be sufficient to meet the principal and interest obligations on this new debt, therefore, Navios's cash flow will not be negatively impacted. However, the current portion of this new debt will cause current liabilities to further exceed current assets.

While projections indicate that existing cash balances and operating cash flow will be sufficient to service exisiting indebtedness as well as the new indebtedness to be incurred in connection with the six vessels to be acquired, management continues to review the company's debt structure with a view toward increasing working capital. In addition, management is in discussions with lenders and is exploring options for rescheduling to later periods a portion of the debt payments presently scheduled for 2006 and beyond. However, there can be no assurance that Navios's projections can be met or that existing debt can be rescheduled.

There were two counterparties who accounted for more than 10% of Navios's counterparty risk during the six months ended June 30, 2005 and represented 19.3% and 11.2% respectively. During the six months ended June 30, 2004 there were no counterparties who accounted for more than 10% of Navios's counterparty risk.

Navios does not consider inflation to be a significant risk to the cost of doing business in the foreseeable future. Inflation has a moderate impact on operating expenses, drydocking expenses and corporate overhead.

Charter hire payments to third parties for certain chartered-in vessels are accounted for as operating leases. Navios is also committed to making rental payments under operating leases for its office premises. With the exception of payments made during the first half of 2005, future minimum rental payments under Navios’s non-cancelable operating leases are unchanged from the amounts disclosed in footnote 16, Commitments and Contingencies, of the 2004 annual statements included in this prospectus.

As of June 30, 2005, Navios was contingently liable for letters of guarantee and letters of credit amounting to $0.6 million issued by various banks in favor of various organizations. These are collateralized by cash deposits which are included as a component of restricted cash. Navios issued guarantees to third parties totaling $1.0 million at June 30, 2005, as compared to $0 at June 30, 2004, pursuant to which Navios irrevocably and unconditionally guarantees its subsidiaries’ obligations under the dry bulk shipping FFAs. The guarantees remain in effect for a period of 6 months following the last trade date, which was June 30, 2005.

In September 2004, ISE, our legal predecessor, issued 4,250,000 shares of ISE common stock, which, by virtue of the acquisition of Navios by ISE and reincorporation through the merger of ISE with and into Navios, became Navios common stock, to the individuals set forth below for $25,000 in cash, at an average purchase price of approximately $0.006 per share, as follows:

On November 29, 2004, ISE’s board of directors authorized a stock dividend of approximately 0.676 shares of common stock for each outstanding share of common stock, effectively lowering the purchase price to approximately $0.004 per share.

The holders of the majority of these shares will be entitled to make up to two demands that Navios register these shares pursuant to a registration rights agreement previously entered into. The holders of the majority of these shares may elect to exercise these registration rights at any time after the date on which these shares of common stock are released from escrow, which, except in limited circumstances, is not before December 2007. In addition, these stockholders have certain ‘‘piggy-back’’ registration rights on registration statements filed subsequent to the date on which these shares of common stock are released from escrow. Navios will bear the expenses incurred in connection with the filing of any such registration statements.

As of December 16, 2004, Ms. Frangou had advanced a total of approximately $350,000 to ISE, on a non-interest bearing basis, for payment of offering expenses on ISE’s behalf. These loans were paid without interest on December 21, 2004. In addition, Ms. Frangou agreed to loan ISE funds to cover its transaction expenses, including bank commitment fees and deposits, in connection with the acquisition of Navios that exceed the amount of funds held outside of ISE’s trust, which loan in the aggregate amount of approximately $8.6 million was repaid, without interest, at the closing of the acquisition of Navios.

Navios owns 50% of the common stock of Acropolis Chartering and Shipping Inc., or Acropolis. Navios also uses Acropolis as a broker and paid commissions to Acropolis during the years ended December 31, 2004 and 2003 of $877,000, and $597,000, respectively. During the years ended December 31, 2004 and 2003, Navios received dividends of $699,000 and $78,000, respectively. As of December 31, 2004, $147,000 was due to Acropolis. During 2005, Navios received dividends totaling $972,378.

During 2003 and 2002, prior to Navios becoming a public company, Navios used Levant Maritime Company Ltd., or Levant, as an agent. Agency fees paid to Levant amounted to $1,003,000 and $846,000 respectively. Levant was managed by a former director and shareholder of Navios, and Navios ceased using Levant’s services as of December 31, 2003.

In November 2002, prior to Navios becoming a public company, a predecessor company to Navios issued a promissory note for $367,000 to Kastella Trading, Inc., or Kastella, a Marshall Islands Corporation. Interest accrued at 4.6% per year and was payable at the note’s due date. Kastella was wholly-owned by one of the predecessor company’s executives. This loan was repaid in full in 2004.

In August 2004, prior to Navios becoming a public company, Navios advanced to one of its shareholders and executive officers the amount of $50,000. The loan was repaid in full during the year. No interest was calculated for the duration of this loan.

All ongoing and future transactions between Navios and any of its officers and directors or their respective affiliates, including loans by Navios’s officers and directors, if any, will be on terms believed by Navios to be no less favorable than are available from unaffiliated third parties, and such transactions or loans, including any forgiveness of loans, will require prior approval, in each instance by a majority of Navios’s uninterested ‘‘independent’’ directors or the members of Navios’s board who do not have an interest in the transaction, in either case who had access, at Navios’s expense, to its attorneys or independent legal counsel.

Quantitative and Qualitative Disclosure About Market Risks

Navios is exposed to certain risks related to interest rate, foreign currency and charter rate risks. To manage these risks, Navios uses interest rate swaps (for interest rate risk), forward exchange contracts (for foreign currency risk), and FFAs (for charter rate risk).

Interest Rate Risk

Debt Instruments – On June 30, 2005 and December 31, 2004, Navios had a total of $50.0 million and $50.5 million, respectively, in long term indebtedness. The debt is dollar denominated and bears interest at a floating rate. The new senior secured credit facility with HSH Nordbank AG, established by ISE to provide a portion of the funds necessary to acquire Navios, was assumed by Navios in the

45

acquisition/reincorporation. $514.4 million was borrowed under this facility on August 25, 2005. The interest rate under the facility, depending on the tranche being borrowed, is LIBOR or the applicable interest rate swap rate, plus the costs of complying with any applicable regulatory requirements and a margin ranging from 1.5% to 2.75% per annum. Amounts drawn under the facility are secured by the assets of Navios. The fair market value of Navios’s fixed rate debt was, and continues to be, its face value. Because the interest on the debt is at a floating rate, changes in interest rates would have no effect on the value of the debt.

Interest Rate Swaps – Navios has entered into interest rate swap contracts to hedge its exposure to variability in its floating rate long term debt. Under the terms of the interest rate swaps Navios and the banks agreed to exchange, at specified intervals, the difference between a paying fixed rate and floating rate interest amount calculated by reference to the agreed principal amounts and maturities. The interest rate swaps allow Navios to convert long-term borrowings issued at floating rates into equivalent fixed rates.

At December 31, 2004, Navios had entered into a total of four swaps with the Royal Bank of Scotland and Alpha Bank with a total notional principal amount of $49.7 million. The swaps were entered into at various points in 2001 and mature in 2006 and 2010 in the respective amounts of $26.0 million and $23.7 million.

Navios estimates that it would have to pay $3.1 million to terminate these agreements as of December 31, 2004. Navios’s net exposure to interest rate fluctuations is approximately $0.8 million at December 31, 2004. Navios’s net exposure is based on total floating rate debt less the notional principal of floating to fixed interest rate swaps. A one hundred basis point change in interest rates would increase or decrease interest expense by $8,000 per year as of December 31, 2004. The swaps are set by reference to the difference between the 3 month LIBOR (which is the base rate under Navios’s long term borrowings) and the yield on the US ten year treasury bond. The swaps effectively fix interest rates at 5.5%. However, once market interest rates exceed 7.5%, Navios would only be subject to the market interest rates in excess of the 7.5%.

Foreign Currency Risk

Foreign Currency Forward Contracts – In general, the shipping industry is a dollar dominated industry. Revenue is set in US dollars, and approximately 94% of Navios’s expenses are also incurred in US dollars. To cover expenses incurred in Euros, Navios entered into short term forward exchange contracts. These contracts hedge against the fluctuations of the Euro against the US Dollar. Through these contracts Navios purchased €2.5 million at an average exchange rate of $1.32 with a fair value of $3.3 million in the year ending December 31, 2004. These contracts mature within twelve months of the balance sheet date for all periods. Contracts entered into during 2004 will settle monthly between March and June 2005. The fair value of these contracts as of December 31, 2004, amounted to $126,000.

