UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant ☒ Filed by a Party other than the Registrant ☐

Check the appropriate box:

|

|

☐ | Preliminary Proxy Statement |

|

|

☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

|

|

☒ | Definitive Proxy Statement |

|

|

☐ | Definitive Additional Materials |

|

|

☐ | Soliciting Material under §240.14a-12 |

CASA SYSTEMS, INC.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check all boxes that apply):

|

|

|

|

| |

☒ | No fee required. | |

|

| |

☐ | Fee paid previously with preliminary materials. | |

☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. | |

|

|

|

April 1, 2022

Dear Stockholder:

I am pleased to invite you to attend the 2022 Annual Meeting of Stockholders (the “Annual Meeting”) of Casa Systems, Inc. (“Casa Systems”) to be held via the Internet at a virtual live webcast on Thursday, May 12, 2022, at 10:00 a.m. Eastern Time. You can register to attend the Annual Meeting at www.proxydocs.com/CASA.

We are pleased to take advantage of Securities and Exchange Commission rules that allow companies to furnish their proxy materials over the Internet. We are mailing to many of our stockholders a Notice of Internet Availability of Proxy Materials (the “Notice”) instead of a paper copy of our proxy materials and our 2021 Annual Report on Form 10-K. The Notice contains instructions on how to access those documents and to cast your vote via the Internet. The Notice also contains instructions on how to request paper copies of those documents. All stockholders who do not receive a Notice will receive paper copies of the proxy materials and the 2021 Annual Report on Form 10-K by mail. This process allows us to provide our stockholders with the information they need on a more timely basis, while reducing the environmental impact and lowering the costs of printing and distributing our proxy materials.

To support your health and well-being in light of the continuing concerns resulting from the coronavirus (COVID-19) pandemic, our Annual Meeting will be a “virtual meeting” of stockholders, which will be conducted exclusively via the Internet at a virtual web conference. There will not be a physical meeting location, and stockholders will not be able to attend the Annual Meeting in person. This means that you can attend the Annual Meeting online, as well as vote your shares electronically and submit questions during the Annual Meeting, by visiting the above-mentioned Internet site. In light of the public health and safety concerns related to COVID-19, we believe that hosting a “virtual meeting” will enable greater stockholder attendance and participation from any location around the world.

Your vote is important. Whether or not you plan to virtually attend the Annual Meeting, I hope you will vote as soon as possible. You may vote over the Internet at the Annual Meeting or by mailing a proxy card or voting by telephone. Please review the instructions on the Notice or on the proxy card regarding your voting options.

Thank you for being a Casa Systems stockholder. We look forward to seeing you at our Annual Meeting.

|

Sincerely, |

|

|

Jerry Guo |

President, Chief Executive Officer and Chairman |

YOUR VOTE IS IMPORTANT In order to ensure your representation at the Annual Meeting, whether or not you plan to virtually attend the Annual Meeting, please vote your shares as promptly as possible over the Internet by following the instructions on the Notice or on your proxy card. Your participation will help to ensure the presence of a quorum at the Annual Meeting and save Casa Systems the extra expense associated with additional solicitation. If you hold your shares through a broker, your broker is not permitted to vote on your behalf in the election of directors, unless you provide specific instructions to your broker by completing and returning any voting instruction form that your broker provides (or following any instructions that allow you to vote your broker-held shares via telephone or the Internet prior to the Annual Meeting). For your vote to be counted, you will need to communicate your voting decision in accordance with the instructions set forth in the proxy materials. Voting your shares in advance will not prevent you from virtually attending the Annual Meeting, revoking your earlier submitted proxy in accordance with the instructions set forth in the proxy materials, or voting your shares at the virtual Annual Meeting. |

CASA SYSTEMS, INC.

100 Old River Road

Andover, Massachusetts 01810

NOTICE OF 2022 ANNUAL MEETING OF STOCKHOLDERS

Notice is hereby given that Casa Systems, Inc. will hold its 2022 Annual Meeting of Stockholders (the “Annual Meeting”) via the Internet at a virtual live webcast on Thursday, May 12, 2022, at 10:00 a.m. Eastern Time, for the following purposes:

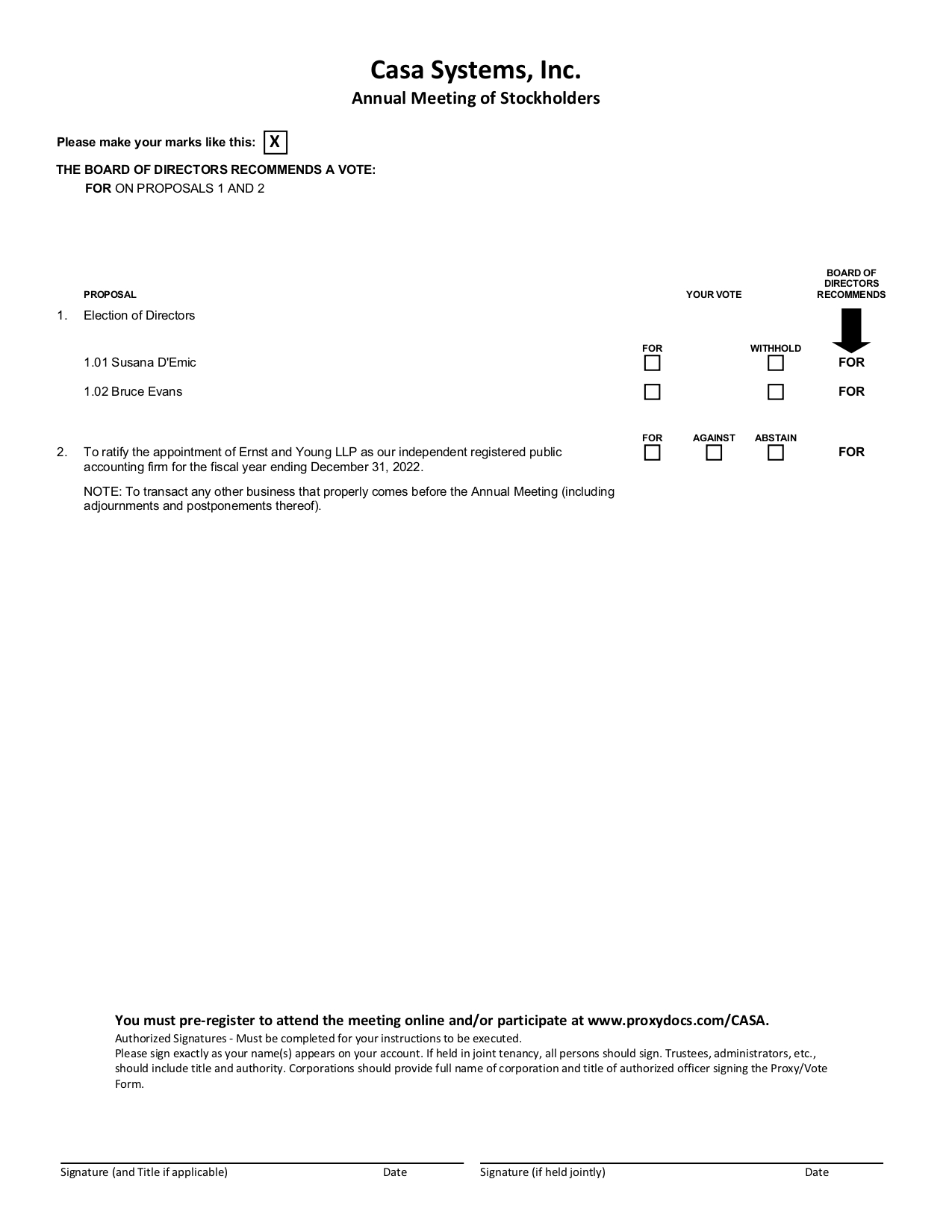

| • | To elect two Class II directors to hold office until our 2025 annual meeting of stockholders or until their successors are duly elected and qualified, subject to their earlier resignation or removal; |

| • | To ratify the appointment of Ernst and Young LLP (“Ernst & Young”) as our independent registered public accounting firm for the fiscal year ending December 31, 2022; and |

| • | To transact any other business that properly comes before the Annual Meeting (including adjournments and postponements thereof). |

To support your health and well-being in light of the continuing concerns resulting from the coronavirus (COVID-19) pandemic, our Annual Meeting will be a “virtual meeting” of stockholders, which will be conducted exclusively via the Internet at a virtual web conference. There will not be a physical meeting location, and stockholders will not be able to attend the Annual Meeting in person. This means that you can attend the Annual Meeting online, as well as vote your shares electronically and submit questions during the Annual Meeting. In light of the public health and safety concerns related to COVID-19, we believe that hosting a “virtual meeting” will enable greater stockholder attendance and participation from any location around the world.

