UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

November 8, 2024

Date of Report (Date of earliest event reported)

Date of Report (Date of earliest event reported)

URANIUM ENERGY CORP.

(Exact name of registrant as specified in its charter)

(Exact name of registrant as specified in its charter)

Nevada | 001-33706 | 98-0399476 |

| (State or other jurisdiction of incorporation) | (Commission File Number) | (IRS Employer Identification No.) |

500 North Shoreline, Ste. 800, Corpus Christi, Texas, U.S.A. | 78401 |

| (U.S. corporate headquarters) | (Zip Code) |

1830 – 1188 West Georgia Street Vancouver, British Columbia, Canada | V6E 4A2 |

| (Canadian corporate headquarters) | (Zip Code) |

(Address of principal executive offices)

(361) 888-8235

(Registrant’s telephone number, including area code)

(Registrant’s telephone number, including area code)

Not applicable.

(Former name or former address, if changed since last report)

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading Symbol (s) | Name of each exchange on which registered |

| Common Stock | UEC | NYSE American |

Indicate by check mark whether the registrant is an emerging growth company as defined in as defined in Rule 405 of the Securities Act of 1933 (Section 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (Section 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

__________

Item 7.01 | Regulation FD Disclosure |

On November 8, 2024, Uranium Energy Corp. (the “Company” or “UEC”) issued a news release to report the filing of an initial assessment technical report summary that includes an economic analysis and mineral resource estimate for its 100% owned Roughrider Project, located in Northern Saskatchewan, Canada. All currency references are in United States dollars.

Amir Adnani, President, and CEO stated: “This Initial Economic Assessment marks a pivotal milestone for Roughrider, validating it as a top-tier, high-margin operation with a clear path to development into a world-class mine and mill. With a post-tax estimated net present value of $946 million, today’s results underscore the strength of our 2022 decision to acquire Roughrider from Rio Tinto for $150 million, consistent with our strategy to acquire accretive assets at opportune points in the uranium price cycle.

Key competitive advantages that position Roughrider as an elite underground development project include:

1) | high grade operation with 2.36% U3O8 Life of Mine feed grade, |

2) | one of the lowest capex profiles in Canada and |

3) | location in the Eastern Athabasca Basin, where future development will benefit from proximity to power, roads, and the Points North Landing airport and construction facility. |

Additionally, we see significant potential for further value creation as we advance the project through the prefeasibility stage, supported by recent exploration drill results and the discovery of the Roughrider North Deposit.

Roughrider is poised to benefit from uranium and nuclear energy’s growing prominence to address North America’s rising electricity demand for safe, reliable, economic, and clean energy sources. Given UEC’s capabilities as an established uranium producer, we are uniquely positioned to leverage our operational expertise and financial strength to advance and de-risk Roughrider, maximizing value for our shareholders, stakeholders, and rightsholders.”

Key Highlights:

| ● | Estimated post-tax NPV8 of $946 million, IRR of 40%, post-tax payback period of 1.4 years based on a long-term uranium price of $85/lb U3O8 and utilizing an 8% discount rate (NPV 8%), Table 1. |

| ● | Expected Life of Mine (“LOM”) production of 61.2 million lbs U3O8 produced over nine years with an average annual production rate of 6.8 million lbs U3O8. Initial capex estimated at $545 million including mill and underground mine. See Table 2. |

| ● | AISC of $20.48/lb U3O8. See Table 3. |

| ● | Average Annual LOM earnings before interest, taxes, depreciation and amortization (“Average EBITDA”) of $395 million. See Table 4. |

