In January 2016, AXA Financialpre-paid a $177 million term loan from AXA Insurance UK PLC and $72 million term loan from AXA France IARD S.A. As a result of thispre-payment, AXA Financial incurred a prepayment penalty of $43 million.

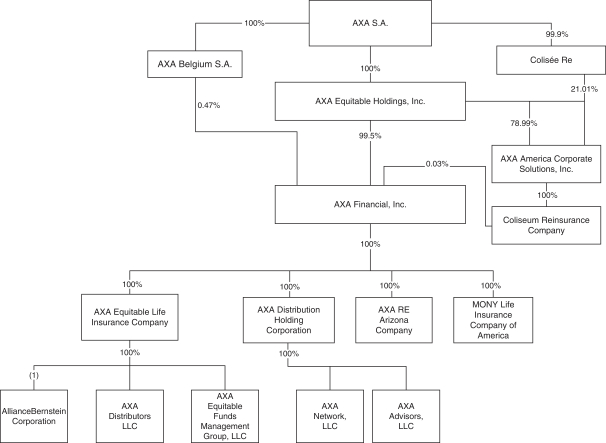

In October 2012, AXA Financial issued a note denominated in Euros in the amount of €300 million or $391 million to AXA Belgium. This note had an interest rate of Europe Interbank Offered Rate (“EURIBOR”) plus 115 basis points and a maturity date of October 23, 2017. Concurrently, AXA Financial entered into a swap with AXA covering the exchange rate on both the interest and principal payments related to this note. The interest rate on the swap was 6-month LIBOR plus 147.5 basis points. In October 2017, the note was extended to March 30, 2018. The extended note has a floating interest rate of 1-month EURIBOR plus six basis points with a minimum rate of 0%. Concurrently, AXA Financial entered into a swap with AXA covering the exchange rate on both the interest and principal payments related to the extended note until March 30, 2018. Both the loan and the swap were repaid on March 29, 2018. The 2017, 2016 and 2015 interest cost related to this note totaled approximately $12 million, $9 million and $7 million, respectively.

In December 2014, AXA Financial received a $2,727 million,3-month LIBOR plus 1.06% margin term loan from AXA. The loan has a maturity date of December 18, 2024. In June 2015, AXA Financial repaid $520 million and during 2016 repaid an additional $1,200 million of this loan. The outstanding balance on this loan at December 31, 2017 is $1,007 million. The 2017, 2016 and 2015 interest cost related to this loan totaled approximately $23 million, $23 million and $33 million, respectively.

In December 2015, AXA Financial received a $300 million1-month LIBOR plus 0.58% unsecured loan from AXA. The Company repaid this loan on June 30, 2016.

In 2015, Holdings received a $366 million 3-month LIBOR plus 1.44% loan from AXA. The loan has a maturity date of October 8, 2022. The 2017, 2016 and 2015 interest cost related to this loan totaled approximately $9 million, $8 million and $2 million, respectively.

In 2013, Holdings received $242 million and $145 million 4.75% loans from Coliseum Re. The loans each have a maturity date in December 2028. The 2017, 2016 and 2015 interest cost related to both loans from Coliseum Re totaled approximately $18 million each year.

In 2017, Holdings repaid a $56 million 1.39% loan from AXA CS originally made in 2015. The 2017, 2016 and 2015 interest cost related to the loan was approximately $2 million, $1 million and $1 million, respectively. In 2017, Holdings received a $100 million and $10 million loan from AXA CS. The loans had interest rates of 1.86% and 1.76%, respectively, and were repaid on their maturity date of February 5, 2018.

In 2016, AXA Tech repaid a $4 million 12-month LIBOR plus 1.42% loan from SAS.

In December 2017, Holdings received a $622 million, 3-month LIBOR plus 0.439% margin term loan from AXA. The loan has a maturity date of June 8, 2018. The loan was repaid on March 22, 2018.

Guarantees

AXA Financial paid fees to AXA for certain guarantees related to our employee benefit plans which were terminated in May 2016. For the years ended December 31, 2016 and 2015, fees associated with these guarantees were $0.4 million and $1.2 million, respectively.

We pay fees to AXA for its guarantee of our borrowing under certain third-party credit facilities, commercial paper and from AXA Belgium. For the years ended December 31, 2017, 2016 and 2015, fees associated with these guarantees were $8.7 million, $7.9 million and $8.0 million, respectively.

307