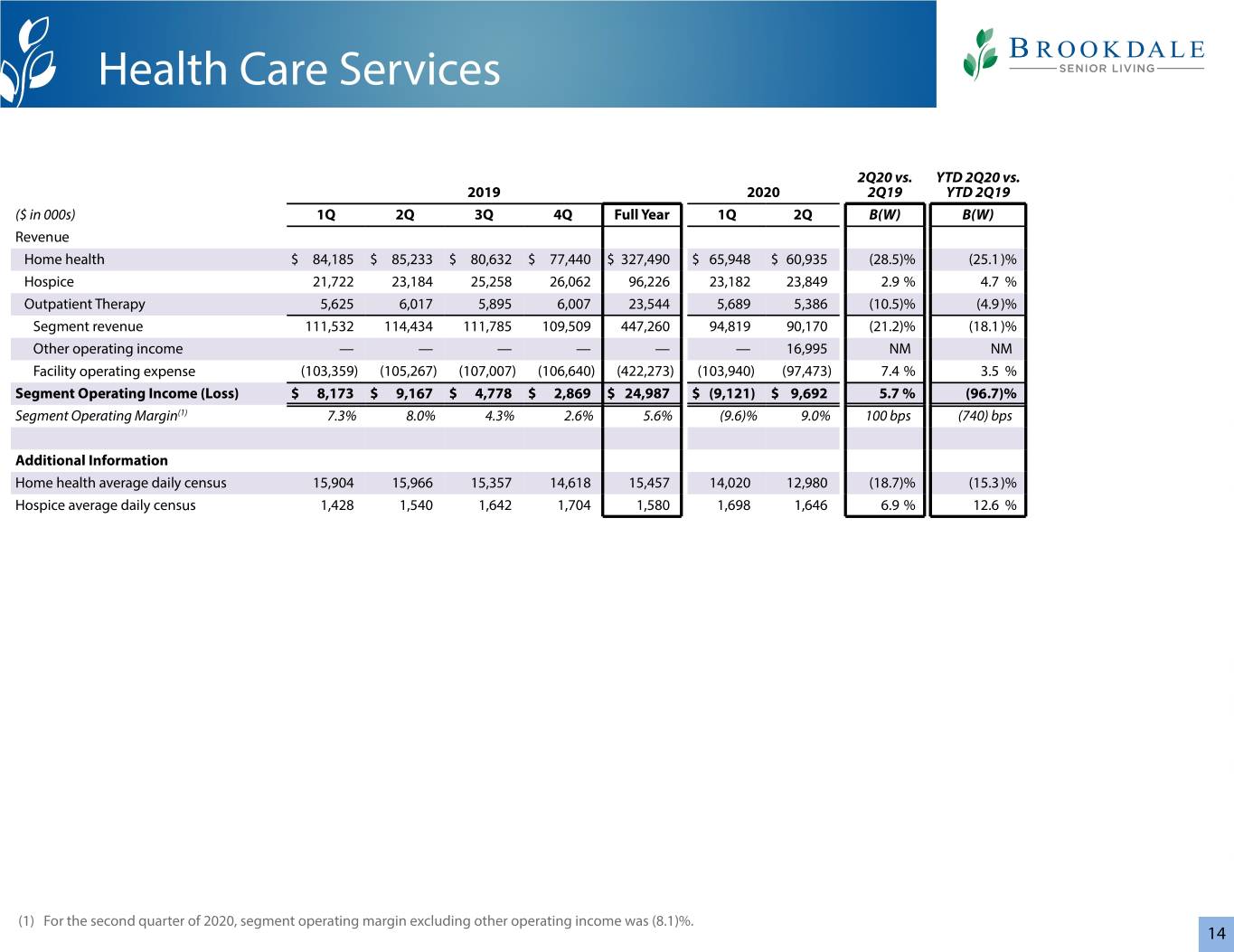

Health Care Services 2Q20 vs. YTD 2Q20 vs. 2019 2020 2Q19 YTD 2Q19 ($ in 000s) 1Q 2Q 3Q 4Q Full Year 1Q 2Q B(W) B(W) Revenue Home health $ 84,185 $ 85,233 $ 80,632 $ 77,440 $ 327,490 $ 65,948 $ 60,935 (28.5)% (25.1)% Hospice 21,722 23,184 25,258 26,062 96,226 23,182 23,849 2.9 % 4.7 % Outpatient Therapy 5,625 6,017 5,895 6,007 23,544 5,689 5,386 (10.5)% (4.9)% Segment revenue 111,532 114,434 111,785 109,509 447,260 94,819 90,170 (21.2)% (18.1)% Other operating income — — — — — — 16,995 NM NM Facility operating expense (103,359) (105,267) (107,007) (106,640) (422,273) (103,940) (97,473) 7.4 % 3.5 % Segment Operating Income (Loss) $ 8,173 $ 9,167 $ 4,778 $ 2,869 $ 24,987 $ (9,121) $ 9,692 5.7 % (96.7)% Segment Operating Margin(1) 7.3% 8.0% 4.3% 2.6% 5.6% (9.6)% 9.0% 100 bps (740) bps Additional Information Home health average daily census 15,904 15,966 15,357 14,618 15,457 14,020 12,980 (18.7)% (15.3)% Hospice average daily census 1,428 1,540 1,642 1,704 1,580 1,698 1,646 6.9 % 12.6 % (1) For the second quarter of 2020, segment operating margin excluding other operating income was (8.1)%. 14

G&A Expense 2Q20 vs. YTD 2Q20 vs. Consolidated, unless otherwise noted 2019 2020 2Q19 YTD 2Q19 ($ in 000s) 1Q 2Q 3Q 4Q Full Year 1Q 2Q B(W) B(W) G&A expense allocations (1) Senior Housing Owned Portfolio allocation $ 15,693 $ 16,875 $ 15,759 $ 13,553 $ 61,880 $ 18,635 $ 18,336 (8.7)% (13.5)% Senior Housing Leased Portfolio allocation 13,078 13,986 13,027 11,387 51,478 13,221 12,933 7.5% 3.4% Health Care Services allocation 7,077 6,730 6,385 5,439 25,631 6,953 5,355 20.4% 10.9% Management Services allocation 13,646 13,321 11,399 8,901 47,267 7,848 6,407 51.9% 47.1% Subtotal G&A expense allocations 49,494 50,912 46,570 39,280 186,256 46,657 43,031 15.5% 10.7% Non-cash stock-based compensation expense 6,356 6,030 5,929 4,711 23,026 5,957 6,119 (1.5%) 2.5% Transaction and Organizational Restructuring Costs 461 634 3,910 5,002 10,007 1,981 3,368 NM NM General and administrative expense $ 56,311 $ 57,576 $ 56,409 $ 48,993 $ 219,289 $ 54,595 $ 52,518 8.8 % 5.9 % 2Q20 vs. YTD 2Q20 vs. 2019 2020 2Q19 YTD 2Q19 1Q 2Q 3Q 4Q Full Year 1Q 2Q B(W) B(W) Resident fee revenue $ 809,479 $ 801,863 $ 801,237 $ 797,352 $3,209,931 $ 782,707 $ 731,629 (8.8)% (6.0)% Other operating income — — — — — — 26,693 NM NM Resident fee revenue under management (2) 321,952 294,114 275,796 259,437 1,151,299 184,145 131,558 (55.3)% (48.8)% Other operating income under management (2) — — — — — — 8,066 NM NM Total (consolidated and under management) $1,131,431 $1,095,977 $1,077,033 $1,056,789 $4,361,230 $ 966,852 $ 897,946 (18.1)% (16.3)% Allocated G&A Expense as a Percentage of Resident Fee Revenue and Other Operating Income (Consolidated and Under Management) G&A expense (excluding non-cash stock-based compensation expense and Transaction and Organizational Restructuring Costs) 4.4 % 4.6 % 4.3 % 3.7 % 4.3 % 4.8 % 4.8 % (20) bps (30) bps Non-cash stock-based compensation expense 0.6 % 0.6 % 0.6 % 0.4 % 0.5 % 0.6 % 0.7 % (10) bps 0 bps G&A expense (excluding Transaction and Organizational Restructuring Costs) (3) 5.0 % 5.2 % 4.9 % 4.1 % 4.8 % 5.5 % 5.5 % (30) bps (30) bps Transaction and Organizational Restructuring Costs — % 0.1 % 0.4 % 0.5 % 0.2 % 0.2 % 0.4 % (30) bps (30) bps G&A expense (including non-cash stock-based compensation expense and Transaction and Organizational Restructuring Costs) (3) 5.0% 5.3% 5.2% 4.6% 5.0% 5.6% 5.9% (60) bps (60) bps (1) G&A allocations are calculated using a methodology which the Company believes matches the type of general and administrative cost with the community, segment, or portfolio. Some of the allocations are based on direct utilization and some are based on formulas such as unit proportion. G&A allocations presented herein exclude non-cash stock-based compensation expense and Transaction and Organizational Restructuring Costs. (2) Not included in consolidated reported amounts. (3) For the second quarter of 2020, G&A expense (excluding Transaction and Organizational Restructuring Costs) excluding other operating income and other operating income under management was 5.7% of revenue. For the second quarter of 2020, G&A expense (including non-cash stock-based compensation expense and Transaction and Organizational Restructuring 15 Costs) excluding other operating income was 6.1%.

