As filed with the Securities and Exchange Commission on June 30, 2011

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 20-F/A

(AMENDMENT NO. 1)

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended: December 31, 2010

Commission file number: 000-51490

CONTAX PARTICIPAÇÕES S.A.

(Exact Name of Registrant as specified in its charter)

Contax Holding Company | The Federative Republic of Brazil |

(Translation of Registrant’s name into English) | (Jurisdiction of incorporation or organization) |

________________

Rua do Passeio 56, 16º andar (parte)

20021-290 Rio de Janeiro – RJ – Brazil

(Address of principal executive offices)

Marco Norci Schroeder, Tel: +55 21 3131-0010, ri@contax.com.br, Rua do Passeio 56, 16º andar

CEP: 20021-290, Rio de Janeiro – RJ – Brazil

(Name, Telephone, E-mail and/or Facsimile number and Address of Company Contact Person)

________________

Securities registered or to be registered pursuant to Section 12(b) of the Act: None

Securities registered or to be registered pursuant to Section 12(g) of the Act:

Title of Each Class | Name of Each Exchange on Which Registered |

Preferred Shares, without par value (“preferred shares”) | BM&FBovespa |

Common Shares, without par value (“common shares”) | BM&FBovespa |

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act:None

________________

The number of outstanding shares of each of the Issuer’s classes of capital, common or preferred stock, as of the close of the period covered by the annual report was:

36,681,000 preferred shares

23,089,600 common shares

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes£ NoR

If this report is an annual or transition report, indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934. Yes£ NoR

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. YesR No£

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer. See definition of “accelerated filer and large accelerated filer” in Rule 12b-2 of theExchange Act. (Check one):

Large accelerated filer£ Accelerated filer R Non-accelerated filer£

Indicate by check mark which basis of accounting the registrant has used to prepare the financial statements included in this filing:

U.S. GAAP£ | International Financial Reporting Standards as issued by the International Accounting Standards BoardR | Other£ |

If “Other” has been checked in response to the previous question, indicate by check mark which financial statement item the registrant has elected to follow. Item 17£ Item 18£

If this is an annual report, indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

Yes£ NoR

(APPLICABLE ONLY TO ISSUERS INVOLVED IN BANKRUPTCY PROCEEDINGS DURING THE PAST FIVE YEARS)

Indicate by check mark whether the registrant has filed all documents and reports required to be filed by Sections 12, 13 or 15(d) of the Securities Exchange Act of 1934 subsequent to the distribution of securities under a plan confirmed by a court. Yes£ No£

Explanatory Note

This Amendment No. 1 to Form 20-F (the “Form 20-F/A”) amends our annual report on Form 20-F for the fiscal year ended December 31, 2010, originally filed with the U.S. Securities and Exchange Commission (“SEC”) on June 27, 2011 (the “Form 20-F”). The sole purpose of this Form 20-F/A is to amend the Form 20-F to update “Item 18. Financial Statements”by amending the amounts related to the year ended December 31, 2008 in the table of Note 6.4 on page F-36 and in the first two tables of Note 7 on page F-37 of the Form 20-F,andto change the page reference under the heading “Item 18. Financial Statements” from “F-1 through F-13” to “F-1 through F-94”.

Item 18. Financial Statements

See pages F-1 through F-94

SIGNATURES

Contax Participações S.A. hereby certifies that it meets all of the requirements for filing on Form 20-F and that it has duly caused and authorized the undersigned to sign this Amendment No. 1 to annual report on Form 20-F on its behalf.

.

CONTAX PARTICIPAÇÕES S.A.

By:/s/ Michel Neves Sarkis

Name: Michel Neves Sarkis

Title: Chief Executive Officer

Dated: June 30, 2011

Contax Participações S.A.

Consolidated Financial Statements as of December 31, 2010 and 2009 and for the three years 2010 ended and

Reports of Independent Registered Public Accounting Firms

Index to the Consolidated Financial Statements | F-1 |

Management’s Report on Internal Control over Financial Reporting | F-2 |

Report of Independent Registered Public Accounting Firm, on Internal Control Over Financial Reporting | F-4 |

Reports of Independent Registered Public Accounting Firms, on Consolidated Financial Statements | F-6 |

Consolidated Balance Sheets as of December 31, 2010 and 2009 | F-8 |

Consolidated Statements of Income for the Years ended December 31, 2010, 2009 and 2008 | F-9 |

Consolidated Statements of Comprehensive Income for the Years ended December 31, 2010, 2009 and 2008 | F-10 |

Consolidated Statements of Changes in Shareholders’ Equity for the Years ended December 31, 2010, 2009 and 2008 | F-11 |

Consolidated Statements of Cash Flows for the Years ended December 31, 2010, 2009 and 2008 | F-12 |

Notes to the Consolidated Financial Statements for the Years Ended December 31, 2010, 2009 and 2008 | F-13 |

MANAGEMENT’S REPORT ON INTERNAL CONTROL OVER FINANCIAL REPORTING

The management ofContax Participações S.A. and subsidiaries (the “Company”) is responsible for establishing and maintaining effective internal control over financial reporting and for its assessment of the effectiveness of internal control over financial reporting as defined in Rules 13a-15(f) under the Securities Exchange Act of 1934.

The Company’s internal control over financial reporting is designed to provide reasonable assurance to our management and board of directors regarding the preparation and fair presentation of published financial statements in accordance with International Financial Reporting Standards (IFRSs), as issued by the International Accounting Standards Board (IASB). Our internal control over financial reporting includes those policies and procedures that: (1) pertain to the maintenance of records that, in reasonable detail, accurately and fairly reflect the transactions and dispositions of our assets; (2) provide reasonable assurance that transactions are recorded as necessary to permit preparation of consolidated financial statements in accordance with International Financial Reporting Standards (IFRSs), and that our receipts and expenditures are being made only in accordance with authorizations of our management and directors; and (3) provide reasonable assurance regarding prevention or timely detection of unauthorized acquisition, use, or disposition of our assets that could have a material effect on the consolidated financial statements.

Because of its inherent limitations, internal control over financial reporting may not prevent or detect material misstatements on a timely basis. Therefore even those systems determined to be effective can provide only reasonable assurance with respect to financial statement preparation and presentation. Also, projections of any evaluation of effectiveness to future periods are subject to the risk that controls may become inadequate because of changes in conditions, or that the degree of compliance with the policies or procedures may deteriorate.

Our management, under the supervision and with the participation of our Chief Executive Officer and our Chief Financial and Investor Relations Officer, assessed the effectiveness of the Company's internal control over financial reporting as of December 31, 2010, based on the criteria established inInternal Control - Integrated Framework issued by the Committee of Sponsoring Organizations of the Treadway Commission (the “COSO Framework”).

Based on our assessment, we have concluded that our internal control over financial reporting was effective at December 31, 2010.

Table of Contents

In reliance on guidance set forth in Question 3 of a “Frequently Asked Questions” interpretative release issued by the Staff of the SEC’s Office of the Chief Accountant and the Division of Corporation Finance in September 2004, as revised on September 24, 2007, regarding Securities Exchange Act Release No. 34-47986, Management’s Report on Internal Control over Financial Reporting and Certification of Disclosure in Exchange Act Periodic Reports, our management determined that it would exclude the business of Ability Comunicação Integrada Ltda. (“Ability”) from the scope of its assessment of the effectiveness of internal control over financial reporting for the year ended December 31, 2010. The reason for this exclusion is that we acquired Ability in September 2010 and it was not possible for management to conduct an assessment of internal control over financial reporting in the period between the date the acquisition was completed and the date of management’s assessment. Accordingly, management excluded Ability from its assessment of the effectiveness of internal control over financial reporting during the year ended December 31, 2010. Ability’s total assets represent approximately 8% of the Company’s total assets and total net operating revenue and net income represent approximately 1% and 2% of the Company’s total net operating revenue and net income, respectively, as reflected in the Company’s Consolidated Financial Statements as of and for the year ended December 31, 2010. Ability will be included in management’s assessment of the effectiveness of internal control over financial reporting starting no later than our annual assessment for the fiscal year beginning January 1, 2011.

The Company’s independent registered public accounting firm, Deloitte Touche Tohmatsu Auditores Independentes, has issuedits report on the effectiveness of the Company’s internal control over financial reporting, included herein.

