UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant x Filed by a Party other than the Registrant ¨

Check the appropriate box:

| | |

| ¨ | | Preliminary Proxy Statement |

| |

| ¨ | | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| |

| x | | Definitive Proxy Statement |

| |

| ¨ | | Definitive Additional Materials |

| |

| ¨ | | Soliciting Material Pursuant to §240.14a-12 |

NCI, INC.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| | | | |

| |

| x | | No fee required. |

| |

| ¨ | | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | |

| | (1) | | Title of each class of securities to which transaction applies: |

| | (2) | | Aggregate number of securities to which transaction applies: |

| | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | (4) | | Proposed maximum aggregate value of transaction: |

| | (5) | | Total fee paid: |

| |

| ¨ | | Fee paid previously with preliminary materials. |

| |

| ¨ | | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | |

| | (1) | | Amount Previously Paid: |

| | (2) | | Form, Schedule or Registration Statement No.: |

| | (3) | | Filing Party: |

| | (4) | | Date Filed: |

NCI, Inc.

11730 Plaza America Drive, Suite 700

Reston, Virginia 20190

April 30, 2014

Dear Fellow Stockholder:

You are invited to attend the NCI, Inc. Annual Meeting of Stockholders to be held on Wednesday, June 4, 2014 at 9:00 a.m., local time, at the Hyatt Regency, 1800 Presidents Street, Reston, Virginia 20190.

We have provided details of the business to be conducted at the meeting in the accompanying Notice of Annual Meeting of Stockholders, proxy statement, and form of proxy. We encourage you to read these materials, so you may be informed about the business to come before the meeting.

Your participation is important, regardless of the number of shares you own. In order for us to have an efficient meeting, please sign, date, and return the enclosed proxy card promptly in the accompanying reply envelope. You can find additional information concerning our voting procedures in the accompanying materials.

We look forward to seeing you at the meeting.

|

| Sincerely, |

|

| Charles K. Narang |

| Chairman and Chief Executive Officer |

Page 2

NCI, INC.

11730 Plaza America Drive, Suite 700

Reston, Virginia 20190

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD ON JUNE 4, 2014

You are invited to attend the NCI, Inc. Annual Meeting of Stockholders to be held on Wednesday, June 4, 2014 at 9:00 a.m., local time, at the Hyatt Regency, 1800 Presidents Street, Reston, Virginia 20190.

The matters proposed for consideration at the meeting are:

| | 1. | To elect eight persons as directors of the Company, each to serve for a term of one year or until their respective successors shall have been duly elected and qualified. |

| | 2. | To ratify the appointment of Deloitte & Touche LLP as the independent registered public accounting firm of NCI, Inc. for the current year. |

| | 3. | To re-approve the material terms of the performance goals under the Amended and Restated 2005 Performance Incentive Plan. |

| | 4. | To hold an advisory vote on executive compensation. |

| | 5. | To transact such other business as may properly come before the meeting or any adjournment or postponement thereof. |

Our Board of Directors has set April 17, 2014 as the record date for determining stockholders entitled to notice of and to vote at the Annual Meeting. A complete list of stockholders eligible to vote at the Annual Meeting will be made available for examination by our stockholders, for any purpose germane to the Annual Meeting, during the 10 days before the Annual Meeting during ordinary business hours at the principal executive office of the Company at the previously indicated address. We will also produce the stockholder list at the Annual Meeting, and you may inspect it at any time during the Annual Meeting.

All stockholders are cordially invited to attend the Annual Meeting in person. Regardless of whether you expect to attend the Annual Meeting, your vote is important. To ensure your representation at the Annual Meeting, please sign and date the enclosed proxy card and return it promptly in the accompanying reply envelope, which requires no additional postage. Should you receive more than one proxy because your shares are registered in different names and addresses, each proxy should be signed and returned to ensure all your shares are voted. The accompanying proxy statement and form of proxy are first being sent or given to our stockholders on or about April 30, 2014.

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE

ANNUAL MEETING TO BE HELD ON JUNE 4, 2014

The proxy statement and our 2013 annual report are also available at

http://materials.proxyvote.com/62886K.

| | | | | | |

| | | | | | | By Order of the Board of Directors, |

| | | | | |  |

| Reston, Virginia | | | | | | Michele R. Cappello General Counsel and Corporate Secretary |

April 30, 2014

Page 3

IT IS IMPORTANT THAT YOU COMPLETE AND RETURN

THE ENCLOSED PROXY CARD PROMPTLY

Page 4

TABLE OF CONTENTS

Page 5

NCI, INC.

11730 Plaza America Drive, Suite 700

Reston, Virginia 20190

PROXY STATEMENT FOR

2014 ANNUAL MEETING OF STOCKHOLDERS

The Board of Directors of NCI, Inc. (the Board) solicits the accompanying proxy to be voted at the 2014 Annual Meeting of Stockholders (the Annual Meeting) to be held on Wednesday, June 4, 2014 at 9:00 a.m., local time, at the Hyatt Regency, 1800 Presidents Street, Reston, Virginia 20190, and at any adjournments or postponements thereof. In this proxy statement, unless the context requires otherwise, when we refer to “we,” “us,” “our,” “the Company” or “NCI,” we are describing NCI, Inc.

This proxy statement, the accompanying Notice of Annual Meeting of Stockholders and the enclosed proxy card are first being sent or given to our stockholders on or about April 30, 2014. This proxy statement and our 2013 annual report are also available at http://materials.proxyvote.com/62886K.

PURPOSES OF THE MEETING

At the Annual Meeting, we will ask you to consider and act upon the following matters:

| | 1. | To elect eight persons as directors of the Company, each to serve for a term of one year, or until their respective successors shall have been duly elected and qualified. |

| | 2. | To ratify the appointment of Deloitte & Touche LLP as the independent registered public accounting firm of NCI, Inc. for the current year. |

| | 3. | To re-approve the material terms of the performance goals under the Amended and Restated 2005 Performance Incentive Plan. |

| | 4. | To hold an advisory vote on executive compensation. |

| | 5. | To transact such other business as may properly come before the meeting or any adjournment or postponement thereof. |

GENERAL INFORMATION

Record Date and Stockholders Entitled to Vote

Record Date. Our Board has fixed the close of business on April 17, 2014 as the record date (the Record Date) for purposes of determining stockholders entitled to receive notice of and to vote at the Annual Meeting. Only stockholders of record as of the Record Date will be entitled to vote at the Annual Meeting.

Our Common Stock. We have two classes of outstanding stock: our Class A Common Stock and Class B Common Stock. As of April 17, 2014 a total of 12,953,332 shares were outstanding: 8,253,332 shares of Class A Common Stock and 4,700,000 shares of Class B Common Stock. Holders of Class A Common Stock are entitled to one vote for each share of Class A Common Stock they hold on the Record Date. Holders of Class B Common Stock are entitled to 10 votes for each share of Class B Common Stock they hold on the Record Date.

Stockholder List. We will make a complete list of stockholders eligible to vote at the Annual Meeting available for examination during the 10 days before the Annual Meeting. During such time, you may visit us at our principal executive office at the previously indicated address during ordinary business hours to examine the stockholder list for any purpose germane to the Annual Meeting.

Page 6

Voting Requirements and Other Matters

Quorum. The holders of a majority in voting power of the common stock entitled to vote at the Annual Meeting must be present, either in person or by proxy, to constitute a quorum for the transaction of business at the Annual Meeting. In accordance with Delaware law, we will count abstentions and broker non-votes for the purpose of establishing a quorum.

Broker Non-Votes. A broker non-vote occurs when a stockholder that owns shares in “street name” through a nominee (usually a bank or a broker) fails to provide the nominee with voting instructions, and the nominee does not have discretionary authority to vote the shares with respect to the matter to be voted on, or when the nominee otherwise fails to vote the shares.