Only stockholders of record at the close of business on March 21, 2022 (the “Record Date”) are entitled to notice of and to vote at the Annual Meeting as set forth in the proxy statement (the “Proxy Statement”). You are entitled to virtually attend the Annual Meeting only if you were a stockholder as of the close of business on the Record Date or hold a valid proxy for the Annual Meeting. If you are a stockholder of record, your ownership as of the Record Date will be verified prior to admittance into the Annual Meeting. In order to attend, you must register in advance at www.proxydocs.com/CASA prior to the deadline of May 10, 2022, at 5:00 p.m. Eastern Time. Upon completing your registration, you will receive further instructions via email, including your unique links that will allow you access to the Annual Meeting and will permit you to submit questions. You will not be able to attend the Annual Meeting in person. If you are not a stockholder of record but hold shares through a broker, trustee or nominee, you must also register in advance at www.proxydocs.com/CASA. For instructions on how to vote your shares, please refer to the section titled “Voting” beginning on page 1 of the Proxy Statement or the proxy card.

Important Notice Regarding the Availability of Proxy Materials for the Annual

Meeting of Stockholders to be Held on Thursday, May 12, 2022, for Casa Systems, Inc.

The Proxy Statement, our Annual Report on Form 10-K, instructions to access the Annual Meeting and voting instructions are available at www.proxydocs.com/CASA.

|

By Order of our Board of Directors, |

|

|

Jerry Guo |

President, Chief Executive Officer and Secretary |

Andover, Massachusetts

April 1, 2022

TABLE OF CONTENTS

PROXY STATEMENT

FOR THE 2022 ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD THURSDAY, MAY 12, 2022

Our board of directors solicits your proxy on our behalf for the 2022 Annual Meeting of Stockholders, or the Annual Meeting, and at any postponement or adjournment of the Annual Meeting for the purposes set forth in this Proxy Statement and the accompanying proxy card. The Annual Meeting will be held virtually at 10:00 a.m. Eastern Time on Thursday, May 12, 2022, via the Internet at a virtual live webcast. You can register to attend the Annual Meeting at www.proxydocs.com/CASA. Information on how to vote, including over the Internet at the Annual Meeting, is discussed below.

Pursuant to rules adopted by the Securities and Exchange Commission, or SEC, we are providing access to our proxy materials over the Internet. Accordingly, we are sending a Notice of Internet Availability of Proxy Materials, or the Notice, to our stockholders of record and beneficial owners as of the record date identified below. The mailing of the Notice to our stockholders is scheduled to begin by no later than April 1, 2022.

In this Proxy Statement the terms “Casa Systems,” “the company,” “we,” “us,” and “our” refer to Casa Systems, Inc. The mailing address of our principal executive offices is Casa Systems, Inc., 100 Old River Road, Andover, Massachusetts 01810. All website addresses set forth in this Proxy Statement are for information purposes only and are not intended to be active links or to incorporate any website information into this document.

March 21, 2022. | |

|

|

A majority of the shares of all issued and outstanding capital stock entitled to vote on the Record Date must be present or represented by proxy to constitute a quorum. | |

|

|

84,833,827 shares of common stock outstanding as of March 21, 2022. | |

|

|

There are four ways a stockholder of record can vote: | |

|

|

| (1)By Internet Prior to the Annual Meeting: If you are a stockholder as of the Record Date, you may vote over the Internet prior to the Annual Meeting by following the instructions provided in the proxy card. |

|

|

| (2)By Telephone Prior to the Annual Meeting: If you are a stockholder as of the Record Date, you can vote by telephone by following the instructions in the proxy card. |

|

|

| (3)By Mail Prior to the Annual Meeting: If you are a stockholder as of the Record Date, you can vote by mailing your proxy card as described in the proxy materials. |

|

|

| (4)Voting Over the Internet at the Annual Meeting: Although we encourage you to complete and return a proxy prior to the Annual Meeting to ensure that your vote is counted, you can virtually attend the Annual Meeting and vote your shares online by visiting www.proxydocs.com/CASA and registering prior to the deadline of May 10, 2022, at 5:00 p.m. Eastern Time. You will need your control number included in your proxy materials in order to be able to vote during the Annual Meeting.

If you hold your shares through a broker, bank or other nominee and want to vote virtually during the Annual Meeting you may also be instructed to obtain a legal proxy from your broker, bank or other nominee and to submit a copy in advance of the Annual Meeting. Further instructions will be provided to you as part of the registration process. |

|

|

1

2

Each share of our common stock outstanding on the Record Date is entitled to one vote on any proposal presented at the Annual Meeting. There is no cumulative voting in the appointment of directors:

For Proposal One, the election of directors, the nominees receiving the highest number of votes properly cast FOR election of each class of directors, or a “plurality” of the votes properly cast, will be elected as directors.

For Proposal Two, a majority of the votes properly cast FOR the proposal is required to ratify the appointment of Ernst & Young as our independent registered public accounting firm for the fiscal year ending December 31, 2022. | |

|

|

Votes withheld from any nominee, abstentions and “broker non-votes” (i.e., where a broker has not received voting instructions from the beneficial owner and for which the broker does not have discretionary power to vote on a particular matter) are counted as present for purposes of determining the presence of a quorum. Shares voting “withheld” have no effect on the election of directors. Abstentions have no effect on the ratification of the appointment of Ernst & Young as our independent registered public accounting firm for the fiscal year ending December 31, 2022.

Under the rules that govern brokers holding shares for their customers, brokers who do not receive voting instructions from their customers have the discretion to vote uninstructed shares on routine matters, but do not have discretion to vote such uninstructed shares on non-routine matters. Only Proposal Two, the ratification of the appointment of Ernst & Young, is considered a routine matter where brokers are permitted to vote shares held by them without instruction. If your shares are held through a broker, those shares will not be voted in the election of directors unless you affirmatively provide the broker instructions on how to vote. | |

|

|

If you complete and submit your proxy voting instructions, the persons named as proxies will follow your instructions. If you submit proxy voting instructions but do not direct how your shares should be voted on each item, the persons named as proxies will vote FOR the election of the nominees for directors and FOR the ratification of the appointment of Ernst & Young as our independent registered public accounting firm. The persons named as proxies will vote on any other matters properly presented at the Annual Meeting in accordance with their best judgment. | |

| |

|

|

We will announce preliminary voting results during the Annual Meeting. We will report final voting results by filing a Current Report on Form 8-K within four business days after the Annual Meeting. If final voting results are not available at that time, we will provide preliminary voting results in the Form 8-K and final voting results in an amendment to the Form 8-K after they become available. | |

|

|

We are paying for the distribution of the proxy materials and solicitation of the proxies. As part of this process, we reimburse brokerage houses and other custodians, nominees and fiduciaries for their reasonable out-of-pocket expenses for forwarding proxy and solicitation materials to our stockholders. Proxy solicitation expenses that we will pay include those for preparation, mailing, returning and tabulating the proxies. Our directors, officers and employees may also solicit proxies on our behalf in person, by telephone, email or facsimile, but they do not receive additional compensation for providing those services. We may also utilize the assistance of third parties in connection with our proxy solicitation efforts and we would compensate such third parties for their efforts. | |

|

|

Some banks, brokers and other nominee record holders may be participating in the practice of “householding” proxy statements and annual reports. This means that only one copy of the Proxy Statement and Annual Report on Form 10-K for the fiscal year ended December 31, 2021, will be delivered to multiple stockholders sharing an address unless we, or the applicable bank, broker or other nominee record holder, have received contrary instructions. We will promptly deliver a separate copy of any of these documents to you if you write to us at Investor Relations at Casa Systems, Inc., 100 Old River Road, Andover, Massachusetts 01810 or call us at (978) 688-6706. If you want to receive separate copies of the Proxy Statement or Annual Report in the future, or if you are receiving multiple copies and would like to receive only one copy for your household, you should contact your bank, broker, or other nominee record holder, or you may contact us at the above address or telephone number. |

3

ELECTION OF DIRECTORS

Number of Directors; Board Structure

Our board of directors is divided into three staggered classes of directors as nearly equal in number as possible. Our Restated Certificate of Incorporation states that one class is to be elected each year at the annual meeting of stockholders for a term of three years. Directors are elected to hold office for a three-year term or until the election and qualification of their successors in office.

