Navios Maritime Holdings Inc. Management Presentation September 2016 Exchange Offer for any and all outstanding American Depository Shares each representing 1/100th of a share of the 8.75% Series G Cumulative Redeemable Perpetual Preferred Stock 8.625% Series H Cumulative Redeemable Perpetual Preferred Stock and Consent to the Amended and Restated Certificate of Designation for each series of Preferred Stock Exhibit (a)(5)(B)

Exchange Offer Summary Navios Maritime Holdings Inc. is offering to exchange: Cash and / or Common Stock of Navios Maritime Holdings Inc. (NYSE:NM) Any and all outstanding American Depository Shares (ADSs) each representing 1/100th of a share of the 8.75% Series G Cumulative Redeemable Perpetual Preferred Stock 8.625% Series H Cumulative Redeemable Perpetual Preferred Stock and Consent to the Amended and Restated Certificate of Designation for each series of Preferred Stock for

Holders of more than one ADS may elect any combination of: Cash $5.85 per share for Series G ADSs Cash = 10% premium to 20-day Volume Weighted Average Trading Price of the Series G ADSs 8.6% premium to the closing price on 9/16/2016 Stock 4.77 shares of NM common stock, worth $5.58 using the $1.17 closing price of NM common stock on 9/16/16 Stock = 5% premium to 20-day Volume Weighted Average Trading Price of the Series G ADSs 3.7% premium to the closing price on 9/16/2016 Exchange Offer - Series G ADSs No more than 50% of the ADSs tendered will receive cash ADSs tendered in excess of the 50% cash limitation will receive shares No limitation on ADSs tendered for stock

Holders of more than one ADS may elect any combination of: Cash $5.75 per share for Series H ADSs Cash = 10% premium to 20-day Volume Weighted Average Trading Price of the Series H ADSs 8.5% premium to the closing price on 9/16/2016 Stock 4.69 shares of NM common stock, worth $5.49 using the $1.17 closing price of NM common stock on 9/16/16 Stock = 5% premium to 20-day Volume Weighted Average Trading Price of the Series H ADSs 3.5% premium to the closing price on 9/16/2016 Exchange Offer - Series H ADSs No more than 50% of the ADSs tendered will receive cash ADSs tendered in excess of the 50% cash limitation will receive shares No limitation on ADSs tendered for stock

