# Mercer International Inc. Investor Presentation August 2021 EXHIBIT 99.1

Forward-looking Statements The Private Securities Litigation Reform Act of 1995 provides a “safe harbor” for forward-looking statements. Certain information included in this presentation contains statements that are forward-looking, such as statements relating to results of operations and financial conditions, market expectations and business development activities, as well as capital spending and financing sources. Such forward-looking information involves important risks and uncertainties that could significantly affect anticipated results in the future and, accordingly, such results may differ materially from those expressed in any forward-looking statements made by or on behalf of Mercer. For more information regarding these risks and uncertainties, review Mercer’s filings with the United States Securities and Exchange Commission. Unless required by law, we do not assume any obligation to update forward-looking statements based on unanticipated events or changed expectations.

Building a Platform for Growth 2021 Stendal capacity expansion +80,000 tonnes Rosenthal tall oil plant

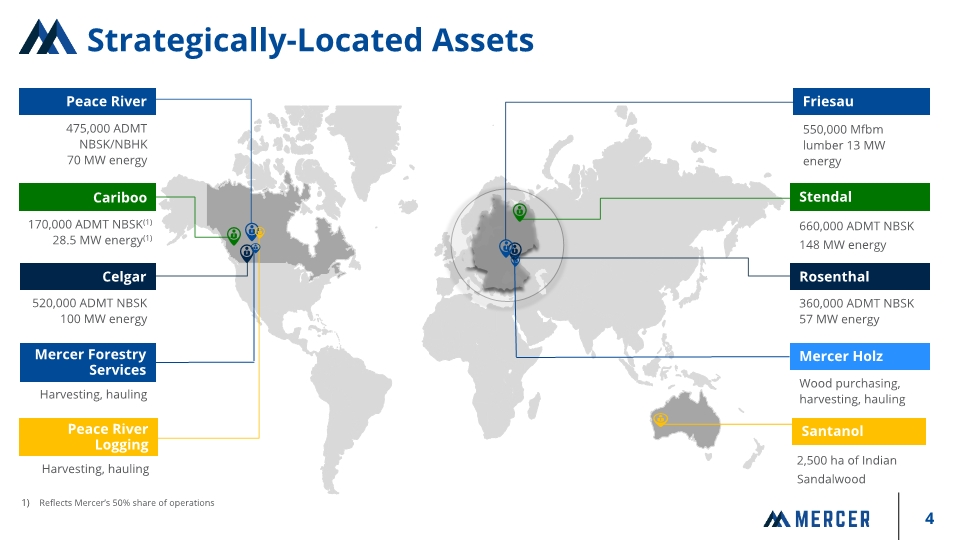

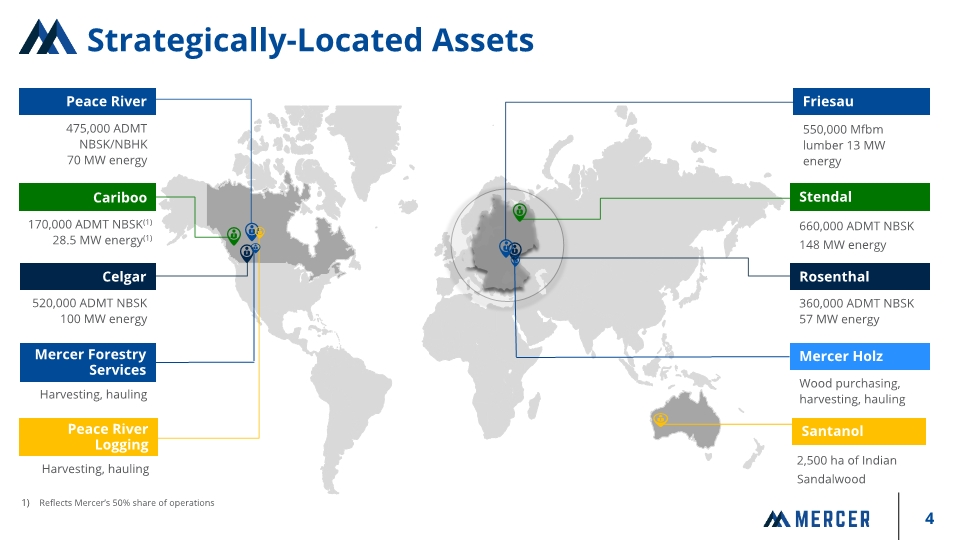

Strategically-Located Assets Reflects Mercer’s 50% share of operations

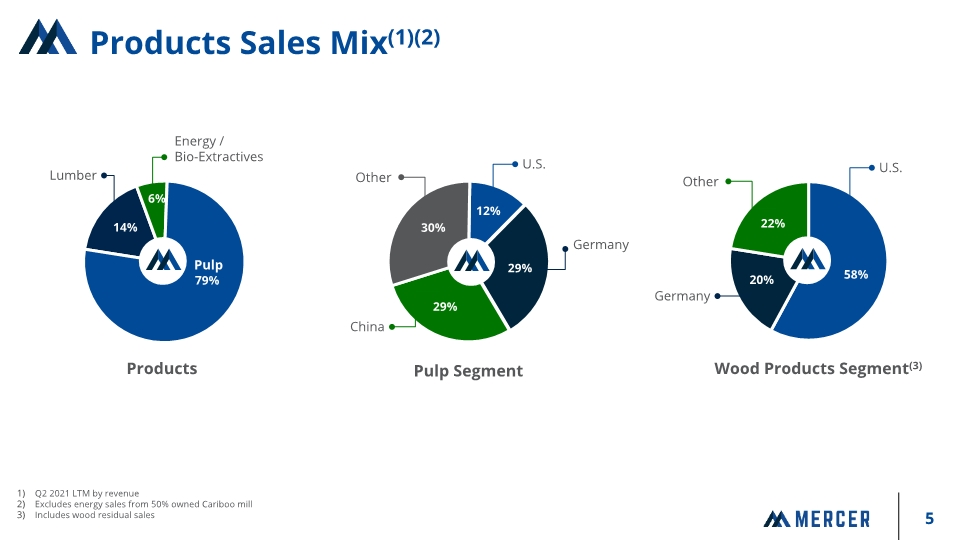

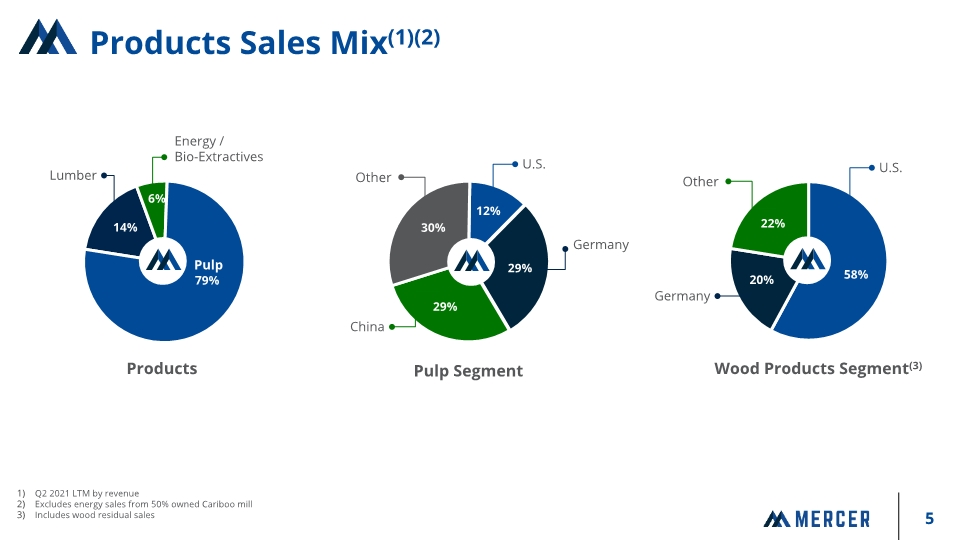

Products Sales Mix(1)(2) Q2 2021 LTM by revenue Excludes energy sales from 50% owned Cariboo mill Includes wood residual sales Germany U.S. Other Products Pulp Segment Wood Products Segment(3)

Operate World-class Assets Manage the Integrity of our Balance Sheet and Liquidity Sustainable Operations Develop Our Talent Growth and Diversification where we have Core Competencies Mercer’s 5-Pillar Strategy Pulp Wood Products Wood Extractives Green Energy 6

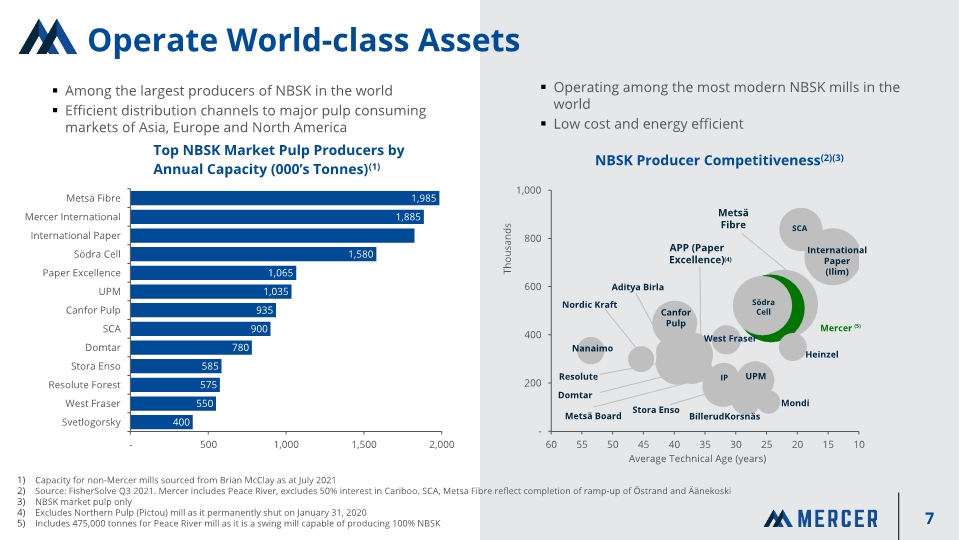

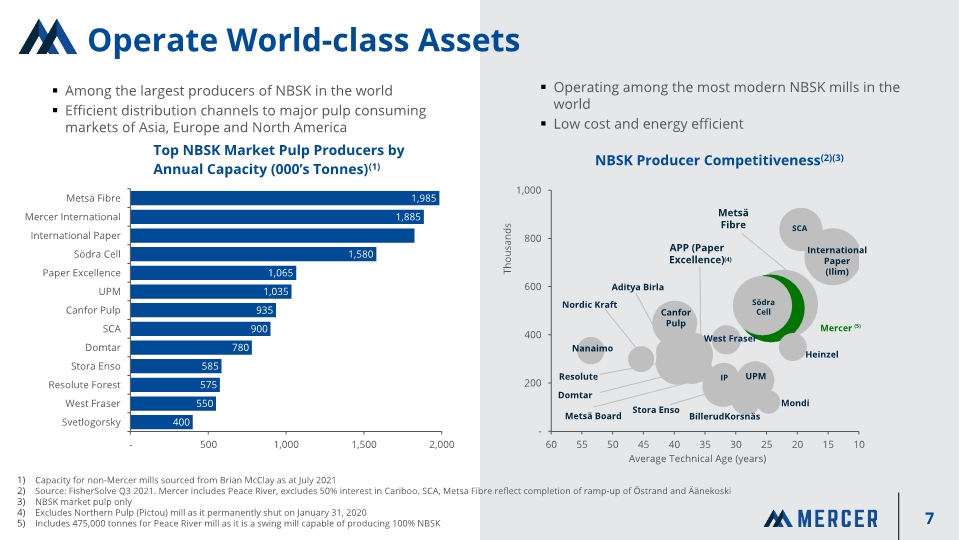

Operate World-class Assets Among the largest producers of NBSK in the world Efficient distribution channels to major pulp consuming markets of Asia, Europe and North America 7 Capacity for non-Mercer mills sourced from Brian McClay as at July 2021 Source: FisherSolve Q3 2021. Mercer includes Peace River, excludes 50% interest in Cariboo. SCA, Metsa Fibre reflect completion of ramp-up of Östrand and Äänekoski NBSK market pulp only Excludes Northern Pulp (Pictou) mill as it permanently shut on January 31, 2020 Includes 475,000 tonnes for Peace River mill as it is a swing mill capable of producing 100% NBSK Operating among the most modern NBSK mills in the world Low cost and energy efficient West Fraser (4) (5)

