March 2019 Investor Presentation

This presentation contains forward-looking statements within the meaning of federal securities laws. These forward-looking statements are not historical facts but rather are based on our current beliefs, assumptions and expectations. These beliefs, assumptions and expectations can change as a result of many possible events or factors, not all of which are known to us or are within our control. If a change occurs, our business, financial condition, liquidity and results of operations may vary materially from those expressed in our forward-looking statements. You should not place undue reliance on these forward-looking statements, which reflect our view only as of the date of this presentation. We use words such as “anticipate,” “expect,” “intend,” “plan,” “believe,” “seek,” “estimate,” “target,” and variations of these words and similar expressions to identify forward-looking statements. Forward-looking statements are subject to various risks and uncertainties that could cause actual results to vary from our forward-looking statements, including, but not limited to: Forward Looking Statements and Other Disclosures changes in our industry, interest rates, the debt securities markets, real estate markets or the general economy; increased rates of default and/or decreased recovery rates on our investments; the performance and financial condition of our borrowers; the cost and availability of our financings, which depends in part on our asset quality, the nature of our relationships with our lenders and other capital providers, our business prospects and outlook and general market conditions; the availability and attractiveness of terms of additional debt repurchases; availability, terms and deployment of short-term and long-term capital; availability of, and ability to retain, qualified personnel; changes in our business strategy; availability of investment opportunities in commercial real estate-related and commercial finance assets; the degree and nature of our competition; the resolution of our non-performing and sub-performing assets; our ability to comply with financial covenants in our debt instruments; the adequacy of our cash reserves and working capital; We undertake no obligation, and specifically disclaim any obligation, to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as required by law. In light of these risks and uncertainties, the forward-looking events and circumstances discussed in this presentation might not occur and actual results, performance or achievement could differ materially from those anticipated or implied in the forward-looking statements. the timing of cash flows, if any, from our investments; unanticipated increases in financial and other costs, including a rise in interest rates; our ability to maintain compliance with over-collateralization and interest coverage tests in our CDOs and/or CLOs; our dependence on Exantas Capital Manager Inc. (f/k/a Resource Capital Manager, Inc.), our “Manager”, and ability to find a suitable replacement in a timely manner, or at all, if we or our Manager were to terminate the management agreement; environmental and/or safety requirements; our ability to satisfy complex rules in order for us to qualify as a REIT, for federal income tax purposes and qualify for our exemption under the Investment Company Act of 1940, as amended, and our ability and the ability of our subsidiaries to operate effectively within the limitations imposed by these rules; legislative and regulatory changes (including changes to laws governing the taxation of REITs or the exemptions from registration as an investment company); and other factors discussed under Item IA. Risk Factors in our Annual Report on Form 10-K for the year ended December 31, 2018 and those factors that may be contained in any subsequent filing we make with the Securities and Exchange Commission. i

Past performance is not indicative of future results. There is no guarantee that any investment strategy referenced herein will work under all market conditions. Prior to making any investment decision, you should evaluate your ability to invest for the long-term, especially during periods of downturns in the market. You alone assume the responsibility of evaluating the merits and risks associated with any potential investment or investment strategy referenced herein. This presentation contains information regarding financial results that is calculated and presented on the basis of methodologies other than in accordance with accounting principles generally accepted in the United States (“GAAP”), which management believes is relevant to assessing the company’s financial performance. Please refer to page 30 for the reconciliation of Net Income (Loss) to Core Earnings. Unless otherwise indicated, information included in this presentation is as of or for the period ended December 31, 2018. Core Earnings Core earnings is a non-GAAP financial measure that we use to evaluate our operating performance and we believe is useful to analysts, investors and other parties in the evaluations of REITs. Core Earnings exclude the effects of certain transactions and accounting principles generally accepted in the United States of America (“GAAP”), adjustments that we believe are not necessarily indicative of our current CRE loan portfolio and other CRE-related investments and operations. Core Earnings exclude income (loss) from all non-core assets such as commercial finance, middle market lending, residential mortgage lending, certain legacy CRE loans and other non-CRE assets designated as assets held for sale at the initial measurement date. Core Earnings, for reporting purposes, is defined as GAAP net income (loss) allocable to common shareholders, excluding (i) non-cash equity compensation expense, (ii) unrealized gains and losses, (iii) non-cash provisions for loan losses, (iv) non-cash impairments on securities, (v) non-cash amortization of discounts or premiums associated with borrowings, (vi) net income or loss from a limited partnership interest owned at the initial measurement date, (vii) net income or loss from non-core assets, (viii) real estate depreciation and amortization, (ix) foreign currency gains or losses and (x) income or loss from discontinued operations. Core Earnings may also be adjusted periodically to exclude certain one-time events pursuant to changes in GAAP and certain non-cash items. Pursuant to the Third Amended and Restated Management Agreement, we calculate incentive compensation using Core Earnings excluding incentive fees payable to the Manager beginning with the three months ended December 31, 2017. For reporting purposes, beginning with the three months and year ended December 31, 2017, we include incentive fees payable to the Manager in Core Earnings. No Offer or Sale of Securities This presentation is for informational purposes only and does not constitute an offer to sell or the solicitation of any offer to buy any securities of Exantas Capital Corp. (“XAN”) or any other entity. Any offering of securities would be made pursuant to separate documentation and any such securities would not be offered or sold in the United States absent registration or an applicable exemption from registration requirements. Hypothetical Performance Hypothetical performance results presented herein are for illustrative purposes only and should not be interpreted as an indication of future performance. Hypothetical performance results have many inherent limitations, some of which, but not all, are described herein. No representation is being made that any fund or account will or is likely to achieve profits or losses similar to those shown herein. In fact, there are frequently sharp differences between hypothetical performance results and the actual results subsequently realized by any particular investment program. One of the limitations of hypothetical performance results is that they are generally prepared with the benefit of hindsight. In addition, hypothetical investing does not involve financial risk, and no hypothetical track record can completely account for the impact of financial risk in investing. For example, the ability to withstand losses or adhere to a particular investment program in spite of losses are material points which can adversely affect actual investment results. The hypothetical performance results contained herein represent the application of the models as currently in effect, and there can be no assurance that the models or portfolio constituents will remain the same in the future or that an application of the current models in the future will produce similar results because the relevant market and economic conditions that prevailed during the hypothetical performance period will not necessarily recur. There are numerous other factors related to the markets in general or to the implementation of any specific investment program which cannot be fully accounted for in the preparation of hypothetical performance results, all of which can adversely affect actual investment results. Historical data and analysis should not be taken as an indication or guarantee of any future performance. Forward Looking Statements and Other Disclosures ii

Exantas Capital Corp. Overview CRE Credit Expertise Extensive multicycle investment expertise. Access to C-III’s differentiated data and local contacts. Ability to source and underwrite in non-primary markets. Sponsor Experience Extensive multi-cycle track record. Full scale platform. Management continuity. Focused Investment Strategy Self-originated CRE loans. Longer duration commercial real estate credit investments. CRE credit focused REIT NYSE: XAN Externally managed by C-III Capital Partners (“C-III”)1 Headquarters: New York, NY Rejuvenated Business Plan CRE credit focused. Improved cost of capital. Divested non-core businesses and assets. XAN is externally managed by Exantas Capital Manager Inc., an indirect wholly-owned subsidiary of C-III. 1

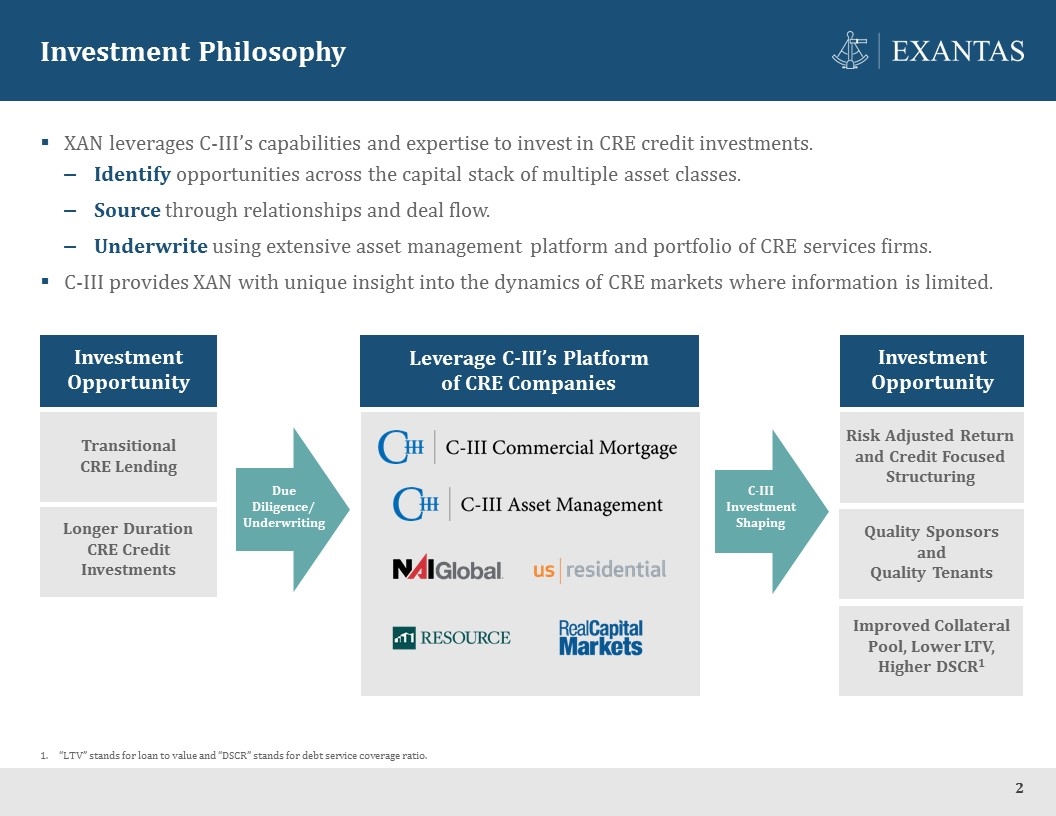

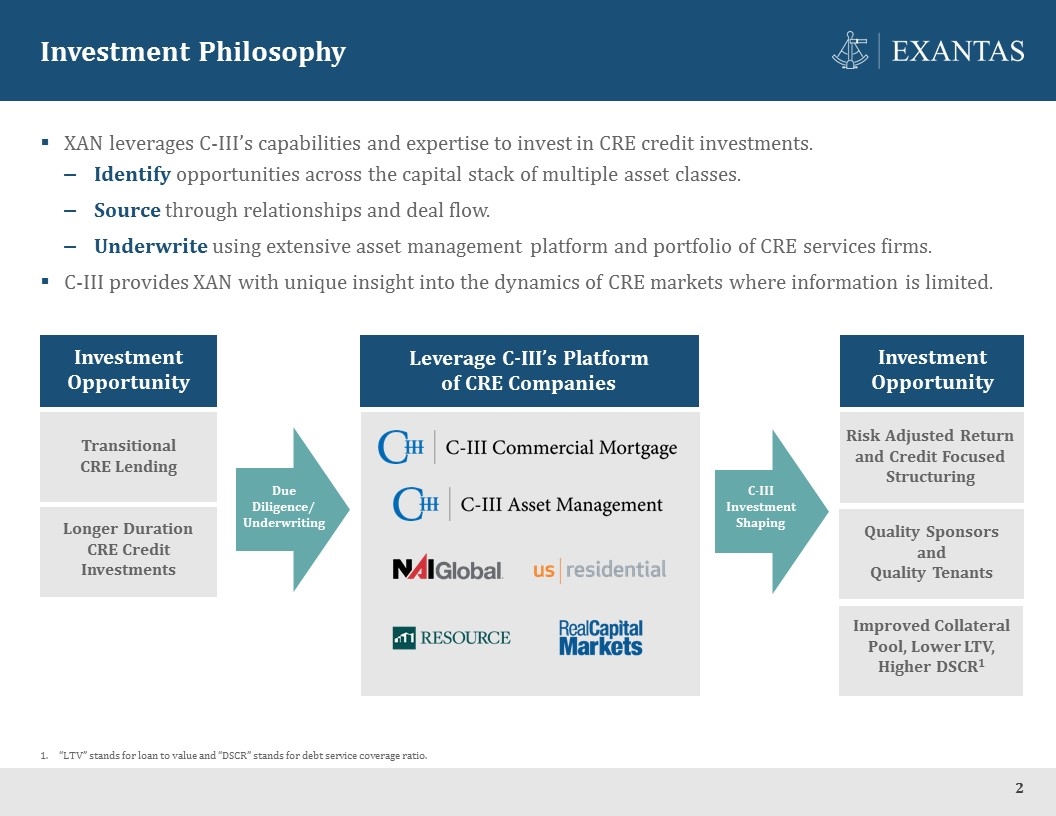

Investment Philosophy XAN leverages C-III’s capabilities and expertise to invest in CRE credit investments. Identify opportunities across the capital stack of multiple asset classes. Source through relationships and deal flow. Underwrite using extensive asset management platform and portfolio of CRE services firms. C-III provides XAN with unique insight into the dynamics of CRE markets where information is limited. Investment Opportunity Resulting Investment Transitional CRE Lending Longer Duration CRE Credit Investments Risk Adjusted Return and Credit Focused Structuring Quality Sponsors and Quality Tenants Due Diligence/ Underwriting C-III Investment Shaping Improved Collateral Pool, Lower LTV, Higher DSCR1 “LTV” stands for loan to value and “DSCR” stands for debt service coverage ratio. Investment Opportunity Leverage C-III’s Platform of CRE Companies 2

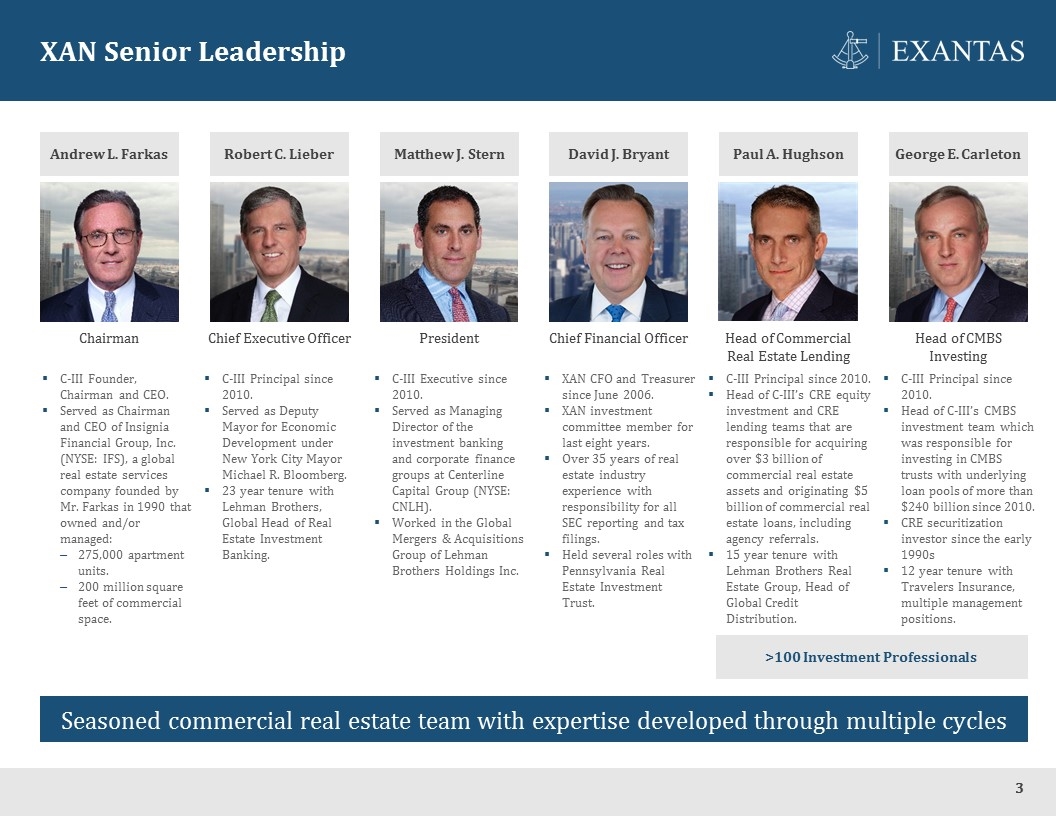

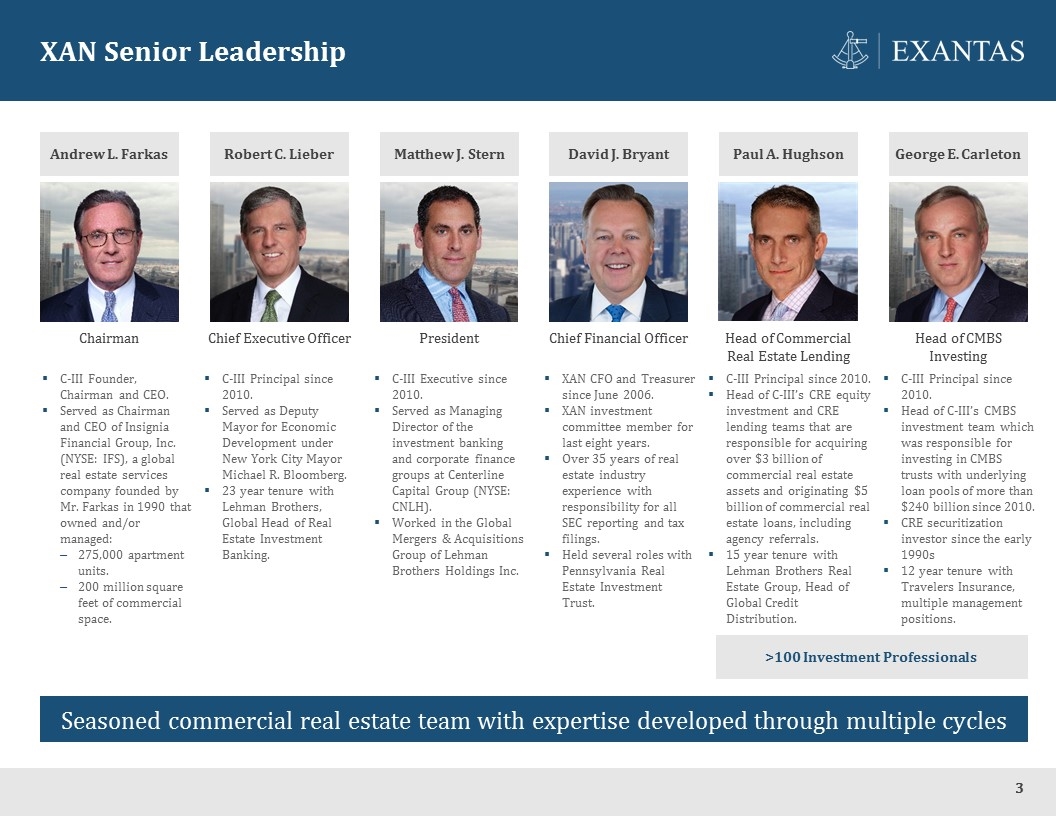

XAN Senior Leadership Andrew L. Farkas Robert C. Lieber Matthew J. Stern David J. Bryant Paul A. Hughson George E. Carleton Chairman Chief Executive Officer President Chief Financial Officer Head of Commercial Real Estate Lending Head of CMBS Investing C-III Founder, Chairman and CEO. Served as Chairman and CEO of Insignia Financial Group, Inc. (NYSE: IFS), a global real estate services company founded by Mr. Farkas in 1990 that owned and/or managed: 275,000 apartment units. 200 million square feet of commercial space. C-III Principal since 2010. Served as Deputy Mayor for Economic Development under New York City Mayor Michael R. Bloomberg. 23 year tenure with Lehman Brothers, Global Head of Real Estate Investment Banking. C-III Executive since 2010. Served as Managing Director of the investment banking and corporate finance groups at Centerline Capital Group (NYSE: CNLH). Worked in the Global Mergers & Acquisitions Group of Lehman Brothers Holdings Inc. XAN CFO and Treasurer since June 2006. XAN investment committee member for last eight years. Over 35 years of real estate industry experience with responsibility for all SEC reporting and tax filings. Held several roles with Pennsylvania Real Estate Investment Trust. C-III Principal since 2010. Head of C-III’s CRE equity investment and CRE lending teams that are responsible for acquiring over $3 billion of commercial real estate assets and originating $5 billion of commercial real estate loans, including agency referrals. 15 year tenure with Lehman Brothers Real Estate Group, Head of Global Credit Distribution. C-III Principal since 2010. Head of C-III’s CMBS investment team which was responsible for investing in CMBS trusts with underlying loan pools of more than $240 billion since 2010. CRE securitization investor since the early 1990s 12 year tenure with Travelers Insurance, multiple management positions. Seasoned commercial real estate team with expertise developed through multiple cycles >100 Investment Professionals 3

