EXHIBIT 99.3

Acquisition of

Cadence

Pharmaceuticals

February 11, 2014

Additional Information and Where To Find It

The tender offer for the outstanding shares of Cadence Pharmaceuticals, Inc. (“Cadence Pharmaceuticals”) referenced in this document has not yet commenced. This document is for informational purposes only and is neither an offer to purchase nor a solicitation of an offer to sell shares, nor is it a substitute for the tender offer materials that Mallinckrodt plc (“Mallinckrodt”) and its subsidiary will file with the Securities and Exchange Commission (“SEC”). At the time the tender offer is commenced, Mallinckrodt and its subsidiary will file tender offer materials on Schedule TO, and thereafter Cadence Pharmaceuticals will file a Solicitation/Recommendation Statement on Schedule 14D-9 with the SEC with respect to the tender offer.

THE TENDER OFFER MATERIALS (INCLUDING AN OFFER TO PURCHASE, A RELATED LETTER OF TRANSMITTAL AND CERTAIN OTHER TENDER OFFER DOCUMENTS) AND THE SOLICITATION/RECOMMENDATION STATEMENT WILL CONTAIN IMPORTANT INFORMATION. HOLDERS OF SHARES OF CADENCE PHARMACEUTICALS COMMON STOCK ARE URGED TO READ THESE DOCUMENTS CAREFULLY WHEN THEY BECOME AVAILABLE (AS EACH MAY BE AMENDED OR SUPPLEMENTED FROM TIME TO TIME) BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION THAT HOLDERS OF SHARES OF CADENCE PHARMACEUTICALS COMMON STOCK SHOULD CONSIDER BEFORE MAKING ANY DECISION REGARDING TENDERING THEIR SHARES.

2/10/2014 1

Additional Information and Where To Find It (cont.)

The Offer to Purchase, the related Letter of Transmittal and certain other tender offer documents, as well as the Solicitation/Recommendation Statement, will be made available to all holders of shares of Cadence Pharmaceuticals common stock at no expense to them. The tender offer materials and the Solicitation/Recommendation Statement will be made available for free at the SEC’s website at www.sec.gov.

Additional copies of the tender offer materials may be obtained for free by contacting Mallinckrodt plc at 675 James S. McDonnell Blvd, Hazelwood, MO 63042, Attention: John Moten, Vice President Investor Relations, (314) 654-6650. In addition to the Offer to Purchase, the related Letter of Transmittal and certain other tender offer documents, as well as the Solicitation/Recommendation Statement, Cadence Pharmaceuticals and Mallinckrodt file annual, quarterly and current reports and other information with the SEC.

You may read and copy any reports or other information filed by Cadence Pharmaceuticals or Mallinckrodt at the SEC public reference room at 100 F Street, N.E., Washington, D.C. 20549. Please call the Commission at 1-800-SEC-0330 for further information on the public reference room. Cadence Pharmaceuticals’ and Mallinckrodt’s filings with the SEC are also available to the public from commercial document-retrieval services and at the SEC’s website at www.sec.gov.

2/10/2014 2

Forward-Looking Statements

Statements in this document that are not strictly historical, including statements regarding the proposed acquisition, the expected timetable for completing the transaction, future financial and operating results, benefits and synergies of the transaction, future opportunities for the combined businesses and any other statements regarding events or developments that we believe or anticipate will or may occur in the future, may be “forward-looking” statements within the meaning of the federal securities laws, and involve a number of risks and uncertainties. There are a number of important factors that could cause actual events to differ materially from those suggested or indicated by such forward-looking statements and you should not place undue reliance on any such forward-looking statements. These factors include risks and uncertainties related to, among other things:

• general economic conditions and conditions affecting the industries in which Mallinckrodt and Cadence Pharmaceuticals operate;

• the commercial success of OFIRMEV;

• Mallinckrodt’s and Cadence Pharmaceuticals’ ability to protect intellectual property rights;

• the uncertainty of approval under the Hart Scott Rodino Antitrust Improvements Act;

• the parties’ ability to satisfy the tender offer and merger agreement conditions and consummate the tender offer and the merger on the anticipated timeline or at all;

• the availability of financing, including the financing contemplated by the debt commitment letter, on anticipated terms or at all;

2/10/2014 3

Forward-Looking Statements (cont.)