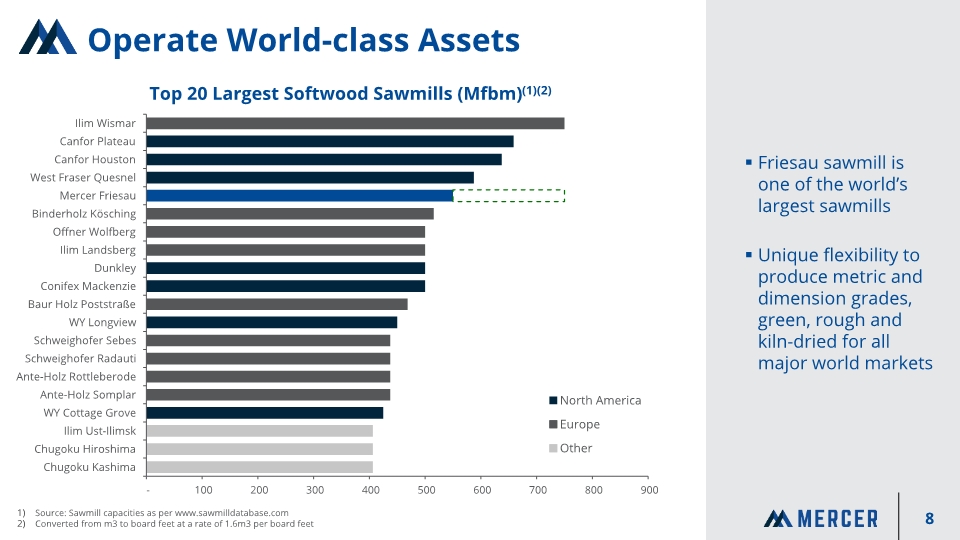

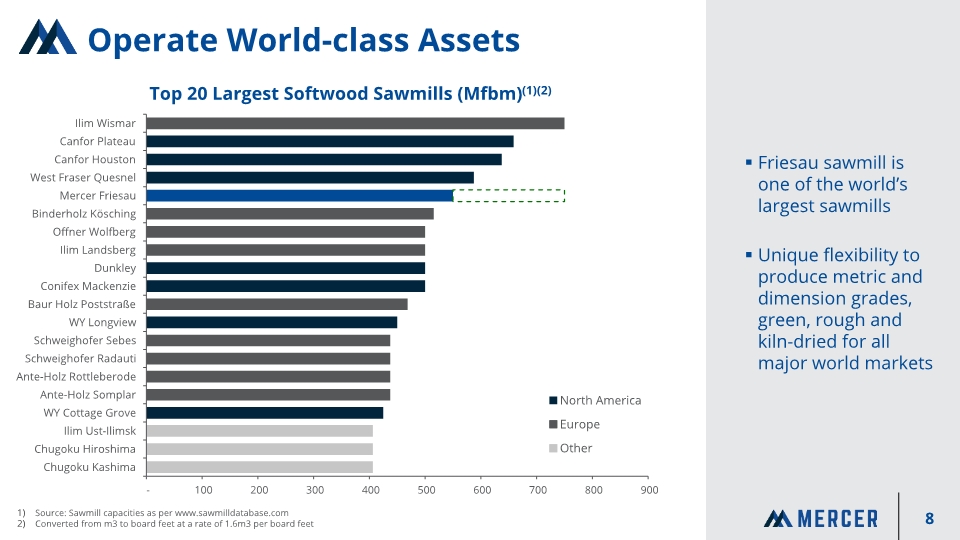

Operate World-class Assets Friesau sawmill is one of the world’s largest sawmills Unique flexibility to produce metric and dimension grades, green, rough and kiln-dried for all major world markets 8 Source: Sawmill capacities as per www.sawmilldatabase.com Converted from m3 to board feet at a rate of 1.6m3 per board feet

Operation Optimization Continuous improvement culture drives innovation and process optimization Logistics Innovation: Design and construction of dedicated trains and truck fleet for shipping wood and end-products Dedicated ports and breakbulk access for wood, pulp and lumber Construction Expertise: Greenfield and brownfield pulp mill, sawmill, power plant, and extractive plant construction Continuous Improvement: Forest waste material recovery Pulp and lumber wood yield improvements Extractives capacity expansion Energy yield Chemical and resource use reductions

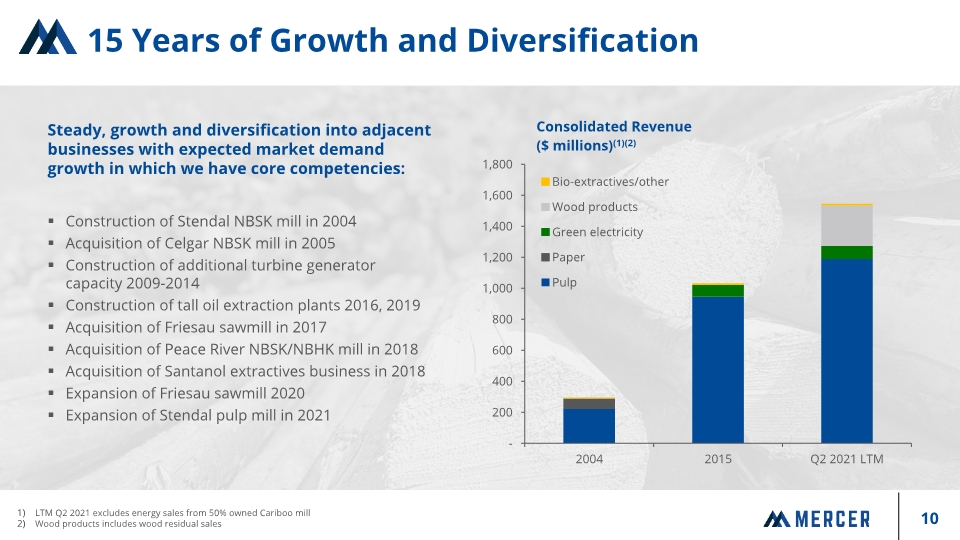

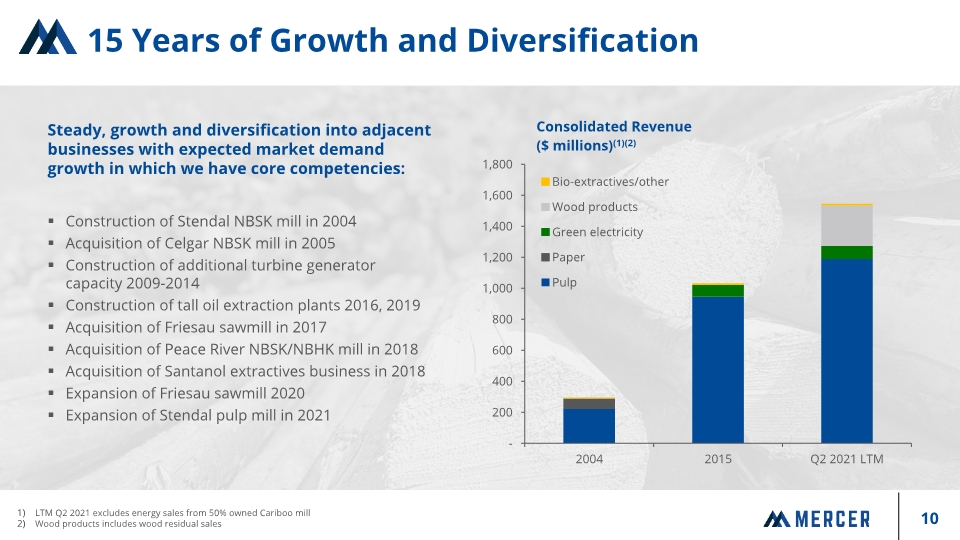

15 Years of Growth and Diversification Steady, growth and diversification into adjacent businesses with expected market demand growth in which we have core competencies: Construction of Stendal NBSK mill in 2004 Acquisition of Celgar NBSK mill in 2005 Construction of additional turbine generator capacity 2009-2014 Construction of tall oil extraction plants 2016, 2019 Acquisition of Friesau sawmill in 2017 Acquisition of Peace River NBSK/NBHK mill in 2018 Acquisition of Santanol extractives business in 2018 Expansion of Friesau sawmill 2020 Expansion of Stendal pulp mill in 2021 LTM Q2 2021 excludes energy sales from 50% owned Cariboo mill Wood products includes wood residual sales

