- LEDS Dashboard

- Financials

- Filings

-

Holdings

-

Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

DEF 14A Filing

SemiLEDs (LEDS) DEF 14ADefinitive proxy

Filed: 1 Aug 22, 7:33am

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

Filed by the Registrant ☒ | Filed by a Party other than the Registrant ☐ |

Check the appropriate box: |

| |

☐ | Preliminary Proxy Statement | |

☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

☒ | Definitive Proxy Statement | |

☐ | Definitive Additional Materials | |

☐ | Soliciting Material under §240.14a-12 | |

SEMILEDS CORPORATION

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box): |

| ||

☒ | No fee required. |

| |

|

|

| |

☐ | Fee paid previously with preliminary materials. | ||

|

| ||

☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. | ||

SemiLEDs Corporation

3F, No. 11 Ke Jung Rd., Chu-Nan Site

Hsinchu Science Park, Chu-Nan 350

Miao-Li County, Taiwan, R.O.C.

+886-37-586788

August 1, 2022

Dear Stockholder:

I am pleased to invite you to attend the 2022 Annual Meeting of Stockholders of SemiLEDs Corporation. The meeting will be held on Tuesday, September 13, 2022 at 9 a.m. local time at SemiLEDs office, which is located at 3rd floor – No. 11 Ke Jung Road, Chu-Nan Site, Hsinchu Science Park, Miao-Li County, Taiwan.

We are furnishing our proxy materials to stockholders primarily over the Internet. This process expedites stockholders’ receipt of proxy materials, while significantly lowering the costs of our annual meeting and conserving natural resources. On August 1, 2022, we mailed to our stockholders a notice containing instructions on how to access our Proxy Statement and 2021 Annual Report to Stockholders and to vote online. The notice also included instructions on how you can receive a paper copy of your annual meeting materials. If you received your annual meeting materials by mail, the Proxy Statement, 2021 Annual Report to Stockholders and proxy card were enclosed.

At this year’s annual meeting, the agenda includes the following items:

Agenda Item |

| Board Recommendation |

Election of directors |

| FOR |

|

|

|

Ratification of the appointment of KCCW Accountancy Corp as our independent registered public accounting firm for fiscal year 2022 |

| FOR |

|

|

|

|

|

|

Details regarding the meeting and the business to be conducted are more fully described in the accompanying Notice of 2022 Annual Meeting of Stockholders and Proxy Statement.

Your vote is important. Whether or not you plan to attend the annual meeting, I hope you will vote as soon as possible. You may vote over the Internet or in person at the annual meeting or, if you receive your proxy materials by U.S. mail, you also may vote by mailing a proxy card or voting by telephone. Please review the instructions on the notice or on the proxy card regarding your voting options. Only stockholders showing proof of ownership on the record date will be allowed to attend the meeting in person.

Sincerely yours,

Trung T. Doan

Chairman of the Board and President and

Chief Executive Officer

SemiLEDs Corporation

3F, No. 11 Ke Jung Rd., Chu-Nan Site

Hsinchu Science Park, Chu-Nan 350

Miao-Li County, Taiwan, R.O.C.

+886-37-586788

NOTICE OF 2022 ANNUAL MEETING OF STOCKHOLDERS

TIME AND DATE | 9 a.m. local time on Tuesday, September 13, 2022 | |

|

| |

PLACE | SemiLEDs 3rd floor – No. 11 Ke Jung Road, Chu-Nan Site, Hsinchu Science Park, Miao-Li County, Taiwan | |

|

| |

AGENDA | | Elect the five director nominees named in the Proxy Statement |

|

| |

| | Ratify the appointment of KCCW Accountancy Corp as our independent registered public accounting firm for fiscal year 2022

|

| | Transact such other business as many properly come before the annual meeting (including adjournment and postponements)

|

|

|

|

|

| |

RECORD DATE | July 18, 2022 | |

|

| |

VOTING | Please vote as soon as possible to record your vote, even if you plan to attend the annual meeting. Your broker will NOT be able to vote your shares with respect to the election of directors and most of the other matters presented at the meeting unless you have given your broker specific instructions to do so. We strongly encourage you to vote. You have three options for submitting your vote before the annual meeting: | |

|

| |

| | Internet |

|

| |

| | Phone |

|

| |

| | |

|

| |

By Order of the Board of Directors,

Christopher Lee

Corporate Secretary

Chu-Nan, Taiwan

August 1, 2022

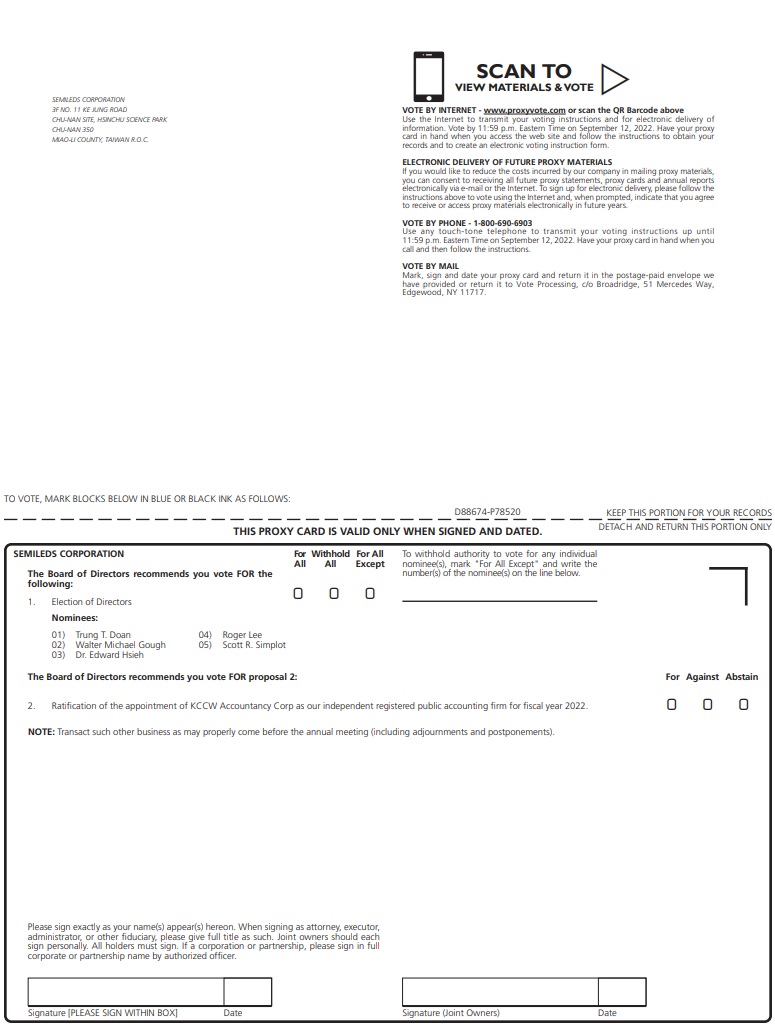

INTERNET AVAILABILITY OF PROXY MATERIALS

We are furnishing proxy materials to our stockholders primarily via the Internet. On August 1, 2022, we mailed most of our stockholders on the record date a Notice Regarding the Availability of Proxy Materials (“Notice of Internet Availability”) containing instructions on how to access and review all of the important information contained in our proxy materials, including our Proxy Statement and our 2021 Annual Report to Stockholders. The Notice of Internet Availability also instructs you on how to vote via the Internet. Other stockholders, in accordance with their prior requests, have been mailed paper copies of our proxy materials and a proxy card or voting form.

