INVESTOR

PRESENTATION

May 2007

Page 1

Safe Harbor Statement

The attached presentation was filed with the Securities and Exchange Commission as part of the Form 8-K

filed by Argyle Security Acquisition Corporation (“Argyle”) on May 2, 2007. Argyle is holding presentations

for its stockholders regarding its purchase of ISI Detention Contracting Group, Inc. (“ISI”), as described in

an earlier Form 8-K filed by Argyle which describes the acquisition in more detail.

Rodman & Renshaw LLC (“Rodman”), the managing underwriter of Argyle’s initial public offering (“IPO”)

consummated in January 2006, is assisting Argyle in its efforts and will receive approximately $1.4 million,

the deferred portion of its underwriting discount from the IPO, upon consummation of the acquisition of ISI.

Argyle and its directors and executive officers and Rodman may be deemed to be participants in the

solicitation of proxies for the special meeting of Argyle’s stockholders to be held to approve this

transaction. Each of Argyle’s officers and directors are also stockholders of Argyle and have waived their

rights to any liquidation distribution Argyle makes with respect to shares they acquired before the IPO.

Therefore, their securities will be worthless if Argyle does not acquire a target business within two years of

the IPO date, as required by its Certificate of Incorporation. Interested persons can also read Argyle’s

registration statement on Form S-4, as amended, and definitive proxy statement, when available, as well

as Argyle’s final IPO prospectus, dated January 24, 2006, as well as periodic reports Argyle filed with the

SEC, for more information about Argyle, its officers and directors, and their individual and group security

ownership in Argyle, and interests in the successful consummation of the acquisition of ISI.

Argyle’s stockholders and other interested persons are advised to read Argyle’s registration statement on

Form S-4, as amended, and definitive proxy statement, when available, in connection with Argyle’s

solicitation of proxies for the special meeting to approve the acquisition because these documents will

contain important information. The definitive proxy statement will be mailed to stockholders as of a record

date to be established for voting on the acquisition. The definitive proxy statement will be mailed to

stockholders as of a record date to be established for voting on this transaction. Stockholders will also be

able to obtain a copy of the definitive proxy statement, the final prospectus, other documents relating to the

acquisition of ISI and periodic reports filed with the Securities and Exchange Commission, without charge,

by visiting the Securities and Exchange Commission’s Internet site at (http://www.sec.gov).

Page 2

Safe Harbor Statement

Certain statements in this presentation constitute forward-looking

statements within the meaning of the Private Securities Litigation

Reform Act of 1995, as amended. When used in this press

release, words such as "will," "believe," "expect," "anticipate,"

"encouraged" and similar expressions, as they relate to the

company or its management, as well as assumptions made by

and information currently available to the company's

management identify forward-looking statements. Additional

information concerning forward looking statements is contained

under the heading of risk factors listed from time to time in the

company's filings with the Securities and Exchange Commission.

We do not assume any obligation to update the forward-looking

information.

Page 3

Safe Harbor Statement

This presentation contains disclosure of EBITDA and backlog (including “Total

Backlog”) for certain periods, which may be deemed to be non-GAAP financial

measures within the meaning of Regulation G promulgated by the Securities and

Exchange Commission. As used in this presentation, adjusted EBITDA reflects the

removal from the calculation of EBITDA of certain expenses that Argyle Security

and ISI agreed should not reduce EBITDA. The companies do not expect these

expenses to continue after the closing of the merger. Management believes that

adjusted EBITDA, or earnings before interest, taxes, depreciation and amortization,

is an appropriate measure of evaluating operating performance and liquidity,

because it reflects the resources available for strategic opportunities including,

among others, investments in the business and strategic acquisitions. Management

believes that the backlog, or unearned revenues on projects that have been booked,

is an appropriate measure of evaluating operating performance, because it reflects

future potential revenues. Adjusted EBITDA or backlog may not be comparable to

similarly titled measures reported by other companies. Neither EBITDA nor backlog

is a recognized term under U.S. GAAP, and EBITDA and backlog should be

considered in addition to, and not as substitutes for, or superior to, operating

income, cash flows, revenue, or other measures of financial performance prepared

in accordance with generally accepted accounting principles. Neither adjusted

EBITDA nor backlog is a completely representative measure of either the historical

performance or, necessarily, the future potential of ISI.