Charter Rate Risk

Forward Freight Agreements (FFAs) – Navios enters into FFAs as economic hedges relating to identifiable ship and/or cargo positions and as economic hedges of transactions that Navios expects to carry out in the normal course of its shipping business. By using FFAs, Navios manages the financial risk associated with fluctuating market conditions. The effectiveness of a hedging relationship is assessed at its inception. If an FFA qualifies for hedge accounting, any gain or loss on the FFA is first recognized when measuring the profit or loss of related transaction. However, for the years ended December 31, 2004 and 2003, none of the FFAs qualified for hedge accounting, and, accordingly, all gains or losses from FFAs have been recorded in the statement of operations for such periods. It is anticipated that FFAs will continue to be so treated, and, accordingly, may result in material fluctuation in results from operations.

FFAs cover periods ranging from one month to one year and are based on time charter rates or freight rates on specific quoted routes. FFAs are executed either over-the-counter, between two

46

parties, or through NOS ASA, a Norwegian clearing house. FFAs are settled in cash monthly based on publicly quoted indices. NOS ASA requires both base and margin collaterals. Certain portions of these collateral funds may be restricted at any given time, as determined by NOS ASA. On June 30, 2005 and 2004, Navios’s restricted cash with NOS ASA was $2.9 million and $3.5 million, respectively, including $0.6 million (2005) and $0.7 million (2004) held in security in the form of letters of guarantee or letters of credit. As of December 31, 2004, and December 31, 2003, Navios’s restricted balance with NOS ASA was $2.8 million and $0, respectively.

Navios is exposed to market risk in relation to its FFAs and could suffer substantial losses from these activities in the event expectations are incorrect. Navios trades FFAs with an objective of both economically hedging the risk on the fleet, specific vessels or freight commitments and taking advantage of short term fluctuations in market prices. The total principal amount of open FFAs at December 31, 2004 was approximately $1.8 million. A ten percent change in underlying freight market indices would increase or decrease net income by $1.0 million as of December 31, 2004.

47

BUSINESS INFORMATION ABOUT NAVIOS

Introduction

Navios is one of the leaders in seaborne shipping, specializing in the worldwide carriage, trading, storing, and other related logistics of international dry bulk cargo transportation. For over 50 years, Navios has worked with raw materials producers, agricultural traders and exporters, industrial end-users, shipowners, and charterers and, more recently, acquired an in-house technical ship management expertise. Navios’s core fleet, the average age of which is approximately 3.5 years, consists of a total of 27 vessels, aggregating approximately 1.8 million deadweight tons or dwt. Navios owns six modern Ultra-Handymax (50,000-55,000 dwt) vessels and operates 21 Panamax (70,000-83,000 dwt) and Ultra-Handymax vessels under long-term time charters, 15 of which are currently in operation, with the remaining seven scheduled for delivery at various times over the next two years. Navios has options, many of which are ‘‘in the money,’’ to acquire 13 of the 21 time chartered vessels. The owned vessels have a substantial net asset value, and the vessels controlled under the in-charters are at rates well below the current market. Operationally, Navios has, at various times over the last two years, deployed over 50 vessels at any one time, including its core fleet.

Navios also owns and operates the largest bulk transfer and storage facility in Uruguay. While a relatively small portion of Navios’s overall enterprise, management believes that this terminal is a stable business with strong growth and integration prospects.

The International Dry Bulk Shipping Industry

Industry Overview

The marine industry provides the only practicable and cost-effective means of transporting large volumes of basic commodities and finished products over long distances. In 2004, approximately 2.5 billion tons of dry bulk cargo was transported by sea, comprising more than one-third of all international seaborne trade. The breakdown of all seaborne trade by main commodity type is shown below.

World Seaborne Trade 2004

|  |  |  |  |  |  |  |  |  |  |

| |  | Tons (Million) |  | % Total |

| All Cargo |  | | | |  | | | |

| Dry Bulk |  | | 2,543 | |  | | 39.1 | % |

| Liquid (Oils/Gases/Chemicals |  | | 2,520 | |  | | 38.8 | % |

| Container Cargo |  | | 928 | |  | | 14.3 | % |

| Non-Container General Cargo |  | | 510 | |  | | 7.8 | % |

| Total |  | | 6,501 | |  | | 100 | % |

| Trade in Drybulk Commodities Only |  | | | |  | | | |

| Coal |  | | 650 | |  | | 10.0 | % |

| Iron Ore |  | | 587 | |  | | 9.0 | % |

| Grain |  | | 248 | |  | | 3.8 | % |

| Minor Bulks |  | | 1,057 | |  | | 16.3 | % |

| Total |  | | 2,543 | |  | | 39.1 | % |

|

|  |

| Source: Drewry |

Dry bulk cargoes consist primarily of the major and minor bulk commodities. The following is an overview, categorized by cargo type, of the primary trade routes and principal vessel sizes used for shipments of the major (coal, iron, ore and grain) and minor bulk cargoes:

|  |  |

| • | Coal. There are two principal types of coal: steam (or thermal) coal and coking (or metallurgical) coal. The main exporters of coal are Australia, South Africa, Indonesia, United |

48

|  |  |

| | States, Colombia, Canada, and China. The main importers of coal are Europe, Japan, South Korea, Taiwan, China, India, and the Middle East. The coking coal market is closely linked to demand from integrated steel makers who use coking coal in blast furnaces to make pig iron which, in turn, is converted into steel. Steam coal is mainly used in the production of electricity, and the transportation of steam coal is the backbone of the Capesize and Panamax markets. Increases in steam coal demand have been significant, as both developed and developing nations require increasing amounts of electric power. |

|  |  |

| • | Iron Ore. Until the start of the 1990s, when it was overtaken by the combined steam and coking coal sectors, iron ore was the largest dry bulk trade. It remains, however, the primary employer of the largest ships in the dry bulk fleet. Used principally as the primary raw material in steel making, iron ore imports are dominated by Europe, Japan, China, South Korea, and the United States. The primary exporters of iron ore are Brazil, Australia and India. Other significant exporters include Canada, Sweden, South Africa, Venezuela, Mauritania, Peru and Chile. |

|  |  |

| • | Grain. The principal exporters of grain are Canada, United States, Europe, Australia, and South America. The principal importers are Japan, South Korea, China, South East Asia, the Middle East, North Africa, and Europe. Grain production is subject to both growing conditions and natural disasters which affect crop yields and demand patterns. |

|  |  |

| • | Minor Bulk Cargoes. Minor bulk cargoes include steel products, forest products, agricultural products, bauxite and alumina, phosphates, petcoke, cement, sugar, salt, minerals, scrap metal, and pig iron. Minor dry bulk cargoes are not a major component of Capesize or Panamax carrier demand, although Panamax vessels also transport cargoes such as bauxite, phosphate rock, sulphur, some fertilizers, various other ores and minerals and a few agribulks. |

Demand for Dry Bulk Vessels

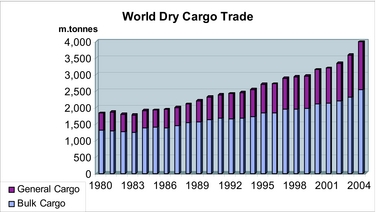

The dry bulk trade is influenced by the underlying demand for the dry bulk commodities which, in turn, is influenced by the level of worldwide economic activity. Generally, growth in gross domestic product, or GDP, and industrial production correlate with peaks in demand for seaborne transportation. The following chart demonstrates a steady increase in world dry cargo trade over the last two decades, with an average increase of 4% over the last five years:

Source: Drewry

49

Moreover, the dry bulk shipping market over the last two years has displayed strong industry fundamentals, driven primarily by:

|  |  |

| • | Economic growth and urbanization in China, Brazil, India, and the Far East, with attendant increases in steel production, power generation, and grain consumption, leading to greater demand for dry bulk shipping; |

|  |  |

| • | Inefficient transportation bottlenecks due to long term under-investment in global transportation infrastructure and high demand for dry bulk commodities; and |

|  |  |

| • | Limited capacity of shipyards due to the orderbook for tankers and container ships, restricting future deliveries of dry bulk newbuildings.. |

Historically, certain economies have acted from time to time as the ‘‘locomotive’’ of the dry bulk carrier market. In the 1990s, Japan acted as the locomotive with demand for seaborne trade correlating with Japanese industrial production. Currently, China is the main driving force behind the increase in seaborne dry bulk trades and the demand for dry bulk carriers. Chinese imports of coal, iron ore, and, more recently, steel products (China used to be an exporter but, due to its own high demand, now needs to import steel products) have also increased sharply in the last five years, thereby creating additional demand for dry bulk carriers. Management expects India, with its large population, economic growth and urbanization to sustain this trend of greater demand for dry bulk shipping.