Internet distribution of our proxy materials is designed to expedite receipt by stockholders, lower the cost of the annual meeting, and conserve natural resources. However, if you would prefer to receive paper copies of proxy materials, please follow the instructions included in the Notice of Internet Availability.

Important Notice Regarding the Availability of Proxy Materials for

the Annual Meeting of Stockholders to be Held on September 13, 2022:

The Notice of the 2022 Annual Meeting, the Proxy Statement and

the 2021 Annual Report to Stockholders are available at www.proxyvote.com.

ATTENDING THE ANNUAL MEETING

QUESTIONS

For questions regarding | Contact: |

|

|

Annual meeting | Investor Relations |

| investor@semileds.com |

| +886-37-586788 |

|

|

Stock ownership for registered holders | American Stock Transfer & Trust Company |

| 6201 15th Avenue |

| Brooklyn, NY 11219 |

| 800-937-5449 US & Canada |

| 718 921 8124 International |

| Email Address: info@amstock.com |

|

|

| Hearing Impaired (TTY): (866) 703-9077 / |

| (718) 921-8386 |

| Internet: www.amstock.com |

|

|

Stock ownership for beneficial holders | Please contact your broker, bank, or other nominee |

SemiLEDs Corporation

3F, No. 11 Ke Jung Rd., Chu-Nan Site

Hsinchu Science Park, Chu-Nan 350

Miao-Li County, Taiwan, R.O.C.

+886-37-586788

PROXY STATEMENT

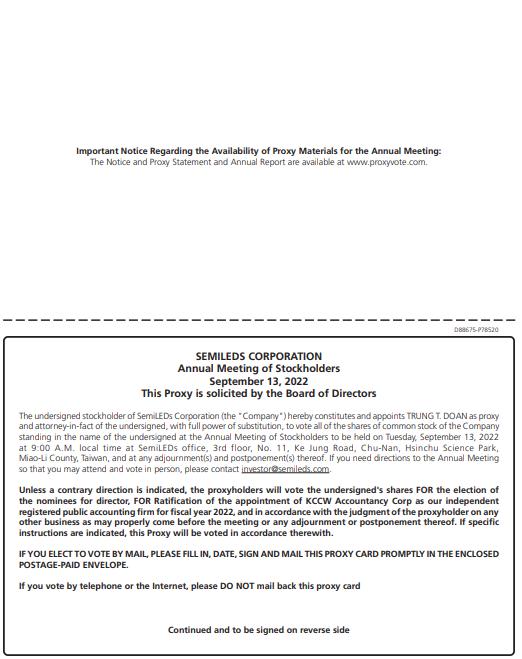

Our Board of Directors (the “Board”) solicits your proxy for the 2022 Annual Meeting of Stockholders and any postponement or adjournment of the meeting for the matters set forth in “Notice of 2022 Annual Meeting of Stockholders.” The annual meeting will be held on Tuesday, September 13, 2022 at 9 a.m. local time at SemiLEDs office, which is located at 3rd floor – No. 11 Ke Jung Road, Chu-Nan Site, Hsinchu Science Park, Miao-Li County, Taiwan. We made this Proxy Statement available to stockholders beginning on August 1, 2022.

Record Date | July 18, 2022 |

|

|

Quorum | Holders of a majority of the voting power of all issued and outstanding shares on the record date must be present in person or represented by proxy |

|

|

Shares Outstanding | 4,530,154 shares of common stock outstanding as of July 18, 2022 |

|

|

Voting by Proxy | Internet, telephone, or mail |

|

|

Voting at the Meeting | We encourage stockholders to vote in advance of the annual meeting, even if they plan to attend the meeting. In order to be counted, proxies submitted by Internet or telephone must be received by 11:59 p.m. Eastern Standard Time on September 12, 2022. Stockholders can vote in person during the meeting. Stockholders of record who attend the annual meeting in person may obtain a ballot. Beneficial holders who attend the annual meeting in person must obtain a proxy from their broker, bank, or other nominee prior to the date of the annual meeting and present it with their ballot. Voting in person by a stockholder during the meeting will replace any previous votes. |

|

|

Changing Your Vote | Stockholders of record may revoke their proxy at any time before the polls close by submitting a later-dated proxy card, by voting in person at the annual meeting, by delivering instructions to our Corporate Secretary before the annual meeting or by voting again using the Internet or telephone before the cut-off time. (Your latest Internet or telephone proxy is the one that will be counted.) If you hold shares through a broker, bank, or other nominee, you may revoke any prior voting instructions by contacting that firm. |

|

|

Votes Required to Adopt Proposals | Each share of our common stock outstanding on the record date is entitled to one vote on each of the five director nominees and one vote on each other matter. The election of directors is determined by the plurality of votes. Approval of each of the other matters on the agenda is determined by a majority of votes cast affirmatively or negatively. |

|

|

1

Effect of Abstentions and Broker Non-Votes | Shares voting “withhold” have no effect on the election of directors. Abstentions will have no effect on the ratification of the appointment of KCCW Accountancy Corp as our independent registered public accounting firm for fiscal year 2022. Broker non-votes (shares held by brokers that do not have discretionary authority to vote on a matter and have not received voting instructions from their clients) have no effect on the ratification of the appointment of KCCW Accountancy Corp. If you are a beneficial holder and do not provide specific voting instructions to your broker, the organization that holds your shares will not be authorized to vote on the election of directors. Accordingly, we encourage you to vote promptly, even if you plan to attend the annual meeting. |

|

|

Voting Instructions | If you complete and submit your proxy voting instructions, the persons named as proxies will follow your instructions. If you are a stockholder of record and you submit proxy voting instructions but do not direct how to vote on each proposal, the persons named as proxies will vote as the Board recommends on each proposal. The persons named as proxies will vote on any other matters properly presented at the annual meeting in accordance with their best judgment. Our Bylaws set forth requirements for advance notice of nominations and agenda items for the annual meeting, and we have not received timely notice of any such matters that may be properly presented for voting at the annual meeting, other than the items from the Board described in this Proxy Statement. |

|

|

Voting Results | We will announce preliminary results at the annual meeting. We will report final results in a filing with the U.S. Securities and Exchange Commission (“SEC”) on Form 8-K. |

2

PROPOSAL 1: ELECTION OF DIRECTORS

Upon the recommendation of our Nominating and Corporate Governance Committee, our Board has nominated the five persons listed below to serve as directors. Each director’s term runs from the date of his election until our next annual stockholders’ meeting, or until his successor is elected or appointed. If any director nominee is unable or unwilling to serve as a nominee at the time of the annual meeting, the persons named as proxies may vote for a substitute nominee chosen by the present Board to fill the vacancy. We have no reason to believe that any of the nominees will be unwilling or unable to serve if elected as a director.

