UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K/A

REPORT OF FOREIGN ISSUER PURSUANT TO

RULE 13a-16 OR 15d-16 OF THESECURITIES

EXCHANGE ACT OF 1934

For the month of June, 2011

Commission

File Number 000-5149

CONTAX PARTICIPAÇÕES S.A.

(Exact name of Registrant as specified in its Charter)

Contax Holding Company

(Translation of Registrant's name in English)

Rua do Passeio, 56 – 16th floor

Rio de Janeiro, RJ

Federative Republic of Brazil

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file

annual reports under cover Form 20-F or Form 40-F.

Form 20-Fþ Form 40-Fo

Indicate by check mark whether the registrant by furnishing the

information contained in this Form is also thereby furnishing the

information to the Commission pursuant to Rule 12g3-2(b) under

the Securities Exchange Act of 1934.

Yeso Noþ

CONTAX PARTICIPAÇÕES S.A.

CorporateTaxpayer’sID (CNPJ): 04.032.433/0001-80

Company Registry (NIRE): 33300275410

Publicly Held Company

MANAGEMENT PROPOSAL

Shareholders:

In compliance with the provisions of Ruling No. 481 of the Securities Commission of December 17, 2009 ("ICVM 481" ), we submit the following management proposal of CONTAX PARTICIPAÇÕES S.A. ("Company" or "Contax Participações") ("Proposal") with respect to matters to be decided at the Company's Special Shareholders Meeting to be held on July 1,

2011 at 10:00 am ("AGE").

Atthe AGE the following items shall be decided:

(i)Review, discussion and resolution on the Protocol and Justification for Merger of Mobitel S.A.("Mobitel") Shares into the Company and other documents relating to that merger of shares, by which Mobitel will become a wholly owned subsidiary of the Company;

(ii)Ratification of the appointment and contracting of specialized companies responsible for preparing (i) thevaluation report on the equity value of Mobitelshares; and (ii) theeconomic valuation report of the Company's and Mobitel's shares;

(iii)Approval of the respective valuation reports;

(iv)Resolution onthe proposed mergerof Mobitel's shares into the Company with consequent increase of the Company's capital by issuing new common and preferred shares;

(v)Approval of amendment to the By-laws of the Company due to the increase of its capital;

(vi)Replacement of the Board of Directors, to complete their term of office.

A. INFORMATION ABOUT THE CAPITAL INCREASE (IN ACCORDANCE WITH

EXHIBIT 14 OF ICVM RULING 481).

1. Amount of increase and newcapital:

Due to the merger of shares of Mobitel into Contax Participações ("Merger of Shares"), the Company's capital will increase from thirty-four million, four hundred andfifty-five thousand, eight hundred and forty Reais and fifty-six centavos (R$

34,455,840.56)to two hundred and fifty-eight million, three hundredand twenty-eight thousand,nine hundred and fifty-six Reais and sixty-six cents (R$ 258,328,956.66) andone hundred forty-three million, seven hundred and sixty thousand, onehundred andnineteen Reais and twelve centavos (R$ 143,760,119.12) will be allocatedto the capital reserve ofContax Participações.

2. Sourceof the capital increase, from the following options: a) conversion of debentures intoshares; b) the exercise of subscription rightsor subscriptionwarrants; c) capitalization of profits or reserves; or d) subscription of new shares:

TheCompany's capital increase will bemade by thesubscription of new common and preferredshares of theCompany, due to the Merger of Shares, which willbe inserted into the corporate restructuring described insection 3 below.

3. Reasons for the increase and theireconomicand legal consequences:

OnJanuary 25, 2011, an Agreement for Merger of Mobitel Shares into Contax Participações("Merger of Shares Agreement"), which provides, under certain conditions for the Merger of Shares, through which Mobitel becomes a wholly owned subsidiary ofContax Participações("Restructuring"), allpursuant to the Notice of Material Event of Contax Participações released on January 25, 2011 ("Notice of Material Event").

TheAGE will have as part of the resolution onthe Merger of Shares, and as a result of thetransfer ofthe shares of Mobitelto theCompany, the Company's current share capital of two hundred twenty-threemillion,eight hundred and seventy and three thousandone hundred and sixteen Reais and ten centavos (R$ 223,873,116.10) shall beincreased to two hundred and fifty-eight million, three hundred and twenty-eight thousand,nine hundred fifty-six Reais and sixty-six centavos (R$ 258,328,956.66), withthis being anincrease of thirty-fourmillion, four hundred andfifty-five thousand, eighthundred andforty Reais and fifty-six centavos (R$34,455,840.56), according to the valuation reportof Mobitel shares preparedspecificallyforthe Merger ofShares.

TheCompany's shares to be issued as a result of the Merger of Shares will be paid-in with

Mobitelissued shares.

4. Copy ofthe opinion of the Fiscal Council:

Theopinion of the Company's Fiscal Council is in the minutes of the Fiscal Council

Meeting held on June 14, 2011, attached tothisProposal (Exhibit I).

5. In case ofcapitalincreasesthrough subscription of shares:

a) Use of proceeds:

Theshares to be issued by the Company will be paid-in by thetransfer of all shares representing thecapital ofMobitel andacquired by the Company, pursuant to the Merger ofShares transaction described insection 3 above.

b) Number ofissued shares ofeach type and class:

Onemillion, eight hundred and seventy-sixthousand, nine hundred and eighty-two (1,876,982) new common shares and three million, thirty-eightthousand, four hundred and ninety-nine (3,038,499) new preferred shares of the Company will be issued, all registered andwith no parvalue.

c) Rights, benefits and restrictions attaching to shares to beissued:

Theshares to be issued by the Company in accordance with item 5 (b) above shall conferrights equal to those conferred by other shares of the respective type currently in existence, including participation in the profits that may be declared by the Company from the dateon which theMerger of Sharesis approved.

d) Information on the form of subscription (public or private):

Thesubscription shall be private asa result of the Merger of Shares transaction described initem 3 above.

e) In the case of private subscription, inform if the related parties as defined byaccounting rules that address this topic,will subscribe shares in the capital increase,specifying therespective amounts, when those amounts arealreadyknown:

As a result of the Merger of Shares, Mobitel will subscribe on behalf of its shareholders theentire capital increase, pursuant to the share exchange ratio defined in theMerger of Shares Subscription Protocoland Justification. Portugal Telecom Brasil S.A.,which is a shareholder of Mobitel and will receive shares of the Company in the Merger of Shares, is ashareholder of CTX Participações S.A., which, in turn, holds a controllingstake in theCompany.

f) Information on the issue price of new shares or the reasons by which its establishment shall be delegatedto theboard of directors in the cases of public distribution:

Theissue price of shares issued in the Merger of Sharesshall be thirty-six Reais and fraction (R$36.2561) per share and represents the equity value of Mobitel's shareson December 31, 2010, incorporated to theCompany's assets, divided by the number of shares to beissued, accordingto the exchange ratio applicable to theMerger of Shares.

g) Par value of shares issued or in the case of no par value shares, the portion ofthe issueprice thatwill be allocated to capital reserve:

Theshares have no par value.The book value of Mobitel's shares, thirty-fourmillion, four hundred andfifty-five thousand, eight hundred and fortyReais and fifty-six centavos (R$34,455,840.56) shall beallocated tothe Company's capital, and one hundredand forty-threemillion, seven hundred andsixty thousand, one hundredand nineteenReais and twelve centavos (R$ 143,760,119,12) shall be allocated tothe Company's capital reserve.

h) Management's opinion on theeffects of thecapital increase, especially with regard to the dilution caused by the increase:

Thecapital increase will occur solely as a result of the Merger of Shares. The Company's management intends that theMerger of Shareswill produce the following effects: strengthen Mobitel’s andthe Company’s performance in its mainmarkets, integration of complementary expertise of bothcompanies; reduction of administrative costs, bringing benefits to administrative, economic and financial benefits, by reducing combined operating expenses, as the Company and Mobitel willbelong to the same economic group. In addition, the Company's management believes that the Mergerof Shareswill enable thecreation of valuethrough theexchange of bestmanagement practices, resulting inimprovements in productivity and profitability of the Company and Mobitel.

Thepercentages indicative of thedilution resulting from theCapital Increase are described inItem 5 (n)below.

i) The criteria for calculating the issue price and justification of the economic aspects thatdetermineits choice:

Inthe case of capital increase asa result of the Merger of Shares, the share issue price was determined by means of division of the equity value of Mobitel's shares on December 31,

2010, merged into the assets of Contax Participações by the amount of shares to be issued.

j) Ifthe issue price has been fixed at a premium or discount in relation to market value, the reason for this premiumor discount:

There wasno premium or discountin the issue of shares.

k) Copy of all reports andstudiesthat supported the pricing issue:

Attachedto this Proposal are the following reports used in the Merger of Shares described initem 3 above:

(i) Valuation report of Mobitel's shares at book value based on its audited financialstatements reported on December 31, 2010, prepared by Apsis Consultoria eAvaliações Ltda. ("Valuation Report of Mobitel's Net Book Value"), pursuant to Art. 8 ofLaw No. 6404/76;and