- 2 -

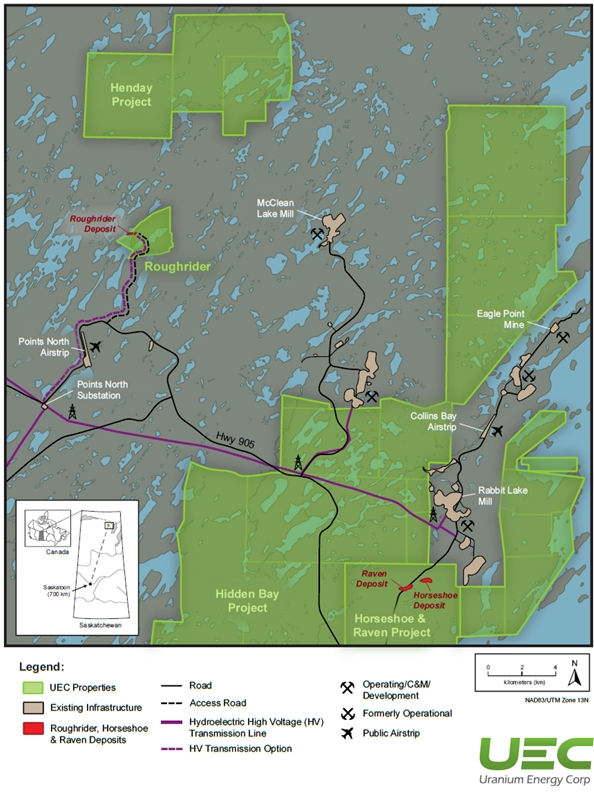

| ● | The Roughrider Project is in the well-established infrastructure of eastern Athabasca Basin, with an adjacent high-voltage 138 kV transmission line, hydroelectric power generation, 7 km north of the commercial airport at Points North Landing, and highway system. See Figure 4. |

The economic analysis is included in a technical report summary titled “S-K 1300 Initial Assessment Report – Roughrider Uranium Project, Saskatchewan, Canada” issued on November 5, 2024 and prepared for UEC by Tetra Tech Canada Inc., Understood Mineral Resources Ltd., Snowden Optiro, Terracon Geotechnique Ltd. and Clifton Engineering Group Inc.; in accordance with Item 1302 of SEC Regulation S-K 1300 (“S-K 1300”) a copy of which is available under UEC’s profile at www.sec.gov (the “Technical Report Summary”). The Technical Report Summary has now been filed through EDGAR on Form 8-K and is also available as a Material Document on SEDARplus. The economic analysis included therein and summarized in this news release is preliminary in nature and includes inferred mineral resources that are considered too speculative geologically to have modifying factors applied to them that would enable them to be categorized as mineral reserves, and there is no certainty that this economic assessment will be realized.

Table 1. Base Case Financial Highlights

Base Case Financials | ||

Pre-Tax Cash Flow (undiscounted) | ($ millions) | $3,366 |

Pre-Tax NPV8 | ($ millions) | $1,629 |

| Pre-Tax IRR | % | 53% |

| Pre-Tax Payback Period | Years | 1.2 |

| Post-Tax Cash Flow | ($ millions) | $2,040 |

Post-Tax NPV8 | ($ millions) | $946 |

| Post-Tax IRR | % | 40% |

| Post-Tax Payback Period | Years | 1.4 |

The base case reflected in the analysis assumes, among other things, an $85/lb U3O8 uranium price, an exchange rate of 0.75 United States dollars to Canadian dollars, and that all costs are in Q4 2024 dollars with no inflation applied. For further information regarding the impact of excluding such inferred mineral resources from the analysis, please refer to the Technical Report Summary.

