Resource Capital Corp.

JMP Conference Company Presentation

May 10, 2010

1

Safe Harbor

This presentation contains forward-looking statements that involve risks and uncertainties. These forward-looking statements are not historical facts but rather are based on

current beliefs, assumptions and expectations. These beliefs, assumptions and expectations can change as a result of many possible events or factors, not all of which are

known to us or are within our control. If a change occurs, our business, financial condition, liquidity and results of operations may vary materially from those expressed in our

forward-looking statements. You should not place undue reliance on these forward-looking statements, which reflect our view only as of the date of this presentation, and we

undertake no obligation to update these forward-looking statements in the future. We use words such as “anticipate,” “expect,” “intend,” “plan,” “believe,” “seek,” “estimate,” and

variations of these words and similar expressions to identify forward-looking statements. Forward-looking statements are subject to various risks and uncertainties that could

cause actual results to vary from our forward-looking statements, including:

current beliefs, assumptions and expectations. These beliefs, assumptions and expectations can change as a result of many possible events or factors, not all of which are

known to us or are within our control. If a change occurs, our business, financial condition, liquidity and results of operations may vary materially from those expressed in our

forward-looking statements. You should not place undue reliance on these forward-looking statements, which reflect our view only as of the date of this presentation, and we

undertake no obligation to update these forward-looking statements in the future. We use words such as “anticipate,” “expect,” “intend,” “plan,” “believe,” “seek,” “estimate,” and

variations of these words and similar expressions to identify forward-looking statements. Forward-looking statements are subject to various risks and uncertainties that could

cause actual results to vary from our forward-looking statements, including:

§ changes in our industry, interest rates, the debt securities markets, real estate markets or the general economy;

§ increased rates of default and/or decreased recovery rates on our investments;

§ the performance and financial condition of our borrowers;

§ the cost and availability of our financings, which depends in part on our asset quality, the nature of our relationships with our lenders and other capital providers, our

business prospects and outlook and general market conditions;

business prospects and outlook and general market conditions;

§ the availability and attractiveness of terms of additional debt repurchases;

§ availability, terms and deployment of short-term and long-term capital;

§ availability of, and ability to retain, qualified personnel;

§ changes in governmental regulations, tax rates and similar matters;

§ changes in our business strategy;

§ availability of investment opportunities in commercial real estate-related and commercial finance assets;

§ the resolution of our non-performing and sub-performing assets;

§ our ability to comply with financial covenants in our debt instruments;

§ the degree and nature of our competition;

§ the adequacy of our cash reserves and working capital;

§ the timing of cash flows, if any, from our investments;

§ unanticipated increases in financial and other costs, including a rise in interest rates;

§ our ability to maintain compliance with over-collateralization and interest coverage tests in our CDOs;

§ our dependence on our Manager and ability to find a suitable replacement in a timely manner, or at all, if we or our Manager were to terminate the management

agreement;

agreement;

§ legislative and regulatory changes (including changes to laws governing the taxation of REITs or the exemptions from registration as an investment company);

§ environmental and/or safety requirements;

§ our ability to satisfy complex rules in order for us to qualify as a REIT, for federal income tax purposes and qualify for our exemption under the Investment Company

Act of 1940, as amended and our ability and the ability of our subsidiaries to operate effectively within the limitations imposed by these rules;

Act of 1940, as amended and our ability and the ability of our subsidiaries to operate effectively within the limitations imposed by these rules;

§ the continuing threat of terrorist attacks on the national, regional and total economies; and

§ other factors discussed under Item IA. Risk Factors of our Annual Report on Form 10-K for the year ended December 31, 2009 and those factors that may be

contained in any filing we make with the Securities Exchange Commission.

contained in any filing we make with the Securities Exchange Commission.

We undertake no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as required

by law. In light of these risks and uncertainties, the forward-looking events and circumstances discussed in this presentation might not occur and actual results, performance or

achievement could differ materially from that anticipated or implied in the forward-looking statements.

by law. In light of these risks and uncertainties, the forward-looking events and circumstances discussed in this presentation might not occur and actual results, performance or

achievement could differ materially from that anticipated or implied in the forward-looking statements.

