Exhibit (a)(5)(H)

Filed in Fourth Judicial District Court

12/27/2012 9:49:13 AM

Hennepin County Civil, MN

| | | | | | |

STATE OF MINNESOTA | | | | | | DISTRICT COURT |

| | |

COUNTY OF HENNEPIN | | | | | | FOURTH JUDICIAL DISTRICT |

| | |

| | | | | | CASE TYPE: CIVIL |

| | |

| | | X | | | |

JAMES RANDOLPH RICHESON, | | | : | | | Case No. 27-cv-12-24893 |

Individually and on Behalf of All Others | | | : | | | |

Similarly Situated, | | | : | | | |

| | | : | | | |

Plaintiff, | | | : | | | CLASS ACTION |

| | | : | | | |

vs. | | | : | | | |

| | | : | | | AMENDED DIRECT SHAREHOLDER |

| CARIBOU COFFEE COMPANY INC., | | | : | | | CLASS ACTION COMPLAINT FOR |

| MICHAEL J. TATTERSFIELD, GARY A. GRAVES, | | | : | | | BREACH OF FIDUCIARY DUTIES |

| KIP R. CAFFEY, SARAH PALISI CHAPIN, | | | : | | | |

| PHILIP H. SANFORD, CHARLES H. OGBURN, | | | : | | | |

| WALLACE B. DOOLIN, JAB BEECH INC., | | | : | | | |

| PINE MERGER SUB INC., | | | : | | | |

| | | : | | | |

Defendants, | | | : | | | JURY TRIAL DEMAND |

| | | : | | | |

| | | : | | | |

| | | X | | | |

Plaintiff James Randolph Richeson (“Plaintiff”), by his attorneys, submits this Amended Direct Shareholder Class Action Complaint Based upon Breach of Fiduciary Duties (the “Complaint”) against the herein-named Defendants, and in support thereof, alleges as follows:

SUMMARY OF THE ACTION

1. This is a direct stockholder class action brought by Plaintiff on behalf of the holders of Caribou Coffee Company, Inc. (“Caribou” or the “Company”) common stock against Caribou, its

Filed in Fourth Judicial District Court

12/27/2012 9:49:13 AM

Hennepin County Civil, MN

Board of Directors (the “Board”), and the affiliates of the Joh, A. Benckiser Group (“JAB”), arising out of their breaches of fiduciary duty, and/or aiding and abetting those breaches, in connection with the Board’s decision to sell the Company to JAB via an inherently unfair process designed to ensure that JAB, and only JAB, continues to participate in Caribou’s robust and improving financial condition (the “Proposed Transaction”).

2. JAB is a German holding company for the Reinmann family who has shown an appetite for well-known brands. It already owns the likes of Coty, the cosmetics maker; Jimmy Choo, the crafter of sleek women’s shoes, and Reckitt Benckiser, the household products giant.

3. On December 17, 2012, both companies announced that they had entered into a definitive merger agreement to sell Caribou to JAB (the “Merger Agreement”) through a tender offer. The tender offer commenced on December 21, 2012 and is set to expire on January 22, 2013. At the effective time of the Merger, each share of Company common stock issued and outstanding will be automatically cancelled and converted into the right to receive $16.00 in cash (the “Merger Consideration”), without interest. The deal is estimated to be worth 340 million dollars.

4. The Proposed Transaction is the product of a fundamentally flawed process that fails to maximize shareholder value, which was entered into in bad faith and in breach of the Defendants’ fiduciary duties, and that is designed to ensure the acquisition of Caribou by JAB on terms preferential to JAB insiders but detrimental to Plaintiff and the other public shareholders of Caribou. Among other things, Defendants have locked up the transaction with preclusive deal protection measures that thwart the prospect of a topping bidder and Caribou shareholders from maximizing their equity stake in the Company.

5. Indeed, the Merger consideration significantly undervalues the Company and its performance and is merely an attempt by JAB to acquire Caribou at a discount. On December 26, 2012 shares of Caribou closed at $ 16.10 per share, above the $16.00 per share Merger Consideration.

2

Filed in Fourth Judicial District Court

12/27/2012 9:49:13 AM

Hennepin County Civil, MN

6. To make matters worse, on December 21, 2012, Caribou’s board of directors caused Caribou to file a Solicitation/Recommendation Statement on Schedule 14D-9 (the “14D-9”), in which the Defendants seek to convince Company shareholders to accept JAB’s tender offer for $16.00 per share. Defendants seek to do this, principally, through a summary of a fairness opinion Moelis & Company LLC (“Moelis”), the Company’s financial advisor, provided to the Company’s board. Put aside the fact that Caribou’s stock has been consistently trading above the $16.00 per share Merger Consideration since the announcement of the Proposed Transaction, the 14D-9 is false and materially misleading. The 14D-9 conceals,inter alia, critical aspects of how Moelis determined that $16.00 per share was somehow fair to Caribou’s shareholders. The 14D-9 deprives Caribou’s shareholders of the ability to rationally, intelligently, and on an informed basis determine whether to tender their shares in favor of the Proposed Transaction or seek appraisal. Without corrective disclosures, Caribou’s shareholders will be irreparably harmed without any adequate remedy at law.

7. Simply put, in pursuing the unlawful plan to sell Caribou to JAB at a discount, each of the Defendants violated applicable law by directly breaching and/or aiding the other Defendants’ breaches of their fiduciary duties of loyalty, due care, independence, candor, good faith, and fair dealing.

8. This action seeks equitable relief only, specifically to require Caribou’s Board to uphold their fiduciary duties to the Company’s public stockholders.

PARTIES

9. Plaintiff is, and at all material times was, a shareholder of Caribou.

10. Defendant Caribou is a Minnesota corporation headquartered at 3900 Lakebreeze Avenue North, Brooklyn Center, MN. The Company is engaged in operating coffeehouses in the United States. As of January 1, 2012, it had 581 coffeehouses, including 169 franchised locations, located in Minnesota, Illinois, Ohio, Michigan, North Carolina, Georgia, Maryland, Wisconsin,

3

Filed in Fourth Judicial District Court

12/27/2012 9:49:13 AM

Hennepin County Civil, MN

Virginia, Pennsylvania, Iowa, Colorado, North Dakota, South Dakota, Kansas, Missouri, Alabama, Nevada, Indiana, Nebraska, Washington, D.C, and international markets. Caribou’s stock is currently traded on NASDAQ under the symbol “CBOU.” According to the Company’s November 9, 2012 quarterly filing with the SEC, on November 8, 2012, there were over 20 million shares of Company stock outstanding.

11. Defendant Michael J. Tattersfield (“Tattersfield”) is, and at all material times was, President, Chief Executive Officer (“CEO”), and a director on the Board of Caribou since April 2009. Tattersfield has responsibility for the financial performance of Caribou and the strategic development of the Caribou brand. Tattersfield serves as an Advisor of Ignite Capital and focuses on retail sector. Tattersfield served in senior executive roles for 13-years with YUM! Brands. He served as the Chief Operating Officer at Lulu lemon Athletica Inc., from November 2006 to February 20, 2008 and also served as its Executive Vice President of Retail Logistics and Sourcing until February 20, 2008. Tattersfield served as Vice President and Head of Store Operations at Limited Brands from 2005 to November 2006. From 1992 to 2005, he served various senior executive operational roles at Yum Restaurants International including Mexico Director of Operations from 1992 to 1997, Mexico Chief Financial Officer and Director of Development from 1997 to 1998, Chief Executive Officer and Managing Director of Puerto Rico/USVI and Venezuela from 1998 to 2003, and the President of A&W Restaurants worldwide from 2003 to 2005. Tattersfield serves as a Director of Peter Piper Pizza and Allina Health System, Inc. He also serves as a Member of KARE-11’s Eleven Who Care Board of Governors.

12. Defendant Gary A. Graves (“Graves”) is, and at all material times was, a Director of Caribou, Graves serves on the audit and nominating and corporate governance committees. Graves has been the Chief Executive Officer and President of LPA Holding Corp. since December 2002 and also its Chief Operating Officer since August 2002. Graves served as the CEO of American Laser

4

Filed in Fourth Judicial District Court

12/27/2012 9:49:13 AM

Hennepin County Civil, MN

Centers-Partner Inc, since December 2007 and also served as its President. Graves served as the CEO and President of La Petite Academy Inc., a wholly owned subsidiary of LPA Holding Corp. from December 2002 to January 2007, and its Chief Operating Officer (“COO”) since August 2002. Graves joined LPA Holding Corp. and La Petite Academy Inc. in August 2002. He served as Executive Vice President, Finance of Boston Market Corporation (a/k/a, Boston Chicken Inc.) since March 1998. He served as Chief Operating Officer of InterParking Inc. from 1998 to 2001. From October 1996 to March 1998, Graves served as President of BC Great Lakes, L.L.C., Boston Chicken Inc.’s area developer for the Great Lakes region. From December 1994 to October 1996, Mr. Graves served as Division Vice President of Pizza Hut, Inc., and from August 1992 to November of 1994, he served as Vice President of Pizza Hut, Inc. From 1996 to 1998, he served as an Executive Vice President of Boston Market Corporation. From 1989 to 1996, he served various positions in Operations for PepsiCo. Mr. Graves has been a Non-Executive Chairman of the Board of Caribou Coffee Company, Inc. since November 2007. He serves as a Director of La Petite Academy Inc. and LPA Holding Corp.

13. Defendant Kip R. Caffey (“Caffey”) is, and at all material times was, a Director of Caribou. Caffey serves on the audit and compensation committees. Caffey has been Managing Director of Cary Street Partners LLC since July 2004 and serves as Head of its Atlanta office. From July 1999 to March 2004, Mr. Caffey served at SunTrust Robinson Humphrey Capital Markets and its predecessor firm, The Robinson-Humphrey Company Inc., where he served as Senior Managing Director and Co-Head of Investment Banking and he was a driving force in launching its wealth management business, Alexander Key, which focuses on providing services to high net worth individuals. Prior to joining Robinson Humphrey, Caffey spent 18 years in investment banking with J.C. Bradford & Co., where he was a Partner.

