Exhibit (a)(5)(G)

| | | | |

| | | | FILED |

| | UNITED STATES DISTRICT COURT | | 2010 AUG 23 P 3:37 |

| | EASTERN DISTRICT OF VIRGINIA | | CLERK US DISTRICT COURT |

| | (Alexandria Division) | | ALEXANDRIA, VIRGINIA |

| | | | |

| HOWARD S. JACKREL, Individually and on | | ) | | Civil Action No. 1:10 CV 941 CMH/TCB |

| Behalf of All Others Similarly Situated, | | ) ) | | CLASS ACTION |

| Plaintiff, | | ) | | |

| | ) | | COMPLAINT BASED UPON BREACH |

vs. | | ) | | OF FIDUCIARY DUTIES |

| | ) | | |

| ICX TECHNOLOGIES, INC., HANS C. | | ) | | |

| KOBLER, COLIN J. CUMMING, E. | | ) | | |

| SPENCER ABRAHAM, RODNEY E. | | ) | | |

| SLATER, JOSEPH M. JACOBS, ROBERT A. | | ) | | |

| MAGINN, JR., and MARK L. PLAUMANN, | | ) | | |

| Defendants. | | ) ) | | |

| | | ) | | DEMAND FOR JURY TRIAL |

Plaintiff alleges upon knowledge as to his own acts and upon information and belief as to all other matters, as follows:

SUMMARY OF THE ACTION

1. This is a stockholder class action brought by plaintiff, individually and on behalf of the public shareholders of ICx Technologies, Inc. (“ICx” or the “Company”) against ICx and the Board of Directors of ICx (the “Board”), arising out of their agreement to sell ICx to FLIR Systems, Inc. (“FLIR”) via a coercive and unfair process (the “Proposed Transaction”) and at the unfair price of $7.75 per share. In pursuing the Proposed Transaction, which is being made via tender offer, each of the defendants has violated applicable law by directly breaching and/or aiding breaches of fiduciary duties of loyalty and due care owed to plaintiff and the proposed Class (as defined herein).

- 1 -

2. ICx develops and integrates advanced sensor technologies for homeland security, force protection and commercial applications.

3. The Proposed Transaction is the product of an unfair sales process designed to deliver the Company to FLIR, on terms preferential to FLIR, so that certain Company insiders could secure material benefits not shared with the Company’s public shareholders.

4. Indeed, the sales process itself was apparently non-existent. Even ICx’s CEO, defendant Colin Cumming, admitted in a letter to ICx employees following the announcement of the Proposed Transaction that the “board agreed that the company would be best served if this process was not made public.”1

5. The non-existent sales process was also designed to benefit ICx’s majority stockholder, Wexford Capital LP (“Wexford”), which has agreed to tender approximately 62% of ICx’s outstanding shares in the Proposed Transaction, so that Wexford can sell its ICx stocken mass,which it would otherwise not be able to do on the open market without driving the price of ICx stock – and, thus, Wexford’s investment in the Company – down substantially. That is, Wexford holds a large, illiquid block of Company stock that it would not be able to cash out absent the Proposed Transaction. Without the liquidity event promised by FLIR in the Proposed Transaction, Wexford could not sell their shares on the open market in a block sale without taking a liquidity discount and/or driving down the Company’s stock price and thus the value of the shares. The only other option would be to sell its shares slowly into the market, which is not an attractive option at all for Wexford, who is looking to cash out quickly.

| 1 | http://www.sec.gov/Archives/edgar/data/l334303/000119312510190360/dsc14d9c.htm. |

- 2 -

6. In further breach of their fiduciary duties, the Board has agreed to lock up the Proposed Transaction with preclusive deal protection devices that make it financially unrealistic for competing bidders to forward with a higher bid for shareholders. Specifically, the Board has agreed to: (i) a top-up option that provides FLIR with the right to buy at a nominal price as many of the Company’s unissued shares as are necessary to reach the minimum threshold to conduct a short-form merger, ownership of 90% of the Company’s outstanding shares, as long FLIR secures tender of a simple majority of the Company’s shares; (ii) a no-shop clause that prohibits the Company from providing confidential Company information to or even communicating with potential competing bidders except under extremely limited conditions; (iii) a termination fee provision that obligates the Company to pay FLIR an over $8 million termination fee in the event the Board decides to change its recommendation in favor of another bidder; and (iv) a tender agreement that obligates Wexford to vote in favor of the Proposed Transaction, which, according to publicly-available information, equates to 61.57% of the Company’s stock.