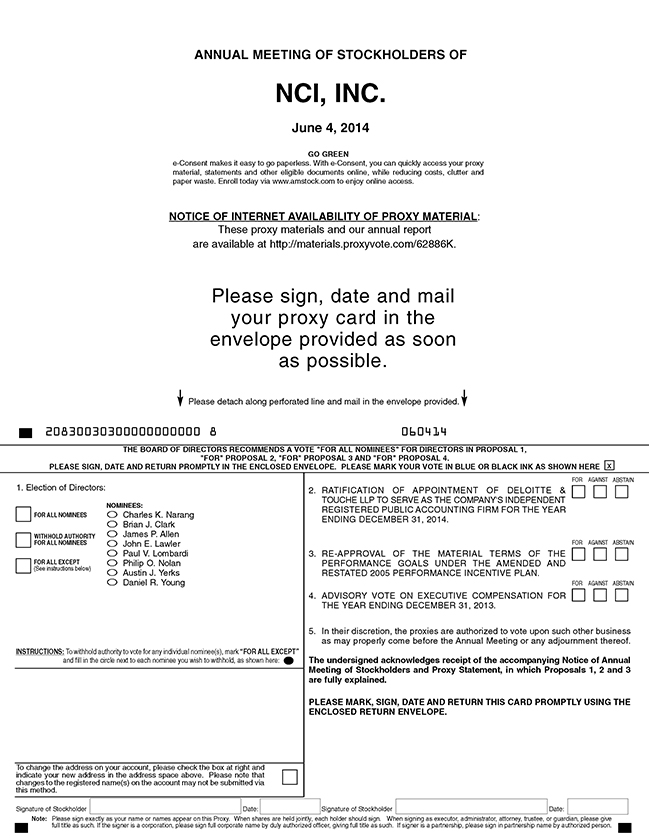

How to Vote Your Shares. Your shares cannot be voted at the Annual Meeting unless you are present either in person or by proxy. If you vote by mail and return a completed, signed, and dated proxy card, your shares will be voted in accordance with your instructions. You may specify your choices by marking the appropriate box and following the other instructions on the proxy card. With respect to the election of directors, you may (i) vote “For” all the nominees or (ii) “Withhold Authority” with respect to some or all nominees. With respect to ratification of the appointment of Deloitte & Touche LLP to serve as the Company’s independent registered public accounting firm for the year ended December 31, 2014, you may (i) vote “For” the proposal, (ii) vote “Against” the proposal, or (iii) “Abstain” from voting on the proposal. With respect to the re-approval of the material terms of the performance goals under the Amended and Restated 2005 Performance Incentive Plan, you may (i) vote “For” the proposal, (ii) vote “Against” the proposal, or (iii) “Abstain” from voting on the proposal. If you vote by mail and you return a proxy card that is unsigned, then your vote cannot be counted. If the returned proxy card is signed and dated, but you do not specify voting instructions, your shares will be voted in accordance with the Board’s recommendations.

Vote Required — Election of Directors. If a quorum is present, the eight nominees for director who receive the most votes cast at the Annual Meeting, either in person or by proxy, will be elected. As a result, abstentions and broker non-votes will not affect the outcome of the vote on this matter — they are treated as neither votes for nor votes against the election of directors.

Vote Required — Ratification of Independent Registered Public Accounting Firm. If a quorum is present, the ratification of the appointment of Deloitte & Touche LLP to serve as our independent registered public accounting firm for the year ending December 31, 2014 will be voted on and will require at least a majority of the votes cast at the Annual Meeting, either in person or by proxy. As a result, abstentions and broker non-votes will not affect the outcome of the vote on this matter — they are treated as neither votes for nor votes against the ratification of Deloitte & Touche, LLP to serve as our independent registered public accounting firm.

Vote Required — Re-approval of the Material Terms of the Performance Goals under the Amended and Restated 2005 Performance Incentive Plan. If a quorum is present, the re-approval of the material terms of the performance goals under the Amended and Restated 2005 Performance Incentive Plan will be voted on and will require at least a majority of the votes cast at the Annual Meeting, either in person or by proxy. As a result, abstentions and broker non-votes will not affect the outcome of the vote on this matter — they are treated as neither votes for nor votes against the re-approval of the material terms of the performance goals under the Amended and Restated 2005 Performance Incentive Plan.

Advisory Vote on Executive Compensation.If a quorum is present, the advisory vote on executive compensation will be held and will require at least a majority of the votes cast at the Annual Meeting, either in person or by proxy. You may “(i) vote “For” the proposal, (ii) vote “Against” the proposal, or (iii) “Abstain” from voting on the proposal. Abstentions will have the same effect as a vote against this proposal, because abstentions on this proposal, although treated as present and entitled to vote for purposes of determining the total pool of votable shares, do not contribute to the affirmative votes that are needed to approve the proposal. Broker non-votes will not affect the outcome of the vote on this matter — they are treated as neither votes for nor votes against the proposal. While the Board of Directors intends to carefully consider the shareholder’s vote resulting from the advisory vote on executive compensation, the final vote will not be binding on us and is advisory in nature.

Other Business at the Meeting. We are not aware of (and have not received any notice with respect to) any business to be transacted at the Annual Meeting other than as described in this proxy statement. If any other matters properly come before the Annual Meeting, Messrs. Charles K. Narang and Brian J. Clark, the named proxies, will vote the shares represented by proxies on such matters in accordance with their discretion and best judgment.

Page 7

Ownership by Insiders. As of April 17, 2014 our directors and executive officers beneficially owned an aggregate of 5,932,748 shares of Class A Common Stock and Class B Common Stock (including shares of common stock that may be issued upon exercise of outstanding options that are currently exercisable or that may be exercised within 60 days after April 17, 2014), which constitutes approximately 46% of our outstanding common stock and 87% of the voting control of common stock entitled to vote at the Annual Meeting.

Tabulation of Votes. Mr. Jon L. Frank, our Vice President and Controller, has been appointed Inspector of Elections for the Annual Meeting. Mr. Frank will separately tabulate the affirmative votes, negative votes, abstentions, and broker non-votes with respect to each of the proposals.

Announcement of Voting Results. We will announce preliminary voting results at the Annual Meeting and within four business days of the Annual Meeting in a current report on Form 8-K that we will file with the Securities and Exchange Commission (SEC). To the extent the final results are not known and disclosed within four business days of the Annual Meeting, we will disclose the final results in an amended current report on Form 8-K that we will file with the SEC within four business days after such final results are known.

Revoking Your Proxy. If you execute a proxy pursuant to this solicitation, you may revoke it at any time before its exercise by doing any one of the following:

| | • | | Delivering written notice to our Corporate Secretary, Ms. Michele R. Cappello, at our principal executive office. |

| | • | | Executing and delivering a proxy bearing a later date to our Corporate Secretary at our principal executive office. |

| | • | | Voting in person at the Annual Meeting. |

To be effective, your notice or later-dated proxy must be received by our Corporate Secretary before the Annual Meeting, or the Inspector of Elections must receive it at the Annual Meeting before the vote. Please note, however, that your attendance at the Annual Meeting without further action on your part will not automatically revoke your proxy.

Solicitation. The Board is making this solicitation of proxies on our behalf. In addition to the solicitation of proxies by use of the mail, our officers and employees may solicit the return of proxies by personal interview, telephone, email, or facsimile. We will not pay additional compensation to our officers and employees for their solicitation efforts, but we will reimburse them for any out-of-pocket expenses they incur in their solicitation efforts.

We will request that brokerage houses and other custodians, nominees, and fiduciaries forward our solicitation materials to beneficial owners of our common stock that is registered in their names. We will bear all costs associated with preparing, assembling, printing, and mailing this proxy statement and the accompanying materials, the cost of forwarding our solicitation materials to the beneficial owners of our common stock, and all other costs of solicitation.

Householding of Proxy Materials.Some banks, brokers, and other nominee record holders may participate in the practice of “householding” proxy statements and annual reports. This means that only one copy of this proxy statement or the Company’s annual report may have been sent to multiple stockholders in your household. The Company will promptly deliver a separate copy of either document to you if you call or write the Company at the following address or phone number: NCI, Inc., 11730 Plaza America Drive, Suite 700, Reston, Virginia 20190, phone: (703) 707-6900, Attention: Investor Relations. If you want to receive separate copies of the Company’s annual report and proxy statement in the future, or if you are receiving multiple copies and would like to receive only one copy for your household, you should contact your bank, broker, or other nominee record holder, or you may contact the Company at the preceding address and phone number.

