UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM10-K

☒ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2017

OR

☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

For the transition period from to

Commission File No.: 000-51826

MERCER INTERNATIONAL INC.

(Exact name of Registrant as specified in its charter)

| Washington | 47-0956945 | |

(State or other jurisdiction of incorporation or organization) | (IRS Employer Identification No.) | |

Suite 1120, 700 West Pender Street, Vancouver, British Columbia, Canada | V6C 1G8 | |

| (Address of Principal Executive Office) | (Zip Code) | |

Registrant’s telephone number including area code:(604) 684-1099

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Name of each exchange on which registered | |

| Common Stock, par value $1.00 per share | NASDAQ Global Select Market |

Securities registered pursuant to Section 12(g) of the Act:None

Indicate by check mark if the Registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☒ No ☐

Indicate by check mark if the Registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. ☐ Yes ☒ No

Indicate by check mark whether the Registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the Registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the Registrant was required to submit and post such files). Yes ☒ No ☐

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of the Registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ☒

Indicate by check mark whether the Registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer”, “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer | ☒ | Accelerated filer | ☐ | |||

Non-accelerated filer | ☐ (Do not check if a smaller reporting company) | Smaller reporting company | ☐ | |||

Emerging growth company | ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the Registrant is a shell company (as defined in Rule 12b-2 of the Act). ☐ Yes ☒ No

The aggregate market value of the Registrant’s voting and non-voting common equity held by non-affiliates of the Registrant as of June 30, 2017, the last business day of the Registrant’s most recently completed second fiscal quarter, based on the closing price of the voting stock on the NASDAQ Global Select Market on such date, was approximately $714.2 million.

As of February 14, 2018, the Registrant had 65,017,288 shares of common stock, $1.00 par value per share, outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

Certain information that will be contained in the definitive proxy statement for the Registrant’s annual meeting to be held in 2018 is incorporated by reference into Part III of this Form 10-K.

TABLE OF CONTENTS

(i)

(ii)

CAUTIONARY NOTE REGARDINGFORWARD-LOOKING STATEMENTS

This annual report on Form10-K includes “forward-looking” statements within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements can be identified by the fact that they do not relate strictly to historical or current facts. They often include words such as “believes”, “expects”, “anticipates”, “estimates”, “intends”, “plans”, “seeks” or words of similar meaning, or future or conditional verbs, such as “will”, “should”, “could”, “may”, “aims”, “intends” or “projects”. A forward-looking statement is neither a prediction nor a guarantee of future events or circumstances, and those future events or circumstances may not occur. You should not place undue reliance on forward-looking statements, which speak only as of the date of this annual report on Form10-K. These forward-looking statements are all based on currently available operating, financial and competitive information and are subject to various risks and uncertainties. Our actual future results and trends may differ materially depending on a variety of factors, including, but not limited to, the risks and uncertainties discussed under Item 1. “Business”, Item 1A. “Risk Factors” and Item 7. “Management’s Discussion and Analysis of Financial Condition and Results of Operations”. Given these risks and uncertainties, you should not rely on forward-looking statements as a prediction of actual results. Any or all of the forward-looking statements contained in this annual report on Form10-K and any other public statement made by us, including by our management, may turn out to be incorrect. We are including this cautionary note to make applicable and take advantage of the safe harbor provisions of the Private Securities Litigation Reform Act of 1995 for forward-looking statements. We expressly disclaim any obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise.

In this annual report on Form10-K, we rely on and refer to information and statistics regarding our market share and the markets in which we compete. We have obtained some of this market share information and industry data from internal surveys, market research, publicly available information and industry publications. Such reports generally state that the information contained therein has been obtained from sources believed to be reliable, but the accuracy or completeness of such information is not guaranteed. Although we believe this information is reliable, we have not independently verified, nor can we guarantee, the accuracy or completeness of that information.

Statements in this annual report on Form10-K concerning the production capacity of our mills are management estimates based primarily on historically achieved levels of production and assumptions regarding maintenance downtime. Statements concerning electrical generating capacity at our mills are also management estimates based primarily on our expected production (which largely determines the amount of electricity we can generate) and assumptions regarding maintenance downtime, in each case within manufacturers’ specifications of capacity.

(1)

The following table sets out exchange rates, based on the noon buying rates in New York City for cable transfers in foreign currencies as certified for customs purposes by the Federal Reserve Bank of New York, referred to as the “Noon Buying Rate”, for the conversion of dollars to euros and Canadian dollars in effect at the end of the following periods, the average exchange rates during these periods (based on daily Noon Buying Rates) and the range of high and low exchange rates for these periods:

| Year Ended December 31, | ||||||||||||||||||||

| 2017 | 2016 | 2015 | 2014 | 2013 | ||||||||||||||||

| ($/€) | ||||||||||||||||||||

End of period | 1.2022 | 1.0552 | 1.0859 | 1.2101 | 1.3779 | |||||||||||||||

High for period | 1.0416 | 1.0375 | 1.0524 | 1.2101 | 1.2774 | |||||||||||||||

Low for period | 1.2041 | 1.1516 | 1.2015 | 1.3927 | 1.3816 | |||||||||||||||

Average for period | 1.1301 | 1.1072 | 1.1096 | 1.3297 | 1.3281 | |||||||||||||||

| ($/C$) | ||||||||||||||||||||

End of period | 0.7989 | 0.7448 | 0.7226 | 0.8620 | 0.9401 | |||||||||||||||

High for period | 0.7275 | 0.6853 | 0.7148 | 0.8588 | 0.9348 | |||||||||||||||

Low for period | 0.8243 | 0.7972 | 0.8529 | 0.9423 | 1.0164 | |||||||||||||||

Average for period | 0.7710 | 0.7558 | 0.7830 | 0.9060 | 0.9712 | |||||||||||||||

On February 12, 2018, the most recent weekly publication of the daily Noon Buying Rate before the filing of this annual report on Form10-K reported that the Noon Buying Rate as of February 9, 2018 for the conversion of dollars to euros and Canadian dollars was $1.2226 per euro and $0.7937 per Canadian dollar.

(2)

| ITEM 1. | BUSINESS |

In this document, please note the following:

| • | references to “we”, “our”, “us”, the “Company” or “Mercer” mean Mercer International Inc. and its subsidiaries, unless the context clearly suggests otherwise, and references to “Mercer Inc.” mean Mercer International Inc. excluding its subsidiaries; |

| • | all references to “$” or “dollars” shall mean U.S. dollars, which is our reporting currency, unless otherwise stated; “€” refers to euros; and “C$” refers to Canadian dollars; |

| • | references to “NBSK” mean northern bleached softwood kraft; |

| • | references to “ADMTs” meanair-dried metric tonnes; |

| • | references to “MW” mean megawatts and “MWh” mean megawatt hours; |

| • | references to “Mfbm” mean thousand board feet of lumber; |

| • | references to “MMfbm” mean million board feet of lumber; |

| • | our lumber metrics are converted from cubic meters to Mfbm using a conversion ratio of 1.6 cubic metres of lumber equaling one Mfbm, which is the ratio commonly used in the industry; and |

| • | references to “net income (loss)” mean net income (loss) attributable to common shareholders. |

Due to rounding, numbers presented throughout this report may not add up precisely to totals we provide and percentages may not precisely reflect the absolute figures.

General

Mercer Inc. is a corporation organized under the laws of the State of Washington. Its common stock is quoted and listed for trading on the NASDAQ Global Select Market (MERC) and the Toronto Stock Exchange (MERC.U).

We are one of the world’s largest producers of “market” NBSK pulp, which is pulp that is sold on the open market. Our size provides us increased presence, better industry information in our markets and close customer relationships with many large pulp consumers. We operate two modern and highly efficient mills in Eastern Germany and one mill in Western Canada and have our headquarters in Vancouver, Canada. We are the sole NBSK producer, and the only significant market pulp producer in Germany, which is the largest pulp import market in Europe. We are able to supply the growing pulp demand in China both through our Canadian mill’s ready access to the Port of Vancouver and through our Stendal mill’s existing logistics arrangements. In addition, as a result of the significant investments we have made inco-generation equipment, all of our mills generate and sell a significant amount of surplus “green” energy to regional utilities. We also produce and sell “tall oil”, aby-product of our production process, which is used as both a chemical additive and as a green energy source.

On April 12, 2017, through our wholly owned subsidiary, Mercer Timber Products GmbH, referred to as “MTP”, we acquired substantially all of the assets of one of Germany’s largest sawmills and abio-mass power plant, referred to as the “Friesau Facility”.

(3)

Since acquiring the Friesau Facility, we have two reportable operating segments, being Pulp and Wood Products.

