|

Exhibit 99.1

|

Exhibit 99.1

CIBC 18th Annual Whistler Institutional Investor Conference

Investor Discussion Materials

January 2015

Forward Looking Statements

The Private Securities Litigation Reform Act of 1995 provides a “safe harbor” for forward-looking statements. Certain information included in this presentation contains statements that are forward-looking, such as statements relating to results of operations and financial conditions and business development activities, as well as capital spending and financing sources. Such forward-looking information involves important risks and uncertainties that could significantly affect anticipated results in the future and, accordingly, such results may differ materially from those expressed in any forward-looking statements made by or on behalf of Mercer. For more information regarding these risks and uncertainties, review Mercer’s filings with the United States Securities and Exchange Commission. Unless required by law, we do not assume any obligation to update forward-looking statements based on unanticipated events or changed expectations.

NASDAQ:MERC | TSX:MRI.U | www.mercerint.com 2

Mercer International Inc.

NASDAQ:MERC | TSX:MRI.U | www.mercerint.com 3

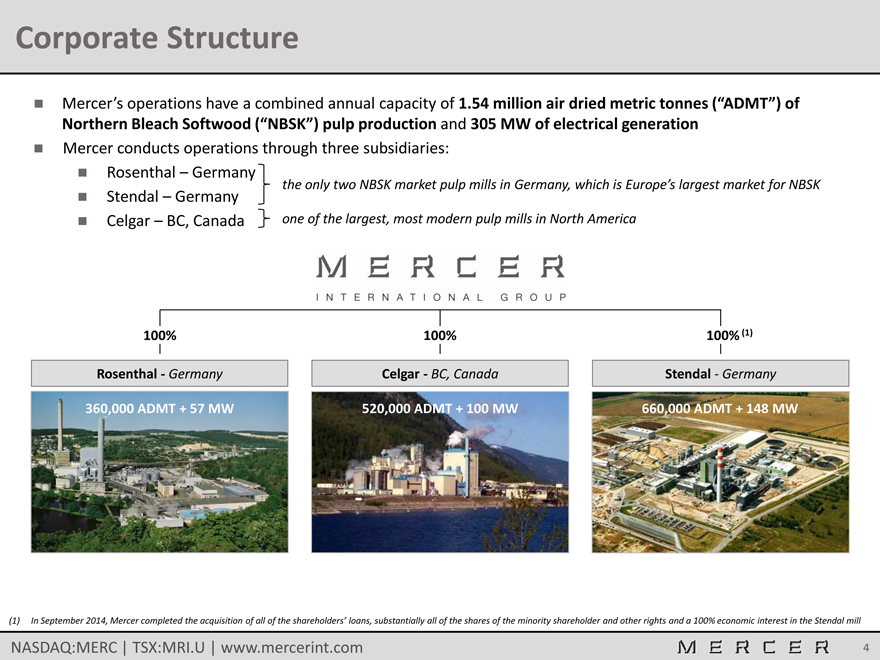

Corporate Structure

Mercer’s operations have a combined annual capacity of 1.54 million air dried metric tonnes (“ADMT”) of Northern Bleach Softwood (“NBSK”) pulp production and 305 MW of electrical generation

Mercer conducts operations through three subsidiaries:

Rosenthal – Germany

the only two NBSK market pulp mills in Germany, which is Europe’s largest market for NBSK

Stendal – Germany

Celgar – BC, Canada one of the largest, most modern pulp mills in North America

100%

Rosenthal—Germany

360,000 ADMT + 57 MW

100%

Celgar—BC, Canada

520,000 ADMT + 100 MW

100% (1)

Stendal—Germany

660,000 ADMT + 148 MW

(1) In September 2014, Mercer completed the acquisition of all of the shareholders’ loans, substantially all of the shares of the minority shareholder and other rights and a 100% economic interest in the Stendal mill

NASDAQ:MERC | TSX:MRI.U | www.mercerint.com

4

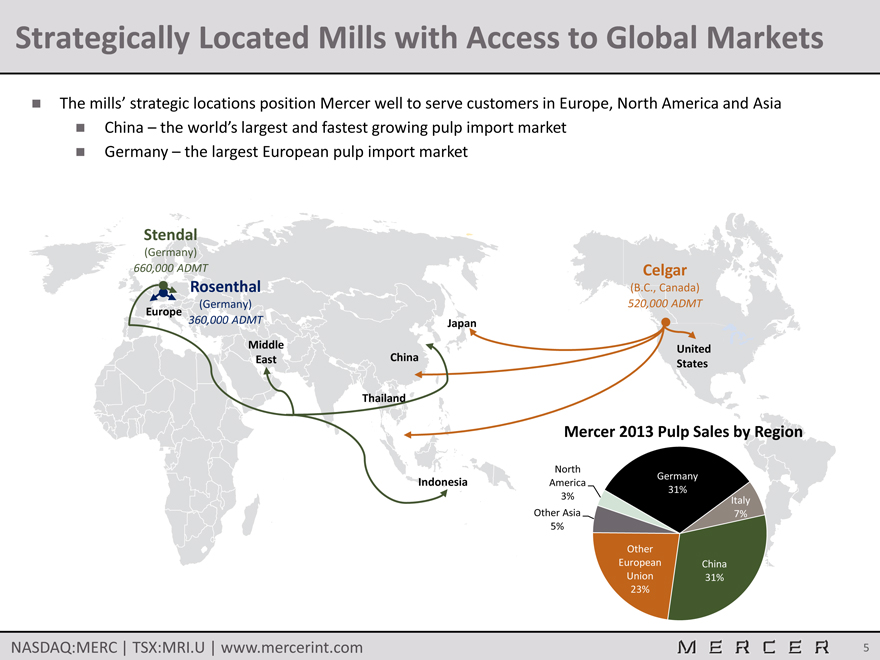

Strategically Located Mills with Access to Global Markets

The mills’ strategic locations position Mercer well to serve customers in Europe, North America and Asia

China – the world’s largest and fastest growing pulp import market

Germany – the largest European pulp import market

Stendal

(Germany)

660,000 ADMT Celgar

Rosenthal (B.C., Canada)

(Germany) 520,000 ADMT

Europe

360,000 ADMT Japan

Middle United East China States

Thailand

Indonesia

Mercer 2013 Pulp Sales by Region

North America 3% Other Asia 5%

Germany 31%

Italy 7%

Other

European China Union 31% 23%

NASDAQ:MERC | TSX:MRI.U | www.mercerint.com 5

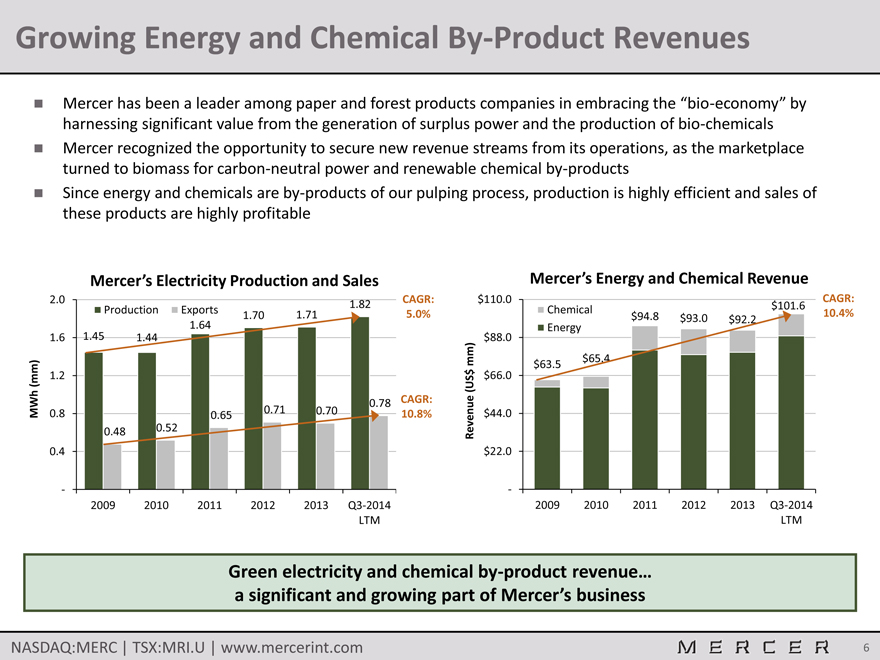

Growing Energy and Chemical By-Product Revenues

Mercer has been a leader among paper and forest products companies in embracing the “bio-economy” by harnessing significant value from the generation of surplus power and the production of bio-chemicals

Mercer recognized the opportunity to secure new revenue streams from its operations, as the marketplace turned to biomass for carbon-neutral power and renewable chemical by-products Since energy and chemicals are by-products of our pulping process, production is highly efficient and sales of these products are highly profitable

