UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934 (Amendment No. )

Filed by the Registrantþ

Filed by a Party other than the Registrant¨

Check the appropriate box:

¨ Preliminary Proxy Statement

¨ Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

þ Definitive Proxy Statement

¨ Definitive Additional Materials

¨ Soliciting Material Pursuant to §240.14a-12

Caribou Coffee Company, Inc.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

þ No fee required.

¨ Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

1) Title of each class of securities to which transaction applies:

2) Aggregate number of securities to which transaction applies:

3) Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

4) Proposed maximum aggregate value of transaction:

5) Total fee paid:

¨ Fee paid previously with preliminary materials.

¨ Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

1) Amount Previously Paid:

2) Form, Schedule or Registration Statement No.:

3) Filing Party:

4) Date Filed:

3900 Lakebreeze Avenue North

Brooklyn Center, Minnesota 55429

March 27, 2012

Dear Shareholders:

You are cordially invited to attend the Caribou Coffee Company, Inc. Annual Meeting of Shareholders on Wednesday, May 9, 2012 at 10 a.m. (Central Time). The meeting will be held at the Hotel Ivy, 201 South Eleventh Street, Minneapolis, Minnesota.

The matters to be acted upon are described in the accompanying Notice of Annual Meeting of Shareholders and proxy statement. At the meeting, we will also report on the Caribou Coffee Company, Inc. operations and respond to any questions you may have.

We are pleased to take advantage of the Securities and Exchange Commission rule allowing companies to furnish proxy materials to shareowners over the Internet. We believe that this e-proxy process expedites shareowners’ receipt of proxy materials, while also lowering the costs and reducing the environmental impact of our annual meeting. On March 30, 2012, we will begin mailing to certain shareowners a Notice of Internet Availability of Proxy Materials containing instructions on how to access our 2012 proxy statement and annual report and vote online. All other shareowners will receive the proxy statement and annual report by mail.

|

| Very truly yours, |

|

|

Michael J. Tattersfield Chief Executive Officer |

|

YOUR VOTE IS VERY IMPORTANT Whether or not you plan to attend the Annual Meeting of Shareholders, we urge you to vote your proxy by telephone, the Internet or by mail in order to ensure the presence of a quorum. If you attend the meeting, you can revoke your proxy and vote your shares in person. If you hold your shares through a broker, bank or other nominee, please follow the instructions you receive from them to vote your shares. |

CARIBOU COFFEE COMPANY, INC.

3900 Lakebreeze Avenue North

Brooklyn Center, Minnesota 55429

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

to be held

May 9, 2012

The Annual Meeting of Shareholders of Caribou Coffee Company, Inc. will be held at the Hotel Ivy, 201 South Eleventh Street, Minneapolis, Minnesota, on Wednesday, May 9, 2012, at 10 a.m. (Central Time), or any adjournment or postponement thereof, for the following purposes:

1. To elect seven directors nominated by the Board of Directors to serve until the 2013 Annual Meeting of Shareholders and until their successors shall be elected and duly qualified.

2. To approve, on an advisory basis, the compensation of our named executive officers, as disclosed in this proxy statement.

3. To indicate, on an advisory basis, the preferred frequency of shareholder advisory votes on the compensation of the Company’s named executive officers.

4. To approve our Amended and Restated 2005 Equity Incentive Plan.

5. To ratify the selection of Ernst & Young LLP as our independent registered public accounting firm for the fiscal year ending December 30, 2012.

6. To consider any other business to properly come before the meeting.

Only shareholders of record at the close of business on March 15, 2012 will be entitled to notice of, and to vote, at the Annual Meeting of Shareholders and any adjournments or postponements of the meeting.

Our proxy statement is attached to this Notice of Annual Meeting of Shareholders. Financial and other information concerning us is contained in the Caribou Coffee Company, Inc. Annual Report to Shareholders for the fiscal year ended January 1, 2012.

Important Notice Regarding the Availability of Proxy Materials for the Shareholder Meeting to Be Held on May 9, 2012:The Caribou Coffee Company, Inc. proxy statement for the 2012 Annual Meeting of Shareholders and the 2011 Annual Report to Shareholders are available at www.proxyvote.com/ .

|

| By Order of the Board of Directors, |

|

|

Dan E. Lee Secretary |

Brooklyn Center, Minnesota

March 27, 2012

TABLE OF CONTENTS

CARIBOU COFFEE COMPANY, INC.

3900 Lakebreeze Avenue North

Brooklyn Center, Minnesota 55429

PROXY STATEMENT

for the

2012 ANNUAL MEETING OF SHAREHOLDERS

This proxy statement is furnished by and on behalf of the Board of Directors (the “Board”) of Caribou Coffee Company, Inc., a Minnesota corporation (“we,” “us,” “our,” “Caribou” or the “Company”), in connection with the solicitation of proxies for use at the Annual Meeting of Shareholders to be held at 10 a.m. (Central Time) on Wednesday, May 9, 2012, at the Hotel Ivy, 201 South Eleventh Street, Minneapolis, Minnesota, and at any adjournment or postponement thereof. The Company will take advantage of the Securities and Exchange Commission rule allowing companies to furnish proxy material over the internet. On March 30, 2012, we will begin mailing to certain shareowners of record on March 15, 2012 a notice of internet availability of proxy materials containing instructions on how to access our 2012 proxy statement and annual report and vote online. All other shareowners of record on March 15, 2012 will receive the proxy statement and annual report by mail.

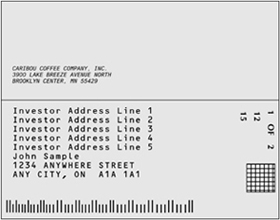

We will bear the expense of preparing, printing and mailing this proxy statement and the proxies we are soliciting. Proxies will be solicited by mail and may also be solicited by directors, officers and other Caribou employees, without additional remuneration, in person or by telephone or facsimile transmission. We will also request brokerage firms, banks, nominees, custodians and fiduciaries to forward proxy materials to the beneficial owners of shares of common stock as of the record date and will reimburse such persons for the cost of forwarding the proxy materials in accordance with customary practice. Your cooperation in promptly voting your shares and submitting your proxy by telephone, the Internet or by completing and returning the enclosed proxy card will help to avoid additional expense. Proxies and ballots will be received and tabulated by Broadridge Financial Solutions, Inc., the inspector of elections for the Annual Meeting.

ABOUT THE MEETING

What am I voting on?

You will be voting on the following: (1) to elect seven directors nominated by the board, (2) to approve, on an advisory basis, the compensation of the Company’s named executive officers, (3) to indicate, on an advisory basis, the preferred frequency of shareholder advisory votes on the compensation of the Company’s named executive officers, (4) to approve our Amended and Restated 2005 Equity Incentive Plan, (5) to ratify the selection of Ernst & Young LLP as our independent registered public accounting firm and (6) to transact such other business as may properly come before the meeting or any adjournment or postponement thereof. No cumulative rights are authorized, and dissenter’s rights are not applicable to the matters being voted upon.

Who is entitled to vote?

You may vote if you owned our common stock as of the close of business on March 15, 2012, the record date. Each share of common stock is entitled to one vote. As of the record date, we had 20,946,279 shares of common stock outstanding.

How do I vote if I do not plan to attend the meeting?

Whether or not you plan to attend the Annual Meeting, you can arrange for your shares to be voted at the meeting. There are three ways to vote your proxy:

1. VOTE BY PHONE — TOLL FREE — 1-800-560-1965

2. VOTE BY INTERNET — http://www.proxyvote.com

3. VOTE BY MAIL — Mark, sign and return the enclosed proxy card.

1

If your shares are held in the name of your broker, bank or another nominee, you should follow the instructions provided by your broker, bank or other nominee to vote your shares.

Can I vote at the meeting?

You may vote your shares at the meeting if you attend in person and the shares are registered in your name. If your shares are held in “street name” by your broker, bank or another nominee, you may not vote your shares in person at the meeting unless you obtain a signed proxy from your broker, bank or another nominee. Even if you plan to attend the meeting, we encourage you to vote your shares by completing, signing and returning the enclosed proxy card or voting by phone or the Internet.

Can I change my vote after I return my proxy card or vote by phone or the Internet?