Our board of directors has nominated Bruce R. Evans and Susana D’Emic for election as Class II directors to serve three-year terms ending at the 2025 annual meeting or until their successors are elected and qualified. Each of the nominees is a current member of our board of directors and has consented to serve if elected.

Unless you direct otherwise through your proxy voting instructions, the persons named as proxies will vote all proxies received “FOR” the election of each nominee. If any nominee is unable or unwilling to serve at the time of the Annual Meeting, the persons named as proxies may vote for a substitute nominee chosen by the members of our board of directors. In the alternative, the proxies may vote only for the remaining nominee, leaving a vacancy on our board of directors. Our board of directors may fill such vacancy at a later date or reduce the size of our board of directors. We have no reason to believe that any of the nominees will be unwilling or unable to serve if elected as a director.

Recommendation of our Board of Directors

THE BOARD RECOMMENDS THAT YOU VOTE “FOR” THE ELECTION OF EACH OF BRUCE R. EVANS AND SUSANA D’EMIC. |

The biographies of each of the director nominees and continuing directors below contain information regarding each such person’s service as a director on our board of directors, business experience, director positions at other companies held currently or at any time during the last five years, and other experiences, qualifications, attributes or skills that caused our board of directors to determine that the person should serve as a director of the company. In addition to the information presented below that led our board of directors to the conclusion that each person should serve as a director, we also believe that each of our directors has a reputation for integrity, honesty and adherence to high ethical standards. Each of our directors has demonstrated business acumen and an ability to exercise sound judgment, as well as a commitment of service to our company and our board of directors, including a commitment to understanding our business and industry. We also value our directors’ experience in relevant areas of business management and on other boards of directors and committees of boards of directors.

Our corporate governance guidelines also dictate that, except as may otherwise be permitted by the listing rules of the Nasdaq Stock Market, or Nasdaq, a majority of our board be composed of independent directors whom our board of directors has determined have no material relationship with the company and are otherwise “independent” directors under Nasdaq listing rules.

4

The names of the nominees for election as Class II directors at the Annual Meeting and of the incumbent Class I and III directors, and certain information about them, including their ages, are set forth below.

Name |

| Age |

| Principal Occupation |

| Director Since |

Nominees for election as Class II directors for terms expiring in 2025: | ||||||

Bruce R. Evans(3) |

| 63 |

| Lead Director of Casa Systems, Inc., President of Evans Capital LLC and Senior Advisor to Summit Partners |

| 2010 |

Susana D'Emic(1)(3) |

| 58 |

| Chief Accounting Officer and Controller of Booking Holdings and Interim Chief Financial Officer of Booking.com |

| 2018 |

Incumbent Class III directors with terms expiring in 2023: | ||||||

Lucy Xie |

| 56 |

| Senior Vice President of Operations of Casa Systems, Inc. |

| 2003 |

Bill Styslinger(2)(3) |

| 75 |

| Former Chariman, President and Chief Executive Officer of SeaChange International |

| 2012 |

Michael Hayashi(1)(2) |

| 65 |

| Former Executive Vice President of Time Warner Cable |

| 2018 |

Incumbent Class I directors with terms expiring in 2024: | ||||||

Jerry Guo |

| 58 |

| President, Chief Executive Officer and Chairman of Casa Systems, Inc. |

| 2003 |

Daniel S. Mead(1)(2) |

| 68 |

| Former President and Chief Executive Officer of Verizon Wireless |

| 2018 |

(1) | Member of the Audit Committee. |

(2) | Member of the Compensation Committee. |

(3) | Member of the Nominating and Corporate Governance Committee. |

Jerry Guo and Lucy Xie are married to one another. There are no other family relationships among any of our directors or executive officers.

Class II Director Nominees for Terms Expiring at the 2025 Annual Meeting

Bruce R. Evans has been a director of our company since 2010 and Lead Director since February 2022. Mr. Evans has served as president of Evans Capital LLC, a private investment fund, since March 2019. Mr. Evans has also served in various positions with Summit Partners, a growth equity and venture capital focused alternative investments firm, since 1986, including most recently as senior advisor to the firm, a role he has held since January 2018. From 2018 to March 2019, he served as chairman of Summit Partners’ board and as a senior advisor to the firm. From 2011 to December 2017, he served as managing director and as chairman of Summit Partners’ board. From 1999 to 2011, he was one of Summit Partners’ co-managing partners. During his 34 years with Summit Partners, Mr. Evans has served as a member of the boards of directors of over 35 technology and other growth industry companies in the United States and Europe, including 14 public companies. Since 2015, he has also served as a director of Analog Devices, a public company which designs and manufactures high-performance semiconductor products. In addition, Mr. Evans is chairman of the Vanderbilt University Board of Trust and the former chairman of Vanderbilt’s Investment Committee. Mr. Evans holds a B.E. in mechanical engineering and economics from Vanderbilt University and an M.B.A. from Harvard Business School. We believe that Mr. Evans is qualified to serve on our board of directors due to his wide-ranging experience in growth equity and venture capital investing in the technology sector and his experience on other private and public company boards.

Susana D’Emic has been a director of our company since December 2018. Ms. D’Emic has served as the senior vice president, chief accounting officer and controller of Booking Holdings, a leader in online travel and related services, since May 2019. She has also served as interim chief financial officer of Booking.com since October 2020. Ms. D’Emic served as the executive vice president and chief financial officer of Time Inc., a leading multi-platform media and content company, from November 2016 to April 2018. Ms. D’Emic was senior vice president, controller and chief accounting officer of Time Inc. from October 2013 to November 2016. Prior to that, Ms. D’Emic served as senior vice president, controller and chief accounting officer of Frontier Communications, a provider of phone, internet and video services to rural towns and cities across the country, from April 2011 to October 2013. Ms. D’Emic served in a number of finance roles, including as senior vice president, controller and chief accounting officer at Trusted Media Brands, Inc. (then Reader’s Digest Association, Inc.) from January 1998 to April 2011. Before joining Reader’s Digest, she held various positions with Kraft Foods International and Colgate-Palmolive Company and was an audit manager with KPMG. Ms. D’Emic is a certified public accountant and has a B.S. in accounting from The State University of New York at Binghamton. We believe that Ms. D’Emic is qualified to serve on our board of directors as a result of her strategic financial leadership experience as well as her experience in digital and organizational transformation.

5

Directors Continuing in Office Until the 2023 Annual Meeting

Lucy Xie has served as our senior vice president of operations since 2011 and as a member of our board of directors since 2003. From 2003 to 2011, Ms. Xie served as our chief financial officer and vice president of operations. Prior to joining Casa Systems, Ms. Xie held various accounting, finance and management positions at Raytheon, a U.S. defense contractor and industrial corporation, and Lucent Technologies, a telecommunications equipment company. Ms. Xie has also served as the vice chairman and a board member of the Asia-America Chamber of Commerce. Ms. Xie holds an M.B.A. in accounting from Fairleigh Dickinson University. We believe that Ms. Xie is qualified to serve on our board of directors due to her experience as an executive in the telecommunications industry, her extensive knowledge of our company and her service as our senior vice president of operations.