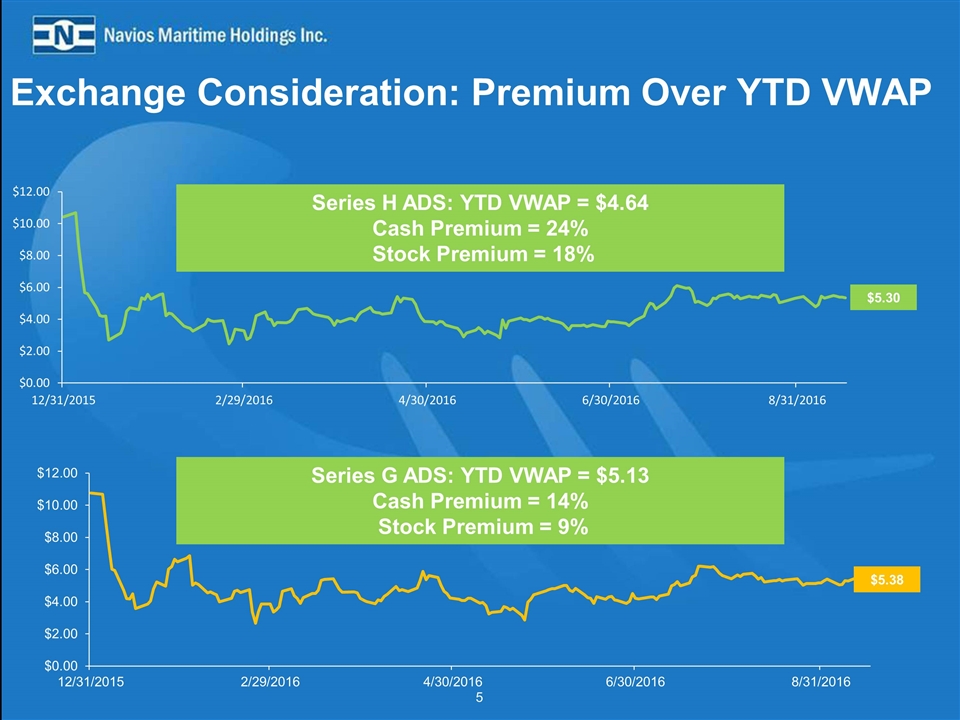

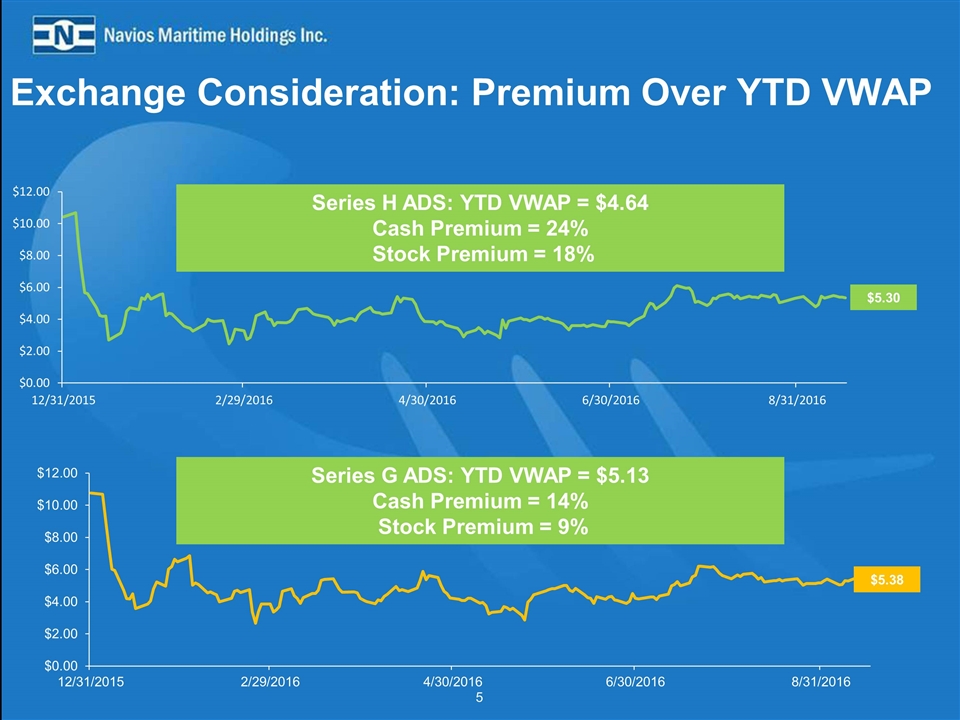

Exchange Consideration: Premium Over YTD VWAP $5.30 $5.38 Series G ADS: YTD VWAP = $5.13 Cash Premium = 14% Stock Premium = 9% Series H ADS: YTD VWAP = $4.64 Cash Premium = 24% Stock Premium = 18%