Rio de Janeiro, June 27, 2011

/s/ Michel Neves Sarkis | | /s/ Marco Norci Schroeder |

Michel Neves Sarkis | | Marco Norci Schroeder |

Chief Executive Officer | | Chief Financial and Investor Relations Officer |

June 27, 2011 | | June 27, 2011 |

Table of Contents

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM, ON INTERNAL CONTROL OVER FINANCIAL REPORTING

To the Board of Directors and Shareholders of

Contax Participações S.A.

Rio de Janeiro, Brazil

We have audited the internal control over financial reporting of Contax Participações S.A. and subsidiaries (the “Company”) as of December 31, 2010, based on criteria established inInternal Control - Integrated Framework issued by the Committee of Sponsoring Organizations of the Treadway Commission. As described in Management’s Report on Internal Control over Financial Reporting, management excluded from its assessment the internal control over financial reporting at Ability Comunicação Integrada Ltda. (“Ability”), which was acquired on September 2010 and whose financial statements constitute approximately 8% of total assets and approximately 1% and 2% of net operating revenue and net income, respectively, of the consolidated financial statement amounts as of and for the year ended December 31, 2010. Accordingly, our audit did not include the internal control over financial reporting at Ability. The Company's management is responsible for maintaining effective internal control over financial reporting and for its assessment of the effectiveness of internal control over financial reporting, included in the accompanying Management’s Report on Internal Control over Financial Reporting. Our responsibility is to express an opinion on the Company's internal control over financial reporting based on our audit.

We conducted our audit in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether effective internal control over financial reporting was maintained in all material respects. Our audit included obtaining an understanding of internal control over financial reporting, assessing the risk that a material weakness exists, and testing and evaluating the design and operating effectiveness of internal control based on the assessed risk, and performing such other procedures as we considered necessary in the circumstances. We believe that our audit provides a reasonable basis for our opinion.

Table of Contents

A company's internal control over financial reporting is a process designed by, or under the supervision of, the company's principal executive and principal financial officers, or persons performing similar functions, and effected by the company's board of directors, management, and other personnel to provide reasonable assurance regarding the reliability of financial reporting and the preparation of financial statements for external purposes in accordance with International Financial Reporting Standards (IFRSs), as issued by the International Accounting Standards Board (IASB). A company's internal control over financial reporting includes those policies and procedures that (1) pertain to the maintenance of records that, in reasonable detail, accurately and fairly reflect the transactions and dispositions of the assets of the company; (2) provide reasonable assurance that transactions are recorded as necessary to permit preparation of financial statements in accordance with International Financial Reporting Standards (IFRSs), as issued by the International Accounting Standards Board (IASB), and that receipts and expenditures of the company are being made only in accordance with authorizations of management and directors of the company; and (3) provide reasonable assurance regarding prevention or timely detection of unauthorized acquisition, use, or disposition of the company's assets that could have a material effect on the financial statements.

Because of the inherent limitations of internal control over financial reporting, including the possibility of collusion or improper management override of controls, material misstatements due to error or fraud may not be prevented or detected on a timely basis. Also, projections of any evaluation of the effectiveness of the internal control over financial reporting to future periods are subject to the risk that the controls may become inadequate because of changes in conditions, or that the degree of compliance with the policies or procedures may deteriorate.

In our opinion, the Company maintained, in all material respects, effective internal control over financial reporting as of December 31, 2010, based on criteria established inInternal Control - Integrated Framework issued by the Committee of Sponsoring Organizations of the Treadway Commission.

We have also audited, in accordance with the standards of the Public Company Accounting Oversight Board (United States),the consolidated financial statements as of and for the year ended December 31, 2010 of the Company and our report dated June 27, 2011 expressed an unqualified opinion on those financial statements.

/s/Deloitte Touche Tohmatsu Auditores Independentes

Deloitte Touche Tohmatsu Auditores Independentes

Rio de Janeiro, Brazil

June 27, 2011

Table of Contents

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM, ON CONSOLIDATED FINANCIAL STATEMENTS

To the Board of Directors and Stockholders of

Contax Participações S.A.

Rio de Janeiro, Brazil

We have audited the accompanying consolidated balance sheets of Contax Participações S.A. and subsidiaries’ (the “Company”) as of December 31, 2010 and 2009, and the related consolidated statements of comprehensive income, changes in shareholders’ equity, and cash flows for each of the two years in the period ended December 31, 2010. These consolidated financial statements are the responsibility of the Company’s management. Our responsibility is to express an opinion on these consolidated financial statements based on our audits.

We conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements. An audit also includes assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. We believe that our audits provide a reasonable basis for our opinion.

In our opinion, the consolidated financial statements referred to above present fairly, in all material respects, the financial position of the Company as of December 31, 2010 and 2009, and the results of its operations and its cash flows for each of the two years in the period ended December 31, 2010, in accordance with International Financial Reporting Standards (IFRSs), as issued by the International Accounting Standards Board (IASB).

We also have audited, in accordance with the standards of the Public Company Accounting Oversight Board (United States), the Company’s internal control over financial reporting as of December 31, 2010, based on criteria established inInternal Control - Integrated Framework issued by the Committee of Sponsoring Organizations of the Treadway Commission (COSO), and our report dated June 27, 2011, expressed an unqualified opinion on the Company’s internal control over financial reporting.

/s/Deloitte Touche Tohmatsu Auditores Independentes

Deloitte Touche Tohmatsu Auditores Independentes

Rio de Janeiro, Brazil

June 27, 2011

Table of Contents

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

To the Board of Directors and Shareholders

Contax Participações S.A.

In our opinion, the consolidated income statement, consolidated statement of changes in equity and consolidated cash flow statements for the year ended December 31, 2008 present fairly, in all material respects, the results of operations and cash flows of Contax Participações S.A. and its subsidiaries for the year ended December 31, 2008, in conformity with International Financial Reporting Standards as issued by the International Accounting Standards Board. These financial statements are the responsibility of the Company's management. Our responsibility is to express an opinion on these financial statements based on our audits. We conducted our audits of these statements in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements, assessing the accounting principles used and significant estimates made by management, and evaluating the overall financial statement presentation. We believe that our audits provide a reasonable basis for our opinion.

/s/ PricewaterhouseCoopers Auditores Independentes

Rio de Janeiro, June 30, 2009 (except with respect to our opinion on the consolidated financial statements insofar as it relates to the retrospective adjustment on the share amounts and earnings per share for the stock split approved on October 27, 2009, for which the date is June 28, 2010)

Table of Contents

| | | | | | | | | | | |

| CONTAX PARTICIPAÇÕES S.A. | | | | | | | | | | |

| |

| CONSOLIDATED BALANCE SHEETS AS OF DECEMBER 31, 2010 AND 2009 | | | | | | | | |

| (Amounts in thousands of Brazilian reais – R$) | | | | | | | | | | |

| |

| ASSETS | Note | 2010 | | 2009 | | EQUITY AND LIABILITIES | Note | 2010 | | 2009 |

| |

| NON-CURRENT ASSETS | | | | | | CAPITAL AND RESERVES | | | | |

| Property, plant and equipment | 10 | 405,873 | | 352,473 | | Issued Capital | 17 | 223,873 | | 223,873 |

| Goodwill on investments | 11 | 49,081 | | - | | Capital reserve | 18 | 14,731 | | 19,639 |

| Other intangible assets | 12 | 69,073 | | 80,446 | | Profit reserves | 18 | 118,329 | | 109,831 |

| Judicial deposits | 24 | 93,865 | | 53,382 | | Treasury shares | 19 | (12,147) | | (10,686) |

| Restricted cash | 16 | 2,013 | | - | | Foreign currency translation reserve | 18 | (46) | | - |

| Recoverable taxes | 13 | 10,383 | | 8,578 | | Proposal for additional dividend distribution | 20 | 74,231 | | 59,403 |

| Deferred tax assets | 14 | 64,269 | | 28,773 | | Equity attributable to the owners of the Parent Company | | 418,971 | | 402,060 |

| Financial investments held to maturity | 16 | 69,869 | | 26,590 | | | | | | |

| Other assets | | 12,058 | | 12,769 | | Non-controlling interests | 21 | 2,000 | | 1,445 |

| Total non-current assets | | 776,484 | | 563,011 | | | | | | |

| | | | | | | Total Equity | | 420,971 | | 403,505 |

| CURRENT ASSETS | | | | | | | | | | |

| Trade receivables | 15 | 176,302 | | 128,486 | | NON-CURRENT LIABILITIES | | | | |

| Recoverable taxes | 13 | 7,133 | | 3,673 | | Borrowings | 22 | 317,994 | | 149,521 |

