UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN ISSUER PURSUANT TO

RULE 13a-16 OR 15d-16 OF THESECURITIES

EXCHANGE ACT OF 1934

For the month of February 2011

Commission

File Number 000-5149

CONTAX PARTICIPAÇÕES S.A.

(Exact name of Registrant as specified in its Charter)

Contax Holding Company

(Translation of Registrant's name in English)

Rua do Passeio, 56 – 16th floor

Rio de Janeiro, RJ

Federative Republic of Brazil

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file

annual reports under cover Form 20-F or Form 40-F.

Form 20-Fþ Form 40-Fo

Indicate by check mark whether the registrant by furnishing the

information contained in this Form is also thereby furnishing the

information to the Commission pursuant to Rule 12g3-2(b) under

the Securities Exchange Act of 1934.

Yeso Noþ

|

| Contax Participações S.A. and Mobitel S.A. |

Valuationreport for theincorporationof 100% of Mobitel S.A. shares by ContaxParticipaçõesS.A.

January 25th, 2011

IMPORTANT DISCLAIMER:Thisdocumentis a freetranslationonly. Due to thecomplexitiesoflanguage translation, translationsare not always precise. The originaldocumentwaspreparedinPortugueseand in case of anydivergence, discrepancyordifference betweenthis version and thePortugueseversion, thePortugueseversion shall prevail. ThePortugueseversion is the only valid andcompleteversion and shall prevail for any and allpurposes.TheTranslationwas made by persons whose nativelanguageis not English,thereforethere is nowarrantyas to theaccuracy, reliabilityorcompletenessof anyinformation transla tedand no one should rely on theaccuracy, reliabilityorcompletenessof suchinformation.There is noassuranceas to theaccuracy, reliabilityorcompletenessof thetranslation.Any person reading thistranslationand relying on it should do so at his or her own risk.

| | | | |

| Index | | | | |

| |

| SECTION 1 | Executive Summary | 02 |

| SECTION 2 | Information About the Evaluator | 07 |

| SECTION 3 | Market and Companies' Overview | 09 |

| | 3 | .A | Market Overview | 10 |

| | 3 | .B | Contax Overview | 13 |

| | 3 | .C | Dedic GPTI Overview | 19 |

| SECTION 4 | General Assumptions | 25 |

| SECTION 5 | Contax Valuation | 27 |

| | 5 | .A | Discounted Cash Flow | 28 |

| | 5 | .B | Comparable Companies Trading Multiples | 36 |

| | 5 | .C | Accounting Book Value | 38 |

| | 5 | .D | Volume Weighted Average Price | 40 |

| SECTION 6 | Dedic GPTI Valuation | 43 |

| | 6 | .A | Discounted Cash Flow | 44 |

| | 6 | .B | Comparable Companies Trading Multiples | 53 |

| | 6 | .C | Accounting Book Value | 55 |

| |

| APPENDIX A | Companies' Weighted Average Cost of Capital (WACC) | 57 |

| APPENDIX B | Comparable Companies Trading Multiples | 59 |

| APPENDIX C | Description of Valuation Methodologies | 62 |

| APPENDIX D | Terms and Definitions Used in the Valuation Report | 67 |

| APPENDIX E | Additional Statements and Information | 69 |

1

|

| SECTION 1 |

| Executive Summary |

2

|

| Introduction |

| |

This Valuation Report was prepared by Banco BTG Pactual S.A. (“BTG Pactual”), upon request by Contax Participações S.A.(“Contax”) for the purposes specified in Law n°6.404, dated December 15th, 1976 (as amended) (“Lei das S.A.”), in connectionwith the incorporation of all Mobitel S.A. (“Dedic GPTI”) shares by Contax (“Transaction”). |

§ | In January 2011, Contax and Dedic GPTI executed an agreement for the incorporation of Dedic GPTI shares by Contax |

| | § | According to the agreement signed by both parties, Contax committed to, subject to a timeline foreseen in the agreement, to conduct all the necessary steps to submit a proposal for the incorporation of Dedic GPTI by Contax, subject to the terms established, making Dedic GPTI a subsidiary of Contax |

| § | As part of the agreement, Contax committed to take all steps, within the terms established by the agreement, envisaging: |

| | § | (i) the calling of a shareholders’ meeting change the Company’s Byelaws, in order to approve the constitution of an independent committee; |

| | § | (ii) the calling of a Board Meeting in order to indicate the members of such independent committee, which will evaluate and deliberate about the terms and conditions of such Incorporation |

| § | Additionally, Dedic GPTI signed in January 2011 a stock purchase agreement to acquire all Dedic GPTI shares held by Mr. Fábio Carlos Pereira (representing 12.5% of total shares issued by the company) for R$ 23 million |

3

|

| Contax Summary Valuation |

| |

Based on the fair economic value calculated using the discounted cash flow to firm methodology, the Contax ON shares’ valueranges from R$37.64 toR$40.30 per share and the Contax PN shares’ value ranges from R$37.59 to R$40.24 per share. Forfurther information on the valuation methodologies, please see Appendix C - Description of Valuation Methodologies, on page62 of this report |

| | | | | | |

| Fair Economic Value (Discounted Cash Flow)(1) | | Book Value |

| (R$ million, except price per share) |  | | (R$ million, except price per share) | |

| Perpetuity growth rate (US$ nominal terms) | 1.50% | 2.00% | 2.50% | | | |

| WACC (US$ nominal terms) | 10.0% | 10.0% | 10.0% | | Total assets | 1,290.9 |

| Enterprise value | $2,143 | $2,217 | $2,301 | | (-) Total liabilities | 880.8 |

| (-) (Net debt) net cash(2) | $90 | $90 | $90 | | (-) Minority interest | 1.8 |

| Equity value | $2,233 | $2,307 | $2,390 | | = Shareholders’ equity | 408.3 |

| Number of ON shares (million)(3) | 22.7 | 22.7 | 22.7 | | Number of shares (million)(3) | 59.4 |

| Price per ON share (R$ / share)(4) | $37.64 | $38.88 | $40.30 | | R$/share | 6.88 |

| Number of PN shares (million)(3) | 36.7 | 36.7 | 36.7 | | | |

| Price per PN share (R$ / share)(4) | $37.59 | $38.84 | $40.24 | | | |

| Fair Economic Value (Trading Multiples) | | Volume Weighted Average Price |

| (R$ million, except multiples and value per share) | | 2011E | 2012E | | | |

| | | | | | 12 months period prior to 12/31/2010 | |

| EBITDA | | 341.1 | 412.0 | | ON:R$29.59 /PN:R$25.29 | |

| EV/EBITDA Multiple(5) | | 6.7x | 6.6x | | | |

| Enterprise value | | 2,280.7 | 2,732.8 | | 6 months period prior to 12/31/2010 | |

| (-) (Net debt) net cash(2) | | 89.7 | 89.7 | | ON:R$31.04/PN:R$26.61 | |

| Equity value | | 2,370.5 | 2,822.5 | | | |

| Number of shares (million)(3) | | 59.4 | 59.4 | | 3 months period prior to 12/31/2010 | |

| R$/share | | 39.93 | 47.54 | | ON:R$31.16/PN:R$29.82 | |

| |

| Source: Company, CVM, Economática and BTG Pactual. |

| Note: | |

| 1 | As of December 31st, 2010. |

| 2 | As of September 30th, 2010. |

| 3 | Excludes treasury shares. |

| 4 | Assumes a ON/PN ratio based on the average spread of ON / PN shares, during the 60 days prior to December 31st, 2010. |

| 5 | Considers the median of comparable companies trading multiples as of December 31st, 2010. Source: Factset. |

4

|

| Dedic GPTI Summary Valuation |

Based on the fair economic value calculated using the discounted cash flow to firm methodology, Dedic GPTI shares’ valueranges from R$1.38 to R$1.57 per share. For further information on the valuation methodologies, please see Appendix C -Description of Valuation Methodologies, on page 62 of this report |

| | | | | | |

| Fair Economic Value (Discounted Cash Flow)(1) | | Book Value |

| |

| (R$ million, except price per share) |  | | (R$ million, except price per share) | |

| Perpetuity growth rate (US$ nominal terms) | 1.50% | 2.00% | 2.50% | | Total assets | 486.3 |

| WACC (US$ nominal terms) | 10.0% | 10.0% | 10.0% | | (-) Total liabilities | 311.1 |

| Enterprise value | $371 | $383 | $397 | | (-) Minority interest | 0.0 |

| (-) (Net debt) net cash(3) | ($184) | ($184) | ($184) | | = Shareholders’ Equity | 175.2 |

| Equity value | $187 | $199 | $213 | | Number of shares (million)(4) | 154.9 |

| Number of shares (million)(4) | 135.5 | 135.5 | 135.5 | | R$/share | 1.13 |

| Price per share (R$ / share) | $1.38 | $1.47 | $1.57 | | | |

| | | |

| Fair Economic Value (Trading Multiples) | |

| (R$ million, except multiples and value per share) | 2011E | 2012E | |

| EBITDA | 84.7 | 95.9 | |

| EV/EBITDA Multiple(2) | 6.7x | 6.6x | |

| Enterprise value | 566.6 | 636.3 | |

| (-) (Net debt) net cash(3) | (183.9 | (183.9 | |

| Equity value | 382.7 | 452.4 | |

| Number of shares (million)(4) | 135.5 | 135.5 | |

| R$/share | 2.82 | 3.34 | |

| |

| Source: Company, CVM, Economática and BTG Pactual. |

| 1 | As of December 31st, 2010. |

| 2 | Considers the median of comparable companies trading multiples as of December 31st, 2010. Source: Factset. |

| 3 | As of August 31st, 2010, plus R$23 million as per note 4 below. |

| 4 | Based on information provided by Dedic GPTI, we considered Dedic GPTI has acquired 19,359,874 shares held by Mr. Fábio Carlos Pereira for R$23 million. This total wasadded to the net debt as of August 31st, 2010 for Dedic GPTI valuation. |