Globally, total seaborne trade in all dry bulk commodities increased from 1.97 billion tons to 2.54 billion tons, representing an increase of 29.2%, as shown by the following chart:

Seaborne Drybulk Trade (Million Tons)

|  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |

| Year |  | Iron

Ore |  | Steam

Coal |  | Coking

Coal |  | Grains |  | Major

Bulks |  | Minor

Bulks |  | Total |  | % Change |

| 1999 |  | | 431 | |  | | 309 | |  | | 173 | |  | | 220 | |  | | 1,133 | |  | | 835 | |  | | 1,968 | |  | | 1.1 | |

| 2000 |  | | 454 | |  | | 344 | |  | | 179 | |  | | 230 | |  | | 1,207 | |  | | 901 | |  | | 2,108 | |  | | 7.2 | |

| 2001 |  | | 452 | |  | | 384 | |  | | 181 | |  | | 234 | |  | | 1,251 | |  | | 890 | |  | | 2,142 | |  | | 1.6 | |

| 2002 |  | | 484 | |  | | 386 | |  | | 184 | |  | | 245 | |  | | 1,299 | |  | | 920 | |  | | 2,219 | |  | | 3.6 | |

| 2003 |  | | 524 | |  | | 430 | |  | | 189 | |  | | 240 | |  | | 1,383 | |  | | 957 | |  | | 2,340 | |  | | 5.5 | |

| 2004 |  | | 587 | |  | | 454 | |  | | 196 | |  | | 248 | |  | | 1,485 | |  | | 1,057 | |  | | 2,543 | |  | | 8.7 | |

|

|  |

| Source: Drewry |

Another industry measure of vessel demand is ton-miles, which is calculated by multiplying the volume of cargo moved on each route by the distance of such voyage. Between 1999 and 2004, ton-mile demand in the dry bulk sector increased by 25%, to 11,511 billion ton-miles.

Ton-Mile Demand

|  |  |  |  |  |  |  |  |  |  |

| Year |  | Billion Ton

Miles |  | % Change |

| 1999 |  | | 9.204 | |  | | 0.8 | |

| 2000 |  | | 9.824 | |  | | 6.7 | |

| 2001 |  | | 9.958 | |  | | 1.4 | |

| 2002 |  | | 10.226 | |  | | 2.7 | |

| 2003 |  | | 10.804 | |  | | 5.7 | |

| 2004 |  | | 11,511 | |  | | 6.5 | |

|

|  |

| Source: Drewry |

50

Supply of Dry Bulk Vessels

The global dry bulk carrier fleet is divided into four categories, based on a vessel’s carrying capacity. These categories consist of:

|  |  |

| • | Capesize. These vessels, which are over 80,000 dwt, are the largest size of dry bulk carriers. Capesize vessels typically carry relatively low value cargoes for which large cargo lot sizes are of primary importance. Consequently, Capesize vessels are mainly used to transport iron ore or coal and, to a lesser extent, grains, primarily on long-haul routes. These vessels are not capable of traversing the Panama Canal due to their size and, therefore, lack the flexibility of smaller vessels. |

|  |  |

| • | Panamax. These vessels range in size from 50,000 to 80,000 dwt and are designed with the maximum width that will allow them to travel fully-loaded through the Panama Canal. They are also often engaged in many major international trade routes that do not involve transit through the Panama Canal. Panamax bulk carriers are mainly used to transport major bulk cargoes, such as coal and grain and, to a lesser degree, iron ore, as well as a number of minor bulk cargoes, such as bauxite, petroleum coke, some fertilizers and fertilizer raw materials, and various minerals. |

|  |  |

| • | Handymax and Ultra-Handymax. Vessels in this category range in size from 30,000 to 55,000 dwt and are often equipped with cargo loading and unloading gear, such as cranes, which makes them well suited to call at ports that either are not equipped with gear for loading or discharging of cargo or have draft restrictions. These vessels can trade on worldwide routes carrying mainly grains and minor bulk cargoes. |

|  |  |

| • | Handysize. Vessels in this sector are the smallest (under 30,000 dwt) and carry finished products and minor bulk cargoes, although, increasingly, vessels in this sector are now more limited to trading regionally and in coastal waters. |

The supply of dry bulk shipping capacity, measured by the amount of suitable vessel tonnage available to carry cargo, is determined by the size of the existing worldwide dry bulk fleet, the number of new vessels on order, the scrapping of older vessels, and the number of vessels out of active service (i.e., laid up or otherwise not available for hire). In addition to prevailing and anticipated freight rates, factors that affect the rate of newbuilding, scrapping, and laying-up include newbuilding prices, second-hand vessel values in relation to scrap prices, costs of bunkers and other voyage expenses, costs associated with classification society surveys, normal maintenance and insurance coverage, the efficiency and age profile of the existing fleets in the market, and government and industry regulation of maritime transportation practices.

The supply of dry bulk vessels is not only a result of the number of ships in service, but also the operating efficiency of the fleet. For example, during times of very heavy commodity demand, bottlenecks develop in the form of port congestion, which absorbs fleet capacity through delays in loading and discharging of cargo. A particularly extreme example occurred during the steam coal demand boom in 1980, when enormous queues developed at the main coal loading ports in the United States and Australia. A similar situation developed in the second half of 2003, when port delays in Australia and China were estimated to have reduced fleet supply by at least 10%.

51

As of September 30, 2005, the world’s dry bulk fleet totaled 6,136 vessels, aggregating approximately 339.9 million dwt. The average age of the fleet is approximately 16 years. 41% of the world dry bulk fleet is over 20 years old, while the orderbook for newbuildings represents 20% of the existing world dry bulk fleet, as shown in the following chart:

The Dry Bulk Carrier Fleet — September 30, 2005

|  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |

| |  | Fleet Profile |  | Ships Older Than 20 Years of Age |  | Orderbook |

| |  | No. of

Ships |  | Dwt

Million |  | % of

Fleet |  | No. of

Ships |  | % of

Class |  | Scrap

Age(1) |  | No. of

Ships |  | Dwt

Million |  | % of

Class |

| Capesize |  | | 637 | |  | | 107.0 | |  | | 31.5 | |  | | 65 | |  | | 10.2 | |  | | 27 | |  | | 137 | |  | | 27.1 | |  | | 25.3 | |

| Panamax |  | | 1,280 | |  | | 92.1 | |  | | 27.1 | |  | | 310 | |  | | 24.2 | |  | | 24 | |  | | 289 | |  | | 23.0 | |  | | 24.9 | |

| Handymax |  | | 2,291 | |  | | 97.1 | |  | | 28.6 | |  | | 937 | |  | | 40.9 | |  | | 26 | |  | | 339 | |  | | 16.3 | |  | | 16.8 | |

| Handysize |  | | 1,928 | |  | | 43.7 | |  | | 12.9 | |  | | 1,174 | |  | | 60.9 | |  | | 28 | |  | | 82 | |  | | 1.8 | |  | | 4.1 | |

| Total |  | | 6,136 | |  | | 339.9 | |  | | 100.0 | |  | | 2,541 | |  | | 41.4 | |  | | 26 | |  | | 847 | |  | | 68.1 | |  | | 20.0 | |

|

|  |

| (1) Average vessel age at scrapping [1999-2004] |

Source: Drewry

The level of scrapping activity is generally a function of scrapping prices in relation to current and prospective charter market conditions, as well as operating, repair and survey costs. The following table illustrates the scrapping rates of dry bulk carriers for the periods indicated.

