Exhibit 99.1

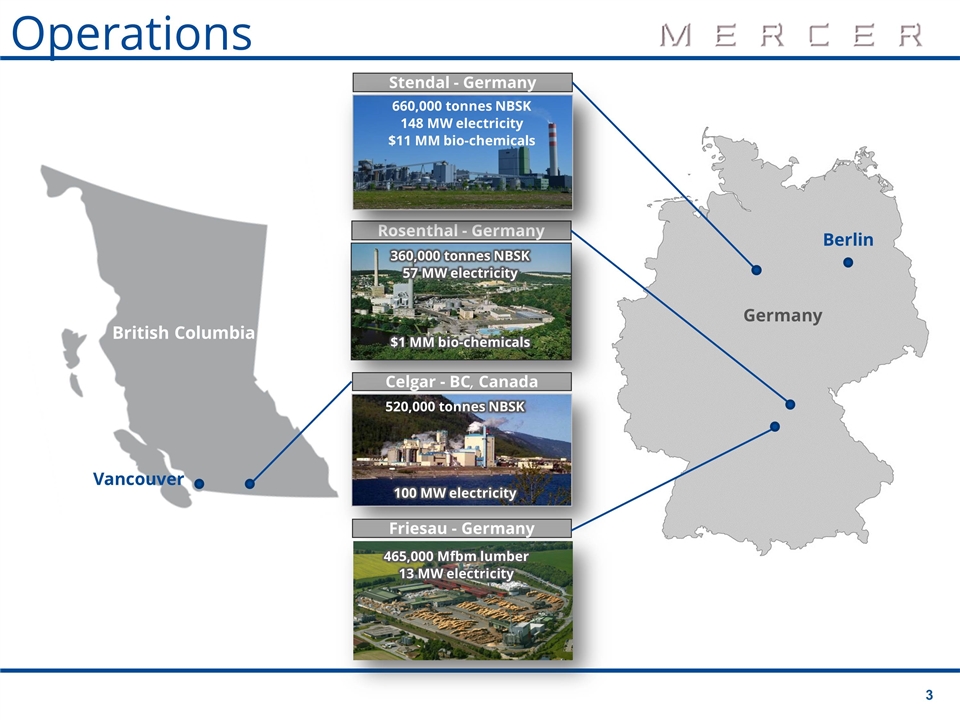

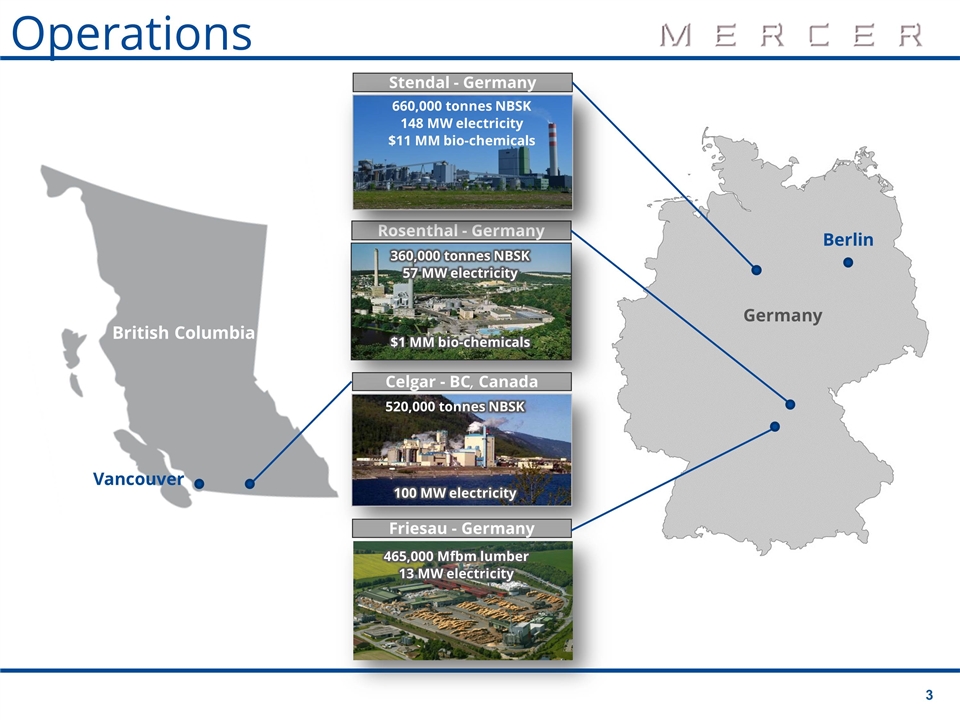

Operations Rosenthal - Germany 360,000 tonnes NBSK 57 MW electricity $1 MM bio-chemicals Stendal - Germany 660,000 tonnes NBSK 148 MW electricity $11 MM bio-chemicals Celgar - BC, Canada 520,000 tonnes NBSK 100 MW electricity Friesau - Germany 465,000 Mfbm lumber 13 MW electricity British Columbia Vancouver Germany Berlin

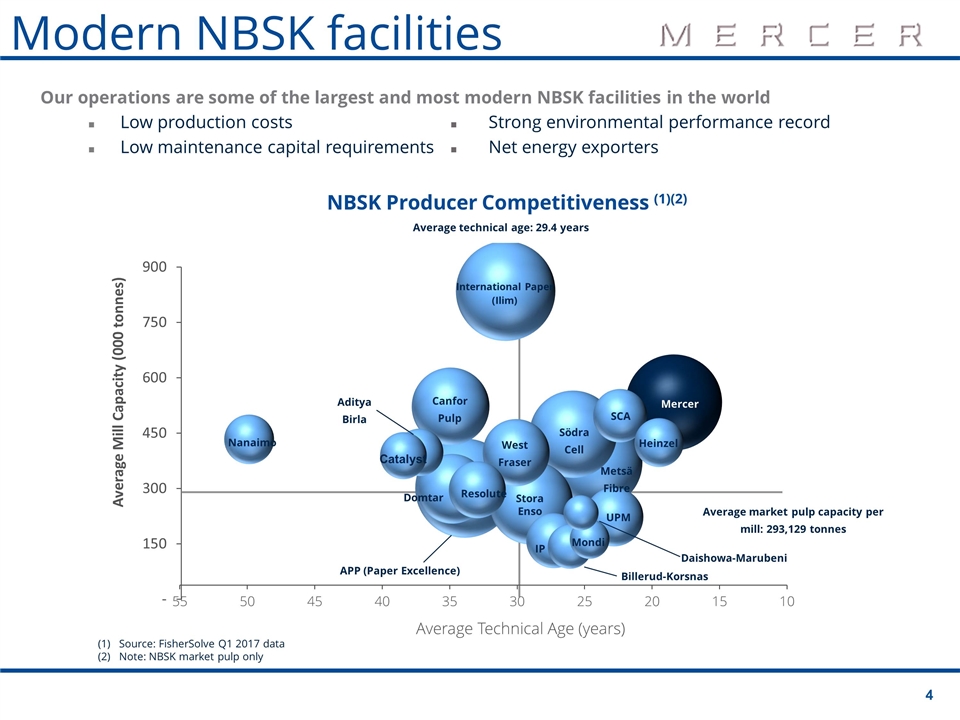

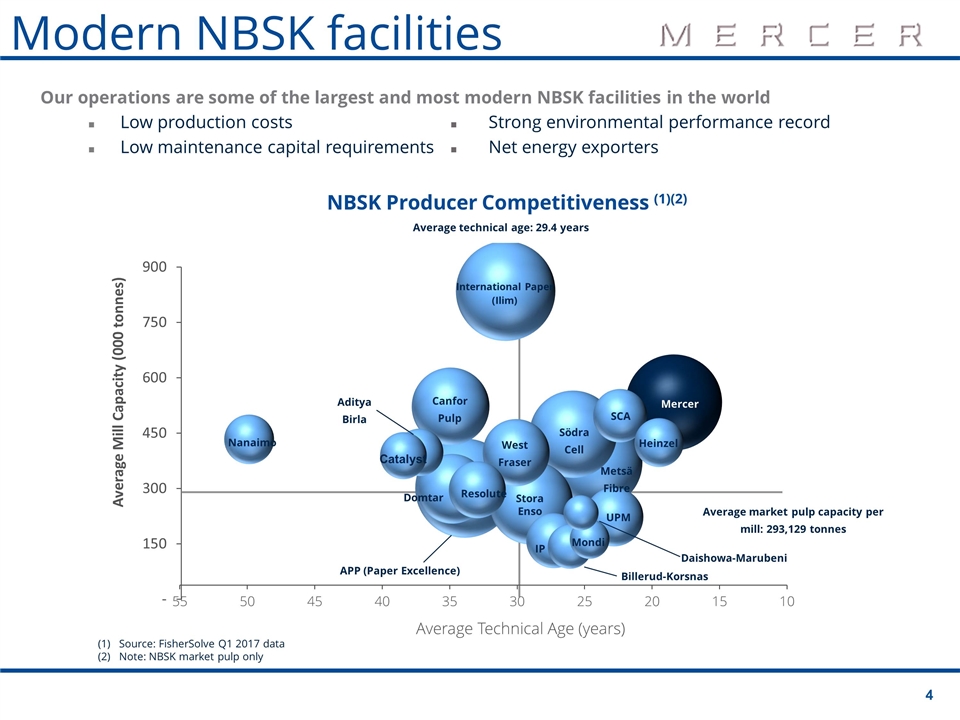

Mercer Metsä Fibre International Paper (Ilim) Stora Enso Södra Cell Catalyst West Fraser SCA Canfor Pulp Resolute UPM Domtar Aditya Birla Average market pulp capacity per mill: 293,129 tonnes Average technical age: 29.4 years Daishowa-Marubeni Mondi Billerud-Korsnas Heinzel APP (Paper Excellence) Nanaimo IP Strong environmental performance record Net energy exporters Our operations are some of the largest and most modern NBSK facilities in the world Low production costs Low maintenance capital requirements Modern NBSK facilities