7. Plaintiff seeks to enjoin the Proposed Transaction.

JURISDICTION AND VENUE

8. This Court has jurisdiction over the subject matter of this action pursuant to 28 U.S.C. §1332(a)(2) in that plaintiff and defendants are citizens of different states and the matter in controversy exceeds $75,000, exclusive of interest and costs. This Court also has jurisdiction over this action pursuant to 15 U.S.C. §78bb(f)(3)(A)(i), because it is a class action based upon the statutory or common law of Delaware, ICx’s state of incorporation, and thus may be maintained in federal court. This Court has supplemental jurisdiction under 28 U.S.C. §1367.

9. Venue is proper in this District pursuant to 28 U.S.C. §1391 because defendant ICx has its principal place of business in this District. Plaintiff’s claims arose in this District, where most of the actionable conduct took place, where most of the documents are electronically stored and

- 3 -

where the evidence exists, and where virtually all the witnesses are located and available to testify at the jury trial permitted on these claims in this Court. Moreover, each of the Individual Defendants, as Company officers and/or directors, has extensive contacts with this District.

PARTIES

10. Plaintiff is, and has been at all times relevant hereto, an ICx shareholder. Plaintiff is a citizen of Arizona.

11. ICx is a Delaware corporation, headquartered in 2100 Crystal Drive, Suite 650, Arlington, VA 22202. ICx is, and at all times relevant hereto was, listed and traded on the Nasdaq Stock Exchange under the symbol “ICXT.” ICx, together with its subsidiaries, engages in the development and integration of advanced sensor technologies for homeland security, force protection, and commercial applications. The company operates through three segments: Detection, Surveillance, and Solutions.

12. Defendant Hans C. Kobler (“Kobler”) is the Executive Chairman and Co-Founder of ICx. Notably, Wexford is the manager or investment manager to,inter alia,DPI LLC and Valentis SB, L.P. Kobler has an ownership interest in DPI and Valentis through an affiliate of DPI. In addition, Kobler serves on the investment advisory committee of Digital Power Capital, LLC, which is an affiliate of Wexford, DPI and Valentis. Kobler also has a contractual relationship with certain Wexford-related entities pursuant to which Kobler receives a payment to be determined based on, in each case, five percent of the net profits in excess of a preferred return realized by the Wexford-related entities from certain investments made by them, including their investments in ICx.2 Kobler is a resident of Suffolk County, NY.

| 2 | http://www.sec.gov/Archives/edgar/data/l334303/000119312510101951/ddef14a.htm. |

- 4 -

13. Defendant Colin J. Cumming (“Cumming”) is the CEO, President, and a director of ICx. Cumming also serves as President and CEO of Nomadics, Inc., a wholly-owned subsidiary of ICx. Cumming is a resident of Payne County, OK.

14. Defendant E. Spencer Abraham (“Abraham”) is an ICx director. Abraham served as Secretary of the Department of Energy from January 2001 until he resigned in November 2004. Prior to becoming Energy Secretary, Abraham represented Michigan in the United States Senate from 1995 to 2001. Before his election to the Senate, Abraham served as co-chairman of the National Republican Congressional Committee from 1991 to 1993. Abraham is a resident of Fairfax County, VA.

15. Defendant Rodney E. Slater (“Slater”) is an ICx director. Slater is currently a partner at the law firm of Patton Boggs LLP, where he has been a member since 2001. Slater served under President Clinton as the 13th Secretary of the Department of Transportation from 1997 to 2001. Before becoming Secretary, Slater was Administrator of the Federal Highway Administration from 1992 to 1997. Slater is a resident of D.C. County, Washington, DC.

