MERCER INTERNATIONAL INC.

NOTES TO THE UNAUDITED PRO FORMA CONSOLIDATED FINANCIAL STATEMENTS

(In thousands)

Note 2. Significant Accounting Policies

The accounting policies used in the preparation of these pro forma consolidated financial statements are those set out in Mercer’s audited consolidated financial statements for the year ended December 31, 2017 and unaudited interim consolidated financial statements for the nine month period ended September 30, 2018. DMI follows IFRS, as outlined in DMI’s audited consolidated financial statements as at December 31, 2017. As a result, in preparation of the pro forma consolidated financial statements, several adjustments were made to the DMI consolidated financial statements to conform to GAAP. The reconciling differences between IFRS and GAAP are reflected in Note 5.

The pro forma consolidated financial statements are presented in U.S. dollars (“$” or “dollars”), Mercer’s reporting currency. DMI’s consolidated financial statements are presented in Canadian dollars (“C$”). Mercer translated DMI’s consolidated balance sheet to dollars using the exchange rate as at September 30, 2018 (C$1.2945 to $1.00) and translated DMI’s consolidated statement of operations at the average rate of exchange for the nine months ended September 30, 2018 (C$1.2876 to $1.00) and September 30, 2017 (C$1.3074 to $1.00) and at the average rate of exchange for the year ended December 31, 2017 (C$1.2986 to $1.00).

Note 3. Acquisition

On October 3, 2018, Mercer entered into a share purchase agreement (the “Purchase Agreement”) to acquire all of the issued and outstanding shares of DMI in consideration for a purchase price of $359,212 (C$465,000) cash, which includes minimum working capital of $85,700 (C$111,000), and is subject to certain customary adjustments (the “Acquisition”).

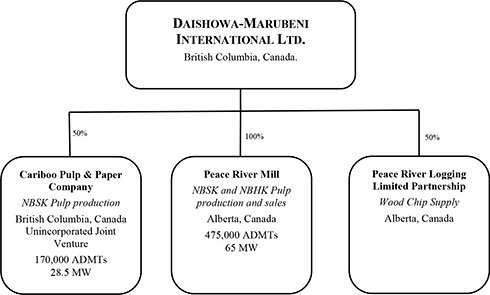

DMI owns 100% of a bleached kraft pulp mill in Peace River, Alberta and a 50% interest in the Cariboo Pulp and Paper Company, a joint venture which operates a bleached kraft pulp mill in Quesnel, British Columbia.

In connection with entering into the Purchase Agreement, on October 3, 2018, Mercer accepted and entered into a Commitment Letter by and among the Company, Credit Suisse Loan Funding LLC and Credit Suisse AG (the “Commitment Letter”) dated September 30, 2018, pursuant to which Credit Suisse AG has agreed to provide Mercer with a senior unsecured bridge facility in the principal amount of up to $350,000 in order to finance the purchase price under the Acquisition. The facility will be replaced or refinanced pursuant to this offering of Senior Notes.

For the purposes of these pro forma consolidated financial statements, Mercer has completed a preliminary estimate of the fair value of all identifiable assets acquired and liabilities assumed. The fair value of all the assets acquired and liabilities assumed will ultimately be determined after the closing of the Acquisition based on the actual assets acquired and liabilities assumed as of the date of the Acquisition. Therefore, it is likely that the fair value of the assets acquired and liabilities assumed will vary from those shown below, and the differences may be material.

The following summarizes the Company’s preliminary allocation of the purchase price to the fair value of the assets acquired and liabilities assumed at the acquisition date:

| | | | |

| | | Purchase Price

Allocation | |

Current assets | | $ | 125,155 | |

Property, plant and equipment | | | 306,531 | |

Investment in joint ventures | | | 36,204 | |

Other long-term assets | | | 2,428 | |

| | | | |

Total assets acquired | | | 470,318 | |

Current liabilities | | | (37,197 | ) |

Employee future benefits | | | (8,333 | ) |

Deferred income tax | | | (62,141 | ) |

Other long-term liabilities | | | (3,435 | ) |

| | | | |

Total liabilities assumed | | | (111,106 | ) |

| | | | |

Net assets acquired | | $ | 359,212 | |

| | | | |

14