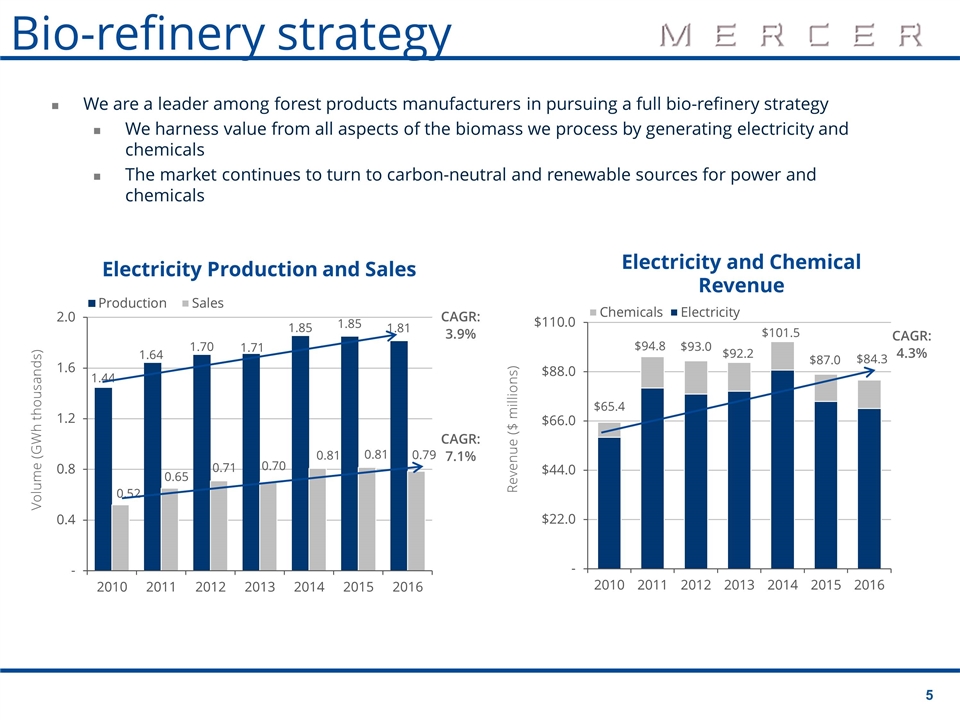

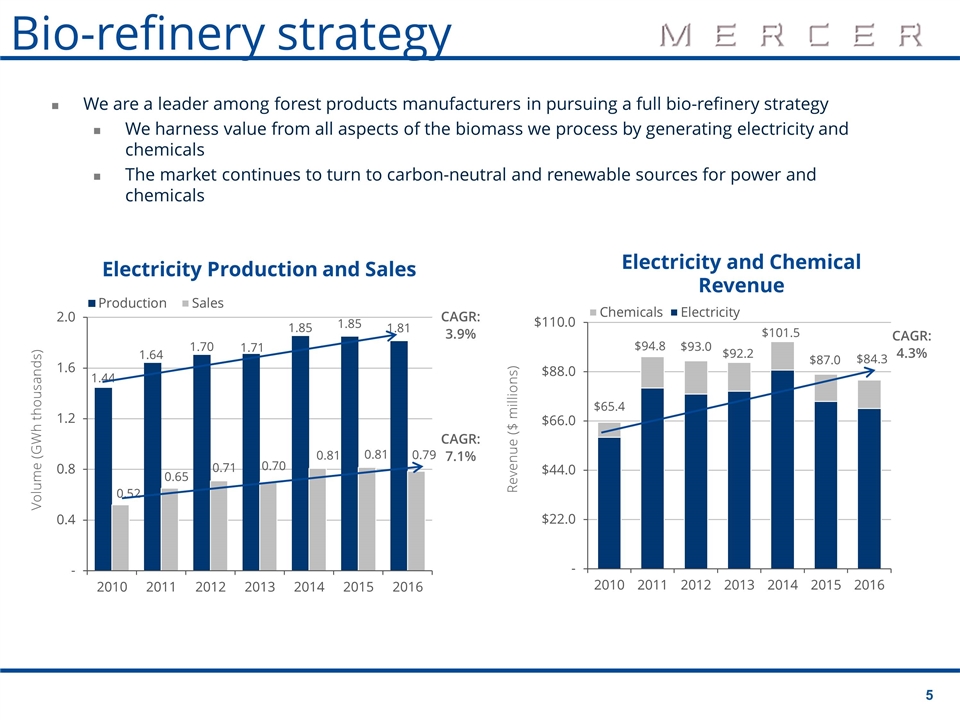

CAGR: 3.9% CAGR: 7.1% CAGR: 4.3% Bio-refinery strategy We are a leader among forest products manufacturers in pursuing a full bio-refinery strategy We harness value from all aspects of the biomass we process by generating electricity and chemicals The market continues to turn to carbon-neutral and renewable sources for power and chemicals

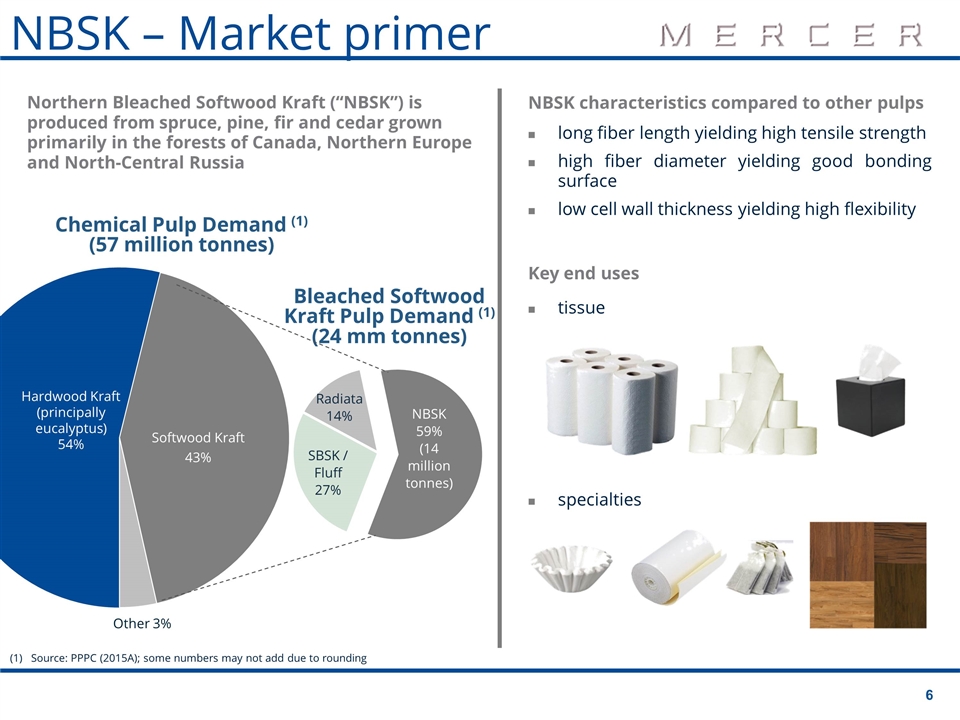

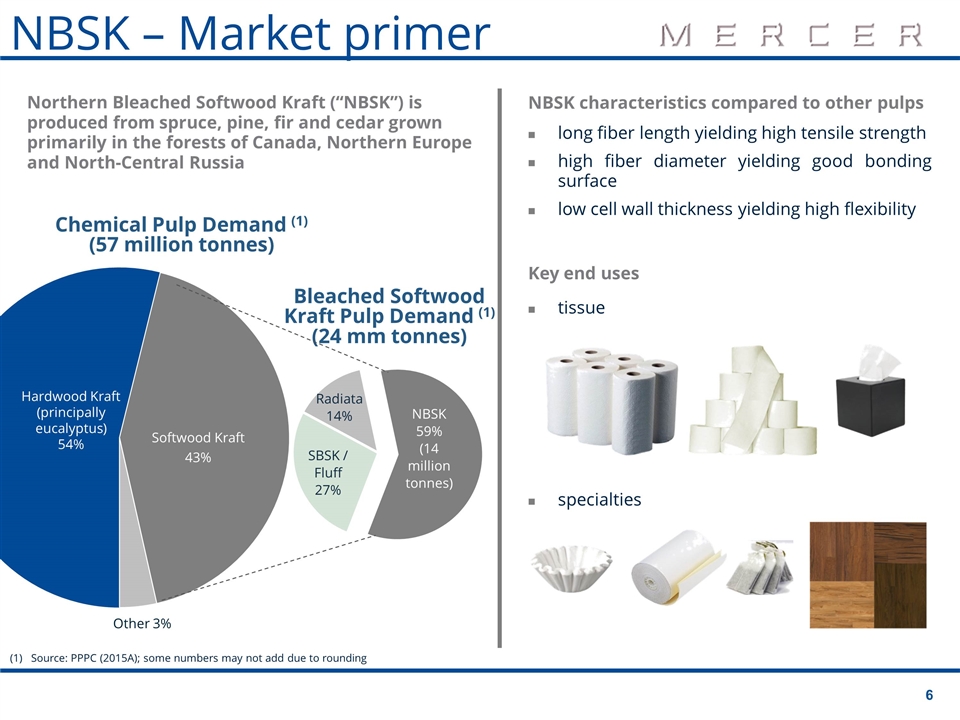

NBSK characteristics compared to other pulps long fiber length yielding high tensile strength high fiber diameter yielding good bonding surface low cell wall thickness yielding high flexibility Key end uses tissue specialties Northern Bleached Softwood Kraft (“NBSK”) is produced from spruce, pine, fir and cedar grown primarily in the forests of Canada, Northern Europe and North-Central Russia (1) Source: PPPC (2015A); some numbers may not add due to rounding NBSK – Market primer Hardwood Kraft (principally eucalyptus)54%