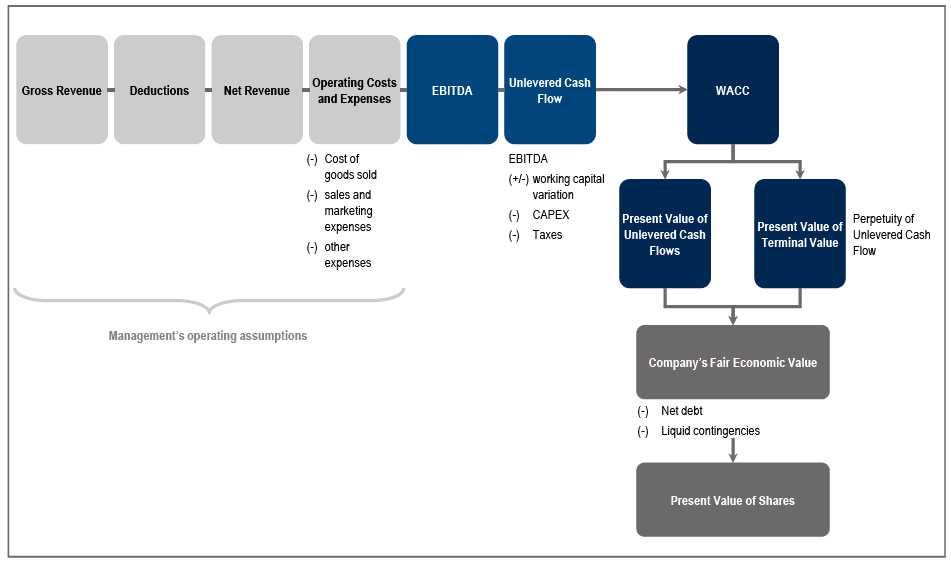

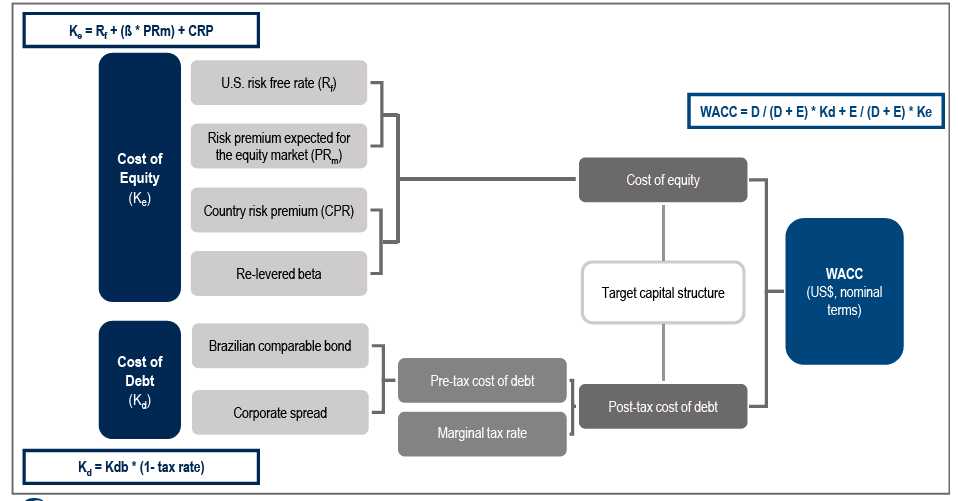

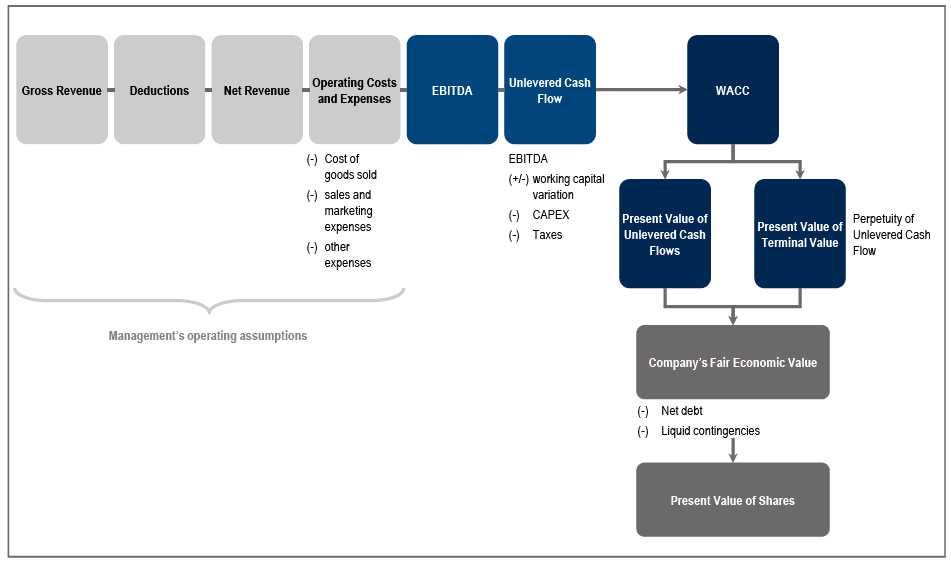

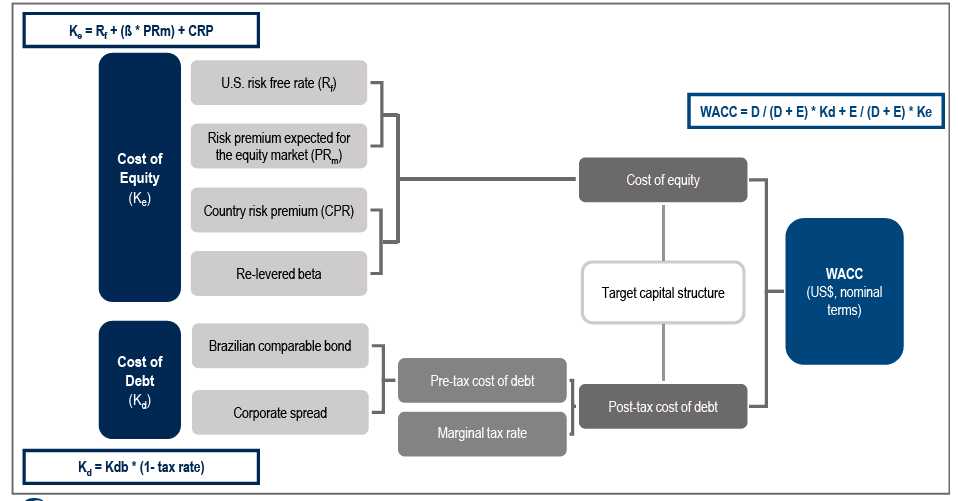

(ii) Valuation Report of ContaxParticipações based on thefuture profitabilitymethodology based on aretrospective analysis, projected scenarios and discounted cash flows on December 31, 2010 ("Exchange RatioValuation Report") prepared by Banco BTG Pactual S.A. forthe purpose of supporting thefixing of the exchange ratio of shares issued by Mobitel for Company shares.

l) Priceof each type and class of the company's shares in the markets on which they aretraded:

l.1)Common Shares

i) Low, average andhigh price for each year for the last three (3) years:

PERIOD | LOWPRICE (R$) | AVERAGEPRICE (R$) | HIGHPRICE (R$) |

2008 | 6.43 | 13.53 | 19.00 |

2009 | 9.50 | 16.44 | 26.87 |

2010 | 24.00 | 30.15 | 34.50 |

ii) Low, average andhigh price for eachquarter for thelast two (2)years:

PERIOD | LOWPRICE (R$) | AVERAGE PRICE (R$) | HIGHPRICE (R$) |

1Q09 | 9.50 | 11.45 | 12.20 |

2Q09 | 11.43 | 13.00 | 14.50 |

3Q09 | 14.00 | 18.07 | 22.00 |

4Q09 | 20.00 | 23.27 | 26.87 |

1Q10 | 26.93 | 28.96 | 31.70 |

2Q10 | 24.00 | 28.75 | 32.00 |

3Q10 | 28.17 | 30.77 | 32.77 |

4Q10 | 30.35 | 31.91 | 34.50 |

iii) Low, average andhigh price ofeach month inthelast six (6)months:

PERIOD | LOWPRICE (R$) | AVERAGEPRICE (R$) | HIGHPRICE (R$) |

12/2010 | 30.35 | 31.61 | 34.50 |

01/2011 | 29.00 | 30.61 | 32.00 |

02/2011 | 27.35 | 29.27 | 30.49 |

03/2011 | 24.30 | 25.53 | 28.30 |

04/2011 | 24.80 | 26.94 | 28.50 |

05/2011 | 23.55 | 25.97 | 27.49 |

iv) Average price forthelast ninety (90) days:

PERIOD | AVERAGEPRICE (R$) |

Last 90 days | 25.78 |

l.2)Preferred Shares

(a)Low, average andhigh price for each year for the last three (3) years:

PERIOD | LOWPRICE (R$) | AVERAGEPRICE (R$) | HIGHPRICE (R$) |

2008 | 5.95 | 10.44 | 13.00 |

2009 | 9.53 | 15.41 | 25.00 |

2010 | 20.00 | 25.59 | 32.70 |

(b)Low, average andhigh price for eachquarter for thelast two (2)years:

PERIOD | LOWPRICE (R$) | AVERAGEPRICE (R$) | HIGHPRICE (R$) |

1Q09 | 9.53 | 10.55 | 11.50 |

2Q09 | 10.63 | 12.21 | 13.89 |

3Q09 | 13.56 | 17.41 | 20.35 |

4Q09 | 18.87 | 21.48 | 25.00 |

1Q10 | 23.79 | 24.99 | 26.11 |

2Q10 | 20.00 | 22.21 | 24.94 |

3Q10 | 21.43 | 24.71 | 28.00 |

4Q10 | 27.60 | 30.20 | 32.70 |

(c)Low, average andhigh price ofeach month inthelast six (6)months:

PERIOD | LOWPRICE (R$) | AVERAGEPRICE (R$) | HIGHPRICE (R$) |

12/2010 | 30.10 | 31.22 | 32.29 |

01/2011 | 29.00 | 30.49 | 31.98 |

02/2011 | 27.85 | 29.09 | 30.30 |

03/2011 | 24.10 | 25.30 | 27.35 |

04/2011 | 23.50 | 25.57 | 26.94 |

05/2011 | 22.65 | 24.10 | 25.49 |

(d)Average price forthelast ninety (90) days:

PERIOD | AVERAGEPRICE (R$) |

Last 90 days | 24.50 |

m) Issue price of sharesin capital increasesmade in the last three (3)years:

Not applicable.

n) Percentage of potential dilution resulting from the issuance:

The percentage ofdilution resultingfrom the issuanceis 8.22%.

o) Terms, conditions andform of subscription and pay-in ofshares issued:

The Company's new shares issued as a result of the Merger of Shares will be subscribed at the AGE and paid-in under the Merger of Shareson thesamedate, pursuant to the transaction described in item3 above.

p) Information about the existence of preemptive rights by the shareholders to subscribenew shares issued:

Pursuantto paragraph1 of article 252 of Law6404/76, the shareholders will have preemptive rights tosubscribenew shares under theMerger ofShares.

q) Management's proposalto treatany remainder:

Therewill be no remainder as the capital increase will result from the merger of Mobitel’sshares asdescribed initem 3 above.

r) Description of procedures to be adopted if there is partial approval of the capital increase:

Not applicable.

s) Iftheissueprice ofshares iswholly or partlymadein assets:

(i) A full description ofthe assets:

TheCompany's new shares will be paid-in throughacquisition by theCompany of common shares,registered and withno par value issued by Mobitel.

(ii) Relationshipbetween the goods merged to the assets of the Company and its corporatepurpose:

Theassets transferred to theCompany's assets are shares issued by Mobitel, whose field of activity is similar to that provided for in theCompany's purpose.

t) A copy of the asset valuation report:

Forinformation on thevaluation reports of Mobitel's net equity value, pleaserefer to item 5 (k)above.