| Prepaid expenses and other assets | | 30,835 | | 18,650 | | Taxes payable | 23 | - | | 944 |

| Cash and cash equivalents | 16 | 387,803 | | 357,853 | | Obligations under finance leases | 25 | - | | 3,899 |

| Total current assets | | 602,073 | | 508,662 | | Provision for contingencies | 24 | 88,266 | | 59,921 |

| | | | | | | Contingent consideration | 24 | 45,685 | | - |

| TOTAL ASSETS | | 1,378,557 | | 1,071,673 | | Other liabilities | 26 | 1,165 | | - |

| | | | | | | Total non-current liabilities | | 453,110 | | 214,285 |

| |

| | | | | | | CURRENT LIABILITIES | | | | |

| | | | | | | Trade payables | | 83,160 | | 77,033 |

| | | | | | | Borrowings | 22 | 64,873 | | 55,070 |

| | | | | | | Payroll and related charges | 27 | 230,569 | | 197,818 |

| | | | | | | Obligations under finance leases | 25 | 4,277 | | 10,118 |

| | | | | | | Taxes payable | 23 | 43,093 | | 33,477 |

| | | | | | | Dividends payable | 20 | 28,959 | | 32,787 |

| | | | | | | Amounts payable to shareholders | 17 | 26,374 | | 16,331 |

| | | | | | | Other liabilities | 26 | 23,171 | | 31,249 |

| | | | | | | Total current liabilities | | 504,476 | | 453,883 |

| | | | | | | | | | | |

| | | | | | | TOTAL LIABILITIES | | 957,586 | | 668,168 |

| | | | | | | | | | | |

| | | | | | | TOTAL EQUITY AND LIABILITIES | | 1,378,557 | | 1,071,673 |

Table of Contents

| | | | | | | |

| CONTAX PARTICIPAÇÕES S.A. | | | | | | |

| |

| CONSOLIDATED STATEMENTS OF INCOME | | | | | | |

| FOR THE YEARS ENDED DECEMBER 31, 2010, 2009 AND 2008 | | | | | |

| (Amounts in thousands of Brazilian reais - R$, except earnings per share) | | | | | |

| |

| | Note | 2010 | | 2009 | | 2008 |

| |

| |

| Net operating revenue(*) | 5 | 2,397,996 | | 2,161,019 | | 1,774,728 |

| |

| Cost of services | 7.1 | (2,026,392) | | (1,760,164) | | (1,507,603) |

| |

| Gross profit | | 371,604 | | 400,855 | | 267,125 |

| |

| Operating income (expenses) | | | | | | |

Selling | 7.1 | (26,976) | | (27,709) | | (28,488) |

General and administrative expenses | 7.1 | (138,007) | | (130,715) | | (84,967) |

Management fees | 7.1 | (7,142) | | (7,879) | | (6,317) |

Financial revenue | 7.4 | 33,213 | | 24,531 | | 32,547 |

Financial expenses | 7.4 | (30,681) | | (39,922) | | (32,597) |

Other operating expenses, net | 7.2 | (24,440) | | (13,440) | | (18,626) |

| | | (194,033) | | (195,134) | | (138,448) |

| | | | | | | |

| Profit before income tax and social contribution | | 177,571 | | 205,721 | | 128,677 |

| |

| Income tax and social contribution expenses: | | | | | | |

Current | 8 | (70,708) | | (70,998) | | (51,370) |

Deferred | 8 | 2,190 | | (3,666) | | 5,522 |

| |

| Net income for the year | | 109,053 | | 131,057 | | 82,829 |

| |

| Net income attributable to: | 9 | | | | | |

Owners of the parent company | | 108,498 | | 131,691 | | 82,826 |

Minority shareholders | | 555 | | (634) | | 3 |

| | | 109,053 | | 131,057 | | 82,829 |

| Earnings per share: | 9 | | | | | |

Basic | | | | | | |

Common shares (cents per share) | | 1.82 | | 2.23 | | 1.39 |

Preferred shares (cents per share) | | 1.83 | | 2.23 | | 1.31 |

Diluted | | | | | | |

Common shares (cents per share) | | 1.80 | | 2.19 | | 1.39 |

Preferred shares (cents per share) | | 1.83 | | 2.23 | | 1.31 |

| |

| (*) Revenues are presented net of sales taxes, returns, allowances and discounts. | | | | | |

| |

| The accompanying notes are an integral part of these consolidated financial statements. |

Table of Contents

| | | | | | | |

| CONTAX PARTICIPAÇÕES S.A. | | | | | | |

| |

| STATEMENTS OF COMPREHENSIVE INCOME FOR THE YEARS ENDED DECEMBER 31, 2010, 2009 AND 2008 | | |

| (Amounts in thousands of Brazilian reais - R$) | | | | | | |

| |

| | Note | 2010 | | 2009 | | 2008 |

| |

| Net income for the year | | 109,053 | | 131,057 | | 82,829 |

| |

| Other comprehensive income: | | | | | | |

| Exchange rate difference in the translation of operations abroad: | | | | | | |

Exchange rate differences in the year | 18 | (46) | | - | | - |

| | | 109,007 | | 131,057 | | 82,829 |

| |

| Total comprehensive income for the year | | 109,007 | | 131,057 | | 82,829 |

| |

| Total comprehensive income attributed to: | | | | | | |

Owners od the parent company | | 109,007 | | 131,057 | | 82,829 |

Minority shareholders | | (555) | | 634 | | (3) |

| | | 108,452 | | 131,691 | | 82,826 |

| |

| |

| The accompanying notes are an integral part of these consolidated financial statements. |

Table of Contents

CONTAX PARTICIPAÇÕES S.A. | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | |

CONSOLIDATED STATEMENT OF CHANGES IN SHAREHOLDERS' EQUITY |

FOR THE YEARS ENDED DECEMBER 31, 2010 AND 2009 | | | | |

(Amounts in thousands of Brazilian reais - R$) | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | Profit Reserves | | | | | | | | | | | |

| | | | | | | | | | | | | | | Foreing

currency

translation

reserve | | | | Equity

attributable to

the owners of the

Parent Company | | | | |

| | | | | Capital

reserve on share

subscripition | | | | | | | | | | | | | | | | |

| | | Share | | | | | | | Unrealized | | Treasury | | | Retained | | | Non-controlling | | |

| Note | | capital | | | Legal | | Statutory | | reserve | | shares | | | earnings | | | interests | | Total |

| | | | | | | | | | | | | | | | | | | | | | | |

Balance at January 1, 2008 | | | 223,873 | | 9,254 | | 10,845 | | 40,595 | | 16,626 | | (10,913) | | - | | 6,725 | | 297,005 | | - | | 297,005 |

| | | | | | | | | | | | | | | | | | | - | | | | - |

Acquisition of own shares | | | - | | - | | - | | - | | - | | (38,935) | | - | | - | | (38,935) | | - | | (38,935) |

Dividends lapsed | | | - | | 28 | | - | | - | | - | | - | | - | | - | | 28 | | - | | 28 |

Profit for the year | | | - | | - | | - | | - | | - | | - | | - | | 82,826 | | 82,826 | | 3 | | 82,829 |

Allocation of the net income for the year: | | | | | | | | | | | | | | | | | | | | | | | |

Legal reserve | | | - | | - | | 4,620 | | - | | - | | - | | - | | (4,620) | | - | | - | | - |

Statutory reserve | | | - | | - | | - | | 54,415 | | - | | - | | - | | (54,415) | | - | | - | | - |

Dividends proposed (R$0.85 per thousand shares) | | | - | | - | | - | | - | | - | | - | | - | | (21,947) | | (21,947) | | - | | (21,947) |

Non-controlling interests | | | - | | - | | - | | - | | - | | - | | - | | | | - | | 2,076 | | 2,076 |

| | | | | | | | | | | | | | | | | | | | | | | |

Balance at December 31, 2008 | | | 223,873 | | 9,282 | | 15,465 | | 95,010 | | 16,626 | | (49,848) | | - | | 8,569 | | 318,977 | | 2,079 | | 321,056 |

| | | | | | | | | | | | | | | | | | | | | | | |

Acquisition of own shares | 19 | | - | | - | | - | | - | | - | | (314) | | - | | - | | (314) | | - | | (314) |

Cancelation of own shares | 19 | | - | | - | | - | | (39,476) | | - | | 39,476 | | - | | - | | - | | - | | - |