• Mallinckrodt’s ability to successfully integrate Cadence Pharmaceuticals’ operations and employees with Mallinckrodt’s existing business;

• the ability to realize anticipated growth, synergies and cost savings;

• Cadence Pharmaceuticals’ performance and maintenance of important business relationships;

• Mallinckrodt’s ability to receive procurement and production quotas granted by the U.S. Drug Enforcement Administration;

• Mallinckrodt’s ability to obtain and/or timely transport molybdenum-99 to our technetium-99m generator production facilities;

• customer concentration;

• cost-containment efforts of customers, purchasing groups, third-party payors and governmental organizations;

• Mallinckrodt’s ability to successfully develop or commercialize new products;

• competition;

• Mallinckrodt’s ability to integrate acquisitions of technology, products and businesses generally;

• product liability losses and other litigation liability;

2/10/2014 4

Forward-Looking Statements (cont.)

• the reimbursement practices of a small number of large public or private issuers;

• complex reporting and payment obligation under healthcare rebate programs;

• changes in laws and regulations;

• conducting business internationally;

• foreign exchange rates; material health, safety and environmental liabilities;

• litigation and violations;

• information technology infrastructure;

and restructuring activities.

Additional information regarding the factors that may cause actual results to differ materially from these forward-looking statements is available in Mallinckrodt’s SEC filings, including its Annual Report on Form 10-K for the fiscal year ended September 27, 2013 and Quarterly Report on Form 10-Q for the quarterly period ended December 27, 2013, as well as Cadence Pharmaceuticals’ SEC filings, including its Annual Report on Form 10-K for the year ended December 31, 2012 and Quarterly Reports on Form 10-Q for the quarterly periods ended March 31, 2013, June 30, 2013 and September 30, 2013. The forward-looking statements made herein speak only as of the date hereof and none of Mallinckrodt, Cadence Pharmaceuticals or any of their respective affiliates assumes any obligation to update or revise any forward looking statement, whether as a result of new information, future events and developments or otherwise, except as required by law.

2/10/2014 5

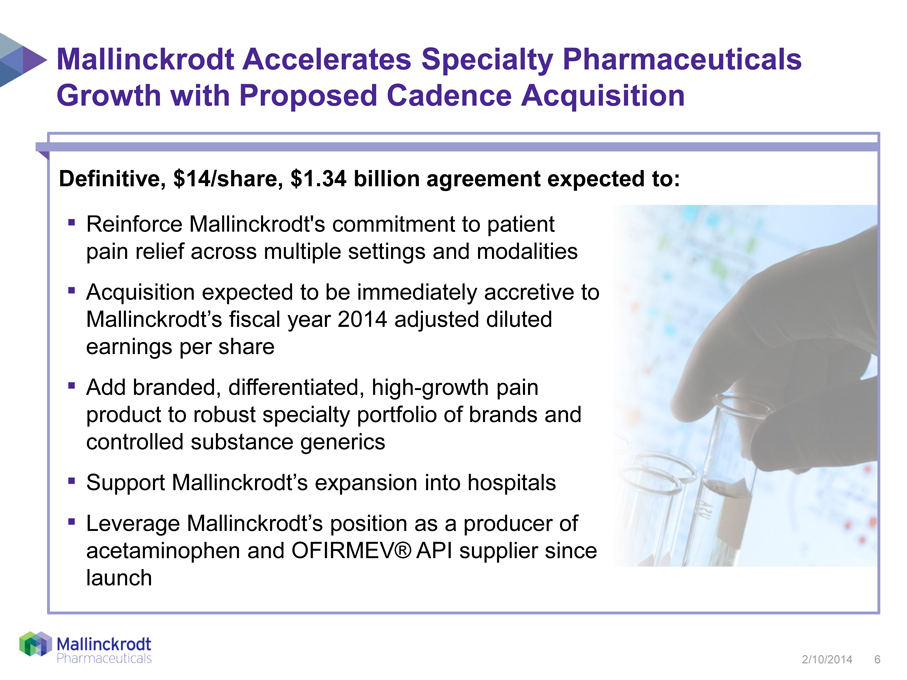

Mallinckrodt Accelerates Specialty Pharmaceuticals

Growth with Proposed Cadence Acquisition

Definitive, $14/share, $1.34 billion agreement expected to:

Reinforce Mallinckrodt’s commitment to patient pain relief across multiple settings and modalities

Acquisition expected to be immediately accretive to Mallinckrodt’s fiscal year 2014 adjusted diluted earnings per share

Add branded, differentiated, high-growth pain product to robust specialty portfolio of brands and controlled substance generics

Support Mallinckrodt’s expansion into hospitals

Leverage Mallinckrodt’s position as a producer of acetaminophen and OFIRMEV® API supplier since launch

2/10/2014 6

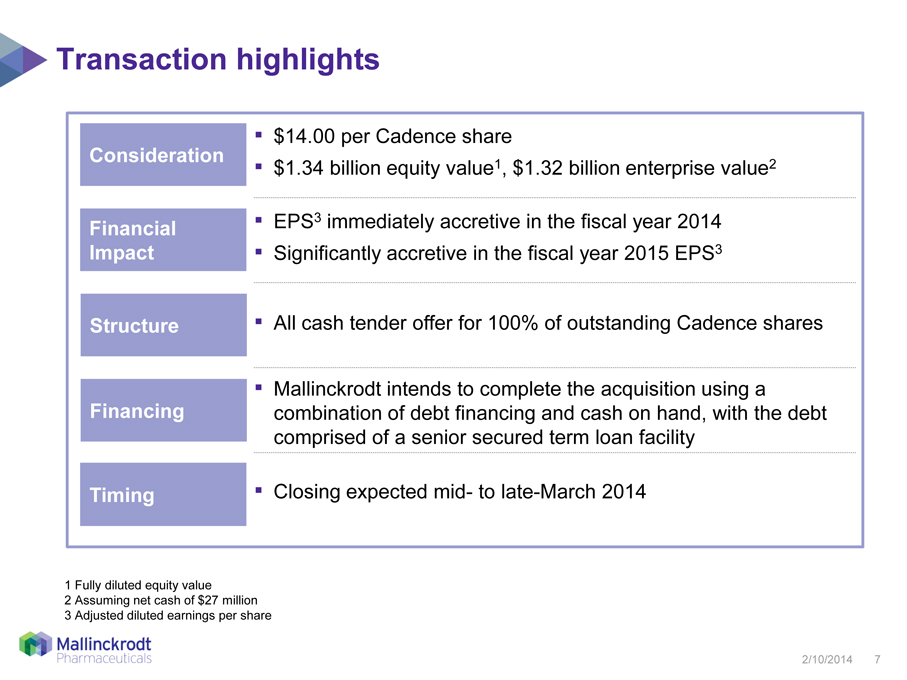

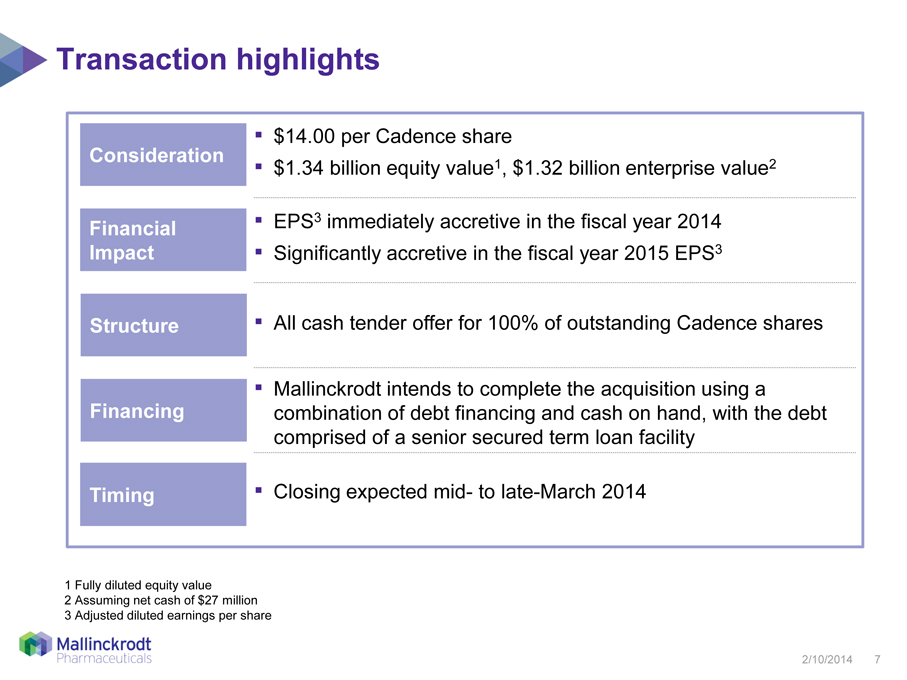

Transaction highlights

Consideration

Financial

Impact

Structure

Financing

Timing

$14.00 per Cadence share

$1.34 billion equity value1, $1.32 billion enterprise value2

EPS3 immediately accretive in the fiscal year 2014

Significantly accretive in the fiscal year 2015 EPS3

All cash tender offer for 100% of outstanding Cadence shares

Mallinckrodt intends to complete the acquisition using a combination of debt financing and cash on hand, with the debt comprised of a senior secured term loan facility