Bill Styslinger has been a director of our company since 2012. Mr. Styslinger served as chairman, president and chief executive officer of SeaChange International, a provider of multiscreen video software and services, from its inception in July 1993 until his retirement in December 2011. Mr. Styslinger has served as a board member of Scotgold Resources, Ltd., a publicly traded mineral exploration company, since September 2018, and Metrosoft, Inc., a fintech company that develops multi-tier, service-oriented asset management software, since October 2017. Mr. Styslinger was also previously a member of the board of directors of Omtool, a provider of enterprise client/server facsimile software solutions. Mr. Styslinger holds a B.S. in engineering science from the State University of New York at Buffalo. We believe that Mr. Styslinger is qualified to serve on our board of directors due to his leadership expertise, including service as chief executive officer of a public company with international operations, as well as his knowledge of the telecommunications industry.

Michael T. Hayashi has been a director of our company since November 2018. Mr. Hayashi served as a partner at Jinsei 2.0 Consulting, a technology and business consulting services firm focusing on the cable industry, from April 2015 to December 2017. Prior to his work at Jinsei, Mr. Hayashi spent more than 20 years at Time Warner Cable, Inc., a cable television service provider, including as executive vice president of architecture, development and engineering from 2010 to March 2015, as senior vice president of advanced engineering and subscriber technologies from 2000 to 2010, and as vice president of advanced engineering from 1993 to 2000. He previously served as chairman of Petrichor Technologies, an early stage developer of video service provider infrastructure software, from December 2016 to April 2019. He also previously served on the boards of directors of Espial Group Inc., a publicly traded supplier of television software and solutions, from April 2015 to April 2018, and Mindspeed Technologies, Inc., a semiconductor supplier, from 2005 until its acquisition by MACOM Technology Solutions Holdings, Inc. in 2013. Mr. Hayashi has a B.S. in engineering from Harvey Mudd College and an M.B.A. from The Ohio State University. We believe that Mr. Hayashi is qualified to serve on our board of directors as a result of his significant leadership experience in the telecommunications industry.

Directors Continuing in Office Until the 2024 Annual Meeting

Jerry Guo, the founder of our company, has served as our president, chief executive officer and as the chairman of our board of directors since our founding in 2003. Prior to founding our company, Mr. Guo served as the vice president of broadband at River Delta Networks, which was acquired by Motorola in 2001. Prior to that, Mr. Guo was a research scientist at Bell Laboratories’ research division. Mr. Guo holds a Ph.D. in electrical engineering from the University of Wisconsin-Madison and an M.S. in optical instruments from the Department of Precision Instruments at Tsinghua University. We believe that Mr. Guo is qualified to serve on our board of directors due to his leadership experience in the broadband and network industries, his extensive knowledge of our company and his service as our president and chief executive officer.

Daniel S. Mead has been a director of our company since March 2018. For over 35 years, Mr. Mead served in various leadership roles at Verizon Communications and its predecessor companies, including serving as the chief executive officer and president of Verizon Wireless from October 2010 to July 2016 and as the chief operating officer and executive vice president of Verizon Wireless from October 2009 to October 2010. Mr. Mead served as the chairman of the Cellular Telecommunications & Internet Association, or the CTIA, from July 2013 to December 2014. Mr. Mead has served on the board of directors of Syniverse Holdings, Inc., a privately held (formerly publicly traded) business services company in the mobile communications industry, since October 2016, and Terrestar, a Canadian-based telecommunications provider, since November 2015. He previously served as a member of the boards of directors of the CTIA from September 2010 to March 2015 and Vodafone Omnitel from September 2009 to October 2010. Mr. Mead also served on the Board of Trustees at Pennsylvania State University from July 2014 to July 2017, including as chairman of its Finance and Capital Planning Committee. Mr. Mead has a B.S. in quantitative business analysis and finance from Pennsylvania State University and an M.B.A. from Pennsylvania State University. We believe that Mr. Mead is qualified to serve on our board of directors as a result of his significant leadership experience in the telecommunications industry.

6

In addition to Mr. Guo, our president and chief executive officer, and Ms. Xie, our senior vice president of operations, who also serve as directors, our executive officers are:

Weidong Chen, age 53, has served as our chief technology officer since 2004. Mr. Chen previously served as a member of our board of directors from 2010 to 2019. Prior to joining Casa Systems, Mr. Chen served as a software manager at Motorola, a multinational telecommunications company, from October 2001 to November 2003. Mr. Chen holds a Ph.D. in physics from the University of Pennsylvania.

Scott Bruckner, age 63, has served as our chief financial officer since January 2020. Mr. Bruckner will be resigning as our chief financial officer, effective as of April 3, 2022, to attend to family matters. Mr. Bruckner previously served as our senior vice president of strategy and corporate development from November 2017 until January 2020. Prior to joining Casa Systems, Mr. Bruckner served as a senior managing director of Macquarie Group from June 2015 to November 2017 and as a partner at Perella Weinberg Partners from April 2007 to May 2015. Mr. Bruckner holds a B.A. in international relations and Slavic languages and literature from the University of Southern California and an M.A. and a Ph.D. in political science and political economy from the University of California, Los Angeles.

Board Experience, Skills and Diversity

We believe that our Board best serves the Company and our stockholders with a diversity of backgrounds, skillsets, industry experiences and expertise. The following matrices highlight our directors’ primary qualifications, demographics, and tenure. These matrices are intended as high-level summaries and not exhaustive lists of each director's skills or contributions to the Board.

Board Experience and Skills Matrix

| Jerry Guo | Susana D’Emic | Bruce Evans | Michael Hayashi | Daniel Mead | William Styslinger | Lucy Xie |

Qualifications | |||||||

CEO Experience | ✓ |

| ✓ |

| ✓ | ✓ |

|

Industry Experience | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ |

Technology Leadership | ✓ |

| ✓ | ✓ | ✓ | ✓ | ✓ |

Governance/Public Company Experience | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ |

|

Financial Experience | ✓ | ✓ | ✓ | ✓ | ✓ |

| ✓ |

International Experience | ✓ | ✓ | ✓ | ✓ |

| ✓ | ✓ |

Strategy Experience | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ |

Risk Management Experience | ✓ | ✓ |

|

| ✓ | ✓ |

|

Cybersecurity Experience |

|

| ✓ |

|

| ✓ | ✓ |

Board Tenure | |||||||

Director Since | 2003 | 2018 | 2010 | 2018 | 2018 | 2012 | 2003 |

7

Board Diversity Matrix

As of March 11, 2022 | ||||

Total Number of Directors: | 7 | |||

| Female | Male | Non-Binary | Did Not Disclose Gender |

Part I: Gender Identity |

|

|

|

|

Directors | 2 | 5 | — | — |

Part II: Demographic Background |

|

|

|

|

African American or Black | — | — | — | — |

Alaskan Native or Native American | — | — | — | — |

Asian | 1 | 2 | — | — |

Hispanic or Latinx | — | — | — | — |

Native Hawaiian or Pacific Islander | — | — | — | — |

White | 1 | 3 | — | — |

Two or More Races or Ethnicities | — | — | — | — |

LGBTQ+ | — | |||

Did not disclose Demographic Background | — | |||

8

Rule 5605 of the Nasdaq listing rules requires a majority of a listed company’s board of directors to be composed of independent directors within one year of listing. In addition, the Nasdaq listing rules require that, subject to specified exceptions, each member of a listed company’s audit, compensation and nominations committees be independent, or if a listed company has no nominations committee, that director nominees be selected or recommended for the board’s selection by independent directors constituting a majority of the board’s independent directors. The audit committee members must also satisfy independence criteria set forth in Rule 10A-3 under the Exchange Act, and compensation committee members must also satisfy the independence criteria set forth in Rule 10C-1 under the Exchange Act. Under Rule 5605(a)(2), a director will only qualify as an “independent director” if, in the opinion of our board of directors, that person does not have a relationship that would interfere with the exercise of independent judgment in carrying out the responsibilities of a director. In order to be considered independent for purposes of Rule 10A-3, a member of an audit committee of a listed company may not, other than in his or her capacity as a member of the audit committee, the board of directors, or any other board committee, accept, directly or indirectly, any consulting, advisory or other compensatory fee from the listed company or any of its subsidiaries or otherwise be an affiliated person of the listed company or any of its subsidiaries.