5

Filed in Fourth Judicial District Court

12/27/2012 9:49:13 AM

Hennepin County Civil, MN

14. Defendant Sarah Palisi Chapin (“Chapin”) is, and at all material times was, a Director of Caribou. Chapin serves on the compensation and nominating and corporate governance committees. She serves as the CEO of Hail Merry, LLC. Chapin is a Founding Partner in The Chain Gang, a private equity restaurant investment practice. Chapin held various in executive positions at PepsiCo and Grand Metropolitan’s Burger King. She served as the Chairman of the Board and CEO of Enersyst Development Center LLC from 2002 to 2003 and from 1995 to 2003 respectively. She was also previously head of food and packaging globally for a $6 billion fast food restaurant chain. Chapin began her career in food retailing on the boardwalk of the Jersey Shore and fine dining restaurants, beachside. She serves as a Director of Sandstone, IRM and Prime Source Foodservice Equipment Inc. She served as a Director of Jersey Mike’s Subs and Maggie Moo’s.

15. Defendant Philip H. Sanford (“Sanford”) is, and at all material times was, a Director of Caribou. Sanford serves on the audit and compensation committees. Sanford serves as a Principal of Port Royal Holdings, LLC and has been with it since August 2003. Sanford has been the President and CEO of Jackson Hewitt Tax Service Inc. since January 6, 2011. Previously, he was the Executive Vice President of Strategy and Performance Measurement at the firm which he joined on August 25, 2010. Previously, he was the President and Chief Operating Officer at Value Place, LLC, from January 2009 to December 2009. Sanford has served as the CEO of Krystal Company from July 1997 to August 2003. Prior to that, Sanford served as Senior Vice President of Finance and Administration of Coca-Cola Enterprises Inc., from 1991 to 1997. He served as Senior Executive of Johnston Coca-Cola Bottling Group until 1991. He served as the Chairman of Krystal Company since July 1997. Sanford has been a Director of Chattem Inc. since 1999. Sanford serves as Director of SunTrust Bank, Chattanooga, N.A.

16. Defendant Charles H. Ogburn (“Ogburn”) is, and at all material times was, a Director of Caribou. Ogburn serves on the audit and nominating and corporate governance committees.

6

Filed in Fourth Judicial District Court

12/27/2012 9:49:13 AM

Hennepin County Civil, MN

Ogburn serves as Senior Managing Director at SunTrust Robinson Humphrey Capital Markets. Ogburn served as Executive Director and Head of Corporate Investment at Arcapita Bank B.S.C.(c), Corporate Investment Arm. He serves as Head of Global Corporate Investment at Church Street Health Management, LLC. He served as an Executive Director of Corporate Investment at Arcapita Bank B.S.C.(c) until 2010. Prior to joining Arcapita in 2001, he spent more than 15 years at The Robinson-Humphrey Company, Inc., most recently serving as a Senior Managing Director and Co-Head of Investment Banking. Prior to Robinson-Humphrey, he was an Attorney at King & Spalding for five years. He serves as Chairman of Southland Log Homes, Inc. He has been Non-Executive Chairman of Crawford & Company since January 2010 and Director since February 2009. Mr. Ogburn has been a Director of Tensar Corporation since September 2005, American Pad & Paper LLC since September 2003 and Caribou Coffee Company, Inc. since January 2003. Ogburn serves as a Director of The Cook & Bynum Fund. He served as an Executive Director of Arcapita Inc. Ogburn served as a Director of Cypress Communications, Inc. He is a Member of the Society of International Business Fellows, a member of the Rotary Club of Atlanta, and a member of the Advisory Board of Duke University Islamic Studies Center.

17. Defendant Wallace B. Doolin (“Doolin”) is, and at all material times was, a Director of Caribou. Doolin founded Black Box Intelligence and serves as its CEO. Doolin serves as Executive Chairman and CEO at ESP Systems LLC. Doolin is also a Director of Share Our Strength, Inc. He served as an Advisor of ESP Systems, LLC. Doolin joined ESP in November 2004. He served as Chief Executive Officer of BUCA Inc. from November 2004 to February 2008 and President from November 2004 to October 9, 2006. He served as the Chief Executive Officer and President of La Madeleine de Corps Inc. (La Madeleine Bakery Caf and Bistro) from May 2002 to October 2004. From January 1994 to May 2002, Doolin served as CEO and President of TGI Fridays and also of its parent, Carlson Restaurants Worldwide Inc. He served as Executive Vice

7

Filed in Fourth Judicial District Court

12/27/2012 9:49:13 AM

Hennepin County Civil, MN

President of Development of Carlson Restaurants World from January 1992 to January 1994. Doolin joined T.G.I. Friday’s in 1989 as Senior Vice President of domestic and international franchise operations and Senior Vice President of corporate development. Doolin is active in many food service industry groups. Doolin served as Senior Vice President and Executive Vice President of CRW and Fridays from 1989 to 1993. He was responsible for the acquisition of Pick Up Stix, which brought CRWs restaurant total to 770. From 1984 to 1986, Doolin also served as President of Applebee’s Neighborhood Grill & Bar. From 1972 to 1989, Doolin held senior leadership positions at W.R. Graces Restaurant Division, Flakey Jakes Inc., and Steak and Ale Restaurants. Doolin serves as Chairman of the ALIMA Fund and ESP Systems. He served as the Chairman of BUCA Inc. from November 2004 to September 2008. Doolin served as Vice Chairman of Board of ESP Systems, LLC. He has been a Director of Famous Dave’s of America Inc. since September 2009. Doolin serves as a Director of ESP Systems, LLC. Doolin serves as a Director of the Employment Policies Institute, chairperson for the COEX 2000 and fundraiser and volunteer for two anti-hunger associations. Doolin serves on the Board of directors for the University of Delaware HR & IM and was a Board member of the Women’s Foodservice Forum and The North Texas Food Bank. Doolin served as a Director of Carlson Restaurants Worldwide, Inc. (CRW) since January 1994. He served as Director at la Madeleine, Inc. In 2003, Mr. Doolin participated in a book published by Aspatore Books. Doolin serves as a Trustee Emeritus of the National Restaurant Association and served as chairman of its Education Foundation.

18. The above-described Company board member defendants are sometimes collectively referred to herein as the “Individual Defendants.”

19. Non-Party JAB is a holding company that operates through its subsidiaries LABELUX Group GmbH, Coty Inc., and Reckitt Benckiser Group plc. The company’s subsidiaries offer household and personal care products in Germany. Its products include fragrance, skin care,

8

Filed in Fourth Judicial District Court

12/27/2012 9:49:13 AM

Hennepin County Civil, MN

and grooming products, as well as cosmetics and detergents. The company is based in Ludwigshafen, Germany. Notably, on July 23, 2012, JAB struck an agreement to buy Peet’s Coffee & Tea, Inc. (“Peet’s”) for $73.50 per share in cash, or roughly $1 billion in total.

20. Defendant JAB Beech Inc., is a Delaware Corporation, a wholly owned subsidiary of JAB, and a vehicle through which Defendants seek to effectuate the Proposed Transaction.

21. Defendant Pine Merger Sub, Inc. is a Minnesota corporation, a wholly owned subsidiary of JAB Beech Inc., and a vehicle through which Defendants seek to effectuate the Proposed Transaction.

22. JAB and Defendants JAB Beech Inc., and Pine Merger Sub, Inc. are collectively referred to herein as “JAB.”

JURISDICTION AND VENUE

23. Jurisdiction is proper in this District because Caribou is headquartered in, and regularly transacts business within, Hennepin County, Defendants have committed torts within Hennepin County, Defendants solicit business in Hennepin County, Defendants derive substantial revenue from interstate or international commerce, and/or Defendants should reasonably expect their acts to have consequences in Hennepin County

24. Venue is proper in this District because,inter alia, Caribou’s principal place of business is located in Hennepin County, and the Individual Defendants regularly conduct business in this jurisdiction. In addition, the acts and transactions complained of herein took place, in all or substantial part, in Hennepin County.

THE INDIVIDUAL DEFENDANTS’ FIDUCIARY DUTIES

25. Under applicable law, in any situation where the directors of a publicly traded corporation undertake a transaction that will result in either: (i) a change in corporate control; or (ii) a break up of the corporation’s assets, the directors have an affirmative fiduciary obligation to obtain the highest value reasonably available for the corporation’s shareholders, and if such transaction will result in a change of corporate control, the shareholders are entitled to receive a significant premium.

9

Filed in Fourth Judicial District Court

12/27/2012 9:49:13 AM

Hennepin County Civil, MN

26. To diligently comply with these duties, the directors and/or officers may not take any action that:

(a) adversely affects the value provided to the corporation’s shareholders;

(b) will discourage or inhibit alternative offers to purchase control of the corporation or its assets;

(c) contractually prohibits themselves from complying with their fiduciary duties;

(d) will otherwise adversely affect their duty to search and secure the best value reasonably available under the circumstances for the corporation’s shareholders; and/or

(e) will provide the directors and/or officers with preferential treatment at the expense of, or separate from, the public shareholders.

27. In accordance with their duties of loyalty and good faith under Minn. Stat. §302A.251, the Individual Defendants, as directors and/or officers of Caribou, are obligated to refrain from:

(a) participating in any transaction where the directors’ or officers’ loyalties are divided;

(b) participating in any transaction where the directors or officers receive, or are entitled to receive, a personal financial benefit not equally shared by the public shareholders of the corporation; and/or

(c) unjustly enriching themselves at the expense, or to the detriment, of the public shareholders.

28. Defendants are also obliged to honor their duty of candor to Caribou’s shareholders by,inter alia, providing all material information to the shareholders regarding a scenario in which

10

Filed in Fourth Judicial District Court

12/27/2012 9:49:13 AM

Hennepin County Civil, MN

they are asked to vote or tender their shares. This duty of candor ensures that shareholders have all the information that will enable them to make informed, rational, and intelligent decisions about whether to vote or tender their shares.

29. Plaintiff alleges herein that Defendants, separately and together, in connection with the Proposed Transaction, are knowingly or recklessly violating their fiduciary duties, including their duties of loyalty, good faith, and independence, owed to Plaintiff and other public shareholders of Caribou. Defendants stand on both sides of the transaction, are engaging in self dealing, and are obtaining for themselves personal benefits, including personal financial benefits not shared equally by Plaintiff or the Class. As a result of Defendants’ self dealing and divided loyalties, neither Plaintiff nor the Class will receive adequate or fair value for their shares of Caribou common stock in the Proposed Transaction.