Mercer’s Electricity Production and Sales

2.0 1.82

Production Exports 1.70 1.71

1.64

1.6 1.45 1.44

(mm) 1.2

MWh 0.71 0.70 0.78

0.8 0.65

0.48 0.52

0.4

—

2009 2010 2011 2012 2013 Q3-2014

LTM

CAGR: 5.0%

CAGR: 10.8%

Mercer’s Energy and Chemical Revenue

$110.0

Chemical $101.6

$94.8 $93.0 $92.2

Energy

$88.0

mm) $65.4

$63.5

$ $66.0

(US

Revenue $44.0

$22.0

—

2009 2010 2011 2012 2013 Q3-2014

LTM

CAGR: 10.4%

Green electricity and chemical by-product revenue… a significant and growing part of Mercer’s business

NASDAQ:MERC | TSX:MRI.U | www.mercerint.com 6

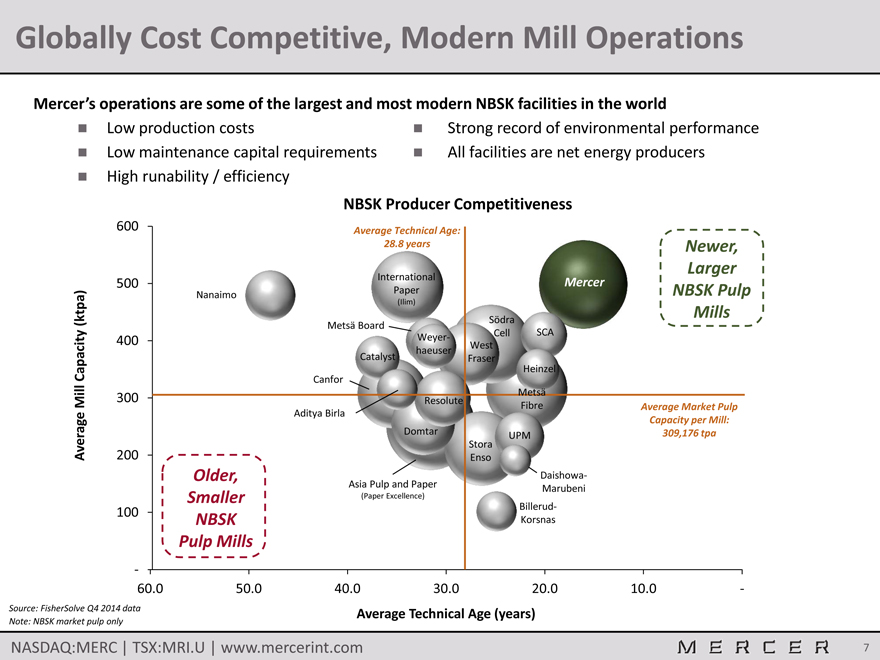

Globally Cost Competitive, Modern Mill Operations

Mercer’s operations are some of the largest and most modern NBSK facilities in the world

Low production costs

Low maintenance capital requirements High runability / efficiency

Strong record of environmental performance All facilities are net energy producers

Average Mill Capacity (ktpa)

NBSK Producer Competitiveness

600 Average Technical Age: 600

28.8 years Newer,

Larger

500 International Mercer 500

Nanaimo Paper NBSK Pulp

(Ilim)

Södra Mills

Metsä Board

400 Weyer- Cell SCA 400

haeuser West

Catalyst Fraser

Heinzel

Canfor

Metsä

300 Resolute 300

Fibre Average Market Pulp

Aditya Birla

Capacity per Mill:

Domtar UPM 309,176 tpa

Stora

200 Enso 200

Older, Daishowa-

Asia Pulp and Paper Marubeni

Smaller (Paper Excellence)

100 Billerud- 100

NBSK Korsnas

Pulp Mills

- -

60.0 50.0 40.0 30.0 20.0 10.0 —

Source: FisherSolve Q4 2014 data Note: NBSK market pulp only

Average Technical Age (years)

NASDAQ:MERC | TSX:MRI.U | www.mercerint.com 7

Mercer Investment Thesis

The NBSK market has transitioned over time from balanced to currently tight

Permanent closure of high cost mills Continued growth from emerging markets

Demand for NBSK from high value paper producers continues to grow

End uses such as tissues, towels and other speciality products

Growth in high value products has outpaced printing & writing paper declines

Mercer’s mills are modern and cost competitive

Low capital requirements Achieving high runnability

Mercer’s green energy and bio-chemicals businesses continue to add value

Significant and stable income streams

Revenue was ~$102 million LTM September 30, 2014

Recent refinancing / acquisition activities have Mercer well positioned

Acquired minority interest in the Stendal mill

Simplified structure / recapitalized balance sheet (new long term senior notes)

Reduced long term debt through more efficient use of cash ($168 million)

Added more flexibility to the operations

NASDAQ:MERC | TSX:MRI.U | www.mercerint.com 8

The NBSK Market

NASDAQ:MERC | TSX:MRI.U | www.mercerint.com 9

Introduction to the Major Themes in NBSK

Current themes surrounding the NBSK market include:

The impact of digital media on paper demand and end uses

The effect of China and other emerging economies’ continuing growth

The net supply impact of mill closures, facility conversions, restarts and new mill announcements

The potential supply impact of integrated players selling their pulp on the market

The impact of additional hardwood capacity coming online

NASDAQ:MERC | TSX:MRI.U | www.mercerint.com 10

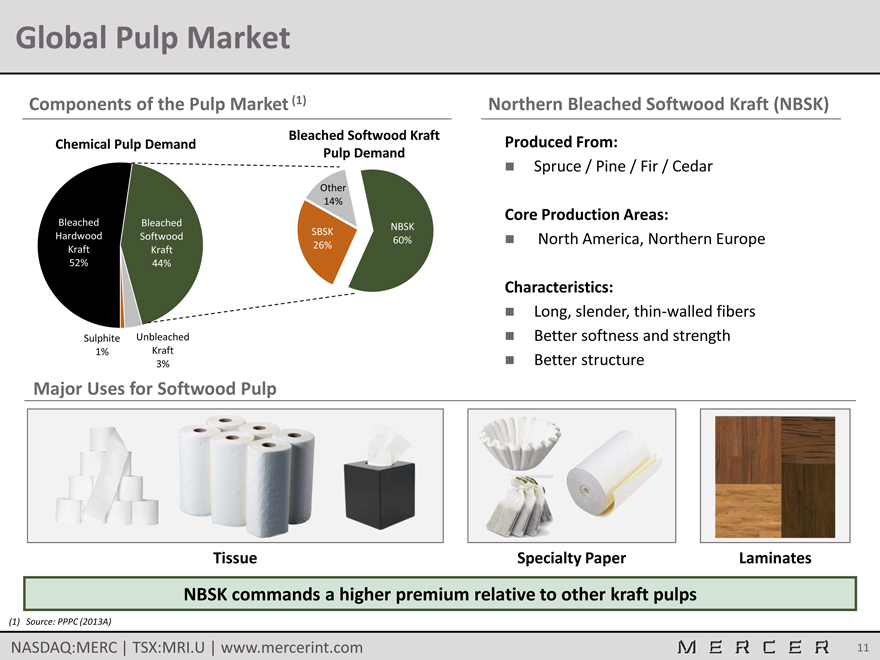

Global Pulp Market

Components of the Pulp Market (1)

Chemical Pulp Demand

Bleached Softwood Kraft Pulp Demand

Bleached Hardwood Kraft 52%

Bleached Softwood Kraft 44%

Sulphite 1%

Unbleached Kraft 3%

Northern Bleached Softwood Kraft (NBSK)

Produced From:

Spruce / Pine / Fir / Cedar

Core Production Areas:

North America, Northern Europe

Characteristics:

Long, slender, thin-walled fibers

Better softness and strength

Better structure

Major Uses for Softwood Pulp

Tissue Specialty Paper Laminates

NBSK commands a higher premium relative to other kraft pulps

(1) Source: PPPC (2013A)