Dividends lapsed | 20 | | - | | 29 | | - | | - | | - | | - | | - | | - | | 29 | | - | | 29 |

Profit for the year | 20 | | - | | - | | - | | - | | - | | - | | - | | 131,691 | | 131,691 | | (634) | | 131,057 |

Stock option plan | 29 | | - | | 10,328 | | - | | - | | - | | - | | - | | - | | 10,328 | | - | | 10,328 |

Allocation of net income for the year: | | | | | | | | | | | | | | | | | | | | | | | |

Legal reserve | 18 | | - | | - | | 6,442 | | - | | - | | - | | - | | (6,442) | | - | | - | | - |

Statutory reserve | 18 | | - | | - | | - | | 32,390 | | - | | - | | - | | (32,390) | | - | | - | | - |

Payment of dividends (R$0.85 per thousand shares) | 20 | | - | | - | | - | | - | | (16,626) | | - | | - | | (11,428) | | (28,054) | | - | | (28,054) |

Dividends proposed (R$1.52 per thousand shares) | 20 | | - | | - | | - | | - | | - | | - | | - | | (30,597) | | (30,597) | | - | | (30,597) |

| | | | | | | | | | | | | | | | | | | | | | | |

Balance at December 31, 2009 | | | 223,873 | | 19,639 | | 21,907 | | 87,924 | | - | | (10,686) | | - | | 59,403 | | 402,060 | | 1,445 | | 403,505 |

| | | | | | | | | | | | | | | | | | | | | | | |

Acquisition of own shares | 19 | | - | | - | | - | | - | | - | | (1,461) | | - | | - | | (1,461) | | - | | (1,461) |

Other comprehensive income: | | | | | | | | | | | | | | | | | | | | | | | |

Exchange rate difference in the translation of operations abroad | 18 | | - | | - | | - | | - | | - | | - | | (46) | | - | | (46) | | - | | (46) |

Profit for the year | 20 | | - | | - | | - | | - | | - | | - | | - | | 108,498 | | 108,498 | | 555 | | 109,053 |

Stock option plan | | | | | | | | | | | | | | | | | | | | | | | |

2007 Program | 29 | | - | | (7,024) | | - | | - | | - | | - | | - | | - | | (7,024) | | - | | (7,024) |

2010 Program | 29 | | - | | 2,116 | | - | | - | | - | | - | | - | | - | | 2,116 | | - | | 2,116 |

Allocation of net income for the year: | | | | | | | | | | | | | | | | | | | | | | | |

Legal reserve | 18 | | - | | - | | 5,425 | | - | | - | | - | | - | | (5,425) | | - | | - | | - |

Statutory reserve | 18 | | - | | - | | - | | 3,073 | | - | | - | | - | | (3,073) | | - | | - | | - |

Payment of dividends (R$1.52 per thousand shares) | 20 | | - | | - | | - | | - | | - | | - | | - | | (59,403) | | (59,403) | | - | | (59,403) |

Dividends proposed (R$1.69 per thousand shares) | 20 | | - | | - | | - | | - | | - | | - | | - | | (25,769) | | (25,769) | | - | | (25,769) |

| | | | | | | | | | | | | | | | | | | | | | | |

Balance at December 31, 2010 | | | 223,873 | | 14,731 | | 27,332 | | 90,997 | | - | | (12,147) | | (46) | | 74,231 | | 418,971 | | 2,000 | | 420,971 |

| | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | |

The accompanying notes are an integral part of these consolidated financial statements. |

Table of Contents

CONTAX PARTICIPAÇÕES S.A. | | |

| | | | | | |

CONSOLIDATED STATEMENT OF CASH FLOWS | | | | | | |

FOR THE YEARS ENDED DECEMBER 31, 2010, 2009 AND 2008 | | | | | | |

(Amounts in thousands of Brazilian reais - R$) | | |

| | | | | | |

|

| 2010 | | 2009 | | 2008 |

| | | | | | |

CASH FLOW FROM OPERATING ACTIVITIES | | | | | | |

| | | | | | |

Profit for the year | | 108,498 | | 131,691 | | 82,826 |

Adjustments to reconcile net income: | | | | | | |

Depreciation and amortization of non-current assets | | 122,109 | | 116,411 | | 118,043 |

Loss (gain) on disposal of permanent assets | | (6) | | 1,710 | | 123 |

Impairment of goodwill | | | | | | 1,788 |

Contingencies and other provisions | | 20,913 | | 1,874 | | 16,401 |

Deferred income tax and social contribution | | (2,190) | | 3,666 | | (5,002) |

Monetary variation gain | | (3,868) | | (1,890) | | (277) |

Cost of stock option plan | | 2,689 | | 9,995 | | 129 |

Interest expenses on loans and financings | | 21,242 | | 31,015 | | 22,295 |

Non-controlling interest | | 555 | | (634) | | 3 |

|

| | | | | |

Changes in assets and liabilities: | | | | | | |

Accounts receivable | | (34,280) | | (26,351) | | (17,271) |

Recoverable taxes | | (7,871) | | (2,720) | | (2,654) |

Other assets | | (11,955) | | (10,076) | | (8,588) |

Payroll and related charges | | 25,537 | | 15,894 | | 38,576 |

Suppliers | | 2,862 | | 186 | | 4,381 |

Taxes payable | | (7,848) | | 10,362 | | 7,505 |

Other liabilities | | 4,500 | | 28,783 | | 16,600 |

Interest expenses on loans and financing | | (20,483) | | (31,130) | | (20,105) |

|

| | | | | |

Net cash provided by operating activities | | 220,404 | | 278,786 | | 254,773 |

| | | | | | |

CASH FLOW FROM INVESTING ACTIVITIES | | | | | | |

|

| | | | | |

Investment acquisition | | (20,019) | | - | | - |

Earnings for the sale of property, plant and equipment | | 179 | | 27 | | 130 |

Additions to property, plant and equipment | | (162,533) | | (158,901) | | (167,930) |

Judicial deposits | | (36,241) | | (16,487) | | (17,550) |

Financial investments held to maturity | | (39,497) | | (26,590) | | |

Restricted cash | | (2,000) | | - | | - |

| | | | | | |

Net cash used in investment activities | | (260,111) | | (201,951) | | (185,350) |

| | | | | | |

CASH FLOW FROM FINANCING ACTIVITIES | | | | | | |

|

| | | | | |

Payment of capital leases | | (9,740) | | (11,674) | | (18,218) |

BNDES financing | | 180,829 | | (13,332) | | 116,731 |

Payment of BNDES financing | | (54,371) | | - | | - |

BNB financing | | 51,000 | | - | | - |

Principal monetary variation | | - | | (210) | | - |

Dividends paid | | (89,000) | | (49,380) | | (13,386) |

Share buyback payments | | (9,061) | | (314) | | (38,935) |

|

| | | | | |

Cash used in financing activiies | | 69,657 | | (74,910) | | 46,192 |

| | | | | | |

Net increase in cash and cash equivalents | | 29,950 | | 1,925 | | 115,615 |

| | | | | | |

Cash and cash equivalents at the beginning of the year | | 357,853 | | 355,928 | | 240,310 |

Cash and cash equivalents at the end of the year | | 387,803 | | 357,853 | | 355,928 |

| | | | | | |

| | | | | | |

Additional information: | | | | | | |

| | | | | | |

Income tax and social contriibution paid | | 69,955 | | 66,194 | | 45,792 |

| | | | | | |

| | | | | | |

The accompanying notes are an integral part of these consolidated financial statements. | |

Table of Contents

CONTAX PARTICIPAÇÕES S.A.