At least annually, our board of directors will evaluate all relationships between us and each director in light of relevant facts and circumstances for the purposes of determining whether a material relationship exists that might signal a potential conflict of interest or otherwise interfere with such director’s ability to satisfy his or her responsibilities as an independent director. Based on this evaluation, our board of directors will make an annual determination of whether each director is independent within the meaning of the independence standards of Nasdaq, the SEC and our applicable board committees.

Our board of directors has determined that each of Messrs. Evans, Hayashi, Mead and Styslinger and Ms. D’Emic is an “independent director” as currently defined under Rule 5605(a)(2) of the Nasdaq listing rules. With respect to our audit committee, our board of directors determined that each of Messrs. Hayashi and Mead and Ms. D'Emic satisfies the independence standards for audit committee membership established by the SEC and the Nasdaq listing rules. Our board of directors also determined that each of Messrs. Hayashi, Styslinger and Mead, who comprise our compensation committee, satisfy the independence standards for such committee established by the SEC and the Nasdaq listing rules. With respect to our nominating and corporate governance committee, our board of directors determined that each of Messrs. Evans and Styslinger and Ms. D’Emic satisfies the independence standards for such committee established by the SEC and the Nasdaq listing rules. In making such determinations, our board of directors considered the relationships that each such non-employee director has with our company and all other facts and circumstances our board of directors deemed relevant, including the beneficial ownership of our capital stock by each non-employee director and any institutional stockholder with which he or she is affiliated.

Our board of directors has considered the leadership structure of the board and determined that at this time Mr. Guo should serve both as our chief executive officer and as chairman of the board. Since 2003, Mr. Guo has served as our president and chief executive officer and has been an integral part of the leadership of our company and our board of directors, and his strategic vision has guided our growth and performance. Our board of directors believes that having Mr. Guo also serve as our chairman facilitates the board’s decision-making process and enables Mr. Guo to act as the key link between the board of directors and other members of management.

Our board of directors believes that it is beneficial for us and our stockholders to designate one of the directors as a lead director. The lead director serves a variety of roles including serving as principal liaison on board-wide issues between the independent directors and the chairman, presiding at the executive sessions of independent directors, assisting in the recruitment of board candidates, and having active involvement in establishing committee membership and committee chairs. Mr. Evans was elected by the independent directors to serve as our lead director.

Code of Business Conduct and Ethics

We have adopted a written code of business conduct and ethics that applies to our directors, officers and employees, including our principal executive officer, principal financial officer, and principal accounting officer or controller, or persons performing similar functions. A copy of the code is posted on the “Documents & Charters” page under the heading “Governance” on the Investor Relations section of our website, which is located at investors.casa-systems.com. In addition, we intend to continue to post on our website all disclosures that are required by law or the Nasdaq listing rules concerning any amendments to, or waivers from, any provision of the code.

9

Corporate Governance Guidelines

Our board of directors has adopted corporate governance guidelines to assist in the exercise of its duties and responsibilities and to serve the best interests of our company and our stockholders. The guidelines provide that:

| • | our board’s principal responsibility is to oversee the management of our company; |

| • | a majority of the members of our board must be independent directors; |

| • | the independent directors will meet in executive session at least twice a year; |

| • | directors have full and free access to management and, as necessary, independent advisors; |

| • | new directors participate in an orientation program and all directors are expected to participate in continuing director education on an ongoing basis; and |

| • | our board will conduct periodic self-evaluations to determine whether it and its committees are functioning effectively. |

A copy of our corporate governance guidelines is posted on the “Documents & Charters” page under the heading “Governance” on the Investor Relations section of our website, which is located at investors.casa-systems.com.

In February 2022, our board of directors adopted stock ownership guidelines establishing a minimum share ownership requirement for our non-employee directors, other than non-employee directors that elect not to receive compensation in connection with their service as non-employee directors. See the section titled “Executive Compensation—Other Compensation Policies—Stock Ownership Guidelines.”

Our board of directors meets on a regularly scheduled basis during the year to review significant developments affecting us and to act on matters requiring its approval. It also holds special meetings when important matters require action between scheduled meetings. Members of senior management regularly attend meetings to report on and discuss their areas of responsibility. Our board of directors met four times and took action by unanimous written consent two times during the fiscal year ended December 31, 2021.

Each of our directors attended at least 75% of the aggregate of all meetings of our board of directors and meetings of committees of our board of directors upon which they served during 2021. Our board of directors regularly holds executive sessions of the independent directors. Executive sessions do not include employee directors or directors who do not qualify as independent under Nasdaq and SEC rules.

It is our policy that members of our board of directors are encouraged to attend annual meetings of our stockholders. All of our directors attended our 2021 annual meeting of stockholders, which was a virtual meeting due to the coronavirus (COVID-19) pandemic.

Our board of directors has established an audit committee, compensation committee, and nominating and corporate governance committee. Each of these committees operates under a charter that has been approved by our board of directors. Copies of the committee charters are posted on the “Documents & Charters” page under the heading “Governance” on the Investor Relations section of our website, which is located at investors.casa-systems.com.

Audit Committee

The members of our audit committee are Messrs. Hayashi and Mead and Ms. D’Emic. Ms. D’Emic is the chair of our audit committee. Our board of directors has determined that Messrs. Hayashi and Mead and Ms. D’Emic are independent within the meaning of Rule 10A-3 under the Exchange Act. Our board of directors has determined that Ms. D’Emic is an “audit committee financial expert” as defined by applicable SEC rules.

Our audit committee’s responsibilities include:

| • | appointing, approving the compensation of, and assessing the independence of our registered public accounting firm; |

10

|

| • | overseeing the work of our registered public accounting firm, including through the receipt and consideration of reports from such firm; |

| • | reviewing and discussing with management and the registered public accounting firm our annual and quarterly financial statements and related disclosures; |

| • | monitoring our internal control over financial reporting, disclosure controls and procedures and code of business conduct and ethics; |

| • | discussing our risk management policies; |

| • | establishing policies regarding hiring employees from the registered public accounting firm and procedures for the receipt and retention of accounting related complaints and concerns; |

| • | meeting independently with our registered public accounting firm and management; |

| • | reviewing and approving or ratifying any related person transactions; and |

| • | preparing the audit committee report required by SEC rules. |

All audit services and all non-audit services, other than de minimis non-audit services, to be provided to us by our independent registered public accounting firm are required to be approved in advance by our audit committee.

Our audit committee met five times and took action by unanimous written consent one time during the fiscal year ended December 31, 2021. Our audit committee operates under a written charter adopted by our board of directors, a current copy of which is available on the “Documents & Charters” page under the heading “Governance” on the Investor Relations section of our website, which is located at investors.casa-systems.com.

Compensation Committee

The members of our compensation committee are Messrs. Hayashi, Mead and Styslinger. Mr. Styslinger is the chair of our compensation committee. Our board of directors has determined that Mr. Hayashi, Mr. Mead and Mr. Styslinger are independent within the meaning of Rule 10C-1 under the Exchange Act.

The compensation committee’s responsibilities include:

| • | annually reviewing and approving corporate goals and objectives relevant to CEO compensation; |

| • | determining our CEO’s compensation; |

| • | reviewing and approving, or making recommendations to our board of directors with respect to, the compensation of our other executive officers; |

| • | overseeing an evaluation of performance of our senior executives; |

| • | overseeing and administering our equity incentive plans; |

| • | reviewing and making recommendations to our board of directors with respect to director compensation; |

| • | reviewing and discussing annually with management our “Compensation Discussion and Analysis” disclosure to the extent such disclosure is required by SEC rules; and |

| • | preparing annual compensation committee reports to the extent required by SEC rules. |

Typically, our compensation committee meets quarterly and with greater frequency if necessary. The agenda for each meeting is usually developed by the chair of our compensation committee, in consultation with our senior vice president of operations, who is responsible for human resources. Our compensation committee meets regularly in executive session. Our president and chief executive officer does not participate in any deliberations or determinations of our compensation committee regarding his compensation or individual performance objectives. Our compensation committee has the authority to obtain, at our expense, advice and assistance from compensation consultants and internal and external legal, accounting or other advisors and other external resources that our compensation committee considers necessary or appropriate in the performance of its duties. Our compensation committee may select, or receive advice from, a compensation consultant, legal counsel or other adviser to the compensation committee, other than in-house legal counsel, and certain other types of advisers, only after assessing the independence of such person in accordance with SEC and Nasdaq requirements that bear upon the adviser’s independence; however, there is no requirement that any adviser be independent.