The Valuation Report of the Net Book Value of Mobitel, which contains the valuation of assetsto bemerged to the Company's assets is available for consultation by the Company's shareholders on thewebsites of CVM (www.cvm.gov.br), BM&FBOVESPA(www.bovespa.com.br) and of theCompany (www.contax.com.br/ri).

Itis clarified that items 6 and 7 ofExhibit 14 to CVM Ruling 481 are not applicable to thiscase.

B. INFORMATION ABOUT VALUATION RIGHTS (IN ACCORDANCE WITH EXHIBIT

20OF CVM RULING 481).

1. Description of event that will give rise to the valuation rights and the legal basis:

TheMerger of Mobitel’s Shares into Contax Participações, described in Section3 of Chapter"A" above,will givedissenting shareholders at the Company's AGE theright towithdraw from theCompany, upon repayment of the value of their shares in accordance with Article 137 and Article 252, paragraph 1 of Law6404/76.

2. Shares and classeswhich aresubject tothe valuation rights:

Thevaluation rights will apply to holders of common and preferred shares of the dissentingShareholders of the Company.

3. Dateof the first publication of the shareholders meeting call notice and the dateof communicating the Notice of Material Events relating to the resolution thatwill give rise tothe right ofwithdrawal:

OnJune 16, 2011, the first publication of the AGE's call notice shall occur to resolve on theMerger ofShares.

OnJanuary 25, 2011, the Company's Notice of Material Eventwas released which announcedthe Merger of Shares, which is why this will be considered the Notice of Material Event that gave rise to the valuation rights pursuant to Art. 137, paragraph 1 ofLaw 6404/76.

4. The deadline for exercising the valuation rights and the date to be considered forpurposes of determining the shareholders who may exercise the valuationrights:

Thedeadline for the exercise of valuation rights will be 30 days from the publication ofthe AGE'sminutes, pursuant to article 137, IVofLaw No. 6404/76.

Thedissident shareholders at the AGE who verifiably hold common and preferred shares issued by the Company, uninterruptedly, since the publication date of the Noticeof Material Event, which gave notice of the Merger of Shares to the market, therefore,on January 25, 2011,having computed thestock exchange trading transactions ofthat date, inclusive, until the effective exercise of valuation rights.

5. Amountof reimbursement or, if it is not possible to determine it previously, a management estimate of thisamount:

Therepayment amount to be paid to the Company’s dissenting shareholders will be sevenReais andfraction (R$7.0097) per share, subject tosuch shareholder requesting thereporting of aspecial balancesheet for purposes of calculating the reimbursement amount, as provided in Article 45, paragraph 2, of LawNo.6.404/76.

6. Form ofcalculating thereimbursement amount:

TheCompany's dissident shareholders shall have the right to repayment of the equity value oftheir shares based on the Company's Financial Statements reported on December 31, 2010 andreleased on March 2, 2011.

7. Will the shareholders be entitled to request a special balance sheet?

Dissenting shareholders may request reporting of a special balance sheet for purposes of calculating the amount of the repayment, as provided in Article 45, paragraph 2 of Law

6404/76.

8. List of experts or specialized companies recommended by management:

Notapplicable inview that the repayment amount will be calculated according to the equity valueof the Company’s shares on December 31, 2010.

9. In the event of Merger of Shares:

a) Calculation of the share exchange ratio based on the net equity value at market pricesor other criteria accepted by the Brazilian Securities Commission (CVM):

Theprovisions ofArt. 264 of Law No. 6404/76 do not apply to the Merger of Shares, so that theexchange ratios were not calculated according to the net asset criteria at market prices.

b) Are the share exchange ratios established in the transaction protocol less advantageous than those calculated under item 9.a above?

Notapplicable.

c) The reimbursement amount calculated based on the net equity value at market pricesor other criteria accepted by the Brazilian Securities Commission (CVM):

Notapplicable.

10. Equity value of each share ascertained according to the last approved balance sheet:

According to the Company's Financial Statements reported on December 31, 2010 and released on March 2, 2011, the equity value per share of the Company is seven Reais and fraction (R$ 7.0097).

11. Quote ofeach class or kind of shares which aresubject to valuation in the markets in which they are traded, as follows: a) Low, average and high price of each year for the last three (3) years, b) Low, average and high price of each quarter for the last two (2) years: c) Low,average and maximum price of each month in the last six (6) months:d) Averageprice forthe last ninety (90) days:

11.1 - Common Shares

(a)Low, average andhigh price for each year for the last three (3) years:

PERIOD | LOWPRICE (R$) | AVERAGEPRICE (R$) | HIGHPRICE (R$) |

2008 | 6.43 | 13.53 | 19.00 |

2009 | 9.50 | 16.44 | 26.87 |

2010 | 24.00 | 30.15 | 34.50 |

(b)Low, average andhigh price for eachquarter for thelast two (2)years:

PERIOD | LOWPRICE (R$) | AVERAGEPRICE (R$) | HIGHPRICE (R$) |

1Q09 | 9.50 | 11.45 | 12.20 |

2Q09 | 11.43 | 13.00 | 14.50 |

3Q09 | 14.00 | 18.07 | 22.00 |

4Q09 | 20.00 | 23.27 | 26.87 |

1Q10 | 26.93 | 28.96 | 31.70 |

2Q10 | 24.00 | 28.75 | 32.00 |

3Q10 | 28.17 | 30.77 | 32.77 |

4Q10 | 30.35 | 31.91 | 34.50 |

(c)Low, average andhigh price ofeach month inthelast six (6)months:

PERIOD | LOWPRICE (R$) | AVERAGEPRICE (R$) | HIGHPRICE (R$) |

12/2010 | 30.35 | 31.61 | 34.50 |

01/2011 | 29.00 | 30.61 | 32.00 |

02/2011 | 27.35 | 29.27 | 30.49 |

03/2011 | 24.30 | 25.53 | 28.30 |

04/2011 | 24.80 | 26.94 | 28.50 |

05/2011 | 23.55 | 25.97 | 27.49 |

(d)Average price forthelast ninety (90) days:

PERIOD | AVERAGEPRICE (R$) |

Last 90 days | 25.78 |

11.2-Preferred Shares

(a)Low, averageandhigh price for each year for the last three (3) years:

PERIOD | LOWPRICE (R$) | AVERAGEPRICE (R$) | HIGHPRICE (R$) |

2008 | 5.95 | 10.44 | 13.00 |

2009 | 9.53 | 15.41 | 25.00 |

2010 | 20.00 | 25.59 | 32.70 |

(b)Low, average andhigh price for eachquarter for thelast two (2)years:

PERIOD | LOWPRICE (R$) | AVERAGEPRICE (R$) | HIGHPRICE (R$) |

1Q09 | 9.53 | 10.55 | 11.50 |

2Q09 | 10.63 | 12.21 | 13.89 |

3Q09 | 13.56 | 17.41 | 20.35 |

4Q09 | 18.87 | 21.48 | 25.00 |

1Q10 | 23.79 | 24.99 | 26.11 |

2Q10 | 20.00 | 22.21 | 24.94 |

3Q10 | 21.43 | 24.71 | 28.00 |

4Q10 | 27.60 | 30.20 | 32.70 |

(c)Low, average andhigh price ofeach month inthelast six (6)months:

PERIOD | LOWPRICE (R$) | AVERAGEPRICE (R$) | HIGHPRICE (R$) |

12/2010 | 30.10 | 31.22 | 32.29 |

01/2011 | 29.00 | 30.49 | 31.98 |

02/2011 | 27.85 | 29.09 | 30.30 |

03/2011 | 24.10 | 25.30 | 27.35 |

04/2011 | 23.50 | 25.57 | 26.94 |

05/2011 | 22.65 | 24.10 | 25.49 |

(d)Average price forthelast ninety (90) days:

PERIOD | AVERAGEPRICE (R$) |

Last 90 days | 24.50 |

C. INFORMATION ABOUT THE EVALUATORS (IN ACCORDANCE WITH EXHIBIT 21 OFCVM RULING 481).

1. Evaluator recommended by management:

Forpreparation of the valuations of Mobitel and Contax Participações for the purposes of the Company's Restructuring and the Merger of Mobitel’s Shares into the Company, the following specialized companies were chosen ad referendum at the Shareholders Meetings:

(i) APSIS Consultoria e Avaliações Ltda. to value Mobitel's net book equity value based onits audited financial statements reported on December 31, 2010, based on its audited financialstatements contained in Exhibit II to this proposal; and

(ii) Banco BTG Pactual S.A. to conduct the valuation of both Mobitel and Contax by the futureprofitability methodology based on a retrospective analysis, projected scenarios and discounted cash flows on December 31, 2010, pursuant to the criteria and assumptions listed inExhibit III to this proposal.

2. Description of the qualifications of the recommended evaluator:

Theevaluators have recognized experiencein valuation of companies, as can be seen based onthe history of work conducted on their websites (www.apsis.com.br) and(www.btgpactual.com.br).

3. Copy of the work proposal and remuneration of the recommended evaluator:

Thework proposal and remuneration of therecommended evaluators are in Exhibit IV to this proposal. A copy of the work proposals and remuneration of the evaluators for preparation ofthe reports mentioned above was also made available to shareholders ofContax Participações, throughthe IPE System, which can be accessed through the websites of CVM(www.cvm.gov.br), BM&F (www.bovespa.com.br) and the Company (www.contax.com.br/ri).

4. Description of any material relationship existing in the last three (3) years between the recommended evaluator and the parties related to the company, as defined by the accounting rules that deal with this subject:

Apsiswas the company hired by Contax Participações to prepare the valuation reports for thepurposes of Art. 256 of Law 6404/76, (i) Ability Comunicação Integrada Ltda., at the time ofits acquisition bythe Company, approved on September 19, 2010, at the Company's shareholders meeting; and (ii) of the companiesStratton Spain S.L., Allus Spain S.L., Stratton ArgentinaS.A., Stratton Peru S.A. and Multienlace S.A. ("Allus Group"), upon acquisition of theAllus Group by the Company's subsidiaries, Contax S.A. and Contax Colombia S.A.S., approved on April 25, 2011, by the Company's shareholders meeting.

D. INFORMATION ON THE STATUTORY CHANGE(IN ACCORDANCE WITH ARTICLE 11 OFICVM 481).

1.Copy of the by-laws containing the proposed amendments highlighted:

Copy of the by-laws containing the proposed amendments highlighted in Exhibit V to thisproposal.

