Exhibit 99.4

SUPPLEMENTAL INFORMATION FOR HOLDERS OF AMERICAN DEPOSITARY SHARES TO ACCOMPANY THE INVITATION AND AGENDA FOR THE 2019 ANNUAL GENERAL MEETING

In this letter (1) “FMC AG & Co. KGaA”, the “Company”, “we” or “our” refer to Fresenius Medical Care AG & Co. KGaA, a German partnership limited by shares, (2) “Fresenius Medical Care AG” and “FMC-AG” refer to us as a German stock corporation before the transformation of our legal form into a partnership limited by shares; (3) “Fresenius SE” refers to Fresenius SE & Co. KGaA, a German partnership limited by shares resulting from the change of legal form of Fresenius SE (effective as of January 2011), a European Company (Societas Europaea) previously called Fresenius AG, a German stock corporation. Each of “Management AG”, “FMC Management AG” and the “General Partner” refers to Fresenius Medical Care Management AG, FMC-AG & Co. KGaA’s general partner and a wholly owned subsidiary of Fresenius SE. “Management Board” and “our Management Board” refer to the members of the management board of Management AG and, except as otherwise specified, “Supervisory Board” and “our Supervisory Board” refer to the supervisory board of FMC-AG & Co. KGaA. “THOUS” is used to denote the presentation of amounts in thousands and “M” is used to denote the presentation of amounts in millions. Share data are presented in actual amounts.

As a foreign private issuer under the rules and regulations of the United States (“U.S.”) Securities and Exchange Commission (“SEC”), we are not subject to the SEC’s Proxy Rules. However, under the stipulations of the Pooling Agreement among us, Fresenius SE & Co. KGaA, our general partner and our independent directors, FMC AG & Co. KGaA has agreed that in connection with any exercise of voting or consent rights by our shareholders, we will furnish to the SEC and make available for holders of our American Depositary Shares (“ADSs”) information which is generally comparable to that which would be provided by a U.S. corporation, except that it agreed to provide the following information as it would be provided by a foreign private issuer under the SEC’s rules:

(i) Security Ownership of Certain Beneficial Owners of Fresenius Medical Care AG & Co. KGaA; (ii) Trading Markets for our Securities; (iii) Directors and Senior Management; (iv) Compensation of the Management Board and the Supervisory Board; (v) Options to Purchase Our Securities, and (vi) Material Transactions between FMC-AG & Co. KGaA and its Subsidiaries and Directors, Officers and Controlling Persons of FMC-AG & Co. KGaA. The above information contained in this letter, as well as the information in item (vii) “Principal Accountant Fees and Services,” has been derived principally from our Annual Report on Form 20-F for the year ended December 31, 2018 filed with the SEC (our “2018 20-F”). Our 2018 20-F is available on the web site maintained by the SEC at www.sec.gov and on our web site at www.freseniusmedicalcare.com on the “News and Publications” page. The information in this letter supplements the information in the accompanying convenience translation of the Agenda and Invitation to the Annual General Meeting (“AGM”) to be held on May 16, 2019 (the “2019 AGM Invitation”) and the other reports furnished with the 2019 AGM Invitation.

(i) Security Ownership of Certain Beneficial Owners of Fresenius Medical Care AG & Co. KGaA and Fresenius SE & Co. KGaA

Security ownership of certain beneficial owners of Fresenius Medical Care

Our outstanding share capital consists of shares issued only in bearer form. Accordingly, unless we receive information regarding acquisitions of our shares through a filing with the Securities and Exchange Commission or through the German statutory requirements referred to below, or except as described below with respect to our shares held in American Depositary Receipt (“ADR”) form, we face difficulties precisely determining who our shareholders are at any specified time or how many shares any particular shareholder owns.

Since we are a foreign private issuer under the rules of the Securities and Exchange Commission, our directors and officers are not required to report their ownership of our equity securities or their transactions in our equity securities pursuant to Section 16 of the Securities and Exchange Act of 1934. However, persons who become “beneficial owners” of more than 5% of our shares are required to report their beneficial ownership pursuant to Section 13(d) of the Securities and Exchange Act of 1934.

In addition, under Article 19(1) of the Regulation (EU) No. 596/2014 of the European Parliament and of the Council of April 16, 2014 on market abuse (Market Abuse Regulation or “MAR”), persons discharging managerial responsibilities within an issuer of shares, as well as persons closely associated with them, are obliged to notify the issuer and the competent authority, i.e. for the Company as issuer, the German Federal Financial Supervisory Authority (Bundesanstalt für Finanzdienstleistungsaufsicht or “BaFin”), of every transaction conducted on their own account relating to the shares or debt instruments of the issuer or to derivatives or other financial instruments linked thereto no later than three business days after the date of the transaction. Persons discharging managerial responsibilities, inter alia, include the members of management as well as supervisory boards.

In addition, holders of voting securities of a German company listed on the regulated market (Regulierter Markt) of a German stock exchange or a corresponding trading segment of a stock exchange within the European Union are, under Sections 33, 34 of the German Securities Trading Act (Wertpapierhandelsgesetz or “WpHG”), obligated to notify the company of held or attributed holding whenever such holding reaches, exceeds or falls below certain

1

thresholds, which have been set at 3%, 5%, 10%, 15%, 20%, 25%, 30%, 50% and 75% of a company’s outstanding voting rights. Such notification obligations will also apply pursuant to Section 38 of the WpHG to the direct or indirect holder of instruments granting an unconditional right to acquire voting rights when due or providing discretion as to the acquisition of shares or instruments that have a similar economic effect as well as pursuant to Section 39 of the WpHG to the aggregate of held or attributed voting rights and instruments (in each case excluding the 3% threshold). For threshold notifications furnished to us by third parties please see note 17 of the notes to the consolidated financial statements included in our 2018 20-F.

We have been informed that as of February 11, 2019, Fresenius SE owned 94,380,382, 30.75% of our shares. As the sole shareholder of our General Partner, Fresenius SE is barred from voting its shares on certain matters, including the election of our Supervisory Board. See Item 16G, “Corporate governance — Supervisory Board” in our 2018 20-F. Subject to any applicable statutory limitations, all of our outstanding shares have the same voting rights.

According to a Schedule 13G filed by BlackRock, Inc. on February 4, 2019, the various BlackRock entities named in the Schedule 13G are the beneficial owners of a total of 19,847,628 shares, or 6.4% of our shares.

Bank of New York Mellon, our ADR depositary, informed us, that as of December 31, 2018, 21,185,060 ADSs, each representing one half of a share, were held of record by 2,827 U.S. holders. For more information regarding ADRs and ADSs see Item 10B, “Articles of Association — Description of American depositary receipts” in our 2018 20-F.

Security ownership of certain beneficial owners of Fresenius SE

Fresenius SE’s share capital consists solely of ordinary shares, issued only in bearer form. Accordingly, Fresenius SE has difficulties precisely determining who its shareholders are at any specified time or how many shares any particular shareholder owns. However, under the WpHG, holders of voting securities of a German company listed on the regulated market (Regulierter Markt) of a German stock exchange or a corresponding trading segment of a stock exchange within the European Union are obligated to notify a company of certain levels of holdings, as described above.

The Else Kröner-Fresenius-Stiftung is the sole shareholder of Fresenius Management SE, the general partner of Fresenius SE, and has sole power to elect the supervisory board of Fresenius Management SE. In addition, based on the most recent information available, Else Kröner-Fresenius-Stiftung owns approximately 26.30% of the Fresenius SE ordinary shares. See item (vi), “Material Transactions between FMC-AG & Co. KGaA and its Subsidiaries and Directors, Officers and Controlling Persons of FMC-AG & Co. KGaA” below.

(ii) Trading Markets for our Securities

The principal trading market for our shares is the Frankfurt Stock Exchange (FWB® Frankfurter Wertpapierbörse). The ordinary shares of Fresenius Medical Care AG had been listed on the Frankfurt Stock Exchange since October 2, 1996. Trading in the ordinary shares of FMC-AG & Co. KGaA on the Frankfurt Stock Exchange commenced on February 13, 2006.

Our shares have been listed on the Regulated Market (Regulierter Markt) of the Frankfurt Stock Exchange and on the Prime Standard of the Regulated Market, which is a sub-segment of the Regulated Market with additional post-admission obligations. Admission to the Prime Standard requires the fulfillment of the following transparency criteria: publication of quarterly reports; preparation of financial statements in accordance with international accounting standards (International Financial Reporting Standards, “IFRS,” or U.S. Generally Accepted Accounting Principles “U.S. GAAP”); publication of a company calendar; convening of at least one analyst conference per year; and publication of ad-hoc messages (i.e., certain announcements of material developments and events) in English. Companies aiming to be listed in this segment have to apply for admission. Listing in the Prime Standard is a prerequisite for inclusion of shares in the selection indices of the Frankfurt Stock Exchange, such as the DAX®, the index of 30 major German stocks.