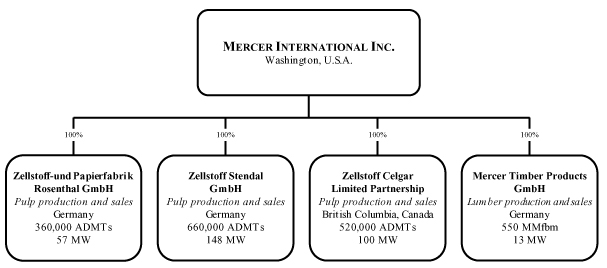

We have consolidated annual production capacity of approximately 1.5 million ADMTs of NBSK pulp, 550 million board feet of lumber and 318 MW of electricity. Key operating details for each of our mills are as follows:

| • | Rosenthal mill. Our Rosenthal mill is a modern, efficient ISO 9001, 14001 and 50001 certified NBSK pulp mill that has an annual production capacity of approximately 360,000 ADMTs and 57 MW of electrical generation. The Rosenthal mill generated and exported 166,093 MWh of electricity in 2017, resulting in approximately $17.1 million in revenues. The Rosenthal mill is located in the town of Blankenstein, Germany, approximately 300 kilometers south of Berlin. |

| • | Stendal mill. Our Stendal mill is astate-of-the-art, single line, ISO 9001, 14001 and 50001 certified NBSK pulp mill that has an annual production capacity of approximately 660,000 ADMTs and 148 MW of electrical generation. The Stendal mill generated and exported 508,733 MWh of electricity in 2017, resulting in approximately $48.3 million in revenues. The Stendal mill is located near the town of Stendal, Germany, approximately 130 kilometers west of Berlin. |

| • | Celgar mill. Our Celgar mill is a modern, efficient ISO 9001 and 14001 certified NBSK pulp mill with an annual production capacity of approximately 520,000 ADMTs and 100 MW of electrical generation. The Celgar mill generated and exported 147,294 MWh of electricity in 2017, resulting in approximately $12.4 million in revenues. The Celgar mill is located near the city of Castlegar, British Columbia, Canada, approximately 600 kilometers east of Vancouver. |

| • | Friesau Facility.Our Friesau Facility is one of Germany’s largest sawmills with an annual production capacity of approximately 550 million board feet of lumber and 13 MW of electrical generation from a modernbio-mass fueled cogeneration power plant built in 2009. From the date of its acquisition in April 2017, the Friesau Facility generated and exported 73,698 MWh of electricity during the period ended December 31, 2017, resulting in approximately $8.9 million in revenues. The Friesau Facility is located approximately 16 kilometers west of our Rosenthal mill and has historically been one of the Rosenthal mill’s largest fiber suppliers. |

We currently employ approximately 1,840 people.

Pulp Segment

Our pulp mills are some of the newest and most modern NBSK pulp mills in Europe and North America. We believe the relative age, production capacity and electrical generation capacity of our mills provide us with certain manufacturing cost and other advantages over many of our competitors. We believe our competitors’ older mills do not have the equipment or capacity to produce or sell surplus power or chemicals in a meaningful amount. In addition, since our mills are relatively new, they benefit from lower maintenance capital requirements and higher efficiency relative to many of our competitors’ mills.

(4)

The following table sets out our pulp production and pulp revenues for the periods indicated:

| Year Ended December 31, | ||||||||||||

| 2017 | 2016 | 2015 | ||||||||||

Pulp production (‘000 ADMTs) | 1,507.0 | 1,428.4 | 1,458.0 | |||||||||

Pulp sales (‘000 ADMTs) | 1,515.1 | 1,428.7 | 1,463.1 | |||||||||

Pulp revenues (in thousands) | $ | 979,645 | $ | 847,328 | $ | 946,237 | ||||||

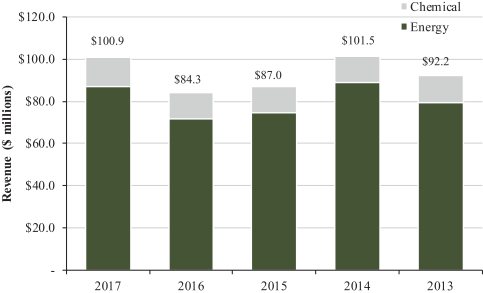

Our modern pulp mills generate electricity, which is surplus to their operating requirements, providing our mills with a stable revenue source unrelated to pulp prices. Additionally, our German pulp mills generate tall oil from black liquor, which is sold to third parties for use in numerous applications includingbio-fuels. Since our energy and chemical production areby-products of our pulp production process, there are minimal incremental costs and our surplus energy and chemical sales are highly profitable. All of our mills generate and sell surplus energy to regional utilities. Our German mills benefit from special tariffs under Germany’sRenewable Energy Sources Act, referred to as the “Renewable Energy Act”, which provides for premium pricing on green energy. Our Celgar mill is party to a fixed electricity purchase agreement with the regional public utility provider for the sale of surplus power through 2020.

The following table sets out the amount of surplus energy we produced and sold and revenues from the sale of suchsurplus energy and chemicals in our pulp segment for the periods indicated:

| Year Ended December 31, | ||||||||||||||||||||||||

| 2017 | 2016 | 2015 | ||||||||||||||||||||||

| (MWh) | ($) | (MWh) | ($) | (MWh) | ($) | |||||||||||||||||||

| (thousands) | (thousands) | (thousands) | ||||||||||||||||||||||

Surplus electricity | 822,120 | 77,867 | 785,845 | 71,539 | 814,966 | 74,736 | ||||||||||||||||||

Chemicals | 14,203 | 12,756 | 12,231 | |||||||||||||||||||||

|

|

|

|

|

| |||||||||||||||||||

Total | 92,070 | 84,295 | 86,967 | |||||||||||||||||||||

|

|

|

|

|

| |||||||||||||||||||

Our strategic pulp mill locations position us well to serve customers in Europe, Asia and North America. We primarily work directly with customers to capitalize on our geographic diversity, coordinate sales and enhance customer relationships. We believe our ability to deliver high-quality pulp on a timely basis and our customer service make us a preferred supplier for many customers.

Wood Products Segment

We entered into the wood products business with the acquisition of the Friesau Facility. As a result, we manufacture, sell and distribute lumber, electricity and other wood residuals. The Friesau Facility can produce lumber for European, U.S. and other lumber export markets.

During the two years prior to our acquisition of the Friesau Facility, it was being operated on a restricted basis and well below its production capacity. Since our acquisition, we have been ramping up the mill’s lumber production and capitalizing on synergies. In the Friesau Facility’s fiber region, major sawlog contracts are generally awarded on a yearly basis. As a result, we initially expected our ramp up to materially increase at the start of 2018 when new contracts are awarded.

However, due to the successful procurement of wood, the mill’s ramp up proceeded faster than we initially budgeted and began generating positive operating income in the second quarter of 2017. The ramp up of production steadily improved our operating efficiency and costs. In the third quarter of 2017, we

(5)

commenced lumber sales into the U.S. market which accounted for approximately 31% of our lumber sales volumes in the fourth quarter of 2017 while substantially all the rest were to Europe. Depending on market conditions, we intend, over time, to have a diverse geographic mix for our lumber sales, primarily focused on the European, U.S. and Japanese markets.

Our acquisition of the Friesau Facility has allowed us to expand into the German lumber business and further grow ourbio-mass energy profile. It has also created operating synergies relating to the sharing of wood andbio-mass fuel resources and the optimization of staffing and services with our Rosenthal mill.

The European and U.S. lumber markets are very different. In the European market, lumber is generally customized in terms of dimensions and finishing, whereas the U.S. market is driven primarily by demand from new housing starts and dimensions and finishing are generally standardized.

Additionally, lumber production and sales in Europe are commonly measured in cubic meters, whereas in the U.S. they are measured in thousand board feet or Mfbm.

For the purposes of this annual report on Form10-K, we have converted our lumber metrics from cubic meters to Mfbm using a conversion ratio of 1.6 cubic meters of lumber equaling one Mfbm, which is the ratio commonly used in the industry.

The following table sets out our lumber production and revenues from April 12, 2017, being the date we acquired the Friesau Facility, to December 31, 2017:

Lumber production (MMfbm) | 281.3 | |||

Lumber sales (MMfbm) | 213.5 | |||

Lumber revenues (in thousands) | $ | 82,176 |

The Friesau Facility generates electricity for minimal incremental costs, all ofwhich is sold,providing a stable revenue source unrelated to lumber prices. The Friesau Facility’s modernbio-mass fueled cogeneration power plant has an annual production capacity of approximately 13 MW of electricity. The plant sells electricity pursuant to a long-term fixed price green power tariff that runs to 2029. From its acquisition date of April 12, 2017 to December 31, 2017, the Friesau Facility produced and sold 73,698 MWh of surplus energy for revenues of $8.9 million.