Board Composition

Our Nominating and Corporate Governance Committee is charged with identifying and evaluating individuals qualified to serve as members of the Board and recommending to the full Board nominees for election as directors. We seek directors with experience in areas relevant to the strategy and operations of the Company. We seek a Board that collectively has a range and diversity of skills, experience, age, industry knowledge and other factors in the context of the needs of the Board. The biographies of each of the nominees below contains information regarding the person’s service as a director, business experience, director positions held currently or at any time during the last five years and the experiences, qualifications, attributes or skills that caused the Nominating and Corporate Governance Committee to determine that the person should serve as a director of our Company. In addition to the information presented below regarding each director’s specific experience, qualifications, attributes and skills that led our Nominating and Corporate Governance Committee and Board to the conclusion that he should serve as a director, we also believe that each of our directors has a reputation for integrity, honesty and adherence to high ethical standards. Each of our directors has demonstrated business acumen and an ability to exercise sound judgment, as well as a commitment of service to our Company and our Board. Each of our director nominees is currently serving on the Board.

Our nominees for election as directors at the annual meeting include our President and Chief Executive Officer (“CEO”) and four independent directors, as defined in the applicable rules for companies traded on The Nasdaq Stock Market (“Nasdaq”) - Walter Michael Gough, Dr. Edward Kuan Hsiung Hsieh, Roger Lee and Scott R. Simplot. See “Corporate Governance—Director Independence” below.

THE BOARD RECOMMENDS THAT YOU VOTE “FOR” THE ELECTION OF EACH OF THE FOLLOWING NOMINEES.

Nominees

Trung T. Doan, 63, has served as a director, Chairman of our Board and as our CEO since January 2005, and as our President since August 2012. Prior to joining us, Mr. Doan served as Corporate Vice President of Applied Global Services (AGS) Product Group at Applied Materials, Inc. and also served as President and Chief Executive Officer of Jusung Engineering, Inc., a semiconductor/LCD equipment company in Korea. In addition, Mr. Doan served as Vice President of Process Development at Micron Technology Inc. Mr. Doan previously served as a director of Advanced Energy Industries, a publicly traded manufacturer of power conversion and control systems within the past five years. Mr. Doan also previously served as a director of Dolsoft Corporation, a privately held software company, as a director of Nu Tool Inc., a semiconductor technology company, and as a director of EMCO, a publicly traded manufacturer of advanced flow control devices and systems. Mr. Doan holds a Bachelor of Science in nuclear engineering from the University of California, Santa Barbara, where he graduated with honors, and a Master of Science in chemical engineering from the University of California, Santa Barbara. Our Board has determined that Mr. Doan should serve on our Board and as our Chairman based on his in-depth knowledge of our business and industry and his experience serving on the boards of directors of several major technology companies, as well as in management roles in the technology industry.

3

Walter Michael Gough, 68, has served as a director since April 2016. Mr. Gough has led Gough and Associates, a firm that specializes in financial consulting for domestic and international companies since 2005. He is also a tenured faculty member in Accounting and Business at DeAnza College in Cupertino, California where he has taught since 1985. From June 2000 to June 2004, he was Chief Financial Officer and Financial Consultant at NuTool Inc., a semiconductor equipment manufacturer. From 1995 through 1999, he was a founding member and Chief Financial Officer of Invest In Yourself, LLC; an organization that provided consulting for professional sports franchises. Prior to teaching and consulting, Mr. Gough was a financial analyst and contracts manager at Watkins-Johnson Company, a high technology electronics firm. Before Watkins-Johnson, Mr. Gough worked for Kidder Peabody, an investment banking firm. He holds MBA and BA degrees (cum laude) from Santa Clara University, and a Masters in English from Notre Dame de Namur University. Our Board has determined that Mr. Gough should serve on our Board based on his experience as a consultant to technology companies in both the United States and Taiwan, his prior experience as a chief financial officer of several companies, and his expertise in accounting and finance.

Dr. Edward Kuan Hsiung Hsieh, 70, has served as a director since February 2012. Dr. Hsieh has been Chairman, Chief Executive Officer and a director of Eton Intelligent Technologies, a media and publications company, since April 2000 and Chairman, Chief Executive Officer and a director of VR Networks, a VoIP and VR application company, since January 2000. He has also served as an Adjunct Professor at National Taiwan University since February 2009. From February 2007 to February 2010, Dr. Hsieh was Chief Executive Officer of Asia Pacific Telecom, a 3G mobile, and fixed line telecommunications company, as well as Executive Director of APOL, an Internet service provider. He also served as Chairman of Good Neighbors Taiwan since 2019. Dr. Hsieh holds a Bachelor of Science in electrical engineering from National Taiwan University, a Master of Science in electrical engineering from the University of California, Santa Barbara, and a Doctor of Philosophy in electrical engineering and applied physics from Cornell University. He also studied accounting at the University of California, Los Angeles. Our Board has determined that Dr. Hsieh should serve as a director based on his experience teaching Master of Business Administration classes at National Taiwan University, his service as an International Financial Adviser with Merrill Lynch, Pierce, Fenner & Smith and his management roles at several start-up companies.

Roger Lee, 63, has served as a director since September 2019. Mr. Lee previously served as a director and an Audit Committee member of SemiLEDs from August 2017 to March 2019. Mr. Lee has more than 30 years of semiconductor experience and leadership. He has been the President and CEO of TF Semiconductor Solutions (TFSS) since August 2014. Prior to becoming the CEO of TFSS, Mr. Lee served as world-wide COO and Interim President & CEO of Telefunken Semiconductors located in Roseville, California and Heilbronn, Germany from May 2011 to July 2014. Mr. Lee began his career as an engineer for Texas Instruments. During his career, Mr. Lee has served on numerous boards and held a variety of executive and senior-level positions for several companies, including senior vice president of SMIC. Previously, he co-founded the SMIC-Toppan JV (TSES) where he served as its vice chairman of its Board of Directors, and had held several senior management positions, including senior fellow and head of flash memory at Micron Technology and was instrumental to the development of Micron’s flash memory program. More recently, he was COO and a board member of Founder Microelectronics, Inc. in Shenzhen, China where he was responsible for overall company operations, including fab manufacturing, sales and marketing, facilities, and R&D operations. Mr. Lee holds a Bachelor of Science degree and Master in Science degree in Electrical Engineering from Iowa State University. Our Board has determined that Mr. Lee should serve on our Board based on his experience with technology companies and other organizations in the United States, Germany and China.

