Supplemental Information 1st Quarter 2022 Exhibit 99.2

2 Overview 3 Segment Overview 6 Senior Housing 7 General and Administrative ("G&A") Expense 12 Capital Expenditures 13 Cash Facility Lease Payments 14 Capital Structure 15 Definitions 16 Appendices: Summary Financial Impact: COVID-19 19 Non-GAAP Financial Measures 21 Table of Contents

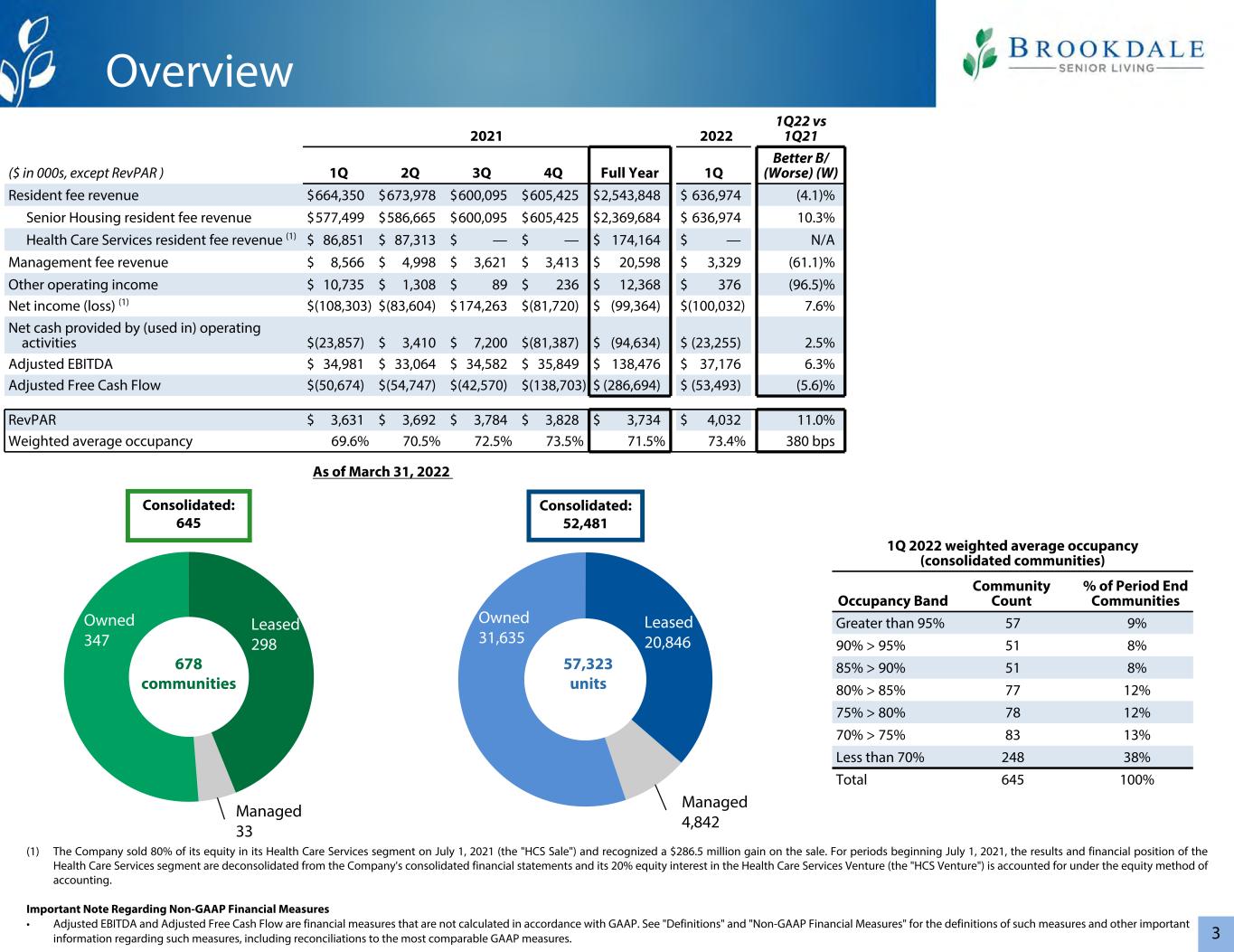

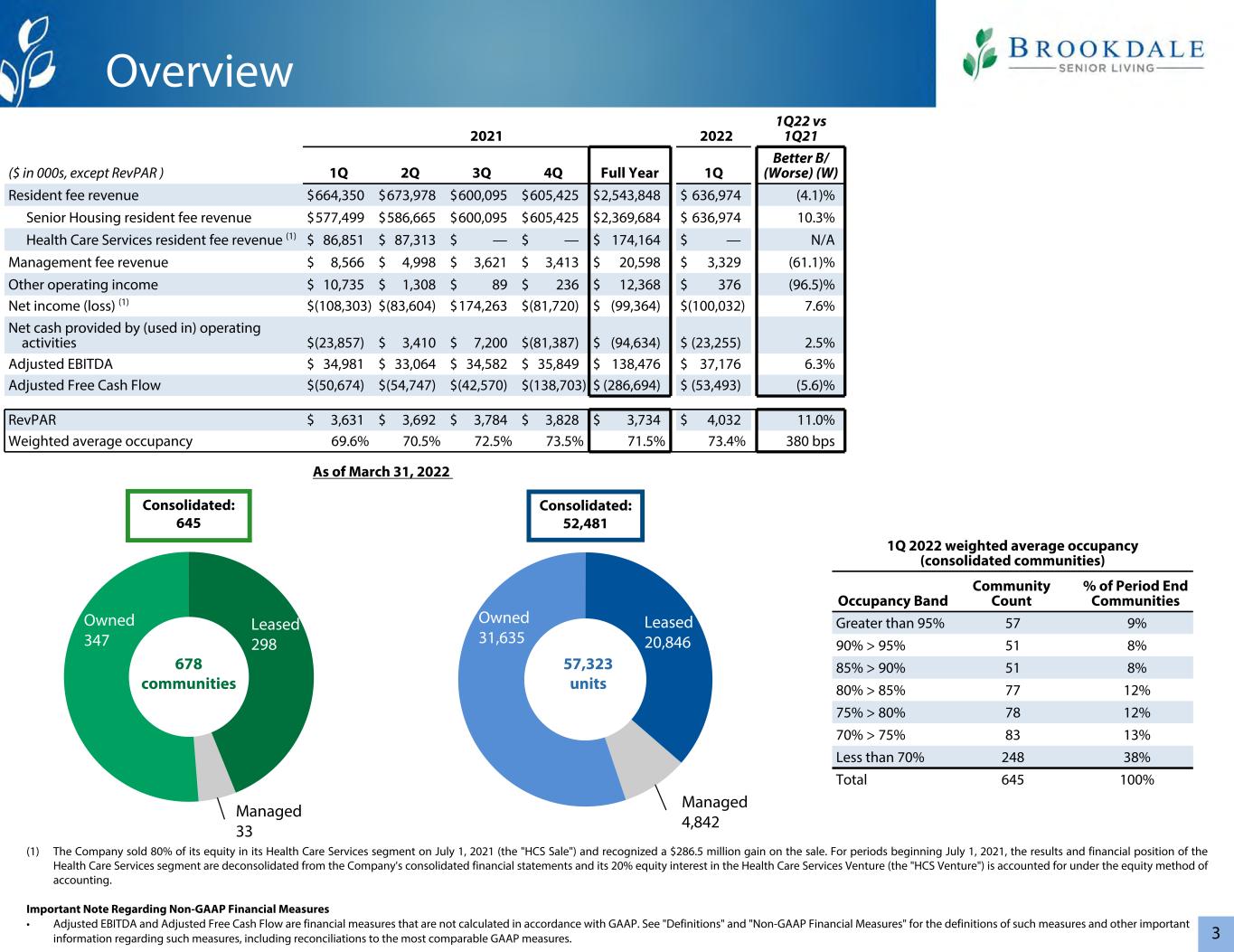

3 Managed 4,842 Owned 31,635 Leased 20,846 Managed 33 Owned 347 Leased 298 678 communities 57,323 units (1) The Company sold 80% of its equity in its Health Care Services segment on July 1, 2021 (the "HCS Sale") and recognized a $286.5 million gain on the sale. For periods beginning July 1, 2021, the results and financial position of the Health Care Services segment are deconsolidated from the Company's consolidated financial statements and its 20% equity interest in the Health Care Services Venture (the "HCS Venture") is accounted for under the equity method of accounting. Important Note Regarding Non-GAAP Financial Measures • Adjusted EBITDA and Adjusted Free Cash Flow are financial measures that are not calculated in accordance with GAAP. See "Definitions" and "Non-GAAP Financial Measures" for the definitions of such measures and other important information regarding such measures, including reconciliations to the most comparable GAAP measures. 2021 2022 1Q22 vs 1Q21 ($ in 000s, except RevPAR ) 1Q 2Q 3Q 4Q Full Year 1Q Better B/ (Worse) (W) Resident fee revenue $ 664,350 $ 673,978 $ 600,095 $ 605,425 $ 2,543,848 $ 636,974 $ 636,974 (4.1) % Senior Housing resident fee revenue $ 577,499 $ 586,665 $ 600,095 $ 605,425 $ 2,369,684 $ 636,974 10.3 % Health Care Services resident fee revenue (1) $ 86,851 $ 87,313 $ — $ — $ 174,164 $ — N/A Management fee revenue $ 8,566 $ 4,998 $ 3,621 $ 3,413 $ 20,598 $ 3,329 (61.1) % Other operating income $ 10,735 $ 1,308 $ 89 $ 236 $ 12,368 $ 376 (96.5) % Net income (loss) (1) $ (108,303) $ (83,604) $ 174,263 $ (81,720) $ (99,364) $ (100,032) 7.6 % Net cash provided by (used in) operating activities $ (23,857) $ 3,410 $ 7,200 $ (81,387) $ (94,634) $ (23,255) 2.5 % Adjusted EBITDA $ 34,981 $ 33,064 $ 34,582 $ 35,849 $ 138,476 $ 37,176 6.3 % Adjusted Free Cash Flow $ (50,674) $ (54,747) $ (42,570) $ (138,703) $ (286,694) $ (53,493) (5.6) % RevPAR $ 3,631 $ 3,692 $ 3,784 $ 3,828 $ 3,734 $ 4,032 11.0 % Weighted average occupancy 69.6% 70.5% 72.5% 73.5% 71.5% 73.4% 380 bps 1Q 2022 weighted average occupancy (consolidated communities) Occupancy Band Community Count % of Period End Communities Greater than 95% 57 9% 90% > 95% 51 8% 85% > 90% 51 8% 80% > 85% 77 12% 75% > 80% 78 12% 70% > 75% 83 13% Less than 70% 248 38% Total 645 100% Overview As of March 31, 2022 Consolidated: 52,481 Consolidated: 645

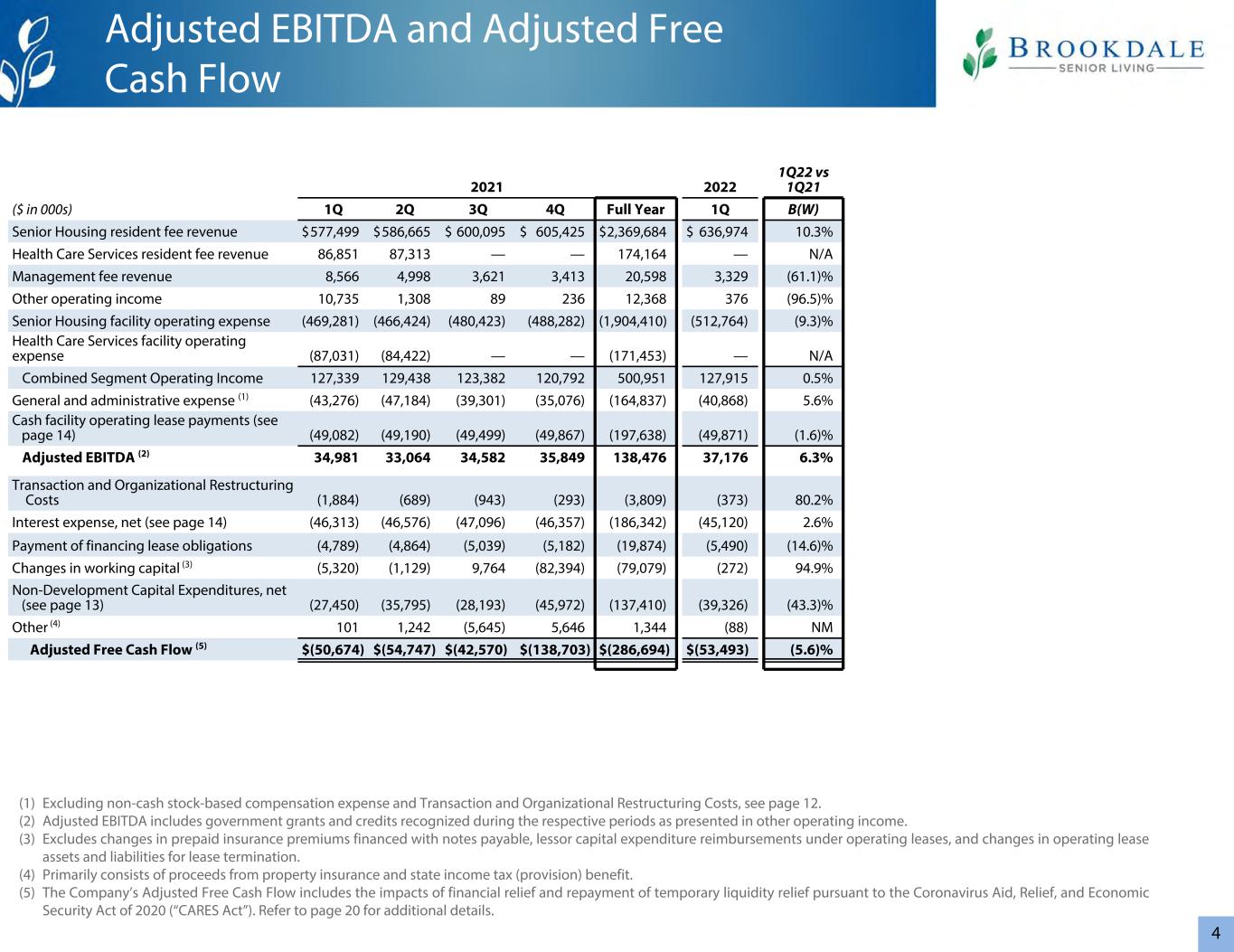

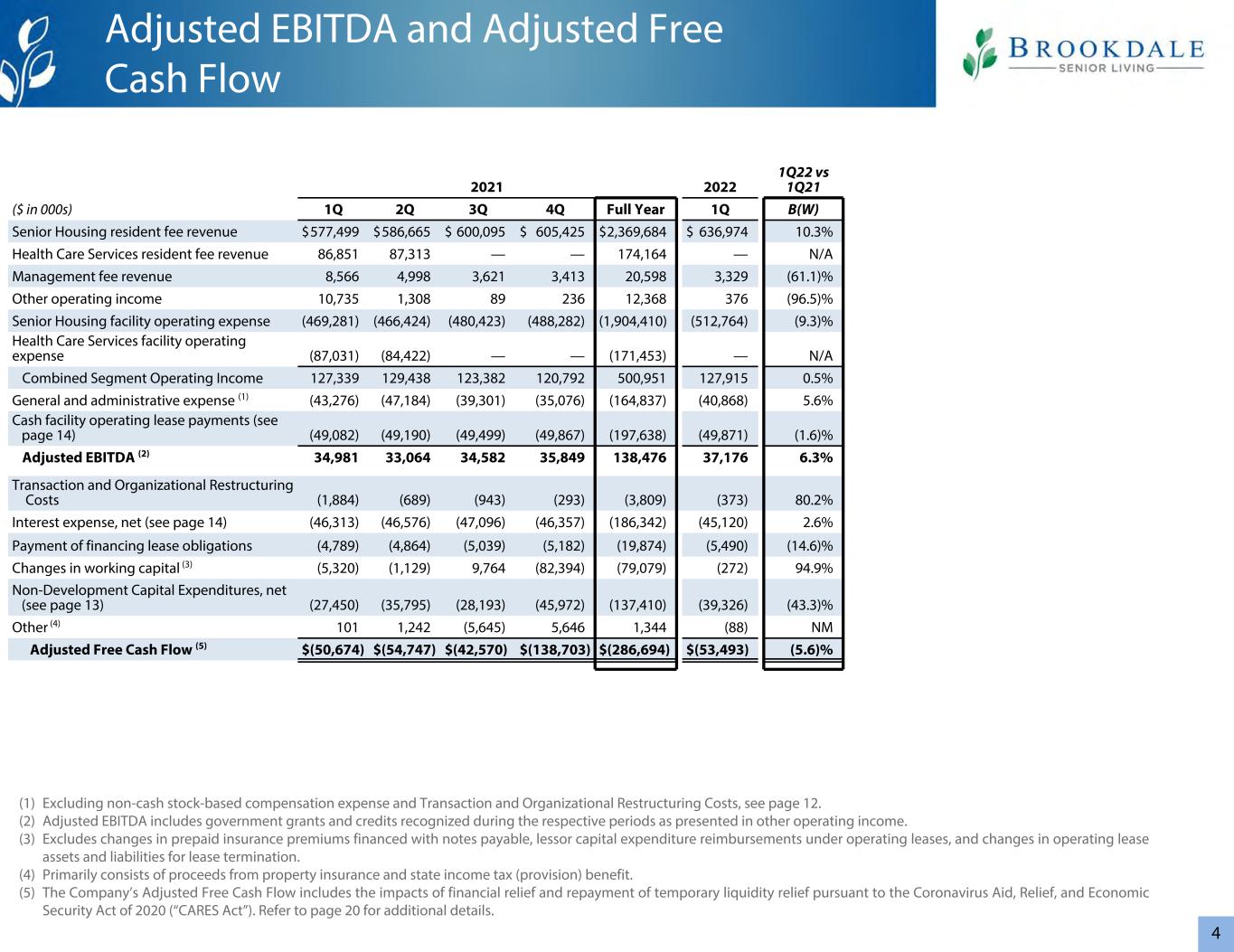

4 2021 2022 1Q22 vs 1Q21 ($ in 000s) 1Q 2Q 3Q 4Q Full Year 1Q B(W) Senior Housing resident fee revenue $ 577,499 $ 586,665 $ 600,095 $ 605,425 $ 2,369,684 $ 636,974 10.3 % Health Care Services resident fee revenue 86,851 87,313 — — 174,164 — N/A Management fee revenue 8,566 4,998 3,621 3,413 20,598 3,329 (61.1) % Other operating income 10,735 1,308 89 236 12,368 376 (96.5) % Senior Housing facility operating expense (469,281) (466,424) (480,423) (488,282) (1,904,410) (512,764) (9.3) % Health Care Services facility operating expense (87,031) (84,422) — — (171,453) — N/A Combined Segment Operating Income 127,339 129,438 123,382 120,792 500,951 127,915 0.5 % General and administrative expense (1) (43,276) (47,184) (39,301) (35,076) (164,837) (40,868) 5.6 % Cash facility operating lease payments (see page 14) (49,082) (49,190) (49,499) (49,867) (197,638) (49,871) (1.6) % Adjusted EBITDA (2) 34,981 33,064 34,582 35,849 138,476 37,176 6.3 % Transaction and Organizational Restructuring Costs (1,884) (689) (943) (293) (3,809) (373) 80.2 % Interest expense, net (see page 14) (46,313) (46,576) (47,096) (46,357) (186,342) (45,120) 2.6 % Payment of financing lease obligations (4,789) (4,864) (5,039) (5,182) (19,874) (5,490) (14.6) % Changes in working capital (3) (5,320) (1,129) 9,764 (82,394) (79,079) (272) 94.9 % Non-Development Capital Expenditures, net (see page 13) (27,450) (35,795) (28,193) (45,972) (137,410) (39,326) (43.3) % Other (4) 101 1,242 (5,645) 5,646 1,344 - 8 (88) NM Adjusted Free Cash Flow (5) $ (50,674) $ (54,747) $ (42,570) $ (138,703) $ (286,694) $ (53,493) (5.6) % Adjusted EBITDA and Adjusted Free Cash Flow (1) Excluding non-cash stock-based compensation expense and Transaction and Organizational Restructuring Costs, see page 12. (2) Adjusted EBITDA includes government grants and credits recognized during the respective periods as presented in other operating income. (3) Excludes changes in prepaid insurance premiums financed with notes payable, lessor capital expenditure reimbursements under operating leases, and changes in operating lease assets and liabilities for lease termination. (4) Primarily consists of proceeds from property insurance and state income tax (provision) benefit. (5) The Company’s Adjusted Free Cash Flow includes the impacts of financial relief and repayment of temporary liquidity relief pursuant to the Coronavirus Aid, Relief, and Economic Security Act of 2020 (“CARES Act”). Refer to page 20 for additional details.

