ACRES Commercial Realty Corp. Fourth Quarter 2021 Earnings Presentation March 3, 2022 Exhibit 99.2

Disclaimer Forward-Looking Statements This presentation contains forward-looking statements within the meaning of federal securities laws. These forward-looking statements are not historical facts but rather are based on our current beliefs, assumptions and expectations. These beliefs, assumptions and expectations can change as a result of many possible events or factors, not all of which are known to us or are within our control. If a change occurs, our business, financial condition, liquidity and results of operations may vary materially from those expressed in our forward-looking statements. You should not place undue reliance on these forward-looking statements, which reflect our view only as of the date of this presentation. We use words such as “anticipate,” “expect,” “intend,” “plan,” “believe,” “seek,” “estimate,” “target,” and variations of these words and similar expressions to identify forward-looking statements. Forward-looking statements are subject to various risks and uncertainties that could cause actual results to vary from our forward-looking statements, including, but not limited to: ACRESREIT.COM 2 changes in our industry, interest rates, the debt securities markets, real estate markets or the general economy; increased rates of default and/or decreased recovery rates on our investments; the performance and financial condition of our borrowers; the cost and availability of our financings, which depend in part on our asset quality, the nature of our relationships with our lenders and other capital providers, our business prospects and outlook and general market conditions; the availability and attractiveness of terms of additional debt repurchases; availability, terms and deployment of short-term and long-term capital; availability of, and ability to retain, qualified personnel; changes in our business strategy; availability of investment opportunities in commercial real estate-related and commercial finance assets; the degree and nature of our competition; the resolution of our non-performing and sub-performing assets; The outbreak of widespread contagious disease, such as the novel coronavirus, COVID-19; our ability to comply with financial covenants in our debt instruments; the adequacy of our cash reserves and working capital; the timing of cash flows, if any, from our investments; unanticipated increases in financial and other costs, including a rise in interest rates; our ability to maintain compliance with over-collateralization and interest coverage tests in our CDOs and/or CLOs; our dependence on ACRES Capital, LLC, our “Manager”, and ability to find a suitable replacement in a timely manner, or at all, if our Manager or we were to terminate the management agreement; environmental and/or safety requirements; our ability to satisfy complex rules in order for us to qualify as a REIT, for federal income tax purposes and qualify for our exemption under the Investment Company Act of 1940, as amended, and our ability and the ability of our subsidiaries to operate effectively within the limitations imposed by these rules; legislative and regulatory changes (including changes to laws governing the taxation of REITs or the exemptions from registration as an investment company); and other factors discussed under Item IA. Risk Factors in our Annual Report on Form 10-K for the year ended December 31, 2020 and those factors that may be contained in any subsequent filing we make with the Securities and Exchange Commission.

Disclaimer (continued) ACRESREIT.COM 3 Forward-Looking Statements (continued) We undertake no obligation, and specifically disclaim any obligation, to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as required by law. In light of these risks and uncertainties, the forward-looking events and circumstances discussed in this presentation might not occur and actual results, performance or achievement could differ materially from those anticipated or implied in the forward-looking statements. Past Performance Waiver Past performance is not indicative of future results. There is no guarantee that any investment strategy referenced herein will work under all market conditions. Prior to making any investment decision, you should evaluate your ability to invest for the long-term, especially during periods of downturns in the market. You alone assume the responsibility of evaluating the merits and risks associated with any potential investment or investment strategy referenced herein. Notes on Presentation This presentation contains information regarding financial results that is calculated and presented on the basis of methodologies other than in accordance with accounting principles generally accepted in the United States (“GAAP”), which management believes is relevant to assessing ACRES Commercial Realty Corp.’s (“ACR’s” or the “Company’s”) financial performance. Please refer to page 25 for the reconciliation of Net (Loss) Income, a GAAP financial measure, to Core Earnings, a Non-GAAP financial measure. Unless otherwise indicated, information included in this presentation is as of or for the period ended December 31, 2021. No Offer or Sale of Securities This presentation is for informational purposes only and does not constitute an offer to sell or the solicitation of any offer to buy any securities of ACR or any other entity. Any offering of securities would be made pursuant to separate documentation and any such securities would not be offered or sold in the United States absent registration or an applicable exemption from registration requirements.

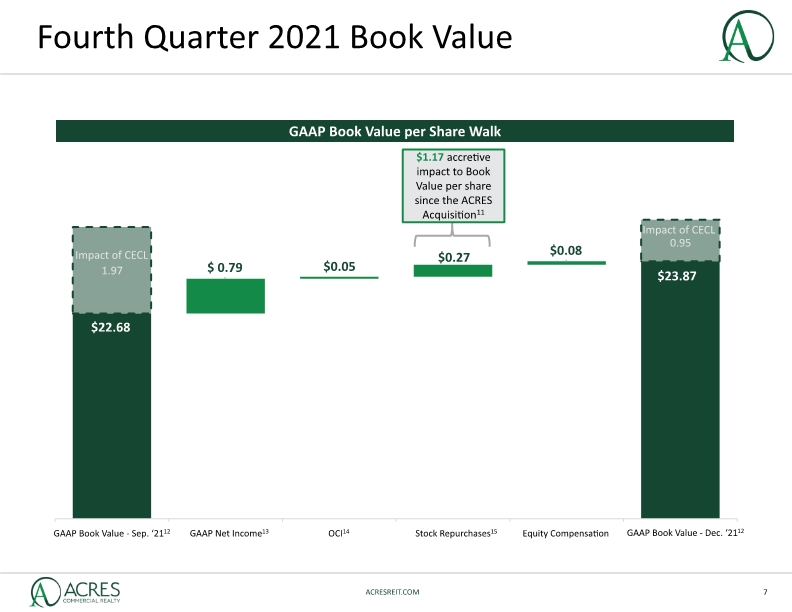

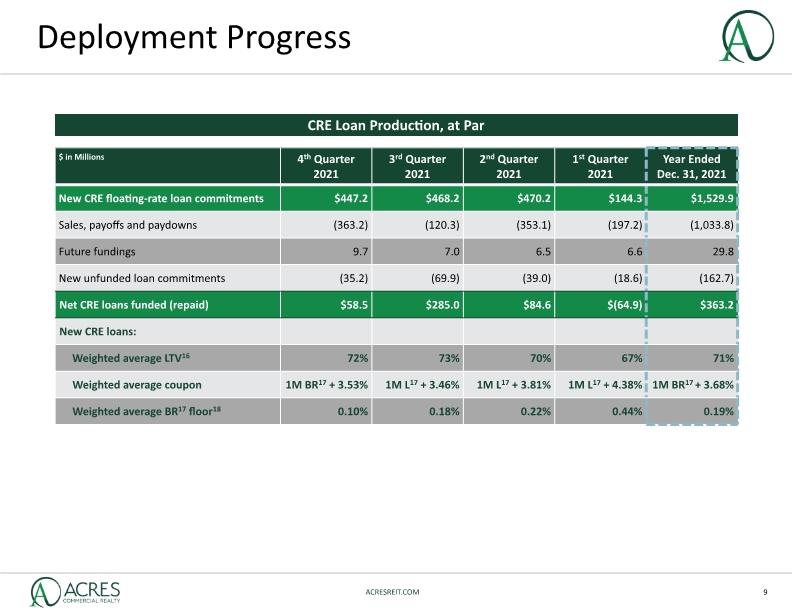

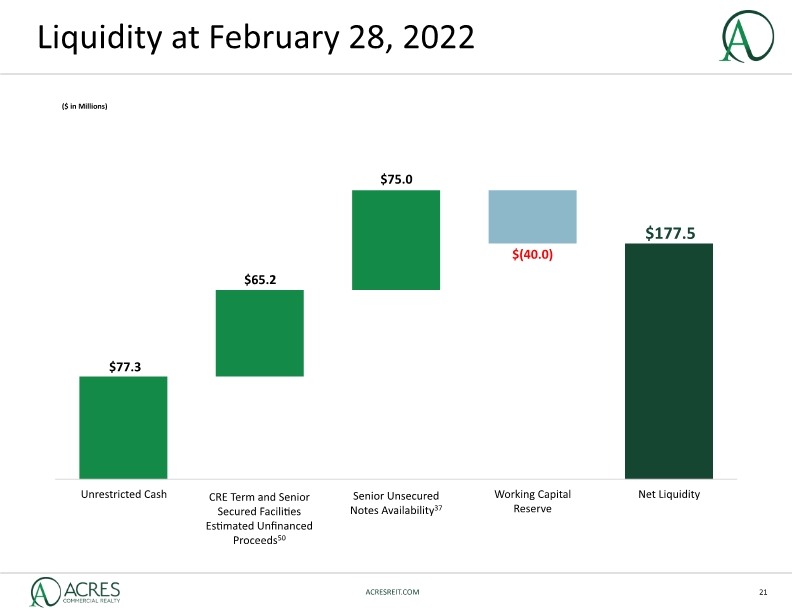

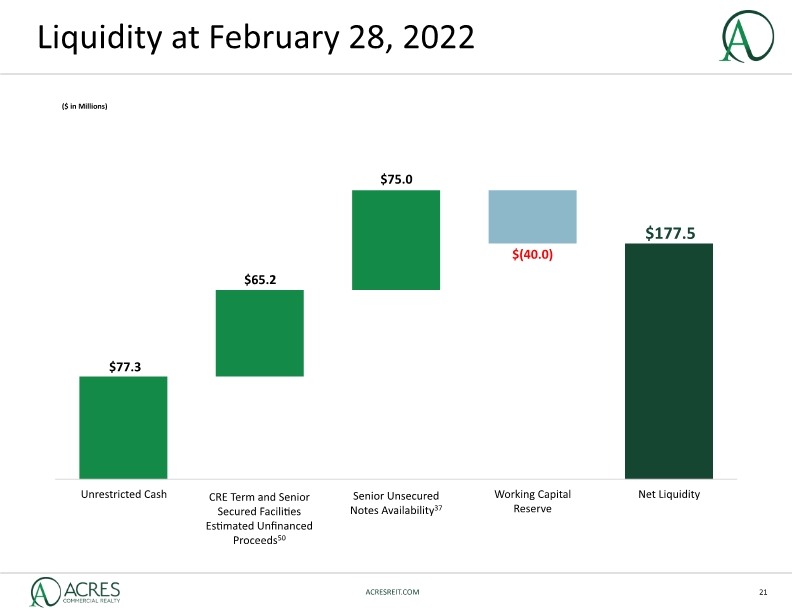

Fourth Quarter 2021 Highlights1 Over $1.5 billion of CRE2 loan originations in 2021, a record year in the Company’s history The close of two managed CLOs2 in 2021 provided over $1.5 billion of financing capacity that can be reinvested into the vehicles for two years each from the respective dates of close ACRESREIT.COM 4 $447M of CRE loan originations were closed $0.76 per share-diluted $178M of net liquidity, including unrestricted cash, CRE term facility and senior secured financing facility2 unfinanced proceeds and 12.00% Senior Unsecured Notes2 availability $700M of CRE loan financing capacity was funded with non-recourse floating-rate notes issued through the close of a managed CLO, which has a 180-day ramp-up acquisition period and 24-month reinvestment period $29M of direct investments in commercial real estate, equity completed6 $3.7M or 274,529 shares, of common stock was repurchased by ACR, which resulted in $0.27 per share7 of accretion to book value7, in the fourth quarter. $16.3M remains available at December 31, 2021 for repurchase Company Repurchased Common Stock Invested in New Investments in Real Estate New Managed CLO2 Closed in December GAAP Net Income2 Robust Liquidity at February 28, 2022 Growth in CRE Loan Originations