Scott R. Simplot, 75, has served as our director since March 2005. Mr. Simplot has been Chairman of the Board of Directors and a Director of J.R. Simplot Company since May 2001 and August 1970, respectively. Mr. Simplot served as a Manager of or Partner in various closely held entities such as Block 22 LLC, Broadway Hospitality LLC, Columbia Developments LLC, Empty JP3 Shell, LLC, Idaho Sports Properties LLC, Indian Creek Cattle, LLC, JRS Management L.L.C., JRS Properties III L.P., ESP Development LLC, Hotel 43 LLC, SBP LLLP, Simplot Ketchum Investment, LLC, Simplot Ketchum Properties, LLC, SR Management LLC, SRS Green River LLC, Sunny Slope Orchards Partnership, SRS Properties LLLP, and Sylvan Beach, LLC. Mr. Simplot also serves as a director to various companies such as Bar -U-, Inc., Block 65 and 66 Master Association, Inc., Cal-Ida Chemical Company, Censa of California, Inc., Claremont Realty Company, CS Beef Packers, LLC, CS Property Development, LLC, Glen Dale Farms, Inc., J.R. Simplot Company Foundation, Inc., J.R. Simplot Foundation, Inc., JUMP, Inc., JRS India Corporation Private Limited, OSL Depot Condominium Management Association, Inc., Simplot India, LLC, Simplot India Foods Private Limited, Simplot India Properties LLC, Simplot International, Inc., Simplot Latin America Holdings, S.A., Simplot Livestock Co., Simplot Taiwan Inc., SPS International, Inc., SR Simplot Foundation, Inc.,

4

Three Creek Ranch Company, and Camas, Inc. Mr. Simplot holds a Bachelor of Science degree in business from the University of Idaho and a Master's in Business Administration from the University of Pennsylvania. Our Board of Directors has determined that Mr. Simplot should serve as a director based on the extensive knowledge and insight he brings to our board of directors from his experience serving as Chairman and holding a variety of management positions at a large private company and serving on the boards of directors of companies in a variety of industries. Mr. Simplot became a Director on our board as part of his duties as the Chairman of the Board of J. R. Simplot Company, the 100 % owner of Simplot Taiwan, Inc., which was entitled to designate two members of our board of directors in connection with J.R. Simplot Company's investment in our Series A convertible preferred stock.

Executive Officers

In addition to Mr. Doan, our CEO, who also serves as a director, our executive officers as of July 18, 2022 consisted of the following:

Christopher Lee, 51, has served as our Chief Financial Officer since September 2015. From November 2014 until his appointment as Chief Financial Officer, Mr. Lee was the interim Chief Financial Officer of the Company. Mr. Lee joined SemiLEDs in September 2014. Mr. Lee has over 25 years of experience in accounting and finance, including US GAAP, PCAOB standards and SEC rules and regulations. Prior to joining us, Mr. Lee was a partner of KEDP CPA Group from August 2009 to June 2011 and a self-employed accountant from July 2011 to August 2014. Mr. Lee holds a BS degree in accounting from The Ohio State University and a MS degree in business taxation from Golden Gate University and is licensed as a Certified Public Accountant (CPA) in the United States.

CORPORATE GOVERNANCE

Board Responsibilities and Structure

The Board oversees, counsels, and directs management in the long-term interests of the Company and our stockholders. The Board’s responsibilities include:

The Board and its committees met throughout the year on a set schedule, held special meetings, and acted by written consent from time to time as appropriate. During fiscal year 2021, the Board held executive sessions for the independent directors to meet without Mr. Doan present at the end of every Board meeting.

Our Bylaws do not dictate a particular Board structure, and the Board is free to determine whether or not to have a Chairman and, if so, to select that Chairman and our CEO in the manner it considers our best interest. Currently, the Board has selected Mr. Doan to hold the position of both Chairman of the Board and CEO. Mr. Doan’s experience at the Company has afforded him intimate knowledge of the issues, challenges and opportunities facing each of the Company’s businesses. Accordingly, he is well positioned to focus the Board’s attention on the most pressing issues facing the Company. The Board has not appointed a lead independent director. The Board believes its administration of its risk oversight function has not affected the Board’s leadership structure.

5

Director Independence

The published listing requirements of Nasdaq dictate that a majority of the Board be comprised of independent directors whom our Board has determined have no material relationship with our Company and who are otherwise “independent” directors under those listing requirements. Our current Board consists of the five persons listed above. The Board has determined that each of our current directors, other than Mr. Doan, our CEO, qualifies as an independent director, such that more than a majority of our directors are independent directors under the Nasdaq rules.

The Nasdaq rules have objective tests and a subjective test for determining who is an “independent director.” Under the objective tests, a director cannot be considered independent if:

The subjective test states that an independent director must be a person who lacks a relationship that, in the opinion of the Board, would interfere with the exercise of independent judgment in carrying out the responsibilities of a director. The Board has not established categorical standards or guidelines to make these subjective determinations but considers all relevant facts and circumstances.

In addition to the Board-level standards for director independence, the Nasdaq rules provide that directors, of whom there must be three, who serve on the Audit Committee must each satisfy standards established by the SEC that require that members of audit committees must not be affiliated persons of the issuer and may not accept directly or indirectly any consulting, advisory, or other compensatory fee from the issuer other than their director compensation.

Transactions Considered in Independence Determinations

In making its independence determinations, the Board considered transactions that occurred since the beginning of fiscal year 2020 between the Company and entities associated with the independent directors or members of their immediate family. All identified transactions that appeared to relate to the Company and a family member of, or entity with a known connection to, a director, were presented to the Board for consideration.

None of the non-employee directors was disqualified from “independent” status under the objective tests. In making its subjective determination that each of our Company’s non-employee director is independent, the Board

6

reviewed and discussed additional information provided by the directors and the Company with regard to each director’s business and personal activities as they may relate to the Company and the Company’s management. The Board considered the transactions in the context of the Nasdaq objective standards, the special standards established by the SEC for members of audit committees, and the SEC standards for compensation committee members. Based on all of the foregoing, as required by the Nasdaq rules, the Board made a subjective determination that, because of the nature of the director’s relationship with the entity and/or the amount involved, no relationships exist that, in the opinion of the Board, would impair the director’s independence.