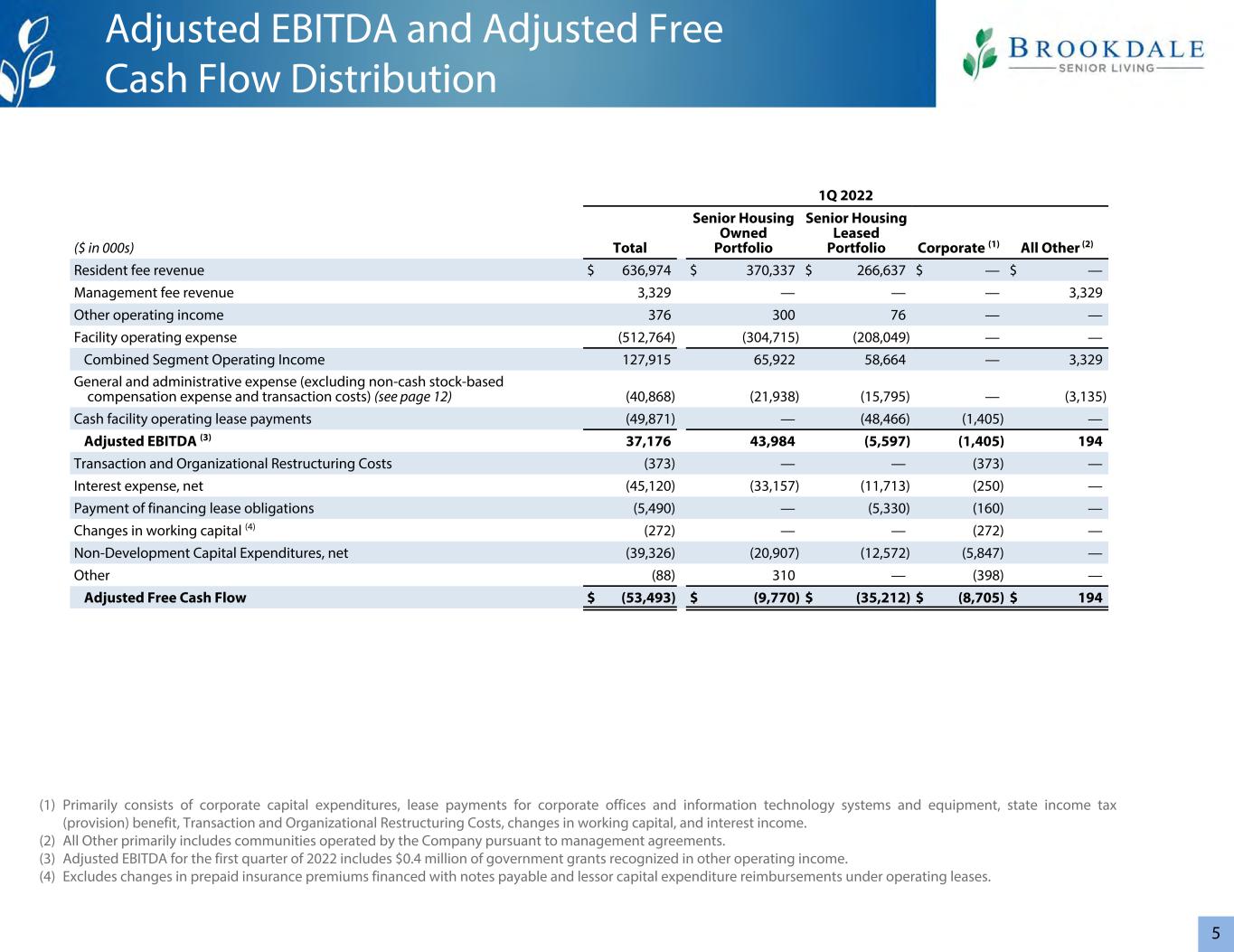

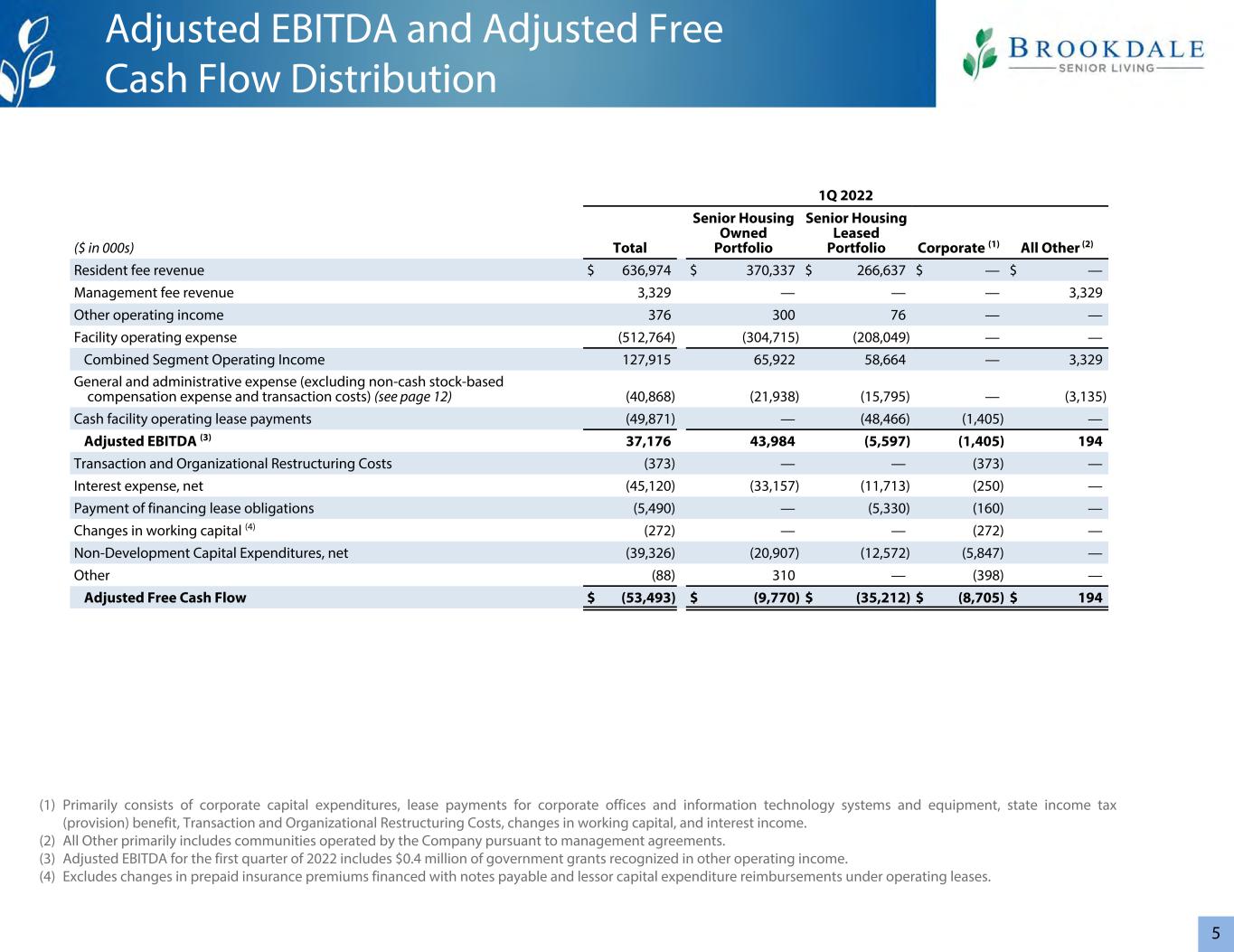

5 (1) Primarily consists of corporate capital expenditures, lease payments for corporate offices and information technology systems and equipment, state income tax (provision) benefit, Transaction and Organizational Restructuring Costs, changes in working capital, and interest income. (2) All Other primarily includes communities operated by the Company pursuant to management agreements. (3) Adjusted EBITDA for the first quarter of 2022 includes $0.4 million of government grants recognized in other operating income. (4) Excludes changes in prepaid insurance premiums financed with notes payable and lessor capital expenditure reimbursements under operating leases. 1Q 2022 ($ in 000s) Total Senior Housing Owned Portfolio Senior Housing Leased Portfolio Corporate (1) All Other (2) Resident fee revenue $ 636,974 $ 370,337 $ 266,637 $ — $ — Management fee revenue 3,329 — — — 3,329 Other operating income 376 300 76 — — Facility operating expense (512,764) (304,715) (208,049) — — Combined Segment Operating Income 127,915 65,922 58,664 — 3,329 General and administrative expense (excluding non-cash stock-based compensation expense and transaction costs) (see page 12) (40,868) (21,938) (15,795) — (3,135) Cash facility operating lease payments (49,871) — (48,466) (1,405) — Adjusted EBITDA (3) 37,176 43,984 (5,597) (1,405) 194 Transaction and Organizational Restructuring Costs (373) — — (373) — Interest expense, net (45,120) (33,157) (11,713) (250) — Payment of financing lease obligations (5,490) — (5,330) (160) — Changes in working capital (4) (272) — — (272) — Non-Development Capital Expenditures, net (39,326) (20,907) (12,572) (5,847) — Other (88) 310 — (398) — Adjusted Free Cash Flow $ (53,493) $ (9,770) $ (35,212) $ (8,705) $ 194 Adjusted EBITDA and Adjusted Free Cash Flow Distribution

6 2021 2022 1Q22 vs 1Q21 ($ in 000s, except RevPAR and RevPOR) 1Q 2Q 3Q 4Q Full Year 1Q B(W) Total Senior Housing, Health Care Services, and All Other Revenue (1) $ 672,916 $ 678,976 $ 603,716 $ 608,838 $ 2,564,446 $ 640,303 (4.8) % Other operating income $ 10,735 $ 1,308 $ 89 $ 236 $ 12,368 $ 376 (96.5) % Combined Segment Operating Income $ 127,339 $ 129,438 $ 123,382 $ 120,792 $ 500,951 $ 127,915 0.5 % Combined segment operating margin 18.6 % 19.0 % 20.4 % 19.8 % 19.4 % 20.0 % 140 bps Combined segment adjusted operating margin (2) 17.3 % 18.9 % 20.4 % 19.8 % 19.1 % 19.9 % 260 bps Senior Housing Segments (see page 7) Revenue $ 577,499 $ 586,665 $ 600,095 $ 605,425 $ 2,369,684 $ 636,974 10.3 % Other operating income $ 8,152 $ 786 $ 89 $ 236 $ 9,263 $ 376 (95.4) % Senior Housing Operating Income $ 116,370 $ 121,027 $ 119,761 $ 117,379 $ 474,537 $ 124,586 7.1 % Senior Housing operating margin 19.9 % 20.6 % 20.0 % 19.4 % 19.9 % 19.5 % (40) bps Senior Housing adjusted operating margin (2) 18.7 % 20.5 % 19.9 % 19.3 % 19.6 % 19.5 % 80 bps Number of communities (period end) 650 648 648 646 646 645 (0.8) % Total Average Units 52,971 52,911 52,811 52,665 52,840 52,586 (0.7) % RevPAR $ 3,631 $ 3,692 $ 3,784 $ 3,828 $ 3,734 $ 4,032 11.0 % Weighted average occupancy 69.6 % 70.5 % 72.5 % 73.5 % 71.5 % 73.4 % 380 bps RevPOR $ 5,219 $ 5,237 $ 5,219 $ 5,210 $ 5,221 $ 5,493 5.3 % Health Care Services Segment (3) Revenue $ 86,851 $ 87,313 $ — $ — $ 174,164 $ — N/A Other operating income $ 2,583 $ 522 $ — $ — $ 3,105 $ — N/A Segment Operating Income $ 2,403 $ 3,413 $ — $ — $ 5,816 $ — N/A All Other All Other Segment Operating Income (comprised solely of management fees) $ 8,566 $ 4,998 $ 3,621 $ 3,413 $ 20,598 $ 3,329 (61.1) % Resident fee revenue under management (4) $ 82,468 $ 64,410 $ 55,156 $ 51,409 $ 253,443 $ 52,898 (35.9) % Segment Overview (1) Excludes reimbursed costs on behalf of managed communities. (2) Excludes other operating income. (3) The Company sold 80% of its equity in its Health Care Services segment on July 1, 2021 and recognized a $286.5 million gain on the sale. For periods beginning July 1, 2021, the results and financial position of the Health Care Services segment are deconsolidated from the Company's consolidated financial statements and its 20% equity interest in the HCS Venture is accounted for under the equity method of accounting. (4) Not included in consolidated reported amounts.

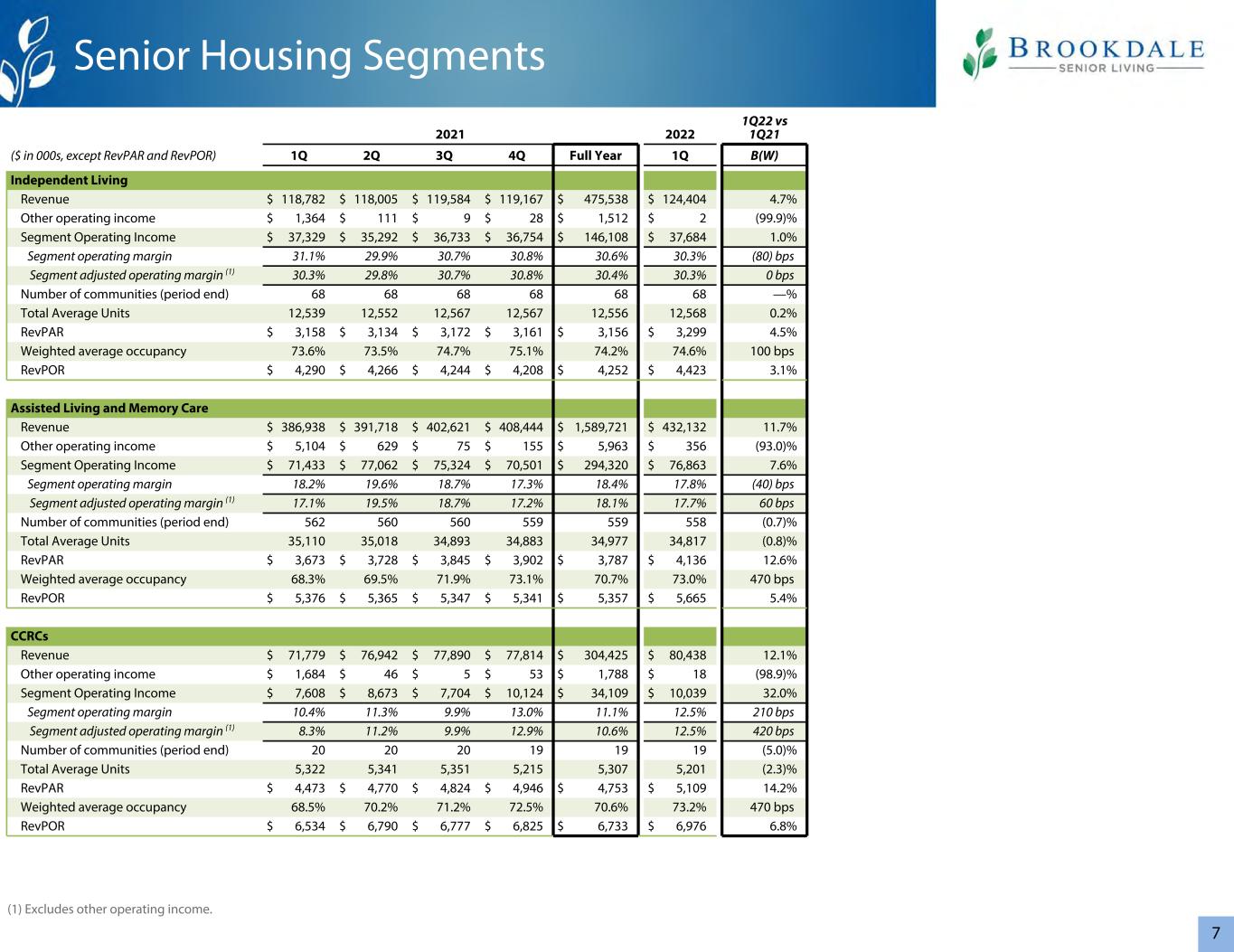

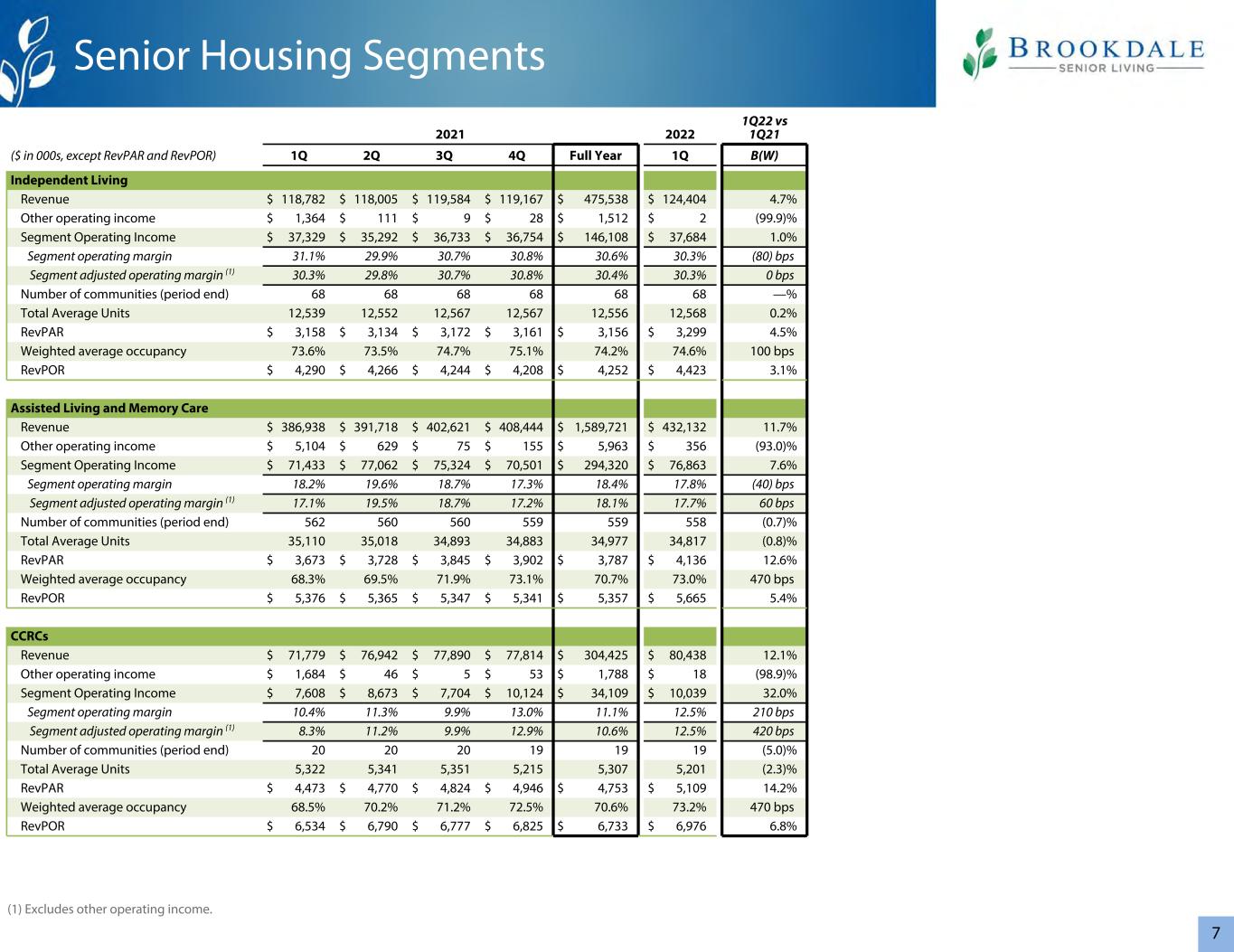

7 2021 2022 1Q22 vs 1Q21 ($ in 000s, except RevPAR and RevPOR) 1Q 2Q 3Q 4Q Full Year 1Q B(W) Independent Living Revenue $ 118,782 $ 118,005 $ 119,584 $ 119,167 $ 475,538 $ 124,404 4.7 % Other operating income $ 1,364 $ 111 $ 9 $ 28 $ 1,512 $ 2 (99.9) % Segment Operating Income $ 37,329 $ 35,292 $ 36,733 $ 36,754 $ 146,108 $ 37,684 1.0 % Segment operating margin 31.1 % 29.9 % 30.7 % 30.8 % 30.6 % 30.3 % (80) bps Segment adjusted operating margin (1) 30.3 % 29.8 % 30.7 % 30.8 % 30.4 % 30.3 % 0 bps Number of communities (period end) 68 68 68 68 68 68 — % Total Average Units 12,539 12,552 12,567 12,567 12,556 12,568 0.2 % RevPAR $ 3,158 $ 3,134 $ 3,172 $ 3,161 $ 3,156 $ 3,299 4.5 % Weighted average occupancy 73.6 % 73.5 % 74.7 % 75.1 % 74.2 % 74.6 % 100 bps RevPOR $ 4,290 $ 4,266 $ 4,244 $ 4,208 $ 4,252 $ 4,423 3.1 % Assisted Living and Memory Care Revenue $ 386,938 $ 391,718 $ 402,621 $ 408,444 $ 1,589,721 $ 432,132 11.7 % Other operating income $ 5,104 $ 629 $ 75 $ 155 $ 5,963 $ 356 (93.0) % Segment Operating Income $ 71,433 $ 77,062 $ 75,324 $ 70,501 $ 294,320 $ 76,863 7.6 % Segment operating margin 18.2 % 19.6 % 18.7 % 17.3 % 18.4 % 17.8 % (40) bps Segment adjusted operating margin (1) 17.1 % 19.5 % 18.7 % 17.2 % 18.1 % 17.7 % 60 bps Number of communities (period end) 562 560 560 559 559 558 (0.7) % Total Average Units 35,110 35,018 34,893 34,883 34,977 34,817 (0.8) % RevPAR $ 3,673 $ 3,728 $ 3,845 $ 3,902 $ 3,787 $ 4,136 12.6 % Weighted average occupancy 68.3 % 69.5 % 71.9 % 73.1 % 70.7 % 73.0 % 470 bps RevPOR $ 5,376 $ 5,365 $ 5,347 $ 5,341 $ 5,357 $ 5,665 5.4 % CCRCs Revenue $ 71,779 $ 76,942 $ 77,890 $ 77,814 $ 304,425 $ 80,438 12.1 % Other operating income $ 1,684 $ 46 $ 5 $ 53 $ 1,788 $ 18 (98.9) % Segment Operating Income $ 7,608 $ 8,673 $ 7,704 $ 10,124 $ 34,109 $ 10,039 32.0 % Segment operating margin 10.4 % 11.3 % 9.9 % 13.0 % 11.1 % 12.5 % 210 bps Segment adjusted operating margin (1) 8.3 % 11.2 % 9.9 % 12.9 % 10.6 % 12.5 % 420 bps Number of communities (period end) 20 20 20 19 19 19 (5.0) % Total Average Units 5,322 5,341 5,351 5,215 5,307 5,201 (2.3) % RevPAR $ 4,473 $ 4,770 $ 4,824 $ 4,946 $ 4,753 $ 5,109 14.2 % Weighted average occupancy 68.5 % 70.2 % 71.2 % 72.5 % 70.6 % 73.2 % 470 bps RevPOR $ 6,534 $ 6,790 $ 6,777 $ 6,825 $ 6,733 $ 6,976 6.8 % Senior Housing Segments (1) Excludes other operating income.