5

|

Exchange Ratio Based on Discounted Cash Flow |

| Analysis of the exchange ratio based on the discounted cash flow to firm methodology |

| | | | | | | | | | | | | | |

| Contax | | Dedic GPTI |

| (Fair economic value per share based on the discounted cash flow method(1). R$ million, except price per share) | | (Fair economic value per share based on the discounted cash flow method(1). R$ million, except price per share) |

|  | | |  |

| Perpetuity growth rate (US$ nominal terms) | 1.50% | 2.00% | 2.50% | | Perpetuity growth rate (US$ nominal terms) | 1.50% | 2.00% | 2.50% |

| WACC (US$ nominal terms) | 10.0% | 10.0% | 10.0% | | WACC (US$ nominal terms) | 10.0% | 10.0% | 10.0% |

| Enterprise value | $2,143 | 2,217 | $2,301 | | Enterprise value | $371 | $383 | $397 |

| (-) (Net debt) net cash(2) | $90 | $90 | $90 | | (-) (Net debt) net cash (5) | ($184) | ($184) | ($184) |

| Equity value | $2,233 | 2,307 | $2,390 | | Equity value | $187 | $199 | $213 |

| Number of ON shares (million)(3) | 22.7 | 22.7 | 22.7 | | Number of shares (million) | 135.5 | 135.5 | 135.5 |

| Price per ON share (R$ / share)(4) | $37.64 | 38.88 | $40.30 | | Price per share (R$ / share) | $1.38 | $1.47 | $1.57 |

| Number of PN shares (milhões)(3) | 36.7 | 36.7 | 36.7 | | | | | | | | |

| Price per PN share (R$ / share)(4) | $37.59 | 38.84 | $40.24 | | | | | | | | |

| | | | | | | | ON:0.03425595x PN:0.03429939x | | | | | | |

| | | | | | | ON:0.03779068x PN:0.03783860X | | | | | |

| | | | | | ON:0.04172383x PN:0.04177674X | | | | |

- Based on themethodologyandassumptions presentedtheexchangeratio rangebetweenContax and Dedic GPTI shares isbetween 0.03425595xand0.04172383xfor ON shares and0.03429939xand0.04177674xfor PN shares, based on thecomparisonof theindicativevalues per sharecalculatedfor bothCompaniesand the ratio ON/PN of Contax shares based on the VWAP of each class of share in the period of 60 days beforeDecember31st, 2010

| |

| Source: Company, CVM, Economática and BTG Pactual. |

| 1 | As of December 31st, 2010. |

| 2 | As of September 30th, 2010. |

| 3 | Excludes treasury shares. |

| 4 | Assumes a ON/PN ratio based on the average spread of ON / PN shares, during the 60 days prior to December 31st, 2010. |

| 5 | As of August 31st, 2010, plus R$23 million as per note 6 below. |

| 6 | Based on information provided by Dedic GPTI, we considered Dedic GPTI has acquired 19,359,874 shares held by Mr. Fábio Carlos Pereira for R$23 million. This total wasadded to the net debt as of August 31st, 2010 for Dedic GPTI valuation. |

6

|

| SECTION 2 |

| Information About the Evaluator |

7

|

| Information About the Evaluator |

| As established in CVM Instruction No. 319, Banco BTG Pactual S.A. (“BTG Pactual”) represents that: |

1.BTG Pactual holds nosecuritiesissued by ContaxParticipaçõesS.A.(CTAX3,CTAX4 andCTXNY),based on data as of January 17th, 2011.

2.It has no direct or indirect interest in Contax, Dedic GPTI or in theTransaction,and there is no other relevantcircumstancethat may beconsidereda conflict of interest;

3.Thecontrolling shareholderormanagersof Contax and Dedic GPTI have notdirected,limited,hinderedorperformedany act thatadverselyaffected or may haveadverselyaffected the access to, use orknowledgeofinformation,assets,documentsor workmethodologiesrelevant for the quality of therespective conclusions;.

4.It has no conflict of interest that may in any way restrict its capacity to arrive at theconclusions independently presentedin thisValuationReport.

8

|

| SECTION 3 |

| Market and Companies' Overview |

9

|

| SECTION 3.A |

| Market and Companies' Overview |

| Market Overview |

10

|

| Brazilian Contact Center Market Overview |

Brazilian Contact Center and Information Technology market presents several growth opportunities and benefits directly frompositive Brazilian macroeconomic perspectives |

|

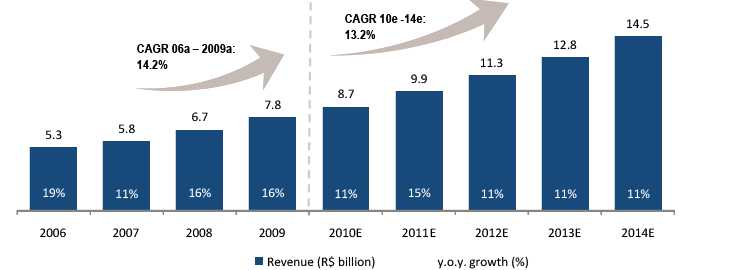

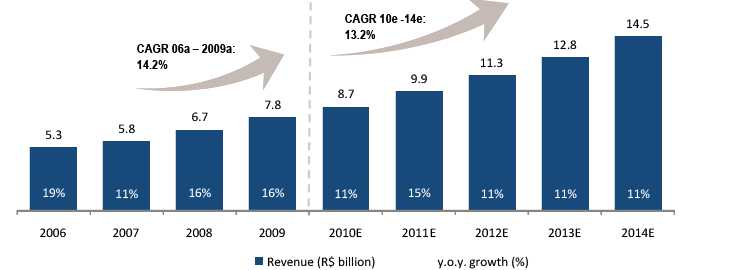

| Revenue Evolution of the Brazilian Contact Center Market |

| (US$ billion) |

|

| The Brazilian Contact Center Market |

| The Brazilian market presents a huge outsourcing potential |

| | | Brazil is gaining importance in the global scenario and already represents 7.2% of the global market |

| | | Growth should be driven by the increase in outsourcing of non-core activities by the industries that most demand contact center services (banking, telecom and retail) |

Source: IDC andBRASCOM.

11

|

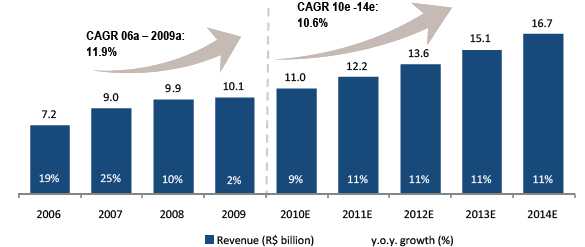

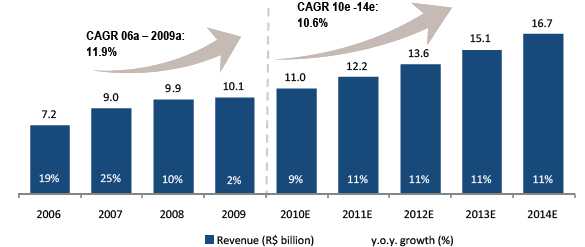

| Brazilian Information Technology Market Overview |

Brazilian Contact Center and Information Technology market presents several growth opportunities and benefits directly frompositive Brazilian macroeconomic perspectives |

|

| Revenue Evolution of the BrazilianInformation TechnologyMarket |

| (US$ billion; annual growth %) |

| | | |

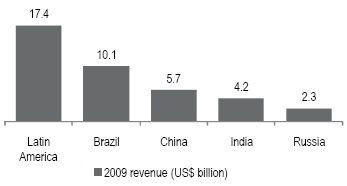

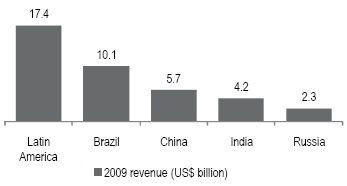

| The Brazilian Information Technology Market | | Information Technology Market Revenues, by Country |

- The Brazilian IT sector benefits from the following aspects:

| |

|

| - The Brazilian IT sector combines technological expertise with anextensive knowledge of business processes for specific businesses,such as the financial sector

| |

| - Global trend to play an important role in IT infrastructure in LatinAmerica for multinational companies (ex. Unilever, Merck, Rhodia)

| |

12

|

| SECTION 3.B |

| Market and Companies' Overview |

| Contax Overview |

13

|

| Contax Overview |

| Company Overview |

| | |

| Brief Overview |

| |

§Contax Participações S.A. is one of the largest companies in corporate services in Brazil, the market leader in contact center and collection and isexpanding its services portfolio to become the leading company in BPO (Business Process Outsourcing), specialized, in a comprehensive manner, inthe client relationship management (CRM) |

|

|

§Currently, the largest portion of its activity is focused in the segments of Customer Services, Debt Collection, Telemarketing, Retention, Back-office,Technology Services and Trade Marketing |

|

| §Contax has approximately 80 clients ans its business strategy is focused in the development of long term relationship with its clients, largecorporations of different sectors that use its services, such as telecomunication, financials, utilities, services, retail, among others |

|

| | §In September 2010, Contax had approximately 84 thousand employees distributed in 9 Brazilian states and in the Distrito Federal |

| |

| |

| Recent Events |

| |

§August 31st, 2010: Contax announced the acquisition of Ability Comunicação Integrada Ltda. for a price that could reach a total of R$82,474,000.00.Ability is one of Brazil’s largest and best known companies in the Trade Marketing segment, which involves the promotion and sale of products andservices at points of sale, posting revenues of R$ 104 million and EBITDA of R$ 10 million in the year ended on December 31, 2009. |

|

|

§December 17th, 2010: Contax announced a change in its Executives Board. Mr. Michel Sarkis, Contax’s Chief Financial and Investor Relations Officerwill take over the position of Chief Executive Officer, previously held by Mr. James Meaney. Michel Sarkis is 41 years old and one of the first executiveofficers hired by Contax. |

|

|

14

|

| Contax Overview |

| Company Overview |

| |

| Board of Directors and Executives Board |

§Board of Directors | §Executives Board |

-Fernando Antonio Pimentel Melo,Chairman | -Michel Neves Sarkis,Chief Executive, Chief Financial and Investor Relations Officer |

-Pedro Jereissati,Member | -Eduardo Nunes de Noronha,Director |

-Carlos Jereissati,Member | -Dimitrius Rogério de Oliveira,Director |

-Cristina Anne Betts,Member | |

-Otavio Marques de Azevedo,Member | |

-Antonio Adriano Silva,Member | |

-Armando Galhardo Nunes Guerra Junior,Member | |

-Paulo Edgar Trapp,Member | |

-Marcel Cecchi Vieira,Member | |

-Sergio Francisco da Silva,Member | |

-Newton Carneiro da Cunha,Member | |

-Manuel Jeremias Leite Caldas,Member | |

| | | | | | |

| Shareholder Structure |

| |

| | Number of ON | | Number of PN | | Total Number of | |

| | Shares | % of Total ON | Shares | % of Total PN | Shares | % of Total |

| |

CTX Participações S.A. | 15,992,929 | 69.3% | 3,880,666 | 10.6% | 19,873,595 | 33.2% |

