QuickLinks -- Click here to rapidly navigate through this documentAs filed with the SEC on December 9, 2005

Registration No. 333-127409

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

AMENDMENT NO. 2 TO

FORM SB-2

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933

BANKGREENVILLE FINANCIAL CORPORATION

(Exact name of registrant as specified in its charter)

South Carolina

(State or other Jurisdiction of Incorporation or Organization) | | 6022

(Primary Standard Industrial Classification Code Number) | | 20-2645711

(I.R.S. Employer Identification No.) |

116 South Pleasantburg Drive

Greenville, South Carolina 29607

(864) 271-1245

(Address and Telephone Number of Intended Principal Place of Business)

Russel T. Williams

Chief Executive Officer

116 South Pleasantburg Drive

Greenville, South Carolina 29607

(864) 271-1245

(Name, Address, and Telephone Number of Agent For Service)

Copies of all communications, including copies of all communications sent to agent for service, should be sent to:

Neil E. Grayson, Esq.

Nelson Mullins Riley & Scarborough LLP

Poinsett Plaza, Suite 900

104 South Main Street

Greenville, South Carolina 29601

(864) 250-2235

Fax: (864) 250-2359 | | George P. Whitley, Esq.

Scott H. Richter, Esq.

LeClair Ryan, A Professional Corporation

Riverfront Plaza, East Tower

951 East Byrd Street

Richmond, Virginia 23219

(804) 783-2003

Fax: (804) 783-2294 |

Approximate Date of Commencement of Proposed Sale to the Public: As soon as practicable after this Registration Statement becomes effective.

If this form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act of 1933, check the following box and list the Securities Act of 1933 registration statement number of the earlier effective registration statement for the same offering. o

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act of 1933, check the following box and list the Securities Act of 1933 registration statement number of the earlier effective registration statement for the same offering. o

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act of 1933, check the following box and list the Securities Act of 1933 registration statement number of the earlier effective registration statement for the same offering. o

If delivery of the prospectus is expected to be made pursuant to Rule 434, check the following box. o

CALCULATION OF REGISTRATION FEE

|

Title of Each Class of

Securities to be Registered

| | Amount to be

Registered

| | Proposed Maximum

Offering Price

Per Share

| | Proposed Maximum

Offering Aggregate Price

| | Amount of

Registration Fee

|

|---|

|

| Common Stock, no par value per share | | 1,467,000(1) | | $10 | | $14,670,000 | | $1,727(2) |

|

| Warrants | | 110,000(3) | | $0 | | $0 | | $0 |

|

- (1)

- Includes 177,000 shares that the underwriter has the option to purchase to cover over-allotments, if any.

- (2)

- $1,727 was previously paid.

- (3)

- Includes 5,000 warrants eligible to be issued to organizers Halter and Howson if they each purchase an additional 2,500 shares.

The registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the Registration Statement shall become effective on such date as the Commission, acting pursuant to such Section 8(a), may determine.

SUBJECT TO COMPLETION, DATED DECEMBER 9, 2005

The information in this preliminary prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

PRELIMINARY PROSPECTUS

1,180,000 Shares

BANKGREENVILLE FINANCIAL CORPORATION

A PROPOSED BANK HOLDING COMPANY FOR

Common Stock

We are offering shares of common stock of BankGreenville Financial Corporation to fund the start-up of a new community bank, BankGreenville, a proposed South Carolina state- chartered bank. We are currently obtaining regulatory approval for the bank and expect to open for business in the first quarter of 2006. BankGreenville Financial Corporation will be the holding company and sole owner of BankGreenville. The bank will be headquartered in Greenville, South Carolina. This is our first offering of stock to the public, and there is no public market for our shares. Unless otherwise waived by us, any one investor may purchase up to a maximum of 50,000 shares. We have requested that quotations for the common shares be made on the OTC Bulletin Board under the symbol " ."

Our directors and executive officers intend to purchase at least 180,000 shares in this offering, for a total investment of $1,800,000. As a result, they will own approximately 15% of the shares to be outstanding after the offering. These amounts represent the minimum amount our organizers intend to purchase. They may purchase more, including up to 100% of the offering amount. Additionally, each of the organizers will receive warrants to purchase three shares of common stock for $10 per share for every four shares they purchase in the offering, up to a maximum of 10,000 shares per organizer. Each warrant will have a term of 10 years. If each organizer exercises his or her warrants in full and we do not issue any other shares, the directors' and executive officers' ownership of BankGreenville Financial Corporation would increase to approximately 22%, as adjusted for the issuance of the warrants. We describe the warrants in more detail in the "Management—Stock Warrants" section on page 44.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the accuracy or adequacy of this prospectus. Any representation to the contrary is a criminal offense.

An investment in our common stock involves significant risks. You should not invest in this offering unless you can afford to lose some or all of your investment. See "Risk Factors" beginning on page 8 to read about factors you should consider before buying shares of our common stock.

Shares of our common stock are not deposits, savings accounts, or other obligations of a depository institution and are not insured by the Federal Deposit Insurance Corporation or any other governmental agency.

| | Per Share

| | Total

|

|---|

| Price to public | | $10.00 | | $11,800,000 |

| Underwriting discount(1) | | $0.53 | | $628,940 |

| Proceeds, before expenses, to BankGreenville Financial Corporation(2) | | $9.47 | | $11,171,060 |

- (1)

- This is a firm commitment underwriting. The underwriter may also purchase up to 177,000 additional shares from us at the public offering price, less the underwriting discount, to cover over-allotments. If the underwriter exercises this option in full, the total price to public will be $13,570,000, the total underwriting discount will be $723,281, and the total proceeds to us, before expenses, will be $12,846,719.

- (2)

- We estimate that we will incur approximately $100,000 in expenses in connection with this offering.

The underwriter expects to deliver the common stock to purchasers on or about , 2005.

Scott & Stringfellow, Inc.

, 2005

BANKGREENVILLE FINANCIAL CORPORATION

ORGANIZERS AND BOARD OF DIRECTORS

| |  | |  | |  | |  |

Russel T. Williams

President &

Chief Executive Officer,

BankGreenville | | Paula S. King

Executive Vice President & Chief Financial Officer,

BankGreenville | | Jeffrey L. Dezen

Jeff Dezen Public

Relations | | Roger H. Gower, MD

Greenville Ob-Gyn Associates | | Frank B. Halter, Jr.

Coldwell Banker Caine Residential |

|

|

|

|

|

|

|

|

|

|

|

R. Bruce Harman

R.L. Kunz, Inc. | | Arthur L. Howson, Jr.

Board Chairman,

BankGreenville

Gallivan, White & Boyd, P.A. | | Robert L. Kunz

R.L. Kunz, Inc. | | Jonathan T. McClure

ISO Poly Films, Inc. | | David A. Merline, Jr.

Merline &

Meacham, P.A. | | William H. Pelham

Pelham Architects, L.L.C. |

SUMMARY

This summary highlights selected information about us and the offering that is contained elsewhere in this prospectus. The summary does not contain all the information that you should consider before investing in our common stock. You should read this summary together with the entire prospectus. Except as otherwise indicated by the context, references in this prospectus to "we," "our" or "us" are to the combined business of BankGreenville Financial Corporation and our wholly owned subsidiary, BankGreenville.