Table 2. Key Physical Highlights

Initial Assessment Report Physical Highlights | ||

| Avg. LOM Annual Production | M lbs U3O8 | 6.8 |

| LOM Production | M lbs U3O8 | 61.2 |

| Mine Life | Years | 9 |

| Mill Processing rate | tonnes / day | 400 |

| Underground peak mining rate | tonnes / day | 818 |

| LOM tonnes processed | tonnes | 1,205,000 |

| LOM Avg. Head Grade | %U3O8 | 2.36 |

| Process Recovery | % | 97.5 |

- 3 -

Table 3. Cost Summary

Initial Assessment Report Financial Highlights* | ||

| Mining | $ / lb U3O8 | $3.25 |

| Processing | $ / lb U3O8 | $4.30 |

| Surface and G&A | $ / lb U3O8 | $2.18 |

Average LOM Operating Cost | $ / lb U3O8 | $9.72 |

| Royalties | $ / lb U3O8 | $7.84 |

| Offsite Charges | $ / lb U3O8 | $0.28 |

| Sustaining Capital + Closure | $ / lb U3O8 | $2.64 |

All in Sustaining Costs (AISC) | $ / lb U3O8 | $20.48 |

| *Note: totals may not add due to rounding. |

Table 4. Sensitivity to Uranium Price

Roughrider Project Financial Estimates based on Uranium Price | |||

Uranium Price ($ / lb U3O8) | After-Tax NPV8 | After-Tax IRR | Annual Average EBITDA ($) |

$ 150 / lb U3O8 | $ 2.1 Billion | 64% | $ 730 Million |

$ 100 / lb U3O8 | $ 1.2 Billion | 46% | $ 473 Million |

$ 90 / lb U3O8 | $ 1.0 Billion | 42% | $ 421 Million |

$ 85 / lb U3O8 | $ 0.9 Billion | 40% | $ 395 Million |

$ 50 / lb U3O8 | $ 0.3 Billion | 21% | $ 215 Million |

Mine Plan

The initial economic assessment envisions that the Roughrider deposit will be mined using the longhole stoping method utilizing retreat mining in a transverse stope orientation with various orientations between the three main mineralized zones. Various underground mining methods were considered; however, longhole stoping was ultimately selected to reduce cost. Development will be located to the south of the deposits and will be accessed using a ramp decline which will also be the primary source of fresh air ventilation. Exhaust shafts will be used to ventilate the mine.

- 4 -

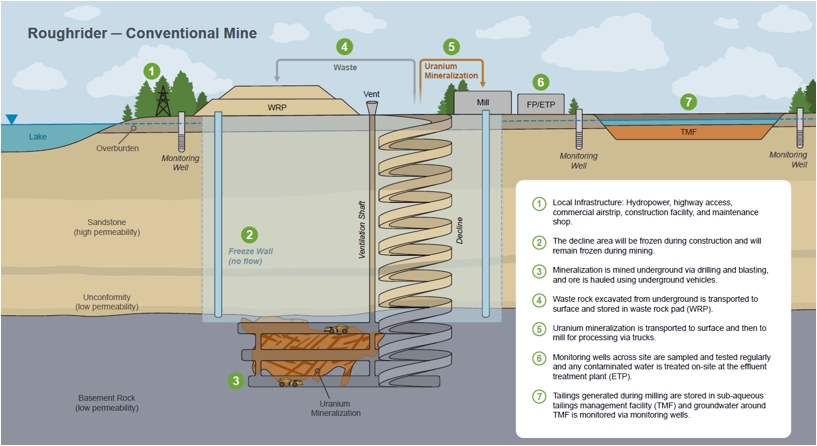

Ground freezing will be used to control water inflows into the main decline to a depth below the unconformity as well as into the three mining zones. Freeze wells will be installed from surface around the perimeter of each zone with active freezing starting at least 12 months prior to mining. Figure 1 was generated by UEC as a conceptual image of the conventional underground mine. Further details of proposed mining and milling methods are set out in the Technical Report Summary.