|  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |

| |  | 1999 |  | 2000 |  | 2001 |  | 2002 |  | 2003 |  | 2004 |

| Dry Bulk Carrier Scrapping: |  | | | |  | | | |  | | | |  | | | |  | | | |  | | | |

| Capesize |  | | | |  | | | |  | | | |  | | | |  | | | |  | | | |

| No. of vessels |  | | 13 | |  | | 4 | |  | | 3 | |  | | 8 | |  | | 2 | |  | | 1 | |

| Dwt (in millions) |  | | 1.2 | |  | | 0.5 | |  | | 0.4 | |  | | 0.9 | |  | | 0.3 | |  | | 0.1 | |

| % of fleet scrapped |  | | 1.5 | |  | | 0.6 | |  | | 0.5 | |  | | 1.0 | |  | | 0.3 | |  | | 0.1 | |

| Panamax |  | | | |  | | | |  | | | |  | | | |  | | | |  | | | |

| No. of vessels |  | | 45 | |  | | 11 | |  | | 28 | |  | | 18 | |  | | 7 | |  | | 1 | |

| Dwt (in millions) |  | | 3 | |  | | 0.7 | |  | | 1.9 | |  | | 1.2 | |  | | 0.5 | |  | | 0.1 | |

| % of fleet scrapped |  | | 4.1 | |  | | 1.0 | |  | | 2.5 | |  | | 1.5 | |  | | 0.6 | |  | | 0.11 | |

| Handymax |  | | | |  | | | |  | | | |  | | | |  | | | |  | | | |

| No. of vessels |  | | 53 | |  | | 40 | |  | | 40 | |  | | 25 | |  | | 29 | |  | | 0 | |

| Dwt (in millions) |  | | 2.2 | |  | | 1.5 | |  | | 1.5 | |  | | 0.9 | |  | | 1.1 | |  | | 0 | |

| % of fleet scrapped |  | | 3.1 | |  | | 2.0 | |  | | 1.9 | |  | | 1.1 | |  | | 1.3 | |  | | 0.0 | |

| Handysize |  | | | |  | | | |  | | | |  | | | |  | | | |  | | | |

| No. of vessels |  | | 66 | |  | | 50 | |  | | 62 | |  | | 64 | |  | | 25 | |  | | 5 | |

| Dwt (in millions) |  | | 1.5 | |  | | 1.2 | |  | | 1.4 | |  | | 1.6 | |  | | 0.6 | |  | | 0.1 | |

| % of fleet scrapped |  | | 3.2 | |  | | 2.6 | |  | | 3.2 | |  | | 3.7 | |  | | 1.4 | |  | | 0.3 | |

| Total |  | | | |  | | | |  | | | |  | | | |  | | | |  | | | |

| No. of vessels |  | | 177 | |  | | 105 | |  | | 123 | |  | | 115 | |  | | 63 | |  | | 7 | |

| Dwt (in millions) |  | | 8.3 | |  | | 3.8 | |  | | 5.2 | |  | | 4.7 | |  | | 2.4 | |  | | 0.3 | |

| % of fleet scrapped |  | | 3.1 | |  | | 1.4 | |  | | 1.8 | |  | | 1.6 | |  | | 0.8 | |  | | 0.1 | |

|

Source: Drewry

The average age at which a vessel is scrapped over the last five years has been 26 years.

52

Charter Market

Dry bulk carriers are employed in the market through a number of different chartering options. The general terms typically found in these types of contracts are described below.

|  |  |

| • | Bareboat Charter. A bareboat charter involves the use of a vessel usually over longer periods of time ranging over several years. In this case, all voyage related costs, mainly vessel fuel and port dues, as well as all vessel-operating expenses, such as day-today operations, maintenance, crewing, and insurance, are for the charterer’s account. The owner of the vessel receives monthly charter hire payments on a U.S. Dollar per diem basis and is responsible only for the payment of capital costs related to the vessel. |

|  |  |

| • | Time Charter. A time charter involves the use of the vessel, either for a number of months or years or for a trip between specific delivery and redelivery positions, known as a trip charter. The charterer pays all voyage-related costs. The owner of the vessel receives semi-monthly charter hire payments on a U.S. Dollar per diem basis and is responsible for the payment of all vessel operating expenses and capital costs of the vessel. |

|  |  |

| • | Voyage Charter. A voyage charter involves the carriage of a specific amount and type of cargo on a load port-to-discharge port basis, subject to various cargo handling terms. Most of these charters are of a single voyage nature, as trading patterns do not encourage round voyage trading. The owner of the vessel receives one payment derived by multiplying the tonnage of cargo loaded on board by the agreed upon freight rate expressed on a U.S. Dollar per ton basis. The owner is responsible for the payment of all voyage and operating expenses, as well as the capital costs of the vessel. |

|  |  |

| • | Contract of Affreightment. A contract of affreightment, or COA, relates to the carriage of multiple cargoes over the same route and enables the COA holder to nominate different ships to perform the individual voyages. Essentially, it constitutes a series of voyage charters to carry a specified amount of cargo during the term of the COA, which usually spans a number of years. All of the ship's operating expenses, voyage expenses, and capital costs are borne by the ship owner. Freight normally is agreed on a U.S. per ton basis. |

|  |  |

| • | Spot Charter. Spot chartering activity involves chartering either on a single voyage or a trip charter. |

Charter Rates

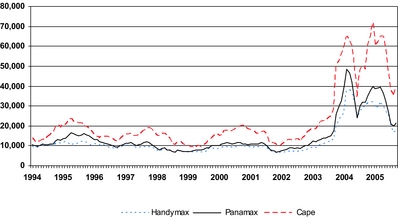

Charter (or hire) rates paid for dry bulk carriers are generally a function of the underlying balance between vessel supply and demand. Over the past 25 years, dry bulk cargo charter rates have passed through cyclical phases with these changes in the vessel supply-demand imbalance, creating a pattern of rate ‘‘peaks’’ and ‘‘troughs.’’ In 2003 and 2004, rates for all sizes of dry bulk carriers strengthened to their highest levels ever. The most crucial driver of this upsurge in charter rates was the high level of demand for raw materials imported by China.

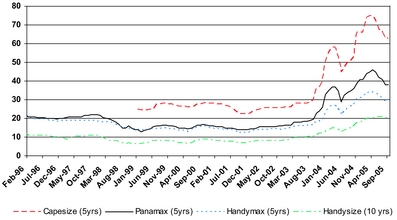

In the time charter market, rates vary depending on the length of the charter period as well as ship specific factors, such as age, speed, and fuel consumption. Generally, short-term time charter rates are higher than long-term charter rates. The market benchmark tends to be a 12-month time charter rate, based on a modern vessel. The following chart shows one year time charter rates for Handymax, Panamax and Capesize dry bulk carriers between 1996 and September 2005.

53

Time Charter Rates

(in U.S. dollars per day)

Source: Drewry

In the voyage charter market, rates are influenced by cargo size, commodity, port dues, and canal transit fees, as well as delivery and redelivery regions. In general, larger cargo size is quoted at a lower per ton rate than a smaller cargo size. Routes with costly ports or canals command higher rates than routes with low port dues and no canals to transit. Voyages with a load port within a region that includes ports where vessels usually discharge cargoes or a discharge port within a region with ports where vessels load cargoes would also be quoted at lower rates. These voyages increase vessel utilization by reducing the unloaded portion (or ballast leg) that was included in the calculations of the previous charter back to the loading area.

The Baltic Exchange, an independent organization comprised of shipbrokers, shipping companies, and other shipping players, provides daily independent shipping market information and has created freight rate indices reflecting the average freight rates (that incorporate actual business concluded as well as daily assessments provided to the exchange by a panel of independent shipbrokers) for the major bulk carrier trading routes. These indices include the Baltic Panamax Index (BPI, the index with the longest history), and, more recently, the Baltic Capesize Index (BCI) and the Baltic Handymax Index (BHI).

Accompanying the recent surge in freight rates has been renewed interest in freight forward agreements, or FFAs. An FFA is a freight forward swap agreement between counterparties or entered into over an exchange, where the settlement price designated for a future period is derived from the Baltic Exchange indices. FFAs enable a market participant thereby manage their exposure to a fluctuating market.

Vessel Prices

The shipping industry is currently in a relatively unusual position. Each of its major sectors — dry bulk carriers, tankers, and containerships — has been prospering. This has triggered an upsurge in newbuilding activity in each sector. In addition, newbuilding demand is also strong for Liquefied Natural Gas, or LNG, carriers, and other specialized vessels. This is significant because the near term availability of newbuilding berths for vessel delivery before the third and fourth quarters of 2008 is scarce, which directly impacts the supply of new vessels to the market. Thus, the combination of shortage of berth space, rising demand for vessels, and rising raw material costs (especially the price of steel), has greatly increased newbuilding prices.

54

The following tables present the average prices for both secondhand and newbuilding dry bulk carriers for the periods indicated.

Dry Bulk Carrier Newbuilding Prices

(in millions of U.S. dollars)

Source: Drewry

Dry Bulk Carrier Secondhand Prices

(in millions of U.S. dollars)

Source: Drewry

In the secondhand market, the steep increase in newbuilding prices and the strength in the charter market have also affected vessel prices. With vessel earnings running at relatively high levels and a limited availability of newbuilding berths, the ability to deliver a vessel early has resulted in increases in secondhand prices, especially for modern tonnage.

55

Navios Maritime Holdings Inc.

Navios Corporation, the legal predecessor company to Navios, was incorporated in 1954 as a corporate subsidiary of United States Steel Corporation for the transportation of its iron ore requirements. In the mid-1970s, Navios transformed itself from a captive ore carrier for United States Steel to a third party cargo carrier that, in the mid-1980s, was sold to Fednav Limited, Canada’s largest international shipping group. From 1989 until 2002, Navios underwent a series of leveraged management buyouts and corporate restructuring with the support of various shipping groups, while at the same time adapting its business model to suit the changing requirements of the dry bulk shipping market.