BankGreenville Financial Corporation and BankGreenville

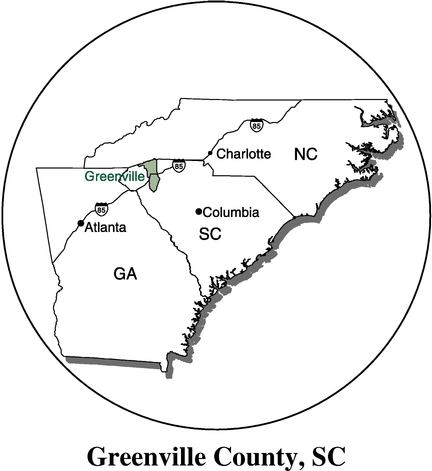

We incorporated BankGreenville Financial Corporation on March 18, 2005 to serve as the holding company for BankGreenville, a proposed new South Carolina state-chartered bank we are forming to be located in Greenville, South Carolina. The bank will focus on the Greenville community, emphasizing personal service to individuals and small-to-medium-sized businesses primarily in Greenville County, including the communities of Mauldin, Simpsonville, Greer and Taylors. Greenville County is centrally located between two of the largest cities in the Southeast, Charlotte and Atlanta, is the largest county in South Carolina, and is one of the faster growing areas in the country. We have filed a charter application with the South Carolina Board of Financial Institutions and an application with the FDIC for federal deposit insurance. We have also filed for approval from the Federal Reserve Board to become a bank holding company and acquire all of the stock of the new bank upon its formation. In September 2005, we received preliminary approval from the the South Carolina Board of Financial Institutions. In October 2005, we received preliminary approval from the FDIC and in December 2005 we received preliminary approval from the Federal Reserve Board. We expect to receive all final regulatory approvals in the fourth quarter of 2005 and open for business in the first quarter of 2006. Until we receive these regulatory approvals, we cannot commence banking operations and generate any operational revenue. During this offering process, we will continue to incur start-up expenses. We incurred a net loss of $125,626 for the period from our inception on March 18, 2005 through September 30, 2005.

Business Strategy

Our strategic plan is comprised of the following four components:

- •

- Personalized Client Service. We will focus on providing high quality, consultative service to small-to-medium-sized businesses and the professional segment of the growing Greenville area market. We will offer a full complement of business and consumer services but will place particular emphasis on that portion of the market that values small business expertise and relationship-oriented service. We believe a community bank that focuses on personalized client service can better serve the local business community than a branch or subsidiary of a larger banking organization headquartered outside of the city or state.

- •

- Experienced Community Bankers and Lending Officers with Significant Market Ties. To compete for the banking services of Greenville businesses, individuals, and professionals that want to bank with a locally-owned and managed institution offering a high level of service and personal attention, we intend to hire seasoned community banking professionals recognized for their community involvement and market experience. Our executive management team is indicative of the caliber of individuals we will seek to retain:

- •

- Russel T. Williams will lead the management team as our president and chief executive officer. He has over 20 years of banking and financial services experience, all in the Greenville County market. He most recently served as senior vice president for The Palmetto Bank, an Upstate-based community bank. Prior to his employment with The Palmetto Bank, Mr. Williams served in various management positions with New Commerce Bank, Carolina First, and National Bank of South Carolina.

3

- •

- Paula S. King, CPA, will be our executive vice president and chief financial officer. She has over 20 years of banking and financial services experience in Greenville. She previously served as senior vice president and chief financial officer of New Commerce Bank and senior vice president and controller of Greenville National Bank. Additionally, she has served as a de novo bank consultant, was a vice president of a commercial mortgage brokerage firm, and has been employed in the banking group of a regional accounting firm.

- •

- Focus on Small-to-Medium-Sized Businesses and Relationship-Oriented Consumer Banking Clients. The Greenville banking market has seen a significant amount of consolidation as larger out-of-market institutions have acquired local community banks. While larger banks may target the small and medium-sized business market, we believe that through more personalized client service and local decision making we will be able to effectively source loan and deposit business from these clients, even without a larger operational infrastructure. We will target businesses with less than $15 million in annual revenues as well as their related owners and employees. Through our relationships and contacts in and around Greenville, we believe that we can attract business and consumer banking clients who desire consistent and personal banking relationships.

- •

- Disciplined Approach To Growth. Attention to the fundamentals of risk management with a focus on credit quality will be hallmarks of our bank. We believe that our success and the success of our shareholders will be enhanced through a measured approach to asset growth, with an emphasis on long-term financial performance. We believe that this strategy will enable us to avoid some of the challenges created by rapid growth. We intend to open our headquarters in Greenville and do not expect to branch within the first three years. We will, after reaching sustained profitability, consider branching opportunities in the growth areas of our defined market.

The Greenville, South Carolina Market

The Greenville metropolitan area, positioned on the internationally known I-85 corridor, boasts one of the highest levels of foreign capital investment per capita in the nation, is a designated foreign trade zone, and is home to over 240 international companies such as BMW, Hitachi, and Michelin. With such significant international investment and business growth, the area's demographics have changed considerably over the past 10 years. The cities of Fountain Inn, Greenville, Greer, Mauldin, Simpsonville, and Travelers Rest make up Greenville County. While the population in the city of Greenville has remained stable between 56,000 and 58,000 residents for several decades, according to 2000 census data, Greenville County's population has grown significantly, from 287,913 residents in 1980 to 379,616 residents in 2000. The most dramatic numerical growth has occurred in the cities of Greer, Mauldin, and Simpsonville, where dozens of new single-family developments and apartment communities have been constructed since 1980. Greenville is one of the 10 counties that comprise the Upstate region, which has a population of more than 1.2 million people. The Greenville MSA includes Greenville, Pickens, and Laurens counties. Based on 2002 Census Bureau population estimates, the Greenville MSA is ranked 84th nationally with a population of 574,939.

Greenville County, South Carolina's largest county, has experienced a significant population increase over the past decade. According to South Carolina State Data Center and U.S. Census Bureau projections, Greenville County's 2005 population is estimated at 395,760. By 2010, the county population is expected to be 420,910 and 472,450 by 2020. The ten-year period of 1993-2002 saw Greenville County's population increase 18.3% from 330,282 to 390,843 (estimated). This compared favorably to the 12.9% increase in the South Carolina population from 3,634,842 to 4,103,770 (estimated) for the same period.

4

Greenville County has also exhibited favorable income trends. During the ten-year period of 1993-2002, per capita personal income for Greenville County rose 44.3% from $20,480 to $29,544. The state of South Carolina figures also reflected 44.4% growth in per capital personal income from $17,665 to $25,502 for that ten-year period. Median household income for the 1993 - 2002 timeframe also showed significant growth in Greenville County, moving up 23.2% from $33,807 to $41,658. Statewide, median household income grew 33.9% for the period moving from $27,962 to $37,442. The county and the state median household income figures of $41,658 and $37,442, respectively, continue to move closer to the national figure of $43,564 estimated by the Census Bureau for 2003.

We are organizing the bank with the belief that the market in Greenville County, with its unique location on the expanding I-85 corridor, presents an excellent opportunity for a locally-owned and operated financial institution. Our organizers believe that a high service institution, focused on the Greenville market and managed by local community bankers, can better identify and serve the banking needs of the small-to-medium-sized business and relationship-oriented consumer than can a branch or subsidiary of a larger out-of-market institution. Our organizers expect to generate immediate business opportunities for the bank due to their extensive contacts and business experience in Greenville.

Complementing the four major components of our business strategy, we will place emphasis on our community bank orientation—local ownership, responsive decision-making flexibility, desire to provide consultative service in a person-to-person banking relationship, and well-known management team and organizing group. We plan to pursue small business and specialized consumer loan opportunities which will help us illustrate our commitment to community reinvestment. We plan to maintain enough flexibility to modify our products and services to accommodate the changing needs of our clients and also to realize our full profit potential. However, no assurance can be given that economic conditions will remain favorable in our market or that we successfully achieve or maintain profitability in the future.