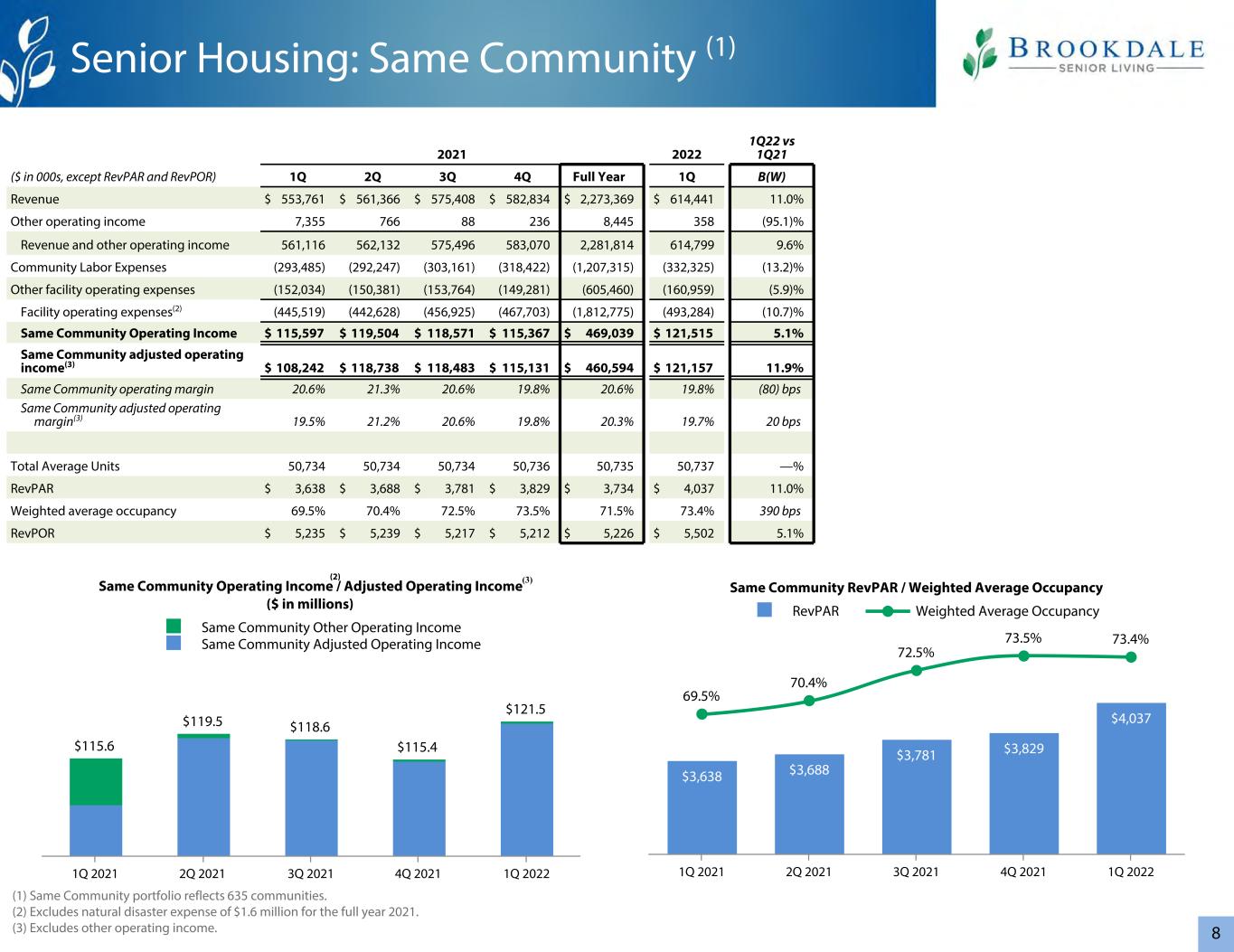

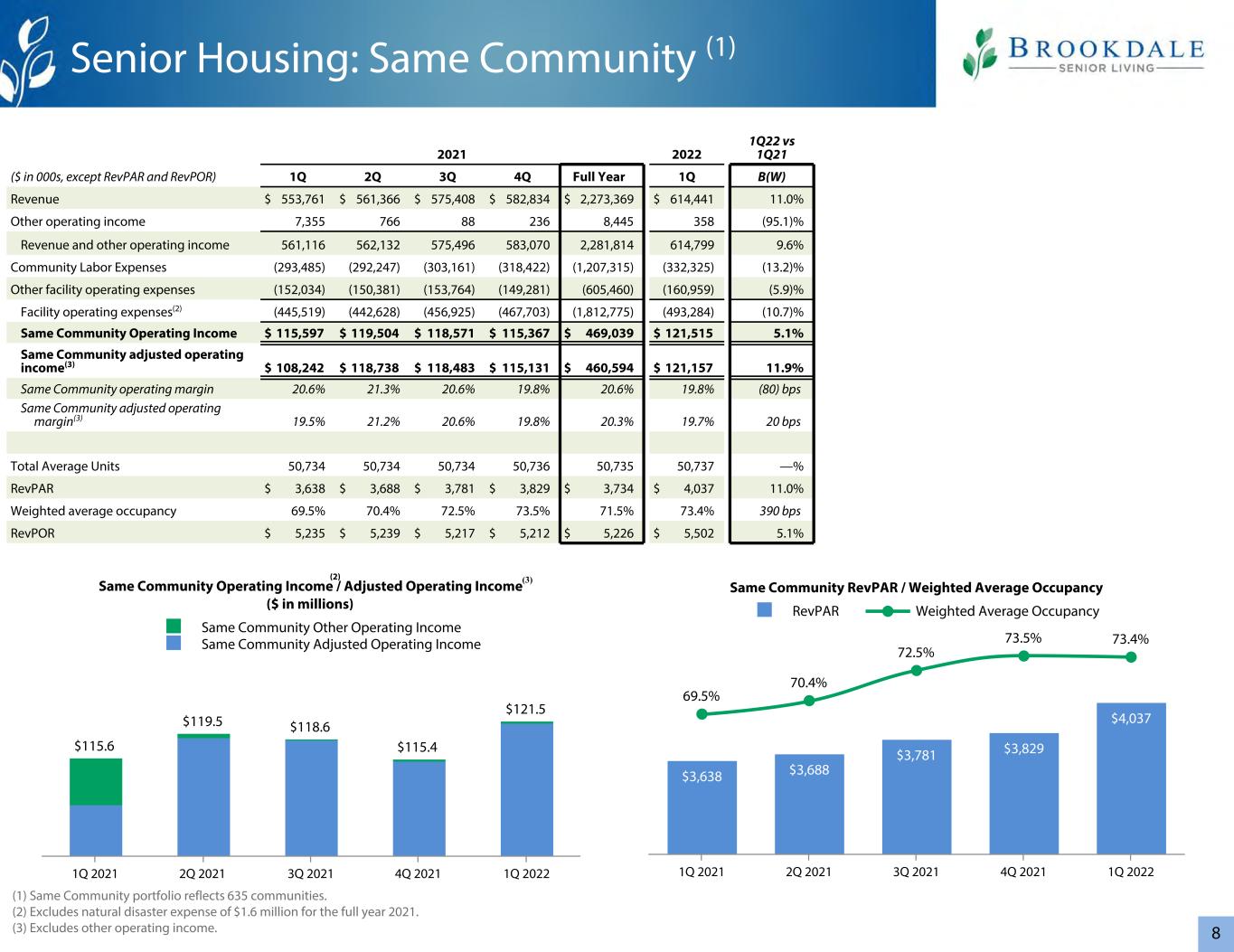

8 2021 2022 1Q22 vs 1Q21 ($ in 000s, except RevPAR and RevPOR) 1Q 2Q 3Q 4Q Full Year 1Q B(W) Revenue $ 553,761 $ 561,366 $ 575,408 $ 582,834 $ 2,273,369 $ 614,441 11.0 % Other operating income 7,355 766 88 236 8,445 358 (95.1) % Revenue and other operating income 561,116 562,132 575,496 583,070 2,281,814 614,799 9.6 % Community Labor Expenses (293,485) (292,247) (303,161) (318,422) (1,207,315) (332,325) (13.2) % Other facility operating expenses (152,034) (150,381) (153,764) (149,281) (605,460) (160,959) (5.9) % Facility operating expenses(2) (445,519) (442,628) (456,925) (467,703) (1,812,775) (493,284) (10.7) % Same Community Operating Income $ 115,597 $ 119,504 $ 118,571 $ 115,367 $ 469,039 $ 121,515 5.1 % Same Community adjusted operating income(3) $ 108,242 $ 118,738 $ 118,483 $ 115,131 $ 460,594 $ 121,157 11.9 % Same Community operating margin 20.6 % 21.3 % 20.6 % 19.8 % 20.6 % 19.8 % (80) bps Same Community adjusted operating margin(3) 19.5 % 21.2 % 20.6 % 19.8 % 20.3 % 19.7 % 20 bps Total Average Units 50,734 50,734 50,734 50,736 50,735 50,737 — % RevPAR $ 3,638 $ 3,688 $ 3,781 $ 3,829 $ 3,734 $ 4,037 11.0 % Weighted average occupancy 69.5 % 70.4 % 72.5 % 73.5 % 71.5 % 73.4 % 390 bps RevPOR $ 5,235 $ 5,239 $ 5,217 $ 5,212 $ 5,226 $ 5,502 5.1 % Same Community Operating Income / Adjusted Operating Income ($ in millions) $115.6 $119.5 $118.6 $115.4 $121.5 Same Community Other Operating Income Same Community Adjusted Operating Income 1Q 2021 2Q 2021 3Q 2021 4Q 2021 1Q 2022 Same Community RevPAR / Weighted Average Occupancy $3,638 $3,688 $3,781 $3,829 $4,037 69.5% 70.4% 72.5% 73.5% 73.4% RevPAR Weighted Average Occupancy 1Q 2021 2Q 2021 3Q 2021 4Q 2021 1Q 2022 Senior Housing: Same Community (1) (1) Same Community portfolio reflects 635 communities. (2) Excludes natural disaster expense of $1.6 million for the full year 2021. (3) Excludes other operating income. (2) (3)

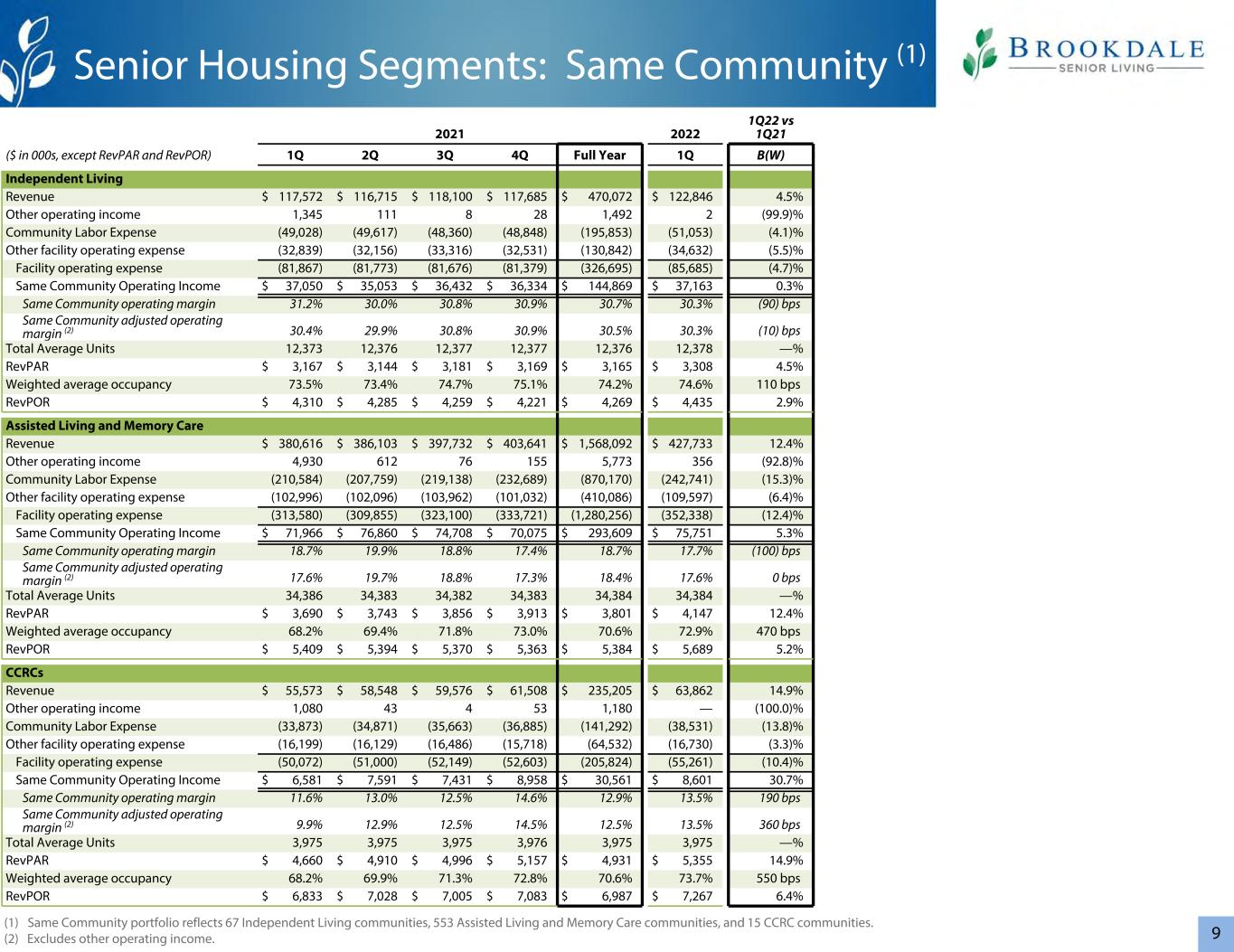

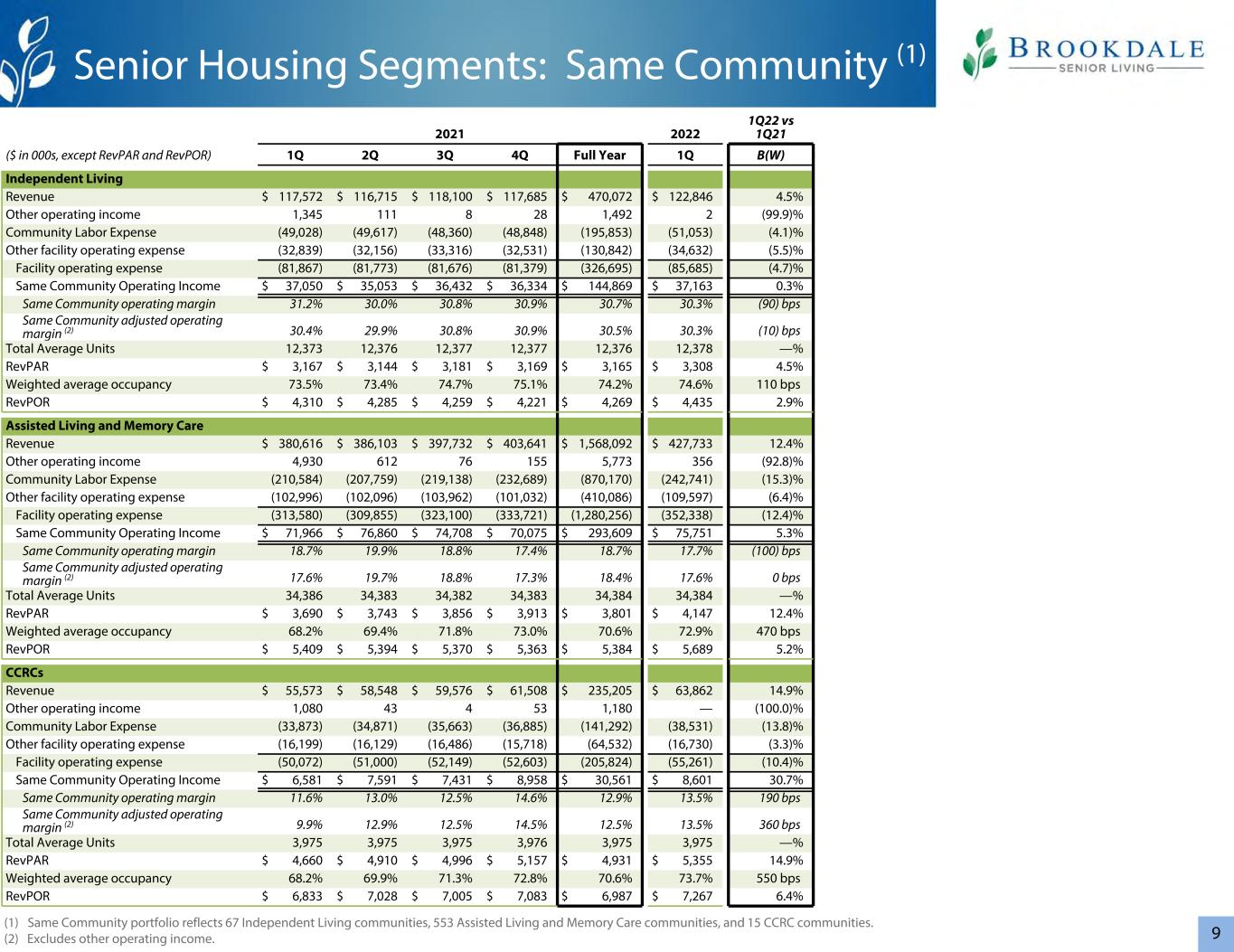

9 2021 2022 1Q22 vs 1Q21 ($ in 000s, except RevPAR and RevPOR) 1Q 2Q 3Q 4Q Full Year 1Q B(W) Independent Living Revenue $ 117,572 $ 116,715 $ 118,100 $ 117,685 $ 470,072 $ 122,846 4.5 % Other operating income 1,345 111 8 28 1,492 2 (99.9) % Community Labor Expense (49,028) (49,617) (48,360) (48,848) (195,853) (51,053) (4.1) % Other facility operating expense (32,839) (32,156) (33,316) (32,531) (130,842) (34,632) (5.5) % Facility operating expense (81,867) (81,773) (81,676) (81,379) (326,695) (85,685) (4.7) % Same Community Operating Income $ 37,050 $ 35,053 $ 36,432 $ 36,334 $ 144,869 $ 37,163 0.3 % Same Community operating margin 31.2 % 30.0 % 30.8 % 30.9 % 30.7 % 30.3 % (90) bps Same Community adjusted operating margin (2) 30.4 % 29.9 % 30.8 % 30.9 % 30.5 % 30.3 % (10) bps Total Average Units 12,373 12,376 12,377 12,377 12,376 12,378 — % RevPAR $ 3,167 $ 3,144 $ 3,181 $ 3,169 $ 3,165 $ 3,308 4.5 % Weighted average occupancy 73.5 % 73.4 % 74.7 % 75.1 % 74.2 % 74.6 % 110 bps RevPOR $ 4,310 $ 4,285 $ 4,259 $ 4,221 $ 4,269 $ 4,435 2.9 % Assisted Living and Memory Care Revenue $ 380,616 $ 386,103 $ 397,732 $ 403,641 $ 1,568,092 $ 427,733 12.4 % Other operating income 4,930 612 76 155 5,773 356 (92.8) % Community Labor Expense (210,584) (207,759) (219,138) (232,689) (870,170) (242,741) (15.3) % Other facility operating expense (102,996) (102,096) (103,962) (101,032) (410,086) (109,597) (6.4) % Facility operating expense (313,580) (309,855) (323,100) (333,721) (1,280,256) (352,338) (12.4) % Same Community Operating Income $ 71,966 $ 76,860 $ 74,708 $ 70,075 $ 293,609 $ 75,751 5.3 % Same Community operating margin 18.7 % 19.9 % 18.8 % 17.4 % 18.7 % 17.7 % (100) bps Same Community adjusted operating margin (2) 17.6 % 19.7 % 18.8 % 17.3 % 18.4 % 17.6 % 0 bps Total Average Units 34,386 34,383 34,382 34,383 34,384 34,384 — % RevPAR $ 3,690 $ 3,743 $ 3,856 $ 3,913 $ 3,801 $ 4,147 12.4 % Weighted average occupancy 68.2 % 69.4 % 71.8 % 73.0 % 70.6 % 72.9 % 470 bps RevPOR $ 5,409 $ 5,394 $ 5,370 $ 5,363 $ 5,384 $ 5,689 5.2 % CCRCs Revenue $ 55,573 $ 58,548 $ 59,576 $ 61,508 $ 235,205 $ 63,862 14.9 % Other operating income 1,080 43 4 53 1,180 — (100.0) % Community Labor Expense (33,873) (34,871) (35,663) (36,885) (141,292) (38,531) (13.8) % Other facility operating expense (16,199) (16,129) (16,486) (15,718) (64,532) (16,730) (3.3) % Facility operating expense (50,072) (51,000) (52,149) (52,603) (205,824) (55,261) (10.4) % Same Community Operating Income $ 6,581 $ 7,591 $ 7,431 $ 8,958 $ 30,561 $ 8,601 30.7 % Same Community operating margin 11.6 % 13.0 % 12.5 % 14.6 % 12.9 % 13.5 % 190 bps Same Community adjusted operating margin (2) 9.9 % 12.9 % 12.5 % 14.5 % 12.5 % 13.5 % 360 bps Total Average Units 3,975 3,975 3,975 3,976 3,975 3,975 — % RevPAR $ 4,660 $ 4,910 $ 4,996 $ 5,157 $ 4,931 $ 5,355 14.9 % Weighted average occupancy 68.2 % 69.9 % 71.3 % 72.8 % 70.6 % 73.7 % 550 bps RevPOR $ 6,833 $ 7,028 $ 7,005 $ 7,083 $ 6,987 $ 7,267 6.4 % Senior Housing Segments: Same Community (1) (1) Same Community portfolio reflects 67 Independent Living communities, 553 Assisted Living and Memory Care communities, and 15 CCRC communities. (2) Excludes other operating income.