NASDAQ:MERC | TSX:MRI.U | www.mercerint.com 11

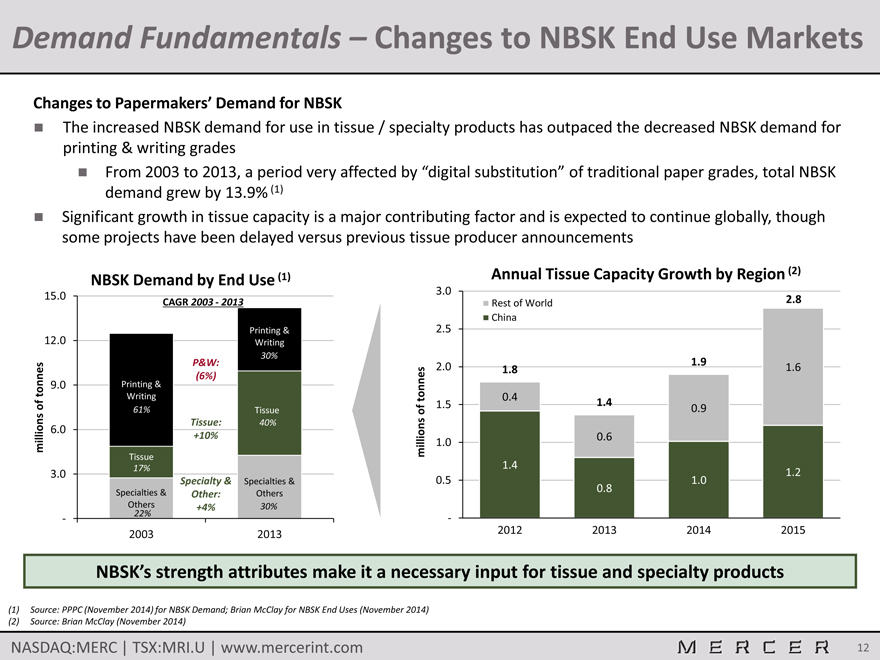

Demand Fundamentals – Changes to NBSK End Use Markets

Changes to Papermakers’ Demand for NBSK

The increased NBSK demand for use in tissue / specialty products has outpaced the decreased NBSK demand for printing & writing grades

From 2003 to 2013, a period very affected by “digital substitution” of traditional paper grades, total NBSK demand grew by 13.9% (1)

Significant growth in tissue capacity is a major contributing factor and is expected to continue globally, though some projects have been delayed versus previous tissue producer announcements

Annual Tissue Capacity Growth by Region (2)

NBSK Demand by End Use (1)

15.0 CAGR 2003—2013

Printing &

12.0 Writing

30%

P&W:

(6%)

tonnes 9.0 Printing &

Writing

of 61% Tissue

Tissue: 40%

millions 6.0 +10%

Tissue

3.0 17%

Specialty & Specialties &

Specialties & Other: Others

Others +4% 30%

— 22%

2003 2013

3.0

Rest of World 2.8

China

2.5

1.9

2.0 1.8 1.6

tonnes 0.4

1.5 1.4

of 0.9

millions 1.0 0.6

1.4

1.2

0.5 1.0

0.8

—

2012 2013 2014 2015

NBSK’s strength attributes make it a necessary input for tissue and specialty products

(1) Source: PPPC (November 2014) for NBSK Demand; Brian McClay for NBSK End Uses (November 2014) (2) Source: Brian McClay (November 2014)

NASDAQ:MERC | TSX:MRI.U | www.mercerint.com 12

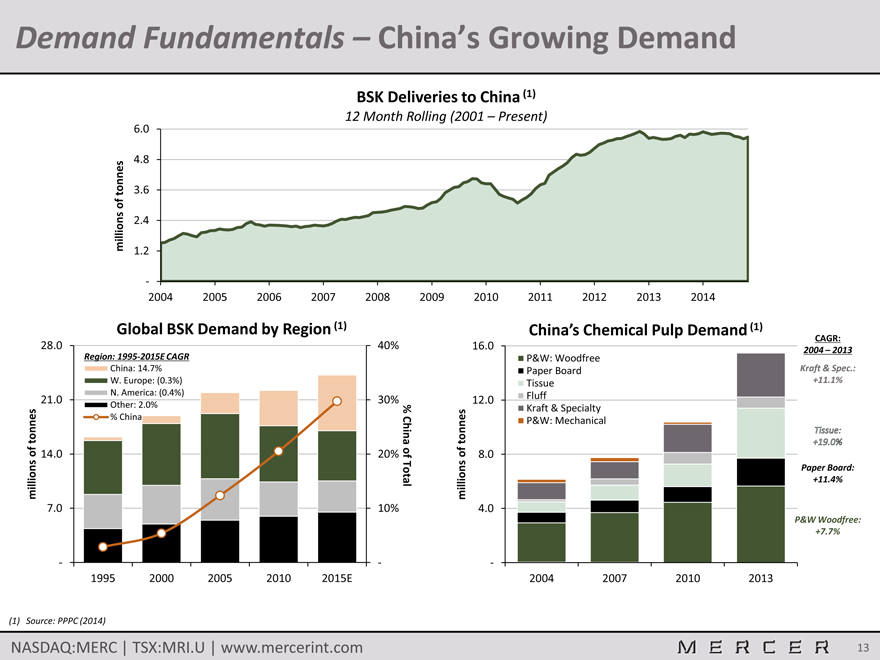

Demand Fundamentals – China’s Growing Demand

BSK Deliveries to China (1)

12 Month Rolling (2001 – Present)

6.0

4.8

tonnes 3.6

of

millions 2.4

1.2

—

2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014

Global BSK Demand by Region (1)

28.0 40%

Region: 1995-2015E CAGR

China: 14.7%

W. Europe: (0.3%)

N. America: (0.4%)

21.0 30%

Other: 2.0% %

tonnes % China China

of 14.0 20% of

millions Total

7.0 10%

— -

1995 2000 2005 2010 2015E

China’s Chemical Pulp Demand (1)

16.0

P&W: Woodfree

Paper Board

Tissue

12.0 Fluff

Kraft & Specialty

tonnes P&W: Mechanical

of 8.0

millions

4.0

—

2004 2007 2010 2013

CAGR:

2004 – 2013

Kraft & Spec.: +11.1%

Paper Board: +11.4%

P&W Woodfree: +7.7%

Tissue: +19.0%

(1) Source: PPPC (2014)

NASDAQ:MERC | TSX:MRI.U | www.mercerint.com 13

Demand Fundamentals – China’s Growing Demand (Cont’d)

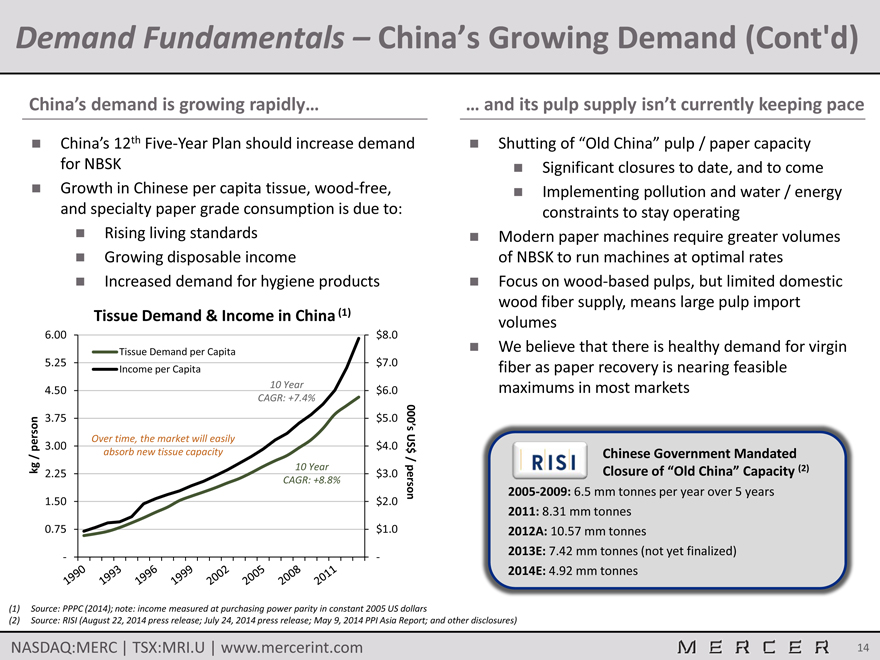

China’s demand is growing rapidly…

China’s 12th Five-Year Plan should increase demand for NBSK

Growth in Chinese per capita tissue, wood-free, and specialty paper grade consumption is due to:

Rising living standards Growing disposable income

Increased demand for hygiene products

Tissue Demand & Income in China (1)

6.00 $ 8.0

Tissue Demand per Capita

5.25 $ 7.0

Income per Capita

10 Year

4.50 $ 6.0

CAGR: +7.4%

3.75 $ 5.0 000’s

person 3.00 Over time, the market will easily $ 4.0 US

absorb new tissue capacity $

/ /

kg 2.25 10 Year $ 3.0

CAGR: +8.8% person

1.50 $ 2.0

0.75 $ 1.0

— —

… and its pulp supply isn’t currently keeping pace

Shutting of “Old China” pulp / paper capacity

Significant closures to date, and to come

Implementing pollution and water / energy constraints to stay operating

Modern paper machines require greater volumes of NBSK to run machines at optimal rates

Focus on wood-based pulps, but limited domestic wood fiber supply, means large pulp import volumes

We believe that there is healthy demand for virgin fiber as paper recovery is nearing feasible maximums in most markets