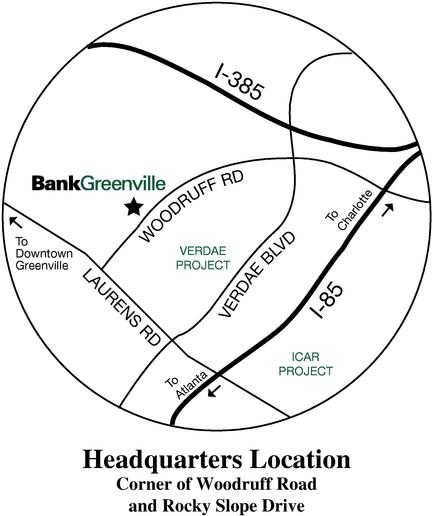

Along with our extensive market contacts, we expect that the location of our proposed future headquarters will generate a meaningful level of commercial and retail traffic. This location sits on the edge of the recently announced 1,100-acre Verdae master planned development and is in close proximity to the Clemson International Center for Automotive Research ("ICAR"). Our site will be one of the closest bank locations to the Verdae master planned development, which is expected to bring a significant number of new residents and businesses to our market area over the next decade and has the potential to be one of the largest multi-faceted projects in the history of South Carolina. The ICAR project is a public-private partnership led by Clemson University and BMW Manufacturing Corporation, IBM, Microsoft, Michelin and others. With a focus on automotive research, ICAR has the potential to gain global interest from automotive-related industries and bring a significant number of jobs and millions of dollars in new investment to the community. Our location will be convenient to ICAR, and our bank will be well suited to serve the banking needs of many of the people that will be working in this fast-developing project.

Our Organizers, Board of Directors, and Management

We were founded and organized by 11 business leaders, all of whom are either Greenville natives or have lived in Greenville for over 20 years. We believe our organizers' long-standing ties to their communities and their significant business experience will provide BankGreenville with the ability to effectively assess and address the needs of our proposed market area. The organizers believe that our experienced board, when combined with the extensive banking experience of Russel T. "Russ" Williams, our proposed chief executive officer, and Paula S. King, our proposed chief financial officer, will deliver high quality banking services to the community. These organizers are also community leaders and serve

5

on numerous charitable and service organizations throughout Greenville County. Our organizers include the following:

| • | | Jeffrey L. Dezen | | • | | Robert L. Kunz |

| • | | Roger H. Gower | | • | | Jonathan T. McClure |

| • | | Frank B. Halter, Jr. | | • | | David A. Merline, Jr. |

| • | | R. Bruce Harman | | • | | William H. Pelham |

| • | | Arthur L. Howson, Jr. | | • | | Russel T. Williams |

| • | | Paula S. King | | | | |

The Offering and Ownership by Our Organizers and Directors

We are offering 1,180,000 shares of our common stock at $10 per share. We have granted the underwriter an over-allotment option to purchase an additional 177,000 shares for sale in the offering. Our organizers and executive officers intend to purchase at least 180,000 shares, which represents approximately 15% of the shares to be outstanding after the offering. These amounts represent the minimum amount our organizers intend to purchase. They may purchase more, including up to 100% of the offering amount. To compensate our organizers for their financial risk and efforts in organizing the bank, they will receive warrants to purchase three shares of common stock for $10 per share for every four shares they purchase in this offering, up to a maximum of 10,000 shares per organizer. If each organizer exercises his or her warrants in full and we do not issue any other shares, our organizers and executive officers would own approximately 22% of our outstanding stock, adjusted for the issuance of the warrants, after the offering. We intend to sell most of the remaining shares to individuals and businesses in Greenville County who share our desire to support a new local community bank. Additionally, we intend to adopt a stock incentive plan covering a number of shares not to exceed 18% of the total outstanding shares immediately following the offering. The plan will permit us to issue restricted stock and options from time to time to our employees and directors and includes the shares underlying the options to be issued to Russel T. Williams and Paula S. King which are described under "Employment Agreements" beginning at page 42. If each organizer exercises his or her warrants in full, and Mr. Williams and Ms. King exercise their options in full, and we do not issue any other shares, our organizers and executive officers would own approximately 28% of our outstanding stock, adjusted for the issuance of the warrants and exercise of the options, after the offering. In addition, if each organizer exercises his or her warrants in full, and all the options are issued and exercised in full, and we do not issue any other shares, our organizers, executive officers, and other key employees would own approximately 33% of our outstanding stock, adjusted for the issuance of the warrants and exercise of the options, after the offering. We anticipate that the options will be issued over at least a five-year period following the offering.

Products and Services

We believe that our personal and consultative approach to client service will distinguish us from the quality of service provided by larger banks. We plan to offer most of the products and services offered by larger banks by utilizing modern delivery systems. We intend to hire seasoned lenders, who can partner with their clients and originate any type of loan which the client may need during the relationship. Our lending services will include consumer loans and lines of credit, commercial and business loans and lines of credit, residential and commercial real estate loans, and construction loans. Our client service team will be comprised of experienced decision-makers. We will offer an array of products, including commercial and consumer checking accounts, money market accounts, savings accounts, certificates of deposit, IRAs, and a commercial sweep product. We will competitively price our deposit products. We plan to offer internet banking which will provide clients with the ability to electronically perform transactions on their accounts and will provide our commercial clients with a cash management system. We will also provide cashier's checks, credit cards, traveler's checks, direct deposit, and United States savings bonds. We will deliver our services though a variety of channels, including an ATM, waiver of foreign ATM charges, on-line banking, banking by mail, commercial account courier services, telephone banking, and drive-through banking.

6

The Offering

| Shares Offered | | 1,180,000 shares of common stock.(1) |

Offering Price |

|

$10 per share. |

Net Proceeds |

|

The net proceeds of this offering will be approximately $11.1 million without giving effect to any exercise of the underwriter's over-allotment option. |

Use of Proceeds |

|

We will use the first $11.0 million we raise in this offering to capitalize BankGreenville. This is the amount of capital we believe our banking regulators will require for us to open the bank. We will use the remaining net proceeds at the holding company level for general corporate purposes. For more detailed information see "Use of Proceeds" beginning on page 15. |

Dividend Policy |

|

Because we are a new business, we will not pay dividends in the foreseeable future. We intend to use all available earnings to fund the continued operation and growth of the bank. See "Dividend Policy" at page 17. |

Proposed OTC Bulletin Board Symbol |

|

" ." |

- (1)

- The number of shares offered assumes that the underwriter's over-allotment option is not exercised. If the over-allotment option is exercised in full, we will issue and sell 1,357,000 shares. Except as otherwise indicated, all information in this prospectus assumes no exercise of the underwriter's over-allotment option.

Risk Factors

Investing in our common stock involves investment risks. You should carefully review the information contained under "Risk Factors" beginning at page 8 before deciding to purchase shares of our common stock.

Future Headquarters

We intend to locate our first office and headquarters at a centrally located site near the intersection of Woodruff Road and Laurens Road within the Greenville city limits. More specifically, we have entered into a purchase/ground lease option contract for up to a 1.5 acre site at the corner of Woodruff Road and Rocky Slope Drive. We are presently located at 116 South Pleasantburg Drive, Greenville, South Carolina, 29607. Our telephone number is (864) 271-1245.