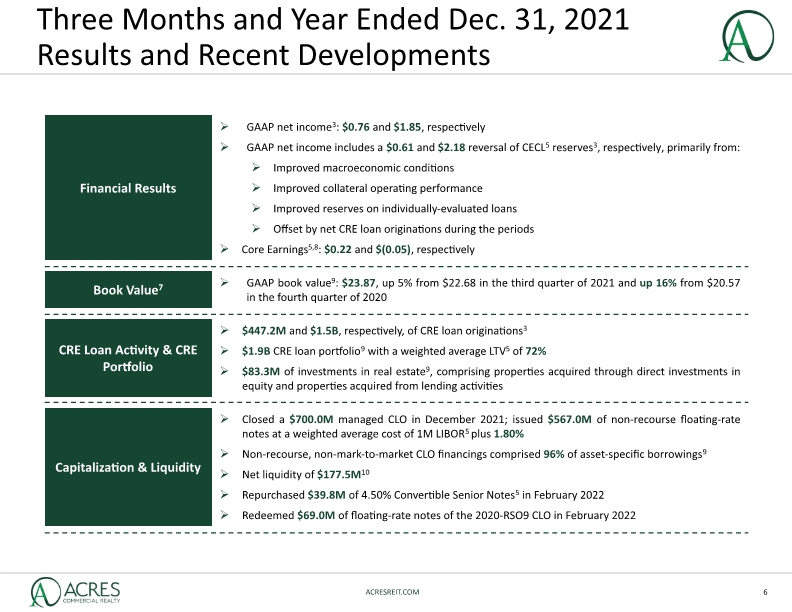

Results for Quarter and Year Ended December 31, 2021

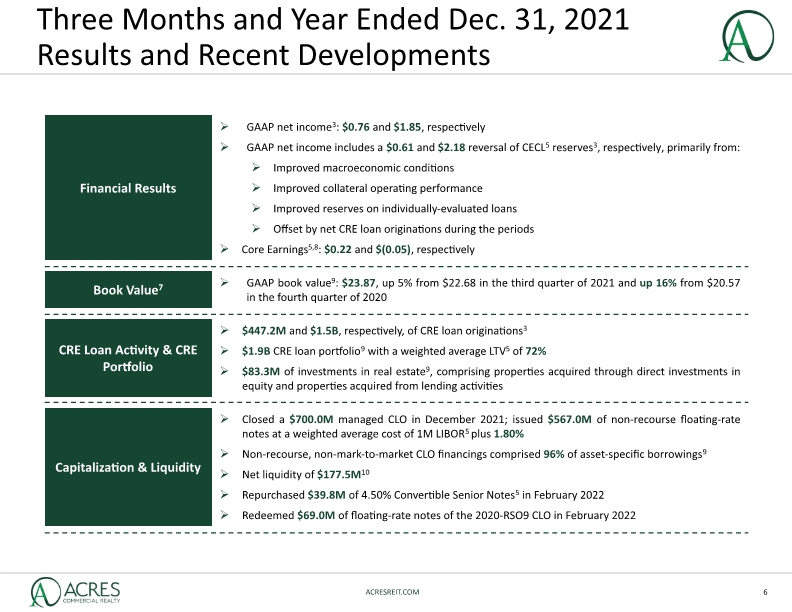

Three Months and Year Ended Dec. 31, 2021 Results and Recent Developments ACRESREIT.COM 6

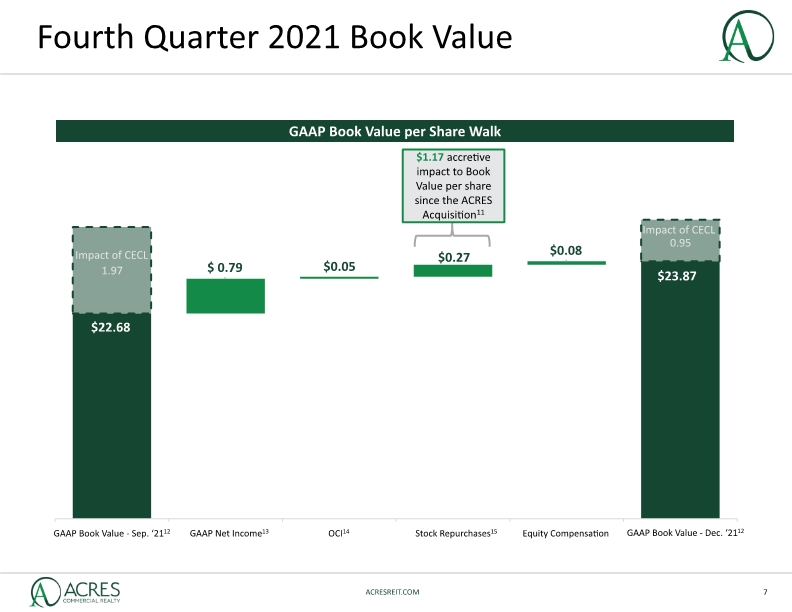

Fourth Quarter 2021 Book Value ACRESREIT.COM 7 GAAP Book Value per Share Walk $1.17 accretive impact to Book Value per share since the ACRES Acquisition11

CRE Loan Activity and CRE Portfolio

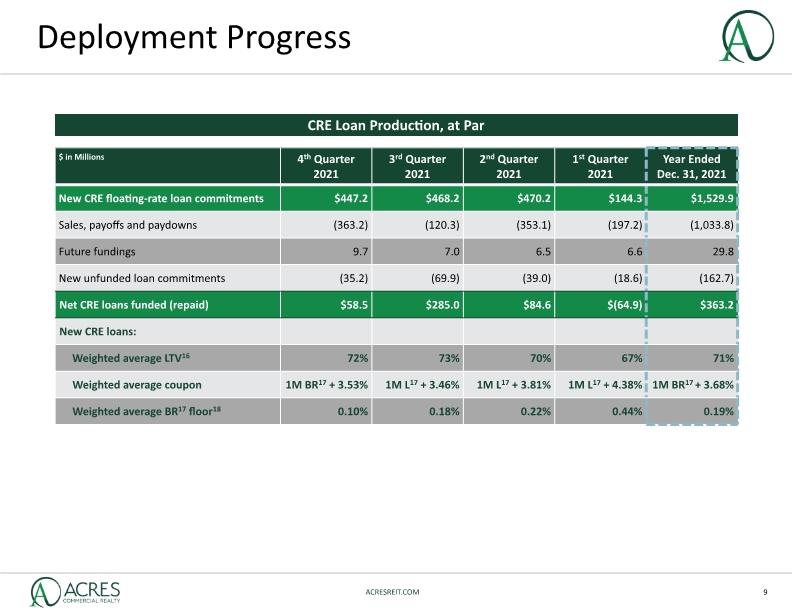

Deployment Progress ACRESREIT.COM 9 CRE Loan Production, at Par

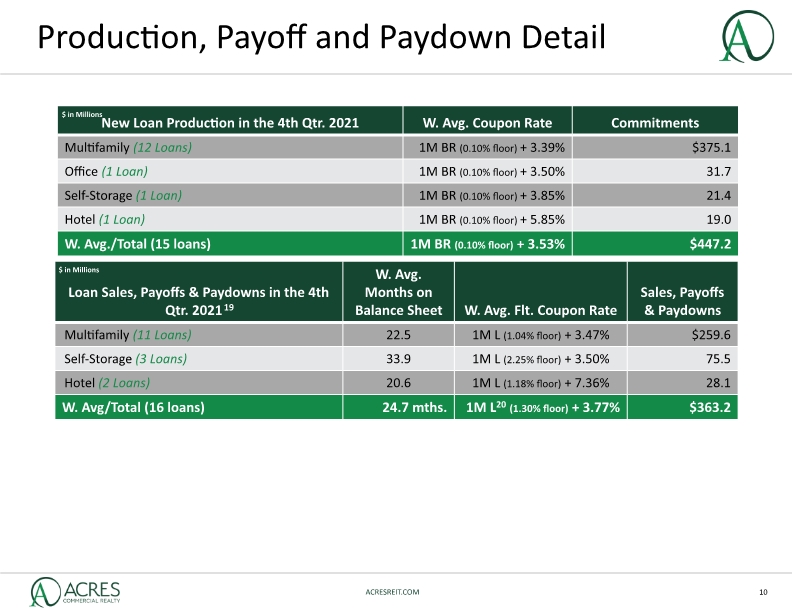

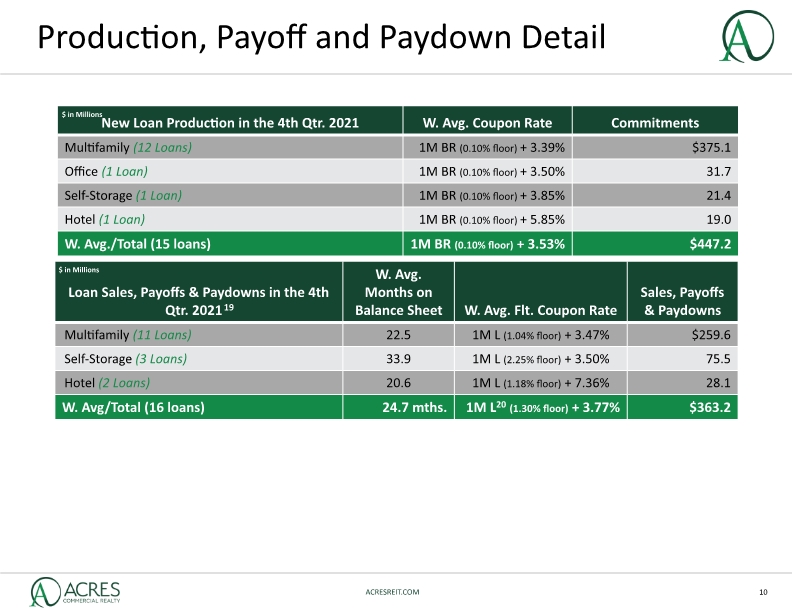

Production, Payoff and Paydown Detail ACRESREIT.COM 10 $ in Millions $ in Millions