ADSs representing the ordinary shares of Fresenius Medical Care AG had been listed on the New York Stock Exchange (“NYSE”) since October 1, 1996. Trading in the ADSs representing the ordinary shares of FMC AG & Co. KGaA on the NYSE, under the symbol FMS, commenced in February of 2006. Effective December 3, 2012, we effected a two-for-one split of our outstanding ADSs, which changed the ratio our ADSs to shares from one ADSs representing one share to two ADSs representing one share. The Depositary for the ADSs is Bank of New York Mellon (the “Depositary”). For more information regarding ADRs see Item 10B. “Articles of Association — Description of American Depositary Receipts” in our 2018 20-F.

Trading on the Frankfurt Stock Exchange

Deutsche Börse AG operates the Frankfurt Stock Exchange, which is the largest of the six German stock exchanges by value of shares traded. Our shares are traded on Xetra, the electronic trading system of the Deutsche Börse. The trading hours for Xetra are between 9:00 a.m. and 5:30 p.m. Central European Time (“CET”). Only brokers and

2

banks that have been admitted to Xetra by the Frankfurt Stock Exchange have direct access to the system and may trade on it. Private investors can trade on Xetra through their banks and brokers.

Deutsche Börse AG publishes information for all traded securities on the Internet, http://www.deutsche-boerse.com.

Transactions on Xetra and the Frankfurt Stock Exchange settle on the second business day following the trade except for trades executed on Xetra International Markets, the European Blue Chip segment of Deutsche Börse AG, which settle on the third business day following a trade. The Frankfurt Stock Exchange can suspend a quotation if orderly trading is temporarily endangered or if a suspension is deemed to be necessary to protect the public.

The Hessian Stock Exchange Supervisory Authority (Hessische Börsenaufsicht) and the Trading Monitoring Unit of the Frankfurt Stock Exchange (HÜST Handelsüberwachungsstelle) both monitor trading on the Frankfurt Stock Exchange.

BaFin, an independent federal authority, is responsible for the general supervision of securities trading pursuant to MAR, WpHG and other applicable laws.

The table below sets forth for the periods indicated, the high and low closing sales prices in euro for our shares on the Frankfurt Stock Exchange, as reported by the Frankfurt Stock Exchange Xetra system. All shares on German stock exchanges trade in euro.

As of March 28, 2019, the closing price for shares traded on XETRA was €70.96.

Price per share of FME:GR | | | | | | | |

in € | | | | | | | |

| | | | High | | Low | |

2019 | | March (through March 28,2019) | | 70.96 | | 66.42 | |

2019 | | February | | 70.58 | | 63.72 | |

2019 | | January | | 64.36 | | 55.58 | |

2018 | | December | | 73.78 | | 56.64 | |

| | November | | 75.62 | | 66.30 | |

| | October | | 91.42 | | 68.92 | |

| | September | | 89.66 | | 85.80 | |

| | August | | 91.24 | | 83.64 | |

2018 | | Fourth quarter | | 91.42 | | 56.64 | |

| | Third quarter | | 91.24 | | 82.38 | |

| | Second quarter | | 88.50 | | 80.90 | |

| | First quarter | | 93.00 | | 79.40 | |

2017 | | Fourth quarter | | 88.57 | | 80.88 | |

| | Third quarter | | 85.94 | | 76.53 | |

| | Second quarter | | 88.90 | | 77.97 | |

| | First quarter | | 82.20 | | 74.69 | |

2018 | | Annual | | 93.00 | | 56.64 | |

2017 | | Annual | | 88.90 | | 74.69 | |

2016 | | Annual | | 85.65 | | 71.62 | |

2015 | | Annual | | 83.13 | | 60.57 | |

2014 | | Annual | | 61.85 | | 47.15 | |

3

Trading on the New York Stock Exchange

As of March 28, 2019, the closing price for the ADSs traded on the NYSE was $39.75.

The table below sets forth, for the periods indicated, the high and low closing sales prices for the Ordinary ADSs on the NYSE.

Price per share of FMS.US | | | | | | | |

in $ | | | | | | | |

| | | | High | | Low | |

2019 | | March (through March 28,2019) | | 40.67 | | 37.38 | |

2019 | | February | | 39.93 | | 36.48 | |

2019 | | January | | 36.74 | | 31.10 | |

2018 | | December | | 41.89 | | 31.30 | |

| | November | | 43.17 | | 37.53 | |

| | October | | 52.82 | | 38.92 | |

| | September | | 52.19 | | 50.00 | |

| | August | | 53.37 | | 47.56 | |

2018 | | Fourth quarter | | 52.82 | | 31.30 | |

| | Third quarter | | 53.37 | | 47.56 | |

| | Second quarter | | 52.78 | | 49.17 | |

| | First quarter | | 57.51 | | 49.78 | |

2017 | | Fourth quarter | | 52.72 | | 47.74 | |

| | Third quarter | | 49.48 | | 44.95 | |

| | Second quarter | | 49.90 | | 41.50 | |

| | First quarter | | 42.74 | | 39.70 | |

2018 | | Annual | | 57.51 | | 31.30 | |

2017 | | Annual | | 52.72 | | 39.70 | |

2016 | | Annual | | 47.43 | | 38.37 | |

2015 | | Annual | | 45.72 | | 35.96 | |

2014 | | Annual | | 37.63 | | 32.06 | |

Dividends

We generally pay annual dividends on our shares in amounts that we determine on the basis of FMC-AG & Co. KGaA’s prior year’s retained earnings (Bilanzgewinn) as shown in the statutory unconsolidated financial statements that we prepare under German law on the basis of the accounting principles of the German Commercial Code (Handelsgesetzbuch or HGB). The payment of dividends is subject to a resolution of the general meeting of shareholders. Our goal is for the dividend development to be closely aligned with our growth in basic earnings per share, while maintaining dividend continuity.

The General Partner and our Supervisory Board propose dividends to the AGM and the AGM approves dividends. The dividends are paid in respect of the fiscal year preceding the respective AGM. Since all of our shares are in bearer form, we remit dividends to the depositary bank (Depotbank) on behalf of the shareholders.

The table below provides information regarding the annual dividend per share that we paid on our shares. These payments were made in the years shown in the table. They relate to the results of operations in the year preceding the payment.

| | 2018 | | 2017 | | 2016 | |

Per share amount | | € | 1.06 | | € | 0.96 | | € | 0.80 | |

| | | | | | | | | | |

At our AGM on May 16, 2019, our General Partner and our Supervisory Board will propose to the shareholders a dividend of €1.17 per share for 2018, payable in 2019. The dividend is subject to approval by our shareholders at our AGM, as described in the 2019 AGM Invitation.

Except as described herein, holders of ADSs will be entitled to receive dividends on the shares represented by the respective ADSs. We will pay any cash dividends payable to such holders to the depositary in euros and, subject to certain exceptions, the depositary will convert the dividends into U.S. dollars and, after deduction of its fees and any taxes, distribute the dividends to ADS holders. See Item 10, “Additional information — Description of American

4

depositary receipts — Share dividends and other distributions” in our 2018 20-F. Fluctuations in the exchange rate between the U.S. dollar and the euro will affect the amount of dividends that ADS holders receive. Dividends paid to holders and beneficial holders of the ADSs will be subject to deduction of German withholding tax. You can find a discussion of German withholding tax, including a description of the procedures for U.S. ADS holders to apply for a partial refund of such withholding taxes pursuant to the U.S.-German tax treaty, in “Item 10.E. Taxation” in our 2018 20-F.

(iii) Directors and Senior Management

General

As a partnership limited by shares, under the German Stock Corporation Act (Aktiengesetz or AktG), our corporate bodies are our General Partner, our Supervisory Board and our general meeting of shareholders. Our sole General Partner is Management AG, a wholly-owned subsidiary of Fresenius SE. Management AG is required to devote itself exclusively to the management of Fresenius Medical Care AG & Co. KGaA.

For a detailed discussion of the legal and management structure of Fresenius Medical Care AG & Co. KGaA, including the more limited powers and functions of the Supervisory Board compared to those of the General Partner, see Item 16.G, “Corporate governance — The Legal Structure of Fresenius Medical Care AG & Co. KGaA” in our 2018 20-F.

Our General Partner has a supervisory board and a management board. These two boards are separate and no individual may simultaneously be a member of both boards. A person may, however, serve on both the supervisory board of our General Partner and on our Supervisory Board.