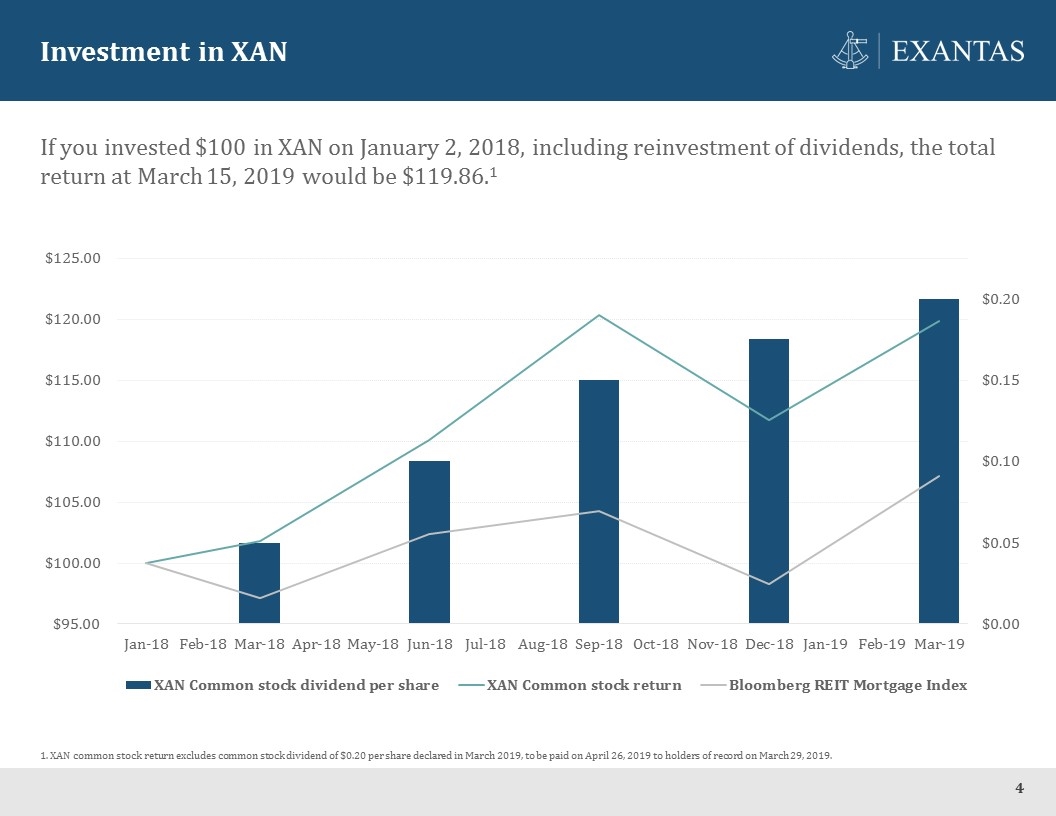

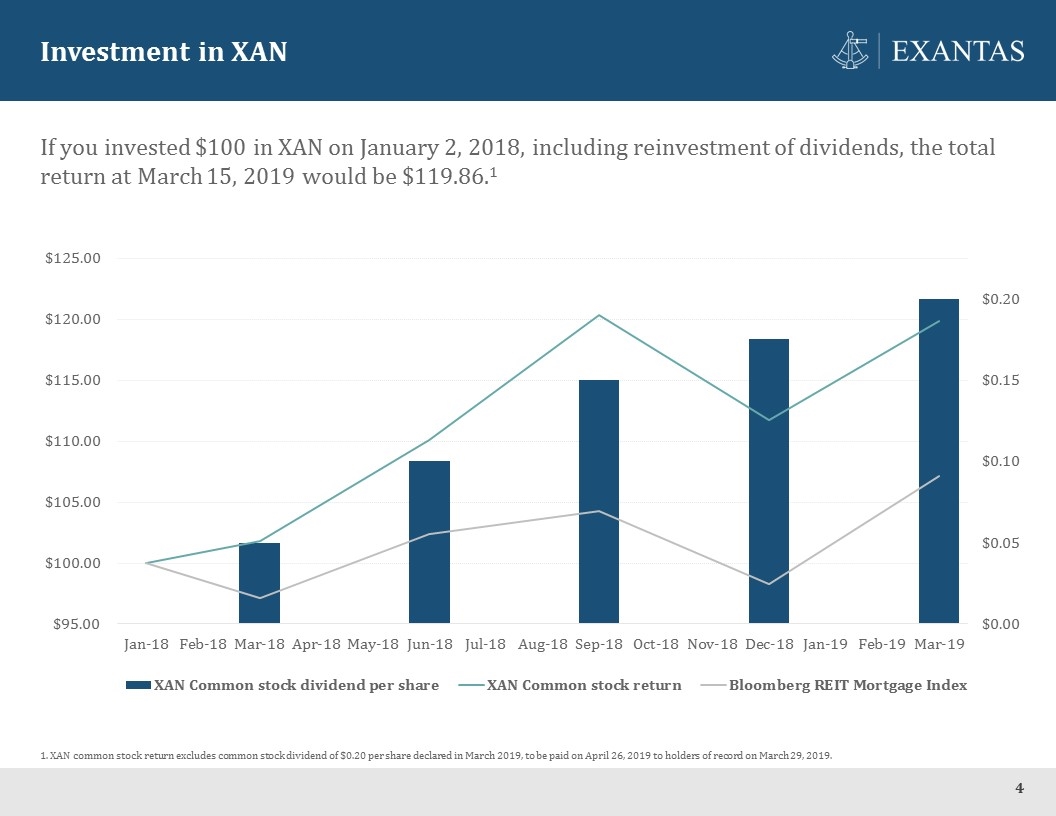

Investment in XAN 1. XAN common stock return excludes common stock dividend of $0.20 per share declared in March 2019, to be paid on April 26, 2019 to holders of record on March 29, 2019. If you invested $100 in XAN on January 2, 2018, including reinvestment of dividends, the total return at March 15, 2019 would be $119.86.1 4

Manager Overview 5

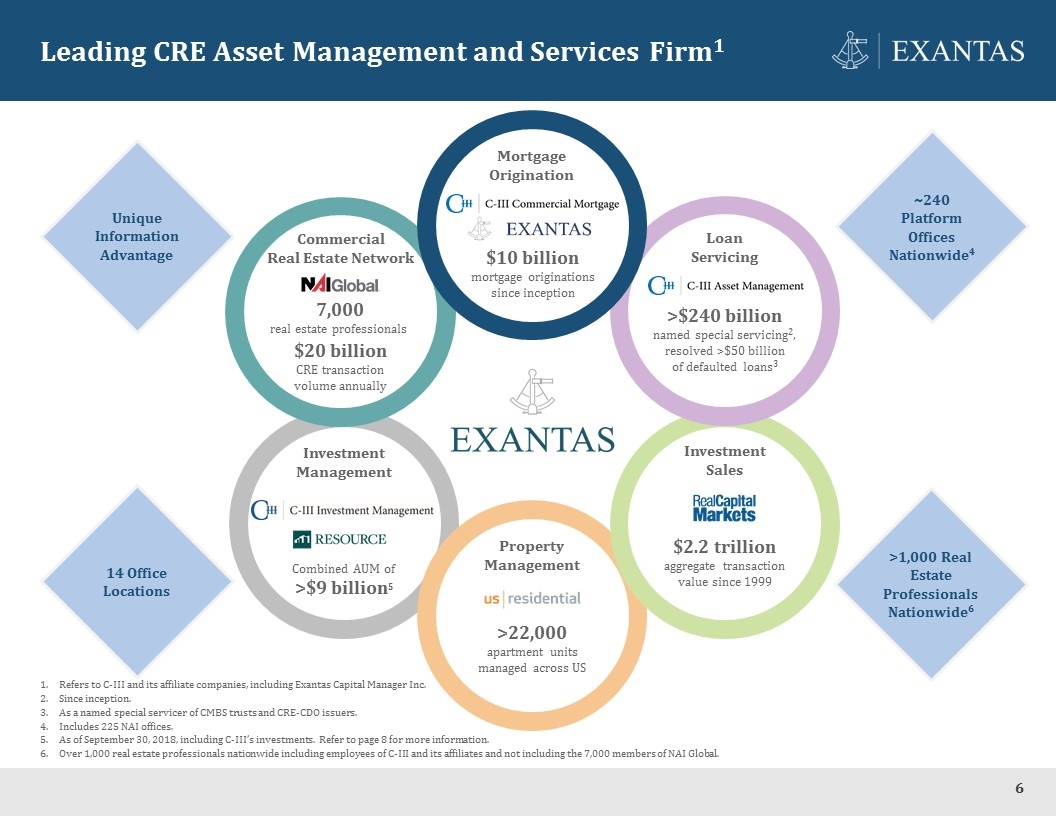

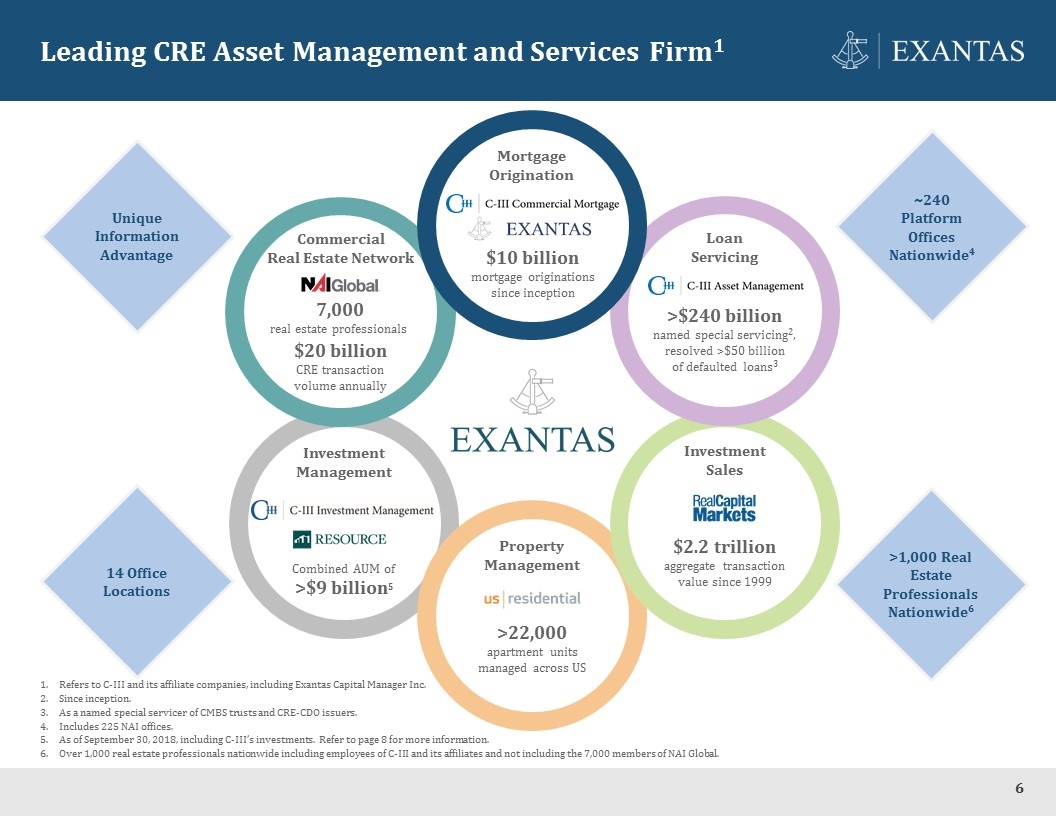

Leading CRE Asset Management and Services Firm1 Refers to C-III and its affiliate companies, including Exantas Capital Manager Inc. Since inception. As a named special servicer of CMBS trusts and CRE-CDO issuers. Includes 225 NAI offices. As of September 30, 2018, including C-III’s investments. Refer to page 8 for more information. Over 1,000 real estate professionals nationwide including employees of C-III and its affiliates and not including the 7,000 members of NAI Global. Unique Information Advantage 14 Office Locations ~240 Platform Offices Nationwide4 Investment Management Combined AUM of >$9 billion5 Property Management >22,000 apartment units managed across US Commercial Real Estate Network 7,000 real estate professionals $20 billion CRE transaction volume annually Investment Sales $2.2 trillion aggregate transaction value since 1999 Loan Servicing >$240 billion named special servicing2, resolved >$50 billion of defaulted loans3 Mortgage Origination $10 billion mortgage originations since inception >1,000 Real Estate Professionals Nationwide6 6

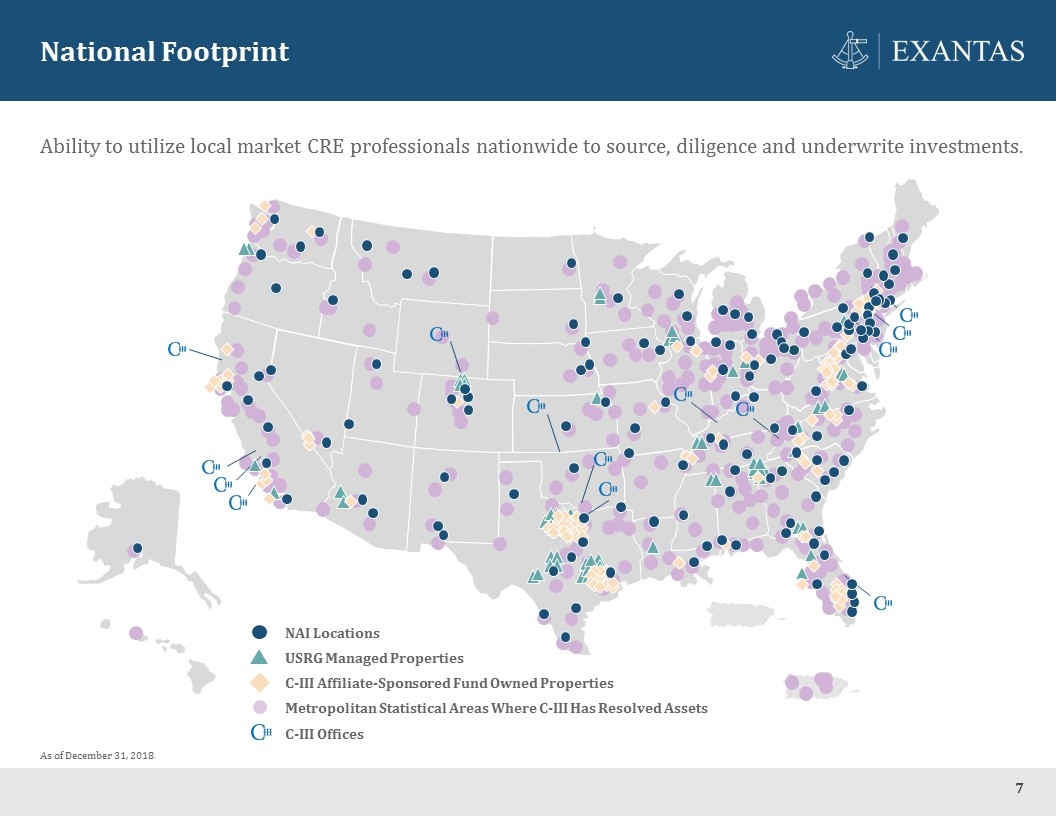

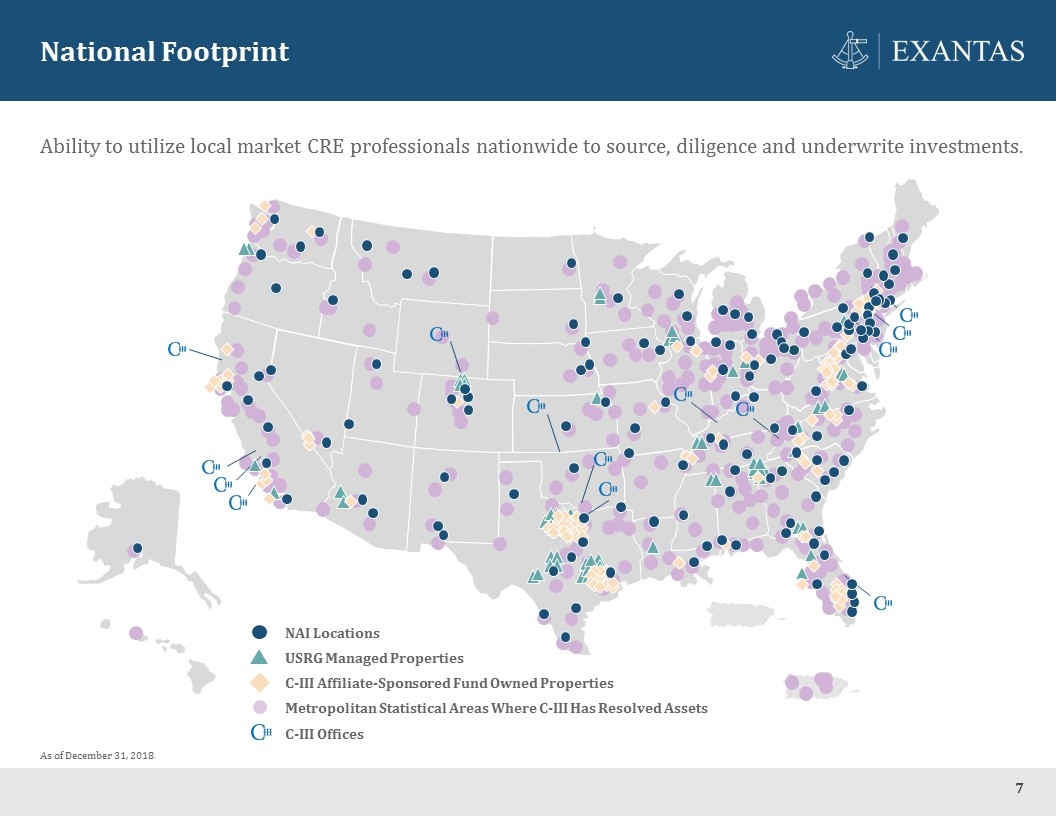

National Footprint Ability to utilize local market CRE professionals nationwide to source, diligence and underwrite investments. As of December 31, 2018. NAI Locations USRG Managed Properties Metropolitan Statistical Areas Where C-III Has Resolved Assets C-III Offices C-III Affiliate-Sponsored Fund Owned Properties 7