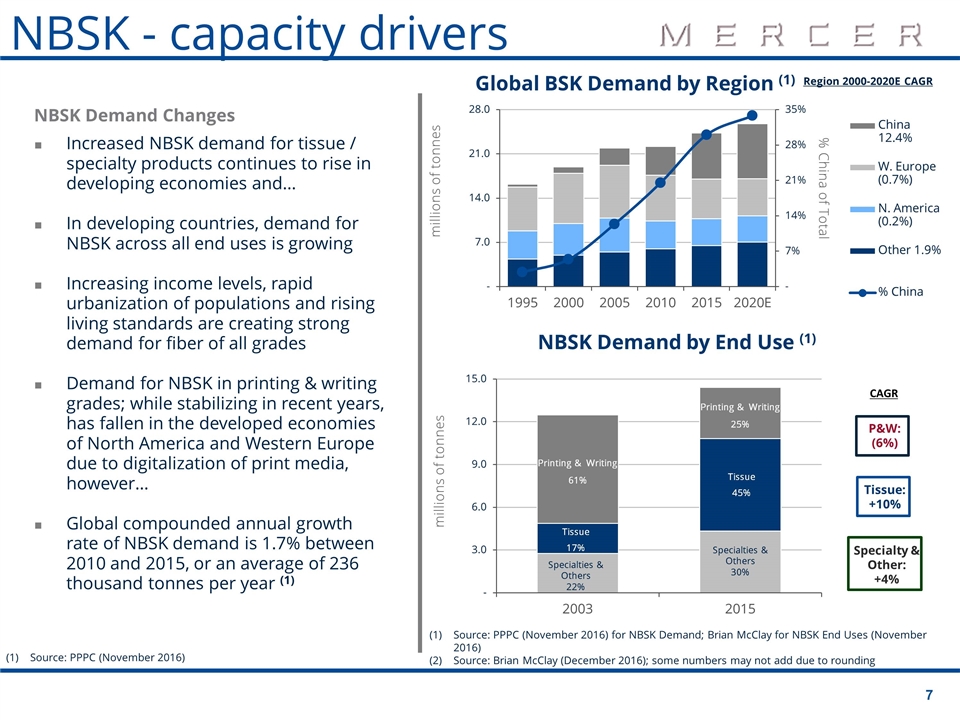

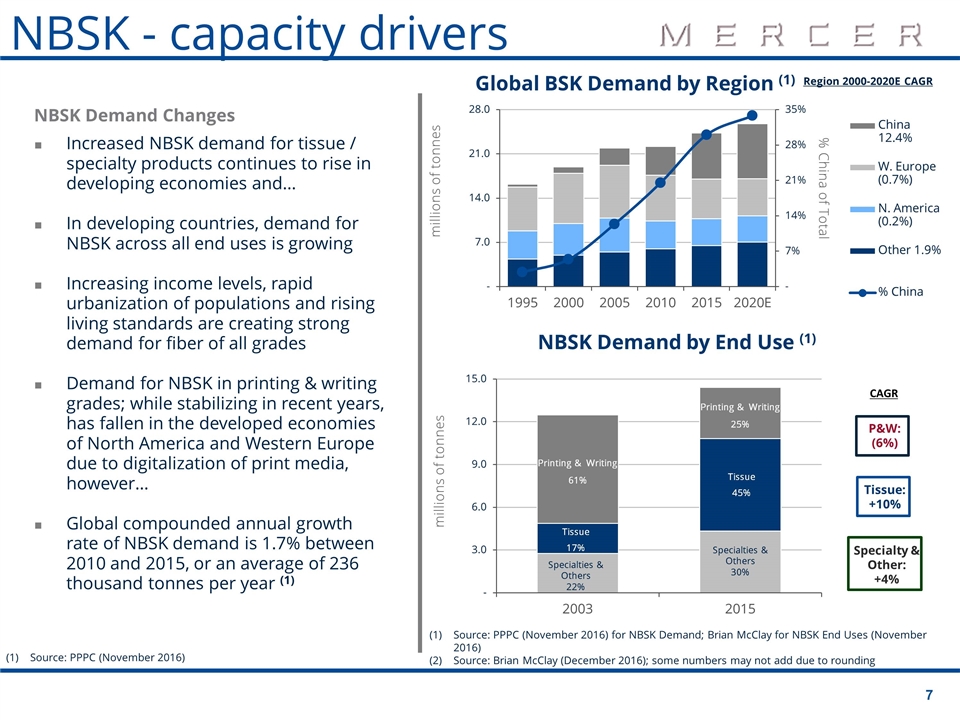

NBSK Demand Changes Increased NBSK demand for tissue / specialty products continues to rise in developing economies and… In developing countries, demand for NBSK across all end uses is growing Increasing income levels, rapid urbanization of populations and rising living standards are creating strong demand for fiber of all grades Demand for NBSK in printing & writing grades; while stabilizing in recent years, has fallen in the developed economies of North America and Western Europe due to digitalization of print media, however… Global compounded annual growth rate of NBSK demand is 1.7% between 2010 and 2015, or an average of 236 thousand tonnes per year (1) Source: PPPC (November 2016) for NBSK Demand; Brian McClay for NBSK End Uses (November 2016) Source: Brian McClay (December 2016); some numbers may not add due to rounding Source: PPPC (November 2016) NBSK - capacity drivers CAGR P&W: (6%) Tissue: +10% Specialty & Other: +4% Printing & Writing 61% Printing & Writing 25%