If you are a shareholder of record, you may change your vote at any time before the polls close at the meeting. You may do this by (i) voting again over the Internet or by phone at least 24 hours prior to the Annual Meeting, (ii) executing and delivering a later dated proxy card to the Secretary of the Company prior to the Annual Meeting, (iii) delivering written notice of revocation of the proxy to the Secretary of the Company prior to the Annual Meeting or (iv) attending and voting in person at the Annual Meeting. Attendance at the Annual Meeting, in and of itself, will not constitute a revocation of a proxy. If you hold your shares in “street name,” you may submit new voting instructions by contacting your broker, bank or other nominee.

What does it mean if I receive more than one proxy card?

It means that you have multiple accounts with brokers, banks or other nominees. Please vote all of these shares. We recommend that you contact the record holder of your shares to consolidate as many accounts as possible under the same name and address.

How can I attend the meeting?

The Annual Meeting is open to all holders of our common stock as of the record date. To attend the meeting, you will need to bring evidence of your stock ownership. If your shares are registered in your name, your admission card is included with this proxy statement. You will need to bring the admission card together with valid picture identification. If your shares are held in the name of your broker, bank or another nominee or you received your proxy materials electronically, you will need to bring evidence of your stock ownership, such as your most recent brokerage account statement, and valid picture identification. Registration and seating will begin at 9:45 a.m. Camera, recording devices and other similar electronic devices will not be permitted at the meeting.

May shareholders ask questions at the meeting?

Yes. Representatives of the Company will answer shareholders’ questions of general interest at the end of the meeting. In order to give a greater number of shareholders an opportunity to ask questions, individuals or groups will be allowed to ask only one question and no repetitive or follow-up questions will be permitted.

How many votes must be present to hold the meeting?

Your shares are counted as present at the meeting if you attend the meeting in person, if you properly return the enclosed proxy card or if you grant a proxy to vote by the internet or phone. In order for us to conduct our meeting, a majority of our outstanding shares of common stock as of March 15, 2012, must be present in person or by proxy at the meeting. This is referred to as a quorum. Abstentions and broker non-votes will be counted for purposes of establishing a quorum at the meeting.

2

How may I vote for the nominees for election to director, and how many votes must the nominee receive to be elected?

With respect to the election of directors, you may:

| | • | | vote FOR the election of the seven nominees for director; |

| | • | | vote FOR the election of the seven nominees for director, except as marked; or |

| | • | | vote WITHHELD for all seven nominees for director. |

The seven nominees that receive the greatest number of votes “For” will be elected as directors. This is called a plurality. Abstentions and broker non-votes are neither counted for nor withheld under a plurality vote standard.

How many votes are needed to approve the other proposals?

Assuming the presence of a quorum, the affirmative vote of the greater of (i) a majority of the outstanding shares of our voting securities present in person or by proxy and entitled to vote on the item at the meeting and (ii) a majority of the minimum number of shares entitled to vote that would constitute a quorum for the transaction of business at the meeting, will be required for approval of each of these proposals. Abstentions will be considered shares entitled to vote in the tabulation of votes cast and will have the same effect as negative votes on each of these proposals.

What if I sign and return my proxy card but do not provide voting instructions or vote by phone or the Internet?

If the enclosed proxy card is signed and returned (and not revoked) prior to the Annual Meeting, but does not provide voting instructions, the shares of common stock represented thereby will be voted: (1) “For” the election of the seven director candidates nominated by the Board, (2) “For” the approval of the advisory resolution on executive compensation; (3) to conduct future advisory votes on executive compensation “every year”; (4), “For” the approval of our Amended and Restated 2005 Equity Incentive Plan, (5) “For” the ratification of the selection of Ernst & Young LLP as our independent registered public accounting firm for the fiscal year ending December 30, 2012 (“fiscal 2012”), and (6) in accordance with the best judgment of the named proxies on any other matters properly brought before the Annual Meeting.

Will my shares be voted if I do not sign and return my proxy card, vote over the Internet, vote by phone or vote in person at the Annual Meeting?

Unless you provide voting instructions to any broker holding shares on your behalf, your broker may not use discretionary authority to vote your shares on any of the matters to be considered at the annual meeting other than the ratification of our independent registered public accounting firm. Please vote your proxy so your vote can be counted. Proxies and ballots will be received and tabulated by Broadridge Financial Services, our inspector of elections for the annual meeting.

We encourage you to provide instructions to your brokerage firm by voting your proxy. This action ensures your shares will be voted at the Annual Meeting

Can my shares be voted on matters other than those described in this proxy statement?

Yes. We have not received proper notice of, and are not aware of, any business to be transacted at the meeting other than as indicated in this proxy statement. If any other item or proposal properly comes before the meeting, the proxies received will be voted on those matters in accordance with the discretion of the proxy holders.

3

PROPOSAL 1 — ELECTION OF DIRECTORS

In accordance with our Amended and Restated Bylaws, the number of directors to constitute the Board shall be determined from time to time by resolution of the Board. The number of directors that constitute the Board is currently set at seven.

We maintain a standing Nominating and Corporate Governance Committee, which we refer to in this section as the Committee, comprised solely of independent directors who are responsible for identifying individuals qualified to become Board members and recommending director nominees to the Board. You may access the Committee’s charter on our website atwww.cariboucoffee.comunder the headings “Investors” and “Corporate Governance.”

Nominees for director are selected based on the following criteria: (i) integrity; (ii) outstanding achievement in their careers; (iii) broad experience; (iv) independence; (v) financial expertise; (vi) ability to make independent, analytical inquiries; (vii) understanding of the business environment; and (viii) willingness to devote adequate time to Board duties. The Board believes that each director should have, and expects the nominees to have, the capacity to obtain a basic understanding of: (i) our principal operational and financial objectives, plans and strategies; (ii) our results of operations and financial condition and of any significant subsidiaries or business segments; and (iii) our relative standing and our business segments in relation to our competitors. The Committee considers it essential that the Audit Committee have at least one member who qualifies as an “audit committee financial expert.” The Committee does not have an official diversity policy; however, the Committee seeks to nominate candidates who bring diverse experiences and perspectives to our Board. In evaluating candidates, the Committee’s practice is to consider, among other things, diverse business experiences and the candidate’s range of experiences with public companies. Evaluations of potential candidates generally involve a review of the candidate’s background and credentials by the Committee, interviews with members of the Committee, the Committee as a whole, or one or more other Board members, and discussions of the Committee and the Board. The Committee then recommends candidates to the full Board which, in turn, selects candidates to be nominated for election by the shareholders or to be elected by the Board to fill a vacancy.

Nominees for director are elected to serve for a term of one year and until their respective successors have been elected and qualified. Each director shall hold office until the next regular meeting of the shareholders after such director’s election and until a successor is elected and has qualified, or until the earlier death, resignation, removal or disqualification of the director.

The terms of the current seven directors, Messrs. Caffey, Doolin, Graves, Ogburn, Sanford and Tattersfield and Ms. Palisi Chapin, expire upon the election and qualification of the directors to be elected at the Annual Meeting.

Unless otherwise directed, the persons named in the proxy intend to vote all proxies “For” the election of the seven nominees for director to the Board. The nominees have consented to serve as directors if elected. If, at the time of the Annual Meeting, any of the nominees is unable or declines to serve as a director, the discretionary authority provided in the enclosed proxy will be exercised to vote for a substitute candidate designated by the Board. The Board has no reason to believe any of the nominees will be unable or will decline to serve as a director.

Set forth below is certain information furnished to us by the director nominees. The ages provided for each nominee are as of March 27, 2012. There are no family relationships among any of our directors or executive officers.

Nominees for Directors

Kip R. Caffey,age 56, has served as a director since October 2005. Mr. Caffey is the Managing Partner of Cary Street Partners, LLC, an investment banking and wealth management firm, where he has been a partner

4

since July 2004. From July 1999 to March 2004, Mr. Caffey was employed by SunTrust Robinson Humphrey and its predecessor firm, The Robinson-Humphrey Company, Inc., where he was Senior Managing Director and co-head of Investment Banking.

Expertise and Qualifications: Among many qualifications, Mr. Caffey brings significant expertise in working with small and mid-cap companies as a result of nearly 30 years as an investment banker. In addition, he has general management expertise from running a complex investment banking and wealth management company. His experience includes matters relating to strategy, public markets, finance, accounting and general management.

