UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

PROXY STATEMENT PURSUANT TO SECTION 14(a) OF THE SECURITIES

EXCHANGE ACT OF 1934 (Amendment No. )

Filed by the Registrant R

Filed by a Party other than the Registrant o

Check the appropriate box:

| | |

| o | Preliminary Proxy Statement |

| o | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| R | Definitive Proxy Statement |

| o | Definitive Additional Materials |

| o | Soliciting Material Pursuant to §240.14a-12 |

| COGDELL SPENCER INC. |

| (Name of Registrant as Specified In Its Charter) |

| |

| (Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

| Payment of Filing Fee (Check the appropriate box): |

| |

| R | No fee required. |

| | |

| o | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | |

| | (1) | Title of each class of securities to which the transaction applies: |

| | | |

| | | |

| | (2) | Aggregate number of securities to which the transaction applies: |

| | | |

| | | |

| | (3) | Per unit price or other underlying value of the transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | | |

| | | |

| | (4) | Proposed maximum aggregate value of the transaction: |

| | | |

| | | |

| | (5) | Total fee paid: |

| | | |

| | | |

| o | Fee paid previously with preliminary materials. |

| | |

| o | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | |

| | (1) | Amount Previously Paid: |

| | | |

| | | |

| | (2) | Form, Schedule or Registration Statement No.: |

| | | |

| | | |

| | (3) | Filing Party: |

| | | |

| | | |

| | (4) | Date Filed: |

| | | |

COGDELL SPENCER INC.

4401 Barclay Downs Drive, Suite 300

Charlotte, NC 28209-4670

March 25, 2009

Dear Stockholder:

We cordially invite you to attend the 2009 Annual Meeting of stockholders of Cogdell Spencer Inc. The meeting will be held on Tuesday, May 5, 2009, at 9:00 a.m., local time, at the Company headquarters located at 4401 Barclay Downs Drive, Suite 300, Charlotte, North Carolina 28209. The matters expected to be acted upon at the meeting are described in detail in the accompanying Proxy Statement. We encourage you to read these materials carefully and to take part in the affairs of our Company by voting on matters described in the Proxy Statement.

I am pleased to inform you that we are taking advantage of the Securities and Exchange Commission’s new rules that allow us to furnish our Proxy Statement and related proxy materials to our stockholders over the Internet. We believe the new rules will expedite stockholders’ receipt of proxy materials, lower our costs of delivery and reduce the environmental impact of our Annual Meeting. The “About the Meeting” section of the Proxy Statement contains instructions on how you can receive a paper copy of the Proxy Statement and Annual Report.

Your vote is very important. Whether or not you plan to attend the meeting, please submit your proxy as promptly as possible. If you attend the meeting, you may continue to have your shares of common stock voted as instructed in the proxy or you may withdraw your proxy at the meeting and vote your shares of common stock in person. We look forward to seeing you at the meeting.

| | |

| | Sincerely, |

| |  |

| | FRANK C. SPENCER |

| | President and Chief Executive Officer |

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

To Be Held May 5, 2009

NOTICE IS HEREBY GIVEN that the 2009 Annual Meeting of Stockholders (the “Annual Meeting”) of Cogdell Spencer Inc., a Maryland corporation, will be held at Company headquarters located at 4401 Barclay Downs Drive, Suite 300, Charlotte, North Carolina 28209 on Tuesday, May 5, 2009 at 9:00 a.m., local time, for the following purposes as further described in the accompanying Proxy Statement:

| | |

| | 1. To elect nine members to the board of directors, each to serve until the 2010 annual meeting of stockholders and until his successor is duly elected and qualifies. The nominees to the board of directors are the following: James W. Cogdell, Frank C. Spencer, John R. Georgius, Richard B. Jennings, Christopher E. Lee, Richard C. Neugent, Randolph D. Smoak, M.D., David J. Lubar and Scott A. Ransom; |

| | |

| | 2. To consider and vote upon ratification of the appointment of Deloitte & Touche LLP as our independent registered public accounting firm for the year ending December 31, 2009; and |

| | |

| | 3. To transact such other business as may properly come before the Annual Meeting or any adjournments or postponements thereof. |

Our board of directors has fixed the close of business on Friday, March 6, 2009 as the Record Date for determination of stockholders entitled to receive notice of and to vote at the Annual Meeting, or any adjournments or postponements of the Annual Meeting. Only holders of record of our common stock at the close of business on that day will be entitled to vote at the Annual Meeting, or any adjournments or postponements of the Annual Meeting.

| | |

| | By Order of the Board of Directors |

| |  |

| | CHARLES M. HANDY |

| | Corporate Secretary |

| |

WHETHER OR NOT YOU EXPECT TO ATTEND THE ANNUAL MEETING, TO ENSURE YOUR REPRESENTATION AT THE ANNUAL MEETING, PLEASE PROMPTLY VOTE BY INTERNET, OR BY MARKING, SIGNING, DATING AND RETURNING YOUR PROXY CARD AS PROMPTLY AS POSSIBLE SO THAT YOUR SHARES WILL BE REPRESENTED AT THE MEETING. IF YOU ATTEND THE MEETING, YOU MAY CONTINUE TO HAVE YOUR SHARES OF COMMON STOCK VOTED AS INSTRUCTED IN THE PROXY OR YOU MAY WITHDRAW YOUR PROXY AT THE MEETING AND VOTE YOUR SHARES OF COMMON STOCK IN PERSON. |

| |

TABLE OF CONTENTS

| | | |

| | | Page |

| General Information | | 5 |

| About the Meeting | | 5 |

| Items to Be Voted On by Stockholders | | 7 |

| Information About the Board and Its Committees | | 10 |

| Executive Officers and Other Officers | | 12 |

| Report of the Audit Committee | | 12 |

| Corporate Governance Matters | | 13 |

| Executive Compensation | | 14 |

| Security Ownership of Certain Beneficial Owners and Management | | 29 |

| Certain Relationships and Related Transactions | | 31 |

| Other Matters | | 31 |

COGDELL SPENCER INC.

4401 Barclay Downs Drive, Suite 300

Charlotte, NC 28209-4670

PROXY STATEMENT

ANNUAL MEETING OF STOCKHOLDERS

To Be Held May 5, 2009

GENERAL INFORMATION

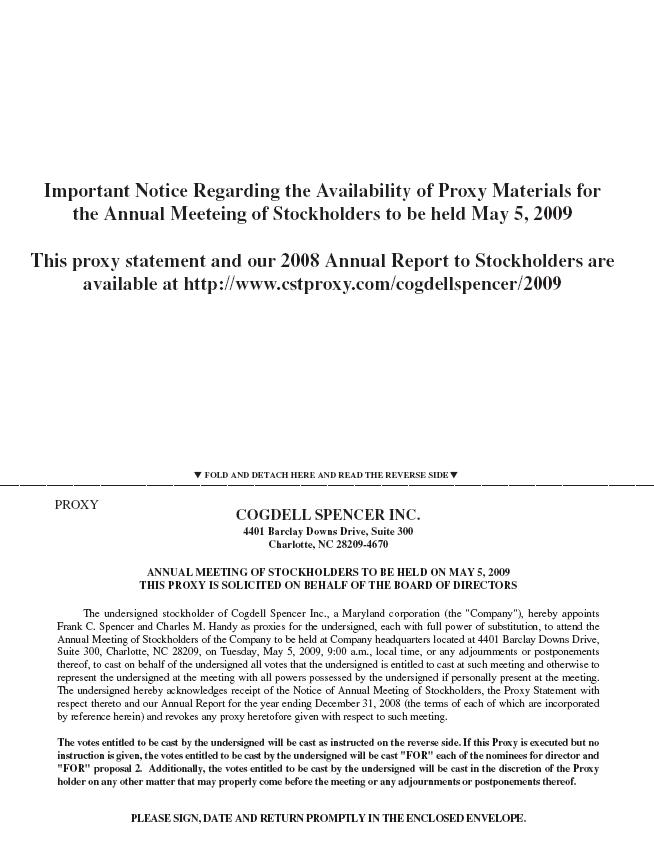

We are sending this Proxy Statement and, if you requested a printed version of these materials, the accompanying proxy card in connection with the solicitation of proxies by the board of directors (the “Board”) of Cogdell Spencer Inc. (the “Company”), a Maryland corporation, for use at our 2009 Annual Meeting of Stockholders (the “Annual Meeting”), and at any adjournments or postponements thereof, to be held at Company headquarters located at 4401 Barclay Downs Drive, Suite 300, Charlotte, North Carolina 28209 on Tuesday, May 5, 2009 at 9:00 a.m., local time. The purposes of the Annual Meeting are:

| | |

| | (1) To elect nine members to the Board, each to serve until the 2010 annual meeting of stockholders and until his successor is duly elected and qualifies, the nominees to the Board being James W. Cogdell, Frank C. Spencer, John R. Georgius, Richard B. Jennings, Christopher E. Lee, Richard C. Neugent, Randolph D. Smoak, M.D., David J. Lubar and Scott A. Ransom; |

| | |

| | (2) To consider and vote upon ratification of the appointment of Deloitte & Touche LLP as our independent registered public accounting firm for the year ending December 31, 2009; and |

| | |

| | (3) To transact such other business as may properly come before the Annual Meeting or any adjournments or postponements thereof. |

This proxy statement is accompanied by a copy of our Annual Report to Stockholders for the fiscal year ended December 31, 2008.