30. Because Defendants are, in bad faith, knowingly or recklessly breaching their duties of loyalty, good faith, candor, and independence in connection with the Proposed Transaction, the burden of proving the inherent, or entire fairness, of the Proposed Transaction, including all aspects of its negotiation, structure, price, and terms, is placed upon Defendants as a matter of law.

SUBSTANTIVE ALLEGATIONS

The Company’s Future Success Is Undeniable

31. Caribou is the second largest coffee retailer in the United States. As of September 30, 2012, the Company had 610 coffeehouses, including 202 franchised locations, in 22 states, the District of Columbia and ten international markets. Caribou provides high quality handcrafted beverages, foods and coffee lifestyle items in a comfortable and welcoming coffeehouse environment. In addition, Caribou’s unique coffees are available within grocery stores, mass merchandisers, club stores, office coffee and foodservice providers, hotels, entertainment venues and e-commerce channels. Caribou has received the Rainforest Alliance Corporate Green Globe Award and has publicly stated that it is committed to operating practices that promote sustainability and environmental protection.

11

Filed in Fourth Judicial District Court

12/27/2012 9:49:13 AM

Hennepin County Civil, MN

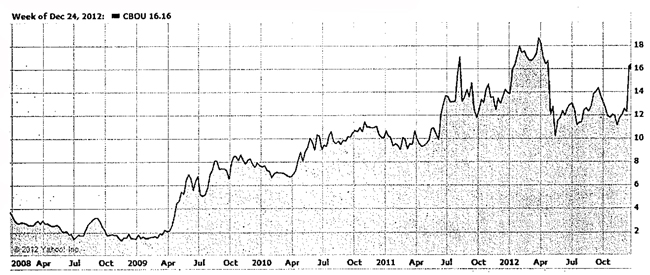

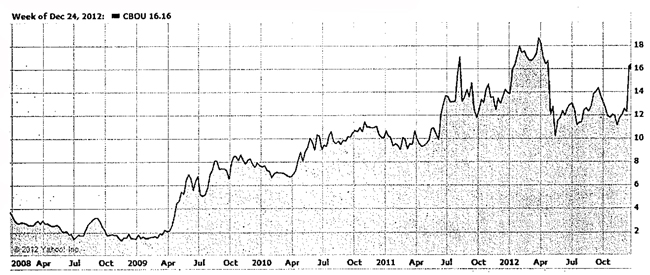

32. Despite its success, Caribou’s current stock price does not reflect the Company’s true intrinsic value. Indeed, Caribou, like many other coffee businesses, suffered as a result of significantly higher commodity costs. However, its long-term performance has been impressive:

33. All indications are that the Company is poised for future success. Analysts estimate that Caribou will experience nearly a 20% growth rate for fiscal year 2013 and a 22% growth rate for the next five years.http://investing.money.msn.com/investments/earnings-estimates?symbol=CBOU (last visited, Dec. 26, 2012). The Company’s quarterly filings reflect this significant potential.

34. For instance, commenting on the Company’s second quarter 2012 results, Defendant Tattersfield stated,

We were pleased to have held pro forma net income steady compared to the prior year period in the face of coffee commodity cost pressure and a lower contribution from the Keurig single-serve platform. Growth in comparable coffeehouse sales, has also now been extended to eleven consecutive quarters and benefited from our continued focus on product innovation. In addition, we also reached a new franchise milestone of 100 international coffeehouses further demonstrating the extensive popularity of Caribou Coffee outside of the U.S.

* * *

12

Filed in Fourth Judicial District Court

12/27/2012 9:49:13 AM

Hennepin County Civil, MN

Although our updated projections for Caribou-branded K-cups have led us to adjust our full year outlook, we view the dynamics affecting our single-serve business as temporary challenges and remain committed to strengthening our Green Mountain relationship. More importantly, the diversification afforded to us through our multi-channel model provides us numerous levers to achieve sustainable growth in sales and profitability over the long-term.

35. The market’s reaction to the $16 per share offer also reflects Caribou’s significant potential, as the Company’s stock closed at $16.10 per share on December 26, 2012 and has been consistently trading at above $16.00 per share since announcement of the Proposed Transaction.

Defendants Announce the Unfair Proposed Transaction

36. Despite the Company’s impressive and consistently improving performance, as well as its undeniable growth potential, on December 17, 2012, Defendants announced the unfair Proposed Transaction:

Caribou Enters into Merger Agreement to be Acquired by Joh. A. Benckiser for $16.00 Per Share in Cash

Transaction Valued at Approximately $340 Million

MINNEAPOLIS, MN – December 17, 2012 – Caribou Coffee Company, Inc. (NASDAQ: CBOU), the second-largest company-owned premium coffeehouse operator in the United States based on the number of coffeehouses, and the Joh. A. Benckiser Group (JAB) announced a definitive merger agreement under which an affiliate of JAB will acquire Caribou for $16.00 per share in cash, or a total of approximately $340 million. The agreement, which has been unanimously approved by Caribou’s independent directors, represents a premium of approximately 30 percent over Caribou’s closing stock price on December 14, 2012, the last trading day prior to the announcement of the transaction.

At the close of the transaction, Caribou will continue to be operated as an independent company with its own brand, management team and growth strategy. Caribou will remain based in Minneapolis, Minnesota.

“Caribou Coffee is a great company, with dedicated people, world-class customer service, exceptionally high quality coffeehouse beverages and food and a state-of-the-art roasting facility. The employees of Caribou should feel very proud of all they’ve been able to accomplish over the years, and I look forward to continued success in Caribou’s future,” said Gary Graves, Non-Executive Chairman of Caribou.

13

Filed in Fourth Judicial District Court

12/27/2012 9:49:13 AM

Hennepin County Civil, MN

“We anticipate the next chapter in Caribou’s journey will be filled with tremendous opportunities to grow this great brand, with new ownership,” said Michael Tattersfield, President and Chief Executive Officer of Caribou.

“Caribou has a fantastic brand and unique culture, and fits perfectly with JAB’s investment philosophy of investing in premium and unique brands in attractive growth categories like coffee,” said Bart Becht, Chairman of Joh. A. Benckiser Group. “JAB is committed to investing in Caribou as a standalone business out of Minneapolis to ensure the Company continues its current highly successful track record.”

Under the terms of the merger agreement, an affiliate of JAB will promptly commence a tender offer to acquire all of the outstanding shares of Caribou’s common stock at a price of $16.00 per share in cash. Following successful completion of the tender offer, JAB will acquire all remaining shares not tendered in the offer through a second-step merger at the same price as in the tender offer.

The consummation of the tender offer is subject to various conditions, including a minimum tender of at least a majority of outstanding Caribou shares on a fully diluted basis, the expiration or termination of the waiting periods under applicable competition laws, and other customary conditions. The tender offer is not subject to a financing condition.

37. The press release itself demonstrates the significant Company potential upon which JAB will capitalize. And to that end, the Proposed Transaction is the product of a fundamentally flawed process, undertaken in bad faith and in breach of the Defendants’ fiduciary duties, that fails to maximize shareholder value and that is designed to ensure the acquisition of Caribou by JAB on terms preferential to JAB and Caribou insiders but detrimental to Plaintiff and the other public shareholders of Caribou.

38. On December 4, 2012 less that 2 weeks before Defendants announced the Proposed Transaction, analysts from Longbow Researchset a “buy” rating of $17.00 for Caribou’s stock. Merger Consideration fails to account for the Company’s undeniable growth potential. Indeed, since the temporary and acute challenges the Company faced during fiscal 2012, such as the unusually high cost of commodities, Caribou has demonstrated its true value and growth potential.

14

Filed in Fourth Judicial District Court

12/27/2012 9:49:13 AM

Hennepin County Civil, MN

39. A December 17, 2012 article entitled,Are Caribou shareholders getting enough in Benckiser deal?, from the Minneapolis/St. Paul Business Journal further spells out the breach of fiduciary duties owed to the Company’s shareholders in the Proposed Transaction with JAB:

German private equity firm Joh. A. Benckiser Group’s deal to acquire Caribou Coffee Co. Inc. represents a 30 percent premium over Friday’s closing price, but at least one shareholder is underwhelmed.

In an interview with Bloomberg News, Accretive Capital Partners Managing Director Richard Fearon criticized Benckiser’s offer of $16 per share, or approximately $340 million.

“We don’t think they are paying anywhere near enough,” Fearon said. “The price should be closer to $30-$35.”

Matt Bendixen, an analyst at Minneapolis-based Craig-Hallum Capital Group, agreed that Benckiser’s offer is “probably a little light.” He had a $19 per share target on the stock, saying it has been “pretty undervalued” since plunging along with other coffee-related stocks in May, when Green Mountain Coffee Roasters Inc. reduced its sales forecast due to hard-to-predict demand for its Keurig single-serve coffee brewers and packs.

“I think theres a small chance you could maybe see another group try to come in over the top,” he told the Minneapolis/St. Paul Business Journal in a telephone interview on Monday.

Robert W. Baird & Co. analyst David Tarantino said he doesn’t see that happening.

“As indicated in recent research notes, we had considered Caribou a logical buyout target, given the company’s attractive business model, clean balance sheet and modest valuation,” he wrote in a new research note on Monday. “That said, with the proposed transaction valuing Caribou above the average for recent restaurant buyouts, we suspect that a competing bid for Caribou is unlikely, especially when considering the mixed financial performance the company has exhibited year-to-date.”

40. A December 17, 2012 Bloomberg article entitled,UPDATE 2-Germany’s Benckiser Group to Buy Caribou Coffee, also shows why the Proposed Transaction was the product of a breach of fiduciary duties to the Company’s shareholders:

Caribou shares jumped to $16.64 on the Nasdaq, suggesting some investors anticipate a higher offer, before easing back to $16.01 by early afternoon, still just above the offer price.

15

Filed in Fourth Judicial District Court

12/27/2012 9:49:13 AM

Hennepin County Civil, MN

“We don’t think they are paying anywhere near enough. The price should be closer to $30-$35,” said Richard Fearon, managing director of Hedge fund Accretive Capital Partners LLC, whose largest shareholding is in Caribou.

“At $16 per share (Caribou) is being stolen for less than 0.9 times sales and 10.5 times earnings before interest, taxes, depreciation and amortization,” Fearon said.

Peet’s, in contrast, was taken private at 2.4 times sales and 21 times EBITDA, Fearon said.