The General Partner’s Supervisory Board

The supervisory board of Management AG consists of six members who are elected by Fresenius SE (acting through its general partner, Fresenius Management SE), the sole shareholder of Management AG. Pursuant to a pooling agreement for the benefit of the public holders of our shares, at least one-third (but no fewer than two) of the members of the General Partner’s supervisory board are required to be independent directors as defined in the pooling agreement, i.e., persons with no substantial business or professional relationship with us, Fresenius SE, the General Partner, or any affiliate of any of them.

Unless resolved otherwise by Fresenius SE in the general meeting of shareholders of Management AG, the terms of each of the members of the supervisory board of Management AG will expire at the end of the general meeting of shareholders held during the fourth fiscal year following the year in which the Management AG supervisory board member was elected by Fresenius SE, but not counting the fiscal year in which such member’s term begins. Fresenius SE, as the sole shareholder of Management AG, is at any time entitled to re-appoint members of the Management AG supervisory board. The most recent election of members of the General Partner’s supervisory board took place in May 2016. Following Dr. Ulf M. Schneider’s resignation in 2016, Ms. Rachel Empey was elected as a sixth member of the General Partner’s supervisory board, effective, as of September 1, 2017. Members of the General Partner’s supervisory board may be removed only by a resolution of Fresenius SE in its capacity as sole shareholder of the General Partner. Neither our shareholders nor our separate Supervisory Board has any influence on the appointment of the supervisory board of the General Partner.

The General Partner’s supervisory board ordinarily acts by simple majority vote and the Chairman has a tie-breaking vote in case of any deadlock. The principal function of the General Partner’s supervisory board is to appoint and to supervise the General Partner’s management board in its management of the Company, and to approve mid-term planning, dividend payments and other matters which are not in the ordinary course of business and are of fundamental importance to us.

The table below provides the names of the current members of the supervisory board of Management AG and their ages. Each of Dr. Schenk, Mr. Classon and Mr. Johnston is also a member of the Supervisory Board of FMC AG & Co. KGaA.

5

Name | | Current age |

| | |

Mr. Stephan Sturm, Chairman(1) | | 55 |

| | |

Dr. Dieter Schenk, Vice Chairman(1) (4) | | 66 |

| | |

Dr. Gerd Krick(1) | | 80 |

| | |

Mr. Rolf A. Classon(1) (2) (3) (4) | | 73 |

| | |

Mr. William P. Johnston(1) (2) (3) (4) | | 74 |

| | |

Ms. Rachel Empey | | 42 |

(1) Members of the Human Resources Committee of the supervisory board of Management AG

(2) Members of the Audit and Corporate Governance Committee of FMC-AG & Co. KGaA. In addition, Ms. Deborah Doyle McWhinney was a member of the Audit and Corporate Governance Committee of FMC-AG & Co. KGaA until her resignation as a member of our Supervisory Board effective November 1, 2018. In addition, Ms. Pascale Witz, a member of our supervisory board, became a member of the Audit and Corporate Governance Committee of FMC-AG & Co. KGaA on February 11, 2019.

(3) Independent director for purposes of our pooling agreement

(4) Member of the Regulatory and Reimbursement Assessment Committee of the supervisory board of Management AG

MR. STEPHAN STURM has been Chairman of the Management Board of Fresenius Management SE since July 1, 2016, after serving for over 11 years as Fresenius Management SE’s Chief Financial Officer. Prior to joining Fresenius Management SE in 2005, he was a Managing Director of Credit Suisse First Boston (“CSFB”), from 2000 as Head of Investment Banking for Germany and Austria, and also served on CSFB’s European Management Committee. During his more than 13 years in investment banking, Stephan Sturm held various executive positions with BHF-Bank, Union Bank of Switzerland and CSFB in Frankfurt and London. Prior to entering investment banking in 1991, he was a management consultant at McKinsey & Co in Duesseldorf and Frankfurt. Mr. Stephan Sturm holds a degree in Business from Mannheim University. Additionally, Mr. Sturm is the Chairman of the supervisory board of Fresenius Kabi AG, Vice Chairman of the supervisory board of Vamed AG, Austria as well as a member of the supervisory board of Deutsche Lufthansa AG.

DR. DIETER SCHENK has been Vice Chairman of the supervisory board of Management AG since 2005 and is Vice Chairman of the supervisory board of Fresenius Management SE. Dr. Schenk was elected as the Chairman of our Supervisory Board in 2018; previously Dr. Schenk served as the Vice Chairman of our Supervisory Board. He is an attorney and tax advisor and was a partner in the law firm of Noerr LLP (formerly Nörr Stiefenhofer Lutz) from 1986 until December 31, 2017. Additionally, he also serves as the Chairman of the supervisory board of Gabor Shoes AG, Bank Schilling & Co. AG and TOPTICA Photonics AG. Dr. Schenk is also Chairman of the Foundation Board of Else Kröner-Fresenius-Stiftung, the sole shareholder of Fresenius Management SE, which is the sole general partner of Fresenius SE & Co. KGaA.

MR. ROLF A. CLASSON has been a member of the supervisory board of Management AG since July 7, 2011 and a member of our Supervisory Board since May 12, 2011. Mr. Classon also has served on the Board of Directors of Catalent Inc since August 2014 and as a member of the Board of Directors of Perrigo Company plc, since May 8, 2017. Mr. Classon was the Chairman of the Board of Directors for Hill-Rom Holdings, Inc. until March 6, 2018 as well as the Chairman of the Board of Directors for Tecan Group Ltd. until April 18, 2018.

MR. WILLIAM P. JOHNSTON has been a member of the supervisory board of Management AG since May 2006 and also serves on our Supervisory Board. Mr. Johnston has been an Operating Executive of The Carlyle Group since June 2006. He is also Chairman of the Board of The Hartford Mutual Funds, Inc.

MS. RACHEL EMPEY became the Chief Financial Officer of Fresenius Management SE on August 1, 2017 and member of the supervisory board of Management AG on September 1, 2017. Prior to August 1, 2017, she served as Chief Financial and Strategy Officer of Telefónica Deutschland Holding AG and member of the Telefónica Deutschland Management Board, starting in 2011. Previously, Ms.Empey held a number of key international finance and controlling positions in the Telefónica group. She started her career as an audit executive at Ernst & Young and business analyst at Lucent Technologies. Ms. Empey is a chartered accountant and holds an MA (Hons) in Mathematical Sciences from the University of Oxford. Additionally, Ms. Empey has been the Vice Chairman of the supervisory board of Fresenius Kabi AG since October 2017 and has served on the Board of Directors of Inchcape plc since May 2016.

DR. GERD KRICK has been a member of the supervisory board of Management AG since December 2005 and was Chairman of our Supervisory Board until May 17, 2018. He is the Chairman of the supervisory board of Fresenius Management SE and of Fresenius SE & Co. KGaA. Additionally, Dr. Gerd Krick is also Chairman of the supervisory board of Vamed AG, Austria.

6

The General Partner’s Management Board

Each member of the Management Board of Management AG is appointed by the supervisory board of Management AG for a maximum term of five years and is eligible for reappointment thereafter. Their terms of office expire in the years listed below.

The table below provides names, positions and terms of office of the current members of the Management Board of Management AG and their ages:

| | Current | | | | Year term |

Name | | age | | Position | | expires |

Mr. Rice Powell | | 63 | | Chief Executive Officer and Chairman of the Management Board | | 2022 |

| | | | | | |

Mr. Michael Brosnan(1) | | 63 | | Chief Financial Officer | | 2022 |

| | | | | | |

Mr. William Valle | | 58 | | Chief Executive Officer for North America | | 2020 |

| | | | | | |

Dr. Olaf Schermeier | | 46 | | Chief Officer of Global Research & Development | | 2021 |

| | | | | | |

Mr. Kent Wanzek | | 59 | | Chief Executive Officer of Global Manufacturing and Quality | | 2022 |

| | | | | | |

Mr. Harry de Wit | | 56 | | Chief Executive Officer for Asia-Pacific | | 2023 |

| | | | | | |

Dr. Katarzyna Mazur-Hofsäß | | 55 | | Chief Executive Officer for EMEA | | 2021 |

(1) On February 20, 2019, the Company announced that Michael Brosnan plans to retire from the Company after his successor has been identified and transitioned into the role.

MR. RICE POWELL has been with the Company since 1997. He became Chairman and Chief Executive Officer of the Management Board of Management AG effective January 1, 2013. Mr. Powell is also a member of the Management Board of Fresenius Management SE and of the Board of Administration of Vifor Fresenius Medical Care Renal Pharma, Ltd., Switzerland. Mr. Powell was the Chief Executive Officer and director of Fresenius Medical Care North America until December 31, 2012. Mr. Powell has more than 40 years of experience in the healthcare industry, which includes various positions with Baxter International Inc., Biogen Inc., and Ergo Sciences Inc.