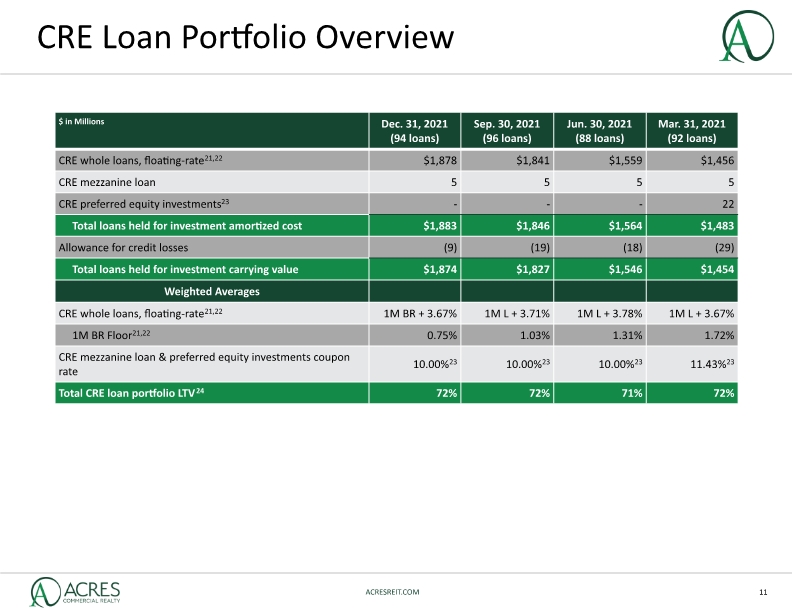

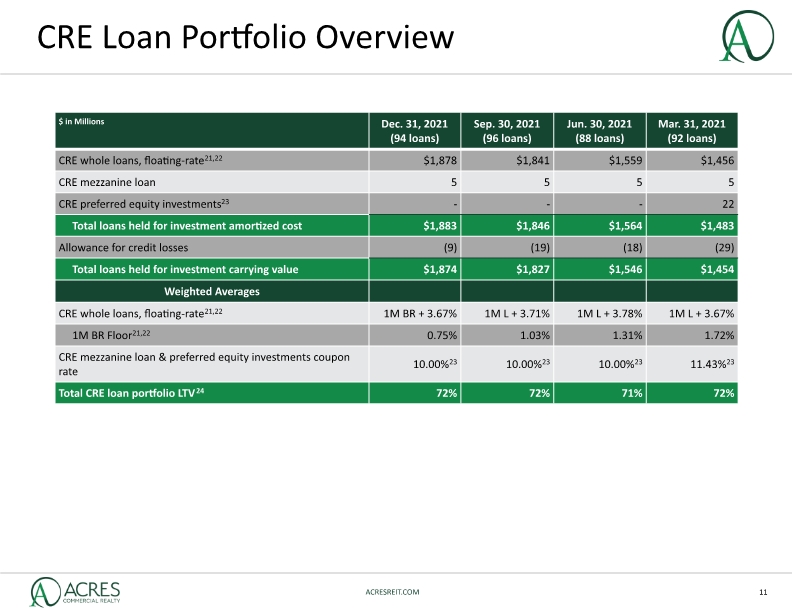

CRE Loan Portfolio Overview ACRESREIT.COM 11

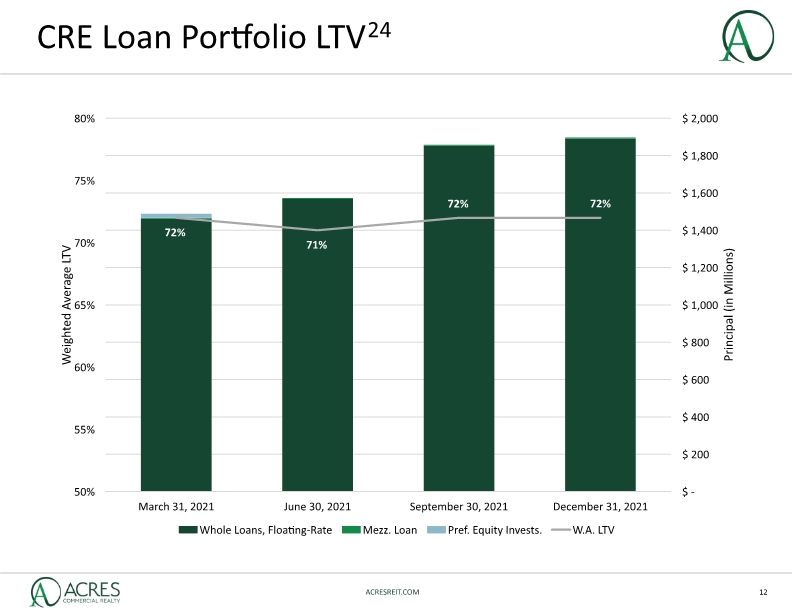

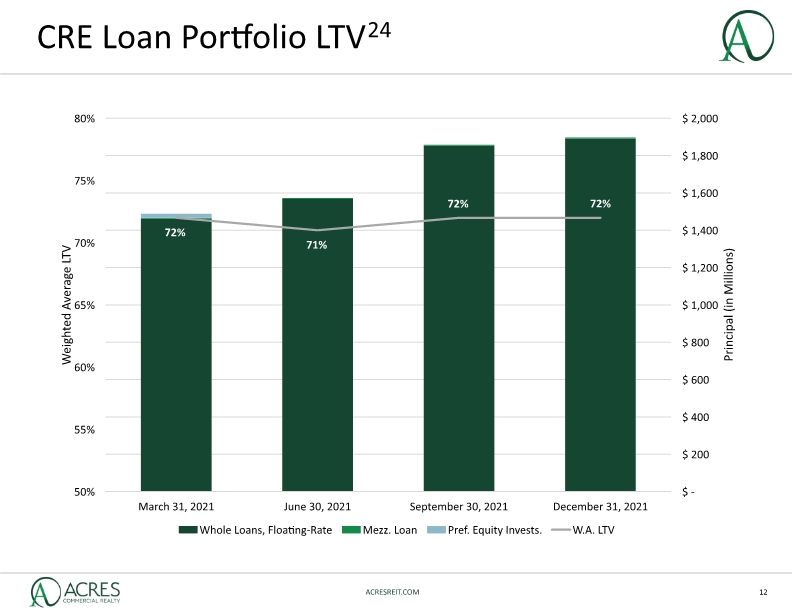

CRE Loan Portfolio LTV24 ACRESREIT.COM 12

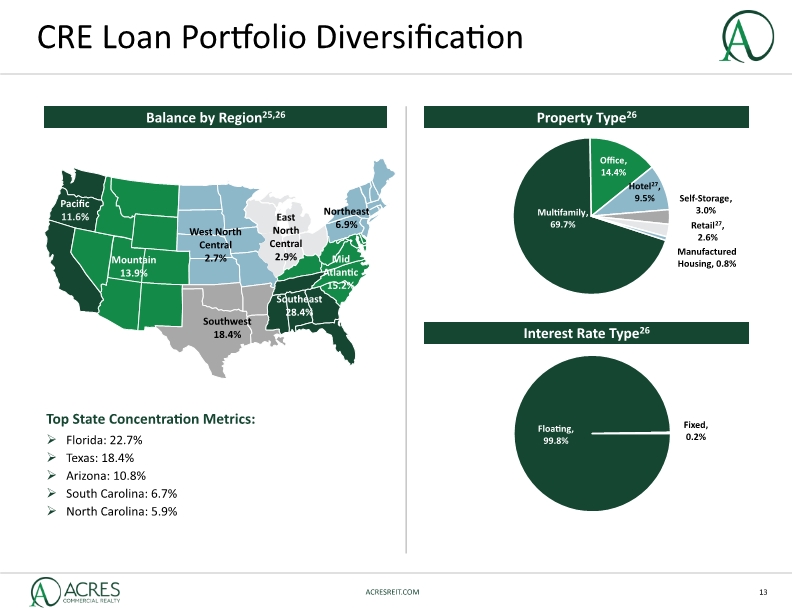

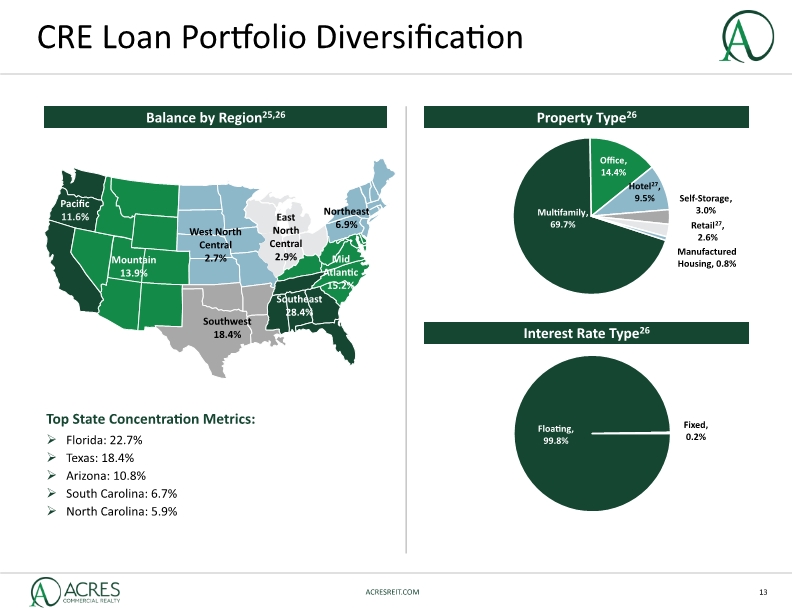

CRE Loan Portfolio Diversification ACRESREIT.COM 13 Top State Concentration Metrics: Florida: 22.7% Texas: 18.4% Arizona: 10.8% South Carolina: 6.7% North Carolina: 5.9% Property Type26 Interest Rate Type26 Balance by Region25,26