Craig Hallum analyst Matt Bendixen, who has a $19 target price on the stock, said he believed Caribou could get a better offer. “The buyer has got a pretty good value here on the purchase price,” he said.

41. In addition, Defendants have also breached their fiduciary duties by attempting to bind Caribou shareholders to the unfair Proposed Transaction by including a preclusive set of deal protection devices in the Merger Agreement. For instance, there is a no solicitation provision prohibiting the Company from seeking alternative business combinations. As indicated in the 14D-9, there was not a pre-signing market canvass for potential suitors. And there are prohibitive difficulties prohibiting a topping bidder from actually seeking a topping bid. There are rapid information rights owned by JAB, allowing JAB a superior vantage point in evaluating the worth of Caribou. Beyond that, JAB has ample matching rights allowing it to hold a topping bidder in abeyance for substantial periods of time and allowing JAB to increase its offer during that time. Likewise, the Merger Agreement requires Caribou’s Board to reaffirm support of the JAB takeover within three business days of JAB’s request, which JAB could employ during the matching rights period to further dissuade a topping bidder. Were a topping bidder to attempt a tender offer, the Merger Agreement requires Caribou’s Board to recommend rejection of the tender offer. Additionally, there is a termination fee of up to over $10 million if the Company accepts a topping bid after January 15, 2013 and over a $5 million fee if the Company accepts a topping bid before that date. The collective, layering effect of the deal protection devices ensures that the Company is sold to JAB through a fundamentally unfair process.

16

Filed in Fourth Judicial District Court

12/27/2012 9:49:13 AM

Hennepin County Civil, MN

42. As if all of this were not enough, the Merger Agreement leaves Caribou shareholders helpless to oppose the Proposed Transaction without Court intervention. Specifically, should Caribou’s shareholders oppose they Proposed Transaction by refusing to tender a majority of the outstanding shares of the Company’s common stock (a condition precedent to closing the Tender Offer), the Merger Agreement grants JAB an irrevocable Top-up Option to purchase an aggregate number of newly-issued Caribou shares that would allow it to possess a majority of the outstanding Caribou shares, thus circumventing shareholder approval of the Proposed Transaction.

43. Simply put, the Proposed Transaction is the product of a fundamentally flawed process that is designed to unlawfully divest Caribou’s public shareholders of their equity holdings and end Caribou’s independent existence without providing Caribou and its shareholders the maximized value to which they are entitled. Defendants know Caribou will continue to produce substantial revenue and earnings for its shareholders and have engaged in self-dealing to assure themselves participation in the future growth of the Company after the Proposed Transaction is completed. Herein, Plaintiff alleges that the Proposed Transaction is being accomplished by deception, illegality, and in breach of Defendants’ fiduciary duties owed to Caribou shareholders.

44. Unless enjoined by this Court, Defendants will continue to breach and/or aid the breaches of fiduciary duties owed to Plaintiff and the Class, and may consummate the Proposed Transaction, which will deprive Class members of a fair and non-fraudulent sales process, all to the irreparable harm of Plaintiff and the Class.

45. Plaintiff and the other members of the Class have no adequate remedy at law.

Defendants File a False and Materially Misleading 14D-9

46. On December 21, JAB commenced a tender offer for the purchase of all of Caribou’s outstanding shares for $16.00 per share. On that same day, Defendants caused Caribou to file a 14D-9 for the ostensible purpose of informing Caribou’s shareholders about the process leading up

17

Filed in Fourth Judicial District Court

12/27/2012 9:49:13 AM

Hennepin County Civil, MN

to the Proposed Transaction as well as the valuation metrics Moelis used in its fairness presentation which the Board used to determine that $ 16.00 per share is fair to Caribou’s shareholders. The 14D-9 falls far short from providing Caribou’s shareholders with sufficient material information in order to make intelligent, rational and informed decisions about whether to tender their shares or seek appraisal. Among other ways, the 14D-9 is false and materially misleading in the following respects:

47.Inadequate Detail Regarding the Company’s Financial Projections. The 14D-9 discloses a handful of line-item financial projections Caribou provided to JAB. However, the 14D-9 does not disclose when these projections were created, why they were created, or whether there were multiple case scenarios. There is also no indication about whether or how the projections accounted for the cost decreases in purchasing coffee. In a July 11, 2012 analyst report of Caribou, Piper Jaffray & Co. (“Piper Jaffray”) noted that, “Lower coffee costs are a benefit for input margins of the retail business.” The 14D-9 is silent on this obvious cost savings that will help Caribou’s bottom line in the near future.

48. To be sure, in the Peet’s buyout by JAB, the proxy provided to Peet’s shareholders how the cost decreases in purchasing coffee were analyzed in the projections:

With respect to both cases, management forecasted that Peet’s would experience coffee cost decreases in 2013 and 2014 as its current coffee inventory and fixed cost commitments (which reflect past purchases at higher prices than currently prevail) are fully used up and the benefit of today’s lower coffee prices are fully realized. In 2013 and beyond, commodity coffee costs were assumed to remain close to their current level, with nominal inflation resuming in 2015.1

| 1 | Peet’s Definitive Proxy Statement date October 4, 2012 at p. 25http://sec.gov/Archives/edgar/data/917968/000119312512414540/d394274ddefm14a.htm (last visited Dec. 26, 2012). |

18

Filed in Fourth Judicial District Court

12/27/2012 9:49:13 AM

Hennepin County Civil, MN

49. Without these above-stated material disclosures, Caribou’s shareholders are unable to properly understand whether $16.00 per share represents fair value.

50. Moreover, the 14D-9 fails to provide the following line-items in the financial projections for Caribou: (a) Depreciation and Amortization; (b) Stock Compensation; (c) Anticipated Tax Rate/Taxes; (d) Changes in Net Working Capital; (e) Capital Expenditures; (f) Free Cash Flow. Without the disclosure of these material line-items, Caribou’s shareholders are unable to properly understand whether $16.00 per share represents fair value. Again, in JAB’s takeover of Peet’s, nearly every single one of these line-items were provided to Peet’s shareholders so that they could determine fair value.2

51.Inadequate Disclosure Regarding Moelis’ Selected Public Companies Analysis. Moelis performed a comparable company analysis, in which it derived a set of implied merger consideration price ranges. However, the 14D-9 does not disclose the criteria Moelis used to select the companies it chose in the analysis. The 14D-9 also does not disclose the reasons for choosing the restaurant companies it did choose that were of a different size and revenue mix than Caribou. Likewise, the 14D-9 does not disclose why Moelis excluded coffee chains from this analysis. Additionally, the 14D-9 does not disclose why the multiples of the companies selected were considered comparable when those companies are dissimilar in size and numbers of stores from Caribou.

| 2 | See note 1supra at p. 26. |

19

Filed in Fourth Judicial District Court

12/27/2012 9:49:13 AM

Hennepin County Civil, MN

52. Without these above-stated material disclosures, Caribou’s shareholders are unable to properly understand whether $16.00 per share represents fair value. This is especially compounded by the fact that analysts made comparable company valuations about or including Caribou that are discordant with Moelis’ selected public companies analysis:

Piper Jaffray July 11, 2012 Comparable Company Valuation About Caribou

COMPARABLE VALUATION

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | As of:

07/10/12 | | | | | Price | | | 52-Week | | | Shares | | | Mkt Cap | | | EPS | | | P/E | | | P/E/G | | | EBITDA | | | EV/EBITDA | |

Company Name | | Ticker | | Rating | | Price | | | Target | | | Low | | | High | | | Out. | | | (ml.) | | | FY1 | | | FY2 | | | FY1 | | | FY2 | | | FY1 | | | FY1 | | | FY2 | | | FY1 | | | FY2 | |

Barton Noah Restaurant Group | | BAGL | | OW | | $ | 17.02 | | | $ | 19.00 | | | $ | 11.48 | | | $ | 17.75 | | | | 17.1 | | | $ | 291.5 | | | $ | 1.01 | | | $ | 1.13 | | | | 16.9 | | | | 15.1 | | | | 0.9 | | | $ | 51.1 | | | $ | 55.6 | | | | 6.9 | | | | 6.4 | |

Bravo Brio Restaurant Group | | BBRG | | OW | | | 18.33 | | | | 25.00 | | | | 14.04 | | | | 24.87 | | | | 20.6 | | | | 377.3 | | | | 0.92 | | | | 1.10 | | | | 19.8 | | | | 16.7 | | | | 1.1 | | | | 47.3 | | | | 54.6 | | | | 6.4 | | | | 7.3 | |

Bj’s Restaurant | | BUR | | OW | | | 39.13 | | | | 59.00 | | | | 36.46 | | | | 56.64 | | | | 29.0 | | | | 1,135.2 | | | | 1.28 | | | | 1.54 | | | | 30.4 | | | | 25.4 | | | | 1.2 | | | | 91.7 | | | | 107.5 | | | | 12.1 | | | | 10.3 | |

Burger King Worldwide | | BKW | | OW | | | 15.31 | | | | 19.00 | | | | 14.40 | | | | 16.31 | | | | 363.2 | | | | 5,580.6 | | | | 0.53 | | | | 0.63 | | | | 28.7 | | | | 24.5 | | | | 1.9 | | | | 633.7 | | | | 687.1 | | | | 12.8 | | | | 11.8 | |

Cheesecake Factory | | CAKE | | OW | | | 31.55 | | | | 33.00 | | | | 23.65 | | | | 33.80 | | | | 55.7 | | | | 1,757.3 | | | | 1.87 | | | | 2.10 | | | | 16.9 | | | | 15.0 | | | | 1.1 | | | | 223.6 | | | | 239.9 | | | | 7.7 | | | | 7.2 | |

Caribou Coffee | | CBOU | | N | | | 13.22 | | | | 14.00 | | | | 9.93 | | | | 18.84 | | | | 21.2 | | | | 260.9 | | | | 0.47 | | | | 0.58 | | | | 28.3 | | | | 22.7 | | | | 1.1 | | | | 27.3 | | | | 32.9 | | | | 8.7 | | | | 7.3 | |

Country Style Cooking | | CCSC | | N | | | 7.50 | | | | 8.00 | | | | 6.60 | | | | 15.90 | | | | 26.3 | | | | 197.2 | | | | 0.30 | | | | 0.50 | | | | 25.0 | | | | 15.0 | | | | 1.3 | | | | 14.3 | | | | 21.6 | | | | 10.4 | | | | 6.9 | |