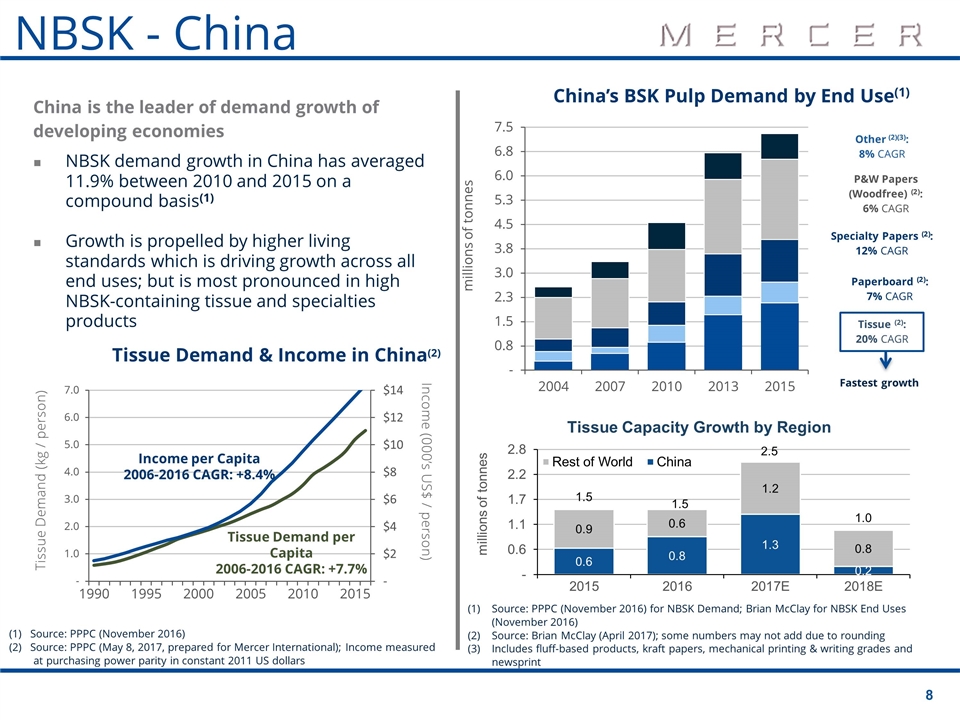

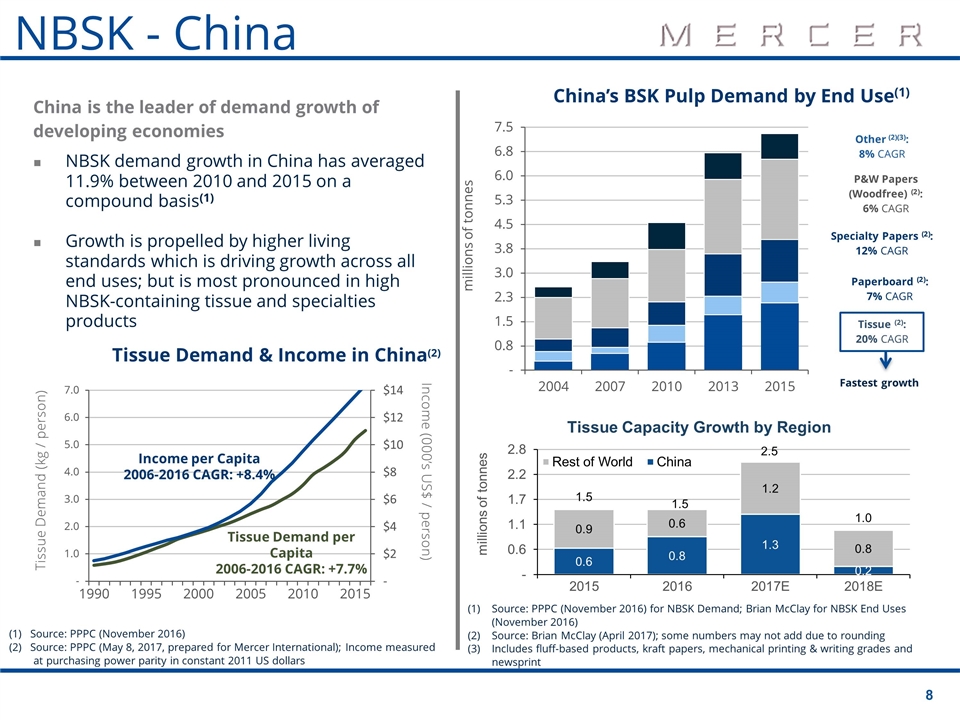

China is the leader of demand growth of developing economies NBSK demand growth in China has averaged 11.9% between 2010 and 2015 on a compound basis(1) Growth is propelled by higher living standards which is driving growth across all end uses; but is most pronounced in high NBSK-containing tissue and specialties products 61% 17% 25% 45% Source: PPPC (November 2016) for NBSK Demand; Brian McClay for NBSK End Uses (November 2016) Source: Brian McClay (April 2017); some numbers may not add due to rounding Includes fluff-based products, kraft papers, mechanical printing & writing grades and newsprint Income per Capita 2006-2016 CAGR: +8.4% Tissue Demand per Capita 2006-2016 CAGR: +7.7% (1) Source: PPPC (November 2016) (2) Source: PPPC (May 8, 2017, prepared for Mercer International); Income measured at purchasing power parity in constant 2011 US dollars NBSK - China Tissue Demand & Income in China(2)

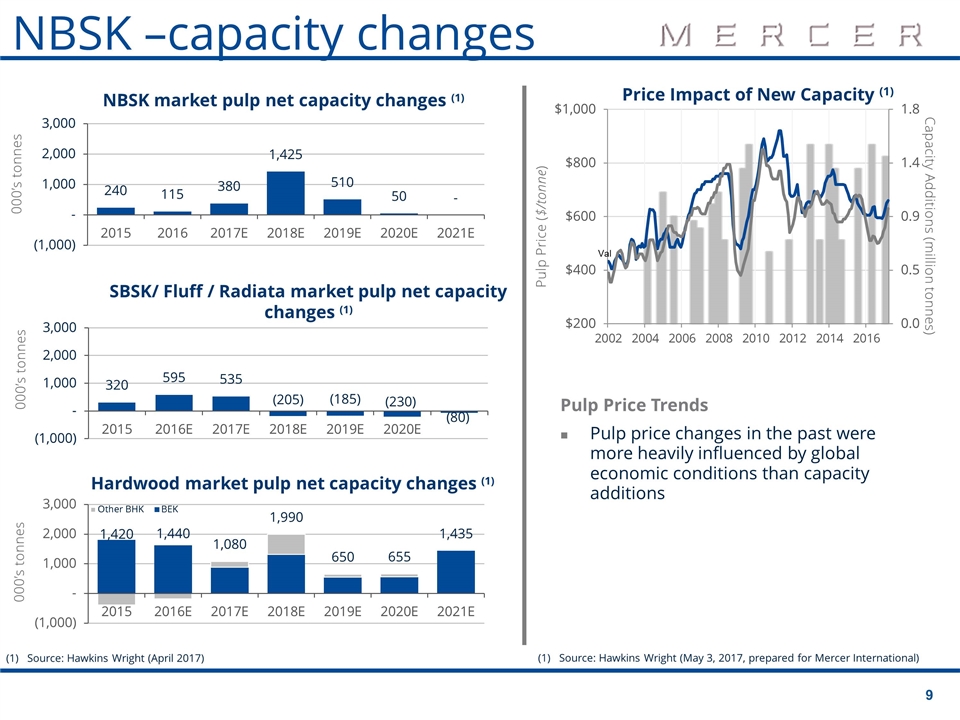

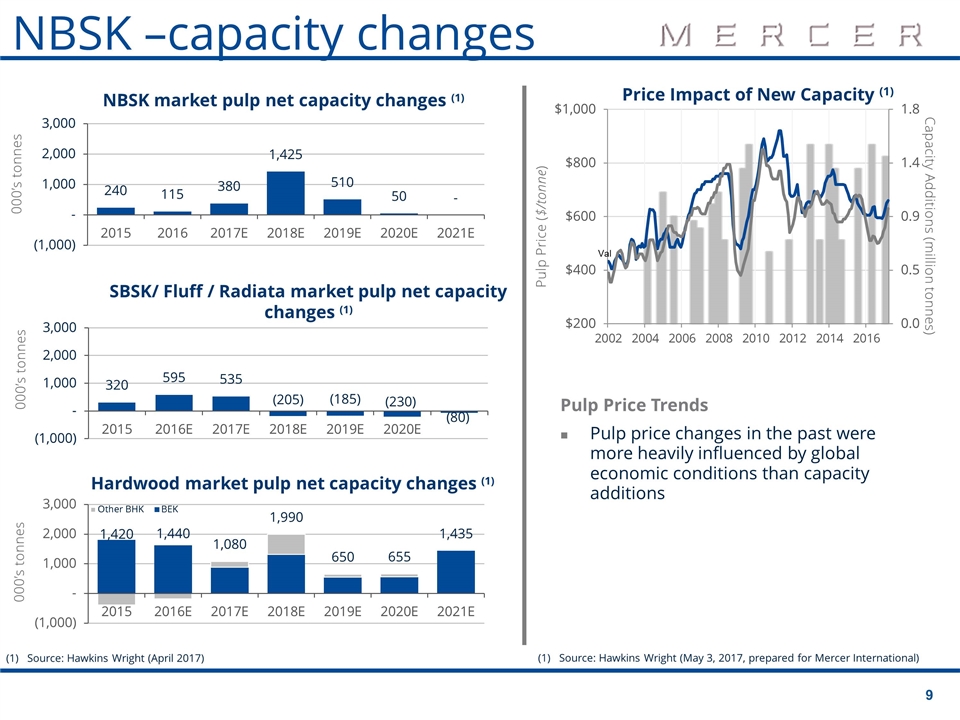

(1) Source: Hawkins Wright (April 2017) Pulp Price Trends Pulp price changes in the past were more heavily influenced by global economic conditions than capacity additions (1) Source: Hawkins Wright (May 3, 2017, prepared for Mercer International) NBSK –capacity changes SBSK/ Fluff / Radiata market pulp net capacity changes (1) Hardwood market pulp net capacity changes (1)