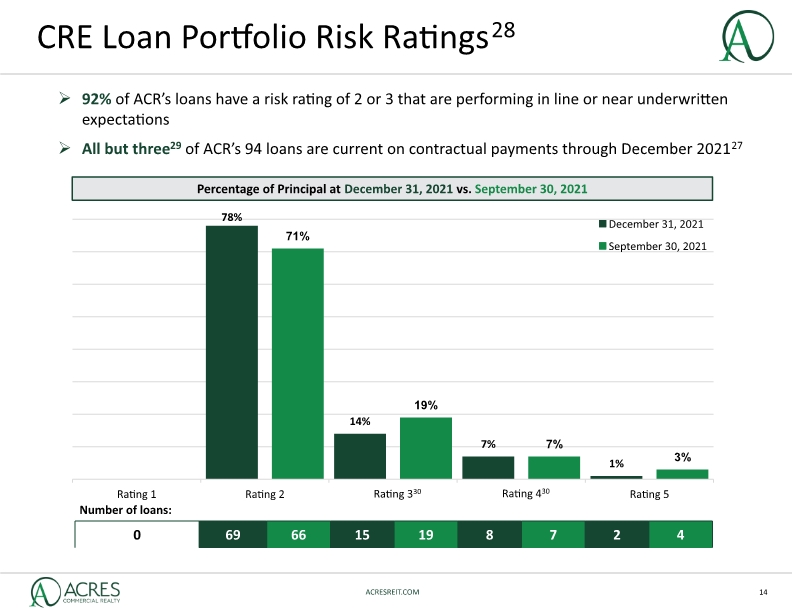

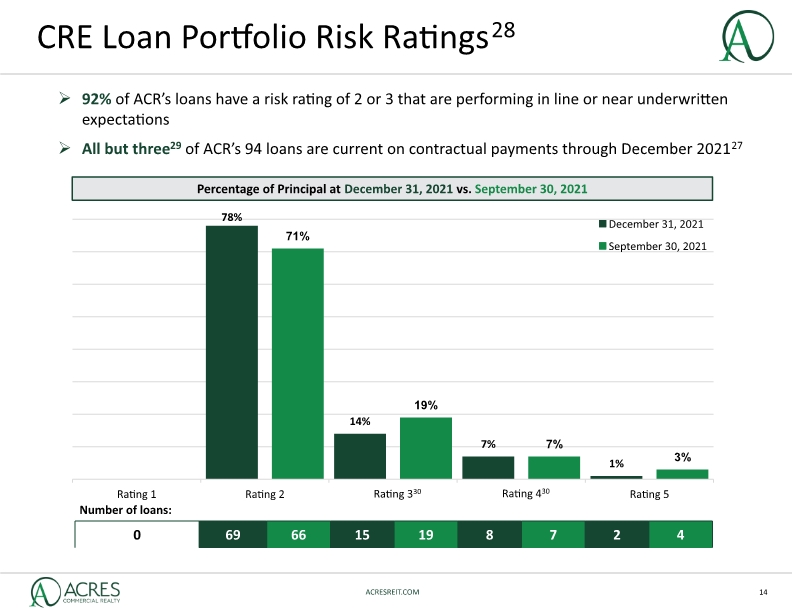

CRE Loan Portfolio Risk Ratings28 ACRESREIT.COM 14 Percentage of Principal at December 31, 2021 vs. September 30, 2021 Number of loans: 92% of ACR’s loans have a risk rating of 2 or 3 that are performing in line or near underwritten expectations All but three29 of ACR’s 94 loans are current on contractual payments through December 202127 Rating 330 Rating 430

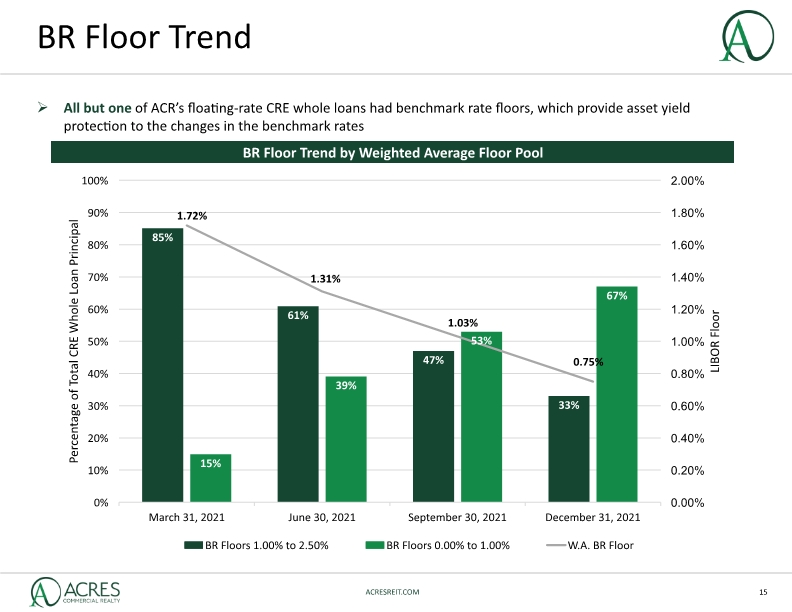

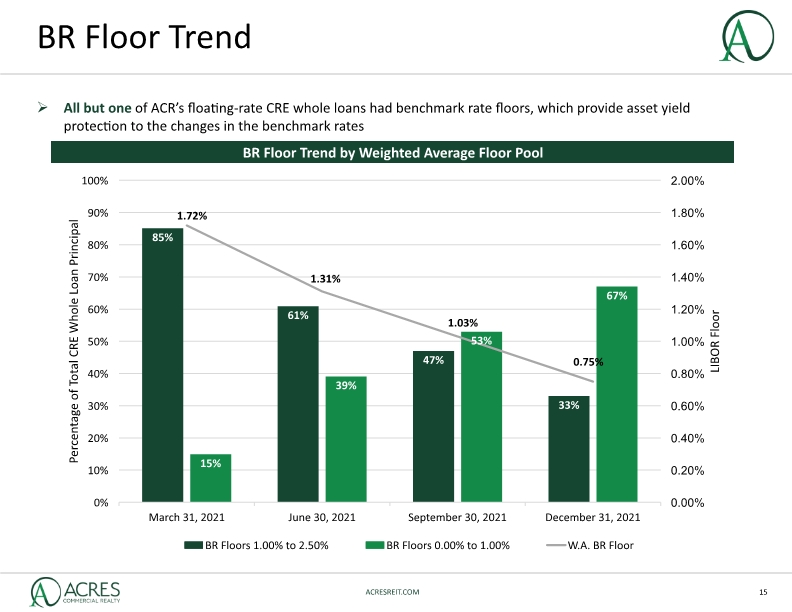

BR Floor Trend ACRESREIT.COM 15 BR Floor Trend by Weighted Average Floor Pool All but one of ACR’s floating-rate CRE whole loans had benchmark rate floors, which provide asset yield protection to the changes in the benchmark rates

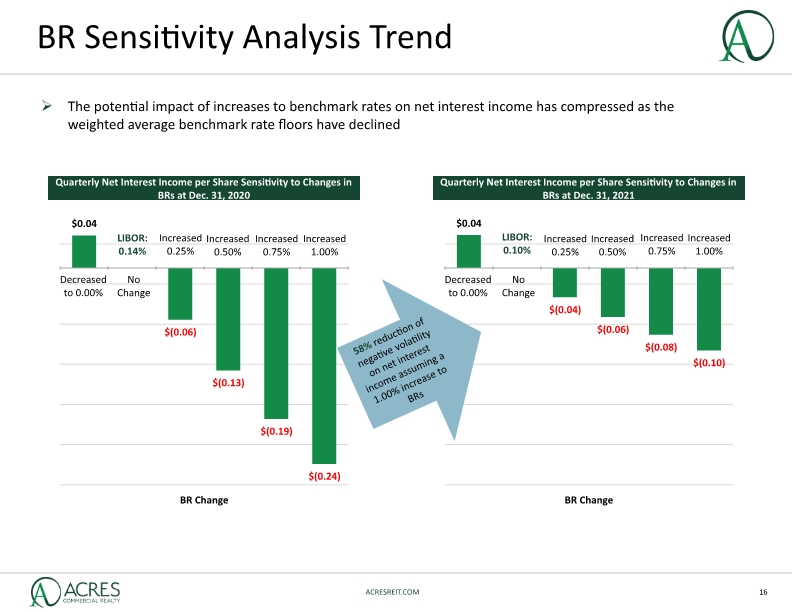

BR Sensitivity Analysis Trend ACRESREIT.COM 16 The potential impact of increases to benchmark rates on net interest income has compressed as the weighted average benchmark rate floors have declined 58% reduction of negative volatility on net interest income assuming a 1.00% increase to BRs