Our compensation committee has engaged Pearl Meyer as an independent compensation consultant. Pearl Meyer assisted the compensation committee with monitoring an appropriate compensation peer group for annual compensation comparison purposes and reviewed the current incentive compensation programs and their performance alignment with the company’s short- and long-term

11

business strategies. Our compensation committee evaluated our compensation consultants’ independence and concluded that the engagement of Pearl Meyer did not raise any conflict of interest after taking into consideration the applicable factors affecting consultant independence.

Our compensation committee met five times and took action by written consent eight times during the fiscal year ended December 31, 2021. Our compensation committee operates under a written charter adopted by our board of directors, a current copy of which is available on the “Documents & Charters” page under the heading “Governance” on the Investor Relations section of our website, which is located at investors.casa-systems.com.

Compensation Committee Interlocks and Insider Participation

The members of our compensation committee in 2021 were Messrs. Hayashi, Mead and Styslinger. None of our executive officers serves as a member of the board of directors or compensation committee, or other committee serving an equivalent function, of any entity that has one or more executive officers who serve as members of our board of directors or our compensation committee. None of the members of our compensation committee is an officer or employee of our company, nor have they ever been an officer or employee of our company.

Nominating and corporate governance committee

The members of our nominating and corporate governance committee are Messrs. Evans and Styslinger and Ms. D’Emic. Mr. Evans is the chair of our nominating and corporate governance committee. Our board of directors has determined that Mr. Evans, Mr. Styslinger and Ms. D’Emic are independent under Nasdaq Rule 5605(a)(2).

The nominating and corporate governance committee’s responsibilities include:

| • | recommending to our board of directors the persons to be nominated by our board of directors for election as directors at any meeting of stockholders and the persons to be elected by our board of directors to fill any vacancies on our board of directors; and |

| • | overseeing our board of directors’ corporate governance guidelines |

Our nominating and corporate governance committee met two times and took action by written consent one time during the fiscal year ended December 31, 2021. Our nominating and corporate governance committee operates under a written charter adopted by our board of directors, a current copy of which is available on the “Documents & Charters” page under the heading “Governance” on the Investor Relations section of our website, which is located at investors.casa-systems.com.

Oversight of Risk

Our board of directors oversees our risk management processes directly and through its committees. Our management is responsible for risk management on a day-to-day basis. The role of our board and its committees is to oversee the risk management activities of our management. They fulfill this duty by discussing with management the policies and practices utilized by management in assessing and managing risks and providing input on those policies and practices. In general, our board oversees risk management activities relating to business strategy, acquisitions, capital allocation, organizational structure and operations; our audit committee oversees risk management activities related to financial controls and legal and compliance risks; and our nominating and corporate governance committee oversees risk management activities related to the composition of our board. Each committee reports to the full board on a regular basis, including reports with respect to each committee’s risk oversight activities as appropriate. In addition, since risk issues often overlap, committees from time to time request that the full board discuss particular risks.

Director Nomination Process

Our nominating and corporate governance committee is responsible for identifying individuals qualified to serve as directors, consistent with criteria approved by our board of directors, and recommending to the board the persons to be nominated for election as directors, except where we are legally required by contract, law or otherwise to provide third parties with the right to nominate.

Our full board of directors is responsible for selecting nominees for election as directors and our board of directors considers the recommendations of our nominating and corporate governance committee when selecting nominees.

The process followed by our nominating and corporate governance committee to identify and evaluate director candidates includes requests to other board members as well as other existing contacts for recommendations, meetings from time to time to evaluate biographical information and background material relating to potential candidates, and interviews of selected candidates. The

12

qualifications, qualities and skills that our nominating and corporate governance committee believe must be met by a recommended nominee for a position on our board of directors are as follows:

| • | Nominees should have a reputation for integrity, honesty and adherence to high ethical standards. |

| • | Nominees should have demonstrated business acumen, experience and ability to exercise sound judgment in matters that relate to our current and long-term objectives and should be willing and able to contribute positively to our decision-making process. |

| • | Nominees should have a commitment to understand our company and our industry and to regularly attend and participate in meetings of our board of directors and its committees. |

| • | Nominees should have the interest and ability to understand the sometimes conflicting interests of our various constituencies, which include stockholders, employees, customers, governmental units, creditors and the general public, and to act in the interests of all stockholders. |

| • | Nominees should not have, nor appear to have, a conflict of interest that would impair the nominee’s ability to represent the interests of all of our stockholders and to fulfill the responsibilities of a director. |

| • | Nominees shall not be discriminated against on the basis of race, religion, national origin, sex, sexual orientation, disability or any other basis proscribed by law. The value of diversity on our board of directors is considered. |

| • | First-time nominees should normally be able to serve for at least five years before reaching the age of 75. |

Our nominating and corporate governance committee may use a third-party search firm in those situations where particular qualifications are required or where existing contacts are not sufficient to identify an appropriate candidate.

Stockholders may recommend individuals to our nominating and corporate governance committee for consideration as potential director candidates. Any such proposals should be submitted to our corporate secretary at our principal executive offices and should include appropriate biographical and background material to allow our independent directors to properly evaluate the potential director candidate and the number of shares of our stock beneficially owned by the stockholder proposing the candidate. The specific requirements for the information that is required to be provided for such recommendations to be considered are specified in our amended and restated by-laws and must be received by us no later than the date referenced below under the heading “Procedures for Submitting Stockholder Proposals.” Assuming that biographical and background material has been provided on a timely basis, any recommendations received from stockholders will be evaluated in the same manner as other potential nominees considered by our nominating and corporate governance committee. If our board of directors determines to nominate a stockholder-recommended candidate and recommends his or her election, then his or her name will be included on our proxy card for our next annual meeting of stockholders.

Our board of directors provides to every stockholder of the company the ability to communicate with our board of directors, as a whole, and with individual directors through an established process for stockholder communication. For a stockholder communication directed to our board of directors as a whole, stockholders may send such communication to the attention of our company’s corporate secretary via U.S. mail or expedited delivery service to: Casa Systems, Inc., 100 Old River Road, Andover, Massachusetts 01810, Attn: Board of Directors, c/o Corporate Secretary.

For a stockholder communication directed to an individual director in his or her capacity as a member of our board of directors, stockholders may send such communication to the attention of the individual director via U.S. mail or expedited delivery service to: Casa Systems, Inc., 100 Old River Road, Andover, Massachusetts 01810, Attn: [Name of Individual Director], c/o Corporate Secretary.

We will forward by U.S. mail any such stockholder communication to each director, and to the chairman of our board of directors in his or her capacity as a representative of our board of directors, to whom such stockholder communication is addressed to the address specified by each such director and the chairman of our board of directors, unless there are safety or security concerns that mitigate against further transmission.

13

RATIFICATION OF THE APPOINTMENT OF

OUR INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

We have appointed Ernst & Young as our independent registered public accounting firm to perform the audit of our consolidated financial statements for the fiscal year ending December 31, 2022 and to perform an audit of the effectiveness of our internal control over financial reporting as of December 31, 2022, and we are asking you and other stockholders to ratify this appointment. Ernst & Young has served as our independent registered public accounting firm since 2020.

As a matter of good corporate governance, our board of directors determined to submit to stockholders for ratification the appointment of Ernst & Young. A majority of the votes properly cast is required in order to ratify the appointment of Ernst & Young. In the event that a majority of the votes properly cast do not ratify this appointment of Ernst & Young, we will review our future appointment of Ernst & Young.

The audit committee of our board of directors has adopted policies and procedures for the pre-approval of audit and non-audit services for the purpose of maintaining the independence of our independent registered public accounting firm. We may not engage our independent registered public accounting firm to render any audit or non-audit service unless either the service is approved in advance by the audit committee, or the engagement to render the service is entered into pursuant to the audit committee’s pre-approval policies and procedures.