Notice of Internet Availability

This proxy statement and our 2013 annual report are available athttp://materials.proxyvote.com/62886K.

Page 8

BENEFICIAL OWNERSHIP

The following table sets forth certain information regarding the beneficial ownership of the Company’s common stock as of April 17, 2014 by (i) each person or entity who is known by the Company to be the beneficial owner of more than 5% of the outstanding shares of Class A Common Stock or Class B Common Stock, (ii) each director and director nominee, (iii) each of the executive officers named in the Summary Compensation Table set forth under the caption “Executive Compensation” below and (iv) all directors and executive officers as a group. Unless otherwise indicated, each person or entity named in the table has sole voting power or investment power (or shares such power with his spouse) with respect to all shares of common stock listed as owned by such person or entity.

Unless otherwise indicated, the address of each person is c/o NCI, Inc., 11730 Plaza America Drive, Reston, Virginia 20190.

| | | | | | | | | | | | | | | | | | | | |

| | | Number of Shares | | | Percentage of Class | | | | |

| | | Beneficially Owned (1) | | | Owned (%) | | | Percentage | |

| | | Class A | | | Class B | | | Class A | | | Class B | | | of Total | |

| | | Common | | | Common | | | Common | | | Common | | | Voting | |

| | | Stock | | | Stock | | | Stock | | | Stock | | | Power | |

Charles K. Narang (2) | | | 378,946 | | | | 4,700,000 | | | | 4.6 | % | | | 100.0 | % | | | 85.8 | % |

Brian J. Clark (3) | | | 333,250 | | | | — | | | | 3.9 | | | | — | | | | * | |

Marco F. de Vito (4) | | | 194,027 | | | | — | | | | 2.3 | | | | — | | | | * | |

Michele R. Cappello (5) | | | 71,794 | | | | — | | | | * | | | | — | | | | * | |

Lucas J. Narel (6) | | | 147,731 | | | | — | | | | 1.8 | | | | — | | | | * | |

James P. Allen (7) | | | 13,333 | | | | — | | | | * | | | | — | | | | * | |

John E. Lawler (7) | | | 28,333 | | | | — | | | | * | | | | — | | | | * | |

Paul V. Lombardi (7) | | | 17,333 | | | | — | | | | * | | | | — | | | | * | |

Philip O. Nolan (7) | | | 13,333 | | | | — | | | | * | | | | — | | | | * | |

Austin J. Yerks (8) | | | 3,333 | | | | — | | | | * | | | | — | | | | * | |

Daniel R. Young (7)(9) | | | 31,333 | | | | — | | | | * | | | | — | | | | * | |

All executive officers and directors as a group (11 persons) | | | 1,231,848 | | | | 4,700,000 | | | | 14.8 | | | | 100.0 | | | | 87.3 | |

Narang Family Trust and affiliates (10) | | | 1,500,000 | | | | — | | | | 18.2 | | | | — | | | | 2.7 | |

FMR LLC (11) | | | 1,088,030 | | | | — | | | | 13.2 | | | | — | | | | 2.0 | |

| (1) | The number of shares beneficially owned by each stockholder is determined under rules promulgated by the SEC and the information is not necessarily indicative of beneficial ownership for any other purpose. Under such rules, beneficial ownership includes any shares as to which the individual or entity has sole or shared voting power; and/ or investment power, and any shares as to which the individual or entity has the right to acquire beneficial ownership within 60 days after April 17, 2014 through the exercise of any stock option, warrant, or other right. The inclusion herein of such shares, however, does not constitute an admission that the named stockholder is a direct or indirect beneficial owner of such shares. |

| (2) | Includes 378,946 shares of Class A Common Stock held in two Grantor Retained Annuity Trusts (GRAT), for which Wells Fargo Bank, N.A. is the trustee. Mr. Narang has shared investment power, but no voting power, over these shares. One-half of the total shares reported, 189,473 Class A shares are owned directly by the Chander K. Narang 2004 GRAT for the benefit of Charles K. Narang. One-half of the total shares reported, 189,473 Class A shares are owned directly by the Shashi K. Narang 2004 GRAT for the benefit of Shashi K. Narang, wife of Charles K. Narang. |

| (3) | Includes 245,000 shares of Class A Common Stock issuable upon exercise of options that are currently exercisable or exercisable within 60 days of April 17, 2014. Includes 20,000 shares of unvested restricted stock as to which Mr. Clark has sole voting power. |

| (4) | Includes 169,333 shares of Class A Common Stock issuable upon exercise of options that are currently exercisable or exercisable within 60 days of April 17, 2014. Includes 5,000 unvested shares of restricted stock as to which Mr. de Vito has sole voting power. |

| (5) | Includes 67,500 shares of Class A Common Stock issuable upon exercise of options that are currently exercisable or exercisable within 60 days of April 17, 2014. Includes 2,500 unvested shares of restricted stock as to which Ms. Cappello has sole voting power. |

| (6) | Includes 125,000 shares of Class A Common Stock issuable upon exercise of options that are currently exercisable or exercisable within 60 days of April 17, 2013. Includes 12,500 unvested shares of restricted stock as to which Mr. Narel has sole voting power. |

| (7) | Includes 13,333 shares of Class A Common Stock issuable upon exercise of options that are currently exercisable or exercisable within 60 days of April 17, 2014. |

| (8) | Includes 3,333 shares of Class A Common Stock issuable upon exercise of options that are currently exercisable or exercisable within 60 days of April 17, 2014. |

| (9) | Includes 13,000 shares held in a margin account. |

Page 9

| (10) | Information based solely on a Schedule 13G/A dated March 29, 2012 and filed with the SEC. Includes 1,000,000 shares of Class A Common Stock owned by Narang Family Limited Partnership (NFLP). The general partner of NFLP is Narang Holdings LLC (NHLLC), the manager of which is Dinesh Bhugra. NHLLC and Mr. Bhugra have the power to direct the vote and to direct the disposition of investments owned by NFLP, including the Class A Common Stock, and thus may also be deemed to beneficially own the Class A Common Stock. Narang Family Trust (NFT) is the sole owner of NHLLC and, as such, NFT and its business trustee, Thomas C. Gaspard, have the power to remove Mr. Bhugra as manager and appoint any new manager of NHLLC, and thus may also be deemed to beneficially own the Class A Common Stock. The address of each of NFT, NHLLC and NFLP is c/o GenSpring Family Offices, 4445 Willard Avenue, Suite 1010, Chevy Chase, MD 20815. The address of Mr. Bhugra is 37 Baytree Road London SW25RR, United Kingdom. The address of Mr. Gaspard is 10305 Cutters Lane, Potomac, Maryland 20854. Mr. Narang does not have any beneficial ownership interest in these shares. Narang Holdings II, LLC (NHII) is the record holder of 500,000 shares of Class A stock. NHII is managed by Mr. Bhugra, who has the power to direct the vote and to direct the disposition of investments owned by NHII, including the shares of the Class A stock, and thus may also be deemed to beneficially own the 500,000 shares of Class A Stock owned by NHII. On February 16, 2012, 49.5% of the membership interests in NHII were transferred to each of the Rajiv Narang 2007 Irrevocable Trust u/t/a dated November 9, 2007 and the Sanjiv Narang 2007 Irrevocable Trust u/t/a dated November 9, 2007 (each a “Trust” and collectively, the “Trusts”). Individually, the trusts do not hold the requisite percentage of the membership interests in NHII necessary to remove the manager or appoint any new manager of NHII, and thus neither Trust is deemed to be the beneficial owner of the shares of Class A Stock owned by NHII. However, Mr. Gaspard, as the Business Advisor of each Trust, controls the 99.5% of the membership interest in NHII held by the trusts and has the power to remove the manager and appoint any new manager of NHII, and thus may be deemed to beneficially own the 500,000 shares of Class A stock owned by NHII. |

| (11) | Information based solely on a Schedule 13G/A dated February 14, 2014, and filed with the SEC. FMR LLC (FMR) is deemed to be the beneficial owner of the shares of our Class A Common Stock in the accounts for which it serves as an investment advisor and has the sole power to dispose of 1,088,030 shares of our Class A Common Stock. The address of FMR is 82 Devonshire Street, Boston, MA 02109. |