ABOUT THE MEETING

Record Date

The Board has fixed the close of business on Friday, March 6, 2009 as the Record Date (the “Record Date”) for determination of stockholders entitled to notice of, and to vote at, the Annual Meeting and any adjournments or postponements thereof. Each share of our common stock, $0.01 par value per share (“Common Stock”), is entitled to one vote for each matter to be voted upon. As of the Record Date, there were 17,711,839 shares of Common Stock outstanding and entitled to vote at the Annual Meeting.

Quorum; Voting

The presence, in person or by proxy, of the stockholders entitled to cast a majority of all the votes entitled to be cast at the Annual Meeting shall constitute a quorum for the transaction of business at the Annual Meeting. If a quorum is not present or represented at the Annual Meeting, the Chairman of the Annual Meeting shall have the power to adjourn the Annual Meeting to a date not more than 120 days after the original Record Date without notice other than announcement at the Annual Meeting, until a quorum is present or represented. At any such adjourned Annual Meeting at which a quorum is present or represented, any business may be transacted that might have been transacted at the Annual Meeting as originally noticed.

Each stockholder is entitled to one vote for each share of Common Stock registered in the stockholder’s name on the Record Date. A plurality of all of the votes cast at the Annual Meeting at which a quorum is present shall be sufficient to elect a director. A majority of the votes cast at the Annual Meeting at which a quorum is present is required for the ratification of our independent registered public accounting firm.

If you properly execute a proxy in the accompanying form, and if we receive it prior to voting at the Annual Meeting, the shares that the proxy represents will be voted in the manner specified on the proxy. With respect to the proposals to elect directors (Proposal 1) and to consider and vote upon the ratification of our independent registered accounting firm (Proposal 2), if no specification is made, abstentions and “broker non-votes” will not be counted as votes cast and will have no effect on the result of the vote. If the bank, broker or nominee holding shares for a beneficial owner does not receive instructions from a beneficial owner on a non-discretionary or non-routine matter it will not vote on that proposal because that holder does not have discretionary voting power for that particular item and has not received instructions from the beneficial owner. This is referred to as a “broker non-vote.” Abstentions and “broker non-votes” will be treated as shares that are present and entitled to vote for purposes of determining the presence of quorum, but will not be counted in the number of votes cast on a matter. Proposals 1 and 2 involve matters that we believe are routine.

Shares Held in Street Name

Under New York Stock Exchange (the “NYSE”) rules, if your shares are held in “street name,” you will receive instructions from your nominee, which you must follow in order to have your shares of Common Stock voted.

Revocation of Proxies

If you cast a vote by proxy, you may revoke it at any time before it is voted by:

| | | |

| | ● | giving written notice to our Secretary at our address, |

| | | |

| | ● | expressly revoking the proxy, by signing and forwarding to us a proxy dated later or by voting again on the Internet, or |

| | | |

| | ● | by attending the Annual Meeting and personally voting the Common Stock owned of record by you as of the Record Date. |

Solicitation

This solicitation is being made on behalf of the Board. We will bear the entire cost of soliciting proxies for the Annual Meeting. In addition, further solicitation of proxies may be made by mail, by certain of our directors, executive officers and employees may solicit the return of proxies by telephone, facsimile, personal interview or otherwise without being paid additional compensation. Continental Stock Transfer & Trust Company, our transfer agent and registrar, will assist in the distribution of proxy materials and tabulation of votes. We will also reimburse brokerage firms and other persons representing the beneficial owners of our shares for their reasonable expenses in forwarding proxy solicitation material to the beneficial owners in accordance with the proxy solicitation rules and regulations of the Securities and Exchange Commission (the “SEC”) and the NYSE.

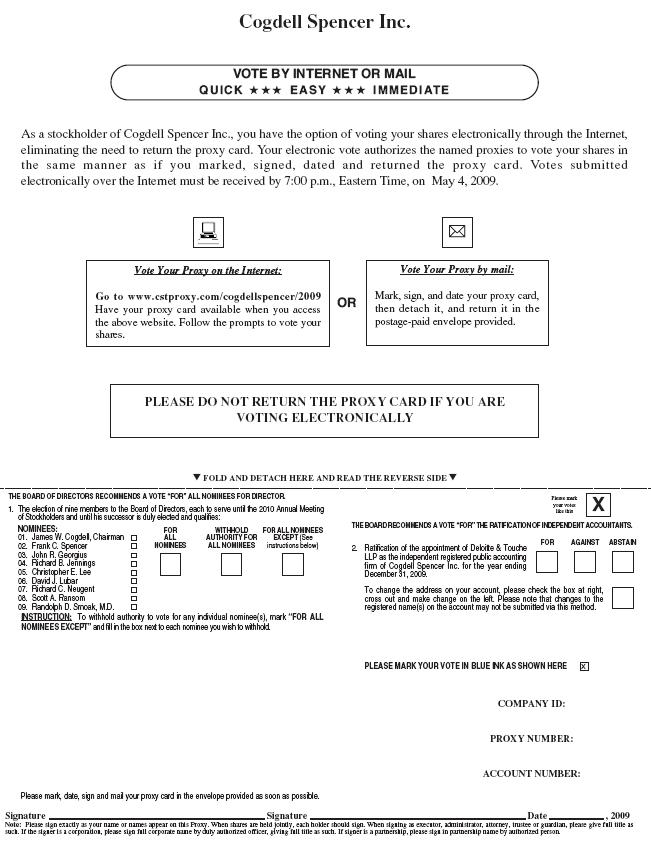

Delivery of Materials

In accordance with new rules adopted by the SEC, instead of mailing a printed copy of our proxy materials to our stockholders, we have elected to furnish proxy materials, including this Proxy Statement and our 2008 Annual Report to Stockholders, by providing access to these documents on the Internet. Accordingly on March 25, 2009, we sent a Notice of Internet Availability of Proxy Materials (the “Notice”) to our holders of record and beneficial owners. The Notice provided instructions for accessing our proxy materials on the Internet and instructions on how to receive printed copies of the proxy materials without charge by mail or electronically by email. Please follow the instructions included in the Notice.

The Notice provides you with instructions regarding how to (1) view our proxy materials for the Annual Meeting on the Internet; (2) vote your shares after you have viewed our proxy materials; (3) request a printed copy of the proxy materials; and (4) instruct us to send our future proxy materials to you. We believe the delivery options that we have chosen this year will allow us to provide our stockholders with the proxy materials they need, while lowering the cost of the delivery of the materials and reducing the environmental impact of printing and mailing printed copies. If you choose to receive our future proxy materials by email, you will receive an email next year with instructions containing a link to view those proxy materials and a link to the proxy voting site. Your election to receive proxy materials by email will remain in effect until you terminate it.

Householding

The rules of the SEC allow us to deliver a single copy of a Notice or set of proxy materials to any address shared by two or more stockholders. This delivery method is referred to as “householding” and can result in significant cost savings. To take advantage of this opportunity, we have delivered only one Notice or one proxy statement and annual report to multiple stockholders who share an address, unless we received contrary instructions from the impacted stockholders prior to the mailing date. We agree to deliver promptly, upon written or oral request, a separate copy of the Notice or proxy materials, as requested, to any stockholder at the shared address to which a single copy of those documents was delivered. If you prefer to receive separate copies of the Notice or proxy materials, please follow the instructions for requesting copies included in the Notice.

ITEMS TO BE VOTED ON BY STOCKHOLDERS

ITEM 1 — ELECTION OF DIRECTORS

In accordance with the provisions of our charter and Bylaws, each member of the Board is elected at the Annual Meeting. Each member of the Board elected will serve for a term expiring at the 2010 annual meeting of stockholders and until his successor has been elected and qualifies, or until his earlier resignation or removal. James W. Cogdell, Frank C. Spencer, John R. Georgius, Richard B. Jennings, Christopher E. Lee, Richard C. Neugent, Randolph D. Smoak, M.D., David J. Lubar and Scott A. Ransom are the Board’s nominees for election.