7

RISK FACTORS

The following is a summary of the risks that we expect to encounter in starting and operating the new bank. You should carefully consider the risk factors below. An investment in our common stock involves a significant degree of risk and you should not invest in the offering unless you can afford to lose your investment. In addition, other risks of which we are not aware, which relate to the banking and financial services industries in general, or which we do not believe are material, may cause earnings to be lower, or hurt our future financial condition. You should read this section together with the other information in this prospectus.

We have no operating history upon which to base an estimate of our future financial performance.

Neither BankGreenville Financial Corporation nor BankGreenville has any operating history on which to base any estimate of our future earning prospects. BankGreenville Financial Corporation was only recently formed, and BankGreenville will not receive final approval from state and federal regulatory agencies to begin operation until after this offering is completed. Consequently, there is no historical operating or financial information that would be helpful in deciding whether to invest in us.

We expect to incur losses for at least our first two years, and there is a risk we may never become profitable.

In order for us to become profitable, we will need to attract a large number of clients to deposit and borrow money. This will take time. We expect to incur large initial expenses and expect to incur losses for at least our first two years. Our future profitability is dependent on numerous factors, including the continued success of the Greenville economy and favorable government regulation. While the economy in our market area has been strong in recent years, an economic downturn in the area would hurt our business. We are also a highly regulated institution. Our ability to grow and achieve profitability may be adversely affected by state and federal regulations that limit a bank's right to make loans, purchase securities, and pay dividends. Although we expect to become profitable in our third year, there is a risk that a deterioration of the local economy or adverse government regulation could affect our plans. If this happens, we may never become profitable and you will lose part or all of your investment.

Failure to implement our business strategies may adversely affect our financial performance.

If we cannot implement our business strategies, we will be limited in our ability to develop business and serve our clients, which will in turn have an adverse effect on our financial performance. The organizers have developed a business plan that details the strategies we intend to implement in our efforts to achieve profitable operations. Our business strategy includes hiring and retaining experienced and qualified employees and attracting individual and business clients by providing effective advice and responding quickly to their various banking needs. Even if the key elements of our business strategy are successfully implemented, they may not have the favorable impact on operations that we anticipate. See "Proposed Business—Business Strategy" on page 22.

We will depend heavily on Russ Williams, Paula King, and the initial directors, and the loss of one or more of these key individuals could curtail our growth and adversely affect our prospects.

Our growth and development will largely be the result of the contributions of our chief executive officer, Russ Williams, and our chief financial officer, Paula King. The performance of community banks, like BankGreenville, is often dependent upon the ability of executive officers to promote the bank in the local market area. Mr. Williams and Ms. King have extensive and long-standing ties within our primary service areas and will provide us with an important medium through which to market our products and services. If we lose the services of Mr. Williams or Ms. King, they would be difficult to

8

replace and our business and development could be materially and adversely affected. We have employment agreements with Mr. Williams and Ms. King and expect to carry $500,000 of life insurance on both officers payable to the bank.

Additionally, our directors' community involvement, diverse backgrounds, and extensive local business relationships are important to our success. If any of our directors discontinues his or her relationship with us, or if the composition of our board of directors changes materially, our growth could be adversely affected. See "Management" on page 38.

If we cannot open the bank because we do not receive final regulatory approvals, we may dissolve and liquidate and you may lose some or all of your investment.

We cannot begin operations until we receive all required regulatory approvals. We will not receive these approvals until we satisfy all requirements for new banks imposed by state and federal regulatory agencies. In September 2005, we received preliminary approval from the South Carolina Board of Financial Institutions. We received preliminary approval from the FDIC in October 2005 and preliminary approval from the Federal Reserve Board in December 2005. We expect to receive final approvals in the fourth quarter of 2005, but it may take longer. If we ultimately do not receive final regulatory approvals, or if we do not open for any other reason, we anticipate that we will dissolve the company, and our net assets, consisting primarily of funds received in this offering, less the costs and expenses we have incurred, would be distributed to our shareholders other than the organizers, who will not receive any distribution until all other shareholders have received their initial investments.

Any delay in opening BankGreenville will result in additional losses.

We intend to open the bank in the first quarter of 2006. If we do not receive all necessary regulatory approvals as planned, the bank's opening will be delayed or may not occur at all. If the bank's opening is delayed, our organizational and pre-opening expenses will increase. Because the bank would not be open and generating revenue, these additional expenses would cause our accumulated losses to increase. We anticipate that these expenses would range from $100,000 to $125,000 each month our opening is delayed.

We will face strong competition for clients from larger and more established banks, which could prevent us from obtaining clients, and may cause us to have to pay higher interest rates to attract clients.

We anticipate offering very competitive loan and deposit rates as we establish ourselves in the market, but if excessive competition forces us to offer more aggressive pricing indefinitely, our net interest margin will suffer and our financial performance will be negatively affected. We will encounter strong competition from numerous other lenders and deposit-takers, including commercial banks, savings and loan associations, credit unions and other types of financial institutions operating in Greenville and the surrounding communities. Some of these competitors have been in business for a long time and have already established their client base and name recognition and have significantly more financial and personnel resources than we will have. Some are large super-regional and regional banks, like Carolina First Bank, Wachovia Bank, Bank of America, and SunTrust Bank, and others are more established community banks, like Greenville First Bank and The Palmetto Bank. Moreover, some of these competitors are not subject to the same degree of regulation as we will be and may have greater resources than will be available to us. See "Proposed Business" on page 21.

9

We may not be able to compete with our larger competitors for larger clients because our lending limits will be lower than theirs.

We will be limited in the amount we can loan a single borrower by an amount equal to 15% of the bank's capital and surplus, known as our legal lending limit. We expect that our initial legal lending limit will be approximately $1,650,000 immediately following the offering. Until the bank is profitable, our capital, and therefore our lending limit, will continue to decline. Our lending limit will be significantly less than the limit for most of our competitors and may affect our ability to seek relationships with larger businesses in our market area. Our management team has also adopted an internal lending limit of $1,000,000 which will initially be lower than the applicable legal limit. We intend to accommodate those loans over either our internal lending limit or our legal lending limit by selling participations in those loans to other financial institutions, but we may still have more difficulty in making these large loans.

Because of our lack of a historical loan loss experience, we may underestimate our loan loss allowance and be required to decrease our net income or capital in order to increase it.

Making loans and other extensions of credit will be essential elements of our business, and we recognize there is a risk that our loans or other extensions of credit will not be repaid. If our loans are not repaid, we will incur losses and be required to charge those losses against our allowance for loan losses. We will attempt to maintain an appropriate allowance for loan losses, but there is no precise method of predicting credit losses. Therefore, we will always face the risk that charge-offs in future periods will exceed our allowance for loan losses, and that additional increases in the allowance for loan losses will be required. Moreover, because we do not have any historical loan loss experience, the risk that we could underestimate the allowance actually needed may be greater than if we had historical information from which to derive our allowance. If we underestimate our loan loss allowance, we may be required by excessive loan losses in any period or by our bank regulators to increase it. Additions to our allowance for loan losses would result in a decrease of our net income and, possibly, our capital. If the additions to our allowance for loan losses deplete too much of our capital, our capital ratios could fall below regulatory standards, and our regulators could restrict or cease our operations and take control of our bank. See the "Proposed Business—Lending Activities—Allowance for Loan Losses" section beginning on page 24 for the factors we will use to determine our allowance, and the "Supervision and Regulation—BankGreenville—Capital Regulations" section beginning on page 35 for information regarding our capital requirements.