MR. MICHAEL BROSNAN has been with the Company since 1998. Mr. Brosnan is a member of the Management Board and Chief Financial Officer of Management AG. Mr. Brosnan is also a member of the Supervisory Board of Morphosys AG, Germany, and of the Board of Administration of Vifor Fresenius Medical Care Renal Pharma, Ltd., Switzerland. Mr. Brosnan was a member of the Board of Directors of Fresenius Medical Care North America (“FMCNA”). Prior to joining Fresenius Medical Care, Mr. Brosnan held senior financial positions at Polaroid Corporation and was an audit partner at KPMG.

MR. WILLIAM VALLE was appointed Chief Executive Officer for FMCNA effective January 2017 and a member of the Management Board of Management AG on February 17, 2017. Prior to that, Mr. William Valle was executive vice president responsible for the dialysis service business and vascular access business of FMCNA from 2014 to 2017. Mr. Valle joined FMCNA in 2009 and has approximately 30 years of experience in the dialysis industry, holding executive positions in sales, marketing and business development at several dialysis companies including Gambro Healthcare, Inc.

DR. OLAF SCHERMEIER was appointed Chief Executive Officer for Global Research and Development on March 1, 2013. Dr. Schermeier serves on the supervisory board of Xenios AG. Prior to FMC-AG & Co. KGaA, Dr. Schermeier served as President of Global Research and Development for Dräger Medical, Lübeck, Germany. Dr. Schermeier has many years of experience in various areas of the health care industry, among others at Charité clinic and at Biotronik, Germany.

MR. KENT WANZEK has been with the Company since 2003. Mr. Wanzek is a member of the Management Board of Management AG since January 1, 2010 with responsibility for Global Manufacturing and Quality and prior to joining the Management Board was in charge of North American operations for the Renal Therapies Group at Fresenius Medical Care North America since 2004. Mr. Wanzek held several senior executive positions with companies in the healthcare industry, including Philips Medical Systems, Perkin-Elmer, Inc. and Baxter Healthcare Corporation.

MR. HARRY DE WIT assumed the role of Chief Executive Officer for the Asia-Pacific Segment on April 1, 2016. Mr. de Wit has worked in the medical device industry for more than 25 years. Mr. de Wit holds a master’s degree in Medicine from the VU University of Amsterdam in the Netherlands and a bachelor’s of Science in Physiotherapy from the School of Physiotherapy of Den Bosch in the Netherlands. Mr. de Wit has been a non-executive member of the Board of Directors of New Asia Investments Pte Ltd. since March 25, 2014.

7

DR. KATARZYNA MAZUR-HOFSÄß assumed the role of Chief Executive Officer for the EMEA Segment on September 1, 2018. Before joining the Company, she had been president for EMEA at the med-tech company Zimmer Biomet since 2013. She has 25 years of professional experience and held various positions in the medical and pharmaceutical industry from her positions, among others at Abbott Laboratories and Roche.

The business address of all members of our Management Board and Supervisory Board is Else-Kröner-Strasse 1, 61352 Bad Homburg, Germany.

The Supervisory Board of FMC-AG & Co. KGaA

Our Supervisory Board consists of six members who are elected by the shareholders of FMC-AG & Co. KGaA in a general meeting. Generally, the terms of office of the members of the Supervisory Board will expire at the end of the general meeting of shareholders of FMC-AG & Co. KGaA, in which the shareholders discharge the Supervisory Board for the fourth fiscal year following the year in which they were elected, but not counting the fiscal year in which such member’s term begins. The most recent election of members of the Supervisory Board took place in May 2016. The next regular elections will take place in 2021. Before the expiration of their term, members of the Supervisory Board may be removed only by a court decision or by a resolution of the shareholders of FMC-AG & Co. KGaA with a majority of three quarters of the votes cast at such general meeting.

Fresenius SE, as the sole shareholder of Management AG, the general partner, is barred from voting for election and/or removal of members of the Supervisory Board as well as from voting on discharge of the Supervisory Board, but it nevertheless has and will retain significant influence over the membership of the Supervisory Board in the foreseeable future. See Item 16.G, “Corporate governance — The Legal Structure of FMC-AG & Co. KGaA” in our 2018 20-F.

The current Supervisory Board consists of five persons, three of whom — Messrs. Schenk (Chairman), Classon (Vice Chairman) and Johnston — are also members of the supervisory board of our General Partner. For information regarding those members of the supervisory board, see “The General Partner’s Supervisory Board,” above.

MS. PASCALE WITZ, 52, has been a member of the Supervisory Board since May 12, 2016. Ms. Witz was the Executive Vice President of Global Diabetes and Cardiovascular of Sanofi S.A. as well as on Sanofi’s executive committee (equivalent to management board), prior to which she held other executive positions in Sanofi S.A. and with GE Healthcare and Becton Dickinson. Ms. Witz has served on the Board of Directors of Regulus Therapeutics Inc. since June 1, 2017, Horizon Pharma plc since August 3, 2017, Perkin Elmer Inc. since October 30, 2017 and Tesaro, Inc. since May 5, 2018. Additionally, Ms. Witz is president of PWH ADVISORS SASU, since November 2016, and the founder of PWH ADVISORS LLC, since May 2018.

PROF. DR. GREGOR ZÜND, 59, has been a member of the Supervisory Board since October 29, 2018. Prof. Dr. Zünd has been Chief Executive Officer of the University Hospital of Zurich since 2016. As Director of Research and Education he has been member of the hospital’s executive board since 2008. In parallel, he has been Managing Director of the Center for Clinical Research and Head of the Surgical Research department at University Hospital Zurich. Until 2001, Prof. Dr. Zünd was senior physician at the clinic for cardiovascular surgery at University Hospital Zurich. He spent several years at Texas Medical Center, Houston, and at Harvard Medical School, Boston. Prof. Dr. Zünd is Professor ad personam at the University of Zurich.

Prof. Dr. Zünd was judicially appointed as a member of the Supervisory Board as the successor to Dr. Gerd Krick, who was a member and the Chairman of the Supervisory Board until May 17, 2018. In line with the applicable recommendation of the German Corporate Governance Code, Prof. Dr. Zünd’s term is limited to the time until the next general meeting of shareholders. At the AGM on May 16, 2019 the Supervisory Board will propose for election as members to the Supervisory Board both Prof. Dr. Zünd and Dr. Dorothea Wenzel (the latter as a successor to Ms. Deborah Doyle McWhinney, who resigned from the Supervisory Board effective November 1, 2018). Dr. Wenzel, who was born in 1969, is Executive Vice President and Head of the Global Business Unit Surface Solutions at Merck KGaA, Darmstadt, Germany. She holds a doctor’s degree in Health Economics (Macroeconomics) and has held various global leadership positions at Merck KGaA, Darmstadt, Germany, and Merck Serono S.A., Geneva, Switzerland, since 2004. Further information on her professional experience is included in the 2019 AGM Invitation. In order to align the terms of the members of the Supervisory Board, the Supervisory Board also intends to propose to limit their respective terms for the time until the shareholders will discharge the Supervisory Board for fiscal year 2020, i.e. at our AGM in 2021.

The principal function of the Supervisory Board is to oversee the management of the Company but, in this function, the supervisory board of a partnership limited by shares has less power and scope for influence than the supervisory board of a stock corporation. The Supervisory Board is not entitled to appoint the General Partner or its executive bodies, nor may it subject the general partner’s management measures to its consent or issue rules of procedure for the general partner. Only the supervisory board of Management AG, elected solely by Fresenius SE, has the authority to appoint or remove members of the General Partner’s Management Board. See Item 16G, “Corporate governance — The legal structure of FMC-AG & Co. KGaA” in our 2018 20-F. Among other matters, the Supervisory Board will, together with the general partner, determine the agenda for the AGM and make recommendations with respect to the approval of the Company’s financial statements and dividend proposals. The Supervisory Board will also propose nominees for election as members of the Supervisory Board. The Audit and Corporate Governance

8

Committee also recommends to the Supervisory Board a candidate as the Company’s auditor to audit our German statutory financial statements to be proposed by the Supervisory Board to our shareholders for approval and, as required by the SEC and NYSE audit committee rules, retains the services of our independent auditors to audit our IFRS financial statements.