From time to time, our audit committee may pre-approve services that are expected to be provided to us by the independent registered public accounting firm during the following 12 months. At the time such pre-approval is granted, the audit committee must identify the particular pre-approved services in a sufficient level of detail so that our management will not be called upon to make a judgment as to whether a proposed service fits within the pre-approved services and, at each regularly scheduled meeting of the audit committee following such approval, management or the independent registered public accounting firm shall report to the audit committee regarding each service actually provided to us pursuant to such pre-approval.

The audit committee has delegated to its chairman the authority to grant pre-approvals of audit or non-audit services to be provided by the independent registered public accounting firm. Any approval of services by the chairman of the audit committee is reported to the committee at its next regularly scheduled meeting.

We expect that a representative of Ernst & Young will attend our Annual Meeting and the representative will have an opportunity to make a statement if he or she so chooses. The representative will also be available to respond to appropriate questions from stockholders.

The Report of the Audit Committee of our board of directors included in this Proxy Statement is submitted by our audit committee. Our audit committee consists of the three directors whose names appear in the Report. None of the members of our audit committee is an officer or employee of Casa Systems, and our board of directors has determined that each member of our audit committee is “independent” for audit committee purposes as that term is defined under Rule 10A-3 of the Exchange Act, and the applicable Nasdaq listing rules. See “Corporate Governance—Director Independence” above for additional discussion regarding our board’s independence determinations with respect to members of our audit committee. Each member of our audit committee meets the requirements for financial literacy under the applicable rules and regulations of the SEC and Nasdaq. Our board of directors has determined that Ms. D’Emic is an “audit committee financial expert,” as defined under the applicable rules of the SEC. Our audit committee operates under a written charter adopted by our board of directors.

Change in Independent Registered Public Accounting Firm

In July 2020, our audit committee began an evaluation of our then current independent registered public accounting firm. We conducted a competitive request for proposal process with several independent registered public accounting firms, including our previous incumbent auditor, PricewaterhouseCoopers LLP, or PwC. Upon conclusion of this evaluation, our audit committee approved the dismissal of PwC on August 24, 2020 and retained Ernst & Young as our independent registered public accounting firm for the fiscal year ending December 31, 2020. There were no disagreements with PwC, and we have authorized them to respond fully to the inquiries of the successor auditors.

The reports of PwC on our consolidated financial statements for each of the two years ended December 31, 2019 and 2018 did not contain an adverse opinion or disclaimer of opinion, nor were such reports qualified or modified as to uncertainty, audit scope or accounting principles.

14

In connection with the audits of our consolidated financial statements for each of the two fiscal years ended December 31, 2019 and 2018, and the subsequent interim period through August 24, 2020, there were no disagreements (as defined in Item 304(a)(1)(iv) of Regulation S-K and the related instructions to Item 304 of Regulation S-K) between our company and PwC on any matter of accounting principles or practices, financial statement disclosure, or auditing scope or procedure, which disagreement, if not resolved to the satisfaction of PwC, would have caused PwC to make reference to the subject matter of such disagreement in connection with its report. During the fiscal years ended December 31, 2019 and 2018, and the subsequent interim period through August 24, 2020, there was no “reportable event,” as described in Item 304(a)(1)(v) of Regulation S-K. In connection with the filing of our Current Report on Form 8-K on August 24, 2020, we provided PwC with a copy of the Form 8-K and requested that PwC furnish us with a letter addressed to the SEC stating whether PwC agreed with the statements made by our company in response to Item 304(a) of Regulation S-K, or if not, stating the respects in which it does not agree. We received the requested letter from PwC and we filed a copy of the letter, dated August 24, 2020, as Exhibit 16.1 to the Form 8-K.

The following table presents fees for professional services and other services rendered by Ernst & Young and PwC, our independent registered public accounting firms, for the years ended December 31, 2021 and 2020.

|

| 2021 Ernst & Young |

|

| 2020 Ernst & Young |

|

| 2020 PwC |

| |||

Audit Fees (1) |

| $ | 825,000 |

|

| $ | 703,000 |

|

| $ | 420,000 |

|

Audit-Related Fees (2) |

|

| — |

|

|

| — |

|

|

| — |

|

Tax Fees (3) |

|

| 677,435 |

|

|

| — |

|

|

| — |

|

All Other Fees (4) |

|

| 132,079 |

|

|

| 4,800 |

|

|

| — |

|

|

| $ | 1,634,514 |

|

| $ | 707,800 |

|

| $ | 420,000 |

|

(1) | Audit Fees represent fees for professional services provided in connection with the audit of our annual consolidated financial statements, the reviews of our quarterly condensed consolidated financial statements and statutory audits, consultations on accounting matters directly related to the audit, consents and assistance with and review of documents filed with the SEC, and services that are normally provided by our independent registered public accounting firm in connection with statutory audits required in regulatory filings. |

(2) | Audit-Related Fees represent fees for assurance and related services that are reasonably related to the performance of the audit or review of our financial statements. |

(3) | Tax Fees represent fees for tax compliance and tax consulting and advice. |

(4) | All Other Fees represent fees for products and services provided by Ernst & Young and PwC that are not included in the service categories above. |

Recommendation of our Board of Directors

THE BOARD RECOMMENDS THAT YOU VOTE “FOR” RATIFICATION OF THE APPOINTMENT OF ERNST & YOUNG LLP AS OUR INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM FOR THE FISCAL YEAR ENDING DECEMBER 31, 2022. |

15

Report of the Audit Committee of our Board of Directors

The information contained in this audit committee report shall not be deemed to be (1) “soliciting material,” (2) “filed” with the SEC under the Securities Act of 1933, as amended (the “Securities Act”), or the Exchange Act, (3) subject to Regulations 14A or 14C of the Exchange Act, or (4) subject to the liabilities of Section 18 of the Exchange Act. No portion of this audit committee report shall be deemed to be incorporated by reference into any filing under the Securities Act or the Exchange Act, through any general statement incorporating by reference in its entirety the proxy statement in which this report appears, except to the extent that Casa Systems specifically incorporates this report or a portion of it by reference.

Our audit committee’s general role is to assist our board of directors in monitoring our financial reporting process and related matters. Its specific responsibilities are set forth in its charter.

Our audit committee has reviewed our consolidated financial statements for 2021 and met with management, as well as with representatives of Ernst & Young, our independent registered public accounting firm, to discuss the consolidated financial statements. Our audit committee also discussed with members of Ernst & Young the matters required to be discussed by the Auditing Standard No. 1301, as adopted by the Public Company Accounting Oversight Board.

In addition, our audit committee received the written disclosures and the letter from Ernst & Young required by applicable requirements of the Public Company Accounting Oversight Board regarding the independent registered public accounting firm’s communications with our audit committee concerning independence, and discussed with members of Ernst & Young its independence.

Based on the foregoing communications, its review of the financial statements and other matters it deemed relevant, our audit committee recommended to our board of directors that our audited consolidated financial statements for 2021 be included in our Annual Report on Form 10-K for the fiscal year ended December 31, 2021.

Audit Committee

Susana D’Emic (Chair)

Daniel S. Mead

Michael Hayashi

16

CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth information with respect to the beneficial ownership of our common stock, as of March 11, 2022, by:

| • | each person, or group of affiliated persons, known by us to beneficially own more than 5% of our common stock; |

| • | each of our directors; |

| • | each of our named executive officers; and |

| • | all of our executive officers and directors as a group. |

The percentages in the table below are based on a total of 84,689,756 shares of our common stock outstanding as of March 11, 2022, but not including any additional shares issuable upon exercise of outstanding options.