2.Report detailing the source and justification ofthe proposed amendments and analyzing their legal and economic effects:

Itis a proposed amendment ofthe main provision of Article 5 of the Company's By- lawsto contemplate theincrease of its capital by thirty-four million, four hundred and fifty- fivethousand, eight hundred and forty Reais and fifty-six centavos (R$ 34,455,840.56) with issuance of one million, eight hundred and seventy-six thousand, nine hundred and eighty- two(1,876,982) newcommon shares and three million, thirty-eight thousand, four hundred andninety-nine preferred shares issued by the Company, resulting from the Merger of Sharesof Mobitel S.A. into the Company to be approved at the Company'sSpecial Shareholders Meeting called for the day of July 1, 2011. Because of the proposed amendment, themain provision of article 5 of the Company's By-Laws shall henceforthbe worded as follows:

"Article 5 - The capital is two hundred and fifty-eight million, three hundred andtwenty-eight thousand, nine hundred and fifty-six Reais and sixty-six centavos (R$ 258,328,956.66), divided into 64,686,081, with 24,966,582 as common shares and 39,719,499 as preferred shares, all book-entry, registered and with no par value."

E. INFORMATION ON THE ELECTION OF MANAGERS (IN ACCORDANCE WITH ARTICLE 10 OF ICVM 481).

1. Information specified in items 12.6 to 12.10 of the reference form, in respect to the candidates nominated or supported by managementof the controlling shareholders.

12.6 Inrespect to each one of the managers and members of the issuer's Fiscal Council, statein table form:

a. Name; b. Age; c. Profession; d. Individual Taxpayer ID (CPF) or passport number; e.

Electedoffice held; f. Election Date; g. InvestitureDate; h. Term of office; i. Other positions orfunctions exercised at the issuer; j.Indication if elected bythe controller or not.

Board of Directors - Effective:

Name: | Born on | Profession/Educat ion | Individual Taxpayer ID (CPF): | Investiture Date | Termof office | Other Positions | Elected by the Controlling Shareholder |

Ricardo Antônio MelloCastanheira | July6,1955 | Civil engineer | 130.218.186-68 | July1,2011 | Shareholders Meeting 2012 | No. | Yes. |

Board of Directors - Alternates:

Name: | Born on | Profession/Education | Individual Taxpayer ID (CPF): | Investiture Date | Term of Office | Other Positions | Elected by the Controlling Shareholder |

CarlosFernando HortaBretas | May7, 1959 | Civil Engineer | 463.006.866-04 | July1,2011 | Shareholders Meeting 2012 | No. | Yes. |

12.7 Provide the information mentioned in item 12.6 in respect of members of statutory committees and Fiscal Councils, risk, and financial compensation, even if such committees are not statutory or structures are not statutory:

Notapplicable.

12.9 In respect to each one of the managers and members of the Fiscal Council, provide:

a. Curriculum Vitae, containing the following information: i. Main professionalexperience overthe past 5 years, including: Company Name, Position and functions of the office, the company's mainactivity in which this experience occurred, highlighting the companiesor organizations that comprise (i) the economic group of the issuer, or (ii) shareholders with direct orindirect holdings of less than5% of the same class orkind of securities of the issuer; ii. Indication of all management positions they hold or have held incompanies.

Boardof Directors (Effective):

Ricardo Antônio Mello Castanheira

Born June 6, 1955, graduated in Civil Engineering from Universidade Federalde Minas Gerais in1980, completed graduate studies in Financial Management at UNA in 1982 and an MBA in Business Administration from USP in 1999. He served as Director of Coordination in Latin Americauntil May/2007 andfrom May 2007 to August 2008 as Director of Argentine Operationsat Construtora Andrade Gutierrez S.A., company of the Andrade Gutierrez S.A. groupfocused on heavy construction, infrastructure, inthe Brazilian and Latin American markets. He was later Chairman ofthe Board of Directors ofGeorad Levantamentos Geofísicos S.A., from October 2009 to December 2010, Companies inthe Oil & Gas market, focusing on Seismic On Shore Services, Diagnosis and Environmental Remediation Services andsupport to exploration Engineering, miningventures. Company controlled by AG Angra Gestão de Informações e Investimentos Ltda, Sergep Serviços Especializados Ltda and Rio ForteÓleo, Gás e Mineração S.A. Later, from September 2008 to December 2010, he was a member of the Executive Committee, representing theinterests of Andrade Gutierrez Participações S.A., AG Angra Gestão de Informações e Investimentos Ltda., a subsidiary of AndradeGutierrez Participações S.A., manager of Private Equity Funds, FIPs, dedicated to infrastructure, integrated also by the partners, Angra Partners Gestão de Recursos e Assessoria Financeira Ltda., Celso Fernandez Quitella and Aconcágua Investimentos e Participações Ltda. Since September 2008, he holds the position of Business Development Managerat AG Concessões S.A.,company of Grupo Andrade Gutierrez S.A. focused on investments andoperations through concessions and holdings in exploration activities of companiesin the Road, Airports, Ports, Energy, Sanitation and other infrastructure areas. He isalso an Alternate Director of Companhia Energética de Minas Gerais -CEMIG and Alternate Directorof CCR SA Concessões de Infraestrutura de Transporte.

Boardof Directors (Alternates):

Carlos Fernando Horta Bretas

Born May 7, 1959, graduated in Civil Engineering in 1984, with postgraduate studies in Economic Engineering from Fundação Don Cabral of Belo Horizonte, an MBA in Finance from USPand an MBA in Business Law from Fundação Getulio Vargas . Since May/1994 he has beenacting as Project Manager of Andrade Gutierrez Concessões S.A. (AGC), holding and private equity company of Grupo Andrade Gutierrez S.A.. He works in finance and project monitoringdevelopment atAGC. Previously he served as a controller engineer for the Goiás office(May 1988 to February 1989) of Mendes Junior Edificações S.A.,a civil engineering company.He worked as a production engineer forthe same company during the periodfrom

1984 to 1988. He was Managing Partner of the company Consultoria in the finance area, in

BeloHorizonte, between March 1989 and February 1994.

b. Description of any of the following events that have occurred during the past 05 years: i.Any criminal conviction; ii. Any conviction in an administrativeproceeding of the BrazilianSecurities Commission (CVM) and penalties applied; iii. A finalconviction at the judicial or administrative level, which has suspended or disqualified him from performingany professional or commercial activity:

Notapplicable.

12.9 Informthe existence ofa marital relationship, civil union or familial relationship to the second degree between:

a. Managers of the issuer

None.

b. (i) Managers of the issuer and (ii) managers of the direct or indirect controlled companiesof the issuer

None.

c. (i) Managers of the issuer orits direct or indirect controlled companies, and (ii) direct or indirect controlling shareholders of the issuer.

None.

d.(i) Managers ofthe issuer and (ii) managers of the direct and indirect controlling shareholders of the issuer

Notapplicable.

12.10 Informregarding subordination relationships, provision of services or control held inthe past 03 fiscal years, between managers of the issuer and:

a. A company controlled directly or indirectly by the issuer

Notapplicable to the Company.

b. Direct or indirect controlling shareholder of the issuer

Mr.Ricardo Antônio Mello Castanheira holds the position of Business Development Managerat AG Concessões S.A., company of Grupo Andrade Gutierrez S.A.;

Mr.CarlosFernandoHorta BretasisProject Manager, working infinance, development andmonitoring of AndradeGutierrez Concessões S.A.,company of Grupo AndradeGutierrez S.A.;

c. Where relevant, supplier, customer, debtor or creditor of the issuer, its controlled companyor controlling shareholder or controlled company of any of these individuals

Notapplicable to the Company.

Riode Janeiro, June 15, 2011

Fernando Antonio Pimentel Melo

Chairman of the BoardofDirectors

EXHIBIT I

To the

MANAGEMENT PROPOSAL

OPINION OF THE FISCAL COUNCIL

-1 -

CONTAX PARTICIPAÇÕES S.A.

National Corporate Taxpayers Register of the Ministry of Finance ( CNPJ/MF) No. 04.032.433/0001-80-

State Registration Number ( NIRE ) 33300275410

Publicly Held Company

FISCAL COUNCIL’S OPINION

The Fiscal Counci l ofCONTAX PARTICIPAÇÕES S.A., pursuant to i ts dut ies as providedfor in i tem III of Ar t icle 163 of Law No. 6404/76, analyzed the proposal for merger ofshares of Mobi tel S.A. into Contax Par t icipações S.A. including: ( i) the net equity book valuereport of Mobitel S.A. prepared by APSIS Consultoria e Avaliações Ltda.; (ii) the valuation reportof Mobitel S.A. and of Contax Participações S.A. according to the future profitability methodologybased on retrospective analysis, projected scenarios and discounted cash flows prepared by BancoBTG Pactual S.A.; (iii) and the Instrument of Justification and Protocol of Merger of Shares ; and(iv) the report of the Special Committee of Contax Participações S.A. Based on the documentsanalyzed, the undersigned members of the Counci l , p ursuant to Ar t icle 163 of Law No.6404/76, voted in favor of the submission of the proposal for merger of shares for approvalat the Annual Shareholders ' Meet ing of Contax Par t icipações S.A to be held on July 1,2011.

Rio de Janeiro, June 14, 2011.

Sérgio Bernstein

Chairman of the Council

Aparecido Carlos Correia Galdino | | Eder Carvalho Magalhães |

| | |

| José Luiz Montans Anacleto Júnior | | Wancler Ferreira da Silva |

rsi/10467.doc

06/20/11

SPECIAL MEETING OFTHE FISCAL COUNCIL OF CONTAX PARTICIPAÇÕES S.A.