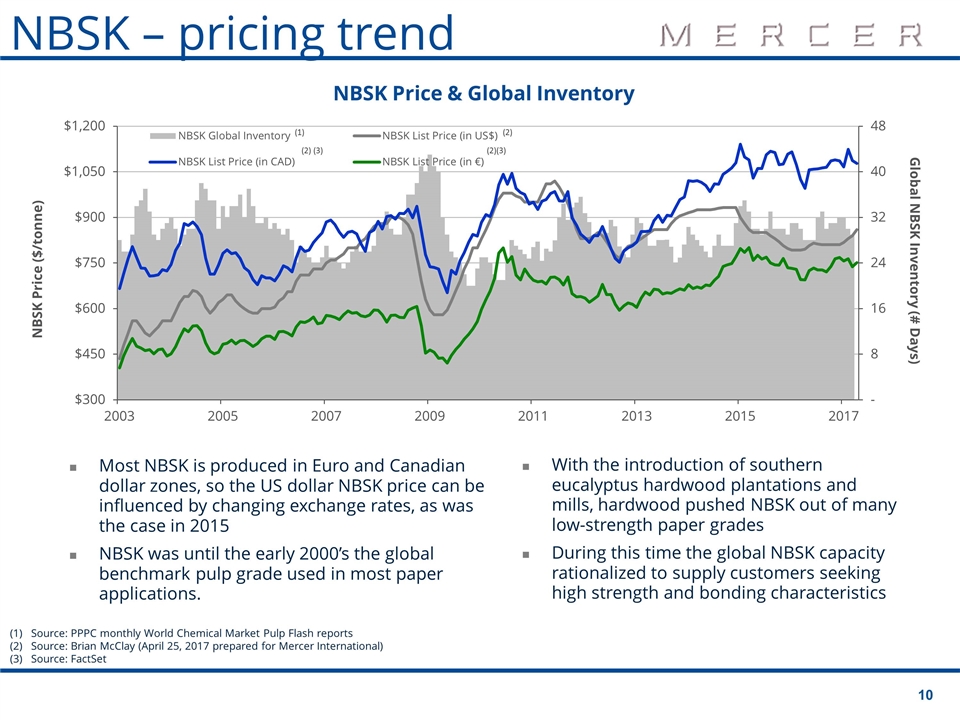

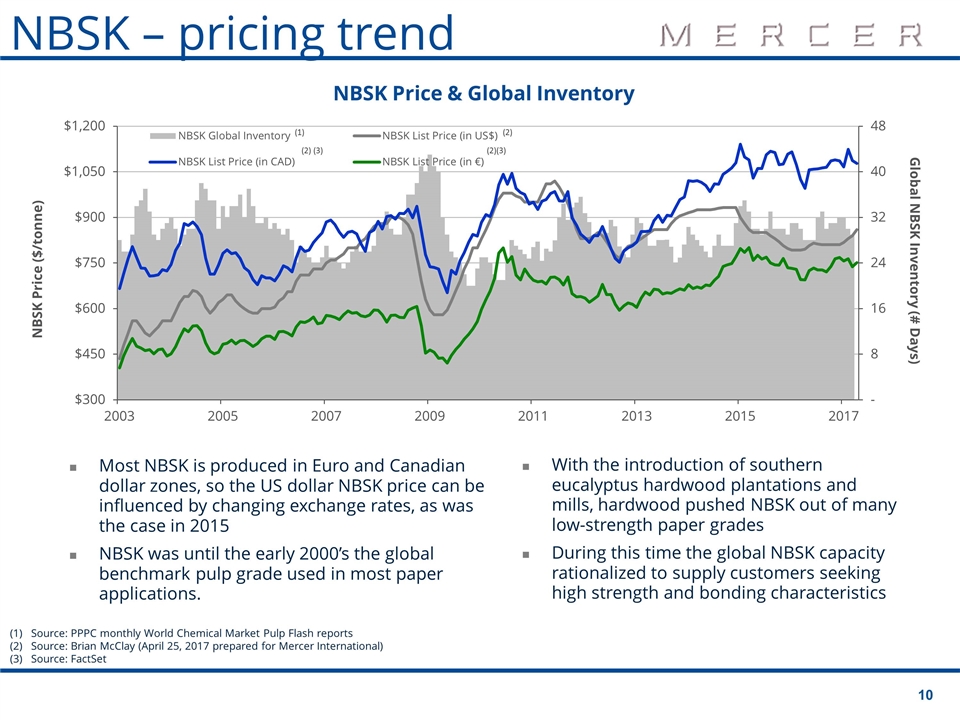

Most NBSK is produced in Euro and Canadian dollar zones, so the US dollar NBSK price can be influenced by changing exchange rates, as was the case in 2015 NBSK was until the early 2000’s the global benchmark pulp grade used in most paper applications. With the introduction of southern eucalyptus hardwood plantations and mills, hardwood pushed NBSK out of many low-strength paper grades During this time the global NBSK capacity rationalized to supply customers seeking high strength and bonding characteristics (1) Source: PPPC monthly World Chemical Market Pulp Flash reports (2) Source: Brian McClay (April 25, 2017 prepared for Mercer International) (3) Source: FactSet (1) NBSK – pricing trend

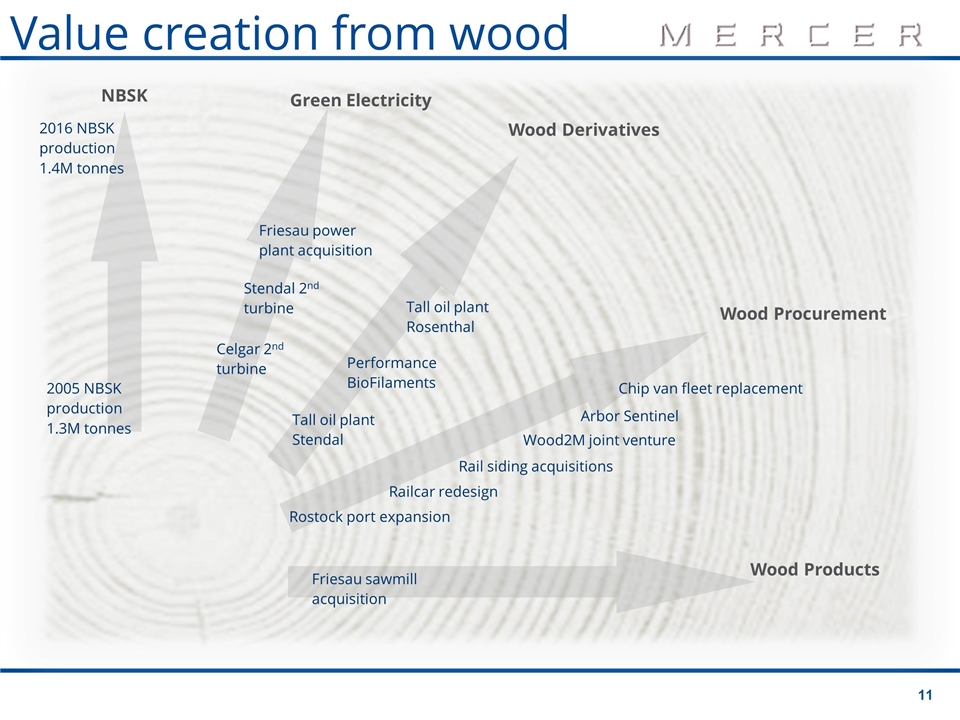

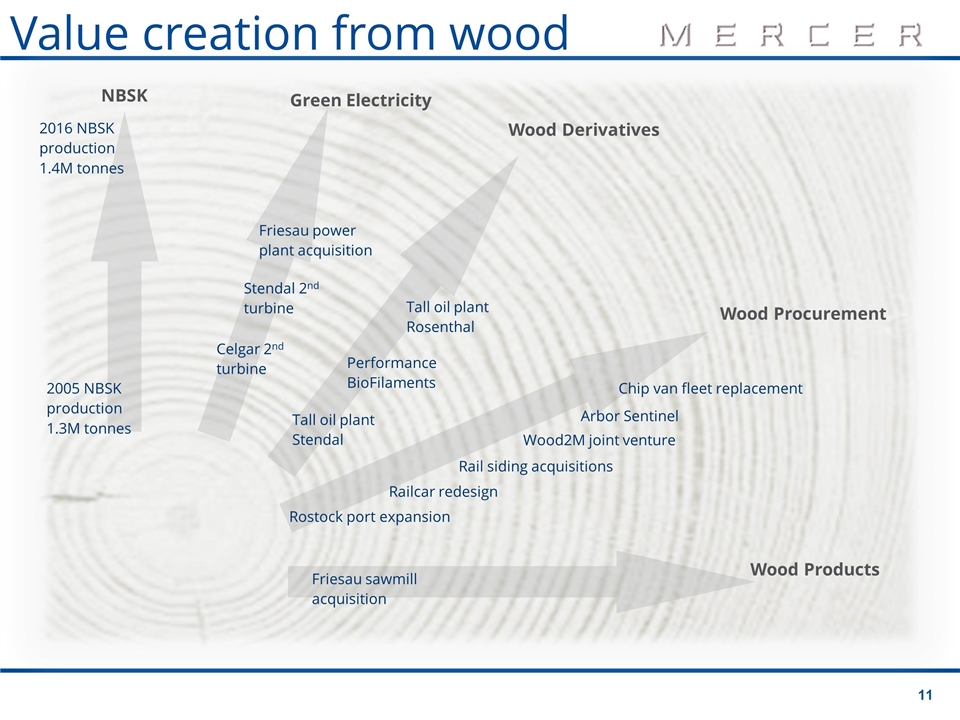

NBSK Green Electricity Wood Derivatives Wood Procurement Wood Products Friesau sawmill acquisition Rostock port expansion Railcar redesign Rail siding acquisitions Wood2M joint venture Arbor Sentinel Chip van fleet replacement Friesau power plant acquisition Stendal 2nd turbine Celgar 2nd turbine Tall oil plant Stendal Performance BioFilaments Tall oil plant Rosenthal 2005 NBSK production 1.3M tonnes 2016 NBSK production 1.4M tonnes Value creation from wood