Proxies that are properly executed and returned will be voted at the Annual Meeting, and any adjournments or postponements thereof, in accordance with the directions on such proxies. If no directions are specified, such proxies will be voted “FOR” the election of the nine persons specified as nominees for directors, each of whom will serve until the 2010 annual meeting of stockholders. We have no reason to believe that any of the nominees will be unable or unwilling to serve if elected. However, should any director nominee named herein become unable or unwilling to serve if elected, it is intended that the proxies will be voted for the election, in his stead, of such other person as the Board may nominate, unless the Board reduces the size of the membership of the Board prior to the Annual Meeting to eliminate the position of any such nominee.

In connection with the merger with Marshall Erdman & Associates, Inc. (“Erdman”) in March 2008, one of the former Erdman shareholders, Lubar Capital LLC (“Lubar”), received the right to nominate one individual for election to the Board. Accordingly, the Board increased the size of the membership of the Board and elected Mr. Lubar as a director on March 10, 2008. Lubar will continue to retain its right to nominate one individual for so long as Lubar and its affiliates continue to maintain at least 75% of their aggregate initial ownership measured in number of equity securities of the Company and its affiliates.

The Board has affirmatively determined that Messrs. Georgius, Lee, Lubar, Jennings, Neugent and Dr. Smoak are independent within the standards prescribed by the NYSE. The Board has also affirmatively determined that no material relationships exist between us and any of the independent directors that would interfere with their judgment in carrying out their responsibilities as a director.

In making its determination that each of our directors (other than Messrs. Cogdell, Spencer and Ransom) is independent, the Board considered Mr. Lubar’s positions as (A) a member of the board of directors and indirect equity owner of two limited liability companies (the “Lubar Entities”) each managed by its own board of directors that had contracted with the Company’s Erdman subsidiary prior to the Company acquiring Erdman, (B) a member of the board of trustees of Northwestern Mutual Life Insurance Company (“Northwestern”), the parent company of the Company’s joint venture partner in its real property acquisition joint venture, and (C) a member of the board of directors of Marshall & Isley Corporation (“M&I”), the parent company of the one of the lenders under the Company’s revolving credit facility and term loan.

The Board affirmatively determined that, with respect to the Lubar Entities, because (1) of the nature of Mr. Lubar’s relationship with these entities (he is an indirect owner but not involved in their management, as he resigned from all management positions with the Lubar Entities on November 17, 2008) , (2) the contracts between the Erdman subsidiary and the Lubar Entities were executed prior to the Company’s acquisition of Erdman and the date Mr. Lubar joined our Board and (3) the contract with one of these entities was substantially completed in mid-September 2008 and the other contract was substantially completed in mid-February 2009, these relationships do not compromise Mr. Lubar’s independence.

The Board further determined that Mr. Lubar’s position as one member of the 21-person board of trustees of Northwestern does not impair Mr. Lubar’s independence because the capital commitment of the Company’s joint venture partner to the property acquisition joint venture is not material to Northwestern.

In addition, the Board determined that Mr. Lubar’s position on the Board of M&I similarly does not affect his independence because (x) M&I’s participation in the Company’s revolving credit facility and term loan is not material to M&I and (y) Mr. Lubar was not yet on our Board at the time the Company or Erdman entered into these loans.

Nominees for Directors

The following table sets forth the name, age and the position(s) with us, if any, currently held by each person nominated as a director:

| Name | | | Age | | Title | |

| James W. Cogdell | | 67 | | Chairman |

| Frank C. Spencer | | 48 | | Chief Executive Officer, President and Director |

John R. Georgius(1)(2) | | 64 | | Director |

Richard B. Jennings(1)(2) | | 65 | | Director |

Christopher E. Lee(2)(3) | | 60 | | Director |

David J. Lubar(1)(3) | | 54 | | Director |

Richard C. Neugent(1)(3) | | 65 | | Director |

| Scott A. Ransom | | 46 | | Director, President of Erdman |

Randolph D. Smoak, M.D.(2)(3) | | 75 | | Director |

| (1) | Member of Audit Committee |

| | |

| (2) | Member of Compensation Committee |

| | |

| (3) | Member of Nominating and Corporate Governance Committee |

Following are biographical summaries for our nominees for election as directors:

| | |

| | James W. Cogdell, Chairman of the Board. From 1972 until 2005 Mr. Cogdell served as the Chairman and Chief Executive Officer of Cogdell Spencer Advisors, Inc. and has served as Chairman of our Board since our inception in 2005. Mr. Cogdell was named Entrepreneur of the Year by the Charlotte Chamber of Commerce for the large companies category in 2002. He was an eight-year chairman of the Citizens Capital Budget Advisory Committee for Mecklenburg County, North Carolina. Mr. Cogdell has been recognized with the Outstanding Layman Award for 2004 by the North Carolina Division of Soil and Water Conservation. He is an activist on civic and cultural development organizations ranging from public schools and child advocacy, to conservation, scouting and the arts. Mr. Cogdell is a member of the United States Eventing Association and the U.S. Equestrian Federation. Mr. Cogdell has developed more than 70 healthcare real estate properties valued at over $400 million during his career. |

| | |

| | Frank C. Spencer, Chief Executive Officer, President and Director. Mr. Spencer, our Chief Executive Officer and President, has served as one of our directors since our inception in 2005. Since 1998, Mr. Spencer has served as President of Cogdell Spencer Advisors, Inc. and prior to that in other executive capacities with Cogdell Spencer Advisors, Inc. since joining us in 1996. Prior to his employment with Cogdell Spencer Advisors, Inc. Mr. Spencer was Executive Director of The Children’s Services Network, a non-profit organization, from 1993 to 1996. He began his real estate career with the Crosland Group, where he was Corporate Vice President responsible for portfolio management, marketing and advisory services. Mr. Spencer was named to the 40 under 40 list for top young business executives by the Charlotte Business Journal in 2000. He has had works published in Urban Land Magazine and the Institutional Real Estate Letter on Real Estate Finance. Mr. Spencer has been an instructor at the Healthcare Financial Management Association’s state, regional and national meetings, a member of the University of North Carolina at Charlotte Real Estate Program Board of Advisors, an instructor at Montreat College and a full member of the Urban Land Institute and is Chairman of the board of directors of The Mountain Retreat Association (Montreat). Mr. Spencer was instrumental in the establishment of McCreesh Place, a permanent residence for 64 formerly homeless men in Mecklenburg County, North Carolina, led a mission group for Habitat for Humanity to Malawi, Africa and has served as Vice Chairman of the Transitional Families Program for the Charlotte Mecklenburg Housing Authority. Mr. Spencer received a B.A. with honors in German from the University of North Carolina where he was a Morehead Scholar and received an M.B.A. from Harvard Business School with high distinction and was designated as a Baker Scholar. |

| | |

| | John R. Georgius, Director. Mr. Georgius has served as one of our directors since our inception in 2005. He is an advisory member of the CEO Council of Council Ventures, LP, a technology-focused venture capital fund in which he is a founding investor. From 1975 to December 1999, Mr. Georgius served in various executive positions at First Union Corporation including President and Chief Operating Officer, Vice Chairman, President of First Union National Bank and Senior Vice President and head of the trust division. Over his 37-year banking career, Mr. Georgius directed or otherwise participated in more than 140 acquisitions in the financial services arena. Mr. Georgius has served as a director of First Union Corporation, First Union National Bank, VISA USA, and VISA International. He currently serves as a director for Alex-Lee Corporation, has been a member of its audit and compensation committees. Mr. Georgius received a B.B.A. in accounting and corporate finance from Georgia State University and is a graduate of the American Bankers Association National Graduate Trust School at Northwestern University. |

| | |

| | Richard B. Jennings, Director. Mr. Jennings has served as one of our directors since our inception in 2005. He is President of Realty Capital International LLC, a real estate investment banking firm he founded in 1991. From 1990 to 1991, Mr. Jennings served as Senior Vice President of Landauer Real Estate Counselors, and from 1986 to 1989 Mr. Jennings served as Managing Director of Real Estate Finance at Drexel Burnham Lambert Incorporated. From 1969 to 1986, Mr. Jennings oversaw the REIT investment banking business at Goldman, Sachs & Co. During his tenure at Goldman, Sachs & Co., Mr. Jennings founded and managed the Mortgage Finance Group from 1979 to 1986. Mr. Jennings also serves as a member of the board of directors of National Retail Properties, Inc. and is Lead Director of Alexandria Real Estate Equities, Inc. He is a licensed New York real estate broker. Mr. Jennings received a B.A. in economics, Phi Beta Kappa and Magna Cum Laude, from Yale University, and received an M.B.A. from Harvard Business School. |

