Exhibit 99.1

Resource Capital Corp.

JMP Conference Presentation

September 26, 2011

Safe Harbor

This presentation contains forward-looking statements that involve risks and uncertainties. These forward-looking statements are not historical facts but rather are based on

our current beliefs, assumptions and expectations. These beliefs, assumptions and expectations can change as a result of many possible events or factors, not all of which are

known to us or are within our control. If a change occurs, our business, financial condition, liquidity and results of operations may vary materially from those expressed in our

forward-looking statements. You should not place undue reliance on these forward-looking statements, which reflect our view only as of the date of this presentation.

our current beliefs, assumptions and expectations. These beliefs, assumptions and expectations can change as a result of many possible events or factors, not all of which are

known to us or are within our control. If a change occurs, our business, financial condition, liquidity and results of operations may vary materially from those expressed in our

forward-looking statements. You should not place undue reliance on these forward-looking statements, which reflect our view only as of the date of this presentation.

We use words such as “anticipate,” “expect,” “intend,” “plan,” “believe,” “seek,” “estimate,” and variations of these words and similar expressions to identify forward-looking

statements. Forward-looking statements are subject to various risks and uncertainties that could cause actual results to vary from our forward-looking statements, including:

§ changes in our industry, interest rates, the debt securities markets, real estate markets or the general economy;

§ increased rates of default and/or decreased recovery rates on our investments;

§ the performance and financial condition of our borrowers;

§ the cost and availability of our financings, which depends in part on our asset quality, the nature of our relationships with our lenders and other capital providers, our

business prospects and outlook and general market conditions;

business prospects and outlook and general market conditions;

§ the availability and attractiveness of terms of additional debt repurchases;

§ availability, terms and deployment of short-term and long-term capital;

§ availability of, and ability to retain, qualified personnel;

§ changes in our business strategy;

§ availability of investment opportunities in commercial real estate-related and commercial finance assets;

§ the resolution of our non-performing and sub-performing assets;

§ our ability to comply with financial covenants in our debt instruments;

§ the degree and nature of our competition;

§ the adequacy of our cash reserves and working capital;

§ the timing of cash flows, if any, from our investments;

§ unanticipated increases in financial and other costs, including a rise in interest rates;

§ our ability to maintain compliance with over-collateralization and interest coverage tests in our CDOs and/or CLOs;

§ our dependence on our Manager and ability to find a suitable replacement in a timely manner, or at all, if we or our Manager were to terminate the management

agreement;

agreement;

§ legislative and regulatory changes (including changes to laws governing the taxation of REITs or the exemptions from registration as an investment company);

§ environmental and/or safety requirements;

§ our ability to satisfy complex rules in order for us to qualify as a REIT, for federal income tax purposes and qualify for our exemption under the Investment Company

Act of 1940, as amended, and our ability and the ability of our subsidiaries to operate effectively within the limitations imposed by these rules; and

Act of 1940, as amended, and our ability and the ability of our subsidiaries to operate effectively within the limitations imposed by these rules; and

§ other factors discussed under Item IA. Risk Factors of our Annual Report on Form 10-K for the year ended December 31, 2010 and those factors that may be

contained in any subsequent filing we make with the Securities Exchange Commission.

contained in any subsequent filing we make with the Securities Exchange Commission.

We undertake no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as required

by law. In light of these risks and uncertainties, the forward-looking events and circumstances discussed in this presentation might not occur and actual results, performance or

achievement could differ materially from that anticipated or implied in the forward-looking statements.

by law. In light of these risks and uncertainties, the forward-looking events and circumstances discussed in this presentation might not occur and actual results, performance or

achievement could differ materially from that anticipated or implied in the forward-looking statements.

2

Business Overview

(1) Reflects share price of $5.55 as of September 22, 2011 and total shares outstanding as of August 3, 2011

(2) As of June 30, 2011

(3) This includes dividends declared for the September 30, 2011 quarter to be paid on October 27, 2011