Navios Corporation, a Marshall Islands corporation, and Anemos Maritime Holdings, a Cayman Islands company, merged effective December 11, 2002. This business combination marked the transformation of Navios from being primarily an operator of large physical contracts of affreightment, based on relationships with industrial end-users, to a leading international maritime enterprise focused on the transportation and handling of dry bulk cargoes through the ownership, operation, and chartering of vessels. Anemos was incorporated in the Cayman Islands in February 1999 to hold all of the capital stock of certain Cayman Islands and Liberian corporations that owned and operated six older dry bulk vessels in the international shipping market. Anemos was also formed to hold the capital stock of nine Marshall Islands corporations that each contracted with Sanoyas Shipyard in Mizushima, Japan for the construction of a series of dry bulk ultra-handymax vessels. Another subsidiary of Anemos, named Levant Maritime International SA, which was originally incorporated in Liberia but was later redomiciled in the Marshall Islands and re-named Navios ShipManagement Inc., was responsible for the technical management of all vessels owned by Anemos’s subsidiaries, including the older vessels, and for the supervision of the construction of the nine newbuildings at the Sanoyas shipyard. Commercial management of the Anemos fleet was contracted to Levant Maritime Co. Ltd., a UK company based in London which was affiliated with two of Anemos’s former minority shareholders. Anemos modernized its fleet by selling off the older vessels, as the newbuildings delivered from the shipyard, between 2000 and early 2003. The personnel of Navios ShipManagement Inc. include the manager of the Piraeus office, a former senior marine classification society surveyor with B.Sc. and M.Sc. degrees in mechanical engineering from the Illinois Institute of Technology and experience in supervising newbuilding construction; a Greek-educated naval architect; and three port captains and two marine superintendent engineers, who are all graduates of official Greek merchant marine academies, and who all served as officers on bulk carriers before assuming responsibilities and gaining relevant experience in shore-side technical ship management.

Today, Navios maintains offices in Piraeus, Greece, Norwalk, Connecticut and Montevideo, Uruguay. Navios’s corporate structure is functionally organized: commercial ship management and risk management are conducted through Navios Corporation and its wholly-owned subsidiaries (out of South Norwalk and Piraeus, respectively), while the ownership and technical management of Navios’s owned vessels are conducted through Anemos Maritime Holdings Inc. and its wholly-owned subsidiaries (out of Piraeus). Navios owns the Nueva Palmira port and transfer facility indirectly through its Uruguayan subsidiary, Corporación Navios Sociedad Anonima, or CNSA. All of Navios’s subsidiaries are wholly-owned, except for Acropolis Shipping & Trading Inc., a charter broker that acts on behalf of both Navios and third parties and of which Navios owns 50% of the outstanding equity. The remaining 50% equity of Acropolis is owned by Mr. Stavros Liaros, Acropolis’s Chief Executive Officer and a resident of Piraeus, Greece. The chart below sets forth Navios’s current corporate structure following the acquisition and reincorporation (all corporations are domiciled in the Republic of the Marshall Islands, except for Acropolis, which is a Liberian corporation, and CNSA, which is an Uruguayan company):

56

Business Strategy

Navios’s strategy and business model involves the following:

|  |  |

| • | Operation of a high quality, modern fleet. Navios owns and charters in a modern, high quality fleet, having an average age of approximately 3.5 years, that provides numerous operational advantages, including more efficient cargo operations, lower insurance and vessel maintenance costs, higher levels of fleet productivity, and an efficient operating cost structure; |

|  |  |

| • | Pursue an appropriate balance between vessel ownership and a long-term chartered in fleet. Navios controls, through a combination of vessel ownership and long-term time chartered vessels, approximately 1.8 million dwt in dry bulk tonnage, making Navios one of the largest independent dry bulk operators in the world. Navios’s ability, through its longstanding relationships with various shipyards and trading houses, to charter in vessels at favorable rates allows it to control additional shipping capacity without the capital |

57

|  |  |

| | expenditures required by new vessel acquisition. In addition, having purchase options on 13 of the 21 time chartered vessels permits Navios to determine when is the most commercially opportune time to own or charter in vessels. Navios intends to monitor developments in the sales and purchase market to maintain the appropriate balance between owned and long-term time chartered vessels; |

|  |  |

| • | Capitalize on Navios’s established reputation. Navios believes its reputation and commercial relationships enable it to obtain favorable long-term time charters, step into the market and increase its short term tonnage capacity to several times the capacity of its core fleet, as well as obtain access to freight opportunities through COA arrangements not readily available to other industry participants. This reputation has also enabled Navios to obtain favorable vessel acquisition terms, as reflected in the purchase options contained in many of its long-term charters, which are superior to the prevailing purchase prices in the open vessel sale and purchase market; |

|  |  |

| • | Utilize industry expertise to take advantage of market volatility. The dry bulk shipping market is cyclical and volatile. Navios uses its experience in the industry, sensitivity to trends, and knowledge and expertise as to risk management and FFAs to hedge against, and in some cases, generate profit from, such volatility; |

|  |  |

| • | Maintain high fleet utilization rates. The shipping industry uses fleet utilization to measure a company’s efficiency in finding suitable employment for its vessels and minimizing the days its vessels are off-hire. At 99.6%, Navios believes that it has one of the highest fleet utilization rates in the industry. |

|  |  |

| • | Maintain customer focus and reputation for service and safety. Navios is recognized by its customers for high quality of its service and safety record. Navios’s high standards for performance, reliability, and safety provides Navios with an advantageous competitive profile. |

|  |  |

| • | Enhance vessel utilization and profitability through a mix of spot charters, time charters, and COAs and strategic backhaul and triangulation methods. Specifically, this strategy is implemented as follows: |

|  |  |

| • | The operation of voyage charters or spot fixtures for the carriage of a single cargo from load port to discharge port; |

|  |  |

| • | The operation of time charters, whereby the vessel is hired out for a predetermined period but without any specification as to voyages to be performed, with the shipowner being responsible for operating costs and the charterer for voyage costs; and |

|  |  |

| • | The use of COAs, under which Navios contracts to carry a given quantity of cargo between certain load and discharge ports within a stipulated time frame, but does not specify in advance which vessels will be used to perform the voyages. |

In addition, Navios attempts, through selecting COAs on what would normally be backhaul or ballast legs, to enhance vessel utilization and, hence, profitability. The cargoes are in such cases used to position vessels at or near major loading areas (such as the US Gulf) where spot cargoes can readily be obtained. This reduces ballast time to be reduced as a percentage of the round voyage. This strategy is referred to as triangulation.

Navios is one of relatively few major owners and operators of this type in the dry bulk market, and it is one of the most experienced. In recent years, it has further raised the commercial sophistication of its business model by using market intelligence derived from its risk management operations and, specifically, its freight derivatives hedging desk, to make more informed decisions in the management of its fleet.

Competitive Advantages

Controlling approximately 1.8 million dwt in dry bulk tonnage, Navios is one of the largest independent dry bulk operators in the world. Management believes that Navios occupies a competitive

58

position within the industry in that its reputation in the global dry bulk markets permits it to step in at any time, and take on spot, medium, or long- term freight commitments, depending on its view of future market trends. In addition, many of the long-term charter deals that form the core of Navios’s fleet were brought to the attention of Navios prior to their ever being quoted in the open market. Even in the open market, Navios’s solid reputation allows it, on very short notice, to take in large amounts of tonnage on a short, medium, or long-term basis. This ability is possessed by relatively few shipowners and operators, and is a direct consequence of Navios’s market reputation for reliability in the performance of its obligations in each of its roles as a shipowner, COA operator, and charterer. Navios, therefore, has much greater flexibility than a traditional shipowner or charterer to quickly go ‘‘long’’ or ‘‘short’’ relative to the dry bulk markets.

Navios’s long involvement and reputation for reliability in the Asian region have also allowed the company to develop its privileged relationships with many of the largest trading houses in Japan, such as Marubeni Corporation and Mitsui & Co. Through these institutional relationships, Navios obtains relatively low-cost, long-term charter deals, with options to extend time charters on the majority of its vessels, and purchase the vessels transactions. Through its established reputation and relationships, Navios has access to opportunities not readily available to most other industry participants who lack Navios’s brand recognition, credibility, and track record.