Page 4

History of Argyle &

ISI Acquisition

June 2005: Forms a Special Purpose Acquisition Corporation

(“SPAC”) to acquire businesses in the security sector

January 2006: Raises $30.6 million

December 2006: Agrees to acquire ISI Security Group (“ISI”), a

total solutions provider in the U.S. physical security industry

May 2007: Expects the SEC to conclude its review of the proxy

statement with Argyle stockholder vote to follow

$18.2 million cash

$8.8 million Argyle stock*

$11.7 million borrowings**

*Based on 1,180,000 common shares of Argyle’s common stock, using the April 16, 2007 closing price of $7.46.

**Assumption of $6M in long-term debt and approximately $5.7 million of debt outstanding under ISI’s revolving line

of credit, as of April 16, 2007.

Page 5

ISI Security Group Acquisition:

Meets Our Objectives

Acquire a well established security industry company that meets

Argyle acquisition criteria:

Founded in San Antonio, TX in 1976, ISI is the privately-held parent company for

three security services / solutions providers:

Obtain a highly experienced security industry management team:

ISI’s senior management team has approximately 120 years of combined

experience in the physical security industry

Make acquisition at attractive purchase price:

Transaction Value of $38.7 million*, or 7.7 X 2006 Adjusted EBITDA**, represents

discount to market multiples and discounted cash flow value

*Calculated using April 16, 2007 market values of Argyle’s common stock.

**As used in this presentation, adjusted EBITDA reflects the removal from the calculation of EBITDA of certain expenses totaling

$900,000 that Argyle Security and ISI agreed should not reduce EBITDA.

ISI-Detention

MCS-Detention

MCS-Commercial

Page 6

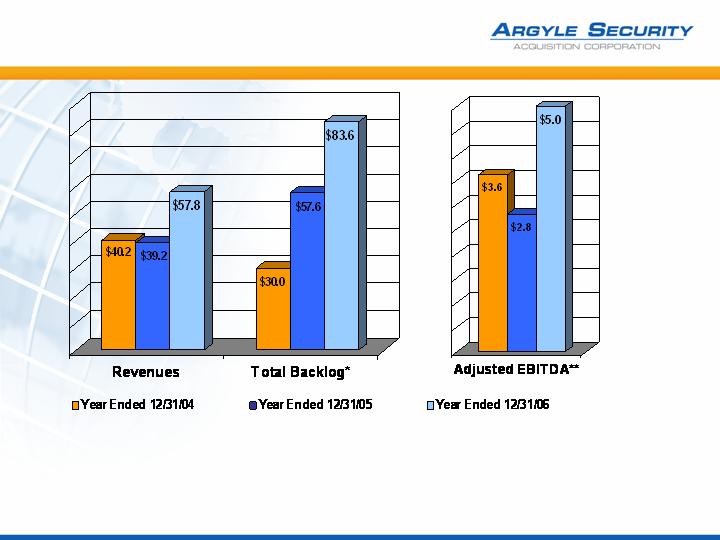

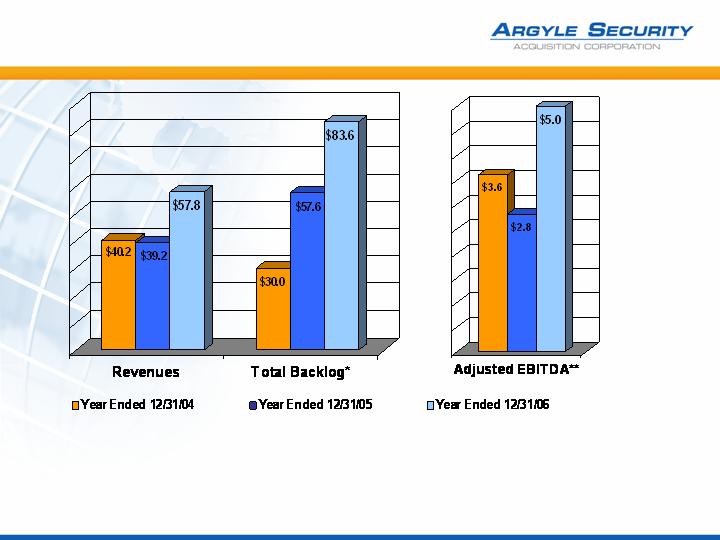

ISI Highlights:

Strong Financial Trends

*Total backlog includes intercompany amounts. Amounts were as follows for each of the following years: 2004 ($4,166,421);

2005 ($12,190,414); 2006 ($17,316,943).