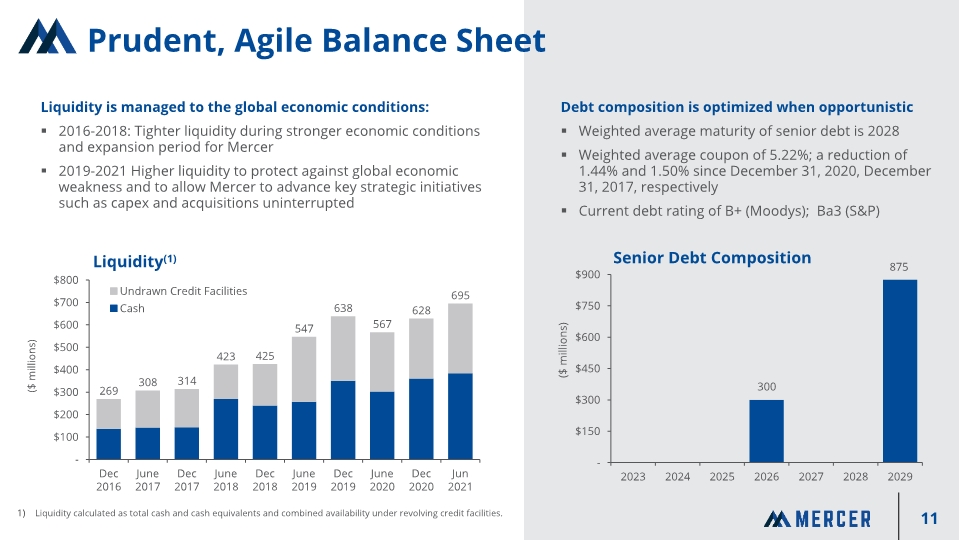

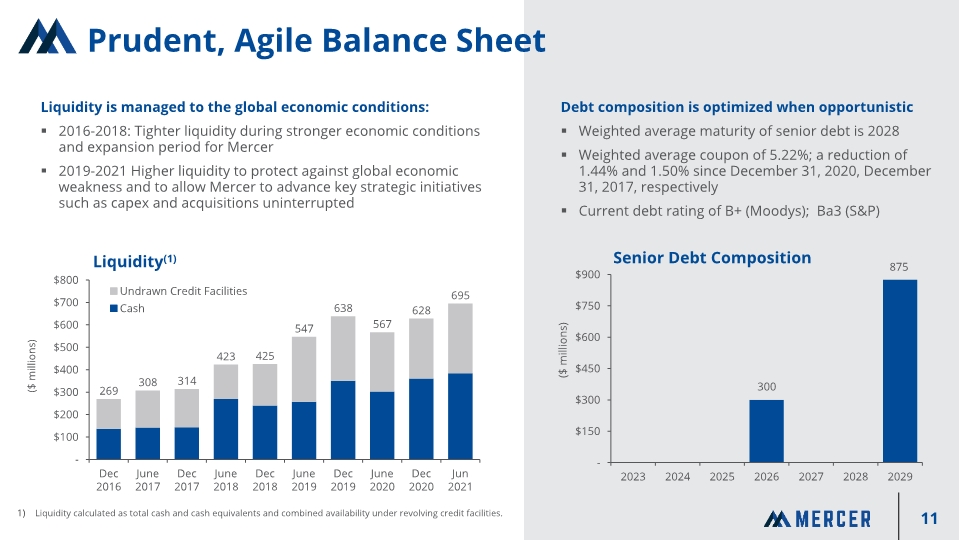

11 Prudent, Agile Balance Sheet Liquidity is managed to the global economic conditions: 2016-2018: Tighter liquidity during stronger economic conditions and expansion period for Mercer 2019-2021 Higher liquidity to protect against global economic weakness and to allow Mercer to advance key strategic initiatives such as capex and acquisitions uninterrupted Debt composition is optimized when opportunistic Weighted average maturity of senior debt is 2028 Weighted average coupon of 5.22%; a reduction of 1.44% and 1.50% since December 31, 2020, December 31, 2017, respectively Current debt rating of B+ (Moodys); Ba3 (S&P) Liquidity calculated as total cash and cash equivalents and combined availability under revolving credit facilities.

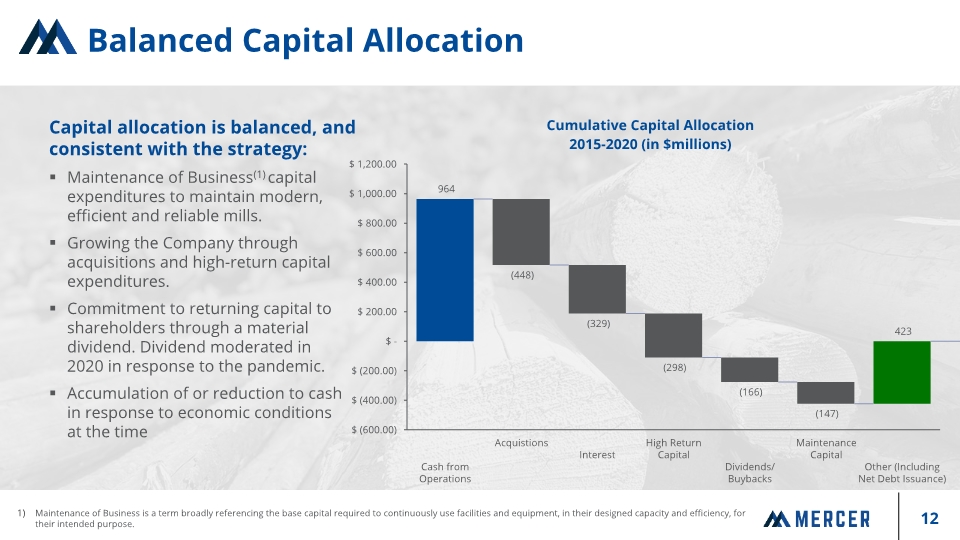

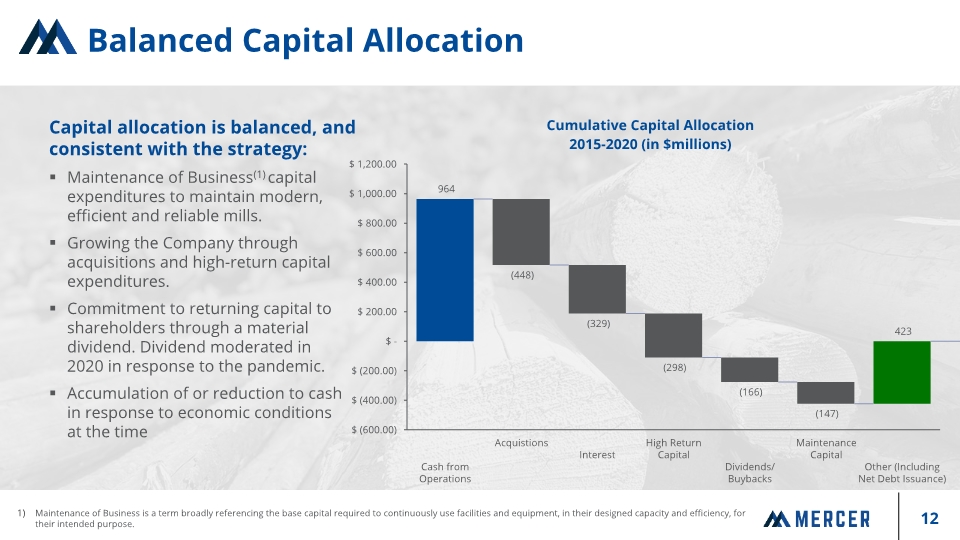

Balanced Capital Allocation Capital allocation is balanced, and consistent with the strategy: Maintenance of Business(1) capital expenditures to maintain modern, efficient and reliable mills. Growing the Company through acquisitions and high-return capital expenditures. Commitment to returning capital to shareholders through a material dividend. Dividend moderated in 2020 in response to the pandemic. Accumulation of or reduction to cash in response to economic conditions at the time Maintenance of Business is a term broadly referencing the base capital required to continuously use facilities and equipment, in their designed capacity and efficiency, for their intended purpose.

Sustainable, biodegradable, recyclable products for a carbon-conscious world: Kraft pulp from wood residuals and forest waste for the production of recyclable paper, containers, and specialty products Solid wood products from certified forests for home construction and renovation; carbon capturing products competing with carbon intensive concrete and steel construction methods Green electricity generated from waste heat captured in the pulp production process Extractives and oils competing with petro-chemical alternatives for fragrances, aromatics, food additives, and fuels R&D partnerships to develop and commercialize other carbon-displacing products Sustainable Products

Sustainable Processes Modern assets and pulping innovation make our processes sustainable; continuous improvement culture keeps us advancing. Climate change scenario analysis conducted in 2020 85% of energy comes from renewable biomass Completed Scope 3 carbon emission study in 2020 100% electricity self sufficiency from renewable energy 66.2% of wood from certified sources 3% reduction in water use per tonne of pulp since 2017 22% reduction in waste material to landfill since 2017 Peace River’s science-based forest management (EMEND) nationally recognized for exceptional sustainability outcomes Replaced 356 of 380 rail cars in Germany to reduce Scope 3 GHG emissions ESG risk rating evaluations by MSCI, ISS, and Sustainalytics

Sustainable People Development 15

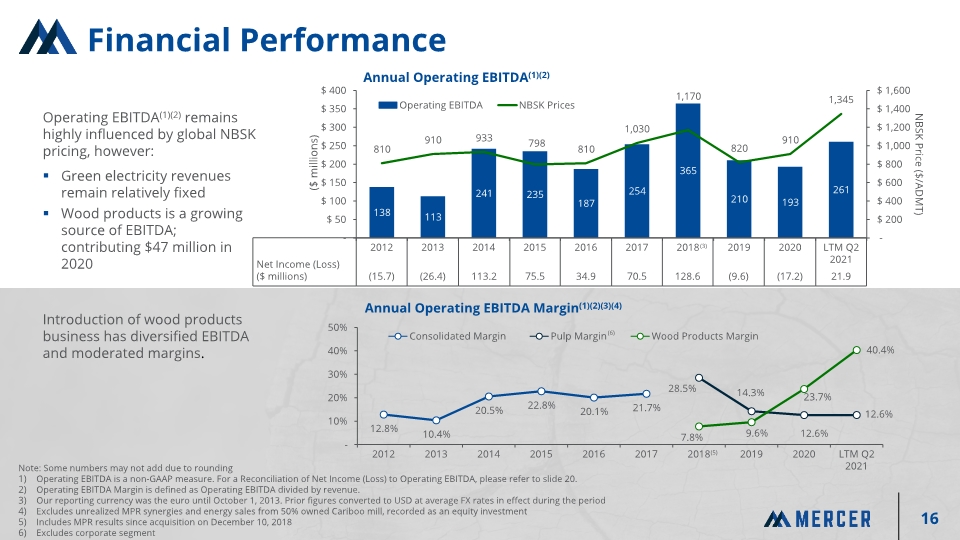

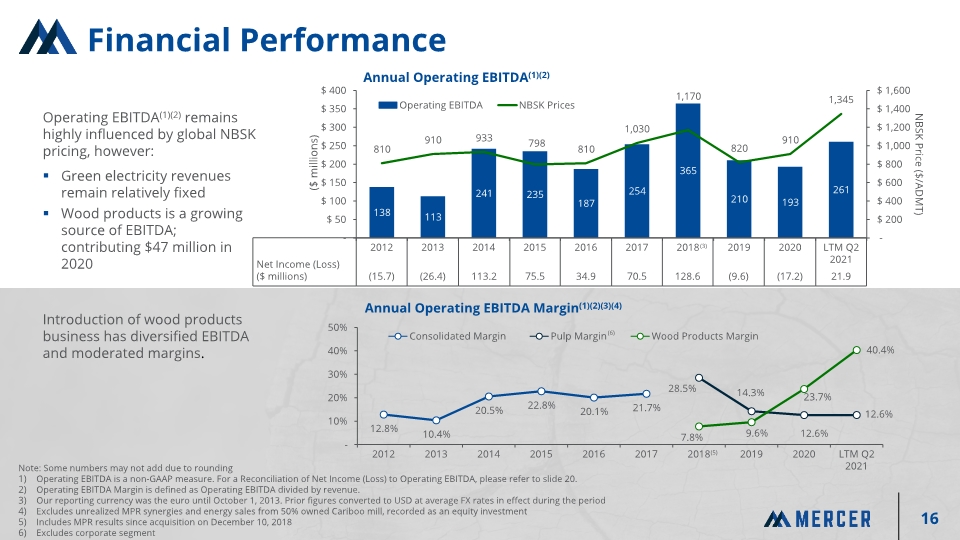

Financial Performance Operating EBITDA(1)(2) remains highly influenced by global NBSK pricing, however: Green electricity revenues remain relatively fixed Wood products is a growing source of EBITDA; contributing $47 million in 2020 Introduction of wood products business has diversified EBITDA and moderated margins. (5) Note: Some numbers may not add due to rounding Operating EBITDA is a non-GAAP measure. For a Reconciliation of Net Income (Loss) to Operating EBITDA, please refer to slide 20. Operating EBITDA Margin is defined as Operating EBITDA divided by revenue. Our reporting currency was the euro until October 1, 2013. Prior figures converted to USD at average FX rates in effect during the period Excludes unrealized MPR synergies and energy sales from 50% owned Cariboo mill, recorded as an equity investment Includes MPR results since acquisition on December 10, 2018 Excludes corporate segment 16 (6)