Governance Matters and Board Practices

ADSs representing our shares are listed on the NYSE. However, because we are a “foreign private issuer,” as defined in the rules of the SEC, we are exempt from substantially all of the governance rules set forth in Section 303A of the NYSE’s Listed Companies Manual, other than the obligation to maintain an audit committee in accordance with Rule 10A-3 under the Exchange Act, the obligation to notify the NYSE if any of our executive officers becomes aware of any material non-compliance with any applicable provisions of Section 303A, the obligation to file annual and interim written affirmations on forms mandated by the NYSE relating to our compliance with applicable NYSE governance rules, and the obligation to disclose the significant ways in which the governance standards that we follow differ from those applicable to U.S. companies under the NYSE governance rules. Many of the governance reforms instituted by the Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010, including the requirements to provide shareholders with “say-on-pay” and “say-on-when” advisory votes related to the compensation of certain executive officers, are implemented through the SEC’s proxy rules. Because foreign private issuers are exempt from the proxy rules, these governance rules are not applicable to us. However, the compensation system for our Management Board is reviewed by an independent external compensation expert as amendments to the system are made. See item (iv) below, “Compensation of the Management Board.” Similarly, the more detailed disclosure requirements regarding management compensation applicable to U.S. domestic companies (including requirements for pay ratio disclosure and a proposal for disclosure of the relationship between executive compensation actually paid and a registrant’s financial performance issued in 2015 but currently on the SEC’s “long-term actions” agenda without a target date for adoption) are found in SEC Regulation S-K, whereas compensation disclosure requirements for foreign private issuers are set forth in Form 20-F. That form generally limits our compensation disclosure obligations to the information we disclose under German law. In 2015 the SEC also issued its proposed compensation “clawback” rule which would direct U.S. stock exchanges to establish listing standards that would require listed issuers to develop, implement and disclose policies providing for the recovery, under certain circumstances, of incentive-based compensation based on financial information that is subsequently restated. Although not withdrawn, that proposal is also on the SEC’s “long-term actions” agenda. Under the terms and conditions of our Fresenius Medical Care Long-Term Incentive Plan 2016 (hereinafter: “LTIP 2016”) (see item (iv) below, “Compensation of the Management Board and the Supervisory Board”), and the employment contracts concluded with individual members of the Management Board as from January 1, 2018, the Company is entitled to reclaim previously earned and paid compensation components. Such right to reclaim exists in case of relevant violations of internal guidelines or undutiful conduct. If the SEC’s proposed clawback rule is eventually adopted as proposed, requirements of that rule would apply to both U.S. domestic and foreign private issuers and would impose clawback requirements without fraud or other misconduct as a necessary prerequisite. Subject to the exceptions noted above, instead of applying their governance and disclosure requirements to foreign private issuers, the rules of both the SEC and the NYSE require that we disclose the significant ways in which our corporate practices differ from those applicable to U.S. domestic companies under NYSE listing standards.

As a German company FMC-AG & Co. KGaA follows German corporate governance practices. German corporate governance practices generally derive from the provisions of the AktG, capital market related laws, the German Codetermination Act (Mitbestimmungsgesetz, or “MitBestG”) and the German Corporate Governance Code. Our Articles of Association also include provisions affecting our corporate governance. German standards differ from the corporate governance listing standards applicable to U.S. domestic companies which have been adopted by the NYSE. See Item 16.G “Corporate governance” in our 2018 20-F for information regarding our organizational structure, management arrangements and governance, including information regarding the legal structure of a KGaA, management by a general partner, certain provisions of our Articles of Association and the role of the Supervisory Board in monitoring the management of our company by our General Partner. Item 16.G. of our 2018 20-F includes a brief general summary of the principal differences between German and U.S. corporate governance practices, together with, as appropriate, a comparison to U.S. principles or practices.

For information relating to the terms of office of the Management Board and the supervisory board of the General Partner, Management AG, and of the Supervisory Board, and the periods in which the members of those bodies have served in office, see item (iii), “Directors and Senior Management,” above. For information regarding certain compensation payable to certain members of the General Partner’s Management Board after termination of employment, see item (iv), “Compensation of the Management Board and the Supervisory Board” below. Determination of the compensation system and of the compensation to be granted to the members of the Management Board is made by the full supervisory board of Management AG. It is assisted in these matters, particularly evaluation and assessment of the compensation of the members of the General Partner’s management board, by the Human Resources Committee of the General Partner’s supervisory board, the members of which are currently Stephan Sturm (Chairman) Dr. Gerd Krick (Vice Chairman), Rolf A. Classon, William P. Johnston, and Dr. Dieter Schenk.

The Audit and Corporate Governance Committee of the Supervisory Board currently consists of William P. Johnston (Chairman), Rolf A. Classon (Vice Chairman), and Pascale Witz, all of whom are independent directors for purposes of SEC Rule 10A-3 and NYSE Rule 303A.06. The primary function of the Audit and Corporate Governance

9

Committee is to assist FMC-AG & Co. KGaA’s Supervisory Board in fulfilling its oversight responsibilities, primarily through:

· overseeing FMC-AG & Co. KGaA’s accounting and financial reporting processes, the performance of the internal audit function and the effectiveness of the internal control systems;

· overseeing the independence and performance of FMC-AG & Co. KGaA’s outside auditors

· overseeing the effectiveness of our systems and processes utilized to comply with relevant legal and regulatory standards for global healthcare companies, including adherence to our Code of Ethics and Business Conduct;

· overseeing the effectiveness of our risk management system;

· overseeing our corporate governance performance according to the German Corporate Governance Code;

· providing an avenue of communication among the outside auditors, management and the Supervisory Board;

· overseeing our relationship with Fresenius SE & Co. KGaA and its affiliates and reviewing the report of our General Partner on relations with related parties and for reporting to the overall Supervisory Board thereon;

· recommending to the Supervisory Board a candidate as an independent auditor to audit our German statutory financial statements (to be proposed by the Supervisory Board for election by our shareholders at our AGM) and approval of their fees;

· retaining the services of our independent auditors to audit our consolidated financial statements and approval of their fees; and

· pre-approval of all audit and non-audit services performed by our independent auditors.

The Audit and Corporate Governance Committee has also been in charge of conducting the internal investigation described in Item 15B, “Management’s annual report on internal control over financial reporting” in our 2018 20-F.

In 2005, we established a joint committee (the “Joint Committee”) (Gemeinsamer Ausschuss) of FMC-AG & Co. KGaA consisting of four members, two of which are members of the supervisory board of the General Partner, Management AG, designated by the General Partner, and two of which are members of our Supervisory Board elected by the AGM. The two members from the supervisory board of the General Partner are Dr. Gerd Krick and Stephan Sturm. The two members from our Supervisory Board are Rolf A. Classon and William P. Johnston. The Joint Committee advises on and approves certain extraordinary management measures, including:

· transactions between us and Fresenius SE and its subsidiaries if considerable importance is attributed to them and the value exceeds 0.25% of our consolidated revenue, and

· acquisitions and sales of significant participations and parts of companies, the spin-off of significant parts of our business, initial public offerings of significant subsidiaries and similar matters. A matter is “significant” for purposes of this approval requirement if 40% of our consolidated revenues, our consolidated balance sheet total assets or consolidated profits, determined by reference to the arithmetic average of the said amounts shown in our audited consolidated accounts for the previous three fiscal years, are affected by the matter.

Furthermore, a nomination committee prepares candidate proposals for the Supervisory Board and suggests suitable candidates to the Supervisory Board and for its election proposals to the General Meeting. The nomination committee of the Supervisory Board currently consists of Dr. Dieter Schenk (Vice Chairman) and Rolf A. Classon.

The supervisory board of our General Partner, Management AG, is supported by a Regulatory and Reimbursement Assessment Committee, whose members are currently Rolf A. Classon (Chairman), William P. Johnston (Vice Chairman) and Dr. Dieter Schenk. The primary function of this committee is to assist and to represent the supervisory board in fulfilling its responsibilities, primarily through assessing the Company’s affairs in the area of its regulatory obligations and reimbursement structures for dialysis services. In the United States, these reimbursement regulations are mandated by the U.S. Department of Health and Human Services and the Centers for Medicare and Medicaid Services for dialysis services. Similar regulatory agencies exist country by country in the international regions to address the conditions for payment of dialysis treatments. Furthermore, the supervisory board of Management AG has its own nomination committee, which consists of Stephan Sturm (Chairman), Dr. Gerd Krick and Dr. Dieter Schenk.

We are exempt from the NYSE rule requiring companies listed on that exchange to maintain compensation committees and nominating committees consisting of independent directors. See Item 16G, “Corporate governance” in our 2018 20-F. As noted above, the full supervisory board of Management AG (which includes

10

persons who would not be independent directors under the NYSE compensation committee rule) determines the compensation of the members of the Management Board.

(iv) Compensation of the Management Board and the Supervisory Board

Report of the Management Board of Management AG, our General Partner

The Compensation Report of FMC-AG & Co. KGaA summarizes the main elements of the compensation system for the members of the Management Board of Fresenius Medical Care Management AG, the General Partner of FMC-AG & Co. KGaA, and in this regard notably explains the amounts and structure of the compensation paid to the Management Board. Furthermore, the principles and the amount of the compensation of the Supervisory Board of the Company are described. The Compensation Report is part of the Management Report on the annual financial statements and the annual consolidated group financial statements of FMC-AG & Co. KGaA as at December 31, 2018 that we prepare in accordance with German Law (HGB). The Compensation Report is prepared on the basis of the recommendations of the German Corporate Governance Code. The Compensation Report also includes the disclosures as required pursuant to the applicable statutory regulations, notably in accordance with the German Commercial Code (HGB).