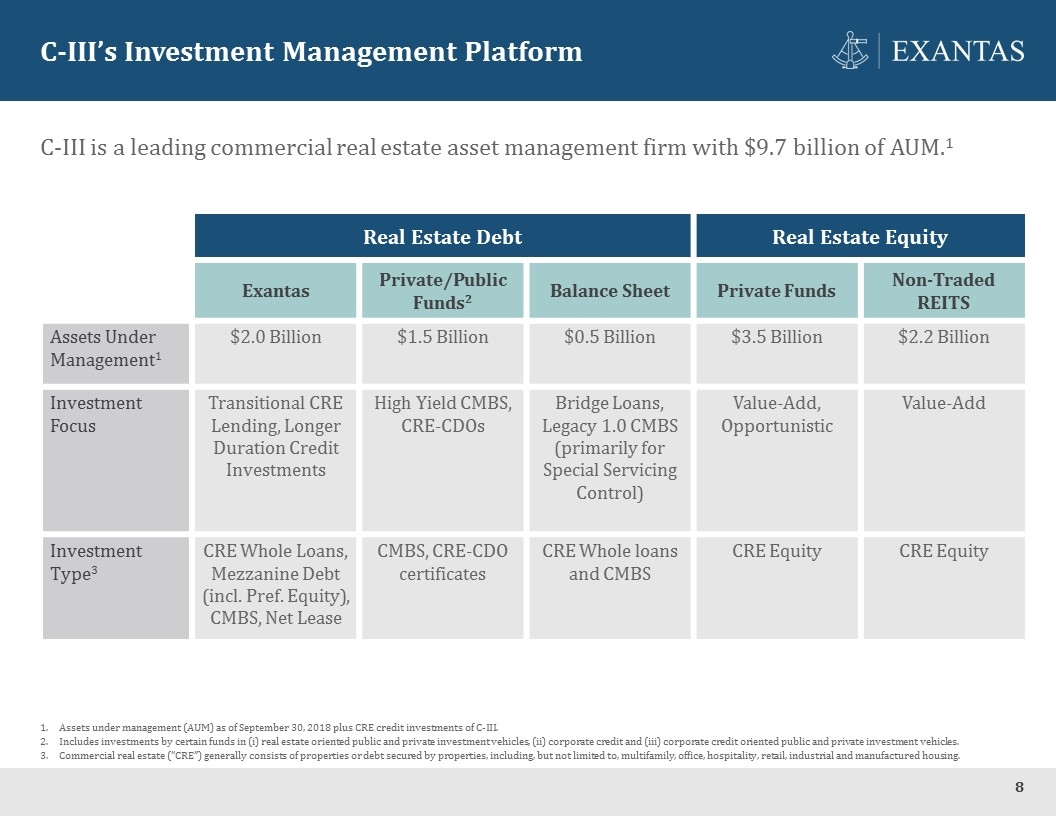

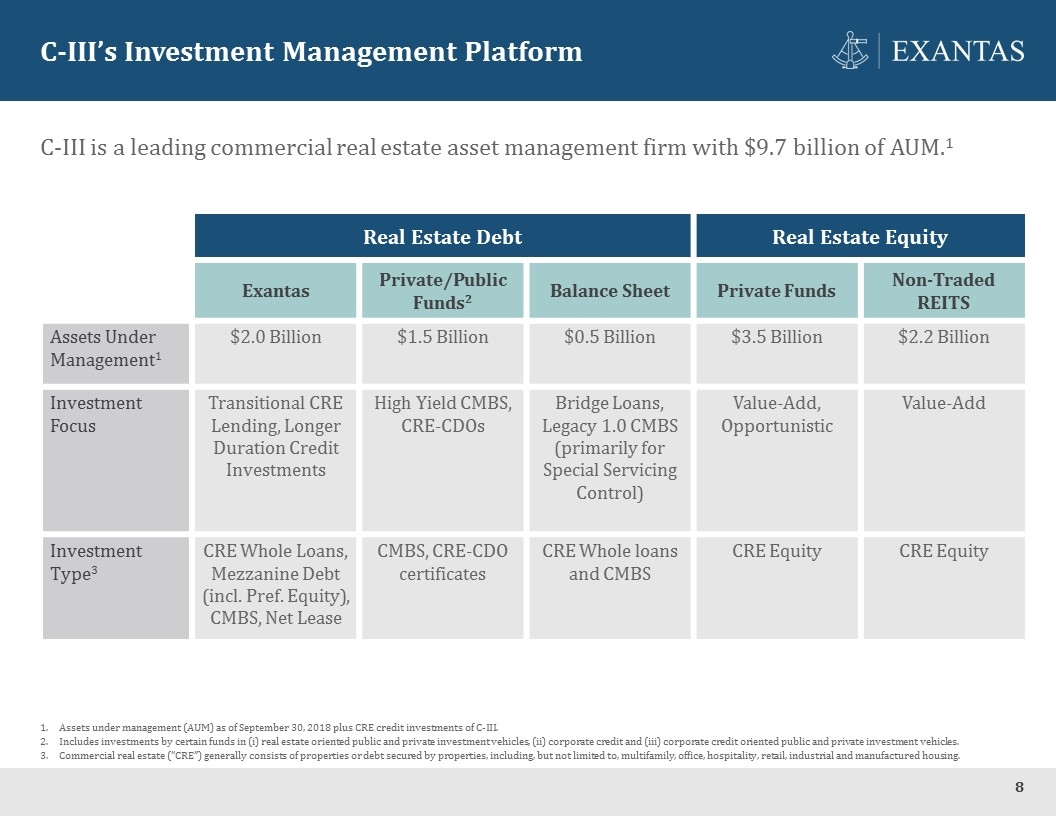

C-III’s Investment Management Platform C-III is a leading commercial real estate asset management firm with $9.7 billion of AUM.1 Real Estate Debt Real Estate Equity Exantas Private/Public Funds2 Balance Sheet Private Funds Non-Traded REITS Assets Under Management1 $2.0 Billion $1.5 Billion $0.5 Billion $3.5 Billion $2.2 Billion Investment Focus Transitional CRE Lending, Longer Duration Credit Investments High Yield CMBS, CRE-CDOs Bridge Loans, Legacy 1.0 CMBS (primarily for Special Servicing Control) Value-Add, Opportunistic Value-Add Investment Type3 CRE Whole Loans, Mezzanine Debt (incl. Pref. Equity), CMBS, Net Lease CMBS, CRE-CDO certificates CRE Whole loans and CMBS CRE Equity CRE Equity Assets under management (AUM) as of September 30, 2018 plus CRE credit investments of C-III. Includes investments by certain funds in (i) real estate oriented public and private investment vehicles, (ii) corporate credit and (iii) corporate credit oriented public and private investment vehicles. Commercial real estate (“CRE”) generally consists of properties or debt secured by properties, including, but not limited to, multifamily, office, hospitality, retail, industrial and manufactured housing. 8

Path Forward 9

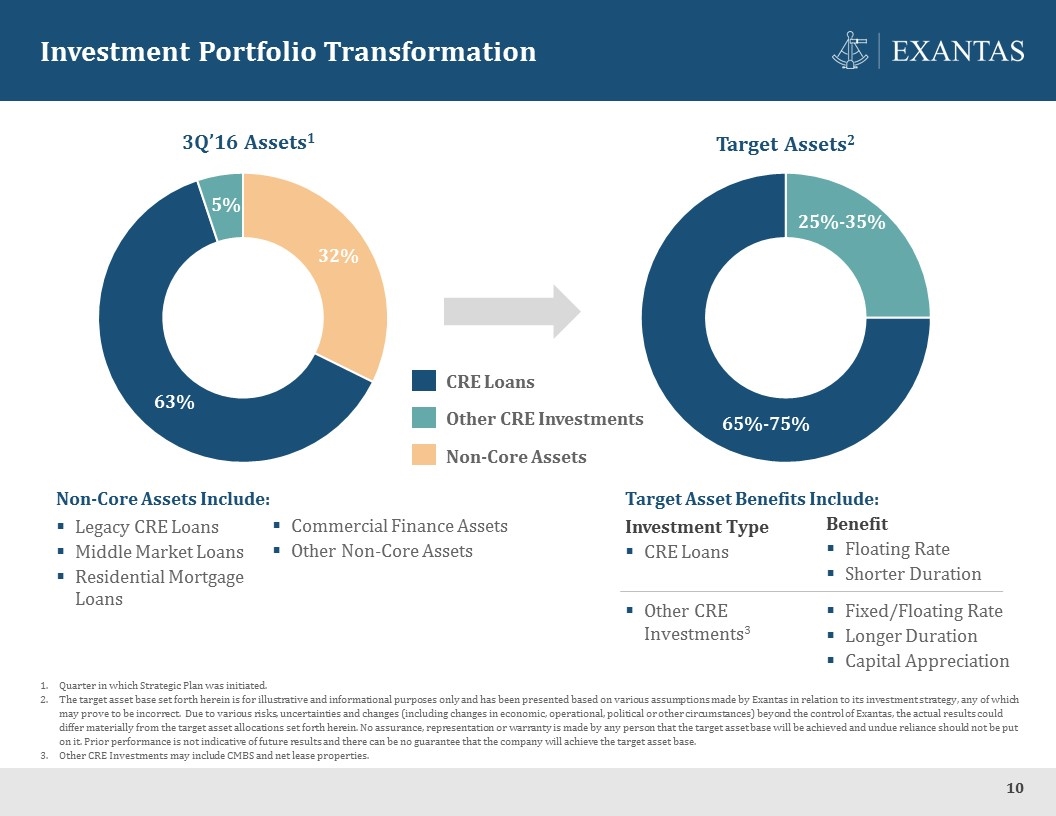

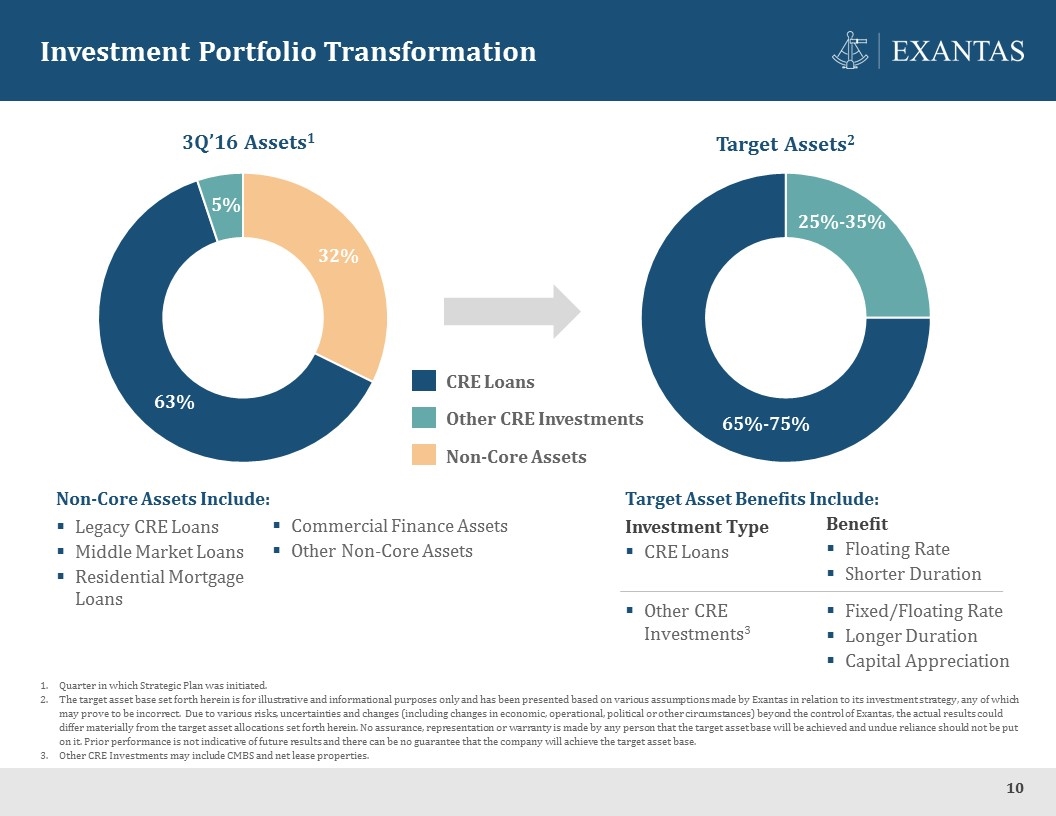

Investment Portfolio Transformation Quarter in which Strategic Plan was initiated. The target asset base set forth herein is for illustrative and informational purposes only and has been presented based on various assumptions made by Exantas in relation to its investment strategy, any of which may prove to be incorrect. Due to various risks, uncertainties and changes (including changes in economic, operational, political or other circumstances) beyond the control of Exantas, the actual results could differ materially from the target asset allocations set forth herein. No assurance, representation or warranty is made by any person that the target asset base will be achieved and undue reliance should not be put on it. Prior performance is not indicative of future results and there can be no guarantee that the company will achieve the target asset base. Other CRE Investments may include CMBS and net lease properties. 3Q’16 Assets1 Target Assets2 65%-75% 25%-35% CRE Loans Other CRE Investments Non-Core Assets 32% 63% 5% Non-Core Assets Include: Legacy CRE Loans Middle Market Loans Residential Mortgage Loans Benefit Floating Rate Shorter Duration Target Asset Benefits Include: Investment Type CRE Loans Fixed/Floating Rate Longer Duration Capital Appreciation Other CRE Investments3 Commercial Finance Assets Other Non-Core Assets 10

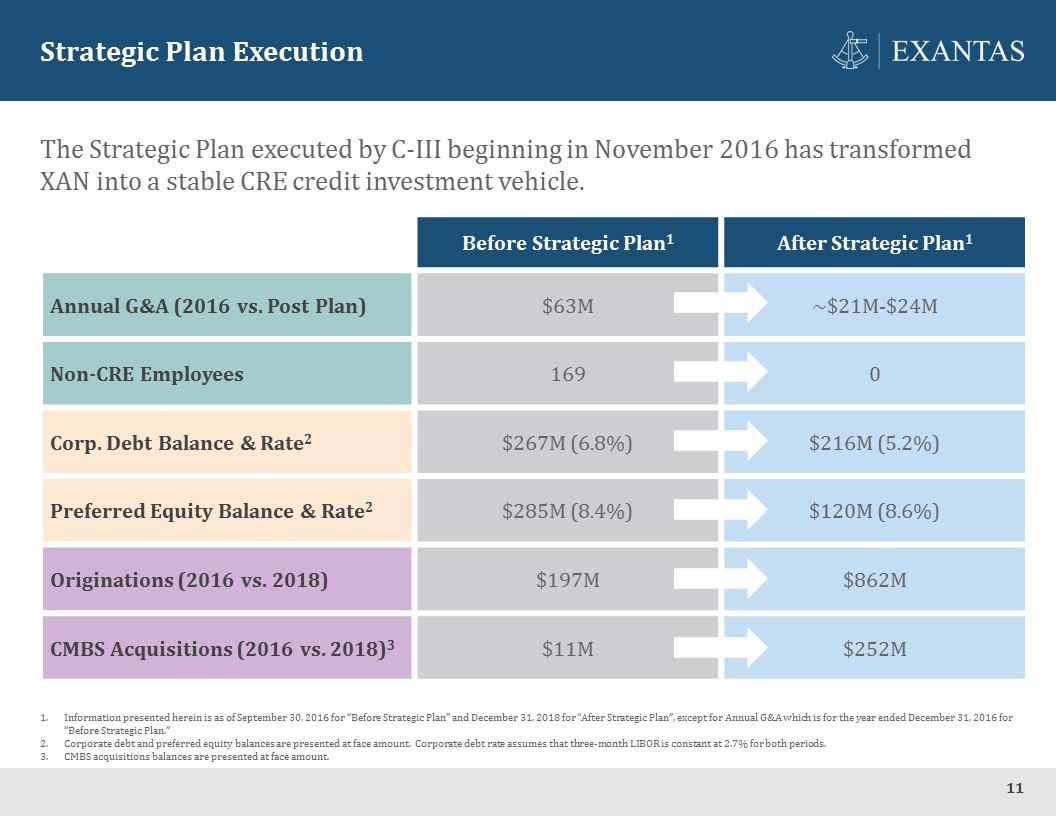

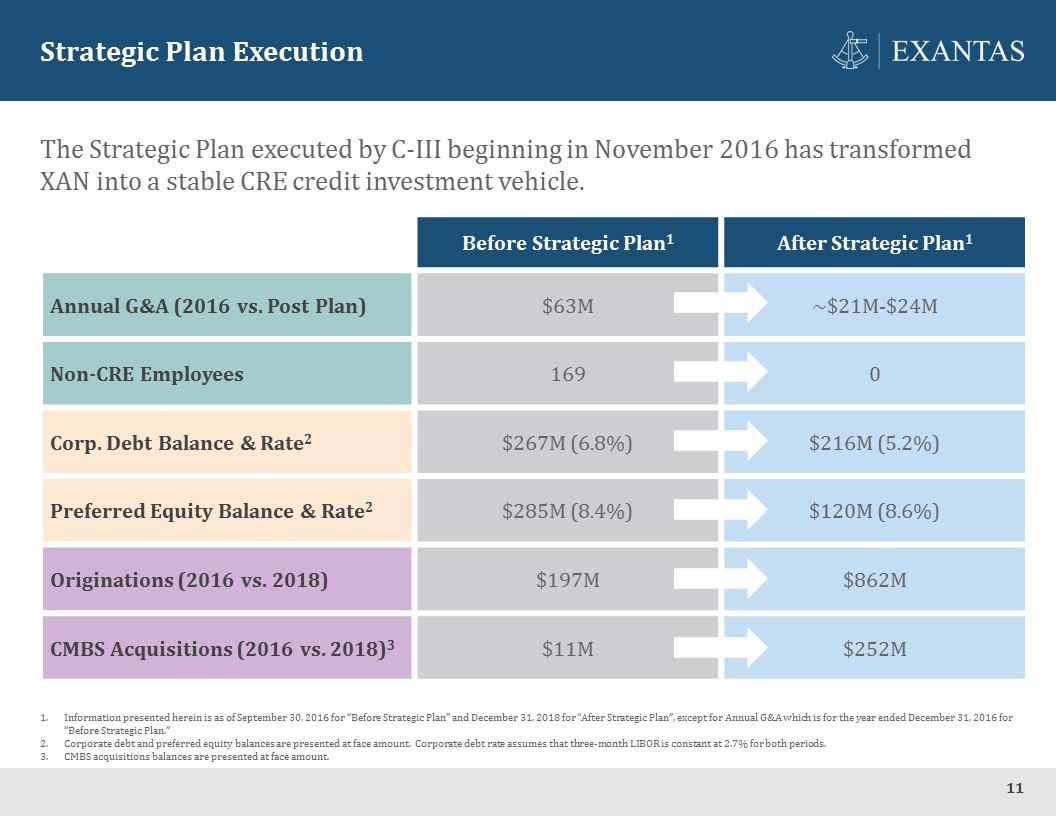

Strategic Plan Execution The Strategic Plan executed by C-III beginning in November 2016 has transformed XAN into a stable CRE credit investment vehicle. Before Strategic Plan1 After Strategic Plan1 Annual G&A (2016 vs. Post Plan) $63M ~$21M-$24M Non-CRE Employees 169 0 Corp. Debt Balance & Rate2 $267M (6.8%) $216M (5.2%) Preferred Equity Balance & Rate2 $285M (8.4%) $120M (8.6%) Originations (2016 vs. 2018) $197M $862M CMBS Acquisitions (2016 vs. 2018)3 $11M $252M Information presented herein is as of September 30, 2016 for “Before Strategic Plan” and December 31, 2018 for “After Strategic Plan”, except for Annual G&A which is for the year ended December 31, 2016 for “Before Strategic Plan.” Corporate debt and preferred equity balances are presented at face amount. Corporate debt rate assumes that three-month LIBOR is constant at 2.7% for both periods. CMBS acquisitions balances are presented at face amount. 11