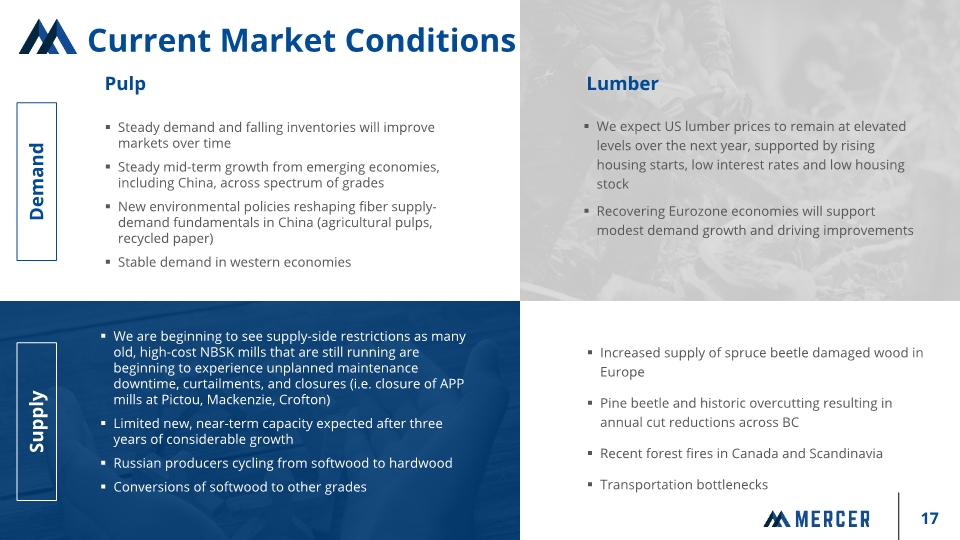

Pulp Lumber Steady demand and falling inventories will improve markets over time Steady mid-term growth from emerging economies, including China, across spectrum of grades New environmental policies reshaping fiber supply-demand fundamentals in China (agricultural pulps, recycled paper) Stable demand in western economies We expect US lumber prices to remain at elevated levels over the next year, supported by rising housing starts, low interest rates and low housing stock Recovering Eurozone economies will support modest demand growth and driving improvements We are beginning to see supply-side restrictions as many old, high-cost NBSK mills that are still running are beginning to experience unplanned maintenance downtime, curtailments, and closures (i.e. closure of APP mills at Pictou, Mackenzie, Crofton) Limited new, near-term capacity expected after three years of considerable growth Russian producers cycling from softwood to hardwood Conversions of softwood to other grades Increased supply of spruce beetle damaged wood in Europe Pine beetle and historic overcutting resulting in annual cut reductions across BC Recent forest fires in Canada and Scandinavia Transportation bottlenecks Demand Supply Current Market Conditions

Attractive long-term fundamentals in key markets Management committed to growth, in spaces where we have clear competencies Prudent and agile balance sheet discipline, commitment to the dividend Commitment to sustainability, our people and our communities; a sound foundation for value creation Sustainable, Long-term Growth

Mercer International inc. P: +1 (604) 684 1099 info@mercerint.com Suite 1120, 700 West Pender St Vancouver, B.C. Canada V6C 1G8 Contact Information www.mercerint.com

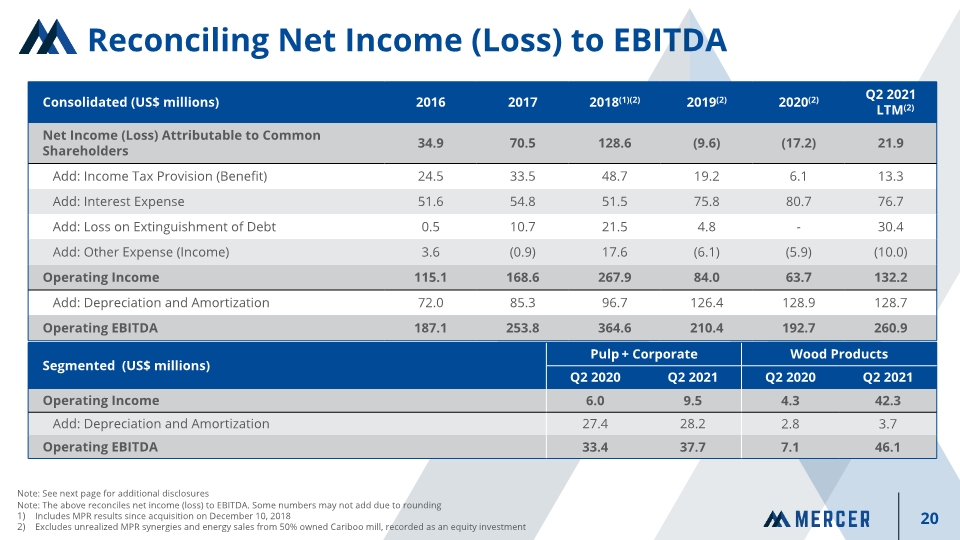

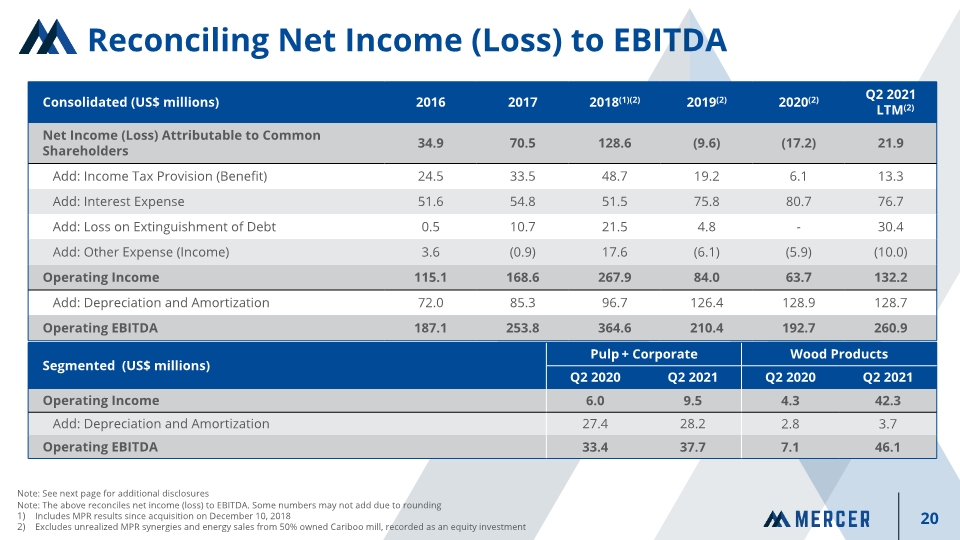

Reconciling Net Income (Loss) to EBITDA Note: See next page for additional disclosures Note: The above reconciles net income (loss) to EBITDA. Some numbers may not add due to rounding Includes MPR results since acquisition on December 10, 2018 Excludes unrealized MPR synergies and energy sales from 50% owned Cariboo mill, recorded as an equity investment

Reconciling Net Income (Loss) to EBITDA Note: For other reconciliations of Net Income (Loss) to Operating EBITDA in periods not shown, please refer to that period’s respective Form 10-Q or 10-K, which can be found on our website (www.mercerint.com) Operating EBITDA is defined as operating income (loss) plus depreciation and amortization and non-recurring capital asset impairment charges. Operating EBITDA Margin is defined as Operating EBITDA divided by revenue. Management uses Operating EBITDA and Operating EBITDA Margin as benchmark measurements of its own operating results, and as benchmarks relative to its competitors. Management considers these measures to be a meaningful supplement to operating income (loss) as a performance measure primarily because depreciation expense and non-recurring capital asset impairment charges are not an actual cash cost, and depreciation expense varies widely from company to company in a manner that management considers largely independent of the underlying cost efficiency of their operating facilities. In addition, we believe Operating EBITDA and Operating EBITDA Margin is commonly used by securities analysts, investors and other interested parties to evaluate our financial performance. Operating EBITDA does not reflect the impact of a number of items that affect our net income (loss) attributable to common shareholders, including financing costs and the effect of derivative instruments. Operating EBITDA is not a measure of financial performance under the accounting principles generally accepted in the United States of America (“GAAP”), and should not be considered as an alternative to net income (loss) or income (loss) from operations as a measure of performance, nor as an alternative to net cash from operating activities as a measure of liquidity. Operating EBITDA and Operating EBITDA Margin have significant limitations as analytical tools, and should not be considered in isolation, or as a substitute for analysis of our results as reported under GAAP. Operating EBITDA should only be considered as a supplemental performance measure and should not be considered as a measure of liquidity or cash available to us to invest in the growth of our business. Because all companies do not calculate Operating EBITDA in the same manner, Operating EBITDA and Operating EBITDA Margin as calculated by us may differ from Operating EBITDA or EBITDA and Operating EBITDA Margin, or EBITDA Margin as calculated by other companies. We compensate for these limitations by using Operating EBITDA and Operating EBITDA Margin as supplemental measures of our performance and by relying primarily on our GAAP financial statements.

Appendix: Market Attributes Sustainable. By Design.