June 14, 2011

EXHIBIT II

TOTHE

MANAGEMENT PROPOSAL

VALUATION REPORT OF THE NETASSET BOOKVALUE

OFMOBITEL

-2 -

Valuation Report

RJ-0310/11-01

MOBITEL S.A.

| REPORT: | | RJ-0310/10-01 |

| BASEDATE: | | December 31, 2010 |

| | | |

| REQUESTING PARTY: | | CONTAX PARTICIPAÇÕES SA, a publicly-heldtraded company, with headquartersat Rua do Passeio, No. 48-56, part, in the Cityand State of Rio de Janeiro, Brazil, enrolled with the National Corporate Taxpayers Register of the Ministry of Finance (CNPJ/MF) under No. 04.032.433/0001-80, hereinafter referred to asCONTAX. |

| | | |

| SUBJECT MATTER: | | MOBITEL SA, a joint-stock corporation, with headquarters at Rua Desembargador Eliseu Guilherme, No. 282-292, District ofParaíso, City and State of São Paulo, Brazil, enrolled with the National Corporate Taxpayers’Register of the Ministry of Finance(CNPJ/MF) under No. 67.313.221/0001-90, hereinafter referred to as MOBITEL. |

| | | |

| PURPOSE: | | Determining the book value of MOBITEL shares for merger of shares by CONTAX, pursuant to art. 252 of Law No. 6,404 of December 15,1976 (Corporate Law). |

1

CONTENTS | | |

| | | |

| 1.INTRODUCTION | | 3 |

| 2.PRINCIPLES AND QUALIFICATIONS | | 4 |

| 3.LIMITATIONS OF LIABILITY | | 5 |

| 4.VALUATION METHODOLOGY | | 6 |

| 5.VALUATION OF SHAREHOLDERS' VALUE | | 7 |

| 6.CONCLUSION | | 8 |

| 7.LISTOFEXHIBITS | | 9 |

1. INTRODUCTION | | |

APSISConsultoria e Avaliações Ltda., hereinafter referred to as APSIS, withheadquarters at Rua da Assembleia, No. 35, 12th floor, Downtown, in the Cityand State of Rio de Janeiro, Brazil, enrolled with the CNPJ under No. 08.681.365/0001-30, with the Regional Accounting Council CRC/RJ-005112/O-9, was appointed to determineof the book value of MOBITEL shares for merger ofshares by CONTAX,pursuant to art. 252 of Law No. 6,404 of December 15, 1976(Corporate Law). Inpreparation of thisreport, information and data provided by third parties wasused in the form of documents and oral interviews with the client. The estimates used in this process are based on documents and information,whichinclude the following: § MOBITEL’saudited Balance Sheet as of December 31, 2010. (Exhibit 01) APSIS recently conducted valuations for various purposes in the following publicly-held companies: § AMÉRICALATINA LOGÍSTICA DO BRASIL S/A § BANCO PACTUAL S/A § CIMENTO MAUÁ S/A § ESTA-EMPRESA SANEADORA TERRITORIAL AGRÍCOLA S/A. § GEODEXCOMMUNICATIONS DO BRASIL S/A § GERDAU S/A § HOTÉIS OTHON S/A § IBESTS/A § L.R. CIA.BRAS.PRODS.HIGIENEE TOUCADOR S/A § LIGHT SERVIÇOS DE ELETRICIDADE S/A § LOJAS AMERICANAS S/A § REPSOL YPF BRASIL S/A

| | § TAMTRANSPORTESAÉREOS MERIDIONALS/A § WAL PETROLEOS/A APSIS team responsible for this work consists of the following professionals: |

| § AMILCARDECASTRO Director Bachelorof Law § ANA CRISTINA FRANÇA DESOUZAManaging partner CivilEngineer(CREA/RJ 91.1.03043-4) Graduate degree in Accounting § ANTÔNIO LUIZ FEIJÓNICOLAUProject Manager § ANTÔNIO REISSILVA FILHO Director CivilEngineer(CREA/SP 107.169) Master's degree in Business Administration § BETINA DENGLERProject Manager § CARLOS MAGNO SANCHESProject Manager § CLAUDIO MARÇAL DEFREITASAccountant (CRC/RJ 55029/O-1) § FELLIPEF. ROSMANProject Manager § GABRIEL ROCHA VENTURIMProject Manager § LUIZPAULOCESARSILVEIRA Director Mechanical Engineer(CREA/RJ 89.1.00165-1) Master's degree in Business Administration § MARGARETH GUIZAN DA SILVA OLIVEIRA Director CivilEngineer(CREA/RJ 91.1.03035-3) § RICARDODUARTECARNEIRO MONTEIROManaging Partner CivilEngineer(CREA/RJ 30137-D) Graduate degree in Economic Engineering § RENATA POZZATOCARNEIRO MONTEIROProject Manager § SERGIOFREITASDE SOUZA Director Economist (CORECON/RJ23521-0) |

| |

| |

| |

| 2. PRINCIPLES AND QUALIFICATIONS | | |

|

The report that is the subject matter of the work listed, calculated and particularized, strictly follows the fundamental principles described below: |

| | |

§ The consultants have no interest, direct or indirect, in the companiesinvolved or in the operation,and there is no other relevant circumstance thatmay characterize a conflict of interests. § To the best of the consultants’ knowledge and credit, the analyses,opinions and conclusions expressed in this report are based on true andaccurate data, investigations, research and surveys. § The report presents all the restrictive conditions imposed by the adopted methodologies, which affect the analysis, opinions and conclusions contained in it. § APSIS’s professional fees are not in any way, subject to the findings of this report. § APSIS assumes full responsibility for Engineering Appraisal , includingimplicit matters, to perform its honorable duties, as primarily establishedin laws, codes or own regulations. § Any information received from third parties is assumed to be correct, and thesources thereof are contained in this report.

| | § The report was prepared by APSIS and no one, except their own consultants, prepared the analysis andrespective conclusions. § For projection purposes, we assumed the inexistence of liens or encumbrances of any kind, whether judicial or extra judicial, affectingthe companies in question, other than those listed in this report. § This report meets the specifications and criteria established by USPAP(Uniform Standards of Professional Appraisal Practice), in addition to therequirements imposed by different bodies, such as: Ministry of Finance,Central Bank, Banco do Brasil, CVM - Brazilian Securities Commission, SUSEP - Superintendenceof Private Insurance, RIR - Regulation of Income Taxetc. § The controller and the managers of the companies involved didnot direct,limit, hinder or performedany acts that have or might have compromisedaccess to, use or knowledge of information, assets, documents or work methodologiesrelevant to the quality of the respective conclusions contained in this work. |

4

3. LIMITATIONSOF LIABILITY

§ For this report, APSIS used information and historical data audited by third parties orunaudited, and unaudited projected data, provided for in writingor orally by company management or obtained from the sources mentioned. Therefore, APSIS assumed the data and informationobtained for this report as true and is not liable with respect to its accuracy.

§ The scope of this work does not include an audit of the financialstatements or a review of the work performed byauditors.

§ Our work is designed for use by the requesting company, its partners andother companiesinvolved in the project,aiming towards the previously described goal.

§ We are not liable for occasional losses to the requesting party and itssubsidiaries, partners,officers, creditorsor other parties as a result of the

useof data and information provided by the company and in this report.

5

4. VALUATIONMETHODOLOGY

Examination of the supporting documentation previously mentioned, in order to check for good bookkeepingin compliance with regulatory, normative andstatutory provisions governing the matter, pursuant “GenerallyAccepted Accounting Principles and Conventions”

MOBITEL’s accounting books and all other documentsnecessary to prepare thisreport were examined based on MOBITEL’s audited balance sheet as of December 31, 2010.

Experts have established thatMOBITEL’sassets and liabilities are properlyaccounted for.

6

5.VALUATIONOF SHAREHOLDERS EQUITY |

| |

| MOBITEL’saccounting bookswere examined along with all other documents | | MOBITEL S.A | FINANCIAL STATEMENTS |

| necessary to prepare this report. | | BALANCE SHEET (IN REAIS) | BALANCES AS OF DECEMBER 31, 2010 |

| Experts have established that the MOBITEL’s shareholders’equity is one | | CURRENT ASSETS | 105,793,489.69 |

| hundred seventy-eight million,twohundred fifteenthousand,nine hundred and | | NON-CURRENT ASSENTS | 328,866,705.10 |

| fifty-nine Reais and sixty-eight cents (R$178,215,959.68), asofDecember 31, | | LONG TERM RECEIVABLES | 54,274,850.81 |

| 2010. Considering that thetotalnumberofMOBITEL shares is one hundred fifty- | | PERMANENT ASSETS | 274,591,854.29 |

| four million, eight hundred seventy-eight thousand, nine hundred and ninety- | | Investments | 140,168,901.28 |

| three (154,878,993), the book valuepershare is oneReal point one fivezero | | Property and equipment | 100,312,293.70 |

| seven (R$ 1.1507). | | Intangible assets | 34,110,659.31 |

| | TOTAL ASSETS | 434,660,194.79 |

| | CURRENT LIABILITIES | 100,711,445.13 |

| | NON-CURRENT LIABILITIES | 155,732,789.98 |

| | LONG TERM LIABILITIES | 155,732,789.98 |

| | SHAREHOLDERS' EQUITY | 178,215,959.68 |

| | TOTAL LIABILITIES | 434,660,194.79 |

| | Quantity of shares of Capital Stock | 154,878,993 |

| | Equity Value per Share | 1.1507 |

7

6. CONCLUSION

Based on the examinationof the documentation mentioned above and on the basis of APSIS’s studies, the experts concluded thatMOBITEL’s shareholders’ equity, for merger of shares by CONTAX, corresponds to one hundred and seventy-eightmillion, two hundred fifteen thousand, nine hundred and fifty-nine Reais and sixty-eight cents (R$178,215,959.68), or one Real point one five seven zero (R$1.1507) per share as of December 31, 2010.

Report RJ-0310/11-01, composed of nine (09) pages typed on one side and two (02) exhibits, is concluded. APSISConsultoria e Avaliações Ltda.,CRC/RJ-005112/O-9, a company specialized in asset valuation, legally represented below by its directors, is at your disposal to answer any questions that may be necessary.

Rio de Janeiro, May 07, 2011.

| AMILCAR DE CASTRO | | CLAUDIO MARÇAL DE FREITAS |

| Director | | Accountant (CRC/RJ 55029/0-1) |

8

7. LIST OF EXHIBITS

1. SUPPORTDOCUMENTATION

2. APSIS’SGLOSSARY ANDPROFILE

SÃO PAULO – SP | | RIO DE JANEIRO –RJ |

Av.Angélica, nº2.503, Conj. 42 | | Rua daAssembléia, nº 35, 12º andar |

Consolação, CEP: 01227-200 | | Centro, CEP: 20011-001 |

| Tel.: +55113666.8448Fax: +55113662.5722 | | Tel.: +55212212.6850Fax: +55212212.6851 |

dmp/10475.doc

06/20/11

9

Mobitel S.A. and Subsidiary

Financial Statements

for the Year ended December 31, 2010 and

Independent Auditors’Report on the Financial Statements

Deloitte Touche Tohmatsu Independent Auditors

INDEPENDENT AUDITORS’REPORT ON THE FINANCIAL STATEMENTS

To the Shareholders and Directors of Mobitel S.A.

São Paulo - SP

We have examined the individual and consolidated financial statements of Mobitel S.A. (“the Company”), identified respectively as Parent Company and Consolidated, which consist of the balancesheet as of December 31, 2010, and the accompanying statements ofincome , changes in shareholders’equity and cash flows for the accounting period then ended , as well as the summary of the principal accounting practices and other notes.