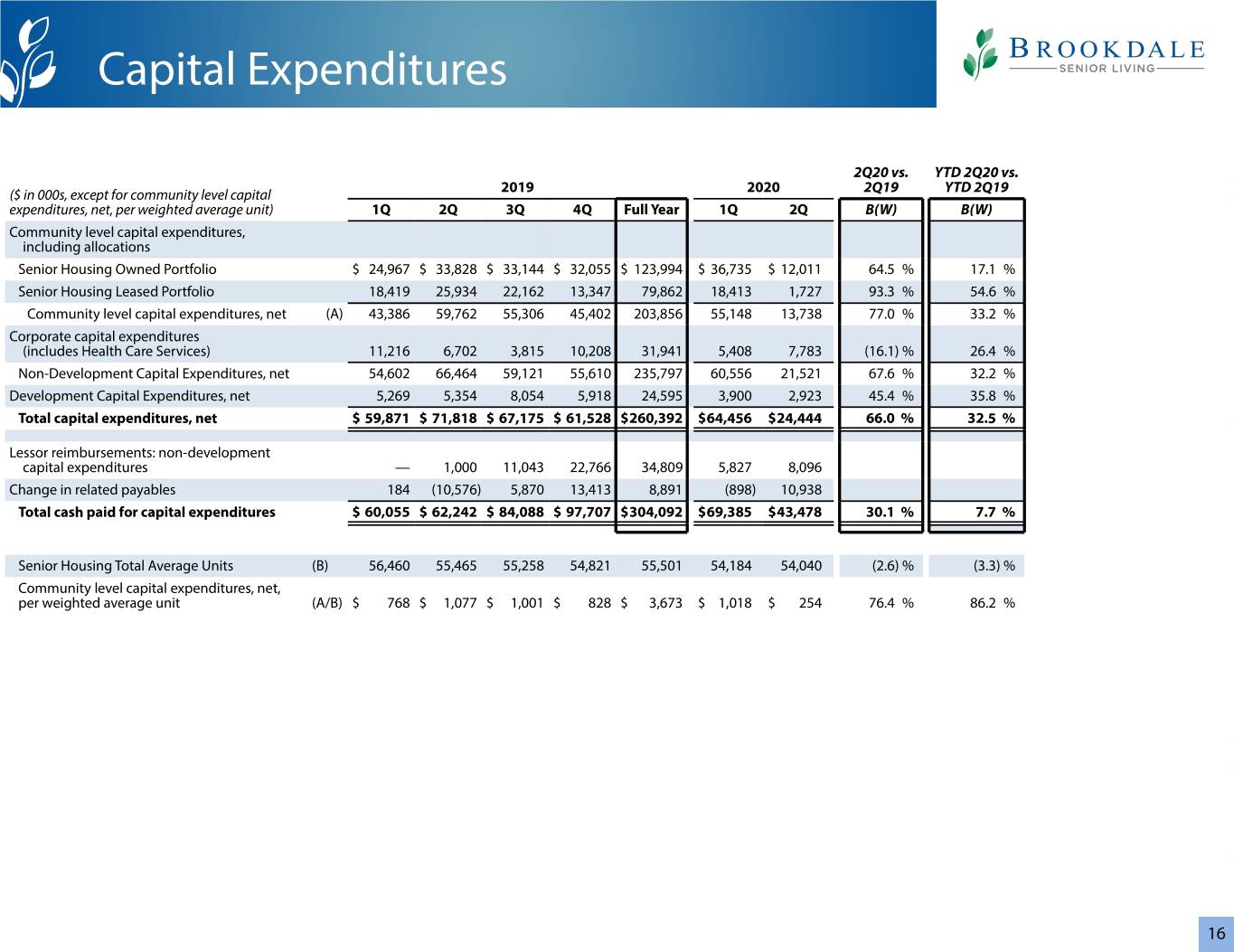

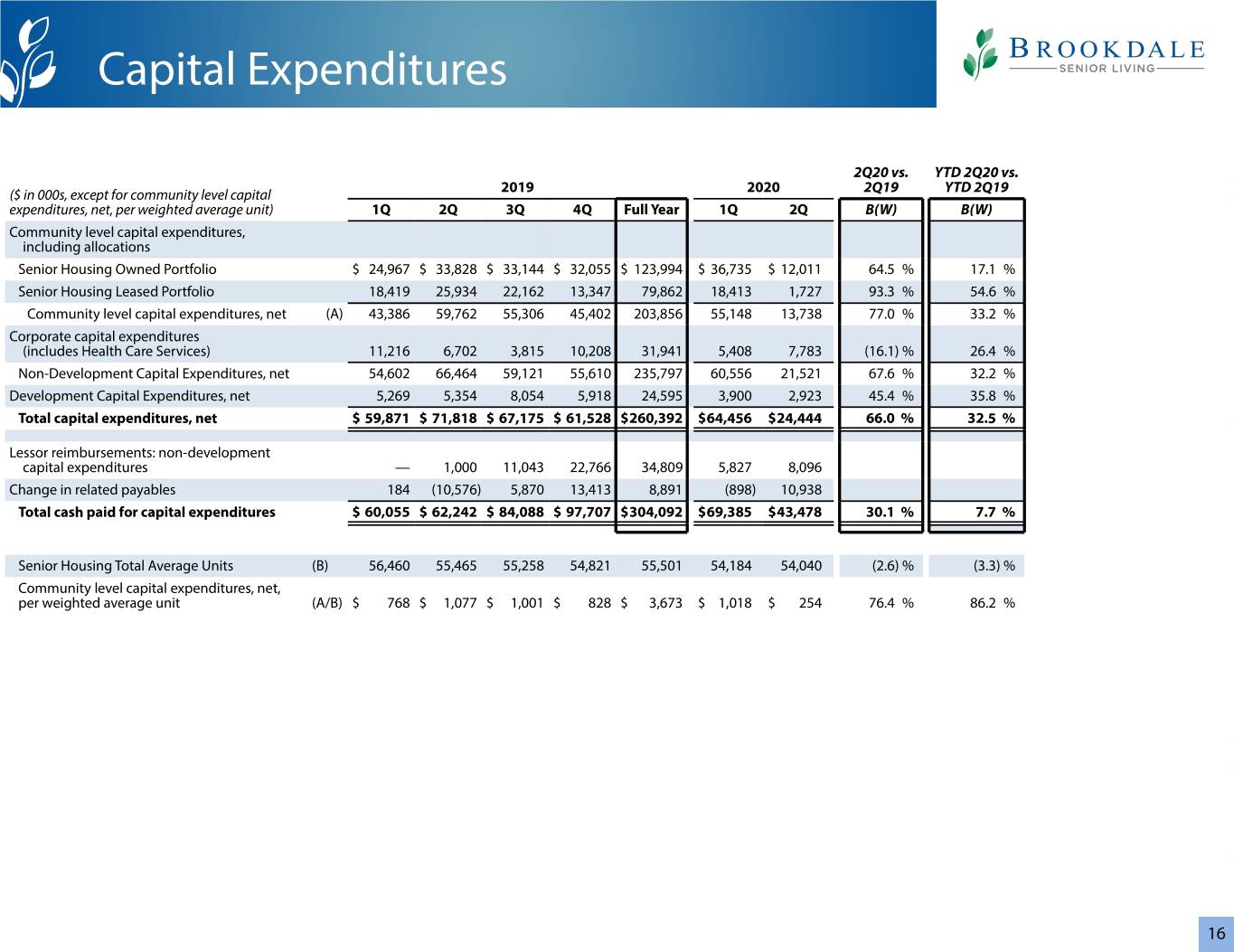

Capital Expenditures 2Q20 vs. YTD 2Q20 vs. 2019 2020 2Q19 YTD 2Q19 ($ in 000s, except for community level capital expenditures, net, per weighted average unit) 1Q 2Q 3Q 4Q Full Year 1Q 2Q B(W) B(W) Community level capital expenditures, including allocations Senior Housing Owned Portfolio $ 24,967 $ 33,828 $ 33,144 $ 32,055 $ 123,994 $ 36,735 $ 12,011 64.5 % 17.1 % Senior Housing Leased Portfolio 18,419 25,934 22,162 13,347 79,862 18,413 1,727 93.3 % 54.6 % Community level capital expenditures, net (A) 43,386 59,762 55,306 45,402 203,856 55,148 13,738 77.0 % 33.2 % Corporate capital expenditures (includes Health Care Services) 11,216 6,702 3,815 10,208 31,941 5,408 7,783 (16.1) % 26.4 % Non-Development Capital Expenditures, net 54,602 66,464 59,121 55,610 235,797 60,556 21,521 67.6 % 32.2 % Development Capital Expenditures, net 5,269 5,354 8,054 5,918 24,595 3,900 2,923 45.4 % 35.8 % Total capital expenditures, net $ 59,871 $ 71,818 $ 67,175 $ 61,528 $260,392 $64,456 $24,444 66.0 % 32.5 % Lessor reimbursements: non-development capital expenditures — 1,000 11,043 22,766 34,809 5,827 8,096 Change in related payables 184 (10,576) 5,870 13,413 8,891 (898) 10,938 Total cash paid for capital expenditures $ 60,055 $ 62,242 $ 84,088 $ 97,707 $304,092 $69,385 $43,478 30.1 % 7.7 % Senior Housing Total Average Units (B) 56,460 55,465 55,258 54,821 55,501 54,184 54,040 (2.6) % (3.3) % Community level capital expenditures, net, per weighted average unit (A/B) $ 768 $ 1,077 $ 1,001 $ 828 $ 3,673 $ 1,018 $ 254 76.4 % 86.2 % 16