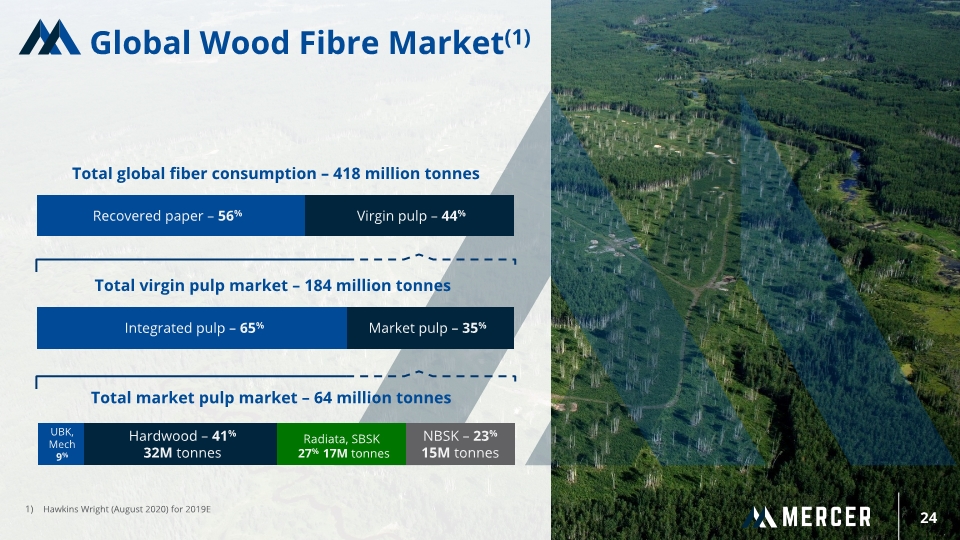

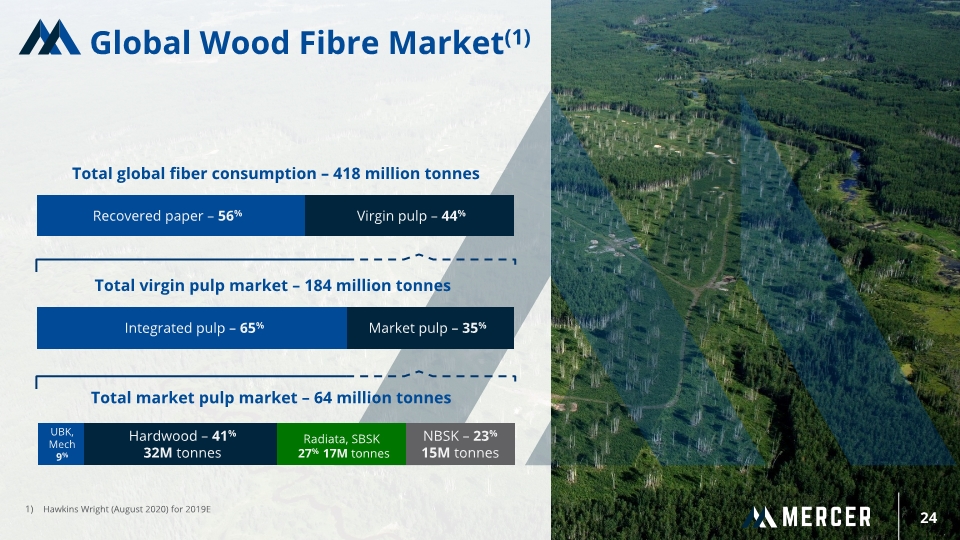

Global Wood Fibre Market The global demand for wood fibre is principally met by the recycling of packaging and graphics paper Today, NBSK makes up 3.5% of global fibre demand; it has become a highly specialized niche product used for strength and bonding attributes. It is principally produced in northern regions: Canada, Scandinavia, and Russia Hardwood is principally sought for its softness and opacity and is dominated by South American and Asian Eucalyptus plantation producers Today, NBSK is particularly sought for tissue and specialties paper grades and to a diminishing extent to graphics and packaging 23

24 Global Wood Fibre Market(1) Hawkins Wright (August 2020) for 2019E

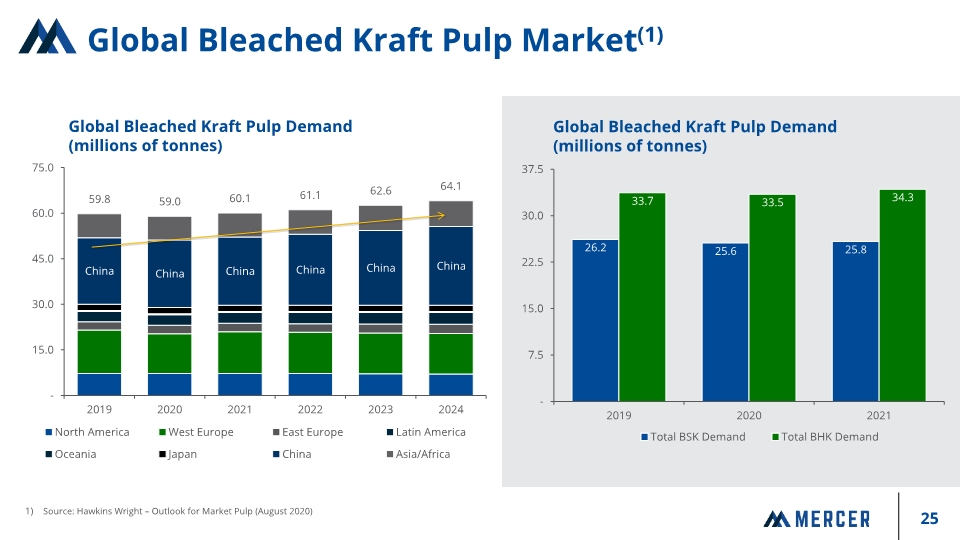

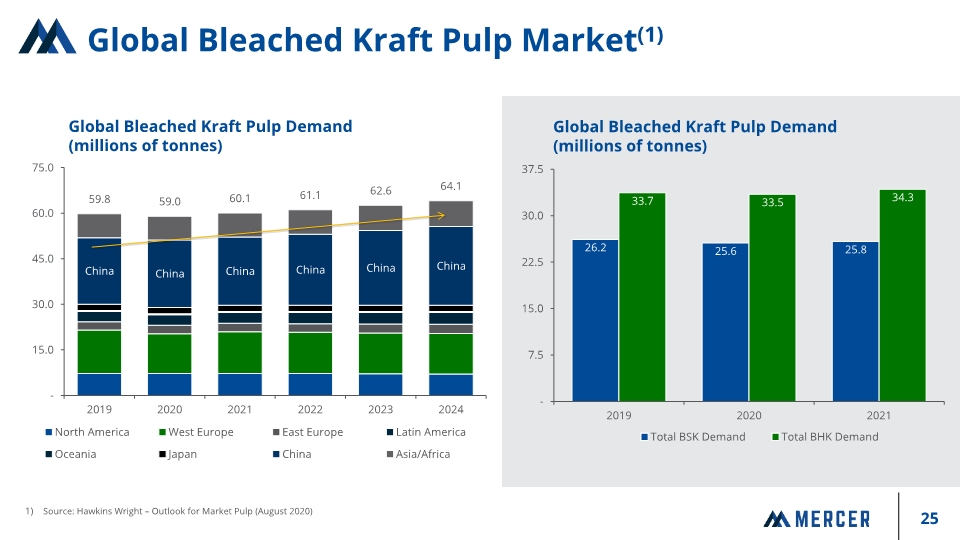

Global Bleached Kraft Pulp Market(1) Global Bleached Kraft Pulp Demand (millions of tonnes) Source: Hawkins Wright – Outlook for Market Pulp (August 2020)

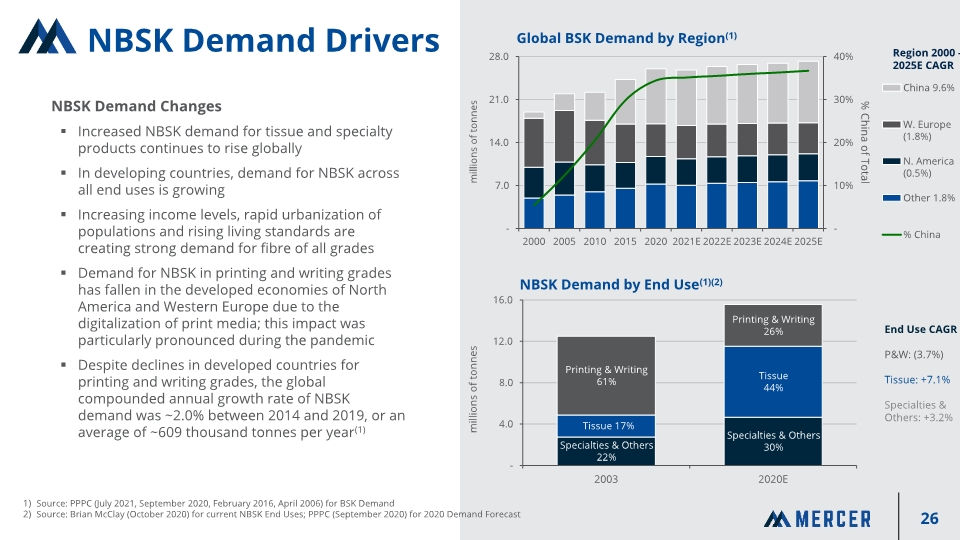

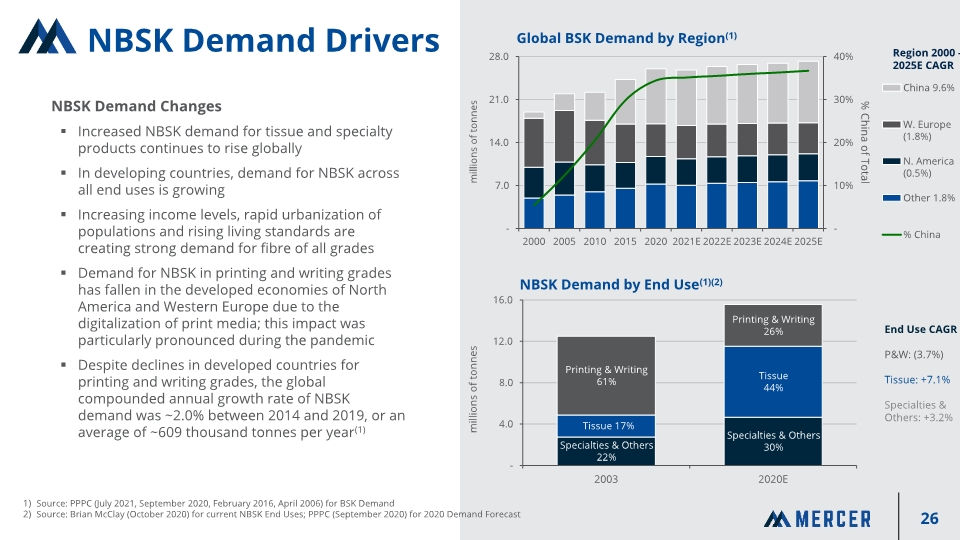

NBSK Demand Drivers NBSK Demand Changes Increased NBSK demand for tissue and specialty products continues to rise globally In developing countries, demand for NBSK across all end uses is growing Increasing income levels, rapid urbanization of populations and rising living standards are creating strong demand for fibre of all grades Demand for NBSK in printing and writing grades has fallen in the developed economies of North America and Western Europe due to the digitalization of print media; this impact was particularly pronounced during the pandemic Despite declines in developed countries for printing and writing grades, the global compounded annual growth rate of NBSK demand was ~2.0% between 2014 and 2019, or an average of ~609 thousand tonnes per year(1) Source: PPPC (July 2021, September 2020, February 2016, April 2006) for BSK Demand Source: Brian McClay (October 2020) for current NBSK End Uses; PPPC (September 2020) for 2020 Demand Forecast 26