| | Christopher E. Lee, Director. Mr. Lee has served as one of our directors since our inception in 2005. He is President and Chief Executive Officer of CEL & Associates, Inc., one of the nation’s leading real estate advisory firms. For the past 28 years, Mr. Lee has provided a variety of strategic, compensation, organizational and performance improvement and benchmarking services to hundreds of real estate firms nationwide. Mr. Lee is a frequent speaker at national real estate conferences, a regular contributor to various real estate publications and is the editor of the national real estate newsletter, Strategic Advantage. Prior to his consulting career, Mr. Lee worked for the Marriott and Boise Cascade corporations. Mr. Lee serves on the Advisory Board for the Real Estate School at San Diego State University. Mr. Lee received a B.A. from San Diego State University, an M.S. degree from San Jose State University, and a Ph.D. in organizational development from Alliant International University. |

| | Richard C. Neugent, Director. Mr. Neugent has served as one of our directors since our inception in 2005. He is President of RCN Healthcare Consulting Inc., a firm that he formed in 2003 which develops business for a national healthcare consulting practice in strategic and operational improvement services for hospitals, health systems and academic medical centers in the southeastern United States. Mr. Neugent has been involved in the healthcare industry for over 40 years. He was President and Chief Executive Officer of Bon Secours-St. Francis Health System in Greenville, South Carolina from 1981 to 2003. Prior to that time, he was Chief Operating Officer of Rapides Regional Medical Center in Alexandria, Louisiana. Mr. Neugent also served as a Captain in the Medical Service Corps of the U.S. Air Force where he oversaw the construction of hospitals and dispensaries. Mr. Neugent constructed the first women’s hospital in the state of South Carolina. Mr. Neugent was named the 2001 Greenville Magazine’s Nelson Mullins Business Person of the Year. In 2003, Mr. Neugent was presented with the Order of the Palmetto, the state of South Carolina’s highest civilian award. Mr. Neugent has served on the advisory boards of Clemson University, The University Center in Greenville and First Union National Bank. In addition, he has served on the board of the United Way and has held leadership positions in several United Way annual campaigns. He also served on the Greenville Chamber of Commerce board. Mr. Neugent consults with the Christian Blind Mission International, USA located in Greenville, South Carolina. Mr. Neugent received a B.S. from Alabama College and received an M.S. from The University of Alabama in hospital administration. |

| | |

| | Randolph D. Smoak, M.D., Director. Dr. Smoak has served as one of our directors since our inception in 2005. He is a clinical professor of surgery and is a former President of the American Medical Association (AMA), having served from 2000 to 2001. Dr. Smoak also served as a member of the Board of Trustees with the AMA from 1992 through 2002. Since his retirement, he has served on various boards including The Hollins Cancer Center Advisory Board, The Tobacco Free Kids Board, The Orangeburg Calhoun Technical College Foundation Board and The Greenville Family Partnership Board. He was the lead spokesperson for the AMA’s anti-smoking campaign, representing the Department of Health and Human Services Interagency Committee on Smoking and Health. Dr. Smoak was a member of Orangeburg Surgical Associates from 1967 through 2001. Dr. Smoak served as President and Chairman of South Carolina Medical Association as well as president of the South Carolina Division of the American Cancer Society. He is a founding member of the South Carolina Oncology Society, completed two terms as Governor from South Carolina to the American College of Surgeons, and served as Chairman of the Board of Directors of the World Medical Association. Dr. Smoak received a B.S. from The University of South Carolina and received an M.D. from The Medical University of South Carolina. |

| | |

| | David J. Lubar, Director. Mr. Lubar has served as one of our directors since 2008. Mr. Lubar is president of Lubar & Co., a family office and private investment firm founded in 1977 whose investment activities include acquisitions of middle market operating companies as well as growth financings for emerging businesses. Over the past 30 years, Lubar & Co. has successfully invested in and built growing companies in a wide range of industries and various stages of development, including financial services, food production and processing, industrial products manufacturing, transportation and logistics, design-build construction services, energy services, contract drilling, gas transmission, drilling products and services, real estate development and others. Mr. Lubar serves on the Boards of Directors of Northwestern Mutual Life Insurance Company, Marshall & Ilsley Corporation (NYSE: MI), the Milwaukee Brewers baseball team, as well as many private companies. Mr. Lubar is also on the Boards of several not-for-profit organizations, including University of Wisconsin-Milwaukee Foundation, University School of Milwaukee, Greater Milwaukee Foundation, Froedtert & Community Health System, Milwaukee Jewish Federation, Metropolitan Milwaukee Association of Commerce, and United Way of Greater Milwaukee. Previously, Mr. Lubar spent five years with Norwest Bank N.A. in Minneapolis in the commercial and correspondent banking departments. Mr. Lubar received a Bachelor of Arts degree from Bowdoin College and an M.B.A. from the University of Minnesota. He resides in Milwaukee, Wisconsin with his wife and three children. |

| | |

| | Scott A. Ransom, Director. Mr. Ransom has served as one of our directors since 2008. He is President and Chief Executive Officer of Erdman Company, an innovative national leader in healthcare facility solutions, offering comprehensive services from advanced planning and building to real estate developing and financing. Prior to joining ME&A, Mr. Ransom spent 9 years with PricewaterhouseCoopers providing financial consulting services to large privately and publicly held companies. Marshall Erdman, the founder of the company, recruited Ransom from PricewaterhouseCoopers in 1994. Mr. Ransom began at Marshall Erdman as Director of Finance; in 1998, he was named Chief Financial Officer; and in 2001, he was named President. In 2004, Mr. Ransom was appointed Chief Executive Officer and a member of the Board of Directors. He then led Marshall Erdman’s transition from a family-owned business to a management and investor-owned business. Mr. Ransom has been instrumental in devising and implementing a strategic plan to achieve long-term sustainable growth, while continuing to provide customers with the highest levels of quality and service, and creating an energized working environment. He serves on the Board of Directors of MSI General, a design-build firm in Milwaukee, Wisconsin, and on the Advisory Board for the University of Wisconsin-Madison James A. Graaskamp Center for Real Estate. Mr. Ransom was past Vice Chair of the United Way Campaign of Dane County and past Co-Chair of the American Heart Association annual fundraiser. Mr. Ransom graduated summa cum laude with a bachelor of business in accounting from the University of Wisconsin-Oshkosh. In 2006, he was awarded the University of Oshkosh Distinguished Alumni Award, the University’s highest honor for professional and community contributions. |

Recommendation Regarding the Election of Directors

The Board recommends that you vote “FOR” the election of the nine named nominees.

ITEM 2 — RATIFICATION OF APPOINTMENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

The Audit Committee of the Board has appointed Deloitte & Touche LLP as our independent registered public accounting firm for the year ending December 31, 2009, subject to ratification of this appointment by our stockholders. We have been advised by Deloitte & Touche LLP that it is a registered public accounting firm with the Public Company Accounting Oversight Board (the “PCAOB”) and complies with the auditing, quality control and independence standards and rules of the PCAOB and the SEC. We expect that representatives of Deloitte & Touche LLP will be present at the Annual Meeting to make a statement if they desire to do so. They will also be available to answer appropriate questions from stockholders. Our charter and Bylaws do not require that stockholders ratify the appointment of the independent registered public accounting firm. We are submitting the appointment for ratification because the Board believes it is a matter of good corporate practice.

Recommendation Regarding Ratification of the Appointment of Deloitte & Touche LLP

The Board recommends that you vote “FOR” ratification of this appointment.

INFORMATION ABOUT THE BOARD AND ITS COMMITTEES

Board Meetings

The Board intends to hold at least four regularly scheduled meetings per year and additional special meetings as necessary. Each director is expected to attend scheduled and special meetings, unless unusual circumstances make attendance impractical. The Board may also take action from time to time by written consent. The Board met nine times during 2008. Each of our directors attended at least 75% of the meetings of our Board and 75% of the meetings of the committees of our Board on which the director served. We expect each of our directors to attend the Annual Meeting in person unless unusual circumstances make attendance impractical. In 2008 all of our directors attended our annual meeting of stockholders.

Executive Sessions of Non-Management Directors

It is the policy of the Board that the non-management members of the Board meet separately without management (including management directors) at least twice per year during regularly scheduled Board meetings in order to discuss such matters as the non-management directors consider appropriate. The lead non-management director will assume the responsibility of chairing the meetings of non-management directors and shall bear such further responsibilities which the non-management directors as a whole or the Board might designate from time to time. Our lead non-management director is Richard C. Neugent. Our independent auditors, finance staff, legal counsel, other employees and other outside advisers may be invited to attend these meetings.