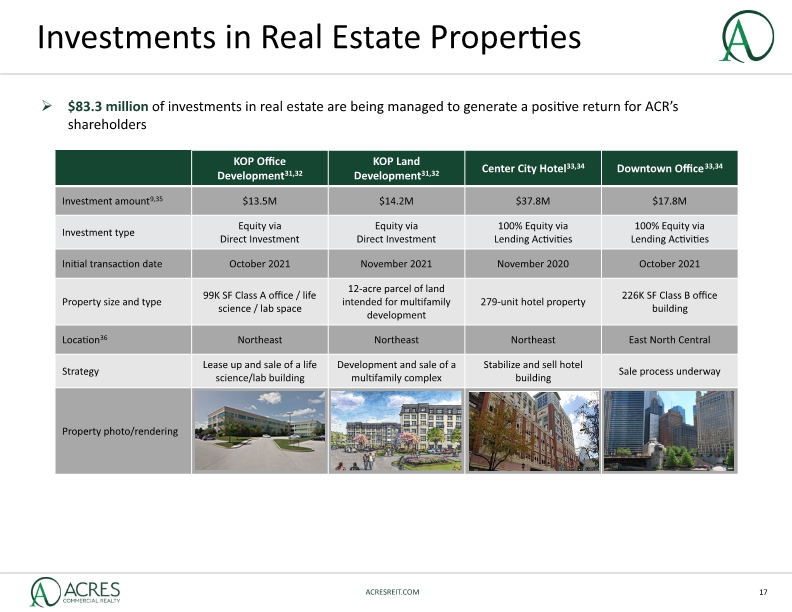

Investments in Real Estate Properties ACRESREIT.COM 17 $83.3 million of investments in real estate are being managed to generate a positive return for ACR’s shareholders

Capitalization and Liquidity

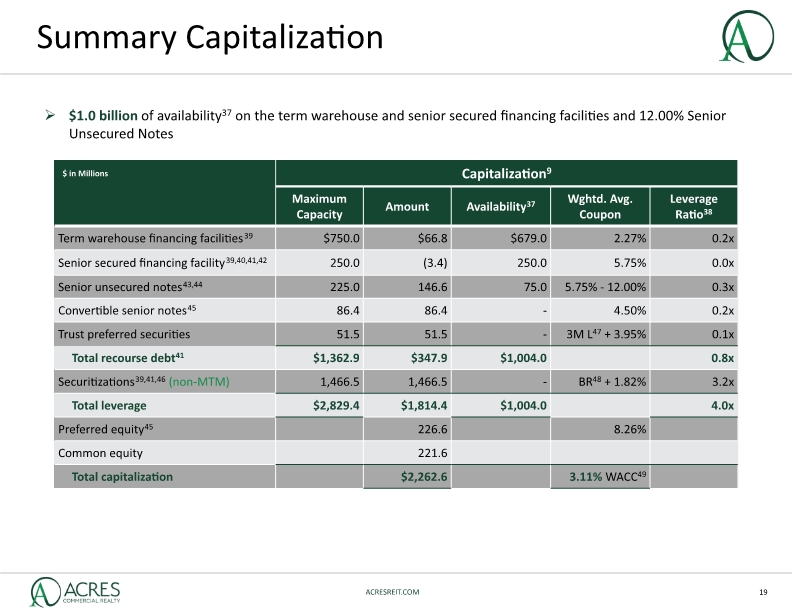

Summary Capitalization $1.0 billion of availability37 on the term warehouse and senior secured financing facilities and 12.00% Senior Unsecured Notes ACRESREIT.COM 19

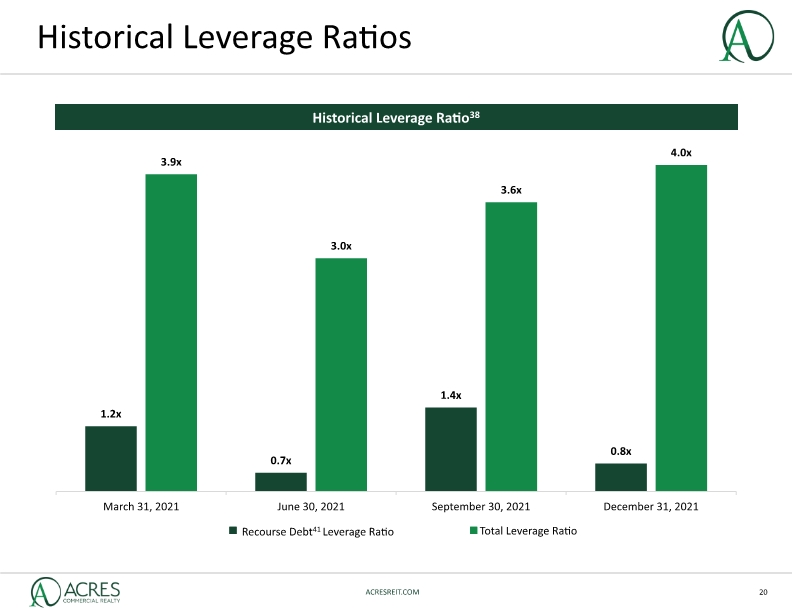

Historical Leverage Ratios ACRESREIT.COM 20 Historical Leverage Ratio38

Liquidity at February 28, 2022 ACRESREIT.COM 21

Appendix

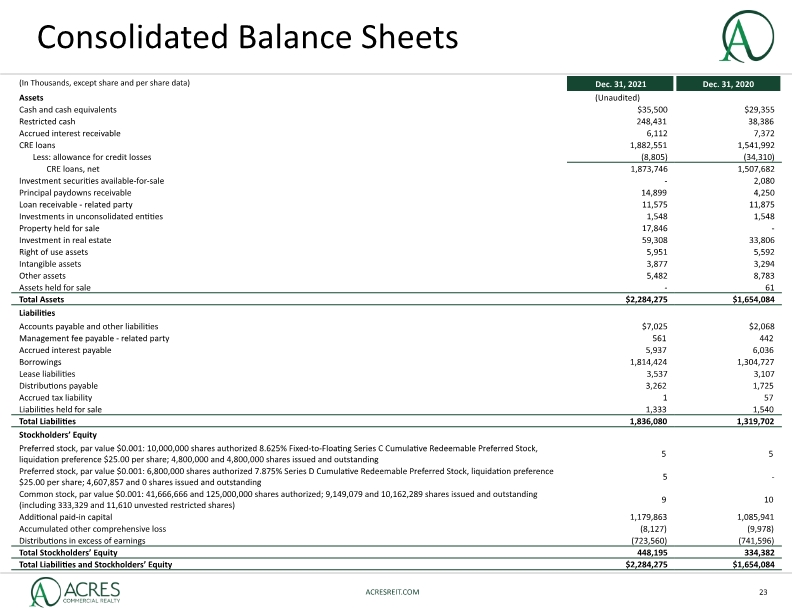

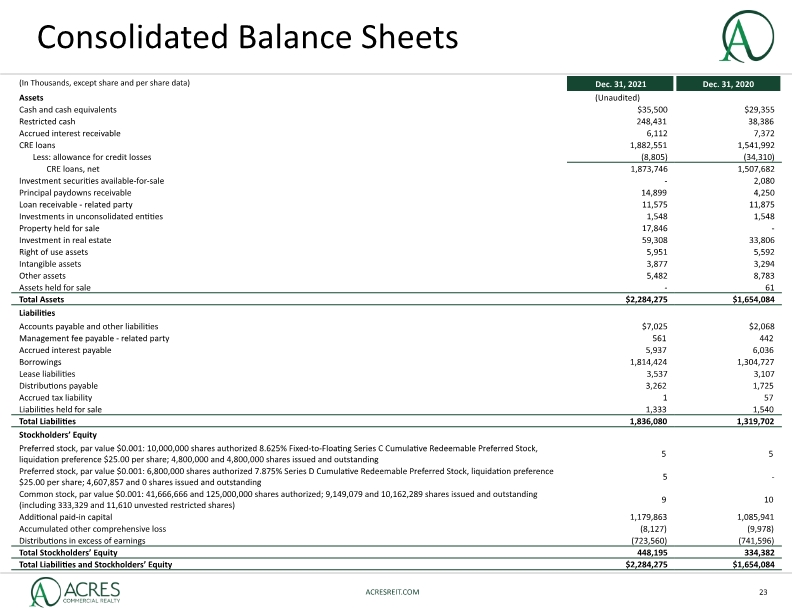

Consolidated Balance Sheets ACRESREIT.COM 23 (In Thousands, except share and per share data)

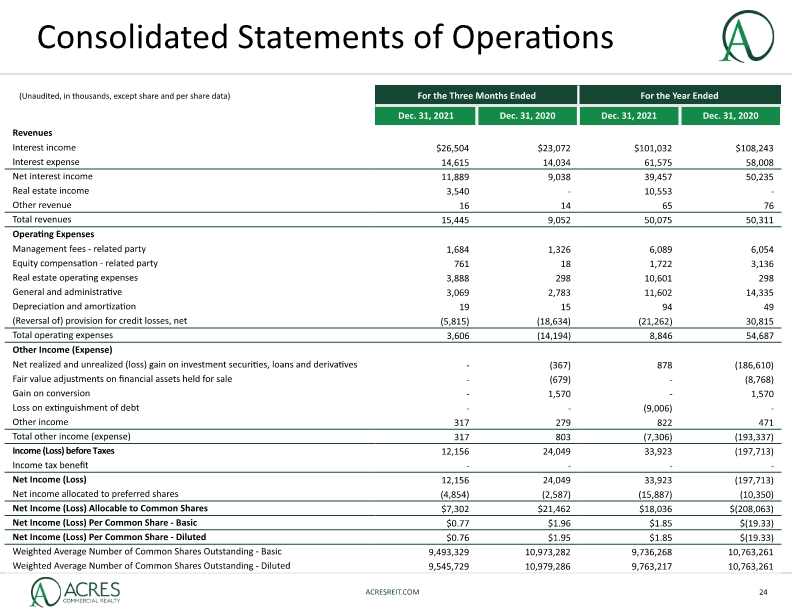

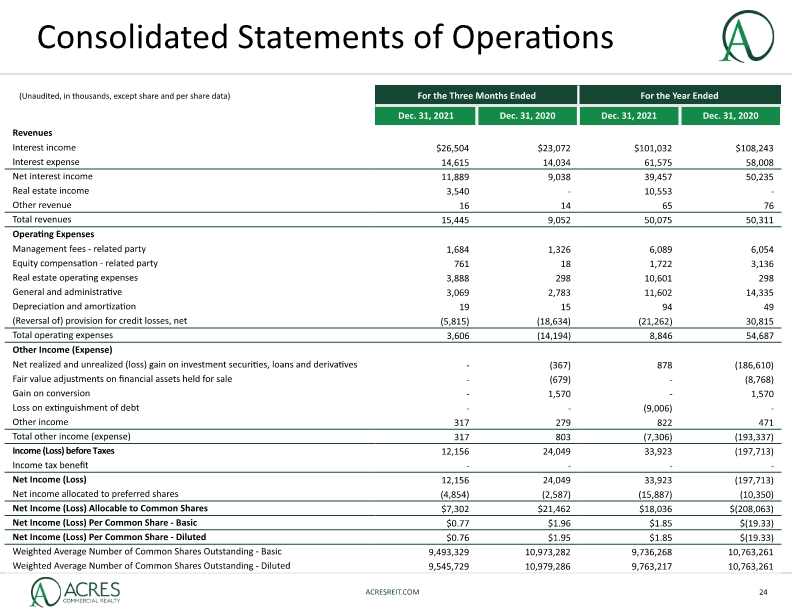

Consolidated Statements of Operations ACRESREIT.COM 24 (Unaudited, in thousands, except share and per share data)

