- ACR Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

8-K Filing

ACRES Commercial Realty (ACR) 8-KRegulation FD Disclosure

Filed: 21 Mar 06, 12:00am

Exhibit 99.1

Resource America, Inc.

(NASDAQ: REXI)

and

Resource Capital Corp

(NYSE: RSO)

Piper Jaffray

2006 Financial Services Conference

Safe Harbor

WHEN USED IN THIS CONFERENCE, THE WORDS “BELIEVES”,

“ANTICIPATES”, “EXPECTS” AND SIMILAR EXPRESSIONS ARE

INTENDED TO IDENTIFY FORWARD LOOKING STATEMENTS.

SUCH STATEMENTS ARE SUBJECT TO CERTAIN RISKS AND

UNCERTAINTIES, WHICH COULD CAUSE ACTUAL RESULTS TO DIFFER

MATERIALLY.

THE RISKS AND UNCERTAINTIES ARE DISCUSSED IN OUR 2004

ANNUAL REPORT ON FORM 10-K; PARTICULARLY THE SECTION TITLED

RISK FACTORS. LISTENERS ARE CAUTIONED NOT TO PLACE UNDUE

RELIANCE ON THESE FORWARD LOOKING STATEMENTS, WHICH

SPEAK ONLY AS OF THE DATE HEREOF.

THE COMPANY UNDERTAKES NO OBLIGATION TO UPDATE ANY OF

THESE FORWARD LOOKING STATEMENTS OR TO PUBLICLY RELEASE

THE RESULTS OF ANY REVISIONS TO FORWARD LOOKING

STATEMENTS, WHICH MAY BE MADE TO REFLECT EVENTS OR

CIRCUMSTANCES AFTER THE DATE HEREOF OR TO REFLECT THE

OCCURRENCE OF UNANTICIPATED EVENTS.

RESOURCE AMERICA, INC.

(NASDAQ: REXI)

Resource America is a specialized asset

management company that uses industry

specific expertise to generate and

administer investment opportunities for its

own account and for outside investors in

the financial fund management, real estate

and equipment leasing sectors.

Resource America, Inc.

Resource America, Inc.

____________________________________

(1)

As of March 17, 2006.

(2)

Approximate amount as of February 28, 2006.

(3)

Includes CDOs closed in March 2006.

Public Offering:

1996

Market Capitalization: (1)

$340 million

Assets Under Management: (2)

$9.3 billion

Number of CDOs / Assets Managed: (3)

15 / $6.35 billion

Number of Equity Partnerships/

22 /

Equity Under Management (1)

$290 million

Resource Capital Corp. Assets Managed: (2)

$1.9 billion

Investment professionals: (2)

62

Continuing a Transformation

Resource America is transforming itself from a

Company managing assets for its own account to a

specialized asset manager.

Completed the spin-off of Atlas America in June 2005.

Selling low yielding legacy real estate.

Purchased 765,146 shares (4.3% of outstanding) since July

2005 for $13.5 million.

Building asset managers

Apidos, Ischus, Trapeza, LEAF, Resource Real Estate

Leverage success of multi-product asset management.

Private equity

Private REIT

Hedge fund

Resource Capital Corp.

Core competencies

Financial Institutions – 9 CDOs / Private Equity

Asset-Backed Securities – 4 CDOs / Agency Portfolio

Syndicated Loans – 3 CLOs *

Real Estate – Legacy assets / 5 private limited partnerships / 3 investment offerings / Commercial Real Estate

Debt – Resource Capital Corp

Scalable, fee-based model

Generating investment opportunities for its own account

and third party investors

Existing teams in place / marginal costs to add assets under management

Unique capital raising channels

Approximately $430 million of equity raised for new products in CY 2005

Broker dealer network / CDO investor network / high net worth individuals / institutions

Exceptional asset origination capabilities

Approximately $4.0 billion originated in CY 2005.