**EBITDA and backlog (including intercompany amounts) reflect non-GAAP financial measures within the meaning of Regulation

G promulgated by the Securities and Exchange Commission. As used in this presentation, adjusted EBITDA reflects the removal

from the calculation of EBITDA of certain expenses totaling $900,000 that Argyle Security and ISI agreed should not reduce

EBITDA. The companies do not expect these expenses to continue after the closing of the merger. ISI had income/(loss) before

tax for the twelve month periods ended December 31, 2006, 2005 and 2004 of ($695,587), ($1,709,318) and ($2,940,642),

respectively.

Page 7

ISI Q1 ’07 Update:

Strong Financial Trends

*Total backlog includes inter-company amounts. Amounts were as follows for each of the following years: 3/31/06 ($9,914,789);

3/31/07 ($19,242,534).

**EBITDA and backlog (including inter-company amounts) reflect non-GAAP financial measures within the meaning of

Regulation G promulgated by the Securities and Exchange Commission. As used in this presentation, adjusted EBITDA reflects

the removal from the calculation of EBITDA of certain expenses totaling $224,000 for 2006 and $118,000 for 2007 that Argyle

Security and ISI agreed should not reduce EBITDA. The companies do not expect these expenses to continue after the closing of

the merger. ISI had income/(loss) for the three month periods ended March 31, 2007 and 2006 of $185,903 and ($390,334),

respectively.

Page 8

ISI Acquisition:

Attractively Priced

$38.7 million purchase price

Received fairness opinion from Giuliani Capital Advisors (“GCA”)

GCA’s fairness opinion had average value indication of $76.6 million

ISI price is approximately 50% lower than average value indication

from GCA

7.7 X

0.7 X

ISI

10.2 X

13.1 X

1.0 X

1.2 X

Aggregate Median

10.3 X

12.9 X

1.3 X

1.5 X

Aggregate Mean

2007

2006

2007

2006

EV/EBITDA

EV/SALES

GIULIANI CAPITAL ADVISORS COMPARABLE MULTIPLE SUMMARY

GCA, in its fairness opinion, determined that the merger consideration for ISI is within or below the range of

enterprise values implied by the multiples of selected comparable companies (above). Comparable transaction

and DCF analyses performed by GCA also indicate that the merger consideration is within or below the range of

enterprise values implied by these analyses.

Page 9

Argyle / ISI Transaction Yields

Immediate Positive Effects

Equity $(13.0)M $37.0M

Current assets $25.8M $32.5M

Cash* $0.4M $7.0M

Bonding capacity Near Capacity Meets Needs

Current liabilities $19.7M $18.0M

Long-term debt $16.0M $6.0M

Interest on long-term debt $1.9M $0.7M

*Assumes Maximum Shareholder Approval

Page 10

Pro Forma Ownership:

Interests Well Aligned

7.4

440,288

ISI Institutional

Shareholder

100.0%

5,961,307

Total

62.1

3,700,046

ASAC Public Investors

12.4

739,712

ISI Management Team

18.1%

1,081,261

Argyle Executives,

Directors and Affiliated

Entities

% Ownership

Shares

Holder

Page 11

To Become a Leading Global

Company in the Physical

Electronic Security Industry

Argyle’s Vision

Channel Focus: Video Surveillance, Access Control,

Perimeter/Outdoor Protection, Intrusion Protection, Fire Detection

and Threat Analysis

Market Focus: Selected Commercial and Governmental sectors

Page 12

Video

()

Intrusion

Access

Outdoor/

Perimeter

Video

Surveillance

Intrusion

Access

Outdoor

Perimeter

ISI Fits Argyle’s Vision:

Market Focused Solutions

Products + Software + Service = Solutions

Digital convergence, cost effective new technologies and growing

addressable markets have positioned Argyle to offer its customers

total security solutions:

Control

Page 13

ISI Strongly Positioned

To Address Attractive Markets

Focus on key vertical markets/channel segments

Single source for a wide range of security solutions,

utilizing proprietary and third-party products

Strong brand equity and solid reputation with long

established customer base

Proven ability to capitalize on technological change

Deep and experienced management team with a track

record of managing both organic and acquisition growth

Expanding ability to serve growing target market segments

Page 14

ISI Services All Customers:

Public and Private Sectors

Detention

Commercial

Manufacturers

Municipal

Energy

Financial / Services

Technology

Education

Private Prison Operators

Page 15

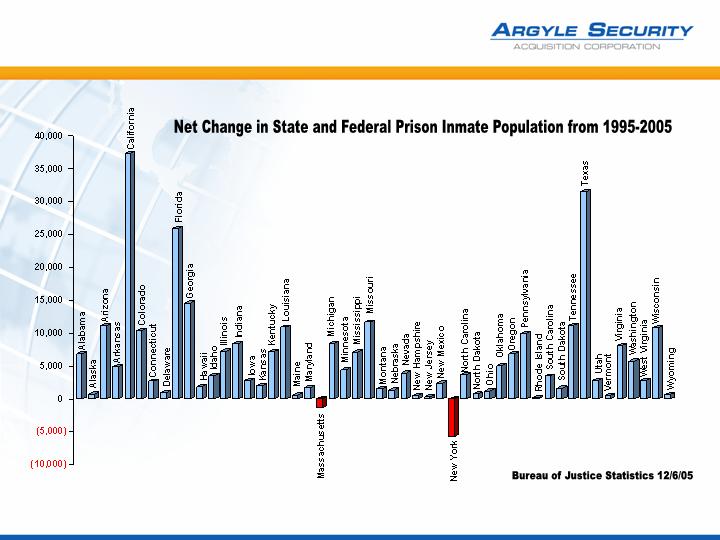

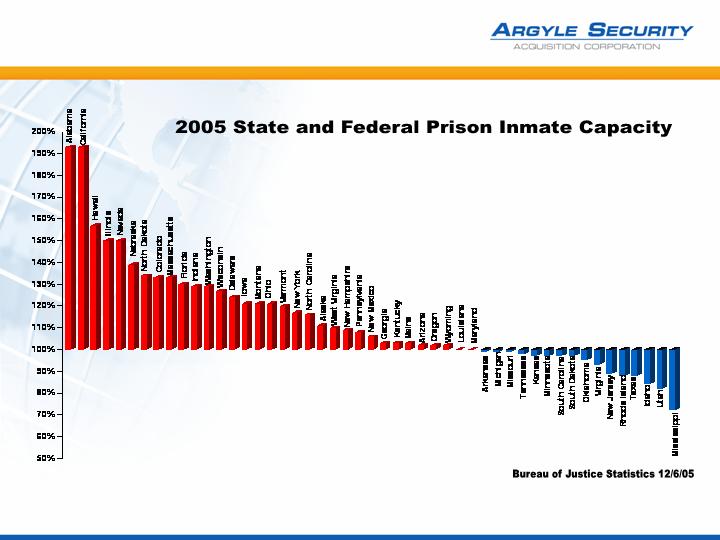

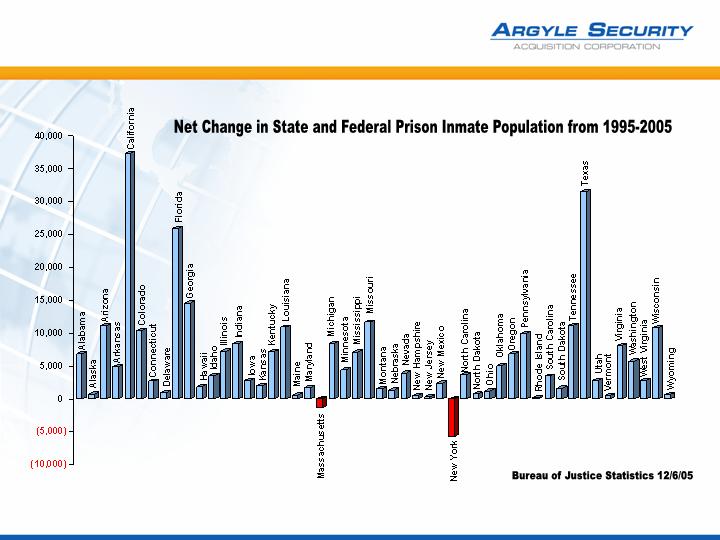

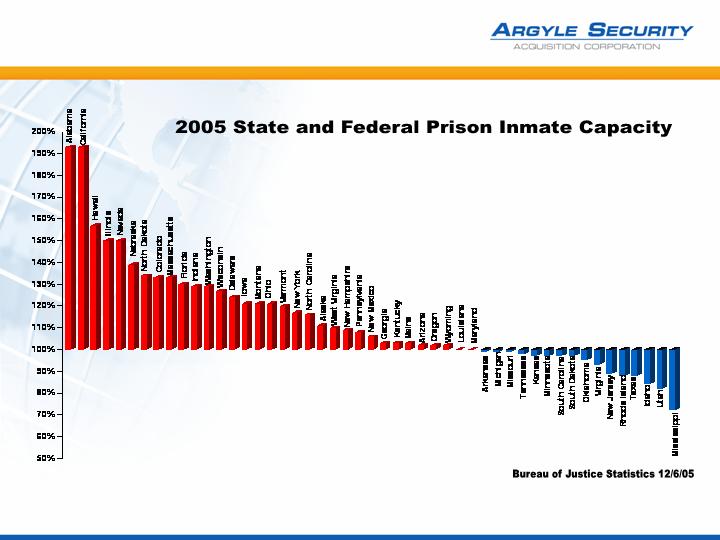

Favorable Industry Dynamics

Benefit ISI

Over-crowding of inmate populations

In 2005, state prisons operated between 1% below and 14%

above capacity, while federal prisons were 34% above

capacity

Growth in detention facilities

Private prison capacity growing at much faster rate than the

2.5 - 3.0% overall inmate growth rate

Higher unit construction costs

Growth in Commercial Sector

MCS-Commercial participates in the two fastest growing