2

Business Overview

Ø Exchange / Ticker NYSE : “RSO”

Ø 144A Offering March 2005 $214.8 million

Ø Market Capitalization1 $309.3 million

Ø Trust preferred - May / September 2006 $50.0 million

Ø Investment Portfolio as of 3/31/2010 $1.8 billion

Ø Formed in 2005 - have paid 23 consecutive quarters of a cash dividend of $6.97/share

Ø Anticipated Dividend guidance for 2010 $1.00/share

§ Externally managed by a subsidiary of Resource America, Inc. (NASDAQ: “REXI”)

(1) Reflects Share price as of May 3, 2010 and total shares outstanding as of the same date

Resource Capital Corp.

3

Ø A commercial finance business structured as a REIT with substantial focus on

commercial mortgage investments as well as commercial loans

commercial mortgage investments as well as commercial loans

Ø Provides customized financing solutions

• Whole loans

• B notes

• Mezzanine loans

• Bank loans

• Small business loans and leases

Ø Committed and experienced sponsor and management team

•12.6% ownership by management team and affiliates

•Long track record in creating public stockholder value

Ø Substantially match-funded through 5 structured credit vehicles

Ø Predominantly invests in senior secured loans in real estate and leveraged

corporate loans

corporate loans

Ø RSO has paid off all short-term debt

4

Ø All RSO Real Estate Portfolios and Corporate Lending Portfolios continue to pay all

classes according to their terms and are in compliance with OC and IC tests as of

3/31/2010

classes according to their terms and are in compliance with OC and IC tests as of

3/31/2010

– 2 real estate portfolios generated cash flow of $33.7 million in 2009

– 3 corporate loan portfolios generated cash flow of $20.6 million in 2009

Ø Solid Origination Capabilities

– Dedicated team of 12 real estate professionals bolstered by 35 additional professionals at

Resource Real Estate

Resource Real Estate

– Diversified corporate loan team of 18 professionals bolstered by 15 additional professionals

at Resource America

at Resource America

Well Positioned

Strong Management and Large Team that

Can Deliver Solutions

Can Deliver Solutions

5

Resource Capital

Corp.

Corp.

CORPORATE LENDING

TEAM

TEAM

REAL ESTATE TEAM

– Dedicated team of 12 professionals

bolstered by 35 additional

professionals at Resource Real

Estate

bolstered by 35 additional

professionals at Resource Real

Estate

– Management team has worked

together for over 10 years

together for over 10 years

– The team is experienced in investing

in periods of distress

in periods of distress

– The team has 18 professionals

bolstered by 15 additional professionals

at Resource America

bolstered by 15 additional professionals

at Resource America

– We believe that our corporate lending

team possesses one of the top

performing portfolios relative to similar

sized competitors

team possesses one of the top

performing portfolios relative to similar

sized competitors

– Have a team in the U.S. and in Europe

with their ear to the ground to capitalize

on potential investment opportunities

with their ear to the ground to capitalize

on potential investment opportunities

6

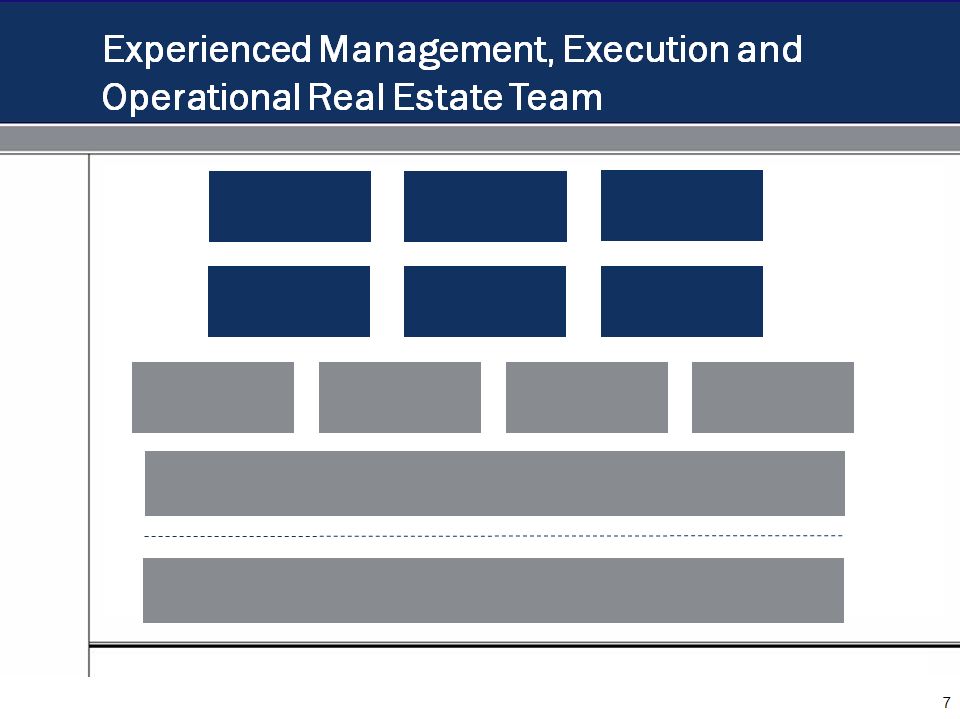

Jonathan Z. Cohen

President & CEO

Steven J. Kessler

Chairman, Resource

Capital Corp.