Compensation of the Management Board

The Supervisory Board of Fresenius Medical Care Management AG is responsible for determining the compensation of the Management Board members. The Supervisory Board of Fresenius Medical Care Management AG is assisted in this task by a personnel committee, the Human Resources Committee, a committee which is composed of individual members of the Supervisory Board of Fresenius Medical Care Management AG and which is also responsible for the tasks of a compensation committee. The Human Resources Committee is composed of Mr. Stephan Sturm (Chairman), Dr. Gerd Krick (Vice Chairman), Mr. William P. Johnston, Dr. Dieter Schenk and Mr. Rolf A. Classon.

The current Management Board compensation system was approved by the General Meeting of FMC-AG & Co. KGaA on May 12, 2016, and is reviewed by an independent external compensation expert on a regular basis. The objective of the compensation system is to enable the members of the Management Board to participate reasonably in the sustainable development of the Company’s business and to reward them based on their duties and performance as well as their success in managing the Company’s economic and financial position giving due regard to the peer environment.

The amount of the total compensation of the members of the Management Board is measured taking particular account of a horizontal comparison with the compensation of management board members of other DAX-listed companies and similar companies of comparable size and performance in a relevant peer environment. Furthermore, the relation of the overall compensation of the members of the Management Board and that of the senior management as well as the staff overall, as determined by way of a vertical comparison, is taken into account.

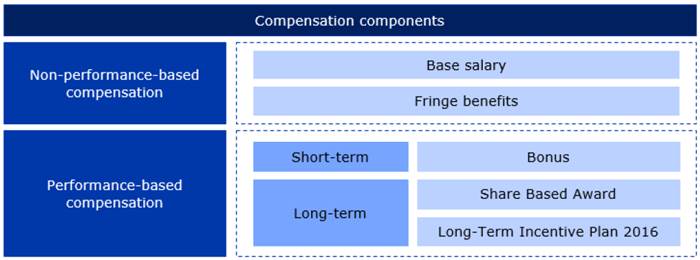

The compensation of the Management Board is, as a whole, performance-based and geared to promoting sustainable corporate development. It consists of three components:

1. non-performance-based compensation (base salary and fringe benefits)

2. short-term performance-based compensation (one-year variable compensation)

3. components with long-term incentive effects (multi-year variable compensation comprised of share-based compensation with cash settlement and stock options, the latter granted in previous fiscal years).

11

Compensation components granted during the fiscal year

I. Non-performance-based compensation

The Management Board members receive a base salary. In Germany or (applicable to Mr. Harry de Wit, who is resident in Hong Kong) Hong Kong, as the case may be, the base salary is paid in twelve equal monthly instalments. To the extent the base salary is paid to members of the Management Board in the U.S., the payment is made in accordance with local customs in twenty-four equal instalments.

Moreover, the members of the Management Board received fringe benefits. These consisted mainly of payments for insurance premiums, the private use of company cars and special payments such as school fees, housing, rent and relocation supplements, reimbursement of fees for the preparation of tax returns, reimbursement of charges, compensation for forfeited compensation benefits from the previous employment relationship, anniversary payments, contributions to pension, accident, life and health insurance as well as tax burden compensation due to varying tax rates applicable in Germany and the U.S. (net compensation) and other benefits in kind and fringe benefits, also in case accruals have been set up therefore.

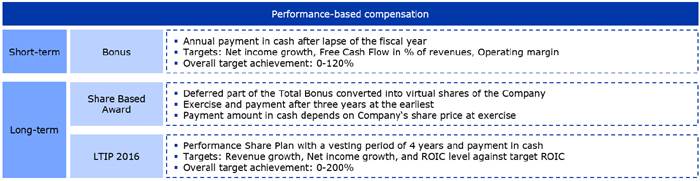

II. Performance-based compensation

Performance-based compensation is awarded as a short-term cash component (one-year variable compensation) and as components with long-term incentive effects (comprising share-based compensation with cash settlement). The one-year variable compensation consists of an amount that is payable without deferral after the end of the fiscal year (“Bonus”) and an amount that is converted into virtual shares of the Company as an amount to be deferred (the so-called Share Based Award, together with the Bonus the “Total Bonus”). The share-based compensation with cash settlement consists of the Share Based Award as well as of Performance Shares, which have been granted in the context of LTIP 2016.

Performance-based compensation components granted in the fiscal year

Under the Fresenius Medical Care Long-Term Incentive Program 2011 (hereinafter: “LTIP 2011”), individual members of the Management Board may under certain conditions also exercise stock options already granted or receive a share-based compensation with cash settlement from already granted phantom stock.

One-year variable compensation and Share Based Award

The amount of the one-year variable compensation and of the Share Based Award depends on the achievement of the following individual and joint targets which are derived from the corporate strategy:

· net income growth,

12

· free cash flow (net cash provided by (used in) operating activities after capital expenditures, before acquisitions and investments) in percent of revenue,

· operating income margin.

The targets are weighted differently depending on the Management Board department or function. In the case of Messrs. Rice Powell and Michael Brosnan (both with corporate group functions) as well as Dr. Olaf Schermeier (Research & Development), the net income growth is weighted with 80%. In the case of Dr. Katarzyna Mazur-Hofsäß (Management Board member since September 1, 2018) and Messrs. William Valle and Harry de Wit (each of them being Management Board members with regional responsibility) as well as Mr. Kent Wanzek (Global Manufacturing & Quality), the net income growth is weighted with 60%. In the case of the members of the Management Board last named, the valuation of the operating margins contributes another 20%. The target free cash flow as a percentage of the sales revenues is uniformly measured with 20% for all members of the Management Board.

| | Net income growth | | Free cash flow

in % of revenues | | Operating margin

(regional) | |

Corporate group function and/or Research & Development | | 80 | % | 20 | % | — | |

Regional functions and/or Global Manufacturing & Quality | | 60 | % | 20 | % | 20 | % |

The degree of the achievement of the specific targets (target achievement) is determined by comparing the actual values with the target values to be achieved. The net income growth is taken into account up to a growth rate of 10%. The targets regarding the respective free cash flow as a percentage of revenues fall within a range of rates between 3% and 6% and are evaluated within the Group or, as the case may be, in the relevant regions. For the benefit of Management Board members with regional responsibilities as well as for the benefit of the Management Board member responsible for Global Manufacturing & Quality, growth of regional operating income margins is compensated within individual targets ranging between 13% and 18.5%, reflecting the particularities of the respective regions and responsibilities:

| | 0% target achievement

(Minimum) | | 100% target achievement | | 120% target achievement (Maximum) | |

Net income growth | | 0.00 | % | 8.00 | % | 10.00 | % |

Free cash flow in % of revenues | | 3.00 | % | 5.71 | % | 6.00 | % |

Operating margin | | Individual target corridors between 13.00% and 18.50%, depending on the respective responsibilities | |

The degree of overall target achievement of each member of the Management Board is determined by the weighted arithmetic mean of the target achievement of the individual targets. Multiplying the degree of the respective overall target achievement by the respective base salary and another fixed multiplier results in the Total Bonus, of which a 75% share is paid out in cash to the Management Board members as one-year variable compensation after approval of the annual financial statements of FMC-AG & Co. KGaA for the respective fiscal year as Bonus. Since the degree of target achievement is limited to a maximum of 120%, the Management Board’s maximum achievable one-year variable compensation has maximum limits (cap).