Free float | 6,694,875 | 29.0% | 32,800,334 | 89.4% | 39,495,209 | 66.1% |

Treasury shares | 401,796 | 1.7% | - | 0.0% | 401,796 | 0.7% |

| |

Total | 23,089,600 | 100.0% | 36,681,000 | 100.0% | 59,770,600 | 100.0% |

15

|

| Contax Overview |

| Financial Statements: Income Statement |

| | | | | | | | | |

| | Twelve months ended: | | Nine months ended: |

| Income Statement | 12/31/2007 | | 12/31/2008 | | 12/31/2009 | | 09/30/2009 | | 09/30/2010 |

| (Values in R$ ‘000) | | | | | | | | | |

| |

| Gross revenue | 1.475.488 | | 1.916.115 | | 2.335.252 | | 1.703.692 | | 1.898.011 |

Deductions | (109.673) | | (141.387) | | (174.233) | | (127.472) | | (138.451) |

| |

| Net revenue | 1.365.815 | | 1.774.728 | | 2.161.019 | | 1.576.220 | | 1.759.560 |

Cost of products sold / services rendered | (1.185.079) | | (1.490.647) | | (1.757.272) | | (1.311.860) | | (1.498.726) |

| |

| Gross profit | 180.736 | | 284.081 | | 403.747 | | 264.360 | | 260.834 |

Operating income / (expenses) | (106.031) | | (138.213) | | (195.126) | | (144.719) | | (136.403) |

Selling | (23.986) | | (28.488) | | (27.709) | | (21.143) | | (19.051) |

General and administrative | (62.920) | | (91.049) | | (138.586) | | (102.599) | | (98.433) |

Financial | (3.546) | | (50) | | (15.391) | | (12.021) | | 56 |

Other operating revenue / (expenses) | (15.579) | | (18.626) | | (13.440) | | (8.956) | | (18.975) |

| |

| Operating result | 74.705 | | 145.868 | | 208.621 | | 119.641 | | 124.431 |

| |

| Earnings before income taxes and social contribution | 74.705 | | 145.868 | | 208.621 | | 119.641 | | 124.431 |

Income tax and social contribution | (24.450) | | (51.370) | | (70.998) | | (40.559) | | (51.920) |

Deferred taxes | (2.881) | | (2.086) | | 1.659 | | (2.385) | | 2.432 |

| |

| Minority interest | - | | (3) | | 634 | | 587 | | (366) |

| |

| Net profit (losses) | 47.374 | | 92.409 | | 139.916 | | 77.284 | | 74.577 |

16

|

| Contax Overview |

| Financial Statements: Consolidated Balance Sheet |

| | | | | | | |

| | Period ended: |

| ASSETS | 12/31/2007 | | 12/31/2008 | | 12/31/2009 | | 09/30/2010 |

| (Values in R$ ‘000) | | | | | | | |

| Current assets | 374.248 | | 524.083 | | 578.322 | | 565.023 |

| Cash & cash equivalents | 240.310 | | 355.928 | | 357.853 | | 306.522 |

| Credits (clients) | 83.492 | | 102.134 | | 128.486 | | 173.004 |

| Other credits | 1.371 | | - | | - | | - |

| Inventory | - | | - | | - | | - |

| Others | 49.075 | | 66.021 | | 91.983 | | 85.497 |

| |

| Non-current assets | 47.928 | | 79.336 | | 119.658 | | 200.701 |

| Deferred and recoverable taxes | 17.574 | | 25.346 | | 26.917 | | 39.832 |

| Judicial deposits | 17.787 | | 35.338 | | 53.382 | | 81.823 |

| Credits receivables | 11.678 | | 17.530 | | 11.425 | | 10.576 |

| Financial investments | - | | - | | 26.590 | | 66.081 |

| Other assets | 889 | | 1.122 | | 1.344 | | 2.389 |

| |

| Fixed assets | 322.443 | | 389.267 | | 432.919 | | 525.131 |

| Investments | - | | - | | - | | 74.365 |

| Plant, property & equipment | 254.467 | | 304.800 | | 352.473 | | 377.849 |

| Intangible assets | 67.976 | | 84.467 | | 80.446 | | 72.917 |

| |

| Total Assets | 744.619 | | 992.686 | | 1.130.899 | | 1.290.855 |

17

|

| Contax Overview |

| Financial Statements: Consolidated Balance Sheet |

| | | | | | | |

| | Period ended: |

| LIABILITIES AND SHAREHOLDERS’ EQUITY | 12/31/2007 | | 12/31/2008 | | 12/31/2009 | | 09/30/2010 |

| (Values in R$ ‘000) | | | | | | | |

| Current liabilities | 290.098 | | 411.393 | | 556.180 | | 501.585 |

| Short-term loans and financing | 300 | | 14.219 | | 55.070 | | 61.359 |

| Debentures | - | | - | | - | | - |

| Suppliers | 72.466 | | 76.847 | | 77.033 | | 69.933 |

| Taxes payable | 38.990 | | 68.749 | | 92.703 | | 85.906 |

| Dividend payable | 14.271 | | 51.364 | | 92.190 | | 3.192 |

| Provisions | - | | - | | - | | - |

| Related parties | - | | - | | - | | - |

| Others | 164.071 | | 200.214 | | 239.184 | | 281.195 |

| |

| Long term liabilities | 175.325 | | 296.516 | | 230.616 | | 379.204 |

| Long-term loans and financing | 100.060 | | 203.750 | | 149.521 | | 219.523 |

| Debentures | - | | - | | - | | - |

| Provisions | 46.860 | | 64.151 | | 59.921 | | 85.594 |

| Related parties | - | | - | | - | | - |

| Others | 28.405 | | 28.615 | | 21.174 | | 74.087 |

| | | | | | | |

| Minority interest | - | | 2.079 | | 1.446 | | 1.810 |

| | | | | | | |

| Shareholders’ Equity | 279.196 | | 282.698 | | 342.657 | | 408.256 |

| Capital stock | 223.873 | | 223.873 | | 223.873 | | 223.873 |

| Capital reserves | 9.254 | | 29 | | 19.639 | | 13.634 |

| Income reserves | 57.153 | | 69.880 | | 99.145 | | 96.172 |

| Accumulated profit / losses | (11.084) | | (11.084) | | - | | 74.577 |

| |

| Total Liabilities and Shareholders’ Equity | 744.619 | | 992.686 | | 1.130.899 | | 1.290.855 |

18

|

| SECTION 3.C |

| Market and Companies' Overview |

| Dedic GPTI Overview |

19

|

| Dedic GPTI Overview |

| Company Overview |

| | |

| Brief Description |

| §Founded in 2002, Dedic is currently one of the largest Brazilian contact center companies |

| | | §Part of Grupo Portugal Telecom, |

| | | §Serves clients from telecom, financials, utilities, services and other sectors |

| | | §As of March 2010, Dedic acquired all shares issued by GPTI, one of the largest provider of Information Technology (IT) solutions and Business Process Outsourcing (BPO) in Brazil, creating DEDIC GPTI |

| §GPTI: one of the largest providers of Information Technology solutions in the Brazilian market, offering a complete portfolio of solutions, which includes development of systems, network management and IT infrastructure, applications, training, business processing and IT and integrated practices (ITO and BPO). |

| |

| Recent Events |

| §February 8th, 2010: Portugal Telecom announced the acquisition of 100% of GPTI SA (“GPTI”), a player with a large experience in the Information Systems (IS) and Information Technology (IT) services market in Brazil. The acquisition was concluded with the issuance of new shares by Dedic, a PT subsidiary which operates in the Brazilian contact center market. |

| §March 2010: Dedic assumed full control of GPTI |

20

|

| Dedic GPTI Overview |

| Company Overview |

| |

| Board of Directors and Executives Board |

§Board of Directors | §Executives Board |

-Shakhaf Wine,Chairman | -Paulo Neto Leite,Chief Executive Officer |

-Fábio Carlos Pereira,Vice President | -André Halm Gomes Costa,Chief Financial Officer |

-Paulo Luís Neto de Carvalho Leite,Member | -Renato Bufálo,Contact Center Administrative Director |

-Fabiana Faé Vicente Rodrigues,Member | -Edson Moreno, IT Administrative Director |

| | |

| | | | | | | | |

| Shareholder Structure1 |

| |

| Current | | Post Transaction with Minority Shareholder |

| |

| | Number of Shares | | % of Total Capital | | | Number of Shares | | % of Total Capital |

| Portugal Telecom Brasil S.A. | 135,519,119 | | 87.5% | | Portugal Telecom Brasil S.A. | 135,519,119 | | 100.0% |

| Fabio Carlos Pereira | 19,359,874 | | 12.5% | | Total | 135,519,119 | | 100.0% |

| Total | 154,878,993 | | 100.0% | | | | | |

| |

| Source: Company |

| 1 | Based on information provided by Dedic GPTI, we considered Dedic GPTI has acquired 19,359,874 shares held by Mr. Fábio Carlos Pereira for R$23 million. This total was added to the net debt as of August 31st, 2010 for Dedic GPTI valuation. |

21

|

| Dedic GPTI Overview |

| Financial Statements: Income Statement |

| | | | | | | |

| | Twelve months period ended: | | Eight months period ended: |

| Income Statement | 12/31/2007 | | 12/31/2008 | | 12/31/2009 | | 08/30/2010 |

| (Values in R$ ‘000) | | | | | | | |

| |

| Gross revenue | 290.715 | | 331.353 | | 434.315 | | 417.404 |

Deductions | (21.048) | | (23.506) | | (32.755) | | (30.532) |

| |

| Net revenue | 269.667 | | 307.847 | | 401.560 | | 386.872 |

Cost of products sold / services rendered | (242.304) | | (253.245) | | (330.590) | | (316.105) |

| |

| Gross profit | 27.363 | | 54.602 | | 70.970 | | 70.767 |

Operating income / (expenses) | (29.642) | | (43.593) | | (57.725) | | (63.569) |