Sarah Palisi Chapin, age 50, has served as a director since August 2007. Since March 2009 she has been the Chief Executive Officer of Hail Merry Snacks, a manufacturer and marketer of raw, vegan and gluten-free snacks. Ms. Palisi Chapin was a founding partner in The Chain Gang, a restaurant investment consultancy and advisory practice, from December 2004 to January 2009. From 1995 to 2003, Ms. Palisi Chapin was Chief Executive Officer of Enersyst Development Center, a research and development, intellectual property, food and technology incubator, and from 2002 to 2003 Ms. Palisi Chapin served as its Chair. She currently serves on the board of directors of Hail Merry Snacks and PrimeSource Foodservice Equipment, a global restaurant equipment distribution company.

Expertise and Qualifications: Among many qualifications, Ms. Palisi Chapin brings significant expertise as a result of many years in the restaurant industry with a wide variety of organizations such as Hail Merry Snacks, The Chain Gang, Prime Source Foodservice Equipment, Grand Metropolitan and PepsiCo, Inc. Her experience includes matters relating to strategy, franchising, supply chain, innovation, product development, commercial foodservice, international brand strategy and development, technology, marketing, manufacturing and customer relationship management. In addition, Ms. Palisi Chapin is influenced by her experience outside the restaurant industry with organizations such as Enersyst Development Center.

Wallace B. Doolin,age 65, has served as a director since October 2005. Mr. Doolin is the founder and Chairman of Black Box Intelligence, a restaurant industry business intelligence company, since January 2009 and is the Chairman of ESP Systems a hospitality technology company since June 2008. Mr. Doolin was the Chairman of the Board of Directors of Buca, Inc., an owner and operator of full service restaurants, from November 2004 to September 2008. Mr. Doolin is also the former Chief Executive Officer and President of Buca, Inc. From May 2002 to October 2004, Mr. Doolin was Chief Executive Officer, President and a board member of La Madeleine de Corps, Inc., a French restaurant and bakery company. From 1989 to 2002, Mr. Doolin served in various positions including CEO/ President of TGI Friday’s and Carlson Restaurants Worldwide.

Expertise and Qualifications: Among many qualifications, Mr. Doolin brings significant general management and restaurant industry expertise as a result of successfully managing several other organizations such as Buca, Inc., La Madeleine de Corps, Inc. and TGI Fridays, Inc. His experience includes matters relating to strategy, innovation, technology, marketing, manufacturing, customer relationship management as well as transformational change. In addition, his perspectives are influenced by serving on the boards of other public and private organizations.

Gary A. Graves, age 52,has served as our Non-Executive Chairman since November 2007 and as a director since August 2007. Since November 2008, he has been an independent consultant with Huntley, Mullaney, Spargo & Sullivan, a real estate restructuring company. From February 2007 to November 2008, Mr. Graves was the Chief Executive Officer of American Laser Centers, Inc. From August 2002 to January 2007, Mr. Graves served as President and Chief Executive Officer for La Petite Academy, a preschool educational facility.

Expertise and Qualifications: Among many qualifications, Mr. Graves brings significant general management expertise as a result of successfully operating enterprises in a variety of industries such as American Laser Centers, Inc. and La Petite Academy. In addition, he has substantial management and industry experience

5

from his roles with Boston Market Corporation and PepsiCo, Inc. as well as having been a consultant with McKinsey and Company. His experience includes matters relating to strategy, innovation, marketing, real estate, customer relationship management as well as transformational change.

Charles H. Ogburn,age 56, has served as a director since January 2003. Mr. Ogburn was an Executive Director of Arcapita Bank B.S.C. (c), a global investment bank, from March 2001 until July 2010. Prior to joining Arcapita, Mr. Ogburn spent more than 15 years at the investment banking firm of The Robinson-Humphrey Company, Inc., most recently as Senior Managing Director and co-head of Investment Banking. Mr. Ogburn currently serves on the Board of Directors of Crawford & Company, an insurance claims management and related services provider, and The Cook & Bynum Fund, a publicly listed equity mutual fund.

Expertise and Qualifications: Among many qualifications, Mr. Ogburn brings significant private equity investment banking, legal and general management expertise as a result of many years in the investment banking industry as well as in private legal practice. In addition, his experience and perspectives are informed by his years of experience overseeing and advising the management of Arcapita, Inc.’s portfolio companies in a variety of industries, including communications, health care, manufacturing, retail and restaurants.

Philip H. Sanford,age 58, has served as a director since April, 2009. Since August of 2010 Mr. Sanford has served as the President and Chief Executive Officer of Jackson Hewitt Tax Service Inc., a tax return preparation and electronic filing services company. From January 2009 to December 2009, Mr. Sanford was the President and Chief Operating Officer of Value Place, LLC, an extended stay hotel chain. From August 2003 to present, Mr. Sanford has been the Principal of Port Royal Holdings, LLC, a private equity firm. From July 1997 to August 2003, he was the Chairman and Chief Executive Officer of The Krystal Company, an owner, operator and franchisor of quick-service restaurants. Mr. Sanford was the Chairman of the Compensation Committee and Lead Director of Chattem, Inc., a publicly traded marketer and manufacturer of over-the-counter healthcare products, toiletries and dietary supplements, from 1998 until the sale of the company in March 2010.

Expertise and Qualifications: Among many qualifications, Mr. Sanford brings significant general management expertise as a result of his significant management roles in a variety of other organizations in the hospitality, quick-service restaurant and healthcare products industries such as Value Place, LLC, The Krystal Company and Chattem, Inc. His experience includes matters relating to strategy, innovation, finance, marketing, manufacturing and customer relationship management. In addition, Mr. Sanford has significant experience on public company boards from service as the Chairman of The Krystal Company and the Chairman of the Compensation Committee and the Lead Director of Chattem, Inc.

Michael J. Tattersfield,age 46, has served as a director since April 2009. Mr. Tattersfield has also served as the President and Chief Executive Officer of the Company since August 2008. From 2006 to 2008, Mr. Tattersfield served as Chief Operating Offer and Executive Vice President of lululemon athletica, a yoga-inspired athletic apparel company based in Vancouver, British Columbia. From 2005 to 2006, Mr. Tattersfield served as Vice President Store Operations for The Limited Brands, Inc., and operator of specialty stores that sell apparel, personal care, beauty and lingerie products. From 2003 to 2005, Mr. Tattersfield was President of A&W All American Food Restaurants of Yum! Brands, Inc. a quick-service restaurant company, and from 1992 to 2002, Mr. Tattersfield served in various positions for Yum! Brands, Inc.

Expertise and Qualifications: Among many qualifications, Mr. Tattersfield brings significant general management expertise as a result of his significant management roles in a variety of organizations in the retail and restaurant industries such as lululemon athletica, The Limited Brands and YUM! Brands. His experience includes matters relating to strategy, finance, accounting, innovation, marketing, real estate, franchising and customer relationship management. In addition, his perspectives are influenced by years in direct management as well as serving on the board of another company.

6

THE BOARD RECOMMENDS THAT SHAREHOLDERS VOTEFOR THE ELECTION OF THE SEVEN NOMINEES TO THE BOARD.

Affirmative Determinations Regarding Director Independence and Other Matters

The Board has determined that Kip R. Caffey, Wallace B. Doolin, Gary A. Graves, Charles H. Ogburn, Sarah Palisi Chapin and Philip H. Sanford are “independent directors” as defined under the applicable NASDAQ Global Market (“NASDAQ”) rules. The Board determined that Mr. Ogburn’s former affiliation with Arcapita, Inc. did not prevent it from reaching a determination that Mr. Ogburn is now an independent director based on his July 2010 retirement and the fact that Arcapita is no longer our controlling shareholder. Mr. Tattersfield, our President and Chief Executive Officer, is not an independent director.

In this proxy statement the directors who have been affirmatively determined by the Board to be “independent directors” under this rule are referred to individually as an “Independent Director” and collectively as the “Independent Directors.”

The Board has also determined that each member of the three committees of the Board meets the independence requirements applicable to those committees prescribed by NASDAQ and the Securities and Exchange Commission (“SEC”). The Board has further determined that Mr. Caffey is an “audit committee financial expert” as such term is defined by SEC rules.