Figure 1 Roughrider Project Conventional Mine Schematic

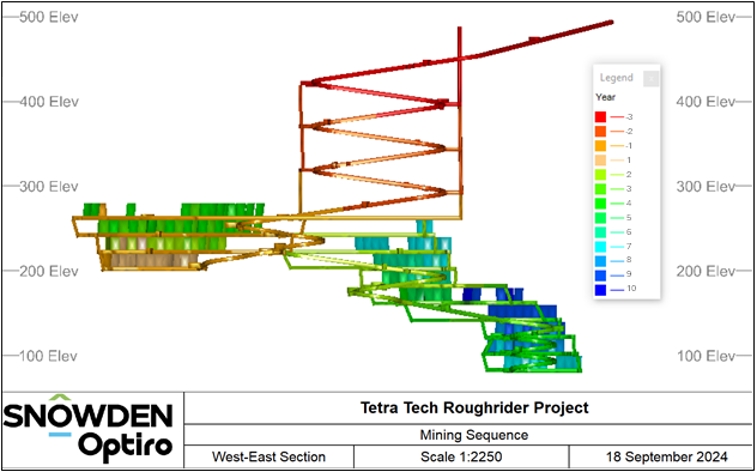

The initial construction focus is on the development of the decline, ventilation and secondary egress from surface (red to yellow). Once the decline reaches the deposit, initial focus will be on the Roughrider West (“RRW”) deposit with the decline held while levels and ventilation are developed in this area (green). Mining then progresses to the Roughrider East (“RRE”) deposit (cyan) and finally Roughrider Far East (“RRFE”) deposit (blue). See Figure 2.

- 5 -

Figure 2. Isometric View of the Mining Sequence

Mill, Processing and Tailings Design

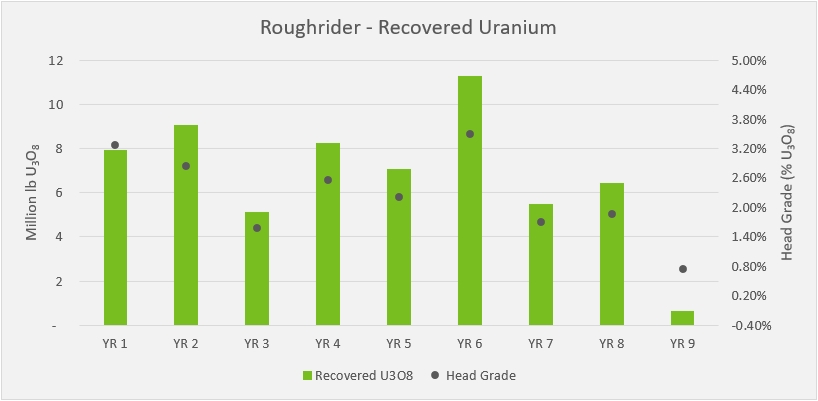

The processing facility incorporated in the initial economic assessment is designed using established methods from other Athabasca operations, such as Rabbit Lake, Key Lake and McClean Lake. It will operate at a nominal throughput of 400 t/d with an LOM average mill feed grade of 2.36% U3O8 and a recovery rate of 97.5%. LOM average annual production of yellowcake product is expected to be about 3.08 million kg (6.80 million lbs) at 95% U3O8. See Table 5 for the key processing parameters and Figure 3 for the recovered uranium LOM plan.

Table 5. Mill Processing Parameters

Key Processing Data | ||

| Mill Processing Rate | tonnes / day | 400 |

| LOM tonnes Processed | tonnes | 1,205,000 |

| LOM Average Head Grade | %U3O8 | 2.36 |

| LOM Feed | M lbs U3O8 | 62.7 |

| Process Recovery | % | 97.5 |

| LOM Recovered | M lbs U3O8 | 61.2 |

- 6 -

Based on prior metallurgical test work, the following conclusions can be made:

| ● | The comminution test work showed that Roughrider samples are soft in nature with an average Bond Ball Mill Work Index of 10.6 kWh/t. |

| ● | Agitated tank leach test results showed that Roughrider mineralization is amenable for uranium extraction via atmospheric acid leaching. On average 98.5% of extraction can be achieved within 12 hours of leach retention time at 50°C with a grind size of 250 µm. Further, it was found that there was no significant difference in dissolution and extraction of uranium from the different deposits (RRW, RRE and RRFE). |

| ● | Two different approaches (strong acid strip with uranyl peroxide precipitation and ammonia strip with ammonium diuranate precipitation) were examined for production of final yellowcake product. It was found that organic extraction followed by strong acid strip produced higher quality yellowcake meeting refinery specifications compared to the ammonium sulfate strip method. |

| ● | Tailings neutralization and effluent treatment test work based on the standard approaches used in the Athabasca region indicated that effluent quality meeting the MDMER guidelines can be achieved. |