EQUITY COMPENSATION PLAN INFORMATION

The following table provides additional information as of December 31, 2013 regarding shares of our Class A Common Stock authorized for issuance under our equity compensation plan.

| | | | | | | | | | | | |

| Plan Category | | Number of

Securities to be

Issued Upon

Exercise of

Outstanding

Options

(a) | | | Weighted

Average Exercise

Price of

Outstanding

Options | | | Number of Securities

Remaining Available For

Future Issuance Under

Equity Compensation Plans

(Excluding Securities

Reflected in Column (a)) | |

Equity Compensation Plans Approved by Stockholders (1) | | | 1,785,526 | | | $ | 5.43 | | | | 678,602 | |

Equity Compensation Plans Not Approved by Stockholders | | | — | | | | — | | | | — | |

| | | | | | | | | | | | |

Total | | | 1,785,526 | | | $ | 5.43 | | | | 678,602 | |

| | | | | | | | | | | | |

| (1) | Our only equity compensation plan is The Amended and Restated 2005 Performance Incentive Plan. |

Page 10

ELECTION OF DIRECTORS

(PROPOSAL 1)

General Information

During 2013, the Board held seven meetings. Our Board is currently composed of eight members. Each current member’s term expires at the Annual Meeting (subject to the election and qualification of his successor, or his earlier death, resignation, or removal).

Upon the unanimous recommendation of the Nominating/Governance Committee, the Board has nominated each of the eight persons named below to serve as a director until the 2015 Annual Meeting of Stockholders (or until his successor has been duly elected and qualified, or until his earlier death, resignation, or removal). Each nominee is a current member of the Board, has agreed to stand for election and serve if elected, and has consented to be named in this proxy statement.

Substitute Nominees

If, at the time of or before the Annual Meeting, any nominee is unable to be a candidate when the election occurs, or otherwise declines to serve, the persons named as proxies may use the discretionary authority provided to them in the proxy to vote for a substitute nominee designated by the Board. At this time, we do not anticipate any nominee will be unable to be a candidate for election or will otherwise decline to serve.

Vacancies

Under our Amended and Restated Bylaws, the Board has the authority to fill any vacancies created by the resignation of a director, or to increase in the number of directors as the Board determines to be in the best interest of the Company. Any nominee so elected or appointed by the Board would hold office for the remainder of the term of office of all directors, which term expires annually at our annual meeting of stockholders.

Information Regarding the Nominees for Election as Directors

The name of each nominee for election as director, age, and certain additional information with respect to each nominee concerning his principal occupation, other affiliations, and business experience during the last five years, are set forth below.

Nominees for Election as Director

| | | | | | |

| | | Age | | Director

Since | | Committees |

Charles K. Narang | | 75 | | 1989 | | |

Brian J. Clark | | 43 | | 2012 | | |

James P. Allen | | 65 | | 2004 | | Audit (Chair) and Compensation |

John E. Lawler | | 64 | | 2004 | | Nominating/Governance (Chair)and Audit |

Paul V. Lombardi | | 72 | | 2004 | | Compensation(Chair) and Audit |

Philip O. Nolan | | 55 | | 2011 | | Compensation |

Austin J. Yerks | | 68 | | 2013 | | |

Daniel R. Young | | 80 | | 2005 | | Compensation and Nominating/Governance |

Charles K. Narang founded our predecessor and wholly owned subsidiary, NCI Information Systems, Inc., during 1989 and has served as our Chairman and Chief Executive Officer since that time. Mr. Narang has more than 30 years of experience in corporate management and the analysis of large financial and information management systems for the Federal Government and Fortune 100 clients. Mr. Narang holds a Master’s degree in Industrial Engineering, a Master of Business Administration, and is a Certified Public Accountant.

Mr. Narang possesses particular knowledge and experience in providing information technology and professional services to the Federal Government that strengthen the Board’s collective qualifications, skills, and experience. His demonstrated capabilities in leading and guiding our Company through 22 years of substantial growth provide the Board with a key understanding of the Company, its culture, its personnel, and its strengths and weaknesses. These capabilities combined with his prior business, financial and managerial experience strengthen the Board’s collective qualifications, skills, and experience and make him ideally qualified to lead NCI’s Board.

Page 11

Brian J. Clark joined us in April 2011 as our Executive Vice President, Chief Financial Officer and Treasurer, until he was promoted to President effective January 1, 2012. Prior to joining NCI, Mr. Clark served as the Executive Vice President, Chief Financial Officer and Treasurer of Stanley, Inc. (“Stanley”), a publicly-traded provider of information technology services and solutions to U.S. defense, intelligence, and federal civilian government agencies from 2006 until 2010, when Stanley was acquired by CGI Group, Inc. Prior to joining Stanley, he held various executive positions at Titan Corporation from 2001 to 2006, most recently as Vice President and Corporate Controller. Prior thereto he had been Titan’s Vice President of Strategic Transactions where he managed the company’s mergers and acquisitions program, as well as divestitures, equity joint ventures and other strategic transactions. From 1996 to 2001, he held various positions at Arthur Andersen LLP, a public accounting firm, most recently as a Senior Manager. From 1994 to 1996, he held various positions at Deloitte & Touche LLP, a public accounting firm, most recently as a senior staff accountant. Mr. Clark holds a B.S. degree in Accounting from Virginia Polytechnic Institute and State University and is a Certified Public Accountant.

Mr. Clark possesses particular knowledge and experience in providing financial and operational leadership to companies of our size and in our industry that provide information technology and professional services to the Federal Government. Mr. Clark’s background brings important capabilities to the Board, particularly in finance, capital markets, corporate development and compensation, which further strengthens the Board’s collective qualifications, skills, and experience.

James P. Allen has served on our Board of Directors since October 2004. Mr. Allen previously served as Executive Vice President and Chief Financial Officer of Global Defense Technology & Systems, Inc. (now known as Sotera Defense Solutions, Inc.), a provider of mission-critical systems and services to the national security agencies of the Federal Government, from May 2009 until September 2010. Previously, Mr. Allen served as the Senior Vice President and Chief Financial Officer of Veridian Corporation, a publicly traded Federal IT services contractor, from May 2000 until its sale to General Dynamics Corporation during August 2003. Before Veridian, he served as CFO for both GRC International, Inc. and CACI International Inc., both publicly traded companies in the Federal IT services sector.

Mr. Allen possesses particular knowledge and experience in providing financial leadership to companies of our size and in our industry that provide information technology and professional services to the Federal Government. Mr. Allen’s background brings an important capability to the Board, as well as the Audit Committee, and strengthens the Board’s collective qualifications, skills, and experience.

John E. Lawler has served on our Board of Directors since October 2004. Mr. Lawler is a principal in two investment advisory and wealth management firms, currently serving as CEO and Chairman of the Board of Sterling Wealth Management, Inc., and Managing Partner of East West Investment Advisors, LLC. and President of East West Financial Services, Inc., a diversified financial management, tax, and consulting firm. Before forming these companies, Mr. Lawler served in executive positions of two major Washington, D.C. public affairs and governmental relations firms, including Gray and Company, which he assisted in its IPO and served as its Chief Financial Officer. Mr. Lawler also served in top administrative positions of the U.S. House of Representatives, including Chief of the Office of Finance. Mr. Lawler currently serves on the Board of Trustees of two non-profit endowments.

Mr. Lawler’s experience has provided him with in-depth knowledge of Federal Government appropriations and legislative procedures that are key to our business. He also brings an understanding of investor relations, analyst reporting, and the perspective of the investment community. As President of East West Financial Services, Inc., he remains abreast of important governance matters for directors of public companies as well as a financial background that qualifies him as a designated financial expert. As a result of these and other professional experiences, Mr. Lawler possesses particular knowledge and experience that strengthen the Board’s collective qualifications, skills, and experience.

Paul V. Lombardi has served on our Board of Directors since October 2004. Mr. Lombardi served as President and Chief Executive Officer of DynCorp from 1997 until its sale to Computer Sciences Corporation (CSC) during 2003. Before his association with DynCorp, Mr. Lombardi was employed at PRC, Inc. where he held a variety of executive-level positions, including Senior Vice President and General Manager of PRC’s Applied Management Group, which provided information technology and systems integration in the Federal IT services sector. Before entering the private sector, Mr. Lombardi had 17 years of public service in increasing higher executive positions in the Defense and Energy Departments.