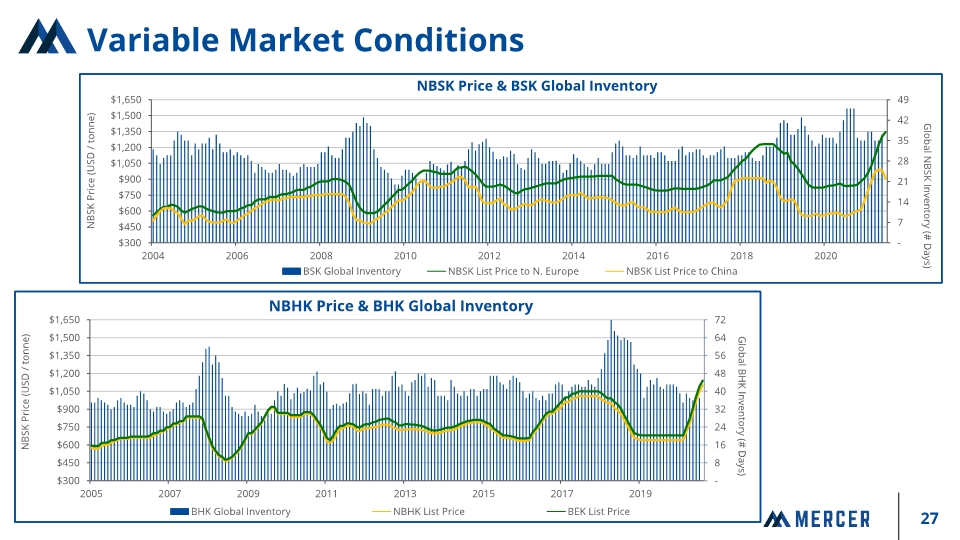

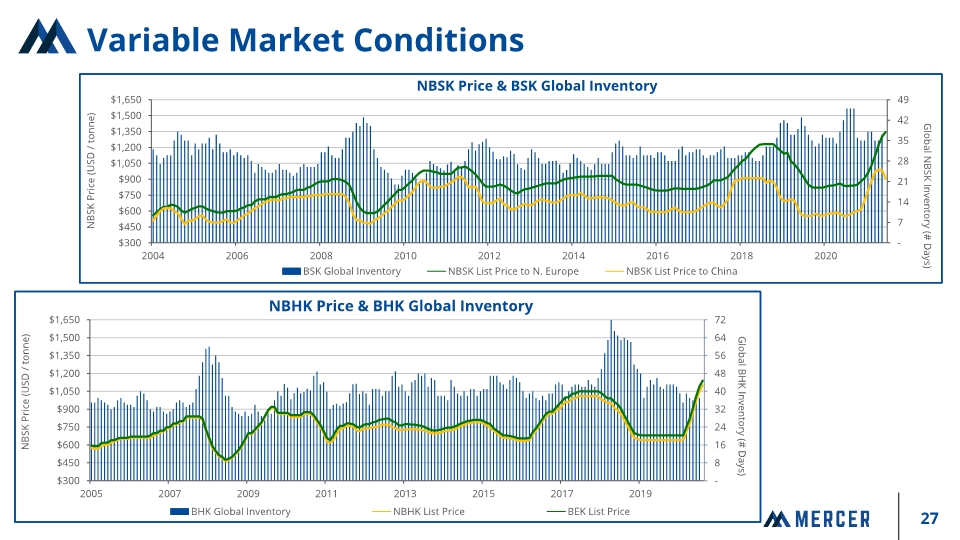

Variable Market Conditions

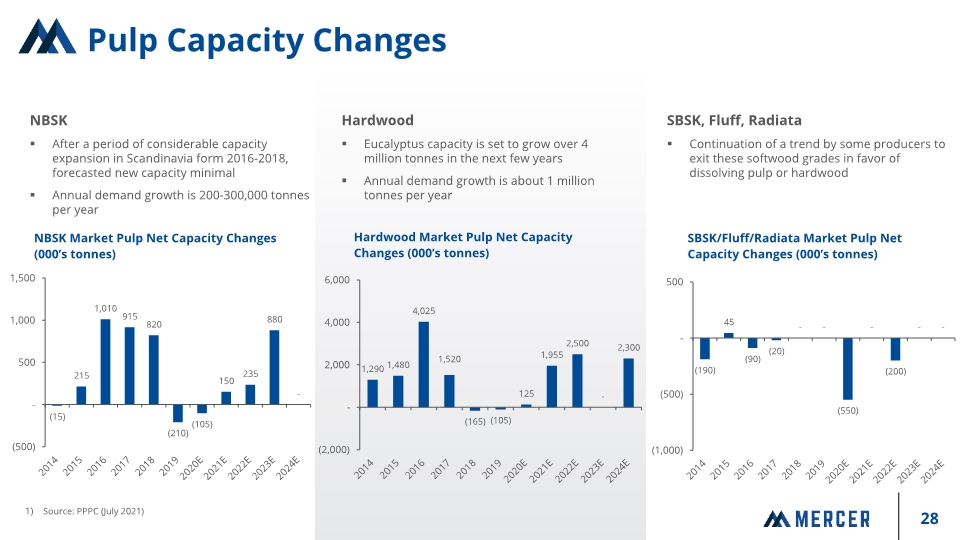

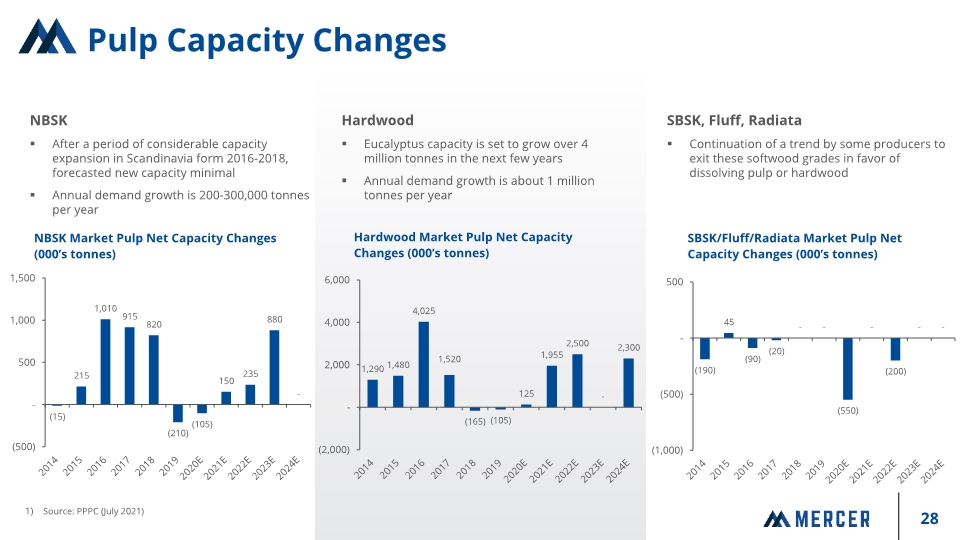

Pulp Capacity Changes NBSK After a period of considerable capacity expansion in Scandinavia form 2016-2018, forecasted new capacity minimal Annual demand growth is 200-300,000 tonnes per year Hardwood Eucalyptus capacity is set to grow over 4 million tonnes in the next few years Annual demand growth is about 1 million tonnes per year SBSK, Fluff, Radiata Continuation of a trend by some producers to exit these softwood grades in favor of dissolving pulp or hardwood Source: PPPC (July 2021)

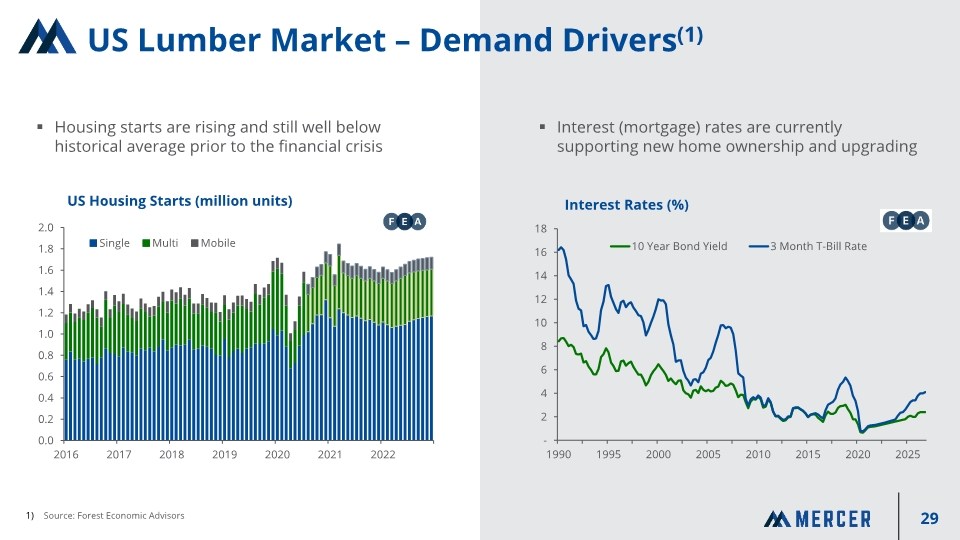

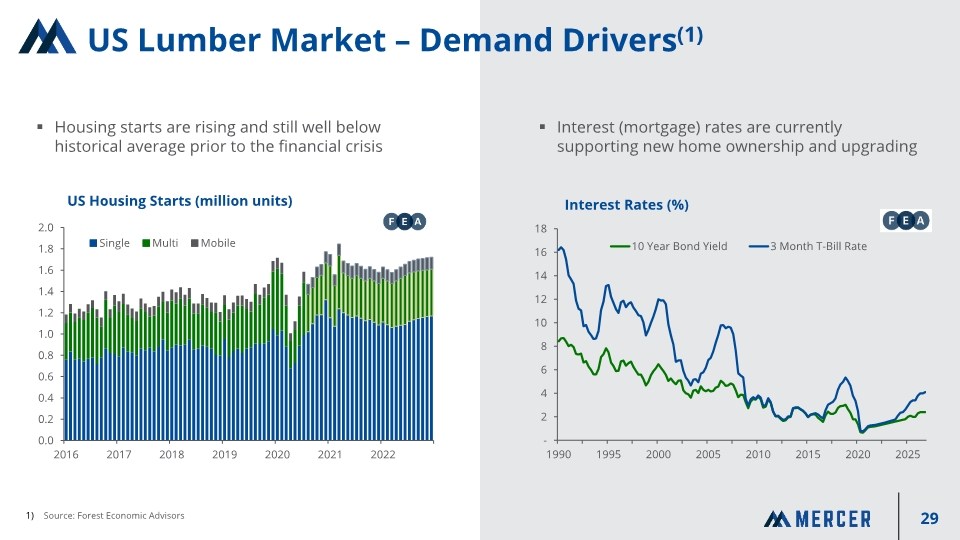

US Lumber Market – Demand Drivers(1) Housing starts are rising and still well below historical average prior to the financial crisis Interest (mortgage) rates are currently supporting new home ownership and upgrading Source: Forest Economic Advisors 29