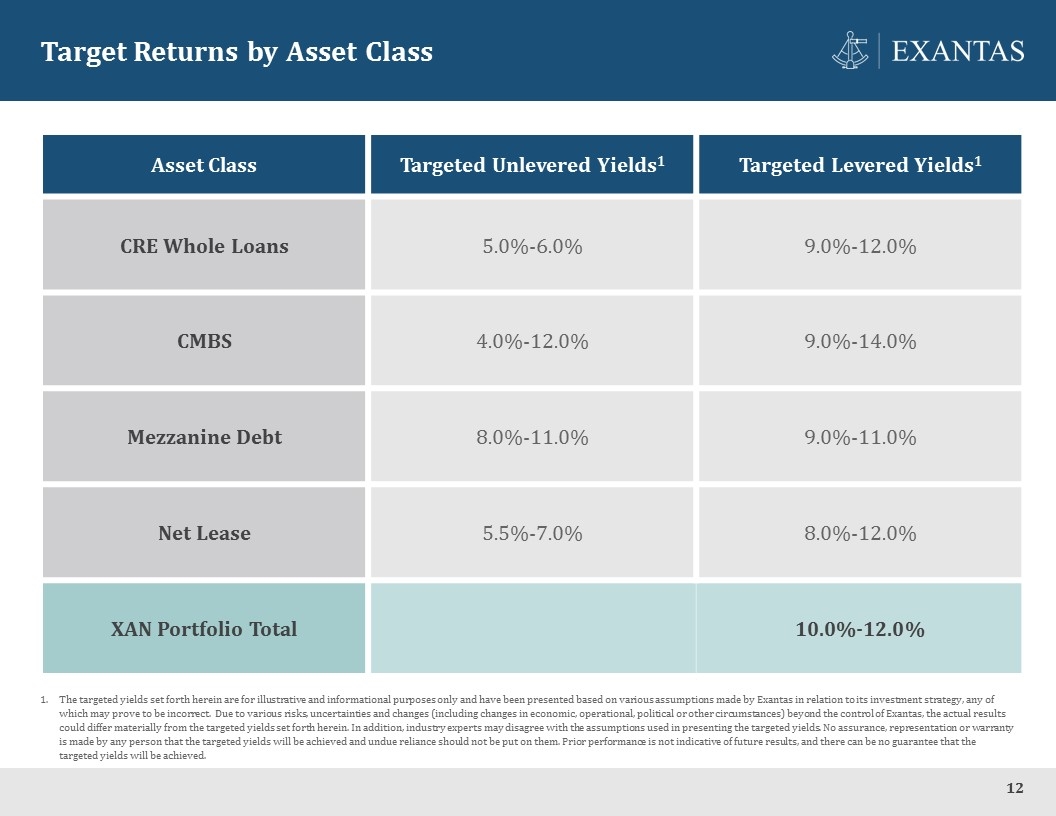

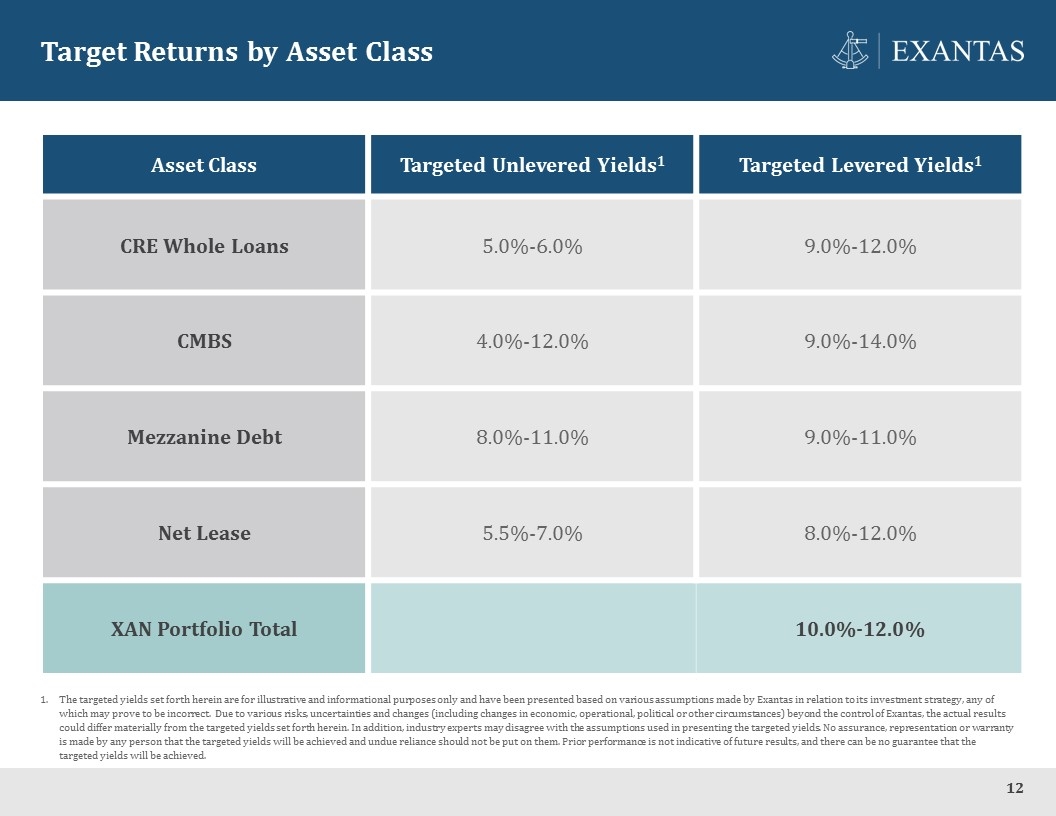

Target Returns by Asset Class Asset Class Targeted Unlevered Yields1 Targeted Levered Yields1 CRE Whole Loans 5.0%-6.0% 9.0%-12.0% CMBS 4.0%-12.0% 9.0%-14.0% Mezzanine Debt 8.0%-11.0% 9.0%-11.0% Net Lease 5.5%-7.0% 8.0%-12.0% XAN Portfolio Total 10.0%-12.0% The targeted yields set forth herein are for illustrative and informational purposes only and have been presented based on various assumptions made by Exantas in relation to its investment strategy, any of which may prove to be incorrect. Due to various risks, uncertainties and changes (including changes in economic, operational, political or other circumstances) beyond the control of Exantas, the actual results could differ materially from the targeted yields set forth herein. In addition, industry experts may disagree with the assumptions used in presenting the targeted yields. No assurance, representation or warranty is made by any person that the targeted yields will be achieved and undue reliance should not be put on them. Prior performance is not indicative of future results, and there can be no guarantee that the targeted yields will be achieved. 12

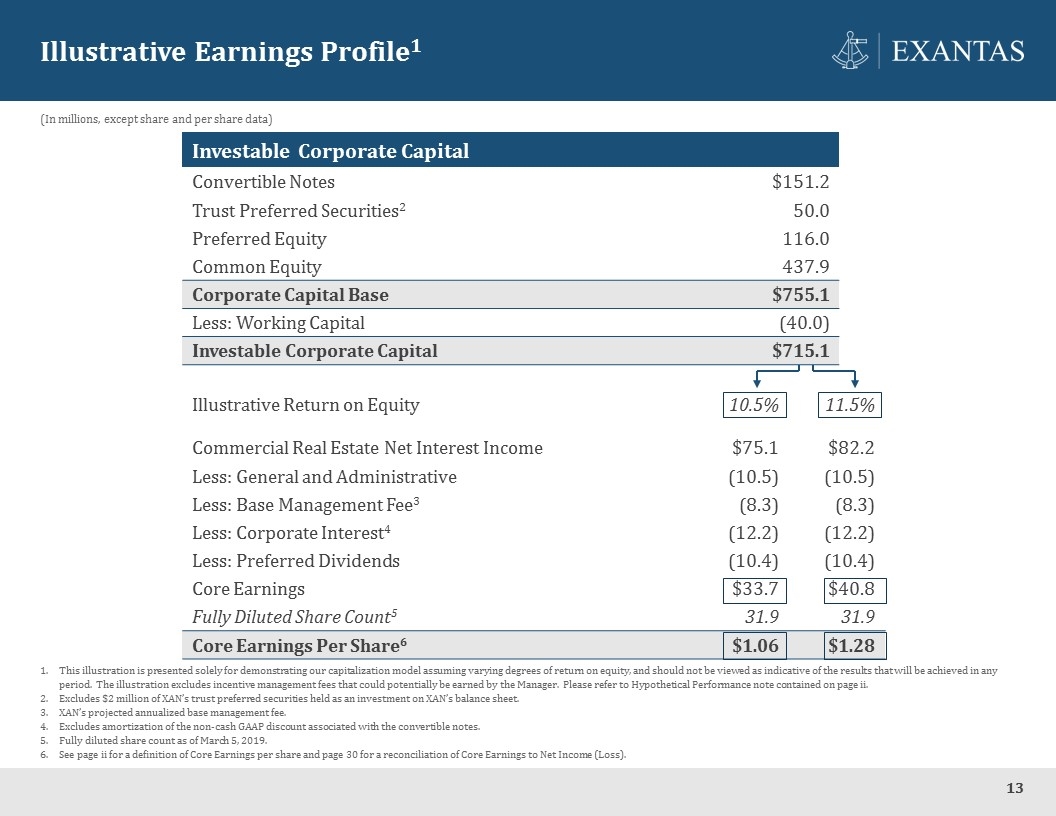

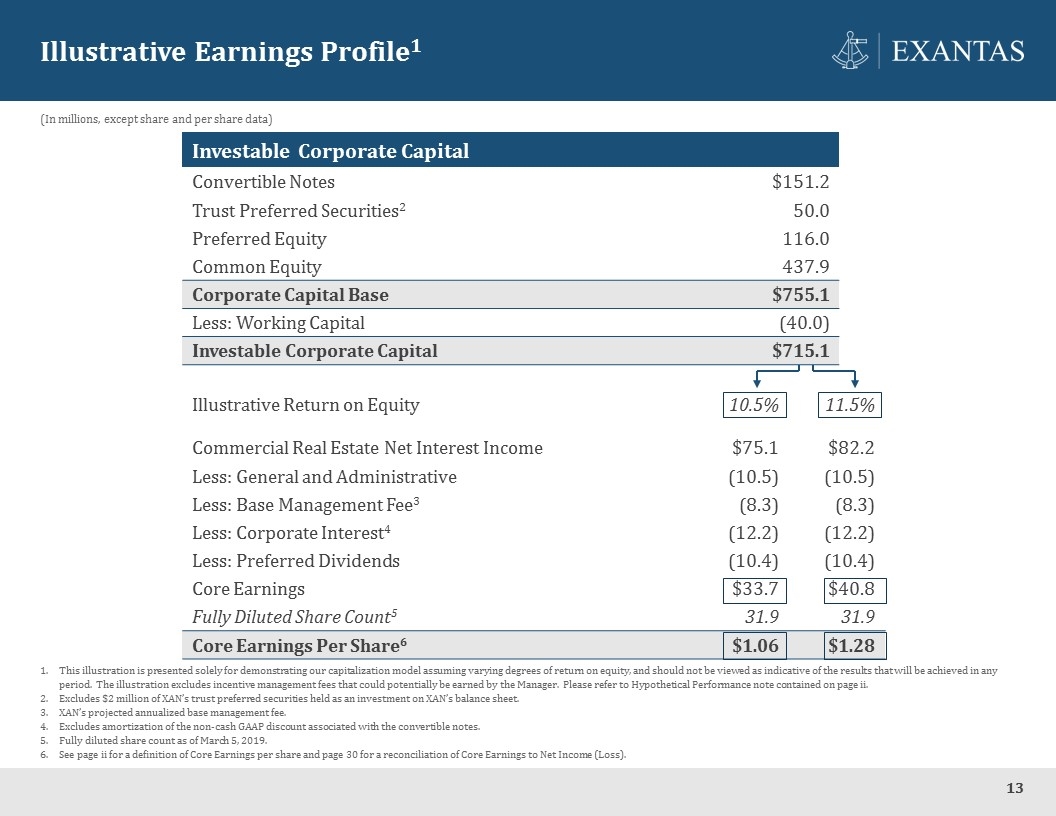

Illustrative Return on Equity 10.5% 11.5% Commercial Real Estate Net Interest Income $75.1 $82.2 Less: General and Administrative (10.5) (10.5) Less: Base Management Fee3 (8.3) (8.3) Less: Corporate Interest4 (12.2) (12.2) Less: Preferred Dividends (10.4) (10.4) Core Earnings $33.7 $40.8 Fully Diluted Share Count5 31.9 31.9 Core Earnings Per Share6 $1.06 $1.28 Illustrative Earnings Profile1 Investable Corporate Capital Convertible Notes $151.2 Trust Preferred Securities2 50.0 Preferred Equity 116.0 Common Equity 437.9 Corporate Capital Base $755.1 Less: Working Capital (40.0) Investable Corporate Capital $715.1 This illustration is presented solely for demonstrating our capitalization model assuming varying degrees of return on equity, and should not be viewed as indicative of the results that will be achieved in any period. The illustration excludes incentive management fees that could potentially be earned by the Manager. Please refer to Hypothetical Performance note contained on page ii. Excludes $2 million of XAN’s trust preferred securities held as an investment on XAN’s balance sheet. XAN’s projected annualized base management fee. Excludes amortization of the non-cash GAAP discount associated with the convertible notes. Fully diluted share count as of March 5, 2019. See page ii for a definition of Core Earnings per share and page 30 for a reconciliation of Core Earnings to Net Income (Loss). (In millions, except share and per share data) 13

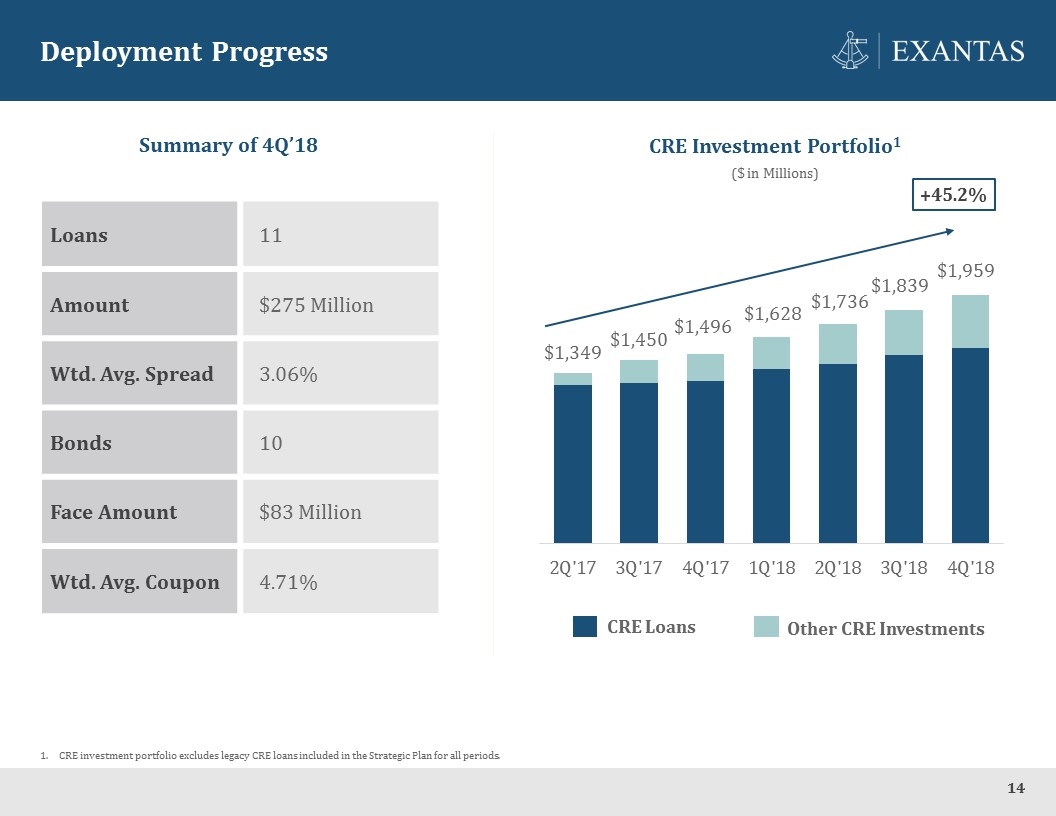

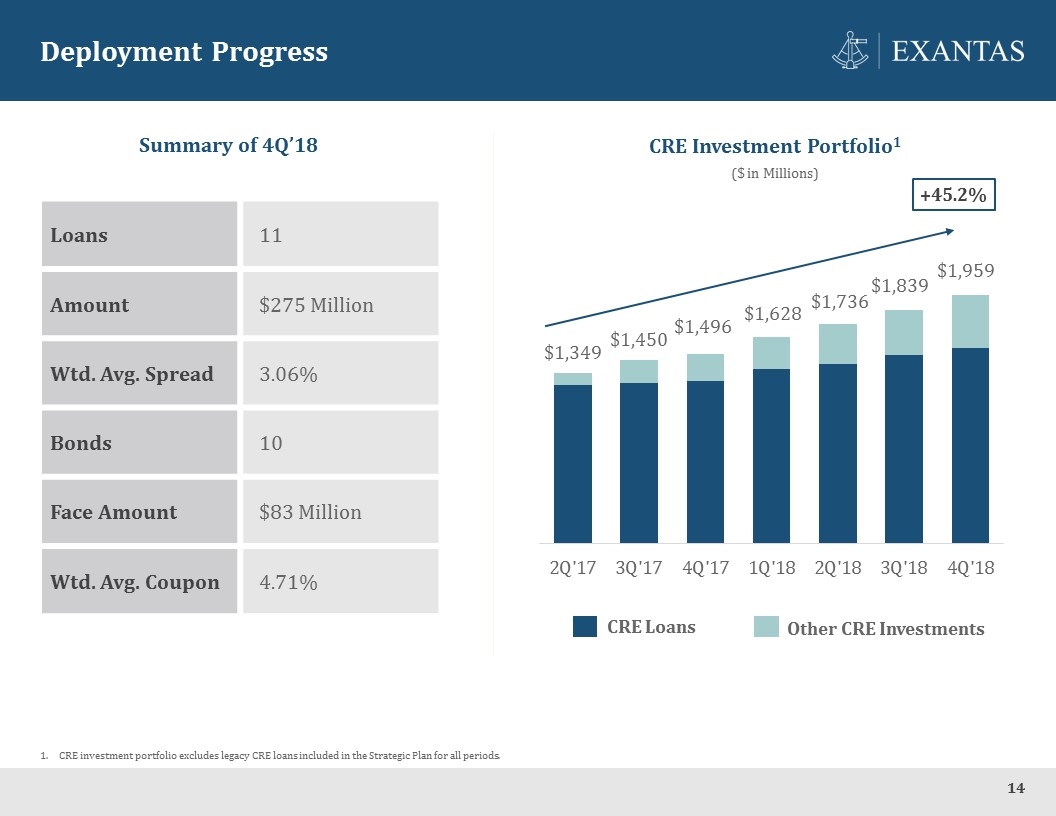

Deployment Progress Summary of 4Q’18 CRE Investment Portfolio1 Loans 11 Amount $275 Million Wtd. Avg. Spread 3.06% Bonds 10 Face Amount $83 Million Wtd. Avg. Coupon 4.71% $1,349 $1,450 $1,628 $1,736 +45.2% ($ in Millions) CRE Loans Other CRE Investments CRE investment portfolio excludes legacy CRE loans included in the Strategic Plan for all periods. 14