Selling | (4.467) | | (3.046) | | (2.925) | | (4.223) |

General and administrative | (25.175) | | (40.450) | | (55.504) | | (59.396) |

Equity interest | - | | - | | - | | - |

Other operating income / (expenses) | - | | (97) | | 704 | | 50 |

| |

| Earnings before financial result | (2.279) | | 11.009 | | 13.245 | | 7.198 |

Financial income | 7.603 | | 12.600 | | 3.074 | | 1.944 |

Financial expenses | (21.306) | | (27.730) | | (17.686) | | (14.018) |

| |

| Operating result | (15.982) | | (4.121) | | (1.367) | | (4.876) |

Non-operating result | (923) | | - | | - | | - |

| |

| Earnings before income tax and social contribution | (16.905) | | (4.121) | | (1.367) | | (4.876) |

Income tax and social contribution | (761) | | (912) | | - | | (35) |

Deferred income tax and social contribution | 8.015 | | 15.772 | | (2.106) | | 1.687 |

| |

| Net profit (loss) | (9.651) | | 10.739 | | (3.473) | | (3.224) |

22

|

| Dedic GPTI Overview |

| Financial Statements: Consolidated Balance Sheet |

| | | | | | | |

| | Period ended: |

| ASSETS | 12/31/2007 | | 12/31/2008 | | 12/31/2009 | | 08/31/2010 |

| (Values in R$ ‘000) | | | | | | | |

| Current assets | 51.279 | | 58.194 | | 67.463 | | 165.650 |

| Cash & cash equivalents | 22.654 | | 4.524 | | 3.169 | | 15.746 |

| Credits (clients) | 18.003 | | 41.819 | | 49.628 | | 127.768 |

| Recoverable taxes | 4.335 | | 4.518 | | 5.077 | | 8.843 |

| Deferred taxes | 1.811 | | 3.332 | | 853 | | - |

| Prepaid expenses | 25 | | 681 | | 2.298 | | 8.345 |

| Other credits | 4.451 | | 3.320 | | 6.438 | | 4.948 |

| |

| Non-current assets | 23.403 | | 39.792 | | 46.534 | | 49.583 |

| Judicial deposits | 1.941 | | 4.181 | | 6.245 | | 8.630 |

| Recoverable taxes | 2.368 | | 2.266 | | 6.570 | | 4.694 |

| Deferred taxes | 19.094 | | 33.345 | | 33.719 | | 36.259 |

| |

| Fixed assets | 49.411 | | 88.054 | | 112.261 | | 271.028 |

| Plant, properties and equipment | 49.078 | | 68.797 | | 88.571 | | 108.715 |

| Intangible assets | - | | 19.257 | | 23.691 | | 162.313 |

| Deferred assets | 333 | | - | | - | | - |

| |

| Total Assets | 124.093 | | 186.040 | | 226.258 | | 486.261 |

23

|

| Dedic GPTI Overview |

| Financial Statements: Consolidated Balance Sheet |

| | | | | | | |

| | Period ended: |

| LIABILITIES AND SHAREHOLDERS’ EQUITY | 12/31/2007 | | 12/31/2008 | | 12/31/2009 | | 08/31/2010 |

| (Values in R$ ‘000) | | | | | | | |

| Current liabilities | 52.243 | | 79.920 | | 91.997 | | 143.500 |

| Short-term loans and financing | 12.580 | | 2.771 | | 353 | | 15.475 |

| Suppliers | 6.688 | | 21.118 | | 12.612 | | 20.556 |

| Taxes recoverable | 2.043 | | 3.189 | | 4.159 | | 7.268 |

| Installment payment of taxes | 780 | | 981 | | 916 | | 2.831 |

| Wages, provisions and social contributions | 23.345 | | 29.213 | | 39.163 | | 70.991 |

| Advances from clients | - | | - | | - | | 1.513 |

| Other liabilities | - | | - | | - | | 340 |

| Related companies | 6.807 | | 22.648 | | 34.794 | | 24.526 |

| |

| Long-term liabilities | 81.140 | | 104.671 | | 83.208 | | 167.604 |

| Long-term loans and financing | 56.606 | | 60.383 | | - | | - |

| Suppliers | - | | 2.917 | | 8.439 | | 6.904 |

| Contingencies provisions | 13.459 | | 14.423 | | 11.899 | | 18.913 |

| Installment payment of taxes | 5.075 | | 4.014 | | 4.600 | | 9.347 |

| Related companies | 6.000 | | 22.934 | | 58.270 | | 132.440 |

| | | | | | | |

| Shareholders’ Equity | (9.290) | | 1.449 | | 51.053 | | 175.157 |

| Capital stock | 87.928 | | 87.928 | | 141.005 | | 262.487 |

| Capital reserves | - | | - | | - | | 5.846 |

| Accumulated profit / losses | (97.218) | | (86.479) | | (89.952) | | (93.176) |

| |

| Total Liabilities and Shareholders’ Equity | 124.093 | | 186.040 | | 226.258 | | 486.261 |

24

|

| SECTION 4 |

| General Assumptions |

25

|

| General Assumptions |

| Macroeconomic Assumptions |

| The macroeconomic assumptions reflect Banco Central’s Focus report estimates as of December 31st2010, except otherwise indicated |

| | | | | | | | | | | | | | | | | | | | | |

| Macroeconomic Assumptions | 2010E | | 2011E | | 2012E | | 2013E | | 2014E | | 2015E | | 2016E | | 2017E | | 2018E | | 2019E | | 2020E |

| |

| Gross Domestic Product | | | | | | | | | | | | | | | | | | | | | |

GDP Real Growth | 7.6% | | 4.5% | | 4.5% | | 4.6% | | 4.7% | | 4.7% | | 4.7% | | 4.7% | | 4.7% | | 4.7% | | 4.7% |

| |

| Inflation | | | | | | | | | | | | | | | | | | | | | |

IPCA | 5.9% | | 5.4% | | 4.7% | | 4.5% | | 4.5% | | 4.5% | | 4.5% | | 4.5% | | 4.5% | | 4.5% | | 4.5% |

IGPM | 11.3% | | 5.7% | | 4.7% | | 4.6% | | 4.6% | | 4.3% | | 4.3% | | 4.3% | | 4.3% | | 4.3% | | 4.3% |

U.S. Inflation (CPI)(1) | 1.5% | | 1.0% | | 1.9% | | 2.5% | | 2.8% | | 2.8% | | 2.8% | | 2.8% | | 2.8% | | 2.8% | | 2.8% |

| |

| FX rates | | | | | | | | | | | | | | | | | | | | | |

R$/US$ FX rate – Average | 1.76 | | 1.73 | | 1.80 | | 1.85 | | 1.89 | | 1.92 | | 1.95 | | 1.98 | | 2.01 | | 2.05 | | 2.08 |

R$/US$ FX rate – End of period | 1.67 | | 1.75 | | 1.82 | | 1.86 | | 1.90 | | 1.93 | | 1.96 | | 2.00 | | 2.03 | | 2.06 | | 2.10 |

| |

| Interest rate | | | | | | | | | | | | | | | | | | | | | |

Average SELIC | 9.9% | | 12.1% | | 11.3% | | 10.5% | | 10.0% | | 9.8% | | 9.8% | | 9.8% | | 9.8% | | 9.8% | | 9.8% |

|

| Since Focus estimates are published for the next 5 years, following the sixth year the estimates were maintained constant at the same levels of the fifth year, |

| except for FX rates, which were adjusted to reflect the maintenance of the purchase power parity between Brazil and U.S. currencies |

| |

| Source: Banco Central’s Focus report as of December 31st2010 |

| Notes: | |

| 1 | Source: Economist Intelligence Unit, as of December 31st2010 |

26

|

| SECTION 5 |

| Contax Valuation |

27

|

| SECTION 5.A |

| Contax Valuation |

| Discounted Cash Flow |

28

|

| General Considerations on the Valuation |

| BTG Pactual evaluated Contax based on the discounted cash flow to firm ("FCFF") methodology |

| | | |

| Valuation Methodology | |

| §Unlevered cash flow method |

| | - | Projection of unlevered cash flows |

| | - | Cash flows are discounted by company’s weighted average cost of capital (WACC), when calculating its present value |

| |

| |

| Information Sources | |

| §BTG Pactual used, for the purposes of the valuation, the operating and financial projections provided and / or discussed with Contax management, in R$ nominal terms |

| |

| |

| Currency | |

| §Projection in R$, in nominal terms |

| §The unlevered cash flow is converted yearly into US$ before it is discounted |

| |

| |

| Discounted cash flow | |

| §Data base: December 31st2010; cash flows are discounted to present value to December 31st2010 |

| §Projections horizon: 2011 to 2020 |

| §Assumes cash flows are generated over the year (“mid-year convention”) |

| §Discounted cash flows are in US$, in nominal terms |

29

|

| Main Assumptions |

| BTG Pactual considered, for purposes of the calculation of the fair economic value, operating and financial estimates supplied and/or discussed with Contax management team |

| | |

| Macroeconomic | | §Banco Central’s Focus report dated December 31st, 2010 and Economist Intelligence Unit dated December 31st, 2010 |

| | | |

| Revenue growth | | §2011 growth was based in the expected growth in volume on existing clients and in new services and clients currently in Company’s commercial pipeline |

| §Revenues from 2012 to 2014 were estimated based on expected market growth for each business |

| §Revenues from 2015 to 2020 assume a 5.0% y.o.y. growth in nominal terms, based on Company’s estimates |

| | | |

Operating costs

and expenses(1) | | §Assumes a slight decrease in EBITDA margin in 2010 and 2011, mainly due to specific factors that generated lower productivity in operations |

| §After 2012 Company expects margins recovery, given new initiatives to increase productivity in main clients |

| §After 2012 Company expects stable margins, with limited efficiency gains in the long-term |

| | | |

| Investments | | §Projected based on the ammount needed to restore the assets depreciation and to meet Company’s growing need for operating infrastructure each year |

| | §In 2011 larger investments are expected in the replacement of a relevant technology platform and transfer of operations to the Northeast |

| | | |

| Working capital | | |

| §According to Company’s estimates, based on historical days receivable and payable |

| | |

| | | |

| Terminal value | | §Gordon perpetuity growth model(2), in 2020 |

| §Assumes perpetuity growth rate ranges from 1.5% to 2.5% in US$ nominal terms |

| | | |

| Discount rate | | §Calculated based on: (i) Contax de-levered beta, (ii) target capital structure based on discussions with Company’s management team, (iii) country risk and (iv) equity market risk premium(3) |

| |

| Note: | |

| 1 | Costs herein contemplated were projected without considering depreciation and amortization expenses. |

| 2 | Estimated based on the free cash flow of the last projection year, increased by the growth expectancy, using the Constant Growth Model or Gordon Model as per the equation demonstrated in Appendix C. |

| 3 | Long-term equity market risk premium estimated on historical basis. Source: 2009 Ibbotson report. |