Notes to the Consolidated Financial Statements

For the Years ended December 31, 2010, 2009 and 2008

(In thousands of Brazilian reais, except when otherwise indicated)

1. GENERAL INFORMATION

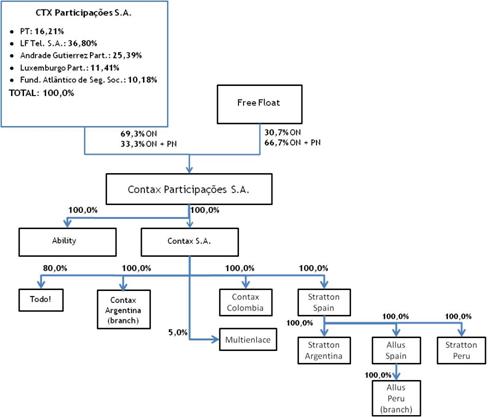

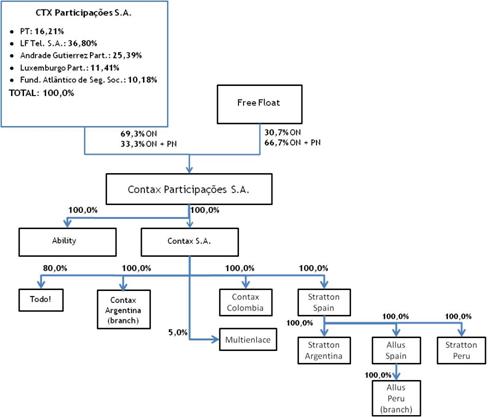

Contax Participações S.A. (the "Company"), established In July 2000, is a publicly-held company, listed in the BM&FBovespa, whose registered corporate purpose is to hold interests in other commercial enterprises and civil societies as a partner, shareholder or quotaholder in Brazil or abroad.The Company is headquartered at Rua do Passeio no 48 a 56 (Parte), Centro – Rio de Janeiro – RJ.

The Company has (i) Contax S.A. and Ability Comunicação Integrada Ltda., as direct subsidiaries, and (ii) TODO BPO Soluções em Tecnologia S.A., BRC Empreendimentos Imobiliários Ltda, and Contax Sucursal Empresa Extranjera as indirect subsidiaries.The Company and its subsidiaries are jointly referred to in the financial statements as “Company” or “Group”. The operations of the direct and indirect subsidiaries are as follows:

1.1. Contax S.A.

Contax S.A. (“Contax”) was established in December 2002, after changing the corporate name of the extinguished TNext S.A., an entity established in August 1998. Contax is a joint-stock, privately-held company, whose corporate purpose is providing tele-assistance services in general, offering a variety of integrated customer interaction solutions between its customers and their consumers, including telemarketing operations, customer services, customer retention, technical support and bill collection through a variety of communication channels, including telephone contacts, internet access, e-mail, fax, development of technological solutions related to the tele-assistance services, among others.

1.2. Ability Comunicação Integrada Ltda.

In September 2010, Contax acquired the entire control of Ability Comunicação Integrada Ltda. (“Ability”). Incorporated in June 2001, Ability is a limited-liability company whose purpose is to provide services related to publicity and advertising, sales promotion, merchandising and marketing, campaign and publicity planning, publicity consulting, market and public-opinion research, among others.

1.3. TODO Soluções em Tecnologia S.A.

TODO Soluções em Tecnologia S.A. (“TODO”) was established in September 2008, a joint-stock, privately-held company, whose corporate purpose is to provide information technology services, software development and integrated, full and customized solutions, including the full or partial management of the value chain of outsourced processes of business in general; back office processing; customer relationship management, among others.

Table of Contents

CONTAX PARTICIPAÇÕES S.A.

Notes to the Consolidated Financial Statements

For the Years ended December 31, 2010, 2009 and 2008

(In thousands of Brazilian reais, except when otherwise indicated)

1.4. BRC Empreendimentos Imobiliários Ltda.

In November 2009, Contax acquired BRC Empreendimentos Imobiliários Ltda.(“BRC”) for R$61. This acquisition aimed at separately developing and executing the real estate project included in the Selective Incentive Program for the adjacent region of Estação da Luz (“Nova Luz Program”), in the downtown area of the city of São Paulo.

1.5. Contax Sucursal Empresa Extranjera

Contax Sucursal Empresa Extranjera (“Contax Argentina”) was incorporated in September 2010 with an initial capital stock of R$817, in the city of Buenos Aires, Argentina. Contax Argentina’s corporate purpose is to provide general telephone services, offering integrated services for client-consumer relations in Argentina.

2. NEW, REVISED OR AMENDED STANDARDS AND INTERPRETATIONS NOT EFFECTIVE AND NOT EARLY ADOPTED

The new pronouncements, changes in the existing pronouncements and new interpretations listed below were published and are mandatory for the years beginning on January 1st, 2011 or after that date.

The Company did not make these changes in advance for the consolidated financial statements of December 31, 2010.

2.1. Amendment to IFRS 7 to Improve Disclosure Requirements on the Transfer of Financial Assets

On October 7, 2010, IASB issued the amendment to IFRS 7 – Financial Instruments: Disclosures, with the improvements that increase the disclosure requirements on the transfer of financial assets. The guideline for the write off of financial assets set forth in IAS 39 – Financial Instruments: Recognition and Measurement, incorporated into the revised version of IFRS 9 – Financial Instruments, has not been amended.

The amendments to IFRS 7 require enhanced level of disclosure when the asset is transferred but not written off, and introduces new disclosures for assets written off, where the company is still subject to continued exposure to the asset after the sale. The purpose of the changes is to clarify the relation among transferred financial assets and the financial obligations and the risks associated to those assets.

The application of the amendments is mandatory for years beginning on or after July 1st, 2011, and allows for early adoption. It is not necessary to disclose information for periods prior to the date of the mandatory adoption of the amendments. The Company is evaluating the effects of adopting such pronouncement.

2.2. IFRS 9 – Financial Instruments (revised in 2010)

Table of Contents

CONTAX PARTICIPAÇÕES S.A.

Notes to the Consolidated Financial Statements

For the Years ended December 31, 2010, 2009 and 2008

(In thousands of Brazilian reais, except when otherwise indicated)

In November 2009, IASB issued IFRS 9 – Financial Instruments and, on October 28, 2010, it issued a new revised version of this rule, maintaining the requirements for the classification and measurement of financial assets in compliance with the version published in November 2009 and included a guideline on the classification and measurement of financial liabilities. As part of IFRS 9 restructuring, IASB also included a guideline on the write off of financial instruments, in addition to the implementation guide of IAS 39 – Financial Instruments: Recognition and Measurement.

IFRS 9 establishes that all financial assets recognized, as set forth by IAS 39 – Financial Instrument: Recognition and Measurement, are subsequently measured at amortized cost or fair value. Specifically, debt instruments held according to a business model whose purpose is to receive cash flows from the agreements, exclusively for the payment of the principal and interest on the principal are usually measured at amortized cost at the end of the following fiscal periods. All other debt instruments and investments in equity instruments are measured at the fair value at the end of the following fiscal periods.

The most significant effect of IFRS 9 on the classification and measurement of financial liabilities refers to the accounting of the changes in the fair value of a financial liability (calculated through the income statement), which can be attributed to changes on the credit risk of that liability. Specifically, according to IFRS 9, for financial liabilities recognized at fair value through the income statement, the value of the change in the fair value of the financial liability can be attributed to changes in the credit risk of that liability and is recognized in “Other comprehensive income”, unless the effects of changes in the credit risk of that liability is recognized in “Other comprehensive results” causes or increases accounting mismatch in the Company’s income. The changes in the fair value, attributed to the credit risk of a financial liability, are not reclassified to the income. According to IAS 39, the total value of the change in the fair value of a financial liability recognized at fair value through result was previously recognized in the result.

The Company is evaluating the possible effects of adopting such pronouncement.

The mandatory application of the revised version of IFRS 9 is January 1st, 2013, the same date of the previous version. The revised version allows for early adoption. If a company decides to apply the guideline relating to the classification and measurement of financial liabilities in advance, it should also apply any other IFRS 9 requirement previously concluded by then. The revised rule should be applied retrospectively according to the IAS 8.

Table of Contents

CONTAX PARTICIPAÇÕES S.A.

Notes to the Consolidated Financial Statements

For the Years ended December 31, 2010, 2009 and 2008

(In thousands of Brazilian reais, except when otherwise indicated)

2.3. IAS 24 – Disclosure of Related Party Transactions (revised in 2009)

In 2009, IASB issued the amendment to IAS 24 – Related Party Disclosures. The revised rule simplifies the disclosure requirements for subsidiaries, jointly-owned subsidiaries or significantly influenced by a government (referred to as entities related to the Government) and changes the definition of a related party. The Standard requires the retroactive application. Therefore, on the year of the initial requirement, companies should correct the disclosure for the period under comparison.

Exemptions introduced by the revision of IAS 24 do not affect the Company and its subsidiaries given that they are not entities related to the Government. However, the disclosures related to third party transactions and the balances of consolidated financial statements can be affected when the revised rule is applied in future periods, considering that some parties were not included in the definition of related party and may be within the scope of the revised standard.

The amendments are mandatory for years beginning on or after January 1st, 2011, and allow for early adoption.

