Exhibit (a)(5)(K)

The Process

The acquisition of ICx Technologies, Inc. (“ICx”) by Indicator Merger Sub, Inc.’s (“Purchaser”), a wholly-owned subsidiary of FLIR Systems, Inc. (“FLIR”), will take place in two steps:

Step One – the Offer: The tender offer is Purchaser’s offer to purchase (the “Offer”) all issued and outstanding shares of common stock of ICx (the “Shares”) for $7.55 per Share in cash, without interest and less any required withholding taxes (the “Offer Price”), that are validly tendered and not validly withdrawn. The Offeronly applies to Shares that are issued and outstanding and doesnot apply to stock options and unvested RSUs. Stock options and unvested RSUs will be handled in the subsequent merger described below. Please note that certain affiliates of Wexford Capital LP own approximately 62% of the outstanding Shares of ICx and have agreed to tender their Shares in the Offer pursuant to the terms and subject to the conditions of the tender and support agreement, dated August 16, 2010, by and among those entities, FLIR and Purchaser.

Step Two – the Merger: Assuming that Purchaser acquires at least a majority of the outstanding Shares of ICx through the Offer, Purchaser will merge with and into ICx, with ICx as the surviving entity (the “Merger”). In the Merger, Purchaser will acquire all remaining outstanding Shares of ICx (except for Shares held by FLIR, Purchaser or stockholders who perfect their dissenter’s rights or Shares held by ICx as treasury stock) for an amount equal to the Offer Price payable in cash, without interest and less any required withholding taxes, and pay holders of vested options an amount in cash equal to the difference between the exercise price of the relevant option and the Offer Price, without interest and less any required withholding taxes. Unvested options and RSUs will be converted into options and RSUs to acquire shares of FLIR, with appropriate adjustments to the number of shares of FLIR common stock subject thereto and the per share exercise price to reflect the Merger. Please see Section 11, “Transaction Agreements—The Merger Agreement—Stock Options; Restricted Stock Units; Warrants”, at page 24 of Purchaser’s offer to purchase, dated September 3, 2010 (the “Offer to Purchase”), for details on the treatment of stock options and RSUs in the Merger.

Step One,the Offer, started on September 3, 2010 and stockholders should have received one or more packets of information that included Offer to Purchase and a Letter of Transmittal among other documents. In the Offer, employees who own outstanding Shares (not stock options or unvested RSUs, which will be handled in the Merger) havetwo choices with respect to such outstanding Shares:

1. Tender those Shares. Purchaser will purchase all Shares validly tendered and not validly withdrawn prior to the expiration of the Offer. The Offer is currently scheduled to expire at 12:00 midnight, New York City time, on Friday, October 1, 2010, though the offer may be extended pursuant to the terms and subject to the conditions of the merger agreement, dated August 16, 2010, by and among ICx, FLIR and Purchaser. If an employee wishes to tender his or her outstanding Shares in the Offer, he or she should follow the instructions for completing the

relevant documents, summarized below and more fully explained in the packet sent by Purchaser.

2. Do nothing. This will delay the acquisition of your outstanding Shares until the Merger is completed. Unless you perfect your dissenters’ rights (as described in more detail in Section 12, “Purpose of the Offer; Plans for the Company—Appraisal Rights,” at page 36 of the Offer to Purchase) your outstanding Shares will be converted in the Merger into the right to receive an amount equal to the Offer Price payable in cash, without interest and less any required withholding taxes

Please note:

| | • | | Each stockholder wishing to tender his or her Shares is responsible for presenting such Shares for sale to Purchaser in this process. Your Shares will not be tendered automatically. |

| | • | | The Offer applies to all Shares you may hold in a brokerage account, and there are specific procedures for tendering these shares that your broker can provide. |

| | • | | You may have exercised stock options or received Shares pursuant to an RSU award at various times during your employment and those Shares must also be presented for sale to Purchaser in this process. |

| | • | | You must have possession of the certificates for your Shares. If you have lost or misplaced any of these certificates, YOU MUST OBTAIN REPLACEMENT CERTIFICATES IN ORDER TO RECEIVE PAYMENT FOR THOSE SHARES. There are procedures for obtaining replacement certificates. |

For now, we should focus on theOffer, and the following information is targeted to this process.