Figure 3. Roughrider Project Recovered Uranium and Head Grade

The Technical Report Summary provides for the construction of a tailing management facility (“TMF”) to store the uranium tailings produced from processing. The TMF will be located approximately one km northeast of the proposed processing plant on gently sloping terrain. Thickened slurry tailings will be deposited into three adjacent storage cells sequentially constructed over the LOM. The design incorporates a double liner seepage containment system and a ‘pervious surround’ rock filter. This approach will allow for staged TMF cell construction and progressive reclamation. Containment will be enhanced by construction of a filter rock drain system used successfully at other uranium operations and identified as the ‘pervious surround’ approach. The storage of tailings solids below grade will reduce risk and promote secure physical containment.

- 7 -

At closure, the water cover will be pumped out of the cell and a cover of soil and geomembrane layers will be placed over the tailings surface. With the multi-cell design, it will be possible to progressively reclaim the TMF storage cells during the operational phase.

Capital Expenditure

The capital and operating cost estimates are based on a 400 t/d processing throughput. The cost was estimated based on the mine plan and process flowsheet. All costs are reported in US dollars and the Association for the Advancement of Cost Engineering (“AACE”) Class 5 initial capital cost estimate has been prepared in accordance with the standards of AACE International. The accuracy range of the initial capital cost estimate is ±50%. This estimate was prepared with a base date of the fourth quarter of 2024. See Table 6 for summary of total initial capital cost.

Table 6. Estimated Capital Cost Summary

| Capital Cost Area | Value ($ million) |

| Mining | 96.8 |

| Processing Plant | 89.5 |

| Infrastructure | 80.1 |

| Tailings and Waste Rock Management | 19.0 |

Direct Cost | 285.4 |

| Indirect Cost* | 99.9 |

| Owner’s Cost | 60.2 |

| Contingency | 99.9 |

Total Initial Capital Cost | 545.5 |

| Pre-production Cost | 35.6 |

Total Initial Capital Cost (inc. pre-production) | 581.1 |

Note: Totals may not add due to rounding. *Includes EPCM cost of $34.0 million. |

Next Steps, Licensing and Permitting

UEC continues to advance the Roughrider Project through technical and environmental studies, community engagement and assessing opportunities to further de-risk the project. The parallel processes of updating the environmental baseline work and Indigenous engagement will support a future Environmental Impact Assessment required for uranium production. UEC plans to follow-up encouraging exploration results in 2024 with an updated mineral resource estimate on or about the first quarter of 2025 to support the development of a pre-feasibility study in 2025.

- 8 -

Resource Update and Exploration

The 2024 mineral resource estimate that is set out in the Technical Report Summary has been prepared in accordance with the requirements of S-K 1300. To meet the requirement of reasonable prospects of eventual economic extraction, the mineral resource estimate is reported within a constrained mineable shape optimizer as informed by a breakeven cut-off grade of 0.30% U3O8. The mineral resource estimate is reported diluted, including waste and mineralization below cut-off.

The mineral resource estimate set forth in the Technical Report Summary is summarized in Table 7. No Mineral Reserves have been estimated at the project.