Cash Facility Lease Payments 2Q20 vs. YTD 2Q20 vs. 2019 2020 2Q19 YTD 2Q19 ($ in 000s) 1Q 2Q 3Q 4Q Full Year 1Q 2Q B(W) B(W) Operating Lease Obligations Facility lease expense $ 68,668 $ 67,689 $ 67,253 $ 66,056 $ 269,666 $ 64,481 $ 62,379 Operating lease expense adjustment 4,383 4,429 4,814 5,827 19,453 6,733 8,221 Cash facility operating lease payments $ 73,051 $ 72,118 $ 72,067 $ 71,883 $ 289,119 $ 71,214 70,600 2.1 % 2.3 % Financing Lease Obligations Interest expense: financing lease obligations $ 16,743 $ 16,649 $ 16,567 $ 16,394 $ 66,353 $ 13,282 $ 11,892 Payment of financing lease obligations 5,453 5,500 5,549 5,740 22,242 5,087 4,677 Cash financing lease payments $ 22,196 $ 22,149 $ 22,116 $ 22,134 $ 88,595 $ 18,369 $ 16,569 25.2 % 21.2 % Total cash facility lease payments (1) $ 95,247 $ 94,267 $ 94,183 $ 94,017 $377,714 $ 89,583 $ 87,169 7.5 % 6.7 % Interest Expense Reconciliation to Income Statement Interest expense: financing lease obligations $ 16,743 $ 16,649 $ 16,567 $ 16,394 $ 66,353 $ 13,282 $ 11,892 28.6 % 24.6 % Interest income (3,084) (2,813) (2,162) (1,800) (9,859) (1,455) (2,243) (20.3)% (37.3)% Interest expense: debt $ 45,643 $ 45,193 $ 44,344 $ 42,538 $ 177,718 $ 41,763 $ 38,974 13.8 % 11.1 % Interest expense, net $ 59,302 $ 59,029 $ 58,749 $ 57,132 $ 234,212 $ 53,590 $ 48,623 17.6 % 13.6 % Amortization of deferred financing costs and debt premium (discount) 979 986 1,167 1,138 4,270 1,315 1,556 Interest income 3,084 2,813 2,162 1,800 9,859 1,455 2,243 Interest expense per income statement $ 63,365 $ 62,828 $ 62,078 $ 60,070 $248,341 $ 56,360 $ 52,422 16.6 % 13.8 % (1) Includes cash lease payments for leases of corporate offices and information technology systems and equipment. 17

Capital Structure Total Liquidity Debt Structure (1) Debt (1)(2) ($ in millions) ($ in millions) ($ in millions) Maturity Weighted Rate Variable rate debt with 2020 $ 36 4.16% interest rate caps $600 2021 332 5.90% $600 $536 Fixed rate 2022 349 3.58% $479 $481 $455 debt $1,261 2023 230 3.53% ) s n $400 o $2,300 i l 34% l i 2024 296 4.33% $309 M $315 $562 ( $291 $501 62% $ Thereafter 2,449 3.52% $200 Total $ 3,692 3.81% $164 $164 $172 $131 $38 4% Variable rate (1) Includes the carrying value of mortgage debt and $0 $35 debt - unhedged other notes payable of which 96.9%, or $3.6 billion, 06/30/2019 09/30/2019 12/31/2019 03/31/2020 06/30/2020 represented non-recourse property-level mortgage As of June 30, 2020 financings. Excludes the Company's line of credit balance of $166.4 million as of June 30, 2020. Line of credit available to draw Weighted Rate Fixed rate debt 4.61% (2) Reflects market rates as of June 30, 2020 and (2) applicable cap rates for hedged debt. Cash and cash equivalents and marketable securities Variable rate debt 2.49% Total debt 3.81% (3) Leverage ratios include results of operations of communities disposed of through the disposition date. (3) Leverage Ratios (4) Excludes $10.1 million of the non-recurring, non-cash ($ in 000s) impact of ASC 842 for 2019 periods (see page 26), and includes the $100.0 million management agreement Annualized termination fee. Trailing Twelve Months Ended June 30, 2020 Leverage (5) Excludes operating lease obligations related to Adjusted EBITDAR (4) (A) $ 706,263 certain non-facility leases for which the related lease Cash facility operating lease payments (see page 17) (285,764) expense is included in Adjusted EBITDAR. Adjusted EBITDA (4) 420,499 Important Note Regarding Non-GAAP Financial Cash financing lease payments (see page 17) (79,188) Measures. Adjusted EBITDAR, Adjusted EBITDA, Adjusted EBITDA after cash financing lease payments, Net Debt, and (4) Adjusted EBITDA after cash financing lease payments (B) $ 341,311 Adjusted Net Debt are financial measures that are not calculated in accordance with GAAP. See “Definitions” and As of June 30, 2020 “Non-GAAP Financial Measures” for the definitions of such Debt $ 3,692,365 measures and other important information regarding such measures, including reconciliations to the most Line of credit 166,381 comparable GAAP measures. Cash and cash equivalents (452,441) Marketable securities (109,873) Restricted cash held as collateral against existing debt (1,212) Net Debt (C) 3,295,220 9.7x (C/B) Operating and financing lease obligations (5) 1,965,968 Adjusted Net Debt (D) $ 5,261,188 7.4x (D/A) 18

Definitions Adjusted EBITDA is a non-GAAP performance measure that the Company defines as net Lease Coverage is calculated based on the trailing-twelve months Leased Portfolio income (loss) excluding: benefit/provision for income taxes, non-operating income/ Operating Income, excluding resident fee revenue, other operating income, and facility expense items, and depreciation and amortization; and further adjusted to exclude operating expense of communities disposed during such period adjusted for an implied income/expense associated with non-cash, non-operational, transactional, cost 5% management fee and capital expenditures at $350/unit, divided by the trailing-twelve reduction or organizational restructuring items that management does not consider as months cash facility lease payments for both operating leases and financing leases, part of the Company’s underlying core operating performance and that management excluding cash lease payments for leases of communities disposed during such period, believes impact the comparability of performance between periods. For the periods corporate offices, and information technology systems and equipment, vehicles and presented herein, such other items include non-cash impairment charges, gain/loss on other equipment. For any trailing-twelve month period that includes one or more periods facility lease termination and modification, operating lease expense adjustment, from 2019, an adjustment was made to exclude the 2019 impact of applying the lease amortization of deferred gain, change in future service obligation, non-cash stock-based accounting standard under ASC 842 for residency agreements. compensation expense, and Transaction and Organizational Restructuring Costs. Leased Portfolio Operating Income is defined by the Company as resident fee revenue Adjusted EBITDAR is a non-GAAP financial measure that the Company defines as and other operating income (excluding Health Care Services segment revenue), less Adjusted EBITDA before cash facility operating lease payments. facility operating expense for the Company’s Senior Housing Leased Portfolio. Leased Portfolio Operating Income does not include general and administrative expense (unless Adjusted Free Cash Flow is a non-GAAP liquidity measure that the Company defines as otherwise noted) or depreciation and amortization. net cash provided by (used in) operating activities before: distributions from unconsolidated ventures from cumulative share of net earnings, changes in prepaid Net Debt is a non-GAAP financial measure that the Company defines as the total of its insurance premiums financed with notes payable, changes in operating lease liability for debt (mortgage debt and other notes payable) and the outstanding balance on the line lease termination and modification, cash paid/received for gain/loss on facility lease of credit, less unrestricted cash, marketable securities, and cash held as collateral against termination and modification, and lessor capital expenditure reimbursements under existing debt. operating leases; plus: property insurance proceeds and proceeds from refundable entrance fees, net of refunds; less: Non-Development Capital Expenditures and payment NM means not meaningful. of financing lease obligations. Non-Development Capital Expenditures is comprised of corporate and community- Adjusted Net Debt is a non-GAAP financial measure that the Company defines as Net level capital expenditures, including those related to maintenance, renovations, Debt, plus operating and financing lease obligations. Operating and financing lease upgrades, and other major building infrastructure projects for the Company’s obligations exclude operating lease obligations related to certain non-facility leases for communities. Non-Development Capital Expenditures does not include capital which the related lease expense is included in Adjusted EBITDAR. expenditures for community expansions, major community redevelopment and repositioning projects, and the development of new communities (i.e., Development Combined Segment Operating Income is defined by the Company as resident fee and Capital Expenditures). Amounts of Non-Development Capital Expenditures are presented management fee revenue and other operating income of the Company, less facility net of lessor reimbursements. operating expense. Combined Segment Operating Income does not include general and administrative expense or depreciation and amortization. Owned Portfolio Operating Income is defined by the Company as resident fee revenue and other operating income (excluding Health Care Services segment revenue), less Community Labor Expense is a component of facility operating expense that includes facility operating expense for the Company’s Senior Housing Owned Portfolio. Owned regular and overtime salaries and wages, bonuses, paid-time-off and holiday wages, Portfolio Operating Income does not include general and administrative expense or payroll taxes, contract labor, employee benefits, and workers compensation. depreciation and amortization. Development Capital Expenditures means capital expenditures for community RevPAR, or average monthly senior housing resident fee revenue per available unit, is expansions, major community redevelopment and repositioning projects, and the defined by the Company as resident fee revenue for the corresponding portfolio for the development of new communities. Amounts of Development Capital Expenditures are period (excluding Health Care Services segment revenue and entrance fee amortization, presented net of lessor reimbursements. and, for the 2019 periods, the additional resident fee revenue recognized as a result of the application of the lease accounting standard under ASC 842), divided by the weighted Interest Coverage is calculated based on the trailing-twelve months Owned Portfolio average number of available units in the corresponding portfolio for the period, divided Operating Income adjusted for an implied 5% management fee and capital expenditures by the number of months in the period. at $350/unit, divided by the trailing-twelve months property level and corporate debt interest expense. For any trailing-twelve month period that includes one or more periods from 2019, an adjustment was made to exclude the 2019 impact of applying the lease accounting standard under ASC 842 for residency agreements. 19