30

|

| Operating and Financial Summary Projections |

| Net Revenues and Gross Profit |

|

| Net Revenues (R$ million) |

| CAGR (2010E-2020E): 6.6% |

|

| Gross Profit (R$ million) and Gross Margin1 |

| CAGR (2010E-2020E): 6.6% |

|

| Note: |

| 1) Excludes depreciation and amortization expenses. |

31

|

| Operating and Financial Summary Projections |

| Operating Costs |

|

| Operating Costs (R$ million) |

| CAGR (2010E-2020E): 6.6% |

|

| Operating Costs Composition (% of Total) |

|

| Note: figures exclude depreciation and amortization expenses. |

32

|

| Operating and Financial Summary Projections |

| Operating Expenses and EBITDA |

|

| Operating Expenses (R$ million) and % of Net Revenues |

| EBITDA(R$ million) andEBITDAMargin |

|

| Note: figures exclude depreciation and amortization expenses. |

33

|

| Operating and Financial Summary Projections |

| Investments and Depreciation |

| Investments (R$ million) |

|

| Depreciation and Amortization (R$ million) |

34

|

| Valuation |

| Discounted Cash Flow |

|

| Free Cash Flow to Firm (R$ million, except otherwise indicated) |

| | | | | | | | | | | | | | | | | | | | | |

| | 2011E | | 2012E | | 2013E | | 2014E | | 2015E | | 2016E | | 2017E | | 2018E | | 2019E | | 2020E | | Perpetuity |

| |

| Earnings before interest and taxes (EBIT) | 236 | | 290 | | 301 | | 310 | | 308 | | 307 | | 312 | | 369 | | 411 | | 427 | | 427 |

| (-) Taxes | (80) | | (99) | | (102) | | (105) | | (105) | | (104) | | (106) | | (126) | | (140) | | (145) | | (145) |

| Net operating profit after taxes (NOPAT) | 156 | | 191 | | 199 | | 205 | | 204 | | 203 | | 206 | | 244 | | 271 | | 282 | | 282 |

| (+) Depreciation and amortization | 105 | | 122 | | 146 | | 170 | | 196 | | 223 | | 245 | | 215 | | 202 | | 217 | | 217 |

| (+/-) Working capital variation | 18 | | 18 | | 18 | | 17 | | 12 | | 13 | | 14 | | 14 | | 15 | | 16 | | 16 |

| (-) Investments | (313) | | (126) | | (177) | | (186) | | (193) | | (199) | | (205) | | (211) | | (221) | | (232) | | (232) |

| |

| Free cash flow to firm (R$ mm) | (34) | | 206 | | 185 | | 206 | | 219 | | 240 | | 259 | | 262 | | 267 | | 282 | | 282 |

| Free cash flow to firm (US$ mm) | (20) | | 114 | | 100 | | 109 | | 114 | | 123 | | 131 | | 130 | | 131 | | 136 | | 136 |

|

| Fair Economic Value based on the Discounted Cash Flow to Firm Methodology |

| The fair economic value range of Contax shares calculated based on the discounted cash flow methodology, as of 12/31/2010, is from R$37.64 to R$40.30 per ON share and from R$37.59 to R$40.24 per PN share(1) |

| | | | | | | | | | |

| Perpetuity growth rate (US$ nominal terms) | | 1.50% | | 1.75% | | 2.00% | | 2.25% | | 2.50% |

| WACC (US$ nominal terms) | | 10.0% | | 10.0% | | 10.0% | | 10.0% | | 10.0% |

| Enterprise value (R$ million) | | $2,143 | | $2,179 | | $2,217 | | $2,258 | | $2,301 |

| (-) (Net debt) net cash (R$ million) | | $90 | | $90 | | $90 | | $90 | | $90 |

| Equity value (R$ million) | | $2,233 | | $2,269 | | $2,307 | | $2,347 | | $2,390 |

| Number of ON shares (million) | | 22.7 | | 22.7 | | 22.7 | | 22.7 | | 22.7 |

| Price per ON share (R$ / share) | | $37.64 | | $38.24 | | $38.88 | | $39.57 | | $40.30 |

| Number of PN shares (million) | | 36.7 | | 36.7 | | 36.7 | | 36.7 | | 36.7 |

| Price per PN share (R$ / share) | | $37.59 | | $38.20 | | $38.84 | | $39.52 | | $40.24 |

| Ratio ON / PN share price(2) | | 1.001 | | 1.001 | | 1.001 | | 1.001 | | 1.001 |

| |

| Source: Company, financial statements as of 09/30/2010 and BTG Pactual |

| 1 | Assumes a range in perpetuity growth rate from 1.5% to 2.5% in US$ nominal terms |

| 2 | Assumes a ON/PN ratio based on the average spread of ON / PN shares, based on the VWAP during the 60 days prior to December 31st, 2010. |

35

|

| SECTION 5.B |

| Contax Valuation |

| Comparable Companies Trading Multiples |

36

|

| Comparable Companies Trading Multiples |

| The value of Contax share price ranges from R$39.93 to R$47.54 per share, based on comparable companies 2011 and 2012 EV/EBITDA trading multiples |

| | |

| Fair economic value based on the comparable companies trading multiples method |

| (R$ million, except price per share) | | |

| | 2011E | 2012E |

| EBITDA | 341.1 | 412.0 |

| EV/EBITDA Multiple(1) | 6.7x | 6.6x |

| Enterprise value | 2,280.7 | 2,732.8 |

| (-) (Net debt) net cash(2) | 89.7 | 89.7 |

| Equity value | 2,370.5 | 2,822.5 |

| Number of shares (million)(3) | 59.4 | 59.4 |

| R$/share | 39.93 | 47.54 |

| |

| Source: Company and BTG Pactual |

| Note: | |

| 1 | Considers the median of trading multiples of comparable companies as of December 31st2010. Details on the calculation of negotiation multiples is detailed in Appendix B - Comparable Companies Trading Multiples, page 60 of this report. Source: Factset. |

| 2 | As of September 30th2010. |

| 3 | Excludes treasury shares. |

37

|

| SECTION 5.C |

| Contax Valuation |

| Accounting Book Value |

38

|

| Accounting Book Value |

| Contax value is R$6.88 per share, based on its accounting book value |

| |

| Book Value | |

| As of September 30th2010 | |

| (R$ million, except otherwise indicated) | |

| |

| Total assets | 1,290.9 |

| (-) Total liabilities | 880.8 |

| (-) Minority interest | 1.8 |

| = Shareholders’ equity | 408.3 |

| |

| Number of shares (million)(1) | 59.4 |

| |

| R$/share | 6.88 |

| |

| Source: CVM and Company. |

| Note: | |

| 1 | Excludes treasury shares |

39

|

| SECTION 5.D |

| Contax Valuation |

| Volume Weighted Average Price |

40

|

| Volume Weighted Average Price |

| Price evolution of Contax shares negotiated in the BOVESPA |

|

| (Price in R$ per share and volume in R$ million) |

| | |

| ON Shares (CTAX3) | | PN Shares (CTAX4) |

| |

|

|

| Source: CVM and Economática, as of Decemeber 31st2010. Prices are adjusted for dividends and corporate events. |

| Note: number of shares excludes treasury shares. |

41

|

| Volume Weighted Average Price |

| Volume weighted average price of Contax shares negotiated in the BOVESPA |

| (R$, except otherwise indicated) |

| | | |

| | ON Shares | PN Shares | Total Shares |

| 12 months prior to 12-31-10 (included) | | | |

| VWAP | 29.594 | 25.292 | |

| Number of shares (million) | 22.7 | 36.7 | 59.4 |

| Market value (R$ million) | 671.4 | 927.7 | 1,599.1 |

| |

| 6 months prior to 12-31-10 (included) | | | |

| VWAP | 31.042 | 26.607 | |

| Number of shares (million) | 22.7 | 36.7 | 59.4 |

| Market value (R$ million) | 704.3 | 976.0 | 1,680.2 |

| |

| 3 months prior to 12-31-10 (included) | | | |

| VWAP | 31.164 | 29.817 | |

| Number of shares (million) | 22.7 | 36.7 | 59.4 |

| Market value (R$ million) | 707.1 | 1,093.7 | 1,800.8 |

| |

| 2 months prior to 12-31-10 (included) | | | |

| VWAP | 31.036 | 30.997 | |

| Number of shares (million) | 22.7 | 36.7 | 59.4 |

| Market value (R$ million) | 704.1 | 1,137.0 | 1,841.1 |

| |

| 1 month prior to 12-31-10 (included) | | | |

| VWAP | 30.663 | 31.136 | |

| Number of shares (million) | 22.7 | 36.7 | 59.4 |

| Market value (R$ million) | 695.7 | 1,142.1 | 1,837.8 |

| |

| Source: | CVM and Economática, as of December 31st2010. Prices are adjusted for dividends and corporate events. |

| Note: | |

| (1) | Number of shares excludes treasury shares |

| (2) | VWAP of ON and PN shares, calculated based on the market value divided by total shares |