Exchange / Ticker | NYSE: "RSO" | |

Business Structure | REIT | |

Market Capitalization(1) | $417.9 million | |

Investment Portfolio(2) | $2.0 billion | |

Cumulative cash dividends since inception (June ‘05)(3) | $8.47/share | |

External Manager | Resource America, Inc. (NASDAQ: "REXI") |

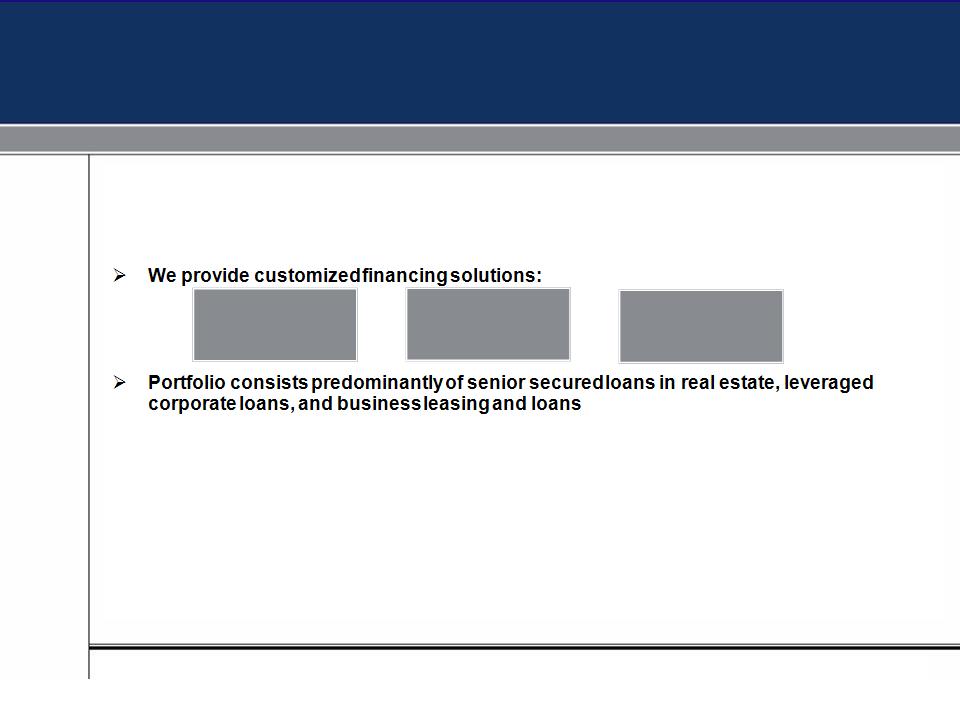

Ø RSO is a commercial finance business structured as a REIT with substantial focus on

commercial real estate mortgage investments as well as commercial loans and leases

commercial real estate mortgage investments as well as commercial loans and leases

Ø Approximately $2.0 billion in assets as of 6/30/2011

Ø Our Floating-rate assets (LIBOR based) provide protection against rising interest rates

Ø Committed and experienced sponsor and management team

Ø Approximately 8% ownership by management team and affiliates

Ø Assets are predominantly term-funded

Ø RSO had $217 million of cash as of July 29, 2011(1)

Resource Capital Corp. Overview

3

COMMERCIAL REAL

ESTATE LOANS

ESTATE LOANS

BANK LOANS

SMALL BUSINESS

LOANS AND LEASES

LOANS AND LEASES

(1) Includes restricted cash of approximately $189 million

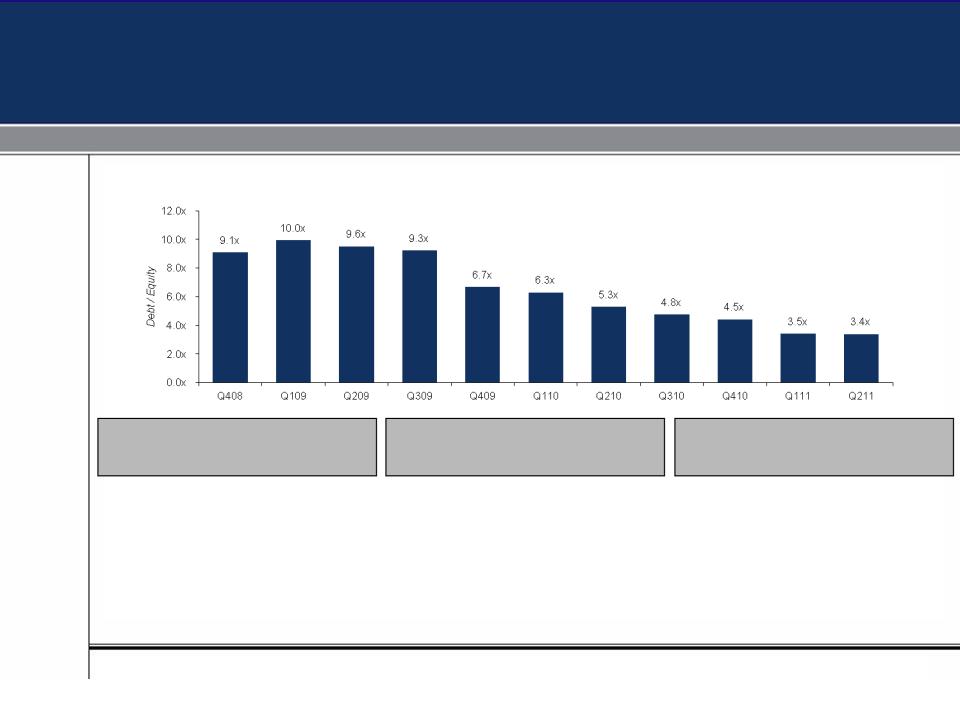

Ø Cleaned up balance sheet and brought leverage down from a high of 10.0x to 3.4x as of