Definitions RevPOR, or average monthly senior housing resident fee revenue per occupied unit, is Segment Operating Income (Loss) is defined by the Company as segment revenue and defined by the Company as resident fee revenue for the corresponding portfolio for the other operating income less segment facility operating expense. Segment Operating period (excluding Health Care Services segment revenue and entrance fee amortization, Income (Loss) does not include general and administrative expense or depreciation and and, for the 2019 periods, the additional resident fee revenue recognized as a result of amortization. Management Services Segment Operating Income excludes revenue for the application of the lease accounting standard under ASC 842), divided by the weighted reimbursements for which the Company is the primary obligor of costs incurred on behalf average number of occupied units in the corresponding portfolio for the period, divided of managed communities, and there is no facility operating expense associated with the by the number of months in the period. Management Services segment. See the Segment Information note to the Company’s consolidated financial statements for more information regarding the Company’s Same Community information reflects operating results and data of a consistent segments. population of communities by excluding the impact of changes in the composition of our portfolio of communities. The operating results exclude hurricane and natural disaster Senior Housing Leased Portfolio represents Brookdale leased communities and does expense and related insurance recoveries, and for the 2019 periods, exclude the not include owned or managed communities. additional resident fee revenue and facility operating expense recognized as a result of the application of the lease accounting standard ASC 842. We define our same community Senior Housing Operating Income is defined by the Company as segment revenue and portfolio as communities consolidated and operational for the full period in both other operating income less segment facility operating expense for the Company’s comparison years. Consolidated communities excluded from the same community Independent Living, Assisted Living and Memory Care, and CCRCs segments on an portfolio include communities acquired or disposed of since the beginning of the prior aggregate basis. Senior Housing Operating Income does not include general and year, communities classified as assets held for sale, certain communities planned for administrative expense or depreciation and amortization. disposition, certain communities that have undergone or are undergoing expansion, Senior Housing Owned Portfolio represents Brookdale owned communities and does redevelopment, and repositioning projects, certain communities that have expansion, not include leased or managed communities. redevelopment, and repositioning projects that are anticipated to be under construction in the current year, and certain communities that have experienced a casualty event that Total Average Units represents the average number of units operated during the period. significantly impacts their operations. Transaction and Organizational Restructuring Costs are general and administrative Same Community Operating Income is defined by the Company as resident fee revenue expenses. Transaction costs include those directly related to acquisition, disposition, and other operating income (excluding Health Care Services segment revenue and, for financing, and leasing activity, the Company’s assessment of options and alternatives to the 2019 periods, the additional resident fee revenue recognized as a result of application enhance stockholder value, and stockholder relations advisory matters, and are primarily of the lease accounting standard under ASC 842), less facility operating expense comprised of legal, finance, consulting, professional fees, and other third party costs. (excluding hurricane and natural disaster expense and related insurance recoveries, and Organizational restructuring costs include those related to the Company’s efforts to for the 2019 periods, the additional facility operating expense recognized as a result of reduce general and administrative expense and its senior leadership changes, including application of the lease accounting standard under ASC 842) for the Company's Same severance and retention costs. Community portfolio. Same Community Operating Income does not include general and administrative expense or depreciation and amortization. 20

Appendices Pro-Forma Financial Information 22 Lease Accounting Standard (ASC 842) Impact 26 Non-GAAP Financial Measures 27 21