In addition to its superior and long-standing reputation and flexible business model, management believes that Navios is well positioned in the dry bulk market on the basis of the following factors:

|  |  |

| • | A high quality, modern fleet of vessels that provides a variety of operational advantages, such as lower insurance premiums, higher levels of productivity, and efficient operating cost structures, as well as a competitive advantage over owners of older fleets, especially in the time charter market, where age and quality of a vessel are of significant importance in competing for business; |

|  |  |

| • | A core fleet which has been chartered in (through 2013, assuming all available charter extension periods are exercised) on attractive terms (based on prices locked-in before the upswing in rates began in 2003) that allow Navios to charter out the vessels at a considerable spread during strong markets and to weather down cycles in the market while maintaining low operating expenses; |

|  |  |

| • | Strong cash flows from creditworthy counterparties; |

|  |  |

| • | Strong commercial relationships with both freight customers and Japanese trading houses and ship owners, providing Navios with an entrée to future attractive long-term time charters on newbuildings with valuable purchase options; and |

|  |  |

| • | Visibility into worldwide commodity flows through its physical shipping operations and terminal operations in Uruguay. |

Management intends to maintain and build on this qualitative advantage, while at the same time continuing to benefit from Navios’s favorable reputation and capacity position.

Shipping Operations

Navios’s Fleet. Navios operates a core fleet of vessels that represents a store of embedded value in today’s strong dry bulk market. This fleet is comprised of six modern owned Ultra-Handymax vessels and 21 Ultra-Handymax and Panamax vessels (13 of which have purchase options that are ‘‘in the money’’) chartered in at rates well below the market.

Owned Fleet. Navios owns a fleet of six modern Ultra-Handymax vessels whose technical specifications and youth distinguish them in a market where approximately 25% of the dry bulk world fleet is composed of 20+ year-old ships. With an average age of approximately 3.5 years, the owned vessels have a substantial net asset value.

59

|  |  |  |  |  |  |  |  |  |  |

| Vessel Name |  | Year Built |  | Deadweight |

| |  | | | |  | (in metric tons) |

| Navios Achilles |  | | 2001 | |  | | 52,063 | |

| Navios Apollon |  | | 2000 | |  | | 52,073 | |

| Navios Herakles |  | | 2001 | |  | | 52,061 | |

| Navios Hios |  | | 2003 | |  | | 55,180 | |

| Navios Ionian |  | | 2000 | |  | | 52,068 | |

| Navios Kypros |  | | 2003 | |  | | 55,180 | |

|

The owned vessels are substantially identical sister vessels (they were all built at the Sanoyas Shipyard in Japan) and, as a result, Navios has built-in economies of scale with respect to technical ship management. Further, they have been built to technical specifications that far exceed those of comparable tonnage in the marketplace today, such as the following:

|  |  |

| • | Four of the six owned vessels each have five cranes (which is more than the industry standard), allowing for increased loading and discharging rates, thereby increasing the efficiency of vessel operations; |

|  |  |

| • | The majority of the owned vessels are equipped with cranes that have 30 and 35 metric tons of lifting capacity, allowing for lifting of different types of heavy cargoes, thereby increasing the vessels’ trading flexibility and efficiency; |

|  |  |

| • | The owned vessels have CO2 fittings throughout all cargo holds, allowing for the loading of a variety of special cargoes (such as timber and wood pulp), thereby enhancing the potential trading routes and profitability of the vessels; and |

|  |  |

| • | The tank top strengths in all holds are of 24mt/m2, also allowing for the carriage of heavy cargoes. |

Long Term Fleet. In addition to the six owned vessels, Navios operates a fleet of 21 Panamax (70,000-83,000 dwt) and Ultra-Handymax (50,000-55,000 dwt) vessels under long-term time charters, having an average age of approximately 3.5 years. Of the 21 chartered vessels, 15 are currently in operation and six are scheduled for delivery at various times over the next two years, as set forth in the following table:

|  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |

| Vessel Name |  | Year Built/Yard |  | Deadweight

(in metric tons) |  | Delivery Date

of Vessel |  | Time Charter Period |  | Purchase Option |

| ULTRA-HANDYMAXES |

| Navios Horizon |  | 2001/Mitsui |  | | 50,346 | |  | April 17, 2001 |  | 5 years + 3 years option |  | Yes |

| Navios Vector |  | 2002/Mitsui |  | | 50,296 | |  | October 17, 2002 |  | 5 years + 3 years option |  | Yes |

| Navios Meridian |  | 2002/Mitsui |  | | 50,316 | |  | August 8, 2002 |  | 5 years + 3 years option |  | Yes |

| Navios Mercator |  | 2002/Imabari |  | | 53,553 | |  | July 17, 2002 |  | 5 years + 2 years option |  | Yes |

| Navios Arc |  | 2003/Imabari |  | | 53,514 | |  | January 28, 2003 |  | 5 years + 2 years option |  | Yes |

| Navios TBN |  | 2006/Imabari |  | | 53,400 | |  | 2006 |  | 7 years + 2 years option |  | Yes |

| Navios TBN |  | 2007/Imabari |  | | 53,400 | |  | 2007 |  | 5 years + 3 years option |  | Yes |

|

60

|  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |

| Vessel Name |  | Year Built/Yard |  | Deadweight

(in metric tons) |  | Delivery Date of

Vessel |  | Time Charter Period |  | Purchase Option |

| PANAMAXES |

| Linda Oldendorff |  | 1995/B&W |  | | 75,100 | |  | November 11, 2003 |  | 2.25 years |  | No |

| Navios Magellan |  | 2000/Namura |  | | 74,333 | |  | January 25, 2000 |  | 5 years + 3 years option |  | Yes |

| Navios Galaxy |  | 2002/Namura |  | | 74,195 | |  | June 5, 2001 |  | 5 years + 3 years option |  | Yes |

| Marilena D’Amato |  | 2001/Hudong |  | | 74,500 | |  | November 7, 2003 |  | 2 years |  | No |

| Navios Star |  | 2002/Imabari |  | | 76,662 | |  | April 1, 2002 |  | 5 years + 3 years option |  | Yes |

| Navios Cielo |  | 2003/Sanoyasu |  | | 75,829 | |  | June 12, 2003 |  | 5 years + 2 years option |  | No |

| Navios Hyperion |  | 2004/Sanoyasu |  | | 75,500 | |  | February 10, 2004 |  | 5 years + 2 years option |  | Yes |

| Navios Orbiter |  | 2004/Imabari |  | | 76,000 | |  | February 8, 2004 |  | 5 years + 3 years option |  | Yes |

| Navios Orion |  | 2005/Imabari |  | | 76,000 | |  | January 10, 2005 |  | 5 years + 3 years option |  | No |

| Navios Aurora |  | 2005/Universal |  | | 75,200 | |  | June 22, 2005 |  | 5 years + 3 years option |  | Yes |

| Navios Titan |  | 2006/Tsuneishi |  | | 82,800 | |  | 2005 |  | 5 years + 3 years option |  | No |

| Navios TBN |  | 2006/Sanoyasu |  | | 75,500 | |  | 2006 |  | 7 years |  | No |

| Navios TBN |  | 2006/Tsuneishi |  | | 82,800 | |  | 2006 |  | 5 years + 3 years option |  | No |

| Navios TBN |  | 2007/Universal |  | | 75,200 | |  | 2007 |  | 7 years |  | No |

|

Many of Navios’s current long-term, chartered-in tonnage is chartered from shipowners with whom Navios has long-standing relationships. Navios pays these shipowners daily rates of hire for such vessels, and then charters out these vessels to other parties, who pay Navios a daily rate of hire. Navios also enters into COAs pursuant to which Navios has agreed to carry cargoes, typically for industrial customers, who export or import dry bulk cargoes. Further, Navios enters into spot market voyage contracts, where Navios is paid a rate per ton to carry a specified cargo from point A to point B.

The chartered vessels are chartered in at rates well below the market, allowing Navios to charter out those vessels at a significant spread over the daily hire it pays for the vessels to their owners. Navios can take advantage of options it has to extend the period of its long-term charters, maintaining low charter-in rates and, thus, lower overall operational expenses. Navios also has the ability to exercise its purchase options, many of which are ‘‘in the money,’’ with respect to 13 of the 21 chartered vessels.

Short Term Fleet. Navios’s fleet consists entirely of Panamax and Ultra-Handmax vessels and is classified by Navios into the following three categories: (1) Navios’s ‘‘owned fleet’’ are the six Ultra-Handymax vessels that Navios owns; (2) Navios’s ‘‘long-term fleet’’ that are the Panamax and Ultra-Handymax vessels that Navios, as a charterer, takes into its commercial employment under long-term charters, meaning charters for a duration of more than 12 months, that, together with its owned fleet, are termed Navios’s ‘‘core fleet;’’ and (3) Navios’s ‘‘short term fleet’’ which is comprised of between 20 to 40 Panamax and Handymax vessels that at any given time Navios, as a charterer, has under charter for a duration of less than 12 months.