Chipotel Mexican Grill | | OMG | | OW | | | 379.69 | | | | 471.00 | | | | 271.53 | | | | 442.40 | | | | 31.8 | | | | 12,098.0 | | | | 8.81 | | | | 10.96 | | | | 43.1 | | | | 34.7 | | | | 1.7 | | | | 539.2 | | | | 651.6 | | | | 21.8 | | | | 18.0 | |

Dunking Brands Group | | DNKN | | OW | | | 33.88 | | | | 39.00 | | | | 23.24 | | | | 37.02 | | | | 121.3 | | | | 4,110.2 | | | | 1.25 | | | | 1.45 | | | | 27.2 | | | | 23.4 | | | | 1.8 | | | | 332.5 | | | | 364.1 | | | | 16.2 | | | | 14.6 | |

Darden Restaurants | | DRI | | OW | | | 50.66 | | | | 55.00 | | | | 40.69 | | | | 55.84 | | | | 131.6 | | | | 6,666.9 | | | | 3.58 | | | | 3.97 | | | | 14.2 | | | | 12.8 | | | | 0.9 | | | | 1,088.8 | | | | 1,141.4 | | | | 8.0 | | | | 7.6 | |

Drinker International | | EAT | | UW | | | 32.07 | | | | 26.00 | | | | 19.50 | | | | 32.95 | | | | 79.7 | | | | 2,557.1 | | | | 1.91 | | | | 2.17 | | | | 16.6 | | | | 14.8 | | | | 1.2 | | | | 367.4 | | | | 395.4 | | | | 8.3 | | | | 7.8 | |

Green Mountain Coffee Roasters | | GMCR | | N | | | 21.95 | | | | 40.00 | | | | 19.45 | | | | 115.96 | | | | 159.4 | | | | 3,498.3 | | | | 2.40 | | | | 3.17 | | | | 9.2 | | | | 6.9 | | | | 0.3 | | | | 733.9 | | | | 996.2 | | | | 5.2 | | | | 3.8 | |

Ionite Restaurant Group | | IRG | | OW | | | 19.01 | | | | 20.00 | | | | 16.50 | | | | 19.87 | | | | 24.8 | | | | 470.5 | | | | 0.67 | | | | 0.77 | | | | 28.4 | | | | 24.7 | | | | 1.4 | | | | 47.5 | | | | 56.4 | | | | 12.2 | | | | 10.3 | |

McDonald’s Corp | | MCD | | OW | | | 90.25 | | | | 95.00 | | | | 82.01 | | | | 102.22 | | | | 1,030.0 | | | | 92,957.5 | | | | 5.58 | | | | 6.18 | | | | 16.2 | | | | 14.6 | | | | 1.6 | | | | 10,130.2 | | | | 10,721.2 | | | | 10.2 | | | | 9.6 | |

Peef’s Coffee & Tea | | FEET | | N | | | 55.37 | | | | 61.00 | | | | 51.16 | | | | 77.60 | | | | 13.5 | | | | 746.5 | | | | 1.77 | | | | 2.19 | | | | 31.2 | | | | 25.3 | | | | 2.1 | | | | 53.3 | | | | 62.7 | | | | 13.2 | | | | 11.2 | |

Panera Bread Co. | | PNRA | | OW | | | 145.56 | | | | 165.00 | | | | 96.68 | | | | 165.99 | | | | 29.5 | | | | 4,287.9 | | | | 5.60 | | | | 6.62 | | | | 26.0 | | | | 22.0 | | | | 1.3 | | | | 351.4 | | | | 406.5 | | | | 11.6 | | | | 10.0 | |

Red Robin Gourmet Burgers | | RRGB | | UW | | | 31.20 | | | | 34.00 | | | | 21.68 | | | | 39.32 | | | | 15.0 | | | | 467.5 | | | | 1.89 | | | | 2.19 | | | | 15.5 | | | | 14.2 | | | | 1.4 | | | | 96.9 | | | | 106.9 | | | | 5.7 | | | | 5.3 | |

Ruth’s Hospitality Group | | RUTH | | OW | | | 6.69 | | | | 9.00 | | | | 3.79 | | | | 7.74 | | | | 34.2 | | | | 228.6 | | | | 0.50 | | | | 0.59 | | | | 13.5 | | | | 11.4 | | | | 0.9 | | | | 41.7 | | | | 47.2 | | | | 7.3 | | | | 6.4 | |

Starbucks Corp. | | SBUX | | OW | | | 52.34 | | | | 67.00 | | | | 33.72 | | | | 62.00 | | | | 773.3 | | | | 40,474.5 | | | | 1.80 | | | | 2.23 | | | | 29.1 | | | | 23.4 | | | | 1.7 | | | | 2,527.3 | | | | 3,160.0 | | | | 15.7 | | | | 12.5 | |

Sonic Corp. | | SONC | | OW | | | 10.88 | | | | 11.00 | | | | 6.35 | | | | 11.34 | | | | 60.0 | | | | 652.4 | | | | 0.57 | | | | 0.67 | | | | 19.1 | | | | 16.2 | | | | 1.6 | | | | 128.4 | | | | 131.6 | | | | 8.8 | | | | 8.6 | |

| | | | | | | | | | | | | | | | | | | All Median | | | | 1,161.5 | | | | | | | | | | | | 18.4x | | | | 15.3x | | | | 1.3x | | | | | | | | | | | | 7.3x | | | | 7.3x | |

| | | | | | | | | | | | | | | | | | | Limited Service | | | $ | 1,796.6 | | | | | | | | | | | | 19.3x | | | | 17.4x | | | | 1.5x | | | | | | | | | | | | 10.8x | | | | 9.9x | |

| | | | | | | | | | | | | | | | | | | Full Service | | | | 730.0 | | | | | | | | | | | | 16.1 | | | | 14.5 | | | | 1.2 | | | | | | | | | | | | 7.7 | | | | 7.2 | |

S&P 500 Index | | SPX | | | | | 1,341.5 | | | | | | | | 1,099.2 | | | | 1,419.0 | | | | | | | | | | | | | | | | | | | | 13.0 | | | | 12.0 | | | | | | | | | | | | | | | | | | | | | |

Restaurants | | SP393 | | | | | 773.0 | | | | | | | | 632.6 | | | | 660.5 | | | | | | | | | | | | | | | | | | | | 18.5 | | | | | | | | | | | | | | | | | | | | | | | | | |

Source: Piper Jaffray & Co. estimates, FactSet Research Systems, and company filings

* * *

Stephens Inc. May 22, 2012 Comparable Company Valuation About Caribou

Figure 25 – Comparative Valuation

(Dollars in Millions, Except per Share)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Ticker | | Company Name | | Stepherd

Rating | | Price

Target | | | Price as

of

05/18/12 | | | Market

Cap | | | Enterprise

Value | | | Sales | | | Adj. Eps | | | EBITDA | | | Price/Earnings | | | EV/EBITDA | |

| | | | | | | | 2011A | | | 2012E | | | 2011A | | | 2012E | | | 2011A | | | 2012E | | | 2011A | | | 2012E | | | 2011A | | | 2012E | |

| | QSR/Fast Casual/Other | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

MDC | | McDonald’s Corp | | — | | | — | | | $ | 89.85 | | | $ | 91,309.6 | | | $ | 100,251 | | | $ | 28,305.9 | | | $ | 29,971.0 | | | $ | 572 | | | $ | 6.93 | | | $ | 10,393.6 | | | $ | 11,161.6 | | | | 15.7x | | | | 14.2x | | | | 9.8x | | | | 9.0x | |

| | Growth | | | | | | | | | | | | | | | | | | | | | | | | | 1.0 | % | | | | | | | 10.4 | % | | | | | | | | | | | | | | | | | | | | | | | | |

SBUX | | Starbucks Corp | | OW | | | 66.00 | | | | 51.53 | | | | 39,812.7 | | | | 28,950.1 | | | | 11,700.4 | | | | 12,323.1 | | | | 1.62 | | | | 1.84 | | | | 2,397.0 | | | | 2,740.3 | | | | 31.0 | | | | 28.0 | | | | 16.2 | | |

| 14.2

|

|

| | Growth | | | | | | | | | | | | | | | | | | | | | | | | | 15.6 | % | | | | | | | 13.0 | % | | | | | | | 14.3 | % | | | | | | | | | | | | | | | | |

OMG | | Chipotel Mexican Grill | | | | | | | | | 392.13 | | | | 12,431.9 | | | | 11,979.3 | | | | 2,777.2 | | | | 1,257.2 | | | | 8.71 | | | | 10.87 | | | | 550.7 | | | | 677.1 | | | | 45.0 | | | | 36.1 | | | | | | | | 17.7 | |

| | Growth | | | | | | | | | | | | | | | | | | | | | | | | | 17.5 | % | | | | | | | 24.7 | % | | | | | | | 21.0 | % | | | | | | | | | | | | | | | | |

DNON | | Dunkin Brands Group Inc | | OW | | | 27.00 | | | | 31.42 | | | | 2,810.5 | | | | 5,050.8 | | | | 628.2 | | | | 678.8 | | | | 0.80 | | | | 1.24 | | | | 274.5 | | | | 226.2 | | | | 34.3 | | | | 25.3 | | | | 18.4 | | | | 18.2 | |

| | Growth | | | | | | | | | | | | | | | | | | | | | | | | | 48.1 | % | | | | | | | 38.0 | % | | | | | | | 21.7 | % | | | | | | | | | | | | | | | | |

PNRA | | Panera Bread Co. | | — | | | — | | | | 143.25 | | | | 4,061.1 | | | | 3,829.4 | | | | 2,094.6 | | | | 2,370.3 | | | | 5.59 | | | | 6.63 | | | | 361.0 | | | | 420.5 | | | | 25.6 | | | | 21.6 | | | | 10.6 | | | | 9.1 | |

| | Growth | | | | | | | | | | | | | | | | | | | | | | | | | 13.2 | % | | | | | | | 18.6 | % | | | | | | | 16.5 | % | | | | | | | | | | | | | | | | |