sectors: Video Surveillance and Access Control

Growth in demand for solutions

Page 16

More juveniles (Increase in crime rate and laws)

More women (Change in percentage population)

Violent sexual predators requiring special

facilities

Aging and 24/7 usage of existing facilities

Migration and relocation of population

Growth in inmate population

Aging of inmate population

Increase in illegal aliens

Retrofit demand continuing

Approximately 1,000 new

inmates per week

Correctional Market:

Summary Growth Drivers

ISI positioned to expand – new products, people, resources

Sources: “Public Safety Performance Report,” Pew Charitable Trust, 2007

“Correctional News,” February 2007

Page 17

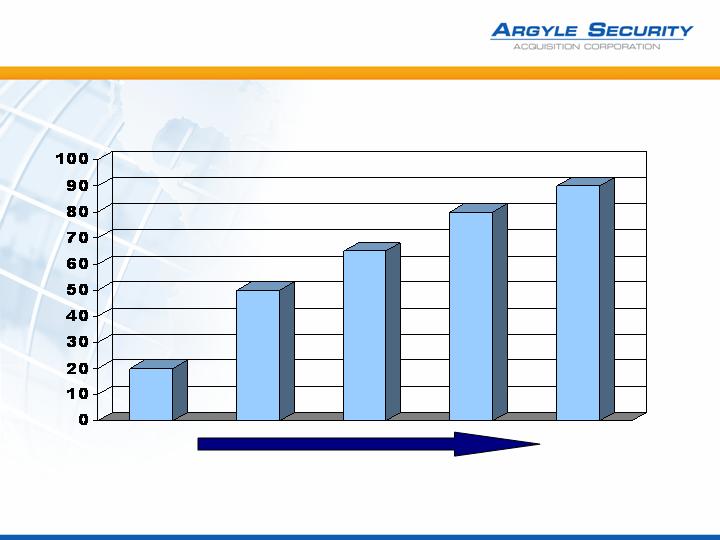

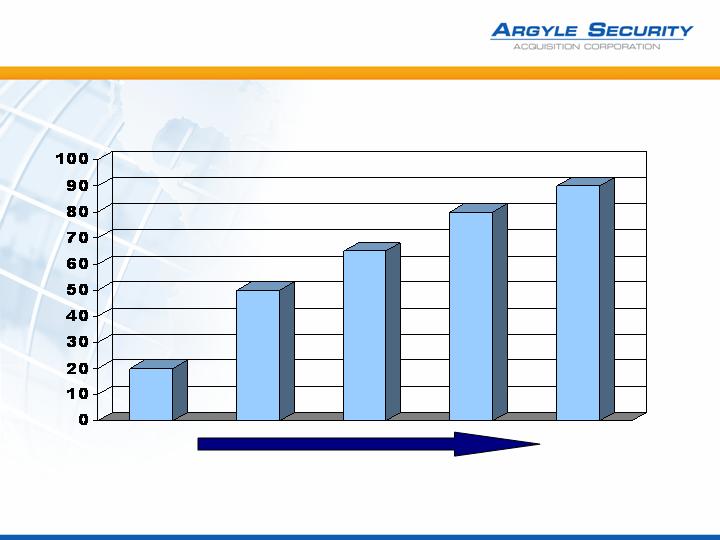

Correctional Market:

Needs Exhibiting Significant Growth

Page 18

Correctional Market:

Capacity At Crisis Levels

Page 19

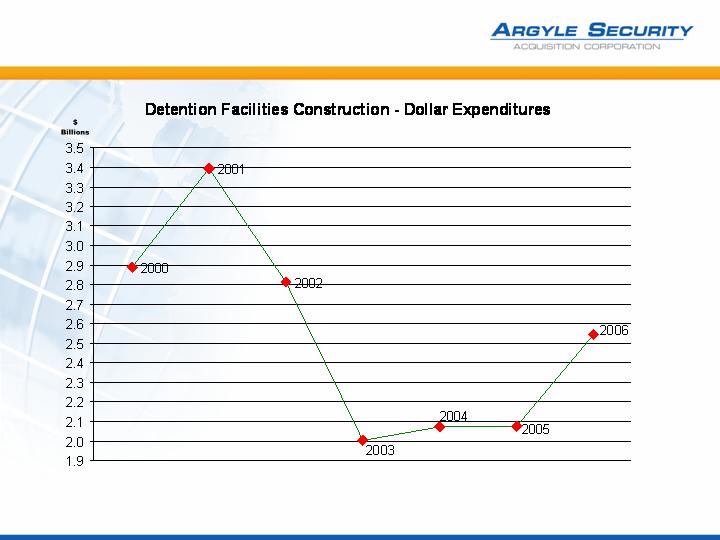

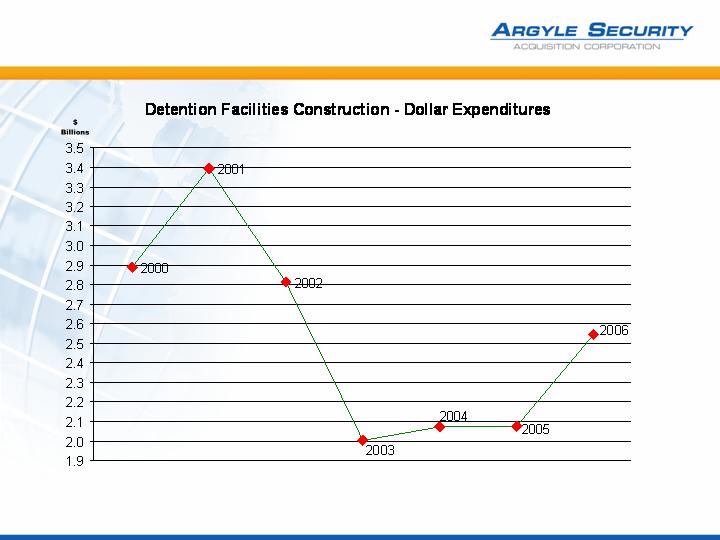

Correctional Market:

Strong Expenditure Cycle Expected

Source: McGraw-Hill

Page 20

ISI-Detention: Ideally Situated

To Capitalize On Market Trends

ISI-Detention

60% repeat customers – primarily negotiated sales

Incremental sales from new products, such as metal wall panels

New products can double the size of a contract

Travis County: $8M vs. $15.4M (with wall panels)

Benefits of wall panels to customer:

Increased beds/square foot

30% lighter than concrete

Speeds up construction

Lower cost than cement / concrete

Lower on-site labor (high costs / scarcity)

Economical

Benefits of wall panels to ISI:

Increases contract size without reducing margin percentage

Limits competition by size (Labor, Bonding, Ability)

Gives ISI something new to sell

Incremental sales from synergies created by depth and breadth of MCS product line

Page 21

MCS-Detention:

Growing Coverage Footprint

2000

Today

Page 22

Starting with a single offering, MCS-Detention has expanded and broadened its product line since 2000, making

it now possible to participate in 90% of available market opportunities.