2.4. IFRS 10 Consolidated Financial Statements

In 2011 IASB issued IFRS 10. The IFRS 10 replaces the consolidation guidance in IAS 27 Consolidated and Separate Financial Statements and SIC-12 Consolidation - Special Purpose Entities by introducing a single consolidation model for all entities based on control, irrespective of the nature of the investee (i.e., whether an entity is controlled through voting rights of investors or through other contractual arrangements as is common in special purpose entities). Under IFRS 10, control is based on whether an investor has 1) power over the investee; 2) exposure, or rights, to variable returns from its involvement with the investee; and 3) the ability to use its power over the investee to affect the amount of the returns. This standard has an effective date for annual periods beginning on or after January 1st, 2013 with earlier application permitted so long as each of the new standards IFRS 11, IFRS 12 and amendments of the standards IAS 27 and IAS 28 is also early applied.

2.5. IFRS 11 Joint Arrangements

In 2011 IASB issuedIFRS 11. The IFRS 11 introduces new accounting requirements for joint arrangements, replacingIAS 31Interests in Joint Ventures. The option to apply the proportional consolidation method when accounting for jointly controlled entities is removed. Additionally, IFRS 11 eliminates jointly controlled assets to now only differentiate between joint operations and joint ventures. A joint operation is a joint arrangement whereby the parties that have joint control have rights to the assets and obligations for the liabilities. A joint venture is a joint arrangement whereby the parties that have joint control have rights to the net assets. This standard has an effective date for annual periods beginning on or after January 1st, 2013 with earlier application permitted so long as each of the new standards IFRS 10, IFRS 12 and amendments of the standards IAS 27 and IAS 28 is also early applied.

2.6. IFRS 12 Disclosure of Interests in Other Entities

In 2011 IASB issuedIFRS 12. The IFRS 12 requires enhanced disclosures about both consolidated entities and unconsolidated entities in which an entity has involvement. The objective of IFRS 12 is to require information so that financial statement users may evaluate the basis of control, any restrictions on consolidated assets and liabilities, risk exposures arising from involvements with unconsolidated structured entities and non-controlling interest holders' involvement in the activities of consolidated entities. This standard has an effective date for annual periods beginning on or after January 1st, 2013 with earlier application permitted so long as each of the new standards IFRS 10, IFRS 11 and amendments of the standards IAS 27 and IAS 28 is also early applied.

2.7. IFRS 13 Fair Value Measurement

In 2011 IASB issued IFRS 13. The IFRS 13 established a single framework for measuring fair value where that is required by other Standards. The Standard applies to both financial and non-financial items measured at fair value. Fair value is defined as “the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date”. IFRS 13 is effective for annual periods beginning on or after January 1st, 2013, with early adoption permitted, and applies prospectively from the beginning of the annual period in which the Standard is adopted.

2.8. IAS 27 Separate Financial Statements (2011)

In 2011, IASB issued the amendment to IAS 27 – Separate Financial Statements. The requirements relating to separate financial statements are unchanged and are included in the amendedIAS 27. The other portions of IAS 27 are replaced by IFRS 10. This amendment has an effective date for annual periods beginning on or after January 1st, 2013 with earlier application permitted so long as each of the new standards IFRS 10, IFRS 11, IFRS 12 and amendments of the standard IAS 28 is also early applied.

2.9. IAS 28 Investments in Associates and Joint Ventures (2011)

In 2011, IASB issued the amendment to IAS 28 – Investments in Associates and Joint Ventures.IAS 28is amended for conforming changes based on the issuance of IFRS 10, IFRS 11 and IFRS 12. This amendment has an effective date for annual periods beginning on or after January 1st, 2013 with earlier application permitted so long as each of the new standards IFRS 10, IFRS 11, IFRS 12 and amendments of the standard IAS 28 is also early applied.

2.10. Improvements to IFRSs 2010

On May 6, 2010, IASB issued a document called Improvements to IFRSs 2010, which contains amendments to seven standards. This is the third set of amendments issued through the annual improvement process, intended to make the necessary, but not urgent, improvements to the IFRSs.

The Company’s Management is analyzing possible impacts from the adoption of those improvements on its financial statements. However, it does not expect material impacts.

Table of Contents

CONTAX PARTICIPAÇÕES S.A.

Notes to the Consolidated Financial Statements

For the Years ended December 31, 2010, 2009 and 2008

(In thousands of Brazilian reais, except when otherwise indicated)

The table below summarizes all the improvements made in the existing rules and interpretations:

| | |

Rule | Reason to Change | Adoption and Transition |

| | |

| | |

IFRS 1 – First-time Adoption of International Financial Reporting Standards | Change in the accounting policies in the year of the adoption | Mandatory for the years beginning on or after January 1st, 2011. Early adoption allowed. |

| |

Revaluation as deemed cost | Mandatory for the years beginning on or after January 1st, 2011. Early adoption allowed. |

| |

Use of deemed cost for operations subject to regulatory prices | Mandatory for the years beginning on or after January 1st, 2011. Early adoption allowed. |

| | |

| | |

IFRS 3 – Business Combinations (2008) | Measurement of minority interest | Mandatory for the years beginning on or after July 1st, 2010. It should be prospectively applied as of the date the entity adopts the IFRS 3 (2008). Early adoption allowed. |

| |

Payment of share-based premiums not replaced or voluntarily replaced | Mandatory for the years beginning on or after July 1st, 2010. It should be prospectively applied as of the date the entity adopts the IFRS 3 (2008). Early adoption allowed. |

| |

Transition requirements for contingent counterparties of a business combination executed prior to the mandatory adoption date of IFRS 3 (2008) | Mandatory for the years beginning on or after July 1st, 2010. Early adoption allowed. |

| | |

| | |

IFRS 7 – Financial Instruments: Disclosures | Clarification on disclosures | Mandatory for the years beginning on or after January 1st, 2011. Early adoption allowed. |

| | |

| | |

IAS 1 – Presentation of Financial Statements | Clarification on the statement of changes of shareholders’ equity | Mandatory for the years beginning on or after January 1st, 2011. Early adoption allowed. |

| | |

| | |

IAS 27 – Consolidated and Separate Financial Statements (2008) | Transition requirements from the changes introduced by IAS 27 (2008) | Mandatory for the years beginning on or after July 1st, 2011. Early adoption allowed. |

| | |

| | |

IAS 34 – Interim Financial Reporting | Material events and transactions | Mandatory for the years beginning on or after January 1st, 2011. Early adoption allowed. |

| | |

| | |

IFRIC 13 – Customer Loyalty Programs | Fair value of premium credits | Mandatory for the years beginning on or after January 1st, 2011. Early adoption allowed. |

Table of Contents

CONTAX PARTICIPAÇÕES S.A.

Notes to the Consolidated Financial Statements

For the Years ended December 31, 2010, 2009 and 2008

(In thousands of Brazilian reais, except when otherwise indicated)

3. SIGNIFICANT ACCOUNTING POLICIES

3.1. Statement of compliance

The consolidated financial statements of the Group have been prepared in accordance with International Financial Reporting Standards (IFRSs) as issued by the International Accounting Standards Board (IASB).

3.2. Basis of presentation

The consolidated financial statements of the Group are presented in thousands of Brazilian reais (R$) and have been prepared on the historical cost basis except for the revaluation of certain financial instruments. Historical cost is generally based on the fair value of the consideration given in exchange for assets.

The principal accounting policies applied in the preparation of these consolidated financial statements are set out below. These policies have been consistently applied to all years presented, unless otherwise stated.

3.3. Basis of consolidation

3.3.1. Subsidiaries

Subsidiaries are all entities (including special purpose entities) over which the Group has the power to govern the financial and operating policies generally accompanying a shareholding of more than one half of the voting rights. The existence and effect of potential voting rights that are currently exercisable or convertible are considered when assessing whether the Group controls another entity. Subsidiaries are fully consolidated from the date on which control is transferred to the Group. They are de-consolidated from the date that control ceases.

Intercompany transactions, balances and unrealized gains on transactions between Group companies are eliminated. Unrealized losses are also eliminated. Accounting policies of subsidiaries have been changed where necessary to ensure consistency with the policies adopted by the Group.

3.3.2. Non-controlling interests

The Group applies a policy of treating transactions with non-controlling interests as transactions with parties external to the Group. Disposals of non-controlling interests result in gains and losses for the Group and are recorded in the income statement.

