UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K/A

REPORT OF FOREIGN ISSUER PURSUANT TO

RULE 13a-16 OR 15d-16 OF THESECURITIES

EXCHANGE ACT OF 1934

For the month of July, 2011

Commission

File Number 000-5149

CONTAX PARTICIPAÇÕES S.A.

(Exact name of Registrant as specified in its Charter)

Contax Holding Company

(Translation of Registrant's name in English)

Rua do Passeio, 56 – 16th floor

Rio de Janeiro, RJ

Federative Republic of Brazil

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file

annual reports under cover Form 20-F or Form 40-F.

Form 20-Fþ Form 40-Fo

Indicate by check mark whether the registrant by furnishing the

information contained in this Form is also thereby furnishing the

information to the Commission pursuant to Rule 12g3-2(b) under

the Securities Exchange Act of 1934.

Yeso Noþ

CONTAX PARTICIPAÇÕES S.A.

National Corporate Taxpayers Register (CNPJ/MF) No. 04.032.433/0001-80

State Enrollment (NIRE) No. 33.300.275410

Publicly-Traded Company

MINUTES OF THEEXTRAORDINARY SHAREHOLDERS MEETING

HELDON JULY 1, 2011

Drafted in summary form, as provided in Article 130 et seq.

of Law No. 6404/76.

1. Time, Date and Place: Held at 10:00 am on July 1, 2011, at the headquarters of Contax Participações S.A. ("Company" or "Contax Participações"), located at Rua do Passeio Nos. 48 to 56, part, Rio de Janeiro, state of Rio de Janeiro.

2. Call: Call Notice published in the "Official Gazette of the State of Rio de Janeiro", Part V, in the editions of the days of: June 16, 2011, June 17, 2011 and June 20, 2011, pages 7, 23 and 14, and in the newspaper "Valor Econômico - National Edition" in the editions of June 16, 2011, June 17, 2011, June 18, 2011, June 19, 2011 and June 20, 2011, pages A10, C11 and C7.

3. Agenda:(i) Examine, discuss and decide on the Share Merger Protocol and Justification of Mobitel S.A. Shares (“Mobitel”) by the Company and the other documents in respect to such share merger, whereby Mobitel will become a wholly owned subsidiary of the Company;(ii) Ratification of appointments and contracting of specialized companies responsible for preparation of (i) valuation report of the asset value of Mobitel's shares; and (ii) economic valuation report of the shares of the Company's and Mobitel's shares;(iii) Approval of the respective valuation reports;(iv) Resolution the merger of Mobitel's shares by the Company, with consequent increase of the Company's capital through issuance of new common and preferred shares;(v)Approval of the amendment to the Company's By-Laws due to the capital increase; and(vi) Substitution of the members of the Board of Directors for completion of the mandate.

4. Attendance:shareholders representing more than 82.20% of the capital entitled to vote, pursuant to the signatures contained in the Shareholders' Attendance Registration Book. Also present Marco Norci Schroeder (Director of Finance and Investor Relations) and Eder Carvalho Magalhães (representative of the Audit Committee).

5. Presiding Members:Chairman: Mr.Marco Norci Schroeder, Secretary: Ms.Cristina Alves Corrêa Justo Reis.

Special Shareholders Meeting of Contax Participacoes SA of July 1, 2011

6. Resolutions: By shareholders representing more than 82.20% of the voting capital of the Company present at the Shareholders Meeting the following resolutions were decided:

6.1. Approval with no dissenting vote and the abstention of shareholders CSHG Verde Equity Master Fundo de Investimentos em Ações; CSHG Verde Master Fundo de Investimentos Multimercado; Green HG Fund LLC e HSBC Global Investment Funds - Brazil Equity, representing 8.61% of the shares entitled to vote, after review and discussion, the Share Merger Protocol and Justification, which establishes the terms and conditions of the merger of Mobitel's shares, a corporation, headquartered in city of São Paulo, state of São Paulo, at Rua Desembargador Eliseu Guilherme, Nos. 282/292, Paraiso, CEP 04004-030, enrolled with the National Corporate Taxpayers Register (CNPJ/MF) under No. 67.313.221/0001-90, by Contax Participações ("Share Merger") whereby Mobitel shall become a wholly owned subsidiary of the Company ("Share Merger Protocol and Justification") and all its exhibits, which shall be an integral part of these minutes asExhibit I. The Protocol and Justification of the Share Merger establishes all the terms and conditions of the Share Merger.

6.2. Without a dissenting vote and the abstention of the shareholders CSHG Verde Equity Master Fundo de Investimentos em Ações; CSHG Verde Master Fundo de Investimentos Multimercado; Green HG Fund LLC and HSBC Global Investment Funds - Brazil Equity, representing 8.61% of the shares entitled to vote: (i) ratify the appointment of APSIS Consultoria e Avaliações Ltda., enrolled with the National Corporate Taxpayers Register (CNPJ/MF) under No. 08.681.365/0001-30, and Regional Accounting Council of Rio de Janeiro (CRC/RJ) under number 005112/0-9, with headquarters at Rua da Assembléia No. 35, 12th floor, Centro District, city of Rio de Janeiro, state of Rio de Janeiro, previously made by the management of the Company and Mobitel, to appraise the net book value of Mobitel, based on its audited financial statements reported onDecember 31, 2010,pursuant to the Share Merger Protocol and Justification and preparation of the respective valuation report ("Valuation Report of Mobitel’s Net Book Value"), and (ii) ratify the appointment of Banco BTG Pactual S.A., enrolled with the National Corporate Taxpayers Register (CNPJ/MF) under No. 30.306.294/0001-45, headquartered at Av. Brigadeiro Faria Lima No. 3.729, 9th floor, in the city of São Paulo, state of São Paulo, previously made by the management of the Company and Mobitel, for valuation of both companies by the methodology of future profitability based on retrospective analysis, projection of scenarios and cash flows discounted on December 31, 2010, under the Share Merger Protocol and Justification, and preparation of the Exchange Ratio Valuation Report (the "Exchange Ratio Valuation Report") on December 31, 2010, under the Share Merger Justification and Protocol.

6.3. Approve with no dissenting vote and the abstention of shareholders CSHG Verde Equity Master Fundo de Investimentos em Ações; CSHG Verde Master Fundo de Investimentos Multimercado; Green HG Fund LLC and HSBC Global Investment Funds - Brazil Equity, representing 8.61% of the shares entitled to vote, after review and discussion of the Valuation Report of Mobitel’s Net Book Value, which shall be incorporated to these minutes asExhibit II, with the net assets of Mobitel, for purposes of merger of shares issued by it into the Company's assets, valued on the base date of December 31, 2010 in the amount of one hundred and seventy-eight million, two hundred and fifteen thousand, nine hundred and fifty-nineReais and sixty-eight cents (R$178,215,959.68), and approve, without reservation, after review and discussion, the Exchange Ratio Valuation Report, which shall be incorporated to these minutes as itsExhibit III.

Special Shareholders Meeting of Contax Participacoes SA of July 1, 2011

6.4. Approve with no dissenting vote and the abstention of shareholders CSHG Verde Equity Master Fundo de Investimentos em Ações; CSHG Verde Master Fundo de Investimentos Multimercado; Green HG Fund LLC and HSBC Global Investment Funds - Brazil Equity, representing 8.61% of the shares entitled to vote, the Share Merger, in accordance with the Share Merger Protocol and Justification, with the consequent transformation of Mobitel into a wholly owned subsidiary of the Company and authorize the Company's managers to perform all acts necessary for the implementation and finalization of the Share Merger, pursuant to the Share Merger Protocol and Justification.

6.4.1. According to the exchange ratio approved pursuant to the Exchange Ratio Valuation Report approved above, each Mobitel shareholder shall receive zero point zero three six two (0.0362) common shares multiplied by the percentage of common shares in which Contax Participações' capital is divided and zero point zero three six three (0.0363) preferred shares multiplied by the percentage of preferred shares in which Contax Participações' capital is divided, issued by the Company for each Mobitel common share held by it, resulting in the total issue by the Company of one million, eight hundred and seventy-six thousand, nine hundred and eighty-two (1,876,982) common shares and three million, thirty-eight thousand, four hundred ninety-nine (3,038,499) preferred shares, all book-entry and with no par value, to be distributed to shareholders of Mobitel, according to their respective holdings in the capital of Mobitel.

6.4.2. In compliance with the provisions of Article 252, paragraph 1 of the Corporations Law, the shareholders of the Company that maintain uninterrupted ownership of the shares since January 25, 2011, inclusive, of the date of publication of the Material Fact which gave notice of the Share Merger to the market, up until the date of the effective exercise of the appraisal rights and dissent in the resolution on the Share Merger may exercise their appraisal to such shares, withdrawing from the Company, through reimbursement of the value of their shares, as provided in the Share Merger Protocol and Justification.

Special Shareholders Meeting of Contax Participacoes SA of July 1, 2011

6.5. Approve without dissenting vote and with abstention of the shareholders CSHG Verde Equity Master Fundo de Investimentos em Ações; CSHG Verde Master Fundo de Investimentos Multimercado; Green HG Fund LLC and HSBC Global Investment Funds - Brazil Equity, representing 8.61% of the shares entitled to vote, the capital increase of the Company, resulting from the Share Merger in the amount of one hundred and seventy-eight million, two hundred and fifteen thousand, nine hundred and fifty-nineReais and sixty-eight cents (R$178.215.959,68), with the amount of thirty-four million, four hundred and fifty-five thousand, eight hundred and fortyReais and fifty-six cents (R$34.455.840,56) allocated to the share capital, which shall henceforth go from two hundred and twenty-three million, eight hundred and seventy-three thousand, and one hundred and sixteenReais and ten cents (R$223,873,116.10) to two hundred and fifty-eight million, three hundred and twenty-eight thousand, nine hundred and fifty-sixReais and sixty-six cents (R$258,328,956.66),pursuant to theValuation Report of Mobitel's Net Book Value contained inExhibit II to these minutes, with the balance in the amount of one hundred and forty-three million, seven hundred and sixty thousand and one hundred and nineteenReais and twelve cents (R$143,760,119.12) to the capital reserve. The capital increase shall result in the issuance of one million, eight hundred and seventy-six thousand, nine hundred and eighty-two (1,876.982) new common shares and three million, thirty-eight thousand, four hundred and ninety-nine (3,038,499) preferred shares, all book-entry and with no par value to be fully assigned to Mobitel's shareholders, pursuant to their respective holdings in Mobitel's capital.