Responsibility of Management for the financial statements

The Management of the Company is responsible for the preparation and the adequate presentation of the individual financial statements in accordance with the accounting principles generally accepted in Brazil (BR GAAP), and of the consolidated financial statements in accordance with the International Financial Reporting Standards (IFRSs) issued by the International Accounting Standards Board (IASB) and with the BR GAAP. Management is also responsible for the internal controls which it has considered necessary to allow the preparation of financial statements free from material misstatement, whether caused by fraud or error.

Responsibility of the independent accountants

Our responsibility is to express an opinion on these financial statements on the basis of our audit, which is conducted in accordance with Brazilian and international auditing standards. These standards require the auditors to comply with ethical requirements, and to plan and perform their audit so as to give reasonable assurance that the financial statements are free from material misstatement.

An audit involves the performance of selected procedures to obtain evidence regarding the amounts and disclosures contained in the financial statements. The procedures selected depend on the auditor’sjudgment, including an assessment of the risks of material misstatements in the financial statements, whether caused by fraud or error. In this assessment of risks, the auditor takes into account the internal controls relevant to the preparation and presentation of the financial statements of the Company so as to plan the audit procedures which are appropriate to the circumstances; but not so as to express an opinion on the effectiveness of these internal controls of the Company. An audit also includes an assessment of whether the accounting practices used by the Company are adequate and whether the accounting estimates made by Management are reasonable, as well as an assessment of the presentation of the financial statements taken as a whole.

We believe that the evidence obtained in the audit is sufficient and appropriate to serve as the basis forour opinion.

Basis for qualified opinion

1. The Company included in its current assets the amount of R$9,149 thousand, relating to training expenses for employees, which it believes should be deferred over the period of a year.

2. The Company did not review the useful life of items included in its property, plant and equipment, as has been a requirement of the BR GAAP since the beginning of 2010.

Qualified opinion on the individual financial statements

In our opinion, with the exception of the effects of the matter noted in paragraph 1, and with the exception of the possible effects, if any, of the matter noted in paragraph 2, the financial statements referred to above fairly represent , in all material respects, Mobitel S.A.’s equity and financial position as of December 31, 2010, the result of its operations and its cash flows for the year then ended , in accordance with the BR GAAP.

Opinion on the consolidated financial statements

In our opinion, with the exception of the effects of the matter noted in paragraph 1, and with the exception of the possible effects, if any, of the matter noted in paragraph 2, the financial statements referred to above fairly represent , in all material respects, Mobitel S.A.’s consolidated equity andfinancial position as of December 31, 2010, the consolidated result of its operations and its consolidated cash flows for the year then ended , in accordance with the IFRSs issued by the IASB and the BR GAAP.

Emphasis of Matters

As indicated in note No.10, the individual financial statements were prepared in accordance with the BR GAAP. In the case of the Company these practices differ from the IFRSs, which are applicable to the individual financial statements, only in respect of the valuation of investments in subsidiaries by the equity method, whereas for the purposes of the IFRSs they would be at cost or at fair value.

São Paulo, March 25, 2011

(sgd)

DELOITTE TOUCHE TOHMATSU

Independent Auditors

CRC No. 2 SP 011609/O-8

(sgd)

José Domingos do Prado

Accountant

CRC No. 1 SP 185087/O-0

Mobitel S.A.

FINANCIAL STATEMENTS AS OF DECEMBER 31, 2010 AND 2009

(In thousands of Reais – R$)

| | | | | | |

| | Note | Parent Company | Consolidated |

| ASSETS | 12/31/10 | 12/31/09 | 01/01/09 | 12/31/10 |

| CURRENT ASSETS | | | | | |

| Cash and Cash equivalents | 5 | 6,765 | 3,169 | 4,524 | 7,167 |

| Trade accounts receivable | 6 | 81,169 | 49,628 | 41,819 | 132,778 |

| Taxes recoverable | 7 | 5,090 | 5,077 | 4,518 | 9,024 |

| Prepaid expenses | 8 | 9,612 | 2,298 | 681 | 9,779 |

| Miscellaneous credits | 9 | 3,157 | 6,438 | 3,320 | 3,353 |

| Total current assets | | 105,793 | 66,610 | 54,862 | 162,101 |

| | | | | | |

| NON-CURRENT ASSETS | | | | | |

| Court Deposits | | 10,816 | 7,774 | 4,747 | 10,974 |

| Taxes recoverable | 7 | 3,643 | 6,570 | 2,266 | 3,643 |

| Deferredincomeandsocial | 23 | 39,816 | 34,572 | 36,677 | 39,816 |

| contribution taxes | | | | | |

| Investments | 10 | 140,169 | - | - | - |

| Property, plant and equipment | 11 | 100,312 | 88,571 | 68,797 | 103,367 |

| Intangible assets | 12 | 34,111 | 23,691 | 19,257 | 157,346 |

| Total non-current assets | | 328,867 | 161,178 | 131,744 | 315,146 |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| TOTAL ASSETS | | 434,660 | 227,788 | 186,606 | 477,247 |

| | | | | | |

| | Note | Parent Company | Consolidated |

| | 12/31/10 | 12/31/09 | 01/01/09 | 12/31/10 |

| LIABILITIESAND SHAREHOLDERS’ EQUITY | | | | | |

| CURRENT LIABILITIES | | | | | |

| Loans and financing | 13 | 15,146 | 353 | 2,771 | 15,146 |

| Suppliers | 14 | 14,879 | 12,612 | 21,118 | 18,682 |

| Taxes payable | | 5,823 | 4,161 | 3,188 | 11,516 |

| Taxes paid in installments | 16 | 1,276 | 1,097 | 1,484 | 2,987 |

| Payroll,provisionsandsocial contributions | 15 | 42,523 | 38,982 | 28,711 | 55,109 |

| Advances from customers | | - | - | - | 1,910 |

| Related companies | 17 | 21,065 | 34,794 | 23,582 | 26,425 |

| Other liabilities | | - | - | - | 266 |

| Total current liabilities | | 100,712 | 91,999 | 80,854 | 132,041 |

| | | | | | |

| NON-CURRENT LIABILITIES | | | | | |

| | | | | | |

| Loans and financing | 13 | - | - | 60,383 | - |

| Suppliers | 14 | 4,319 | 8,439 | 2,917 | 4,319 |

| Provision for tax, labor and other risks | 18 | 10,783 | 13,427 | 14,989 | 17,499 |

| Taxes paid in installments | 16 | 4,502 | 4,600 | 4,014 | 9,044 |

| Affiliates | 17 | 136,129 | 58,270 | 22,000 | 136,129 |

| Total non-current liabilities | | 155,733 | 84,736 | 104,303 | 166,991 |

| SHAREHOLDERS’ EQUITY | | | | | |

| Capital stock | 19 | 262,487 | 141,005 | 87,928 | 262,487 |

| Capital reserve | | 5,846 | - | - | 5,846 |

| Accumulated losses | | (90,118) | (89,952) | (86,479) | (90,118) |

| Total shareholders’ equity | | 178,215 | 51,053 | 1,449 | 178,215 |

| TOTALLIABILITIESAND SHAREHOLDERS’ EQUITY | | 434,660 | 227,788 | 186,606 | 477,247 |

The accompanying notes are an integral part of the financial statements.

Mobitel S.A.

STATEMENTS OF INCOME

FOR THE YEARS ENDED DECEMBER 31, 2010 AND 2009

(In thousands ofReais- R$, except for loss per share)

| | | | | |

| | | Parent Company | Consolidated |

| | Note | 12/31/10 | 12/31/09 | 12/31/10 |

| NET OPERATING REVENUE | 20 | 475,359 | 401,560 | 605,973 |

| Cost of services rendered | 21 | (384,922) | (330,590) | (487,765) |

| GROSS PROFIT | | 90,437 | 70,970 | 118,208 |

| OPERATING REVENUE (EXPENSES) | | | | |

| Selling | 21 | (4,434) | (2,925) | (6,676) |

| General and administrative | 21 | (80,639) | (55,504) | (93,350) |

| Equity pick-up | 10 | 9,786 | | - |

| Other operating revenue | | 777 | 770 | 777 |

| Other operating expenses (non-recurring) | 21 | (6,083) | (66) | (6,083) |

| | | (80,593) | (57,725) | (105,332) |

| | | | | |

| OPERATING INCOME BEFORE FINANCIAL RESULT | | 9,844 | 13,245 | 12,876 |

| Financial revenue | 22 | 1,851 | 11,869 | 2,394 |

| Financial expenses | 22 | (17,105) | (26,481) | (19,228) |

| | | | | |

| LOSS FOR THE PERIOD BEFORE INCOME AND SOCIAL CONTRIBUTION TAXES | | (5,410) | (1,367) | (3,958) |

| INCOME AND SOCIAL CONTRIBUTION TAXES | | | | |

| Current | 23 | - | - | (1,452) |

| Deferred | 23 | 5,244 | (2,106) | 5,244 |

| LOSS FOR THE PERIOD | | (166) | (3,473) | (166) |

| LOSS PER SHARE OF CAPITAL STOCK | | | | |

| | | | | |

| AS OF THE BALANCE SHEET DATE–R$ | | (0.001) | (0.043) | (0.001) |

The accompanying notes are an integral part of the financial statements

MOBITEL S.A.

STATEMENTS OF CHANGES IN SHAREHOLDERS’ EQUITY FOR THE YEARS ENDEDDECEMBER 31, 2010 AND 2009 (In thousands ofReais–R$)

| | | | | |

| | Capital stock | Capital

reserve | Accumulated

losses | Total |

| BALANCES AS OF JANUARY 1, 2009 | 87,928 | | (86,479) | 1,449 |

| Capital increase | 53,077 | | - | 53,077 |

| Loss for the period | | | (3,473) | (3,473) |

| BALANCES AS OF DECEMBER 31, 2009 | 141,005 | | (89,952) | 51,053 |

| Capital reserve | | 5,846 | | 5,846 |

| Capital increase | 121,482 | | | 121,482 |

| Loss for the period | | | (166) | (166) |

| BALANCES AS OF DECEMBER 31, 2010 | 262,487 | 5,846 | 90,118 | 178,215 |

The accompanying notes are an integral part of the financial statements

MOBITEL S.A.