WEH | | Wendy’s Co. | | — | | | — | | | | 4.49 | | | | 1,751.1 | | | | 2,608.4 | | | | 2,493.8 | | | | 2,590.8 | | | | 0.17 | | | | 0.22 | | | | 319.0 | | | | 346.2 | | | | 25.9 | | | | 20.2 | | | | 8.3 | | | | 8.1 | |

| | Growth | | | | | | | | | | | | | | | | | | | | | | | | | 3.8 | % | | | | | | | 28.4 | % | | | | | | | | | | | | | | | | | | | | | | | | |

JACK | | Jack In The Box Inc | | — | | | — | | | | 23.66 | | | | 1,046.2 | | | | 1,503.3 | | | | 2,184.0 | | | | 2,225.9 | | | | 1.36 | | | | 1.55 | | | | 212.6 | | | | 221.6 | | | | 17.5 | | | | 15.3 | | | | 7.1 | | | | 6.8 | |

| | Growth | | | | | | | | | | | | | | | | | | | | | | | | | 1.4 | % | | | | | | | 14.4 | % | | | | | | | 4.2 | % | | | | | | | | | | | | | | | | |

SONIC | | Sonic Corp | | OW | | | 10.00 | | | | 7.73 | | | | 478.3 | | | | 980.2 | | | | 545.1 | | | | 528.9 | | | | 0.31 | | | | 0.58 | | | | 129.6 | | | | 133.4 | | | | 15.9 | | | | 12.8 | | | | 7.4 | | | | 7.3 | |

| | Growth | | | | | | | | | | | | | | | | | | | | | | | | | 20 | % | | | | | | | 2.5 | % | | | | | | | 2.0 | % | | | | | | | | | | | | | | | | |

KKD | | Krispy Kreme Doughnuts Inc | | EW/V | | | 9.00 | | | | 6.01 | | | | 405.3 | | | | 395.3 | | | | 403.2 | | | | 444.6 | | | | 0.32 | | | | 0.23 | | | | 37.6 | | | | 47.0 | | | | 19.0 | | | | 26.1 | | | | 10.5 | | | | 8.4 | |

| | Growth | | | | | | | | | | | | | | | | | | | | | | | | | 30.3 | % | | | | | | | -27.1 | % | | | | | | | 25.0 | % | | | | | | | | | | | | | | | | |

AFCE | | Afc Enterprises Inc | | — | | | — | | | | 17.57 | | | | 428.4 | | | | 455.9 | | | | 170.6 | | | | 185.6 | | | | 0.96 | | | | 1.12 | | | | 52.4 | | | | 60.7 | | | | 18.3 | | | | 15.7 | | | | 6.7 | | | | 7.5 | |

| | Growth | | | | | | | | | | | | | | | | | | | | | | | | | 9.4 | % | | | | | | | 17.0 | % | | | | | | | 16.0 | % | | | | | | | | | | | | | | | | |

CBOU | | Caribou Coffee Co | | OW/V | | | 18.0 | | | | 10.24 | | | | 215.9 | | | | 172.3 | | | | 326.5 | | | | 352.1 | | | | 0.42 | | | | 0.49 | | | | 33.0 | | | | 36.0 | | | | 24.4 | | | | 21.1 | | | | 8.3 | | | | 4.8 | |

| | Growth | | | | | | | | | | | | | | | | | | | | | | | | | 7.8 | % | | | | | | | 15.7 | % | | | | | | | 9.2 | % | | | | | | | | | | | | | | | | |

BAGL | | Barton Noah Restaurant Group | | OW/V | | | 20.00 | | | | 15.34 | | | | 264.1 | | | | 240.0 | | | | 421.4 | | | | 435.1 | | | | 0.31 | | | | 1.00 | | | | 47.1 | | | | 60.8 | | | | 18.8 | | | | 18.5 | | | | 7.2 | | | | 8.7 | |

| | Growth | | | | | | | | | | | | | | | | | | | | | | | | | 2.8 | % | | | | | | | 10.1 | % | | | | | | | 7.4 | % | | | | | | | | | | | | | | | | |

TAST | | Carrols Restaurant Group Inc | | — | | | — | | | | 5.30 | | | | 122.8 | | | | 376.7 | | | | 974.7 | | | | 1,076.3 | | | | 0.90 | | | | 1.15 | | | | 93.7 | | | | 105.7 | | | | 5.9 | | | | 4.6 | | | | 4.0 | | | | 3.6 | |

| | Growth | | | | | | | | | | | | | | | | | | | | | | | | | 10.4 | % | | | | | | | 27.8 | % | | | | | | | 12.6 | % | | | | | | | | | | | | | | | | |

Min | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | 5.9x | | | | 4.6x | | | | 4.0x | | | | 3.6x | |

Max | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | 45.0 | | | | 36.1 | | | | 21.8 | | | | 17.7 | |

Mean | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | 22.7 | | | | 19.7 | | | | 10.5 | | | | 9.2 | |

Median | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | 19.8 | | | | 19.1 | | | | 9.2 | | | | 8.2 | |

Source: FactSet Research Systems Inc., company documents and Stephens Inc. for BAGL, CBOU, DNKN, KKD, SBUX and SONC.

20

Filed in Fourth Judicial District Court

12/27/2012 9:49:13 AM

Hennepin County Civil, MN

* * *

Wedbush Securities, Inc. (“Wedbush”) Nov. 5, 2012 Comparable Company Valuation

Including Caribou

Figure 20: Comparable Valuations

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Ticker | | Price

11/05/12 | | | Market

Cap

($ Mil.) | | | Ent

Value | | | P/E | | | EV/Sales | | | EV/EBITDA | | | Revenue

Growth

2013/12 | | | PF EPS

Growth

2013/12 | |

Company | | | | | ($ Mil.) | | | 2012 | | | 2013 | | | 2012 | | | 2013 | | | 2012 | | | 2013 | | | |

| | | | | | | | | | | | |

GLOBAL FRANCHISED-MODEL PEERS | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Mcdonald’s Corporation | | MCD | | $ | 87.46 | | | $ | 88,807 | | | $ | 99,877 | | | | 16.4x | | | | 15.0x | | | | 3.6x | | | | 3.4x | | | | 10.0x | | | | 9.5x | | | | 5 | % | | | 9 | % |

Yum! Brands, Inc. | | YUM | | $ | 72.23 | | | $ | 34,093 | | | $ | 38,145 | | | | 22.0x | | | | 19.3x | | | | 2.6x | | | | 2.4x | | | | 12.4x | | | | 11.2x | | | | 9 | % | | | 14 | % |

Burger King Worldwide, Inc. | | BKW | | $ | 15.41 | | | $ | 5,464 | | | $ | 8,030 | | | | 26.3x | | | | 21.6x | | | | 4.2x | | | | 6.5x | | | | 12.6x | | | | 12.1x | | | | -36 | % | | | 22 | % |

Domino’s Pizza, Inc. | | DPZ | | $ | 41.17 | | | $ | 2,409 | | | $ | 3,881 | | | | 20.9x | | | | 18.1x | | | | 2.3x | | | | 2.2x | | | | 12.8x | | | | 12.0x | | | | 5 | % | | | 15 | % |

The Wendy’s Company | | WEN | | $ | 4.32 | | | $ | 1,687 | | | $ | 2,646 | | | | 28.8x | | | | 23.1x | | | | 1.1x | | | | 1.0x | | | | 8.1x | | | | 7.6x | | | | 4 | % | | | 25 | % |

Papa John’s International, Inc. | | PZZA | | $ | 51.65 | | | $ | 1,245 | | | $ | 1,262 | | | | 19.8x | | | | 17.5x | | | | 1.0x | | | | 0.9x | | | | 9.7x | | | | 9.1x | | | | 5 | % | | | 13 | % |

Unweighted Average | | | | | | | | | | | | | | | | | 22.4x | | | | 19.1x | | | | 2.5x | | | | 2.8x | | | | 10.9x | | | | 10.2x | | | | -1 | % | | | 16 | % |

| | | | | | | | | | | | |

Dunkin’ Brands Group, Inc. (ex. Outliers) | | DNKN | | $ | 31.59 | | | $ | 3,635 | | | $ | 5,319 | | | | 25.0x | | | | 21.0x | | | | 8.0x | | | | 7.4x | | | | 15.2x | | | | 13.5x | | | | 8 | % | | | 19 | % |

Premium/(Discount) | | | | | | | | | | | | | | | | | 11 | % | | | 10 | % | | | 224 | % | | | 169 | % | | | 39 | % | | | 31 | % | | | | | | | | |

| | | | | | | | | | | | |

SNACK PEERS | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Starbucks Corporation | | SBUX | | $ | 51.15 | | | $ | 39,733 | | | $ | 37,785 | | | | 28.8x | | | | 24.0x | | | | 2.8x | | | | 2.5x | | | | 14.8x | | | | 12.5x | | | | 11 | % | | | 20 | % |

Tim Hortons Inc. | | THI | | $ | 49.84 | | | $ | 7,775 | | | $ | 8,092 | | | | 18.5x | | | | 16.3x | | | | 2.6x | | | | 2.4x | | | | 10.9x | | | | 10.0x | | | | 7 | % | | | 13 | % |

Green Mountain Coffee Roasters, Inc. | | GMCR | | $ | 25.10 | | | $ | 3,998 | | | $ | 4,258 | | | | 11.2x | | | | 10.0x | | | | 1.1x | | | | 1.0x | | | | 5.8x | | | | 5.0x | | | | 15 | % | | | 12 | % |

Peet’s Coffee & Tea, Inc. | | PEET | | $ | 73.46 | | | $ | 995 | | | $ | 957 | | | | 42.8x | | | | 32.8x | | | | 2.4x | | | | 2.2x | | | | 18.3x | | | | 14.2x | | | | 9 | % | | | 30 | % |

Krispy Kreme Doughnuts, Inc. | | KKD | | $ | 7.70 | | | $ | 535 | | | $ | 520 | | | | 18.1x | | | | 15.0x | | | | 1.2x | | | | 1.1x | | | | 11.6x | | | | 9.7x | | | | 9 | % | | | 21 | % |

Teavana Holdings, Inc. | | TEA | | $ | 11.02 | | | $ | 425 | | | $ | 434 | | | | 19.5x | | | | 15.0x | | | | 1.9x | | | | 1.5x | | | | 9.5x | | | | 7.1x | | | | 25 | % | | | 31 | % |

Caribou Coffee Company, Inc. | | CBOU | | $ | 12.20 | | | $ | 255 | | | $ | 218 | | | | 27.5x | | | | 21.4x | | | | 0.7x | | | | 0.6x | | | | 7.3x | | | | 6.1x | | | | 6 | % | | | 28 | % |