Board Committees

The Board has three standing committees: an Audit Committee, a Compensation Committee and a Nominating and Corporate Governance Committee. Each of these committees has at least three directors and is composed exclusively of independent directors, by reference to the rules, regulations and listing standards of the NYSE, the national exchange on which our Common Stock is traded.

Committee Charters

The Audit Committee, Compensation Committee and Nominating and Corporate Governance Committee charters meet the standards that have been established by the NYSE. Copies of these charters are available on our website at www.cogdellspencer.com or will be provided to any stockholder upon request.

Audit Committee

The Audit Committee assists our Board in overseeing the integrity of our Company’s financial statements, our compliance with legal and regulatory requirements including the Sarbanes-Oxley Act of 2002, the qualifications and independence of the independent auditor and the performance of the internal audit function and independent auditor. The Audit Committee prepares the report that the rules of the SEC require to be included in the annual proxy statement and provides an open avenue of communication among the independent auditor, the internal auditor, our management and our Board. John R. Georgius chairs the Audit Committee and serves as our Audit Committee financial expert, as that term is defined by the SEC, and Richard B. Jennings, David J. Lubar and Richard C. Neugent serve as members of this committee. Mr. Lubar and Mr. Jennings became members of the Audit Committee in March 2008 and November 2008, respectively, and Dr. Smoak ceased to be a member in February 2009. The Audit Committee met six times in 2008.

Compensation Committee

The Compensation Committee determines how the Chief Executive Officer and the Chairman of the Board should be compensated, sets policies and reviews management decisions regarding compensation of our senior executives, reviews and approves written employment agreements of our Company and our subsidiaries, administers and makes recommendations to our Board regarding stock incentive plans, reviews and discusses with our management the Compensation Discussion & Analysis to be included in our proxy statement and produces an annual report on executive compensation for inclusion in our proxy statement. The Compensation Committee may delegate all or a portion of its duties and responsibilities to a subcommittee of the Compensation Committee, provided that a charter is adopted for such subcommittee. Executive officers play a role in determining or recommending the amount or form of executive officer and director compensation. Prior to establishing our general compensation philosophy, the Compensation Committee consults with our Chairman of the Board and Chief Executive Officer. Our Chairman of the Board and Chief Executive Officer provide recommendations to the Compensation Committee with regard to the compensation of our executive officers and with regard to our other highly paid employees and the executive officers and employees of our subsidiaries. Christopher E. Lee chairs the Compensation Committee and John R. Georgius, Richard B. Jennings and Randolph D. Smoak, M.D. serve as members of this committee. Mr. Jennings became a member of the Compensation Committee in November 2008. The Compensation Committee met four times in 2008.

Nominating and Corporate Governance Committee

The Nominating and Corporate Governance Committee develops and recommends to our Board a set of corporate governance guidelines, identifies individuals qualified to fill vacancies or newly created positions on our Board, recommends to our Board the persons it should nominate for election as directors at the annual meeting of our stockholders and recommends directors to serve on all committees of our Board. Richard C. Neugent chairs the Nominating and Corporate Governance Committee and Christopher E. Lee, David J. Lubar and Randolph D. Smoak, M.D. serve as members of this committee. In March 2008, Mr. Lubar became a member of the Nominating and Corporate Governance Committee and Dr. Smoak ceased to be a member but subsequently rejoined the committee in February 2009. The Nominating and Corporate Governance Committee met three times in 2008.

The Nominating and Corporate Governance Committee will consider recommendations made by stockholders. Under our current Bylaws, and as SEC rules permit, stockholders must follow certain procedures to nominate a person for election as a director at an annual or special meeting, or to introduce an item of business at an annual meeting. A stockholder must notify our Secretary in writing of the director nominee or the other business. For annual meetings the notice must include the required information (as set forth below, “Other Matters — Stockholder Proposals and Nominations for the Board”) and be delivered to our Secretary at our principal executive offices not earlier than the 150th day and not later than 5:00 p.m., Eastern time, on the 120th day prior to the first anniversary of the date of mailing of the notice for the preceding year’s annual meeting.

If the date of the Annual Meeting is advanced or delayed by more than 30 days from the first anniversary of the date of the preceding year’s annual meeting, notice by the stockholder must be delivered as described above not earlier than the 150th day prior to the date of mailing of the notice for such annual meeting and not later than 5:00 p.m., Eastern time, on the later of the 120th day prior to the date of such annual meeting or the 10th day following the day on which public announcement of the date of such meeting is first made. The public announcement of an adjournment or postponement of an annual meeting does not change or create a new opportunity for notice as described above.

Director Compensation

Each non-employee member of our Board is entitled to receive annual compensation for his services as a director as follows effective January 1, 2009: $25,000 per year, $1,500 per meeting attended, $750 per teleconference. Committee meetings, attended either in person or telephonically, are $750 per instance. The chairperson of the Audit Committee is entitled to receive an additional $15,000 annually and the chairperson of the Compensation Committee is entitled to receive an additional $12,000 annually in compensation. The chairperson of the Nominating and Corporate Governance Committee is entitled to receive an additional $5,000 annually in compensation. Such amounts shall be paid in cash.

The following table sets forth compensation information for each of our non-employee directors for the fiscal year ended December 31, 2008:

Director Compensation

| Name | | Fees Earned or Paid in Cash | | Stock Awards | | Option Awards | | Non-Equity Incentive Plan Compensation | | Change in Pension Value and Nonqualified Deferred Compensation Earnings | | All Other Comp. | | Total | |

| John R. Georgius | | $ | 52,250 | | $ | 47,025 | | $ | — | | $ | — | | $ | — | | $ | — | | $ | 99,275 | |

| Richard B. Jennings | | $ | 36,250 | | $ | 47,025 | | $ | — | | $ | — | | $ | — | | $ | — | | $ | 83,275 | |

| Christopher E. Lee | | $ | 47,000 | | $ | 47,025 | | $ | — | | $ | — | | $ | — | | $ | — | | $ | 94,025 | |

| David J. Lubar | | $ | 35,557 | | $ | — | | $ | — | | $ | — | | $ | — | | $ | — | | $ | 35,557 | |

| Richard C. Neugent | | $ | 46,500 | | $ | 47,025 | | $ | — | | $ | — | | $ | — | | $ | — | | $ | 93,525 | |

| Randolph D. Smoak | | $ | 43,000 | | $ | 47,025 | | $ | — | | $ | — | | $ | — | | $ | — | | $ | 90,025 | |

Effective February 26, 2009, each non-employee member of our board of directors was granted restricted shares of our common stock or long term incentive plan units in the Operating Partnership (“LTIP units”) as follows: Messrs. Georgius, Lee, Lubar and Neugent were each granted 6,569 LTIP units, and Messrs. Jennings and Smoak were each granted 6,569 restricted shares of our common stock.

EXECUTIVE OFFICERS AND OTHER OFFICERS

Key Executive Officers

Information for James W. Cogdell, Frank C. Spencer and Scott A. Ransom is contained above under the heading “Item 1 — Election of Directors.” Information with respect to some of our other key executive officers is set forth below. All of our executive officers are appointed as executive officers at the meeting of the Board held at the time of each annual meeting of stockholders.

Charles M. Handy, age 47, Chief Financial Officer, Senior Vice President and Secretary. Mr. Handy has served as our Chief Financial Officer, Senior Vice President and Secretary since our inception in 2005. Prior to that, Mr. Handy had served as the Chief Financial Officer, Treasurer and Corporate Secretary for Cogdell Spencer Advisors, Inc. since 1997. Formerly, Mr. Handy was Corporate Controller for Faison & Associates, Inc., a commercial real estate management and development firm headquartered in Charlotte, North Carolina, and began his career at Ernst & Young. Mr. Handy has more than 21 years of experience in commercial real estate, accounting, finance and operations. Mr. Handy is a member of the American Institute of Certified Public Accountants and the North Carolina Association of Certified Public Accountants. He has also acted as the Compliance Officer for Cogdell Spencer Advisors, Inc.’s licensing and regulation process. Mr. Handy is a licensed real estate broker in North Carolina. Mr. Handy received a B.S.B.A. in accounting and real estate from Appalachian State University and received an M.B.A. from Wake Forest University.