STATEMENTS OF CASH FLOW

FOR THE YEARS ENDED DECEMBER 31, 2010 AND 2009

(In thousands ofReais–R$)

| | | | |

| | Parent Company | Consolidated |

| | 12/31/10 | 12/31/09 | 12/31/10 |

| CASH FLOW FROM OPERATIONS | | | |

| Loss for the period | (166) | (3,473) | (166) |

| Adjustments to reconcile loss for the period with net cash from (used in) operations: | | | |

| Depreciation and amortization | 43,175 | 27,968 | 44,076 |

| Reversal of provision (provision) for doubtful accounts | 216 | (2 I 6) | 340 |

| Equity pick-up | (9,786) | | - |

| Deferred taxes | (5,244) | 2,106 | (5,244) |

| Financial charges, monetary and foreign exchange variations | 16,916 | (4,733) | 17,972 |

| Income on forward and swap contracts | - | (6,888) | - |

| Disposal of property, plant and equipment and intangible assets | 1,235 | 337 | 1,262 |

| Reversal of provisions for tax, labor and other risks | (3,280) | (269) | (597) |

| Increase in trade accounts receivable | (31,757) | (7,593) | (51,611) |

| Increase in other current assets | (4,033) | (4,735) | (3,563) |

| | | | | |

| (Increase) decrease in taxes recoverable | | 2,914 | (4,864) | 3,599 |

| Increase in court deposits | | (3,042) | (3,424) | (3,126) |

| Increase (decrease) in payroll, provisions and social contributions | | 3,541 | 9,947 | (16,473) |

| Increase in suppliers | | (1,853) | (5,163) | (714) |

| Increase in taxes payable | | 1,662 | 909 | 2,622 |

| Decrease in other liabilities | | - | (40) | (3,173) |

| Interest paid | | (280) | (2,741) | (289) |

| Payment of tax, labor and other risks | | (1,547) | (1,293) | (1,952) |

| Net cash from (used in) operations | | 8,671 | (4,165) | (17,037) |

| CASH FLOW FROM INVESTMENT ACTIVITIES | | | | |

| Additions to intangible assets | | (19,670) | (12,779) | (20,528) |

| Additions to property, plant and equipment | | (42,003) | (39,734) | (43,573) |

| Net cash and cash equivalents from acquisition of GPTI | | - | - | 29 |

| Capital payment for subsidiary GPTI | | (99,000) | - | - |

| Net cash used in investment activities | | (160,673) | (52,513) | (64,072) |

| CASH FLOW FROM FINANCING ACTIVITIES | | | | |

| Capital increases | | 93,230 | 53,077 | 93,230 |

| Loans repaid | | (2,355) | (44,543) | (76,597) |

| New financing | | 15,000 | - | 15,000 |

| New financing from related companies | | 50,770 | 46,200 | 55,770 |

| Loan installment payments | | (1,047) | 589 | (2,296) |

| Net cash from financing activities | | 155,598 | 55,323 | 85,107 |

| | | | | |

| INCREASE (DECREASE) IN BALANCE OF CASH AND CASH EQUIVALENTS | | 3,596 | (1,355) | 3,998 |

| | | | | |

| CASH AND CASH EQUIVALENTS | | | | |

| Opening balance | | 3,169 | 4,524 | 3,169 |

| Closing balance | | 6,765 | 3,169 | 7,167 |

| | | | | |

| INCREASE (DECREASE) IN BALANCE OF CASH AND CASH EQUIVALENTS | | 3,596 | (1,355) | 3,998 |

The accompanying notes are an integral part of the financial statements

MOBITEL S.A. AND SUBSIDIARY

NOTES TO THE FINANCIAL STATEMENTS FOR THE YEAR ENDED DECEMBER 31, 2010

(Amounts in thousands ofReais–R$, except where otherwise indicated.)

OPERATIONS

Mobitel S.A. (“the Company”) was established in 1991 and during the year 2000 started operating inthe contact center market. It is a subsidiary of Portugal Telecom Brasil S.A., a company in the Portugal Telecom Group.

The Company has been suffering operating losses during the last few years and has required the injection of additional funds by the majority shareholder in order to carry out its new corporate purpose in the contact centersector. The Company’s business plan, which has been reviewed andapproved by the shareholders, depends on an increase in activity in selected areas, taking into account the significant growth in the industry. The plan is supported by a conservative project for new investments, with a view to updating its technological resources. It is expected that this growth, together with other initiatives for improving operational efficiency (management of personnel and renegotiation of current contracts), and under normal conditions for business development, will allow for the dilution of structural costs and an increase in margins, with a positive impact on operating cash generation.

On February 28, 2010, the Company became the controlling shareholder of GPTI Tecnologia daInformação S.A. (“GPTI”), in an operation involving the exchange of shares. The Company exchanged12.5% of its common shares for 100% of the shares held by the shareholders of GPTI. The ratio used for this exchange of shares was calculated on the basis of the respective fair value of the shares, in accordance with the opinion given in a report prepared by independent experts.

2. PRESENTATION OF THE FINANCIAL STATEMENTS

2.1. Statement of compliance

The financial statements of the parent company were prepared according to the BR GAAP, which include the requirements of Brazilian corporate legislation as well as the technical pronouncements, guidelines and interpretations issued by the Accounting Pronouncements Committee (CPC).

The Company’s consolidated financial statements were prepared in accordance with the International Financial Reporting Standards (IFRSs) issued by the International Accounting Standards Board (IASB), and with the BR GAAP.

2.2. Basis for preparation of the statements

The financial statements were prepared on the basis of historic cost, except for certain financial instruments which are stated at fair value, as described in the following accounting principles. The historic cost is generally based on the fair value of the consideration paid in exchange for assets.

In the preparation of its financial statements, the Company adopted the changes in accounting principles which came into effect in Brazil as a result of technical pronouncements CPC 15 to 40.The effects of the adoption of the new CPC pronouncements are stated in note No.3.

The individual financial statements show the investments in subsidiaries valued according to the equity method, as required by the legislation currently in force in Brazil. These individual financial statements are not therefore considered to be in accordance with the IFRSs, which require such investments to bevalued in the parent company’s separate statements at fair value or at cost.

The consolidated shareholders’ equity and the consolidated income attributable to the parentcompany’s shareholders, as shown in the consolidated financial statements prepared in accordance withthe IFRSs and BR GAAP, are identical to the shareholders’s equity and parent company’s income asshown in the individual financial statements prepared according to BR GAAP. The Company has therefore chosen to show the individual and the consolidated financial statements in a single table, side by side.

2.3. Consolidated financial statements

The consolidated financial statements include the statements of the Company and of its subsidiary GPTI.

The principal consolidation procedures were (a) the elimination of balances of asset and liability accounts outstanding between the two companies; and (b) the elimination of the share of the parentcompany in the shareholders’ equity of the subsidiary company.

3. PRINCIPAL ACCOUNTING PRACTICES

3.1. Effects on the consolidated financial statements of the initial adoption of the IFRSs

The consolidated financial statements of the Company for the year ended December 31, 2010, are the first to be presented in accordance with the IFRSs.The transition date was January 1, 2009 (“openingbalance sheet– Parent company”).

3.2 Effect on the individual financial statements of the initial adoption of the new BR GAAP.

In the preparation of its individual financial statements, the Company adopted all the technical pronouncements, guidelines and interpretations issued by the CPC, which, together with the accounting practices included in Brazilian corporate legislation, are referred to as the BR GAAP, as stated in note No.2.

The Company adopted the new accounting practices in all the accounting periods shown, which include the opening balance sheet as of January 1, 2009. In calculating the adjustments and preparing this opening balance sheet, the Company followed the requirements contained in CPC 43(R1)–Initial Adoption of Technical Pronouncements CPC 15 to 40. This meant adjusting the individual financial statements in such a way that, when consolidated, they would show the same values for shareholders’equity attributable to the owners of the parent company, and for income, as would be shown by a consolidation carried out according to the IFRSs, by the application of IFRS 1 and CPC 37(R1)–Initial Adoption of International Accounting Standards.

3.3 Reconciliation with previous accounting practices

The requirements of IFRS 1 and CPC 37(R1) are that reconciliations must be shown of the balance sheets and statements of income , both individual and consolidated, as of the transition date (January 1, 2009) and as of the date of the last financial statement published in accordance with previous accounting practices (December 31, 2009), in order to allow interested parties to understand the relevant adjustments made as a result of the transition to the IFRSs.

The Company will not show the above-mentioned reconciliation for the Consolidated accounts, in view of the fact that the Company only started to prepare consolidated financial statements as of the year ended December 31, 2010.

The Company is required by the application of CPC 37(R1) – Initial Adoption of International Accounting Standards, to give the following explanation of the impact on the individual financial statements of the transition to the new BR GAAP:

a) Judicial deposits: Amounts in respect of judicial deposits relating to provisions for tax, labor and other risks, were previously shown in the balance sheet in an account set off against the respective provision, on the credit side. This practice was reversed by the adoption of CPC 25–Provisions, Contingent Liabilities and Contingent Assets, and these amounts are now shown in an account among the non-current assets of the Company.

b) Deferred income and social contribution taxes: Amounts in respect of deferred income and social contribution taxes have been re-classified as non-current assets, as required by accounting pronouncement CPC 26–Presentation of Financial Statements.

These adjustments had no effect on the statements of income, on the changes in shareholders’ equityor on the cash flows; for this reason these statements have not been shown again.

| | | | | | | |

| | BR GAAP |

On January 1, 2009 (transition

date) | As of December 31, 2009 (date

of last financial statements

shown in accordance with

previous accounting practices) |

|

|

|

Previous

BR.

GAAP | Effect

of

adoption

of CPCs | Adjusted

BR

GAAP | Previous

BR.