Unweighted Average | | | | | | | | | | | | | | | | | 23.8x | | | | 19.2x | | | | 1.8x | | | | 1.6x | | | | 11.2x | | | | 9.2x | | | | 12 | % | | | 22 | % |

| | | | | | | | | | | | |

Dunkin’ Brands Group, Inc. | | DNKN | | $ | 31.59 | | | $ | 3,635 | | | $ | 5,319 | | | | 25.0x | | | | 21.0x | | | | 8.0x | | | | 7.4x | | | | 15.2x | | | | 13.5x | | | | 8 | % | | | 19 | % |

Premium/(Discount) | | | | | | | | | | | | | | | | | 5 | % | | | 9 | % | | | 340 | % | | | 357 | % | | | 36 | % | | | 46 | % | | | | | | | | |

| | | | | | | | | | | | |

RESTAURANT GROWTH | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Starbucks Corporation | | SBUX | | $ | 51.15 | | | $ | 39,733 | | | $ | 37,785 | | | | 28.8x | | | | 24.0x | | | | 2.8x | | | | 2.5x | | | | 14.8x | | | | 12.5x | | | | 11 | % | | | 20 | % |

Chipotle Mexican Grill, Inc. | | CMG | | $ | 265.40 | | | $ | 8,452 | | | $ | 7,882 | | | | 29.9x | | | | 25.5x | | | | 2.9x | | | | 2.5x | | | | 14.4x | | | | 12.5x | | | | 14 | % | | | 17 | % |

Panera Bread Company | | PNRA | | $ | 169.48 | | | $ | 4,963 | | | $ | 4,673 | | | | 28.7x | | | | 24.0x | | | | 2.2x | | | | 1.9x | | | | 12.5x | | | | 11.0x | | | | 15 | % | | | 19 | % |

Buffalo Wild Wings, Inc. | | BWLD | | $ | 75.60 | | | $ | 1,415 | | | $ | 1,321 | | | | 24.2x | | | | 20.9x | | | | 1.3x | | | | 1.1x | | | | 8.5x | | | | 7.1x | | | | 21 | % | | | 16 | % |

Bj’s Restaurants, Inc. (Cons.) | | BJRI | | $ | 32.89 | | | $ | 949 | | | $ | 910 | | | | 29.3x | | | | 24.3x | | | | 1.3x | | | | 1.1x | | | | 10.6x | | | | 9.0x | | | | 15 | % | | | 20 | % |

Unweighted Average | | | | | | | | $ | 3,945 | | | $ | 3,696 | | | | 28.1x | | | | 23.7x | | | | 2.1x | | | | 1.8x | | | | 12.2x | | | | 10.4x | | | | 15 | % | | | 18 | % |

| | | | | | | | | | | | |

Dunkin’ Brands Group, Inc. | | DNKN | | $ | 31.59 | | | $ | 3,635 | | | $ | 5,319 | | | | 25.0x | | | | 21.0x | | | | 8.0x | | | | 7.4x | | | | 15.2x | | | | 13.5x | | | | 8 | % | | | 19 | % |

Premium/(Discount) | | | | | | | | | | | | | | | | | -11 | % | | | -12 | % | | | 280 | % | | | 304 | % | | | 25 | % | | | 29 | % | | | | | | | | |

Source: Company data, Wedbush Securities, Inc.

* * *

21

Filed in Fourth Judicial District Court

12/27/2012 9:49:13 AM

Hennepin County Civil, MN

WedBush July 24, 2012 Comparable Company Valuation Including Caribou

Figure 1: Comparable Public Valuations

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | Price | | | Market Cap | | | Em Value | | | P/E | | | EV/Sales | | | EV/EBITDA | | | Revenue Growth | | | PF EPS

Growth | |

Company | | Ticker | | 07/23/12 | | | ($ Mil.) | | | ($ Mil.) | | | 2012 | | | 2013 | | | 2012 | | | 2013 | | | 2012 | | | 2013 | | | 2013/12 | | | 2013/12 | |

PEERS | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Starbucks Corporation | | SBUX | | $ | 50.00 | | | $ | 38,425 | | | $ | 36,701 | | | | 27.0x | | | | 21.7x | | | | 2.8x | | | | 2.5x | | | | 14.0x | | | | 11.9x | | | | 11 | % | | | 24 | % |

Caribou Coffee Company, Inc. | | CBOU | | $ | 11.36 | | | $ | 238 | | | $ | 194 | | | | 22.5x | | | | 17.6x | | | | 0.5x | | | | 0.5x | | | | 5.7x | | | | 4.7x | | | | 11 | % | | | 28 | % |

Green Mountain Coffee Roasters, Inc. | | GMCR | | $ | 18.04 | | | $ | 2,875 | | | $ | 3,261 | | | | 6.8x | | | | 4.9x | | | | 0.8x | | | | 0.6x | | | | 3.9x | | | | 2.8x | | | | 30 | % | | | 38 | % |

Dunkin’ Brands Group, Inc. | | DNKN | | $ | 32.26 | | | $ | 3,884 | | | $ | 5,111 | | | | 26.6x | | | | 22.7x | | | | 7.7x | | | | 7.2x | | | | 15.6x | | | | 14.0x | | | | 8 | % | | | 17 | % |

Teavana Holdings, Inc. | | TEA | | $ | 11.11 | | | $ | 434 | | | $ | 416 | | | | 18.5x | | | | 14.1x | | | | 1.9x | | | | 1.6x | | | | 8.7x | | | | 6.6x | | | | 25 | % | | | 31 | % |

Unweighted Average (ex. Outlier) | | | | | | | | | | | | | | | | | 23.6x | | | | 19.0x | | | | 2.7x | | | | 2.5x | | | | 9.6x | | | | 9.3x | | | | 17 | % | | | 28 | % |

Unweighted Average | | | | | | | | | | | | | | | | | 20.3x | | | | 16.2x | | | | 2.7x | | | | 2.5x | | | | 9.6x | | | | 8.0x | | | | 17 | % | | | 28 | % |

| | | | | | | | | | | | |

Peet’s Coffee & Tea, Inc. - Cons. | | PEET | | $ | 73.50 | | | $ | 981 | | | $ | 947 | | | | 41.3x | | | | 32.4x | | | | 2.3x | | | | 2.1x | | | | 17.6x | | | | 15.1x | | | | 9 | % | | | 27 | % |

Premium/(Discount) | | | | | | | | | | | | | | | | | 75 | % | | | 70 | % | | | -16 | % | | | -13 | % | | | 83 | % | | | 63 | % | | | | | | | | |

| | | | | | | | | | | | |

OTHER GROWTH PEERS | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Buffalo Wild Wings, Inc. | | BWLD | | $ | 81.01 | | | $ | 1,510 | | | $ | 1,407 | | | | 24.7x | | | | 20.6x | | | | 1.3x | | | | 1.1x | | | | 8.8x | | | | 7.4x | | | | 17 | % | | | 20 | % |

Bj’s Restaurants, Inc. (Cons.) | | BJRI | | $ | 40.06 | | | $ | 1,173 | | | $ | 1,127 | | | | 30.2x | | | | 24.4x | | | | 1.6x | | | | 1.4x | | | | 12.0x | | | | 9.8x | | | | 17 | % | | | 24 | % |

Panera Bread Company | | PNRA | | $ | 141.27 | | | $ | 4,154 | | | $ | 3,931 | | | | 25.2x | | | | 21.2x | | | | 1.9x | | | | 1.7x | | | | 11.2x | | | | 9.5x | | | | 13 | % | | | 19 | % |

Chipotle Mexican Grill, Inc. | | CMG | | $ | 304.76 | | | $ | 9,686 | | | $ | 9,234 | | | | 34.8x | | | | 28.0x | | | | 3.3x | | | | 2.9x | | | | 17.1x | | | | 13.9x | | | | 17 | % | | | 24 | % |

Unweighted Average | | | | | | | | $ | 4,131 | | | $ | 3,925 | | | | 28.7x | | | | 23.6x | | | | 2.0x | | | | 1.8x | | | | 12.3x | | | | 10.2x | | | | 0.2x | | | | 0.2x | |

| | | | | | | | | | | | |

Peet’s Coffee & Tea, Inc. - Cons. | | PEET | | $ | 73.50 | | | $ | 981 | | | $ | 947 | | | | 41.3x | | | | 32.4x | | | | 2.3x | | | | 2.1x | | | | 17.6x | | | | 15.1x | | | | 9 | % | | | 27 | % |

Premium/(Discount) | | | | | | | | | | | | | | | | | 44 | % | | | 33 | % | | | 14 | % | | | 21 | % | | | 43 | % | | | 49 | % | | | | | | | | |

Source: Thomson Financial, Company data, Wedbush Securities, Inc.

53.Inadequate Disclosure Regarding Moelis’ Selected Precedent Transactions Analysis. Moelis performed a selected precedent analysis, in which it derived a set of implied merger consideration price ranges. JAB just paid over a 20x EBITDA multiple for Peet’s but is expected to pay just a 10x EBITDA multiple for Caribou. The transactions Moelis selected here reduced the median EBITDA multiple from the Peet’s takeover, and 14D-9 fails to explain how and why these transactions were included in the analysis. The 14D-9 fails to disclose the specific criteria Moelis used within the “restaurant industry” to select the transactions, especially since some include non-beverage chains, and why transactions with other coffee roasters were excluded. The 14D-9 also fails to disclose the premiums observed for each of the transactions. Without these above-stated material disclosures, Caribou’s shareholders are unable to properly understand whether $16.00 per share represents fair value.

22

Filed in Fourth Judicial District Court

12/27/2012 9:49:13 AM

Hennepin County Civil, MN

54.Inadequate Disclosure Regarding Moelis’ Discounted Cash Flow Analysis. The 14D-9 leaves out fundamental, material assumptions Moelis made in formulating its discounted cash flow analysis, including: (a) How Moelis treated stock-based compensation in its analysis (i.e., as a cash or non-cash expense); (b) The inputs and assumptions Moelis used to derive the range of discount rates (10.5% to 11.5%) used in its analysis; and (c) The basis for Moelis’ decision to imply a terminal value for the Company ranging from 8.0 to 9.0x, considering that the top-end of that range is below the LTM EBITDA 9.1x median multiple observed by Moelis in its comparable companies analysis. Without these material disclosures, Caribou’s shareholders are unable to properly understand whether $16.00 per share represents fair value.