16. Defendant Joseph M. Jacobs (“Jacobs”) is an ICx director. Jacobs is the President of Wexford. Jacobs is a resident of Westchester County, NY.

17. Defendant Robert A. Maginn, Jr. (“Maginn”) is an ICx director. Maginn currently serves as Chief Executive Officer and Chairman of Jenzabar, Inc., a provider of software and services for higher education. Maginn joined Jenzabar’s Board of Directors in 1998 and became their CEO in March 2001. Prior to his tenure at Jenzabar, Maginn worked for over seventeen years at private equity giant Bain & Company, where he attained the position of Senior Partner and Director. Maginn is a resident of Middlesex County, MA.

- 5 -

18. Defendant Mark L. Plaumann (“Plaumann”) is an ICx director. Plaumann is currently a Managing Member of Greyhawke Capital Advisors LLC, which he co-founded in 1998. Prior to founding Greyhawke, Plaumann was a Senior Vice President of Wexford. Plaumann is a resident of Westchester County, NY.

19. The defendants identified in ¶¶ (12-18 are at times collectively referred to as the “Individual Defendants.”

20. The Individual Defendants, as officers and directors of the Company, owe fiduciary duties to the public shareholders. As alleged herein, they have breached their fiduciary duties by failing to maximize shareholder value in a proposed sale of the Company.

CLASS ACTION ALLEGATIONS

21. Plaintiff brings this action individually and as a class action pursuant to Federal Rule of Civil Procedure 23, on behalf of all holders of ICx stock who are being and will be harmed by defendants’ actions described herein (the “Class”). Excluded from the Class are defendants herein and any person, firm, trust, corporation, or other entity related to or affiliated with any defendants.

22. This action is properly maintainable as a class action.

23. The Class is so numerous that joinder of all members is impracticable. ICx has outstanding approximately 34.9 million shares owned by thousands of shareholders.

24. There are questions of law and fact which are common to the Class, including,inter alia,the following:

(a) whether the Individual Defendants have breached their fiduciary duties of undivided loyalty and due care with respect to plaintiff and the other members of the Class in connection with the Proposed Transaction;

(b) whether the Individual Defendants have erected barriers designed to deter interested bidders, other than FLIR;

- 6 -

(c) whether the Individual Defendants have disclosed to the Company’s public shareholders all material information necessary for said shareholders to make a decision as to whether to vote their shares in support of the Proposed Transaction; and

(d) whether plaintiff and the other members of the Class will be irreparably harmed if the transactions complained of herein are consummated.

25. Plaintiff’s claims are typical of the claims of the other members of the Class and plaintiff does not have any interests adverse to the Class.

26. Plaintiff is an adequate representative of the Class, has retained competent counsel experienced in litigation of this nature, and will fairly and adequately protect the interests of the Class.

27. The prosecution of separate actions by individual members of the Class would create a risk of inconsistent or varying adjudications which would establish incompatible standards of conduct for the party opposing the Class.

28. Defendants have acted on grounds generally applicable to the Class with respect to the matters complained of herein, thereby making appropriate the relief sought herein with respect to the Class as a whole.

SUBSTANTIVE ALLEGATIONS

ICx’s Growth Potential Is Undeniable

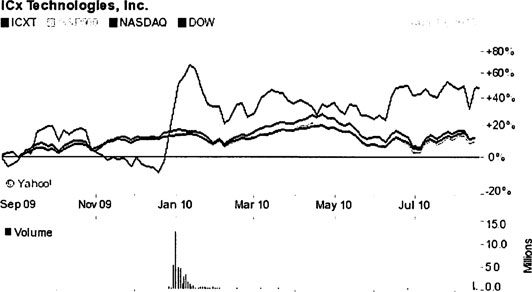

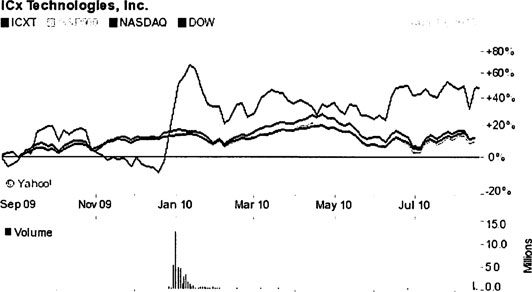

29. ICx’s stock chart exemplifies the Company’s tangible rise to the range of share prices ICx’s stock holders have been experiencing lately, and before the announcement of the Proposed Transaction, which also shows that the Company’s stock has beenabovethe consideration in the Proposed Transaction very recently, and has outperformed the general market:

- 7 -

- 8 -

30. Indeed, analysts watching ICx have set a price target for the Company at $10.00 per share:3

| | |

Analyst Opinion | | |

Recommendation Summary* | | |

Mean Recommendation (this week): | | 2.5 |

Mean Recommendation (last week): | | 2.5 |

Change: | | 0.00 |

- (Strong Buy) 1.0 - 5.0 (Sell) | | |

| | |

Compare to Industry | | |

Price Target Summary | | |

Mean Target: | | 10.00 |

Median Target: | | 10.00 |

High Target: | | 10.00 |

Low Target: | | 10.00 |

No. of Brokers: | | 1 |

Data provided byThomson/First Call | | |

The Proposed Acquisition of the Company

31. All indications - including from ICx and FLIR - are that ICx’s value (and, thus, its share price) is steadily poised to continue climbing.

32. Yet, Defendants want to give this Company away at a steal to FLIR.

33. Indeed, ICx shareholders, however, will not be allowed to share in the Company’s bright future profits. On August 16, 2010, defendants announced the Proposed Transaction in a press release entitled “ICx Technologies Agrees to be Acquired by FLIR Systems for $7.55 Per Share in Cash.” The press release stated, in relevant part:

ARLINGTON, Va. (August 16, 2010) ICx Technologies, Inc. (Nasdaq GM: ICXT),

a developer of advanced sensor technologies for homeland security, force protection

and commercial applications, has entered into a definitive merger agreement with

FLIR Systems, Inc. (Nasdaq: FLIR) pursuant to which ICx would be acquired

through a cash tender offer, followed by a merger with a subsidiary of FLIR, for a

| 3 | http://finance.yahoo.com/q/ao?s=ICXT+A21nalyst+Opinion (last visited, Aug. 20, 2010). |

- 9 -

price of $7.55 per share in cash. FLIR is a leader in the design, manufacturing, and marketing of thermal imaging and stabilized camera systems for a wide variety of thermography and imaging applications. ICx anticipates that the transaction could be completed in the fourth quarter of 2010.

ICx’s Board of Directors has unanimously approved the merger agreement and the transactions contemplated by the merger agreement, and has resolved to recommend that ICx’s stockholders tender their shares in connection with the tender offer. In addition, certain affiliates of Wexford Capital LP have agreed to tender approximately 62% of ICx’s outstanding shares in the tender offer, subject to the ICx Board of Directors’ continued recommendation of the transaction. The closing of the tender offer is subject to certain customary conditions, including the tender of at least a majority of ICx’s shares outstanding on a fully diluted basis and antitrust clearance. The merger agreement contemplates that the merger would be completed shortly following completion of the tender offer if a “short form” merger is available under Delaware law. If a short form merger is not available, then the merger would be completed after approval of the merger at a stockholders’ meeting, which would held as soon as reasonably permissible under Delaware law and applicable rules and regulations of the Securities and Exchange Commission.

Subject to compliance with the merger agreement, ICx would be permitted to consider unsolicited acquisition proposals and to terminate the merger agreement to accept a superior proposal following an opportunity given to FLIR to offer to improve the terms of its proposed acquisition and upon payment of a breakup fee to FLIR of $8.2 million.

34. FLIR recognizes the unique value of ICx’s products. As was stated by Earl Lewis, President and CEO of FLIR, “The transaction presents an attractive opportunity to add ICx’s market leading CBRNE technologies to FLIR’s product portfolio and leverage FLIR’s global infrastructure to reduce costs and drive growth.”

35. In fact, despite a weak performance in the first quarter 2010, FLIR CEO Lewis expects a much better second quarter: “The second half should be much better than the first half. They – I haven’t actually read their announcement which I think is out this morning but clearly their first half didn’t ship a number of things that should have shipped, it seems. So, we would suspect that they would have a much better second half.”