REPORT OF THE AUDIT COMMITTEE

The Audit Committee (the “Audit Committee”) of the Board of Directors (the “Board”) of Cogdell Spencer Inc., a Maryland corporation (the “Company”), assists the Board in fulfilling its responsibility for oversight of the quality and integrity of the Company’s accounting, auditing and financial reporting practices, and the Company’s compliance with laws, regulations and corporate policies, and the independent registered public accounting firm’s qualifications, performance and independence. Consistent with this oversight responsibility, the Audit Committee has reviewed and discussed with management the audited financial statements for the fiscal year ended December 31, 2008 and their assessment of internal control over financial reporting as of December 31, 2008. Deloitte & Touche LLP, our independent registered public accountants, issued its unqualified report on our financial statements.

The Audit Committee also has discussed and reviewed with Deloitte & Touche LLP the matters required to be discussed in accordance with Statement on Auditing Standards No. 61, Communication with Audit Committees, as amended. The Audit Committee also has received the written disclosures and the letter from Deloitte & Touche LLP required by Independence Standards Board Standard No. 1, Independence Discussions with Audit Committees, as amended, and has conducted a discussion with Deloitte & Touche LLP relative to its independence. The Audit Committee has considered whether Deloitte & Touche LLP’s provision of non-audit services is compatible with its independence.

As set forth in the charter of the Audit Committee, our management is responsible for the preparation, presentation and integrity of our financial statements. Management is also responsible for maintaining appropriate accounting and financial reporting principles and policies and internal controls and procedures that provide for compliance with accounting standards and applicable laws and regulations. Our independent registered public accounting firm is responsible for planning and carrying out a proper audit of our annual financial statements, and reviews of our quarterly financial statements prior to the filing of each Quarterly Report on Form 10-Q. The members of the Audit Committee are not our full-time employees and are not performing the functions of auditors or accountants. All members of the Audit Committee have been affirmatively determined by the Board to be independent within the standards prescribed by the New York Stock Exchange and the applicable rules promulgated by the Securities and Exchange Commission (the “SEC”). The Board also has determined that the Audit Committee has at least one “audit committee financial expert,” as defined in Item 401(h) of SEC Regulation S-K, such expert being Mr. Georgius, and that he is “independent,” as that term is used in Item 7(d)(3)(iv) of Schedule 14A under the Securities Exchange Act of 1934, as amended (the “Exchange Act”).

Members of the Audit Committee rely without independent verification on the information provided to them and on the representations made by management and the independent registered public accounting firm. Accordingly, the Audit Committee’s oversight does not provide an independent basis to determine that management has maintained appropriate accounting and financial reporting principles or appropriate internal controls and procedures designed to assure compliance with accounting standards and applicable laws and regulations. Furthermore, the Audit Committee’s considerations and discussions referred to above do not assure that the audit of the Company’s consolidated financial statements has been carried out in accordance with the auditing standards of the Public Company Accounting Oversight Board (United States), that the consolidated financial statements are presented in accordance with accounting principles generally accepted in the United States of America, that Deloitte & Touche LLP is in fact “independent” or the effectiveness of the Company’s internal controls.

Based on these reviews and discussions, the Audit Committee recommended to the Board that our audited financial statements for the fiscal year ended December 31, 2008 be included in our Annual Report on Form 10-K for filing with the SEC.

Respectfully submitted by the members of the Audit Committee:

| | |

| | John R. Georgius, Chairman |

| | Richard B. Jennings |

| | David J. Lubar |

| | Richard C. Neugent |

| | Randolph D. Smoak, M.D. |

CORPORATE GOVERNANCE MATTERS

Corporate Governance Guidelines

Our Board, in its role of overseeing the conduct of our business, is guided by our Corporate Governance Guidelines. Our Corporate Governance Guidelines reflect the NYSE listing standards. Among other things, our Corporate Governance Guidelines contain categorical standards for determining director independence in accordance with the NYSE listing standards. A copy of our Corporate Governance Guidelines is available in print to any shareholder who requests it and also available on our website at www.cogdellspencer.com.

Director Independence

The Guidelines provide that a majority of our directors serving on our Board must be independent as required by the listing standards of the NYSE and the applicable rules promulgated by the SEC. Our Board has affirmatively determined, based upon its review of all relevant facts and circumstances, that each of the following directors has no material relationship with us (either directly or as a partner, shareholder or officer of an organization that has a relationship with us) and is independent under the listing standards of the NYSE and the applicable rules promulgated by the SEC: Messrs. Georgius, Lee, Lubar, Jennings, Neugent and Dr. Smoak. The Board has determined that each of Mr. Cogdell, the Chairman of the Board, Mr. Spencer, our President and Chief Executive Officer and Mr. Ransom, President and Chief Operating Officer of our Erdman subsidiary, are not independent directors because each is a named executive officer.

Criteria for Board Membership

Nominees for the Board should be committed to enhancing long-term stockholder value and must possess a high level of personal and professional ethics, sound business judgment and integrity. The Board’s policy is to encourage selection of directors who will contribute to the Company’s overall corporate goals: responsibility to its stockholders, understanding of the medical office industry, leadership, effective execution, high customer satisfaction and a superior employee working environment. The Nominating and Corporate Governance Committee may from time to time review the appropriate skills and characteristics required of Board members, including such factors as business experience, diversity and personal skills in finance, marketing, financial reporting and other areas that are expected to contribute to an effective Board. In evaluating potential candidates for the Board, the Nominating and Corporate Governance Committee considers these factors in the light of the specific needs of the Board at that time. Board members are expected to prepare for, attend and participate in meetings of the Board and committees on which they serve, and are strongly encouraged to attend the Company’s annual meetings of stockholders. Each member of the Board is expected to ensure that other existing and planned future commitments do not materially interfere with the member’s service as a director. These other commitments will be considered by the Nominating and Corporate Governance Committee and the Board when reviewing Board candidates and in connection with the Board’s annual evaluation process.

Whistleblowing and Whistleblower Protection Policy

The Audit Committee has established procedures for: (1) the receipt, retention and treatment of complaints received by us regarding accounting, internal accounting controls or auditing matters, and (2) the confidential and anonymous submission by our employees of concerns regarding questionable accounting or auditing matters. If you wish to contact the Audit Committee to report complaints or concerns relating to our financial reporting, you may do so by (i) calling the Compliance Hotline at 1-800-595-5573, (ii) emailing our Compliance Email Box at whistleblower@cogdellspencer.com, or (iii) delivering the report via regular mail, which may be mailed anonymously, to c/o Audit Committee, Cogdell Spencer Inc., 4401 Barclay Downs Drive, Suite 300, Charlotte, NC 28209. A copy of the policy is available on our website at www.cogdellspencer.com.

Code of Business Conduct and Ethics

Our Code of Business Conduct and Ethics (the “Code of Ethics”) documents the principles of conduct and ethics to be followed by our employees, executive officers and directors, including our principal executive officer, financial officer and accounting officer. The purpose of the Code of Ethics is to promote honest and ethical conduct, including the ethical handling of actual or apparent conflicts of interest between personal and professional relationships; promote avoidance of conflicts of interest, including disclosure to an appropriate person or committee of any material transaction or relationship that reasonably could be expected to give rise to such a conflict; promote full, fair, accurate, timely and understandable disclosure in reports and documents that we file with, or submit to, the SEC and in other public communications we make; promote compliance with applicable governmental laws, rules and regulations; promote the prompt internal reporting to an appropriate person or committee of violations of the Code of Ethics; promote accountability for adherence to the Code of Ethics; provide guidance to employees, executive officers and directors to help them recognize and deal with ethical issues; provide mechanisms to report unethical conduct; and help foster our longstanding culture of honesty and accountability. A copy of the Code of Ethics has been provided to, and signed by, each of our directors, executive officers and employees. A copy of the Code of Ethics is available on our website at www.cogdellspencer.com and can be provided to any stockholder upon request.

Disclosure Committee

We maintain a Disclosure Committee consisting of members of our executive management and senior staff. The Disclosure Committee meets at least quarterly. The purpose of the Disclosure Committee is to bring together executive management and employees involved in the preparation of our financial statements so that the group can discuss any issues or matters of which the members are aware that should be considered for disclosure in our public SEC filings.

Communications with Stockholders

We provide the opportunity for stockholders and interested parties to communicate with the members of the Board. They may communicate with the independent Board members, non-management directors or the Chairperson of any of the Board’s committees by email or regular mail. All communications should be sent to: stockholdercommunications@cogdellspencer.com, or to the attention of the Independent Directors, the Audit Committee Chairman, the Compensation Committee Chairman or the Nominating and Corporate Governance Committee Chairman at 4401 Barclay Downs Drive, Suite 300, Charlotte, NC 28209. The means of communication with members of the Board is available on our website under “Communications Policy” at www.cogdellspencer.com.