Board Committees and Charters

The Board delegates various responsibilities and authority to different Board committees. Committees regularly report on their activities and actions to the full Board. The Board currently has, and appoints the members of, a standing Audit Committee, Compensation Committee, and Nominating and Corporate Governance Committee. Each of the Board committees has a written charter approved by the Board, and we post each charter on our web site at https://www.semileds.com/corporategovernance. Each committee can engage outside experts, advisors and counsel to assist the committee in its work. The following table identifies the directors who served on committees during fiscal 2021.

Name |

| Audit |

| Compensation |

| Nominating and Corporate Governance |

Dr. Edward Kuan Hsiung Hsieh |

| Chair |

| ✓ |

|

|

Walter Michael Gough |

| ✓ |

|

|

|

|

Roger Lee |

| ✓ |

|

|

|

|

Scott R. Simplot |

|

|

| Chair |

| Chair |

Number of Committee Meetings Held in Fiscal Year 2021 |

| 4 |

| 2 |

| 2 |

Audit Committee

Our Audit Committee is responsible for, among other things:

The Board believes that each current member of our Audit Committee is an independent director under the Nasdaq rules and meets the additional SEC independence requirements for audit committee members. It has also determined that Dr. Hsieh and Mr. Gough meet the requirements of an “audit committee financial expert,” as defined in Regulation S-K.

Compensation Committee

Our Compensation Committee is responsible for, among other things:

7

Although the Compensation Committee has the authority to determine the compensation paid to executive officers, other officers, employees, consultants and advisors, it can delegate its responsibility for setting compensation for individuals other than the CEO to a subcommittee, in the case of other officers, or to officers, in the case of employees and consultants. It may also delegate to officers the authority to grant options or other equity or equity-based awards to employees who are not executive officers or members of the Board. It may also generally take into account the recommendations of the CEO, other than with respect to his own compensation. The Compensation Committee has not engaged an independent compensation consultant to assist it since fiscal 2014.

Nominating and Corporate Governance Committee

Our Nominating and Corporate Governance Committee is responsible for, among other things:

Our Nominating and Corporate Governance Committee has not established any minimum qualifications for directors although in assessing the skills and characteristics of individual members, it must give due regard for independence and financial literacy considerations dictated by the Nasdaq rules. The Nominating and Corporate Governance Committee does not at this time have a policy regarding its consideration of director candidates recommended by stockholders, as it has not yet received any such recommendations. It may adopt a policy if such recommendations are received. In nominating candidates, the Nominating and Corporate Governance Committee takes into consideration such factors as it deems appropriate. These factors may include judgment, skill, diversity, experience with businesses or other organizations of comparable size, the interplay of the candidate’s experience with the experience of other Board members, requirements of Nasdaq and the SEC to maintain a minimum number of independent or non-interested directors, requirements of the SEC as to disclosure regarding persons with financial expertise on the Company’s Audit Committee and the extent to which the candidate generally would be a desirable addition to the Board and any committees of the Board. The Committee believes the Board generally benefits from diversity of skills, experience, age, industry knowledge of background, and views among its members, and considers this a factor in evaluating the composition of the Board, but has not adopted any specific policy in this regard. Any stockholder wishing to nominate a director must follow the procedures described in “Other Matters” below.

Attendance at Board, Committee and Annual Stockholders’ Meetings

The Board held four meetings in fiscal year 2021. We expect each director to attend every meeting of the Board and the committees on which he serves and encourage them to attend the annual stockholders’ meeting. All current directors attended at least 75% of the aggregate meetings of the Board and the committees on which they served in fiscal year 2021, and all directors attended the 2021 annual meeting of stockholders.

8

Risk Management

The Board is involved in the oversight of risks that could affect the Company. The Board also monitors cyber threat trends, regulatory developments, and major threats to the Company, including setting expectations and accountability for management, as well as assessing the adequacy of resources, funding, and focus on cyber risk management activities. This oversight is conducted primarily through the Audit Committee which, on behalf of the Board, is charged with overseeing the principal risk exposures we face and our mitigation efforts in respect of these risks. The Audit Committee is responsible for interfacing with management and discussing with management the Company’s principal risk exposures and the steps management has taken to monitor and control risk exposures, including risk assessment and risk management policies. The Compensation Committee also plays a role in that it is charged, in overseeing the Company’s overall compensation structure, with assessing whether that compensation structure creates risks that are reasonably likely to have a material adverse effect on us.

Code of Business Conduct and Ethics

We have adopted a Code of Business Conduct and Ethics that applies to all of our employees, officers and directors, including those officers responsible for financial reporting. These standards are designed to deter wrongdoing and to promote honest and ethical conduct. The Code of Business Conduct and Ethics is available at our website at https://www.semileds.com/corporategovernance. Any amendments to the Code, or any waivers of its requirements required to be disclosed pursuant to SEC or Nasdaq requirements, will be disclosed on the website.

Communications from Stockholders and Other Interested Parties to Directors

The Board recommends that stockholders and other interested parties initiate communications with the Board, any committee of the Board or any individual director in writing to the attention of our Corporate Secretary at our principal executive office at 3F, No. 11 Ke Jung Rd., Chu-Nan Site, Hsinchu Science Park, Chu-Nan 350, Miao-Li County, Taiwan, R.O.C. This process will assist the Board in reviewing and responding to stockholder communications in an appropriate manner. The Board has instructed our Corporate Secretary to review such correspondence and, at his discretion, not to forward items if he deems them to be of a commercial or frivolous nature or otherwise inappropriate for the Board’s consideration.

Board Diversity Matrix

The matrix below is information concerning the gender and demographic background of each of our current directors, as self-identified and reported by each director. This information is being provided in accordance with Nasdaq’s board diversity rules.

Board Diversity Matrix (as of August 1, 2022) | |||||||||

Total Number of Directors |

|

| 5 |

| |||||

|

|

| Male |

|

| Female |

| ||

Part I: Gender Identity |

|

|

|

|

|

|

| ||

Directors |

|

| 5 |

|

| — |

| ||

Part II: Demographic Background |

|

|

|

|

|

|

| ||

Asian |

|

| 3 |

|

| — |

| ||

White |

|

| 1 |

|

| — |

| ||

Did Not Disclose Demographic Background |

|

| 1 |

|

| — |

| ||

9

PROPOSAL 2: RATIFICATION OF APPOINTMENT OF INDEPENDENT REGISTERED

PUBLIC ACCOUNTING FIRM FOR FISCAL YEAR 2022

KCCW Accountancy Corp served as our independent registered public accounting firm for fiscal years 2021 and 2020. The Audit Committee has once again selected KCCW Accountancy Corp as our independent registered public accounting firm for the fiscal year ending August 31, 2022. As a matter of good corporate governance, the Audit Committee is submitting its appointment to our stockholders for ratification. If the appointment of KCCW Accountancy Corp is not ratified by the majority of the shares of common stock present or represented at the annual meeting and entitled to vote on the proposal, the Audit Committee will review its future appointment of an independent registered public accounting firm in light of that vote result.