Board Committees

During fiscal 2011, the Board had three standing committees: the Compensation Committee, the Audit Committee and the Nominating and Corporate Governance Committee. Committee and committee chair assignments are made annually by the Board at its meeting immediately following the Annual Meeting of Shareholders. Each of these committees operates pursuant to a written charter, which are available in the “Investors” section of our website under the heading “Corporate Governance”. The current composition of each Board committee is as follows.

| | | | |

Audit | | Compensation | | Nominating and Corporate Governance |

| Kip R. Caffey (Chair) | | Sarah Palisi Chapin (Chair) | | Wallace B. Doolin (Chair) |

| Wallace B. Doolin | | Kip R. Caffey | | Sarah Palisi Chapin |

| Gary A. Graves | | Wallace B. Doolin | | Gary A. Graves |

| Philip H. Sanford | | Philip H. Sanford | | Philip H. Sanford |

The Board committee assignments are expected to change following the Annual Meeting as follows.

| | | | |

Audit | | Compensation | | Nominating and Corporate Governance |

| Kip R. Caffey (Chair) | | Sarah Palisi Chapin (Chair) | | Philip H. Sanford (Chair) |

| Wallace B. Doolin | | Kip R. Caffey | | Sarah Palisi Chapin |

| Gary A. Graves | | Wallace B. Doolin | | Gary A. Graves |

| Charles H. Ogburn | | Philip H. Sanford | | Charles H. Ogburn |

Board and Committee Meetings

During fiscal 2011, the Board held five meetings, the Audit Committee held six meetings, the Compensation Committee held five meetings and the Nominating and Corporate Governance Committee held two meetings. Each director attended at least 85% of the meetings of the Board of Directors and the meetings of each committee on which the director served during fiscal 2011. We have not adopted a formal policy regarding Board members’ attendance at Annual Meetings; however, all Board members attended the 2011 Annual Meeting.

The Responsibilities and Duties of the Nominating and Corporate Governance Committee

The purpose of the Nominating and Corporate Governance Committee is to assist the Board in fulfilling its responsibilities relating to:

| | • | | identification of individuals qualified to become Board members and recommendation of director nominees to the Board prior to each Annual Meeting of Shareholders; |

| | • | | recommendation of nominees for committees of the Board; and |

| | • | | matters concerning corporate governance practices. |

7

To carry out its nominating function, the Committee has the following responsibilities and duties:

| | • | | Retain, as deemed necessary, any search firm to be used to identify director candidates. The Committee has sole authority to select such search firm and approve its fees and other retention terms. |

| | • | | Determine desired board skills and attributes. The Committee shall consider personal and professional integrity, ability and judgment and such other factors deemed appropriate. |

| | • | | Actively seek individuals whose skills and attributes reflect those desired and evaluate and propose nominees for election to the Board. |

| | • | | Review the slate of directors who are to be re-nominated to determine whether they are meeting the Board’s expectations of them. |

| | • | | Make recommendations to the full Board for appointments to fill vacancies of any unexpired term on the Board. |

| | • | | Annually recommend to the Board nominees for submission to shareholders for approval at the time of the Annual Meeting of Shareholders. |

| | • | | Annually review committee chairs and membership and recommend any changes to the full Board. |

The Nominating and Corporate Governance Committee has not adopted a specific policy regarding the consideration of shareholder director nominees, but its general policy is to welcome future nominees recommended by shareholders. Shareholders who wish to recommend individuals for consideration by the Nominating and Corporate Governance Committee to become nominees for election to our Board may do so by submitting a written recommendation to Caribou Coffee Company, Inc., 3900 Lakebreeze Avenue North, Brooklyn Center, Minnesota 55429, Attention: Secretary. Submissions must include sufficient biographical information concerning the recommended individual, including age, five-year employment history with employer names and a description of the employer’s business, whether such individual can read and understand basic financial statements and board memberships (if any) for the Committee to consider. The Nominating and Corporate Governance Committee does not intend to alter the manner in which it evaluates nominees based on whether or not the nominee was recommended by a shareholder.

The Nominating and Corporate Governance Committee uses a variety of sources in order to identify new candidates. New candidates may be identified through recommendations from independent directors or members of management, search firms, discussions with other persons who may know of suitable candidates to serve on the Board and shareholder recommendations. Evaluations of prospective candidates typically include a review of the candidate’s background and qualifications by the Nominating and Corporate Governance Committee, interviews with the Nominating and Corporate Governance Committee as a whole, one or more members of the Nominating and Corporate Governance Committee, or one or more other Board members, and discussions of the Nominating and Corporate Governance Committee and the full Board. The Nominating and Corporate Governance Committee then recommends candidates to the full Board, with the full Board selecting the candidates to be nominated for election by the shareholders or to be elected by the Board to fill a vacancy.

Board Leadership Structure

Since November 2007, we have separated the role of President and Chief Executive Officer from the role of Chairman of the Board, and Mr. Graves has served as our Non-Executive Chairman of the Board. We believe this current board leadership structure is best for our Company and our shareholders.

The President and Chief Executive Officer is responsible for the day-to-day leadership and management of the Company, and the Non-Executive Chairman’s responsibility is to provide oversight, direction and leadership of the Board, such as the following:

| | • | | facilitating communication among the directors and the flow of information between our management and directors on a regular basis; |

8

| | • | | setting Board meeting agendas in consultation with the President and Chief Executive Officer; |

| | • | | presiding at Board meetings, Board executive sessions and shareholder meetings; and |

| | • | | providing input to the Board’s annual self-evaluation and committee composition and leadership. |

We believe having a Non-Executive Chairman provides strong leadership for our Board, while also positioning our Chief Executive Officer as the leader of the Company in the eyes of our business partners, employees, shareholders and other stakeholders.

Board’s Role in Risk Oversight

Our Board is responsible for overseeing our risk management. The Board delegates some of its risk oversight role to the Audit Committee. Under its charter, the Audit Committee is responsible for discussing with management our exposure to risk and major financial risk exposures. The Audit Committee oversees our corporate compliance programs, as well as the internal audit function. In addition to the Audit Committee’s work in overseeing risk management, our full Board regularly engages in discussions of the most significant risks that the Company is facing and how these risks are being managed, and the Board receives reports on risk management from senior officers of the Company and from the Chairman of the Audit Committee, as well as from outside advisors. The Board believes that the work undertaken by the Audit Committee, together with the work of the full Board and management, enables the Board to effectively oversee the Company’s risk management function.

AUDIT COMMITTEE REPORT

During fiscal 2011, Messrs. Kip R. Caffey, Wallace B. Doolin, Gary A. Graves and Philip H. Sanford served on the Audit Committee. Messrs. Caffey, Doolin, Graves and Sanford (i) meet the independence criteria prescribed by the applicable law and the rules of the SEC for audit committee membership and are “independent directors” as defined in NASDAQ rules, and (ii) meet NASDAQ’s financial knowledge and sophistication requirements. Mr. Caffey has been determined by the Board to be an “audit committee financial expert” under SEC rules. The audit committee helps ensure the integrity of our financial statements and the qualifications and independence of our independent auditors.

The audit committee:

| | • | | evaluates the independent auditors’ qualifications, independence and performance; |

| | • | | determines the terms of engagement of the independent auditors; |

| | • | | approves the retention of the independent auditors to perform any proposed permissible non-audit services; |

| | • | | monitors the rotation of partners of the independent auditors on the engagement team as required by law; |

| | • | | reviews our financial statements; |

| | • | | review our critical accounting policies and estimates; and |

| | • | | discusses with management and the independent auditors the results of the annual audit and the review of our quarterly financial statements, among other things. |

The Audit Committee also reviewed our consolidated financial statements for 2011 with Ernst & Young LLP, our independent registered public accounting firm for 2011 (“Ernst & Young”), which is responsible for expressing an opinion on the conformity of those audited financial statements with accounting principles generally accepted in the United States. Further, the Audit Committee reviewed with Ernst & Young its judgment

9

as to the quality, not just the acceptability, of the Company’s accounting principles. In addition, the Audit Committee met with Ernst & Young, with and without management present, to discuss the results of its examinations, its evaluations of our internal controls, and the overall quality of our financial reporting.