Offer Packet Checklist

You should have received an Information Packet containing the following:

| | White Booklet #1: | Offer to Purchase |

| | White Booklet #2: | Letter to Stockholders from ICx CEO and Schedule 14D-9 |

| | Blue Booklet: | Letter of Transmittal |

| | Grey Booklet: | Notice of Guaranteed Delivery |

| | Yellow Booklet: | Letter to Clients for use by Brokers, Dealers, Commercial Banks, Trust Companies and Other Nominees |

| | |

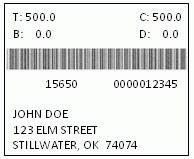

Sample of Label Found on Blue Booklet | |  |

What you will need to do if you would like to tender your Shares:

| | 1. | Gather all your Share certificates. |

| | 2. | Verify you have ALL your Share certificates by checking your Solium account and your account with the American Stock Transfer & Trust Company, LLC (“AST”) as well as by checking with any broker through whom you may have purchased Shares. |

| | 3. | Fill out the appropriate forms. Contact your broker regarding the process for tendering Shares held for you by such broker. |

| | 4. | MAKE COPIES OF EVERYTHING YOU ARE MAILING TO AST. |

| | 5. | Send your certificates and forms VIA REGISTERED MAIL WITH RETURN RECEIPT REQUESTED, AND PROPERLY INSURED, to AST at the address indicated on the Letter of Transmittal. |

Questions and Answers

When were the packets mailed out?

The packet mail-out began on September 7, 2010. If you hold your shares through a brokerage account, the information may have been mailed later during that week.

Who is supposed to receive an information packet?

Anyone who holds shares in his/her own name and retains physical possession of a Share certificate(s).

Why did I receive more than one information packet in the mail?

For some reason, AST may have more than one account listed for you. You can log onto your AST account and find out which Share certificates go with which account by using the account number found on the white label on the blue packet, or you can call AST’s Shareholder Services at 800-937-5449 or 718-921-8124.

I have not received my information packet in the mail. What do I do?

Contact Alison Chakraborty at 405-372-9535 orAlison.Chakraborty@icxt.com.

How do I know I have received all the packets I’m supposed to get?

Look at the label on the blue booklet. If the number above the barcode matches the number of shares that vested on Solium (minus shares held for taxes if you chose that option) and you do not hold shares through a brokerage account then chances are you won’t be getting further packets.

What do the numbers on the label of the blue booklet mean?

The numbers above the bar code represents the number of shares for your account. Your account number is the 10-digit number listed under the bar code on the right-hand side. The 5-digit number on the left side is ICx’s company account number.

I’ve have purchased ICx stock through a broker what do I do?

Contact your broker directly for tender instructions. Some brokers charge fees for this service.

I don’t have a Solium account, but I have ICx stock. What do I do?

If you have purchased your Shares through a broker, contact your broker for instructions on how to tender your Shares. If you have a physical Share certificate, and have not received a packet, call Alison Chakraborty at 405-372-9535.

How do I find out how many stock certificates and/or shares I should have?

Log-in to your Solium account. The exact number of Shares issued to you will be found under your Account Summary. If you opted for taxes to be taken out prior to the issuance of a Share certificate, remember to add up the number of Shares released minus the Shares held for taxes.

I’ve never logged into my Solium account. What do I do?

Call Solium at 877-380-7793 or 403-515-3909 to get an account number and password.

Where do I find my AST account number?

Your AST account number can be found on the label on the blue booklet. It is the 10-digit number under the bar code.

I’ve never logged into my AST account. What do I do?

Contact AST athttp://www.amstock.com/shareholder/shareholder_services.asp or 800-937-5449 and they will help you with your password and account number.

Do I need to turn in all my Share certificates?

Yes. If you don’t have all of them, please contact Alison Chakraborty at 405-372-9535.

Do I need to use the return envelope included in the packet?

No. You can use any envelope. Just make sure you send your Share certificates, the Letter of Transmittal and any other necessary forms to AST’s Reorganization Department. We highly recommend you send your documents via registered mail with return receipt requested and properly insured. If you are in Stillwater, bring your documents to Alison Chakraborty and she’ll send them in for you.

I’m confused about how to fill in the forms. Who can I contact?

Call the Information Agent, Phoenix Advisory Partners, LLC, at 800-576-4314. Many questions can also be answered by Alison Chakraborty at 405-372-9535.

What happens if I don’t want to participate in the tender offer?

Please refer to the Summary Term Sheet at page 5 of the Offer to Purchase.

What happens if I can’t get everything submitted by the expiration of the Offer?

You can still participate in the Offer if you submit a Notice of Guaranteed Delivery prior to the expiration of the Offer and provide all of the required documentation within three business days of the expiration of the Offer. See the procedure described in Section 3, “Procedures for Accepting the Offer and Tendering Shares—Guaranteed Delivery”, at page 12 of the Offer.

I gave some or all of my Share certificates to my broker. What do I do?

Fill out the forms for the Share certificates you have in your possession. Call your broker to give tender instructions regarding the other Shares.

I have lost one (or more) of my Share certificates. What do I do?