MTI

______

20%

Basic

PLC

System

______

Omron

50%

Direct

Select

System

______

Added

Allen

Bradley

65%

Basic

Functional

Groups

________

Added

GE

80%

Enhanced

Functional

Groups

________

90%

%

Market

Opportunities

MCS-Detention:

Products Address Market Needs

2000

2006

Page 23

MCS-Commercial –

Largest/Fastest Growing Division

MCS-Commercial offers security and fire alarm solutions in

five locations:

San Antonio, Austin, Dallas, Houston and Denver

Successful strategic buildup over past five years, including

five acquisitions and two Greenfields

ISI's largest and fastest growing division

Over 39% of ISI's total revenues

Page 24

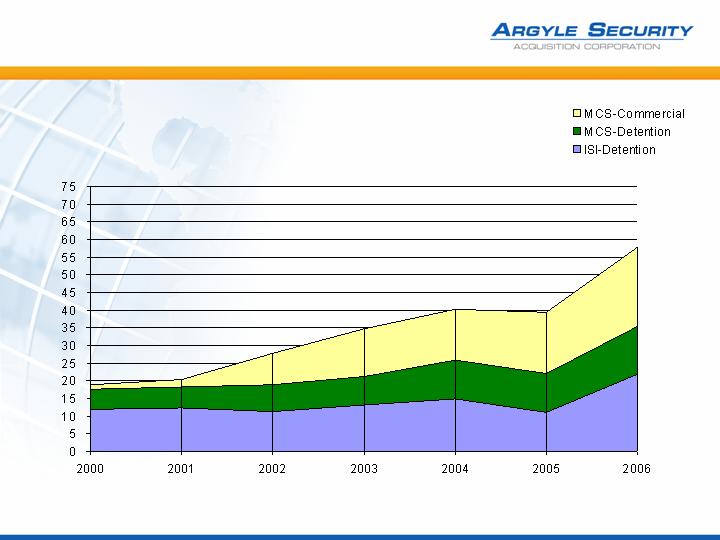

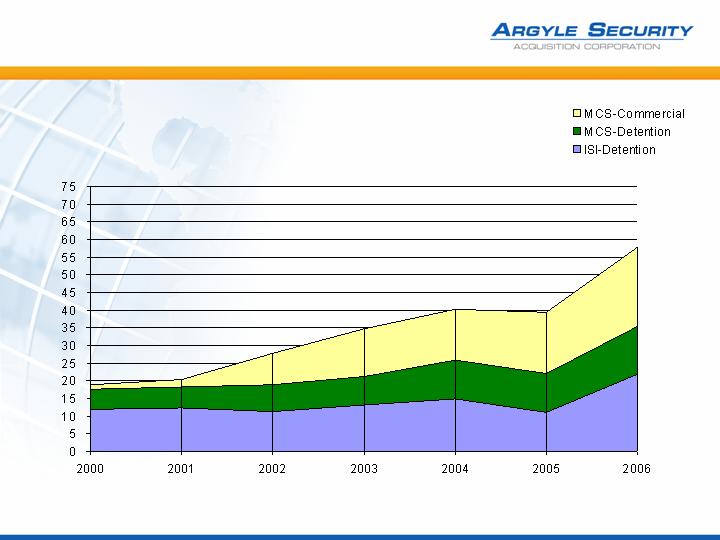

ISI Security:

Leveraging Growth Markets

Revenues

2000-2006

$ Millions

MCS was acquired in 2000 and split into MCS-Commercial and MCS-Detention.

Page 25

MCS-Commercial

Proven Strategy Based on Seven

Strategic Principles:

Offer broad range of products that provide

customers with total solutions

Cultivate strong sales relationships

focused on higher margin, negotiated

projects

Establish stringent estimating and cost

controls

Offer Best of Breed products

Focus on recurring service revenues and

repeat customers

“Control” the end user/customer

Take responsibility for building customer

relationships that will foster direct contact

with ISI

Ready for Expansion:

Strong management, currently

under-utilized, is poised to grow

business

Recent past financial performance

demonstrates proven ability to

generate profitable growth

Greater access to capital and

increased bonding capacity due to

Argyle will enable MCS-

Commercial to capture additional

sales

Carefully positioned to capitalize

on dynamically growing industry

ISI Security:

Strategically Positioned

Page 26

ISI Security:

Well Formulated Growth Plan

Grow organically in all three of ISI’s business segments

Expand geographically and penetrate new channels through both

organic growth and strategic acquisitions

Offer new technologies, products and solutions, utilizing the Argyle

team’s broad industry access

Capitalize on greater access to capital and bonding capacity

resulting from the merger

Leverage Argyle’s leadership experience in:

Developing and growing successful public companies

Gaining access to international markets

Page 27

Argyle Security:

Creating A Major Global Platform

Grow business organically and through strategic

acquisitions

Capitalize on abundance of acquisition targets in today’s

fragmented global physical security industry

Leverage technology, products, channels and skill sets

Enhance and leverage valuable brands, such as ISI,

across new geographic regions and markets

Page 28

Experienced Executive Team

Bob Marbut, Chairman, Co-CEO and Co-Founder, Argyle

Executive Chairman of Electronics Line 3000 LTD, an international security company

listed on the Frankfurt exchange (2004 – Present)

General Partner of Argyle Global Opportunities, an investment partnership focusing

on the physical electronic security industry (2001- Present)

Co-Founder, Chairman and Co-CEO of Hearst-Argyle Television, leading a strategic

buildup strategy that created the second largest independent television group (NYSE)

(1997 – 2002)

Co-Founder, Chairman and CEO of Argyle Television, a strategic buildup that

became a successful Nasdaq company (1995 -1997)

Founder and CEO of Argyle Television Holding, a $700M strategic buildup of a private

television group (1993 – 1995)

President and CEO of Harte-Hanks Communications, transforming it from a family-

owned Texas newspaper company into a nationwide Fortune 500 company that, as a

public NYSE company, had 50 consecutive quarters of EPS growth, compounding at

17% (1970 – 1991)

Instrumental in raising over $4B of private and public capital for a variety of

companies in which he served as senior executive

Page 29

Experienced Executive Team

Ron Chaimovski, Vice-Chairman, Co-CEO and Co-Founder, Argyle

Vice Chairman of Electronics Line 3000 LTD (2004 – Present)

General Partner of Argyle Global Opportunities, LLP (2001 – Present)

Israel Economic Minister to North America (1998-2001)

Founder and Chairman of Transplan Enterprises Group, an investment company

specializing in technology

Former Managing Partner of Tel-Aviv based corporate law firm

Former Naval Officer – Commanding officer of a ship and Commanding officer of a

flotilla

Page 30

Experienced Executive Team

Sam Youngblood, CEO, ISI Security Group (17 years)

Founder, President and CEO of Adtec, Inc., a detention hardware company which

was ranked as the ninth fastest growing public company in America in 1989

10-year tenure at Southern Steel, most recently as President and instrumental in

turning around the company through introduction of new detention hardware product

Page 31

Experienced Independent Directors

General (Ret.) Wesley Clark, Director, Argyle

Chairman and CEO of Wesley K. Clark & Associates, a business services and

development firm

Chairman of Rodman & Renshaw, a full service investment bank with an active

practice specializing in biotech and security

38 years of experience with the U.S. military, which included commanding NATO

forces; retired as a four-star general

John J. (Chip) Smith, Director, Argyle

Director of Security for the Bank of New York, supervising a multi-national staff

focusing on the investigation and prevention of fraud, as well as the physical

protection of corporate assets, employees, customers and executives

24 years of experience in the US Secret Service – agent in charge of largest office

(New York)

Page 32

Argyle Consultants

Mark Mellin, Financial Consultant

Former SVP and CFO of ILEX Oncology, Inc., a public biotech firm which was

acquired for $1B

20-year tenure through 2002 with Arthur Andersen LLP, most recently as Managing

Partner in the San Antonio office

Alan Wachtel, Security Consultant

SVP of SecTecGLOBAL, Inc., a marketing firm dedicated to developing residential

security business in the cable television and electrical utility sectors

22-year tenure through 2003 with Pittway Corp. (later Honeywell Security), most

recently as VP, International Marketing

Former Chairman and member of various SIA committees developing security

industry standards, and former Chairman of NBFAA Advisory Board developing

security industry training programs

Page 33

Argyle Consultants

Graham Wallis, Security Consultant

CEO of Wallis Consultancy, a management advisory firm

Former President and Director of Dedicated Micros USA Inc.

Founding member of various UK technology companies

Former President of Javelin Systems, the video security system group of Ademco

(later Honeywell)

Former President of Ferranti Semiconductors (later Plessey Semiconductors)

Page 34