EXECUTIVE COMPENSATION

Compensation Discussion and Analysis

Overview

This section of the proxy statement discusses the principles underlying our executive compensation policies and decisions and the most important factors relevant to an analysis of these policies and decisions. It provides qualitative information regarding the manner and context in which compensation is awarded to, and earned by, our executive officers and places in perspective the data presented in the tables and narrative that follow.

Compensation Philosophy and Objectives

The Compensation Committee, in consultation with our Board and Chief Executive Officer, sets our compensation philosophy.

The basic philosophy underlying our executive compensation policies, plans, and programs is that executive and stockholder financial interests should be aligned as closely as possible, and that compensation should be based on delivering pay commensurate with performance. Accordingly, the executive compensation program for our Chairman and Chief Executive Officer and our other executive officers has been structured to achieve the following objectives:

| | | |

| | ● | Provide compensation that attracts, retains, and motivates key executive officers to lead our company effectively and continue our short and long-term profitability and growth; |

| | | |

| | ● | Link executive compensation and our financial and operating performance, by setting executive compensation based on the attainment of certain objective and subjective company and department performance goals; and |

| | | |

| | ● | Align the interests of our executive officers and stockholders by implementing and maintaining compensation programs that provide for the acquisition and retention of significant equity interests in us by executive officers. |

Based on these objectives, the executive compensation program has been designed to assist us in attracting, motivating and retaining executive officers to help us achieve our performance goals. The program is structured to provide our executive officers with a combination of base salaries, annual cash incentive awards, long-term incentive awards and stock ownership opportunities.

We have entered into written employment agreements with each of our named executive officers and certain other key employees. Some aspects of the compensation paid for our executive officers are affected by the terms of the applicable employment agreement. For example, if a base salary is decreased during the term of an employment agreement, the employee may terminate the agreement for good reason and would be entitled to certain severance benefits. Descriptions of these agreements are set forth under the heading “Agreements with Executive Officers.”

Setting Executive Compensation

The Compensation Committee is comprised of four independent directors, Messrs. Lee (Chairman), Georgius and Jennings and Dr. Smoak. The Compensation Committee exercises independent discretion in respect of executive compensation matters and administers our 2005 long-term stock incentive plan. The Compensation Committee operates under a written charter adopted by the Board, a copy of which is available on our website at www.cogdellspencer.com.

The Compensation Committee determines the total compensation and the allocation of such compensation among base salary, annual bonus amounts and other long-term incentive compensation as well as the allocation of such items among cash and equity compensation for our Chairman and our Chief Executive Officer. With respect to the compensation of our other executive officers, the Compensation Committee solicits recommendations from our Chief Executive Officer regarding compensation and reviews his recommendations. We do not have a pre-established policy for the allocation between either cash and non-cash compensation or annual and long-term incentive compensation. The ultimate determination on total compensation and the elements that comprise that total compensation is made solely by the Compensation Committee.

The Compensation Committee meets regularly during the year (four meetings in 2008) and has periodic conference calls, as needed, to evaluate executive performance against the goals and objectives set at the beginning of the year, to monitor market conditions in light of these goals and objectives and to review the compensation practices. The Compensation Committee makes regular reports to the Board.

What the Executive Compensation Plan is Designed to Reward

The Compensation Committee has designed the executive compensation plan to achieve three primary objectives:

| | | |

| | ● | Attracting, Motivation and Retaining Key Executives. We have been successful in creating an experienced and highly effective team with long tenure and a deep commitment to us. |

| | | |

| | ● | Linking Compensation to Performance. The Compensation Committee generally rewards the achievement of specific annual, long-term and strategic goals of both our Company and each individual executive officer. The Compensation Committee measures performance of each executive officer, by considering (1) our Company performance and (2) the performance of each executive officer’s department and/or area of responsibility against financial measures established at the beginning of the year, and (3) a subjective evaluation of each executive officer. The Compensation Committee evaluates the performance of our Chairman of the Board and Chief Executive Officer. |

| | | |

| | ● | Aligning the Interest of our Executive Officers with our Stockholders. Long-term incentive compensation is designed to provide incentives for each executive officer to successfully implement our long-term strategic goals and to retain such executive officer. We have designed our annual and long-term incentive programs to award performance-based equity to allow our executive officers to grow their ownership in our company and create a further alignment with our stockholders. |

Role of the Compensation Consultant

Our executive compensation is designed to be competitive with those of executive officers of other equity REITs and private real estate companies, while also taking into account the executive officers’ performance. The compensation amounts paid by other equity REITs and private real estate companies were determined based upon the review of independent third party sources on executive compensation in the real estate industry, including the CEL & Associates Inc. National Real Estate Compensation and Benefits Survey5, the NAREIT Compensation Survey and a Compensation Benchmarking Analysis prepared for the Company by our compensation consultant, FPL Associates, L.P. (“FPL”).

5 It should be noted that Christopher Lee, a member of the Company’s Board and chairman of the Compensation Committee, is the President of CEL & Associates, Inc. No fees or other consideration were paid to Mr. Lee or CEL & Associates, Inc. in connection with the Compensation Committee’s review of the CEL & Associates, Inc. published report.

The FPL Compensation Benchmarking Analysis included a competitive benchmarking analysis for our named executive officers in the specific compensation components of base salary, total annual cash compensation (base salary plus incentive), long-term incentive award value, and total remuneration (total annual cash compensation plus long-term incentive award value). Each compensation component was analyzed on the basis of 25th percentile, median, average, and 75th percentile. Cogdell Spencer’s executive compensation was then compared to the peer group as a percentage of market median and market average.

A key issue in conducting a competitive benchmarking analysis is the identification of the appropriate market definition, or comparative peer group(s). Comparative peer groups form the barometer for evaluating and establishing pay levels, incentive opportunities, long-term incentive grants, performance measures and expectations. The FPL Compensation Benchmarking Analysis determined the peer group based on the following factors: asset focus, geographic location, company size, talent/recruitment, investment dollars and growth objectives or performance. The peer groups identified compete with the Company for talent, investment dollars and/or business.

In examining a representative view of the public REIT marketplace, FPL utilized two peer groups of public real estate companies as the foundation for benchmarking the Company’s executives. The peer groups were asset-based (seven public REITs that focus on the healthcare sector), including Cousins Properties, Healthcare Realty Trust, Investors Real Estate Trust, LTC Properties, Medical Properties Trust, Omega Healthcare Investors and Washington Real Estate Investment Trust; and size –based (ten public REITs and one public real estate operating company that focus on a variety of asset classes and are similar in size to the Company in terms of total capitalization), including Acadia Realty Trust, American Land Lease, AmREIT, and Associated Estates Realty Corporation and others. The peer groups were rated according to metrics including total shareholder return (share price appreciation plus dividends) and funds from operations (“FFO”) per share growth (year over year growth in FFO on a per share basis).

Measuring 2008 Performance

Our compensation philosophy measures our performance as a whole and the performance of each department. Our Compensation Committee has prepared performance targets for our Chief Executive Officer. Our Chief Executive Officer has prepared performance targets for each of our executive officers, other than the Chairman and Chief Executive Officer, and these performance targets have been approved and adopted by the Compensation Committee. These targets measure performance through the achievement of specific, objective, financial goals by us and the department of each executive officer as well as through a subjective evaluation of each executive officer. Our Chairman of the Board, Mr. Cogdell, does not participate in this aspect of our incentive compensation plan. Mr. Cogdell was the Company’s largest stockholder as of December 31, 2008 and in light of his significant ownership interest in the Company, the Compensation Committee believes that his long-term interests are currently aligned with those of the Company’s stockholders.

The Compensation Committee has established three strategic goals for use in executive achievement incentive compensation formulas. For 2008, the goals were expressed is three separately evaluated categories: (1) Gross Revenue; (2) earnings before interest, taxes, depreciation and amortization (“EBITDA”); and (3) funds from operations modified (“FFOM”). The corporate-level performance targets set by the Compensation Committee and our Chief Executive Officer for 2008 for Messrs. Spencer and Handy are set forth in the table below.