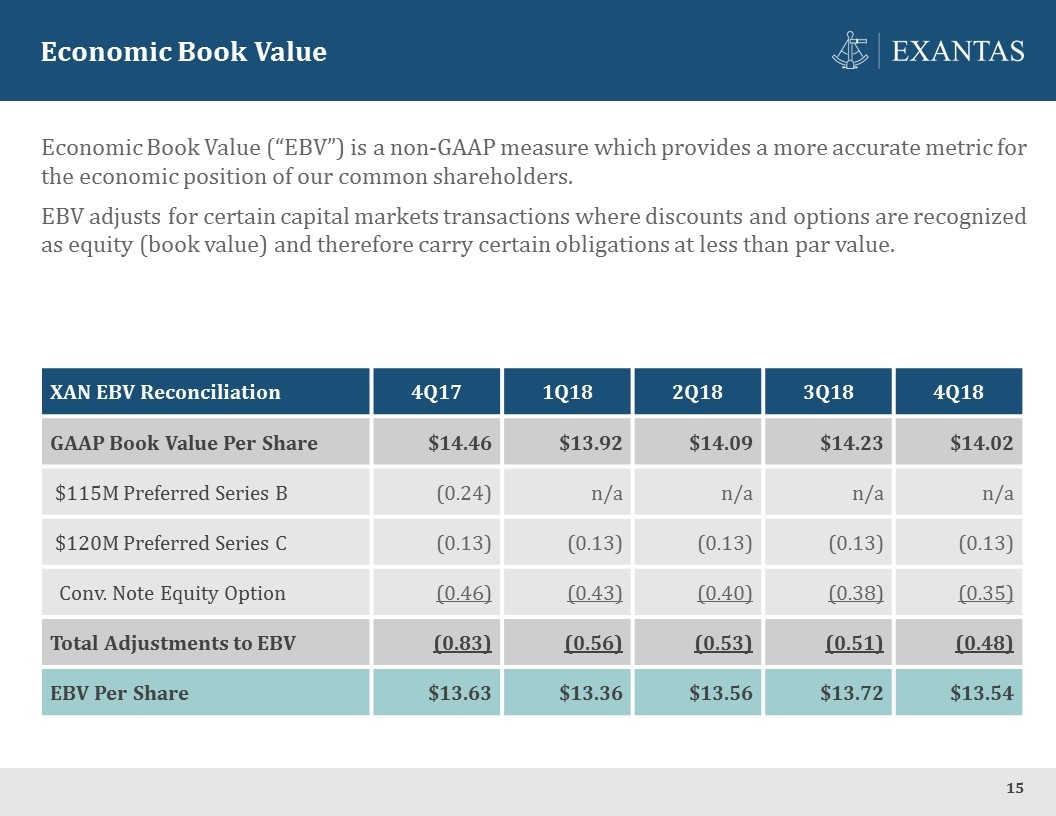

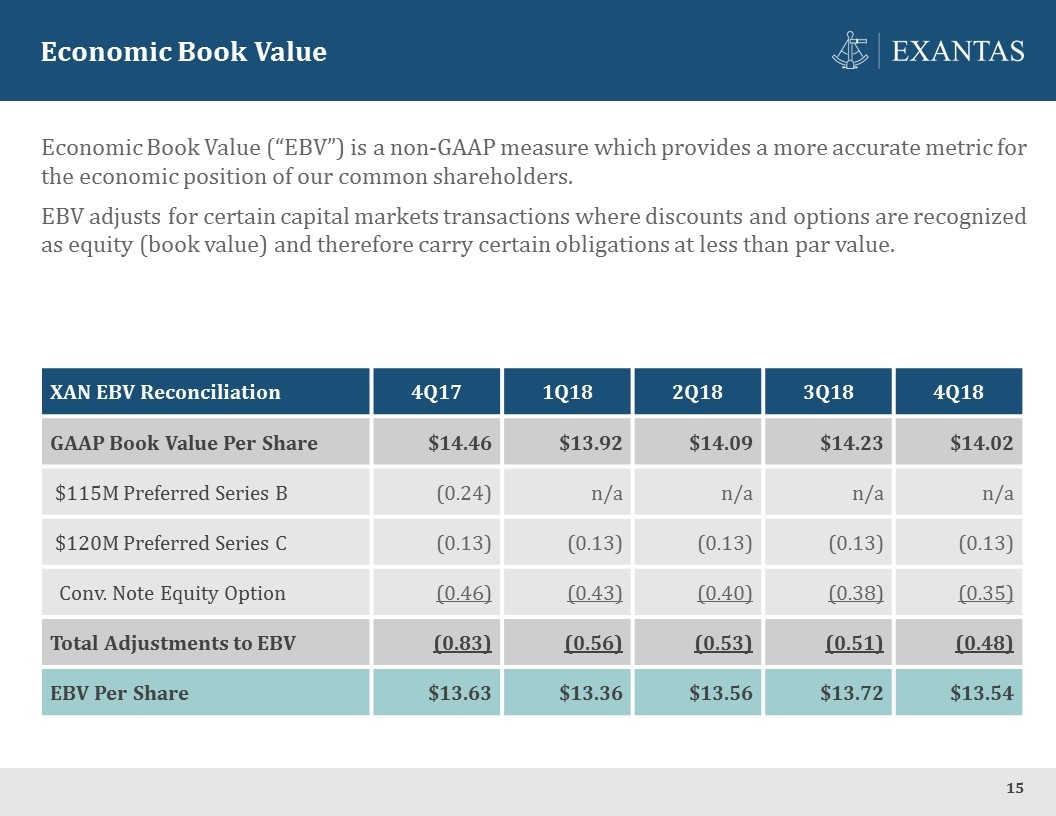

Economic Book Value Economic Book Value (“EBV”) is a non-GAAP measure which provides a more accurate metric for the economic position of our common shareholders. EBV adjusts for certain capital markets transactions where discounts and options are recognized as equity (book value) and therefore carry certain obligations at less than par value. XAN EBV Reconciliation 4Q17 1Q18 2Q18 3Q18 4Q18 GAAP Book Value Per Share $14.46 $13.92 $14.09 $14.23 $14.02 $115M Preferred Series B (0.24) n/a n/a n/a n/a $120M Preferred Series C (0.13) (0.13) (0.13) (0.13) (0.13) Conv. Note Equity Option (0.46) (0.43) (0.40) (0.38) (0.35) Total Adjustments to EBV (0.83) (0.56) (0.53) (0.51) (0.48) EBV Per Share $13.63 $13.36 $13.56 $13.72 $13.54 15

CRE Loan Origination 16

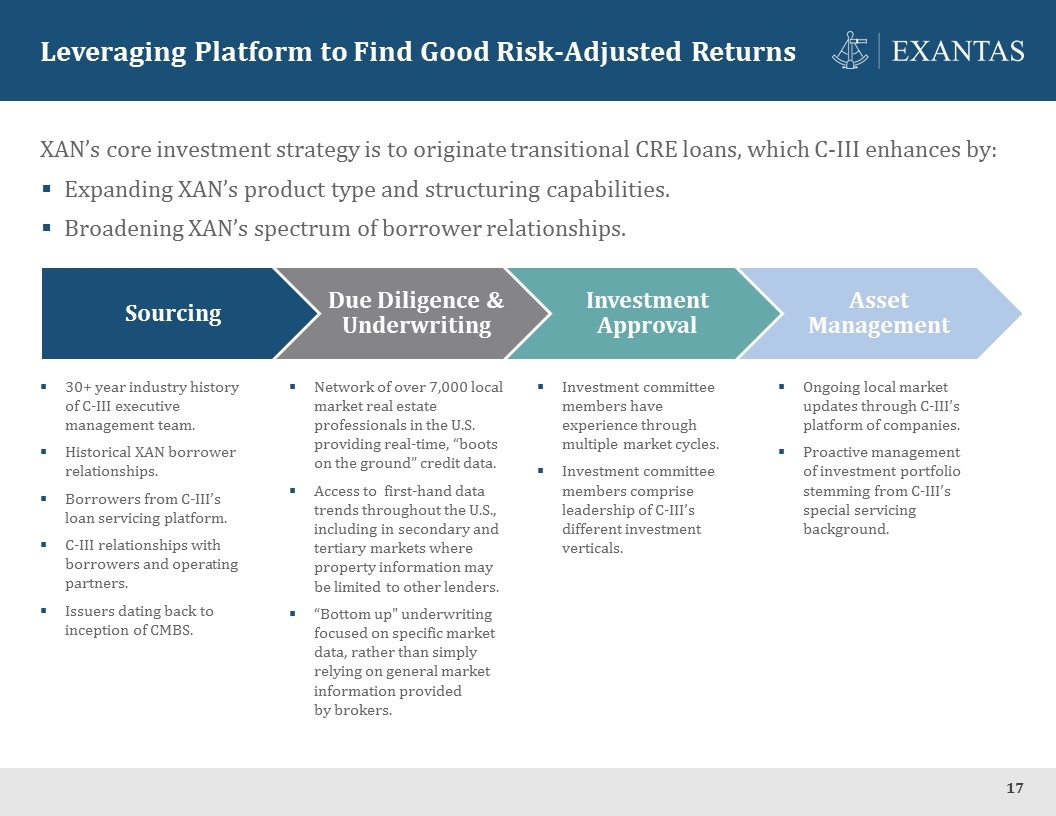

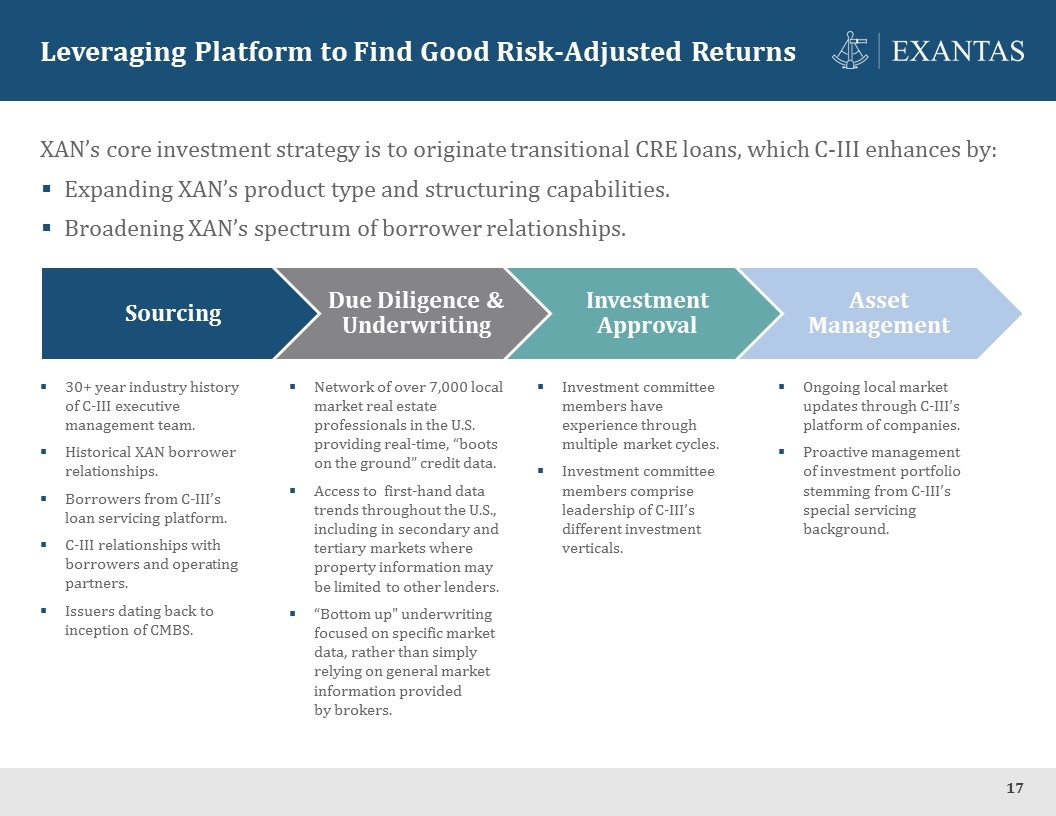

Leveraging Platform to Find Good Risk-Adjusted Returns XAN’s core investment strategy is to originate transitional CRE loans, which C-III enhances by: Expanding XAN’s product type and structuring capabilities. Broadening XAN’s spectrum of borrower relationships. 30+ year industry history of C-III executive management team. Historical XAN borrower relationships. Borrowers from C-III’s loan servicing platform. C-III relationships with borrowers and operating partners. Issuers dating back to inception of CMBS. Network of over 7,000 local market real estate professionals in the U.S. providing real-time, “boots on the ground” credit data. Access to first-hand data trends throughout the U.S., including in secondary and tertiary markets where property information may be limited to other lenders. “Bottom up" underwriting focused on specific market data, rather than simply relying on general market information provided by brokers. Investment committee members have experience through multiple market cycles. Investment committee members comprise leadership of C-III’s different investment verticals. Ongoing local market updates through C-III’s platform of companies. Proactive management of investment portfolio stemming from C-III’s special servicing background. 17 Sourcing Due Diligence & Underwriting Investment Approval Asset Management

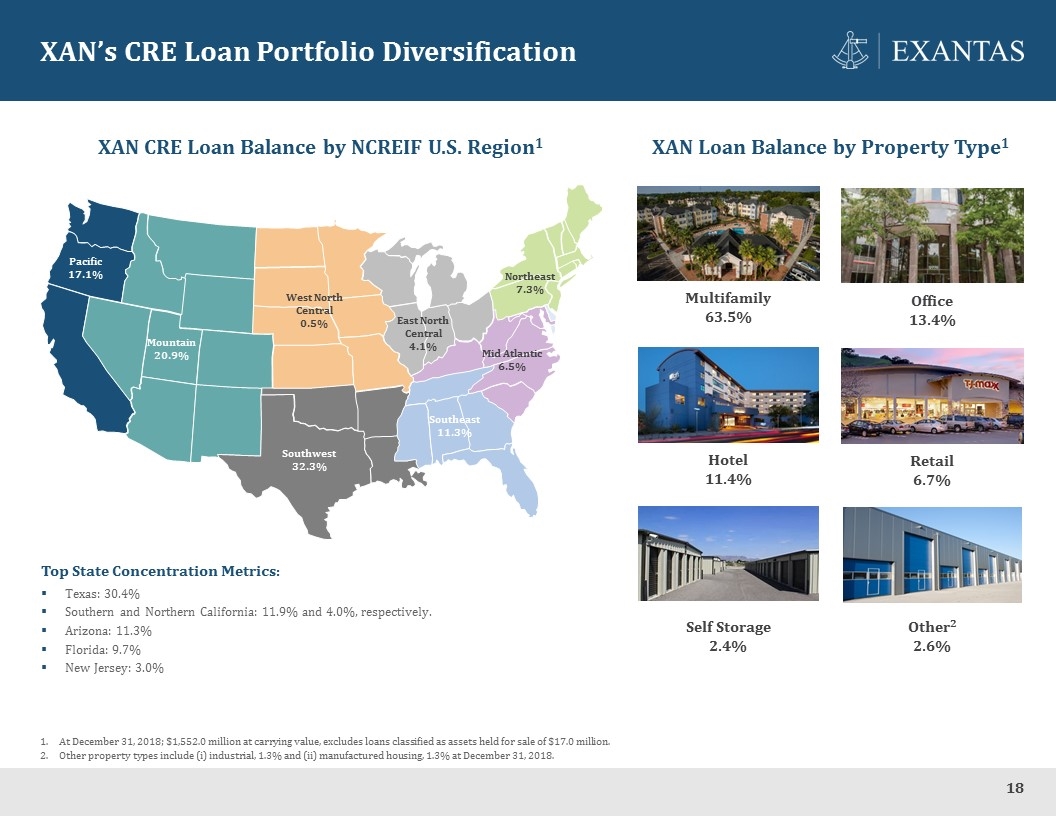

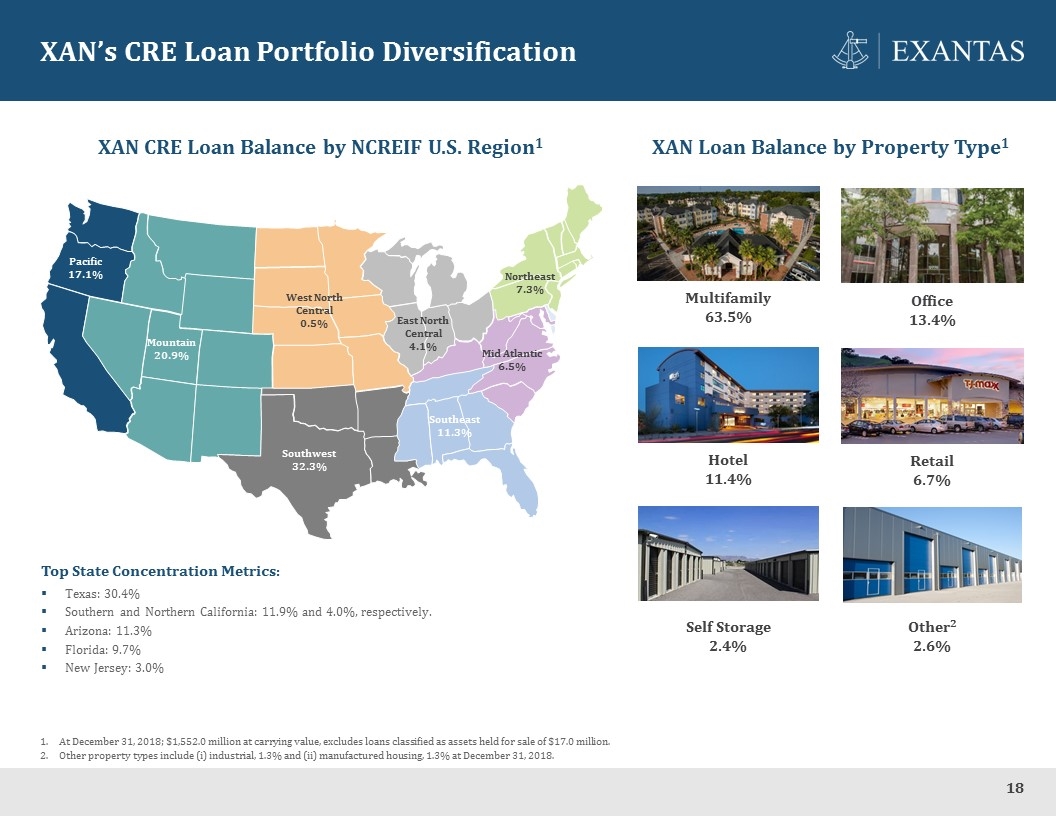

XAN’s CRE Loan Portfolio Diversification XAN Loan Balance by Property Type1 XAN CRE Loan Balance by NCREIF U.S. Region1 Pacific 17.1% Mountain 20.9% West North Central 0.5% Southwest 32.3% Southeast 11.3% East North Central 4.1% Mid Atlantic 6.5% Northeast 7.3% Multifamily 63.5% Office 13.4% Top State Concentration Metrics: Texas: 30.4% Southern and Northern California: 11.9% and 4.0%, respectively. Arizona: 11.3% Florida: 9.7% New Jersey: 3.0% Retail 6.7% Hotel 11.4% Self Storage 2.4% Other2 2.6% At December 31, 2018; $1,552.0 million at carrying value, excludes loans classified as assets held for sale of $17.0 million. Other property types include (i) industrial, 1.3% and (ii) manufactured housing, 1.3% at December 31, 2018. 18