Page 12

Mr. Lombardi’s experiences as a CEO and senior executive at several government information technology and professional services companies which do business with the Federal Government provides relevant insight and a breadth of knowledge and experience that strengthen the Board’s collective qualifications, skills, and experience.

Mr. Philip O. Nolan has served on our board since February 2011. Mr. Nolan is currently the Chairman and CEO of Galeon Group, LLC. Previously, Mr. Nolan was the Chairman and Chief Executive Officer of Stanley, Inc. (Stanley) a provider of information technology services and solutions to U.S. defense, intelligence, and federal civilian government agencies. Prior to joining Stanley in 1989, Mr. Nolan served on active duty in the U.S. Navy from 1981 to 1988. Mr. Nolan remained an active member of the U.S. Navy Reserve following his release from active duty until his retirement in December 2005. Mr. Nolan serves on the Board of Directors of Camber Corporation and as an outside director on the SSA board of Cap Gemini Government Solutions, Inc. In addition, he is on the advisory board of Blue Delta Capital Partners, LLC.

Mr. Nolan’s 22 years of service as a senior executive officer and 14-year tenure as President of Stanley, as well as his prior experience in the armed services, provides the Board of Directors a deep understanding and appreciation of our business and the customers we serve. His service to Stanley, together with the leadership positions he has maintained in our industry, provide him with valuable perspective on leadership and management challenges that face our company.

Austin J. Yerks is currently the President and founder of AJY III Government Strategies, LLC. Previously, Mr. Yerks was the President of CSC’s North American Public Sector Defense and Intelligence Group from 2005 to 2011. Prior to that Mr. Yerks was the president of CSC’s Federal Business Development organization responsible for all business development and strategic marketing oversight for the operational business units of CSC’s federal sector. Mr. Yerks holds a B.S. in Business Administration from the U.S. Military Academy at West Point, and a Master’s Degree in Business Administration from the University of Miami. Mr. Yerks also served ten years in the U.S. Army.

Mr. Yerks has been a senior executive in the federal marketplace for over 30 years, and is known for his technologically forward thinking vision and for solving the most difficult and complex client challenges.

Daniel R. Young has served on our Board of Directors since January 2005. Mr. Young is currently Managing Partner of the Turnberry Group, an advisory practice to CEOs and other senior executives. He was the Vice Chairman and Chief Executive Officer of Federal Data Corporation (FDC) before retiring after having served the company in various executive capacities for 25 years. Before joining FDC, Mr. Young was an executive with Data Transmission Company and before that, he held various engineering, sales, and management positions at Texas Instruments, Inc. Mr. Young sits on the boards of Dewberry, a privately-held engineering, architectural and consulting company; and KCG Corporation, a privately-held cybersecurity company. Mr. Young also served as an officer in the U.S. Navy.

Mr. Young brings to the Board extensive experience within our market sector spanning 26 years of managing and directing companies of similar and larger size. In addition, Mr. Young continues to be active in our market area and has significant insight into market activities and issues. Mr. Young’s senior executive background provides NCI with a broad range of expertise to include business strategy, execution and compensation industry practices. His background and experience strengthen the Board’s collective qualifications, skills, and experience.

THE BOARD OF DIRECTORS RECOMMENDS THAT THE STOCKHOLDERS VOTE “FOR” THE ELECTION OF THE NOMINEES PREVIOUSLY NAMED.

Independence and Composition

The NASDAQ listing standards require that a majority of our Board be “independent” directors, as defined in the NASDAQ listing standards. The Board, upon the unanimous recommendation of the Nominating/Governance Committee, has determined that Messrs. Allen, Lawler, Lombardi, Nolan, Yerks, and Young, representing a majority of our Board, are “independent” as defined in the NASDAQ listing standards. The Board made its determination based on information furnished by all directors regarding their relationships with the Company and third parties as well as research conducted by management. In addition, the Nominating/Governance Committee consulted with our General Counsel to ensure that the Board’s determination would be consistent with all relevant securities laws and regulations, as well as the NASDAQ listing standards.

Page 13

Stockholder Communication with the Board

We believe that it is important for our stockholders to be able to communicate their concerns to our Board. Stockholders may correspond with any director, committee member, or the Board of Directors generally by writing to the following address: NCI, Inc., 11730 Plaza America Drive, Suite 700, Reston, Virginia 20190, Attention: Ms. Michele R. Cappello, Corporate Secretary. Please specify to whom your correspondence should be directed. Our Corporate Secretary has been instructed to promptly forward all correspondences to the relevant director, committee member, or the full Board of Directors, as indicated in your correspondence.

Director Attendance at Annual Meeting of Stockholders

We invite all our directors to attend our annual meeting of stockholders, and we strongly encourage them all to do so. All our directors serving at the time of the 2013 Annual Meeting of Stockholders were in attendance.

Code of Ethics

During July 2012, we updated ourCode of Ethics, which sets forth the policies composing our code of conduct. Our policies satisfy the SEC’s requirements for a “code of ethics” applicable to our principal executive officer, principal financial officer, principal accounting officer, controller, and persons performing similar functions, as well as NASDAQ’s requirements for a code of conduct applicable to all directors, officers, and employees. Among other principles, our Code of Ethics includes guidelines relating to the ethical handling of actual or potential conflicts of interest, compliance with laws, accurate financial reporting, and procedures for promoting compliance with (and reporting violations of) such standards. A copy of our Code of Ethics is available on the “Investor” page on our website, www.nciinc.com, under Corporate Governance, and in print to any stockholder who requests it. We are required to disclose any amendment to, or waiver from, a provision of our code of ethics applicable to our principal executive officer, principal financial officer, principal accounting officer, controller, or persons performing similar functions. We intend to use our website as a method of disseminating this disclosure, as permitted by applicable SEC rules.

The Board’s Role in Risk Oversight

The Board of Directors has oversight responsibility of the processes established by management to report and monitor systems for material risks applicable to the Company. In addition, the Board considers the risks inherent in NCI’s corporate strategy and offers insight to management relating to enterprise risk. At Board meetings, the Board considers strategic risks and opportunities as well as risks to the Company’s reputation and reviews risks related to the sustainability of its operations. The Board regularly receives reports from its committees which include risk oversight in their areas of responsibility. Presentations from the President, CFO, and General Counsel, as well as operational mangers, are reviewed and areas of risk are discussed. It is management’s responsibility to manage risk and bring to the Board of Directors’ attention the most material risks to the Company. The Audit Committee also regularly reviews risks associated with treasury (insurance, credit, and debt), financial reporting and accounting, legal, compliance, information technology security, and other risk areas. The Compensation Committee considers risks related to the attraction and retention of executive officers and risks relating to the design of compensation programs and arrangements. The Nominating/Governance Committee, as part of its regular meeting, reviews ethics compliance, and director qualifications as a means of monitoring enterprise risk associated with those areas.

Board Leadership Structure

Mr. Narang is our Chairman and Chief Executive Officer. Mr. Narang founded the Company over 25 years ago and has built the Company to over 1,900 employees. Mr. Narang has approximately 39% economic ownership of the Company and approximately 86% voting ownership of Company. The Board continues to believe that Mr. Narang is the best person to continue leading the Company for the foreseeable future.

The lead independent director position for any executive session is determined by the issues to be discussed by the independent members of the Board during the executive session. Independent members of the Board met in executive session three times during 2013. Mr. Lawler, as Chairman of the Nominating /Governance Committee, was the lead director during these executive sessions.

Page 14

Attendance at Board and Committee Meetings

It is the Company’s policy to encourage all directors to attend in person or, if not possible, via teleconference where feasible, all Board of Directors and Committee meetings. Nevertheless, the Company recognizes that this may not always be possible due to conflicting personal or professional commitments. The Board held seven meetings during 2013. Each member of our Board was present for 75% or more of the combined total of (i) all meetings of the Board of Directors held during the part of 2013 which they served and (ii) all meetings of all committees of the Board of Directors held during the part of 2013 during which they served on any such committee.