6.5.1.Due to the capital increase described in the above item, the Company's capital shall then be represented by sixty-four million, six hundred and eighty-six thousand and eighty-one shares (64,686,081) , with twenty-four million, nine hundred and sixty-six thousand, five hundred and eighty-two (24,966,582) common shares and thirty-nine million, seven hundred and nineteen thousand, four hundred and ninety-nine (39,719,499) preferred shares, all book-entry and with no par value, and the main provision of Article 5 of the By-laws of the Company shall henceforth read as follows:

"Article 5 -The capital is two hundred and fifty-eight million, three hundred and twenty-eight thousand, nine hundred and fifty-sixReais and sixty-six cents (R$258,328,956.66), divided into 64,686,081 shares, being 24,966,582 common shares and 39,719,499 preferred shares, all book-entry, registered and with no par value."

6.5.2.The shares to be issued by the Company by reason of the Share Merger shall be entitled to all rights that are then ensured to the Company's existing shares, including profit sharing still not declared and paid by the Company to its shareholders.

6.6 Without a dissenting vote and with the abstention of the shareholder HSBC Global Investment Funds-Brazil Equity, representing 1.31% of the shares entitled to vote, appoints to join the Board of Directors of the Company, to complete the mandate until the Annual Shareholders Meeting to be held in 2012:(i) as full member, Mr. RICARDO ANTÔNIO MELLO CASTANHEIRA, Brazilian citizen, married, civil engineer, bearer of identity card No. MG-1.190.558, issued by SSP-MG and enrolled with the National Individual Taxpayers Register (CPF/MF) under No. 130.218.186-68, resident in the city of Belo Horizonte, state of Minas Gerais, at Avenida do Contorno, No. 8123, Cidade Jardim, Postal Code (CEP): 30110-937, replacing Mr. Paulo Roberto Reckziegel Guedes, who requested removal, and (ii) Mr.CARLOS FERNANDO HORTA BRETAS, Brazilian citizen, married, civil engineer, bearer of identity card No. 40.277/D issued by Engineering and Architecture Council of Minas Gerais (CREA MG) and enrolled with the National Individual Taxpayers Register (CPF/MF) under No. 463.006.866-04, resident in the city of Belo Horizonte, state of Minas Gerais, at Avenida do Contorno No. 8123, Cidade Jardim, Postal Code (CEP): 30110-937, in the office ofalternate member of director Renato Torres de Faria. The newly-elected directors declared that they are involved in any crimes that may deprive them of office and provided the declaration under paragraph 4 of article 147 of Law No. 6404/76.

Special Shareholders Meeting of Contax Participacoes SA of July 1, 2011

7.Adjournment : As there is nothing future, the preparation of these minutes was authorized in summary form, which after having been read and approved, were signed by the shareholders present, who authorized publication thereof without the respective signature, in accordance with article 130, paragraph 2, of Law No. 6404/76. Marco Norci Schroeder (Chairman); Eder Carvalho Magalhães (Audit Committee Representative); Shareholders Present: CTX Participações S.A (by poa Ana Carolina dos Remédios Monteiro da Motta); Eton Park Fund, L.P; EP Tisdale LLC; Capital World Growth and Income Fund Inc; Ford Motor Company Defined Benefit Master Trust; Skopos Cardeal Fundo de Investimento em Ações; Skopos Master Fundo de Investimento em Ações; HSBC Global Investment Funds -Brazil Equity; Green Hg Fund LLC; CSHG Verde Equity Master Fundo de Investimentos em Ações; CSHG Verde Master Fundo de Investimentos Multimercado (by poa Leonardo Zucolotto Galdioli). I certify that this is a true copy of the respective Minutes book of the Company.

Rio de Janeiro, July 1, 2011

SECRETARY

Cristina Alves Corrêa Justo Reis

Special Shareholders Meeting of Contax Participacoes SA of July 1, 2011

CONTAX PARTICIPAÇÕES S.A.

National Corporate Taxpayers Register (CNPJ/MF) No. 04.032.433/0001-80

State Enrollment (NIRE) No. 33.300.275410

Publicly-Traded Company

MINUTES OF THESPECIAL SHAREHOLDERS MEETING

HELDON JULY 1, 2011

Exhibit I

Protocol and Justification of Share Merger

Exhibit II

Value Report of Mobitel's Net Book Value

Exhibit III

Exchange Ratio Valuation Report

Special Shareholders Meeting of Contax Participacoes SA of July 1, 2011

Draft for Discussion

June 3, 2011

INSTRUMENT OF JUSTIFICATION AND PROTOCOL OF MERGER OF SHARES

By this private instrument, the managers of the companies mentioned below enter intothis Instrument of Justification and Protocol of Merger of Shares (“Instrument”)according to articles 224, 225, and 252 of Law No. 6404 of December 15, 1976, asamended (“Law No. 6404/76”) and Brazilian Securities Commission (“CVM”) Ruling 319 of December 3, 1999, as amended (“ICVM 319”).

(a) MOBITEL S.A.a corporation, with its principal place of business in the City of São Paulo, State of São Paulo, at Rua Desembargador Eliseu Guilherme, Nos. 282/292, Paraíso District, Postal Code 04004-030, enrolled with the National Corporate Taxpayers Register under CNPJ No. 67.313.221/0001-90, hereinafter referred to as

“Mobitel”, “Dedic” or “Merging Company”; and

(b) CONTAX PARTICIPAÇÕES S.A., a publicly-held corporation, with its principal place of business in the City of Rio de Janeiro, State of Rio de Janeiro, at Rua do Passeio, No. 56, 16thfloor, enrolled with the National Corporate Taxpayers Register of the Ministry of Finance under CNPJ/MF No. 04.032.433/0001-80, hereinafterreferred to simply as “Contax Participações” or “Surviving Company”;

Mobitel and Contax Participações, represented by their managers, are hereinafterreferred to individually as “Party” and jointly as “Parties”;

WHEREAS, the Parties wish that all the shares issued by Mobitel be merged into

Contax Participações (“Merger of Shares”);

WHEREAS, pursuant to the recommendation from the Securities Commissionexpressed in Guideline No. 35 of September 1, 2008 (“CVM Guideline 35”), a special shareholders’ meeting of Contax Participações was held on March 30, 2011 in order topass resolutions on its By-laws for the purpose of approving the creation of a special and independent committee according toCVM Guideline 35 (“Special Committee”);

WHEREAS, on April 26, 2011, there was a Meeting of the Board of Directors of Contax Participações to pass resolutions on the election of members of the Special Committee, all managers of Contax Participações or not, with vast experience and technical capacity in accordance with the same parameters set forth in the BM&FBOVESPA New Market Regulations for the qualification of a new member of the Board of Directors of a publicly-held corporation as an “independent member”;

WHEREAS, on June 8, 2011, the Special Committee of Contax Participações submitted to the managers of Contax Participações and of Mobitel its thoughts on the conditionsof the proposal for the Merger of Shares, including the replacement of shares issued by Mobitel with shares issued by Contax Participações;

1

Draft for Discussion

June 3, 2011

NOW, THEREFORE, the Parties resolve to enter into this Instrument of Justificationand Protocol of Merger of Shares (“Instrument”), which shall be submitted for approval and ratification of the shareholders of Contax Participações and of Mobitel gathered in ashareholders’ meeting, pursuant to the following terms and conditions.

1.INTRODUCTION

1.1. Subject Matter. The subject matter of this Instrument is to consolidate the justifications, terms, and conditions of the transaction of merger of shares to beproposed to shareholders’ meetings of the Parties, whereby all the shares issued by Mobitel shall be merged into Contax Participações (“Merger of Shares”) and Mobitel shall become a wholly-owned subsidiary of Contax Participações. The purpose of the Merger of Shares covered by this Instrument is to integrate all the activities andshareholding structures of Contax Participações and of Mobitel (“Corporate Restructuring”), in accordance withthe Notice of Material Event of Contax

Participações disclosed on January 25, 2011 (“Notice of Material Event”).

1.1.1. The Corporate Restructuring is limited to the Merger of Shares with the issuance by Contax Participações of common and preferred shares according to the replacement ratio mentioned in item 4.3 of this Instrument, to be attributed to the shareholder that, on the date of the corresponding release, holds shares issued by Mobitel.