June 30, 2011

June 30, 2011

Ø Maintained a cash dividend throughout the downturn and paid $5.48 in cash dividends

since June 2007

since June 2007

Ø Increased and diversified investments in real estate lending, corporate loans and CMBS

Ø Significantly decreased legacy portfolio

Ø Took advantage of the displaced market and bought discounted formerly AAA rated

CMBS bonds and bank loans and sold them for substantial profit

CMBS bonds and bank loans and sold them for substantial profit

Ø Opened a permanent CMBS financing facility

Ø Began investing in distressed real estate and have realized gains

RSO Highlights Since the Financial Crisis

4

5

Powerful and Established Core Platform

REAL ESTATE TEAM

CORPORATE LENDING &

COMMERCIAL FINANCE TEAMS

COMMERCIAL FINANCE TEAMS

Ø Dedicated team of 12 professionals led by Dave Bloom

bolstered by 35 additional professionals at Resource

Real Estate

bolstered by 35 additional professionals at Resource

Real Estate

Ø Management team has worked together for over 10

years - we still have the same team intact as before the

crisis

years - we still have the same team intact as before the

crisis

Ø We have our own origination team which maximizes our

ability to control the assets and monitor credit quality

ability to control the assets and monitor credit quality

Ø This team is experienced in investing in periods of

distress

distress

Ø The corporate loan team has 15 professionals led by

Gretchen Bergstresser bolstered by 15 additional

professionals at Resource America

Gretchen Bergstresser bolstered by 15 additional

professionals at Resource America

• All of the CLOs in RSO were nominated as

finalists for Best Performing CLO for 2005, 2006

and 2007 by Creditflux

finalists for Best Performing CLO for 2005, 2006

and 2007 by Creditflux

Ø Grew position in the commercial finance space via a

direct investment in the leasing platform of LEAF

Commercial Capital, Inc (LCC) a premier small ticket

equipment leasing and finance company

direct investment in the leasing platform of LEAF

Commercial Capital, Inc (LCC) a premier small ticket

equipment leasing and finance company

• LCC, a regular programmatic issuer in

securitization paper, was the #2 issuer in its

asset class in 2010 (1)

securitization paper, was the #2 issuer in its

asset class in 2010 (1)

(1) 2010 Year End Database Asset-Backed Alert - Harrison Scott Publications.

Business Segments

Commercial Real Estate | Leverage Loans | Other Credit Opportunities | ||||

Types of Assets | • Commercial Mortgages • Newer real estate assets that we originate • Downsizing our legacy portfolio • Whole loans, Mezzanine loans • CMBS | • Corporate Bank Loans covering a wide array of industries and ABS held to maturity • RCAM (Resource Capital Asset Management) | • Preferred equity stake in Leasing JV • Proprietary Structured Products | |||

Structure | 2 CRE CDOs & Warehouse Facility | 3 Bank Loan CLOs & Warehouse Facility | Taxable REIT Subsidiaries | |||

Equity Allocation | 66% | 21% | 13% | |||

Asset Breakdown ($2.0 billion) | 41% | 55% | 4% | |||

% of RSO Gross Interest Income | 32% | 51% | 17% | |||

% Net Interest Income | 25% | 57% | 18% | |||

Return on Equity | 12-15% | 18-22% | 10-35% |

6

7

Ø In the past 18 months the CMBS market re-emerged but then pulled back

dramatically

dramatically

§ Very few CMBS lenders currently quoting

§ Leverage amounts, pricing and terms have all changed with a much more conservative approach across the

board - 60-65% LTV and 11%+ in-place debt yields

board - 60-65% LTV and 11%+ in-place debt yields

§ Fixed rate lending on stabilized assets is returning, but the bid for floating rate transitional loans remains

scarce

scarce

Ø Lenders have retreated to their traditional core competencies

§ Wall Street conduits focused on 10 year fixed rate deals for stabilized properties