3.4. Business combination

In the consolidated financial statements, business acquisitions are accounted for at the acquisition method. The consideration transferred in a business combination is measured at fair value, calculated as the aggregate of the fair value of the assetstransferred and liabilities assumed by the Group on the acquisition date to the former controlling shareholders of the acquiree and the interests issued by the Group in exchange for the control of the acquiree. Acquisition-related costs are usually recognized in profit or loss when incurred.

Table of Contents

CONTAX PARTICIPAÇÕES S.A.

Notes to the Consolidated Financial Statements

For the Years ended December 31, 2010, 2009 and 2008

(In thousands of Brazilian reais, except when otherwise indicated)

Identifiable assets acquired and liabilities assumed are recognized at fair value on the acquisition date, except for:

• Deferred tax assets or liabilities, and assets and liabilities related to employee benefit agreements, which are recognized and measured under IAS 12 – Income Taxes, and IAS 19 – Employee Benefits;

• Liabilities or equity instruments related to share-based payment agreements of the acquiree or payment arrangements based on Group stock, executed to replace the share-based payment agreements of the acquiree, are measured under IFRS 2 – Share-based Payment on the acquisition date; and

• Assets (or disposal groups) classified as held for sale under IFRS 5 – Non-Current Assets Held for Sale and Discontinued Operations are measured in compliance with this standard.

Goodwill is measured as the difference between the aggregate of the consideration transferred, the amount of any minority interests in the acquiree, and the fair value of the acquirer's previously-held equity interest in the acquiree, if any; and the net of the acquisition-date amounts of the identifiable assets acquired and the liabilities assumed. If, after the assessment, the net of the acquisition-date amounts of the identifiable assets acquired and the liabilities assumed are higher than the aggregate of the consideration transferred, the amount of any minority interests in the acquiree, and the fair value of the acquirer's previously-held equity interest in the acquiree, if any, this surplus is immediately recognized in income as gains.

Minority interests corresponding to current holding and granting holders the right to a proportionate share of the net assets of the entity in case of liquidation may be initially measured at fair value or based on the proportionate share of the non-controlling interests on recognized amounts of identifiable net assets of the acquiree. The measurement method to be applied is chosen on a transaction by transaction basis. Other types of minority interests are fair valued or, when applicable, as determined by another IFRS.

Table of Contents

CONTAX PARTICIPAÇÕES S.A.

Notes to the Consolidated Financial Statements

For the Years ended December 31, 2010, 2009 and 2008

(In thousands of Brazilian reais, except when otherwise indicated)

When the consideration transferred by the Group in a business combination includes assets or liabilities derived from a contingent consideration arrangement, the contingent consideration is fair valued on the acquisition date and included in the consideration transferred in a business combination. Changes to the fair value of the contingent consideration classified as adjustments of the measurement period are retrospectively adjusted, with the corresponding adjustment in goodwill. Adjustments to the measurement period correspond to adjustments resulting from additional information obtained during the "measurement period" (which shall not be longer than twelve months from the acquisition date) related to facts and circumstances existing on the acquisition date.

The subsequent accounting for changes to the fair value of the contingent consideration not classified as adjustments of the measurement period depend on how the contingent consideration is classified. Contingent consideration classified as equity is not remeasured at subsequent financial statement dates, and its corresponding settlement is accounted for in equity. Contingent consideration classified as asset or liability is remeasured on subsequent financial statement dates, under IAS 39 and IAS 37 – Provisions, Contingent Liabilities and Contingent Assets, as applicable, and the corresponding gain or loss is recognized in the income.

When a business combination is achieved in stages, the interest previously held by the Group in the acquiree is remeasured at fair value on the acquisition date (that is, the date the Group obtained that control), and the corresponding gain or loss, if any, is recognized in the income. The amounts of the interests in the acquiree prior to the acquisition date previously recognized in "Other comprehensive income" are reclassified in the income, provided that such treatment is appropriate in case such interest is disposed of.

If the initial accounting for a business combination is incomplete by the end of the reporting period when such combination occurred, the Group records provisional amounts for the items whose accounting is incomplete. These provisional amounts are adjusted during the measurement period (see above), or additional assets and liabilities are recognized to reflect new information obtained regarding facts and circumstances existing on the acquisition date that would have affected the amounts recognized on that date if they had been known.

3.5. Goodwill

Goodwill resulting from a business combination is stated at cost on the transaction date (see item 3.4), net of accumulated loss in the recoverable amount, if any.

For purposes of impairment testing, goodwill is allocated to each of the Group's cash-generating units (or groups of cash-generating units) that will benefit from the synergies of the combination. Goodwill generated on the acquisition of Ability in September 2010 was not tested for impairment, because a year has not elapsed since the acquisition date and such goodwill has not presented any indication of impairment.

Table of Contents

CONTAX PARTICIPAÇÕES S.A.

Notes to the Consolidated Financial Statements

For the Years ended December 31, 2010, 2009 and 2008

(In thousands of Brazilian reais, except when otherwise indicated)

The cash-generating unit’s goodwill was allocated to be tested for impairment on a yearly basis, or at shorter intervals whenever there is an indication that the unit may be impaired. If the recoverable amount of the cash-generating unit is lower than its book value, an impairment loss is firstly allocated to reduce the book value of any goodwill allocated to the unit and later to the other assets of the unit, proportionately to the book value of each of its assets. Any goodwill impairment loss is directly recognized in the income for the period. Impairment losses are not reversed in subsequent periods.

Upon the disposal of the corresponding cash-generating unit, the attributable goodwill amount is included in the calculation of the profit or loss of the disposal.

3.6. Revenue recognition

Revenue comprises the fair value of the consideration received or receivable for services rendered in the normal course of the Group’s activities. Revenue is presented net of sales taxes, returns, allowances, discounts and after eliminating sales within the Group.

The Group recognizes revenue when (i) the amount of revenue can be reliably measured, (ii) it is probable that future economic benefits will flow to the entity and (iii) specific criteria have been met for each of the Group’s activities as described below. The amount of revenue is not considered to be reliably measurable until all contingencies relating to the sale have been resolved. The Group bases its estimates on historical results, taking into consideration the type of customer, the type of transaction and the specifics of each arrangement.

The Group renders services of telemarketing, contact center and credit recovery services to other companies. These services are provided on a speaking time, workstation position or performance basis or as a fixed-price contract.

Revenue from speaking time service contracts is measured on the basis of hours delivered whereas workstation position service contracts’ revenue is measured based on the number of workstation positions that were used by the client.

Revenue from performance targets (i.e., credit recovery services) are recognized based on the fee percentage agreed with the client over the recovered credits and the client’s confirmation of such recovered credits.

If circumstances arise that may change the original estimates of revenues, costs or extent of progress toward completion, estimates are revised. These revisions may result in increases or decreases in estimated revenues or costs and are reflected in income in the period in which the circumstances that give rise to the revision become known by management.

Table of Contents

CONTAX PARTICIPAÇÕES S.A.

Notes to the Consolidated Financial Statements

For the Years ended December 31, 2010, 2009 and 2008

(In thousands of Brazilian reais, except when otherwise indicated)

3.7. Leasing

Leases are classified as finance leases whenever the terms of the lease transfer substantially all the risks and rewards of ownership to the lessee. All other leases are classified as operating leases.

Assets held under finance leases are initially recognized as assets of the Group at their fair value at the commencement of the lease or, if lower, at the present value of the minimum lease payments. The corresponding liability to the lessor is included in the balance sheet as a finance lease obligation.

Lease payments are apportioned between finance charges and reduction of the lease obligation so as to achieve a constant rate of interest on the remaining balance of the liability. Finance charges are charged directly to profit or loss. Contingent rentals are recognized as expenses in the periods in which they are incurred.

Operating lease payments are recognized as expenses on a straight-line basis over the lease term, except where another systematic basis is more representative of the time pattern in which economic benefits from the leased asset are consumed.

In the event that lease incentives are received to enter into operating leases, such incentives are recognized as a liability. The aggregate benefit of incentives is recognized as a reduction of rental expense on a straight-line basis, except where another systematic basis is more representative of the time pattern in which economic benefits from the leased asset are consumed.

3.8. Foreign currencies

The individual financial statements of each group entity are presented in the currency of the primary economic environment in which the entity operates (its functional currency). For the purpose of the consolidated financial statements, the results and financial position of each group entity are expressed in Brazilian reais (R$), which is the functional currency of the Group and the presentation currency for the consolidated financial statements.