1.2.Corporate Structure Before Corporate Restructuring. Currently, the corporate restructuring of the Parties is the following:

Mobitel

| | | |

| Shareholder | No. of Shares | % of the Total and |

| | | Voting Capital |

| Portugal Telecom Brasil S.A. | 135,519,119 | 87.5% |

| Fábio Carlos Pereira | 19,359,874 | 12.5% |

| Total | 154,878,993 | 100% |

2

Draft for Discussion

June 3, 2011

Contax Participações

| | | | | | | |

| Shareholder | No. of

Registered

Common

Shares | % of

Registered

Common

Shares | No. of

Registered

Preferred

Shares | % of

Registered

Preferred

Shares | Total

Registered

Common

and

Registered

Preferred

Shares | % of

Total

Capital |

| CTX Participações S.A. | 15,992,959 | 69.26% | 3,880,666 | 10.58% | 19,873,625 | 33.25% |

Credit Suisse Hedging

Griffo CV S.A. | 1,684,000 | 7.29% | 8,803,600 | 24.00% | 10,487,600 | 17.55% |

Skopos Administradora

de Recursos Ltda. | 679,400 | 2.94% | 6,869,600 | 18.73% | 7,549,000 | 12.63% |

| HSBC Bank Brasil S.A. | 303,200 | 1.31% | 4,467,000 | 12.18% | 4,770,200 | 7.98% |

Eton Park Capital

Management, L.P. | 1,314,200 | 5.69% | - | - | 1,314,200 | 2.20% |

| Others | 3,115,841 | 13.49% | 12,660,134 | 34.51% | 15,775,975 | 26.39% |

| TOTAL | 23,089,600 | 100.00% | 36,681,000 | 100.00% | 59,770,600 | 100.00% |

1.3.Corporate Structure After Corporate Restructuring.After the events described in Section 1.1 above, the corporate structure of the Parties shall be the following, takinginto account Fábio’s exercise of withdrawal right pursuant to item 2.6below and the consequent cancellation of his Mobitel shares:

Mobitel

| | | |

| Shareholder | No. of Shares | % of the Total and |

| | | Voting Capital |

| Contax Participações | 135.519.119 | 100% |

| TOTAL | 135.519.119 | 100% |

Contax Participações

| | | | | | | |

| Shareholder | No. of

Registered

Common

Shares | % of

Registered

Common Shares | No. of

Registered

Preferred

Shares | % of

Registered

Preferred

Shares | Total

Registered

Common

and

Registered

Preferred

Shares | % of the

Total Capital |

| CTX Participações S.A. | 15.992.959 | 64,06% | 3.880.666 | 9,77% | 19.873.625 | 30,72% |

| Credit Suisse Hedging Griffo CV S.A. | 1.684.000 | 6,75% | 8.803.600 | 22,16% | 10.487.600 | 16,21% |

3

Draft for Discussion

June 3, 2011

| | | | | | | |

| Shareholder | No. of

Registered

Common

Shares | % of

Registered

Common Shares | No. of

Registered

Preferred

Shares | % of

Registered

Preferred

Shares | Total

Registered

Common

and

Registered

Preferred

Shares | % of the

Total Capital |

Skopos Administradora

de Recursos Ltda. | 679.400 | 2,72% | 6.869.600 | 17,30% | 7.549.000 | 11,67% |

Portugal Telecom

Brasil S.A. | 1.876.982 | 7,52% | 3.038.499 | 7,65% | 4.915.481 | 7,60% |

| HSBC Bank Brasil S.A. | 303.200 | 1,21% | 4.467.000 | 11,25% | 4.770.200 | 7,37% |

Eton Park Capital

Management, L.P. | 1.314.200 | 5,26% | - | - | 1.314.200 | 2,03% |

| Others | 3.115.841 | 12,48% | 12.660.134 | 31,87% | 15.775.975 | 24,39% |

| TOTAL | 24.966.582 | 100,00% | 39.719.499 | 100,00% | 64.686.081 | 100,00% |

2.JUSTIFICATION FORCORPORATERESTRUCTURING

2.1.Justifications for Corporate Restructuring. Bearing in mind that Mobitel and Contax Participações are companies whose business purpose includes activities of the same line of business, that is, contact center, with their activities being complementary, especially regarding their customer base and offered services, the Corporate Restructuring is justified by potential efficiency gains.

2.2. The Corporate Restructuring will combine the experiences of two players, thereby enabling the improvement of contact center activities and the offer of better services to their users. It will also strengthen the performance of both companies on their main markets and will integrate the complementary activities of each company.

2.3. The Corporate Restructuring will also reduce costs and bring administrative, economic, and financial benefits with the reduction of combined operating expenses inasmuch as both Contax Participações and Mobitel will begin to belong to the same economic group.

2.4. Finally, the Corporate Restructuring will enable the creation of worth through the exchange of administrative best practices, thereby resulting in significant improvements in productivity and profitability for Mobitel and for Contax Participações.

4

Draft for Discussion

June 3, 2011

3.SPECIALIZEDCOMPANIES

3.1Specialized Companies.For the preparation of valuations of the Parties for

Corporate Restructuring purposes, the following specialized companies (“Specialized Companies”)have been chosenad referendumby shareholders’ meetings of the Parties,and such companies hereby represent that there are no current or potential conflicts of or common interests with direct or indirect controlling shareholders of Contax Participações and with direct or indirect controlling shareholders of Mobitel, or with minority shareholders of Contax Participações, or with shareholder(s) of the other companies of their respective groups concerning the Merger of Shares and the Corporate Restructuring as a whole:

| (i) | APSIS Consultoria e Avaliações Ltda., enrolled with the National Corporate Taxpayers Register of the Ministry of Finance under CNPJ/MF No. 08.681.365/0001-30, and with the Regional Accounting Council of the State of Rio de Janeiro under CRC/RJ No. 005112/0-9, with its principal place of business at Rua da Assembléia No. 35, 12thfloor, Downtown, in the City of Rio de Janeiro, State of Rio de Janeiro, to conduct the valuation of the book net worth of Mobitel based on the audited financial statements drawn up on December 31, 2010; and |

| (ii) | Banco BTG Pactual S.A., to conduct the valuation of both Mobitel and Contax Participações through future profitability methodology based on retrospective analysis, scenario projection, and discounted cash flow on |

| | December 31, 2010 (“Base Date”), in accordancewith the criteria and premises listed inExhibit IIto this Instrument. |

4.MERGER OF SHARES OFMOBITEL INTOCONTAXPARTICIPAÇÕES, VALUATIONS,ANDREPLACEMENTRATIO

4.1.Merger of Shares. By means of the Merger of Shares of Mobitel Shares, Mobitel shall become a wholly-owned subsidiary of Contax Participações, pursuant to and for the purposes of article 252 of Law No. 6404/76.

4.2.Valuations. For the purposes of the Merger of Mobitel Shares, the Specialized Companies, as the case may be, conducted the following valuations:

4.2.1.Book Net Worth Valuation. For the purposes of accounting registration of the Mobitel shares to be transferred to Contax Participações and the consequent increase in the capital stock of Contax Participações, the book net worth of Mobitel wasvaluated based on its financial statements drawn up on December 31, 2010, in the amount of one hundred and seventy-eight million, two hundred and fifteen thousand, nine hundred and fifty-nineReaisand sixty-eight cents (R$178,215,959.68), or oneReal, fifteen cents and fraction thereof (R$1.1507) per share, in accordance with the accounting report contained inExhibit Ihereto, prepared by APSIS Consultoria e Avaliações Ltda.

5

Draft for Discussion

June 3, 2011

4.2.2.Economic Valuation. For the purposes of supporting the definition of the ratio of replacement of shares issued by Mobitel with shares issued by Contax Participações, both Mobitel and Contax Participações were valuated in accordance with the fairness opinion independently prepared by Banco BTG Pactual S.A. using future profitability methodology based on retrospective analysis, projected scenario and discounted cash flows on December 31, 2010, in accordance with the criteria and premises listed inExhibit IIto this Instrument.

4.3.Share Replacement Ratio Proposed for the Merger of Mobitel Shares: Thereplacement ratio was negotiated and determined independently by the Parties’managers based on: (i) the fairness opinion on the economic value of the companies obtained by the Parties from Banco BTG Pactual S.A.; and (ii) the economic value of Mobitel and of Contax Participações pursuant to the valuation reports contained in Exhibit II to this Instrument after the managers of Mobitel and of Contax Participações examined and discussed the recommendations and conclusions of the Special Committee of Contax Participações, as shown in the tables below:

Replacement Ratio Based on the Reports contained in Exhibit II

| | | |

| Company | Economic Value | Replacement Ratio |

| Mobitel | R$187 million to 213 million | 1 |

| | | 0.0343 to 0.0417 Registered |

| | | Common Shares |

Contax

Participações | R$2,233 million to 2,390 million | |

| | | 0.0343 to 0.0418 Registered |

| | | Preferred Shares |

4.3.1. Each shareholder of Mobitel shall receive, per each common share of Mobitel owned by it, zero point zero three hundred and sixty-two (0.0362) common shares issued by Contax Participações, multiplied by the percentage of common shares in which the capital stock of Contax Participações is divided, and, per each common share of Mobitel owned by it, zero point zero three hundred and sixty-three (0.0363) preferred shares issued by Contax Participações, multiplied by the percentage of preferred shares in which the capital stock of Contax Participações divided, resulting in the total issuance by Contax Participações of one million, eight hundred and seventy-six thousand, nine hundred and eighty-two (1,876,982) common shares and three millionand thirty-eight thousand, four hundred and ninety-nine (3,038,499) preferred shares, all book-entry shares with no par value.

6

Draft for Discussion

June 3, 2011

4.3.2.Allocation of the Value of Mobitel Shares and Increase in the Capital Stock of Contax Participações. In the event of Merger of Mobitel Shares to be approved pursuant to this Instrument, the book value of Mobitel shares of one hundred and seventy-eight million, two hundred and fifteen thousand, nine hundred and fifty-nineReaisand sixty-eight cents (R$178,215,959.68) pursuant to the valuation mentioned in item 4.2.1, thirty-four million, four hundred and fifty-five thousand, eight hundred and fortyReaisand fifty-six cents (R$34,455,840.56) shall be allocated to the capital stock of Contax Participações and one hundred and forty-three million, seven hundred and sixty thousand, one hundred nineteenReaisand twelve cents (R$143,760,119.12) shall be allocated to the capital reserve of Contax Participações. Therefore, the capital stock of Contax Participações shall be increased by thirty-four million, four hundred and fifty-five thousand, eight hundred and fortyReaisand fifty-six cents (R$34,455,840.56), thereby increasing from two hundred and twenty-three million, eight hundred and seventy-three thousand, one hundred and sixteenReaisand ten cents (R$223,873,116.10) to two hundred and fifty-eight million, three hundred and twenty-eight thousand, nine hundred and fifty-sixReaisand sixty-six cents (R$258,328,956.66), in accordance with the accounting report contained inExhibit IIto this Instrument.

4.3.3.Shares Issued in the Merger of Shares. In the event the Merger of Shares is approved, one million, eight hundred and seventy-six thousand, nine hundred and eighty-two (1,876,982) new common shares and three million and thirty-eight thousand, four hundred and ninety-nine (3,038,499) new preferred shares, all registered and with no book value, shall be issued to be fully attributed to the shareholders of Mobitel in accordance with their corresponding equity interest in the capital stock of Mobitel.