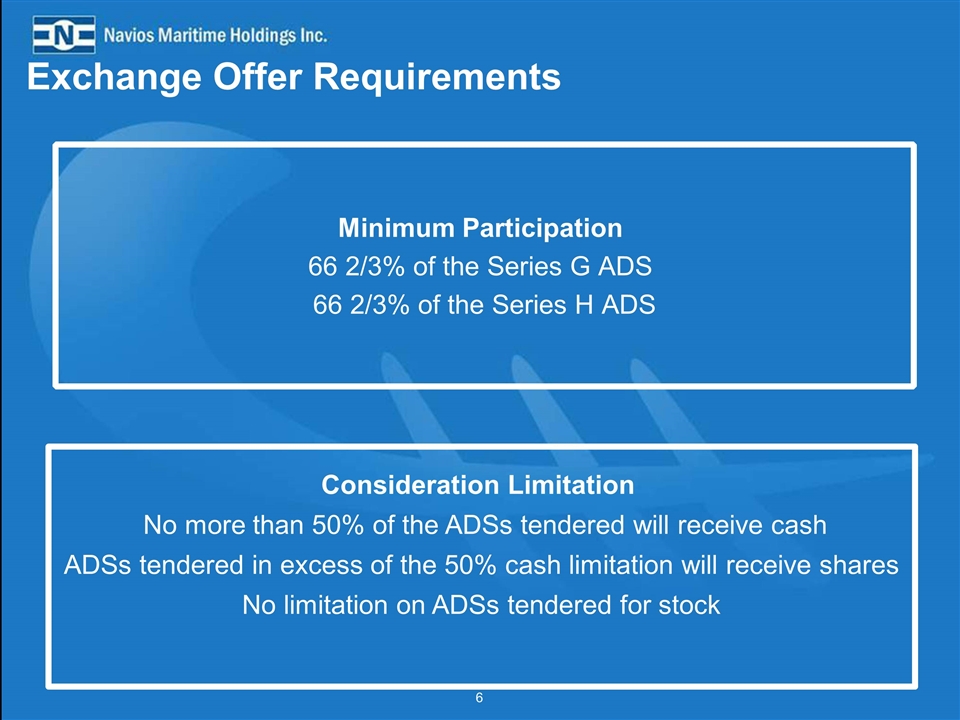

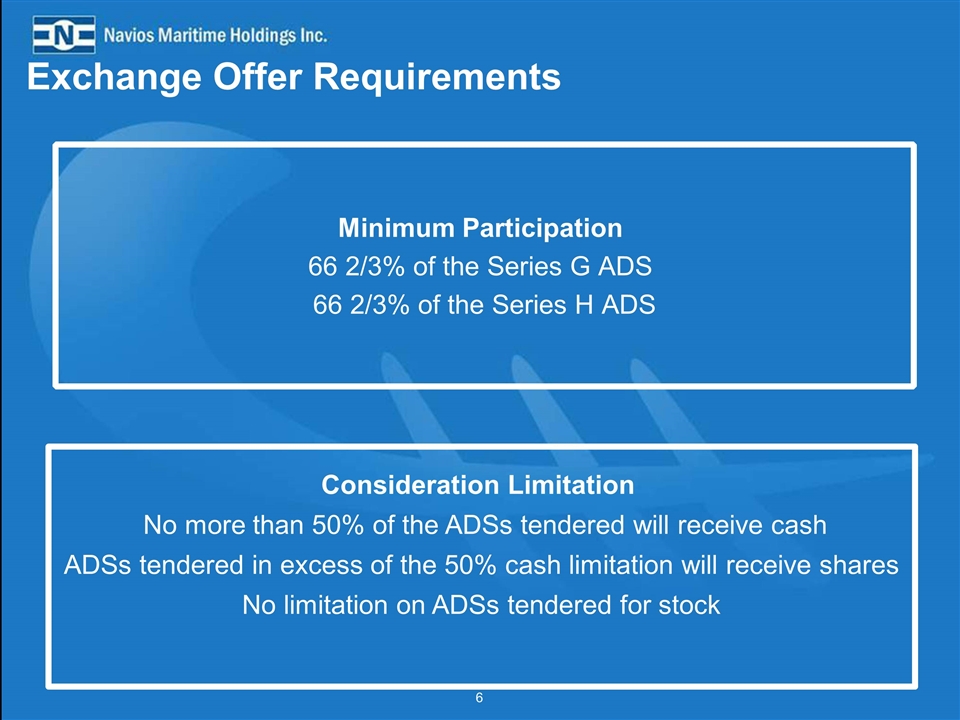

Minimum Participation 66 2/3% of the Series G ADS 66 2/3% of the Series H ADS Consideration Limitation No more than 50% of the ADSs tendered will receive cash ADSs tendered in excess of the 50% cash limitation will receive shares No limitation on ADSs tendered for stock Exchange Offer Requirements

Exchange Offer Rationale Optimizes Long-Term Capital Structure Simplifies capital structure and improves access to capital markets Reduces market overhang and enhances financial flexibility by eliminating economically burdensome cumulative preferred stock Positions company favorably to refinance upcoming maturities Aligns Common Shareholder Interest for Continued Growth Improves ability to address near term liquidity requirements Preserves company cash for potential strategic growth opportunities Increases cash available to all stockholders in the future Expected improvement of institutional investor interest in company Holders of the Series G and Series H Preferred shares will own a percentage of the common equity in the company Eliminates all Preferred Stock Voting Rights & Restrictive Covenants Eliminates all restrictive covenants including: Accrual feature on dividends (retrospectively & prospectively) Right to elect board member Dividend step up if dividends are in arrears Prohibitions on certain private market preferred stock purchases 66 2/3% vote required to amend Certificate of Designation Voting rights