10 2021 2022 1Q22 vs 1Q21 ($ in 000s, except RevPAR and RevPOR) 1Q 2Q 3Q 4Q Full Year 1Q B(W) Revenue $ 336,160 $ 342,355 $ 350,664 $ 352,894 $ 1,382,073 $ 370,337 10.2 % Other operating income 5,098 552 77 196 5,923 300 (94.1) % Facility operating expense (280,235) (280,169) (287,180) (290,347) (1,137,931) (304,715) (8.7) % Owned Portfolio Operating Income $ 61,023 $ 62,738 $ 63,561 $ 62,743 $ 250,065 $ 65,922 8.0 % Owned Portfolio operating margin 17.9 % 18.3 % 18.1 % 17.8 % 18.0 % 17.8 % (10) bps Owned Portfolio adjusted operating margin (1) 16.6 % 18.2 % 18.1 % 17.7 % 17.7 % 17.7 % 110 bps Additional Information Interest expense: property level and corporate debt $ (35,351) $ (35,425) $ (35,708) $ (34,925) $ (141,409) $ (33,157) 6.2 % Community level capital expenditures, net (see page 13) $ (14,286) $ (16,973) $ (17,237) $ (25,203) $ (73,699) $ (20,907) (46.3) % Number of communities (period end) 349 348 348 347 347 347 (0.6) % Total Average Units 31,844 31,785 31,783 31,648 31,766 31,635 (0.7) % RevPAR $ 3,514 $ 3,584 $ 3,672 $ 3,711 $ 3,620 $ 3,893 10.8 % Weighted average occupancy 68.4 % 69.6 % 71.7 % 72.7 % 70.6 % 72.5 % 410 bps RevPOR $ 5,135 $ 5,151 $ 5,121 $ 5,108 $ 5,128 $ 5,370 4.6 % Senior Housing Owned Portfolio Interest Coverage as of March 31, 2022 1.2x Net Debt as of March 31, 2022 (see page 15) $3,361,622 (1) Excludes other operating income.

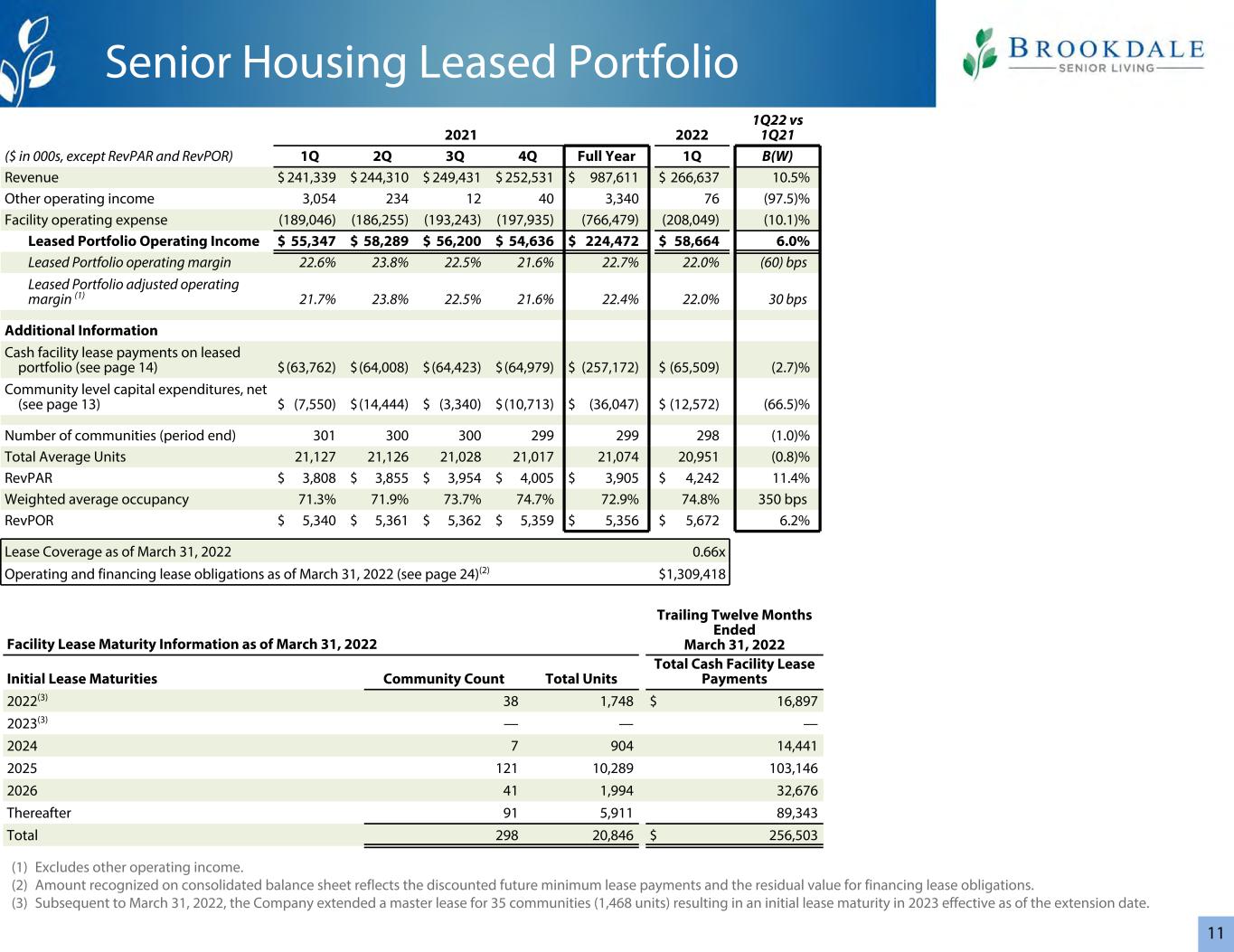

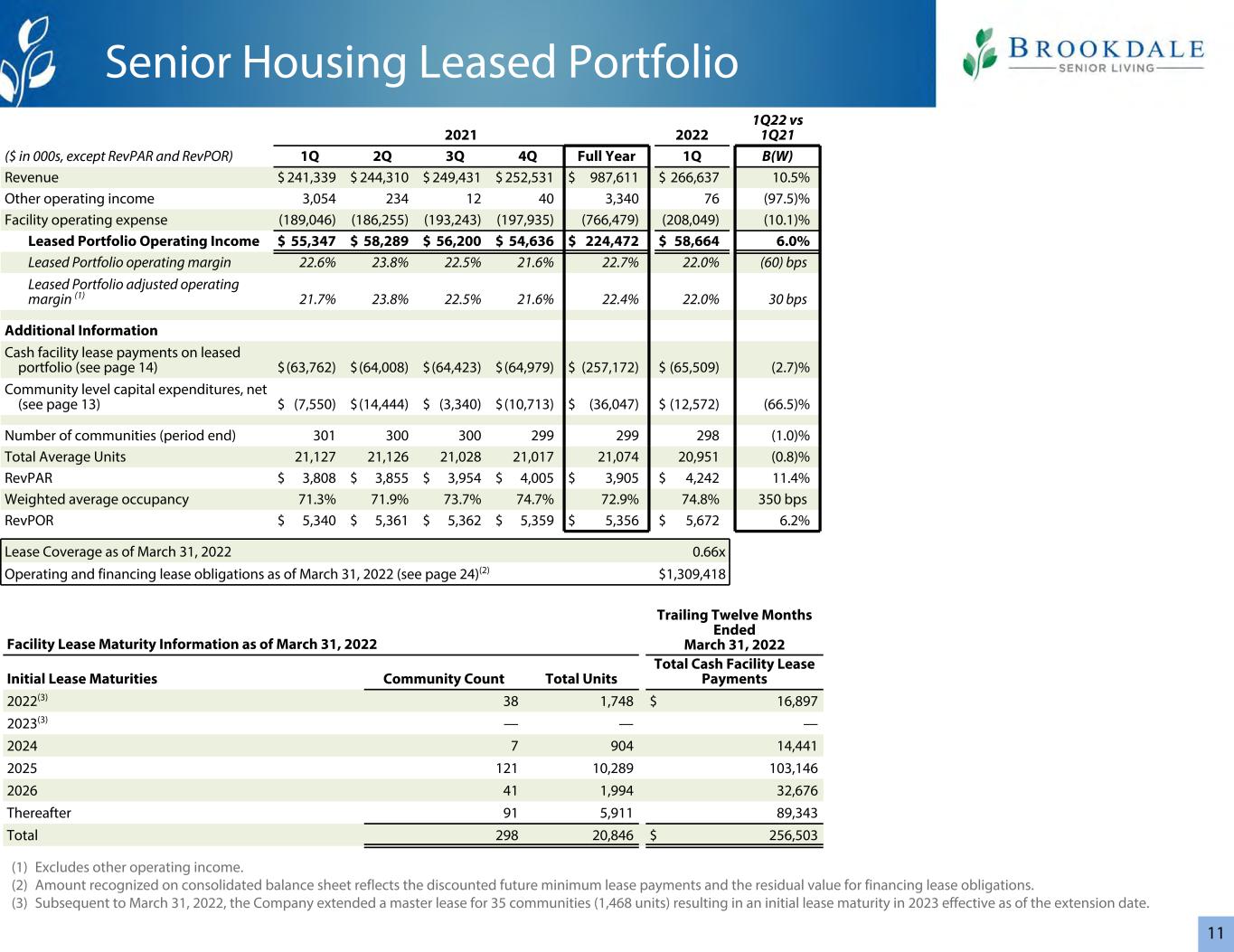

11 2021 2022 1Q22 vs 1Q21 ($ in 000s, except RevPAR and RevPOR) 1Q 2Q 3Q 4Q Full Year 1Q B(W) Revenue $ 241,339 $ 244,310 $ 249,431 $ 252,531 $ 987,611 $ 266,637 10.5 % Other operating income 3,054 234 12 40 3,340 76 (97.5) % Facility operating expense (189,046) (186,255) (193,243) (197,935) (766,479) (208,049) (10.1) % Leased Portfolio Operating Income $ 55,347 $ 58,289 $ 56,200 $ 54,636 $ 224,472 $ 58,664 6.0 % Leased Portfolio operating margin 22.6 % 23.8 % 22.5 % 21.6 % 22.7 % 22.0 % (60) bps Leased Portfolio adjusted operating margin (1) 21.7 % 23.8 % 22.5 % 21.6 % 22.4 % 22.0 % 30 bps Additional Information Cash facility lease payments on leased portfolio (see page 14) $ (63,762) $ (64,008) $ (64,423) $ (64,979) $ (257,172) $ (65,509) (2.7) % Community level capital expenditures, net (see page 13) $ (7,550) $ (14,444) $ (3,340) $ (10,713) $ (36,047) $ (12,572) (66.5) % Number of communities (period end) 301 300 300 299 299 298 (1.0) % Total Average Units 21,127 21,126 21,028 21,017 21,074 20,951 (0.8) % RevPAR $ 3,808 $ 3,855 $ 3,954 $ 4,005 $ 3,905 $ 4,242 11.4 % Weighted average occupancy 71.3 % 71.9 % 73.7 % 74.7 % 72.9 % 74.8 % 350 bps RevPOR $ 5,340 $ 5,361 $ 5,362 $ 5,359 $ 5,356 $ 5,672 6.2 % Lease Coverage as of March 31, 2022 0.66x Operating and financing lease obligations as of March 31, 2022 (see page 24)(2) $ 1,309,418 Facility Lease Maturity Information as of March 31, 2022 Trailing Twelve Months Ended March 31, 2022 Initial Lease Maturities Community Count Total Units Total Cash Facility Lease Payments 2022(3) 38 1,748 $ 16,897 2023(3) — — — 2024 7 904 14,441 2025 121 10,289 103,146 2026 41 1,994 32,676 Thereafter 91 5,911 89,343 Total 298 20,846 $ 256,503 Senior Housing Leased Portfolio (1) Excludes other operating income. (2) Amount recognized on consolidated balance sheet reflects the discounted future minimum lease payments and the residual value for financing lease obligations. (3) Subsequent to March 31, 2022, the Company extended a master lease for 35 communities (1,468 units) resulting in an initial lease maturity in 2023 effective as of the extension date.

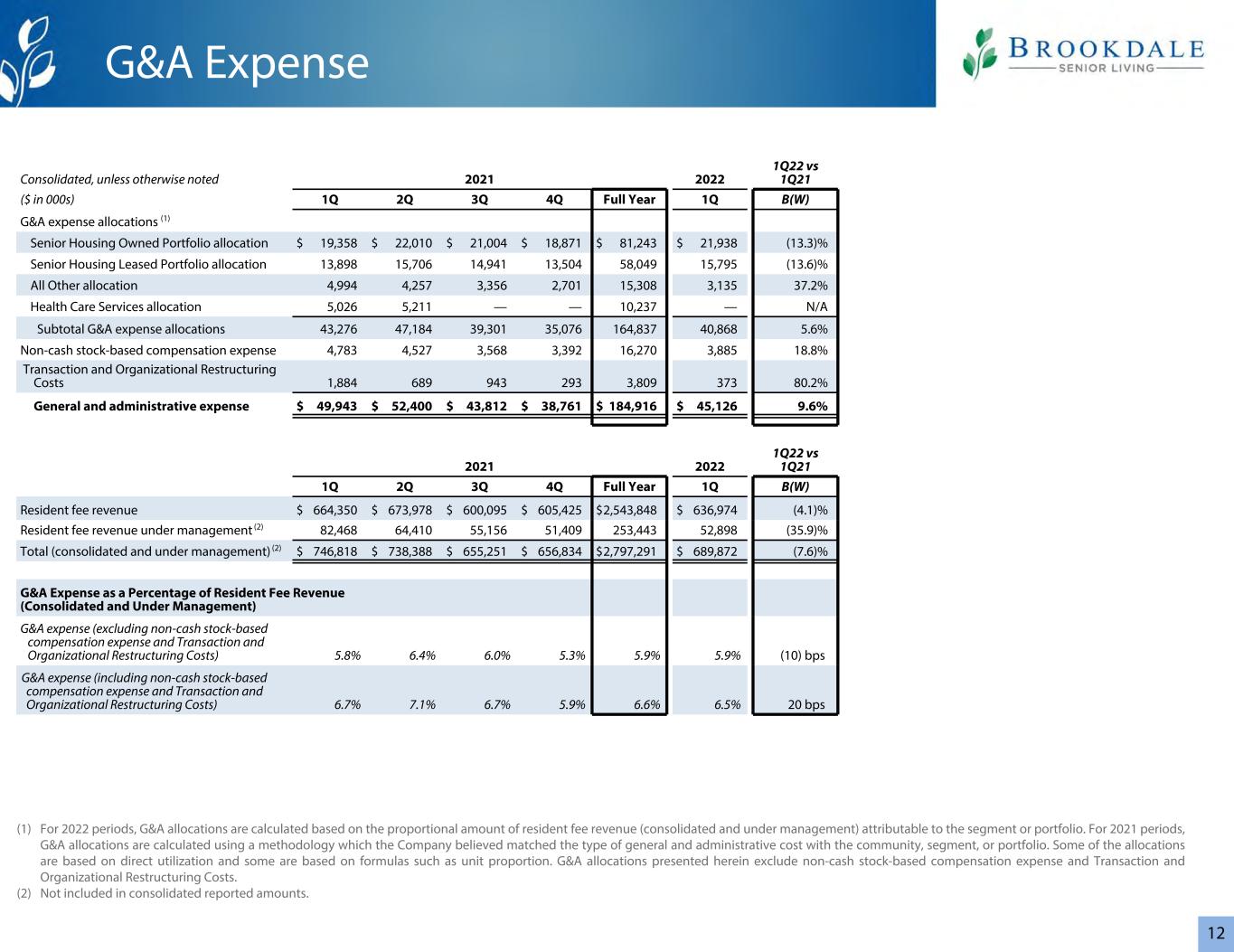

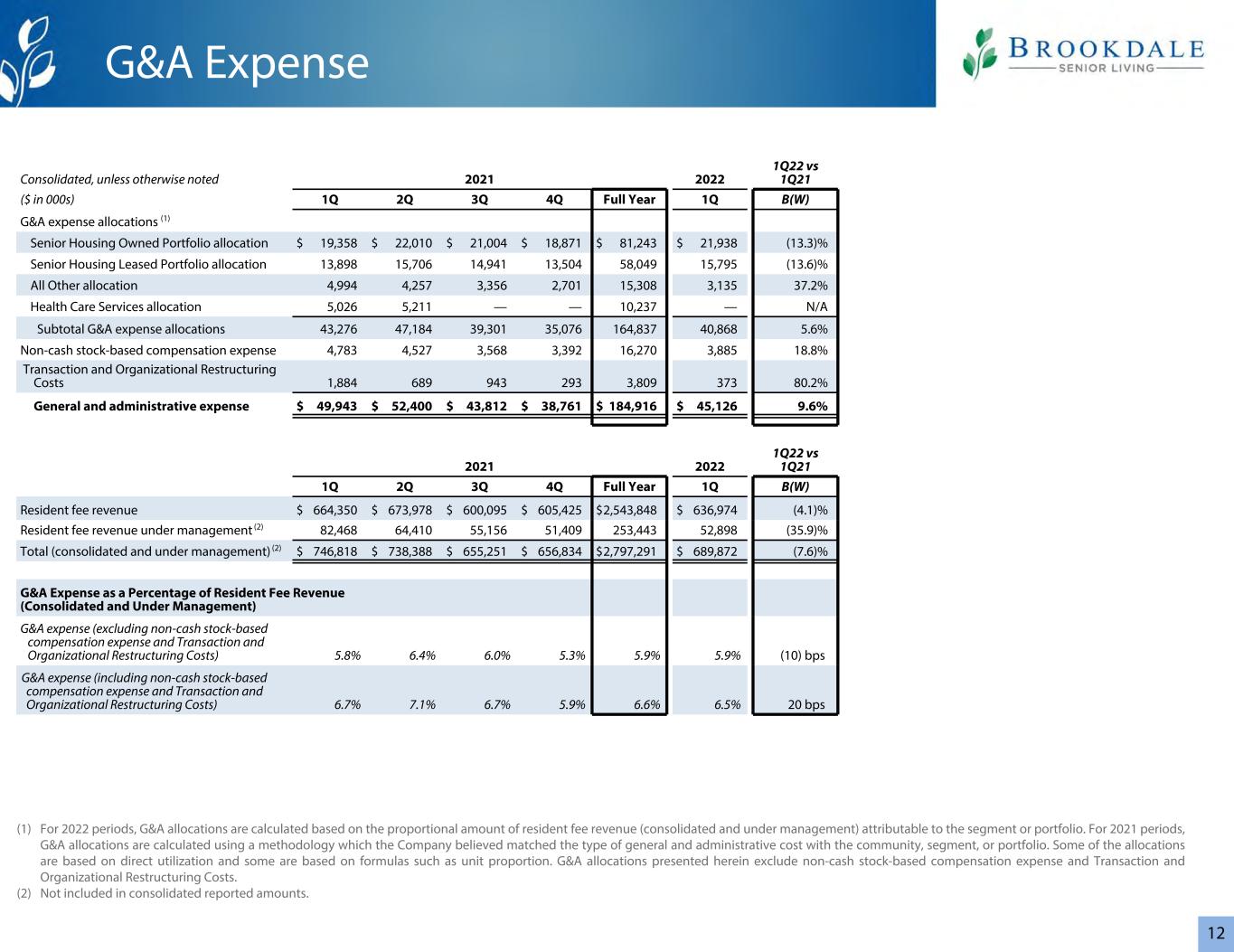

12 (1) For 2022 periods, G&A allocations are calculated based on the proportional amount of resident fee revenue (consolidated and under management) attributable to the segment or portfolio. For 2021 periods, G&A allocations are calculated using a methodology which the Company believed matched the type of general and administrative cost with the community, segment, or portfolio. Some of the allocations are based on direct utilization and some are based on formulas such as unit proportion. G&A allocations presented herein exclude non-cash stock-based compensation expense and Transaction and Organizational Restructuring Costs. (2) Not included in consolidated reported amounts. Consolidated, unless otherwise noted 2021 2022 1Q22 vs 1Q21 ($ in 000s) 1Q 2Q 3Q 4Q Full Year 1Q B(W) G&A expense allocations (1) Senior Housing Owned Portfolio allocation $ 19,358 $ 22,010 $ 21,004 $ 18,871 $ 81,243 $ 21,938 (13.3) % Senior Housing Leased Portfolio allocation 13,898 15,706 14,941 13,504 58,049 15,795 (13.6) % All Other allocation 4,994 4,257 3,356 2,701 15,308 3,135 37.2 % Health Care Services allocation 5,026 5,211 — — 10,237 — N/A Subtotal G&A expense allocations 43,276 47,184 39,301 35,076 164,837 40,868 5.6 % Non-cash stock-based compensation expense 4,783 4,527 3,568 3,392 16,270 3,885 18.8% Transaction and Organizational Restructuring Costs 1,884 689 943 293 3,809 373 80.2% General and administrative expense $ 49,943 $ 52,400 $ 43,812 $ 38,761 $ 184,916 $ 45,126 9.6 % 2021 2022 1Q22 vs 1Q21 1Q 2Q 3Q 4Q Full Year 1Q B(W) Resident fee revenue $ 664,350 $ 673,978 $ 600,095 $ 605,425 $ 2,543,848 $ 636,974 (4.1) % Resident fee revenue under management (2) 82,468 64,410 55,156 51,409 253,443 52,898 (35.9) % Total (consolidated and under management) (2) $ 746,818 $ 738,388 $ 655,251 $ 656,834 $ 2,797,291 $ 689,872 (7.6) % G&A Expense as a Percentage of Resident Fee Revenue (Consolidated and Under Management) G&A expense (excluding non-cash stock-based compensation expense and Transaction and Organizational Restructuring Costs) 5.8% 6.4% 6.0% 5.3% 5.9% 5.9% (10) bps G&A expense (including non-cash stock-based compensation expense and Transaction and Organizational Restructuring Costs) 6.7% 7.1% 6.7% 5.9% 6.6% 6.5% 20 bps G&A Expense