3.9. Share-based payments

Share-based payments to employees are measured at the fair value of the equity instruments at the grant date. Details regarding the determination of the fair value of share-based transactions are set out in Note 29.

The fair value determined at the grant date of the share-based payments is expensed on a straight-line basis over the vesting period, based on the Group’s estimate of the number of equity instruments that will eventually vest. At each balance sheet date, the Group revises its estimate of the number of equity instruments expected to vest. The impact of the revision of the original estimates, if any, is recognized in profit or loss over the remaining vesting period.

Table of Contents

CONTAX PARTICIPAÇÕES S.A.

Notes to the Consolidated Financial Statements

For the Years ended December 31, 2010, 2009 and 2008

(In thousands of Brazilian reais, except when otherwise indicated)

3.10. Taxation

Income tax expense represents the sum of the tax currently payable and deferred tax.

Provisions for deferred and payable income tax and social contribution and tax credit on temporary differences are established at the composite base rate of 34%, comprised of a 25% federal income tax rate plus a 9% social contribution rate.

Prepaid income tax and social contribution are recorded as “Recoverable taxes.”

3.10.1. Current tax

The tax currently payable is based on taxable profit for the year. Taxable profit differs from profit as reported in the consolidated income statement because it excludes items of income or expense that are taxable or deductible in other years and it further excludes items that are never taxable or deductible. The Group’s liability for current tax is calculated using tax rates that have been enacted or substantively enacted by the balance sheet date.

3.10.2. Deferred tax

Deferred tax is recognized on temporary differences between the carrying amounts of assets and liabilities in the consolidated financial statements and their corresponding tax bases used, and is computed using the balance sheet liability method. However, deferred income tax is not accounted for if the temporary difference arises from the initial recognition of goodwill or from the initial recognition (other than in a business combination) of other assets and liabilities in a transaction that affects neither the taxable profit nor the accounting profit.

The carrying amount of deferred tax assets is reviewed at each balance sheet date and is only recognized to the extent that it is probable that future taxable profits will be available against which the temporary differences can be utilized.

Deferred tax assets are measured at the tax rates that are expected to apply in the period in which the liability is settled or the asset realized, based on tax rates (and tax laws) that have been enacted or substantively enacted by the balance sheet date. The measurement of deferred tax liabilities and assets reflects the tax consequences that would follow from the manner in which the Group expects, at the reporting date, to recover or settle the carrying amount of its assets and liabilities.

Deferred tax assets and liabilities are offset when there is a legally enforceable right to set off current tax assets against current tax liabilities and when they relate to income taxes levied by the same taxation authority and the Group intends to settle its current tax assets and liabilities on a net basis.

Table of Contents

CONTAX PARTICIPAÇÕES S.A.

Notes to the Consolidated Financial Statements

For the Years ended December 31, 2010, 2009 and 2008

(In thousands of Brazilian reais, except when otherwise indicated)

3.10.3. Current and deferred income tax and social contribution for the period

Current and deferred income tax and social contribution are recognized as expense or revenue in the income for the period, unless these correspond to items recorded under “Other comprehensive income”, or directly in shareholders’ equity, in which case current and deferred taxes are also recognized in “Other comprehensive income” or directly in shareholders’ equity, respectively. Where current and deferred taxes result from the initial recognition of a business combination, the tax effect is included in the accounting for the business combination.

3.11. Property, plant and equipment

Property and equipment held for use in the supply of services, or for administrative purposes, are stated in the balance sheet at original cost, less any subsequent accumulated depreciation and subsequent accumulated impairment losses, when applicable.

Property and equipment are depreciated using the straight-line method over the useful lives of the related assets. Given the complex nature of our telecommunications and IT systems, the estimates of useful lives require considerable judgment and are inherently uncertain, due to rapidly changing technology and practices in our business sector, which could cause early obsolescence of such systems. The assets’ residual values and useful lives are reviewed, and adjusted if appropriate, at each balance sheet date.

Assets held under finance leases are depreciated over their expected useful lives on the same basis as owned assets or, where shorter, the term of the relevant lease.

The gain or loss arising on the disposal or retirement of an item of property and equipment is determined as the difference between the sales proceeds and the carrying amount of the asset and is recognized in profit or loss.

3.12. Intangible assets

Intangible assets represent principally software, and are reported at cost less accumulated amortization and accumulated impairment losses. Amortization is charged on a straight-line basis over their estimated useful lives. The estimated useful life and amortization method are reviewed at the end of each annual reporting period, with the effect of any changes in estimate being accounted for on a prospective basis.

Table of Contents

CONTAX PARTICIPAÇÕES S.A.

Notes to the Consolidated Financial Statements

For the Years ended December 31, 2010, 2009 and 2008

(In thousands of Brazilian reais, except when otherwise indicated)

3.13. Impairment of tangible and intangible assets (excluding goodwill)

Assets that have indefinite useful lives, such as goodwill, are not amortized but tested for impairment at least annually. In addition, at each balance sheet date, the Group reviews its long-lived non-financial assets (such as property and equipment and intangible assets), to determine whether there is any indication that those assets have suffered an impairment loss. If any such indication exists, in connection with events or changes in circumstances that indicate that the carrying amounts of those assets may not be recovered, the recoverable amount of the asset is estimated in order to determine the extent of the impairment loss (if any). Where it is not possible to estimate the recoverable amount of an individual asset, the Group estimates the recoverable amount of the cash-generating unit to which the asset belongs. Where a reasonable and consistent basis of allocation can be identified, corporate assets are also allocated to individual cash-generating units, or otherwise they are allocated to the smallest group of cash-generating units for which a reasonable and consistent allocation basis can be identified.

Recoverable amount is the higher of the asset or group of assets fair value less costs to sell and value in use. In assessing value in use, the estimated future cash flows are discounted to their present value using a pre-tax discount rate that reflects current market assessments of the time value of money and the risks specific to the asset for which the estimates of future cash flows have not been adjusted.

If the recoverable amount of an asset (or cash-generating unit) is estimated to be less than its carrying amount, the carrying amount of the asset (or cash-generating unit) is reduced to its recoverable amount. An impairment loss is recognized immediately in profit or loss.

Where an impairment loss subsequently reverses, the carrying amount of the asset (or cash-generating unit) is increased to the revised estimate of its recoverable amount, but so that the increased carrying amount does not exceed the carrying amount that would have been determined had no impairment loss been recognized for the asset (or cash-generating unit) in prior years. A reversal of an impairment loss is recognized immediately in profit or loss. Impairment loss recognized on goodwill is never reversed in subsequent periods.

3.14. Provisions

Provisions are recognized when the Group has a present obligation (legal or constructive) as a result of a past event, it is probable that the Group will be required to settle the obligation, and a reliable estimate can be made for the amount of the obligation. Provisions are measured at the present value of the expenditures expected to be required to settle the obligation.

Table of Contents

CONTAX PARTICIPAÇÕES S.A.

Notes to the Consolidated Financial Statements

For the Years ended December 31, 2010, 2009 and 2008

(In thousands of Brazilian reais, except when otherwise indicated)

3.15. Financial assets

3.15.1. Classification

The Group classifies its financial assets in the loans and receivables category or as long-term investments depending on the maturity and nature. Loans and receivables are non-derivative financial assets with fixed or determinable payments that are not quoted in an active market. They are included in current assets, except for maturities greater than 12 months after the balance sheet date. These are classified as non-current assets. The Group’s loans and receivables comprise “trade and other receivables” in the balance sheet.

3.15.2. Recognition and measurement

Loans and receivables are carried at amortized cost using the effective interest method. The Group assesses at each balance sheet date whether there is objective evidence that a financial asset or a group of financial assets is impaired.

3.16. Financial liabilities and equity instruments issued by the Group

3.16.1. Classification as debt or equity

Debt and equity instruments are classified as either financial liabilities or as equity in accordance with the substance of the contractual arrangement.

3.16.2. Financial liabilities

Financial liabilities are classified as either financial liabilities at fair value through profit & loss or other financial liabilities recorded at amortized cost.

3.16.3. Derecognition of financial liabilities

The Group derecognizes financial liabilities when, and only when, the Group’s obligations are discharged, cancelled or they expire.

3.17. Costs and expenses

The operating costs and expenses are recorded on an accrual basis and pertain mainly to personnel expenses.

Table of Contents

CONTAX PARTICIPAÇÕES S.A.

Notes to the Consolidated Financial Statements

For the Years ended December 31, 2010, 2009 and 2008