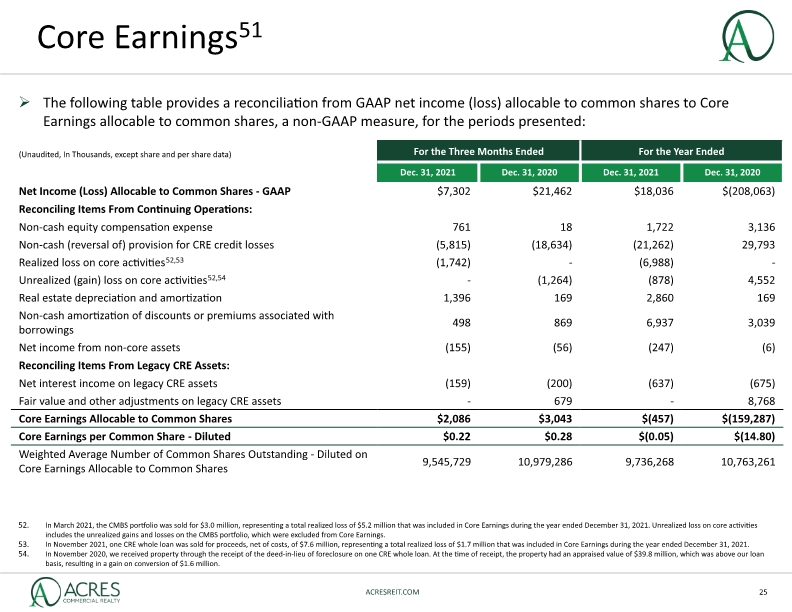

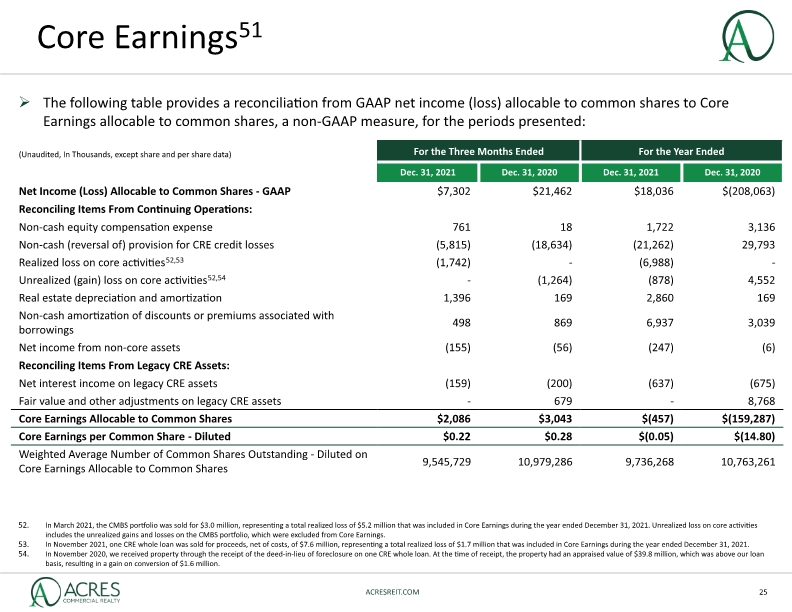

Core Earnings51 ACRESREIT.COM 25 (Unaudited, In Thousands, except share and per share data) The following table provides a reconciliation from GAAP net income (loss) allocable to common shares to Core Earnings allocable to common shares, a non-GAAP measure, for the periods presented: In March 2021, the CMBS portfolio was sold for $3.0 million, representing a total realized loss of $5.2 million that was included in Core Earnings during the year ended December 31, 2021. Unrealized loss on core activities includes the unrealized gains and losses on the CMBS portfolio, which were excluded from Core Earnings. In November 2021, one CRE whole loan was sold for proceeds, net of costs, of $7.6 million, representing a total realized loss of $1.7 million that was included in Core Earnings during the year ended December 31, 2021. In November 2020, we received property through the receipt of the deed-in-lieu of foreclosure on one CRE whole loan. At the time of receipt, the property had an appraised value of $39.8 million, which was above our loan basis, resulting in a gain on conversion of $1.6 million.

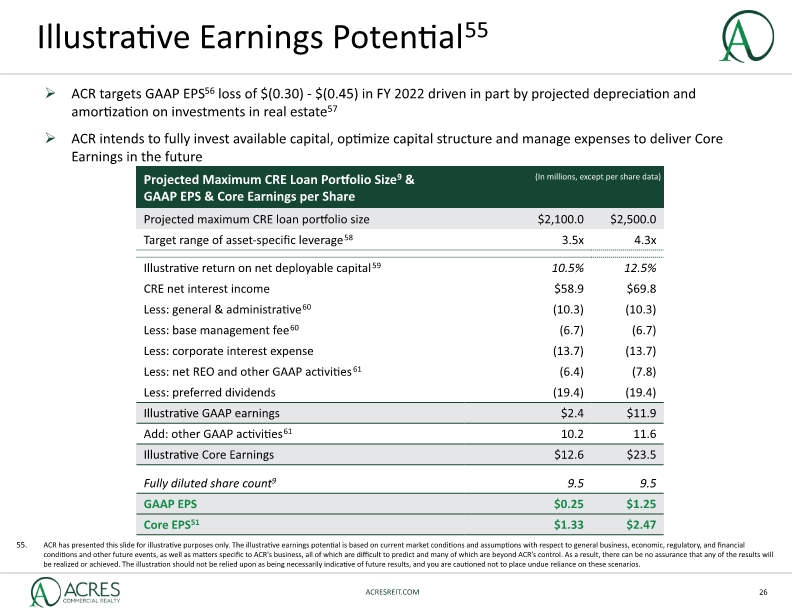

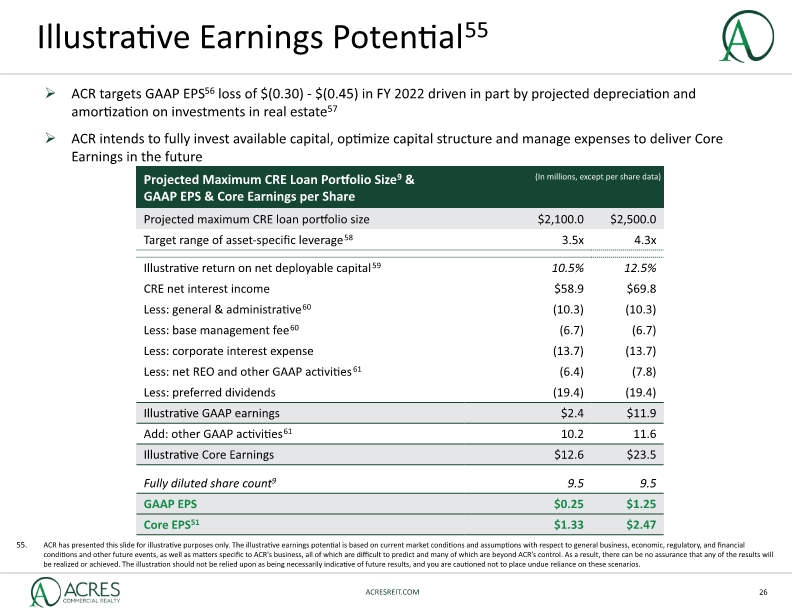

Illustrative Earnings Potential55 ACRESREIT.COM 26 (In millions, except percentages and per share data) ACR has presented this slide for illustrative purposes only. The illustrative earnings potential is based on current market conditions and assumptions with respect to general business, economic, regulatory, and financial conditions and other future events, as well as matters specific to ACR's business, all of which are difficult to predict and many of which are beyond ACR’s control. As a result, there can be no assurance that any of the results will be realized or achieved. The illustration should not be relied upon as being necessarily indicative of future results, and you are cautioned not to place undue reliance on these scenarios. ACR targets GAAP EPS56 loss of $(0.30) - $(0.45) in FY 2022 driven in part by projected depreciation and amortization on investments in real estate57 ACR intends to fully invest available capital, optimize capital structure and manage expenses to deliver Core Earnings in the future (In millions, except per share data)