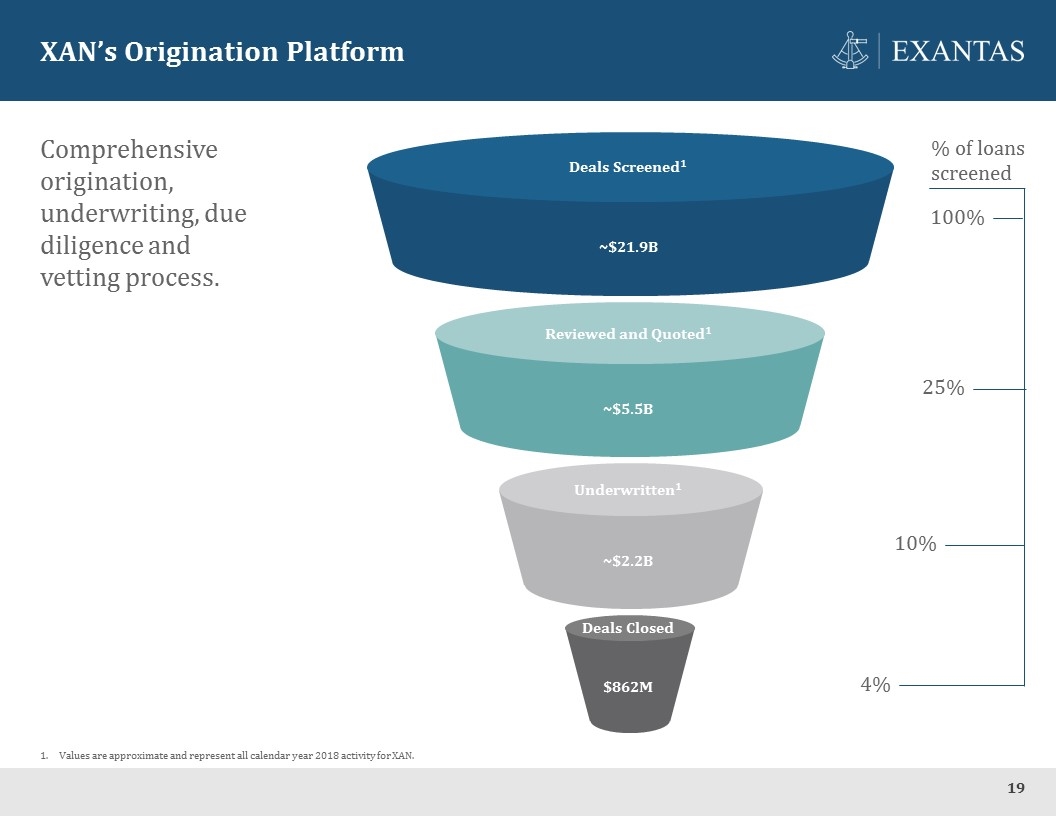

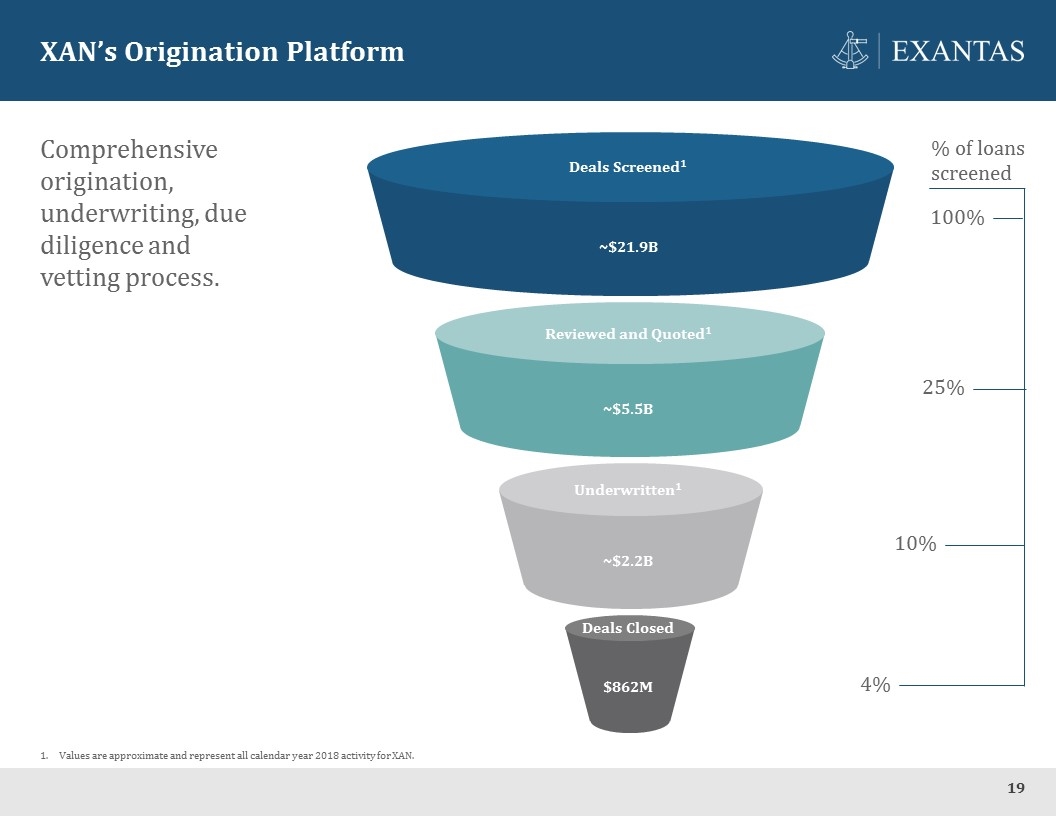

XAN’s Origination Platform Comprehensive origination, underwriting, due diligence and vetting process. Deals Screened1 Reviewed and Quoted1 Underwritten1 Deals Closed ~$21.9B ~$5.5B ~$2.2B $862M % of loans screened 100% 25% 10% 4% Values are approximate and represent all calendar year 2018 activity for XAN. 19

Real Estate Credit Investment Opportunities 20

Benefits of Longer Duration Investments Transitional CRE lending remains XAN’s primary investment strategy. As an open-ended, stable income-oriented investment vehicle, supplementing XAN’s loan portfolio with longer duration investments can enhance return on equity and could provide increased: Earnings visibility; Cash flow stability; and Capital deployment consistency. Select longer duration assets also have attractive portfolio diversification and tax attributes. 21

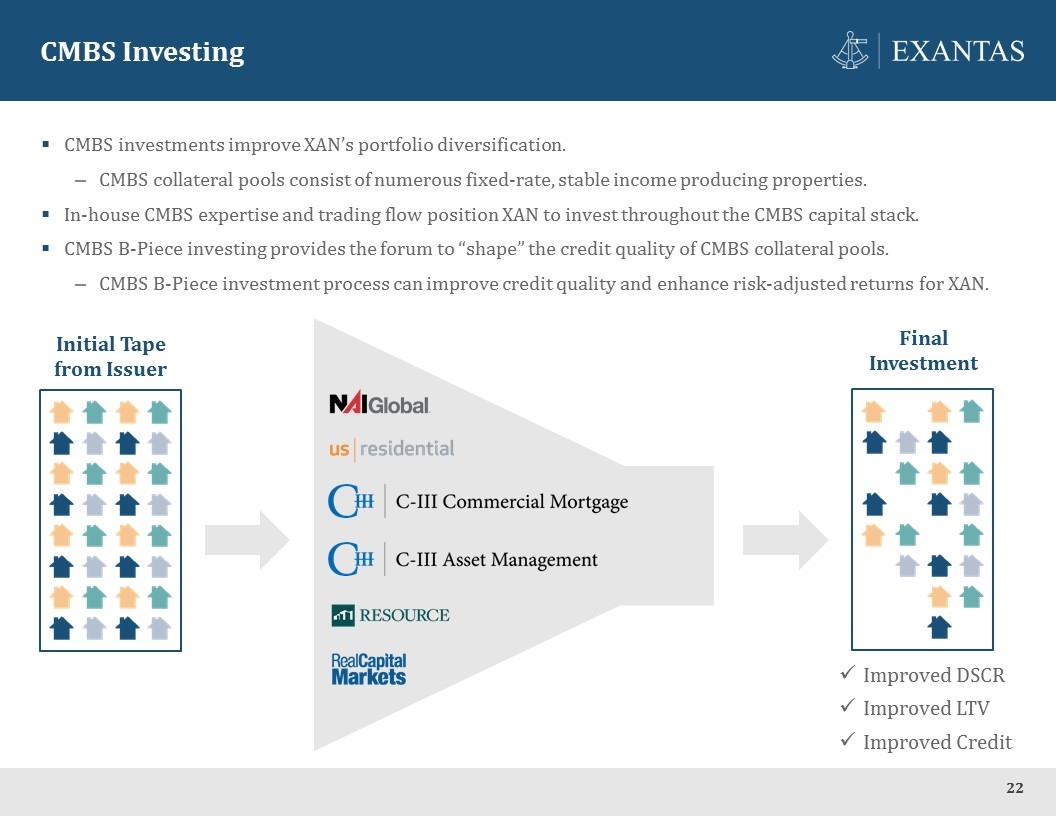

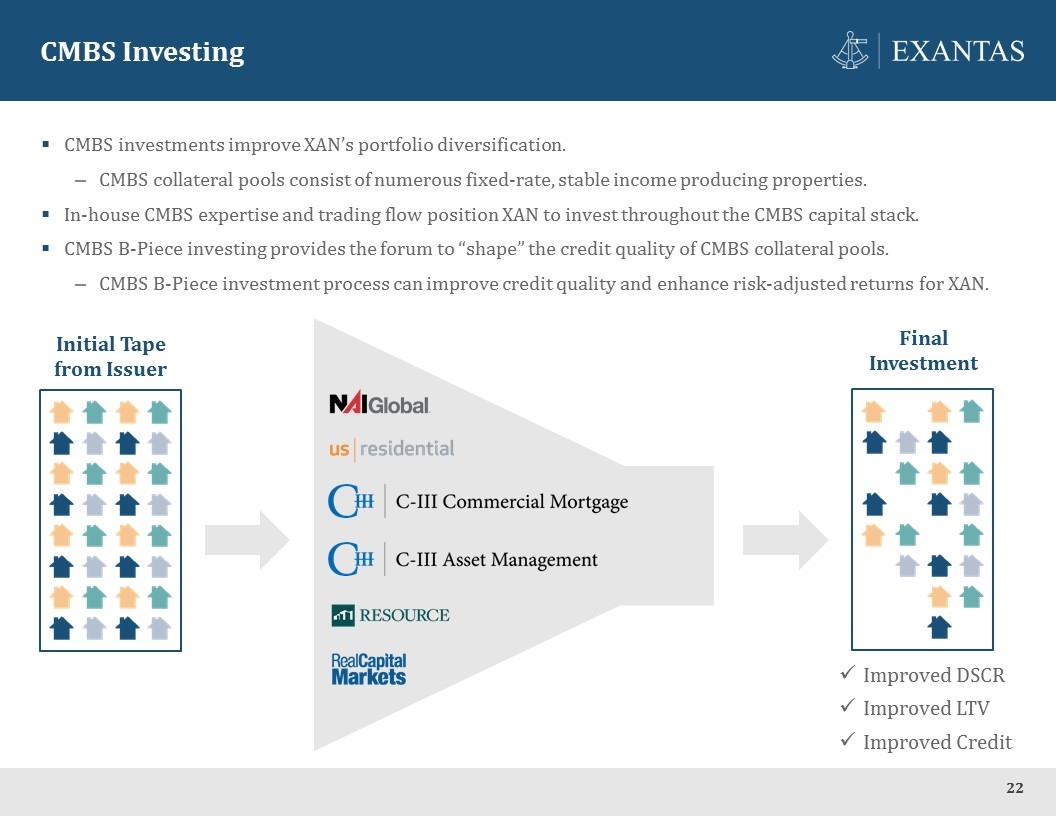

CMBS Investing Improved DSCR Improved LTV Improved Credit CMBS investments improve XAN’s portfolio diversification. CMBS collateral pools consist of numerous fixed-rate, stable income producing properties. In-house CMBS expertise and trading flow position XAN to invest throughout the CMBS capital stack. CMBS B-Piece investing provides the forum to “shape” the credit quality of CMBS collateral pools. CMBS B-Piece investment process can improve credit quality and enhance risk-adjusted returns for XAN. Initial Tape from Issuer Final Investment 22

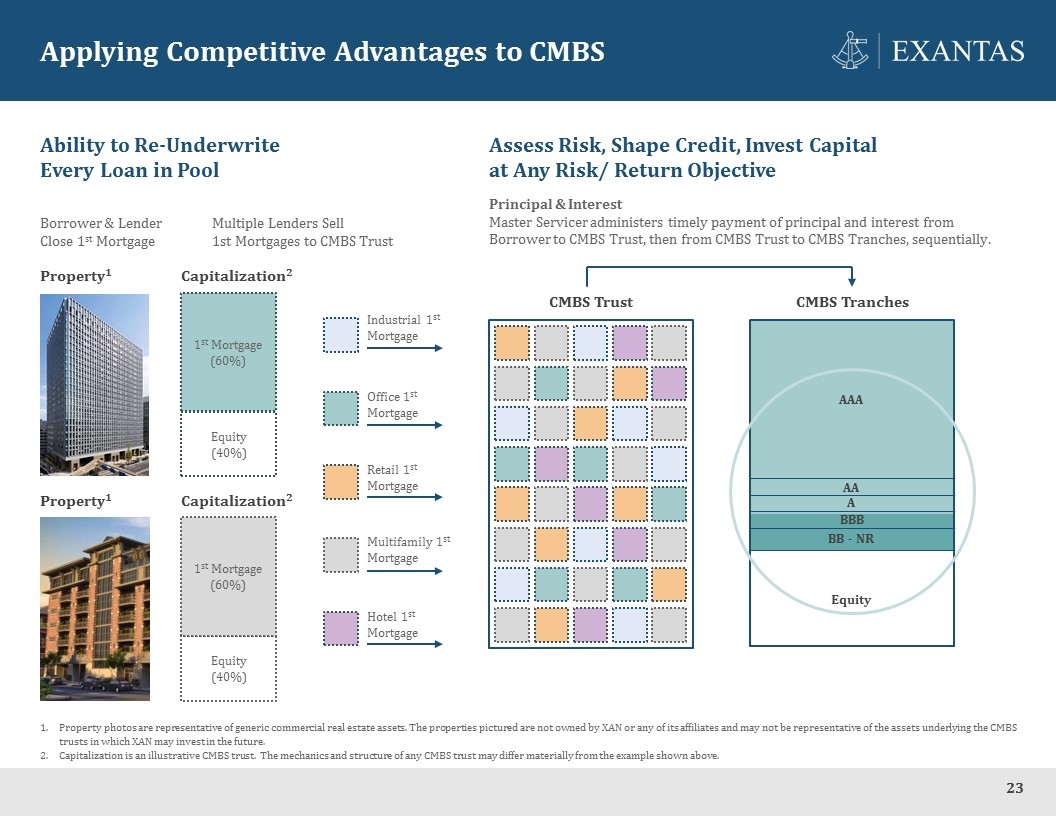

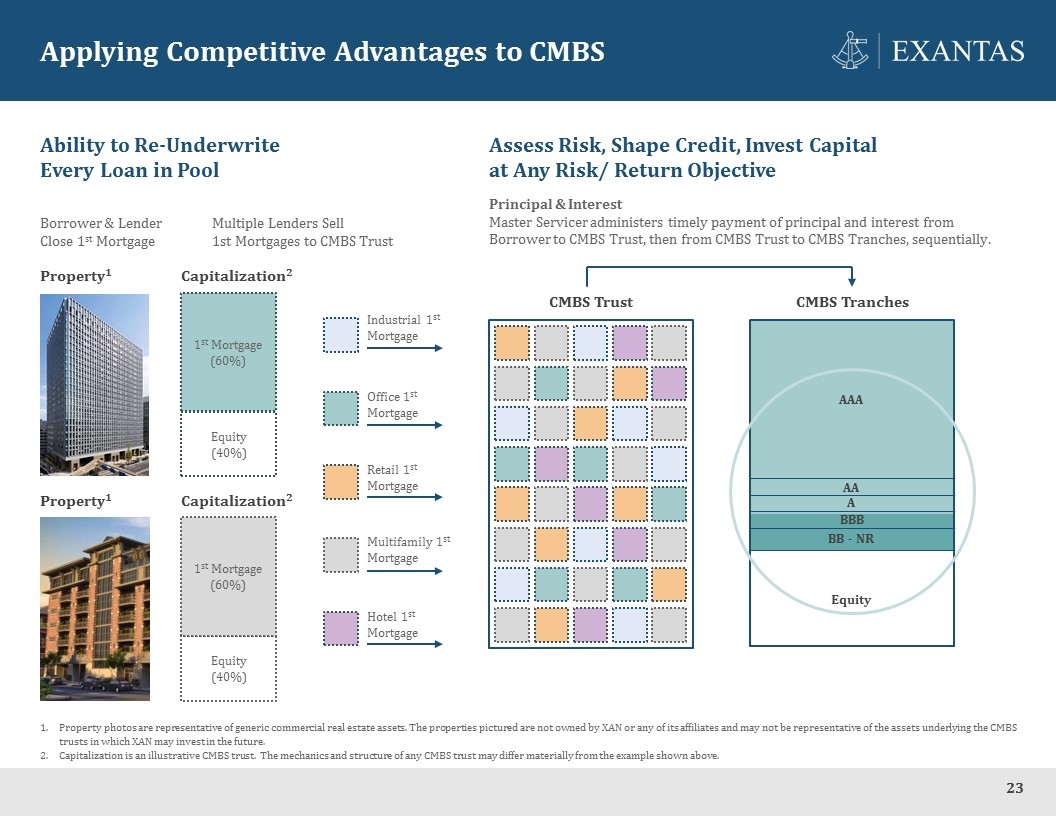

Applying Competitive Advantages to CMBS Property photos are representative of generic commercial real estate assets. The properties pictured are not owned by XAN or any of its affiliates and may not be representative of the assets underlying the CMBS trusts in which XAN may invest in the future. Capitalization is an illustrative CMBS trust. The mechanics and structure of any CMBS trust may differ materially from the example shown above. Ability to Re-Underwrite Every Loan in Pool CMBS Trust Equity AAA AA A CMBS Tranches BB - NR Borrower & Lender Close 1st Mortgage Multiple Lenders Sell 1st Mortgages to CMBS Trust Assess Risk, Shape Credit, Invest Capital at Any Risk/ Return Objective Principal & Interest Master Servicer administers timely payment of principal and interest from Borrower to CMBS Trust, then from CMBS Trust to CMBS Tranches, sequentially. Multifamily 1st Mortgage Office 1st Mortgage Retail 1st Mortgage Hotel 1st Mortgage Industrial 1st Mortgage Property1 Property1 Capitalization2 Equity (40%) 1st Mortgage (60%) Capitalization2 Equity (40%) 1st Mortgage (60%) BBB 23

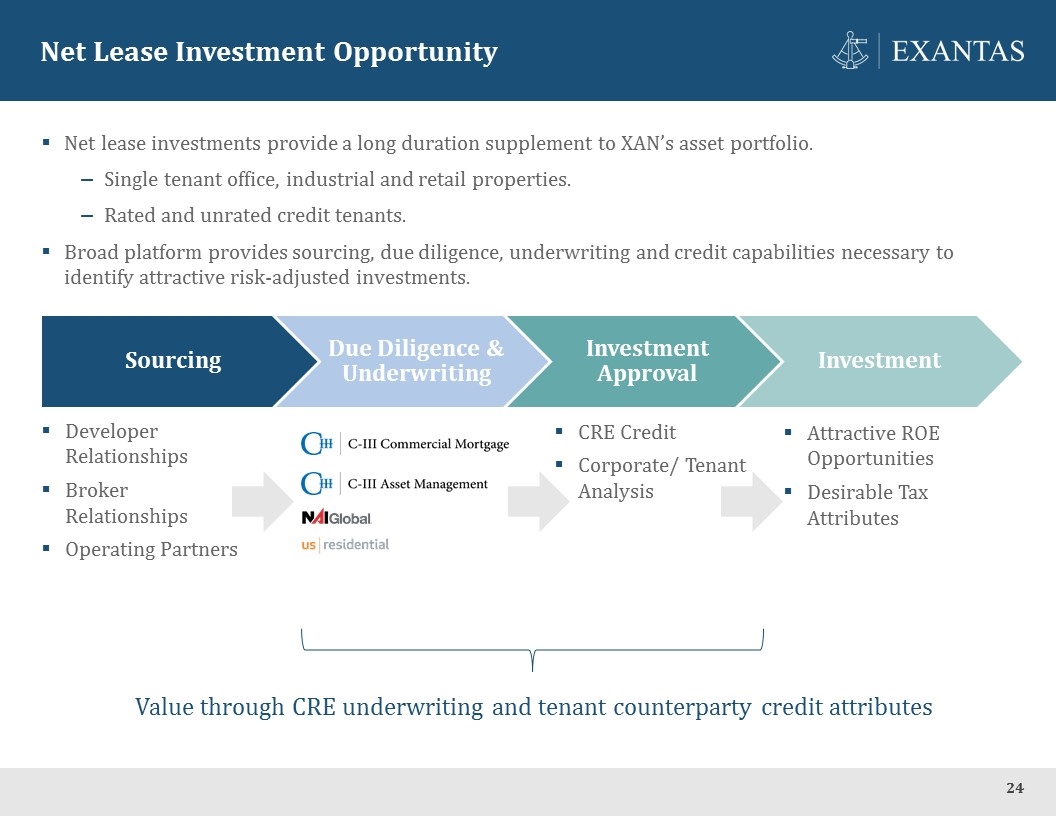

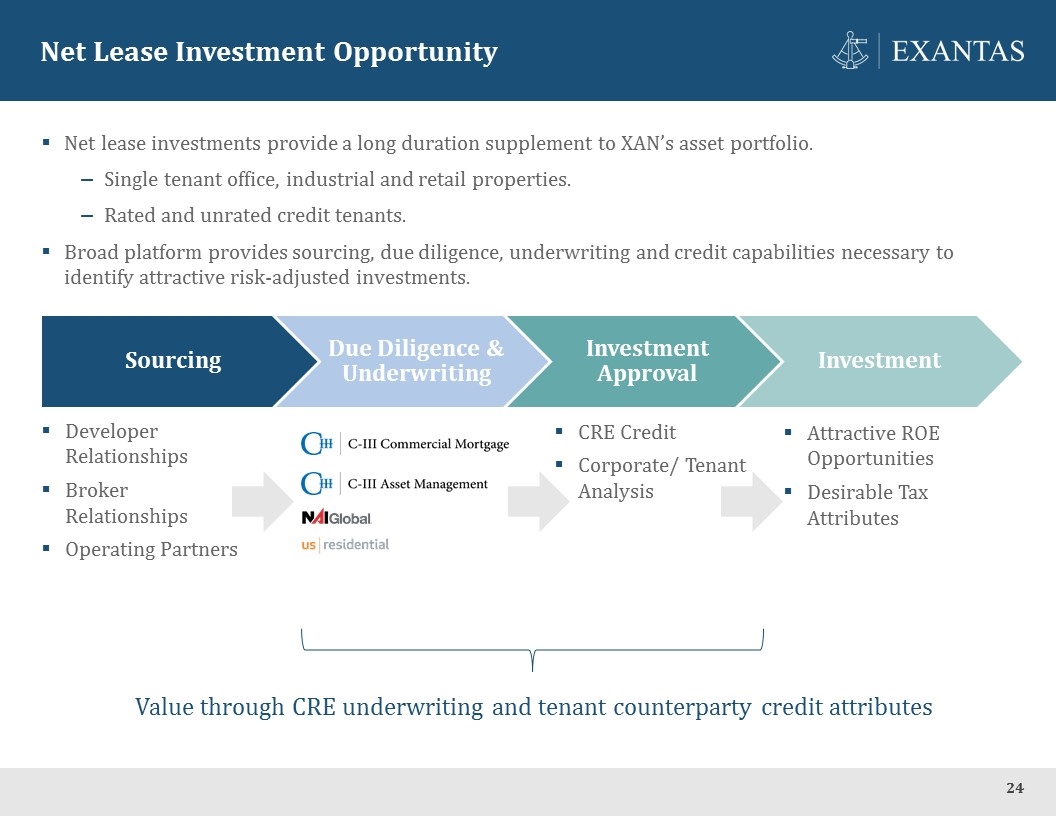

Net lease investments provide a long duration supplement to XAN’s asset portfolio. Single tenant office, industrial and retail properties. Rated and unrated credit tenants. Broad platform provides sourcing, due diligence, underwriting and credit capabilities necessary to identify attractive risk-adjusted investments. Net Lease Investment Opportunity Developer Relationships Broker Relationships Operating Partners CRE Credit Corporate/ Tenant Analysis Attractive ROE Opportunities Desirable Tax Attributes Value through CRE underwriting and tenant counterparty credit attributes 24 Sourcing Due Diligence & Underwriting Investment Approval Investment