36. Clearly, then, FLIR is trying to capitalize on an anomaly in ICx’s stock price downturn following the announcement of poor first quarter 2010 results.

- 10 -

37. The Proposed Transaction is the product of an unfair sales process designed to deliver the Company to FLIR, on terms preferential to FLIR, so that certain Company insiders and Wexford could secure material benefits not shared with the Company’s public shareholders. Indeed, the sales process itself was apparently non-existent.

38. The sales process was driven by materially interested Company insiders led by the Company’s CEO and majority 61% shareholder, Wexford (which has obligated itself and its affiliates to tender its stock in the Proposed Transaction), which means that they will receive a windfall after cashing out their shares if the Proposed Transaction is consummated.

39. The following chart shows the Company insiders’ compensation over the last several years:

EXECUTIVE COMPENSATION

Summary Compensation Table

The following table summarizes compensation for the individuals who served as our Chief Executive Officer during fiscal year 2009 and our Chief Financial Officer (collectively, our “named executive officers”) for the years ended December 31, 2009, 2008 and 2007.

| | | | | | | | | | | | | | | | | | | | | | |

Name and Principal Position | | Year | | Salary

($) | | Bonus

($) | | Stock

Awards

($)(1) | | Option

Awards

($)(1) | | | All Other

Compensation

($)(2) | | | Total ($) |

Hans C. Kobler (3) | | 2009 | | $ | 424,263 | | $ | 50,000 | | $ | — | | $ | 585,126 | (4) | | $ | 3,767 | (5) | | $ | l,063,156 |

Executive Chairman, Former President and Chief Executive Officer | | 2008 | | | 450,000 | | | — | | | — | | | — | | | | 8,328 | (5) | | | 458,328 |

| | 2007 | | | 324,230 | | | 127,500 | | | 1,162,000 | | | — | | | | 8,290 | (5) | | | 1,622,020 |

Colin J. Cumming(6) | | 2009 | | | 316,506 | | | 100,000 | | | — | | | 622,623 | (4) | | | 28,072 | (7) | | | 1,067,201 |

President, Chief Executive Officer and Director, Former Chief Technology Officer and President—Detection | | 2008 | | | 239,583 | | | 62,500 | | | — | | | — | | | | 7,672 | (7) | | | 309,755 |

| | 2007 | | | 197,024 | | | 100,000 | | | 109,919 | | | — | | | | 8,297 | (7) | | | 415,240 |

Deborah D. Mosier | | 2009 | | | 247,275 | | | 70,000 | | | — | | | — | (4) | | | 2,332 | (8) | | | 319,607 |

Chief Financial Officer | | 2008 | | | 235,577 | | | 25,000 | | | 24,270 | | | — | | | | 6,742 | (8) | | | 291,589 |

| | 2007 | | | 175,673 | | | 20,000 | | | 722,200 | | | — | | | | 5,004 | (8) | | | 922,877 |

- 11 -

40. And, the following chart shows ICx’s insiders’ unexercised equity awards which, notably, all contain exercise prices below the consideration in the Proposed Transaction:

Outstanding Equity Awards at Fiscal Year End

The following table sets forth certain information about the equity awards we have made to our named executive officers which are outstanding as of December 31, 2009. All numbers representing options reflect the effect of our option exchange offer which closed on September 8, 2009.

| | | | | | | | | | | | | | | | |

| | | Option Awards | | Stock Awards |

Name | | Number of

Securities

Underlying

Unexercised

Options (#)

Exercisable | | Number of

Securities

Underlying

Unexercised

Options(#)