The Audit Committee has received the written disclosures and the Rule 3526 letter from Ernst & Young required by the applicable requirements of the Public Company Accounting Oversight Board regarding the independent registered public accounting firm’s communications with the Audit Committee concerning independence, as modified or supplemented, and has discussed with Ernst & Young its independence. The Audit Committee considered the compatibility of non-audit services Ernst & Young provided to us with Ernst & Young’s independence. Finally, the Audit Committee discussed with Ernst & Young the matters required to be discussed under Statement on Auditing Standards No. 61, Communications with Audit Committees, as amended and as adopted by the Public Company Accounting Oversight Board in Rule 3200T.

In reliance on the reviews and discussions referred to above, the Audit Committee recommended to the Board, and the Board has approved, the inclusion of the consolidated financial statements in the Annual Report on Form 10-K for the year ended January 1, 2012, for filing with the Securities and Exchange Commission. The Audit Committee has selected Ernst & Young as our independent registered public accounting firm for 2012.

|

| Respectfully submitted, |

|

Kip R. Caffey (Chair) Wallace B. Doolin Gary A. Graves Philip H. Sanford |

|

|

|

Corporate Governance Materials

The following materials related to our corporate governance are available publicly on our website atwww.cariboucoffee.com/aboutus/investorrelations.asp under Corporate Governance:

| | • | | Audit Committee Charter |

| | • | | Compensation Committee Charter |

| | • | | Nominating and Corporate Governance Committee Charter |

| | • | | Code of Business Conduct and Ethics |

Copies may also be obtained, free of charge, by writing to: Senior Vice President, General Counsel and Secretary, Caribou Coffee Company, Inc., 3900 Lakebreeze Avenue North, Brooklyn Center, Minnesota, 55429. Please specify which documents you would like to receive.

10

COMPENSATION OF NON-EMPLOYEE DIRECTORS

Our directors who are not our employees receive compensation for serving on the Board. We provide the non-employee directors $30,000 per member in cash consideration annually for serving on our Board and an additional $3,000 per member for serving as a chairperson on any chartered standing committees of our Board, except for the Chairman of the Audit Committee who receives $6,000 annually. Members of the board who serve on chartered standing committees of the Board receive $750 per meeting in which they participate as an official voting committee member. In addition, under our Amended and Restated 2005 Equity Incentive Plan, each non-employee director receives an initial restricted stock grant immediately after joining the Board of 2,500 shares that vests in full on the first anniversary of the date of grant. In fiscal 2011, under our Amended and Restated 2005 Equity Incentive Plan, each non-employee director was granted 5,000 shares of restricted stock that vests on the first anniversary of the date of grant. We have agreed to reimburse all of our directors for reasonable expenses incurred in connection with their duties as directors.

In February of 2012, the following changes were made to the annual compensation of our non-employee directors.

| | • | | The annual cash consideration for serving as chairperson of the Audit Committee, Compensation Committee and Nominations and Governance Committee will be $10,000, $7,500 and $5,000, respectively. |

| | • | | Each non-employee director will receive annually the equivalent of $50,000 in restricted shares of Company stock subject to a one year vesting period, priced as of the date of such restricted stock award’s 5 day average following the first quarter earnings release. |

The table below sets forth, for each non-employee director that served during fiscal 2011, the amount of compensation paid for his or her service. Mr. Tattersfield, our President and Chief Executive Officer, receives no compensation for his service as a director. His compensation is set forth under “Executive Compensation” below.

| | | | | | | | | | | | |

Name | | Fees

Earned

or Paid

in Cash

($) | | | Stock

Awards

($)(1)(2) | | | Total

($) | |

Kip R. Caffey | | | 39,750 | | | | 45,700 | | | | 85,450 | |

Sarah Palisi Chapin | | | 34,500 | | | | 45,700 | | | | 80,200 | |

Wallace B. Doolin | | | 38,250 | | | | 45,700 | | | | 83,950 | |

E. Stockton Croft IV(3) | | | — | | | | — | | | | — | |

Gary A. Graves | | | 30,750 | | | | 45,700 | | | | 76,450 | |

Kevin J. Keough(3) | | | — | | | | — | | | | — | |

Charles H. Ogburn | | | 26,250 | | | | 45,700 | | | | 71,950 | |

Philip H. Sanford | | | 36,000 | | | | 45,700 | | | | 81,700 | |

| (1) | The amount shown represents the grant date fair value of restricted stock granted during the year calculated as the closing price of our common stock on the date of grant, in accordance with FASB ASC Topic 718. |

| (2) | At the end of fiscal 2011, the aggregate number of shares of restricted stock awards subject to vesting was: Mr. Caffey — 7,500; Ms. Palisi Chapin — 7,500; Mr. Doolin — 7,500; Mr. Graves — 7,500; Mr. Ogburn — 5,000; and Mr. Sanford — 5,000. |

| (3) | Messrs. Croft and Keough served on our board from May 2011 to September 2011. |

Director Stock Ownership Guidelines

The Company has stock ownership guidelines for non-employee directors to encourage our directors to have a long-term equity stake in Caribou and align their interests with the interests of shareholders. Those guidelines provide that each non-employee director must hold the equivalent of $150,000 in Caribou stock. Each non-employee director generally has five years to achieve the minimum ownership requirement. Until the ownership requirement is satisfied, the non-employee director is required to retain 100% of the net shares received upon the exercise of stock options and 100% of the net shares received upon the vesting of RSUs. All non-employee directors exceed these guidelines.

11

EXECUTIVE COMPENSATION

Compensation Discussion and Analysis

Executive Summary

Our compensation philosophy is designed to attract, recognize, reward and retain our executives. The Compensation Committee determines the compensation objectives, philosophy and forms of compensation and benefits for our executives. The Compensation Committee is supported by Meridian Compensation Partners, LLC, its outside independent compensation consultant. Most of our compensation is in the form of variable compensation through our annual incentive bonuses and long-term incentive compensation, and varies with the achievement of specific company results and individual performance. We offer a benefits package to all eligible full and part-time team members, including executives. The Compensation Committee reviews competitive market data when making compensation decisions.

The following discussion summarizes the philosophies and methods the Compensation Committee uses in establishing and administering our executive compensation and incentive programs.

Named Executive Officers for 2011

Our named executive officers include our principal executive officer (Michael J. Tattersfield, President and Chief Executive Officer), our principal financial officer (Timothy J. Hennessy, Chief Financial Officer) and the next three most highly compensated executive officers during the last fiscal year (Daniel J. Hurdle, Senior Vice President, Retail, Alfredo V. Martel, Senior Vice President, Marketing and Dan E. Lee, Senior Vice President, General Counsel and Secretary).

Executive Compensation Policies

Our executive compensation policies are designed to attract and retain qualified executives and to align rewards for our company and individual achievement with those of our shareholders. To accomplish these objectives, the executive compensation program is principally comprised of (1) base salary, (2) an annual performance-based cash bonus and (3) long-term equity incentive compensation, consisting of stock options and restricted stock. Finally, standard health, welfare and retirement benefits are provided such as a 401(k) savings plan, medical, dental, life and short- and long-term disability insurance to be competitive with the marketplace. These elements combine cash and non-cash compensation to comprise our executive officer’s total compensation.

Decisions regarding the level of base salary, performance-based cash bonus opportunities and long-term equity incentive compensation for our executive officers are primarily based upon (1) individual experience and technical capability needed to administer and execute the responsibilities of the positions, (2) competitive practices for executive talent in our industry and company size, (3) our operating performance and (4) individual performance. Our Compensation Committee also reviews compensation information for executive officers at comparator group companies and generally targets the median range of compensation for similar positions at our comparator group companies. Please review “Benchmarking Process” below for additional information regarding our comparator group companies.

Compensation Consultant

The Compensation Committee engaged Meridian at the end of 2011 as its independent compensation consultant to assist the Compensation Committee in creating and implementing executive compensation strategies and programs. Meridian also provides the Compensation Committee with compensation market data, information on executive compensation trends and best practices as well as advises the Compensation Committee with respect to the design of our compensation program for non-employee directors. All of Meridian’s work is done at the direction of or on behalf of the Compensation Committee. The Compensation Committee has the final decision-making authority with respect to all elements of compensation. Prior to the end of 2011, the Compensation Committee had engaged Towers Watson & Co. as its independent compensation consultant.