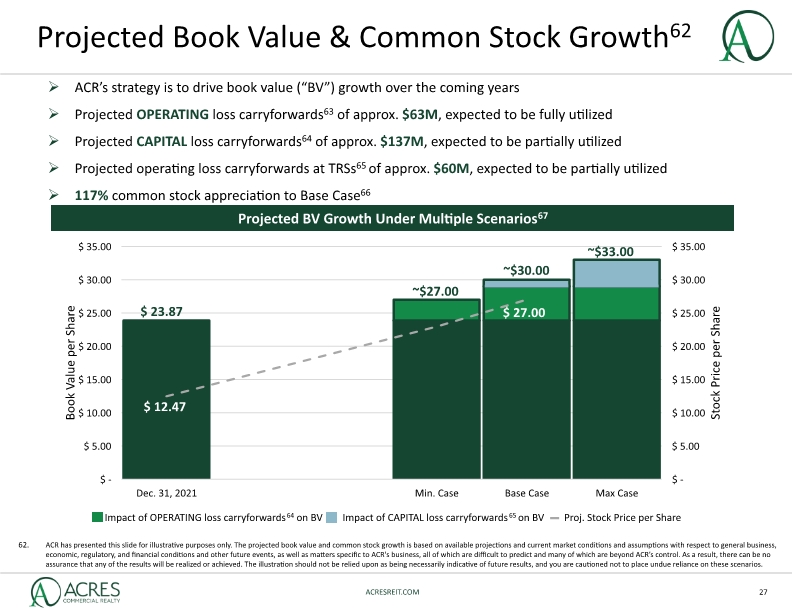

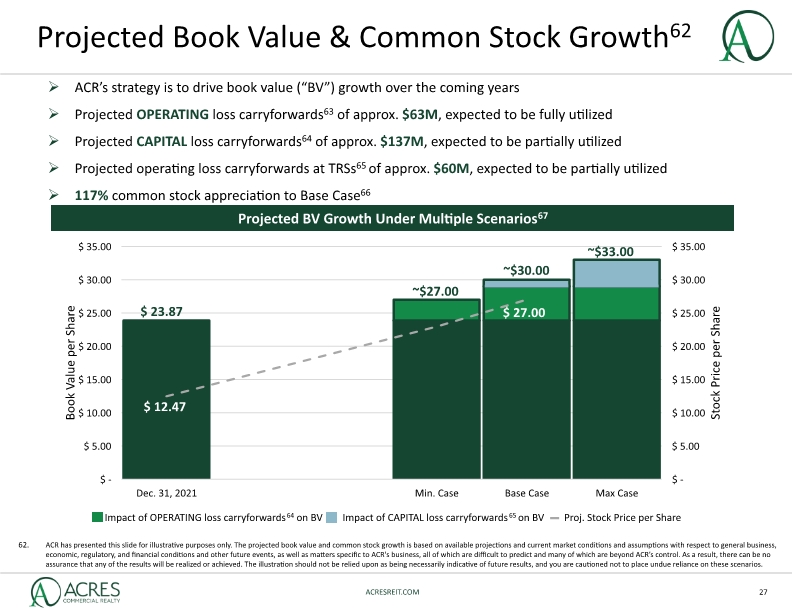

Projected Book Value & Common Stock Growth62 ACRESREIT.COM 27 Impact of OPERATING loss carryforwards64 on BV Impact of CAPITAL loss carryforwards65 on BV Proj. Stock Price per Share Projected BV Growth Under Multiple Scenarios67 ACR’s strategy is to drive book value (“BV”) growth over the coming years Projected OPERATING loss carryforwards63 of approx. $63M, expected to be fully utilized Projected CAPITAL loss carryforwards64 of approx. $137M, expected to be partially utilized Projected operating loss carryforwards at TRSs65 of approx. $60M, expected to be partially utilized 117% common stock appreciation to Base Case66 ~$30.00 ~$33.00 ACR has presented this slide for illustrative purposes only. The projected book value and common stock growth is based on available projections and current market conditions and assumptions with respect to general business, economic, regulatory, and financial conditions and other future events, as well as matters specific to ACR's business, all of which are difficult to predict and many of which are beyond ACR’s control. As a result, there can be no assurance that any of the results will be realized or achieved. The illustration should not be relied upon as being necessarily indicative of future results, and you are cautioned not to place undue reliance on these scenarios.

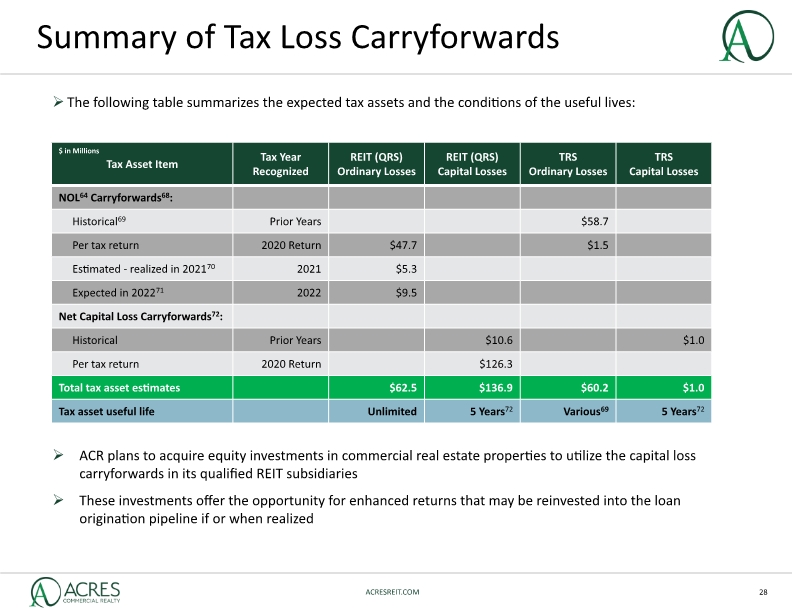

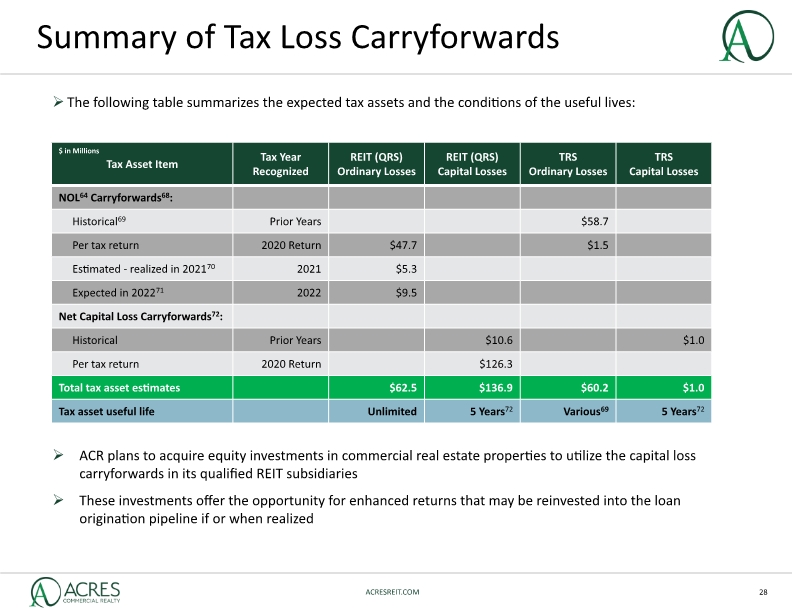

Summary of Tax Loss Carryforwards The following table summarizes the expected tax assets and the conditions of the useful lives: ACRESREIT.COM 28 ACR plans to acquire equity investments in commercial real estate properties to utilize the capital loss carryforwards in its qualified REIT subsidiaries These investments offer the opportunity for enhanced returns that may be reinvested into the loan origination pipeline if or when realized $ in Millions

Footnotes “Fourth quarter 2021 highlights” includes activity that occurred during the first quarter of 2022 or balances at February 28, 2022, where specifically referenced. “CRE” refers to commercial real estate. “CLO” refers to collateralized loan obligation. “GAAP net income” refers to GAAP net income allocable to common shares - diluted. The “senior secured financing facility” refers to the senior secured financing facility with MassMutual with total commitments of $250.0 million. The “12.00% Senior Unsecured Notes” refer to the 12.00% senior unsecured notes issuable until July 31, 2022. During the three months and year ended December 31, 2021. During the year ended December 31, 2021. “CECL” refers to current expected credit losses, the determinant of the estimate of the CRE loan allowance. “Core Earnings” refers to Core Earnings allocable to common shares - diluted, a non-GAAP measure. “LTV” refers to loan-to-collateral value. “LIBOR” refers to the London Interbank Offered Rate. “4.50% Convertible Senior Notes” refer to the 4.50% convertible senior notes due 2022. Excludes the investment in a property through the receipt of the deed-in-lieu of foreclosure, with an appraised value of $17.6 million at acquisition in October 2021. GAAP book value is presented per common share, excluding unvested restricted stock and including warrants to purchase common stock. The measure refers to common stock book value, which is calculated as total stockholders’ equity less preferred stock equity. Refer to page 25 for the reconciliation of Net (Loss) Income, a GAAP financial measure, to Core Earnings, a Non-GAAP financial measure. At December 31, 2021. At February 28, 2022. At July 31, 2020. Per share calculations exclude unvested restricted stock, as disclosed on the consolidated balance sheets, of 333,329 shares at December 31, 2021 and September 30, 2021 and include warrants to purchase up to 466,661 shares of common stock at December 31, 2021 and September 30, 2021, see footnote 44 below. The denominators for the calculations are 9,282,411 and 9,556,940 at December 31, 2021 and September 30, 2021, respectively. The per share amount is calculated with the denominator referenced in footnote 12 at December 31, 2021. Net income per common share - diluted of $0.76 is calculated using the weighted average diluted shares outstanding during the three months ended December 31, 2021. “OCI” refers to the change in accumulated other comprehensive income (loss) attributable to terminated derivatives. ACR’s board of directors (“Board”) authorized and approved the continued use of the share repurchase program to repurchase up to $20.0 million of the currently outstanding common stock initially in November 2020. The initial plan was completed in July 2021. In November 2021, ACR’s Board reauthorized and approved the plan to repurchase an additional $20.0 million of the outstanding common stock. As of December 31, 2021, $3.7 million, or 274,529 shares, were repurchased under the reauthorized plan. LTV is based on the initial funding divided by the as-is appraised property value for new CRE loans, the average of which is weighted based on the initial CRE loan commitments of originated CRE loans. “BR” refers to the collective one-month LIBOR and one-month Term Secured Overnight Finance Rate (“SOFR”) rates that are used as benchmarks on the originated loans during the associated period. “1M L” refers to the one-month London Interbank Offered Rate. Excludes one CRE floating-rate whole loan without a 1M LIBOR floor that was originated in April 2021 with a principal balance of $43.4 million. Excludes partial paydowns of $49,000 on one CRE loan during the fourth quarter. The total weighted average 1M L floor on the floating-rate loan payoffs was 1.30%. Includes one legacy CRE loan reported at its amortized cost of $11.5 million at each period end classified as a CRE loan on the consolidated balance sheets that entered technical default in June 2020. At December 31, 2021, its forbearance period ended and the loan entered delinquency. The loan paid off in January 2022. Includes one loan with an amortized cost of $20.8 million that earned a fixed rate of interest of 5.75% from June 2021 through November 2021 in connection with a modification. The loan’s interest rate was excluded from the calculations of the weighted average CRE whole loan, floating rate and 1M BR floor at September 30, 2021 and June 30, 2021. The loan paid off in November 2021. ACR received payoffs of $6.7 million and $22.1 million on its preferred equity investments in March 2021 and April 2021, respectively. LTV is based on the outstanding principal divided by the as-is appraised property value available as of each respective period end. Regions refer to the regions identified by the National Council of Real Estate Investment Fiduciaries. At December 31, 2021; percentages are calculated based on $1.9 billion carrying value. ACRESREIT.COM 29