4.3.4. In view of the increase in the capital stock as described in Sections 4.3.2 and 4.3.3. above, the capital stock of Contax Participações shall begin to be represented by sixty-four million, six hundred and eighty-six thousand and eighty-one (64,686,081) shares, with twenty-four million, nine hundred and sixty-six thousand, five hundred and eighty-two (24,966,582) common shares and thirty-nine million, seven hundred and nineteen thousand, four hundred and ninety-nine (39,719,499) preferred shares, all registered and with no par value.

4.3.5. The shares to be issued by Contax Participações in view of the Merger of Mobitel Shares shall be entitled to all rights theretofore ensured to already existing shares of Contax Participações, including sharing profits declared by Contax Participações to its shareholder from the date of approval of the Merger of Shares.

7

Draft for Discussion

June 3, 2011

4.4.Withdrawal Right of Contax Participações’ Shareholders.In compliance with the provisions of articles 252, paragraph 1 and article 137, II of Law No. 6404/76, as amended, the dissenting shareholders of Contax Participações who exercise their withdrawal right due to the approval of the Merger of Shares of Mobitel shall be entitled to the reimbursement of the equity value of their shares, calculated based upon the Financial Statements of Contax Participações drawn up on December 31st, 2010 and disclosed on March 2nd, 2011. Therefore, the reimbursement amount to be paid to the dissenting shareholders of Contax Participações shall be seven Reais and fraction (R$7.0097) per share, without prejudice to the mentioned shareholder requesting the drawing up of a special balance sheet for the purposes of calculating the reimbursement amount, as provided for in article 45, paragraph 2 of Law No. 6404/76.

4.4.1.Term for Exercise of the Withdrawal Right of the Shareholders of Contax Participações.The withdrawal right can be exercised by the dissenting shareholder of Contax Participações within no longer than thirty (30) days as of the date of release of the minutes of the shareholders meeting which resolves on the Merger of Shares of Mobitel, as provided for in article 137, IV of Law No. 6404/76, provided that the effective payment of the reimbursement amount shall remain conditioned to the performance of all acts provided for in this Section 4.

4.4.1.1. The dissenting shareholder of Contax Participações may exercise its reimbursement right only in relation to the shares demonstrably owned by such shareholder, continuously maintained by the shareholder from January 25th, 2011, date in which the Corporate Restructuring was released to the market, by means of a Notice of Material Event, and the date of the effective exercise of the withdrawal right.

4.4.2. In case it is understood that the exercise of the withdrawal right by the dissenting shareholders will endanger the financial stability of Contax Participações, the management of Contax Participações may call a new shareholders' meeting to resolve on the ratification or reconsideration of the Merger of Shares, pursuant to art. 137, paragraph 3, of Law No. 6404/76.

4.5.Withdrawal Right of Mobitel Shareholder.In compliance with the provisions of articles 252, paragraph 1, 264 and article 137, II of Law No. 6404/76, as well as pursuant to the terms and conditions of the Agreement for Exercise of Withdrawal Right and other Covenants, executed on January 31st, 2011, by and between Mobitel, GPTITecnologia da Informação S.A., Fábio Carlos Pereira (“Fábio”), and Portugal TelecomBrasil S.A., with the intervention of GET–Gestão Empresarial e Tecnológica Ltda.(“Agreement for Exercise of Withdrawal Right”), in case the Merger of Shares ofMobitel is approved pursuant to this Instrument, the shareholder Fábio, holder of nineteen million, three hundred fifty nine thousand, eight hundred seventy four (19,359,874) common, registered shares with no par value, representing twelve pointfive percent (12.5%) of the total voting capital stock of Mobitel (“Fábio Shares”),undertook to exercise its withdrawal right from Mobitel and, due to the mentioned Agreement for Exercise of Withdrawal Right, shall be entitled to the reimbursement of the amount of its Fabio Shares comprising twenty three million Reais (R$23,000,000.00)1.

1Amount subject to adjustment according to the terms of the Agreement for Exercise of Withdrawal Right.8

Draft for Discussion

June 3, 2011

4.5.1Term for Exercising the Withdrawal Right of the Dissenting Shareholder of Mobitel.The withdrawal right may be exercised by the dissenting shareholder of Mobitel within no longer than thirty (30) days as of the date of release of the minutes of shareholders meeting which resolves on the Merger of Shares of Mobitel, subject-matter of this Section 4, as provided for in article 137, IV of Law No. 6404/76, as amended, provided that the effective payment of the reimbursement amount shall remain conditioned to the performance of all acts provided for in this Section 4, as well as the compliance with the terms and conditions of the Agreement for Exercise of Withdrawal Right.

4.5.1.1 The dissenting shareholder of Mobitel may exercise its reimbursement right in relation to the shares held by him/her on the date of the first release of the call notice for the shareholders meeting which resolved on the Merger of Shares of Mobitel, subject-matter of this Section 4, the call being dispended with pursuant to article 124, paragraph 4 of Law No. 6404, as amended, in relation to the shares he/she holds on the date of the mentioned shareholders meeting.

4.6.Amendment to the Contax Participações’ By-laws. The by-laws of Contax Participações shall be amended in order to reproduce the capital increase described in Section 4.3 above

4.7.Implementation.The managements of Mobitel and Contax Participações undertake to perform all acts, registrations and annotations necessary to the implementation of the Merger of Shares of Mobitel, after the approval by the shareholders' meetings of Mobitel and Contax Participações.

5.STATEMENT OF THESPECIALCOMMITTEE OFCONTAXPARTICIPAÇÕES

5.1. Notwithstanding the Merger of Shares not involving controlling and controlled companies, in compliance with the market good practices, the managers of the Parties complied with CVM Guideline 35, reason why the Independent Special Committee of Contax Participações was formed. The Independent Special Committee of Contax Participações, pursuant to CVM Guideline 35, after reviewing and discussing, independently, the conditions of Merger of Shares, based upon reports and studies of the financial and legal consultants retained by Contax Participações, the proposals of themanagement related to the conditions of the Corporate Restructuring, as well as the other documents presented by the management of Contax Participações, and the valuation prepared by Barclays Capital, independent financial advisor retained exclusively for assisting the analysis of the Committee, presented its considerations to the managements of Contax Participações and Mobitel, concluding that the replacement ratio proposed for the Merger of Shares described in Section 4.3 above is appropriateand, from the Contax Participações’ point of view, equitable for the Merger of Shares.

9

Draft for Discussion

June 3, 2011

6.GENERALPROVISIONS

6.1.Adjustments of equity interests as a result of the exercise of the withdrawal right.All adjustments in the amount of capital stocks and number of shares issued by the Parties deemed necessary shall be carried out, due to the exercise of any withdrawal right by the dissenting shareholders of the shareholders meeting of Contax Participações and the shareholders meeting of Mobitel which resolve on the Merger of Shares of Mobitel, subject-matter hereof.

6.2. Equity changes occurred in Dedic and Contax Participações as of December 31st, 2010, Base Date of the Merger of Shares, to the date of approval of the Merger of Shares shall be directly allocated to each one of the companies.

6.3.Lack of Succession.By virtue of the consummation of the Merger of Shares, Contax Participações shall not absorb assets, rights or liabilities of Mobitel, so that Mobitel will maintain its legal personality intact, no succession being carried out.

6.4.Compliance with Applicable Laws and Regulations.While implementing the Corporate Restructuring, the managers of the Parties shall observe the legal and regulatory provisions applicable, including, without limitation, CVM Guidelines Nos. 319/99, 320/99 and 349/01.

6.5.Annotations and RegistrationsThe management of Contax Participações, with the cooperation of Mobitel's management, shall be accountable for performing all acts necessary to the implementation of the Merger of Shares mentioned hereunder, as well as all communications, registrations and annotations of data and everything else necessary to the consummation of the transaction.

6.6.Jurisdiction.The Parties and their respective managements elect the central courts of the City of Rio de Janeiro, State of Rio de Janeiro, as the courts of jurisdiction to solve any controversies resulting from this Instrument.

The Parties execute this instrument in three (3) identical counterparts, in the presence of two (2) witnesses identified below. Rio de Janeiro, June 14th, 2011.

10

Draft for Discussion

June 3, 2011

| | |

| | MOBITEL S.A. |

| By: | By: |

| Title: | Title: |

| |

| |

| |

| |

| | CONTAX PARTICIPAÇÕES S.A. |

| By: | By: |

| Title: | Title: |

| |

| |

| |

| Witnesses: | |

| Name: | Name: |

| ID CARD (RG): | ID CARD (RG): |

11

Valuation Report

RJ-0310/11-01

MOBITEL S.A.

| REPORT: | | RJ-0310/10-01 |

| BASE DATE: | | December 31, 2010 |

| | | |

| REQUESTING PARTY: | | CONTAX PARTICIPAÇÕES SA, a publicly-heldtraded company, with headquartersat Rua do Passeio, No. 48-56, part, in the Cityand State of Rio de Janeiro, Brazil, enrolled with the National Corporate Taxpayers Register of the Ministry of Finance (CNPJ/MF) under No. 04.032.433/0001-80, hereinafter referred to asCONTAX. |

| | | |

| SUBJECT MATTER: | | MOBITEL SA, a joint-stock corporation, with headquarters at Rua Desembargador Eliseu Guilherme, No. 282-292, District ofParaíso, City and State of São Paulo, Brazil, enrolled with the National Corporate Taxpayers’Register of the Ministry of Finance(CNPJ/MF) under No. 67.313.221/0001-90, hereinafter referred to as MOBITEL. |

| | | |

| PURPOSE: | | Determining the book value of MOBITEL shares for merger of shares by CONTAX, pursuant to art. 252 of Law No. 6,404 of December 15,1976 (Corporate Law). |