Direct origination / Indirect origination / channel origination

Resource America, Inc.

* Includes a $280 million CLO currently in the marketing stage

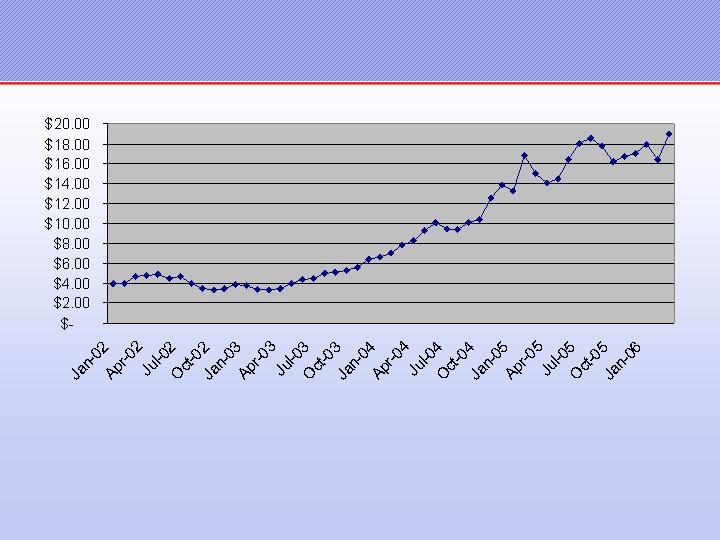

Experience Creating Value

for Shareholders *

* Adjusted for spin-off of Atlas America

Share Price Including

Performance of Atlas America *

* Assumes a REXI shareholder received .59 shares of ATLS on June 30, 2005

* Excludes Atlas America, Inc.’s assets under management.

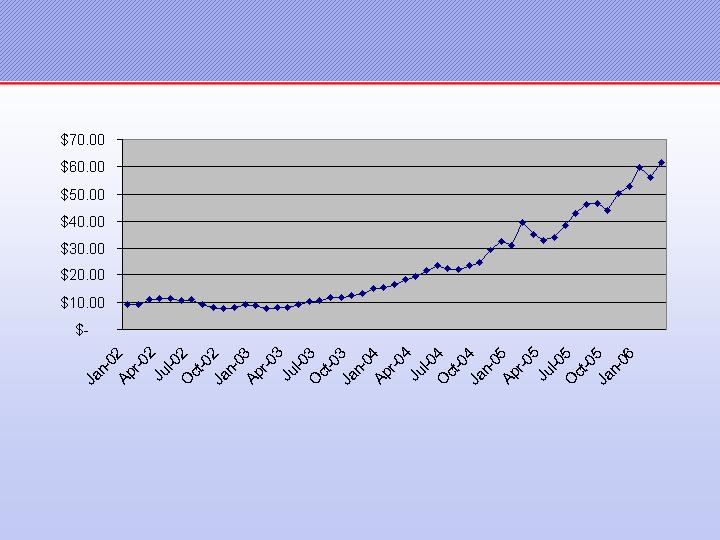

Pro Forma* Assets

Under Management

* Excludes Atlas America, Inc.’s revenue.

Pro Forma* Revenue

* Excludes Atlas America, Inc.’s operating income.