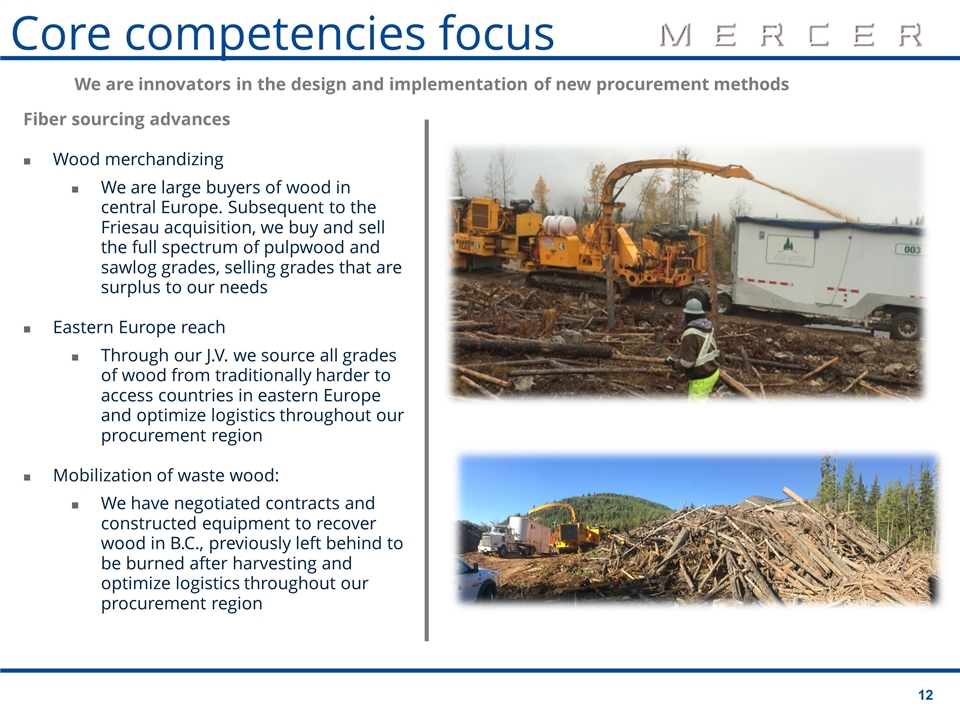

Fiber sourcing advances Wood merchandizing We are large buyers of wood in central Europe. Subsequent to the Friesau acquisition, we buy and sell the full spectrum of pulpwood and sawlog grades, selling grades that are surplus to our needs Eastern Europe reach Through our J.V. we source all grades of wood from traditionally harder to access countries in eastern Europe and optimize logistics throughout our procurement region Mobilization of waste wood: We have negotiated contracts and constructed equipment to recover wood in B.C., previously left behind to be burned after harvesting and optimize logistics throughout our procurement region We are innovators in the design and implementation of new procurement methods Core competencies focus

Current capabilities Fleet of 250 modern wood railcars in Europe Fleet of 13 chip trucks and 29 roundwood trucks in Europe Fleet of 8 Ponsse log harvesters and 8 forwarders Significant internal chipping capacity Pulpwood and sawlog logistics is a core competency Recent advances Baltic sea port expansion enables deeper reach into Baltics including Russia, Estonia, Latvia, Scandinavia and UK direct rail link to Stendal Rail logistics expansion acquisition of dedicated rail sidings construction of log unloading facility at Rosenthal Truck logistics innovation automation of chip unloading at Rosenthal new super-size chip vans at Celgar Core competencies focus

Wood is a core competency we are one of the largest buyers of wood in Europe we have had considerable success turning our innovations into cost reductions strong synergy potential with our German pulp mills wood procurement and logistics wood merchandizing Green electricity production is a core competency we can optimize the Friesau power plant and its EEG contract We like the global prospects for lumber growing demand in US / Europe uncertainty of supply from traditional suppliers Fiber costs are consolidated for Celgar, Rosenthal and Stendal and converted using quarterly average FX rates Why sawmills?

Flexible High capacity mill 3 shift capacity is 465 million board feet (1.1 million m³) ability to produce both European and North American standard lumber dimensions in the mid 2000’s the mill was focused on the US market Modernization opportunity the mill was constructed in the mid-90’s; there have been considerable advances in the mill automation since then Synergies with Mercer’s pulp business powerplant fuel woodchips optimization consolidated fiber purchasing / logistics / administration Why Friesau?

Key capital and optimization projects 2013-2016 2013Workforce reduction at Celgar – cost reduction 2014Workforce reduction at Stendal – cost reduction 2014Project “Blue Mill” expansion of pulp and electricity production at Stendal – higher pulp and electricity production 2014Tall oil plant at Rosenthal 2015Upgraded evaporation plants at Stendal andRosenthal – optimization of tall oil production 2015New automated chip reclaim system at Rosenthal – lower operating costs and improved pulp yield 2016New high capacity log rail car fleet – wood cost reduction 2016Expansion of railway reload at Celgar – pulp delivery cost reduction NBSK margin enhancement

Marketing optimization European mills are central and thus freight logical to Europe’s largest paper producing region Logistics division operates a fleet of 57 trucks Expansion of re-load facility at Celgar giving us access to both BN and CP railways New breakbulk shipping program from Canada to reduce exposure to container shortages. Stendal is close to the port of Hamburg offering access to efficient rates to Asia Development of an internal fiber technology group to assist customers to optimize our products NBSK margin enhancement

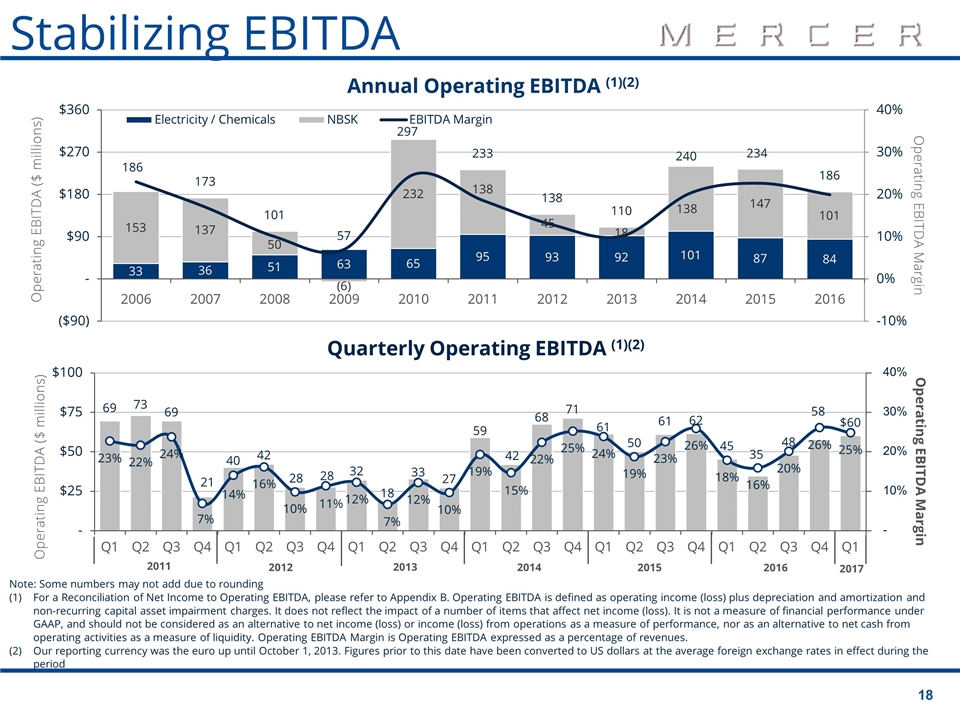

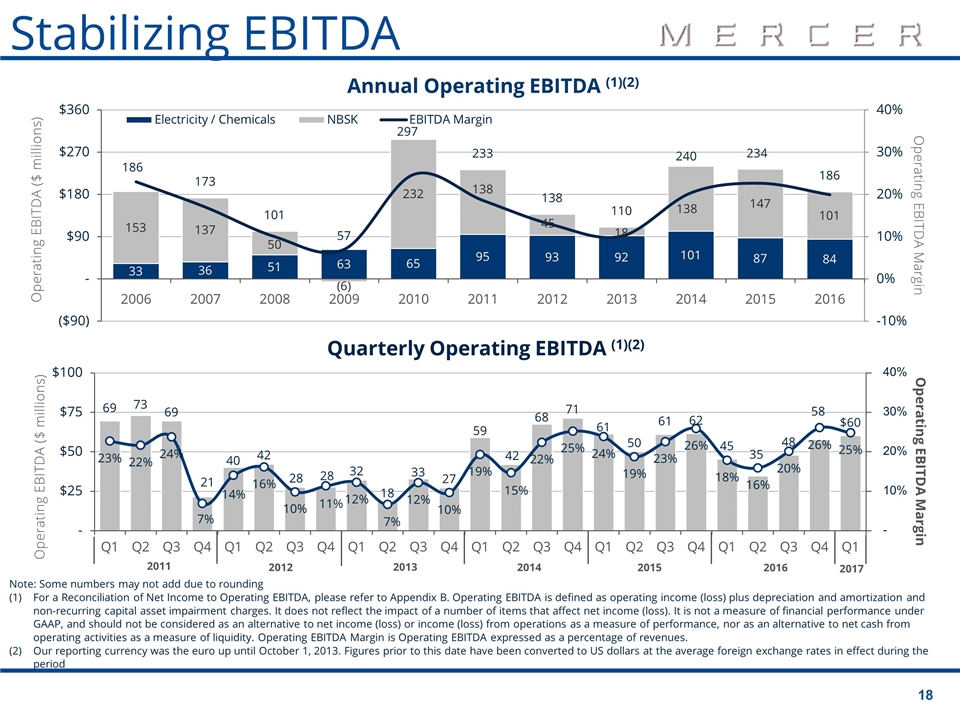

Note: Some numbers may not add due to rounding For a Reconciliation of Net Income to Operating EBITDA, please refer to Appendix B. Operating EBITDA is defined as operating income (loss) plus depreciation and amortization and non-recurring capital asset impairment charges. It does not reflect the impact of a number of items that affect net income (loss). It is not a measure of financial performance under GAAP, and should not be considered as an alternative to net income (loss) or income (loss) from operations as a measure of performance, nor as an alternative to net cash from operating activities as a measure of liquidity. Operating EBITDA Margin is Operating EBITDA expressed as a percentage of revenues. Our reporting currency was the euro up until October 1, 2013. Figures prior to this date have been converted to US dollars at the average foreign exchange rates in effect during the period 2016 2012 2013 2014 2015 2017 Operating EBITDA ($ millions) 2011 Stabilizing EBITDA