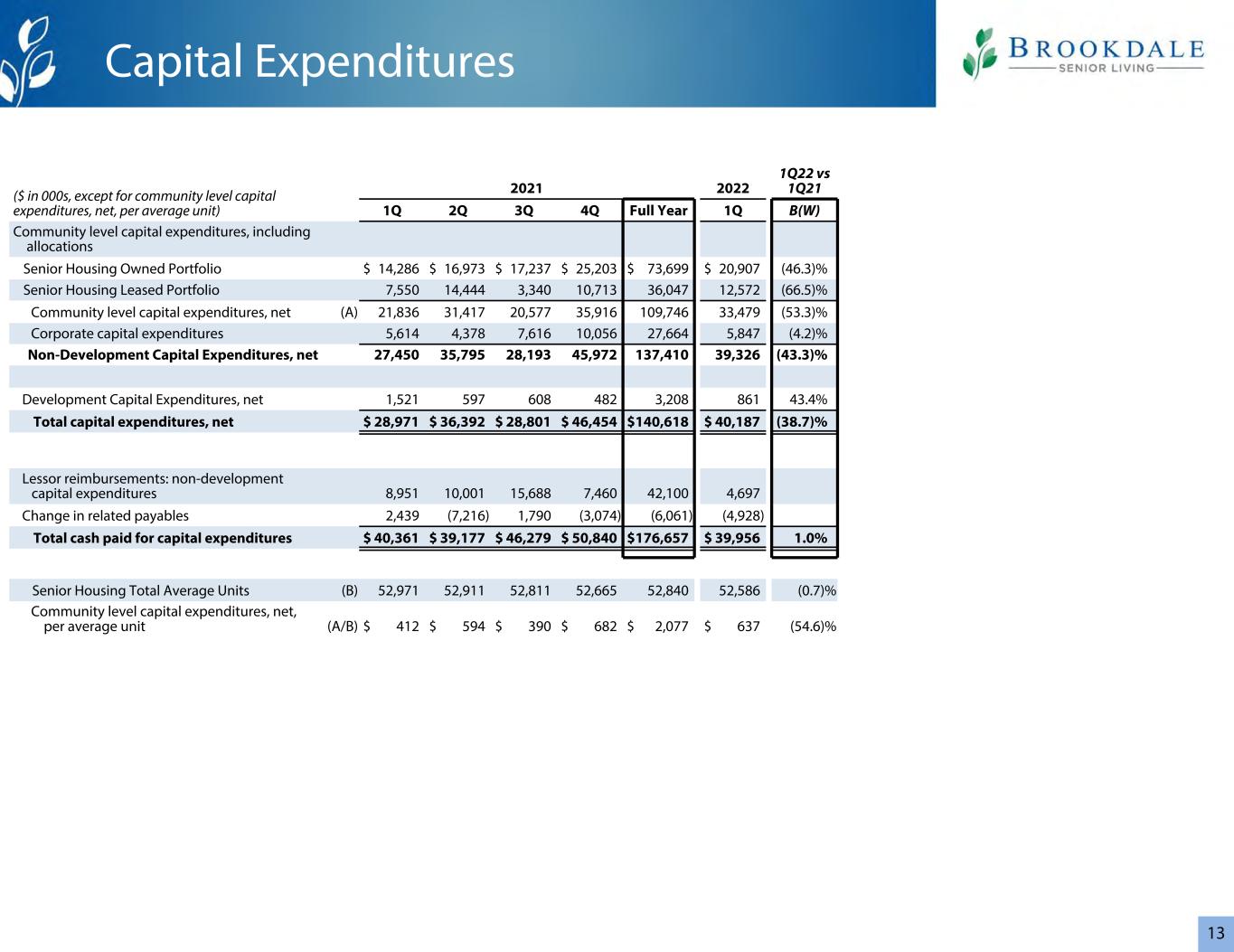

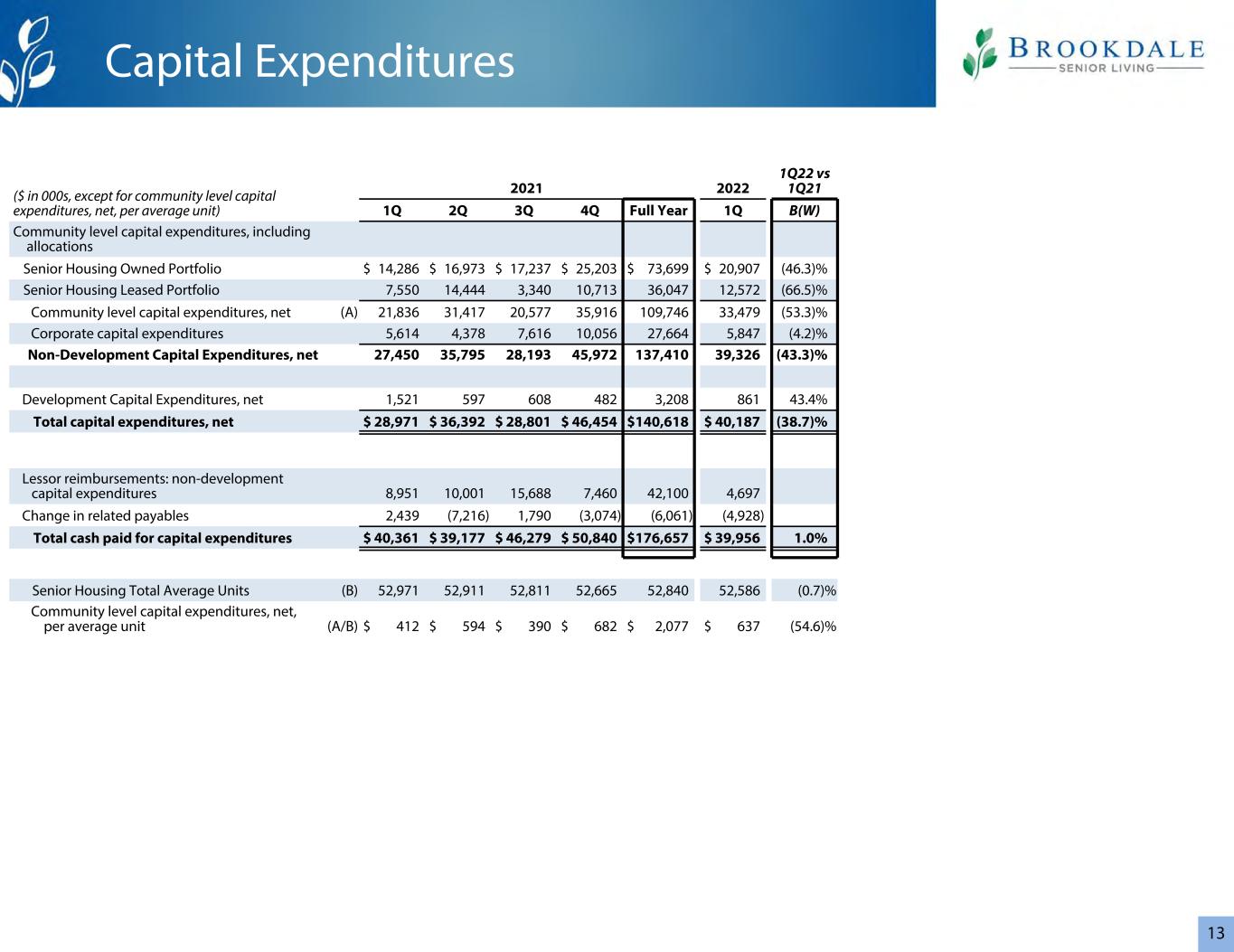

13 ($ in 000s, except for community level capital expenditures, net, per average unit) 2021 2022 1Q22 vs 1Q21 1Q 2Q 3Q 4Q Full Year 1Q B(W) Community level capital expenditures, including allocations Senior Housing Owned Portfolio $ 14,286 $ 16,973 $ 17,237 $ 25,203 $ 73,699 $ 20,907 (46.3) % Senior Housing Leased Portfolio 7,550 14,444 3,340 10,713 36,047 12,572 (66.5) % Community level capital expenditures, net (A) 21,836 31,417 20,577 35,916 109,746 33,479 (53.3) % Corporate capital expenditures 5,614 4,378 7,616 10,056 27,664 5,847 (4.2) % Non-Development Capital Expenditures, net 27,450 35,795 28,193 45,972 137,410 39,326 (43.3) % Development Capital Expenditures, net 1,521 597 608 482 3,208 861 43.4 % Total capital expenditures, net $ 28,971 $ 36,392 $ 28,801 $ 46,454 $ 140,618 $ 40,187 (38.7) % Lessor reimbursements: non-development capital expenditures 8,951 10,001 15,688 7,460 42,100 4,697 Change in related payables 2,439 (7,216) 1,790 (3,074) (6,061) (4,928) Total cash paid for capital expenditures $ 40,361 $ 39,177 $ 46,279 $ 50,840 $ 176,657 $ 39,956 1.0 % Senior Housing Total Average Units (B) 52,971 52,911 52,811 52,665 52,840 52,586 (0.7) % Community level capital expenditures, net, per average unit (A/B) $ 412 $ 594 $ 390 $ 682 $ 2,077 $ 637 (54.6) % Capital Expenditures

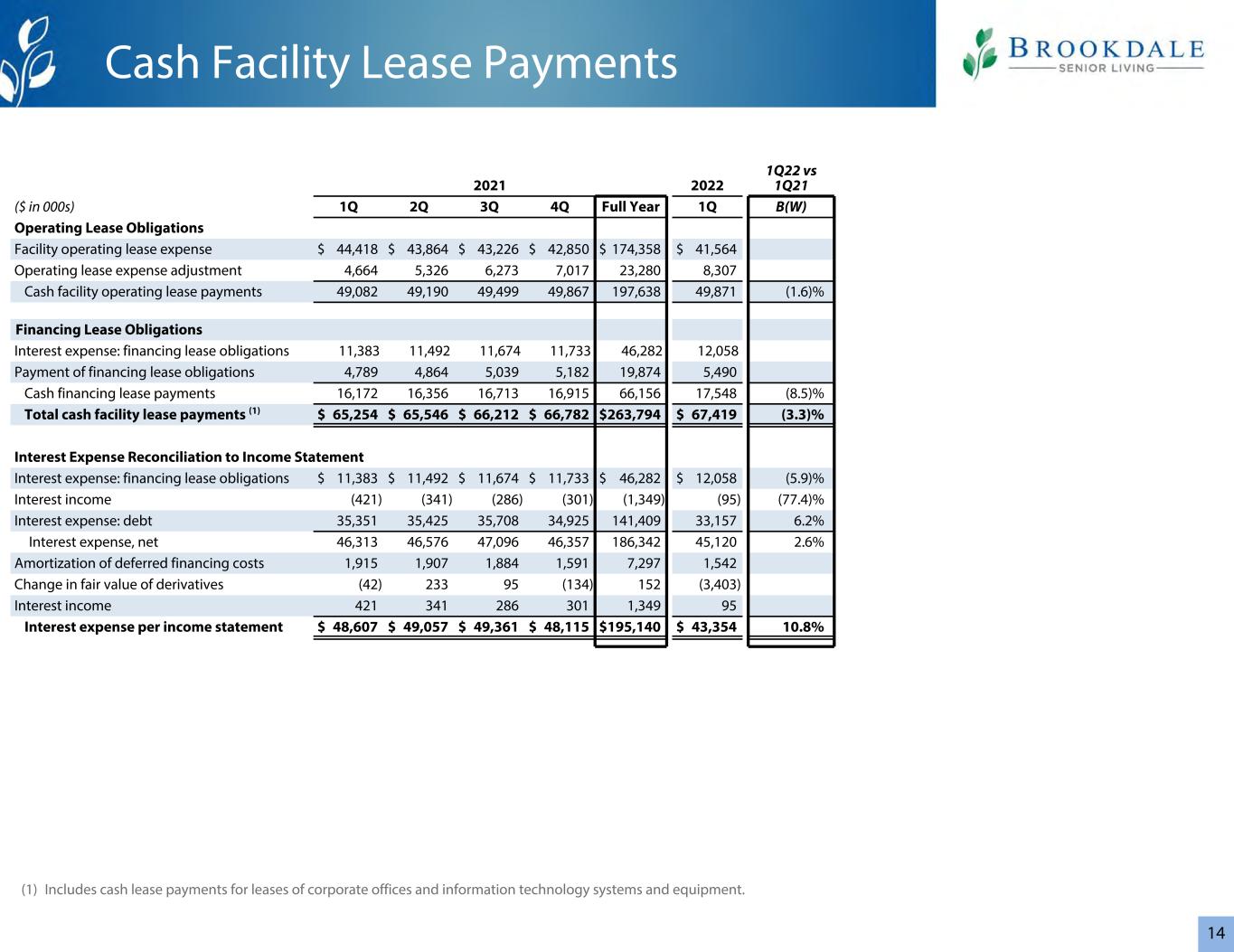

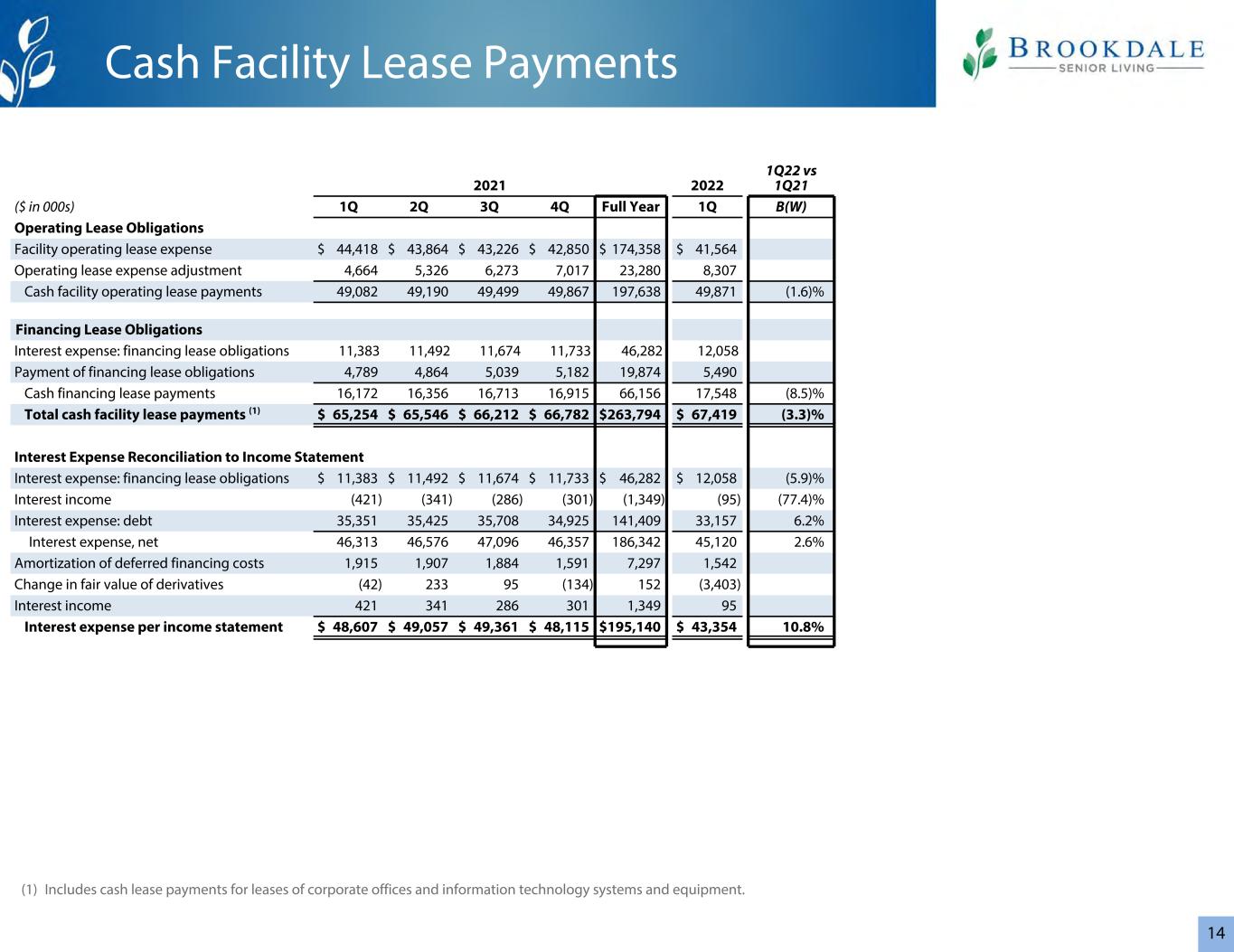

14 (1) Includes cash lease payments for leases of corporate offices and information technology systems and equipment. 2021 2022 1Q22 vs 1Q21 ($ in 000s) 1Q 2Q 3Q 4Q Full Year 1Q B(W) Operating Lease Obligations Facility operating lease expense $ 44,418 $ 43,864 $ 43,226 $ 42,850 $ 174,358 $ 41,564 Operating lease expense adjustment 4,664 5,326 6,273 7,017 23,280 8,307 Cash facility operating lease payments 49,082 49,190 49,499 49,867 197,638 49,871 (1.6) % Financing Lease Obligations Interest expense: financing lease obligations 11,383 11,492 11,674 11,733 46,282 12,058 Payment of financing lease obligations 4,789 4,864 5,039 5,182 19,874 5,490 Cash financing lease payments 16,172 16,356 16,713 16,915 66,156 17,548 (8.5) % Total cash facility lease payments (1) $ 65,254 $ 65,546 $ 66,212 $ 66,782 $ 263,794 $ 67,419 (3.3) % Interest Expense Reconciliation to Income Statement Interest expense: financing lease obligations $ 11,383 $ 11,492 $ 11,674 $ 11,733 $ 46,282 $ 12,058 (5.9) % Interest income (421) (341) (286) (301) (1,349) (95) (77.4) % Interest expense: debt 35,351 35,425 35,708 34,925 141,409 33,157 6.2 % Interest expense, net 46,313 46,576 47,096 46,357 186,342 45,120 2.6 % Amortization of deferred financing costs 1,915 1,907 1,884 1,591 7,297 1,542 Change in fair value of derivatives (42) 233 95 (134) 152 (3,403) Interest income 421 341 286 301 1,349 95 Interest expense per income statement $ 48,607 $ 49,057 $ 49,361 $ 48,115 $ 195,140 $ 43,354 10.8 % Cash Facility Lease Payments