For the fiscal year and the previous year, the amount of cash compensation payments to members of the Management Board without components with long-term incentive effects consisted of the following:

13

Amount of Cash Payments

in € THOUS

| | | | | | | | | | Short-term | | | | | |

| | | | | | | | | | performance | | | |

| | | | | | | | | | based | | Cash compensation | |

| | Non-performance-based compensation | | compensation | | (without long-term | |

| | Base salary | | Fringe benefits | | Bonus | | incentive components) | |

| | 2018 | | 2017(1) | | 2018 | | 2017(1) | | 2018 | | 2017(1) | | 2018 | | 2017(1) | |

| | | | | | | | | | | | | | | | | |

Members of the Management Board serving as of December 31, 2018 | |

Rice Powell | | 1,270 | | 1,217 | | 195 | | 173 | | 2,376 | | 2,297 | | 3,841 | | 3,687 | |

Michael Brosnan | | 720 | | 735 | | 56 | | 134 | | 1,300 | | 1,315 | | 2,076 | | 2,184 | |

Dr. Katarzyna Mazur- Hofsäß(2) | | 233 | | — | | 844 | (3) | — | | 370 | | — | | 1,447 | | — | |

Dr. Olaf Schermeier | | 490 | | 490 | | 131 | | 134 | | 970 | | 970 | | 1,591 | | 1,594 | |

William Valle(2) | | 792 | | 721 | | 330 | | 88 | | 1,395 | | 1,291 | | 2,517 | | 2,100 | |

Kent Wanzek | | 550 | | 575 | | 126 | | 85 | | 1,076 | | 1,085 | | 1,752 | | 1,745 | |

Harry de Wit | | 480 | | 480 | | 315 | | 321 | | 950 | | 950 | | 1,745 | | 1,751 | |

| | | | | | | | | | | | | | | | | |

Former members of the Management Board who resigned during the fiscal year 2017(4) | |

Ronald Kuerbitz | | — | | 109 | | — | | 43 | | — | | — | | — | | 152 | |

Dominik Wehner | | — | | 425 | | — | | 38 | | — | | 732 | | — | | 1,195 | |

Total: | | 4,535 | | 4,752 | | 1,997 | | 1,016 | | 8,437 | | 8,640 | | 14,969 | | 14,408 | |

(1) Please note for purposes of comparison between the amounts indicated and those of the fiscal year that the compensation is subject to foreign exchange rate fluctuations depending on whether it is contractually denominated in euro (Dr. Katarzyna Mazur-Hofsäß as well as Messrs. Dr. Olaf Schermeier and Harry de Wit) or U.S. dollar (Messrs. Rice Powell, Michael Brosnan, William Valle and Kent Wanzek).

(2) Please note for purposes of comparison of the amounts indicated for the fiscal year that Dr. Katarzyna Mazur-Hofsäß has been appointed as member of the Management Board only with effect as of September 1, 2018 and Mr. William Valle with effect as of February 17, 2017 and, therefore, they have received compensation payments to be set out herein only in each case as of such date.

(3) The other benefits of Dr. Katarzyna Mazur-Hofsäß include a one-off special payment in the amount of €800 THOUS by which Dr. Katarzyna Mazur-Hofsäß was compensated for forfeited compensation benefits from the previous employment relationship.

(4) Mr. Dominik Wehner resigned from the Management Board with effect as of the end of December 31, 2017 and Mr. Ronald Kuerbitz with effect as of February 17, 2017.

The portion of the one-year variable compensation not paid out for the fiscal year in question, amounting to 25% of the Total Bonus, is converted into virtual shares not backed by equity and allocated to the members of the Management Board in the form of the so-called Share Based Award. The Share Based Award is attributed to the compensation components with long-term incentive effect and can be exercised at the earliest after a period of three years following the grant date. In special cases (e.g. occupational disability, entry into retirement, non-renewal of expired employment contracts by the Company), a shorter period may apply. The payment from the Share Based Award is made in cash and depends on the share price of FMC-AG & Co. KGaA upon exercise.

In accordance with the targets achieved in the fiscal year, the members of the Management Board who were members of the Management Board on December 31 of the fiscal year acquired entitlements to Share Based Awards valued at €3,414 THOUS (2017: €3,418 THOUS). Based on the already fixed value, the allocation of the specific number of virtual shares made by the Supervisory Board in principle takes place no sooner than March of the following year on the basis of the then current price conditions of the shares of FMC-AG & Co. KGaA. This number will then serve as a multiplier for the share price on the respective exercise date and, thus, as the basis for the determination of the payment amount of the respective share-based compensation.

14

Functionality of the Total Bonus (Bonus and Share Based Award) in principle

Personal Investment from the Bonus 2018 with Stock Holding Condition

To take adequate account of the business development in the fiscal year 2018, the Supervisory Board decided that the members of the Management Board — by mutual agreement — acquire shares in FMC-AG & Co. KGaA for a portion of their Bonus. The shares acquired in this way may only be sold by the respective member of the Management Board after a period of three years from the date of acquisition has expired. The respective portion of the Bonus for which a member of the Management Board acquires shares in FMC-AG & Co. KGaA depends on the respective overall target achievement.

The net amounts to be invested by the members of the Management Board are as follows:

Personal Investment from the Net Bonus Amount for the Fiscal Year 2018

| | Amount Currency | |

Rice Powell | | 605,219 | | US$ | |

Michael Brosnan | | 315,434 | | US$ | |

Dr. Katarzyna Mazur-Hofsäß | | 80,194 | | € | |

Dr. Olaf Schermeier | | 224,542 | | € | |

William Valle | | 305,466 | | US$ | |

Kent Wanzek | | 344,019 | | US$ | |

Harry de Wit | | 164,970 | | € | |

As a consequence of this personal investment, between 51% and 60% of the Total Bonus for the fiscal year 2018 of the respective member of the Management Board will be invested in shares of the Company or converted into Share Based Awards, which can be sold or exercised, respectively, at the earliest after a period of three years. This calculation is based on the simplified assumption of a personal tax and duty burden of 50% on the payout of the Bonus.

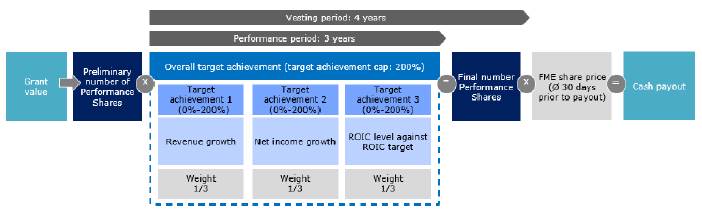

Performance Shares

In addition to the Share Based Award, the members of the Management Board were also granted so-called “Performance Shares” on the basis of the LTIP 2016, as further performance-based component with a long-term incentive effect. The LTIP 2016 was approved in the fiscal year 2016 by the Supervisory Board upon recommendation of the Human Resources Committee and follows on the LTIP 2011, under which, as of the end of 2015, no further stock options may be granted. Performance Shares are virtual compensation instruments not backed by equity. These may provide entitlement to a cash payment depending on the achievement of the performance targets described below and the development of FMC-AG & Co. KGaA’s share price. The LTIP 2016 stipulates that the Management Board members may be granted Performance Shares once or twice a year in the years 2016 to 2018. For the members of the Management Board, the Supervisory Board determines, after due consideration and taking into account the responsibilities and performances of the respective members of the Management Board, the so-called “grant value”, as the initial amount for each grant to be made to members of the Management Board. This grant value is divided by the applicable fair value of a Performance Share at the grant date, in order to determine the number of Performance Shares to be granted. This number may change over a period of three years depending on the degree to which the performance targets are achieved, both the total loss of all granted Performance Shares as well as a doubling (at most) of that number being possible. The number of

15

Performance Shares after the three-year performance period, resulting from the respective target achievement, is considered as vested four years after the date the respective allocation was made. The above-mentioned number of Performance Shares is then multiplied by the average price of the Company’s shares during a thirty-day period prior to the expiration of this vesting period. The resulting amount is paid out in cash to the members of the Management Board for their respective Performance Shares.

The degree of the total target achievement during the three-year performance period is determined based on the three following performance targets which are derived from the long-term corporate strategy:

· revenue growth,

· annual growth of the net income attributable to the shareholders of FMC-AG & Co. KGaA (“net income growth”) as well as

· increase of the return on invested capital (Return on Invested Capital (hereinafter: “ROIC”)).

The target corridors and targets are as set out in the table below:

| | Growth/Increase | | Target achievement | | Weight | |

Performance target 1: Revenue growth | | < 0% | | 0 | % | | |

| | 7% | | 100 | % | 1/3 | |

| | > 16% | | 200 | % | | |

Performance target 2: Net income growth | | < 0% | | 0 | % | | |

| | 7% | | 100 | % | 1/3 | |

| | > 14% | | 200 | % | | |

Performance target 3: ROIC level against target ROIC | | 0.2 percentage points below target ROIC | | 0 | % | | |

| | target ROIC | | 100 | % | 1/3 | |

| | 0.2 percentage points above target ROIC | | 200 | % | | |

Upon the introduction of the LTIP 2016, the initial ROIC target for the year 2016 was set at 7.3%. On this basis, it increases by 0.2 percentage points each year. Consequently, the ROIC target for 2017 was 7.5% and for 2018 was 7.7% (2018). In subsequent years, it will increase to 7.9% (2019) and 8.1% (2020). For each revenue growth and/or any net income growth and ROIC level within the range of the values presented above, the degree of target achievement is linearly interpolated. If the target achievement in relation to the ROIC target in the third year of an assessment period is higher than or equal to the target achievement in each of the two previous years, the ROIC target achievement for the third year applies to all years of the respective assessment period.

Each of these three performance targets accounts for one-third in the calculation of the yearly target achievement, which is calculated for each year of the three-year performance period. The overall target achievement at the end of the three-year performance period is determined by the arithmetic value of these three average yearly target achievements. The overall target achievement can lie in a corridor between 0% and 200% and in this respect has a maximum limit (target achievement cap).