1

CONTENTS | | |

| | | |

| 1.INTRODUCTION | | 3 |

| 2.PRINCIPLES AND QUALIFICATIONS | | 4 |

| 3.LIMITATIONS OF LIABILITY | | 5 |

| 4.VALUATION METHODOLOGY | | 6 |

| 5.VALUATION OF SHAREHOLDERS' VALUE | | 7 |

| 6.CONCLUSION | | 8 |

| 7.LIST OFEXHIBITS | | 9 |

1. INTRODUCTION | | |

APSIS Consultoria e Avaliações Ltda., hereinafter referred to as APSIS, withheadquarters at Rua da Assembleia, No. 35, 12th floor, Downtown, in the Cityand State of Rio de Janeiro, Brazil, enrolled with the CNPJ under No. 08.681.365/0001-30, with the Regional Accounting Council CRC/RJ-005112/O-9, was appointed to determineof the book value of MOBITEL shares for merger ofshares by CONTAX,pursuant to art. 252 of Law No. 6,404 of December 15, 1976(Corporate Law). In preparation of thisreport, information and data provided by third parties wasused in the form of documents and oral interviews with the client. The estimates used in this process are based on documents and information,whichinclude the following: § MOBITEL’saudited Balance Sheet as of December 31, 2010. (Exhibit 01) APSIS recently conducted valuations for various purposes in the following publicly-held companies: § AMÉRICA LATINA LOGÍSTICA DO BRASIL S/A § BANCO PACTUAL S/A § CIMENTO MAUÁ S/A § ESTA-EMPRESA SANEADORA TERRITORIAL AGRÍCOLA S/A. § GEODEX COMMUNICATIONS DO BRASIL S/A § GERDAU S/A § HOTÉIS OTHON S/A § IBEST S/A § L.R. CIA.BRAS.PRODS.HIGIENE E TOUCADOR S/A § LIGHT SERVIÇOS DE ELETRICIDADE S/A § LOJAS AMERICANAS S/A § REPSOL YPF BRASIL S/A

| | § TAM TRANSPORTES AÉREOS MERIDIONAL S/A § WAL PETROLEO S/A APSIS team responsible for this work consists of the following professionals: |

| | § AMILCARDECASTRO Director Bachelorof Law § ANA CRISTINA FRANÇA DESOUZAManaging partner CivilEngineer(CREA/RJ 91.1.03043-4) Graduate degree in Accounting § ANTÔNIO LUIZ FEIJÓNICOLAUProject Manager § ANTÔNIO REISSILVA FILHO Director CivilEngineer(CREA/SP 107.169) Master's degree in Business Administration § BETINA DENGLERProject Manager § CARLOS MAGNO SANCHESProject Manager § CLAUDIO MARÇAL DEFREITASAccountant (CRC/RJ 55029/O-1) § FELLIPEF. ROSMANProject Manager § GABRIEL ROCHA VENTURIMProject Manager § LUIZPAULOCESARSILVEIRA Director Mechanical Engineer(CREA/RJ 89.1.00165-1) Master's degree in Business Administration § MARGARETH GUIZAN DA SILVA OLIVEIRA Director CivilEngineer(CREA/RJ 91.1.03035-3) § RICARDODUARTECARNEIRO MONTEIROManaging Partner CivilEngineer(CREA/RJ 30137-D) Graduate degree in Economic Engineering § RENATA POZZATOCARNEIRO MONTEIROProject Manager § SERGIOFREITASDE SOUZA Director Economist (CORECON/RJ23521-0) |

| | |

| | |

| | |

| 2. PRINCIPLES AND QUALIFICATIONS | | |

|

The report that is the subject matter of the work listed, calculated and particularized, strictly follows the fundamental principles described below: |

| | |

§ The consultants have no interest, direct or indirect, in the companiesinvolved or in the operation,and there is no other relevant circumstance that may characterize a conflict of interests. § To the best of the consultants’ knowledge and credit, the analyses,opinions and conclusions expressed in this report are based on true andaccurate data, investigations, research and surveys. § The report presents all the restrictive conditions imposed by the adopted methodologies, which affect the analysis, opinions and conclusions contained in it. § APSIS’s professional fees are not in any way, subject to the findings of this report. § APSIS assumes full responsibility for Engineering Appraisal , includingimplicit matters, to perform its honorable duties, as primarily establishedin laws, codes or own regulations. § Any information received from third parties is assumed to be correct, and the sources thereof are contained in this report.

| | § The report was prepared by APSIS and no one, except their own consultants, prepared the analysis andrespective conclusions. § For projection purposes, we assumed the inexistence of liens or encumbrances of any kind, whether judicial or extra judicial, affectingthe companies in question, other than those listed in this report. § This report meets the specifications and criteria established by USPAP(Uniform Standards of Professional Appraisal Practice), in addition to therequirements imposed by different bodies, such as: Ministry of Finance,Central Bank, Banco do Brasil, CVM - Brazilian Securities Commission, SUSEP - Superintendenceof Private Insurance, RIR - Regulation of Income Tax etc. § The controller and the managers of the companies involved did not direct,limit, hinder or performedany acts that have or might have compromisedaccess to, use or knowledge of information, assets, documents or work methodologiesrelevant to the quality of the respective conclusions contained in this work. |

4

3. LIMITATIONSOF LIABILITY

§ For this report, APSIS used information and historical data audited by third parties orunaudited, and unaudited projected data, provided for in writingor orally by company management or obtained from the sources mentioned. Therefore, APSIS assumed the data and informationobtained for this report as true and is not liable with respect to its accuracy.

§ The scope of this work does not include an audit of the financialstatements or a review of the work performed byauditors.

§ Our work is designed for use by the requesting company, its partners andother companiesinvolved in the project,aiming towards the previously described goal.

§ We are not liable for occasional losses to the requesting party and itssubsidiaries, partners,officers, creditorsor other parties as a result of the

use of data and information provided by the company and in this report.

5

4. VALUATION METHODOLOGY

Examination of the supporting documentation previously mentioned, in order to check for good bookkeepingin compliance with regulatory, normative andstatutory provisions governing the matter, pursuant “GenerallyAccepted Accounting Principles and Conventions”

MOBITEL’s accounting books and all other documentsnecessary to prepare thisreport were examined based on MOBITEL’s audited balance sheet as of December 31, 2010.

Experts have established that MOBITEL’sassets and liabilities are properlyaccounted for.

6

5.VALUATIONOF SHAREHOLDERS EQUITY |

| |

| MOBITEL’s accounting books were examined along with all other documents | | MOBITEL S.A | FINANCIAL STATEMENTS |

| necessary to prepare this report. | | BALANCE SHEET (IN REAIS) | BALANCES AS OF DECEMBER 31, 2010 |

| Experts have established that the MOBITEL’s shareholders’equity is one | | CURRENT ASSETS | 105,793,489.69 |

| hundred seventy-eight million,two hundred fifteenthousand,nine hundred and | | NON-CURRENT ASSENTS | 328,866,705.10 |

| fifty-nine Reais and sixty-eight cents (R$178,215,959.68), asof December 31, | | LONG TERM RECEIVABLES | 54,274,850.81 |

| 2010. Considering that the total numberof MOBITEL shares is one hundred fifty- | | PERMANENT ASSETS | 274,591,854.29 |

| four million, eight hundred seventy-eight thousand, nine hundred and ninety- | | Investments | 140,168,901.28 |

| three (154,878,993), the book value per share is one Real point one five zero | | Property and equipment | 100,312,293.70 |

| seven (R$ 1.1507). | | Intangible assets | 34,110,659.31 |

| | | TOTAL ASSETS | 434,660,194.79 |

| | | CURRENT LIABILITIES | 100,711,445.13 |

| | | NON-CURRENT LIABILITIES | 155,732,789.98 |

| | | LONG TERM LIABILITIES | 155,732,789.98 |

| | | SHAREHOLDERS' EQUITY | 178,215,959.68 |

| | | TOTAL LIABILITIES | 434,660,194.79 |

| | | Quantity of shares of Capital Stock | 154,878,993 |

| | | Equity Value per Share | 1.1507 |

7

6. CONCLUSION

Based on the examinationof the documentation mentioned above and on the basis of APSIS’s studies, the experts concluded that MOBITEL’s shareholders’ equity, for merger of shares by CONTAX, corresponds to one hundred and seventy-eightmillion, two hundred fifteen thousand, nine hundred and fifty-nine Reais and sixty-eight cents (R$178,215,959.68), or one Real point one five seven zero (R$1.1507) per share as of December 31, 2010.

Report RJ-0310/11-01, composed of nine (09) pages typed on one side and two (02) exhibits, is concluded. APSISConsultoria e Avaliações Ltda.,CRC/RJ-005112/O-9, a company specialized in asset valuation, legally represented below by its directors, is at your disposal to answer any questions that may be necessary.

Rio de Janeiro, May 07, 2011.

| AMILCAR DE CASTRO | | CLAUDIO MARÇAL DE FREITAS |

| Director | | Accountant (CRC/RJ 55029/0-1) |

8

7. LIST OF EXHIBITS

1. SUPPORT DOCUMENTATION

2. APSIS’S GLOSSARY AND PROFILE

SÃO PAULO – SP | | RIO DE JANEIRO – RJ |

Av.Angélica, nº2.503, Conj. 42 | | Rua daAssembléia, nº 35, 12º andar |

Consolação, CEP: 01227-200 | | Centro, CEP: 20011-001 |

| Tel.: +55113666.8448Fax: +55113662.5722 | | Tel.: +55212212.6850Fax: +55212212.6851 |

dmp/10475.doc

06/20/11

9

| |

| Contax Participações S.A. and Mobitel S.A. |

Valuationreport for theincorporationof 100% of Mobitel S.A. shares by ContaxParticipaçõesS.A.