We do not intend to pay dividends for the foreseeable future for both regulatory and business reasons, which could prevent you from obtaining a return on your investment.

It is unlikely that we will pay any cash dividends in the near future. Because we will have no operations independent from the bank, our ability to pay cash dividends will depend primarily on our bank's ability to pay dividends to us, which depends on the profitability of the bank. Bank holding companies and state banks are both subject to significant regulatory restrictions on the payment of cash dividends. In light of these restrictions and the need for us to retain and build capital, it will be our policy to retain earnings at least until all cumulative losses in our bank are recovered and it becomes profitable. Once our bank is cumulatively profitable, we still may not pay any dividends as our future dividend policy will depend on our earnings, capital requirements, regulatory requirements, financial condition, and other factors that we consider relevant. See "Dividend Policy" on page 17. Until we begin paying dividends, the only return you could realize from an investment in our shares would be profit from the sale of your shares if you sold them at a price in excess of $10 per share. However, there is no assurance that the value of our shares will increase or that there will be any liquid market in which you could sell your shares.

10

An economic downturn, especially one affecting our primary service area, may reduce our deposit base and the demand for our loans and other products and may decrease our earnings.

As a holding company for a community bank, our success will depend on the general economic condition of the region in which we operate, which we cannot forecast with certainty. Unlike many of our larger competitors, the majority of our borrowers and depositors will be individuals and small-to-medium-sized businesses located or doing business in our primary service area. The relatively small size of our loan portfolio will prevent us from being as diversified as our larger competitors. As a result, our operations and profitability may be more adversely affected by a local economic downturn than those of our larger, more geographically diverse competitors. Factors that adversely affect the economy in our limited market area could reduce our deposit base and the demand for our products and services, which may decrease our earnings. For example, an adverse change in the local economy could make it more difficult for borrowers to repay their loans, which could lead to loan losses for BankGreenville.

Changes in interest rates may decrease our net interest income.

Our profitability will depend substantially on our net interest income, which is the difference between the interest income earned on our loans and other assets and the interest expense paid on our deposits and other liabilities. A large change in interest rates may significantly decrease our net interest income and eliminate our profitability. Most of the factors that cause changes in market interest rates, including economic conditions, are beyond our control. While we intend to take measures to minimize the effect that changes in interest rates will have on our net interest income and profitability, these measures may not be effective. See "Management's Discussion and Analysis of Financial Condition or Plan of Operation—Liquidity and Interest Rate Sensitivity" on page 19.

Our directors and executive officers will purchase a large percentage of our stock in the offering, which may allow them to control the company and affect our shareholders' ability to receive a premium for their shares.

Our directors and executive officers intend to purchase at least 180,000 shares in this offering, for a total investment of $1,800,000. As a result, they will own approximately 15% of the shares outstanding after we complete the offering. Additionally, each of the organizers will receive warrants to purchase three shares of common stock at $10 per share for every four shares they purchase in the offering, up to a maximum of 10,000 shares per organizer. Each warrant will have a term of 10 years. If each organizer exercises his or her warrants in full and we do not issue any other shares, the directors' and executive officers' ownership of BankGreenville Financial Corporation would increase to approximately 22%, as adjusted for the exercise of the warrants. Additionally, we intend to adopt a stock incentive plan covering a number of shares not to exceed 18% of the total outstanding shares immediately following the offering. The plan will permit us to issue restricted stock and options from time to time to our key employees and directors and includes the shares underlying the options to be issued to Russel T. Williams and Paula S. King which are described under "Employment Agreements" beginning at page 42. If each organizer exercises his or her warrants in full, and Mr. Williams and Ms. King exercise their options in full, and we do not issue any other shares, our organizers and executive officers would own approximately 28% of our outstanding stock, adjusted for the issuance of the warrants and exercise of the options, after the offering. In addition, if each organizer exercises his or her warrants in full, and all the options are issued and exercised in full, and we do not issue any other shares, our organizers, executive officers, and other key employees would own approximately 33% of our outstanding stock, adjusted for the issuance of the warrants and exercise of the options, after the offering. We anticipate that the options will be issued over at least a five-year period following the offering. As a result, this group will have significant influence over our affairs and policies. Their voting power may be sufficient to control the outcome of director elections or block significant transactions

11

affecting BankGreenville Financial Corporation, including acquisitions. This could prevent shareholders from receiving a premium for their shares, if offered by a potential acquirer.

Our organizers may have different reasons than you for investing and as a result you should not base your decision to invest solely on the number of shares purchased by organizers.

Our organizers may have different reasons than an ordinary investor for investing, such as gaining sufficient voting power to control the outcome of director elections or to block significant transactions affecting the company, including acquisitions. The organizers will collectively purchase a large percentage of the offering, while an ordinary investor may end up being one of a very small number of ordinary investors with ownership in the company. The presence of only a few ordinary investors in the company might significantly affect the ability of those investors to sell their shares. Therefore, investors should not base their investment decision solely on the number of shares purchased by organizers.

We determined the offering price of $10 arbitrarily and our stock price may fluctuate below the initial offering price once the shares become freely tradable.

We arbitrarily set the public offering price after considering capital needs, prevailing market conditions, and the price of other start-up community banks. The offering price may not be indicative of the present or future value of the common stock. As a result, the market price of the stock after the offering may be more susceptible to fluctuations than it otherwise might be. The market price will be affected by our operating results, which could fluctuate greatly. These fluctuations could result from expenses of operating and expanding the bank, trends in the banking industry, economic conditions in our market area, and other factors that are beyond our control. If our operating results are below expectations, the market price of the common stock would probably fall.

We will not have a large number of shareholders nor a large number of shares outstanding after the offering, which may limit your ability to sell your shares of common stock.

Prior to the offering, there has been no public market for our common stock. The development of an active trading market normally requires a significant number of shares and shareholders. We plan to issue 1,180,000 shares of our common stock in this offering, excluding the underwriter's over-allotment option of 177,000 additional shares. If an active trading market does not develop or continue after the offering, you may not be able to sell your shares at or above the price at which these shares are being offered to the public. Although the underwriter intends to apply to have quotations for our common stock posted on the OTC Bulletin Board, an active trading market may not develop or continue after the offering, even if we are eventually listed on a recognized trading exchange. Additionally, the sale of a large block of shares outstanding after the close of the offering could adversely affect the market price of the common stock and you should consider a purchase of shares in this offering to be a long-term investment. You should consider carefully the limited liquidity of your investment before purchasing any shares of the common stock. See "Underwriting" on page 50 and "Shares Eligible for Future Sale" on page 49.

The exercise of warrants and stock options will cause stock dilution and may adversely affect the value of our common stock.

The organizers and officers may exercise warrants and options to purchase common stock, which would result in the dilution of your proportionate interests in us. Upon completion of the offering, we will issue to the organizers warrants to purchase three shares of common stock at $10 per share for every four shares they purchase in the offering, up to a maximum of 10,000 shares per organizer. The warrants, which will be represented by separate warrant agreements, will fully vest upon completion of the stock offering and will be exercisable in whole or in part during the 10 year period following that date. In addition, after the offering, we expect to adopt a stock incentive plan which will permit us to

12

grant restricted stock and options to our officers, directors, and employees. We anticipate that we will initially authorize the issuance of a number of shares under the stock incentive plan not to exceed 18% of the shares outstanding after the offering, including options granted to Mr. Williams and Ms. King pursuant to our employment agreements with them. We do not intend to issue stock options with an exercise price less than the fair market value of the common stock on the date of grant.

We are subject to extensive regulation that could limit or restrict our activities.