Chinese Government Mandated

Closure of “Old China” Capacity (2) mm tonnes per year over 5 years tonnes 2012A: 10.57 mm tonnes 2013E: 7.42 mm tonnes (not yet finalized) 2014E: 4.92 mm tonnes

(1) Source: PPPC (2014); note: income measured at purchasing power parity in constant 2005 US dollars

(2) Source: RISI (August 22, 2014 press release; July 24, 2014 press release; May 9, 2014 PPI Asia Report; and other disclosures)

NASDAQ:MERC | TSX:MRI.U | www.mercerint.com 14

Demand Fundamentals – The Importance of NBSK Fibers

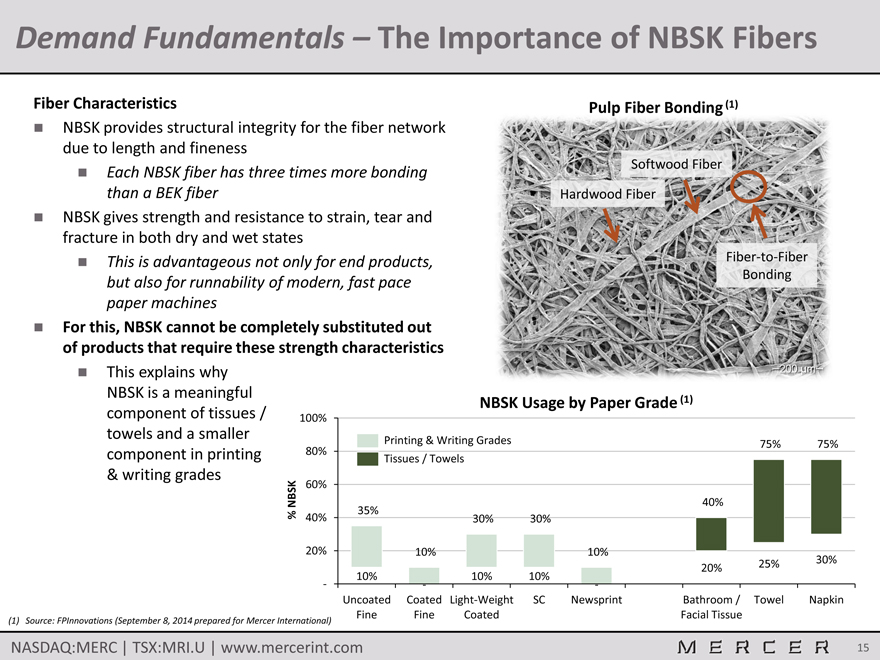

Fiber Characteristics

NBSK provides structural integrity for the fiber network due to length and fineness

Each NBSK fiber has three times more bonding than a BEK fiber

NBSK gives strength and resistance to strain, tear and fracture in both dry and wet states

This is advantageous not only for end products, but also for runnability of modern, fast pace paper machines

For this, NBSK cannot be completely substituted out of products that require these strength characteristics

This explains why NBSK is a meaningful component of tissues / towels and a smaller component in printing & writing grades

Pulp Fiber Bonding (1)

Softwood Fiber

Hardwood Fiber

Fiber-to-Fiber Bonding

NBSK Usage by Paper Grade (1)

100%

Printing & Writing Grades 75% 75%

80%

Tissues / Towels

60%

NBSK 40%

35%

% 40% 30% 30%

20% 10% 10%

25% 30%

20%

10% 10% 10%

- — —

Uncoated Coated Light-Weight SC Newsprint Bathroom / Towel Napkin

Fine Fine Coated Facial Tissue (1) Source: FPInnovations (September 8, 2014 prepared for Mercer International)

NASDAQ:MERC | TSX:MRI.U | www.mercerint.com 15

Demand Fundamentals – Explaining the NBSK-BEK Spread

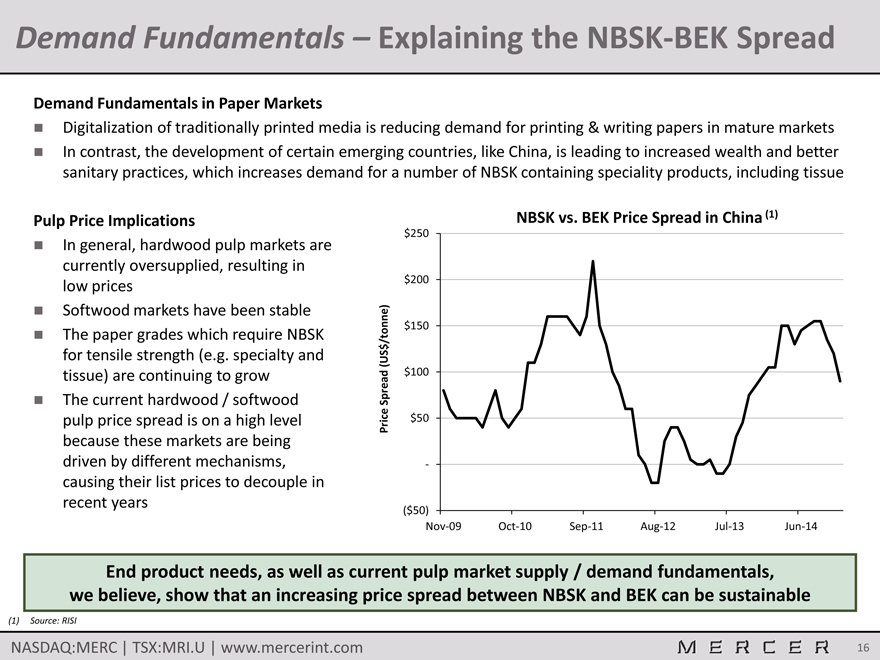

Demand Fundamentals in Paper Markets

Digitalization of traditionally printed media is reducing demand for printing & writing papers in mature markets

In contrast, the development of certain emerging countries, like China, is leading to increased wealth and better sanitary practices, which increases demand for a number of NBSK containing speciality products, including tissue

Pulp Price Implications

In general, hardwood pulp markets are currently oversupplied, resulting in low prices

Softwood markets have been stable

The paper grades which require NBSK for tensile strength (e.g. specialty and tissue) are continuing to grow

The current hardwood / softwood pulp price spread is on a high level because these markets are being driven by different mechanisms, causing their list prices to decouple in recent years

$250 $200 $150 $100 $50 -

($50)

Price Spread (US$/tonne)

NBSK vs. BEK Price Spread in China (1)

Nov-09 Oct-10 Sep-11 Aug-12 Jul-13 Jun-14

End product needs, as well as current pulp market supply / demand fundamentals, we believe, show that an increasing price spread between NBSK and BEK can be sustainable

(1) Source: RISI

NASDAQ:MERC | TSX:MRI.U | www.mercerint.com 16

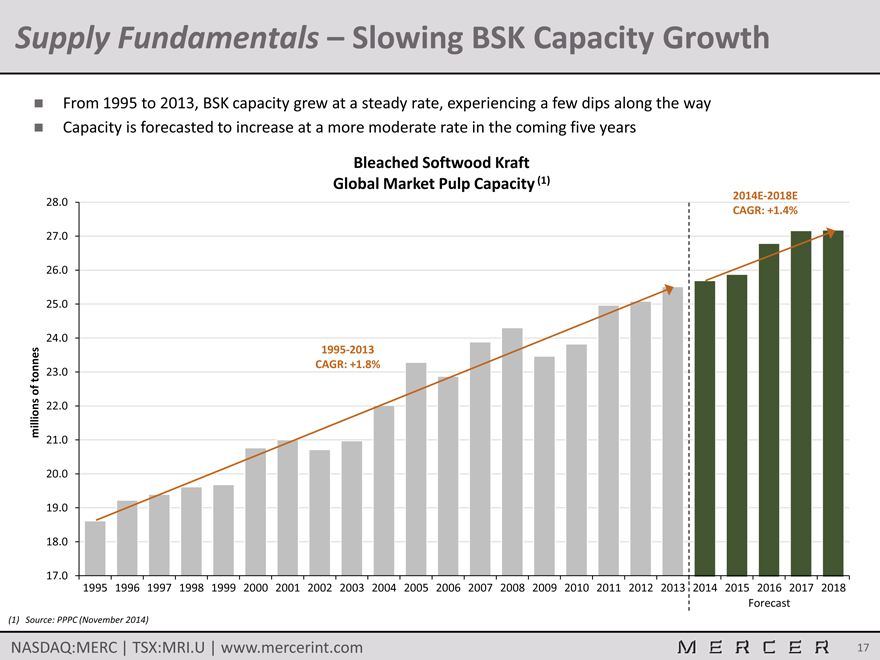

Supply Fundamentals – Slowing BSK Capacity Growth

From 1995 to 2013, BSK capacity grew at a steady rate, experiencing a few dips along the way Capacity is forecasted to increase at a more moderate rate in the coming five years