Capital Corp.

Joan Sapinsley

Managing Director Debt

Origination

Origination

10 Additional Professionals Dedicated to

Commercial Real Estate Lending

Commercial Real Estate Lending

35 Additional Professionals Dedicated

to Commercial Real Estate

Property Acquisitions and Asset Management

to Commercial Real Estate

Property Acquisitions and Asset Management

David Bloom

President, Resource Real

Estate

President, Resource Real

Estate

David Bryant

CFO, Resource Capital

Corp.

CFO, Resource Capital

Corp.

Kyle Geoghegan

Managing Director Debt

Origination

Managing Director Debt

Origination

Darryl Myrose

Managing Director Debt

Origination

Managing Director Debt

Origination

Alan F. Feldman

CEO, Resource Real

Estate

Estate

Jeffrey Brotman

Executive Vice President,

Resource America

Resource America

Yuriko Iwai

Vice President, Debt

Origination

Vice President, Debt

Origination

7

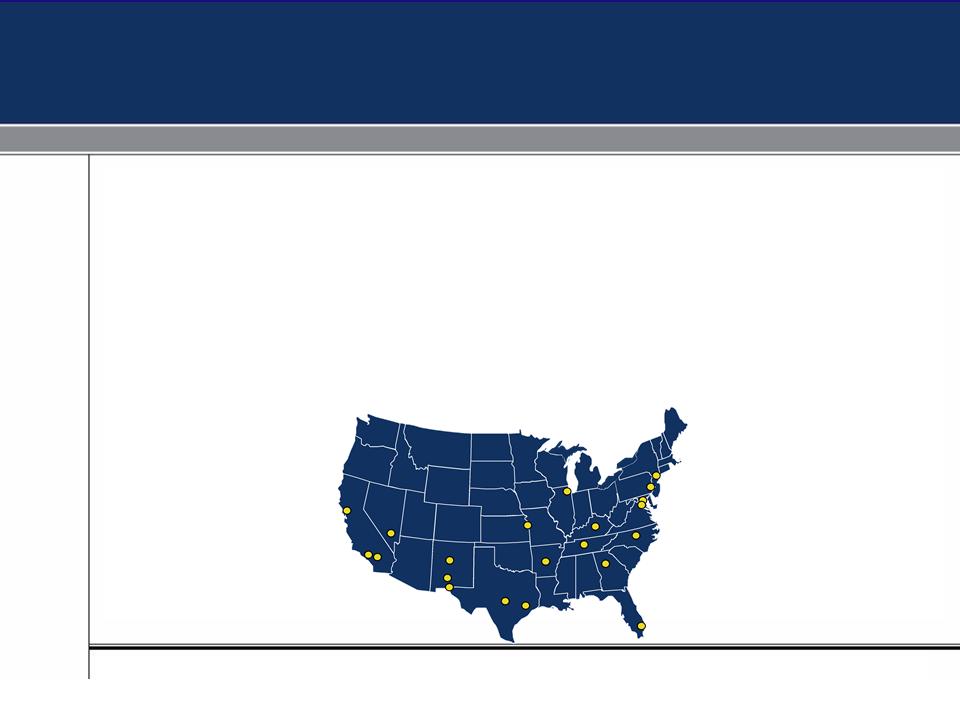

§ Resource Real Estate has a history dating back 1991 and has a track record of investing through market

cycles with investments in major urban areas throughout the United States

cycles with investments in major urban areas throughout the United States

§ Resource Real Estate has sourced and invested in over $5 billion of real estate opportunities

– Deep knowledge of major US markets and experience investing across the capital structure

§ Relationships with borrowers, middle-market contacts and high-end brokers

– Ability to customize solutions solidifies borrower relationships

– Established relationships have brought repeat and referral business to the platform