Conclusion 25

Creating Shareholder Value 1 2 Executed Strategic Plan Leverage C-III’s Sponsorship 3 4 XAN’s Investment Capabilities Generate Long Term Shareholder Value Refocused Investment Strategy Rejuvenated Business Plan Created Path to Deliver Core Earnings Full Scale Platform Differentiated Data and Network Experienced Management Team Experienced Originations Staff Deep Market Relationships Expanded CRE Investment Mandate Enhance Risk-Adjusted Returns Increase Earnings Visibility Grow and Stabilize Core Earnings 26

Appendix 27

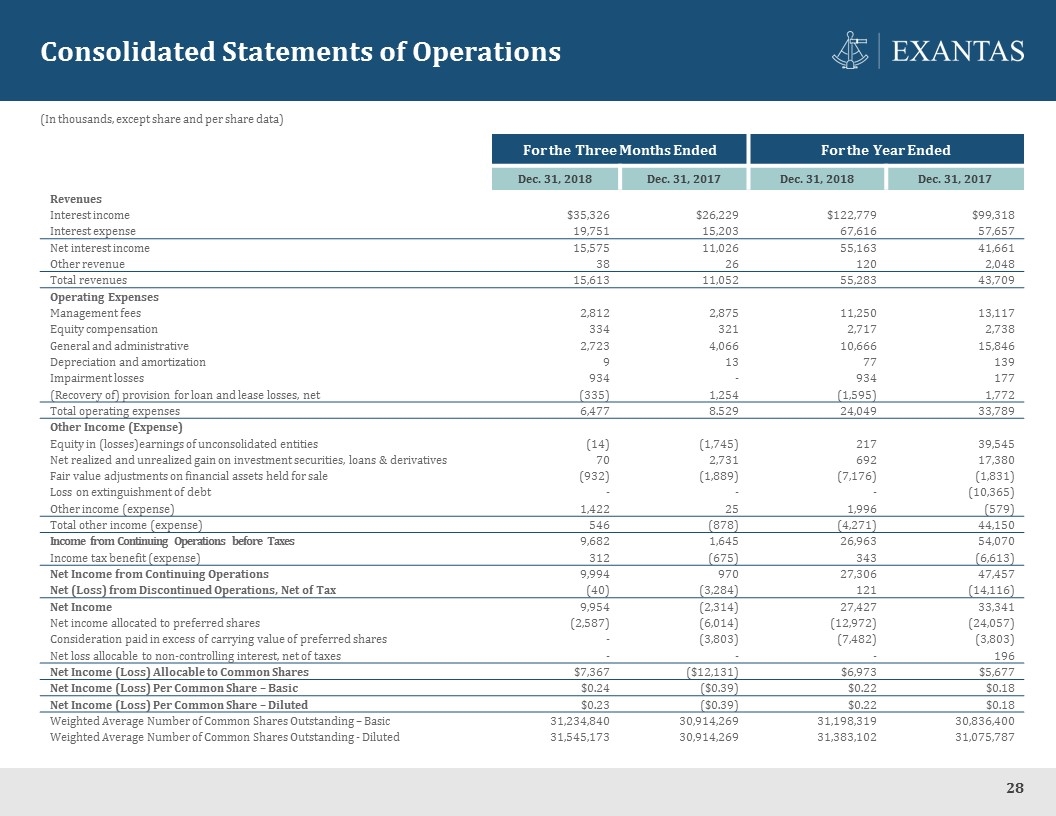

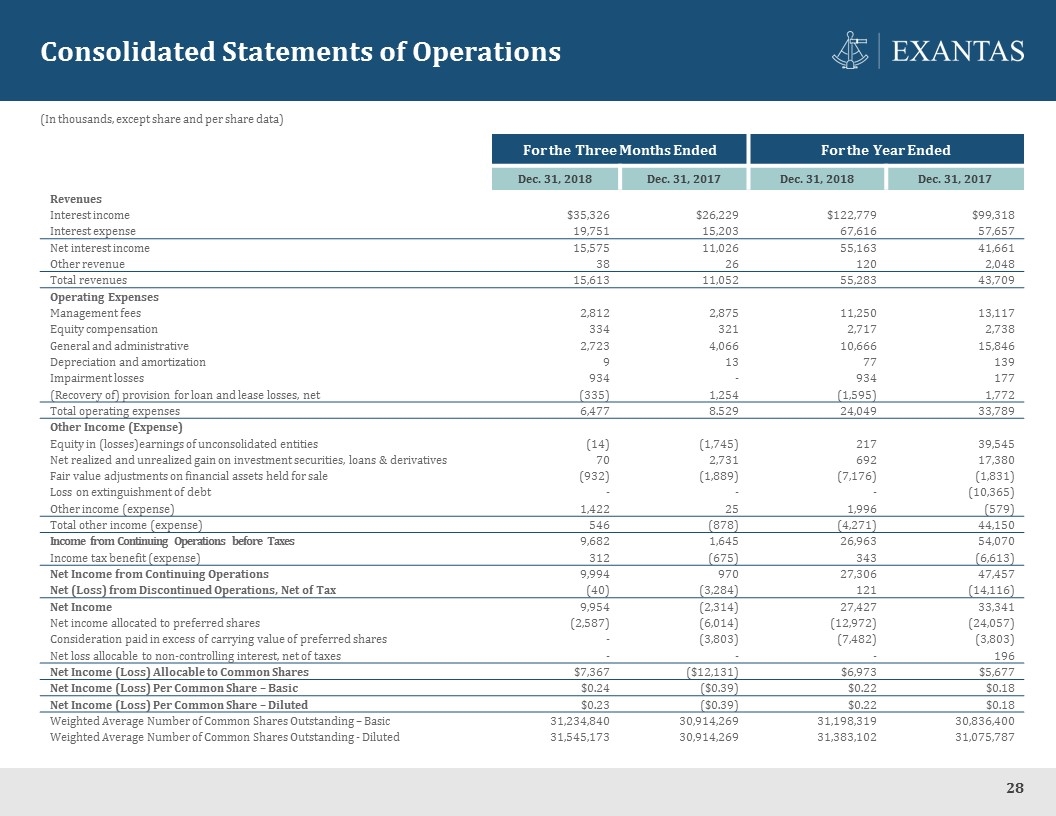

Consolidated Statements of Operations For the Three Months Ended For the Year Ended Dec. 31, 2018 Dec. 31, 2017 Dec. 31, 2018 Dec. 31, 2017 Revenues Interest income $35,326 $26,229 $122,779 $99,318 Interest expense 19,751 15,203 67,616 57,657 Net interest income 15,575 11,026 55,163 41,661 Other revenue 38 26 120 2,048 Total revenues 15,613 11,052 55,283 43,709 Operating Expenses Management fees 2,812 2,875 11,250 13,117 Equity compensation 334 321 2,717 2,738 General and administrative 2,723 4,066 10,666 15,846 Depreciation and amortization 9 13 77 139 Impairment losses 934 - 934 177 (Recovery of) provision for loan and lease losses, net (335) 1,254 (1,595) 1,772 Total operating expenses 6,477 8.529 24,049 33,789 Other Income (Expense) Equity in (losses)earnings of unconsolidated entities (14) (1,745) 217 39,545 Net realized and unrealized gain on investment securities, loans & derivatives 70 2,731 692 17,380 Fair value adjustments on financial assets held for sale (932) (1,889) (7,176) (1,831) Loss on extinguishment of debt - - - (10,365) Other income (expense) 1,422 25 1,996 (579) Total other income (expense) 546 (878) (4,271) 44,150 Income from Continuing Operations before Taxes 9,682 1,645 26,963 54,070 Income tax benefit (expense) 312 (675) 343 (6,613) Net Income from Continuing Operations 9,994 970 27,306 47,457 Net (Loss) from Discontinued Operations, Net of Tax (40) (3,284) 121 (14,116) Net Income 9,954 (2,314) 27,427 33,341 Net income allocated to preferred shares (2,587) (6,014) (12,972) (24,057) Consideration paid in excess of carrying value of preferred shares - (3,803) (7,482) (3,803) Net loss allocable to non-controlling interest, net of taxes - - - 196 Net Income (Loss) Allocable to Common Shares $7,367 ($12,131) $6,973 $5,677 Net Income (Loss) Per Common Share – Basic $0.24 ($0.39) $0.22 $0.18 Net Income (Loss) Per Common Share – Diluted $0.23 ($0.39) $0.22 $0.18 Weighted Average Number of Common Shares Outstanding – Basic 31,234,840 30,914,269 31,198,319 30,836,400 Weighted Average Number of Common Shares Outstanding - Diluted 31,545,173 30,914,269 31,383,102 31,075,787 (In thousands, except share and per share data) 28

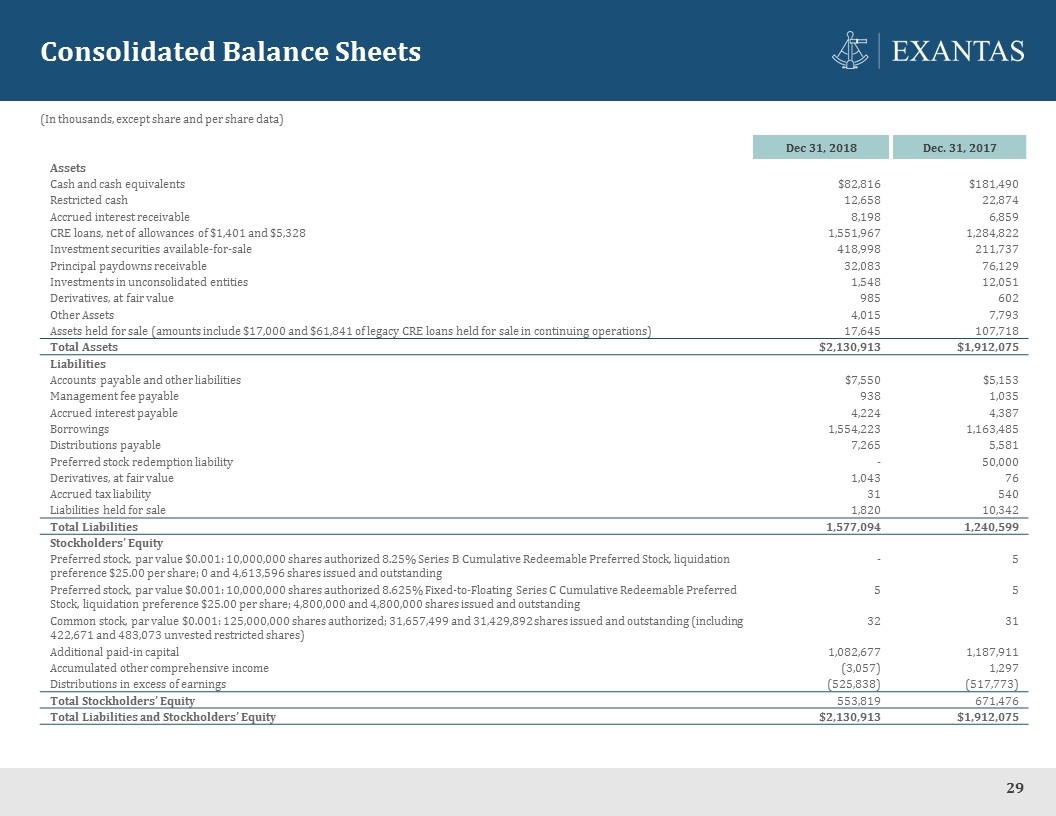

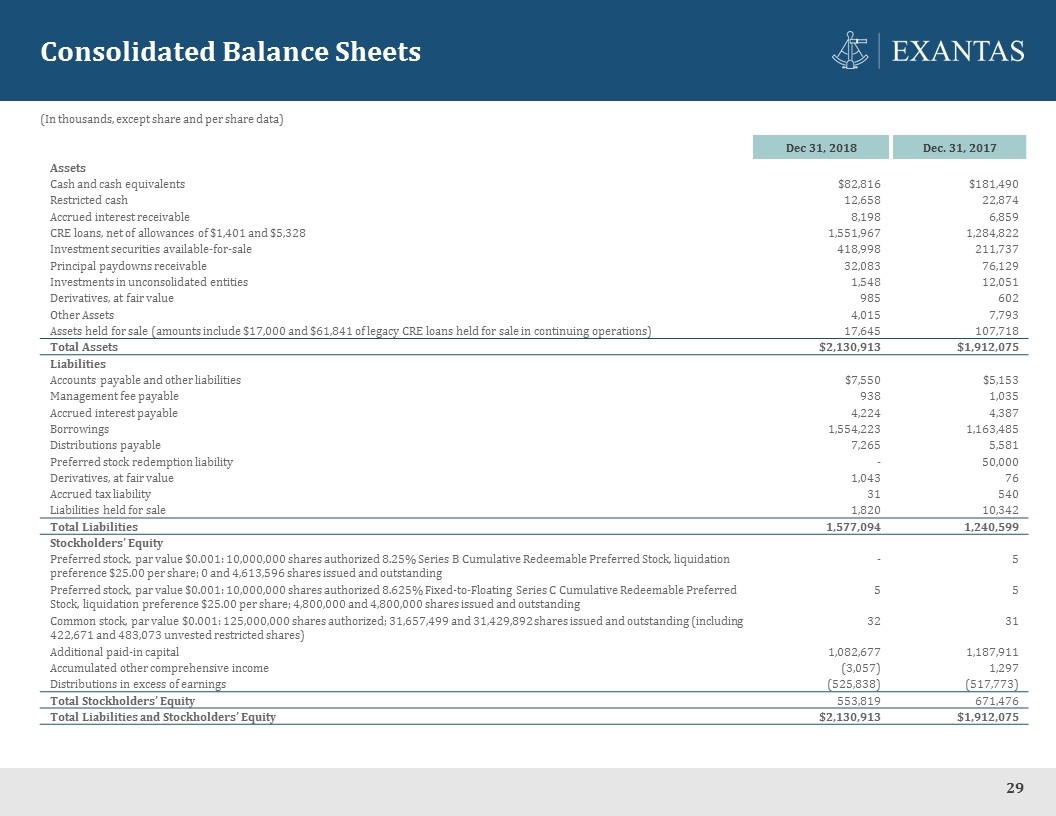

Consolidated Balance Sheets Dec 31, 2018 Dec. 31, 2017 Assets Cash and cash equivalents $82,816 $181,490 Restricted cash 12,658 22,874 Accrued interest receivable 8,198 6,859 CRE loans, net of allowances of $1,401 and $5,328 1,551,967 1,284,822 Investment securities available-for-sale 418,998 211,737 Principal paydowns receivable 32,083 76,129 Investments in unconsolidated entities 1,548 12,051 Derivatives, at fair value 985 602 Other Assets 4,015 7,793 Assets held for sale (amounts include $17,000 and $61,841 of legacy CRE loans held for sale in continuing operations) 17,645 107,718 Total Assets $2,130,913 $1,912,075 Liabilities Accounts payable and other liabilities $7,550 $5,153 Management fee payable 938 1,035 Accrued interest payable 4,224 4,387 Borrowings 1,554,223 1,163,485 Distributions payable 7,265 5,581 Preferred stock redemption liability - 50,000 Derivatives, at fair value 1,043 76 Accrued tax liability 31 540 Liabilities held for sale 1,820 10,342 Total Liabilities 1,577,094 1,240,599 Stockholders’ Equity Preferred stock, par value $0.001: 10,000,000 shares authorized 8.25% Series B Cumulative Redeemable Preferred Stock, liquidation preference $25.00 per share; 0 and 4,613,596 shares issued and outstanding - 5 Preferred stock, par value $0.001: 10,000,000 shares authorized 8.625% Fixed-to-Floating Series C Cumulative Redeemable Preferred Stock, liquidation preference $25.00 per share; 4,800,000 and 4,800,000 shares issued and outstanding 5 5 Common stock, par value $0.001: 125,000,000 shares authorized; 31,657,499 and 31,429,892 shares issued and outstanding (including 422,671 and 483,073 unvested restricted shares) 32 31 Additional paid-in capital 1,082,677 1,187,911 Accumulated other comprehensive income (3,057) 1,297 Distributions in excess of earnings (525,838) (517,773) Total Stockholders’ Equity 553,819 671,476 Total Liabilities and Stockholders’ Equity $2,130,913 $1,912,075 (In thousands, except share and per share data) 29