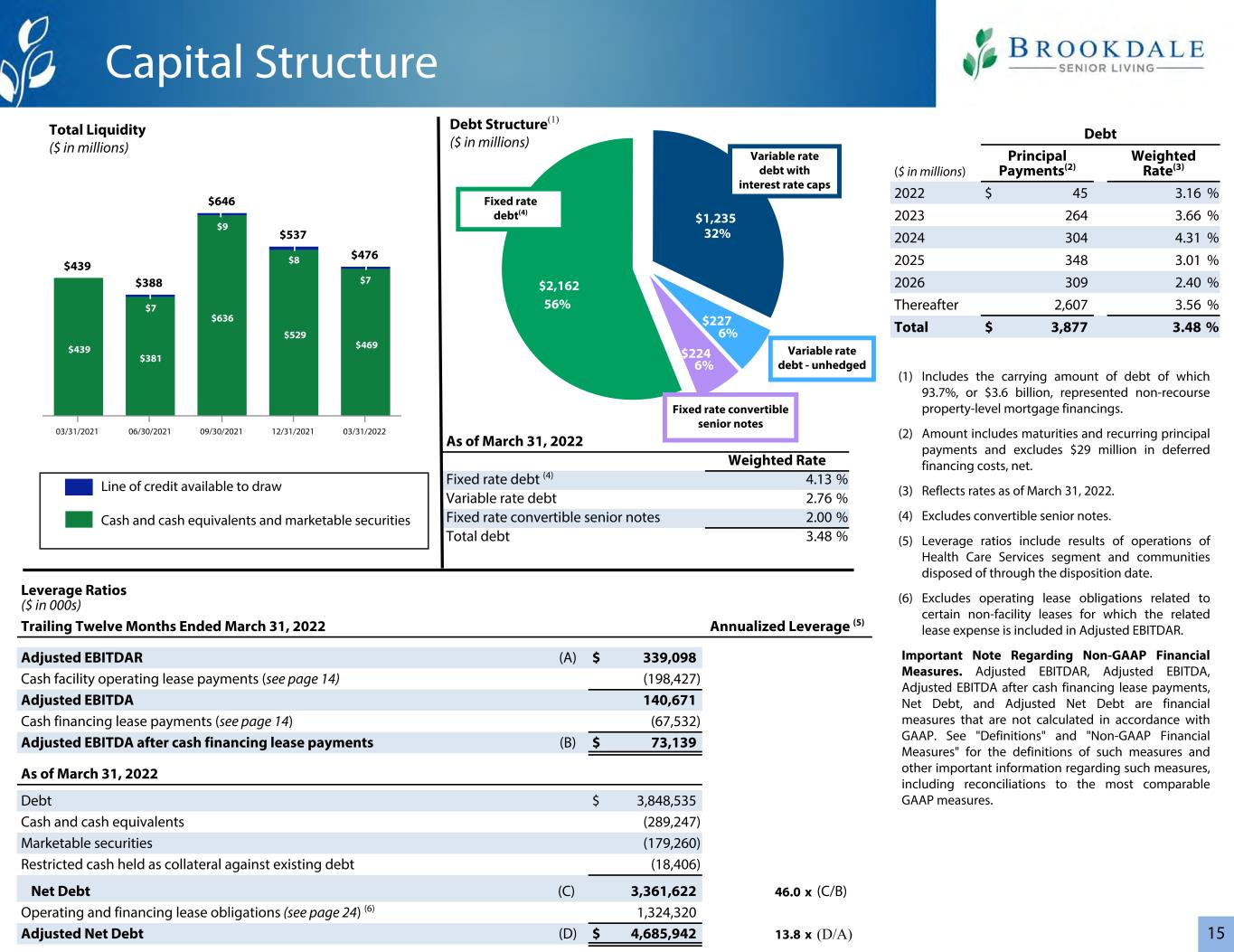

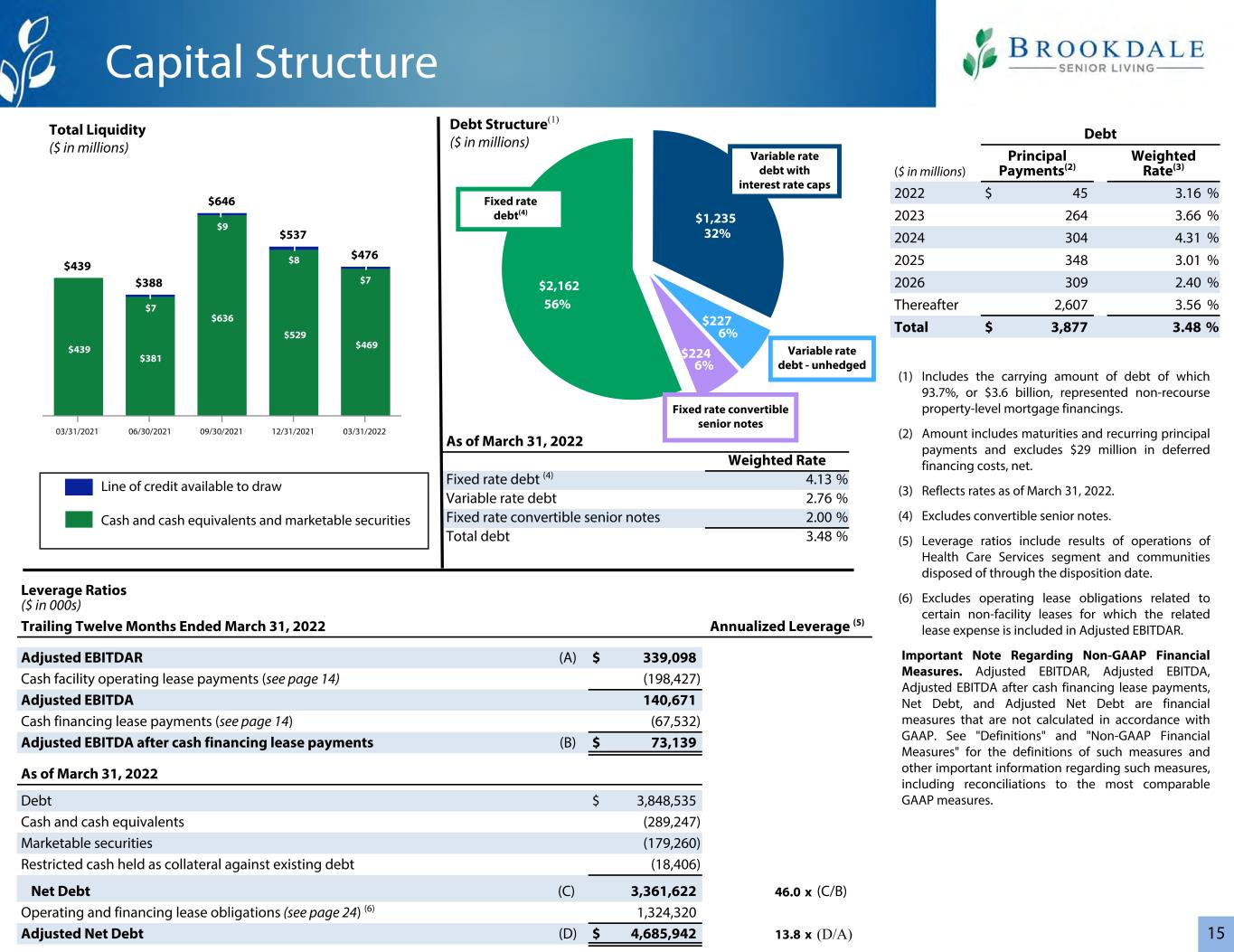

15 $439 $388 $646 $537 $476 $439 $381 $636 $529 $469 $7 $9 $8 $7 03/31/2021 06/30/2021 09/30/2021 12/31/2021 03/31/2022 Total Liquidity ($ in millions) (1) Includes the carrying amount of debt of which 93.7%, or $3.6 billion, represented non-recourse property-level mortgage financings. (2) Amount includes maturities and recurring principal payments and excludes $29 million in deferred financing costs, net. (3) Reflects rates as of March 31, 2022. (4) Excludes convertible senior notes. (5) Leverage ratios include results of operations of Health Care Services segment and communities disposed of through the disposition date. (6) Excludes operating lease obligations related to certain non-facility leases for which the related lease expense is included in Adjusted EBITDAR. Important Note Regarding Non-GAAP Financial Measures. Adjusted EBITDAR, Adjusted EBITDA, Adjusted EBITDA after cash financing lease payments, Net Debt, and Adjusted Net Debt are financial measures that are not calculated in accordance with GAAP. See "Definitions" and "Non-GAAP Financial Measures" for the definitions of such measures and other important information regarding such measures, including reconciliations to the most comparable GAAP measures. Leverage Ratios ($ in 000s) Trailing Twelve Months Ended March 31, 2022 Annualized Leverage (5) Adjusted EBITDAR (A) $ 339,098 Cash facility operating lease payments (see page 14) (198,427) Adjusted EBITDA 140,671 Cash financing lease payments (see page 14) (67,532) Adjusted EBITDA after cash financing lease payments (B) $ 73,139 As of March 31, 2022 Debt $ 3,848,535 Cash and cash equivalents (289,247) Marketable securities (179,260) Restricted cash held as collateral against existing debt (18,406) Net Debt (C) 3,361,622 46.0 x (C/B) Operating and financing lease obligations (see page 24) (6) 1,324,320 Adjusted Net Debt (D) $ 4,685,942 13.8 x (D/A) Debt ($ in millions) Principal Payments(2) Weighted Rate(3) 2022 $ 45 3.16 % 2023 264 3.66 % 2024 304 4.31 % 2025 348 3.01 % 2026 309 2.40 % Thereafter 2,607 3.56 % Total $ 3,877 3.48 % Capital Structure $224 $2,162 $1,235 $227 Debt Structure(1) ($ in millions) As of March 31, 2022 Weighted Rate Fixed rate debt (4) 4.13 % Variable rate debt 2.76 % Fixed rate convertible senior notes 2.00 % Total debt 3.48 % 56% 32% Fixed rate debt(4) Variable rate debt with interest rate caps Variable rate debt - unhedged 6% Line of credit available to draw Cash and cash equivalents and marketable securities 6% Fixed rate convertible senior notes

16 Adjusted EBITDA is a non-GAAP performance measure that the Company defines as net income (loss) excluding: benefit/provision for income taxes, non-operating income/ expense items, and depreciation and amortization; and further adjusted to exclude income/expense associated with non-cash, non-operational, transactional, cost reduction, or organizational restructuring items that management does not consider as part of the Company’s underlying core operating performance and that management believes impact the comparability of performance between periods. For the periods presented herein, such other items include non-cash impairment charges, gain/loss on facility operating lease termination, operating lease expense adjustment, non-cash stock-based compensation expense, and Transaction and Organizational Restructuring Costs. Adjusted EBITDAR is a non-GAAP financial measure that the Company defines as Adjusted EBITDA before cash facility operating lease payments. Adjusted Free Cash Flow is a non-GAAP liquidity measure that the Company defines as net cash provided by (used in) operating activities before: distributions from unconsolidated ventures from cumulative share of net earnings, changes in prepaid insurance premiums financed with notes payable, changes in operating lease assets and liabilities for lease termination, cash paid/received for gain/loss on facility operating lease termination, and lessor capital expenditure reimbursements under operating leases; plus: property insurance proceeds and proceeds from refundable entrance fees, net of refunds; less: Non-Development Capital Expenditures and payment of financing lease obligations. Adjusted Net Debt is a non-GAAP financial measure that the Company defines as Net Debt, plus operating and financing lease obligations. Operating and financing lease obligations exclude operating lease obligations related to certain non-facility leases for which the related lease expense is included in Adjusted EBITDAR. Combined Segment Operating Income is defined by the Company as resident fee and management fee revenue and other operating income of the Company, less facility operating expense. Combined Segment Operating Income does not include general and administrative expense or depreciation and amortization. Community Labor Expense is a component of facility operating expense that includes regular and overtime salaries and wages, bonuses, paid-time-off and holiday wages, payroll taxes, contract labor, employee benefits, and workers compensation. Development Capital Expenditures means capital expenditures for community expansions, major community redevelopment and repositioning projects, and the development of new communities. Amounts of Development Capital Expenditures are presented net of lessor reimbursements. Interest Coverage is calculated based on the trailing-twelve months Owned Portfolio Operating Income adjusted for an implied 5% management fee and capital expenditures at $350/unit, divided by the trailing-twelve months property level and corporate debt interest expense. Lease Coverage is calculated based on the trailing-twelve months Leased Portfolio Operating Income, excluding resident fee revenue, other operating income, and facility operating expense of communities disposed during such period adjusted for an implied 5% management fee and capital expenditures at $350/unit, divided by the trailing-twelve months cash facility lease payments for both operating leases and financing leases, excluding cash lease payments for leases of communities disposed during such period, corporate offices, information technology systems and equipment, vehicles, and other equipment. Leased Portfolio Operating Income is defined by the Company as resident fee revenue and other operating income (excluding amounts from the former Health Care Services segment), less facility operating expense for the Company’s Senior Housing Leased Portfolio. Leased Portfolio Operating Income does not include general and administrative expense or depreciation and amortization. Net Debt is a non-GAAP financial measure that the Company defines as the total of its debt (mortgage debt and other notes payable) and the outstanding balance on the line of credit, less unrestricted cash, marketable securities, and cash held as collateral against existing debt. NM means not meaningful. Non-Development Capital Expenditures is comprised of corporate and community- level capital expenditures, including those related to maintenance, renovations, upgrades, and other major building infrastructure projects for the Company’s communities. Non-Development Capital Expenditures does not include capital expenditures for community expansions, major community redevelopment and repositioning projects, and the development of new communities (i.e. Development Capital Expenditures). Amounts of Non-Development Capital Expenditures are presented net of lessor reimbursements. Owned Portfolio Operating Income is defined by the Company as resident fee revenue and other operating income (excluding amounts from the former Health Care Services segment), less facility operating expense for the Company’s Senior Housing Owned Portfolio. Owned Portfolio Operating Income does not include general and administrative expense or depreciation and amortization. RevPAR, or average monthly senior housing resident fee revenue per available unit, is defined by the Company as resident fee revenue for the corresponding portfolio for the period (excluding revenue from the former Health Care Services segment, revenue for private duty services provided to seniors living outside of the Company's communities, and entrance fee amortization), divided by the weighted average number of available units in the corresponding portfolio for the period, divided by the number of months in the period. Definitions

17 RevPOR, or average monthly senior housing resident fee revenue per occupied unit, is defined by the Company as resident fee revenue for the corresponding portfolio for the period (excluding revenue from the former Health Care Services segment, revenue for private duty services provided to seniors living outside of the Company's communities, and entrance fee amortization), divided by the weighted average number of occupied units in the corresponding portfolio for the period, divided by the number of months in the period. Same Community information reflects operating results and data of a consistent population of communities by excluding the impact of changes in the composition of the Company's portfolio of communities. The operating results exclude natural disaster expense and related insurance recoveries. The Company defines its same community portfolio as communities consolidated and operational for the full period in both comparison years. Consolidated communities excluded from the same community portfolio include communities acquired or disposed of since the beginning of the prior year, communities classified as assets held for sale, certain communities planned for disposition, certain communities that have undergone or are undergoing expansion, redevelopment, and repositioning projects, and certain communities that have experienced a casualty event that significantly impacts their operations. Same Community Operating Income is defined by the Company as resident fee revenue and other operating income (excluding amounts from the former Health Care Services segment), less facility operating expense (excluding natural disaster expense and related insurance recoveries) for the Company's Same Community portfolio. Same Community Operating Income does not include general and administrative expense or depreciation and amortization. Segment Operating Income (Loss) is defined by the Company as segment revenue and other operating income less segment facility operating expense. Segment Operating Income (Loss) does not include general and administrative expense or depreciation and amortization. All Other Segment Operating Income consists primarily of the previously reported Management Services segment and excludes revenue for reimbursements for which the Company is the primary obligor of costs incurred on behalf of managed communities, and there is no facility operating expense associated with the All Other category. See the Segment Information note to the Company’s consolidated financial statements for more information regarding the Company’s segments. Senior Housing Leased Portfolio represents Brookdale leased communities and does not include owned or managed communities. Senior Housing Operating Income is defined by the Company as segment revenue and other operating income less segment facility operating expense for the Company’s Independent Living, Assisted Living and Memory Care, and CCRCs segments on an aggregate basis. Senior Housing Operating Income does not include general and administrative expense or depreciation and amortization. Senior Housing Owned Portfolio represents Brookdale owned communities and does not include leased or managed communities. Total Average Units represents the average number of units operated during the period. Transaction and Organizational Restructuring Costs are general and administrative expenses. Transaction costs include those directly related to acquisition, disposition, financing, and leasing activity, and are primarily comprised of legal, finance, consulting, professional fees, and other third-party costs. Organizational restructuring costs include those related to the Company’s efforts to reduce general and administrative expense and its senior leadership changes, including severance. Definitions