You can contact AST’s Shareholder Services atwww.amstock.com or 800-937-5449. Alison Chakraborty can also help you (405) 372-9535.

I never received one (or more) of my Share certificates. What do I do?

You can contact AST’s Shareholder Services atwww.amstock.com or 800-937-5449. Alison Chakraborty can also help you (405) 372-9535.

One (or more) of my Share certificates has a Restricted Legend. What do I do?

You can send restricted Share certificates in with your Letter of Transmittal and they will be treated the same way as non-restricted Share certificates.

I’ve made a mistake while filling out the form. What do I do?

You can simply draw a line through the mistake, initial it, and write the correct information.

You may also use correction tape or liquid, even on the colored forms.

What do I do if I have options that are vested?

Please refer to Section 11, “Transaction Agreements—The Merger Agreement—Stock Options; Restricted Stock Units; Warrants”, at page 24 of the Offer to Purchase.

What do I do if I have options that have not vested?

Please refer to Section 11, “Transaction Agreements—The Merger Agreement—Stock Options; Restricted Stock Units; Warrants”, at page 24 of the Offer to Purchase.

What do I do if I have RSUs that have not vested?

Please refer to Section 11, “Transaction Agreements—The Merger Agreement—Stock Options; Restricted Stock Units; Warrants”, at page 24 of the Offer to Purchase.

How do I figure out my taxes and the W-9 form in the blue booklet?

Please refer to a tax attorney or accountant for advice. For advice on filling out the W-9, you can contact the Information Agent, Phoenix Advisory Partners, LLC, at 800-576-4314

How will I receive my money?

You will receive a check mailed to the address you listed in the Letter of Transmittal.

When will I get my money if I sell my shares in the Offer?

No payment will be made until the completion of the Offer. Once the Offer is completed, it will take some time to process and validate your paperwork, though you should expect to receive a check within seven to ten business days after the expiration of the Offer.

When will I get my money if I do not sell my shares in the Offer?

After the Merger is completed, you will need to submit your Share certificates along with a different letter of transmittal that will be sent to you after the Merger is completed. Once the Merger is completed, it will take some time to process and validate your paperwork before checks can be mailed.

Do I need to fill out the yellow or grey booklets?

The yellow booklet or something similar might be used by some brokers who want a written response for tendering Shares. Many will take the instructions over the phone or by logging into their brokerage account. Contact your broker directly for tender instructions.

The grey booklet is the “Notice of Guaranteed Delivery” and is used only if a stockholder cannot provide the required documentation before the expiration of the Offer, but can deliver such documentation within three business days of the expiration of the Offer.

Have any other questions and answers been provided?

The following questions (and others) are answered in the Offer to Purchase:

| | |

Who is offering to buy my securities? | | Page 1 |

| |

How much are you offering to pay? | | Page 1 |

| |

What is the form of payment? | | Page 1 |

| |

Will I have to pay any fees or commissions? | | Page 1 |

| |

How long do I have to decide whether to tender my Shares in the Offer? | | Page 2 |

| |

Will you provide a subsequent offering period? | | Page 2 |

| |

How do I tender my shares? | | Page 3 |

| |

If I decide not to tender, how will the Offer affect my Shares? | | Page 5 |

| |

Who should I call if I have questions about the Offer? | | Page 5 |

Additional Information and Where to Find It

The Offer described in this communication has commenced, but this communication is for informational purposes only and is neither an offer to purchase nor a solicitation of an offer to sell shares of ICx Technologies, Inc.’s common stock. The Offer is being made pursuant to a tender offer statement and related materials. INVESTORS AND SECURITY HOLDERS ARE URGED TO READ BOTH THE TENDER OFFER STATEMENT AND RELATED MATERIALS AND THE SOLICITATION/ RECOMMENDATION STATEMENT REGARDING THE TENDER OFFER BECAUSE THEY CONTAIN IMPORTANT INFORMATION. The tender offer statement and related materials, including an Offer to Purchase and Letter of Transmittal, have been filed by Indicator Merger Sub, inc. and FLIR Systems, Inc. with the United States Securities and Exchange Commission, and the solicitation/recommendation statement has been filed by ICx Technologies, Inc. with the United States Securities and Exchange Commission. Investors and security holders may obtain a free copy of these statements and other documents filed by Indicator Merger Sub, inc. and FLIR Systems, Inc. or ICx Technologies, Inc. with the United States Securities and Exchange Commission at the website maintained by the United States Securities and Exchange Commission at www.sec.gov. The tender offer statement and related materials, solicitation/recommendation statement, and such other documents may be obtained for free by directing such requests to Phoenix Advisory Partners, LLC, the information agent for the tender offer, at (347) 578-1396 for banks and brokers or (800) 576-4314 for stockholders and all others.