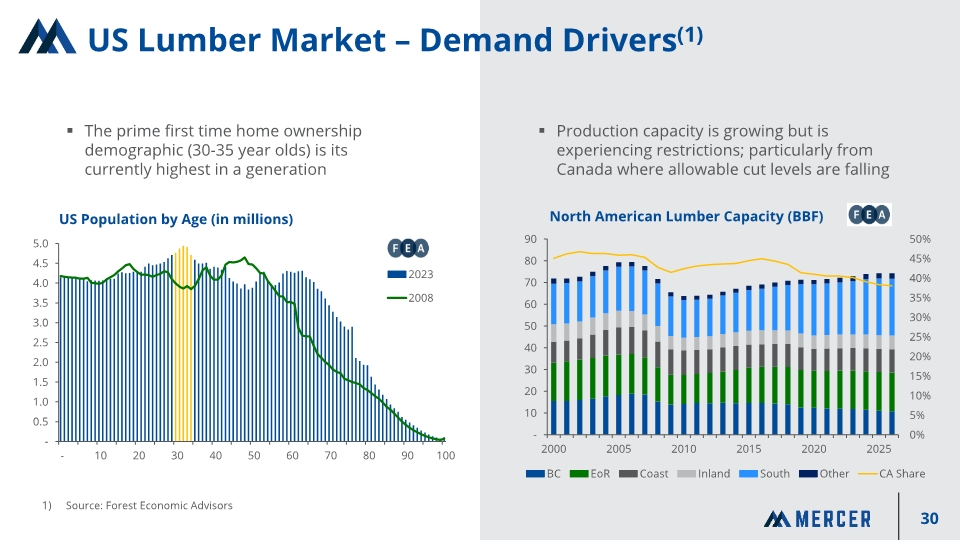

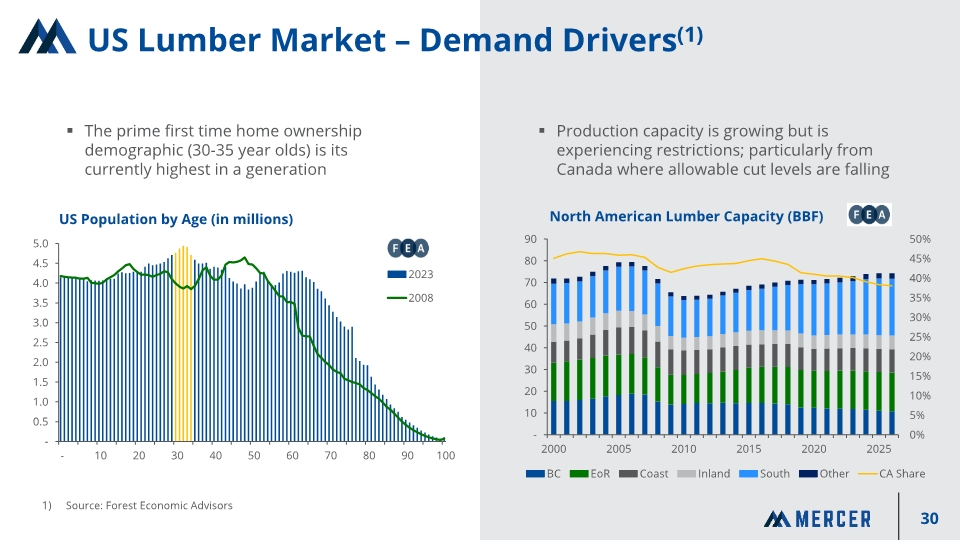

US Lumber Market – Demand Drivers(1) Source: Forest Economic Advisors The prime first time home ownership demographic (30-35 year olds) is its currently highest in a generation Production capacity is growing but is experiencing restrictions; particularly from Canada where allowable cut levels are falling 30

Appendix: Operations Overview Sustainable. By Design.

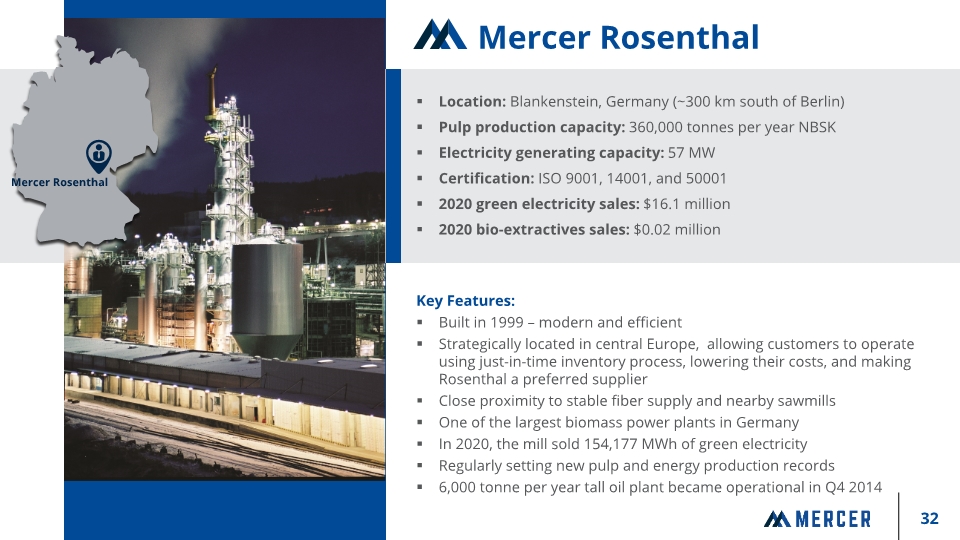

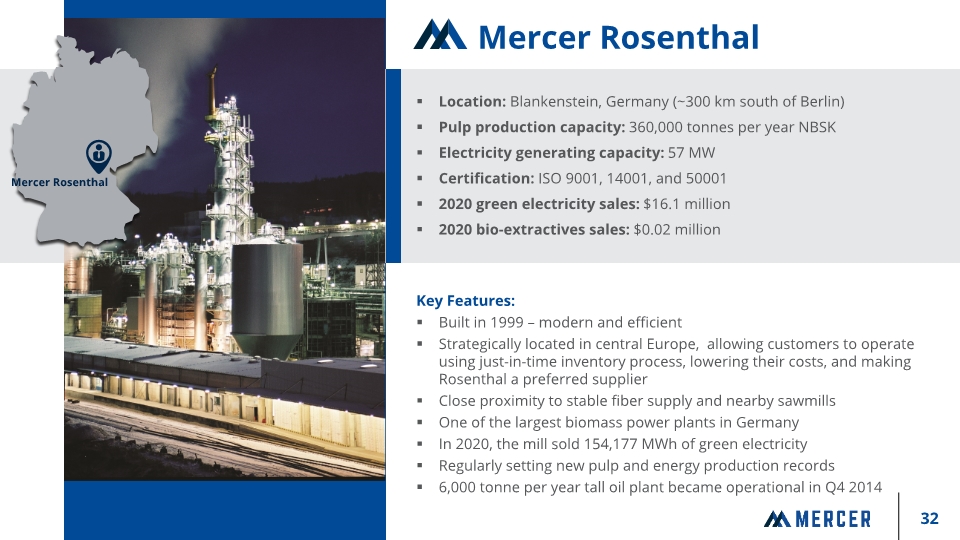

Location: Blankenstein, Germany (~300 km south of Berlin) Pulp production capacity: 360,000 tonnes per year NBSK Electricity generating capacity: 57 MW Certification: ISO 9001, 14001, and 50001 2020 green electricity sales: $16.1 million 2020 bio-extractives sales: $0.02 million Key Features: Built in 1999 – modern and efficient Strategically located in central Europe, allowing customers to operate using just-in-time inventory process, lowering their costs, and making Rosenthal a preferred supplier Close proximity to stable fiber supply and nearby sawmills One of the largest biomass power plants in Germany In 2020, the mill sold 154,177 MWh of green electricity Regularly setting new pulp and energy production records 6,000 tonne per year tall oil plant became operational in Q4 2014 Mercer Rosenthal

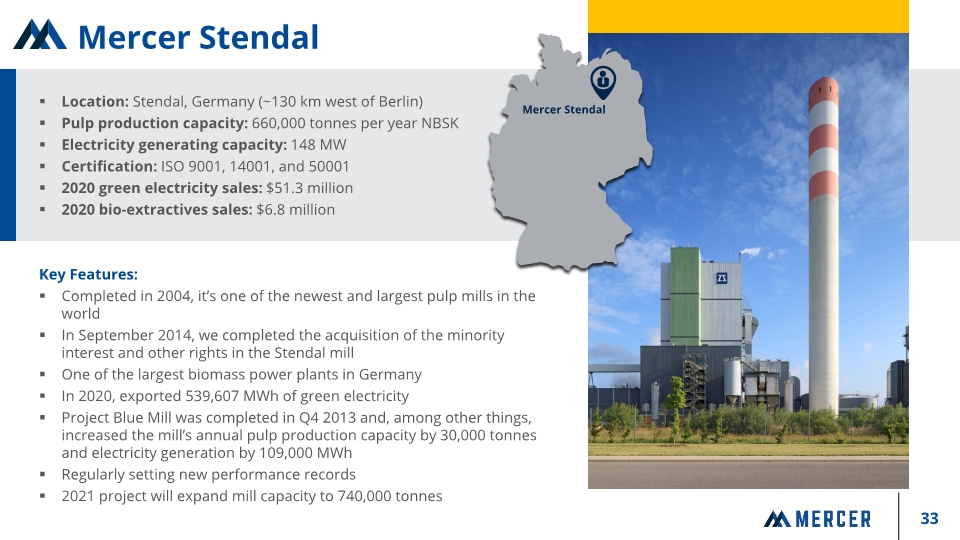

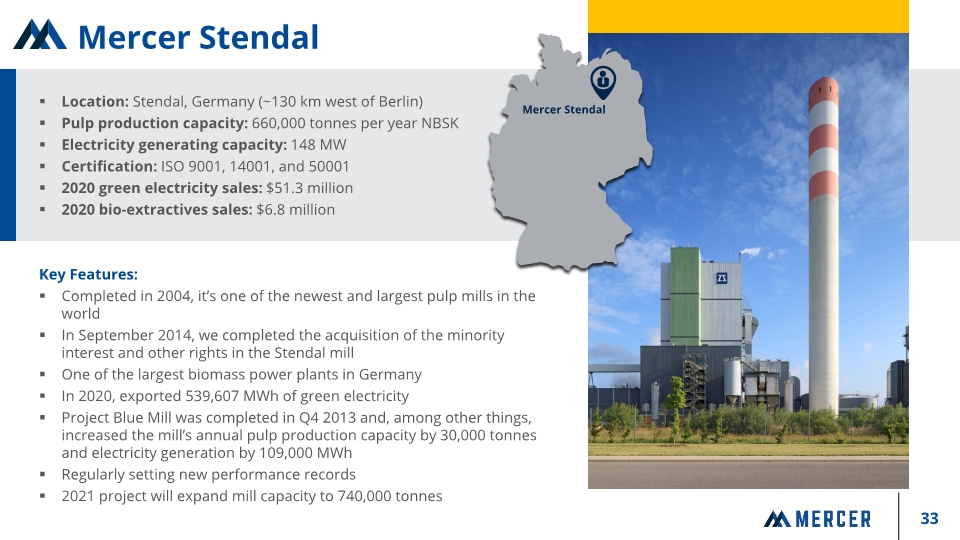

Location: Stendal, Germany (~130 km west of Berlin) Pulp production capacity: 660,000 tonnes per year NBSK Electricity generating capacity: 148 MW Certification: ISO 9001, 14001, and 50001 2020 green electricity sales: $51.3 million 2020 bio-extractives sales: $6.8 million Key Features: Completed in 2004, it’s one of the newest and largest pulp mills in the world In September 2014, we completed the acquisition of the minority interest and other rights in the Stendal mill One of the largest biomass power plants in Germany In 2020, exported 539,607 MWh of green electricity Project Blue Mill was completed in Q4 2013 and, among other things, increased the mill’s annual pulp production capacity by 30,000 tonnes and electricity generation by 109,000 MWh Regularly setting new performance records 2021 project will expand mill capacity to 740,000 tonnes Mercer Stendal Mercer Stendal