January 25th, 2011

IMPORTANT DISCLAIMER:Thisdocumentis a freetranslationonly. Due to thecomplexitiesoflanguage translation, translationsare not always precise. The originaldocumentwaspreparedinPortugueseand in case of anydivergence, discrepancyordifference betweenthis version and thePortugueseversion, thePortugueseversion shall prevail. ThePortugueseversion is the only valid andcompleteversion and shall prevail for any and allpurposes.TheTranslationwas made by persons whose nativelanguageis not English,thereforethere is nowarrantyas to theaccuracy, reliabilityorcompletenessof anyinformation translatedand no one should rely on theaccuracy, reliabilityorcompletenessof suchinformation.There is noassuranceas to theaccuracy, reliabilityorcompletenessof thetranslation.Any person reading thistranslationand relying on it should do so at his or her own risk.

| | | | | |

| Index | | | | |

| |

| SECTION 1 | Executive Summary | 02 |

| SECTION 2 | Information About the Evaluator | 07 |

| SECTION 3 | Market and Companies' Overview | 09 |

| | 3 | .A | Market Overview | 10 |

| | 3 | .B | Contax Overview | 13 |

| | 3 | .C | Dedic GPTI Overview | 19 |

| SECTION 4 | General Assumptions | 25 |

| SECTION 5 | Contax Valuation | 27 |

| | 5 | .A | Discounted Cash Flow | 28 |

| | 5 | .B | Comparable Companies Trading Multiples | 36 |

| | 5 | .C | Accounting Book Value | 38 |

| | 5 | .D | Volume Weighted Average Price | 40 |

| SECTION 6 | Dedic GPTI Valuation | 43 |

| | 6 | .A | Discounted Cash Flow | 44 |

| | 6 | .B | Comparable Companies Trading Multiples | 53 |

| | 6 | .C | Accounting Book Value | 55 |

| |

| APPENDIX A | Companies' Weighted Average Cost of Capital (WACC) | 57 |

| APPENDIX B | Comparable Companies Trading Multiples | 59 |

| APPENDIX C | Description of Valuation Methodologies | 62 |

| APPENDIX D | Terms and Definitions Used in the Valuation Report | 67 |

| APPENDIX E | Additional Statements and Information | 69 |

1

| |

| SECTION 1 |

| Executive Summary |

2

| |

| Introduction |

| |

This Valuation Report was prepared by Banco BTG Pactual S.A. (“BTG Pactual”), upon request by Contax Participações S.A.(“Contax”) for the purposes specified in Law n°6.404, dated December 15th, 1976 (as amended) (“Lei das S.A.”), in connectionwith the incorporation of all Mobitel S.A. (“Dedic GPTI”) shares by Contax (“Transaction”). |

§ | In January 2011, Contax and Dedic GPTI executed an agreement for the incorporation of Dedic GPTI shares by Contax |

| | § | According to the agreement signed by both parties, Contax committed to, subject to a timeline foreseen in the agreement, to conduct all the necessary steps to submit a proposal for the incorporation of Dedic GPTI by Contax, subject to the terms established, making Dedic GPTI a subsidiary of Contax |

| § | As part of the agreement, Contax committed to take all steps, within the terms established by the agreement, envisaging: |

| | § | (i) the calling of a shareholders’ meeting change the Company’s Byelaws, in order to approve the constitution of an independent committee; |

| | § | (ii) the calling of a Board Meeting in order to indicate the members of such independent committee, which will evaluate and deliberate about the terms and conditions of such Incorporation |

| § | Additionally, Dedic GPTI signed in January 2011 a stock purchase agreement to acquire all Dedic GPTI shares held by Mr. Fábio Carlos Pereira (representing 12.5% of total shares issued by the company) for R$ 23 million |

3

| |

| Contax Summary Valuation |

| |

Based on the fair economic value calculated using the discounted cash flow to firm methodology, the Contax ON shares’ valueranges from R$37.64 toR$40.30 per share and the Contax PN shares’ value ranges from R$37.59 to R$40.24 per share. Forfurther information on the valuation methodologies, please see Appendix C - Description of Valuation Methodologies, on page62 of this report |

| | | | | | | |

| Fair Economic Value (Discounted Cash Flow)(1) | | Book Value |

| (R$ million, except price per share) |  | | (R$ million, except price per share) | |

| Perpetuity growth rate (US$ nominal terms) | 1.50% | 2.00% | 2.50% | | | |

| WACC (US$ nominal terms) | 10.0% | 10.0% | 10.0% | | Total assets | 1,290.9 |

| Enterprise value | $2,143 | $2,217 | $2,301 | | (-) Total liabilities | 880.8 |

| (-) (Net debt) net cash(2) | $90 | $90 | $90 | | (-) Minority interest | 1.8 |

| Equity value | $2,233 | $2,307 | $2,390 | | = Shareholders’ equity | 408.3 |

| Number of ON shares (million)(3) | 22.7 | 22.7 | 22.7 | | Number of shares (million)(3) | 59.4 |

| Price per ON share (R$ / share)(4) | $37.64 | $38.88 | $40.30 | | R$/share | 6.88 |

| Number of PN shares (million)(3) | 36.7 | 36.7 | 36.7 | | | |

| Price per PN share (R$ / share)(4) | $37.59 | $38.84 | $40.24 | | | |

| Fair Economic Value (Trading Multiples) | | Volume Weighted Average Price |

| (R$ million, except multiples and value per share) | | 2011E | 2012E | | | |

| | | | | | 12 months period prior to 12/31/2010 | |

| EBITDA | | 341.1 | 412.0 | | ON:R$29.59 /PN:R$25.29 | |

| EV/EBITDA Multiple(5) | | 6.7x | 6.6x | | | |

| Enterprise value | | 2,280.7 | 2,732.8 | | 6 months period prior to 12/31/2010 | |

| (-) (Net debt) net cash(2) | | 89.7 | 89.7 | | ON:R$31.04/PN:R$26.61 | |

| Equity value | | 2,370.5 | 2,822.5 | | | |

| Number of shares (million)(3) | | 59.4 | 59.4 | | 3 months period prior to 12/31/2010 | |

| R$/share | | 39.93 | 47.54 | | ON:R$31.16/PN:R$29.82 | |

| | |

| Source: Company, CVM, Economática and BTG Pactual. |

| Note: | |

| 1 | As of December 31st, 2010. |

| 2 | As of September 30th, 2010. |

| 3 | Excludes treasury shares. |

| 4 | Assumes a ON/PN ratio based on the average spread of ON / PN shares, during the 60 days prior to December 31st, 2010. |

| 5 | Considers the median of comparable companies trading multiples as of December 31st, 2010. Source: Factset. |

4

| |

| Dedic GPTI Summary Valuation |

Based on the fair economic value calculated using the discounted cash flow to firm methodology, Dedic GPTI shares’ valueranges from R$1.38 to R$1.57 per share. For further information on the valuation methodologies, please see Appendix C -Description of Valuation Methodologies, on page 62 of this report |

| | | | | | | |

| Fair Economic Value (Discounted Cash Flow)(1) | | Book Value |

| |

| (R$ million, except price per share) |  | | (R$ million, except price per share) | |

| Perpetuity growth rate (US$ nominal terms) | 1.50% | 2.00% | 2.50% | | Total assets | 486.3 |

| WACC (US$ nominal terms) | 10.0% | 10.0% | 10.0% | | (-) Total liabilities | 311.1 |

| Enterprise value | $371 | $383 | $397 | | (-) Minority interest | 0.0 |

| (-) (Net debt) net cash(3) | ($184) | ($184) | ($184) | | = Shareholders’ Equity | 175.2 |

| Equity value | $187 | $199 | $213 | | Number of shares (million)(4) | 154.9 |

| Number of shares (million)(4) | 135.5 | 135.5 | 135.5 | | R$/share | 1.13 |

| Price per share (R$ / share) | $1.38 | $1.47 | $1.57 | | | |

| | | | |

| Fair Economic Value (Trading Multiples) | |

| (R$ million, except multiples and value per share) | 2011E | 2012E | |

| EBITDA | 84.7 | 95.9 | |

| EV/EBITDA Multiple(2) | 6.7x | 6.6x | |

| Enterprise value | 566.6 | 636.3 | |

| (-) (Net debt) net cash(3) | (183.9 | (183.9 | |

| Equity value | 382.7 | 452.4 | |

| Number of shares (million)(4) | 135.5 | 135.5 | |

| R$/share | 2.82 | 3.34 | |

| | |

| Source: Company, CVM, Economática and BTG Pactual. |

| 1 | As of December 31st, 2010. |

| 2 | Considers the median of comparable companies trading multiples as of December 31st, 2010. Source: Factset. |

| 3 | As of August 31st, 2010, plus R$23 million as per note 4 below. |

| 4 | Based on information provided by Dedic GPTI, we considered Dedic GPTI has acquired 19,359,874 shares held by Mr. Fábio Carlos Pereira for R$23 million. This total wasadded to the net debt as of August 31st, 2010 for Dedic GPTI valuation. |