(6)

Corporate Structure, History and Development of Business

The following simplified chart sets out our principal operating subsidiaries, their jurisdictions of organization, their principal activities and their annual pulp and lumberproduction and electrical generation capacity:

We acquired our Rosenthal mill in 1994. In 1999, we completed a major capital project to convert it to the production of kraft pulp, increase production and improve efficiencies at a cost of approximately $385.7 million, of which approximately $100.8 million was financed through government grants. Subsequent capital investments and efficiency improvements have reduced emissions and energy costs, increased the mill’s annual production capacity and enabled the production of tall oil.

In September 2004, we completed construction of the Stendal mill at a cost of approximately $1.1 billion, which was financed through a combination of government grants of approximately $332.0 million,low-cost, long-term project debt, which was largely severally guaranteed by governments in Germany, and equity. Subsequent capital investments and efficiency improvements have increased the mill’s annual production capacity and its generation of green energy. We initially had a 63.6% interest in Stendal which increased over time through acquisitions and/or further investments until September 2014, when we acquired all of the economic interest in Stendal.

In February 2005, we acquired the Celgar mill for $210.0 million plus defined working capital. Since its acquisition, we have effected several capital projects and other initiatives at the Celgar mill to increase its annual production capacity and its generation of green energy.

In April 2017, we acquired the Friesau Facility for $61.6 million in cash.

Our corporate strategy is to expand our asset and earnings base through organic growth and acquisitions, primarily in Europe and North America. We pursue organic growth through active management and targeted capital expenditures to generate a high return by improving efficiency, reducing costs and increasing production of pulp, lumber, energy andby-products such as chemicals. We are also leveraging our fiber and process expertise to develop innovative new products based on other derivatives of the kraft pulping process. We seek to acquire interests in companies and assets primarily in the forest

(7)

products business and related wood extractive businesses where we can leverage our experience and expertise in adding value through a focused management approach. Key elements of our strategy include:

| • | Focus on Premium Grade Market NBSK Pulp. We produce market NBSK pulp because it is a premium grade kraft pulp and generally obtains the highest price relative to other kraft pulps. Although demand is cyclical, between 2008 and 2017 overall worldwide demand for bleached softwood kraft market pulp grew at an average of approximately 2% per annum. We focus on customers that produce tissue, specialty papers and high-quality printing and writing paper grades. We believe the growth in demand from tissue and specialty paper customers, which utilize a significant proportion of NBSK pulp, has more than offset the secular decline in demand from printing and writing paper customers. This allows us to benefit from our long-term relationships with tissue and specialty paper manufacturers in Europe and participate in higher growth markets in emerging countries such as China where there has been strong growth in tissue demand. |

| • | Increasing Stable Revenues from Renewable Energy and Chemical Sales and Leveraging our Fiber and Process Expertise to Expand Growth. We focus on enhancing our generation and sales of surplus renewable energy and chemicals and, because there are minimal associated incremental costs, such sales are highly profitable. The acquisition of the Friesau Facility has allowed us to expand into the German lumber market and grow ourbio-mass energy profile.Sales of surplus renewable energy and chemicals provide us with a stable income source unrelated to cyclical changes in pulp and lumberprices. Additionally, we seek to capitalize on our fiber and process expertise to expand our commercialization and sales of new products and into new growth areas. |

| • | Targeted Capital Expenditures to Enhance Production Capacity and Efficiency. We operate three large modern pulp mills and the Friesau Facilitywhich provide us with a platform to be an efficient and competitive producer of high-quality NBSK pulp and lumberwithout the need for significant sustaining capital. We seek to make targeted capital expenditures to increase production and operational efficiency, reduce costs and increase electricity and chemical sales. Between 2013 and 2017, we invested approximately $160.0 million (including $19.7 million in associated government grants) in growth capital expenditures for capacity expansions, operational efficiencies and renewable energy and chemical production. |

| • | Achieving Operational Excellence. Operating our pulp mills and the Friesau Facility reliably and at a competitive cost is important for our financial performance. In addition to capital expenditures, we continuously strive to develop maintenance systems and procedures that will improve the throughput of our products by increasing the reliability of our manufacturing processes. We also seek to reduce operating costs by better managing certain operating activities such as fiber procurement, sales, marketing and logistics activities. We believe that our continued focus on operational excellence should allow us to achieve improved profitability and cash flows. |

| • | Strategic Opportunities. We believe there will be continuing change and consolidation in the forest products business, including pulp and lumber, and related wood harvesting, processing and extractive businesses as industry participants continually seek to lower costs, refocus their product lines and react to ever changing global market conditions. We take an opportunistic approach to potential investments or acquisitions that can grow our business and expand our earnings. |

(8)

General

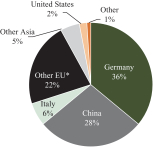

Pulp is used in the production of paper, tissues and paper-related products. Pulp is generally classified according to fiber type, the process used in its production and the degree to which it is bleached. Kraft pulp, a type of chemical pulp, is produced through a sulphate chemical process in which lignin, the component of wood which binds individual fibers, is dissolved in a chemical reaction. Chemically prepared pulp allows the wood’s fiber to retain its length and flexibility, resulting in stronger paper products. Kraft pulp can be bleached to increase its brightness. Softwood kraft pulp is noted for its strength, brightness and absorption properties and is used to produce a variety of products, including lightweight publication grades of paper, tissues and other paper-related products.

There are two main types of bleached kraft pulp, being softwood kraft made from coniferous trees and hardwood kraft made from deciduous trees. Softwood species generally have long, flexible fibers which add strength to paper while fibers from species of hardwood contain shorter fibers which lend bulk and opacity.

We produce and sell NBSK pulp, which is a bleached kraft pulp manufactured using northern softwood and is considered a premium grade because of its strength. It generally obtains the highest price relative to other kraft pulps. Southern bleached softwood kraft pulp is kraft pulp manufactured using southern softwood and does not possess the strength found in NBSK pulp. NBSK pulp is the sole pulp product of our mills.

Most paper users of market kraft pulp use a mix of softwood and hardwood grades to optimize production and product qualities. In 2017, market kraft pulp consumption was approximately 55% hardwood bleached kraft and 42% softwood bleached kraft, with the remainder comprised of unbleached pulp. Over the last several years, production of hardwood pulp, based on fast growing plantation fiber primarily from Asia and South America, has increased much more rapidly than that of softwood grades, based on fiber that has longer growth cycles. Hardwood kraft generally has a cost advantage over softwood kraft as a result of lower fiber costs, higher wood yields and, for newer hardwood mills, economies of scale. As a result of this growth in supply and lower costs, kraft pulp customers have substituted some of the pulp content in their products to hardwood pulp.

Counteracting customers’ ability to substitute lower priced hardwood pulp for NBSK pulp is the requirement for strength and formation characteristics in finished goods. Paper and tissue makers focus on larger paper machines with higher speeds and lower basis weights for certain papers which require the strength characteristics of softwood pulp. Additionally, where paper products are lightweight or specialized, like direct mail, magazine paper or premium tissue, or where strength or absorbency are important, softwood kraft forms a significant proportion of the fiber used. As a result, we believe that the ability of kraft pulp users to further substitute hardwood for softwood pulp is limited by such requirements.

Kraft pulp can be made in different grades, with varying technical specifications, for different end uses. Softwood kraft pulp is valued for its reinforcing role in mechanical printing papers and is sought after by producers of paper for the publishing industry, primarily for magazines and advertising materials. Softwood kraft pulp is also an important ingredient for tissue manufacturing and tissue demand tends to increase with living standards in developing countries. NBSK pulp produced for reinforcement fibers is considered the highest grade of kraft pulp and generally obtains the highest price.

(9)

Markets

We believe that over 135 million ADMTs of chemical pulp are converted annually into tissues, printing and writing papers, carton boards and other specialty grades of paper and paperboard around the world. We also believe that over 40% of this pulp is sold on the open market as market pulp, while the remainder is produced for internal purposes by integrated paper and paperboard manufacturers.

The pulp business is highly cyclical in nature and markets are characterized by periods of supply and demand imbalance, which in turn affect prices. Pulp markets are highly competitive and are sensitive to cyclical changes in the global economy, industry capacity and foreign exchange rates, all of which can have a significant influence on selling prices and our operating results. The length and magnitude of industry cycles have varied over time but generally reflect changes in macro-economic conditions and levels of industry capacity. Pulp is a commodity that is generally available from other producers. Because commodity products have few distinguishing qualities from producer to producer, competition is generally based upon price, which is generally determined by supply relative to demand.