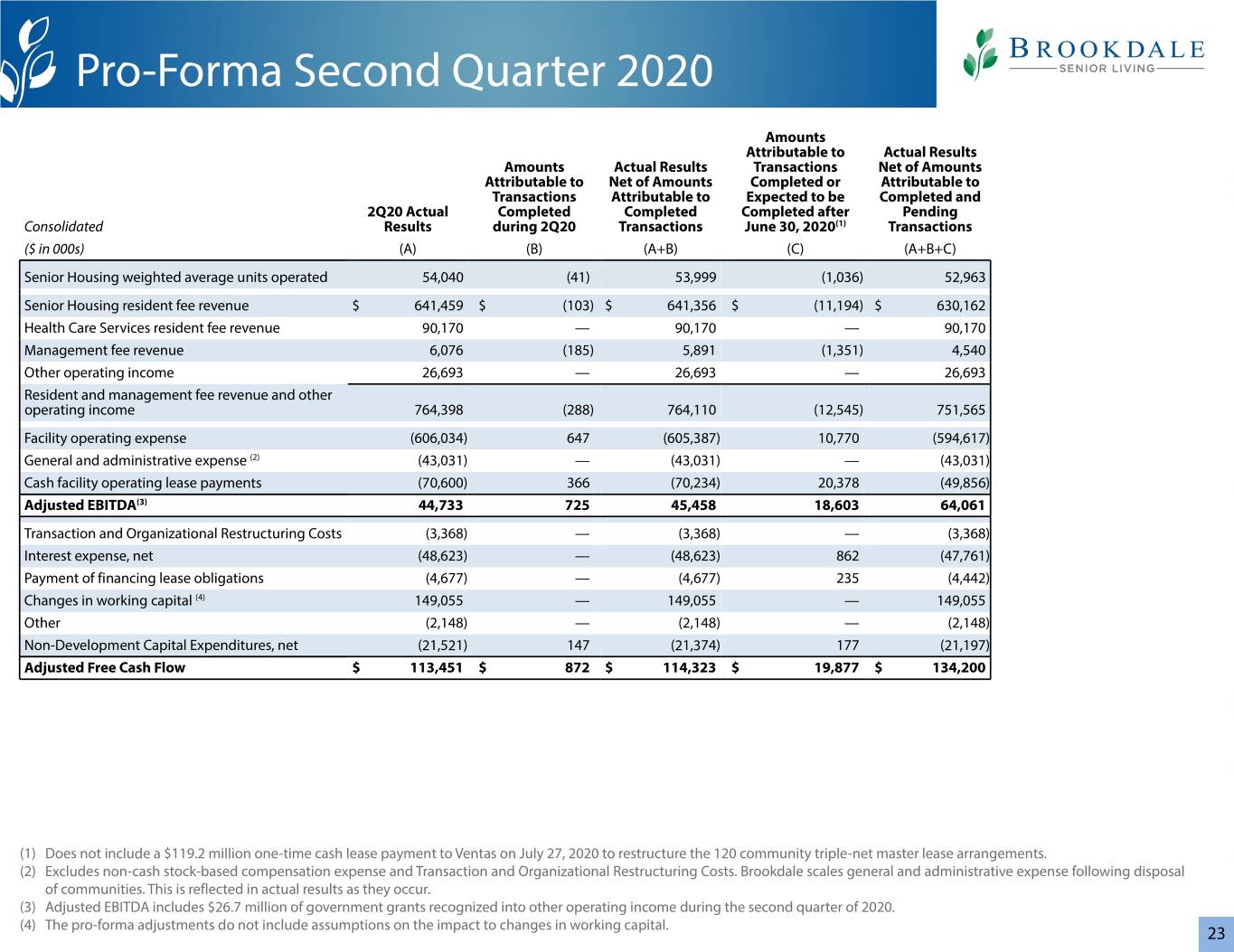

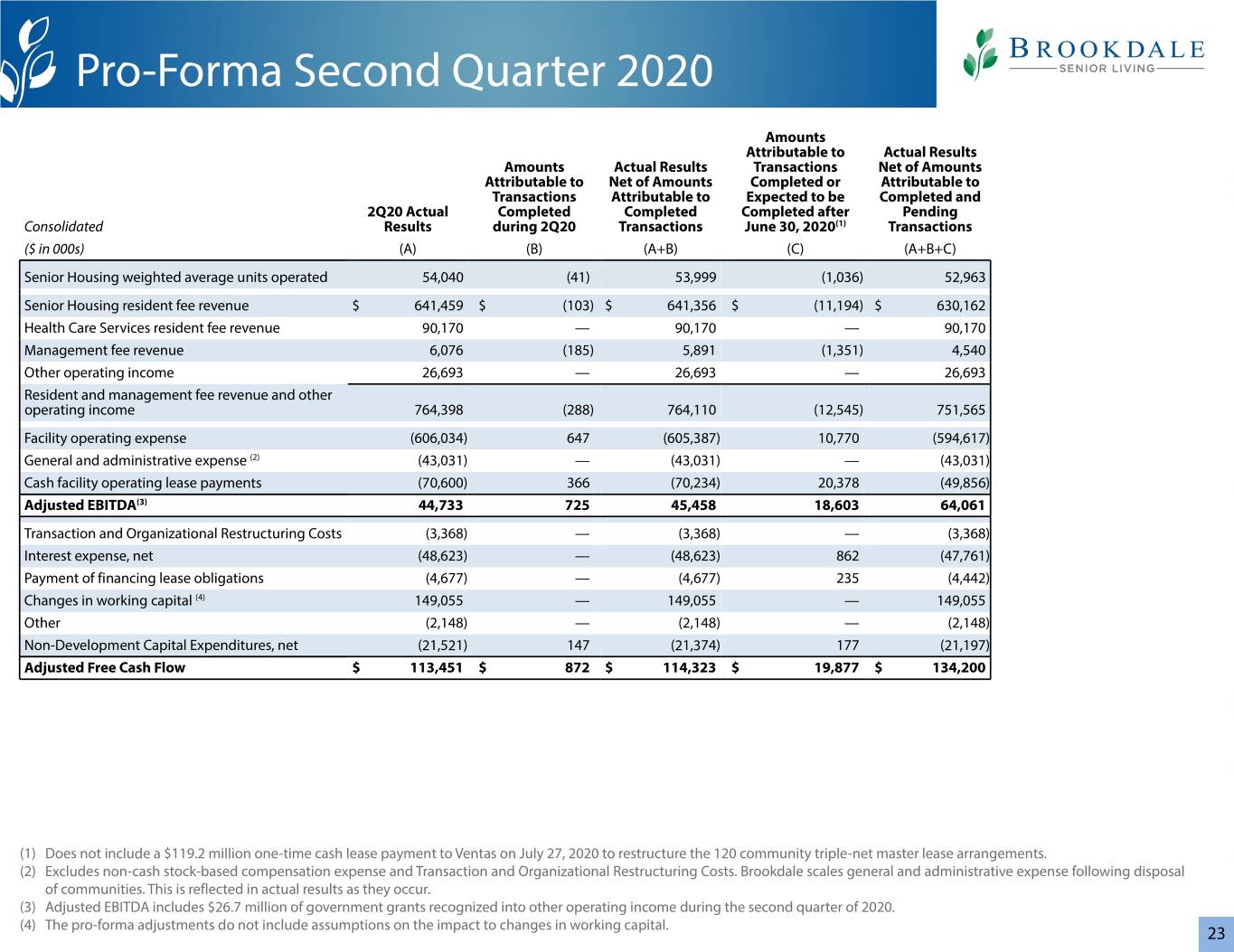

Pro-Forma Financial Information During the period of July 1, 2019 to June 30, 2020, the Company acquired 26 formerly leased communities and financed the acquisitions with $251.9 million of non-recourse mortgage debt, modified the terms of the amended and restated master lease with Healthpeak, sold its equity interest in the unconsolidated entrance fee CCRC Venture, disposed of an aggregate of seven owned communities, terminated triple-net lease obligations on an aggregate of four communities, and transitioned management agreements on 61 net communities. On July 26, 2020, the Company entered into definitive agreements with Ventas, Inc. (Ventas) to restructure its 120 community (10,174 units) triple-net master lease arrangements, as further described in the Company’s Current Report on Form 8-K filed with the SEC on July 27, 2020. In addition, the Company conveyed to Ventas five communities and will manage the communities following the closing. During the next approximately 12 months, the Company additionally expects: • to close on the dispositions of two owned communities classified as held for sale as of June 30, 2020 • termination of its triple-net lease obligations on two communities • termination of certain of its management arrangements, including management arrangements on certain former unconsolidated ventures in which the Company sold its interest, management arrangements on communities owned by unconsolidated ventures, and interim management arrangements on formerly leased communities. The pro-forma results on the following pages summarize the Company’s actual consolidated results excluding the impact of the lease standard adopted in 2019 and the impact of transactions as follows: • The pro-forma table for the second quarter of 2020 table on page 23 reflects the Company’s actual consolidated results excluding the impact on those results assuming that the foregoing completed and expected transactions had closed on March 31, 2020. • The pro-forma table for the 2020 year to date table on page 24 reflects the Company's actual consolidated results excluding the impact on those results assuming that the foregoing completed and expected transactions had closed on December 31, 2019. • The pro-forma table for the twelve months ended June 30, 2020 on page 25 reflects the Company’s actual consolidated results excluding the non-recurring, non-cash impact of the lease standard adopted in 2019 for the six months ended December 31, 2019 and the impact on those results assuming that the foregoing completed and expected transactions had closed on June 30, 2019. The closings of the various pending and expected transactions described above are, or will be, subject to the satisfaction of various conditions, including (where applicable) the receipt of regulatory approvals; however, there can be no assurance that the transactions will close or, if they do, when the actual closings will occur. 22

Pro-Forma Second Quarter 2020 Amounts Attributable to Actual Results Amounts Actual Results Transactions Net of Amounts Attributable to Net of Amounts Completed or Attributable to Transactions Attributable to Expected to be Completed and 2Q20 Actual Completed Completed Completed after Pending Consolidated Results during 2Q20 Transactions June 30, 2020(1) Transactions ($ in 000s) (A) (B) (A+B) (C) (A+B+C) Senior Housing weighted average units operated 54,040 (41) 53,999 (1,036) 52,963 Senior Housing resident fee revenue $ 641,459 $ (103) $ 641,356 $ (11,194) $ 630,162 Health Care Services resident fee revenue 90,170 — 90,170 — 90,170 Management fee revenue 6,076 (185) 5,891 (1,351) 4,540 Other operating income 26,693 — 26,693 — 26,693 Resident and management fee revenue and other operating income 764,398 (288) 764,110 (12,545) 751,565 Facility operating expense (606,034) 647 (605,387) 10,770 (594,617) General and administrative expense (2) (43,031) — (43,031) — (43,031) Cash facility operating lease payments (70,600) 366 (70,234) 20,378 (49,856) Adjusted EBITDA(3) 44,733 725 45,458 18,603 64,061 Transaction and Organizational Restructuring Costs (3,368) — (3,368) — (3,368) Interest expense, net (48,623) — (48,623) 862 (47,761) Payment of financing lease obligations (4,677) — (4,677) 235 (4,442) Changes in working capital (4) 149,055 — 149,055 — 149,055 Other (2,148) — (2,148) — (2,148) Non-Development Capital Expenditures, net (21,521) 147 (21,374) 177 (21,197) Adjusted Free Cash Flow $ 113,451 $ 872 $ 114,323 $ 19,877 $ 134,200 (1) Does not include a $119.2 million one-time cash lease payment to Ventas on July 27, 2020 to restructure the 120 community triple-net master lease arrangements. (2) Excludes non-cash stock-based compensation expense and Transaction and Organizational Restructuring Costs. Brookdale scales general and administrative expense following disposal of communities. This is reflected in actual results as they occur. (3) Adjusted EBITDA includes $26.7 million of government grants recognized into other operating income during the second quarter of 2020. (4) The pro-forma adjustments do not include assumptions on the impact to changes in working capital. 23