Closing expected mid- to late-March 2014

1 Fully diluted equity value

2 Assuming net cash of $27 million

3 Adjusted diluted earnings per share

2/10/2014 7

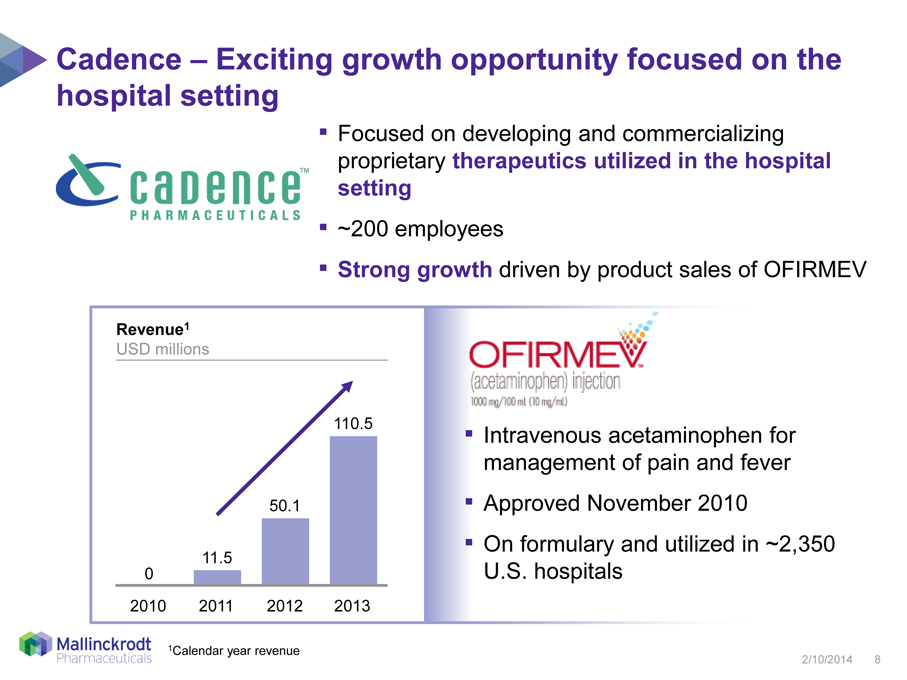

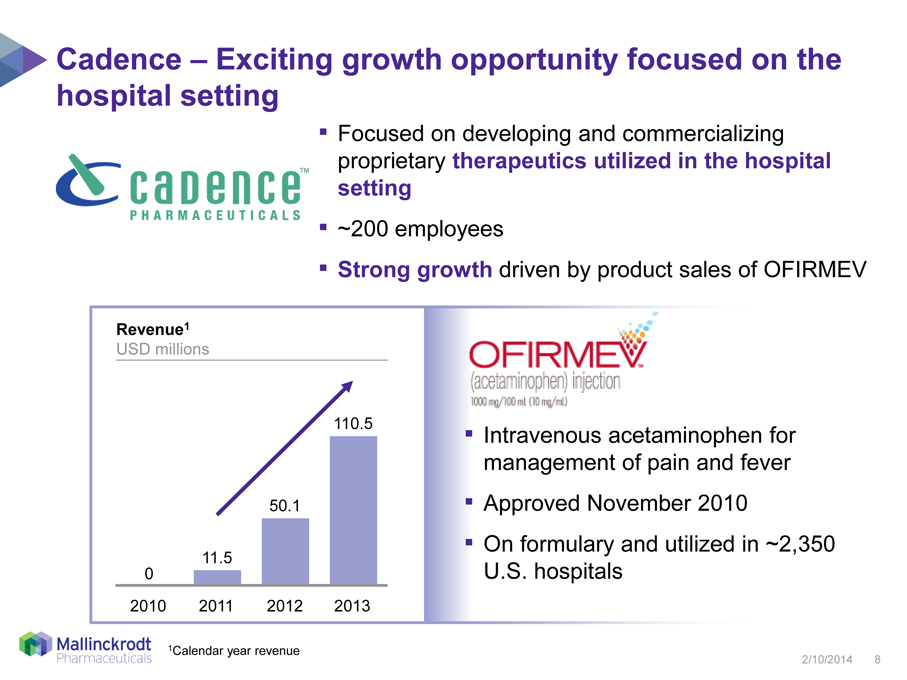

Cadence – Exciting growth opportunity focused on the hospital setting

Focused on developing and commercializing proprietary therapeutics utilized in the hospital setting