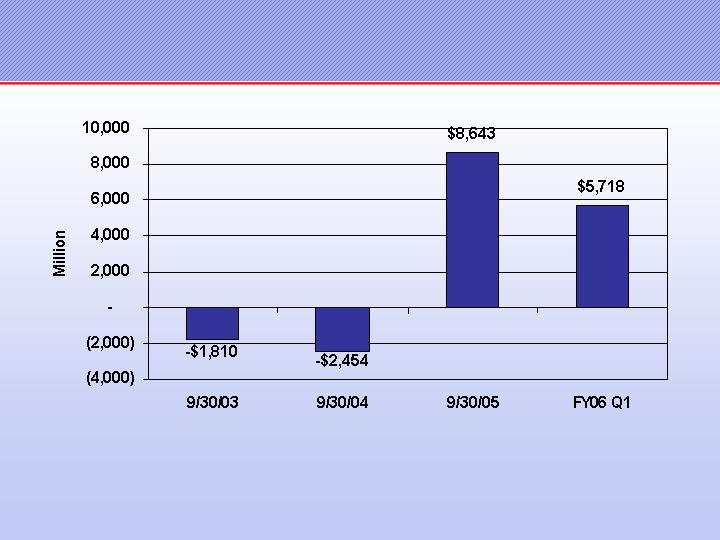

Pro Forma* Operating Income (Loss)

* Excludes Atlas America, Inc.’s income from continuing operations.

Pro Forma* Income (Loss)

from Continuing Operations

LEAF Financial

Originates and manages small-ticket equipment leasing assets

Originates leases by forming strategic marketing alliances with a broad

range of equipment vendors

Assets under management: $463 million

Resource Real Estate

Acquires and manages real estate assets

Utilizes a targeted multifamily acquisition strategy leveraging deep

relationships in the industry across the United States

Assets under management: $685 million*

Resource Financial Fund Management

Originates and manages assets for CDOs, such as Trust Preferred

Securities, Asset Backed Securities and Leveraged Loans

Leverages relationships with financial institutions, regional investment

banks and others in the space

Assets under management: $8.2 billion

Exclusive Asset

Origination Networks

* Includes $277 million managed through funds, $237 million from legacy portfolio and $171 million managed for RCC.

Balance Sheet Overview

17,856

17,856

Outstanding shares

$ 10.60

$ 10.60

Book value per share

Low

Yielding

189,298

189,298

Pro Forma Stockholders’ Equity

34,167

34,167

Other net assets

15,000

15,000

Investment in RCC

11,876

11,876

Net leasing assets

11,079

11,079

Investment in CDOs

48,402

70,732

Real estate loans & ventures

68,774

46,444

Total net current assets

3,647

3,647

Other net current assets

$ 65,127

$ 42,757

Cash

Pro Forma

For Asset Sales

Actual

December 31, 2005

History of creating value in areas of core competence

Extensive capability creating investment opportunities

By originating income-producing long-term assets

Demonstrated success raising capital through exclusive channels

Fee business with contractual long-term revenue streams

Continued transformation to specialized asset

management

Summary

RESOURCE CAPITAL CORP

(NYSE: RSO)

Resource Capital Corp.

Resource Capital Corp. is a specialty

finance company that intends to qualify

and will elect to be taxed as a real estate

investment trust. Our investment strategy

focuses on real estate-related assets and,

to a lesser extent, higher-yielding

commercial finance assets.

Resource Capital Corp.

(1) As of March 17, 2006

144A Offering – March 2005:

$214.8 million

Initial Public Offering – February 2006

$27.6 million

Market Capitalization (1)

$256.2 million

Investment Portfolio

$1.9 billion

Externally managed by a subsidiary of Resource America, Inc.