We will operate in a highly regulated industry and will be subject to examination, supervision, and comprehensive regulation by various regulatory agencies. Our compliance with these regulations will be costly and will restrict certain of our activities, including payment of dividends, mergers and acquisitions, investments, loans and interest rates charged, interest rates paid on deposits, and locations of offices. We will also be subject to capitalization guidelines established by our regulators, which require us to maintain adequate capital to support our growth.

The laws and regulations applicable to the banking industry could change at any time, and we cannot predict the effects of these changes on our business and profitability. Because government regulation greatly affects the business and financial results of all commercial banks and bank holding companies, our cost of compliance could adversely affect our ability to operate profitably.

The costs of being an SEC registered company are proportionately higher for small companies such as BankGreenville Financial Corporation because of the requirements imposed by the Sarbanes-Oxley Act.

The Sarbanes-Oxley Act of 2002 and the related rules and regulations promulgated by the Securities and Exchange Commission have increased the scope, complexity, and cost of corporate governance, reporting, and disclosure practices. These regulations are applicable to our company. We expect to experience increasing compliance costs, including costs related to internal controls, as a result of the Sarbanes-Oxley Act. These necessary costs are proportionately higher for a company of our size and will affect our profitability more than that of some of our larger competitors.

13

CAUTION ABOUT FORWARD-LOOKING STATEMENTS

This prospectus contains "forward-looking statements" relating to, without limitation, our future economic performance, plans and objectives for future operations, and projections of revenues and other financial items that are based on our beliefs, as well as assumptions made by and information currently available to us. The words "may," "will," "anticipate," "should," "would," "believe," "contemplate," "could," "project," "predict," "expect," "estimate," "continue," and "intend," as well as other similar words and expressions of the future, are intended to identify forward-looking statements. Our actual results, performance, or achievements may differ materially from the results expressed or implied by our forward-looking statements.

The cautionary statements in the "Risk Factors" section and elsewhere in this prospectus also identify important factors and possible events which involve risks and uncertainties that could cause actual results to differ materially from those contained in the forward-looking statements. If you are interested in purchasing shares of our common stock, you should consider these risk factors carefully, as well as factors discussed elsewhere in this prospectus, before making a decision to invest. All forward-looking statements in this prospectus are based on information available to us on the date of this prospectus. We do not intend to, and assume no responsibility for, updating any forward-looking statements that may be made by us or on our behalf in this prospectus or otherwise.

14

USE OF PROCEEDS

We estimate that we will receive net proceeds of approximately $11.1 million from the sale of 1,180,000 shares of common stock in the offering, after deducting underwriting discounts and estimated organizational and offering expenses. If the underwriter exercises its over-allotment option in full, we will receive approximately $1.7 million in additional proceeds. We have funded our initial organizational expenses through non-interest-bearing advances from our organizers. We have also established a line of credit in the amount of up to $500,000 at a rate of prime minus 0.25% to pay organizational and pre-opening expenses of the holding company and the bank prior to the completion of the offering. The outstanding balance on the line of credit as of September 30, 2005 was $100,000. We intend to repay organizer advances and pay off the line of credit with the proceeds we receive from this offering. We believe that the gross proceeds of $11.8 million from the offering will satisfy the cash requirements for the next 12 months for both the holding company and our bank. The following two paragraphs describe the proposed use of proceeds.

Use of Proceeds by BankGreenville Financial Corporation

The following table shows the anticipated use of the proceeds by BankGreenville Financial Corporation. As shown, we will use $11.0 million to capitalize the bank. We describe the bank's anticipated use of proceeds in the following section. The underwriter's compensation reflects an underwriter's discount of approximately $629,000, which reflects a discount of $0.53 on 1,180,000 shares. In the event the underwriter exercises its over-allotment option in full, we will receive additional net proceeds of approximately $1.7 million, and we will invest a minimum of $1.0 million of these additional proceeds in the bank and keep the remainder in BankGreenville Financial Corporation. We initially will invest the remaining proceeds, including any additional proceeds that we may receive if the underwriter exercises its over-allotment option, in United States government or government-sponsored securities or deposit them with BankGreenville, but we have not decided specifically how to allocate these proceeds. In the long-term, we will use these funds for operational expenses and other general corporate purposes, including the provision of additional capital to the bank, if necessary. We may also use the proceeds to expand, for example by opening additional offices or acquiring other financial institutions. We do not have any definitive plans for expansion.

| | Total

| |

|---|

| Gross proceeds from offering | | $ | 11,800,000 | |

Less: |

|

|

|

|

Underwriting discount |

|

|

(629,000 |

) |

Offering expenses |

|

|

(100,000 |

) |

Investment in capital stock of the bank |

|

|

(11,000,000 |

) |

| | |

| |

Remaining proceeds |

|

$ |

71,000 |

|

| | |

| |

15

Use of Proceeds by BankGreenville

The following table shows the anticipated use of the proceeds by BankGreenville. If the underwriter exercises its over-allotment option in full, we will invest a minimum of an additional $1.0 million of these additional proceeds in the bank. All proceeds received by the bank will be in the form of an investment in the bank's capital stock by BankGreenville Financial Corporation. The estimated organizational and pre-opening expenses of the bank of $425,000 will be incurred from the initial organization through the opening of the bank. We will pay for these expenses with our organizers' contribution deposits and existing line of credit until we complete the offering. Furniture, fixtures, and equipment of approximately $435,000 will be capitalized and amortized over the life of the lease or over the estimated useful life of the asset. The bank will use approximately $750,000 of the remaining proceeds to purchase our land and $1,550,000 to construct our headquarters building. The remaining proceeds of approximately $7.8 million will be used by the bank to support loan growth and otherwise conduct the business of the bank. We have entered into a purchase/ground lease option on up to 1.5 acres, on which to build our permanent bank headquarters and intend to purchase the site using proceeds from the stock offering. We do not have any other definitive plans for expansion.

| | Total

| |

|---|

Investment by BankGreenville Financial Corporation in the bank's capital stock |

|

$ |

11,000,000 |

|

Less: |

|

|

|

|

Organizational and pre-opening expenses of the bank |

|

|

(425,000 |

) |

Furniture, fixtures, and equipment |

|

|

(435,000 |

) |

Cost of land for bank headquarters site |

|

|

(750,000 |

) |

Cost of construction of bank headquarters |

|

|

(1,550,000 |

) |

| | |

| |

Remaining proceeds |

|

$ |

7,840,000 |

|

| | |

| |

16

CAPITALIZATION

The following table shows our capitalization as of September 30, 2005, and our pro forma consolidated capitalization as adjusted to reflect the proceeds from the sale of 1,180,000 shares in this offering and after deducting the underwriter's discount and the estimated expenses of the offering. Our capitalization as of September 30, 2005 reflects the purchase of 10 shares by Mr. Williams for $10 per share. We will redeem these shares after the offering. After the offering, we will have 1,180,000 shares outstanding. If the underwriter exercises its over-allotment option in full, we will have 1,357,000 shares outstanding after the offering. The "As Adjusted" column reflects our accumulated deficit through September 30, 2005. See "Use of Proceeds" above.

| | As of

September 30, 2005

| | As Adjusted

for the Offering

| |

|---|

| Shareholder's Equity: | | | | | | | |

Common Stock, no par value per share; 10,000,000 shares authorized; 10 shares issued and outstanding; 1,180,000 shares issued and outstanding as adjusted |

|

$ |

100 |

|

$ |

11,071,000 |

|

| Preferred Stock, no par value per share; 10,000,000 shares authorized; no shares issued and outstanding | | | 0 | | | 0 | |

| Accumulated deficit | | | (125,626 | ) | | (125,626 | ) |

| | |

| |

| |

| Total shareholder's equity (deficit) | | $ | (125,526 | ) | $ | 10,945,374 | |

| | |

| |

| |

DIVIDEND POLICY

We expect initially to retain all earnings to operate and expand the business. It is unlikely that we will pay any cash dividends in the near future. Our ability to pay any cash dividends will depend primarily on BankGreenville's ability to pay dividends to BankGreenville Financial Corporation, which depends on the profitability of the bank. See "Supervision and Regulation—BankGreenville—Dividends" on page 34 and "Supervision and Regulation—BankGreenville—Capital Regulations" on page 35. In addition to the availability of funds from the bank, our dividend policy is subject to the discretion of our board of directors and will depend upon a number of factors, including future earnings, financial condition, cash needs, and general business conditions.