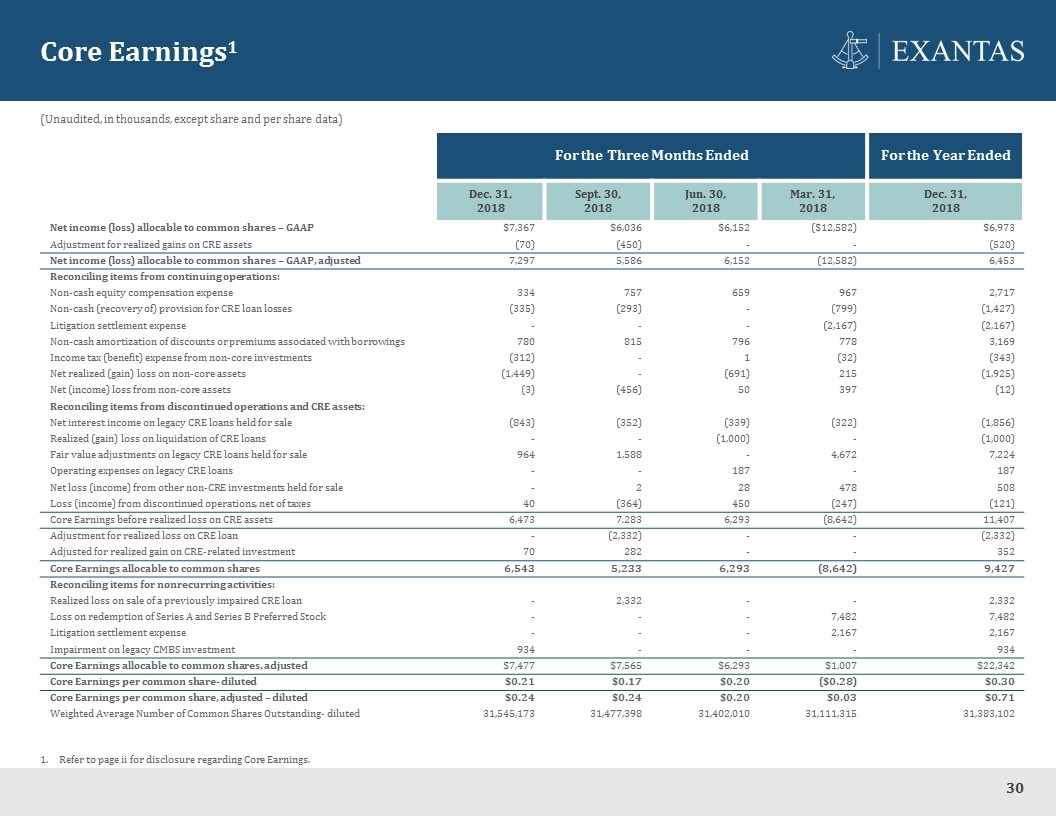

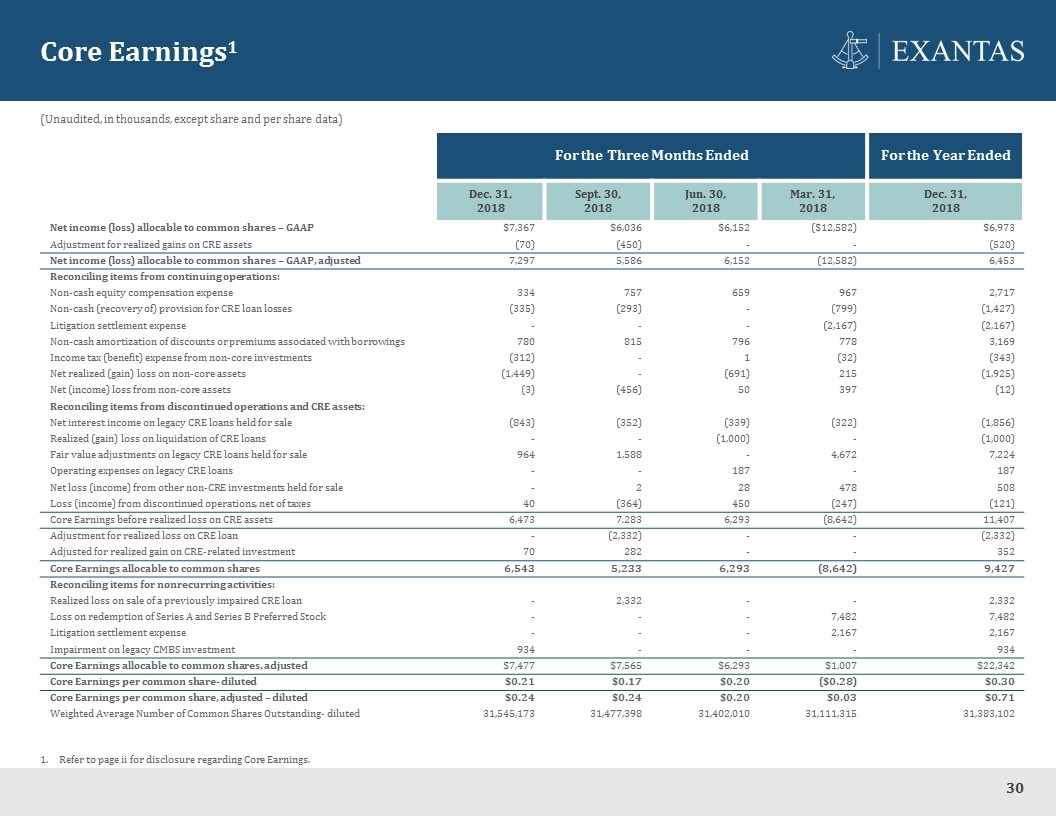

Core Earnings1 For the Three Months Ended For the Year Ended Dec. 31, 2018 Sept. 30, 2018 Jun. 30, 2018 Mar. 31, 2018 Dec. 31, 2018 Net income (loss) allocable to common shares – GAAP $7,367 $6,036 $6,152 ($12,582) $6,973 Adjustment for realized gains on CRE assets (70) (450) - - (520) Net income (loss) allocable to common shares – GAAP, adjusted 7,297 5,586 6,152 (12,582) 6,453 Reconciling items from continuing operations: Non-cash equity compensation expense 334 757 659 967 2,717 Non-cash (recovery of) provision for CRE loan losses (335) (293) - (799) (1,427) Litigation settlement expense - - - (2,167) (2,167) Non-cash amortization of discounts or premiums associated with borrowings 780 815 796 778 3,169 Income tax (benefit) expense from non-core investments (312) - 1 (32) (343) Net realized (gain) loss on non-core assets (1,449) - (691) 215 (1,925) Net (income) loss from non-core assets (3) (456) 50 397 (12) Reconciling items from discontinued operations and CRE assets: Net interest income on legacy CRE loans held for sale (843) (352) (339) (322) (1,856) Realized (gain) loss on liquidation of CRE loans - - (1,000) - (1,000) Fair value adjustments on legacy CRE loans held for sale 964 1,588 - 4,672 7,224 Operating expenses on legacy CRE loans - - 187 - 187 Net loss (income) from other non-CRE investments held for sale - 2 28 478 508 Loss (income) from discontinued operations, net of taxes 40 (364) 450 (247) (121) Core Earnings before realized loss on CRE assets 6,473 7.283 6,293 (8,642) 11,407 Adjustment for realized loss on CRE loan - (2,332) - - (2,332) Adjusted for realized gain on CRE-related investment 70 282 - - 352 Core Earnings allocable to common shares 6,543 5,233 6,293 (8,642) 9,427 Reconciling items for nonrecurring activities: Realized loss on sale of a previously impaired CRE loan - 2,332 - - 2,332 Loss on redemption of Series A and Series B Preferred Stock - - - 7,482 7,482 Litigation settlement expense - - - 2,167 2,167 Impairment on legacy CMBS investment 934 - - - 934 Core Earnings allocable to common shares, adjusted $7,477 $7,565 $6,293 $1,007 $22,342 Core Earnings per common share- diluted $0.21 $0.17 $0.20 ($0.28) $0.30 Core Earnings per common share, adjusted – diluted $0.24 $0.24 $0.20 $0.03 $0.71 Weighted Average Number of Common Shares Outstanding- diluted 31,545,173 31,477,398 31,402,010 31,111,315 31,383,102 Refer to page ii for disclosure regarding Core Earnings. (Unaudited, in thousands, except share and per share data) 30

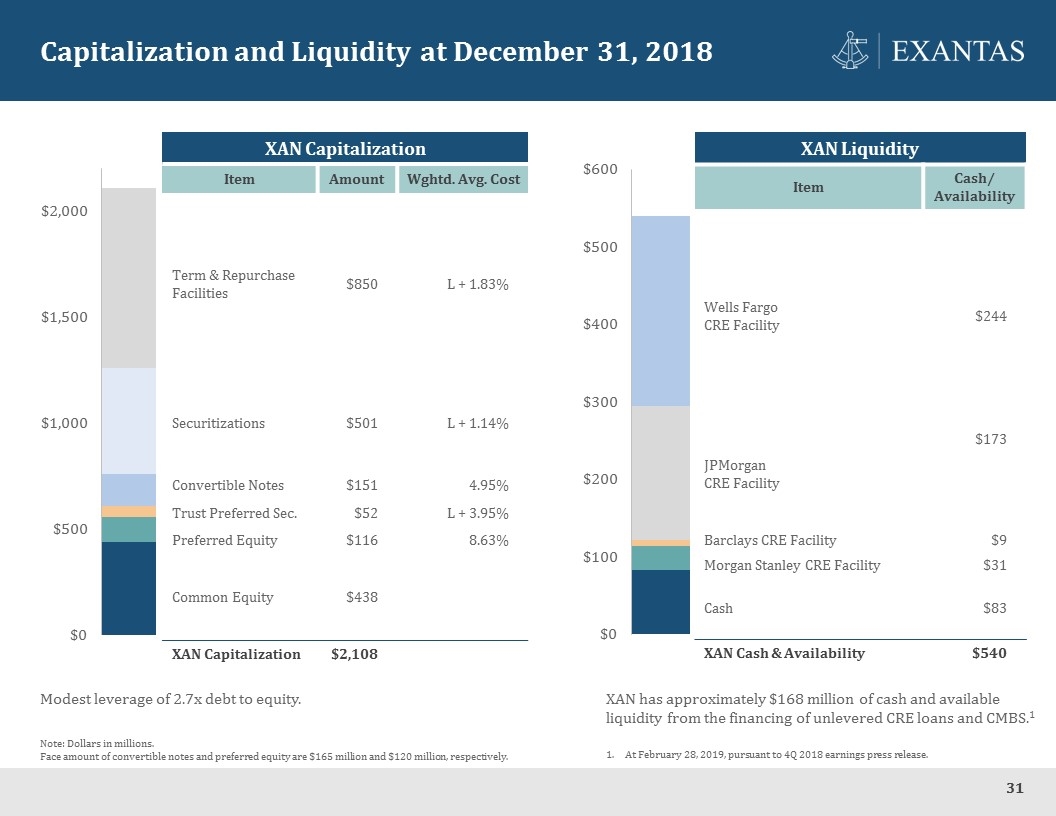

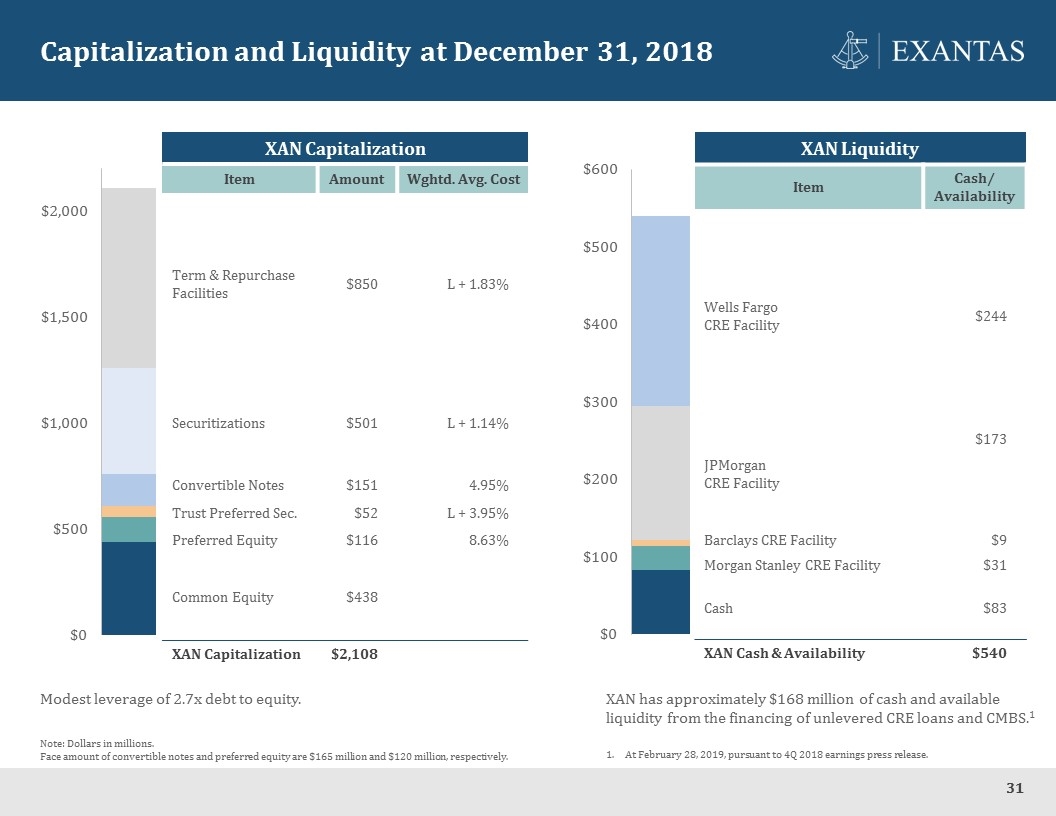

Capitalization and Liquidity at December 31, 2018 Modest leverage of 2.7x debt to equity. Note: Dollars in millions. Face amount of convertible notes and preferred equity are $165 million and $120 million, respectively. XAN has approximately $168 million of cash and available liquidity from the financing of unlevered CRE loans and CMBS.1 XAN Capitalization Item Amount Wghtd. Avg. Cost Term & Repurchase Facilities $850 L + 1.83% Securitizations $501 L + 1.14% Convertible Notes $151 4.95% Trust Preferred Sec. $52 L + 3.95% Preferred Equity $116 8.63% Common Equity $438 XAN Capitalization $2,108 XAN Liquidity Item Cash/ Availability Wells Fargo CRE Facility $244 JPMorgan CRE Facility $173 Barclays CRE Facility $9 Morgan Stanley CRE Facility $31 Cash $83 XAN Cash & Availability $540 At February 28, 2019, pursuant to 4Q 2018 earnings press release. 31

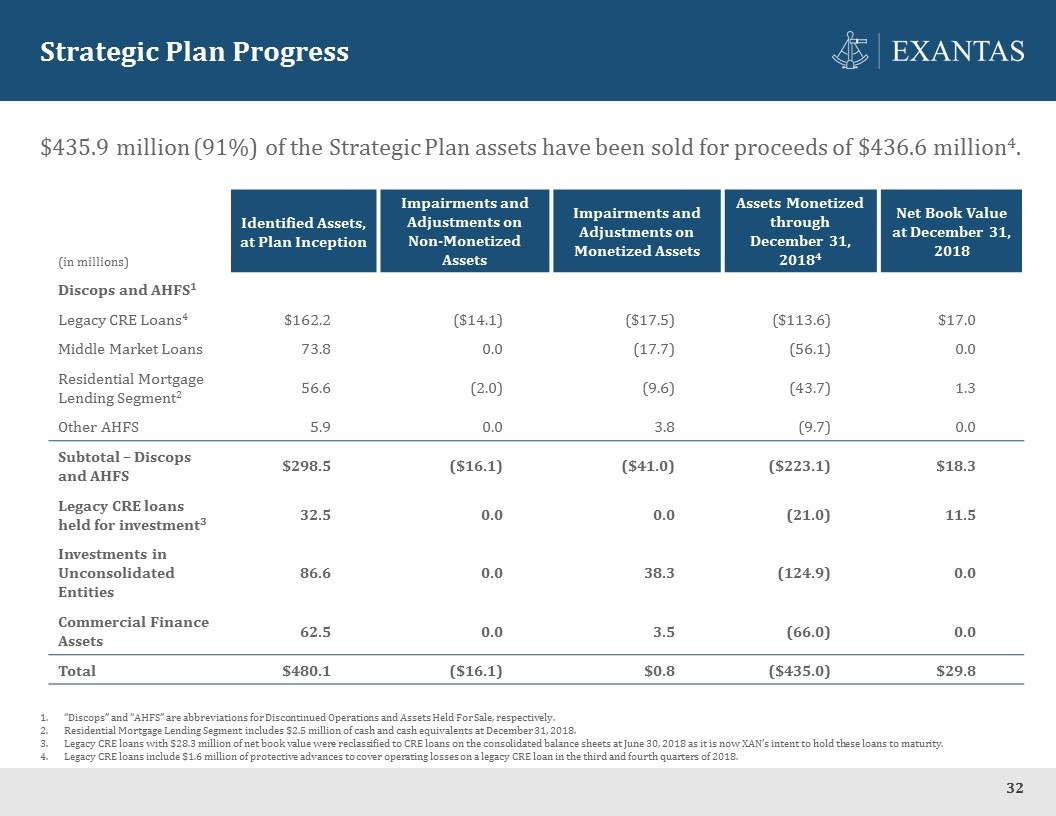

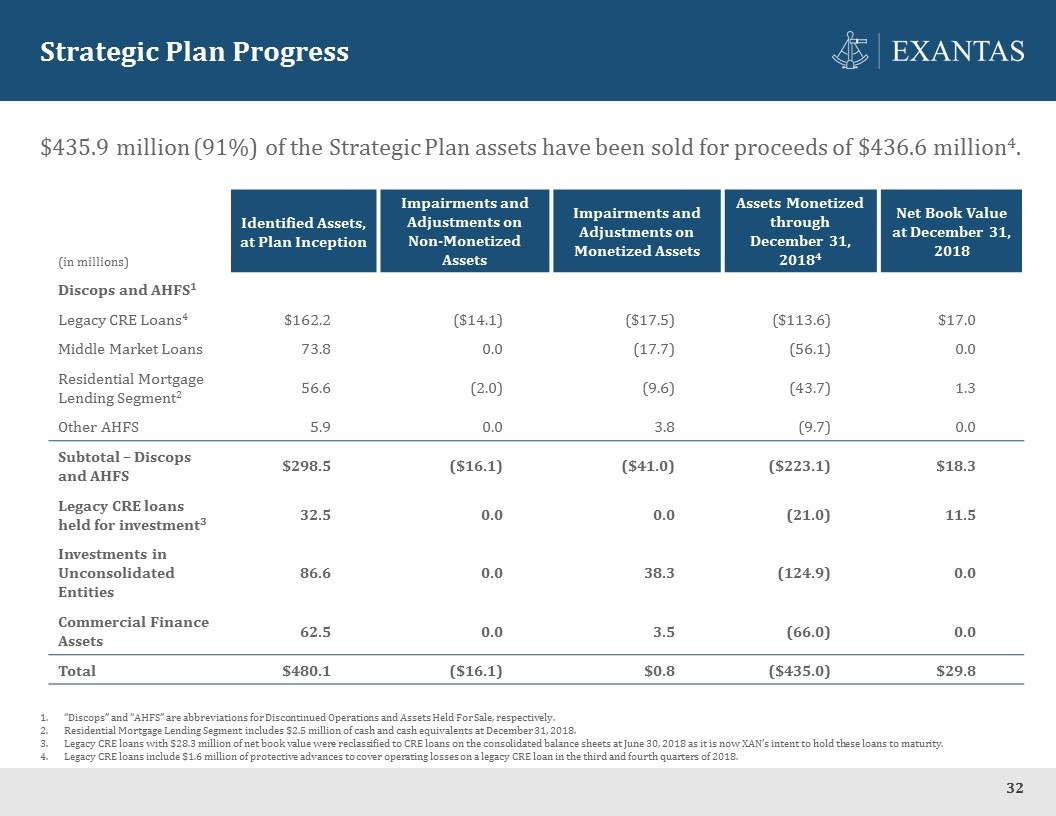

Strategic Plan Progress $435.9 million (91%) of the Strategic Plan assets have been sold for proceeds of $436.6 million4. (in millions) Identified Assets, at Plan Inception Impairments and Adjustments on Non-Monetized Assets Impairments and Adjustments on Monetized Assets Assets Monetized through December 31, 20184 Net Book Value at December 31, 2018 Discops and AHFS1 Legacy CRE Loans4 $162.2 ($14.1) ($17.5) ($113.6) $17.0 Middle Market Loans 73.8 0.0 (17.7) (56.1) 0.0 Residential Mortgage Lending Segment2 56.6 (2.0) (9.6) (43.7) 1.3 Other AHFS 5.9 0.0 3.8 (9.7) 0.0 Subtotal – Discops and AHFS $298.5 ($16.1) ($41.0) ($223.1) $18.3 Legacy CRE loans held for investment3 32.5 0.0 0.0 (21.0) 11.5 Investments in Unconsolidated Entities 86.6 0.0 38.3 (124.9) 0.0 Commercial Finance Assets 62.5 0.0 3.5 (66.0) 0.0 Total $480.1 ($16.1) $0.8 ($435.0) $29.8 “Discops” and “AHFS” are abbreviations for Discontinued Operations and Assets Held For Sale, respectively. Residential Mortgage Lending Segment includes $2.5 million of cash and cash equivalents at December 31, 2018. Legacy CRE loans with $28.3 million of net book value were reclassified to CRE loans on the consolidated balance sheets at June 30, 2018 as it is now XAN’s intent to hold these loans to maturity. Legacy CRE loans include $1.6 million of protective advances to cover operating losses on a legacy CRE loan in the third and fourth quarters of 2018. 32