Committees of the Board of Directors

Our Board of Directors has established an Audit Committee, a Compensation Committee, and a Nominating/Governance Committee. Upon the unanimous recommendation of the Nominating/Governance Committee, the Board has determined that each member of all our Committees are independent as director independence is specifically defined with respect to such members under the NASDAQ listing standards and applicable SEC rules and regulations. Copies of the charters for the Audit Committee, Compensation Committee, and Nominating/Governance Committee are available both at the “Investors” section of the Company’s website located at www.nciinc.com under “Governance” and in print to any stockholder who requests them.

Audit Committee. The Audit Committee, which consists of Messrs. Allen (chairman), Lombardi, and Lawler, reviews the professional services provided by our independent registered public accounting firm, the independence of our independent registered public accounting firm from our management, our annual and quarterly financial statements, and our system of internal control over financial reporting. The Audit Committee also reviews other matters with respect to our accounting, auditing, and financial reporting practices and procedures as it may find appropriate or may be brought to its attention through our management, our independent registered public accounting firm or our ethics or whistleblower hotlines. Upon the unanimous recommendation of the Nominating/Governance Committee, our Board has determined Mr. Allen qualifies as an “audit committee financial expert” as defined in applicable SEC rules and regulations. The Audit Committee held seven meetings during 2013.

Nominating/Governance Committee. The Nominating/Governance Committee, which consists of Messrs. Lawler (chairman), and Young, oversees all aspects of our corporate governance functions; makes recommendations to the Board regarding corporate governance issues; identifies, reviews, and evaluates candidates to serve as directors; and makes such other recommendations to the board regarding affairs relating to our directors. The Nominating/Governance Committee held one meeting during 2013.

Our Nominating/Governance Committee endeavors to identify individuals to serve on the Board who have expertise that is useful to us and complementary to the background, skills, and experience of other Board members. The Nominating/Governance Committee’s consideration of candidates for membership on the Board may include such factors as (a) the skills of each member of the Board, including each director’s business and management experience, accounting experience, and understanding of corporate governance regulations and public policy matters; (b) the characteristics of each member of the Board, which may include leadership abilities, sound business judgment, and independence; and (c) the general composition of the Board, which may include public company experience of the directors. The principal qualification for a director is the ability to act in the best interests of the Company and its stockholders. Each of the candidates for director named in this proxy statement have been recommended by the Nominating/Governance Committee and approved by the Board of Directors for inclusion on the attached proxy card.

Board Diversity.The Company does not have a specific policy on diversity relating to the selection of nominees for the Board, but the Board believes that while diversity and a variety of experiences and viewpoints represented on the Board should always be considered, a director nominee should not be chosen nor excluded solely or largely because of race, color, gender, national origin, sexual orientation, or identity. In selecting a director nominee, the Nominating/Governance Committee focuses on diversity in the broadest sense, considering, among other things, skills, expertise, or background that would complement the existing board, recognizing that the Company’s businesses and operations are unique and focused on the information technology and professional services to the Federal Government.

Page 15

The Nominating/Governance Committee also considers director nominees recommended by stockholders. See the section of this proxy statement titled, “Deadline for Stockholder Proposals,” for a description of how stockholders desiring to make nominations for directors and/or to bring a proper subject before a meeting should do so. The Nominating/Governance Committee evaluates director candidates recommended by stockholders in the same manner as it evaluates director candidates recommended by our directors, management, or employees.

Compensation Committee

General. The Compensation Committee presently consists of Messrs. Lombardi (chairman), Allen, Nolan, and Young. The Compensation Committee held four meetings during 2013. The Compensation Committee typically meets with the Chief Executive Officer and the President and, where appropriate, the General Counsel and other members of management. The Compensation Committee also regularly meets in executive session without management. From time to time, the Committee engages outside consultants who are compensation experts in peer-group company compensation trends. When determining executive compensation, the Compensation Committee typically reviews the following materials, among others:

| | • | | Financial reports on year-to-date performance versus budget and compared to prior year performance. |

| | • | | Calculations and reports on levels of achievement of individual and corporate performance objectives. |

| | • | | Reports on NCI’s strategic objectives and budget for future periods. |

| | • | | Information on the executive officers’ stock ownership and option holdings. |

| | • | | Peer companies’ information regarding compensation programs and compensation levels. |

These materials may also be reviewed during regular Board of Directors meetings.

Role of the Compensation Committee. The Compensation Committee is responsible for (i) overseeing the determination, implementation, and administration of the remuneration (including compensation, benefits, bonuses, and perquisites) of all directors and executive officers of the Company, (ii) reviewing equity compensation to be paid to other Company employees, and (iii) administering the Company’s stock-based compensation plans. Our compensation program and policies are designed to help us attract, motivate, and retain executives of outstanding ability to maximize return to stockholders.

Management’s Role in the Compensation-Setting Process.Management plays a significant role in the compensation-setting process for executive officers. The most significant aspects of management’s role are:

| | • | | Evaluating employee performance; |

| | • | | Recommending business performance targets and objectives; and |

| | • | | Recommending salary levels and option awards. |

The Chief Executive Officer works with the Compensation Committee Chair in establishing the agenda for Compensation Committee meetings. Management also prepares meeting information for each Compensation Committee meeting. The Chief Executive Officer also participates in Compensation Committee meetings at the Compensation Committee’s request to provide:

| | • | | Background information regarding NCI’s strategic objectives; |

| | • | | His evaluation of the performance of the senior executive officers; and |

| | • | | Compensation recommendations as to senior executive officers (other than himself). |

Delegation of Authority. Although our Chief Executive Officer may recommend to the Compensation Committee awards to our executive officers, the Compensation Committee approves the grant of all awards to executive officers under the Company’s Amended and Restated 2005 Performance Incentive Plan (the Plan). However, annually, the Compensation Committee allocates a pool of equity awards and delegates to management the right to grant equity awards from the pool to non-executive employees based on specific guidelines for recruitment, performance incentive, and retention purposes.

Page 16

Compensation Committee Interlocks and Insider Participation. No members of our Compensation Committee during fiscal year 2013 were officers or employees of the Company or former officers of the Company and no members of our Compensation Committee had any relationship with the Company during fiscal year 2013 requiring disclosure as a related party transaction under the SEC’s rules.

None of our executive officers in fiscal year 2013 served as a director or member of the compensation committee (or other board committee performing equivalent functions) of any other entity which had an executive officer serving as one of our directors or a member of our Compensation Committee.

Page 17

EXECUTIVE OFFICERS

Charles K. Narang.See “Election of Directors (Proposal 1) — Information Regarding the Nominees for Election as Directors” above.

Brian J. Clark. See “Election of Directors (Proposal 1) — Information Regarding the Nominees for Election as Directors” above.

Marco F. de Vito, 59, joined us in May 2011 as our Senior Vice President of Corporate Development and was named our Chief Operating Officer in August 2011. From 2009 until joining NCI, Mr. de Vito was the Chief Operating Officer at CRGT, a $100 million systems integrator. From 1991 until 2009, Mr. de Vito worked for Computer Sciences Corporation in various roles, most recently as the Vice President and General Manager of the Joint Defense Integrated Solutions unit from 1996 until 2009.

Michele R. Cappello, 63, joined NCI in August 1997. From August 1997 until February 2009, she held the position of Vice President and General Counsel. In 2009, she was promoted to Senior Vice President and General Counsel and serves in that capacity to the present. In addition, she is the corporate secretary. Ms. Cappello has more than 26 years of experience in Government contract procurement and is responsible for all legal, contractual, and purchasing matters for the corporation. Before joining NCI, Ms. Cappello spent 10 years as in-house Counsel to Network Solutions, Inc. and its spin-off company, Netcom Solutions International, as well as positions with Boeing Computer Systems and Computer Data Systems, Inc. Ms. Cappello received her JD from George Mason University School of Law.