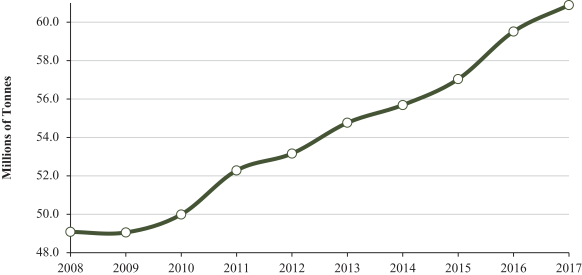

Between 2008 and 2017, worldwide demand for chemical market pulp grew at an average rate of approximately 2% annually, with worldwide demand for bleached softwood kraft market pulp having grown at an average of approximately 2% per annum.

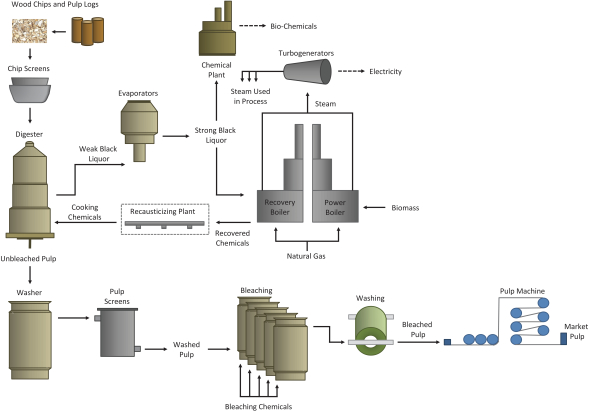

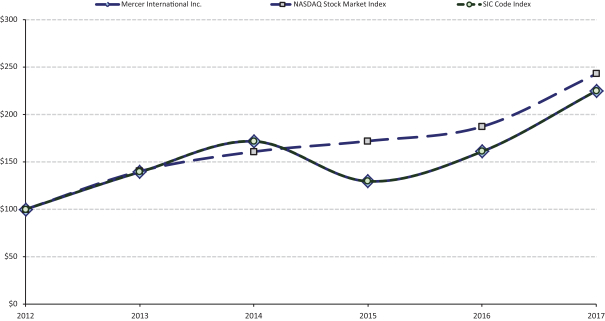

The following chart illustrates the global demand for chemical market pulp for the periods indicated:

Estimated Global Chemical Market Pulp Demand

Key macro-economic trends in worldwide NBSK pulp demand over the last several years include:

| • | a significant increase in demand from emerging markets, and in particular China, which has more than offset declining and stagnating demand in the mature markets of Europe, North America and Japan; and |

| • | a significant shift in demand by end use, as demand from tissue and specialty producers has increased markedly and offset the secular decline in demand for printing and writing paper resulting from the rapid growth in digital media. |

(10)

In late 2017, demand for NBSK pulp tightened primarily as a result of steady demand and a reduction in China’s imports of recovered or waste paper which resulted from a major policy shift announced by China in the third quarter of 2017 to reduce and phase out imports of solid waste and scraps, including those within recovered or waste paper. In late 2017, China also announced goals to stop imports of unsorted paper, solid waste and scrap imports over the next two years.

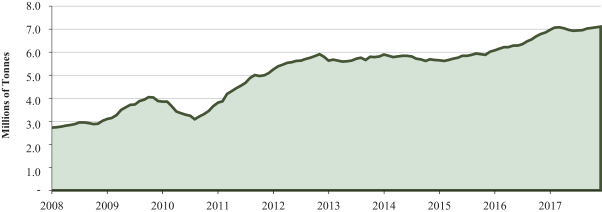

Since 2008, demand for chemical softwood market pulp has grown in the emerging markets of Asia, Eastern Europe and Latin America. China in particular has experienced substantial growth and its imports of chemical softwood market pulp grew by approximately 12% per annum between 2008 and 2017. We believe the emerging markets now account for approximately 54% of total world demand for bleached softwood kraft market pulp. China now accounts for approximately 32% of global bleached softwood kraft market pulp demand, compared to only 17% in 2008. Western Europe currently accounts for approximately 24% of global bleached softwood kraft market pulp demand, compared to approximately 34% in 2008. The demand in the mature markets of Europe, North America and Japan in 2017 declined by approximately 1.5 million ADMTs from 2008.

The following chart sets forth industry-wide bleached softwood kraft deliveries to China for the periods indicated:

12 Month Rolling Bleached Softwood Kraft Pulp Deliveries to China

Growth in NBSK pulp demand in China and other emerging markets has, to a large extent, been driven by increased demand from tissue and specialty paper producers, as a result of economic growth and rising income levels and living standards in such markets. These factors generally contribute to a greater demand for personal hygiene products in such regions. In China alone, tissue production capacity has increased by approximately 4.7 million ADMTs over the last five years. Additional tissue capacity increases of 0.5 million ADMTs have been announced for 2018. At this time there can be no assurance as to when and how much of such capacity expansion will be implemented.

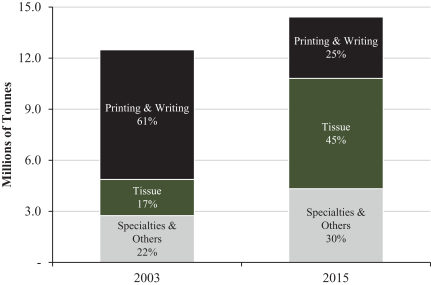

This has also led to an overall shift in demand for NBSK pulp, as demand from tissue producers has increased, while demand from printing and writing end uses has decreased.Between 2003 and 2015, NBSK pulp demand for tissue production increased by approximately 206%, an approximate 10% compound annual growth rate. From 2003 to 2015, a period very affected by “digital substitution” of traditional paper grades, total NBSK demand grew by 15%.

(11)

The following chart compares NBSK pulp demand by end use in each of 2003 and 2015 (the latest year for which figures are currently available):

NBSK Pulp Demand by End Use

We believe 2017 NBSK demand by end use was generally consistent with the trend in the chart above.

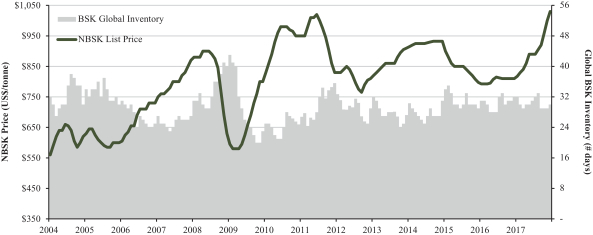

A measure of demand for kraft pulp is the ratio obtained by dividing the worldwide demand of kraft pulp by the worldwide capacity for the production of kraft pulp, or the “demand/capacity ratio”. An increase in this ratio generally occurs when there is an increase in global and regional levels of economic activity. An increase in this ratio also generally indicates greater demand as consumption increases, which often results in rising kraft pulp prices and a reduction of inventories by producers and buyers. As prices continue to rise, producers continue to run at higher operating rates. However, an adverse change in global and regional levels of economic activity generally negatively affects demand for kraft pulp, often leading buyers to reduce their purchases and rely on existing pulp inventories. As a result, producers run at lower operating rates by taking downtime to limit thebuild-up of their own inventories. The demand/capacity ratio for bleached softwood kraft pulp was approximately 93%, 92% and 92% in 2017, 2016 and 2015, respectively.

Between 2013 and 2017, we believe approximately 0.5 million ADMTs of pulp capacity was idled or shut down through mill closures or curtailments. Further, in efforts to improve environmental and safety standards, China closed “old” mills and removed about 15.6 million ADMTs.

In 2017, chemical pulp capacity increased by approximately 2.3 million ADMTs, consisting of increases of 1.1 million ADMTs and 1.2 million ADMTs of softwood and hardwood kraft pulp, respectively. Further bleached hardwood kraft pulp capacity increases of about 2.0 million ADMTs have been announced for 2018. The increase in bleached hardwood kraft pulp is largely targeted at the growing demand for pulp in developing markets, particularly in China, by producers of tissues, specialty papers and packaging. Although not a direct competitor to NBSK pulp, if such additional bleached hardwood kraft pulp supply is not absorbed by such demand growth, as a result of generally lower prices for bleached hardwood

(12)

kraft pulp, this supply increase could put downward pressure on NBSK pulp prices. However, we believe customers’ ability to further substitute lower priced bleached hardwood kraft pulp for NBSK pulp is limited by the strength characteristic of NBSK pulp which is required by large modern paper machines to run lower basis-weight paper products efficiently.