18 Appendices Summary Financial Impact: COVID-19 19 Non-GAAP Financial Measures 21

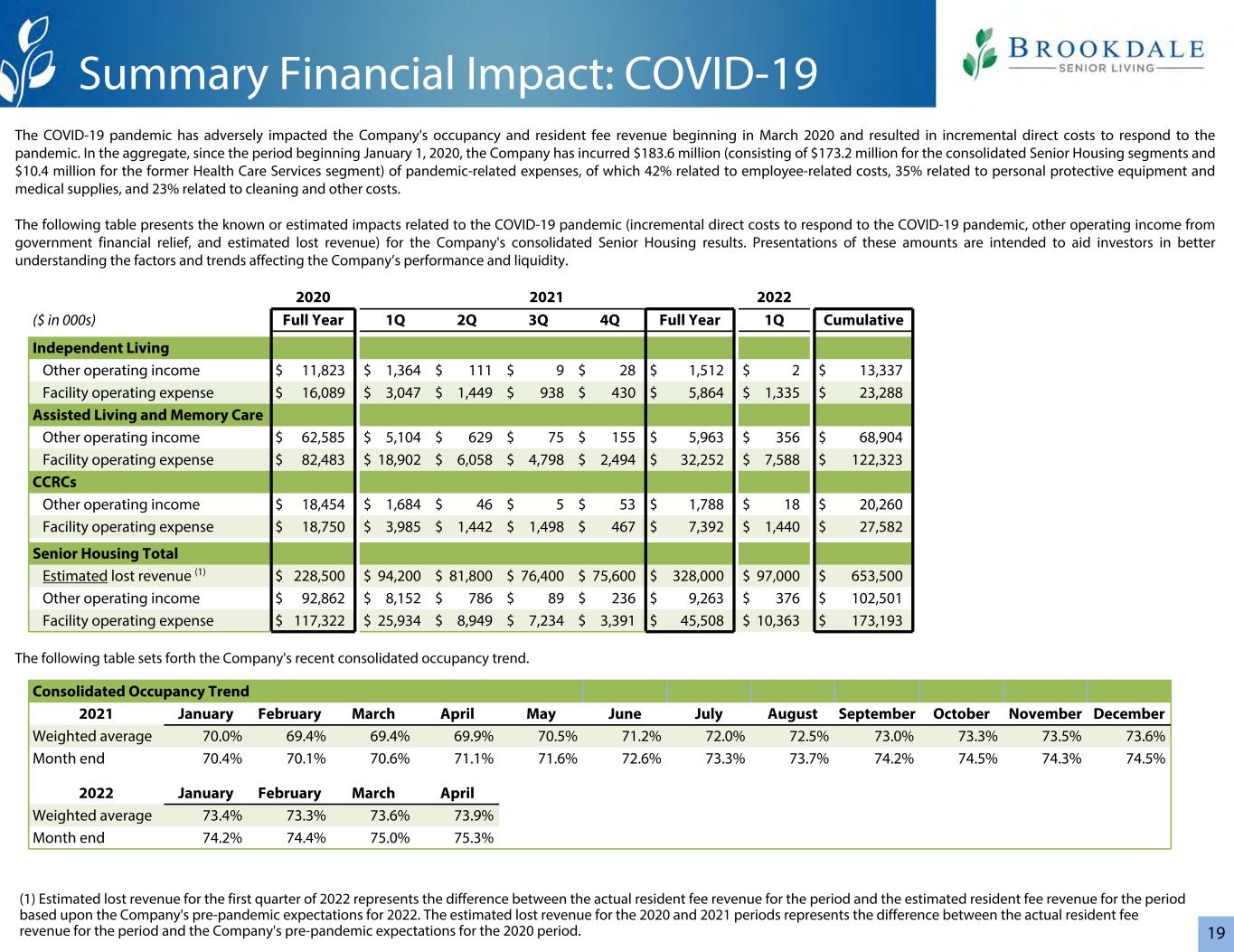

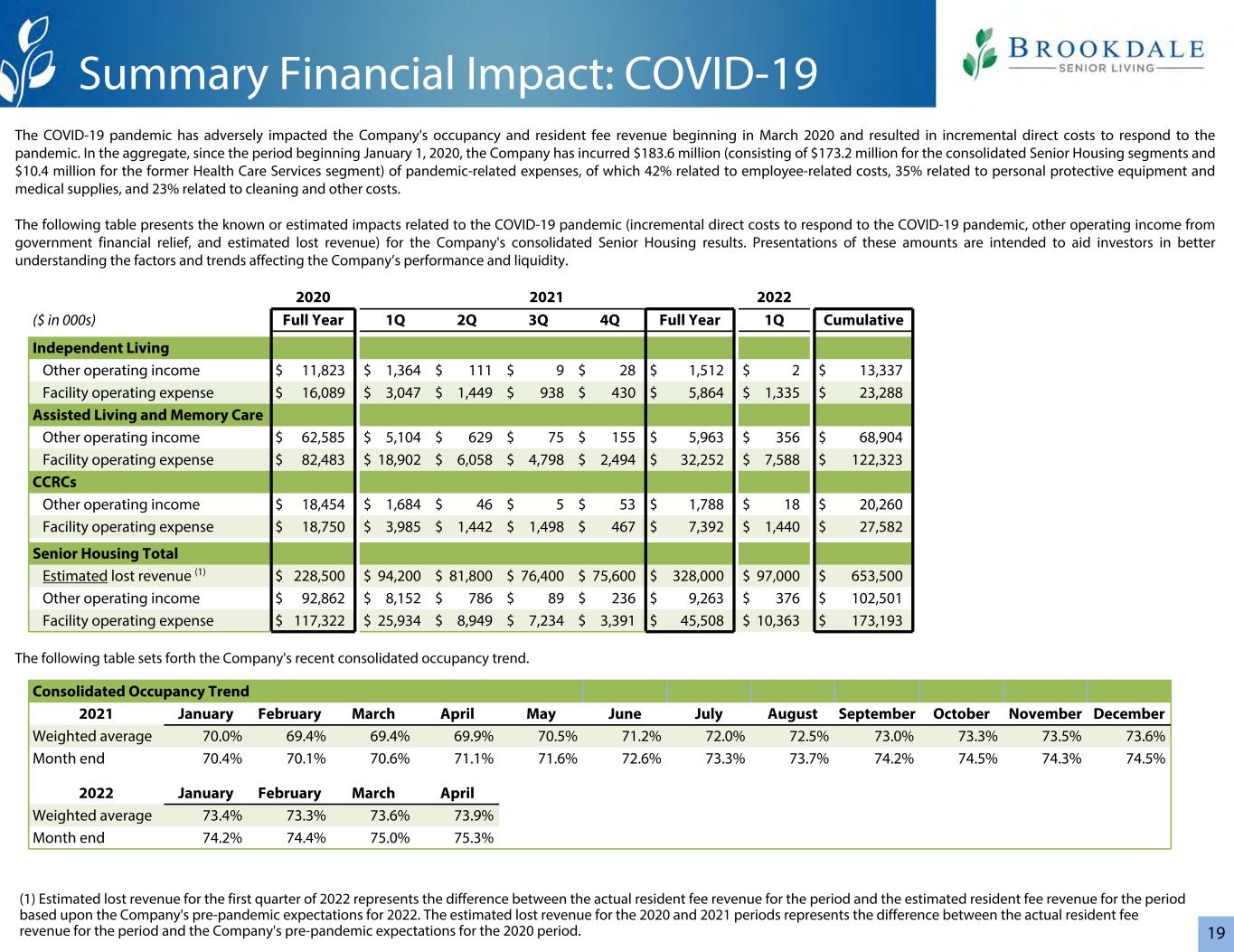

19 Summary Financial Impact: COVID-19 2020 2021 2022 ($ in 000s) Full Year 1Q 2Q 3Q 4Q Full Year 1Q Cumulative Independent Living Other operating income $ 11,823 $ 1,364 $ 111 $ 9 $ 28 $ 1,512 $ 2 $ 13,337 Facility operating expense $ 16,089 $ 3,047 $ 1,449 $ 938 $ 430 $ 5,864 $ 1,335 $ 23,288 Assisted Living and Memory Care Other operating income $ 62,585 $ 5,104 $ 629 $ 75 $ 155 $ 5,963 $ 356 $ 68,904 Facility operating expense $ 82,483 $ 18,902 $ 6,058 $ 4,798 $ 2,494 $ 32,252 $ 7,588 $ 122,323 CCRCs Other operating income $ 18,454 $ 1,684 $ 46 $ 5 $ 53 $ 1,788 $ 18 $ 20,260 Facility operating expense $ 18,750 $ 3,985 $ 1,442 $ 1,498 $ 467 $ 7,392 $ 1,440 $ 27,582 Senior Housing Total Estimated lost revenue (1) $ 228,500 $ 94,200 $ 81,800 $ 76,400 $ 75,600 $ 328,000 $ 97,000 $ 653,500 Other operating income $ 92,862 $ 8,152 $ 786 $ 89 $ 236 $ 9,263 $ 376 $ 102,501 Facility operating expense $ 117,322 $ 25,934 $ 8,949 $ 7,234 $ 3,391 $ 45,508 $ 10,363 $ 173,193 The COVID-19 pandemic has adversely impacted the Company's occupancy and resident fee revenue beginning in March 2020 and resulted in incremental direct costs to respond to the pandemic. In the aggregate, since the period beginning January 1, 2020, the Company has incurred $183.6 million (consisting of $173.2 million for the consolidated Senior Housing segments and $10.4 million for the former Health Care Services segment) of pandemic-related expenses, of which 42% related to employee-related costs, 35% related to personal protective equipment and medical supplies, and 23% related to cleaning and other costs. The following table presents the known or estimated impacts related to the COVID-19 pandemic (incremental direct costs to respond to the COVID-19 pandemic, other operating income from government financial relief, and estimated lost revenue) for the Company's consolidated Senior Housing results. Presentations of these amounts are intended to aid investors in better understanding the factors and trends affecting the Company’s performance and liquidity. Consolidated Occupancy Trend 2021 January February March April May June July August September October November December Weighted average 70.0% 69.4% 69.4% 69.9% 70.5% 71.2% 72.0% 72.5% 73.0% 73.3% 73.5% 73.6% Month end 70.4% 70.1% 70.6% 71.1% 71.6% 72.6% 73.3% 73.7% 74.2% 74.5% 74.3% 74.5% 2022 January February March April Weighted average 73.4% 73.3% 73.6% 73.9% Month end 74.2% 74.4% 75.0% 75.3% The following table sets forth the Company's recent consolidated occupancy trend. (1) Estimated lost revenue for the first quarter of 2022 represents the difference between the actual resident fee revenue for the period and the estimated resident fee revenue for the period based upon the Company's pre-pandemic expectations for 2022. The estimated lost revenue for the 2020 and 2021 periods represents the difference between the actual resident fee revenue for the period and the Company's pre-pandemic expectations for the 2020 period.

20 Summary Financial Impact: COVID-19 2021 2022 ($ in 000s) 1Q 2Q 3Q 4Q Full Year 1Q Independent Living Other operating income $ 1,345 $ 111 $ 8 $ 28 $ 1,492 $ 2 Facility operating expense $ 2,983 $ 1,364 $ 908 $ 431 $ 5,686 $ 1,310 Assisted Living and Memory Care Other operating income $ 4,930 $ 612 $ 76 $ 155 $ 5,773 $ 356 Facility operating expense $ 18,510 $ 5,934 $ 4,764 $ 2,489 $ 31,697 $ 7,511 CCRCs Other operating income $ 1,080 $ 43 $ 4 $ 53 $ 1,180 $ — Facility operating expense $ 3,193 $ 1,036 $ 842 $ 321 $ 5,392 $ 1,154 Total Same Community Other operating income $ 7,355 $ 766 $ 88 $ 236 $ 8,445 $ 358 Facility operating expense $ 24,686 $ 8,334 $ 6,514 $ 3,241 $ 42,775 $ 9,975 Same Community The following table presents the incremental direct costs to respond to the COVID-19 pandemic and other operating income from government financial relief for the Company's same community results. Certain cash flow impacts from the CARES Act and government grants and credits are shown below: 2020 2021 2022 ($ in 000s) Full Year 1Q 2Q 3Q 4Q Full Year 1Q Cash received (recouped) - Medicare advances (1) $ 87,542 $ — $ (14,258) $ (3,527) $ (3,057) $ (20,842) $ (1,848) Deferred payroll taxes (2) 72,674 — — — (31,553) (31,553) — Cash received - government grants 115,748 1,700 405 89 251 2,445 376 Cash received - employee retention credit (3) — — — 1,055 350 1,405 406 Operating cash flow impacts (4) 275,964 1,700 (13,853) (2,383) (34,009) (48,545) (1,066) Less: Other operating income (115,749) (10,735) (1,308) (89) (236) (12,368) (376) Changes in working capital $ 160,215 $ (9,035) $ (15,161) $ (2,472) $ (34,245) $ (60,913) $ (1,442) Liabilities retained by the Company as of March 31, 2022, substantially all due December 2022 $ 32,793 Government Relief (including consolidated Senior Housing segments and the former Health Care Services segment) (1) During the full year 2020, the Company received $87.5 million under the Medicare Accelerated and Advance Payment Program, of which obligations for $9.6 million were retained by the Company following the HCS Sale. The amount began to be recouped in the full year 2021 and the $1.2 million remaining obligation is expected to be recouped in the full year 2022. (2) During the full year 2020, the Company deferred $72.7 million of the employer portion of social security taxes, of which obligations for $63.1 million were retained by the Company following the HCS Sale. One half was repaid during the full year 2021 and the $31.6 million remaining obligation is due December 31, 2022. (3) During the full year 2021, the Company recognized $9.9 million of employee retention credits on wages paid from March 12, 2020 to December 31, 2020 within other operating income. As of March 31, 2022, the Company has received $1.8 million increasing the Company's net cash provided by (used in) operating activities and has $5.3 million of receivables related to employee retention credits. (4) Impacts included in Adjusted Free Cash Flow.

21 Non-GAAP Financial Measures This Supplemental Information contains the financial measures Adjusted EBITDA, Adjusted EBITDAR, Adjusted EBITDA after cash financing lease payments, Adjusted Free Cash Flow, Net Debt, and Adjusted Net Debt (each as defined in the "Definitions" section), which are not calculated in accordance with U.S. generally accepted accounting principles ("GAAP"). Presentations of these non-GAAP financial measures are intended to aid investors in better understanding the factors and trends affecting the Company’s performance and liquidity. However, investors should not consider these non-GAAP financial measures as a substitute for financial measures determined in accordance with GAAP, including net income (loss), income (loss) from operations, net cash provided by (used in) operating activities, short-term debt, long-term debt less current portion, or current portion of long-term debt. Investors are cautioned that amounts presented in accordance with the Company’s definitions of these non-GAAP financial measures may not be comparable to similar measures disclosed by other companies because not all companies calculate non-GAAP measures in the same manner. Investors are urged to review the reconciliations set forth in this Appendix of these non-GAAP financial measures from the most comparable financial measures determined in accordance with GAAP and to review the information under "Reconciliations of Non-GAAP Financial Measures" in the Company’s earnings release dated May 5, 2022 for additional information regarding the Company’s use and the limitations of such non-GAAP financial measures.

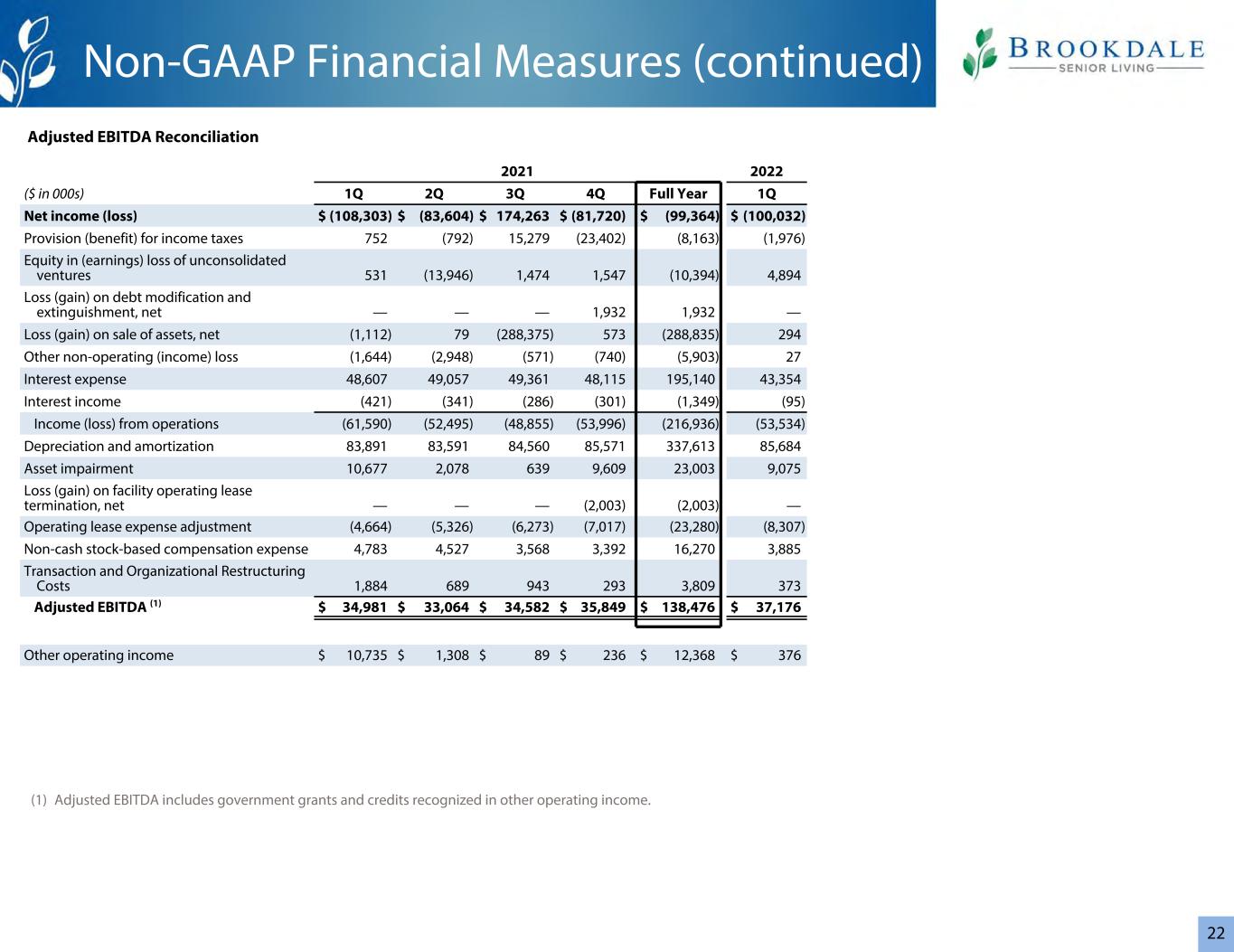

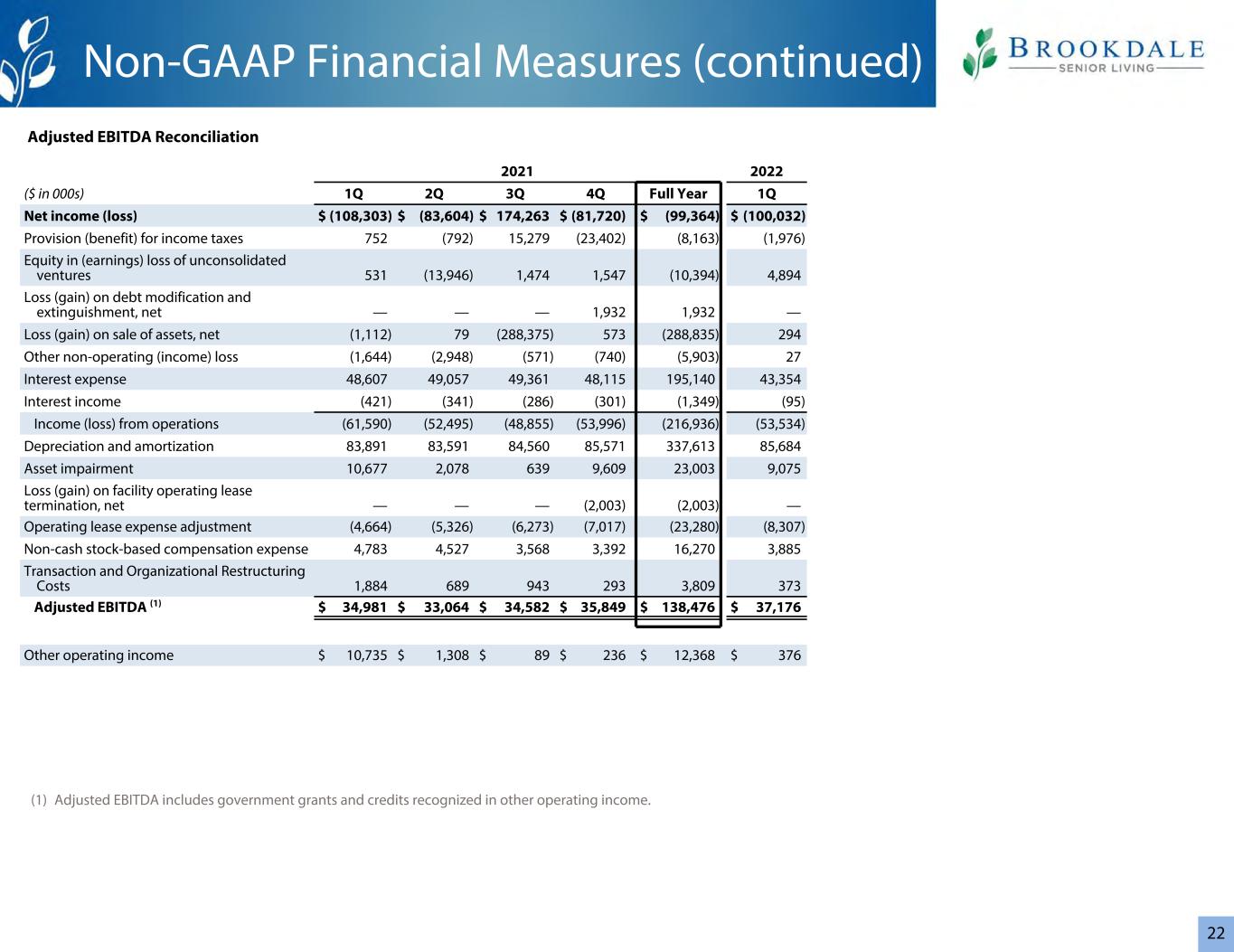

22 2021 2022 ($ in 000s) 1Q 2Q 3Q 4Q Full Year 1Q Net income (loss) $ (108,303) $ (83,604) $ 174,263 $ (81,720) $ (99,364) $ (100,032) Provision (benefit) for income taxes 752 (792) 15,279 (23,402) (8,163) (1,976) Equity in (earnings) loss of unconsolidated ventures 531 (13,946) 1,474 1,547 (10,394) 4,894 Loss (gain) on debt modification and extinguishment, net — — — 1,932 1,932 — Loss (gain) on sale of assets, net (1,112) 79 (288,375) 573 (288,835) 294 Other non-operating (income) loss (1,644) (2,948) (571) (740) (5,903) 27 Interest expense 48,607 49,057 49,361 48,115 195,140 43,354 Interest income (421) (341) (286) (301) (1,349) (95) Income (loss) from operations (61,590) (52,495) (48,855) (53,996) (216,936) (53,534) Depreciation and amortization 83,891 83,591 84,560 85,571 337,613 85,684 Asset impairment 10,677 2,078 639 9,609 23,003 9,075 Loss (gain) on facility operating lease termination, net — — — (2,003) (2,003) — Operating lease expense adjustment (4,664) (5,326) (6,273) (7,017) (23,280) (8,307) Non-cash stock-based compensation expense 4,783 4,527 3,568 3,392 16,270 3,885 Transaction and Organizational Restructuring Costs 1,884 689 943 293 3,809 373 Adjusted EBITDA (1) $ 34,981 $ 33,064 $ 34,582 $ 35,849 $ 138,476 $ 37,176 Other operating income $ 10,735 $ 1,308 $ 89 $ 236 $ 12,368 $ 376 Adjusted EBITDA Reconciliation Non-GAAP Financial Measures (continued) (1) Adjusted EBITDA includes government grants and credits recognized in other operating income.