Anticipated Exercise of Vessel Purchase Options. During September and October, 2005, notice has been given of our intent to exercise our option to purchase the Navios Meridan, the Navios Mercator, the Navios Galaxy and the Navios Magellan. In addition, we expect to exercise our purchase options on the M/V Navios Horizon and the M/V Navios Arc during the fourth quarter of 2005. The option exercise prices on these vessels are substantially below the prices that would be required to purchase vessels of similar types and ages. Accordingly, assuming that there is no substantial change in the prices for vessels or the shipping industry generally, it is anticipated that we will exercise the remaining options. The aggregate cash outlay for the six vessels amounts to approximately $120 million.

We intend to exercise these options and, accordingly, will be required to finance the cost of these vessels with new debt. Although our senior secured credit facility has certain covenants restricting incurrence of additional debt and liens, we are permitted to obtain loans collateralized solely by the vessels being purchased and believe that such loans would be available. If we exercise such options as contemplated, in-charter expenses should decrease as a percentage of revenues, but Navios would also

61

expect to incur additional depreciation and interest charges associated with the vessels. However, exercising the options is anticipated to have a favorable impact on EBITDA.

Management and Operation of the Fleet. Navios’s commercial ship management and vessel operations are conducted out of its South Norwalk, Connecticut and Piraeus, Greece offices. Navios performs the technical management of the owned vessels from its Piraeus office. The financial risk management related to the operation of its fleet is conducted through both its South Norwalk and Piraeus offices, as explained more fully below.

Commercial Ship Management. Commercial management of Navios’s fleet involves identifying and negotiating charter party employment for the vessels. Navios uses the services of Acropolis Shipping & Trading Inc., based in Piraeus, as well as numerous third-party charter brokers, to solicit, research, and propose charters for its vessels. Charter brokers research and negotiate with different charterers and propose charters to Navios for cargoes suitable for carriage by Navios’s vessels. Navios’s then evaluates the employment opportunities available for each type of vessel and arranges cargo and country exclusions, bunkers, loading and discharging conditions, and demurrage.

Technical Ship Management. Navios provides, through its subsidiary, Navios ShipManagement Inc, technical ship management and maintenance services to its owned vessels. Based in Piraeus, Greece, the operation is run by experienced professionals who oversee every step of technical management, from the production of the vessels in Japan to subsequent shipping operations throughout the life of a vessel, including the superintendence of maintenance and repairs and drydocking.

Operations. The operations department, which is located in South Norwalk, Connecticut, supervises the post-fixture business of the vessels in Navios’s fleet (i.e., once the vessel is chartered and being employed) by monitoring their daily positions to ensure that the terms and conditions of the charters are being fulfilled. The operations department also sends superintendents to the vessels to supervise the loading and discharging of cargoes when necessary to minimize time spent in port. The operations department also generally deals with all matters arising in relation to the daily operations of Navios’s fleet that are not covered by Navios’s other departments.

Financial Risk Management. Navios actively engages in assessing financial risks associated with fluctuating future freight rates, daily time charter hire rates, fuel prices, credit risks, interest rates and foreign exchange rates. Financial risk management is carried out under policies approved and guidelines established by the executive management.

|  |  |

| • | Freight Rate Risk. Navios uses FFAs to manage and mitigate its risk to its physical exposures in shipping capacity and freight commitments and respond to fluctuations in the dry bulk shipping market by augmenting its overall long or short position. These FFAs settle monthly in cash on the basis of publicly quoted indices, not physical delivery. These instruments typically cover periods from one month to one year, and are based on time charter rates or freight rates on specific quoted routes. Navios enters into these FFAs through over-the-counter transactions and over NOS ASA, a Norwegian clearing house. Navios’s traders work closely with the chartering group to ensure that the most up-to-date information is incorporated into the company’s commercial ship management strategy and policies. |

|  |  |

| • | Credit Risk. Navios closely monitors its credit exposure to charterers, counter-parties and FFAs. Navios has established policies designed to ensure that contracts are entered into with counter-parties that have appropriate credit histories. Counter-parties and cash transactions are limited to high credit quality financial institutions. Most importantly, Navios has strict guidelines and policies that limit the amount of credit exposure. |

|  |  |

| • | Interest Rate Risk. Navios uses interest rate swap agreements to reduce exposure to fluctuations in interest rates. Specifically, the company enters into interest rate swap contracts that entitle it to receive interest at floating rates on principal amounts and oblige it to pay |

62

|  |  |

| | interest at fixed rates on the same amounts. Thus, these instruments allow Navios to raise long-term borrowings at floating rates and swap them into fixed rates. Although these instruments are intended to minimize the anticipated financing costs and maximize gains for Navios that may be set off against interest expense, they may also result in losses, which would increase financing costs. |

|  |  |

| • | Foreign Exchange Risk. Although Navios’s revenues are dollar-based, 2.7% of it expenses related to its port operations are in Uruguayan pesos and 2.4% of its expenses related to operation of its Piraeus office are in Euros. Navios actively engages its foreign currency transactions to hedge its exposure to fluctuations in such currencies. |

Port and Terminal Operations

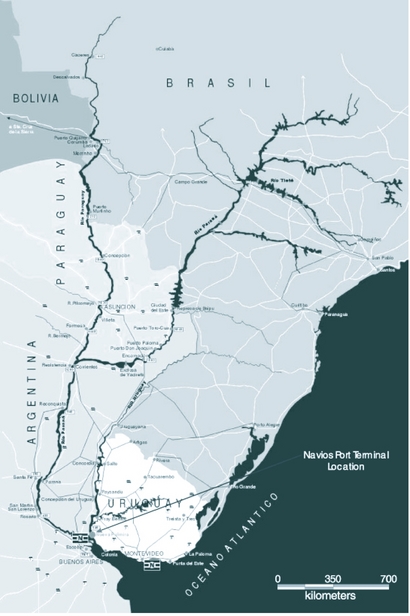

Overview. Navios owns and operates the largest bulk transfer and storage terminal in Uruguay, one of the most efficient and prominent operations of its kind in South America. Situated in a free trade zone in the port of Nueva Palmira at the confluence of the Parana and Uruguay rivers, the terminal operates 24 hours per day, seven days per week, and is ideally located to provide customers, consisting primarily of leading international grain and commodity houses, with a convenient and efficient outlet for the transfer and storage of a wide range of commodities originating in the Hidrovia region of Argentina, Bolivia, Brazil, Paraguay, and Uruguay.

Navios has had a lease with the Republic of Uruguay dating back to the 1950’s for the land on which it operates. The lease has been extended and now expires in 2025, and may be extended for an additional 20 years at Navios’s option. Navios believes the terms of the lease reflect Navios’s very high-level relationships within the Republic of Uruguay. Additionally, since the Navios terminal is located in the Nueva Palmira Tax Free Zone, foreign commodities moving through the terminal is free of Uruguayan taxes. Certificates of deposit are also obtainable for commodity entering into the station facility.

There is also considerable scope for further expansion of this bulk terminal operation in Uruguay. In addition, after completion of the current expansion of its storage capacity through the construction of its largest grain silo, Navios’s terminal port will have approximately 11 acres of available river front land for future development. The increased flow of commodity products through the Nueva Palmira port has allowed Navios to steadily increase throughput. Navios is considering further expansion, as existing and new customers are increasingly demanding long-term terminal transfer and storage services.

Although one of the smaller countries in South America, Uruguay is regarded as one of the most stable countries on the continent. The population is almost 100% literate, with a large middle class and a well-established democracy. The banking system is modern and efficient by international standards.

63

64

Port Infrastructure. The terminal stands out in the region because of its sophisticated design, efficiency, and multimodal operations. The Navios terminal has specially designed storage facilities and conveying systems that provide tremendous flexibility in cargo movements that help to avoid delays to vessels and barge convoys. The terminal offers 205,000 tons of clean and secure grain silo capacity. With nine silos (some with internal separations) available for storage, customers are assured their commodities will be naturally separated. The terminal has the latest generation, high precision, independent weigh scales, both for discharging and loading activity.