Producers have publicly announced an additional 1.0 million ADMTs of NBSK pulp capacity to come online in Europe inmid-2018 pursuant to modernization and expansion projects. However, at this time, we cannot predict which of the publicly announced expansion projects will be completed or how much additional NBSK pulp production capacity may come online and when. As pulp prices are highly cyclical, there can be no assurance that NBSK pulp prices will not decline in the future as a result of increases to the supply of kraft pulp.

In addition, certain integrated pulp and paper producers have the ability to discontinue paper production by idling their paper machines and selling their NBSK pulp production on the market, if market conditions, prices and trends warrant such actions.

NBSK Pulp Pricing

Kraft pulp is a globally traded commodity and prices are highly cyclical and volatile. Kraft pulp prices are generally quoted in dollars. Pricing is primarily influenced by the balance between supply and demand, as affected by global macro-economic conditions, changes in consumption and capacity, the level of customer and producer inventories and fluctuations in exchange rates. Generally, we and other producers consider global NBSK pulp supply and demand to be evenly balanced when world inventory levels are at about 30 days’ supply.

General macro-economic conditions are closely tied to overall global business activity, which helps determine pulp demand and, in turn, impacts pricing.

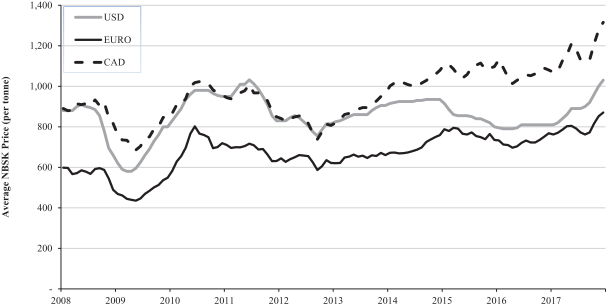

As the majority of market NBSK pulp is produced and sold by Canadian and Northern European producers, while the price of NBSK pulp is generally quoted in dollars, pricing is often affected by fluctuations in the currency exchange rates for the dollar versus the euro and the Canadian dollar. As NBSK pulp producers generally incur costs in their local currency, while pulp is quoted in dollars, a dollar strengthening generally benefits producers’ businesses and operating margins. Conversely, a weakening of the dollar versus the local currency of producers generally adversely affects producers’ businesses and operating margins.

As a corollary to changes in exchange rates between the dollar and the euro and Canadian dollar, a stronger dollar generally increases costs to customers of NBSK pulp producers and results in downward pressure on prices. Conversely, a weakening dollar generally supports higher pulp pricing. However, there is invariably a time lag between changes in currency exchange rates and pulp prices. This lag can vary and is not predictable with any certainty.

As Northern Europe has historically been the world’s largest market and NBSK pulp is the premium grade, the European market NBSK price is generally used as a benchmark price by the industry. The average European list prices for NBSK pulp since 2008 have fluctuated between a low of approximately $575 per ADMT in 2009 and a high of $1,030 per ADMT in late 2017.

(13)

The following chart sets out the changes in list prices for NBSK pulp in Europe, as stated in dollars, Canadian dollars and euros for the periods indicated:

NBSK Pulp Price History (European Delivery)

The following table sets out list prices for NBSK pulp in the regions indicated at the dates indicated:

| December 31, | ||||||||||||

| 2017 | 2016 | 2015 | ||||||||||

| (in $/ADMT) | ||||||||||||

Europe | 1,030 | 810 | 800 | |||||||||

China | 890 | 605 | 595 | |||||||||

North America | 1,205 | 990 | 940 | |||||||||

A producer’s net sales realizations are list prices, net of customer discounts, rebates and other selling concessions. Over the last three years, these have increased as producers compete for customers and sales. The nature of the pricing structure in Asia is different in that, while quoted list prices tend to be lower than Europe, customer discounts and rebates are much lower, resulting in net sales realizations that are generally similar to other markets.

(14)

The following chart sets forth changes in FOEX PIX Pulp Index prices for NBSK pulp in Europe and global bleached softwood kraft inventory levels between 2004 and 2017:

Pulp Price and Global Inventory History

Seasonality

We are exposed to fluctuations in quarterly sales volumes and expenses due to seasonal factors. These factors are common in the NBSK pulp industry. We generally have weaker pulp demand in Europe during the summer holiday months and in China in the period relating to its lunar new year. We typically have a seasonalbuild-up in raw material inventories in the early winter months as our mills build up their fiber supply for the winter when there is reduced availability.

Competition

Pulp markets are large and highly competitive. Producers ranging from small independent manufacturers to large integrated companies produce pulp worldwide. Our pulp and customer services compete with similar products manufactured and distributed by others. While many factors influence our competitive position, particularly in weak economic times, a key factor is price. Other factors include service, quality and convenience of location. Some of our competitors are larger than we are in certain markets and have substantially greater financial resources. These resources may afford those competitors more purchasing power, increased financial flexibility, more capital resources for expansion and improvement and enable them to compete more effectively. Our key NBSK pulp competitors are principally located in Northern Europe and Canada and include Canfor Pulp, Stora Enso, Metsä Fibre, Ilim, Södra Cell and Asia Pulp and Paper.

(15)

Our pulp production capacity and actual production by mill for the periods indicated is set out below:

| Annual Production Capacity(1) |

Year Ended December 31, | |||||||||||||||

| 2017 | 2016 | 2015 | ||||||||||||||

| Pulp Production by Mill: | (ADMTs) | |||||||||||||||

Rosenthal | 360,000 | 361,309 | 353,486 | 353,099 | ||||||||||||

Celgar | 520,000 | 466,558 | 426,317 | 453,215 | ||||||||||||

Stendal | 660,000 | 679,152 | 648,581 | 651,659 | ||||||||||||

|

|

|

|

|

|

|

| |||||||||

Total pulp production | 1,540,000 | 1,507,019 | 1,428,384 | 1,457,973 | ||||||||||||

|

|

|

|

|

|

|

| |||||||||

| (1) | Capacity is the rated capacity of the plants for the year ended December 31, 2017. |

Softwood kraft pulp is valued for its reinforcing role in mechanical printing papers and is sought after by producers of paper for the publishing industry, primarily for magazines and advertising materials. Softwood kraft pulp is also an important ingredient for tissue manufacturing, and tissue demand tends to increase with living standards in developing countries. NBSK pulp produced for reinforcement fibers is considered the highest grade of kraft pulp and generally obtains the highest price.

The NBSK pulp produced at the Rosenthal mill is a long-fibered softwood pulp produced by a sulphate cooking process and manufactured primarily from wood chips and pulp logs. A number of factors beyond economic supply and demand have an impact on the market for NBSK pulp, including requirements for pulp bleached without any chlorine compounds or without the use of chlorine gas. The Rosenthal mill has the capability of producing both “totally chlorine free” and “elemental chlorine free” pulp. Totally chlorine free pulp is bleached to a high brightness using oxygen, ozone and hydrogen peroxide as bleaching agents, whereas elemental chlorine free pulp is produced by substituting chlorine dioxide for chlorine gas in the bleaching process. This substitution virtually eliminates complex chloro-organic compounds from the mill’s effluent. The Rosenthal mill produces pulp for reinforcement fibers to the specifications of certain of our customers. We believe that a number of our customers consider us their supplier of choice.

The NBSK pulp produced at the Stendal mill is of a slightly different grade than the pulp produced at the Rosenthal mill as the mix of softwood fiber used is slightly different. This results in a complementary product more suitable for different end uses. The Stendal mill is capable of producing both totally chlorine free and elemental chlorine free pulp.

The Celgar mill produces high-quality NBSK pulp that is made from a unique blend of slow growing/long-fiber Western Canadian tree species. It is used in the manufacture of high-quality paper and tissue products. We believe the Celgar mill’s pulp is known for its excellent product characteristics, including tensile strength, wet strength and brightness. The Celgar mill is a long-established supplier to paper and tissue producers in Asia.

Generation and Sales of Green Energy and Chemicals at Our Mills

Our pulp mills are large scalebio-refineries that, in addition to pulp, also produce surplus “carbon neutral” or green energy. As part of the pulp production process our mills generate green energy using carbon-neutralbio-fuels such as black liquor and wood waste. Through the incineration ofbio-fuels in the recovery and power boilers, our mills produce sufficient steam to cover all of our steam requirements and

(16)

allow us to produce surplus electricity which we sell to third party utilities. As a result, we have benefited from green energy legislation, incentives and commercialization that have developed over the last decade in Europe and Canada. In addition, in recent years we have applied considerable resources to increasing our capacity to produce and sell chemicals, primarily tall oil for use in numerous applications includingbio-fuels.

Our Friesau Facility also generates and sells green energy produced from itsbio-mass cogeneration power plant.