Table 7: Mineral Resource Statement for the Project (as of November 5, 2024)

Zone | Classification | Tonnage (kt) | Grade U3O8 (%) | Contained U3O8 Metal (M lb U3O8) |

| RRW | Indicated | 431 | 1.89 | 17.97 |

| Inferred | 152 | 2.80 | 9.39 | |

| RRE | Indicated | - | - | - |

| Inferred | 390 | 2.57 | 22.05 | |

| RRFE | Indicated | 268 | 1.67 | 9.89 |

| Inferred | 78 | 1.13 | 1.94 | |

Total | Indicated | 699 | 1.81 | 27.86 |

Inferred | 620 | 2.45 | 33.38 |

Notes:

| 1. | Reported on a 100% ownership basis. |

| 2. | To establish reasonable prospects of eventual economic extraction, a cut-off grade of 0.30% U3O8 was utilized. Such grade was calculated based on the following criteria and assumptions U3O8 price of $85 / lb, transport cost of $0.26 / lb, mining cost of $163 /t, processing cost of $222 / t, G&A cost of $112 / t, royalties of 9.22% / t, and process recovery of 95.5%. |

| 3. | The mineral resource estimate was prepared by Understood Mineral Resources Ltd., one of the independent qualified persons under the Technical Report Summary. The MSO shapes were estimated by Snowden Optiro, one of the independent qualified persons under the Technical Report Summary. |

| 4. | The tonnage is presented in metric tonnes and contained metal is reported in both metric tonnes and imperial pounds. Estimates have been rounded and may not add up due to significant figure rounding. |

Since November 2023, UEC has been continuously exploring the Roughrider Property, see January 31, 2024, August 20, 2024 and September 12, 2024 press releases. As of July 31, 2024, a total of 94 drill holes have been completed, for a total of 29,840 m drilled, with the best drill results so far being between the existing West, East and Far East Zones, down dip of the Far East Zone, and the Roughrider North deposit.

For further details of the initial economic assessment and the resource estimate for the Roughrider Project disclosed herein, including important information regarding their underlying assumptions and methodologies, readers should refer to the Technical Report Summary.

- 9 -

About Canada’s Athabasca Basin

The Athabasca Basin is a world-class uranium district in the northern portion of the provinces of Saskatchewan and Alberta in Canada, occupying an area of about 100,000 square kilometres. The unique geology of the Athabasca Basin often results in deposit grades that exceed the world average of uranium deposits of 0.2% U3O8 by up to 100 times.

All of Canada’s current uranium production occurs from the mines located in the Athabasca Basin. According to the World Nuclear Association, the Athabasca Basin was responsible for producing 15% of the world’s uranium production in 2022.

Uranium mineralization in the Athabasca Basin occurs in fault structures that penetrate the interface between the sandstone and underlying basement rocks. Uranium can be found at the interface, known as the unconformity, or up to several hundreds of metres below the unconformity surface in the underlying basement rock and fault structures.

About the Roughrider Uranium Project

The Roughrider Project is a uranium project located in the eastern Athabasca Basin of northern Saskatchewan, Canada; one of the world’s premier uranium mining jurisdictions. The project is located approximately 13 kilometres west of Orano’s McClean Lake Mill, near UEC’s existing Athabasca Basin properties, see Figure 4. The depth to mineralization at the project is approximately 200 m and hosted primarily in the basement rocks below the unconformity.

- 10 -

Figure 4 Roughrider Location Map

- 11 -

Qualified Person

The technical information in this news release has been reviewed and approved by James Hatley, P.Eng., UEC’s Vice President Production, Canada, who is a Qualified Person for the purposes of SEC Regulation S-K 1300.

A copy of the news release is attached as Exhibit 99.1 hereto.

Item 9.01 | Financial Statements and Exhibits |

(d) | Exhibits |

Exhibit | Description | |

| 99.1 | ||

| 104 | Cover Page Interactive Data File (the cover page XBRL tags are embedded within the inline XBRL document). |

__________

- 12 -

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| URANIUM ENERGY CORP. | |||

| DATE: November 8, 2024. | |||

| By: | /s/ Josephine Man | ||

Josephine Man, Chief Financial Officer, Treasurer and Secretary | |||

__________

- 13 -