Pro-Forma Second Quarter 2020 YTD Amounts Amounts Attributable to Actual Results Attributable to Actual Results Transactions Net of Amounts Transactions Net of Amounts Completed or Attributable to Completed on Attributable to Expected to be Completed and YTD 2Q20 during YTD Completed Completed after Pending Consolidated Actual Results 2Q20 Transactions June 30, 2020(1) Transactions ($ in 000s) (A) (B) (A+B) (C) (A+B+C) Senior Housing weighted average units operated 54,112 (119) 53,993 (1,036) 52,957 Senior Housing resident fee revenue $ 1,329,347 $ (1,455) $ 1,327,892 $ (24,181) $ 1,303,711 Health Care Services resident fee revenue 184,989 — 184,989 — 184,989 Management fee revenue 114,791 (102,164) 12,627 (2,827) 9,800 Other operating income 26,693 — 26,693 — 26,693 Resident and management fee revenue and other operating income 1,655,820 (103,619) 1,552,201 (27,008) 1,525,193 Facility operating expense (1,194,516) 2,476 (1,192,040) 22,456 (1,169,584) General and administrative expense (2) (89,688) — (89,688) — (89,688) Cash facility operating lease payments (141,814) 1,671 (140,143) 40,876 (99,267) Adjusted EBITDA (3) 229,802 (99,472) 130,330 36,324 166,654 Transaction and Organizational Restructuring Costs (5,349) — (5,349) — (5,349) Interest expense, net (102,213) 726 (101,487) 1,956 (99,531) Payment of financing lease obligations (9,764) 458 (9,306) 467 (8,839) Changes in working capital (4) 95,153 — 95,153 — 95,153 Other (6,919) — (6,919) — (6,919) Non-Development Capital Expenditures, net (82,077) 1,120 (80,957) 495 (80,462) Adjusted Free Cash Flow $ 118,633 $ (97,168) $ 21,465 $ 39,242 $ 60,707 (1) Does not include a $119.2 million one-time cash lease payment to Ventas on July 27, 2020 to restructure the 120 community triple-net master lease arrangements. (2) Excludes non-cash stock-based compensation expense and Transaction and Organizational Restructuring Costs. Brookdale scales general and administrative expense following disposal of communities. This is reflected in actual results as they occur. (3) Adjusted EBITDA for year-to-date 2020 includes the $100.0 million management agreement termination fee payment received from Healthpeak related to the sale of Brookdale’s interest in the entry fee CCRC venture, which closed on January 31, 2020, and $26.7 million of government grants recognized into other operating income during the second quarter of 2020. (4) The pro-forma adjustments do not include assumptions on the impact to changes in working capital. 24

Pro-Forma Trailing Twelve Months Amounts Amounts Attributable to Less: Impact of Actual Results Attributable to Actual Results Transactions Lease Standard Net of Amounts Trailing Twelve Transactions Net of Amounts Completed or Adopted on Attributable to the Months Ended Completed on Attributable to Expected to be January 1, 2019 Lease Standard and June 30, 2020 or before Completed Completed after on Actual Results Completed and Consolidated Actual Results June 30, 2020 Transactions June 30, 2020(1) (2) Pending Transactions ($ in 000s) (A) (B) (A+B) (C) (D) (A+B+C+D=E) Senior Housing weighted average units operated 54,576 (583) 53,993 (1,036) — 52,957 Senior Housing resident fee revenue $ 2,706,642 $ (22,094) $ 2,684,548 $ (50,152) $ (18,341) $ 2,616,055 Health Care Services resident fee revenue 406,283 — 406,283 — — 406,283 Management fee revenue 140,707 (114,897) 25,810 (5,776) — 20,034 Other operating income 26,693 — 26,693 — — 26,693 Resident and management fee revenue and other operating income 3,280,325 (136,991) 3,143,334 (55,928) (18,341) 3,069,065 Facility operating expense (2,408,671) 25,351 (2,383,320) 46,164 28,488 (2,308,668) General and administrative expense (3) (175,538) 2,500 (173,038) — — (173,038) Cash facility operating lease payments (285,764) 8,074 (277,690) 78,805 — (198,885) Adjusted EBITDA (4) 410,352 (101,066) 309,286 69,041 10,147 388,474 Transaction and Organizational Restructuring Costs (14,261) — (14,261) — — (14,261) Interest expense, net (218,094) 6,941 (211,153) 4,106 — (207,047) Payment of financing lease obligations (21,053) 2,877 (18,176) 897 — (17,279) Changes in working capital (5) 147,002 — 147,002 — (16,674) 130,328 Other (1,569) (261) (1,830) — — (1,830) Non-Development Capital Expenditures, net (196,808) 6,975 (189,833) 2,018 — (187,815) Adjusted Free Cash Flow $ 105,569 $ (84,534) $ 21,035 $ 76,062 $ (6,527) $ 90,570 Cash facility operating and financing lease payments $ 364,952 $ (22,550) $ 342,402 $ (80,254) $ — $ 262,148 (1) Does not include a $119.2 million one-time cash lease payment to Ventas on July 27, 2020 to restructure the 120 community triple-net master lease arrangements. (2) See page 26 for more information on the non-recurring, non-cash impact of the lease standard adopted on January 1, 2019. Actual results include the impact of the lease accounting standard effective January 1, 2019. (3) Excludes non-cash stock-based compensation expense and Transaction and Organizational Restructuring Costs. Brookdale scales general and administrative expense following disposal of communities. This is reflected in actual results as they occur, with the exception of an estimate of the scaling as a result of the transactions with Healthpeak which is included in column B. (4) Adjusted EBITDA for 2020 includes the $100.0 million management agreement termination fee payment received from Healthpeak related to the sale of Brookdale’s interest in the entry fee CCRC venture, which closed on January 31, 2020, and $26.7 million of government grants recognized into other operating income during the second quarter of 2020. (5) The pro-forma adjustments do not include assumptions on the impact to changes in working capital. Actual Results Less Amounts Pro-forma (from column E above) Attributable to Completed and Owned and Leased Specifically Identifiable Information, and Senior Housing Owned Senior Housing Leased Health Care Services Pending Transactions Other Portfolio Portfolio and Other (from column E above) Weighted average units operated 31,562 21,395 — 52,957 Senior Housing and Health Care Services revenue $ 1,515,351 $ 1,100,704 $ 406,283 $ 3,022,338 Facility operating expense $ (1,117,479) $ (776,129) $ (415,060) $ (2,308,668) Total cash facility lease payments and interest expense, net $ (168,724) $ (256,469) $ 1,982 $ (423,211) Non-Development Capital Expenditures, net $ (116,653) $ (43,948) $ (27,214) $ (187,815) 25