17

MANAGEMENT'S DISCUSSION AND ANALYSIS OR PLAN OF OPERATION

General

BankGreenville Financial Corporation was incorporated on March 18, 2005 as NGCB, Inc. to organize and own all of the capital stock of BankGreenville. On May 19, 2005, our articles were amended to change our name to BankGreenville Financial Corporation. On June 7, 2005, our organizers filed applications with the South Carolina Board of Financial Institutions to charter the bank as a South Carolina state bank and with the FDIC to receive federal deposit insurance. Whether the charter is issued and deposit insurance is granted will depend upon, among other things, compliance with legal requirements imposed by the South Carolina Board of Financial Institutions and the FDIC, including capitalization of the bank with at least a specified minimum amount of capital, which we believe will be $11.0 million. In September 2005, we received preliminary approval from the South Carolina Board of Financial Institutions and in October 2005 we received preliminary approval from the FDIC. In November 2005 we filed for approval by the Federal Reserve Board to acquire all of the stock of the new bank upon its formation. In December 2005 we received preliminary approval from the Federal Reserve Board. This application must be given final approval before we can acquire the capital stock of the bank. We expect to receive all final regulatory approvals in the fourth quarter of 2005.

Financial Condition

As of September 30, 2005, we had total assets of $96,856, consisting primarily of cash of $25,768, a $20,000 earnest money deposit for our proposed bank headquarters site, deferred stock offering costs of $33,187 representing legal and accounting fees, and a $5,000 legal retainer to our SEC attorneys.

Financial Results

We incurred a net loss of $125,626 for the period from our inception on March 18, 2005 through September 30, 2005.

Expenses

Our expenses of $125,626 for the period from our inception on March 18, 2005 through September 30, 2005 included our state charter application fee of $10,000, legal fees of $13,801, and compensation and payroll taxes of $83,423.

On completion of the offering and opening of the bank, we expect we will have incurred the following expenses:

- •

- $628,940 in underwriter's discounts, and $723,281 if the underwriter exercises its over-allotment option in full, which will be deducted from the proceeds of the offering.

- •

- approximately $100,000 in other expenses of the offering, including legal and accounting fees, printing costs and blue sky fees, which will be subtracted from the proceeds of the offering.

- •

- approximately $425,000 in expenses to organize and prepare to open BankGreenville, consisting principally of incorporation and legal expenses, salaries, overhead, and other operating costs, which will be charged to the operations of BankGreenville.

Prior to our completion of this offering, these expenses have been funded by non-interest-bearing advances totaling $90,000 from our organizers and by establishing a line of credit in the amount of up to $500,000 at a rate of prime minus 0.25% that is guaranteed by our organizers, with individual guarantees limited to 125% of the organizer's pro rata share. At September 30, 2005, the balance outstanding on this line of credit was $100,000. We will use the proceeds of this offering to repay these

18

organizer advances and the amounts due under our line of credit. We anticipate that the proceeds of the offering will be sufficient to satisfy the corporation's financial needs for at least the next 12 months.

Offices and Facilities

Our telephone number is (864) 271-1245 and we are presently located at a temporary office at 116 South Pleasantburg Drive, Greenville, South Carolina 29607. Our headquarters will be located at a centrally-located site at the corner of Woodruff Road and Rocky Slope Drive, within the Greenville city limits. Our temporary quarters will be a modular unit, which will be located on or adjacent to the site of the new bank permanent headquarters. Our anticipated expansion plans include construction of our permanent bank headquarters on this site in the first year of operation. We do not currently have plans to establish another branch office in the next three years.

On June 3, 2005, we entered into a purchase/ground lease option agreement for up to 1.5 acres, on which to build our permanent bank headquarters. In consideration of a $10,000 refundable earnest money deposit, we had an initial 120-day inspection period in which to perform due diligence on the site. For an additional $10,000, this inspection period could be extended 90 days. We exercised our inspection extension option in September 2005 and remitted an additional $10,000 deposit. However, if we do not close on the property at the end of this extended inspection period, $10,000 is non-refundable. It is our intention to purchase this site with proceeds from our stock offering or lease this site pursuant to a ground lease clause. If we purchase a maximum 1.5 acres, our total cost will be approximately $752,000. Additionally, at closing, we will pay the sellers a maximum of $26,000 per acre purchased for our share of the maintenance costs of the storm water retention system. Alternatively, ground lease terms include an annual rent of 9% of the purchase price, representing approximately $68,000 annually on 1.5 acres. Prior to the expiration of our extended inspection period, we will obtain an appraisal on the site to ensure that the appraised value is at least equal to the purchase price. An entity known as Woodvan, LLC owns 50% of the subject site and a family partnership of one of our organizers is a one-third partner in Woodvan, LLC. See "Certain Relationships and Related Transactions" on page 46.

Liquidity and Interest Rate Sensitivity

Liquidity represents the ability to convert assets into cash or cash equivalents and the ability to raise additional funds by increasing liabilities. Our organizational and pre-opening expenses are being paid from initial organizers' contribution deposits of $90,000 as well as from availability on a $500,000 line of credit secured on July 18, 2005. At September 30, 2005, cash totaled $25,768, or approximately 27% of total assets. This cash balance represented the initial organizers' contribution deposits and borrowings under the organizational line of credit less organizational expenses to date. At September 30, 2005, $400,000 was available on the line of credit. This line of credit is guaranteed by our organizers, with individual guarantees limited to 125% of the organizer's pro rata share. The line of credit matures 12 months from the closing date. The facility requires interest-only payments for 11 months with a balloon payment of the remaining principal and accrued interest at maturity. We will repay the line of credit with proceeds from the stock offering.

We believe that the net proceeds of approximately $11.1 million from the offering will satisfy the cash requirements for at least 12 months for both BankGreenville Financial Corporation and BankGreenville. We will manage our liquidity by actively monitoring the bank's sources and uses of funds to meet cash flow requirements and maximize profits.

BankGreenville, like most banks, will depend on its net interest income for its primary source of earnings. Net interest income approximates the difference between the interest we charge on our loans and receive from our investments, our assets, and the interest we pay on deposits, our liabilities. Movements in interest rates will cause our earnings to fluctuate. To lessen the impact of these margin

19

swings, we intend to structure our balance sheet so that we can reprice the rates applicable to our assets and liabilities in roughly equal amounts at approximately the same time. We will manage the bank's asset mix by regularly evaluating the yield, credit quality, funding sources, and liquidity of its assets. We will manage the bank's liability mix by expanding our deposit base and converting assets to cash as necessary. If there is an imbalance in our ability to reprice assets and liabilities at any point in time, our earnings may increase or decrease with changes in the interest rate, creating interest rate sensitivity. Interest rates have historically varied widely, and we cannot control or predict them. Despite the measures we plan to take to lessen the impact of interest rate fluctuations, large moves in interest rates may decrease or eliminate our profitability.