42

|

| SECTION 6 |

| Dedic GPTI Valuation |

43

|

| SECTION 6.A |

| Dedic GPTI Valuation |

| Discounted Cash Flow |

44

|

| General Considerations on the Valuation |

| BTG Pactual evaluated Dedic GPTI based on the discounted cash flow to firm ("FCFF") methodology |

| | | |

| Valuation Methodology | |

| §Unlevered cash flow method |

| | - | Projection of unlevered cash flows |

| | - | Cash flows are discounted by company’s weighted average cost of capital (WACC), when calculating its present value |

| |

| |

| Information Sources | |

| §BTG Pactual used, for the purposes of the valuation, the operating and financial projections provided and / or discussed with companies’ management teams, in R$ nominal terms |

| |

| |

| Currency | |

| §Projection in R$, in nominal terms |

| §The unlevered cash flow is converted yearly into US$ before it is discounted |

| |

| |

| Discounted cash flow | |

| §Data base: December 31st2010; cash flows are discounted to present value to December 31st2010 |

| §Projections horizon: 2011 to 2020 |

| §Assumes cash flows are generated over the year (“mid-year convention”) |

| §Discounted cash flows are in US$, in nominal terms |

45

|

| Main Assumptions |

| BTG Pactual considered, for purposes of the calculation of the fair economic value, operating and financial estimates supplied and/or discussed with Dedic GPTI management teams |

| | | |

| Macroeconomic | | §Banco Central’s Focus report dated December 31st, 2010 and Economist Intelligence Unit dated December 31st, 2010 |

| |

| Revenue growth | | §Dedic: | |

| | | §Projections based on Company’s pipeline for 2011 and market growth for 2012, 2013 and 2014 |

| | | §Revenues from 2015 to 2020 assume 5% y.o.y. growth rate in nominal terms |

| | | §Revenue / Service Station (“PA”) grows according to inflation y.o.y. |

| | | §Assumes an important contract cancellation at the end of 2012 |

| §GPTI: | |

| | | §Projections based on Company’s pipeline, market growth and growth with cross-selling of products |

| | | |

Operating costs

and expenses(1) | | §Dedic: | |

| | | §Gross margin gains deriving from higher operating efficiency and consequently reduction of the average number of employees per service station (PA) |

| | | §Higher operating efficiency throughout the projection period |

| §GPTI: | |

| | | §Gross margin evolution according to efficiency gains and change in mix |

| | | §Gains with dilution of operating expenses |

| |

| Investments | | §Dedic: expansion investments realized one year in advance (R$20.6 thousand per new PA) and maintenance investments based on the number of PAs in the previous year (R$3.2 thousand per existing PA) |

| §GPTI: investments projected based on the needs per service line |

| |

| Working capital | | §According to Company’s estimates, based on historical days receivable and payable for both Dedic and GPTI |

| |

| Terminal value | | §Gordon perpetuity growth model(2), in 2020 |

| §Assumes perpetuity growth rate ranges from 1.5% to 2.5% in US$ nominal terms |

| |

| Discount rate | | §Calculated based on: (i) Dedic GPTI de-levered beta, (ii) target capital structure based on discussions with Companies’ management teams, (iii) country risk and (iv) equity market risk premium(3) |

| |

| Note: | |

| 1 | Costs herein contemplated were projected without considering depreciation and amortization expenses. |

| 2 | Estimated based on the free cash flow of the last projection year, increased by the growth expectancy, using the Constant Growth Model or Gordon Model as per the equation demonstrated in Appendix C. |

| 3 | Long-term equity market risk premium estimated on historical basis. Source: 2009 Ibbotson report. |

46

|

| Operating and Financial Summary Projections |

| Revenue and Costs |

|

| Operating Costs (R$ million)1 |

|

| Note: assumes an important contract cancellation at the end of 2012. |

| 1) Excludes depreciation and amortization expenses. |

47

|

| Operating and Financial Summary Projections |

| Gross Profit and Gross Margin |

| Gross Profit (R$ million) |

|

| Gross Margin (% of Net Revenue) |

|

| Note: assumes an important contract cancellation at the end of 2012. |

| Figures exclude depreciation and amortization expenses. |

48

|

| Operating and Financial Summary Projections |

| Operating Expenses and % of Net Revenue |

| Operating Expenses (R$ million) |

| Operating Expenses (% of Net Revenue) |

|

| Note: assumes an important contract cancellation at the end of 2012. |

| Figures exclude depreciation and amortization expenses. |

49

|

| Operating and Financial Summary Projections |

| EBITDA and EBITDA Margin |

| EBITDA (R$ million) |

|

| Note: assumes an important contract cancellation at the end of 2012. |

50

|

| Operating and Financial Summary Projections |

| Investments and Depreciation |

| Investments (R$ million) |

|

| Depreciation and Amortization(1)(R$ million) |

| |

| Note: assumes an important contract cancellation at the end of 2012. |

| 1 | Considers the amortization of the goodwill from GPTI acquisition in 5 years. |

51

|

| Valuation |

| Discounted Cash Flow |

| | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | |

| | | 2011E | | 2012E | | 2013E | | 2014E | | 2015E | | 2016E | | 2017E | | 2018E | | 2019E | | 2020E | | Perpetuity |

| |

| Earnings before interest and taxes (EBIT) | | 26 | | 2(1) | | 12 | | 25 | | 42 | | 69 | | 71 | | 76 | | 83 | | 91 | | 91 |

| (-) Taxes | | (9) | | (7) | | (8) | | (9) | | (14) | | (23) | | (24) | | (26) | | (28) | | (31) | | (31) |

| Net operating profit after taxes (NOPAT) | | 17 | | (5) | | 4 | | 16 | | 27 | | 46 | | 47 | | 50 | | 55 | | 60 | | 60 |

| (+) Depreciation and amortization | | 59 | | 65 | | 59 | | 59 | | 49 | | 29 | | 34 | | 36 | | 37 | | 37 | | 37 |

| (+/-) Working capital variation | | (24) | | (11) | | 18 | | (12) | | (6) | | (6) | | (7) | | (7) | | (7) | | (8) | | (8) |

| (-) Investments | | (35) | | (14)(2) | | (41) | | (30) | | (34) | | (36) | | (38) | | (40) | | (42) | | (44) | | (44) |

| |

| Free cash flow to firm (R$ mm) | | 17 | | 34 | | 41 | | 32 | | 37 | | 32 | | 36 | | 40 | | 43 | | 46 | | 46 |

| Free cash flow to firm (US$ mm) | | 10 | | 19 | | 22 | | 17 | | 19 | | 16 | | 18 | | 20 | | 21 | | 22 | | 22 |

Fair Economic Value based on the Discounted Cash Flow to Firm Methodology |

| The fair economic value of Dedic GPTI shares calculated based on the discounted cash flow methodology, as of 12/31/2010 ranges from R$1.38 to R$1.57 per share(3) |

| Perpetuity growth rate (US$ nominal terms) | | 1.50% | | | | | | 1.75% | | | | 2.00% | | | | 2.25% | | | | | | 2.50% |

| WACC (US$ nominal terms) | | 10.0% | | | | | | 10.0% | | | | 10.0% | | | | 10.0% | | | | | | 10.0% |

| Enterprise value (R$ million) | | $371 | | | | | | $377 | | | | $383 | | | | $390 | | | | | | $397 |

| (-) (Net debt) net cash (R$ million)(4) | | ($184) | | | | | | ($184) | | | | ($184) | | | | ($184) | | | | | | ($184) |

| Equity value (R$ million) | | $187 | | | | | | $193 | | | | $199 | | | | $206 | | | | | | $213 |

| Number of shares (million) | | 135.5 | | | | | | 135.5 | | | | 135.5 | | | | 135.5 | | | | | | 135.5 |

| Price per share (R$ / share) | | $1.38 | | | | | | $1.42 | | | | $1.47 | | | | $1.52 | | | | | | $1.57 |

| |

| Source: Company, financial statements as of 08/30/2010 and BTG Pactual. Note: assumes an important contract cancellation at the end of 2012. |

| 1 | Considers approximately R$29 million in non-recurring expenses with cancellation costs of an important contract at the end of 2012. |

| 2 | Considers approximately R$29 milllion of asset sale (at cost) as a result of the cancellation of an important contrat at the end of 2012. |

| 3 | Assumes a range in perpetuity growth rate from 1.5% to 2.5% in US$ nominal terms. |

| 4 | As of August 31st2010, plus R$23 milllion as per note below. |

| 5 | Based on information provided by Dedic GPTI, we considered Dedic GPTI has acquired 19,359,874 shares held by Mr. Fábio Carlos Pereira for R$23 million. This total was added to the net debt as of August 31st, 2010 for Dedic GPTI valuation. |

52

|

| SECTION 6.B |

| Dedic GPTI Valuation |

| Comparable Companies Trading Multiples |

53

|

| Comparable Companies Trading Multiples |

| The value of Dedic GPTI share price ranges from R$2.82 to R$3.34 per share, based on comparable companies 2011 and 2012 EV/EBITDA trading multiples |

| | | | |

| Fair economic value based on the comparable companies trading multiples method | |

| (R$ million, except price per share) | | | | |

| | 2011E | | 2012E | |

| EBITDA | 84.7 | | 95.9 | |

| EV/EBITDA Multiple(1) | 6.7x | | 6.6x | |

| Enterprise value | 566.6 | | 636.3 | |

| (-) (Net debt) net cash(2) | (183.9) | | (183.9) | |

| Equity value | 382.7 | | 452.4 | |

| Number of shares (million) | 135.5 | | 135.5 | |

| R$/share | 2.82 | | 3.34 | |

| |

| Source: Company and BTG Pactual |

| 1 | Considers the median of trading multiples of comparable companies as of December 31st2010. Details on the calculation of negotiation multiples is detailed in Appendix B - Comparable Companies Trading Multiples, page 60 of this report. Source: Factset. |

| 2 | As of August 31st2010, plus R$23 milllion as per note below. |

| 3 | Based on information provided by Dedic GPTI, we considered Dedic GPTI has acquired 19,359,874 shares held by Mr. Fábio Carlos Pereira for R$23 million. This total was added to the net debt as of August 31st, 2010 for Dedic GPTI valuation. |

54

|

| SECTION 6.C |

| Dedic GPTI Valuation |

| Accounting Book Value |

55

|

| Accounting Book Value |

| Contax value is R$6.88 per share, based on its accounting book value |

| |

| Book Value | |

| As of September 30th2010 | |

| (R$ million, except otherwise indicated) | |

| |

| Total assets | 1,290.9 |

| (-) Total liabilities | 880.8 |

| (-) Minority interest | 1.8 |

| = Shareholders’ equity | 408.3 |

| |

| Number of shares (million)(1) | 59.4 |

| |

| R$/share | 6.88 |

| |

| Source: CVM and Company. |

| Note: | |

| 1 | Excludes treasury shares |

56

|

| Accounting Book Value |

| Dedic GPTI value is R$1.13 per share, based on its accounting book value |

| |

| Book Value | |

| As of August 31st2010 | |

| (R$ million, except otherwise indicated) | |

| |

| Total assets | 486.3 |

| (-) Total liabilities | 311.1 |

| (-) Minority interest | 0.0 |

| = Shareholders’ equity | 175.2 |

| |

| Number of shares (million) | 154.9 |

| |

| R$/share | 1.13 |

| | |

| Source: Company. |

| Note | | |

| 1 | . | Book value as of August 31st2010, before the transaction between the Company and Mr. Fábio Carlos Pereira |