Bleached Softwood Kraft Global Market Pulp Capacity (1)

2014E-2018E

28.0

CAGR: +1.4% 27.0 26.0 25.0

24.0 tonnes 23.0 of millions 22.0 21.0

20.0 19.0 18.0 17.0

1995-2013 CAGR: +1.8%

2014E-2018E CAGR: +1.4%

1995 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 Forecast

(1) Source: PPPC

NASDAQ:MERC | TSX:MRI.U | www.mercerint.com 17

(November 2014)

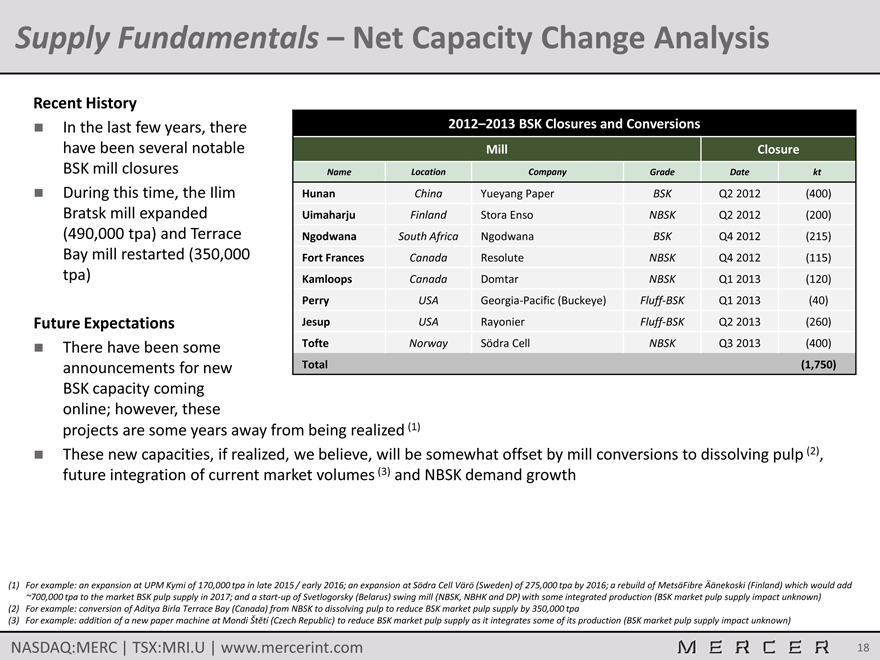

Supply Fundamentals – Net Capacity Change Analysis

Recent History

In the last few years, there have been several notable BSK mill closures

During this time, the Ilim Bratsk mill expanded (490,000 tpa) and Terrace Bay mill restarted (350,000 tpa)

Future Expectations

There have been some Tofte Norway Södra Cell NBSK Q3 2013 (400)

announcements for new Total (1,750) BSK capacity coming online; however, these projects are some years away from being realized (1) These new capacities, if realized, we believe, will be somewhat offset by mill conversions to dissolving pulp (2), future integration of current market volumes (3) and NBSK demand growth

2012–2013 BSK Closures and Conversions

Mill Closure

Name Location Company Grade Date kt

Hunan China Yueyang Paper BSK Q2 2012 (400)

Uimaharju Finland Stora Enso NBSK Q2 2012 (200)

Ngodwana South Africa Ngodwana BSK Q4 2012 (215)

Fort Frances Canada Resolute NBSK Q4 2012 (115)

Kamloops Canada Domtar NBSK Q1 2013 (120)

Perry USA Georgia-Pacific (Buckeye) Fluff-BSK Q1 2013 (40)

Jesup USA Rayonier Fluff-BSK Q2 2013 (260)

(1) For example: an expansion at UPM Kymi of 170,000 tpa in late 2015 / early 2016; an expansion at Södra Cell Värö (Sweden) of 275,000 tpa by 2016; a rebuild of MetsäFibre Äänekoski (Finland) which would add ~700,000 tpa to the market BSK pulp supply in 2017; and a start-up of Svetlogorsky (Belarus) swing mill (NBSK, NBHK and DP) with some integrated production (BSK market pulp supply impact unknown)

(2) For example: conversion of Aditya Birla Terrace Bay (Canada) from NBSK to dissolving pulp to reduce BSK market pulp supply by 350,000 tpa

(3) For example: addition of a new paper machine at Mondi Štĕtí (Czech Republic) to reduce BSK market pulp supply as it integrates some of its production (BSK market pulp supply impact unknown)

NASDAQ:MERC | TSX:MRI.U | www.mercerint.com 18

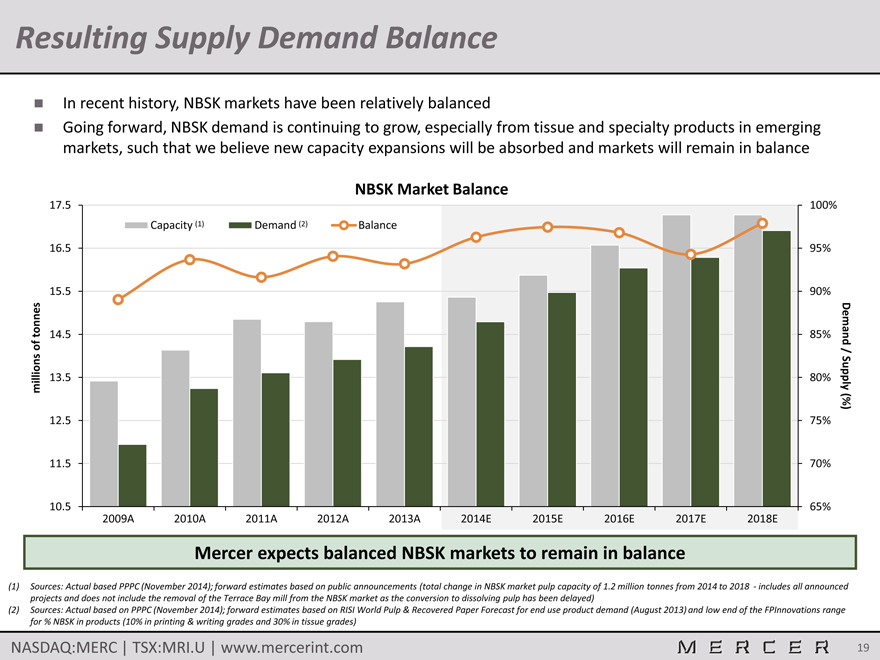

Resulting Supply Demand Balance

In recent history, NBSK markets have been relatively balanced

Going forward, NBSK demand is continuing to grow, especially from tissue and specialty products in emerging markets, such that we believe new capacity expansions will be absorbed and markets will remain in balance

NBSK Market Balance

17.5 100%

Capacity (1) Demand (2) Balance

16.5 95%

15.5 90%

tonnes 14.5 85% Demand

of /

millions 13.5 80% Supply

(%)

12.5 75%

11.5 70%

10.5 65%

2009A 2010A 2011A 2012A 2013A 2014E 2015E 2016E 2017E 2018E

Mercer expects balanced NBSK markets to remain in balance

(1) Sources: Actual based PPPC (November 2014); forward estimates based on public announcements (total change in NBSK market pulp capacity of 1.2 million tonnes from 2014 to 2018 —includes all announced projects and does not include the removal of the Terrace Bay mill from the NBSK market as the conversion to dissolving pulp has been delayed)

(2) Sources: Actual based on PPPC (November 2014); forward estimates based on RISI World Pulp & Recovered Paper Forecast for end use product demand (August 2013) and low end of the FPInnovations range for % NBSK in products (10% in printing & writing grades and 30% in tissue grades)

NASDAQ:MERC | TSX:MRI.U | www.mercerint.com 19

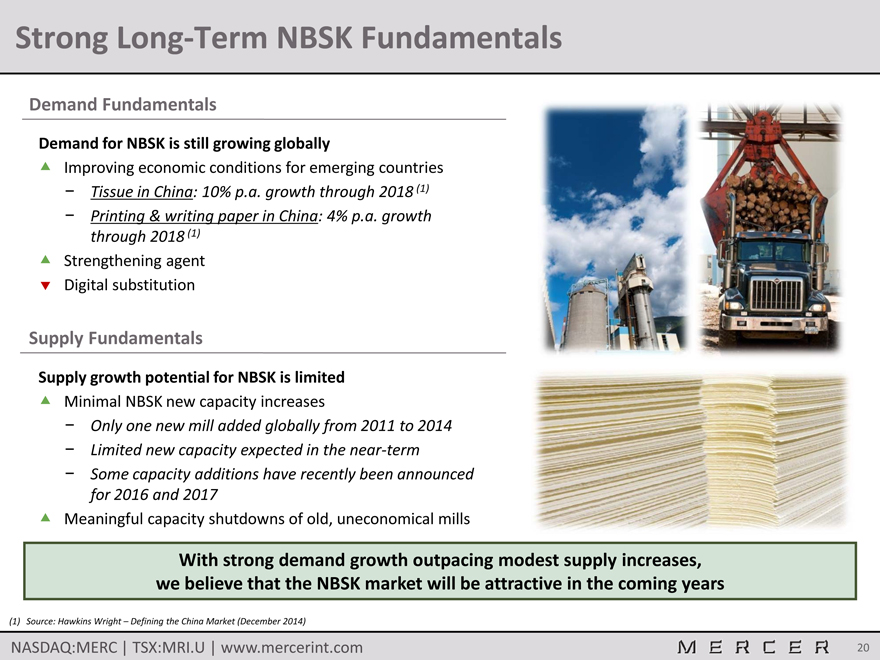

Strong Long-Term NBSK Fundamentals

Demand Fundamentals

Demand for NBSK is still growing globally

Improving economic conditions for emerging countries

Tissue in China: 10% p.a. growth through 2018 (1)