Our surplus energy and chemical sales provide us with a stable revenue source unrelated to pulp or lumber prices. Since our energy and chemical production areby-products of our production processes, there are minimal incremental costs and our surplus energy and chemical sales are highly profitable. We believe that this revenue source gives our mills a competitive advantage over other older mills which do not have the equipment or capacity to produce and/or sell surplus power and/or chemicals in a meaningful amount.

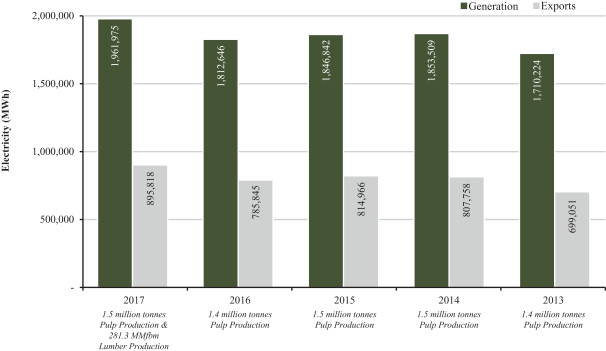

The following table sets out our electricity generation and surplus electricity sales for the five years ended December 31, 2017:

Electricity Generation and Exports

(17)

The following chart sets forth our consolidated revenues from electricity and chemical sales for the five years ended December 31, 2017:

Energy and Chemical Revenue

German Pulp Mills and Friesau Facility

Our German pulp mills and the Friesau Facility participate in a program established pursuant to the Renewable Energy Act, which requires that public electric utilities give priority to electricity produced from renewable energy sources by independent power producers and pay a fixed tariff for such electricity for a period of 20 years. Such tariff expires December 31, 2019 for our Rosenthal mill, December 31, 2024 for our Stendal mill and in 2029 for the Friesau Facility. Recent amendments to the Renewable Energy Act will extend the initial terms for our pulp mills for a further10-year period, based upon the price received in the last year prior to renewal regressing at a rate of 8% per annum. Such amendments are subject to compliance with EU state aid rules. While we expect them to be effective, we can provide no assurance of the same.

Since 2005, our German mills have received emission allowances under the European Union Carbon Emissions Trading Scheme, referred to as the “EU ETS”. However, our eligibility for special tariffs under the Renewable Energy Act has reduced the amount of emissions allowances granted to our German mills under the EU ETS.

In 2017, energy sales for our German pulp mills and the Friesau Facility were as follows:

| Year Ended December 31, 2017 | ||||||||

| (in thousands) | ||||||||

| (MWh) | ($) | |||||||

Rosenthal | 166,093 | 17,103 | ||||||

Stendal | 508,733 | 48,316 | ||||||

Friesau Facility | 73,698 | 8,872 | ||||||

In 2017, our Rosenthal and Stendal mills generated $2.3 million and $11.2 million, respectively, from the sale of tall oil, aby-product of our production process.

(18)

Celgar Mill

The Celgar mill has an electricity sales agreement with the British Columbia Hydro and Power Authority, referred to as “B.C. Hydro”, for the sale of power generated, pursuant to which the mill agreed to supply a minimum of approximately 238,000 MWh of surplus electrical energy annually to the utility over aten-year term. The agreement expires in 2020.

In 2017, our Celgar mill sold approximately 147,294 MWh of renewable electricity for proceeds of approximately $12.4 million.

In 2015, we completed a hearing relating to our claim against the Government of Canada under the North American Free Trade Agreement, referred to as “NAFTA”, regarding our investment in Celgar and unfair and discriminatory treatment regarding its ability to purchase and sell energy. See Item 3. “Legal Proceedings”.

Consolidated cash production costs per ADMT for our pulp mills are set out in the following table for the periods indicated:

| Year Ended December 31, | ||||||||||||||||||||||||

| 2017 | 2016 | 2015 | ||||||||||||||||||||||

Cash Production Costs | (per ADMT) | (%) | (per ADMT) | (%) | (per ADMT) | (%) | ||||||||||||||||||

Fiber | $ | 265 | 56 | $ | 264 | 60 | $ | 286 | 62 | |||||||||||||||

Labor | 55 | 12 | 52 | 12 | 51 | 11 | ||||||||||||||||||

Chemicals | 53 | 11 | 51 | 12 | 51 | 11 | ||||||||||||||||||

Energy | 20 | 4 | 20 | 5 | 18 | 4 | ||||||||||||||||||

Other | 78 | 17 | 54 | 11 | 59 | 12 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||

Total cash production costs(1) | $ | 471 | 100 | $ | 441 | 100 | $ | 465 | 100 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||

| (1) | Cash production costs per ADMT exclude depreciation and amortization. |

Our major costs of pulp production are fiber, labor, chemicals and energy. Fiber, comprised of wood chips and pulp logs, is our most significant operating expense for our pulp segment, representing about 56% of our pulp cash production costs in 2017.

Further, fiber, in the form of sawlogs, represents about 80% of lumber cash production costs.

Given the significance of fiber to our total operating expenses and our limited ability to control its costs compared with our other operating costs, volatility in fiber costs can materially affect our margins and results of operations.

Fiber

Our mills are situated in regions which generally provide a relatively stable supply of fiber. The fiber consumed by our pulp mills consists of wood chips produced by sawmills as aby-product of the sawmilling process and pulp logs. Wood chips are small pieces of wood used to make pulp and are either

(19)

wood residuals from the sawmilling process or pulp logs chipped especially for this purpose. Pulp logs consist of lower quality logs not used in the production of lumber. The Friesau Facility consumes sawlogs and waste wood, which are cyclical in both price and supply.

Generally, the cost of wood chips, pulp logs and sawlogs is primarily affected by the supply and demand for lumber. Additionally, regional factors such as harvesting levels and weather conditions can also have a material effect on the supply, demand and price for fiber.

In Germany, the price and supply of wood chips has been affected by increasing demand from alternative or renewable energy producers and government initiatives for carbon neutral energy. Declining energy prices, weaker economies or warm winters such as in 2014, 2015 and 2016 tempered the demand for wood chips resulting from initiatives by European governments to promote the use of wood as a carbon neutral energy. Over the long-term, we expect thisnon-traditional demand for fiber is likely to continue to remain strong.

During the past few years, certain customers have endeavored to purchase pulp that is produced using fiber that meets certain recognized wood certification requirements from forest certification agencies like FSC, PEFC andSFI-CSA. If the fiber we purchase does not meet certain wood certifications required by customers, it may make it more difficult or prevent us from selling our pulp to such customers. The chain of custody wood certification process is a voluntary process which allows a company to demonstrate that they use forest resources in accordance with strict principles and standards in the areas of sustainable forest management practices and environmental management. In an effort to procure wood only from sustainably managed sources, we employ an FSC Chain of Custody protocol for controlled wood and PEFC certification, which requires tracking of fiber origins and preparing risk based assessments regarding the region and operator. In the areas where we operate, we are actively engaged in the further development of certification processes. However, there is competition among private certification systems along with efforts by supporters to further these systems by having customers of forest products to require products to be certified to their preferred system. Such wood certification standards continue to evolve and are not consistent from jurisdiction to jurisdiction or how they are interpreted and applied. We currently do not expect certification requirements to have a material adverse impact on our fiber procurement and sales. However, if sufficient marketplace demand requires wood raw materials to be sourced from standards that are inconsistent with those in our fiber supply regions, it could increase our operating costs and available harvest levels.

Offsetting some of the increases in demand for wood fiber have been initiatives to increase harvest levels in Germany, particularly from small private forest owners. We believe that Germany has the highest availability of softwood forests in Europe suitable for harvesting and manufacturing. We believe private ownership of such forests is approximately 48%. Many of these forest ownership stakes are very small and have been harvested at rates much lower than their rate of growth.

In 2017, our per unit pulp fiber costs in Germany were flat compared to 2016, primarily as a result of a balanced wood market in Germany. In 2016, our per unit fiber costs in Germany were 9% lower than in 2015, primarily as a result of a balanced wood market in Germany. In 2015, our per unit fiber costs in Germany decreased by approximately 17% due to the strength of the dollar and as a result of a generally balanced wood market.

We believe we are the largest consumer of wood chips and pulp logs in Germany and often provide the best long-term economic outlet for the sale of wood chips in Eastern Germany. We coordinate the wood procurement activities for our German mills to reduce overall personnel and administrative costs, provide greater purchasing power and coordinate buying and trading activities. This coordination and integration of

(20)

fiber flows also allows us to optimize transportation costs, and the species and fiber mix for both mills. In addition, in 2016, we entered into a joint wood purchasing arrangement with another significant wood consumer in Europe, being the Mondi Group.