We expect that representatives of KCCW Accountancy Corp will attend the annual meeting, and the representative will have an opportunity to make a statement if he or she so chooses. The representative will also be available to respond to appropriate questions from stockholders.

Fees Billed by Independent Registered Public Accounting Firm

The following table shows the fees and related expenses for audit and other services provided by KCCW Accountancy Corp billed for fiscal year 2021 and 2020. The services described in the following fee table were approved in conformity with the Audit Committee’s pre-approval process.

|

|

| Fiscal Years Ended August 31, |

| |||||

|

| 2021 |

| 2020 |

| ||||

Audit Fees |

| $ | 173,000 |

| $ | 173,000 |

| ||

Audit-Related Fees |

|

| — |

|

| — |

| ||

Tax Fees |

|

| 7,000 |

|

| 7,000 |

| ||

All Other Fees |

|

| 17,000 |

|

| — |

| ||

Total |

| $ | 197,000 |

| $ | 180,000 |

| ||

Audit Fees. This category includes the audit of our annual consolidated financial statements, review of our quarterly condensed consolidated financial statements and services that are normally provided by our independent auditors in connection with statutory and regulatory filings or engagements. This category also includes statutory audits required by the Tax Bureau of Taiwan for certain of our subsidiaries in Taiwan.

Tax Fees. The services for the fees disclosed in this category include tax return preparation and technical tax advice.

All Other Fees. The services for the fees disclosed in this category include permitted services other than those that meet the criteria above and represent fees related to our at-the-market equity program in fiscal year 2021.

The Audit Committee concluded that the provision of the non-audit services listed above is compatible with maintaining the independence of KCCW Accountancy Corp.

10

Policy on Audit Committee Pre-Approval of Audit and Permissible Non-Audit Services of the Independent Registered Public Accounting Firm

The Audit Committee pre-approves and reviews audit and non-audit services performed by our independent registered public accounting firm, as well as the fees charged for such services. In its pre-approval and review of non-audit service fees, the Audit Committee considers, among other factors, the possible effect of the performance of such services on the auditor’s independence. For additional information concerning the Audit Committee and its activities with the independent registered public accounting firm, see “Corporate Governance” and “Audit Committee Report” in this Proxy Statement.

THE BOARD RECOMMENDS THAT YOU VOTE “FOR” THE RATIFICATION OF THE APPOINTMENT OF KCCW ACCOUNTANCY CORP AS OUR INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM FOR FISCAL YEAR 2022.

11

AUDIT COMMITTEE REPORT

During fiscal year 2021, the Audit Committee of the Board consisted of the three directors whose names appear below.

The Audit Committee’s general role is to assist the Board in monitoring the Company’s financial reporting process and related matters. Its specific responsibilities are set forth in its charter.

The Audit Committee has reviewed the Company’s financial statements for fiscal year 2021 and met with management, as well as with representatives of KCCW Accountancy Corp, the Company’s independent registered public accounting firm, to discuss the financial statements. The Audit Committee also discussed with members of KCCW Accountancy Corp the matters required to be discussed by the Public Company Accounting Oversight Board and SEC.

In addition, the Audit Committee received the written disclosures and the letter from KCCW Accountancy Corp required by applicable requirements of the Public Company Accounting Oversight Board regarding the independent accountant’s communications with the Audit Committee concerning independence, and discussed with members of KCCW Accountancy Corp its independence.

Based on these discussions, the financial statement review and other matters it deemed relevant, the Audit Committee recommended to the Board that the Company’s audited financial statements for fiscal year 2021 be included in the Company’s Annual Report on Form 10-K for fiscal year 2021.

November 29, 2021 | Dr. Edward Kuan Hsiung Hsieh (Chairman) |

| Walter Michael Gough |

| Roger Lee |

12

COMPENSATION OF THE NAMED EXECUTIVE OFFICERS AND DIRECTORS

Executive Compensation

This executive compensation section discloses the compensation awarded to or earned by our “named executive officers” during fiscal years 2021 and 2020.

We held our last non‑binding advisory vote regarding compensation of our named executive officers at the 2021 Annual Meeting of Stockholders and expect to hold our next vote at our 2024 Annual Meeting of Stockholders.

Summary Compensation Table

The following table sets forth all of the compensation earned by our named executive officers during the relevant fiscal years.

Name and Principal Position |

| Fiscal Year |

|

| Salary ($) |

|

| Bonus ($) |

|

| Stock Awards ($)(2)(3) |

| Option Awards ($)(2) |

|

| All Other Compensation ($) |

| Total ($) |

| ||||||

Trung T. Doan |

|

| 2021 |

|

|

| 258,188 |

|

|

| — |

|

|

| — |

|

| — |

|

| — |

|

| 258,188 |

|

Chief Executive Officer |

|

| 2020 |

|

|

| 151,875 |

|

|

| — |

|

|

| — |

|

| — |

|

| — |

|

| 151,875 |

|

Christopher Lee (1) |

|

| 2021 |

|

|

| 91,420 |

|

|

| — |

|

|

| 18,079 |

|

| — |

|

| — |

|

| 109,499 |

|

Outstanding Equity Awards at Fiscal Year-End

The following table sets forth the outstanding equity awards held by Mr. Lee as of the fiscal year ended August 31, 2021. Mr. Doan did not hold any outstanding equity awards as of the fiscal year ended August 31, 2021.

|

| Option Awards |

| Stock Awards | ||||||||||

Name |

| Number of Securities Underlying Unexercised Options Exercisable |

| Equity Incentive Plan Awards: Number of Securities Underlying Unexercised Unearned Options |

| Option Exercise Price ($) |

|

|

| Number of Shares or Units of Stock That Have Not Vested (1) |

| Market Value of Shares or Units of Stock That Have Not Vested ($)(2) |

| Equity Incentive Plan Awards: Market or Payout Value of Unearned Shares, Units or Other Rights That Have Not Vested ($) |

Christopher Lee |

| — |

| — |

| — |

| 11/12/20 |

| 450 | (3) | 4,514 |

| — |

|

| — |

| — |

| — |

| 01/10/20 |

| 6,000 | (4) | 60,180 |

| — |

13

Pension Benefits

We do not maintain any defined benefit pension plans.