Unexercisable | | | Option

Exercise

Price

($) | | Option

Expiration

Date | | Number

of

Shares

or Units

of Stock

That

Have

Not

Vested (#) | | | Market

Value of

shares or

Units of

Stock

That Have

Not

Vested ($) |

Hans C. Kobler | | 19.594 | | 293.906 | (1) | | $ | 5.00 | | 4/14/09 | | — | | | | — |

| | 127.250 | | — | | | $ | 5.36 | | 2/3/16 | | — | | | | — |

Colin J. Cumming | | 65.625 | | 284.375 | (2) | | $ | 5.00 | | 4/14/19 | | — | | | | — |

| | 20.360 | | — | | | | 5.36 | | 10/11/15 | | — | | | | — |

| | — | | — | | | | — | | — | | 375 | (3) | | $ | 3.570 |

Deborah D. Mosier | | 1.200 | | — | | | $ | 3.50 | | 4/1/15 | | — | | | | — |

| | 6.000 | | — | | | $ | 3.50 | | 11/21/14 | | — | | | | — |

| | 2.036 | | — | | | $ | 5.36 | | 10/11/15 | | — | | | | — |

| | — | | — | | | | — | | — | | 375 | (3) | | $ | 3.570 |

| | — | | — | | | | — | | — | | 2.250 | (4) | | $ | 21.420 |

41. Finally, upon a change of control, such as following the consummation of the Proposed Transaction, defendants Kobler and Cumming will receive substantial remuneration not shared by the Company’s public stockholders, including the vesting of all unvested options and restricted stock units held as of the closing date of the change of control transaction, and their base salaries earned but unpaid through the date of their termination.

42. The sales process was clearly designed to benefit certain members of the Board and Wexford, who hold large, illiquid blocks of Company stock and other equity holdings that they would not be able to cash out absent the Proposed Transaction. Specifically, Board members defendants Kobler and Jacobs, with Wexford, hold and/or beneficially control over 61% of the Company’s outstanding shares, and defendant Cumming holds and/or beneficially controls over 3% of the Company’s outstanding shares, representing a total block size of over 23 million shares. Without the liquidity event promised by FLIR in the Proposed Transaction, Kobler, Jacobs, Wexford and Cumming could not sell their shares on the open market in a block sale without taking a liquidity discount and/or driving down the Company’s stock price and thus the value of the shares. The only other option would be to sell their shares slowly into the market, which is not an attractive option at all for someone looking to cash out quickly.

- 12 -

43. In further breach of their fiduciary duties, the Board has agreed to lock up the Proposed Transaction with preclusive deal protection devices that make it financially unrealistic for competing bidders to forward with a higher bid for shareholders. Specifically, the Board has agreed to: (i) a top-up option that provides FLIR with the right to buy at a nominal price as many of the Company’s unissued shares as are necessary to reach the minimum threshold to conduct a short-form merger, ownership of 90% of the Company’s outstanding shares, as long FLIR secures tender of a simple majority of the Company’s shares; (ii) a no-shop clause that prohibits the Company from providing confidential Company information to or even communicating with potential competing bidders except under extremely limited conditions; (iii) a termination fee provision that obligates the Company to pay FLIR an $8 million termination fee in the event the Board decides to change its recommendation in favor of another bidder; and (iv) a tender agreement that obligates Wexford and Company insiders to tender their 61% stockholdings in ICx in the Proposed Transaction.

44. Unless enjoined by this Court, the defendants will continue to breach and/or aid the breaches of fiduciary duties owed to plaintiff and the Class, and may consummate the Proposed Transaction which will deprive Class members of their fair share of ICx’s valuable assets and businesses, to the irreparable harm of the Class.

45. Plaintiff and the other members of the Class have no adequate remedy at law.

COUNT I

Claim for Breaches of Fiduciary Duties

Against the Individual Defendants

46. Plaintiff repeats and realleges each allegation set forth herein.

- 13 -

47. The Individual Defendants have violated their fiduciary duties of care and loyalty owed to the public shareholders of ICx. By the acts, transactions and courses of conduct alleged herein, the Individual Defendants, individually and acting as a part of a common plan, are attempting to unfairly deprive plaintiff and other members of the Class of the true value of their investment in ICx.

48. As demonstrated by the allegations above, the Individual Defendants have failed to exercise the care required, and breached their duties of loyalty because, among other reasons:

(a) they have failed to properly value the Company;

(b) they have failed to take steps to maximize the value of ICx to its public shareholders; and

(c) they have agreed to terms in the Merger Agreement that favor FLIR and themselves, and deter alternative bids.