5

| |

Exchange Ratio Based on Discounted Cash Flow |

| Analysis of the exchange ratio based on the discounted cash flow to firm methodology |

| | | | | | | | | | | | | | | |

| Contax | | Dedic GPTI |

| (Fair economic value per share based on the discounted cash flow method(1). R$ million, except price per share) | | (Fair economic value per share based on the discounted cash flow method(1). R$ million, except price per share) |

| |  | | |  |

| Perpetuity growth rate (US$ nominal terms) | 1.50% | 2.00% | 2.50% | | Perpetuity growth rate (US$ nominal terms) | 1.50% | 2.00% | 2.50% |

| WACC (US$ nominal terms) | 10.0% | 10.0% | 10.0% | | WACC (US$ nominal terms) | 10.0% | 10.0% | 10.0% |

| Enterprise value | $2,143 | 2,217 | $2,301 | | Enterprise value | $371 | $383 | $397 |

| (-) (Net debt) net cash(2) | $90 | $90 | $90 | | (-) (Net debt) net cash (5) | ($184) | ($184) | ($184) |

| Equity value | $2,233 | 2,307 | $2,390 | | Equity value | $187 | $199 | $213 |

| Number of ON shares (million)(3) | 22.7 | 22.7 | 22.7 | | Number of shares (million) | 135.5 | 135.5 | 135.5 |

| Price per ON share (R$ / share)(4) | $37.64 | 38.88 | $40.30 | | Price per share (R$ / share) | $1.38 | $1.47 | $1.57 |

| Number of PN shares (milhões)(3) | 36.7 | 36.7 | 36.7 | | | | | | | | |

| Price per PN share (R$ / share)(4) | $37.59 | 38.84 | $40.24 | | | | | | | | |

| | | | | | | | | ON:0.03425595x PN:0.03429939x | | | | | | |

| | | | | | | | ON:0.03779068x PN:0.03783860X | | | | | |

| | | | | | | ON:0.04172383x PN:0.04177674X | | | | |

- Based on themethodologyandassumptions presentedtheexchangeratio rangebetweenContax and Dedic GPTI shares isbetween 0.03425595xand0.04172383xfor ON shares and0.03429939xand0.04177674xfor PN shares, based on thecomparisonof theindicativevalues per sharecalculatedfor bothCompaniesand the ratio ON/PN of Contax shares based on the VWAP of each class of share in the period of 60 days beforeDecember31st, 2010

| | |

| Source: Company, CVM, Economática and BTG Pactual. |

| 1 | As of December 31st, 2010. |

| 2 | As of September 30th, 2010. |

| 3 | Excludes treasury shares. |

| 4 | Assumes a ON/PN ratio based on the average spread of ON / PN shares, during the 60 days prior to December 31st, 2010. |

| 5 | As of August 31st, 2010, plus R$23 million as per note 6 below. |

| 6 | Based on information provided by Dedic GPTI, we considered Dedic GPTI has acquired 19,359,874 shares held by Mr. Fábio Carlos Pereira for R$23 million. This total wasadded to the net debt as of August 31st, 2010 for Dedic GPTI valuation. |

6

| |

| SECTION 2 |

| Information About the Evaluator |

7

| |

| Information About the Evaluator |

| As established in CVM Instruction No. 319, Banco BTG Pactual S.A. (“BTG Pactual”) represents that: |

1.BTG Pactual holds nosecuritiesissued by ContaxParticipaçõesS.A.(CTAX3,CTAX4 andCTXNY),based on data as of January 17th, 2011.

2.It has no direct or indirect interest in Contax, Dedic GPTI or in theTransaction,and there is no other relevantcircumstancethat may beconsidereda conflict of interest;

3.Thecontrolling shareholderormanagersof Contax and Dedic GPTI have notdirected,limited,hinderedorperformedany act thatadverselyaffected or may haveadverselyaffected the access to, use orknowledgeofinformation,assets,documentsor workmethodologiesrelevant for the quality of therespective conclusions;.

4.It has no conflict of interest that may in any way restrict its capacity to arrive at theconclusions independently presentedin thisValuationReport.

8

| |

| SECTION 3 |

| Market and Companies' Overview |

9

| |

| SECTION 3.A |

| Market and Companies' Overview |

| Market Overview |

10

| |

| Brazilian Contact Center Market Overview |

Brazilian Contact Center and Information Technology market presents several growth opportunities and benefits directly frompositive Brazilian macroeconomic perspectives |

| |

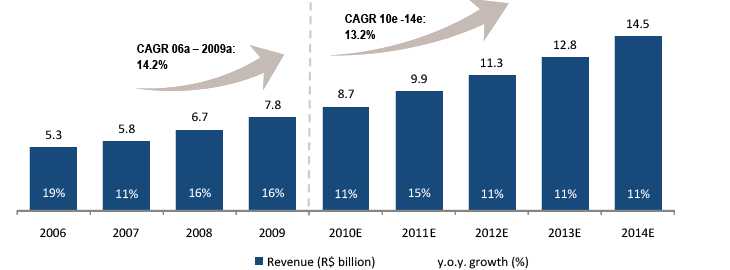

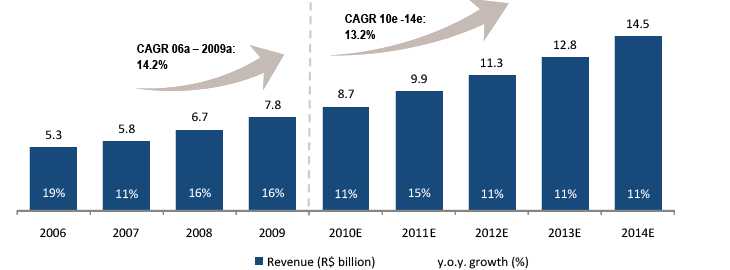

| Revenue Evolution of the Brazilian Contact Center Market |

| (US$ billion) |

| |

| The Brazilian Contact Center Market |

| The Brazilian market presents a huge outsourcing potential |

| | | Brazil is gaining importance in the global scenario and already represents 7.2% of the global market |

| | | Growth should be driven by the increase in outsourcing of non-core activities by the industries that most demand contact center services (banking, telecom and retail) |

Source: IDC andBRASCOM.

11

| |

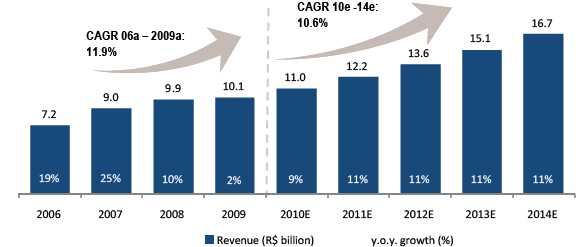

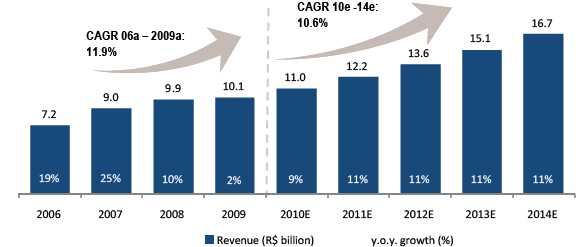

| Brazilian Information Technology Market Overview |

Brazilian Contact Center and Information Technology market presents several growth opportunities and benefits directly frompositive Brazilian macroeconomic perspectives |

| |

| Revenue Evolution of the BrazilianInformation TechnologyMarket |

| (US$ billion; annual growth %) |

| | | | |

| The Brazilian Information Technology Market | | Information Technology Market Revenues, by Country |

- The Brazilian IT sector benefits from the following aspects:

| |

|

| | - The Brazilian IT sector combines technological expertise with anextensive knowledge of business processes for specific businesses,such as the financial sector

| |

| | - Global trend to play an important role in IT infrastructure in LatinAmerica for multinational companies (ex. Unilever, Merck, Rhodia)

| |

12

| |

| SECTION 3.B |

| Market and Companies' Overview |

| Contax Overview |

13

| |

| Contax Overview |

| Company Overview |

| | | |

| Brief Overview |

| |

§Contax Participações S.A. is one of the largest companies in corporate services in Brazil, the market leader in contact center and collection and isexpanding its services portfolio to become the leading company in BPO (Business Process Outsourcing), specialized, in a comprehensive manner, inthe client relationship management (CRM) |

|

|

§Currently, the largest portion of its activity is focused in the segments of Customer Services, Debt Collection, Telemarketing, Retention, Back-office,Technology Services and Trade Marketing |

|

| | §Contax has approximately 80 clients ans its business strategy is focused in the development of long term relationship with its clients, largecorporations of different sectors that use its services, such as telecomunication, financials, utilities, services, retail, among others |

|

| | §In September 2010, Contax had approximately 84 thousand employees distributed in 9 Brazilian states and in the Distrito Federal |

| |

| |

| Recent Events |

| |

§August 31st, 2010: Contax announced the acquisition of Ability Comunicação Integrada Ltda. for a price that could reach a total of R$82,474,000.00.Ability is one of Brazil’s largest and best known companies in the Trade Marketing segment, which involves the promotion and sale of products andservices at points of sale, posting revenues of R$ 104 million and EBITDA of R$ 10 million in the year ended on December 31, 2009. |

|

|

§December 17th, 2010: Contax announced a change in its Executives Board. Mr. Michel Sarkis, Contax’s Chief Financial and Investor Relations Officerwill take over the position of Chief Executive Officer, previously held by Mr. James Meaney. Michel Sarkis is 41 years old and one of the first executiveofficers hired by Contax. |

|

|

14

| |

| Contax Overview |

| Company Overview |

| | |

| Board of Directors and Executives Board |

§Board of Directors | §Executives Board |

-Fernando Antonio Pimentel Melo,Chairman | -Michel Neves Sarkis,Chief Executive, Chief Financial and Investor Relations Officer |

-Pedro Jereissati,Member | - Eduardo Nunes de Noronha,Director |

-Carlos Jereissati,Member | - Dimitrius Rogério de Oliveira,Director |

-Cristina Anne Betts,Member | |

-Otavio Marques de Azevedo,Member | |

-Antonio Adriano Silva,Member | |

-Armando Galhardo Nunes Guerra Junior,Member | |

-Paulo Edgar Trapp,Member | |

-Marcel Cecchi Vieira,Member | |

-Sergio Francisco da Silva,Member | |

-Newton Carneiro da Cunha,Member | |

-Manuel Jeremias Leite Caldas,Member | |

| | | | | | | |

| Shareholder Structure |

| |

| | Number of ON | | Number of PN | | Total Number of | |

| | Shares | % of Total ON | Shares | % of Total PN | Shares | % of Total |

| |

CTX Participações S.A. | 15,992,929 | 69.3% | 3,880,666 | 10.6% | 19,873,595 | 33.2% |

Free float | 6,694,875 | 29.0% | 32,800,334 | 89.4% | 39,495,209 | 66.1% |

Treasury shares | 401,796 | 1.7% | - | 0.0% | 401,796 | 0.7% |

| |

Total | 23,089,600 | 100.0% | 36,681,000 | 100.0% | 59,770,600 | 100.0% |

15

| |

| Contax Overview |

| Financial Statements: Income Statement |

| | | | | | | | | | |

| | Twelve months ended: | | Nine months ended: |

| Income Statement | 12/31/2007 | | 12/31/2008 | | 12/31/2009 | | 09/30/2009 | | 09/30/2010 |

| (Values in R$ ‘000) | | | | | | | | | |

| |

| Gross revenue | 1.475.488 | | 1.916.115 | | 2.335.252 | | 1.703.692 | | 1.898.011 |