57

|

| APPENDIX A |

| Companies' Weighted Average Cost of Capital (WACC) |

58

| | | | | | | | | | | | | | | | | |

| Companies' Weighted Average Cost of Capital (WACC) |

| |

| Beta Analysis | | | | | | | | | | | | | | | | | |

| Companies in the Sector | Price per

Share

(Local

Currency) | | # of

Shares

(million) | | Market

Value

(Local Cy

million) | | Net Debt

(Local Cy

million) | | Debt/

Market

Value (%) | | Tax

Rate

(%) | | Leverage

Factor(1) | | Leveraged

Beta(2) | | Unlevered

Beta(3) |

| Contax Participacoes Sa | 32.0 | | 59.4 | | 1,899.2 | | (91.7) | | 0.0% | | 34.0% | | 1.00 | | 0.43 | | 0.43 |

| Teleperformance | 25.6 | | 56.5 | | 1,448.4 | | (40.8) | | 0.0% | | 33.3% | | 1.00 | | 0.63 | | 0.63 |

| Convergys Corporation | 13.8 | | 121.8 | | 1,675.2 | | 36.9 | | 2.2% | | 40.0% | | 1.01 | | 1.35 | | 1.33 |

| Sykes Enterprises, Incorporated | 19.9 | | 46.9 | | 931.9 | | (206.1) | | 0.0% | | 40.0% | | 1.00 | | 0.98 | | 0.98 |

| TeleTech Holdings Inc. | 20.7 | | 59.1 | | 1,224.9 | | (156.8) | | 0.0% | | 40.0% | | 1.00 | | 0.95 | | 0.95 |

| Telegate AG | 7.6 | | 21.2 | | 161.4 | | (57.9) | | 0.0% | | 29.4% | | 1.00 | | 0.47 | | 0.47 |

| TIVIT Terceirização de Tecnologia e Serviços S/A | 19.2 | | 89.0 | | 1,708.6 | | 120.5 | | 7.1% | | 34.0% | | 1.05 | | 0.47 | | 0.45 |

| Average | | | | | | | | | | | | | | | | | 0.75 |

| | | | |

| Weighted Average Cost of Capital (WACC) |

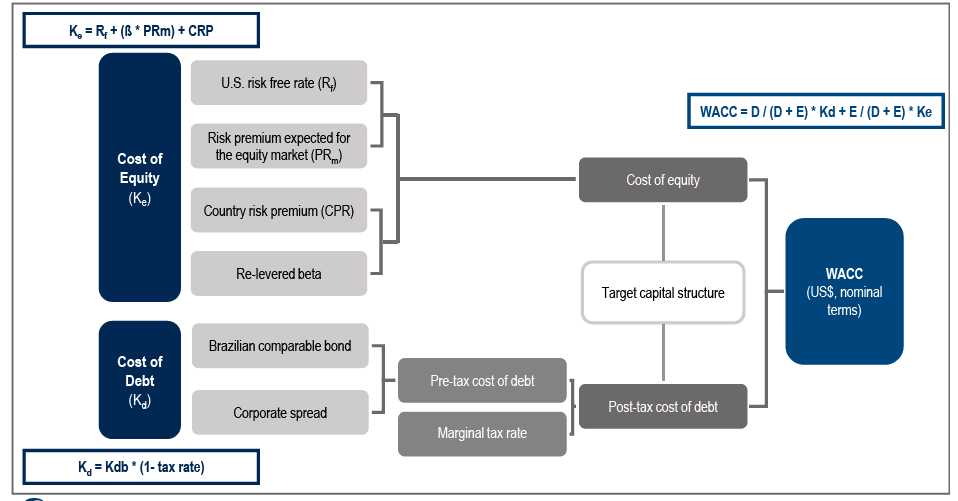

| Cost of Equity - Ke (US$ in nominal terms) | | Weighted Average Cost of Capital (WACC, US$ in nominal terms) |

| U.S. risk free rate (Rf)(4) | 3.2% | | Pre tax cost of debt (US$ in nominal terms) | 10.0% |

| Country risk premium(5) | 2.0% | | Post tax cost of debt (US$ in nominal terms) | 6.6% |

| Risk premium expected for the equity market (PRm)(6) | 6.5% | | | |

| Unlevered beta | 0.75 | | Target Debt / (Debt + Equity) | 30.0% |

| Tax rate | 34.0% | | Target Equity / (Debt + Equity) | 70.0% |

| Targe capital structure (Debt / Equity) | 30.0% | | | |

| Leveraging factor | 1.28 | | Weighted Average Cost of Capital (WACC, US$ in nominal terms)(9) | 10.0% |

| “Re-levered“ beta(7) | 0.96 | | | |

| Cost of Equity - Ke (US$ in nominal terms)(8) | 11.5% | | | |

| |

| Source: Bloomberg and Capital IQ as of December 31st2010. |

| Notes: | |

| 1 | Leveraging factor = (1+((1- marginal tax rate) * % debt / equity). |

| 2 | Levered beta: result from regression analysis based on share price and the benchmark index in the last 104 weeks. Source: Capital IQ. |

| 3 | Unlevered beta = Levered beta / Leveraging factor. |

| 4 | U.S. risk free rate is calculated based on teh average return of U.S. 10-year treasury bond over the last 12 months ended December 31st2010. |

| 5 | Country risk premium (CPR) calculated based in the average of EMBI+ Brasil in the last 12 months ended December 31st2010. |

| 6 | Long term equity market risk premium estimated based on historial data. Source: 2009 Ibbotson report. |

| 7 | “Re-levered” beta: (Unlevered Beta * Leveraging factor). |

| 8 | Cost of equity (Ke) = U.S. risk free rate + “re-levered” beta * (equity market risk premium) + country risk premium. |

| 9 | Weighted average cost of capital (WACC) = post tax cost of debt * [debt /(debt + equity)] + cost of equity * [equity / (debt + equity)]. |

59

|

| APPENDIX B |

| Comparable Companies Trading Multiples |

60

|

| Comparable Companies Trading Multiples |

| | | | | | | | | |

| | | | | | | | EV / EBITDA |

| In USD million, except price per share | Price per

Share (US$) | | Market

Value | | Enterprise

Value | | 2011E | | 2012E |

| |

| Convergys Corp. | 13.75 | | 1,675.2 | | 1,903.7 | | 6.5x | | 6.0x |

| Sykes Enterprises Inc. | 19.89 | | 931.9 | | 728.5 | | 5.6x | | 7.0x |

| Teletech Holdings Inc. | 20.72 | | 1,224.9 | | 1,071.1 | | 6.8x | | 6.6x |

| Tivit Terceirizacao de Processos Servicos e Tecnologia S/A | 11.43 | | 1,016.9 | | 1,088.0 | | 7.0x | | n.d. |

| |

| | | | | | Average | | 6.5x | | 6.5x |

| | | | | | Median | | 6.7x | | 6.6x |

|

| Source: Factset, as of December 31st2010. Estimates based on market consensus |

61

|

| Description of the Comparable Companies |

To evaluate the companies based on comparable companies trading multiples, it was used as reference Brazilian andinternational comparable companies |

| | |

| Convergys Corp. | |

| • | North American company focusedon payables outsourcing and services and solutions management. |

| |

| |

| Sykes Enterprises Inc | |

| • | North American company focused on IT outsourcing |

| |

| |

| TeleTech Holdings Inc | |

| • | TeleTech offers outsourcing services around the World. The company operates mainly in two segments: (i) client management; and (ii) Marketing |

| • | Database Marketing and Consultancy |

| |

| Tivit | |

| • | Tivit is one of the first Brazilian companies to offer integrated services of IT, Systems and BPO -Business Process Outsourcing |

62

|

| APPENDIX C |

| Description of Valuation Methodologies |

63

|

| Valuation Model Structure |

| Method for the construction of the Free Cash Flow to Firm (FCFF) |

64

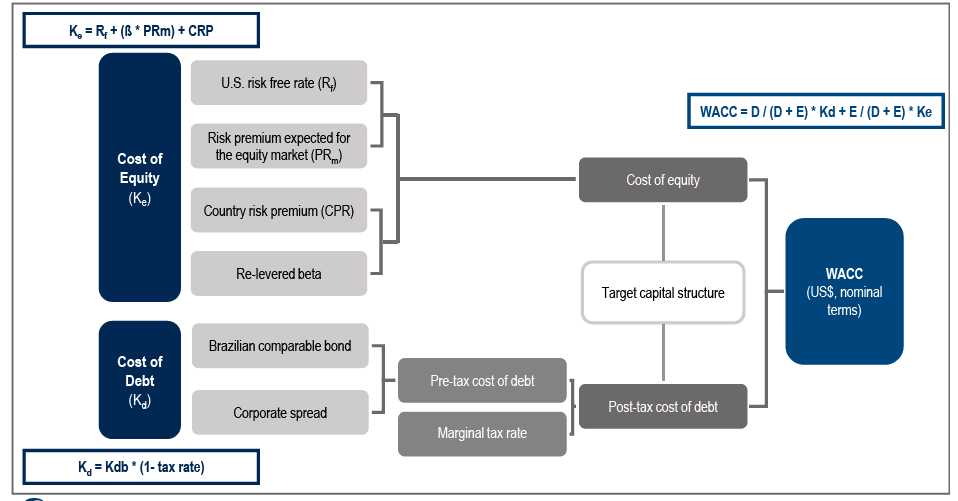

WACC Calculation

WACC wascalculatedwith thecombinationof cost of equity (Ke) and cost of debt (Kd)estimatedfor thecompanyunderanalysis, consideringa target capitalstructure

- Kewas estimated by the evaluator based on the CAPM - Capital Asset Pricing Model, adjusted for country’s risk

- Kdwas estimated by the evaluator considering the credit risk and debt capital markets current dynamics

65

|

| Constant Growth Model or Gordon Model |

| The Constant Growth Model or Gordon Model was used when calculating the perpetuity |

| | | | | |

| | | | | • FCF(n): | Free cash flow in the last projected year |

| | | FCF(n) x (1+g)

WACC - g | | | |

| Perpetuity | = | | •“g”: | Constant perpetuity growth rate of cash flows during the period after projections |

| | | | | |

| | | | | •WACC: | Weighted average cost of capital using company’s target capital structure |

66

|

| Comparable Companies Trading Multiples |

Assesses the company’s value based on market multiples of other publicly traded companies with similar financial andoperating characteristics |

|

| Once the universe ofcomparable companies is selected, company’s implied firm and equity values are calculated by multiplying its metrics (eg net income, EBITDA) by the respective multiples of the universe of comparables |

| |

| The value of comparable companies typically do not incorporate control premiums reflected in mergers and acquisitions transactions involving comparable companies |

| |

| The key element in the comparable companies analysis is to identify the comparability and relevance |

| | |

| | | A good comparable is the one thathas operating and financial characteristics similar to the company under evaluation |

| | |

| | | Examples of operating characteristics: industry expertise, products, markets, customers, seasonality and cyclicality |

| | |

| | | Examples of financial characteristics: size, leverage, shareholder base, growth and margins |

67

|

| APPENDIX D |

| Terms and Definitions Used in the Valuation Report |

68

|

Terms and Definitions Used in the Valuation Report |

- Beta:index that measures the non-diversifiable risk of a stock. Beta measures the relationship between the return of a stock and the marketreturn. Thus, the risk premium will always be multiplied by this coefficient, demanding a higher premium for risk the higher is the change in stockprices versus market return

- Call center / contact center:service centers designed to connect with consumers in an active (connection made from the company to thecustomer) or receptive (from the client to the company), using telephone or other communication channels. Contact center is the broader term,which includes contact by email, fax, chat and voice over IP, for example.