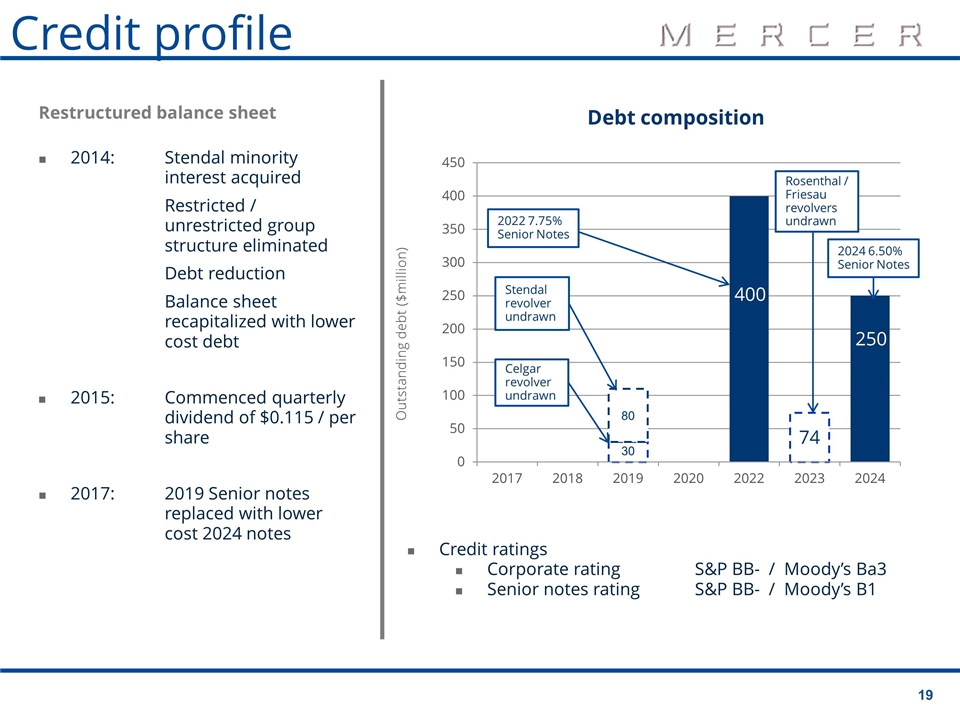

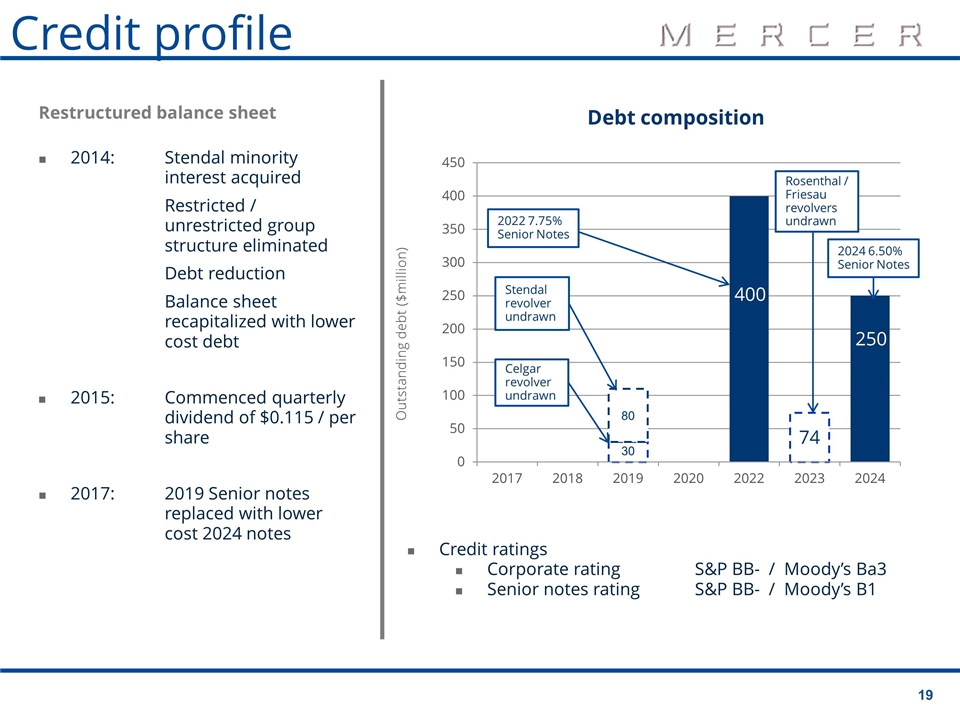

Credit ratings Corporate rating S&P BB- / Moody’s Ba3 Senior notes rating S&P BB- / Moody’s B1 Restructured balance sheet 2014: Stendal minority interest acquired Restricted / unrestricted group structure eliminated Debt reduction Balance sheet recapitalized with lower cost debt 2015:Commenced quarterly dividend of $0.115 / per share 2017: 2019 Senior notes replaced with lower cost 2024 notes Credit profile

Appendix A Detailed Overview of Operations

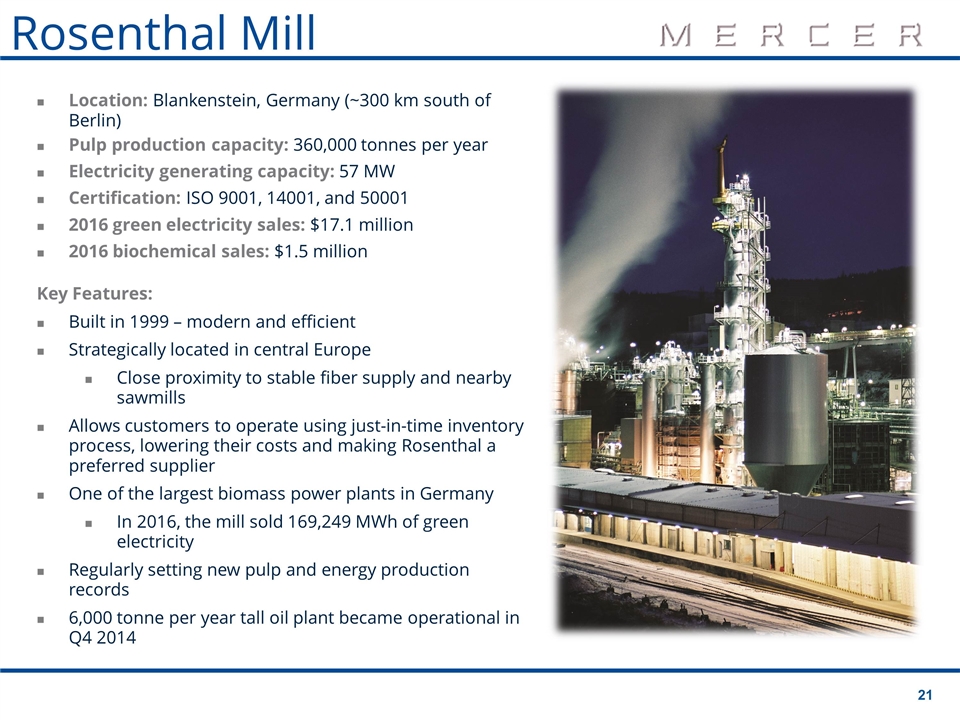

Location: Blankenstein, Germany (~300 km south of Berlin) Pulp production capacity: 360,000 tonnes per year Electricity generating capacity: 57 MW Certification: ISO 9001, 14001, and 50001 2016 green electricity sales: $17.1 million 2016 biochemical sales: $1.5 million Key Features: Built in 1999 – modern and efficient Strategically located in central Europe Close proximity to stable fiber supply and nearby sawmills Allows customers to operate using just-in-time inventory process, lowering their costs and making Rosenthal a preferred supplier One of the largest biomass power plants in Germany In 2016, the mill sold 169,249 MWh of green electricity Regularly setting new pulp and energy production records 6,000 tonne per year tall oil plant became operational in Q4 2014 Rosenthal Mill