12

Components of Executive Compensation

Base Salary

Base salary is a fixed portion of compensation intended to attract and retain our executive talent. Base salary is designed to compensate our executives for the individual experience and technical capability needed to administer and execute the responsibilities of their respective positions. Base salary levels are based in part on review of base salary ranges for similar positions at our comparator group companies and are generally targeted near the median range of base salary of those peers. The Compensation Committee generally reviews and adjusts base salaries annually at its February meeting with new salaries effective at the end of February. In February 2011, the Committee approved the following base salary increases, which became effective in February 2011:

| | | | | | | | | | | | |

| | | Base Salary | |

Named Executive Officer | | Fiscal 2011 ($) | | | Fiscal 2010 ($) | | | % Change | |

Michael J. Tattersfield | | | 480,000 | | | | 442,000 | | | | 8.6 | % |

Timothy J. Hennessy | | | 319,815 | | | | 310,500 | | | | 3.0 | % |

Daniel J. Hurdle | | | 263,294 | | | | 257,500 | | | | 2.3 | % |

Alfredo V. Martel | | | 247,496 | | | | 242,050 | | | | 2.2 | % |

Dan E. Lee | | | 224,680 | | | | 218,136 | | | | 3.0 | % |

The Committee increased Mr. Tattersfield’s fiscal 2011 base salary in recognition of his exceptional performance and his leadership in driving fiscal 2010 results. Fiscal 2011 base salary increases were approved for all other named executive officers in recognition of their individual performance in fiscal 2010. Following the salary adjustments above, base salaries for Mr. Tattersfield, Mr. Hennessy, Mr. Hurdle and Mr. Lee were within the median range of their peers at our comparator group companies. Mr. Martel’s salary was slightly above the median range to reflect his additional responsibilities of overseeing the marketing for three distinct business channels. Our compensation committee believes these base salaries are consistent with our compensation philosophy.

Performance-Based Cash Bonus (Non-Equity Incentive Plan)

The purpose of our performance-based cash bonus plan is to unite the interests of our executive officers with those of our shareholders through the attainment of key annual financial, operational and individual performance objectives approved by the Compensation Committee at the beginning of each year.

The performance-based cash bonus plan approved by our Compensation Committee provides our named executive officers an opportunity to earn a target cash bonus ranging from 40% to 100% of base salary, upon the achievement of performance goals set by the Compensation Committee, as detailed in the table below. The Compensation Committee set primary and secondary performance goals of pre-tax income and net revenue, respectively. The plan requires minimum pre-tax income and net revenue be achieved before any bonus is paid. The amount of bonus available is determined based on the Company exceeding a minimum pre-tax income and net revenue. Should the minimum for the pre-tax income component not be obtained, a bonus will not be paid even if the net revenue minimum has been reached and/or an individual has attained their individual goals.

Furthermore, performance-based cash bonuses attributable to company performance are further adjusted based upon individual performance. An individual meeting all of his or her individual performance goals will have a multiplier of 1.0, meaning his or her bonus will effectively equal the bonus attributable solely to company performance. Exceeding individual performance goals generally results in a multiplier ranging from 1.05 to a maximum of 1.3. Less than complete achievement of individual performance goals generally results in a multiplier of 0.90 to a minimum of 0.

| | | | | | | | | | | | | | | | |

| | | | | | Goal Weighting | |

Named Executive Officer | | Target Bonus (as a %

of Base Salary) | | | Primary

Objective (%) | | | Secondary

Objective (%) | | | Individual Goals | |

Michael J. Tattersfield | | | 100 | | | | 75 | | | | 25 | | | | * | |

Timothy J. Hennessy | | | 60 | | | | 75 | | | | 25 | | | | * | |

Daniel J. Hurdle | | | 50 | | | | 75 | | | | 25 | | | | * | |

Alfredo V. Martel | | | 50 | | | | 75 | | | | 25 | | | | * | |

Dan E. Lee | | | 40 | | | | 75 | | | | 25 | | | | * | |

| * | An individual’s achievement against their individual goals may result in achieving higher or lower than target bonus by applying an individual performance factor of 0 to 1.3. |

13

For compensation purposes, the primary and secondary objective goals of pre-tax income and net revenue were chosen because these measures of Company business performance are key strategic measures and they closely align with the interests of our shareholders. We used the same measures for our broader-based management incentive plan in 2011.

To provide increased incentives for better performance, the primary and secondary objectives had a sliding scale that provided annual incentive bonus payouts greater than the target bonus if achievement of the primary and secondary objectives was greater than the target (up to a maximum of 150% payout) or less than the target bonus if achievement of the primary and secondary objectives was lower than the target (down to a threshold of 50% of target payout, below which the payout would be $0). In setting the objective performance targets, we consider target Company performance under the board-approved annual operating and long-term strategic plans. The Compensation Committee has the discretion to reduce the awards paid under our performance-based cash bonus plan, but does not have discretion to increase payouts that are based on achievement of the objective performance goals or make a payout based on objective performance goals if the threshold targets are not achieved.

The fiscal 2011 performance targets and results for the primary and secondary objective measures are as follows:

| | | | | | | | | | | | | | | | | | | | | | | | |

Primary and Secondary Objective Measure | | Threshold (in

Millions US$) | | | Target (in

Millions US$) | | | Maximum (in

Millions US$) | | | Actual

Performance (in

Millions US$) | | | Adjusted Actual

Performance (in

Millions US$)(1) | | | % Payout | |

Pre-Tax Income | | | 12.3 | | | | 13.1 | | | | 14.7 | | | | 14.9 | | | | 12.8 | | | | 77 | |

Net Revenue | | | 299.4 | | | | 309.4 | | | | 319.4 | | | | 326.5 | | | | 326.5 | | | | 150 | |

| (1) | Management recommended and the Compensation Committee exercised negative discretion to lower the fiscal 2011 pre-tax income performance achievement because of the disparate performance between the Company’s segments during fiscal year 2011. The Compensation Committee determined that the retail segment’s performance during fiscal year 2011, although offset by the commercial segment’s results, did not warrant a 150% payout on pre-tax income. Therefore, the actual pre-tax income performance metric was adjusted downwards to align the resulting payout with the weighted average performance of the Company’s operating units as a whole. |

After the end of fiscal 2011, the Compensation Committee determined the extent to which the performance goals were achieved, and subsequently approved the amount of each award to be paid. The table below shows the fiscal 2011 actual payout levels for each component of our performance-based cash bonus plan, which is also disclosed in the “Non-Equity Incentive Compensation Plan” column of the Summary Compensation Table below.

| | | | | | | | | | | | | | | | | | | | | | | | |

| Fiscal 2011 Performance-Based Cash Bonus Payouts | |

Named Executive Officer | | Payout for

Primary

Objective

Performance

Goal (%) | | | Payout for

Secondary

Objective

Performance

Goal (%) | | | Payout for

Individual

Performance

Goals (%) | | | Total

Payout

($) | | | Target

Bonus

(as a % of

Base Salary) | | | Total

Payout

(as a % of

Base Salary) | |

Michael J. Tattersfield | | | 77 | | | | 150 | | | | 115 | | | | 518,013 | | | | 100 | | | | 108 | |

Timothy J. Hennessy | | | 77 | | | | 150 | | | | 125 | | | | 226,847 | | | | 60 | | | | 71 | |

Daniel J. Hurdle | | | 77 | | | | 150 | | | | 90 | | | | 112,177 | | | | 50 | | | | 43 | |

Alfredo V. Martel | | | 77 | | | | 150 | | | | 100 | | | | 117,163 | | | | 50 | | | | 47 | |

Dan E. Lee | | | 77 | | | | 150 | | | | 105 | | | | 89,245 | | | | 40 | | | | 40 | |

Long-Term Equity Incentive Compensation

Our long-term incentive compensation, which is comprised of stock option and restricted stock grants, is intended to:

| | 1. | Provide strong financial incentives to drive sustainable long-term value creation for shareholders; |

14

| | 2. | Balance near-term financial priorities with long-term growth and strategic objectives; |

| | 3. | Create substantial ownership stake in Caribou; |

| | 4. | Offer competitive opportunities to our named executive officers; and |

| | 5. | Attract and retain key talent. |

The 2011 award values were determined partially based on market data prepared by the independent compensation consultant at that time, Towers Watson, with consideration to company and individual performance and with input from the CEO and the Compensation Committee.