- Capex:capital expenditures, or maintenance and/or capacity expansion investments

- CAPM:capital asset pricing model

- EBIT:earnings before interest and taxes

- EBITDA:earnings before interest, taxes, depreciation and amortization

- FCFF:free cash flow to firm

- LTM:last twelve months

- NOPAT:net operating profit after taxes

- PA:position or service station. It consists of the physical installation (desk, computer, telephones, etc.) used by call center operators.

- Spread:price ratio among two different stocks.

- VWAP:volume weighted average price

- WACC:weighted average cost of capital

69

|

| APPENDIX E |

| Additional Statements and Information |

70

|

| Additional Statements and Information |

ThisValuationReport waspreparedby Banco BTG Pactual S.A. under thesolicitationof ContaxParticipaçõesS.A.(“Contax”),in the context of aincorporationof the total shares issued by Mobitel S.A. (“Dedic GPTI”) by Contax(“Transaction”),for which BTG Pactual was hired toevaluatethe shares of Contax and Dedic GPTI,accordingto the Law 6.404, ofDecember15, 1976 andInstructionCVM 319, ofDecember3, 1999.

The BTG Pactual states that theinformation presentedherein are updated in relation to the limit date of January 25th2011.

The BTG Pactualhighlightsthat its services does not includeadvisementof any nature, such as Legal orAccounting.The content of this material is not and shall not beconsidereda promise or aguaranteein relation to the past or future, neither beconsidereda pricerecommendationfor theTransaction.

The BTG Pactualhighlightsthat theValuationof thecompanieswas made in asegregatedmanner,disregardingpossible impacts related to theTransaction,anddisregardingpossiblesynergies positivesornegativescreated by thecombinationwith Contax.

Theinformation obtainedby BTG Pactual from public sources or from sources that to the best of BTGPactual’s knowledgewasconsidered trustable,has beenincludingfinancialstatementsmadeavailableonSeptember30th, 2010regardingContax and August 31st, 2010regardingDedic GPTI, which was audited by theindependentauditors of theCompanies.Delloitte ToucheTohmatsuin both cases. The BTG Pactual hasobtained informationfrom public sources which wasconsidered trustable, howeverthe BTG Pactual didn’t make anindependent verificationof suchinformationand ofinformation receivedfrom theCompaniesor from the third-parties hired by theCompanies,eitherassumes responsibilitiesfor theprecision, accuracyorcompletenessof suchinformation.

TheCompanies,throughprofessionals designated,has madeavailable informationrelated to data,projections, assumptionsand forecast related to theCompaniesand to markets on which theCompanywasoperatingused in thisValuationReport. Thecompanieswill bereferencedin thisValuationReport jointly as“Information Suppliers”

The BTG Pactual has based its analysis in theinformation mentionedabove and ondiscussionswith theprofessionalsof theCompaniesand otherrepresentativesof theCompanies,and the BTG Pactual didn’t verifiedindependentlyanyinformationpubliclyavailableorfurnishedto BTG Pactual in thepreparationof thisValuationReport. The BTG Pactual does not express any opinion about thereliabilityof theinformation mentionedandhighlightsthat any errors orchangesof thatinformationcould affectsignificantlythe BTGPactual’s analyses.

During thedevelopmentof our work, we runanalyses procedureswhen it wasnecessary. However,wehighlightthat our work ofValuationdidn’t intend to be an audit of financialstatementsor of any otherinformation furnishedby theInformation Suppliers,and it cannot beconsideredsuch as. Our work took into account therelevanceof each item, so, theInformation Suppliershasassumedfullyresponsibilityfor theinformation furnishedto BTG Pactual.

In thepreparationof the presentValuationReport, the BTG Pactual has adopted asassumption,with express consent of theInformation Suppliers,thereliability,accuracy, veracity, completeness, sufficiencyand integrity of all data which wasfurnishedourdiscussed,so BTG Pactual does notassumes,neither has realized any physicalinspectionof any asset orproperty,and has not made anyindependently valuationof the asset and debt of theCompanies,or about theCompanies solvency, consideringasconsistenttheinformationused in theValuationReport, theInformation Suppliershas taken theresponsibility, includingfor itsemployees,partners andrepresentatives,foreverythingwhich wasfurnishedordiscussedwith BTG Pactual.

71

|

| Additional Statements and Information |

Theinformationrelated to data,forecast, assumptionsandestimates,related to theCompaniesand itsmarkets,used orincludedin thisValuationReport, has been based in certain groups of report andpresentationlayout which can beconsiderablydifferent from the group ofaccounts presentedby theCompaniesin thepreparationof its financialstatements.Thisprocedurewas adopted in order to permit that the forecastpresentedwasconsistentwith the group of accountreportedin themanagementfinancialstatements furnished. Occasional Differencesin group of account does not have impact over the results

All theinformation, estimatesand forecast hereinincludedare those used andpresentedby theInformation Suppliers, adjustedby BTG Pactual, at its solediscretion,related toreasonableness,and areassumedas being based in bestvaluationofInformation Suppliersand of itsadministrationin relation to theevolutionof theCompaniesand its markets ofoperation.

Except ifotherwise expressly presented,asindicatedin writing in specific notes orreferences,all data,previous information,marketinformation, forecast, projectionandassumptions, included, considered,used orpresentedin thisValuationReport are thosepresentedby theInformation Suppliersto BTG Pactual.

Theinformationhereincontained,related to theaccountantposition and financial position of theCompaniesand the Market, are thoseavailableon January 25th, 2011. Anychangesin thosepositionscan affect the results of thisValuationReport. The BTG Pactual does not assume anyobligationofupdating, reviewingoramendingthisValuationReport, as result ofdisclosureof anysubsequent informationin relation to January 25th, 2011 or as result of any othersubsequentevent.

There is noguaranteethat theassumptions, estimates, forecast,partial or total results orconclusionused orpresentedin thisValuationReport will beeffectivelyreached or verified, in part or in whole. The future results of theCompaniescan be different from the resultsincludedin theforecast,and those results can besignificant,as result of several factors,including,but not limited to,changesin the marketconditions.The BTG Pactual does not assume anyresponsibilityrelated to suchdifferences.

ThisValuationReport wasgenerated accordingto theeconomicand marketconditions,among others,availablein da date of itselaboration,s o theconclusion presentedare subject tovariationsof several factors on which the BTG Pactual does not have any control.

The sum ofindividualsvaluespresentedin theValuationReport can be different from the sumpresenteddue toroundingof values.

To perform the work, the BTG Pactual adopted asassumptionthat all thegovernmental, regulatory approvals,or other of any nature, andexemption, amendmentsorrenegotiationof anyagreement necessaryto theTransactionwas or will beobtained,and nomodification necessaryto those acts will cause any adversepatrimonialimpact to theCompaniesor reduce those the benefits targeted by theTransaction.

ThisValuationReport waspreparedinaccordanceto the Law 6404,December15, 1976, and to theInstructionCVM 319,December3, 1999,howeverit does not intends to be the only base toevaluatetheCompanies, therefore,theValuationReport does not contain all theinformation necessaryfor such andconsequently,does notrepresent,neitherconstitutesaproposal, solicitation, suggestionorrecommendationby BTG Pactual.

Theshareholdersshall make its ownanalysesin relation to theconvenienceand to theopportunityofapprovingtheTransaction,and shall consult its ownfinancial,tax and legaladvisorsbefore take its own decision about thetransaction,in aindependentlymanner. TheValuationReport shall be read andinterpreted accordingto therestrictionsandqualificationspriormentioned.The reader shall take into account therestrictionsandcharacterof theinformationused.

72

|

| Additional Statements and Information |

ThisValuationReport cannot becirculated,copied,publishedor used in any form, neither can bearchived,include orreferenced,in whole or in part, in anydocument,without apreviousconsent of BTG Pactual, the use of theValuationReport isrestrictedto useddescribedin theInstructionCVM 379/99

Valuationsreport of theCompaniesand sectorselaboratedby othercompany,due to itsautonomy,canconsiderdifferentassumptionsin different manner that was used in thisValuationReport andconsequently,present resultssignificantly different.

73

Banco BTGPactualS.A.

Av.BrigadeiroFaria Lima, 3729 9thfloor

São Paulo, SP – Brazil

Zip Code: 04538-133

Tel: +55 11 3383-2000

74

SIGNATURE

��

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

Date: February 08, 2011

CONTAX PARTICIPAÇÕES S.A. |

| | |

| By: | /S/ Michel Neves Sarkis

| |

| | Name: Michel Neves Sarkis Title: Investor Relations Officer | |

FORWARD-LOOKING STATEMENTS

This press release may contain forward-looking statements. These statements are statements that are not historical facts, and are based on management's current view and estimates of future economic circumstances, industry conditions, company performance and financial results. The words "anticipates", "believes", "estimates", "expects", "plans" and similar expressions, as they relate to the company, are intended to identify forward-looking statements. Statements regarding the declaration or payment of dividends, the implementation of principal operating and financing strategies and capital expenditure plans, the direction of future operations and the factors or trends affecting financial condition, liquidity or results of operations are examples of forward-looking statements. Such statements reflect the current views of management and are subject to a number of risks and uncertainties. There is no guarantee that the expected events, trends or results will actually occur. The statements are based on many assumptions and factors, including general economic and market conditions, industry conditions, and operating factors. Any changes in such assumptions or factors could cause actual results to differ materially from current expectations.