Printing & writing paper in China: 4% p.a. growth through 2018 (1)

Strengthening agent Digital substitution

Supply Fundamentals

Supply growth potential for NBSK is limited

Minimal NBSK new capacity increases

Only one new mill added globally from 2011 to 2014

Limited new capacity expected in the near-term

Some capacity additions have recently been announced for 2016 and 2017

Meaningful capacity shutdowns of old, uneconomical mills

With strong demand growth outpacing modest supply increases, we believe that the NBSK market will be attractive in the coming years

(1) Source: Hawkins Wright – Defining the China Market (December 2014)

NASDAQ:MERC | TSX:MRI.U | www.mercerint.com 20

Financial Performance and Recent Developments

NASDAQ:MERC | TSX:MRI.U | www.mercerint.com 21

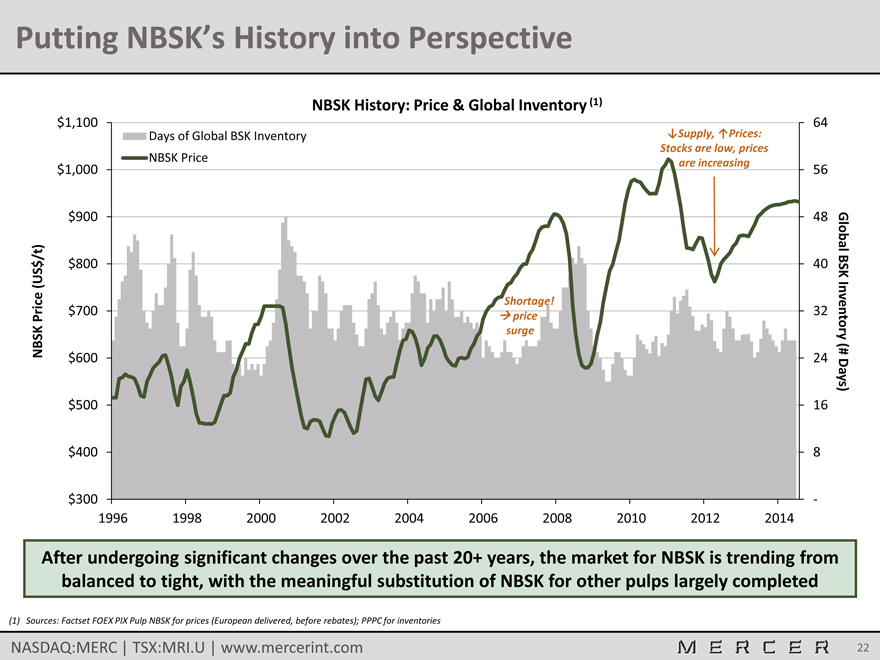

Putting NBSK’s History into Perspective

NBSK History: Price & Global Inventory (1)

$1,100 64

Days of Global BSK Inventory Supply, Prices:

Stocks are low, prices

NBSK Price are increasing

$1,000 56

$900 48

/t) Global

$ $800 40 BSK

(US

Shortage!

$700 price 32

Price surge Inventory

NBSK (#

$600 24

Days)

$500 16

$400 8

$300 —

1996 1998 2000 2002 2004 2006 2008 2010 2012 2014

After undergoing significant changes over the past 20+ years, the market for NBSK is trending from balanced to tight, with the meaningful substitution of NBSK for other pulps largely completed

(1) Sources: Factset FOEX PIX Pulp NBSK for prices (European delivered, before rebates); PPPC for inventories

NASDAQ:MERC | TSX:MRI.U | www.mercerint.com 22

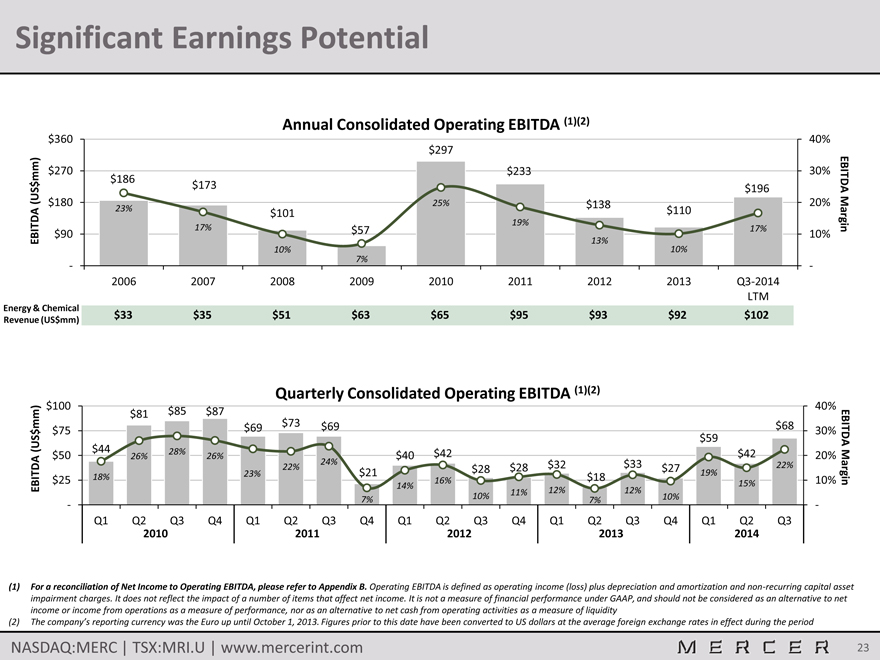

Significant Earnings Potential

Annual Consolidated Operating EBITDA (1)(2)

$360 40%

$297

mm) $270 $186 $233 30%

$ $173 $196 EBITDA

(US $180 25% $138 20%

23% $101 $110

19%

$90 17% $57 17% 10%

EBITDA 13% Margin

10% 10%

7%

- —

2006 2007 2008 2009 2010 2011 2012 2013 Q3-2014

LTM

Energy & Chemical

Revenue (US$mm) $33 $35 $51 $63 $65 $95 $93 $92 $102

Quarterly Consolidated Operating EBITDA (1)(2)

$100 40%

$81 $85 $87

$73

$

(US mm) $75 $69 $69 $59 $68 30% EBITDA

$50 $44 26% 28% 26% $40 $42 $42 20%

22%

23% $21 19%

EBITDA $25 18% 22% 24% 14% 16% $28 $28 $32 $18 $33 $27 15% 10% Margin

11% 12% 12%

7% 10% 7% 10%

— -

Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3

2010 2011 2012 2013 2014

(1) For a reconciliation of Net Income to Operating EBITDA, please refer to Appendix B. Operating EBITDA is defined as operating income (loss) plus depreciation and amortization and non-recurring capital asset impairment charges. It does not reflect the impact of a number of items that affect net income. It is not a measure of financial performance under GAAP, and should not be considered as an alternative to net income or income from operations as a measure of performance, nor as an alternative to net cash from operating activities as a measure of liquidity

(2) The company’s reporting currency was the Euro up until October 1, 2013. Figures prior to this date have been converted to US dollars at the average foreign exchange rates in effect during the period