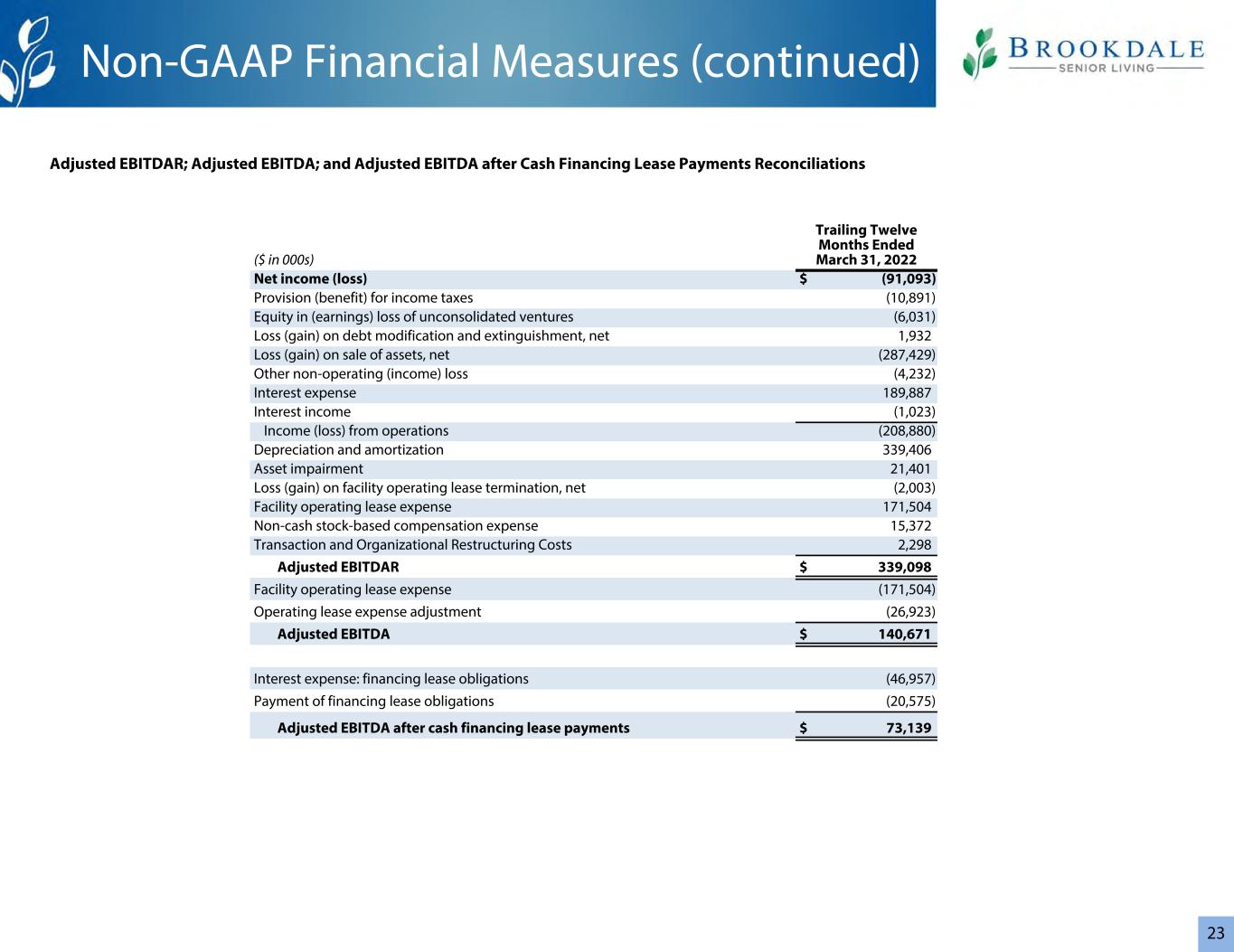

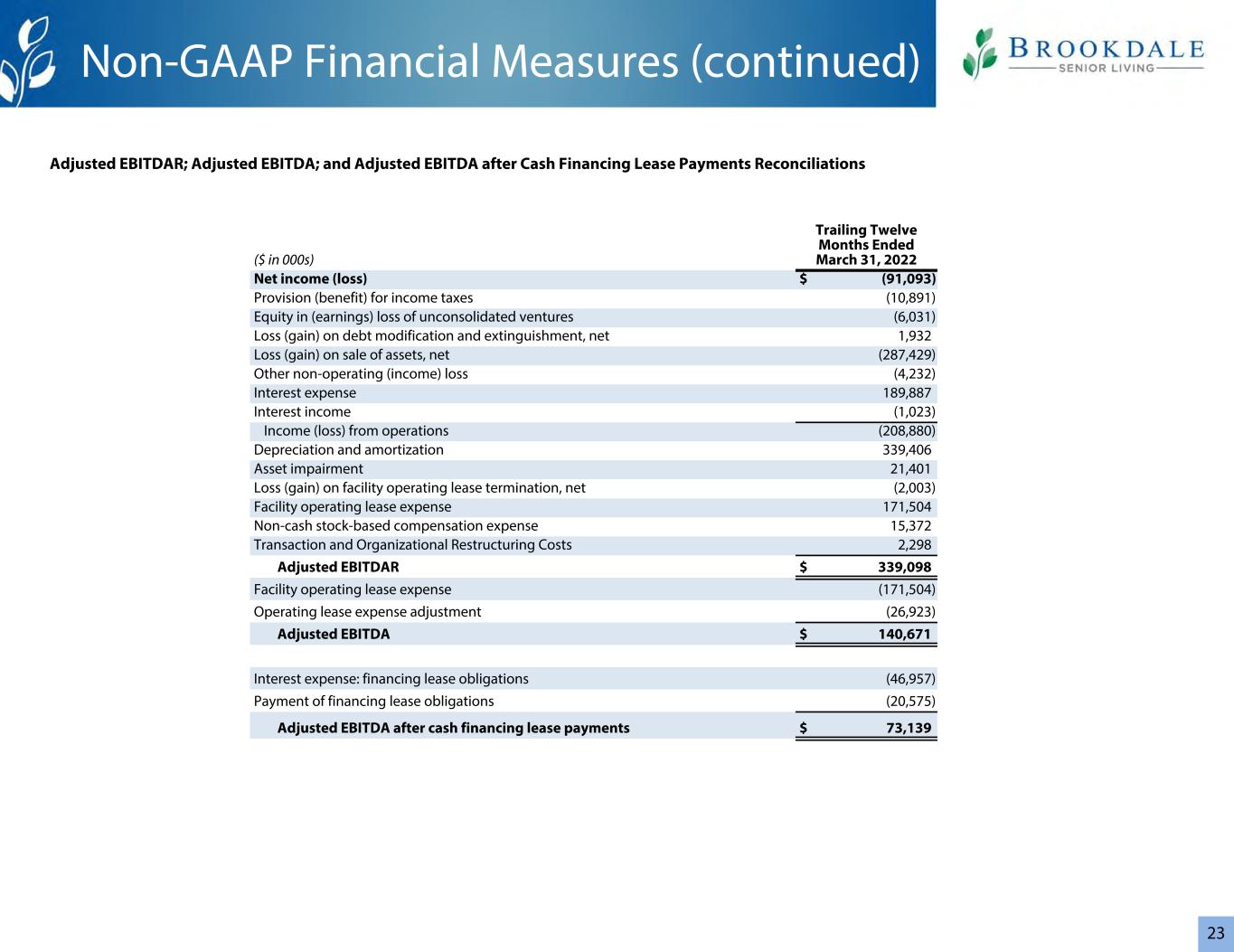

23 Adjusted EBITDAR; Adjusted EBITDA; and Adjusted EBITDA after Cash Financing Lease Payments Reconciliations Trailing Twelve Months Ended March 31, 2022($ in 000s) Net income (loss) $ (91,093) Provision (benefit) for income taxes (10,891) Equity in (earnings) loss of unconsolidated ventures (6,031) Loss (gain) on debt modification and extinguishment, net 1,932 Loss (gain) on sale of assets, net (287,429) Other non-operating (income) loss (4,232) Interest expense 189,887 Interest income (1,023) Income (loss) from operations (208,880) Depreciation and amortization 339,406 Asset impairment 21,401 Loss (gain) on facility operating lease termination, net (2,003) Facility operating lease expense 171,504 Non-cash stock-based compensation expense 15,372 Transaction and Organizational Restructuring Costs 2,298 Adjusted EBITDAR $ 339,098 Facility operating lease expense (171,504) Operating lease expense adjustment (26,923) Adjusted EBITDA $ 140,671 Interest expense: financing lease obligations (46,957) Payment of financing lease obligations (20,575) Adjusted EBITDA after cash financing lease payments $ 73,139 Non-GAAP Financial Measures (continued)

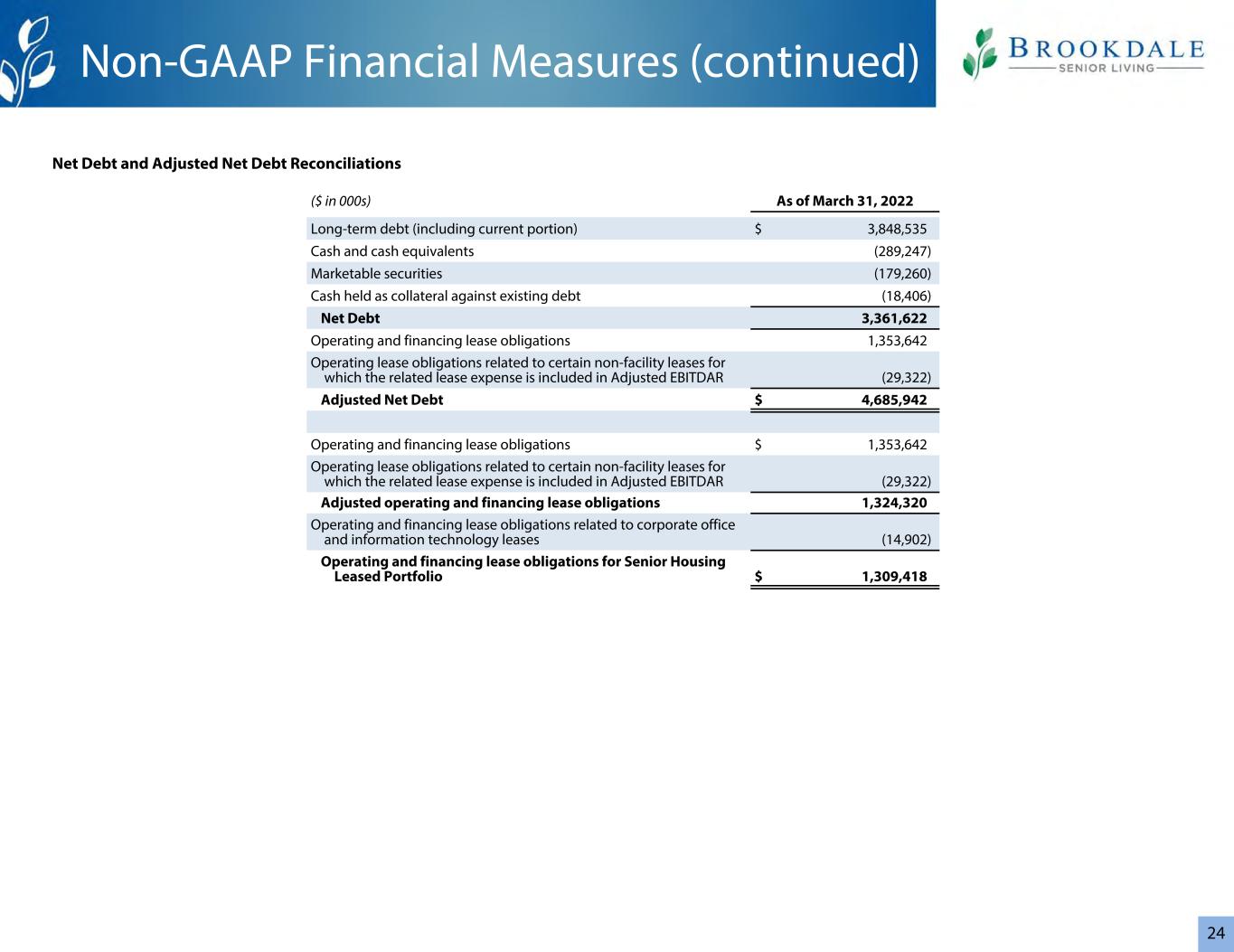

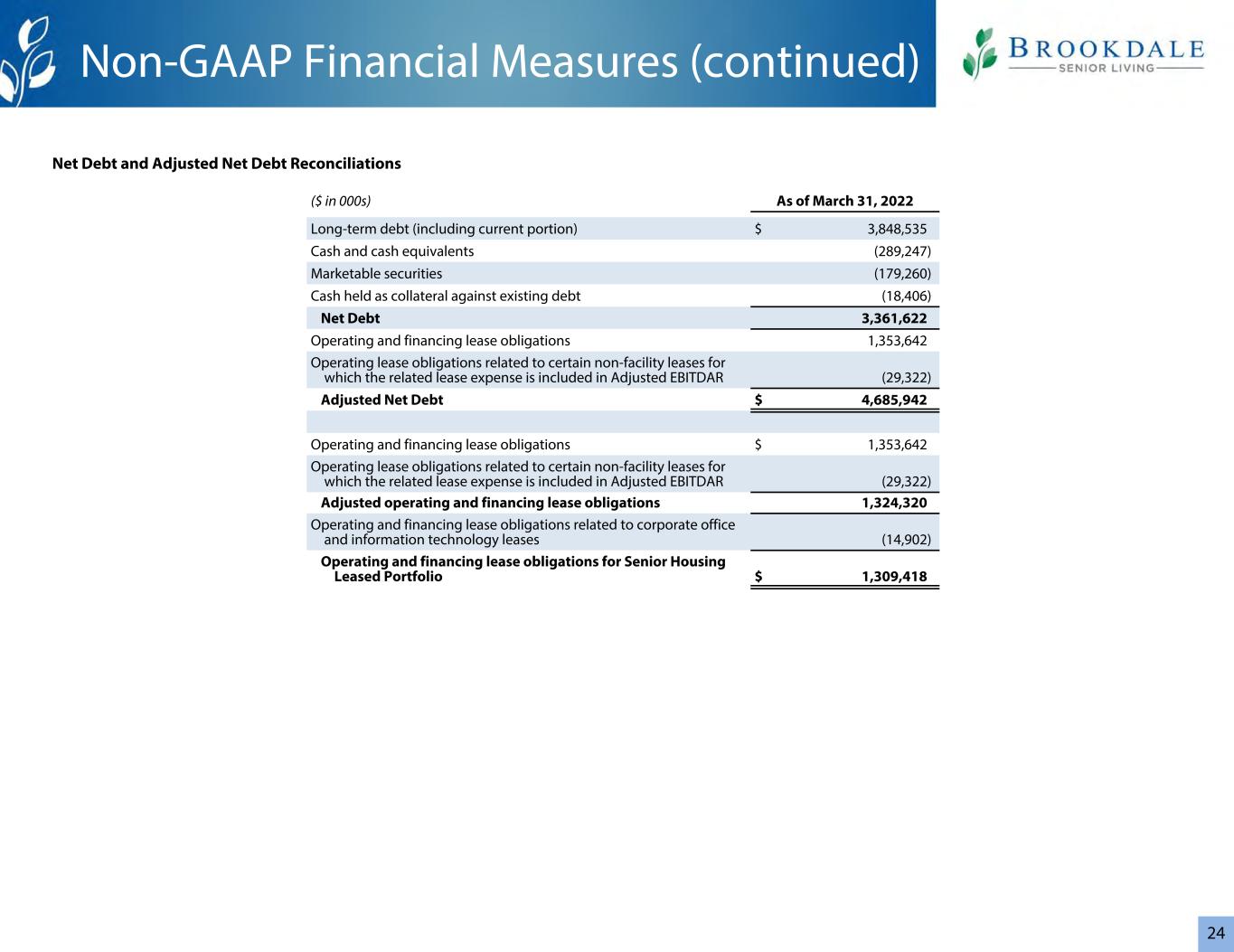

24 Net Debt and Adjusted Net Debt Reconciliations ($ in 000s) As of March 31, 2022 Long-term debt (including current portion) $ 3,848,535 Cash and cash equivalents (289,247) Marketable securities (179,260) Cash held as collateral against existing debt (18,406) Net Debt 3,361,622 Operating and financing lease obligations 1,353,642 Operating lease obligations related to certain non-facility leases for which the related lease expense is included in Adjusted EBITDAR (29,322) Adjusted Net Debt $ 4,685,942 Operating and financing lease obligations $ 1,353,642 Operating lease obligations related to certain non-facility leases for which the related lease expense is included in Adjusted EBITDAR (29,322) Adjusted operating and financing lease obligations 1,324,320 Operating and financing lease obligations related to corporate office and information technology leases (14,902) Operating and financing lease obligations for Senior Housing Leased Portfolio $ 1,309,418 Non-GAAP Financial Measures (continued)

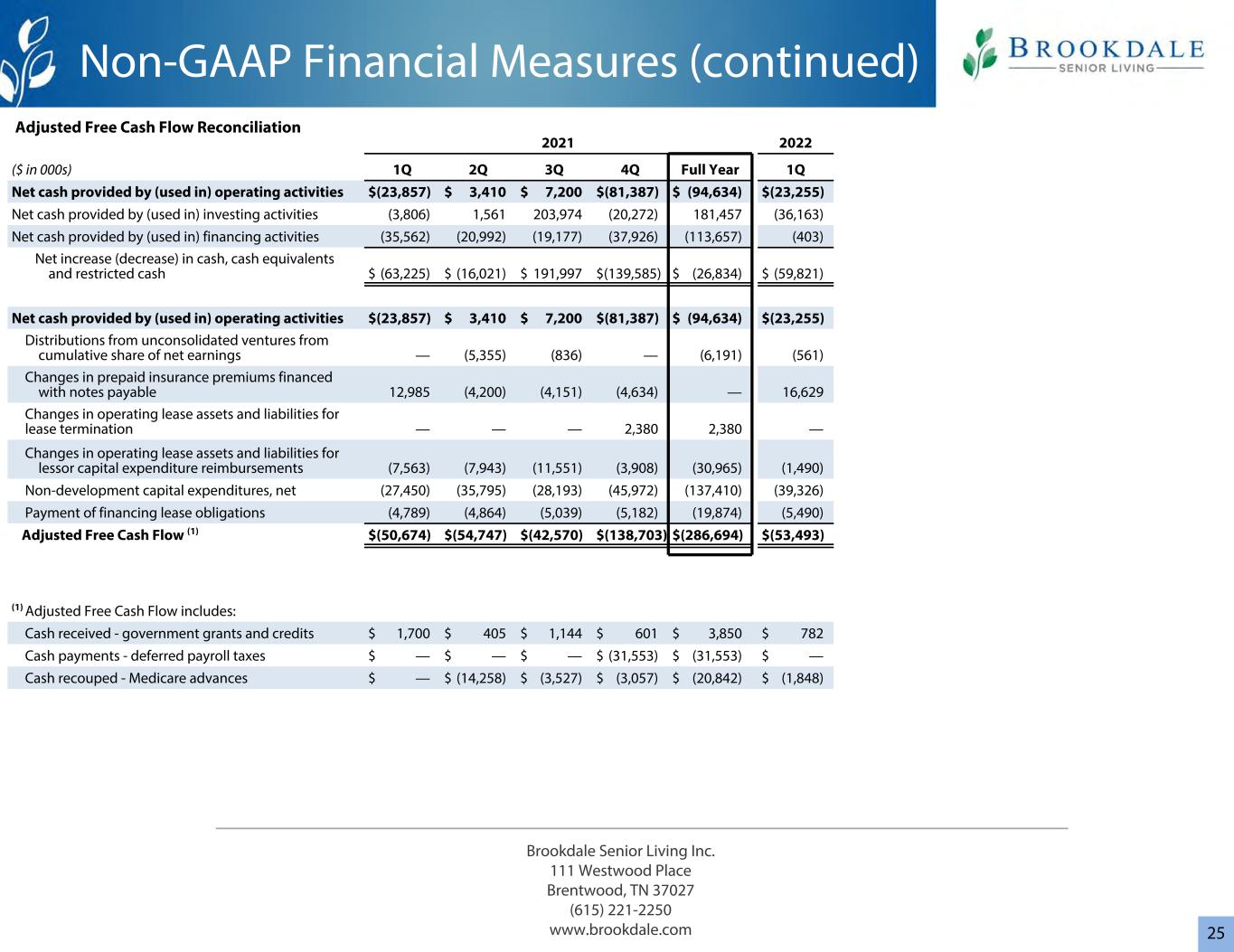

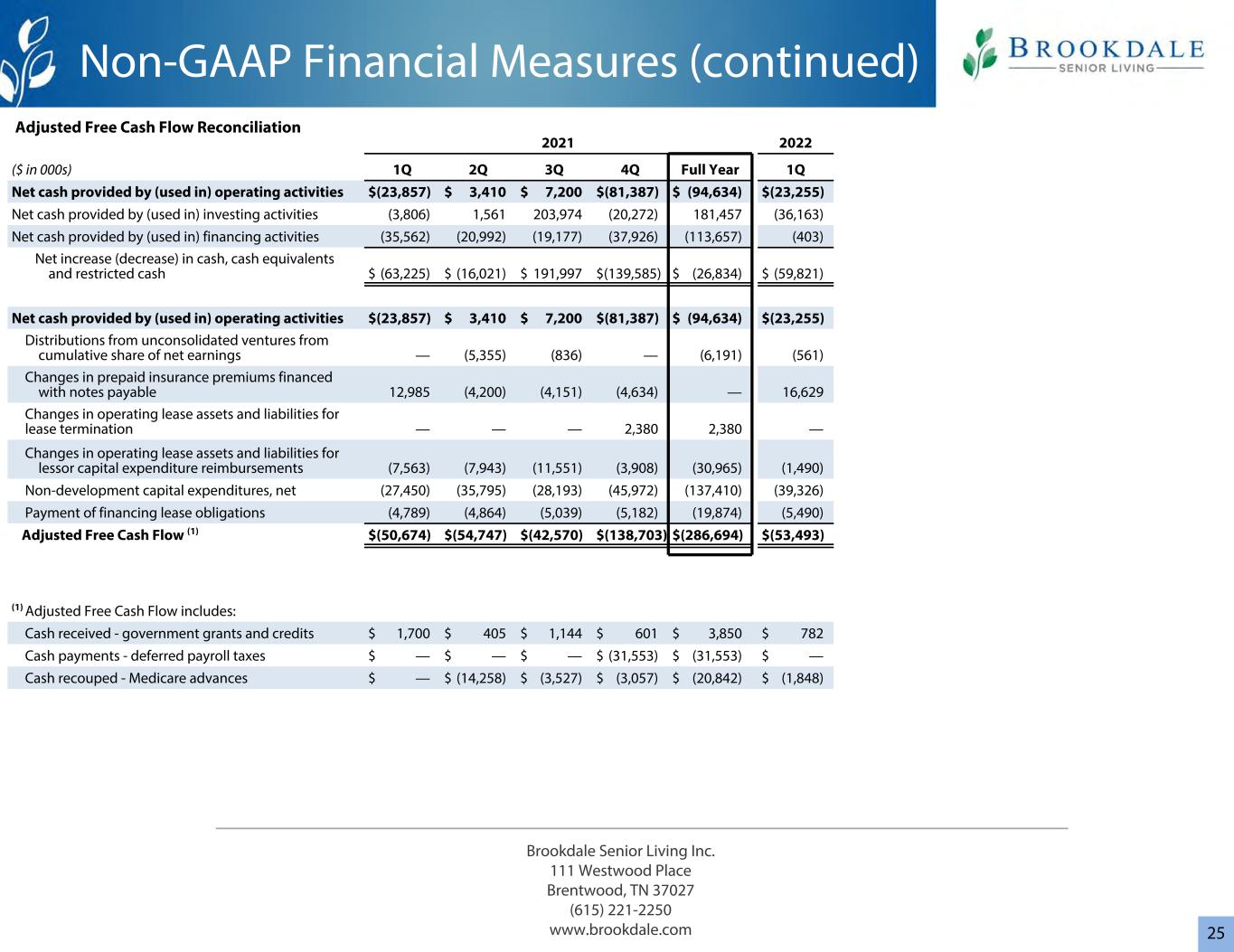

25 2021 2022 ($ in 000s) 1Q 2Q 3Q 4Q Full Year 1Q Net cash provided by (used in) operating activities $ (23,857) $ 3,410 $ 7,200 $ (81,387) $ (94,634) $ (23,255) Net cash provided by (used in) investing activities (3,806) 1,561 203,974 (20,272) 181,457 (36,163) Net cash provided by (used in) financing activities (35,562) (20,992) (19,177) (37,926) (113,657) (403) Net increase (decrease) in cash, cash equivalents and restricted cash $ (63,225) $ (16,021) $ 191,997 $ (139,585) $ (26,834) $ (59,821) Net cash provided by (used in) operating activities $ (23,857) $ 3,410 $ 7,200 $ (81,387) $ (94,634) $ (23,255) Distributions from unconsolidated ventures from cumulative share of net earnings — (5,355) (836) — (6,191) (561) Changes in prepaid insurance premiums financed with notes payable 12,985 (4,200) (4,151) (4,634) — 16,629 Changes in operating lease assets and liabilities for lease termination — — — 2,380 2,380 — Changes in operating lease assets and liabilities for lessor capital expenditure reimbursements (7,563) (7,943) (11,551) (3,908) (30,965) (1,490) Non-development capital expenditures, net (27,450) (35,795) (28,193) (45,972) (137,410) (39,326) Payment of financing lease obligations (4,789) (4,864) (5,039) (5,182) (19,874) (5,490) Adjusted Free Cash Flow (1) $ (50,674) $ (54,747) $ (42,570) $ (138,703) $ (286,694) $ (53,493) (1) Adjusted Free Cash Flow includes: Cash received - government grants and credits $ 1,700 $ 405 $ 1,144 $ 601 $ 3,850 $ 782 Cash payments - deferred payroll taxes $ — $ — $ — $ (31,553) $ (31,553) $ — Cash recouped - Medicare advances $ — $ (14,258) $ (3,527) $ (3,057) $ (20,842) $ (1,848) Adjusted Free Cash Flow Reconciliation Non-GAAP Financial Measures (continued) Brookdale Senior Living Inc. 111 Westwood Place Brentwood, TN 37027 (615) 221-2250 www.brookdale.com