Nonqualified Deferred Compensation

We do not maintain any nonqualified deferred compensation plans.

Severance and Change in Control Benefits

Mr. Doan entered into an employment agreement in 2005, which provides that if he is terminated by us without cause or resigns due to a constructive termination, he will receive as severance an amount equal to six months of his then‑current salary plus his current medical insurance for six months following his termination date. We offered such severance to motivate Mr. Doan to continue as our executive officer by providing severance protection in the event that he is terminated by us without having committed any egregious act constituting cause or if we adversely change his position such that he resigns. Cause is defined as (a) the conviction of a felony or of any criminal offense involving moral turpitude; (b) the repeated failure to satisfactorily perform duties reasonably required by us; (c) material breach of the proprietary information and invention agreement, our written policies established by our Board or any term of his employment agreement; or (d) misappropriation of our property or unlawful appropriation of our corporate opportunity or our business. If we determine cause exists, we will provide Mr. Doan with written notice alleging cause and his failure to remedy the alleged cause within 30 days may result in a termination for cause. Constructive termination is defined as one of the following events when we have not received Mr. Doan’s written consent for such event: (a) a significant reduction of his duties, position or responsibilities relative to his duties, position or responsibilities in effect immediately prior to such reduction or his removal from such position, duties and responsibilities, provided that a reduction in duties, position or responsibilities solely by virtue of us being acquired and made part of a larger entity will not constitute a constructive termination; (b) a substantial reduction, without good business reasons, of the facilities and perquisites available to him immediately prior to such reduction; (c) a reduction of his base salary unless such reduction is a part of a Company‑wide reduction for similarly situated persons; or (d)a material reduction in the kind or level of employee benefits to which he is entitled immediately prior to such reduction, with the result that his overall benefits package is significantly reduced, unless such reductions are part of a Company‑wide reduction for similarly situated persons.

Employment Agreements

Mr. Doan entered into an employment agreement in 2005, which provides for the severance payments and benefits described under “Severance and Change in Control Benefits” above.

Director Compensation

Our Board amended our director compensation policy on November 11, 2020 to replace the annual cash retainers for board and committee service with additional restricted stock units, as a result of which non-employee members of the Board now receive the following compensation for their board and committee services:

The director compensation policy requires directors to attend at least 75% of the meetings each year in order to be re-nominated. The policy also includes an equity ownership guideline whereby our directors will be expected to own and hold shares of our common stock until retirement from their Board service. We also reimburse non-employee directors for travel, lodging and other expenses incurred in connection with their attendance at Board or committee meetings.

14

Director Compensation Table

The following table sets forth the total compensation for our non-employee directors for the year ended August 31, 2021:

Name |

| Fees Earned or Paid in Cash ($) |

|

| Stock Awards ($)(2) |

|

| All Other Compensation ($) |

|

| Total ($) |

| ||||

Dr. Edward Kuan Hsiung Hsieh |

|

| — |

|

|

| 15,000 |

|

|

| — |

|

|

| 15,000 |

|

Walter Michael Gough |

|

| — |

|

|

| 15,000 |

|

|

| — |

|

|

| 15,000 |

|

Roger Lee |

|

| — |

|

|

| 15,000 |

|

|

| — |

|

|

| 15,000 |

|

Scott R. Simplot (1) |

|

| — |

|

|

| — |

|

|

| — |

|

|

| — |

|

15

PRINCIPAL STOCKHOLDERS

The following table sets forth information regarding the beneficial ownership of our common stock as of July 18, 2022 with respect to:

Beneficial ownership is determined in accordance with the rules of the SEC. All shares of our common stock subject to options currently exercisable or exercisable within 60 days of July 18, 2022 and restricted stock units that will vest within 60 days of July 18, 2022, are deemed to be outstanding for the purpose of computing the percentage ownership of the person or group holding options and restricted stock units, but are not deemed to be outstanding for computing the percentage of ownership of any other person.

Unless otherwise indicated by the footnotes below, we believe, based on the information furnished to us, that each stockholder named in the table has sole voting and investment power with respect to all shares beneficially owned, subject to applicable community property laws.

Percentage of ownership is based on 4,530,154 shares of common stock outstanding as of July 18, 2022.

Unless otherwise indicated in the footnotes to the table, the address of each individual listed in the table is c/o SemiLEDs Corporation, 3F, No.11 Ke Jung Rd., Chu-Nan Site, Hsinchu Science Park, Chu-Nan 350, Miao-Li County, Taiwan, R.O.C.

|

| Shares Beneficially Owner |

| |||||

Name and Address of Beneficial Owner |

| Number |

|

| Percent |

| ||

5% Stockholders: |

|

|

|

|

|

|

|

|

Simplot Taiwan, Inc. |

| 1,489,934 | (1) |

|

| 30.2 | % | |

J.R. Simplot Company |

|

|

|

|

|

|

|

|

Trung Tri Doan |

| 536,639 | (2) |

|

| 11.7 | % | |

|

|

|

|

|

|

|

|

|

Executive Officers and Directors: |

|

|

|

|

|

|

|

|

Trung Tri Doan |

| 536,639 | (2) |

|

| 11.7 | % | |

Walter Michael Gough |

|

| 19,818 | (3) |

| * |

| |

Dr. Edward Kuan Hsiung Hsieh |

|

| 32,321 | (3) |

| * |

| |

Scott R. Simplot |

| 1,520,970 | (1)(4) |

|

| 30.7 | % | |

Roger Lee |

| 11,250 | (3) |

|

| * |

| |

Christopher Lee |

|

| 8,800 | (5) |

| * |

| |

|

|

|

|

|

|

|

|

|

All executive officers and directors as a group (6 persons) |

|

| 2,129,798 |

|

|

| 42.3 | % |

* Indicates beneficial ownership of less than 1%.

16

17

CERTAIN RELATIONSHIPS AND RELATED PARTY TRANSACTIONS

Since September 1, 2020, there has not been any transaction or series of similar transactions to which we were or are a party in which the amount involved exceeded or exceeds the lesser of $120,000 or one percent of the average of our total assets at year-end for the last two completed fiscal years, and in which any of our directors or executive officers, any holder of more than 5% of any class of our voting securities or any member of the immediate family of any of the foregoing persons had or will have a direct or indirect material interest, other than the transactions described below, some of which represent continuing transactions from prior periods.