Corporate-Level Performance Targets / Achievement Percentage

| | | | | | | |

| | FFOM per share | | Gross Revenue | | EBITDA | |

| | | (Dollars in millions) | (Dollars in millions) |

| | | | |

| | $1.19 / 50% | $365 / 50% | $61 / 50% |

| | $1.20 / 60% | $367 / 60% | $62 / 60% |

| | $1.21 / 70% | $369 / 70% | $63 / 70% |

| | $1.22 / 80% | $371 / 80% | $64 / 80% |

| | $1.23 / 90% | $373 / 90% | $65 / 90% |

| | $1.24 / 100% | $375 / 100% | $66 / 100% |

| | $1.25 – 1.27 / 115% | $377 -381 / 115% | $67-69 / 115% |

| | $1.28-1.30 / 130% | $382 - 386 / 130% | $70-72 / 130% |

In 2008, without taking into account any achievement bonus earned by Messrs. Spencer and Handy, the Company achieved FFOM per share of $1.25 (or 115% achievement percentage), gross revenues of $335,740,000 (or 0% achievement percentage) and EBITDA of $60,110,000 (or 0% achievement percentage).

Mr. Spencer’s annual achievement bonus for 2008 did not contain discretionary elements and was based entirely on the three corporate-level performance targets outlined above. Mr. Spencer’s annual achievement bonus was determined as follows: (1) 60% attributable to FFOM per share achievement percentage, (2) 20% attributable to Gross Revenue achievement percentage and (3) 20% attributable to EBITDA achievement percentage. In 2008, Mr. Spencer was eligible for an annual achievement bonus of $500,000 based on 100% achievement by the Company of the corporate-level performance targets described above; he was awarded $345,000 based on the Company’s performance in 2008. Targets were not achieved related to Gross Revenue and EBITA thresholds; therefore the full amount of Mr. Spencer’s annual achievement bonus was attributable to achieving the FFOM target.

Mr. Spencer was also eligible for an incentive bonus of $250,000 in 2008 based on 100% achievement of the FFOM growth criteria set forth below:

| | | |

FFOM Growth Over Established Prior Year Target | | % Goal Achievement Towards Incentive Bonus |

| <8.0% | | 0 |

| 8.0% – 8.9% | | 60% or $150,000 |

| 9.0% – 9.9% | | 80% or $200,000 |

| 10.0% & above | | 100% or $250,000 |

In 2008, the minimum FFOM per share that the Company needed to achieve in order for Mr. Spencer to receive any incentive bonus was $1.20, and Mr. Spencer was eligible to receive 60% (or $150,000) based on FFOM per share of $1.20 to 1.2099, 80% (or $200,000) based on FFOM per share of $1.21 to $1.2199 and 100% (or $250,000) based on FFOM per share of $1.22 or greater. In 2008, the Company’s FFOM per share was $1.22 and Mr. Spencer was awarded an incentive bonus of $250,000 based on 100% achievement of the targeted level. Mr. Spencer’s incentive compensation in 2008 was paid entirely in LTIP units, based on the closing price of the Company’s common stock on the final business day of 2008, or December 31, 2008 (or $9.36 per share), resulting in a grant of 63,568 LTIP units.

Mr. Handy’s annual achievement bonus for 2008 was based the following criteria: (1) 70% on the three corporate-level performance targets outlined in the table above, (2) 10% based on certain departmental goals described below and (3) 20% based on subjective evaluation by the Chief Executive Officer. Mr. Handy was eligible to receive $247,000 in cash and $150,000 in LTIP units based on 100% achievement of the criteria described above for 2008. In 2008, Mr. Handy received an annual achievement bonus of $188,843 in cash and $114,450 in LTIP units (11,891 LTIP units). The corporate-level performance component of Mr. Handy’s achievement bonus was determined as follows: (1) 60% attributable to FFOM per share achievement percentage, (2) 20% attributable to Gross Revenue achievement percentage and 20% attributable to EBITDA achievement percentage. Based on the Company’s achievement of these corporate-level performance targets in 2008, Mr. Handy received 69% of his maximum eligible annual achievement bonus, or $191,993 ($119,036 in cash and $72,957 in LTIP units). Targets were not achieved relating to Gross Revenue and EBITDA thresholds; therefore the full amount of Mr. Handy's annual achievement bonus relating to corporate-level performance targets was attributable to achieving the FFOM target. The departmental goal component of Mr. Handy’s achievement bonus was based on corporate G&A. In 2008, 10% of the target bonus that Mr. Handy was eligible to receive was based on the Company limiting corporate G&A to $9,967,000. In 2008, corporate G&A was $10,074,000 and therefore Mr. Handy received 80% of his bonus attributable to his departmental goals, or $31,800 ($19,716 in cash and $12,084 in LTIP units). The criteria on which the Chief Executive Officer based the subjective evaluation component of Mr. Handy’s annual achievement bonus included Mr. Handy’s leadership within his department, the quality of advice and support he provided to the Chief Executive Officer and the Board of Directors, his performance on special projects and his core competencies in departmental management. Based on these criteria, Mr. Handy was awarded the full portion of his bonus attributable to the subjective evaluation of the Chief Executive Officer, or $79,500.

Mr. Handy was also eligible to receive LTIP unit grants in 2008 based on the amount of development projects completed by the Company in 2008. Mr. Handy was eligible to receive LTIP units in 2008 in an amount equal to 0.15% of the asset value of each new completed and owned development project. LTIP units totaling $24,300 based on a price of $15.72 per unit were granted to Mr. Handy related to the completion of Alamance Regional Mebane Outpatient Center during 2008. The LTIP units vested 50% at the certificate of occupancy and the remaining 50% will vest upon rent stabilization.

Mr. Ransom was eligible to receive LTIP unit grants in 2008 under the Company’s equity incentive plan in amounts equal to (1) 16% of the amount by which Erdman’s actual EBITDA, excluding income relating to development projects financed by the Company or one of its affiliated companies (or development fees), exceeded $29.3 million in 2008, and (2) 0.5% of the asset value of each new completed and owned development project, respectively. No LTIP unit grants were granted to Mr. Ransom under this program in 2008.

Mr. Ransom was also eligible for certain performance related bonuses in 2008 under an incentive bonus plan of Erdman that was adopted by the Erdman board of directors and in place prior to the time of the Company’s acquisition of Erdman in March 2008 and the Company’s equity incentive plan. Under Erdman’s incentive bonus plan, Mr. Ransom received $160,695 for 2008.

Special MEA Transaction Award

In recognition of the role played by Messrs. Cogdell, Spencer and Handy in guiding the Company through the acquisition of Erdman in March 2008, the Compensation Committee recommended, and the Board of Directors approved, a special LTIP unit award to each of Messrs. Cogdell, Spencer and Handy of $375,000 of LTIP units, $1,000,000 of LTIP units and $650,000 of LTIP units, respectively, in March 2008. The number of LTIP units initially awarded to each of Messrs Cogdell, Spencer and Handy was 23,511 LTIP units, 62,296 LTIP units and 39,185 LTIP units, respectively, and was calculated using $15.95 per LTIP unit, which was the price per share paid in connection with the Company’s private offering in January 2008. Heidi M. Wilson was also awarded $150,000 of LTIP units, 20% of which vested on March 31, 2008 and the remaining 80% were forfeited under the terms of Ms. Wilson's severance agreement.

Of the total number of LTIP units awarded to Messrs. Cogdell, Spencer and Handy, 20% vested on the effective date of issuance, March 31, 2008. The remaining 80% will vest in variable incremental installments determined each year as follows: the amount, if any, that the FFOM targets for such year (as set forth in the table below) are exceeded, multiplied by the number of shares of the Company outstanding as of the grant date minus the Company’s pro forma compensation charge (as determined under GAAP) which would result from the issuance of such LTIP units. Any portion of the award that is not vested as of December 31, 2015 shall be forfeited. Messrs Cogdell, Spencer and Handy vested in 532 LTIP units, 1,419 LTIP units and 887 LTIP units, respectively, based on exceeding the established 2008 FFOM target per share of $1.22. The price per LTIP unit used in determining these awards was $15.95 per LTIP unit, which as the price per share paid in connection with the Company’s private offering in January 2008.

On May 28, 2008, the Company and Heidi M. Wilson agreed to terminate her employment as Executive Vice President of the Company. Ms. Wilson did not receive any incentive compensation in 2008 and forfeited her unvested equity awards upon the termination of her employment.

Elements of our Executive Compensation Program and Why We Chose Each Element

Our executive compensation plan has been structured to provide short and long-term incentives that promote continuing improvements in our financial results and returns to our stockholders. The elements of our executive compensation are primarily comprised of three elements designed to complement each other: annual base salaries; annual incentive bonuses; and long-term incentives. We review the various components of compensation as related but distinct. The Compensation Committee designs total compensation packages that it believes will best create retention incentives, link compensation to performance and align the interests of our executive officers and our stockholders.

| | | |

| | ● | Annual Base Salaries. Annual base salaries are paid for ongoing performance throughout the year. In the case of each of our named executive officers, annual base salaries are paid in accordance with the employment agreement between us and such executive officers. |

| | | |