Lucas J. Narel, 39, joined NCI in December 2011. Effective January 2012, Mr. Narel became our Executive Vice President, Chief Financial Officer and Treasurer. From August 2010 until December 2011, Mr. Narel served as Vice President of Finance for CGI Federal, a government information technology contractor and wholly-owned subsidiary of CGI Group, overseeing accounting, budgeting and financial operations. Prior to CGI’s acquisition of Stanley, Inc., Mr. Narel held various positions at Stanley from 2000 until 2010, most recently as Vice President and Corporate Controller. Mr. Narel holds a B.S. degree in Finance from Virginia Polytechnic Institute and State University and a Masters in Business Administration from American University.

Page 18

REPORT OF THE AUDIT COMMITTEE

OF THE BOARD OF DIRECTORS

The Audit Committee of the Company’s Board of Directors is composed of Messrs. Allen, Lawler, and Lombardi. Upon the unanimous recommendation of the Nominating/Governance Committee, the Board has determined that each member of our Audit Committee is “independent” as defined under the NASDAQ listing standards and applicable SEC rules and regulations. Upon the unanimous recommendation of the Nominating/Governance Committee, our Board has also determined that each director meets the audit committee composition requirements in the NASDAQ listing standards and that Mr. Allen qualifies as an “audit committee financial expert” as defined in applicable SEC rules and regulations.

In accordance with a written charter adopted by the Board, the Audit Committee assists the Board in fulfilling its responsibility for overseeing the quality and integrity of the NCI, Inc. financial reporting processes. The Audit Committee reviews and reassesses the adequacy of the charter on a regular basis, and at least annually. The Audit Committee Charter is available both at the “Investors” section of the Company’s website located at www.nciinc.com and in print to any stockholder who requests it.

Management is responsible for the Company’s internal control over financial reporting and the financial reporting process. The Company’s independent registered public accounting firm is responsible for performing an independent audit of the Company’s consolidated financial statements in accordance with U.S. generally accepted accounting principles and issuing a report on those consolidated financial statements. The Audit Committee is responsible for monitoring and overseeing these processes. In fulfilling its responsibilities set forth in the Audit Committee Charter, the Committee has accomplished, among other things, the following:

| | • | | It reviewed and discussed the audited financial statements for 2013 with management and Deloitte & Touche LLP, the Company’s independent registered public accounting firm for the fiscal year ended December 31, 2013. |

| | • | | It discussed with Deloitte & Touche LLP, the matters required to be discussed by the applicable standards of the Public Company Accounting Oversight Board (PCAOB). |

| | • | | It received from Deloitte & Touche LLP, written disclosures and the letter required by applicable PCAOB rules regarding the Deloitte & Touche LLP’s communications with the Audit Committee concerning independence. |

| | • | | It discussed with Deloitte & Touche LLP its independence from us. |

Based on its discussions with management and Deloitte & Touche LLP, and its review of the representations and information provided by management and Deloitte & Touche LLP, the Audit Committee recommended to the Company’s Board of Directors that the audited consolidated financial statements be included in the Company’s Annual Report on Form 10-K for the year ended December 31, 2013 for filing with the SEC.

Dated as of April 30, 2014

THE AUDIT COMMITTEE OF THE BOARD OF DIRECTORS

James P. Allen,Chairman

John E. Lawler

Paul V. Lombardi

Page 19

COMPENSATION DISCUSSION AND ANALYSIS

Our Compensation Discussion and Analysis addresses the following topics:

| | • | | Our compensation objectives and elements of executive compensation; |

| | • | | Our compensation evaluation process; |

| | • | | Components of our executive compensation program; and |

| | • | | Our compensation decisions for 2013 and base salary compensation for 2014. |

In this “Compensation Discussion and Analysis” section, the term “Committee” refers to the Compensation Committee of NCI’s Board of Directors.

Compensation Objectives and Elements of Executive Compensation

The primary objectives of our executive compensation program are to:

| | • | | Provide total compensation opportunities that are competitive with opportunities provided to executives of comparable companies at comparable levels of performance; |

| | • | | Ensure that our executives’ total compensation levels vary based on both our short-term financial performance and growth in stockholder value over time; |

| | • | | Focus and motivate executives on the achievement of defined objectives; and |

| | • | | Reward executives in accordance with their relative contributions to achieving strategic milestones and upholding key mission-related objectives. |

In designing and administering our executive compensation program, we attempt to strike an appropriate balance among these objectives. At present, the Board of Directors does not prescribe any stock ownership guidelines for our executive officers.

The Board, through the Compensation Committee, annually revisits the manner in which it implements our compensation policies in connection with executive staff. Our policies will continue to be designed to align the interests of our executives and senior staff with the long-term interests of the stockholders. Our executive compensation programs consist of three principal elements:

| | • | | Base salary compensation; |

| | • | | Short-term incentive compensation (consisting of cash under the Amended and Restated 2005 Performance Incentive Plan and additional cash bonuses); and |

| | • | | Long-term incentive compensation (consisting of equity-based awards under the Amended and Restated 2005 Performance Incentive Plan). |

Executive officers also receive certain benefits and other perquisites.

The Compensation-Evaluation Process

Annual Evaluation

The Committee meets in executive session each year to evaluate the performance of the named executive officers, determine their annual awards under the Plan and additional cash bonuses for the prior year, establish their annual performance objectives for the current year, set their base salaries for the current year (effective February 1), and consider and approve any grants to them of equity incentive compensation.

Although substantially all compensation decisions are generally made in the first quarter of each fiscal year, our compensation-planning process neither begins nor ends with any particular Committee meeting. Compensation decisions are designed to promote our fundamental business objectives and strategy. Business and succession planning, evaluating management performance, and considering the business environment are year-round processes.

Page 20

During the first quarter of 2013, the Compensation Committee met and the following determinations were made:

Based upon an analysis of similarly sized peer companies, the Compensation Committee determined that the base salaries and other compensation of the named executive officers were in line with the base salaries and total compensation of comparable companies.

A thorough review of the metrics used for the 2012 payments under the Plan was done to determine their overall effectiveness in accomplishing the short-term and long-term goals of the company. Based upon the review some changes were made to the 2013 metrics under the Plan to better align them with the corporation’s strategic goals.

Most Recent Stockholder Advisory Vote on Executive Compensation.In June 2011, our stockholders cast an advisory vote on the Company’s executive compensation decisions and policies as disclosed in the proxy statement issued by the Company in April 2011. Approximately 99 percent of the Company’s outstanding shares were voted in support of the compensation decisions and policies as disclosed. The Compensation Committee considered this result an endorsement of the Company’s compensation policies and practices and determined that it was not necessary at this time to make any material changes to those policies and practices in response to the advisory vote.

Performance Objectives

Generally, our process begins with establishing individual and corporate performance objectives for named executive officers in the first quarter of each year. While several key performance goals were met in 2013, the Company continued to experience a challenging year in terms of contract bookings. To maintain the proper incentives, the Compensation Committee engaged in an active dialog with the Chief Executive Officer and President concerning strategic objectives and performance targets throughout 2013. The original financial performance goals determined during the first quarter of 2013 were used to determine the short term incentive bonuses paid for 2013.

The named executive officers are incentivized to reach certain financial milestones such as earnings per share, contract bookings, revenue, day’s sales outstanding, and other financial measures. Presently, we do not have a “claw back” policy for financial bonuses other than that imposed by Section 304 of the Sarbanes-Oxley Act. The claw back feature of Section 304 of the Sarbanes-Oxley Act is limited to the chief executive officer and chief financial officer and is based on misconduct that results in material noncompliance by the issuer with the financial reporting requirements of the federal securities laws. We believe we have sufficient financial policies and procedures in place to prevent situations where a claw back policy would be necessary.

We have determined that it is not reasonably likely that our compensation and benefit plans would have a material adverse effect on the Company. The Company has reached its conclusion using benchmarking against peer company executives to ensure the Company’s compensation policies and practices are in line with those peer companies. The Company also does not base executive compensation solely on one financial criterion but on several critical success factors so as to not place all of management’s focus on achieving a single financial objective. The financial targets are all Company-wide objectives which limit the ability of a single person to influence individual or corporate wide incentive payouts. Thus the Company mitigates potential short-term excessive risk taking and aligns executives’ compensation with increasing long-term shareholder value.