~200 employees

Revenue1

USD millions

110.5

50.1

11.5

0

2010

2011

2012

2013

Strong growth driven by product sales of OFIRMEV

Intravenous acetaminophen for management of pain and fever

Approved November 2010

On formulary and utilized in ~2,350 U.S. hospitals

1Calendar year revenue

2/10/2014 8

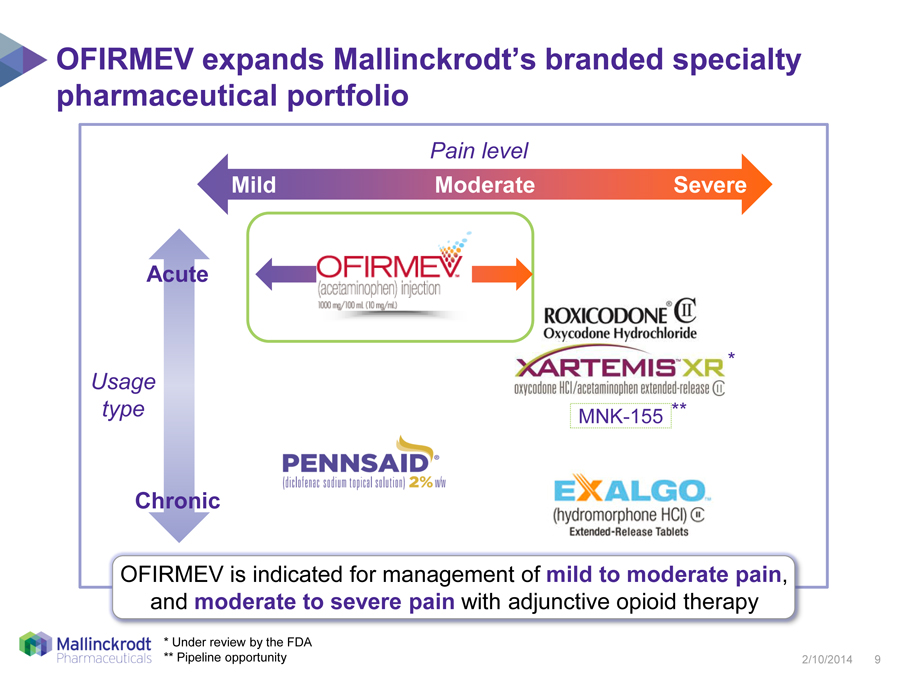

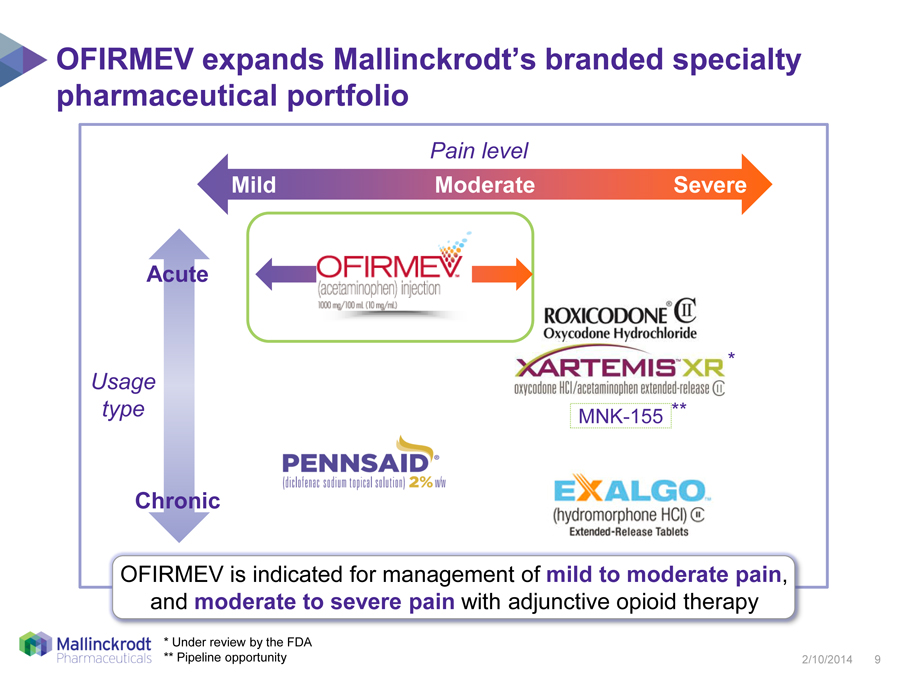

OFIRMEV expands Mallinckrodt’s branded specialty pharmaceutical portfolio

Pain level

Mild

Moderate

Severe

Acute

Usage

type

Chronic

MNK-155**

OFIRMEV is indicated for management of mild to moderate pain, and moderate to severe pain with adjunctive opioid therapy

* | | Under review by the FDA |

** Pipeline opportunity

2/10/2014 9

OFIRMEV offers a compelling value proposition and potential for growth

| | • | | Effective for the management of mild to moderate pain, and moderate to severe pain when used with adjunctive opioid |

analgesics

| | • | | Significant possible value yet to be unlocked given its efficacy, safety and potential health economics benefits, when under the Mallinckrodt umbrella: |

– Strengthen potential for increased hospital formulary penetration

– Broaden physician utilization, with use across more hospital departments than the current base

| | • | | Reinforces Mallinckrodt’s commitment to patient pain relief across multiple settings and modalities |