NASDAQ:MERC | TSX:MRI.U | www.mercerint.com 23

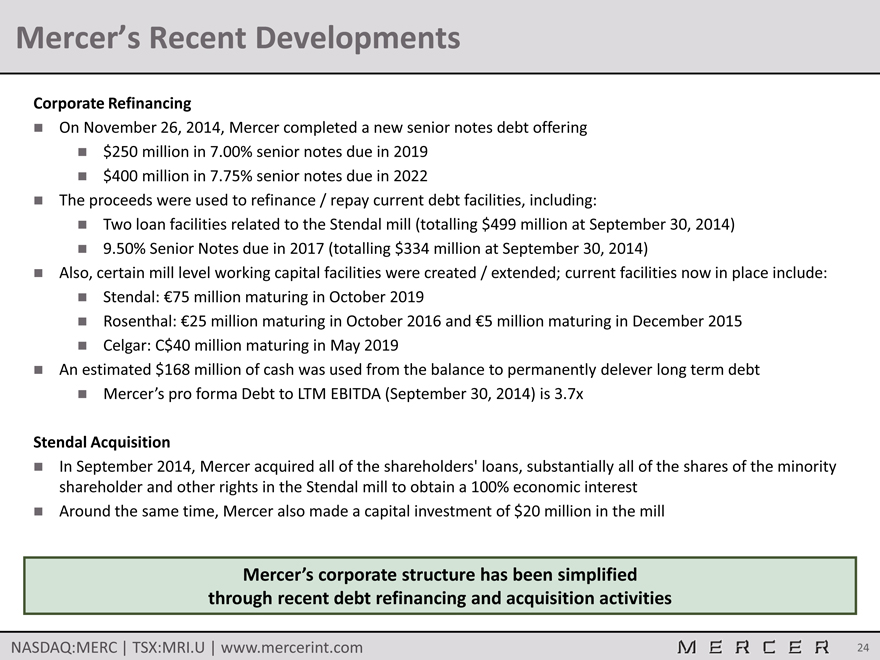

Mercer’s Recent Developments

Corporate Refinancing

On November 26, 2014, Mercer completed a new senior notes debt offering

$250 million in 7.00% senior notes due in 2019

$400 million in 7.75% senior notes due in 2022

The proceeds were used to refinance / repay current debt facilities, including:

Two loan facilities related to the Stendal mill (totalling $499 million at September 30, 2014)

9.50% Senior Notes due in 2017 (totalling $334 million at September 30, 2014)

Also, certain mill level working capital facilities were created / extended; current facilities now in place include:

Stendal: €75 million maturing in October 2019

Rosenthal: €25 million maturing in October 2016 and €5 million maturing in December 2015

Celgar: C$40 million maturing in May 2019

An estimated $168 million of cash was used from the balance to permanently delever long term debt

Mercer’s pro forma Debt to LTM EBITDA (September 30, 2014) is 3.7x

Stendal Acquisition

In September 2014, Mercer acquired all of the shareholders’ loans, substantially all of the shares of the minority shareholder and other rights in the Stendal mill to obtain a 100% economic interest

Around the same time, Mercer also made a capital investment of $20 million in the mill

Mercer’s corporate structure has been simplified through recent debt refinancing and acquisition activities

NASDAQ:MERC | TSX:MRI.U | www.mercerint.com 24

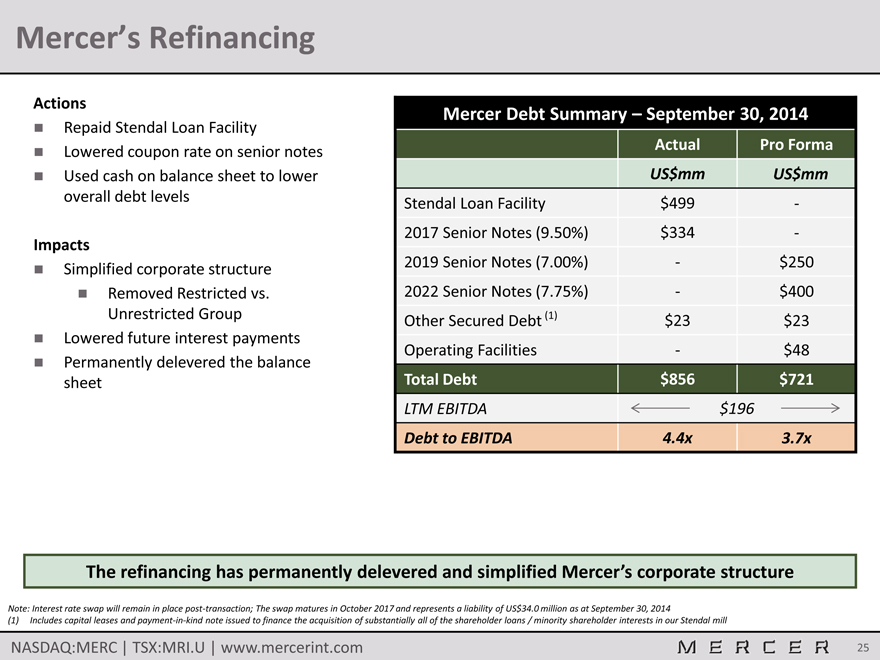

Mercer’s Refinancing

Actions

Repaid Stendal Loan Facility

Lowered coupon rate on senior notes

Used cash on balance sheet to lower overall debt levels

Impacts

Simplified corporate structure

Removed Restricted vs.

Unrestricted Group

Lowered future interest payments

Permanently delevered the balance sheet

Mercer Debt Summary – September 30, 2014

Actual Pro Forma

US$mm US$mm

Stendal Loan Facility $499 -

2017 Senior Notes (9.50%) $334 -

2019 Senior Notes (7.00%) — $250

2022 Senior Notes (7.75%) — $400

Other Secured Debt (1) $23 $23

Operating Facilities — $48

Total Debt $856 $721

LTM EBITDA $196

Debt to EBITDA 4.4x 3.7x

The refinancing has permanently delevered and simplified Mercer’s corporate structure

Note: Interest rate swap will remain in place post-transaction; The swap matures in October 2017 and represents a liability of US$34.0 million as at September 30, 2014

(1) Includes capital leases and payment-in-kind note issued to finance the acquisition of substantially all of the shareholder loans / minority shareholder interests in our Stendal mill

NASDAQ:MERC | TSX:MRI.U | www.mercerint.com 25

Mercer’s Recent Developments (Cont’d)

Capital Projects

Rosenthal’s new 6,000 tonne per year tall oil plant became fully operational in Q4 2014, on schedule and on budget (December 2013)

Completed Stendal’s Project Blue Mill on schedule and on budget

Enhanced pulp production capacity (30,000 ADMT per year) and added new electrical generating capacity (46 MW)

Celgar Workforce Reduction

Expected annual cost savings of $8 to $10 million

Performance BioFilaments

In June 2014, Mercer and Resolute Forest Products launched a new 50/50 joint venture company called Performance BioFilaments

The joint venture is set to commercialize novel product applications for cellulose filaments, an innovative biomaterial derived from wood fiber

NASDAQ:MERC | TSX:MRI.U | www.mercerint.com 26

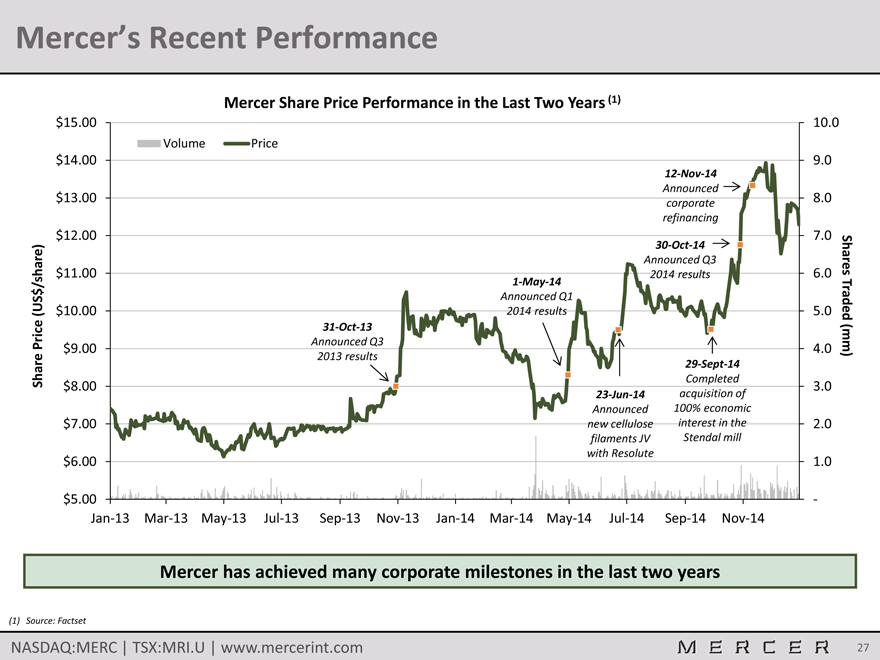

Mercer’s Recent Performance

Mercer Share Price Performance in the Last Two Years (1)

$15.00 $14.00 $13.00

$12.00 share) $11.00 / (US$ $10.00

Price Share $9.00 $8.00

$7.00 $6.00 $5.00

10.0

9.0

8.0

7.0

6.0Shares

5.0 Traded

4.0 (mm)

3.0

2.0

1.0

-

Jan-13 Mar-13 May-13 Jul-13 Sep-13 Nov-13 Jan-14 Mar-14 May-14 Jul-14 Sep-14 Nov-14