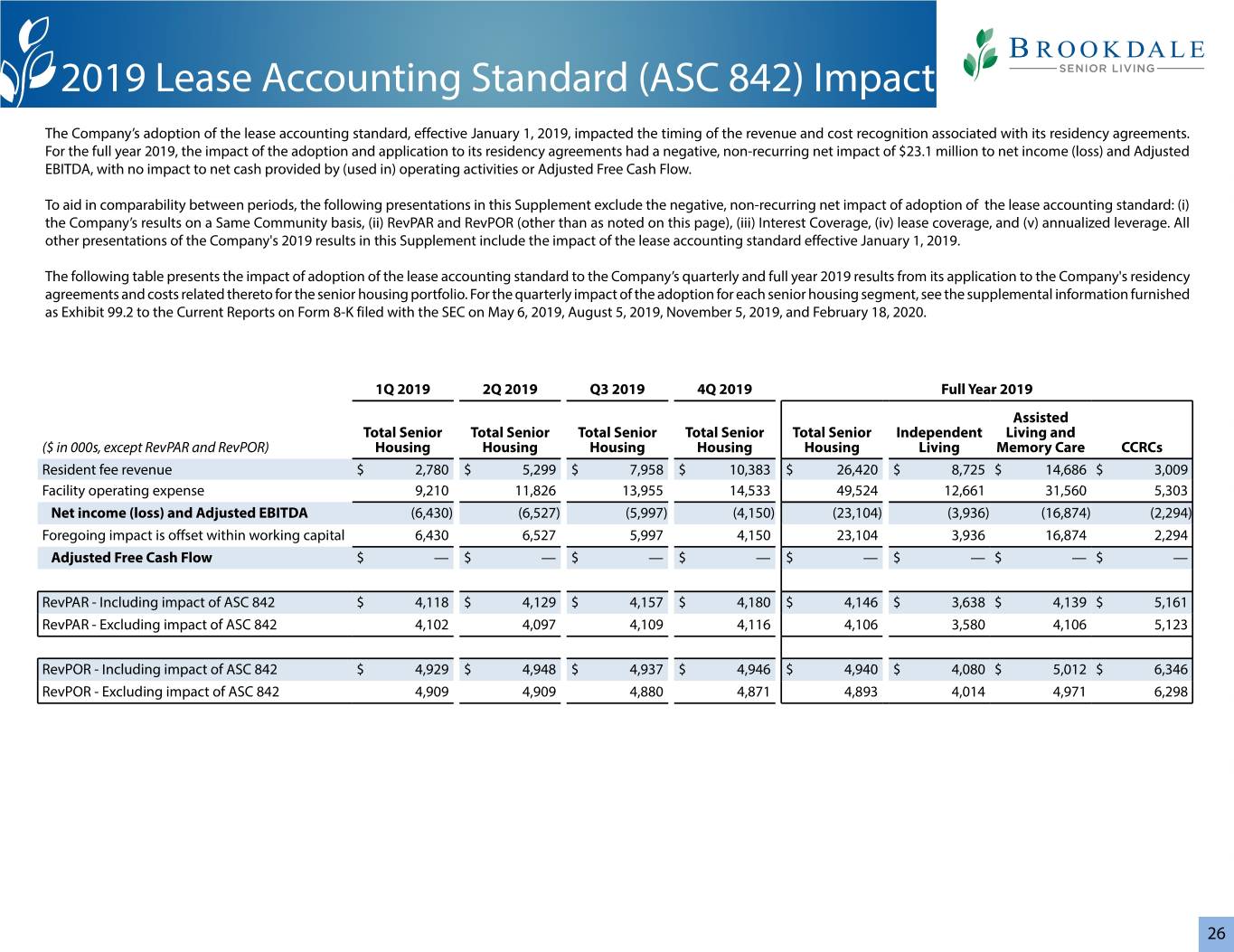

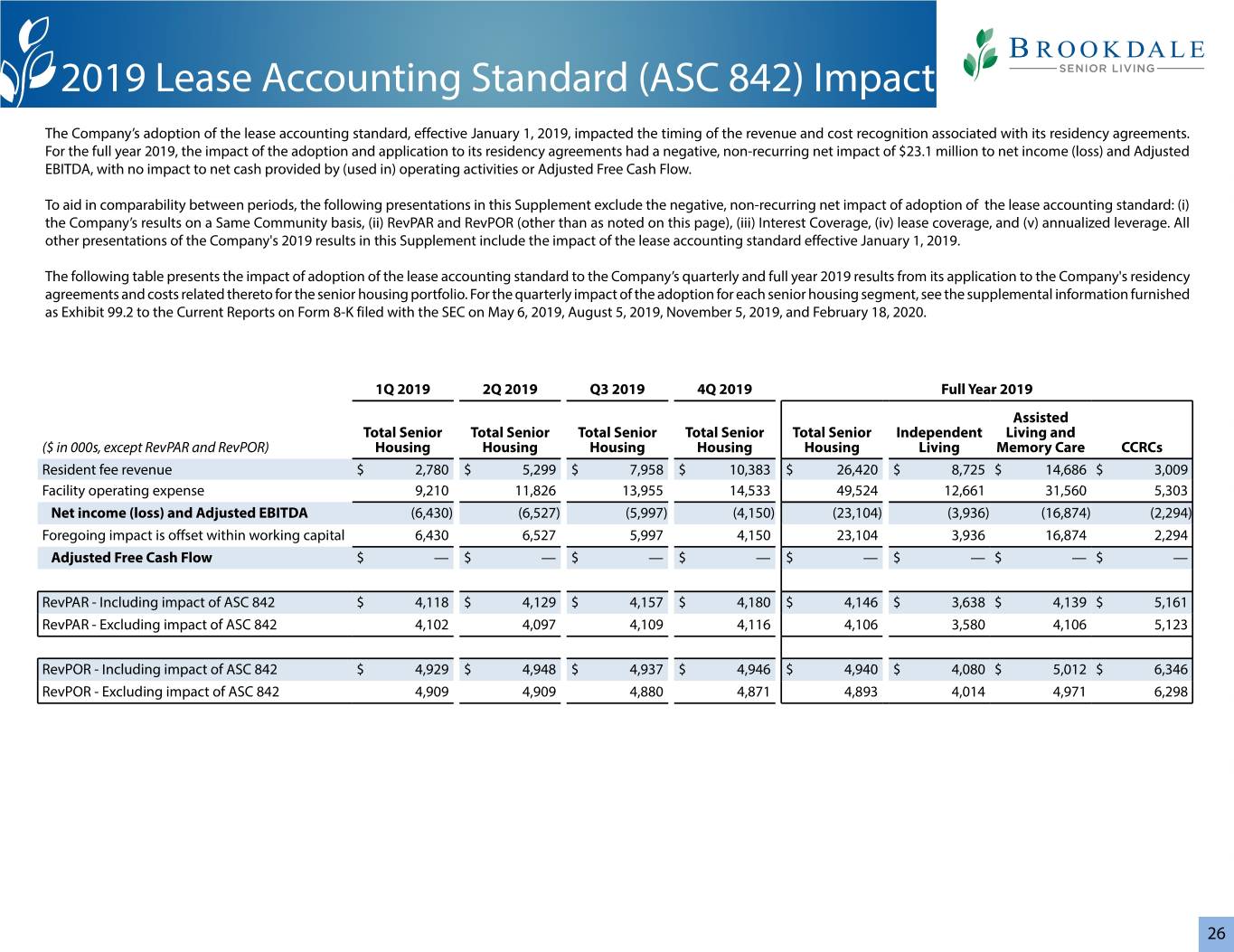

2019 Lease Accounting Standard (ASC 842) Impact The Company’s adoption of the lease accounting standard, effective January 1, 2019, impacted the timing of the revenue and cost recognition associated with its residency agreements. For the full year 2019, the impact of the adoption and application to its residency agreements had a negative, non-recurring net impact of $23.1 million to net income (loss) and Adjusted EBITDA, with no impact to net cash provided by (used in) operating activities or Adjusted Free Cash Flow. To aid in comparability between periods, the following presentations in this Supplement exclude the negative, non-recurring net impact of adoption of the lease accounting standard: (i) the Company’s results on a Same Community basis, (ii) RevPAR and RevPOR (other than as noted on this page), (iii) Interest Coverage, (iv) lease coverage, and (v) annualized leverage. All other presentations of the Company's 2019 results in this Supplement include the impact of the lease accounting standard effective January 1, 2019. The following table presents the impact of adoption of the lease accounting standard to the Company’s quarterly and full year 2019 results from its application to the Company's residency agreements and costs related thereto for the senior housing portfolio. For the quarterly impact of the adoption for each senior housing segment, see the supplemental information furnished as Exhibit 99.2 to the Current Reports on Form 8-K filed with the SEC on May 6, 2019, August 5, 2019, November 5, 2019, and February 18, 2020. 1Q 2019 2Q 2019 Q3 2019 4Q 2019 Full Year 2019 Assisted Total Senior Total Senior Total Senior Total Senior Total Senior Independent Living and ($ in 000s, except RevPAR and RevPOR) Housing Housing Housing Housing Housing Living Memory Care CCRCs Resident fee revenue $ 2,780 $ 5,299 $ 7,958 $ 10,383 $ 26,420 $ 8,725 $ 14,686 $ 3,009 Facility operating expense 9,210 11,826 13,955 14,533 49,524 12,661 31,560 5,303 Net income (loss) and Adjusted EBITDA (6,430) (6,527) (5,997) (4,150) (23,104) (3,936) (16,874) (2,294) Foregoing impact is offset within working capital 6,430 6,527 5,997 4,150 23,104 3,936 16,874 2,294 Adjusted Free Cash Flow $ — $ — $ — $ — $ — $ — $ — $ — RevPAR - Including impact of ASC 842 $ 4,118 $ 4,129 $ 4,157 $ 4,180 $ 4,146 $ 3,638 $ 4,139 $ 5,161 RevPAR - Excluding impact of ASC 842 4,102 4,097 4,109 4,116 4,106 3,580 4,106 5,123 RevPOR - Including impact of ASC 842 $ 4,929 $ 4,948 $ 4,937 $ 4,946 $ 4,940 $ 4,080 $ 5,012 $ 6,346 RevPOR - Excluding impact of ASC 842 4,909 4,909 4,880 4,871 4,893 4,014 4,971 6,298 26

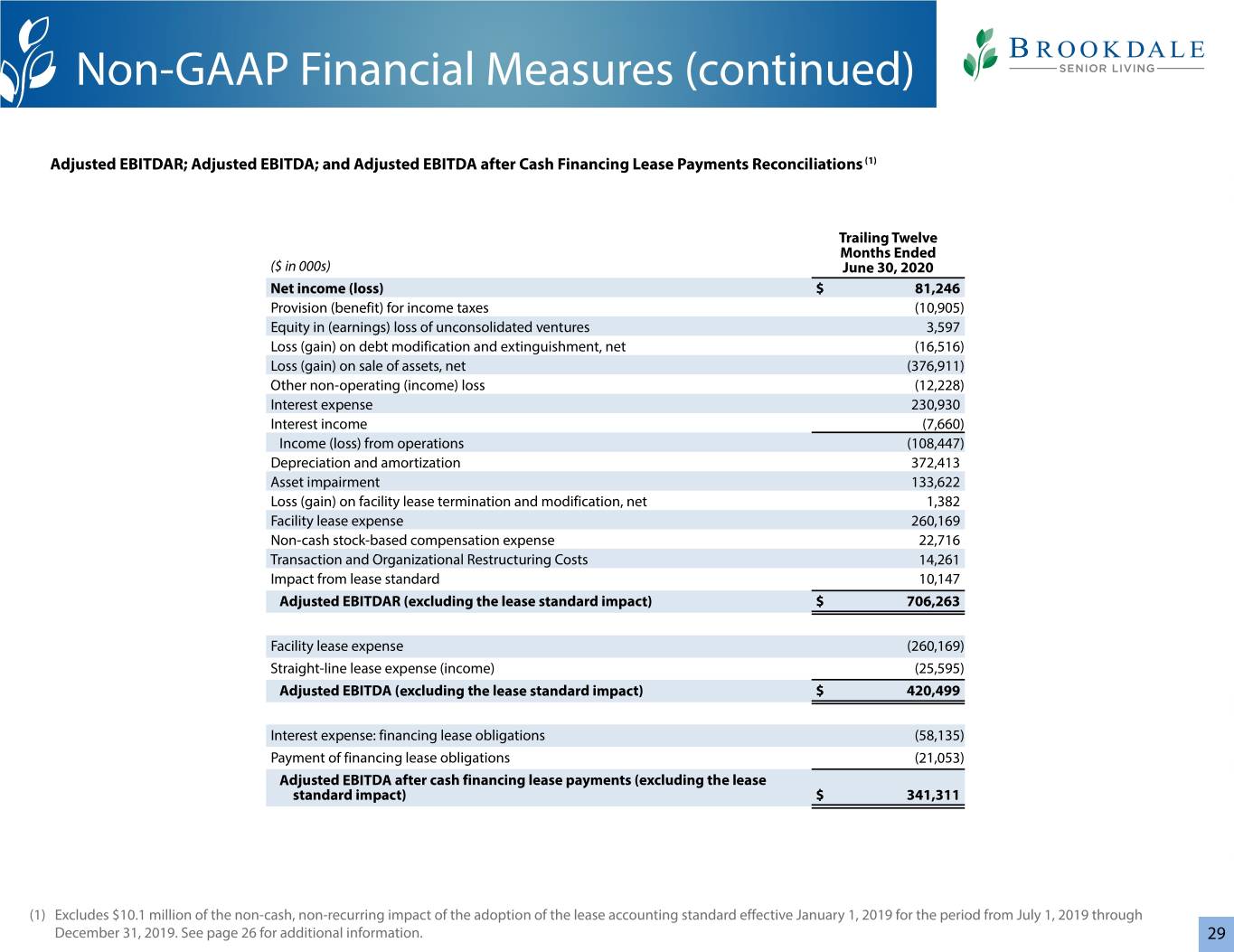

Non-GAAP Financial Measures This Supplemental Information contains the financial measures Adjusted EBITDA, Adjusted EBITDAR, Adjusted EBITDA after cash financing lease payments, Adjusted Free Cash Flow, Net Debt, and Adjusted Net Debt (each as defined in the “Definitions” section), which are not calculated in accordance with U.S. GAAP ("GAAP"). Presentations of these non-GAAP financial measures are intended to aid investors in better understanding the factors and trends affecting the Company’s performance and liquidity. However, investors should not consider these non-GAAP financial measures as a substitute for financial measures determined in accordance with GAAP, including net income (loss), income (loss) from operations, net cash provided by (used in) operating activities, short-term debt, long-term debt less current portion, or current portion of long-term debt. Investors are cautioned that amounts presented in accordance with the Company’s definitions of these non-GAAP financial measures may not be comparable to similar measures disclosed by other companies because not all companies calculate non-GAAP measures in the same manner. Investors are urged to review the reconciliations set forth in this Appendix of these non-GAAP financial measures from the most comparable financial measures determined in accordance with GAAP and to review the information under “Reconciliations of Non-GAAP Financial Measures” in the Company’s earnings release dated August 10, 2020 for additional information regarding the Company’s use and the limitations of such non-GAAP financial measures. 27

Non-GAAP Financial Measures (continued) Adjusted EBITDA Reconciliation 2019 2020 Trailing Twelve Months Ended ($ in 000s) 1Q 2Q 3Q 4Q Full Year 1Q 2Q YTD June 30, 2020 Net income (loss) $ (42,606) $ (56,055) $ (78,508) $ (91,323) $(268,492) $369,497 $(118,420) $ 251,077 $ 81,246 Provision (benefit) for income taxes 679 633 (1,800) (1,781) (2,269) (15,828) 8,504 (7,324) (10,905) Equity in (earnings) loss of unconsolidated ventures 526 991 2,057 970 4,544 1,008 (438) 570 3,597 Loss (gain) on debt modification and extinguishment, net 67 2,672 2,455 53 5,247 (19,181) 157 (19,024) (16,516) Loss (gain) on sale of assets, net 702 (2,846) (579) (4,522) (7,245) (372,839) 1,029 (371,810) (376,911) Other non-operating (income) loss (2,988) (3,199) (3,763) (4,815) (14,765) (2,662) (988) (3,650) (12,228) Interest expense 63,365 62,828 62,078 60,070 248,341 56,360 52,422 108,782 230,930 Interest income (3,084) (2,813) (2,162) (1,800) (9,859) (1,455) (2,243) (3,698) (7,660) Income (loss) from operations 16,661 2,211 (20,222) (43,148) (44,498) 14,900 (59,977) (45,077) (108,447) Depreciation and amortization 96,888 94,024 93,550 94,971 379,433 90,738 93,154 183,892 372,413 Asset impairment 391 3,769 2,094 43,012 49,266 78,226 10,290 88,516 133,622 Loss (gain) on facility lease termination and modification, net 209 1,797 — 1,382 3,388 — — — 1,382 Operating lease expense adjustment (4,383) (4,429) (4,814) (5,827) (19,453) (6,733) (8,221) (14,954) (25,595) Non-cash stock-based compensation expense 6,356 6,030 5,929 4,711 23,026 5,957 6,119 12,076 22,716 Transaction and Organizational Restructuring Costs 461 634 3,910 5,002 10,007 1,981 3,368 5,349 14,261 Adjusted EBITDA (1) (2) $116,583 $104,036 $ 80,447 $100,103 $ 401,169 $ 185,069 $ 44,733 $ 229,802 $ 410,352 $100.0 million management termination fee — — — — — (100,000) — (100,000) (100,000) Adjusted EBITDA, excluding $100.0 million management termination fee $116,583 $104,036 $ 80,447 $100,103 $ 401,169 $ 85,069 $ 44,733 $ 129,802 $ 310,352 (1) The 2019 periods presented include the non-recurring, non-cash impact associated with the Company's adoption of the lease accounting standard effective January 1, 2019. See page 26 for additional information. (2) Adjusted EBITDA for the first quarter and year-to-date of 2020 includes the $100.0 million management agreement termination fee payment received from Healthpeak related to the sale of Brookdale’s interest in the entry fee CCRC venture, which closed on January 31, 2020. Adjusted EBITDA for the second quarter and year-to-date of 2020 includes $26.7 million of government grants recognized in other operating income during the second quarter of 2020. 28

