FINANCIAL CORPORATION

QUARTERLY REPORT TO

SHAREHOLDERS

September 30, 2007

October 15, 2007

Dear Shareholder,

We are pleased to report the results of our third quarter ended September 30, 2007. Our subsidiary, BankGreenville continued to build momentum in this, its sixth full calendar quarter of operation. Contributing to this momentum were the move into our new permanent headquarters building in April, the increase in our client service and loan production staff as well as the growth in our market recognition.

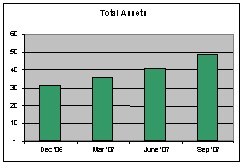

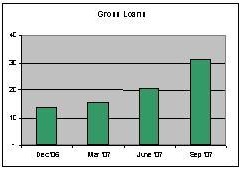

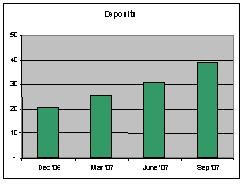

Total assets grew to $48.9 million as of September 30, 2007, an increase of $17.2 million, or 54% from December 31, 2006. Gross loans were $31.3 million at September 30, 2007, an increase of $17.3 million, or 123% from December 31, 2006. At September 30, 2007, deposits totaled $38.7 million, compared to $20.9 million at December 31, 2006, for a $17.8 million or 85% increase.

Our net loss for the nine months ended September 30, 2007 was $454,668, or $0.39 per diluted share compared to a net loss of $639,971, or $0.54 per diluted share for the same period in 2006. Net loss for the third quarter of 2007 was $144,099, or $0.12 per diluted share.

Our strong loan growth of 123% from December 31, 2006 to September 30, 2007, along with anticipated loan growth during the fourth quarter of 2007 will have a positive impact on interest income and results of operations as we near our two year anniversary at the end of January, 2008.

BankGreenville is a community bank, focused on the Greenville market and offering a full complement of commercial banking services including traditional loan and deposit products, online banking, ATM, cash management and other related banking products. We are intent upon providing high quality client service to the Greenville market with a personal and professional approach.

Thank you for your support. We hope to see you at BankGreenville and encourage you to contact us with any questions or needs.

Sincerely,

/s/ Russel T. Williams

Russel T. Williams

President & CEO

FINANCIAL CORPORATION

Financial Highlights

(unaudited)

($ in millions)

FINANCIAL CORPORATION

Financial Highlights

(unaudited)

| | | As of | |

Balance Sheet | | | | | | |

Data: | | 9/30/2007 | | | 12/31/2006 | |

| | | | | | | |

| Total assets | | $ | 48,876,920 | | | $ | 31,656,709 | |

| | | | | | | | | |

| Gross Loans | | | 31,330,725 | | | | 14,025,258 | |

| | | | | | | | | |

| Allowance for loan | | | | | | | | |

| losses | | | (370,721 | ) | | | (210,370 | ) |

| | | | | | | | | |

| Deposits | | | 38,688,921 | | | | 20,932,001 | |

| | | | | | | | | |

| Shareholders’ equity | | | 9,532,923 | | | | 10,066,832 | |

| | | | | | | | | |

Growth Rates: | | | | | | | | |

| | | | | | | | | |

| Percentage increase in assets | | | 54% | | | | | |

| | | | | | | | | |

| Percentage increase in loans | | | 123% | | | | | |

| | | | | | | | | |

| Percentage change in deposits | | | 85% | | | | | |

| | | Quarter | | | Nine Months | |

Results of Operations | | Ended | | | Ended | |

Data: | | 9/30/2007 | | | 9/30/2007 | |

| | | | | | | |

| Net Interest Income | | $ | 372,288 | | | $ | 965,066 | |

| | | | | | | | | |

| Provision for loan | | | | | | | | |

| losses | | | 82,000 | | | | 163,621 | |

| | | | | | | | | |

| Non-interest income | | | 10,599 | | | | 47,841 | |

| | | | | | | | | |

| Non-interest expense | | | 444,986 | | | | 1,303,954 | |

| | | | | | | | | |

| Net loss | | | (144,099 | ) | | | (454,668 | ) |

| | | | | | | | | |

| Net loss per share, diluted | | | (0.12 | ) | | | (0.39 | ) |

Statements contained in this document, which are not historical facts, are forward-looking statements. Such forward-looking statements are necessary estimates reflecting our best judgment based on current information and involve a number of risks and uncertainties. Certain factors which could affect the accuracy of such forward-looking statements are identified in our public filings with the SEC and forward-looking statements contained in this document should be considered in light of those factors. There can be no assurance that such factors or other factors will not affect the accuracy of such statements.

STOCK TRANSFER AGENT

Registrar & Transfer Company

Investor Relations Department

10 Commerce Drive

Cranford, NJ 07016-3572

(800) 368-5948

www.rtco.com

Registrar & Transfer Company makes it possible for you to update shareholder information online. If you have had a change in address or other shareholder information, visit www.rtco.com, click on investor relations, and make your changes now.

FINANCIAL INFORMATION

Shareholders, analysts, and others seeking financial information should contact:

Ms. Paula S. King

Chief Financial Officer

BankGreenville Financial Corporation

P.O. Box 6246

Greenville, SC 29606

FINANCIAL CORPORATION

499 Woodruff Road

Greenville, SC 29607

(864) 335-2200

www.BankGreenville.com

Member FDIC

FINANCIAL CORPORATION

P.O. Box 6246 Greenville, SC 29606