§ Commercial Banks focused on recourse lending for broader relationship purposes

§ Transitional bridge lenders, like RSO, making loans for value-add transactions to well capitalized proven

sponsors

sponsors

Ø Liquidity is returning to the subordinate loan market

§ RSO has taken advantage of this opportunity and has sold legacy, B-note and mezzanine loan positions at

favorable pricing

favorable pricing

§ The sale of these subordinate positions creates liquidity to make whole loans at wider spreads, favorable

terms and superior structure

terms and superior structure

Commercial Mortgage Market

8

Bridge Financing - Acquisition and Refinance

Ø RSO has recently closed or is closing 11 new loans that total approximately $132 million

at an average coupon of 7.83%

at an average coupon of 7.83%

Ø RSO has a full forward pipeline in excess of $500 million and is actively quoting

financing on the following terms:

financing on the following terms:

§ Loan size between $5 million and $25 million

§ Maximum 85% as-is Loan to Value

§ Minimum 1.10X Debt Service Coverage Ratio off of stressed in place net operating income

§ 7%-10% coupon floors (400 to 700 bps over a 3% LIBOR floor)

§ Impounds for Cap Ex and TI/LC reserves

§ One point Commitment Fee and one point Exit Fee

§ Two-year initial terms with three one-year extensions

§ Elements of recourse to the principals in select situations

Real Estate Loan Parameters

9

Ø Corporate credit fundamental picture is healthy

§ Default rates are low and are projected to stay low

§ Leverage multiples are staying intact

Ø New Issue CLO activity

§ Better performing managers can have access to the market again

§ Apidos priced a new $350 million cash flow CLO last week

Ø In Feb. 2011 a subsidiary of RSO purchased Churchill Pacific Asset Management (subsequently named RCAM) for $22.5 million

Ø Through RCAM, RSO receives senior, subordinated and the right to incentive fees related to the management of five CLOs

totaling approximately $1.9 billion in AUM.

totaling approximately $1.9 billion in AUM.

Corporate Loan Market and Portfolio

Comprised of (Amount in Thousands): | 6/30/2011 | ||

Principal/Face | Unamortized Discount | Carrying Value | |

Loans held in CLO’s* | 896,958 | (19,485) | 877,473 |

Loan allowances | (3,559) | ||

Loans, net of allowances | 873,914 | ||

Securities held in CLO’s (held to maturity) | 29,616 | ||

Net Bank Loan Portfolio | 903,530 | ||

* Also includes a loan of $850,000 that is held outside the CLOs | |||

Bank Loan Portfolio

10

RSO’s Targeted Investment in Specialty

Commercial Finance

Commercial Finance

Ø RSO invested $36 million in LEAF Commercial Capital (“LCC”), which operates

an equipment lease and note origination, servicing and financing business, in

preferred stock with a coupon of 10%.

an equipment lease and note origination, servicing and financing business, in

preferred stock with a coupon of 10%.

Ø In addition, RSO was issued warrants to purchase shares representing 48% of

LCC’s common stock.

LCC’s common stock.

Ø In connection with these transactions, LCC entered into a revolving securitized

equipment lease warehouse facility of $50 million.

equipment lease warehouse facility of $50 million.

Ø The lease warehouse facility may be increased to a total of $200 million of

which an additional $110 million has been committed.

which an additional $110 million has been committed.

Ø During FY 2010, RSO repurchased

$46.9 million of its corporate notes

at a 37% discount to par

$46.9 million of its corporate notes

at a 37% discount to par

Ø During FY 2011, RSO repurchased

$5.0 million of its corporate notes

at a 40% discount to par

$5.0 million of its corporate notes

at a 40% discount to par

11

Clean Balance Sheet

Leverage Since 12/31/08 |

CDO Compliance

Maturing Debt

Open Market Repurchases

Ø All RSO structured finance

vehicles continue to pay all

classes according to their terms

vehicles continue to pay all

classes according to their terms

Ø Compliant with OC and IC tests

as of 6/30/11

as of 6/30/11

Ø RSO has paid off all short-term

debt

debt

Ø Only debt outstanding is long-

dated funding through structured

finance vehicles and Trups

dated funding through structured

finance vehicles and Trups

Ø Maintained a cash dividend and paid $8.47 in dividends since inception in June 2005

Ø Powerful core platforms and established management teams in real estate, corporate

lending and commercial finance

lending and commercial finance

Ø Cleaned up balance sheet and brought leverage down from a high of 10.0x to 3.4x as of

June 30, 2011

June 30, 2011

Ø Our Floating-rate assets (LIBOR based) provide protection against rising interest rates

Ø Significantly decreased legacy portfolio

Ø Took advantage of the displaced market and bought deeply discounted bonds and bank

loans and sold them for substantial profit

loans and sold them for substantial profit

Ø Opened a permanent CMBS financing facility

Ø Began investing in distressed real estate and have realized gains

| * | This includes dividends declared for the September 30, 2011 quarter to paid on October 27, 2011 |

RSO Highlights

12