The number of shares beneficially owned by each stockholder is determined under rules of the SEC and includes voting or investment power with respect to securities. Under these rules, beneficial ownership includes any shares as to which the individual or entity has sole or shared voting power or investment power. In computing the number of shares beneficially owned by an individual or entity and the percentage ownership of that person, shares of common stock subject to options or other rights held by such person that are currently exercisable or will become exercisable within 60 days after March 11, 2022, are considered outstanding, although these shares are not considered outstanding for purposes of computing the percentage ownership of any other person. Unless otherwise indicated, the address of all listed stockholders is c/o Casa Systems, Inc., 100 Old River Road, Andover, Massachusetts 01810. Each of the stockholders listed has sole voting and investment power with respect to the shares beneficially owned by the stockholder unless noted otherwise, subject to community property laws where applicable. Beneficial ownership representing less than 1% is denoted with an asterisk (*).

Name of Beneficial Owner |

| Shares Beneficially Owned |

|

| Percentage of Shares Beneficially Owned |

| ||

5% Stockholders |

|

|

|

|

|

|

|

|

Entities affiliated with Summit Partners(1) |

|

| 34,124,480 |

|

|

| 40.2 | % |

AllianceBernstein L.P. |

|

| 4,514,498 |

|

|

| 5.3 | % |

Executive Officers and Directors |

|

|

|

|

|

|

|

|

Jerry Guo(2) |

|

| 13,183,370 |

|

|

| 15.1 | % |

Weidong Chen(3) |

|

| 6,072,374 |

|

|

| 7.1 | % |

Lucy Xie(4) |

|

| 2,729,930 |

|

|

| 3.2 | % |

Scott Bruckner(5) |

|

| 519,890 |

|

| * |

| |

Matthew Slepian |

|

| 23,417 |

|

| * |

| |

Susana D'Emic |

|

| 80,205 |

|

| * |

| |

Bruce R. Evans(1) |

|

| 34,124,480 |

|

|

| 40.2 | % |

Michael T. Hayashi |

|

| 84,801 |

|

| * |

| |

Daniel S. Mead |

|

| 77,777 |

|

| * |

| |

Bill Styslinger |

|

| 513,413 |

|

| * |

| |

All executive officers and directors as a group (10 persons)(6) |

|

| 57,409,657 |

|

|

| 64.8 | % |

(1) | Consists of 21,268,476 shares of common stock held by Summit Partners Private Equity Fund VII-A, L.P., 12,774,194 shares of common stock held by Summit Partners Private Equity Fund VII-B, L.P., 72,605 shares of common stock held by Summit Investors I, LLC and 9,205 shares of common stock held by Summit Investors I (UK), L.P. Summit Partners, L.P. is the managing member of Summit Partners PE VII, LLC, which is the general partner of Summit Partners PE VII, L.P., which is the general partner of each of Summit Partners Private Equity Fund VII-A, L.P. and Summit Partners Private Equity Fund VII-B, L.P. Summit Master Company, LLC is the managing member of Summit Investors Management, LLC, which is the manager of Summit Investors I, LLC, and the general partner of Summit Investors I (UK), L.P. Summit Master Company, LLC, as the managing member of Summit Investors Management, LLC, has delegated investment decisions, including voting and dispositive power, to Summit Partners, L.P. and its investment committee responsible for voting and investment decisions with respect to our company. Summit Partners, L.P., through a three-person investment committee responsible for voting and investment decisions with respect to our company, currently comprised of Peter Y. Chung, Bruce R. Evans and Martin J. Mannion, has voting and dispositive power over the shares held by each of these entities and therefore may be deemed to beneficially own such shares. Each of the Summit entities and persons mentioned in this footnote disclaims beneficial ownership of the shares, except for those shares held of record by such entity, and except to the extent of their pecuniary interest therein. The address of the entities and persons mentioned in this footnote is 222 Berkeley Street, 18th Floor, Boston, Massachusetts |

17

02116. For information regarding Summit Partners, L.P. and its affiliates, we have relied on Amendment No. 1 to Schedule 13G filed by Summit Partners, L.P. with the SEC on February 13, 2019. |

(2) | Consists of (i) 10,785,223 shares of common stock held by Mr. Guo and (ii) options to purchase 2,398,147 shares of common stock that may be exercised within 60 days of March 11, 2022. |

(3) | Consists of (i) 2,167,404 shares of common stock held by Mr. Chen, (ii) options to purchase 320,313 shares of common stock that may be exercised within 60 days of March 11, 2022 and (iii) 3,584,657 shares of common stock held by Dragonfly 2012 Irrevocable Trust, a family trust established for the children of Mr. Guo and Ms. Xie. Mr. Chen serves as trustee for Dragonfly 2012 Irrevocable Trust and has voting and dispositive control over the shares held by Dragonfly 2012 Irrevocable Trust. Mr. Chen and Dragonfly 2012 Irrevocable Trust each disclaim beneficial ownership of such shares, except for those shares held of record by such person or entity, and except to the extent of such person or entity’s pecuniary interest therein. |

(4) | Consists of (i) 2,169,379 shares of common stock held by Ms. Xie and (ii) options to purchase 560,551 shares of common stock that may be exercised within 60 days of March 11, 2022. |

(5) | Consists of (i) 114,890 shares of common stock held by Mr. Bruckner and (ii) options to purchase 375,000 shares of common stock that may be exercised within 60 days of March 11, 2022. |

(6) | Includes (i) 16,046,509 shares of common stock held by our current directors and executive officers, and (ii) options to purchase 3,654,011 shares of common stock that may be exercised within 60 days of March 11, 2022 by our current directors and executive officers. |

18

Section 16(a) Beneficial Ownership Reporting Compliance

Section 16(a) of the Exchange Act requires our directors, executive officers and beneficial owners of more than 10% of our common stock to file reports of holdings and transactions in our common stock and other securities of ours with the SEC. Based solely on our review of copies of such forms that we have received, or written representations from reporting persons, we believe that during the fiscal year ended December 31, 2021, all executive officers, directors and greater than 10% stockholders complied with all applicable filing requirements under Section 16(a) of the Exchange Act.

19

Our compensation program is designed to:

| • | Attract, Motivate and Retain Talent – We seek to offer compensation that will attract exceptional employment candidates, incentivize and reward outstanding employee performance, and offer total compensation that is competitive with the market. |

| • | Align with Company Culture – We seek to structure compensation and incentives to align employee behavior with our core values. |

| • | Align with Performance – We seek to incorporate variability into our compensation program such that compensation will reflect corporate and individual achievement relative to our strategic objectives. |

| • | Align with Stockholder Interests – We seek to structure compensation and incentives, particularly with respect to equity award grants, so as to create alignment with stockholder interests. |

Our compensation committee is responsible for reviewing and ultimately approving the chief executive officer’s compensation and pay recommendations presented by the chief executive officer for our other executive officers. Our management team determines the compensation of all other employees (subject to the compensation committee’s approval of the company-wide merit pool budget, short-term incentive and long-term incentive plan design, cost and share pool budgets).

Our compensation committee is authorized to retain the services of one or more executive compensation advisors, as it sees fit, in connection with the establishment of our executive compensation programs and related policies. Our compensation committee engaged Pearl Meyer in 2021 to assist the compensation committee with monitoring an appropriate compensation peer group for annual compensation comparison purposes and review the current incentive compensation programs and their performance alignment with the company’s short- and long-term business strategies, as well as to evaluate and advise on a performance-based approach to our long-term compensation program for the coming fiscal year with the overall goal of designing the company’s executive compensation philosophy and strategy. We do not believe the retention of, and the work performed by, Pearl Meyer creates any conflict of interest.

Principal Compensation Program

Our compensation program consists of three core elements: (1) base salary and benefits, (2) a short-term incentive plan, and (3) a long-term incentive plan. The table below provides an overview of these elements, their respective purposes, how they are determined and adjusted, and the deliverables associated with each.

Compensation Element | Purpose | Determination & Adjustment Factors | Deliverables |

Base Salary and Benefits | Attract and retain employees through competitive pay and benefit programs; provide alignment with the Company’s core values | Individual performance, experience, tenure, competitive market data, internal equity and employee potential | Base salary – fixed bi-weekly cash payments

Benefits – health and welfare insurance, and retirement savings programs |

Short-Term Incentive Plan | Create an incentive for the achievement of pre-defined annual business and individual objectives | For target bonuses – competitive market data and internal equity

For actual bonus payouts – performance against pre-established criteria | Annual variable cash payout |

20