In 2017, the Rosenthal mill consumed approximately 1.9 million cubic meters of fiber. Approximately 63% of such consumption was in the form of sawmill wood chips and approximately 37% was in the form of pulp logs. The wood chips for the Rosenthal mill are sourced from approximately 46 sawmills located primarily in the states of Bavaria,Baden-Württemberg and Thüringia and primarily within a 300 kilometer radius of the Rosenthal mill. Within this radius, the Rosenthal mill is the largest consumer of wood chips. Given its location and size, the Rosenthal mill is often the best economic outlet for the sale of wood chips in the area. In 2017, approximately 73% of the fiber consumed by the Rosenthal mill was spruce and the remainder was pine. While fiber costs and supply are subject to cyclical changes largely in the sawmill industry, we expect that we will be able to continue to obtain an adequate supply of fiber on reasonably satisfactory terms for the Rosenthal mill due to its location and our long-term relationships with suppliers. We have not historically experienced any significant fiber supply interruptions at the Rosenthal mill.

Wood chips for the Rosenthal mill are normally sourced from sawmills underone-year contracts with quarterly adjustments for market pricing. Substantially all of our chip supply is sourced from suppliers with which we have long-standing relationships. Pulp logs are sourced from the state forest agencies in Thüringia, Saxony and Bavaria and from private and municipal forest owners. In addition, the Rosenthal mill buys relevant volumes from traders and via imports from the Czech Republic and Poland.

In 2017, the Stendal mill consumed approximately 3.4 million cubic meters of fiber. Approximately 26% of such fiber was in the form of sawmill wood chips and approximately 74% was in the form of pulp logs. The core wood supply region for the Stendal mill includes most of the Northern and Western part of Germany primarily within an approximate 300 kilometer radius of the mill. We also purchase wood chips from Southwestern and Southern Germany as well as the Baltic Sea region. The fiber consumed by the Stendal mill consisted of approximately 49% pine, 49% spruce and 2% other species in 2017. The Stendal mill has sufficient chipping capacity to fully operate solely using pulp logs, if required. We source pulp logs from private forest holders, municipal forest owners and from state forest agencies inSaxony-Anhalt, Mecklenburg-Western Pomerania, Saxony, Lower Saxony, North Rhine-Westphalia, Hesse, Brandenburg, Schleswig-Holstein, Rhineland Palatinate and the City of Berlin. The volumes are distributed at optimal costs between the mills. In addition, over the last three years, the Stendal mill also imported fiber from Poland and the Baltic Sea region.

The availability of fiber for the Celgar mill is in large part influenced by the strength of the lumber market. Lumber markets are primarily driven by U.S. housing starts and, to a lesser degree, demand from China.

In 2017, our Celgar mill’s per unit fiber costs were flat compared to 2016, due to a balanced wood market in the Celgar mill’s fiber basket. In 2016, our Celgar mill’s per unit fiber costs were 6% lower than in 2015, due to strong sawmilling activity in the Celgar mill’s fiber basket. In 2015, our Celgar mill’s per unit fiber costs were flat compared to 2014, as the strengthening of the dollar largely offset higher prices in local currency terms.

In 2017, the Celgar mill consumed approximately 2.5 million cubic meters of fiber. Approximately 72% of such fiber was in the form of sawmill wood chips and the remaining 28% came from pulp logs processed through its woodroom or chipped by a third party. Celgar’s woodroom is able to process about 40% of the mill’s fiber needs. The source of fiber at the mill is characterized by a mixture of species (pine,

(21)

douglas fir, hemlock, cedar and spruce) and the mill sources fiber from a number of Canadian and U.S. suppliers.

In 2017, the Celgar mill had access to approximately 27 different chip suppliers from Canada and the United States. Chips are purchased in Canada and the United States in accordance with chip purchase agreements. Generally, pricing is reviewed and adjusted periodically to reflect market prices. One of the longer-term contracts is aso-called “evergreen” agreement, where the contract remains in effect until one of the parties elects to terminate after providing the stipulated notice. All other contracts are generally for one year with quarterly adjustments or on three-month terms.

To secure the volume of pulp logs required by its woodroom and field chippers, the Celgar mill has entered into pulp log supply agreements, which can range from three-month toone-year terms, with a number of different suppliers, many of whom are also contract chip suppliers to the mill. All of the pulp log agreements can be terminated by either party for any reason, upon seven days’ written notice. The Celgar mill also purchased twonon-renewable licenses at a cost of $1.3 million, which will provide saw logs to sawmills in the area and pulp logs for the Celgar mill to use. The Celgar mill also bids on British Columbia timber sales from time to time. The Celgar mill has also commenced second pass harvesting in certain locales to increase harvesting of pulp logs that have traditionally been left as waste after harvesting operations.

Our Friesau Facility is dependent on the consistent supply of sawlog fiber. Wood fiber is the single largest input cost and accounts for about 80% of its cash costs of producing lumber. Our Friesau Facility is located in an area where there is a significant amount of high quality fiber within economic reach. The wood fiber requirements of the Friesau Facility are met primarily through open market purchases and contract purchases from state forestry agencies and private timberland owners.

Labor

Our labor costs are generally steady, with small overall increases due to inflation in wages and health care costs. Over the last three years, we have been able to largely offset such increases by increasing our efficiencies and production and streamlining operations.

Energy

Our energy is primarily generated from renewable carbon neutral sources, such as black liquor and wood waste. Our mills produce all of our energy requirements and generate excess energy which we sell to third party utilities. In 2017, we generated 1,961,975 MWh and sold 895,818 MWh of surplus energy. See also “– Generation and Sales of Green Energy and Chemicals at our Mills”. We utilize fossil fuels, such as natural gas, primarily in our lime kilns and we use a limited amount forstart-up and shut-down operations. Additionally, from time to time, mill process disruptions occur and we consume small quantities of purchased electricity and fossil fuels to maintain operations. As a result, all of our mills are subject to fluctuations in the prices for fossil fuels.

Chemicals

Our pulp mills use certain chemicals which are generally available from several suppliers and sourcing is primarily based upon pricing and location. Our chemical costs have remained stable over the last three years.

In connection with our focus on the growingbio-energy market, we sell tall oil, aby-product of our pulp production process which is used as both a chemical additive and as a green energy source. In 2017, we generated $14.2 million from the sale of tall oil and other chemicals.

(22)

Sales, Marketing and Distribution

Our pulp revenues by geographic area are set out in the following table for the periods indicated:

| Year Ended December 31, | ||||||||||||

| 2017 | 2016 | 2015 | ||||||||||

Revenues by Geographic Area | (in thousands) | |||||||||||

Germany | $ | 342,273 | $ | 326,898 | $ | 344,843 | ||||||

Italy | 51,589 | 53,702 | 53,919 | |||||||||

Other European Union countries(1) | 212,849 | 173,585 | 210,218 | |||||||||

United States | 23,572 | 26,985 | 15,453 | |||||||||

China | 292,231 | 221,773 | 266,632 | |||||||||

Other Asia | 46,355 | 31,897 | 43,981 | |||||||||

Other countries | 10,776 | 12,488 | 11,191 | |||||||||

|

|

|

|

|

| |||||||

Total(2) | $ | 979,645 | $ | 847,328 | $ | 946,237 | ||||||

|

|

|

|

|

| |||||||

| (1) | Excluding Germany and Italy. |

| (2) | Excluding intercompany sales. |

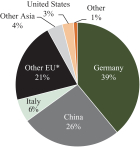

The following charts illustrate the geographic distribution of our pulp revenues as a percentage of our total pulp revenues for the periods indicated:

2017 Geographically Segmented Pulp Sales

| 2016 Geographically Segmented Pulp Sales | 2015 Geographically Segmented Pulp Sales | ||

|  |  | ||

*Excluding Germany and Italy.

The distribution of our pulp sales by end use are set out in the following table for the periods indicated:

| Year Ended December 31, | ||||||||||||

| 2017 | 2016 | 2015 | ||||||||||

| (in thousands of ADMTs) | ||||||||||||

Tissue | 587 | 503 | 501 | |||||||||

Specialty | 203 | 209 | 227 | |||||||||

Printing & Writing | 683 | 663 | 716 | |||||||||

Other | 42 | 54 | 19 | |||||||||

|

|

|

|

|

| |||||||

| 1,515 | 1,429 | 1,463 | ||||||||||

|

|

|

|

|

| |||||||

In 2017, our wood products segment revenues were: (i) 39% from Germany; (ii) 29% from other European Union countries; (iii) 24% from the United States; and (iv) 8% from other countries.