55.Inadequate Disclosure Regarding the Lack of a Pre-Signing Market Check.The 14D-9 reiterates that the Individual Defendants “determined that there was a low likelihood of obtaining a higher price from a pre-signing market check and that insisting on doing so would result in the loss of the JAB Group’s offer.” This is a conclusory justification that is devoid of material substance. Shareholders cannot determine how or whether the Individual Defendants properly discharged their fiduciary duties to maximize shareholder value, including through determining whether another acquiror would be willing to pay more than $16.00 per share. Without more detail about the Individual Defendants’ decision not to conduct a pre-signing market check, Caribou’s shareholders are unable to properly understand whether $16.00 per share represents fair value.

56. Without the disclosure of the information mentioned in the various paragraphs above, Caribou’s shareholders face irreparable harm and have no adequate remedy at law.

CLASS ACTION ALLEGATIONS

57. Plaintiff brings this action individually and as a class action on behalf of all holders of Caribou stock who are being, and will be, harmed by Defendants’ actions described herein (the “Class”).

23

Filed in Fourth Judicial District Court

12/27/2012 9:49:13 AM

Hennepin County Civil, MN

58. Excluded from the Class are Defendants herein and any person, firm, trust, corporation, or other entity related to, or affiliated with, any Defendants.

59. This action is properly maintainable as a class action under Minnesota Rule of Civil Procedure 23.

60. The Class is so numerous that joinder of all members is impracticable. Over 20 million shares of Caribou common stock are held by hundreds, if not thousands, of beneficial holders who are geographically dispersed across the country.

61. There are questions of law and fact which are common to the Class and which predominate over questions affecting any individual Class member. The common questions include,inter alia, the following:

(a) whether the Individual Defendants have breached their fiduciary duties of undivided loyalty, independence, or due care with respect to Plaintiff and the other members of the Class in connection with the Proposed Transaction;

(b) whether the Individual Defendants have breached their fiduciary duty to secure and obtain the best price reasonable under the circumstances for the benefit of Plaintiff and the other members of the Class, in connection with the Proposed Transaction;

(c) whether the Individual Defendants have breached any of their other fiduciary duties to Plaintiff and the other members of the Class in connection with the Proposed Transaction, including the duties of good faith, candor, loyalty, diligence, honesty, and fair dealing;

(d) whether the Individual Defendants have breached their fiduciary duties of candor to Plaintiff and the other members of the Class in connection with the Proposed Transaction by failing to disclose all material information upon which they are able to make an informed decision about whether to tender their shares in favor of the Proposed Transaction;

24

Filed in Fourth Judicial District Court

12/27/2012 9:49:13 AM

Hennepin County Civil, MN

(e) whether the Individual Defendants, in bad faith and for improper motives, have impeded or erected barriers to discourage other strategic alternatives including offers from interested parties for the Company or its assets;

(f) whether Plaintiff and the other members of the Class would be irreparably harmed were the transactions complained of herein consummated; and

(g) whether JAB is aiding and abetting the wrongful acts of the Individual Defendants.

62. Plaintiffs claims are typical of the claims of the other members of the Class and Plaintiff does not have any interests adverse to the Class.

63. Plaintiff is an adequate representative of the Class, has retained competent counsel experienced in litigation of this nature, and will fairly and adequately protect the interests of the Class.

64. The prosecution of separate actions by individual members of the Class would create a risk of inconsistent or varying adjudications with respect to individual members of the Class, which would establish incompatible standards of conduct for Defendants.

65. Plaintiff anticipates that there will be no difficulty in the management of this litigation. A class action is superior to other available methods for the fair and efficient adjudication of this controversy.

66. Defendants have acted on grounds generally applicable to the Class with respect to the matters complained of herein, thereby making appropriate the relief sought herein with respect to the Class as a whole.

25

Filed in Fourth Judicial District Court

12/27/2012 9:49:13 AM

Hennepin County Civil, MN

CAUSES OF ACTION

COUNT I

Breach of Fiduciary Duties

(Against the Individual Defendants)

67. Plaintiff repeats and realleges each allegation as though fully set forth herein.

68. Defendants have knowingly and recklessly, and in bad faith, violated fiduciary duties of care, loyalty, candor, good faith and independence owed to the public shareholders of Caribou and have acted to put the interests of themselves and JAB ahead of the interests of Caribou’s shareholders.

69. By the acts, transactions and courses of conduct alleged herein, Defendants, individually and acting as a part of a common plan, knowingly or recklessly, and in bad faith, are attempting to unfairly deprive Plaintiff and other members of the Class of the true value of their investment in Caribou and the ability to participate in the future growth of the Company.

70. As demonstrated by the allegations above, Defendants knowingly or recklessly failed to exercise the care required, and breached their duties of loyalty, good faith, and independence, owed to the public shareholders of Caribou because,inter alia, they failed to:

(a) fully inform themselves of the market value of Caribou before entering into the Proposed Transaction;

(b) exercise valid business judgment in connection with Proposed Transaction;

(c) act in the best interests of the public shareholders of Caribou common stock;

(d) maximize shareholder value;

(e) fully disclose material information in the Company’s 14D-9 that enables shareholders to make intelligent, rational and informed decisions about whether to tender their shares or seek appraisal;

26

Filed in Fourth Judicial District Court

12/27/2012 9:49:13 AM

Hennepin County Civil, MN

(f) obtain the best financial and other terms when the Company’s independent existence will be materially altered by the Proposed Transaction; and

(g) act in accordance with their fundamental duties of good faith, due care, and loyalty.

71. By reason of the foregoing acts, practices, and course of conduct, Defendants have knowingly or recklessly, and in bad faith, failed to exercise ordinary care and diligence in the exercise of their fiduciary obligations toward Plaintiff and the other members of the Class.

72. Unless enjoined by this Court, Defendants will continue to knowingly or recklessly, and in bad faith, breach their fiduciary duties owed to Plaintiff and the Class, and may consummate the Proposed Transaction, which will exclude the Class from the maximized value they are entitled, all to the irreparable harm of Plaintiff and the Class.

73. Plaintiff and the members of the Class have no adequate remedy at law. Only through the exercise of this Court’s equitable powers can Plaintiff and the Class be fully protected from the immediate and irreparable injury that Defendants’ actions threaten to inflict.

74. Plaintiff seeks to obtain a non-pecuniary benefit for the Class in the form of injunctive relief against the Individual Defendants. Plaintiffs counsel are entitled to recover their reasonable attorneys’ fees and expenses as a result of the conference of a non-pecuniary benefit on behalf of the Class and will seek an award of such fees and expenses at the appropriate time.

COUNT II

Claim for Aiding and Abetting

(Against Caribou and JAB)

75. Plaintiff repeats and realleges each allegation as though fully set forth herein.

76. Defendants Caribou and JAB is sued herein as an aider and abettor of the breaches of fiduciary duties described above by the Individual Defendants, as members of the Board of Caribou.

27

Filed in Fourth Judicial District Court

12/27/2012 9:49:13 AM

Hennepin County Civil, MN

77. The Individual Defendants breached their fiduciary duties of good faith, candor, loyalty, and due care owed to the public shareholders of Caribou because,inter alia, they failed to:

(a) fully inform themselves of the market value of Caribou before entering into the Proposed Transaction;

(b) act in the best interests of the public shareholders of Caribou common stock;

(c) maximize shareholder value;

(d) fully disclose material information in the Company’s 14D-9 that enables shareholders to make intelligent, rational and informed decisions about whether to tender their shares or seek appraisal;

(e)

(f) obtain the best financial and other terms when the Company’s independent existence will be materially altered by the Proposed Transaction; and

(g) act in accordance with their fundamental duties of good faith, due care, and loyalty.

78. Such breaches of fiduciary duties could not, and would not, have occurred but for the conduct of Defendants Caribou and JAB, which, therefore, aided and abetted such breaches via entering into the Proposed Transaction.

79. Defendants Caribou and JAB had knowledge that it was aiding and abetting the Individual Defendants’ breach of their fiduciary duties to the public shareholders of Caribou.

80. Defendants Caribou and JAB rendered substantial assistance to the Individual Defendants in their breach of their fiduciary duties to the public shareholders of Caribou.

81. As a result of the conduct of Defendants Caribou and JAB of aiding and abetting the Individual Defendants’ breaches of fiduciary duties, Plaintiff and the other members of the Class have been, and will be, damaged in that they have been, and will be, prevented from obtaining a fair price for their shares.

28

Filed in Fourth Judicial District Court

12/27/2012 9:49:13 AM

Hennepin County Civil, MN

82. As a result of the unlawful actions of Defendants Caribou and JAB, Plaintiff and the other members of the Class will be irreparably harmed in that they will not receive fair value for their investment Caribou’s assets and business and will be prevented from obtaining the real value of their equity ownership in the Company. Unless the actions of Defendants Caribou and JAB are enjoined by this Court, it will continue to aid and abet the Individual Defendants’ breaches of fiduciary duties owed to Plaintiff and the members of the Class and will aid and abet a process that inhibits the maximization of shareholder value and the disclosure of material information.

83. Plaintiff and the other members of the Class have no adequate remedy at law. Only through the exercise of this Court’s equitable powers can Plaintiff and the Class be fully protected from the immediate and irreparable injury that Defendant’s actions threaten to inflict.

84. Plaintiff seeks to obtain a non-pecuniary benefit for the Class in the form of injunctive relief against Defendants Caribou and JAB. Plaintiffs counsel are entitled to recover their reasonable attorneys’ fees and expenses as a result of the conference of a non-pecuniary benefit on behalf of the Class, and will seek an award of such fees and expenses at the appropriate time.

COUNT III

Claim for Equitable Relief Under Minn. Stat. §302A.467

(Against the Individual Defendants, Caribou and JAB)

85. Plaintiff repeats and realleges each allegation as though fully set forth herein.

86. Minn. Stat. §302A.467 (the “Act”) provides that “if a corporation or an officer or director of the corporation violates a provision of this chapter, a court in this state may, in an action brought by a shareholder of the corporation, grant any equitable relief it deems just and reasonable in the circumstances and award expenses, including attorneys’ fees and disbursements, to the shareholder.”

29