Established Real Estate History

Resource Real Estate Investments

8

Ø Real estate whole loans originated and underwritten by Manager

– Maximizes security and ability to control the asset

– Direct access to borrower

– Provides unique insight into ongoing credit quality

Ø Assets remain on RSO balance sheet

– Not dependent on secondary loan trading market

Direct Origination Differentiates

Dedicated and Experienced Bank Loan Team

in The U.S. and Europe

in The U.S. and Europe

9

Jonathan Z. Cohen

President & CEO

Gretchen Bergstresser

President, Senior PM

(U.S)

(U.S)

Fred Colen

Senior Analyst

6 Additional Professionals Dedicated to

The Bank Loan Team

The Bank Loan Team

Oscar Anderson

PM, Fund COO

PM, Fund COO

Vincent Ingato

PM

Phillip Raciti

Senior Analyst/Trader

Senior Analyst/Trader

Michele Dragonetti

Senior Analyst

Andrew Littell

Managing Director

Christopher Allen

Chief Operating Officer

Eric Ballantine

Senior Analyst

Senior Analyst

David Stanbrook

Senior Analyst

Rob Reynolds

Senior PM (Europe)

Justin Sughrue

Senior Analyst

10

Bank Loan Portfolio at 3/31/2010

Ø $869.0 million carrying value ($906.0 million amortized cost net of $11.9 million allowance

and $25.1 million unrealized MTM on loans and securities)

and $25.1 million unrealized MTM on loans and securities)

Ø Weighted average interest rate of bank loan portfolio LIBOR + 2.70% and weighted average

cost LIBOR + 0.47%, resulting in a net interest spread of 2.23%

cost LIBOR + 0.47%, resulting in a net interest spread of 2.23%

Ø Maturity dates ranging from March 2011 to August 2022

Ø Portfolio is diversified by collateral type and geography

Ø Reinvestment periods for Apidos I, Apidos III and Apidos Cinco continue through July

2011, June 2012 and May 2014, respectively

2011, June 2012 and May 2014, respectively

11

Benefits From Repurchase of Real Estate and

Corporate Loan Debt

Corporate Loan Debt

Recent Repurchases

Ø In FY 2010, RSO repurchased $46.9 million of its corporate notes for $29.7 million

– 37% discount to par

– $17.1 million gain

– Return of 58% on repurchase price(1)

Benefits

§ Reduces RSO liabilities and deleverages balance sheet

§ Increase GAAP and economic book value

(1) Calculated by dividing the $17.1 million realized gain by the repurchase price of $29.7 million

12

Summary Balance Sheet

Note: The Company has not adopted FAS 159 regarding its non-trading financial assets and liabilities.

($ in 000's) | 3/31/2010 Balance |

Cash and equivalents | $ 27,650 |

Restricted cash | 82,176 |

Investments | 82,883 |

Loans pledged as collateral | 1,555,593 |

Loans held for sale | 2,376 |

Other assets | 34,467 |

Total Assets | $ 1,785,145 |

CRE Debt | 567,293 |

Bank Loan Debt | 898,489 |

TRUPS | 51,548 |

Derivatives at Fair Value | 13,267 |

Other Liabilities | 14,901 |

Total Liabilities | $ 1,545,498 |

Equity | 239,647 |

13

Liquidity at 3/31/2010

Description | Amount (in Millions) |

Unrestricted cash balances | $27.6 |

Restricted cash available for investment 73.3 | |

Restricted cash in margin call and other accounts 8.9 | |

Subtotal restricted cash | 82.2 |

Total cash as of March 31, 2010 | $109.8 |

14

Economic Book Value at 3/31/2010

* In thousands except share data

Description | As of 3.31.10 |

Stockholders' equity - GAAP | 239,647 |

Add: | |

Unrealized losses - CMBS Portfolio | 46,869 |

Unrealized losses recognized in excess of value at risk - Interest Rate Swaps | 13,277 |

Unrealized net accretion of bank loans purchased at a discount | 32,845 |

Economic Book Value | 332,638 |

Shares outstanding as of March 31, 2010 | 40,079,753 |

Economic Book Value Per Share | $ 8.30 |

15

§ Balance sheet repositioned for economic climate

§ Portfolio that continues to perform through tough market conditions

§ Integrated commercial finance platform focused on origination of commercial mortgage

investments

investments

§ Experienced management team with a long track record in creating public stockholder value

RSO Has Consistently Delivered on Plan Since Inception

Why Resource Capital?

Resource Capital Corp.

May 2010