Dividends Declared – 3/8/05 – 12/31/05

$0.86 per share

1st Quarter 2006 Dividend

$0.33 per share

Investment Management

Integration of Financial and Commercial Real

Estate Lending Platforms

Disciplined Credit Culture With Proven Results

Avoidance of Interest Rate Risk

Ability to Generate Transactions through Internal

Network

Flexibility in Adapting to Changing Economic

Environments

In a Challenging Market Environment, RCC Has

Consistently Delivered on Plan Since Inception

Experienced Management Team with Long

Track Record of Public Company Value

Creation

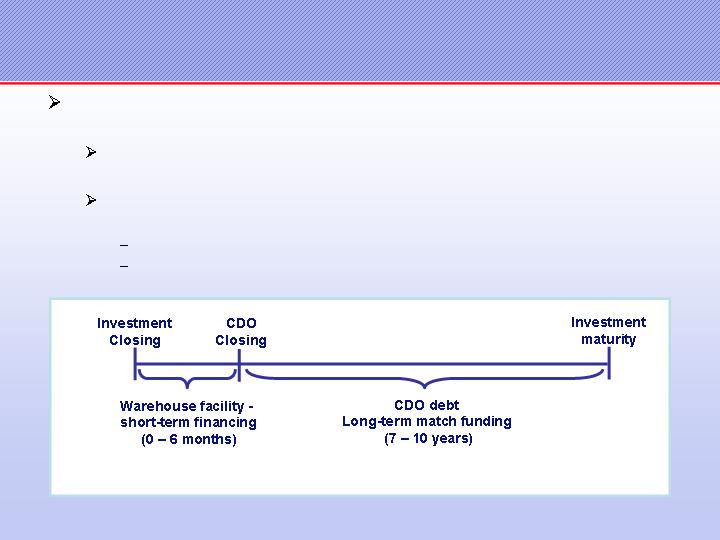

Asset-Liability Management

RCC actively manages the interest rate and mark-to-market risk

associated with its investments

Agency portfolio is financed through repurchase agreements and hedged

with $736 million of interest rate swaps

Non-agency RMBS, Commercial Real Estate-Related Assets, and

Syndicated Bank Loans are match-funded via permanent CDO funding

Closed 2 CDOs in 2005 to finance $750 million of MBS and Bank Loans

2 CDOs currently planned to finance approximate $650 million of commercial

real estate loans and bank loans

Equity Allocation

Equity Allocation - Current

Equity Allocation - Target

Target Investment Profile

Current equity investment portfolio of approximately $700 million

More than 6,000 apartment units

1.6 million sq. ft. of commercial space

Current commercial real estate debt portfolio of $205 million

and commitments for another $100+ million

Loan

Criteria

$5-30 million per commitment

B notes - 60-80% LTV

Mezzanine Loans - 70-85% LTV

Typically 3-5 year term

Floating rate, LIBOR-indexed

Newly originated

Collateral

Type

National, with focus on underserved markets

Multifamily / Condominium

Office

Retail

Hospitality

Industrial

Borrower

Strong balance sheet

Meaningful equity in transaction

Strong management team

Experienced in

industry/market

Commercial Real Estate

Case Study: 1821 Directors Blvd.

Overview:

$7 MM B Note Participation

Austin, TX is a strategic target

market for RRE equity fund

business

Well located property in a dynamic

and growing submarket

Highlights:

Existing relationship with borrower

Acquisition financing with substantial new

equity in deal

Fully leased to an investment grade

tenant

Controlling rights within 1st mortgage

RCC Real Estate Team

As in its other businesses, Resource America has developed a strong team with

extensive experience in the commercial real estate sector:

Edward E. Cohen

Chairman

Jonathan Z. Cohen

President & CEO

David E. Bloom

President,

Resource Real

Estate

Former SVP of Colony

Capital

Former Director of

Sonnenblick-Goldman

Steven J. Kessler

CFO

John R. Boyt

VP, Director of Loan

Originations

Resource America

Senior Management

Resource Real

Estate Funding

Formerly with Bear,

Stearns

and Bankers Trust

6 Additional Professionals Dedicated to

Commercial Real Estate Lending

Resource Real

Estate

16 Additional Professionals Dedicated

to Commercial Real Estate

Property Acquisitions and Asset Management

Investment Highlights

Integration of Financial and Commercial Real Estate

Lending Platforms

Disciplined Credit Culture With Proven Results

Active Management of Interest Rate Risk

Ability to Internally Generate Transactions

Flexibility in Adapting to Changing Economic

Environments

In a Challenging Market Environment, RCC Has

Consistently Delivered on Plan Since Inception

Experienced Management Team with Long Track

Record of Public Company Value Creation