Benchmarking

While we recognize that our compensation practices must be competitive in the marketplace, and that benchmarking is one of many factors that we consider in assessing the reasonableness of compensation, we do not believe that it is appropriate to establish compensation levels based entirely on benchmarking. In December 2012, Mercer was engaged as an independent consultant by the Compensation Committee to advise the Committee about compensation trends within our industry and for other publicly-traded companies of similar size, and presented their findings to the Committee in January of 2013. Of particular interest was the turmoil in the federal contracting industry as a result of federal budgetary issues as well as the turnaround activities specific to NCI that were being undertaken by management. We feel that the analysis presented in January 2013 is still relevant. For purposes of reviewing pay practices, we have used the following companies in the past to constitute our peer group: Agilysys, Inc., Datalink Corp., Dynamics Research Corporation, HEICO Corporation, ICF International, Inc., KEYW Holding Corp., Kratos Defense & Security Solutions, Inc., MAXIMUS, Inc., Syntel, Inc., Telecommunications Systems, Inc., Tyler Technologies Inc., and VSE Corporation. We gather this information from the most recent public documents and filings. We also evaluate our pay practices against various salary surveys.

Page 21

Tax and Accounting Considerations

We select and implement the elements of compensation for their ability to help us achieve the objectives of our compensation program and not based on any unique or preferential financial accounting or tax treatment. However, when awarding compensation, the Committee is mindful of the level of earnings per share dilution and accounting impact that will be caused as a result of the compensation expense related to the Committee’s actions. In addition, Section 162(m) of the Internal Revenue Code provides that public companies cannot deduct compensation in excess of $1 million per year paid to its Chief Executive Officer or any of the three other most highly compensated executive officers at the end of the year (other than the Chief Financial Officer). Exceptions are made for certain qualified “performance-based compensation” provided pursuant to a stockholder-approved plan. The Committee’s intentions when awarding compensation is to ensure it is done in compliance with the Internal Revenue Code so that all compensation be deductible and do not expect that we will pay compensation that is not deductible. We believe that we have structured our current compensation programs in a manner to allow us to fully deduct executive compensation under Section 162(m) of the Internal Revenue Code, although this result cannot be assured. The Committee will continue to assess the impact of Section 162(m) of the Internal Revenue Code on its compensation practices and determine what further action, if any, is appropriate. Such further action could include approving compensation which is not deductible under Section 162 if the Internal Revenue Code.

Components of our Executive Compensation

Base Salary Compensation

Our base salary compensation is a market-based plan referencing our peer group to ensure competitive pay levels. Base salary compensation is reviewed no less than annually. We consider the year-to-year rate increases, if given, to be in line with industry standards.

Short-Term Incentive Compensation

Our compensation philosophy emphasizes incentive pay to leverage both individual and organizational performance. Our short-term incentive compensation program, which consists of cash bonuses, rewards achievement of primarily annual organizational, business unit, and individual objectives. In addition, we may also use cash bonuses to reward extraordinary performance during the period.

Long-Term Incentive Compensation

Our long-term incentive compensation program, which consists of equity awards under the Plan, is designed to reward named executive officers and other key executive officers for long-term growth consistent with Company performance and stockholder return and is not specifically tied to a particular period of performance. The ultimate value of the long-term incentive compensation equity awards is dependent upon the actual performance of our stock price over time. The Compensation Committee must review and approve all equity awards granted to the named executive officers. When making awards under the Plan, the Committee takes into account the potential dilution to which our stockholders are exposed by reviewing our equity award overhang. Equity award overhang, which is represented in percentage form, is calculated as outstanding equity awards granted plus the remaining equity awards available under the Plan divided by our total shares outstanding.

Our Compensation Decisions for 2013 and Base Salary Compensation for 2014

This section describes the compensation decisions that we made with respect to the named executive officers for 2013 and during the first quarter of 2014.

Executive Summary

During 2013, we applied the compensation principles described above in determining the compensation of our named executive officers.

In summary, the compensation decisions made during 2013 and the first quarter of 2014 for the named executive officers were as follows:

| | • | | We did not increase base salaries for the named executive officers in 2013. |

| | • | | We deferred the determination of salary increases for named executive officers in 2014 to a subsequent period. |

Page 22

| | • | | Short-term incentive compensation represented approximately 48% of the cash compensation paid to the named executive officers for 2013. |

| | • | | We granted stock options during 2013 as a long-term and retention incentive to Mr. Clark, Mr. de Vito, Mr. Narel and Ms. Cappello. |

We believe that these decisions:

| | • | | are consistent with our core compensation principles, |

| | • | | reinforce our pay-for-performance culture, |

| | • | | promote the interests of long-term stockholders, and |

| | • | | are reasonable and responsible, and within the average of the industry peer group. |

Base Salary Compensation

The Chief Executive Officer presents to the Committee recommendations for base salary adjustments for the named executive officers (other than himself). Individual adjustments are reviewed and approved by the Compensation Committee based upon individual achievement and contribution. In addition, the Compensation Committee reviews peer company data for executive compensation, which it uses in determining the appropriate cash and total executive compensation.

The following table sets forth recent base salary information for our named executive officers:

| | | | | | | | | | | | |

| | | 2014

Base Salary

(Feb. 1, 2014 to Jan.

31, 2015)* | | | 2013

Base Salary

(Feb. 1, 2013 to Jan.

31, 2014) | | | Percentage

Increase | |

Charles K. Narang | | $ | 550,000 | | | $ | 550,000 | | | | — | % |

Brian J. Clark | | | 450,000 | | | | 450,000 | | | | — | |

Marco F. de Vito | | | 350,000 | | | | 350,000 | | | | — | |

Michele R. Cappello | | | 280,000 | | | | 280,000 | | | | — | |

Lucas J. Narel | | | 280,000 | | | | 280,000 | | | | — | |

| * | The determination of 2014 salary adjustments has been deferred to a subsequent period. |

In setting these base salaries, we considered:

| | • | | The compensation philosophy and guiding principles described above; |

| | • | | Experience and industry knowledge of the named executive officers and the quality and effectiveness of their leadership at the Company; |

| | • | | All the components of executive compensation, including base salary, cash bonuses, restricted stock, stock options, and benefits and perquisites; |

| | • | | Mix of performance pay to total compensation; |

| | • | | Internal pay equity among named and other NCI senior executives; and |

| | • | | Base salary paid to the officers in comparable positions at peer group companies. |

Short-Term Incentive Compensation

Performance Incentive Plan

The Compensation Committee is responsible for approving bonus awards recommended to it by the Chief Executive Officer and President, for the other named executive officers and for reviewing the total actual bonus pool. Bonus awards for 2013 were reviewed and approved by the Compensation Committee in its meetings during the fourth quarter of 2013 and the first quarter of 2014, and bonus payments were made during March 2014. The short-term incentive payouts under the Plan are determined by the Company’s performance related to the following factors: earnings per share and contract bookings.

The factors for earnings per share and bookings represent annual amounts generated in 2013.

Page 23

The table below illustrates the potential cash incentive award payable, which we refer to as the Plan award potential, at each performance level (i.e., threshold, target or maximum) as a percentage of 2013 base salary for each named executive officer:

| | | | | | | | | | | | |

| | | Threshold

Performance | | | Target Performance | | | Maximum

Performance | |

Charles K. Narang | | | 25.0 | % | | | 125.0 | % | | | 187.5 | % |

Brian J. Clark | | | 20.0 | | | | 100.0 | | | | 150.0 | |

Marco F. de Vito | | | 15.0 | | | | 75.0 | | | | 112.5 | |

Michele R. Cappello | | | 15.0 | | | | 75.0 | | | | 112.5 | |

Lucas J. Narel | | | 15.0 | | | | 75.0 | | | | 112.5 | |

Plan award potential is a reflection of the achievement, at threshold, target, or maximum performance levels, within each of the Company performance measures. Generally, the Plan payments will be scaled linearly by the Committee if the performance level falls between the threshold and target or target and maximum performance levels.

The table below illustrates the performance levels the Compensation Committee set for 2013.

| | | | | | | | | | | | |

| | | Threshold | | | Target | | | Maximum | |

Earnings per share | | $ | 0.20 | | | $ | 0.50 | | | $ | 0.60 | |