The terminal has two docks. The main outer dock is 240 meters long and accommodates vessels of up to 85,000 dwt loading to the maximum permitted draft of the Martin Garcia Bar and Mitre Canal. The dock has three new ship loaders capable of loading vessels at rates of up to 20,000 tons per day, depending on commodity. The inner face of this dock is equipped for discharging barge convoys. The secondary inner dock measures 170 meters long and is dedicated to the discharge of barge convoys. This activity is carried out on both sides of the dock. The terminal is capable of discharging barge convoys at rates averaging 10,000 to 14,000 tons per day, depending on the type of barges and commodity. Fixed duty cycle cranes located on each dock carry out the discharging of barge convoys. The process is optimized through the selection of the most appropriate size and type of buckets according to the commodity to be discharged.

The terminal's current theoretical throughput capacity is 3.0 million tons, and management believes that the 2005 throughput should be a record amount of approximately 2.2 million tons.

Port Operation. The commodities most frequently handled include grain and grain by-products, as well as some ores, sugar, and salt. The terminal receives bulk cargoes from barges, trucks, and vessels, and either transfers them directly to dry bulk carriers or stores them in its own modern silos for later shipment.

Dedicated professionals operate the terminal, taking pride in the quality of service and responsiveness to customer requirements. Management is attentive to commodity storage conditions seeking to maintain customer commodity separation at all times and minimize handling losses. The terminal operates 24 hours/day, seven days/week, to provide barge and ship traffic with safe and fast turnarounds. The ability to conduct multiple operations simultaneously involving ocean vessels, barges, trucks, and grain silos further enables the terminal to efficiently service customers’ needs.

The Navios terminal is also unique in its pricing policy by using a fixed fee structure to charge its clients. Other regional competitors charge clients a complicated fee structure, with many variable add-on charges. Navios’ pricing policy provides clients with a transparent, comprehensive, and hassle-free quote that has been extremely well received by port patrons. The Uruguay terminal operations present the additional advantage of generating revenue in US dollars, whereas the majority of its costs are in local currency.

Future Growth. The development of South American grain markets dates back to President Carter’s embargo of grain against the Soviet Union in 1979. As a result of that decision, the USSR took steps to secure grain supplies from sources outside North America. By 1981, Argentina had become a significant grain exporter to the USSR, and Brazil quickly followed. The intervening decade saw the development of grain exports markets from these two countries as successive local governments recognized the significant benefits of US dollar income. In the 1990s, Paraguay began to export small quantities of grain and, more recently, Bolivia has expanded its grain exports; the significance of grain exports from these two countries is that both are land-locked. The table below highlights the gradual development of export volumes through the Navios facility in Nueva Palmira, and Navios believes this growth will continue as both countries continue to drive for larger hard currency income.

65

Navios Uruguay Annual Throughput Volumes

Navios is currently in negotiations with significant existing and new customers, who have expressed high levels of interest in entering in long-term business relationships with the company based on the growing Uruguay grain market.

Navios Uruguay Export Market. Over the past few years, Uruguay has begun to develop its grain exports that, historically, were very small because land was allocated to cattle and sheep farming. The rapid rise in Uruguayan exports is apparent from the chart below. Most importantly for the Navios terminal, the natural growth area for grain in Uruguay is in the western region of the country on land that is located in close proximity to Nueva Palmira.

66

Uruguay Grain Exports

Source: Uruguayan Farm Cooperative (as of December 31, 2004)

67

In 2004, Navios completed construction of four new cylindrical silos designed specifically to receive Uruguayan commodities. Before these silos had been completed, local exporters had booked their total capacity for a period of three years. This was the first time in the terminal’s history that additional silo capacity was booked before completion of construction. As a result of yet further significant new customer demand from companies such as Cargill, Bunge, and Louis Dreyfus, as well as from a number of smaller local grain merchandisers, Navios started construction of a new 75,000 ton silo that, once completed, will be the largest in Uruguay. Completion is scheduled for September 2005. This additional silo will add approximately 35% to the terminal’s existing storage capacity and will service the increased exports of Uruguayan soybeans. The total investment for this project includes the new silo, as well as two new truck un-loaders, and new truck weigh scales. Of traditional horizontal, concrete construction, the silo design incorporates wall separations, mechanical air ventilation systems as well as a sensitive temperature monitoring equipment.

Customers

The international dry bulk shipping industry is highly fragmented and, as a result, there are numerous charterers. The charterers for Navios’s core fleet come from leading enterprises that mainly carry iron ore, coal, and grain cargoes. Navios’s assessment of a charterer’s financial condition and reliability is an important factor in negotiating employment of its vessels. Navios generally charters its vessels to major trading houses (including commodities traders), major producers and government-owned entities rather than to more speculative or undercapitalized entities. Navios’s customers under charterparties, COAs, and its counterparties under FFAs, include national, regional and international companies, such as Cargill International SA, COSCO Bulk Carriers Ltd., Dampskipsskelskapet Norden, Glencore International A.G., Furness Withy Pty. Ltd., Louis Dreyfus Corp., Mitsui O.S.K. Lines Ltd., Rudolf A. Oetker, Sinochart and Taiwan Maritime Transportation Corp. During the year ended December 31, 2004, none of such customers accounted for more than 10% of revenues, with the exception of Taiwan Maritime Transportation Corp. that accounted for 15.92% of revenues. During 2003, none of Navios’s customers or counterparties accounted for more than 10% of Navios’s total revenues, with the exception of Cargill International S.A. that accounted for 29.4%.

Navios’s terminal at Nueva Palmira, Uruguay conducts business with customers engaged in the international sales of agricultural commodities who book parts of the terminal’s silo capacity and transship cargoes through the terminal. In 2004, the two largest customers of the terminal were Agrograin SA, a subsidiary of the Archer Daniels Midland group, which accounted for 46.4% of the terminal’s revenues, and Multigranos SA which accounted for 14.1% of such revenues. These two customers were also the largest two sources of revenues for the terminal in 2003 accounting for the following respective percentages of its total revenues in that year: Agrograin SA (43%) and Multigranos (20%).

Competition

The dry bulk shipping markets are extensive, diversified, competitive, and highly fragmented, divided among approximately 1,500 independent dry bulk carrier owners. The world’s active dry bulk fleet consists of approximately 5,923 vessels, aggregating some 323.8 million dwt. As a general principle, the smaller the cargo carrying capacity of a dry bulk carrier, the more fragmented is its market, both with regard to charterers and vessel owners/operators. Even among the larger dry bulk owners and operators, whose vessels are mainly in the larger sizes, only three companies have fleets of 100 vessels or more: the Chinese Government (directly and through China Ocean Shipping and China Shipping Group) and the two largest Japanese shipping companies, Mitsui OSK Lines and Nippon Yusen Kaisha. There are no more than 30 owners with fleets of between 20 and 100 vessels. However, vessel ownership is not the only determinant of fleet control. Many owners of bulk carriers charter their vessels out for extended periods, not just to end-users (owners of cargo), but also to other owner/operators and to tonnage pools. Such operators may, at any given time, control a fleet many times the size of their owned tonnage. Navios is one such operator; others include CCM (Ceres Hellenic/Coeclerici), Bocimar, Zodiac Maritime, Louis-Dreyfus/Cetragpa, Cobelfret and Torvald Klaveness.

68

Governmental and Other Regulations

Governmental Regulation. Government regulation significantly affects the ownership and operation of vessels. These regulations include international conventions, national, state, and local laws, and regulations in force in the countries in which vessels may operate or are registered. A variety of governmental and private entities subject vessels to both scheduled and unscheduled inspections. These entities include the local port authorities (US Coast Guard, harbor master or equivalent), classification societies, flag state administration (country of registry), and charterers, particularly terminal operators. Certain of these entities require vessel owners to obtain permits, licenses, and certificates for the operation of their vessels. Failure to maintain necessary permits or approvals could require a vessel owner to incur substantial costs or temporarily suspend operation of one or more of its vessels.

We believe that the heightened level of environmental and quality concerns among insurance underwriters, regulators, and charterers is leading to greater inspection and safety requirements on all vessels, and may accelerate the scrapping of older vessels throughout the industry. Increasing environmental concerns have created a demand for vessels that conform to stricter environmental standards. Vessel owners are required to maintain operating standards for all vessels that will emphasize operational safety, quality maintenance, continuous training of officers and crews, and compliance with United States and international regulations.

Environmental Regulations. The International Maritime Organization, or IMO, has negotiated international conventions that impose liability for oil pollution in international waters and a signatory’s territorial waters. In September 1997, the IMO adopted Annex VI to the International Convention for the Prevention of Pollution from Ships, which was ratified on May 18, 2004, and became effective on May 19, 2005. Annex VI sets limits on sulfur oxide and nitrogen oxide emissions from ship exhausts and prohibits deliberate emissions of ozone depleting substances, such as chlorofluorocarbons. Annex VI also includes a global cap on the sulfur content of fuel oil and allows for special areas to be established with more stringent controls on sulfur emissions.