On January 8, 2019, we entered into loan agreements with each of Trung Doan, our Chairman and Chief Executive Officer and J.R. Simplot Company, our largest shareholder, with aggregate amounts of $1.7 million and $1.5 million, respectively, and an annual interest rate in each case of 8%. All proceeds of the loans were exclusively used to return the deposit to Formosa Epitaxy Incorporation in connection with the cancelled proposed sale of our headquarters building pursuant to the agreement dated December 15, 2015. We were required to repay the loans to our Chairman and Chief Executive Officer on January 14, 2021 and the loan to J.R.Simplot Company on January 22, 2021, unless the loans were sooner accelerated pursuant to the terms of the loan agreements. On January 16, 2021, the maturity date of these loans was extended with same terms and interest rate for one year to January 15, 2022, and on January 14, 2022, the maturity date of these loans was further extended with same terms and interest rate for one more year to January 15, 2023. As of February 28, 2022, the outstanding amounts under the loan agreement totaled $3.2 million. The loans are secured by a second priority security interest on our headquarters building.

On November 25, 2019 and on December 10, 2019, we issued convertible unsecured promissory notes (the “Notes”) to J.R. Simplot Company and Trung Doan (together, the “Holders”) with a principal sum of $1.5 million and $500,000, respectively, and an annual interest rate of 3.5%. Principal and accrued interest shall be due on demand by the Holders on and at any time after May 30, 2021. On February 7, 2020, J.R. Simplot Company assigned all of its right, title and interest in the Notes to Simplot Taiwan Inc. The outstanding principal and unpaid accrued interest of the Notes may be converted into shares of our common stock based on a conversion price of $3.00 per share, at the option of the Holders any time from the date of the Notes. On May 25, 2020, each of the Holders converted $300,000 of the Notes into 100,000 shares of our common stock. On May 26, 2021, the Notes were extended with the same terms and interest rate for one year and were scheduled to mature on May 30, 2022, and on May 26, 2022, the Notes were further extended with the same terms and interest rate for one year and now mature on May 30, 2023. As of May 31, 2022, the outstanding principal of these notes totaled $1.4 million.

Employment Agreements

See “Compensation of the Named Executive Officers and Directors—Employment Agreements.”

Policies and Procedures for Related Party Transactions

Our Board has adopted a formal, written related party transactions policy pursuant to which, our executive officers, directors, beneficial owners of more than 5% of our common stock, and any member of the immediate family of and any firm, corporation or other entity at which any of the foregoing persons is employed or is a general partner or principal or in a similar position or in which such person has a 5% or greater beneficial interest, are not permitted to enter into a related party transaction with us without prior consent and approval of our Audit Committee. This policy covers any transaction, arrangement or relationship, or any series of similar transactions, arrangements or relationships in which we are a participant, the aggregate amount involved will or may be expected to exceed $120,000 in any year and a related person has or will have a direct or indirect material interest (other than solely as a result of being a director or a less than 10% beneficial owner of another entity), including, without limitation, purchases of goods or services by or from the related person or entities in which the related person has a material interest, indebtedness, guarantees of indebtedness or employment by us of a related person.

18

The Audit Committee has determined that a related person does not have a direct or indirect material interest in the following categories of transactions and that each will be deemed to be preapproved:

ADDITIONAL MEETING INFORMATION

Meeting Admission. You are entitled to attend the annual meeting only if you were a holder of our common stock as of the close of business on July 18, 2022 or hold a valid proxy for the annual meeting. If attending the physical meeting, you should be prepared to present photo identification for admittance. In addition, if you are a stockholder of record, meaning that you hold shares directly with American Stock Transfer & Trust Company, LLC (“registered holders”), the inspector of elections will have your name on a list, and you will be able to gain entry with a form of photo identification. If you are not a stockholder of record but hold shares through a broker, bank, or nominee (“street name” or “beneficial” holders), in order to gain entry you must provide proof of beneficial ownership as of the record date, such as an account statement or similar evidence of ownership, along with a form of photo identification. If you do not provide photo identification and comply with the other procedures outlined above for attending the annual meeting in person, you will not be admitted to attend the annual meeting in person.

Proxy Solicitation. We will bear the expense of soliciting proxies. Our directors, officers and other employees, without additional compensation, may also solicit proxies personally or in writing, by telephone, e-mail, facsimile or otherwise. We are required to request that brokers, banks, and other nominees who hold stock in their names furnish our proxy materials to the beneficial owners of the stock, and we must reimburse these brokers, banks, and other nominees for the expenses of doing so, in accordance with statutory fee schedules.

Inspector of Elections. Broadridge Financial Solutions, Inc. has been engaged as our independent inspector of elections to tabulate stockholder votes for the annual meeting.

Stockholder List. Our list of stockholders as of July 18, 2022 will be available for inspection at our principal executive office (3F, No. 11 Ke Jung Rd., Chu-Nan Site, Hsinchu Science Park, Chu-Nan 350, Miao-Li County, Taiwan, R.O.C.) for 10 days prior to the annual meeting. If you want to inspect the stockholder list, call our Finance Department at +886-37-586788 to schedule an appointment.

OTHER MATTERS

2023 Stockholder Proposals or Nominations. Pursuant to Rule 14a-8 under the Exchange Act, some stockholder proposals may be eligible for inclusion in the proxy statement for our 2023 Annual Meeting of Stockholders. These stockholder proposals must be submitted, along with proof of ownership of our stock in accordance with Rule 14a-8(b)(2), to our principal executive office (3F, No. 11 Ke Jung Rd., Chu-Nan Site, Hsinchu Science Park, Chu-Nan 350, Miao-Li County, Taiwan, R.O.C.) in care of our Corporate Secretary. Failure to deliver a proposal in accordance with this procedure may result in it not being deemed timely received. We must receive all submissions no later than the close of business (5:00 p.m. Taiwan Time) on April 3, 2023.

In addition, under our Bylaws, any stockholder intending to nominate a candidate for election to the Board or to propose any business at our 2023 Annual Meeting of Stockholders, other than precatory (non-binding) proposals presented under Rule 14a-8, must give notice to our Corporate Secretary no earlier than May 16, 2023 and no later than June 15, 2023, unless the notice also is made pursuant to Rule 14a-8. The notice must include information specified in our Bylaws, including information concerning the nominee or proposal, as the case may be, and information about the stockholder’s ownership of and agreements related to our stock. If the 2023 Annual Meeting of Stockholders is held more than 30 days before or after the anniversary of the 2022 Annual Meeting of Stockholders, the stockholder must submit notice of any such nomination and of any such proposal that is not made pursuant to Rule 14a-8 by the later of the 90th day before the 2023 Annual Meeting of Stockholders or the 10th day following the day on which public announcement of the date of such meeting is first made.

19

We will not entertain any proposals or nominations at the 2023 Annual Meeting of Stockholders that do not meet the requirements set forth in our Bylaws. If the stockholder does not also comply with the requirements of Rule 14a-4(c)(2) under the Exchange Act, we may exercise discretionary voting authority under proxies that we solicit to vote in accordance with our best judgment on any such stockholder proposal or nomination.

20