Executive Stock Ownership Guidelines

The Company has stock ownership guidelines for executive officers to encourage our executives to have a long-term equity stake in Caribou and align their interests with the interests of shareholders. Those guidelines provide that each executive officer must hold a multiple of his or her annual base salary in Caribou as follows:

| | | | |

Position | | Ownership Requirement

(multiple of base salary) | |

Chief Executive Officer | | | 3x | |

Chief Financial Officer | | | 2x | |

Senior Vice Presidents | | | 1x | |

Vice Presidents | | | 0.5x | |

Each officer generally has five years to achieve the minimum ownership requirement. Currently, all officers have met this requirement.

Equity Grant Policies

The Compensation Committee has been given oversight responsibility for our equity incentive plan by our Board of Directors. The general terms of our equity grants have been pre-established by the Compensation Committee, including the life of the options (10 years) and the vesting schedule (25% per year commencing on the first anniversary of the date of grant) of both options and restricted shares. The Compensation Committee is therefore primarily concerned with the number of options and restricted shares granted, to whom they are granted to and the timing of such grants. The exercise price for all stock option grants is the closing market price of our common stock on the date of grant. We do not back-date or re-price stock options.

Other Benefits

Our executive officers, including our Chief Executive Officer, may participate in our other employee benefit plans at their discretion. These other benefit plans include our qualified 401(k) savings plan, medical and dental insurance, life insurance, and short-term and long-term disability. We do not provide any supplemental or non-qualified pension plans or deferred compensation plans to our executive officers other than our 401(k) savings plan. Our 401(k) savings plan allows a discretionary matching contribution. We provide relocation benefits to our executive officers. We do not provide any other perquisites to our executive officers.

Benchmarking Process

Annually, the Compensation Committee reviews a competitive benchmarking analysis of executive officer compensation prepared by the independent compensation consultant. In determining our 2011 compensation, the Compensation Committee adopted a peer group of 21 similarly sized companies in the chain restaurant industry to provide a reasonable comparison basis for benchmarking compensation levels and comparing compensation structure, design and practices. The peer group companies are listed below. Compensation market data is prepared based on this peer group, and is supplemented by the Hay Group Chain Restaurant Compensation

15

Association survey. Our company’s compensation philosophy is to generally target the 50th percentile of the marketplace in setting our named executive officers’ compensation opportunities. However, individual circumstances will be considered in setting individual pay opportunities above or below these levels.

The Compensation Committee focuses on target or grant date values for incentive compensation, it does not benchmark realized pay levels. The Compensation Committee believes that target compensation represents a fitting and typically competitive opportunity for annual compensation. Since short- and long-term incentives are performance-based compensation, what is realized from these awards is a function of the company’s financial performance and stock price results as well as individual contributions. It is not the purpose of the compensation philosophy to deliver a level of earned compensation commensurate with a benchmarking process. Instead what is earned is based on performance.

The peer companies in the Company’s comparative benchmark for fiscal year 2011 were:

| | |

Benihana, Inc. | | BJS Restaurants, Inc. |

Buffalo Wild Wings, Inc. | | Chipotle Mexican Grill, Inc. |

Einstein Noah Restaurant Group | | Famous Dave’s of America, Inc. |

Farmer Brothers Co | | Granite City Food and Brewery |

Green Mountain Coffee Roasters, Inc. | | Hain Celestial Group, Inc. |

Hansen Natural Corp. | | Inventure Group, Inc. |

J & J Snack Foods Corp. | | Jamba, Inc. |

Krispy Kreme Doughnuts, Inc. | | Panera Bread Co. |

Peets Coffee and Tea, Inc. | | Rubio’s Restaurant, Inc. |

Smart Balance, Inc. | | Starbucks Corp. |

Tim Horton’s, Inc. | | |

Role of Executive Officers in Compensation Decisions

The Compensation Committee determines the total compensation of our CEO and oversees the design and administration of compensation and benefit plans for all of the Company’s employees. Generally, our CEO makes recommendations to the Compensation Committee as it relates to the compensation of the other executive officers. In addition, our executive officers, including our CEO, CFO and Vice President of Human Resources, provide input and make proposals regarding the design, operation, objectives and values of the various components of compensation in order to provide appropriate performance and retention incentives for other key employees. These proposals may be made on the initiative of the executive officers or upon the request of the Compensation Committee. In addition, our internal human resources personnel meet with the Compensation Committee to present topical issues for discussion and education as well as specific recommendations for review. The Compensation Committee may also obtain input from our legal, finance and tax functions, as appropriate, as well as one or more executive compensation-consulting firms regarding matters under consideration. The Compensation Committee has delegated to management certain responsibilities related to employee benefit matters.

Compensation-Related Risk

We believe that our compensation programs for our named executive officers and other employees motivate the creation of shareholder value on both an annual and long-term basis. However, our programs and governance process are designed for the prudent evaluation and undertaking of risk to the benefit of our shareholders. As a result, we believe our programs do not encourage excessive or inappropriate risk-taking and are not reasonably likely to have a material adverse effect on us.

16

Compensation Committee Interlocks and Insider Participation

None of the members of the Compensation Committee was an officer or employee of Caribou Coffee Company, Inc. during fiscal year 2011 or in any prior year, and none of the members of the committee had any relationship requiring disclosure under Item 404 of Regulation S-K. There were no Compensation Committee interlocks as described in Item 407(e)(4) of Regulation S-K.

Impact of Tax and Accounting Treatment on Compensation Decisions

The Compensation Committee makes every reasonable effort to ensure that all compensation paid to our executives is fully deductible, provided it determines that application of applicable limits are consistent with our needs and executive compensation philosophy.

Our income tax deduction for executive compensation is limited by Section 162(m) of the Code to $1 million per executive per year, unless compensation above that amount is “performance-based.” This limit applies to our Chief Executive Officer and the other named executive officers.

Compensation Committee Report

The Compensation Committee has reviewed and discussed the Compensation Discussion and Analysis that appears herein with management. Based on such review and discussions, the committee recommended to our Board of Directors that the Compensation Discussion and Analysis be included in this proxy statement.

|

| Respectfully submitted, |

|

| /s/ Sarah Palisi Chapin, Chair |

| /s/ Kip R. Caffey |

| /s/ Wallace B. Doolin |

| /s/ Philip H. Sanford |

Summary

The Compensation Committee believes that the total compensation package has been designed to motivate key management to improve the operations and financial performance of the Company, thereby increasing the market value of our common stock.

17

Summary Compensation Table

The following table sets forth compensation information for our named executive officers for fiscal years 2011, 2010 and 2009:

| | | | | | | | | | | | | | | | | | | | | | | | |

Name and Principal Position | | Year | | | Salary

($)(1) | | | Stock

Awards

($)(2) | | | Non-Equity

Incentive Plan

Compensation

($)(3) | | | All Other

Compensation

($)(4) | | | Total ($) | |

Michael J. Tattersfield | | | 2011 | | | | 474,154 | | | | 895,720 | | | | 518,013 | | | | 5,637 | | | | 1,893,524 | |

President and Chief | | | 2010 | | | | 439,385 | | | | 155,540 | | | | 439,385 | | | | — | | | | 1,034,310 | |

Executive Officer | | | 2009 | | | | 441,346 | | | | 429,000 | | | | 662,019 | | | | — | | | | 1,532,365 | |

| | | | | | |

Timothy J. Hennessy | | | 2011 | | | | 318,382 | | | | 303,905 | | | | 226,847 | | | | 2,821 | | | | 851,955 | |

Chief Financial Officer | | | 2010 | | | | 308,885 | | | | 141,400 | | | | 185,331 | | | | — | | | | 635,616 | |

| | | 2009 | | | | 311,538 | | | | 348,323 | | | | 280,385 | | | | — | | | | 940,246 | |

| | | | | | |

Daniel J. Hurdle | | | 2011 | | | | 262,403 | | | | 117,678 | | | | 112,177 | | | | 1,654 | | | | 493,912 | |

Senior V.P. Operations | | | 2010 | | | | 256,346 | | | | 141,400 | | | | 135,385 | | | | — | | | | 533,131 | |

| | | 2009 | | | | 259,615 | | | | 48,144 | | | | 145,385 | | | | — | | | | 453,144 | |

| | | | | | |

Alfredo V. Martel | | | 2011 | | | | 246,658 | | | | 117,678 | | | | 117,163 | | | | 3,089 | | | | 484,588 | |