Deductions | (109.673) | | (141.387) | | (174.233) | | (127.472) | | (138.451) |

| |

| Net revenue | 1.365.815 | | 1.774.728 | | 2.161.019 | | 1.576.220 | | 1.759.560 |

Cost of products sold / services rendered | (1.185.079) | | (1.490.647) | | (1.757.272) | | (1.311.860) | | (1.498.726) |

| |

| Gross profit | 180.736 | | 284.081 | | 403.747 | | 264.360 | | 260.834 |

Operating income / (expenses) | (106.031) | | (138.213) | | (195.126) | | (144.719) | | (136.403) |

Selling | (23.986) | | (28.488) | | (27.709) | | (21.143) | | (19.051) |

General and administrative | (62.920) | | (91.049) | | (138.586) | | (102.599) | | (98.433) |

Financial | (3.546) | | (50) | | (15.391) | | (12.021) | | 56 |

Other operating revenue / (expenses) | (15.579) | | (18.626) | | (13.440) | | (8.956) | | (18.975) |

| |

| Operating result | 74.705 | | 145.868 | | 208.621 | | 119.641 | | 124.431 |

| |

| Earnings before income taxes and social contribution | 74.705 | | 145.868 | | 208.621 | | 119.641 | | 124.431 |

Income tax and social contribution | (24.450) | | (51.370) | | (70.998) | | (40.559) | | (51.920) |

Deferred taxes | (2.881) | | (2.086) | | 1.659 | | (2.385) | | 2.432 |

| |

| Minority interest | - | | (3) | | 634 | | 587 | | (366) |

| |

| Net profit (losses) | 47.374 | | 92.409 | | 139.916 | | 77.284 | | 74.577 |

16

| |

| Contax Overview |

| Financial Statements: Consolidated Balance Sheet |

| | | | | | | | |

| | Period ended: |

| ASSETS | 12/31/2007 | | 12/31/2008 | | 12/31/2009 | | 09/30/2010 |

| (Values in R$ ‘000) | | | | | | | |

| Current assets | 374.248 | | 524.083 | | 578.322 | | 565.023 |

| Cash & cash equivalents | 240.310 | | 355.928 | | 357.853 | | 306.522 |

| Credits (clients) | 83.492 | | 102.134 | | 128.486 | | 173.004 |

| Other credits | 1.371 | | - | | - | | - |

| Inventory | - | | - | | - | | - |

| Others | 49.075 | | 66.021 | | 91.983 | | 85.497 |

| |

| Non-current assets | 47.928 | | 79.336 | | 119.658 | | 200.701 |

| Deferred and recoverable taxes | 17.574 | | 25.346 | | 26.917 | | 39.832 |

| Judicial deposits | 17.787 | | 35.338 | | 53.382 | | 81.823 |

| Credits receivables | 11.678 | | 17.530 | | 11.425 | | 10.576 |

| Financial investments | - | | - | | 26.590 | | 66.081 |

| Other assets | 889 | | 1.122 | | 1.344 | | 2.389 |

| |

| Fixed assets | 322.443 | | 389.267 | | 432.919 | | 525.131 |

| Investments | - | | - | | - | | 74.365 |

| Plant, property & equipment | 254.467 | | 304.800 | | 352.473 | | 377.849 |

| Intangible assets | 67.976 | | 84.467 | | 80.446 | | 72.917 |

| |

| Total Assets | 744.619 | | 992.686 | | 1.130.899 | | 1.290.855 |

17

| |

| Contax Overview |

| Financial Statements: Consolidated Balance Sheet |

| | | | | | | | |

| | Period ended: |

| LIABILITIES AND SHAREHOLDERS’ EQUITY | 12/31/2007 | | 12/31/2008 | | 12/31/2009 | | 09/30/2010 |

| (Values in R$ ‘000) | | | | | | | |

| Current liabilities | 290.098 | | 411.393 | | 556.180 | | 501.585 |

| Short-term loans and financing | 300 | | 14.219 | | 55.070 | | 61.359 |

| Debentures | - | | - | | - | | - |

| Suppliers | 72.466 | | 76.847 | | 77.033 | | 69.933 |

| Taxes payable | 38.990 | | 68.749 | | 92.703 | | 85.906 |

| Dividend payable | 14.271 | | 51.364 | | 92.190 | | 3.192 |

| Provisions | - | | - | | - | | - |

| Related parties | - | | - | | - | | - |

| Others | 164.071 | | 200.214 | | 239.184 | | 281.195 |

| |

| Long term liabilities | 175.325 | | 296.516 | | 230.616 | | 379.204 |

| Long-term loans and financing | 100.060 | | 203.750 | | 149.521 | | 219.523 |

| Debentures | - | | - | | - | | - |

| Provisions | 46.860 | | 64.151 | | 59.921 | | 85.594 |

| Related parties | - | | - | | - | | - |

| Others | 28.405 | | 28.615 | | 21.174 | | 74.087 |

| | | | | | | | |

| Minority interest | - | | 2.079 | | 1.446 | | 1.810 |

| | | | | | | | |

| Shareholders’ Equity | 279.196 | | 282.698 | | 342.657 | | 408.256 |

| Capital stock | 223.873 | | 223.873 | | 223.873 | | 223.873 |

| Capital reserves | 9.254 | | 29 | | 19.639 | | 13.634 |

| Income reserves | 57.153 | | 69.880 | | 99.145 | | 96.172 |

| Accumulated profit / losses | (11.084) | | (11.084) | | - | | 74.577 |

| |

| Total Liabilities and Shareholders’ Equity | 744.619 | | 992.686 | | 1.130.899 | | 1.290.855 |

18

| |

| SECTION 3.C |

| Market and Companies' Overview |

| Dedic GPTI Overview |

19

| |

| Dedic GPTI Overview |

| Company Overview |

| | | |

| Brief Description |

| | §Founded in 2002, Dedic is currently one of the largest Brazilian contact center companies |

| | | §Part of Grupo Portugal Telecom, |

| | | §Serves clients from telecom, financials, utilities, services and other sectors |

| | | §As of March 2010, Dedic acquired all shares issued by GPTI, one of the largest provider of Information Technology (IT) solutions and Business Process Outsourcing (BPO) in Brazil, creating DEDIC GPTI |

| | §GPTI: one of the largest providers of Information Technology solutions in the Brazilian market, offering a complete portfolio of solutions, which includes development of systems, network management and IT infrastructure, applications, training, business processing and IT and integrated practices (ITO and BPO). |

| |

| Recent Events |

| | §February 8th, 2010: Portugal Telecom announced the acquisition of 100% of GPTI SA (“GPTI”), a player with a large experience in the Information Systems (IS) and Information Technology (IT) services market in Brazil. The acquisition was concluded with the issuance of new shares by Dedic, a PT subsidiary which operates in the Brazilian contact center market. |

| | §March 2010: Dedic assumed full control of GPTI |

20

| |

| Dedic GPTI Overview |

| Company Overview |

| | |

| Board of Directors and Executives Board |

§Board of Directors | §Executives Board |

-Shakhaf Wine,Chairman | -Paulo Neto Leite,Chief Executive Officer |

-Fábio Carlos Pereira,Vice President | -André Halm Gomes Costa,Chief Financial Officer |

-Paulo Luís Neto de Carvalho Leite,Member | -Renato Bufálo,Contact Center Administrative Director |

-Fabiana Faé Vicente Rodrigues,Member | -Edson Moreno, IT Administrative Director |

| | |

| | | | | | | | | |

| Shareholder Structure1 |

| |

| Current | | Post Transaction with Minority Shareholder |

| |

| | Number of Shares | | % of Total Capital | | | Number of Shares | | % of Total Capital |

| Portugal Telecom Brasil S.A. | 135,519,119 | | 87.5% | | Portugal Telecom Brasil S.A. | 135,519,119 | | 100.0% |

| Fabio Carlos Pereira | 19,359,874 | | 12.5% | | Total | 135,519,119 | | 100.0% |

| Total | 154,878,993 | | 100.0% | | | | | |

| | |

| Source: Company |

| 1 | Based on information provided by Dedic GPTI, we considered Dedic GPTI has acquired 19,359,874 shares held by Mr. Fábio Carlos Pereira for R$23 million. This total was added to the net debt as of August 31st, 2010 for Dedic GPTI valuation. |

21

| |

| Dedic GPTI Overview |

| Financial Statements: Income Statement |

| | | | | | | | |

| | Twelve months period ended: | | Eight months period ended: |

| Income Statement | 12/31/2007 | | 12/31/2008 | | 12/31/2009 | | 08/30/2010 |

| (Values in R$ ‘000) | | | | | | | |

| |

| Gross revenue | 290.715 | | 331.353 | | 434.315 | | 417.404 |

Deductions | (21.048) | | (23.506) | | (32.755) | | (30.532) |

| |

| Net revenue | 269.667 | | 307.847 | | 401.560 | | 386.872 |

Cost of products sold / services rendered | (242.304) | | (253.245) | | (330.590) | | (316.105) |

| |

| Gross profit | 27.363 | | 54.602 | | 70.970 | | 70.767 |

Operating income / (expenses) | (29.642) | | (43.593) | | (57.725) | | (63.569) |

Selling | (4.467) | | (3.046) | | (2.925) | | (4.223) |

General and administrative | (25.175) | | (40.450) | | (55.504) | | (59.396) |

Equity interest | - | | - | | - | | - |

Other operating income / (expenses) | - | | (97) | | 704 | | 50 |

| |

| Earnings before financial result | (2.279) | | 11.009 | | 13.245 | | 7.198 |

Financial income | 7.603 | | 12.600 | | 3.074 | | 1.944 |

Financial expenses | (21.306) | | (27.730) | | (17.686) | | (14.018) |

| |

| Operating result | (15.982) | | (4.121) | | (1.367) | | (4.876) |

Non-operating result | (923) | | - | | - | | - |

| |