GAAP | Effect

of

adoption

of CPCs | Adjusted

BR

GAAP |

|

|

|

| | | | | | | |

| ACCOUNTS | | | | | | |

| CURRENT ASSETS | | | | | | |

| Cash and cash equivalents | 4,524 | - | 4,524 | 3,169 | - | 3,169 |

| Trade accounts receivable | 41,819 | - | 41,819 | 49,628 | - | 49,628 |

| Taxes recoverable | 4,518 | - | 4,518 | 5,077 | - | 5,077 |

| Deferred income and social contribution taxes | 3,332 | (3,332) | - | 853 | (853) | - |

| Prepaid expenses | 681 | - | 681 | 2,298 | - | 2,298 |

| Miscellaneous credits | 3,320 | - | 3,320 | 6,438 | - | 6,438 |

| Total current assets | 58,194 | (3,332) | 54,862 | 67,463 | (853) | 66,610 |

| | | | | | | |

| NON-CURRENT ASSETS | | | | | | |

| Court deposits | 4,181 | 566 | 4,747 | 6,245 | 1,529 | 7,774 |

| Taxes recoverable | 2,266 | - | 2,266 | 6,570 | - | 6,570 |

| Deferred income and socialcontribution taxes | 33,345 | 3,332 | 36,677 | 33,719 | 853 | 34,572 |

| Property, plant and equipment | 68,797 | - | 68,797 | 88,571 | - | 88,571 |

| Intangible assets | 19,257 | - | 19,257 | 23,691 | - | 23,691 |

| Total non-current assets | 127,846 | 3,898 | 131,744 | 158,796 | 2,382 | 161,178 |

| | | | | | | |

| TOTAL ASSETS | 186,040 | 566 | 186,606 | 226,259 | 1,529 | 227,788 |

| | | | | | | |

| LIABILITIESAND SHAREHOLDERS’ EQUITY | | | | | | |

| | | | | | | |

| CURRENT LIABILITIES | | | | | | |

| Loans and financing | 2,771 | - | 2,771 | 353 | - | 353 |

| Suppliers | 21,118 | - | 21,118 | 12,612 | - | 12,612 |

| Taxes payable | 3,188 | - | 3,188 | 4,161 | - | 4,161 |

| Taxes paid in installments | 1,484 | - | 1,484 | 1,097 | - | 1,097 |

| Payroll,provisionsandsocial contributions | 28,711 | - | 28,711 | 38,982 | - | 38,982 |

| Related companies | 23,582 | - | 23,582 | 34,794 | - | 34,794 |

| Total current liabilities | 80,854 | - | 80,854 | 91,999 | - | 91,999 |

| | | | | | | |

| NON-CURRENT LIABILITIES | | | | | | |

| Loans and financing | 60,383 | - | 60,383 | - | - | - |

| Suppliers | 2,917 | - | 2,917 | 8,439 | - | 8,439 |

| Provision for tax, labor and other risks | 14,423 | 566 | 14,989 | 11,898 | 1,529 | 13,427 |

| Taxes paid in installments | 4,014 | - | 4,014 | 4,600 | - | 4,600 |

| Related companies | 22,000 | - | 22,000 | 58,270 | - | 58,270 |

| Total non-current liabilities | 103,737 | 566 | 104,303 | 83,207 | 1,529 | 84,736 |

| | | | | | | - |

| SHAREHOLDERS’ EQUITY | | | | | | - |

| Capital stock | 87,928 | - | 87,928 | 141,005 | - | 141,005 |

| Accumulated losses | (86,479) | - | (86,479) | (89,952) | - | (89,952) |

| Total shareholders’ equity | 1,449 | - | 1,449 | 51,053 | - | 51,053 |

| TOTALLIABILITIESAND SHAREHOLDERS’ EQUITY | 186,040 | 566 | 186,606 | 226,259 | 1,529 | 227,788 |

Deemed cost

The Company chose not to adopt the principle of deemed cost, on the basis that there is no significant difference between the book values of the items shown in the financial statements and their respective fair values as of the transition date on January 1, 2009.

4. SUMMARY OF PRINCIPAL ACCOUNTING PRACTICES

a) Cash and cash equivalents

These consist of cash balances, demand deposits and financial investments with redemption periods of up to 90 days from the date of the deposit. The latter are shown at cost plus earnings accrued up to the balance sheet date, and are subject to an insignificant risk of alteration in value.

b) Provision for doubtful accounts

This provision is set up on the basis of an analysis of credits receivable, taking into account the risks involved, and is considered to be sufficient by the Management of the Company.

c) Investments

The shareholding in the subsidiary company GPTI is valued by the equity method.

Goodwill arising from the acquisition of the shares, on account of future profitability, is classified as an intangible asset.

d) Property, plant and equipment and intangible assets

These assets are valued at cost with monetary restatement up to December 31, 1995, less depreciation or amortization similarly corrected. Assets are depreciated on a straight line basis until reaching their estimated residual values. The depreciation rates take into account the estimated useful economic life of the assets. Costs of improvement of property leased from third parties are included as property assets and written off over the term of the lease contracts. Lease contracts with purchase option are booked as assets and depreciated over the estimated useful life of the goods. Goods acquired under leasecontracts are booked as fixed assets under the headings “Communications equipment” or “Data processing equipment”, and the liabilities arising from these contracts appear under “Loans and financing”. There has been no need to set up a provision forimpairmentof the Company’s assets.

Intangible assets with a defined useful life are amortized over the period of their estimated useful economic life. They are submitted to impairment testing , when indications of loss in their recoverable value are identified. Intangible assets with an indefinite useful life are not amortized, but are tested annually for impairment.

e) Revenue

Revenue is taken into income on an accrual basis over the period in which the services are rendered.

f) Credits and liabilities

Rights and obligations subject to adjustment were updated to the date of the balance sheets.

g) Income and social contribution taxes

Provision for income tax was set up at the rate of 15%, plus a further 10% on the taxable income in excess of R$240. Social contribution tax was calculated at the rate of 9% on the adjusted book income. Deferred tax credits shown take into account the estimate of future taxable profit generation, as described in note No.23.

h) Taxes recoverable

As remarked in note No.7, the Company took into current assets, to the credit of other operating revenue, the value of taxes which, in its understanding, and with the support of injunctions and favorable appellate court decisions , were collected in excess of the proper amounts. In accordance with BR GAAP, such bookkeeping entries should be confirmed by final and unappeallable court decisions.

i) Provision for tax, labor and other risks

This provision is determined on the basis of the opinions of legal advisors and of Management, as to the probable result of pending matters. It is updated as of the date of the balance sheets to the probable amount of the loss, taking into account the nature of each provision.

j) Use of estimates

The preparation of financial statements, in accordance with BR GAAP and with the IFRSs, requires Management to use estimates for recording certain transactions: these are transactions which affect assets, liabilities, revenue and expenses of the Company and its subsidiary, as well as the information given out containing details of the financial statements. The final result of these transactions and information, when they are eventually realized in subsequent accounting periods, may differ from the estimates. The principal estimates which apply to the financial statements are in relation to the need to set up provisions for doubtful accounts and for tax, labor and other risks; the determination of the useful life of property, plant and equipment; and the treatment of deferred taxes and of intangible assets with an indefinite useful life.

5. CASH AND CASH EQUIVALENTS

| | | | | |

| | Parent company | Consolidated |

| | 12/31/10 | 12/31/09 | 01/01/09 | 12/31/10 |

| Fixed fund | 35 | 27 | 18 | 41 |

| Banks | 6,730 | 3,142 | 4,506 | 7,126 |

| Total | 6,765 | 3,169 | 4,524 | 7,167 |

6. ACCOUNTS RECEIVABLE FROM CUSTOMERS

| | | | | |

| | Parent company | Consolidated |

| | 12/31/10 | 12/31/09 | 01/01/09 | 12/31/10 |

| Customers for invoicing (*) | 44,502 | 36,955 | 31,623 | 91,045 |

| Customers invoiced | 36,667 | 12,889 | 10,196 | 42,010 |

| Provision for doubtful accounts | - | (216) | - | (277) |

| Total | 81,169 | 49,628 | 41,819 | 132,778 |

(*) This refers to“call center”services supplied, systems development, environment processes and management, applications and training, where the corresponding invoice has not yet been issued. The average period for receipt of these amounts is approximately two months.

Breakdown by maturity date of accounts receivable from invoiced customers:

| | | | |

| | Parent Company | Consolidated |

| | 12/31/10 | 12/31/09 | 12/31/10 |

| Not yet due | 36,448 | 12,176 | 40,694 |

| Overdue: | | | |

| From 1 to 30 days | 134 | 497 | 849 |

| | | | |

| From 31 to 60 days | 86 | - | 181 |

| From 61 to 90 days | - | - | 9 |

| 91 days and over | - | 216 | 277 |

| Total | 36,667 | 12,889 | 42,010 |

7. TAXES RECOVERABLE

| | | | | |

| | Parent Company | Consolidated |

| | 12/31/10 | 12/31/09 | 01/01/09 | 12/31/10 |

| INSS for set-off - SAT | - | 4,304 | - | - |

| PIS recoverable | 956 | 978 | 991 | 956 |

| INSS recoverable | 299 | 805 | 264 | 299 |

| IRRF | 2,454 | 1,806 | 1,727 | 4,891 |

| CSLL withheld | 737 | 814 | 829 | 2,166 |

| COFINS recoverable | 198 | 302 | 361 | 227 |

| IRPJ e CSLL recoverable | 2,613 | 2,515 | 2,499 | 2,633 |

| ISS recoverable (court-ordered) | 1,377 | - | - | 1,377 |

| Others | 99 | 123 | 113 | 118 |

| Total | 8,733 | 11,647 | 6,784 | 12,667 |

| | | | | |

| Current | 5,090 | 5,077 | 4,518 | 9,024 |

| Non-current | 3,643 | 6,570 | 2,266 | 3,643 |

8. PREPAID EXPENSES

| | | | | |

| | Parent Company | Consolidated |

| | 12/31/10 | 12/31/09 | 01/01/09 | 12/31/10 |

| Miscellaneousfees/letterofguarantee | 83 | 79 | 206 | 83 |

| Training | 9,419 | 2,134 | 460 | 9,419 |

| Others | 110 | 85 | 15 | 277 |

| Total | 9,612 | 2,298 | 681 | 9,779 |

9. MISCELLANEOUS CREDITS

| | | | | |

| | Parent Company | Consolidated |

| | 12/31/10 | 12/31/09 | 01/01/09 | 12/31/10 |

| Advances to employees(vacationsandtransportvouchers) | 2,045 | 3,757 | 2,959 | 2,123 |

| Advances to suppliers | 1,112 | 2,681 | 361 | 1,125 |

| Others | - | - | - | 105 |

| Total | 3,157 | 6,438 | 3,320 | 3,353 |

10. INVESTMENTS

| | Number of shares (*) | Share of paid-up capital | Shareholders’ equity as of

December 31,

2010 | Goodwill and contracts (net)

as of

December 31,

2010 (a) | Balance of investment as

of December

31, 2010 |

|

|

|

|

| GPTI | 119,144,000 | 100.00% | 17,536 | 122,633 | 140,169 |

(*)Number of shares held by the Company as of December 31, 2010.

Changes in investments:

| | |

| GPTI negative shareholders’ equity on acquisition date –February 28, 2010 | (91,250) |

| Capital stock paid in during March 2010 | 99,000 |

| Equity pick-up for the period (March 1 to December 31, 2010) | 9,786 |

| | |

| Balance of investments as of December 31, 2010 | 17,536 |