Volume Price

12-Nov-14

Announced

corporate

refinancing

30-Oct-14

Announced Q3

2014 results

1-May-14

Announced Q1

2014 results

31-Oct-13

Announced Q3

2013 results

29-Sept-14

Completed

23-Jun-14 acquisition of

Announced 100% economic

new cellulose interest in the

filaments JV Stendal mill

with Resolute

Mercer has achieved many corporate milestones in the last two years

(1) Source: Factset

NASDAQ:MERC | TSX:MRI.U | www.mercerint.com 27

Mercer – Summary

The largest “pure-play” NBSK market pulp producer

Globally cost competitive, modern mill operations

Strategically located mills with excellent access to key markets

Stable and growing revenue from high-margin energy & bio-chemical by-product sales Strong long-term NBSK fundamentals Significant leverage to the NBSK pulp cycle Recently recapitalized and delevered the balance sheet Experienced management team

NASDAQ:MERC | TSX:MRI.U | www.mercerint.com 28

Appendix A

Detailed Overview of Operations

NASDAQ:MERC | TSX:MRI.U | www.mercerint.com 29

Rosenthal Mill

Location: Blankenstein, Germany (~300 km south of Berlin)

Pulp Production Capacity: 360,000 ADMT per year

Electricity Generating Capacity: 57 MW

Certification: ISO 9001, 14001, and 50001

2013 Green Electricity Sales: US$21.5 million

Key Features:

Built in 1999 – modern and efficient

Strategically located in central Europe

Close proximity to stable fiber supply and nearby sawmills

Allows customers to operate using just in time inventory process, lowering their costs and making Rosenthal a preferred supplier

One of the largest biomass power plants in Germany

In 2013, the mill sold nearly 180,000 MWh of green electricity

Regularly setting new pulp and energy production records

New 6,000 tonne per year tall oil plant became operational in Q4 2014; the project was completed on time and on budget

NASDAQ:MERC | TSX:MRI.U | www.mercerint.com 30

Celgar Mill

Location: Castlegar, BC, Canada (~600 km east of Vancouver)

Pulp Production Capacity: 520,000 ADMT per year

Electricity Generating Capacity: 100 MW

Certification: ISO 9001 and ISO 14001

2013 Green Electricity Sales: US$12.3 million

Key Features:

Modern and efficient

Abundant and low cost fiber, by global standards

Green Energy Project was completed in September 2010

In 2013, the mill sold over 127,000 MWh of green electricity

Secured C$57.7 million in non-repayable capital funding from government of Canada for green capital investments

Majority used to fund Green Energy Project

Continues to demonstrate significant upside potential

Regularly setting production records and increasing the amount of bio-energy generated

NASDAQ:MERC | TSX:MRI.U | www.mercerint.com 31

Stendal Mill

Location: Stendal, Germany (~130 km west of Berlin)

Pulp Production Capacity: 660,000 ADMT per year

Electricity Generating Capacity: 148 MW

Certification: ISO 9001 and ISO 14001 certified

2013 Green Electricity Sales: US$45.6 million

2013 Chemical Sales: US$12.8 million

Key Features:

Completed in 2004, it’s one of the newest and largest pulp mills in the world

In September 2014, Mercer completed the acquisition of all of the shareholders’ loans, substantially all of the shares of the minority shareholder and other rights in the Stendal mill

One of the largest biomass power plants in Germany

In 2013, exported over 390,000 MWh

Project Blue Mill was completed in Q4 2013 (on time and on budget) and increased the mill’s annual pulp production capacity by 30,000 ADMT and electricity generation by 109,000 MWh

Regularly setting new performance records

NASDAQ:MERC | TSX:MRI.U | www.mercerint.com 32

Appendix B

Reconciliation of Net Income to Operating EBITDA

NASDAQ:MERC | TSX:MRI.U | www.mercerint.com 33

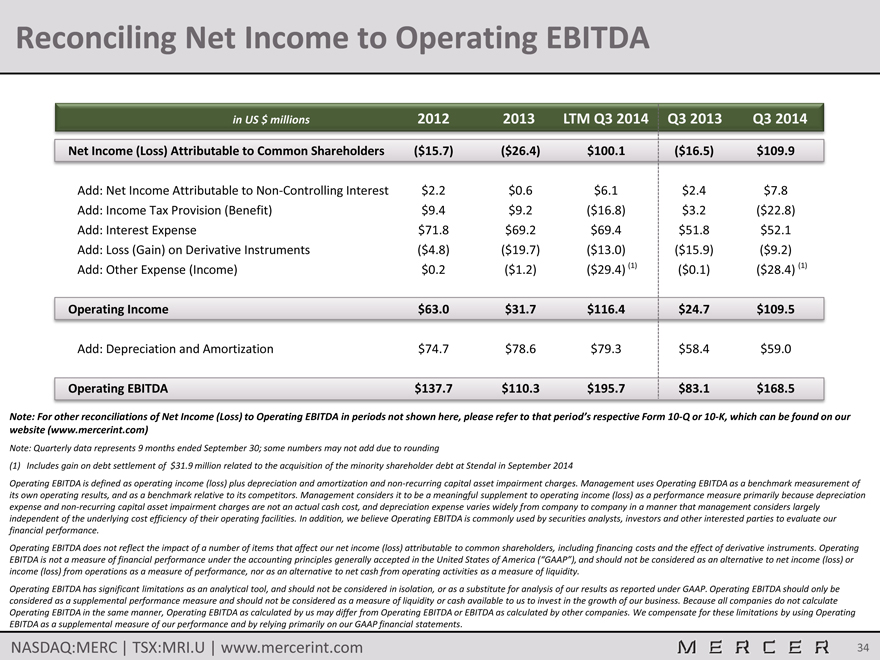

Reconciling Net Income to Operating EBITDA

in US $ millions 2012 2013 LTM Q3 2014 Q3 2013 Q3 2014

Net Income (Loss) Attributable to Common Shareholders ($15.7) ($26.4) $100.1 ($16.5) $109.9

Add: Net Income Attributable to Non-Controlling Interest $2.2 $0.6 $6.1 $2.4 $7.8

Add: Income Tax Provision (Benefit) $9.4 $9.2 ($16.8) $3.2 ($22.8)

Add: Interest Expense $71.8 $69.2 $69.4 $51.8 $52.1

Add: Loss (Gain) on Derivative Instruments ($4.8) ($19.7) ($13.0) ($15.9) ($9.2)

Add: Other Expense (Income) $0.2 ($1.2) ($29.4) (1) ($0.1) ($28.4) (1)

Operating Income $63.0 $31.7 $116.4 $24.7 $109.5

Add: Depreciation and Amortization $74.7 $78.6 $79.3 $58.4 $59.0

Operating EBITDA $137.7 $110.3 $195.7 $83.1 $168.5

Note: For other reconciliations of Net Income (Loss) to Operating EBITDA in periods not shown here, please refer to that period’s respective Form 10-Q or 10-K, which can be found on our website (www.mercerint.com)

Note: Quarterly data represents 9 months ended September 30; some numbers may not add due to rounding

(1) Includes gain on debt settlement of $31.9 million related to the acquisition of the minority shareholder debt at Stendal in September 2014

Operating EBITDA is defined as operating income (loss) plus depreciation and amortization and non-recurring capital asset impairment charges. Management uses Operating EBITDA as a benchmark measurement of its own operating results, and as a benchmark relative to its competitors. Management considers it to be a meaningful supplement to operating income (loss) as a performance measure primarily because depreciation expense and non-recurring capital asset impairment charges are not an actual cash cost, and depreciation expense varies widely from company to company in a manner that management considers largely independent of the underlying cost efficiency of their operating facilities. In addition, we believe Operating EBITDA is commonly used by securities analysts, investors and other interested parties to evaluate our financial performance.

Operating EBITDA does not reflect the impact of a number of items that affect our net income (loss) attributable to common shareholders, including financing costs and the effect of derivative instruments. Operating EBITDA is not a measure of financial performance under the accounting principles generally accepted in the United States of America (“GAAP”), and should not be considered as an alternative to net income (loss) or income (loss) from operations as a measure of performance, nor as an alternative to net cash from operating activities as a measure of liquidity.

Operating EBITDA has significant limitations as an analytical tool, and should not be considered in isolation, or as a substitute for analysis of our results as reported under GAAP. Operating EBITDA should only be considered as a supplemental performance measure and should not be considered as a measure of liquidity or cash available to us to invest in the growth of our business. Because all companies do not calculate Operating EBITDA in the same manner, Operating EBITDA as calculated by us may differ from Operating EBITDA or EBITDA as calculated by other companies. We compensate for these limitations by using Operating EBITDA as a supplemental measure of our performance and by relying primarily on our GAAP financial statements.

NASDAQ:MERC | TSX:MRI.U | www.mercerint.com 34