Location: Castlegar, BC, Canada (~600 km east of Vancouver) Pulp production capacity: 520,000 tonnes per year NBSK Electricity generating capacity: 100 MW Certification: ISO 9001 and 14001 2020 green electricity sales: $10.9 million 2020 bio-extractives sales: $0.06 million Key Features: Modern and efficient Abundant and low cost fiber, by global standards Green Energy Project was completed in September 2010 One of the largest biomass power plants in Canada In 2020, the mill sold 134,444 MWh of green electricity Continues to demonstrate significant upside potential Mercer Celgar Mercer Celgar

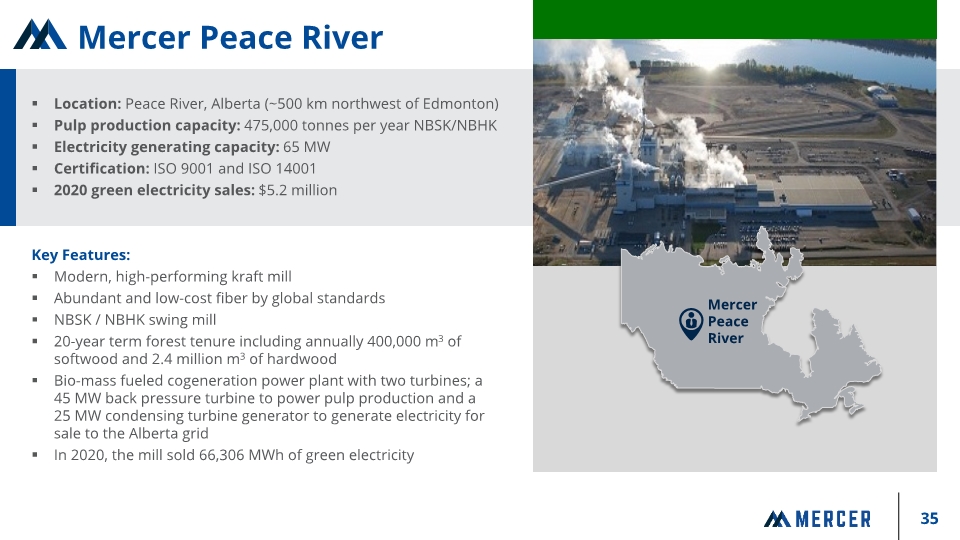

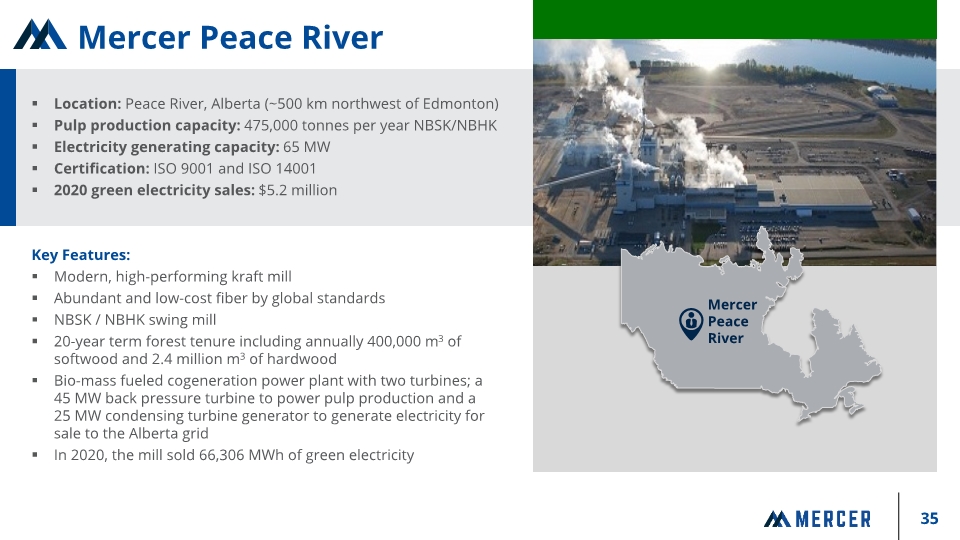

Location: Peace River, Alberta (~500 km northwest of Edmonton) Pulp production capacity: 475,000 tonnes per year NBSK/NBHK Electricity generating capacity: 65 MW Certification: ISO 9001 and ISO 14001 2020 green electricity sales: $5.2 million Key Features: Modern, high-performing kraft mill Abundant and low-cost fiber by global standards NBSK / NBHK swing mill 20-year term forest tenure including annually 400,000 m3 of softwood and 2.4 million m3 of hardwood Bio-mass fueled cogeneration power plant with two turbines; a 45 MW back pressure turbine to power pulp production and a 25 MW condensing turbine generator to generate electricity for sale to the Alberta grid In 2020, the mill sold 66,306 MWh of green electricity Mercer Peace River Mercer Peace River

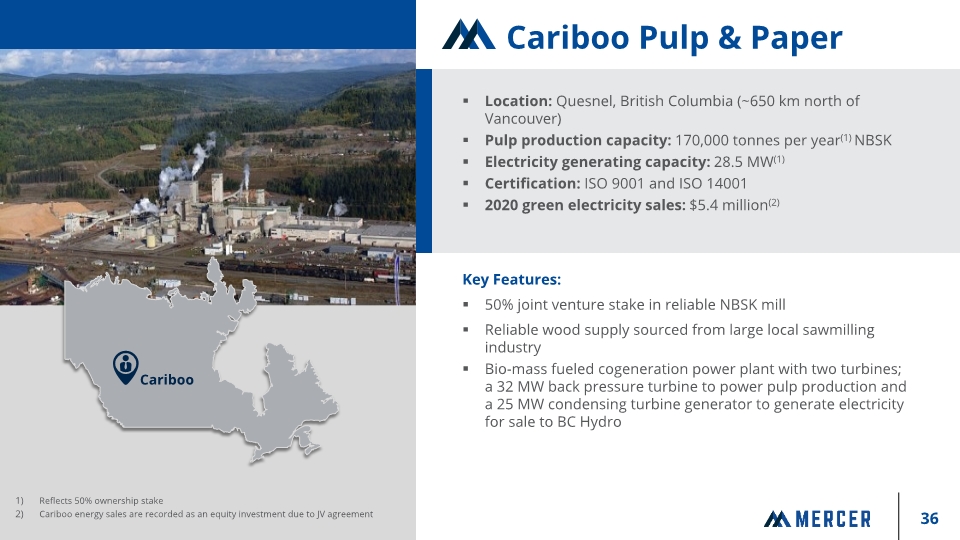

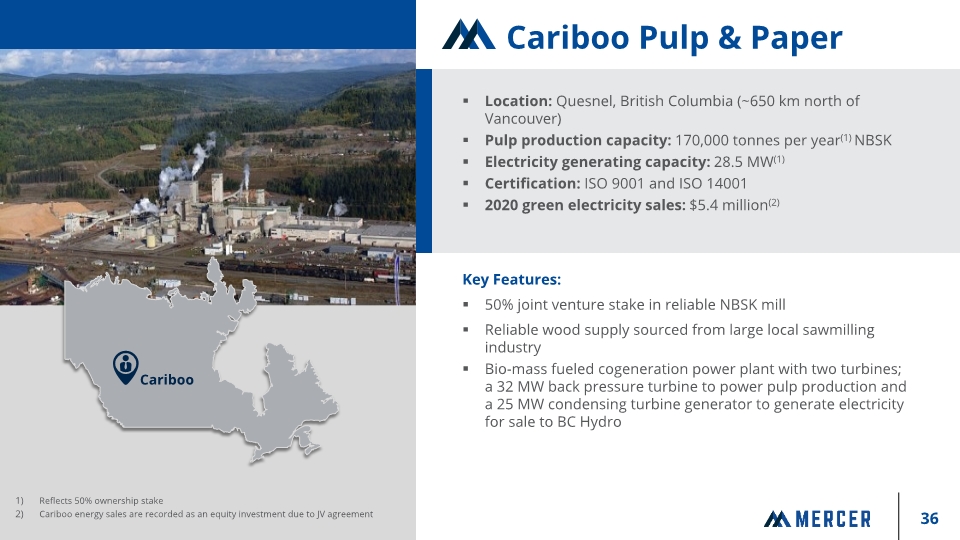

Location: Quesnel, British Columbia (~650 km north of Vancouver) Pulp production capacity: 170,000 tonnes per year(1) NBSK Electricity generating capacity: 28.5 MW(1) Certification: ISO 9001 and ISO 14001 2020 green electricity sales: $5.4 million(2) Key Features: 50% joint venture stake in reliable NBSK mill Reliable wood supply sourced from large local sawmilling industry Bio-mass fueled cogeneration power plant with two turbines; a 32 MW back pressure turbine to power pulp production and a 25 MW condensing turbine generator to generate electricity for sale to BC Hydro Cariboo Pulp & Paper Cariboo Reflects 50% ownership stake Cariboo energy sales are recorded as an equity investment due to JV agreement

Location: Friesau, Germany (~300 km south of Berlin) Lumber production capacity: 550,000 Mfbm Energy generating capacity: 49.5 MW (13 MW electricity) 2020 lumber sales: $180.8 million 2020 wood residuals sales: $6.3 million 2020 green electricity sales: $10.6 million Key Features: High quality logs from surrounding fiber basket Sawmill built in 1992; two high-volume Linck sawlines 2nd planer mill built in 2020 with new continuous kilns and automated grading and sorting systems Diverse product line ranging from custom rough green and dry for the European market to kiln-dried, dimension products for the US, Japan and UK Power plant built in 2008; fueled by bark, chips, sawdust, and recycled wood with EEG feed-in tariff to 2029 Mercer Timber Products (Friesau) Mercer Timber Products

Mercer International inc. P: +1 (604) 684 1099 info@mercerint.com Suite 1120, 700 West Pender St Vancouver, B.C. Canada V6C 1G8 Contact Information www.mercerint.com