The number of Performance Shares granted to the Management Board members at the beginning of the performance period is multiplied by the percentage of the overall target achievement in order to determine the final number of Performance Shares that form the basis of the cash compensation under the LTIP 2016 as described above.

Functionality of the LTIP 2016 in principle

In the course of the fiscal year, a total of 632,804 Performance Shares (2017: 614,985) were granted to all eligible participants under the LTIP 2016. This includes 73,315 Performance Shares (2017: 73,746) with a total value of

16

€5,783 THOUS (2017: €5,474 THOUS) which were granted to the members of the Management Board. The relevant fair value of the Performance Shares issued in July of the fiscal year amounted on the grant date to €80.55 (2017: €75.12) for grants in euro (applies to Messrs. Dr. Olaf Schermeier and Harry de Wit) and to $94.11 (2017: $86.39) for grants in U.S. dollars (applies to Messrs. Rice Powell, Michael Brosnan, William Valle and Kent Wanzek). Dr. Katarzyna Mazur-Hofsäß (member of the Management Board since September 1, 2018) was granted Performance Shares in December of the fiscal year whose fair value on the grant date was €69.05. At the end of the fiscal year, the Management Board members being in office on December 31, 2018 held a total of 204,693 Performance Shares (2017: 150,993).

For the fiscal year, the value of the share-based compensation with cash settlement granted to the members of the Management Board in each case, is shown respectively compared to the previous year, in the following table:

Long-Term Incentive Components

in € THOUS

| | Share-based | |

| | compensation | |

| | with cash settlement(1) | |

| | 2018 | | 2017(2) | |

Members of the Management Board serving as of December 31, 2018 | | | | | |

Rice Powell | | 2,391 | | 2,247 | |

Michael Brosnan | | 1,307 | | 1,290 | |

Dr. Katarzyna Mazur-Hofsäß(3) | | 858 | | — | |

Dr. Olaf Schermeier | | 1,081 | | 1,039 | |

William Valle(3) | | 1,402 | | 1,265 | |

Kent Wanzek | | 1,084 | | 1,060 | |

Harry de Wit | | 1,074 | | 1,033 | |

| | | | | |

Former members of the Management Board who resigned during the fiscal year 2017(4) | | | | | |

Ronald Kuerbitz | | — | | — | |

Dominik Wehner | | — | | 960 | |

Total: | | 9,197 | | 8,894 | |

(1) This includes Performance Shares pursuant to the LTIP 2016 as well as Share Based Awards granted to the Management Board members during the fiscal year. The share-based compensation amounts are based on the fair value on the grant date.

(2) Please note for purposes of comparison between the amounts indicated and those of the fiscal year that the compensation is subject to foreign exchange rate fluctuations depending on whether it is contractually denominated in euro (Dr. Katarzyna Mazur-Hofsäß as well as Messrs. Dr. Olaf Schermeier and Harry de Wit) or U.S. dollar (Messrs. Rice Powell, Michael Brosnan, William Valle and Kent Wanzek).

(3) Please note for purposes of comparison of the amounts indicated for the fiscal year that Dr. Katarzyna Mazur-Hofsäß has been appointed as a member of the Management Board only with effect as of September 1, 2018 and Mr. William Valle with effect as of February 17, 2017 and, therefore, they have received compensation payments to be set out herein only in each case as of such date.

(4) Mr. Dominik Wehner resigned from the Management Board with effect as of the end of December 31, 2017 and Mr. Ronald Kuerbitz with effect as of February 17, 2017.

The Supervisory Board has agreed on a limitation option for the component with a long-term incentive effect in the event of extraordinary developments.

The components with long-term incentive effect entitle to a cash payment or can be exercised only after the expiration of the predefined waiting and/or vesting periods. Their value is distributed over the waiting periods and is proportionally accounted for as an expense in the respective fiscal year.

The expenses pertaining to components with long-term incentive effects for the fiscal year and for the previous year are set out in the following table:

17

Expenses for Long-Term Incentive Components

in € THOUS

| | | | | | Share-based | | | |

| | | | | | compensation with | | Share-based | |

| | Stock Options | | cash settlement(1) | | compensation | |

| | 2018 | | 2017 | | 2018 | | 2017 | | 2018 | | 2017 | |

| |

Members of the Management Board serving as of December 31, 2018 | |

Rice Powell | | 659 | | 957 | | 391 | | 1,960 | | 1,050 | | 2,917 | |

Michael Brosnan | | 330 | | 174 | | 245 | | 639 | | 575 | | 813 | |

Dr. Katarzyna Mazur-Hofsäß(2) | | — | | — | | 9 | | — | | 9 | | — | |

Dr. Olaf Schermeier | | 236 | | 385 | | 229 | | 1,058 | | 465 | | 1,443 | |

William Valle(2) | | — | | — | | 114 | | 121 | | 114 | | 121 | |

Kent Wanzek | | 295 | | 398 | | 128 | | 1,131 | | 423 | | 1,529 | |

Harry de Wit | | — | | — | | 222 | | 596 | | 222 | | 596 | |

| | | | | | | | | | | | | |

Former members of the Management Board who resigned during the fiscal year 2017 | |

Ronald Kuerbitz(3) | | — | | (438 | ) | — | | (852 | ) | — | | (1,290 | ) |

Dominik Wehner(4) | | — | | 718 | | — | | 3,965 | | — | | 4,683 | |

Total: | | 1,520 | | 2,194 | | 1,338 | | 8,618 | | 2,858 | | 10,812 | |

(1) This includes expenses for Performance Shares under the LTIP 2016, expenses for phantom stock under the LTIP 2011 and expenses for the Share Based Award.

(2) Please note for purposes of comparison of the amounts indicated for the fiscal year that Dr. Katarzyna Mazur-Hofsäß has been appointed as a member of the Management Board only with effect as of September 1, 2018 and Mr. William Valle with effect as of February 17, 2017 and, therefore, they have received compensation payments to be set out herein only in each case as of such date.

(3) Mr. Ronald Kuerbitz resigned from the Management Board with effect as of February 17, 2017. Following Mr. Ronald Kuerbitz’s resignation from the Management Board, no further expenses arose. The negative amounts result from the cancelation, without substitution, of all Share Based Awards granted and not vested by February 17, 2017, all multi-year variable compensation components granted under the LTIP 2011 not vested by February 17, 2017 pursuant to the conditions of the LTIP 2011, and all Performance Shares granted under the LTIP 2016.

(4) Mr. Dominik Wehner resigned from the Management Board with effect as of the end of December 31, 2017. The expenses for long-term incentive components result from the compensation components granted to Mr. Dominik Wehner under the LTIP 2011, the LTIP 2016 and the Share Based Award which are payable or can be exercised, as the case may be, by the relevant regular vesting date pursuant to the applicable conditions.

Focus on sustainable corporate development

The compensation of the Management Board is designed to promote sustainable corporate development. This is ensured, among other things, by the fact that the portion of the long-term compensation is always greater than the portion of short-term compensation. To the extent the portion of the performance-based components with long-term incentive effects (i.e. Performance Shares and Share Based Award) does not reach 50% of the sum of all variable compensation components for the respective fiscal year, it has been contractually provided that the one-year variable compensation is reduced accordingly and the Share Based Award is increased correspondingly.

In addition, on the basis of the LTIP 2016 plan conditions and in accordance with the employment contracts concluded with individual members of the Management Board as from January 1, 2018, the Company is entitled to reclaim already earned and paid compensation components (claw back). Such right to reclaim exists in particular in case of relevant violations of internal guidelines or undutiful conduct.

Stock options and phantom stock

Until the end of the fiscal year 2015 grants under the LTIP 2011, which consisted of the Stock Option Plan 2011 and the Phantom Stock Plan 2011, constituted an essential component of the compensation system for the members of the Management Board. As of the end of the fiscal year 2015 grants under the LTIP 2011 are no longer possible. However, the members of the Management Board may exercise stock options or phantom stock which have already been granted, taking into consideration the blackout periods applicable to the exercise of such instruments, the achievement of defined performance targets as well as, subject to deviating stipulations in the individual case, the continuation of the service and/or employment relationship.

Under the LTIP 2011, a combination of stock options and phantom stock awards was granted to the participants. The number of stock options and phantom stock awards to be granted to the members of the Management Board was determined by the Supervisory Board in its reasonable discretion. In principle, all members of the Management Board were entitled to receive the same total number of stock options and phantom stock awards, whereas the Chairman of the Management Board was entitled to receive double the granted quantity. At the time of the grant, the members of the Management Board were entitled to choose a ratio based on the value of the stock options vs. the value of phantom stock awards in a range between 75:25 and 50:50.