49. Unless enjoined by this Court, the Individual Defendants will continue to breach their fiduciary duties owed to plaintiff and the other members of the Class, and may consummate the Proposed Transaction which will deprive the Class of its fair proportionate share of ICx’s valuable assets and businesses, to the irreparable harm of the Class.

50. Plaintiff and the Class have no adequate remedy at law. Only through the exercise of this Court’s equitable powers can plaintiff and the Class be fully protected from the immediate and irreparable injury which the Individual Defendants’ actions threaten to inflict.

COUNT II

Claim for Aiding and Abetting Breaches of

Fiduciary Duties Against ICx

51. Plaintiff repeats and realleges each allegation set forth herein.

- 14 -

52. Defendant ICx, by reason of its status as a party to the Proposed Transaction and its possession of non-public information, has aided and abetted the Individual Defendants in the aforesaid breach of their fiduciary duties.

53. Such breaches of fiduciary duties could not and would not have occurred but for the conduct of defendant ICx, who therefore aided and abetted such breaches in the sale of ICx to FLIR.

54. As a result of the unlawful actions of defendant ICx, plaintiff and the other members of the Class will be irreparably harmed in that they will not receive fair value for ICx’s assets and business. Unless the actions of defendant ICx are enjoined by the Court, ICx will continue to aid and abet the Individual Defendants’ breaches of their fiduciary duties owed to plaintiff and the members of the Class.

55. Plaintiff and the Class have no adequate remedy of law.

PRAYER FOR RELIEF

WHEREFORE, plaintiff demands relief, in plaintiffs favor and in favor of the Class and against defendants, as follows:

A. Declaring and decreeing that the Merger Agreement was entered into in breach of the fiduciary duties of defendants and is therefore unlawful and unenforceable;

B. Enjoining defendants, their agents, counsel, employees and all persons acting in concert with them from consummating the Proposed Transaction, unless and until the Company adopts and implements a procedure or process to obtain a merger agreement providing the best possible terms for shareholders;

C. Rescinding, to the extent already implemented, the Merger Agreement or any of the terms thereof, including the “no solicitation” clause, the top-up option, the termination fee clause, and the tender agreements;

- 15 -

D. Enjoining defendants from consummating the Merger Agreement and Proposed Transaction unless and until curative disclosures are made to ICx’s shareholders;

E. Awarding plaintiff the costs and disbursements of this action, including reasonable attorneys’ and experts’ fees; and

F. Granting such other and further equitable relief as this Court may deem just and proper.

JURY DEMAND

Plaintiff demands a trial by jury.

| | | | | | | | |

| DATED: August 23, 2010 | | | | Respectfully submitted, |

| | | | |

| | | | | | By: | | /s/ Elizabeth K. Tripodi |

| | | | | | Elizabeth K. Tripodi (VSB #73483) FINKELSTEIN THOMPSON, LLP 1050 30th Street NW Washington, D.C. 20007 Telephone: (202) 337-8000 Facsimile: (202) 337-8090 E-mail: etripodi@finkelsteinthompson.com |

| | | |

| | | | | | Counsel for Plaintiff |

| | | |

| | | | | | ROBBINS GELLER RUDMAN & DOWD LLP RANDALL J. BARON A. RICK ATWOOD, JR. DAVID T. WISSBROECKER 655 West Broadway, Suite 1900 San Diego, CA 92101 Telephone: 619/231-1058 619/231-7423 (fax) |

- 16 -

| | | | |

| |

| | | ROBBINS GELLER RUDMAN & DOWD LLP STUART A. DAVIDSON CULLIN A. O’BRIEN 120 East Palmetto Park Road, Suite 500 Boca Raton, FL 33432 Telephone: 561/750-3000 561/750-3364 (fax) |

| |

| | THE BRISCOE LAW FIRM, PLLC WILLIE BRISCOE 8117 Preston Road, Suite 300 Dallas, Texas 75225 Telephone: 214/706-9314 214/706-9315 (fax) |

| |

| | Of Counsel |

- 17 -