Location: Stendal, Germany (~130 km west of Berlin) Pulp production capacity: 660,000 tonnes per year Electricity generating capacity: 148 MW Certification: ISO 9001 and 14001 2016 green electricity sales: $45.0 million 2016 biochemical sales: $11.3 million Key Features: Completed in 2004, it’s one of the newest and largest pulp mills in the world In September 2014, we completed the acquisition of the minority interest and other rights in the Stendal mill One of the largest biomass power plants in Germany In 2016, exported 479,310 MWh Project Blue Mill was completed in Q4 2013 and, among other things, increased the mill’s annual pulp production capacity by 30,000 tonnes and electricity generation by 109,000 MWh Regularly setting new performance records Stendal Mill

Location: Castlegar, BC, Canada (~600 km east of Vancouver) Pulp production capacity: 520,000 tonnes per year Electricity generating capacity: 100 MW Certification: ISO 9001 and 14001 2016 green electricity sales: $9.4 million Key Features: Modern and efficient Abundant and low cost fiber, by global standards Green Energy Project was completed in September 2010 One of the largest biomass power plants in Canada In 2016, the mill sold 137,286 MWh of green electricity Continues to demonstrate significant upside potential Celgar Mill

Location: Friesau, Germany (~300 km south of Berlin) Lumber production capacity: 465 MMBM Energy generating capacity: 49.5 MW (13 MW electricity) FY2016 under prior owner lumber sales: $115 million (+ $20 million in residuals) FY2016 green electricity sales: $10.0 million Key Features: High quality logs from surrounding fiber basket Sawmill built in 1992 Two high-volume Linck sawlines Ability to produce both rough and planed products European metric and specialty lumber; US-dimensional lumber; J-grade Power plant built in 2008 Plant can be fueled by bark, chips, sawdust, recycled wood At input feed of 1.6 million m3, power plant can be fueled entirely by residual bark EEG feed-in tariff extends to 2029 Friesau Sawmill & Power Plant

Appendix B Reconciliation of Net Income to Operating EBITDA

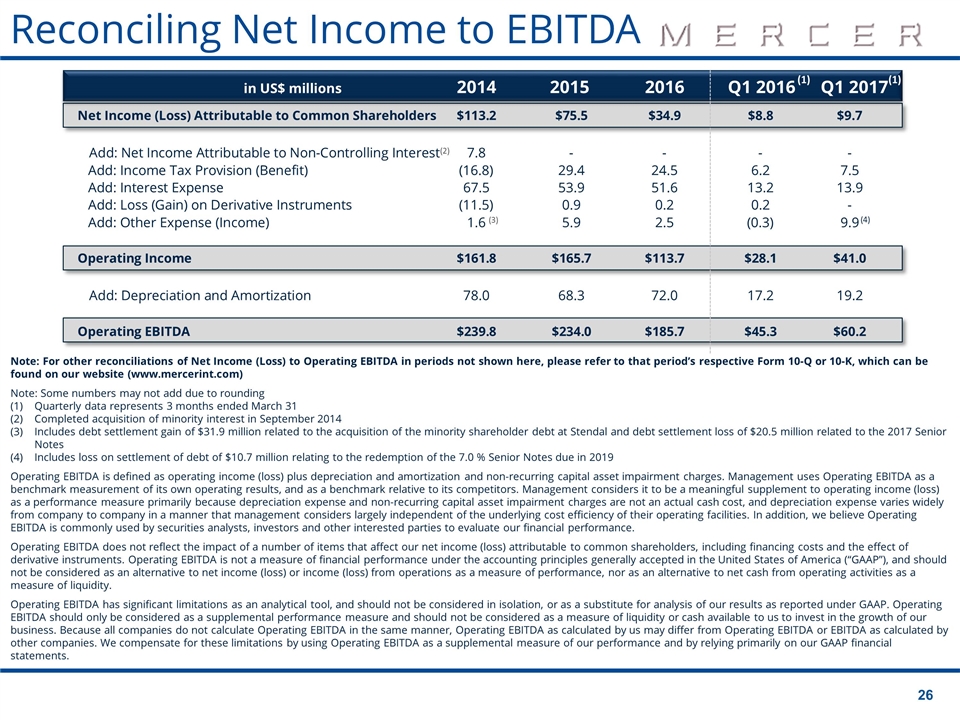

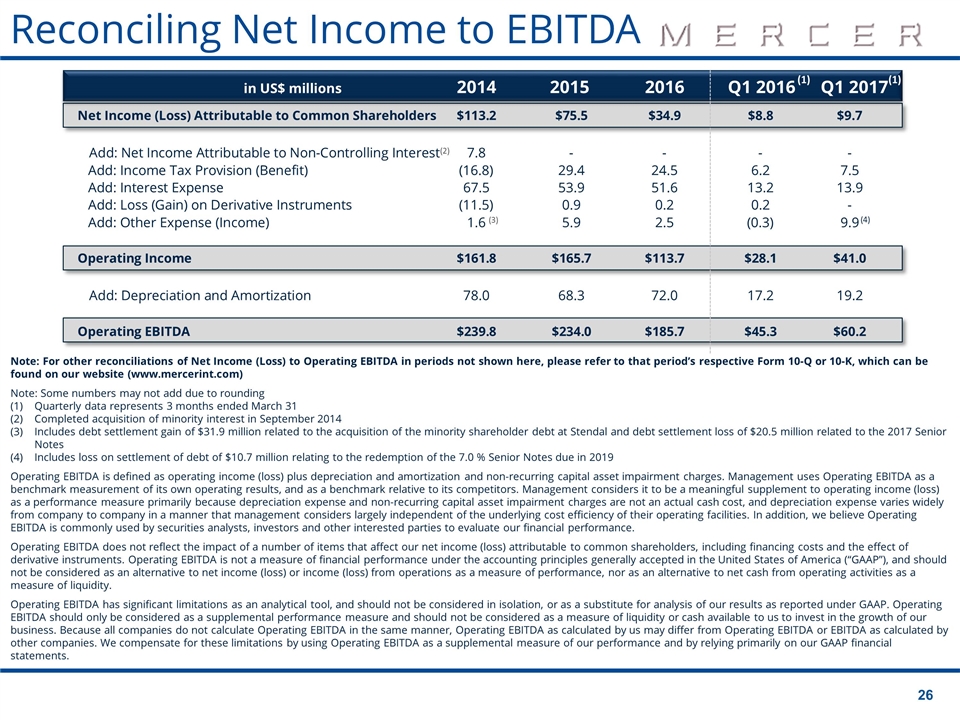

in US$ millions 2014 2015 2016 Q1 2016 Q1 2017 Net Income (Loss) Attributable to Common Shareholders $113.2 $75.5 $34.9 $8.8$9.7 Add: Net Income Attributable to Non-Controlling Interest7.8---- Add: Income Tax Provision (Benefit) (16.8) 29.4 24.5 6.27.5 Add: Interest Expense 67.5 53.9 51.6 13.213.9 Add: Loss (Gain) on Derivative Instruments (11.5) 0.9 0.2 0.2- Add: Other Expense (Income) 1.6 5.9 2.5 (0.3)9.9 Operating Income $161.8$165.7 $113.7 $28.1$41.0 Add: Depreciation and Amortization78.0 68.3 72.0 17.219.2 Operating EBITDA $239.8 $234.0 $185.7 $45.3$60.2 (2) (1) (1) Note: For other reconciliations of Net Income (Loss) to Operating EBITDA in periods not shown here, please refer to that period’s respective Form 10-Q or 10-K, which can be found on our website (www.mercerint.com) Note: Some numbers may not add due to rounding Quarterly data represents 3 months ended March 31 Completed acquisition of minority interest in September 2014 Includes debt settlement gain of $31.9 million related to the acquisition of the minority shareholder debt at Stendal and debt settlement loss of $20.5 million related to the 2017 Senior Notes Includes loss on settlement of debt of $10.7 million relating to the redemption of the 7.0 % Senior Notes due in 2019 Operating EBITDA is defined as operating income (loss) plus depreciation and amortization and non-recurring capital asset impairment charges. Management uses Operating EBITDA as a benchmark measurement of its own operating results, and as a benchmark relative to its competitors. Management considers it to be a meaningful supplement to operating income (loss) as a performance measure primarily because depreciation expense and non-recurring capital asset impairment charges are not an actual cash cost, and depreciation expense varies widely from company to company in a manner that management considers largely independent of the underlying cost efficiency of their operating facilities. In addition, we believe Operating EBITDA is commonly used by securities analysts, investors and other interested parties to evaluate our financial performance. Operating EBITDA does not reflect the impact of a number of items that affect our net income (loss) attributable to common shareholders, including financing costs and the effect of derivative instruments. Operating EBITDA is not a measure of financial performance under the accounting principles generally accepted in the United States of America (“GAAP”), and should not be considered as an alternative to net income (loss) or income (loss) from operations as a measure of performance, nor as an alternative to net cash from operating activities as a measure of liquidity. Operating EBITDA has significant limitations as an analytical tool, and should not be considered in isolation, or as a substitute for analysis of our results as reported under GAAP. Operating EBITDA should only be considered as a supplemental performance measure and should not be considered as a measure of liquidity or cash available to us to invest in the growth of our business. Because all companies do not calculate Operating EBITDA in the same manner, Operating EBITDA as calculated by us may differ from Operating EBITDA or EBITDA as calculated by other companies. We compensate for these limitations by using Operating EBITDA as a supplemental measure of our performance and by relying primarily on our GAAP financial statements. (3) (4) Reconciling Net Income to EBITDA