2/10/2014 10

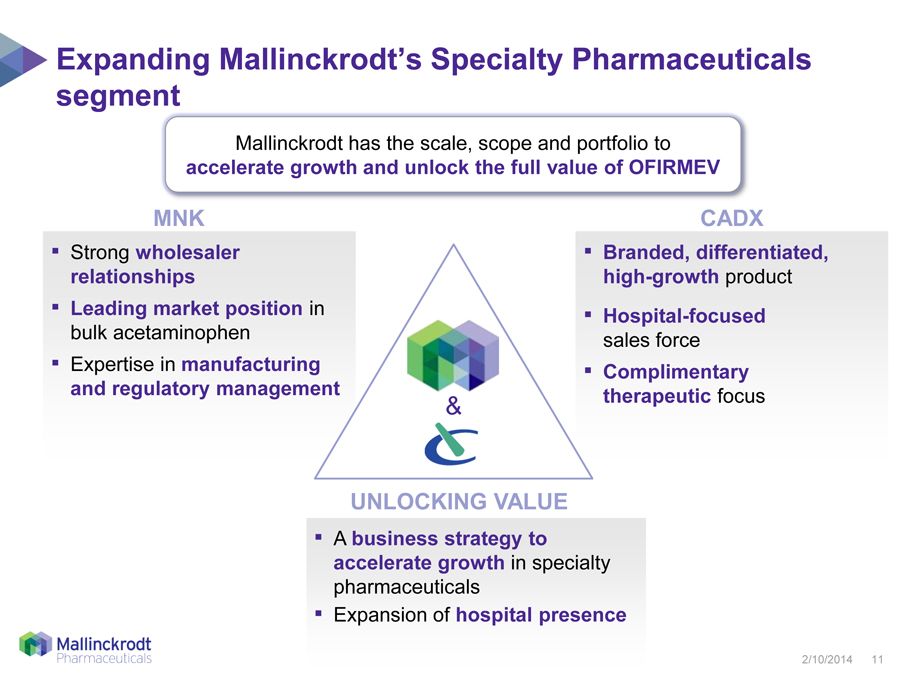

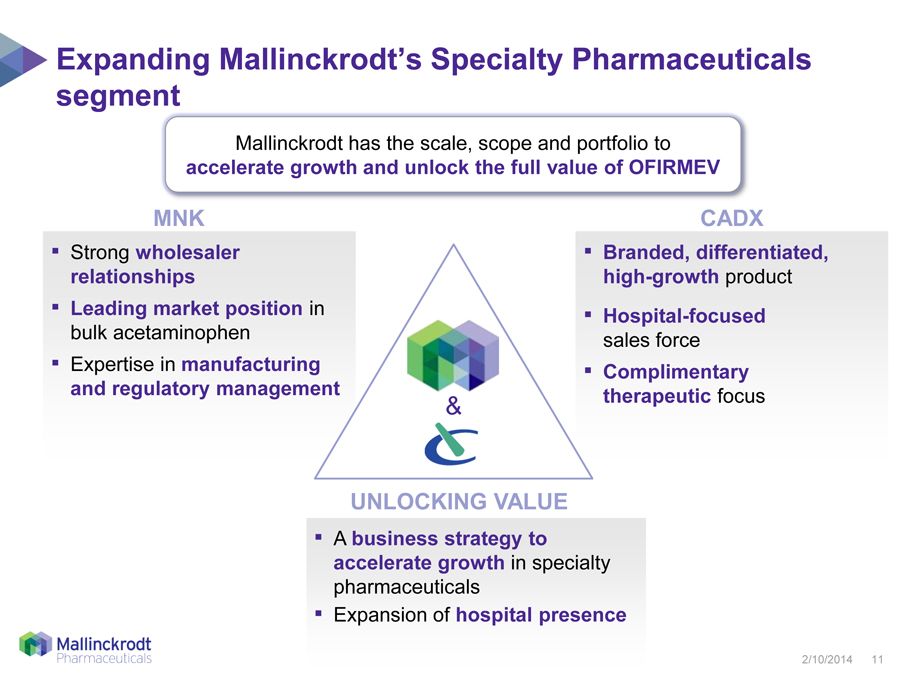

Expanding Mallinckrodt’s Specialty Pharmaceuticals segment Mallinckrodt has the scale, scope and portfolio to accelerate growth and unlock the full value of OFIRMEV MNK Strong wholesaler relationships Leading market position in bulk acetaminophen Expertise in manufacturing and regulatory management CADX Branded, differentiated, high-growth product Hospital-focused sales force Complimentary therapeutic focus UNLOCKING VALUE A business strategy to accelerate growth in specialty pharmaceuticals Expansion of hospital presence 2/10/2014 11