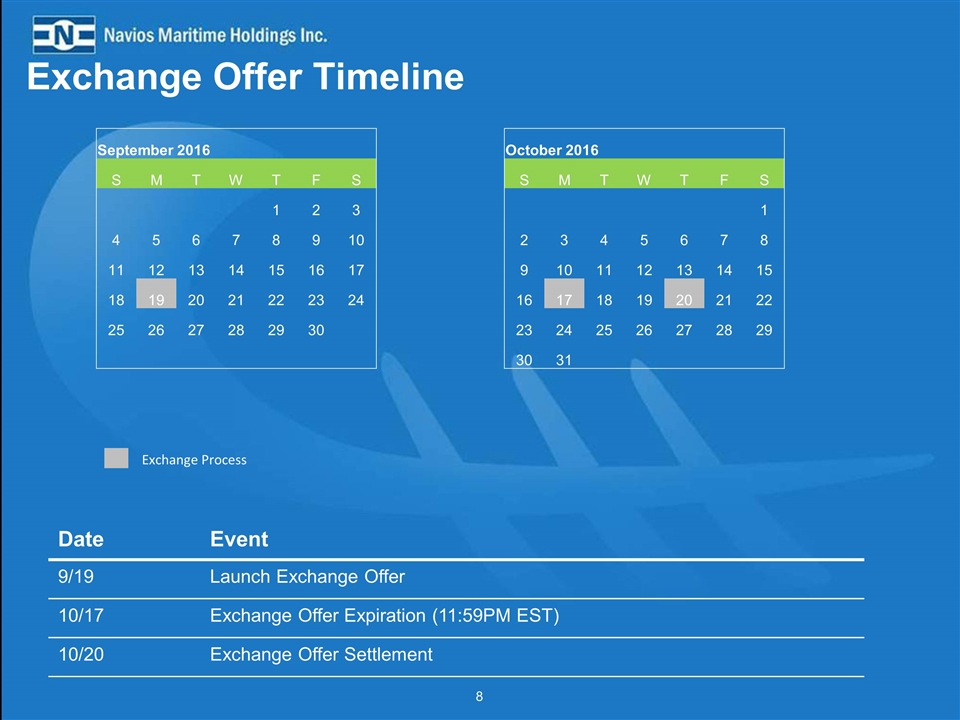

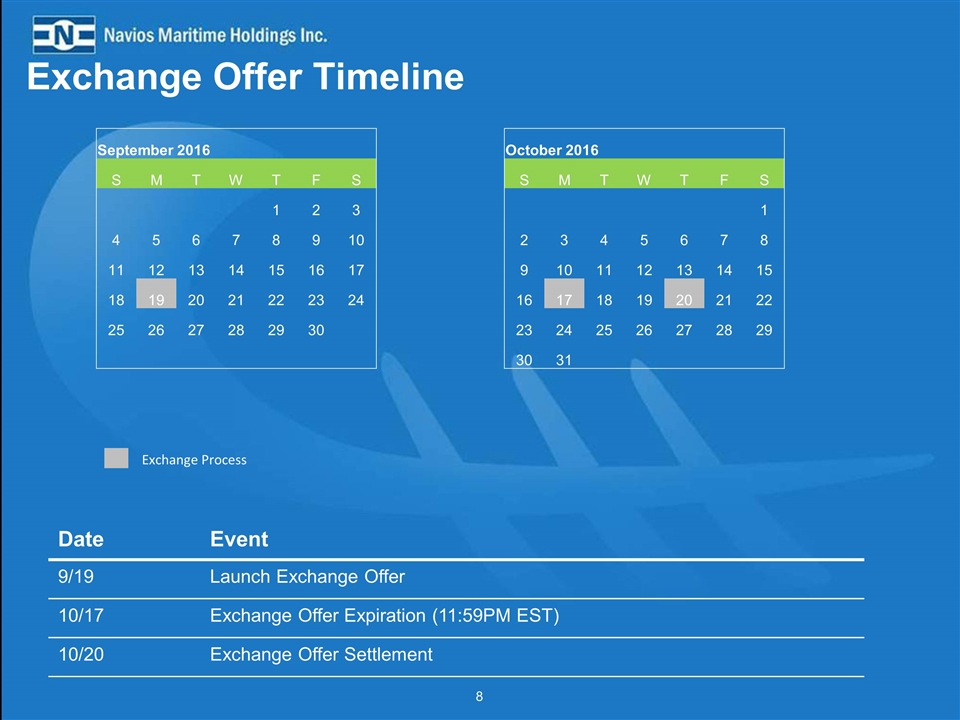

Exchange Offer Timeline October 2016 S M T W T F S 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 September 2016 S M T W T F S 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 Exchange Process Date Event 9/19 Launch Exchange Offer 10/17 Exchange Offer Expiration (11:59PM EST) 10/20 Exchange Offer Settlement

Questions? If you have any questions about in this exchange offer, please contact either: Information agent Georgeson LLC Toll-Free (888) 607-9252 Contact via E-mail at: Navios@georgeson.com or Navios Investor Relations www.navios.com/exchangeoffer (212) 223-7009