Senior V.P. Marketing | | | 2010 | | | | 240,965 | | | | 141,400 | | | | 121,688 | | | | — | | | | 504,053 | |

| | | 2009 | | | | 244,038 | | | | — | | | | 136,662 | | | | — | | | | 380,700 | |

| | | | | | |

Dan E. Lee | | | 2011 | | | | 223,673 | | | | 215,933 | | | | 89,245 | | | | 2,812 | | | | 531,663 | |

Senior V.P. General Counsel | | | 2010 | | | | 217,653 | | | | 77,770 | | | | 89,673 | | | | — | | | | 385,096 | |

| | | 2009 | | | | 203,077 | | | | 116,333 | | | | 94,874 | | | | — | | | | 414,284 | |

| (1) | Represents base salary earned during the year. Base salaries remained the same from fiscal year 2009 to fiscal year 2010; however, fiscal year 2009 contained 53 weeks whereas fiscal year 2010 had only 52 weeks. |

| (2) | Represents the grant date fair value of restricted stock granted during the year calculated as the closing price of our common stock on the date of grant, in accordance with ASC Topic 718. |

| (3) | Represents amounts earned under our performance-based cash plan for performance during the applicable year. |

| (4) | Represents premiums paid for executive long term disability insurance. |

Grants of Plan-Based Awards

The following table sets forth information concerning estimated possible payouts under non-equity incentive plan awards for fiscal year 2011 performance, and equity incentive plan awards granted in fiscal year 2011 to our named executive officers. The terms and conditions applicable to these awards are described above in our “Compensation Discussion and Analysis.”

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | Estimated Possible Payouts Under Non-

Equity Incentive Plan Awards(1) | | | Estimated Future Payouts

Under Equity Incentive Plan Awards | | | All Other

Stock

Awards:

Number of

shares of

Stock (#)(2) | | | Grant Date Fair

Value of Stock

Awards ($)(3) | |

Name | | Grant

Date | | | Threshold

($) | | | Target

($) | | | Maximum

($) | | | Threshold

(#) | | | Target

(#) | | | Maximum

(#) | | | | | | | |

| Michael J. Tattersfield | | | 3/11/2011 | | | | 118,538 | | | | 474,154 | | | | 711,231 | | | | — | | | | — | | | | — | | | | 98,000 | | | | 895,720 | |

| Timothy J. Hennessy | | | 3/11/2011 | | | | 47,757 | | | | 191,029 | | | | 286,544 | | | | — | | | | — | | | | — | | | | 33,250 | | | | 303,905 | |

| Daniel J. Hurdle | | | 3/11/2011 | | | | 32,800 | | | | 131,201 | | | | 196,802 | | | | — | | | | — | | | | — | | | | 12,875 | | | | 117,677 | |

| Alfredo V. Martel | | | 3/11/2011 | | | | 30,832 | | | | 123,329 | | | | 184,994 | | | | — | | | | — | | | | — | | | | 12,875 | | | | 117,677 | |

| Dan E. Lee | | | 3/11/2011 | | | | 22,367 | | | | 89,469 | | | | 134,204 | | | | — | | | | — | | | | — | | | | 23,625 | | | | 215,932 | |

| (1) | Represents information regarding awards under our performance-based cash bonus plan. |

| (2) | Represents the grant of restricted stock under our Amended and Restated 2005 Equity Incentive Plan. |

18

| (3) | Represents the grant date fair value of restricted stock granted during the year calculated as the closing price of our common stock on the date of grant, in accordance with ASC Topic 718. |

Outstanding Equity Awards at January 1, 2012

The following table sets forth information with respect to outstanding equity awards for each of the Named Executive Officers as of January 1, 2012. All awards were granted under our Amended and Restated 2005 Equity Incentive Plan.

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | Option Awards | | | Stock Awards | |

| | | | Number

of Shares

or Units

of Stock

That

Have Not

Vested (#) | | | Market

Value of

Shares or

Units of

Stock That

Have Not

Vested ($) | |

Name | | Number of

Securities

Underlying

Unexercised

Options (#)

Exercisable | | | Number of

Securities

Underlying

Unexercised

Options (#)

Unexercisable | | | Option

Exercise

Price ($) | | | Option

Expiration

Date | | | |

Michael J. Tattersfield | | | 375,000 | | | | 125,000 | (1) | | $ | 1.74 | | | | 8/01/2018 | | | | 152,000 | (2) | | | 2,120,400 | |

Timothy J. Hennessy | | | 206,250 | | | | 68,750 | (3) | | | 3.22 | | | | 9/09/2018 | | | | 69,614 | (4) | | | 917,185 | |

Daniel J. Hurdle | | | 75,000 | | | | 25,000 | (5) | | | 1.60 | | | | 12/0/2018 | | | | 34,675 | (6) | | | 483,716 | |

Alfredo V. Martel | | | 63,750 | | | | 21,250 | (7) | | | 1.91 | | | | 11/03/2018 | | | | 27,875 | (8) | | | 388,856 | |

Dan E. Lee | | | 3,750 | | | | 1,250 | (9) | | | 2.54 | | | | 5/02/2018 | | | | — | | | | — | |

| | | 16,145 | | | | — | | | | 7.24 | | | | 3/30/2017 | | | | — | | | | — | |

| | | 522 | | | | — | | | | 8.95 | | | | 3/17/2016 | | | | — | | | | — | |

| | | 33,333 | | | | — | | | | 9.87 | | | | 8/15/2015 | | | | 39,011 | (10) | | | 544,203 | |

| (1) | Mr. Tattersfield’s 125,000 unexercisable options become exercisable on August 1, 2012. |

| (2) | Mr. Tattersfield’s unvested restricted stock vests as follows: 24,500 shares on March 11, 2012, 5,500 shares on March 12, 2012, 37,500 shares on August 1, 2012, 24,500 shares on March 11, 2013, 5,500 shares on March 12, 2013, 24,500 shares on March 11, 2014, 5,500 shares on March 12, 2014 and 24,500 shares on March 11, 2015. |

| (3) | Mr. Hennessy’s 68,750 unexercisable options become exercisable on September 9, 2012. |

| (4) | Mr. Hennessy’s unvested restricted stock vests as follows: 8,313 shares on March 11, 2012, 5,000 shares on March 12, 2012, 10,685 shares on August 21, 2012, 8,313 shares on March 11, 2013, 5,00 shares on March 12, 2013, 10,685 shares on August 21, 2013, 8,312 shares on March 11, 2014, 5,000 shares on March 12, 2014 and 8,312 shares on March 11, 2015. |

| (5) | Mr. Hurdle’s 25,000 unexercisable options become exercisable on December 1, 2012. |

| (6) | Mr. Hurdle’s unvested restricted stock vests as follows: 3,219 shares on March 11, 2012, 5,000 shares on March 12, 2012, 3,400 shares on April 28, 2012, 3,219 shares on March 11, 2013, 5,000 shares on March 12, 2013, 3,400 shares on April 28, 2013, 3,219 shares on March 11, 2014, 5,000 shares on March 12, 2014 and 3,218 shares on March 11, 2015. |

| (7) | Mr. Martel’s 21,250 unexercisable options become exercisable on November 3, 2012. |

| (8) | Mr. Martel’s unvested restricted stock vests as follows: 3,219 shares on March 11, 2012, 5,000 shares on March 12, 2012, 3,219 shares on March 11, 2013, 5,000 shares on March 12, 2013, 3,219 shares on March 11, 2014, 5,000 shares on March 12, 2014 and 3,218 shares on March 11, 2015. |

| (9) | Mr. Lee’s 1,250 unexercisable options become exercisable on May 2, 2012. |

| (10) | Mr. Lee’s unvested restricted stock vests as follows: 5,906 shares on March 11, 2012, 2,750 shares on March 12, 2012, 3,569 shares on August 1, 2012, 5,906 shares on March 11, 2013, 2,750 shares on March 12, 2013, 3,568 shares on August 1, 2013, 5,906 shares on March 11, 2014, 2,750 on March 12, 2014 and 5,907 shares on March 11, 2015. |

19

Option Exercises and Stock Vested