Footnotes (Continued) In January 2022, two whole loans paid off, including a hotel loan with a carrying value of $8.4 million performing in accordance with a forbearance agreement at December 31, 2021 and a retail loan, which was delinquent, with a carrying value of $9.2 million at December 31, 2021. See page 32 for additional information. Excludes one whole loan with a principal balance of $8.4 million at December 31, 2021 that was in maturity default but performing in accordance with a forbearance agreement. The loan paid off in January 2022, see footnote 27. Includes one mezzanine loan, 0.2% and 0.3% of total principal, risk rated a 4 at December 31, 2021 and a 3 at September 30, 2021, respectively. Gains or losses on sales of investments in real estate, equity, are capital in nature for tax purposes. Net taxable income from operations from investments in real estate, equity, are ordinary in nature. Acquired through direct investments in equity. Net taxable income from operations and gains or losses on sales of investments in real estate from lending activities are ordinary in nature for tax purposes. Acquired through the receipt of the deed from lending activities. Investment amount is equal to the depreciated/amortized cost basis of the real estate-related assets and liabilities for properties that are held for investment or the lower of cost or fair value for properties that are held for sale. Represents the NCREIF region. Availability is calculated as the difference between the maximum capacity on the applicable borrowing and the principal outstanding. The leverage ratio is calculated as the respective period ended borrowings over total equity. Represents asset-specific borrowings. The facility has an initial two-year revolving period followed by a five-year term that matures on July 31, 2027 and charges interest at 5.75%. Borrowings included as recourse debt are guaranteed by ACR while CRE securitizations have no recourse against the Company. Additionally, the senior secured financing facility is guaranteed by Exantas Real Estate Funding 2020-RS08 Investor, LLC and Exantas Real Estate Funding 2020-RS09 Investor, LLC. Amount includes $3.4 million of deferred debt costs that is amortized until the facility’s maturity. In January 2022, $75.0 million availability on the 12.00% Senior Unsecured Notes was extended to July 2022. ACR issued warrants to purchase 466,661 shares of its common stock at an exercise price of $0.03 per share in connection with the issuance of the $50.0 million of 12.00% Senior Unsecured Notes to MassMutual and Oaktree, in the aggregate. The issuance of the remaining $75.0 million of unsecured notes will trigger the issuance of additional warrants to purchase 699,992 common shares ratably as commitments are funded. Face amount of convertible senior notes and preferred equity are $88.0 million and $235.2 million, respectively. Securitizations include (a) a CLO that closed in May 2021 and includes $137.9 million of uninvested proceeds that can be reinvested into the CLO through May 2023; (b) a CLO that closed in December 2021 and includes $98.9 million in an unused proceeds from the issuance of the third-party owned notes that can be used to acquire additional loans 180 days after close. Additionally, the CLO referenced in (b) allows for the reinvestment of principal payoff or paydown proceeds into the CLO through December 2023. “3M L” refers to the three-month LIBOR rate. Effective June 2021, the third-party owned notes at Exantas Capital Corp. 2020-RSO8, Ltd. and Exantas Capital Corp. 2020-RSO9, Ltd. are benchmarked to the compounded SOFR plus a benchmark adjustment. ACRES Commercial Realty 2021-FL1 Issuer, Ltd. and ACRES Commercial Realty 2021-FL2 Issuer, Ltd. are benchmarked to 1M LIBOR. “WACC” refers to the weighted average cost of capital. The calculation of weighted average cost of capital excludes the impact of common equity on the denominator. CRE term and senior secured facilities estimated unfinanced proceeds includes the projected amount of proceeds available to the Company if the unfinanced loans were financed with the applicable facilities. See page 33 for additional information. “GAAP EPS” refers to GAAP earnings per common share-diluted and “Core EPS” refers to Core Earnings per common share-diluted. ACRESREIT.COM 30

Footnotes (Continued) The majority of ACR’s projected GAAP net losses in 2022 are expected to be in the first quarter of 2022, including a recurring depreciation and amortization expense of approximately $1.5 million and non-recurring charges of approximately $1.4 million in connection with the retirement or redemption of certain borrowings. In addition, we expect a decrease in net interest margin of approximately $500,000 resulting from loan originations at lower base rate floors than loans that are expected to payoff. Net loan production volume is expected to improve subsequent to the first quarter of 2022 and create positive net interest margin and earnings growth. Asset-specific leverage is calculated over total equity at December 31, 2021. It excludes corporate leverage. Net deployable capital is calculated as the total current corporate capital of approximately $696.3 million, less total projected commitments for investments in real estate, excluding potential financing, of approximately $96.0 million and a working capital reserve of $40.0 million for a total of $560.3 million. Represents ACR’s projected annualized general and administrative expenses and base management fee. The projection excludes the impact of the expected increase of incentive compensation in the fourth quarter of 2022. Includes annualized projections of real estate income, real estate depreciation, provision for credit losses, equity compensation expense and non-cash amortization expense of the unamortized discount and deferred debt issuance costs on the convertible senior notes. Real estate depreciation, provision for credit losses, equity compensation expense and non-cash amortization expense are excluded from the calculation of Core Earnings. See page 33 for additional information. OPERATING loss carryforwards comprise qualified REIT subsidiary (“QRS”) net operating loss carryforwards, including projections for the tax years ended December 31, 2021 and 2022, which have an unlimited useful life. CAPITAL loss carryforwards comprise QRS net capital loss carryforwards which have a useful life of five years. “TRS” refers to taxable REIT subsidiaries. Calculated as the increase from the $12.47 price per share of ACR’s common stock to $27.00, which is an estimate of 90% of the projected common stock book value. The “Min. Case” scenario assumes the partial utilization of the OPERATING loss carryforwards. The “Base Case” scenario assumes the full utilization of existent OPERATING loss carryforwards ($48 million), plus a portion of the CAPITAL loss carryforwards. The “Max Case” scenario assumes the full utilization of existent OPERATING loss carryforwards, plus a greater portion of the capital loss carryforwards than the “Base Case” Scenario. In general, net operating loss (“NOL”) carryforwards can be used to offset both ordinary taxable income and capital gains in future years. Includes $39.9 million of NOL carryforwards realized prior to the effective date of the Tax Cuts and Jobs Act of 2017, some of which expire in 2044. The remaining NOL carryforwards have an unlimited useful life. Includes original issuance discount (“OID”) losses on senior note classes in two CLOs that were redeemed in 2021. Includes projected OID losses on senior note classes in CLOs that are expected to be redeemed in 2022. Net capital loss carryforwards may be carried forward up to five years to offset future capital gains. ACRESREIT.COM 31

Other Disclosures Commercial Real Estate Loans Risk Ratings CRE loans are collateralized by a diversified mix of real estate properties and are assessed for credit quality based on the collective evaluation of several factors, including but not limited to: collateral performance relative to underwritten plan, time since origination, current implied and/or reunderwritten loan-to-collateral value ratios, loan structure and exit plan. Depending on the loan’s performance against these various factors, loans are rated on a scale from 1 to 5, with loans rated 1 representing loans with the highest credit quality and loans rated 5 representing loans with the lowest credit quality. The factors evaluated provide general criteria to monitor credit migration in the Company’s loan portfolio; as such, a loan’s rating may improve or worsen, depending on new information received. The criteria set forth below should be used as general guidelines and, therefore, not every loan will have all of the characteristics described in each category below. ACRESREIT.COM 32

Other Disclosures (continued) Core Earnings Core Earnings is a non-GAAP financial measure that we use to evaluate our operating performance. Core Earnings exclude the effects of certain transactions and GAAP adjustments that we believe are not necessarily indicative of our current CRE loan portfolio and other CRE-related investments and operations. Core Earnings exclude income (loss) from all non-core assets comprised of investments and securities owned by the Company at the initial measurement date of December 31, 2016 in commercial finance, middle market lending, residential mortgage lending, certain legacy CRE loans and other non-CRE assets designated as assets held for sale. Core Earnings, for reporting purposes, is defined as GAAP net income (loss) allocable to common shares, excluding (i) non-cash equity compensation expense, (ii) unrealized gains and losses, (iii) non-cash provisions for loan losses, (iv) non-cash impairments on securities, (v) non-cash amortization of discounts or premiums associated with borrowings, (vi) net income or loss from a limited partnership interest owned at the initial measurement date, (vii) net income or loss from non-core assets, (viii) real estate depreciation and amortization, (ix) foreign currency gains or losses and (x) income or loss from discontinued operations. Core Earnings may also be adjusted periodically to exclude certain one-time events pursuant to changes in GAAP and certain non-cash items. Although pursuant to the Fourth Amended and Restated Management Agreement we calculate the Manager’s incentive compensation using Core Earnings excluding incentive fees payable to the Manager, we include incentive fees payable to the Manager in Core Earnings for reporting purposes. ACRESREIT.COM 33

Company Information ACRES Commercial Realty Corp. is a real estate investment trust that is primarily focused on originating, holding and managing commercial real estate mortgage loans and equity investments in commercial real estate property through direct ownership and joint ventures. Additional information is available at the Company’s website, www.acresreit.com. ACRESREIT.COM 34