Capital Adequacy

Capital adequacy for banks and bank holding companies is regulated by the South Carolina Board of Financial Institutions, the Federal Reserve Board of Governors, and the FDIC. The primary measures of capital adequacy are risk-based capital guidelines and the leverage ratio. Changes in these guidelines or in our levels of capital can affect our ability to expand and pay dividends. Please see "Supervision and Regulation—BankGreenville—Capital Regulations" on page 35 for a more detailed discussion.

Recently Issued Accounting Standards

The following is a summary of recent authoritative pronouncements that affect our accounting, reporting, and disclosure of financial information.

In December 2004, the Financial Accounting Standards Board issued Statement of Financial Accounting Standard ("SFAS") No. 123 (revised 2004),Share-Based Payment ("SFAS No.123(R)"). SFAS No. 123(R) will require companies to measure all employee stock-based compensation awards using a fair value method and record such expense in its financial statements. In addition, the adoption of SFAS No. 123(R) requires additional accounting and disclosure related to the income tax and cash flow effects resulting from share-based payment arrangements. SFAS No. 123(R) is effective beginning as of the first interim or annual reporting period beginning after December 15, 2005. We are currently evaluating the impact that the adoption of SFAS No. 123(R) will have on our financial position, results of operations, and cash flows.

In April 2005, the Securities and Exchange Commission's Office of the Chief Accountant and its Division of Corporation Finance released Staff Accounting Bulletin ("SAB") No.107 to provide guidance regarding the application of SFAS No. 123(R). SFAS No. 123(R) covers a wide range of share-based compensation arrangements including share options, restricted share plans, performance-based awards, share appreciation rights, and employee share purchase plans. SAB No. 107 provides interpretive guidance related to the interaction between SFAS No. 123(R) and certain SEC rules and regulations, as well as the staff's views regarding the valuation of share-based payment arrangements for public companies. SAB No. 107 also reminds public companies of the importance of including disclosures within filings made with the SEC relating to the accounting for share-based payment transactions, particularly during the transition to SFAS No.123(R).

In March 2004, the SEC issued SAB No. 105,Application of Accounting Principles to Loan Commitments, to inform registrants of the SEC staff's view that the fair value of the recorded loan commitments should not consider the expected future cash flows related to the associated servicing of the future loan. The provisions of SAB No. 105 must be applied to loan commitments accounted for as derivatives that are entered into after March 31, 2004. We do not expect the adoption of SAB No. 105 to have a material impact on our financial condition or results of operations.

Other accounting standards that have been issued or proposed by the FASB or other standards-setting bodies that do not require adoption until a future date are not expected to have a material impact on the consolidated financial statements upon adoption.

20

PROPOSED BUSINESS

General

We formally initiated activity to form BankGreenville in February 2005 and incorporated BankGreenville Financial Corporation as a South Carolina corporation on March 18, 2005 to function as a holding company to own and control all of the capital stock of BankGreenville. We initially will engage in no business other than owning and managing the bank.

We have chosen this holding company structure because we believe it will provide flexibility that would not otherwise be available. Subject to Federal Reserve Board debt guidelines, the holding company structure can assist the bank in maintaining its required capital ratios by borrowing money and contributing the proceeds to the bank as primary capital. Additionally, a holding company may engage in non-banking activities that the Federal Reserve Board has deemed to be closely related to banking. Although we do not presently intend to engage in other activities, we will be able to do so with a proper notice or filing to the Federal Reserve if we believe that there is a need for these services in our market area and that the activities could be profitable.

We filed applications with the South Carolina Board of Financial Institutions to organize the bank as a South Carolina state bank and with the FDIC to obtain deposit insurance on June 7, 2005. We received preliminary approval from the South Carolina Board of Financial Institutions in September 2005 and from the FDIC in October 2005. We have also filed an application with the Board of Governors of the Federal Reserve System for approval to become a bank holding company and in December 2005 received preliminary approval. Subject to receiving final regulatory approval from these agencies, we plan to open the bank by the end of the first quarter of 2006 and will engage in a general commercial and consumer banking business as described below. Final approvals will depend on compliance with regulatory requirements, including our capitalization of the bank with at least $11.0 million from the proceeds of this offering.

Marketing Opportunities

Service Area. Our service area will consist of Greenville County, with a primary focus on the City of Greenville and the surrounding bedroom communities of Mauldin, Simpsonville, Greer and Taylors. Our office will be located at a centrally located site near the intersection of Woodruff Road and Laurens Road within the Greenville city limits and will provide excellent visibility for the bank. This site sits on the edge of the recently announced 1,100-acre Verdae master planned development. Woodruff Road is a well traveled thoroughfare with reasonable traffic counts and excellent accessibility but this new development effort is expected to increase the quality of this already excellent site. Our temporary quarters will be a modular unit, which will be located on or adjacent to the site of the future bank permanent headquarters. Our anticipated expansion plans include opening a permanent main office in the first year of operation. We do not currently have plans to establish another branch office in the next three years. We plan to take advantage of existing contacts and relationships with individuals and companies in this area to more effectively market the services of the bank.

Economic and Demographic Factors. The Greenville metropolitan area, positioned on the internationally known I-85 corridor, boasts one of the highest levels of foreign capital investment per capita in the nation, is a designated foreign trade zone, and is home to over 240 international companies such as BMW, Hitachi, and Michelin. With such significant international investment and business growth, the area's demographics have changed considerably over the past 10 years. The cities of Fountain Inn, Greenville, Greer, Mauldin, Simpsonville, and Travelers Rest make up Greenville County. While the population in the city of Greenville has remained stable between 56,000 and 58,000 residents for several decades, according to 2000 census data, Greenville County's population has grown significantly, from 287,913 residents in 1980 to 379,616 residents in 2000. The most dramatic numerical growth has occurred in the cities of Greer, Mauldin, and Simpsonville, where dozens of new single-

21

family developments and apartment communities have been constructed since 1980. Greenville is one of the 10 counties that comprise the Upstate region, which has a population of more than 1.2 million people. The Greenville MSA includes Greenville, Pickens, and Laurens counties. Based on 2002 Census Bureau population estimates, the Greenville MSA is ranked 84th nationally with a population of 574,939.

Greenville County, South Carolina's largest county, has experienced a significant population increase over the past decade. According to South Carolina State Data Center and U.S. Census Bureau projections, Greenville County's 2005 population is estimated at 395,760. By 2010, the county population is expected to be 420,910 and 472,450 by 2020. The ten-year period of 1993 - 2002 saw Greenville County's population increase 18.3% from 330,282 to 390,843 (estimated). This compared favorably to the 12.9% increase in the South Carolina population from 3,634,842 to 4,103,770 (estimated) for the same period.

Greenville County has also exhibited favorable income trends. During the ten-year period of 1993-2002, per capita personal income for Greenville County rose 44.3% from $20,480 to $29,544. The state of South Carolina figures also reflected 44.4% growth in per capital personal income from $17,665 to $25,502 for that ten-year period. Median household income for the 1993 - 2002 timeframe also showed significant growth in Greenville County, moving up 23.2% from $33,807 to $41,658. Statewide, median household income grew 33.9% for the period moving from $27,962 to $37,442. The county and the state median household income figures continue to move closer to the national figure of $43,564 estimated by the Census Bureau for 2003.