(23)

Our global sales and marketing group is responsible for conducting all sales and marketing of the pulp produced at our mills and currently has approximately 15 employees. This group largely handles all European and North American sales directly. Sales to Asia are made directly or through commission agents overseen by our sales group. The global sales and marketing group handles sales to approximately 200 customers. We coordinate and integrate the sales and marketing activities of our German mills to realize on a number of synergies between them. These include reduced overall administrative and personnel costs and coordinated selling, marketing and transportation activities. We also coordinate sales from the Celgar mill with our German mills on a global basis, thereby providing our larger customers with seamless service across all major geographies. In marketing our pulp, we seek to establish long-term relationships by providing a competitively priced, high-quality, consistent product and excellent service. In accordance with customary practice, we maintain long-standing relationships with our customers, pursuant to which we periodically reach agreements on specific volumes and prices.

Our lumber sales are handled by our sales team in Germany and Vancouver. We also sell lumber through commissioned agents in certain markets.

Our pulp and lumber sales are on customary industry terms. At December 31, 2017, we had no material payment delinquencies. In 2017, one customer of our pulp segment through several of its operations accounted for 13% of our revenues. In 2016, two customers through several of their operations accounted for 19% and 10%, respectively, of our pulp sales. In 2015, one customer through several of its operations accounted for 16% of our pulp sales. We do not believe our pulp sales are dependent upon the activities of any single customer and the loss of any single customer would not have a material adverse effect on us.

Our sales to tissue and specialty paper product manufacturers were approximately 50% of our pulp sales in 2017, 2016 and 2015. Generally tissue producer customers are not as sensitive to cyclical declines in demand caused by downturns in economic activity. The balance of our sales was to other paper product manufacturers.

We transport our NBSK pulp and lumber generally by truck, rail and ocean carriers through third-party carriers. We have a small fleet of trucks in Germany that deliver some of our German mills’ pulp.

Our German pulp mills are currently the only market kraft pulp producers in Germany, which is the largest import market for kraft pulp in Europe. We therefore have a competitive transportation cost advantage compared to Canadian and Northern European pulp producers when shipping to customers in Europe. Due to the location of our German mills, we are able to deliver pulp to many of our customers primarily by truck and rail. Most trucks that deliver goods into Eastern Germany generally do not have significant backhaul opportunities as the region is primarily an importer of goods. We are therefore frequently able to obtain relatively low backhaul freight rates for the delivery of our products to many of our customers.

The Celgar mill’s pulp is transported to customers by rail, truck and ocean carrier to ensure timely delivery. The majority of Celgar’s pulp for overseas markets is initially delivered primarily by rail to the Port of Vancouver for shipment overseas by ocean carrier. Based in Western Canada, the Celgar mill is well positioned to service Asian customers. The majority of the Celgar mill’s pulp for domestic markets is shipped by rail directly to the customer or to third party warehouses in the United States. In 2015, we established a logistics and reload center near Trail, British Columbia. The center provides us with additional warehouse space for our Celgar mill and greater transportation flexibility in terms of access to rail and trucking options.

(24)

The Friesau Facility’s lumber is transported to customers by truck, rail and ocean carriers through third-party carriers.

In each of 2017, 2016 and 2015, outbound transportation costs comprised approximately 9%, 8% and 9%, respectively, of our total consolidated cost of sales. Generally, in recent years, our transportation costs have been stable despite growing overseas shipments due to higher shipping capacity and we have also taken initiatives to target sales to the most “freight logical” customers.

We have continued to make capital investments designed to increase pulp, green energy and chemical production, reduce costs and improve efficiency and environmental performance at our pulpmills. The improvements made over the years have increased the competitive position of our pulp segment. Since its acquisition, we have also made capital investments to optimize sawmill production at the Friesau Facility.

Total capital expenditures at our mills (excluding any related governmental grants) are set out in the following table for the periods indicated:

| Year Ended December 31, | ||||||||||||

| 2017 | 2016 | 2015 | ||||||||||

| (in thousands) | ||||||||||||

Rosenthal | $ | 18,855 | $ | 15,167 | $ | 15,690 | ||||||

Stendal | 6,293 | 7,801 | 18,490 | |||||||||

Celgar | 29,386 | 19,558 | 12,356 | |||||||||

Friesau Facility | 3,197 | |||||||||||

|

|

|

|

|

| |||||||

Total | $ | 57,731 | $ | 42,526 | $ | 46,536 | ||||||

|

|

|

|

|

| |||||||

Capital investments at the Rosenthal mill in 2017 primarily related to the purchase of additional land for raw material storage and a railcar acceptance system for logs. In 2016, they related to a railcar acceptance system for logs and a lime kiln retrofit and, in 2015, they related to a wastewater reduction project consisting of an evaporation plant upgrade and completion of an automated chip storage project.

Capital investments at the Stendal mill in 2017 included a project to reduce nitrogen in wastewater and smaller projects and in 2016 they related to a wastewater reduction project consisting of an evaporation plant upgrade and a project to reduce chloride levels in the process water and, in 2015, they related primarily to the evaporation plant upgrade.

Certain of our capital investment programs in Germany were partially financed through government grants made available by German federal and state governments. Under legislation adopted by the federal and certain state governments of Germany, government grants are provided to qualifying businesses operating in Eastern Germany to finance capital investments. The grants are made to encourage investment and job creation. For example, the government grants received in connection with our main capital project completed at the Stendal mill in 2013 require us to maintain the employment of core employees for five years after completion of the project, among certain other terms. Previously, government grants were available for up to 35% of the cost of qualified investments. These grants at the 35% of cost level required that at least one permanent job be created for each €0.5 million ($0.5 million) of capital investment eligible for such grants and that such jobs be maintained for a period of five years from the completion of the capital investment project. Generally, government grants are not repayable by a recipient

(25)

unless such recipient fails to complete the proposed capital investment or, if applicable, fails to create or maintain the requisite amount of jobs or comply with other applicable terms. In the case of such failure, the government is entitled to revoke the grants and seek repayment unless such failure resulted from material unforeseen market developments beyond the control of the recipient, in which case the government may refrain from reclaiming previous grants. Pursuant to legislation in effect at the time, the Stendal mill recorded approximately $350.0 million of government grants. We believe that we are currently in compliance in all material respects with all of the terms and conditions governing the government grants we have received in Germany.

The following table sets out, as at the dates indicated, the effect of government grants on the recorded value of such assets in our Consolidated Balance Sheets:

| As at December 31, | ||||||||||||

| 2017 | 2016 | 2015 | ||||||||||

| (in thousands) | ||||||||||||

Property, plant and equipment, gross amount less amortization | $ | 1,088,012 | $ | 971,462 | $ | 1,015,569 | ||||||

Less: government grants less amortization | (243,164 | ) | (233,186 | ) | (253,178 | ) | ||||||

|

|

|

|

|

| |||||||

Property, plant and equipment, net (as shown on the Consolidated Balance Sheet) | $ | 844,848 | $ | 738,276 | $ | 762,391 | ||||||

|

|

|

|

|

| |||||||

The following table sets forth, as at the dates indicated, the gross amount of all government grants we have received and capitalized in our balance sheet, the associated amortization and the resulting net balance we include in our property, plant and equipment:

| As at December 31, | ||||||||||||

| 2017 | 2016 | 2015 | ||||||||||

| (in thousands) | ||||||||||||

Government grants – gross(1) | $ | 528,721 | $ | 467,260 | $ | 475,142 | ||||||

Less: Accumulated amortization | (285,557 | ) | (234,074 | ) | (221,964 | ) | ||||||

|

|

|

|

|

| |||||||

Government grants less accumulated amortization | $ | 243,164 | $ | 233,186 | $ | 253,178 | ||||||

|

|

|

|

|

| |||||||

| (1) | Grants were received in euros and Canadian dollars and amounts change when translated into dollars as a result of changes in currency exchange rates. |

Qualifying capital investments at industrial facilities in Germany that reduce effluent discharges offset wastewater fees that would otherwise be required to be paid. For more information about our environmental capital expenditures, see “– Environmental”.

In 2017, capital investments at the Celgar mill included apre-bleach press system upgrade and large maintenance projects. In 2016, they included new wood harvesting equipment, a logistics and reload center and other maintenance projects and, in 2015, they included the logistics and reload center and other maintenance projects.

Capital investments at the Friesau Facility in 2017 primarily related to a saw line improvement project.

In 2018, excluding amounts being financed through government grants, we expect our totalcapital expenditures to be approximately $85 million to $95 million.

(26)

In our pulp segment, plannedcapital expenditures in 2018 are principally comprised of approximately:

| • | $18 million at the Rosenthal mill for new chip screens to improve the consistency of chips for the mill’s digester, bleach plant improvements and other projects; |

| • | $20 million at the Celgar mill for: |

| • | upgrades to the chip infeed system and screens in the digester to increase its run rate by improving the cleaning and liquor removal process and chemical recovery rate; and |