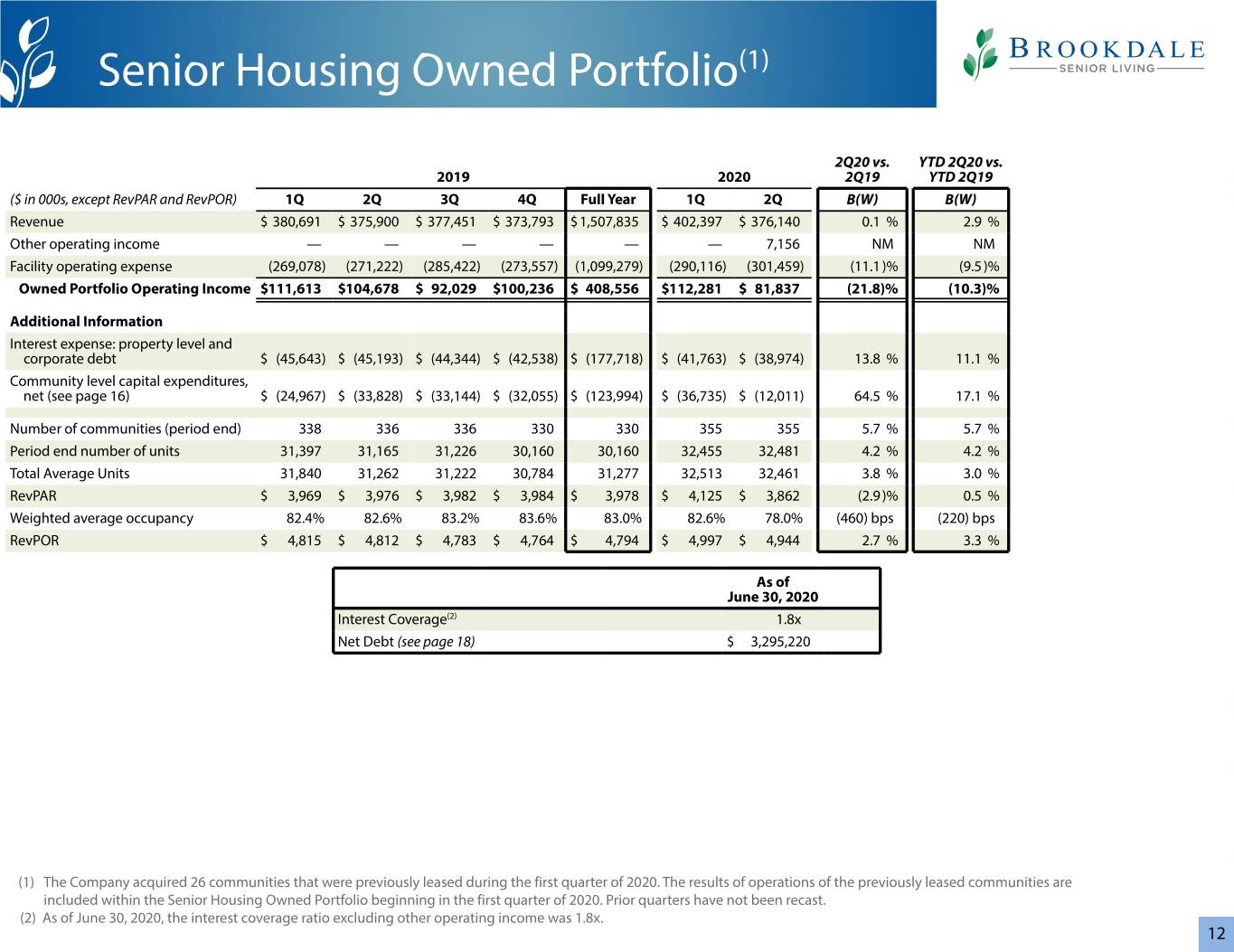

Non-GAAP Financial Measures (continued) Adjusted EBITDAR; Adjusted EBITDA; and Adjusted EBITDA after Cash Financing Lease Payments Reconciliations (1) Trailing Twelve Months Ended ($ in 000s) June 30, 2020 Net income (loss) $ 81,246 Provision (benefit) for income taxes (10,905) Equity in (earnings) loss of unconsolidated ventures 3,597 Loss (gain) on debt modification and extinguishment, net (16,516) Loss (gain) on sale of assets, net (376,911) Other non-operating (income) loss (12,228) Interest expense 230,930 Interest income (7,660) Income (loss) from operations (108,447) Depreciation and amortization 372,413 Asset impairment 133,622 Loss (gain) on facility lease termination and modification, net 1,382 Facility lease expense 260,169 Non-cash stock-based compensation expense 22,716 Transaction and Organizational Restructuring Costs 14,261 Impact from lease standard 10,147 Adjusted EBITDAR (excluding the lease standard impact) $ 706,263 Facility lease expense (260,169) Straight-line lease expense (income) (25,595) Adjusted EBITDA (excluding the lease standard impact) $ 420,499 Interest expense: financing lease obligations (58,135) Payment of financing lease obligations (21,053) Adjusted EBITDA after cash financing lease payments (excluding the lease standard impact) $ 341,311 (1) Excludes $10.1 million of the non-cash, non-recurring impact of the adoption of the lease accounting standard effective January 1, 2019 for the period from July 1, 2019 through December 31, 2019. See page 26 for additional information. 29

Non-GAAP Financial Measures (continued) Net Debt and Adjusted Net Debt Reconciliations ($ in 000s) As of June 30, 2020 Long-term debt (including current portion) $ 3,692,365 Line of credit 166,381 Cash and cash equivalents (452,441) Marketable securities (109,873) Cash held as collateral against existing debt (1,212) Net Debt 3,295,220 Operating and financing lease obligations 2,012,516 Operating lease obligations related to certain non-facility leases for which the related lease expense is included in Adjusted EBITDAR (46,548) Adjusted Net Debt $ 5,261,188 Adjusted Net Debt to Adjusted EBITDAR 7.4x Net Debt to Adjusted EBITDA after cash financing lease payments 9.7x Operating and financing lease obligations $ 2,012,516 Operating lease obligations related to certain non-facility leases for which the related lease expense is included in Adjusted EBITDAR (46,548) Operating lease obligations related to corporate office and information technology leases $ (27,839) Operating and financing lease obligations for Senior Housing Leased Portfolio $ 1,938,129 30

Non-GAAP Financial Measures (continued) Adjusted Free Cash Flow Reconciliation 2019 2020 Trailing Twelve Months Ended ($ in 000s) 1Q 2Q 3Q 4Q Full Year 1Q 2Q YTD June 30, 2020 Net cash provided by (used in) operating activities $ (5,009) $ 64,128 $ 69,211 $ 88,082 $216,412 $ 57,479 $ 151,840 $ 209,319 $ 366,612 Net cash provided by (used in) investing activities (100,073) 19,774 (70,056) (75,184) (225,539) (247,927) (47,483) (295,410) (440,650) Net cash provided by (used in) financing activities (16,636) (87,443) (8,755) (26,560) (139,394) 347,250 (40,726) 306,524 271,209 Net increase (decrease) in cash, cash equivalents and restricted cash $ (121,718) $ (3,541) $ (9,600) $ (13,662) $(148,521) $ 156,802 $ 63,631 $ 220,433 $ 197,171 Net cash provided by (used in) operating activities $ (5,009) $ 64,128 $ 69,211 $ 88,082 $216,412 $ 57,479 $ 151,840 $ 209,319 $ 366,612 Distributions from unconsolidated ventures from cumulative share of net earnings (749) (781) (858) (1,084) (3,472) — — — (1,942) Changes in prepaid insurance premiums financed with notes payable 18,842 (6,752) (6,215) (5,875) — 17,434 (5,770) 11,664 (426) Changes in liabilities for lessor capital expenditure reimbursements under operating leases — (1,000) (11,043) (19,262) (31,305) (4,088) (6,421) (10,509) (40,814) Non-development capital expenditures, net (54,602) (66,464) (59,121) (55,610) (235,797) (60,556) (21,521) (82,077) (196,808) Payment of financing lease obligations (5,453) (5,500) (5,549) (5,740) (22,242) (5,087) (4,677) (9,764) (21,053) Adjusted Free Cash Flow (1) $ (46,971) $ (16,369) $ (13,575) $ 511 $ (76,404) $ 5,182 $ 113,451 $ 118,633 $ 105,569 (1) The first quarter and year-to-date of 2020 includes the $100.0 million management agreement termination fee payment received from Healthpeak related to the sale of Brookdale’s interest in the entry fee CCRC venture, which closed on January 31, 2020. The second quarter and year-to-date of 2020 includes $85.0 million of accelerated/ advanced Medicare payments, $33.5 million of Emergency Fund government grants accepted, and $26.5 million of payroll taxes deferred in the second quarter of 2020. Brookdale Senior Living Inc. 111 Westwood Place, Suite 400 Brentwood, TN 37027 (615) 221-2250 www.brookdale.com 31