February 2, 2010

Ms. Joanna Lam

Securities and Exchange Commission

Division of Corporation Finance

Mail Stop 4628

150 F Street, N.E.

Washington D.C. 20549-4628

| Re: | China Energy Corporation Form 10-K for the Fiscal Year Ended November 30, 2008 Filed on March 16, 2009 Form 10-Q for the Fiscal Quarter Ended February 28, 2009 Filed on April 20, 2009 Form 10-Q for the Fiscal Quarter Ended May 31, 2009 Filed July 22,2009 File No. 000-52409 |

Dear Ms. Lam:

On behalf of our client, China Energy Corporation and pursuant to our telephone conversation, attached please find a draft of the Form 10-K/A in response to the prior Staff’s comment letters.

If you have any questions, please do not hesitate to call.

Very truly yours,

Ronit Fischer

Los Angeles New York Chicago Nashville www.loeb.com

A limited liability partnership including professional corporations

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K/A

T Annual report pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 for the fiscal year ended November 30, 2008

o Transition report pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 for the transition period from ______ to ______.

Commission file number: 000-52409

CHINA ENERGY CORPORATION

(Exact name of registrant as specified in its charter)

| Nevada | 98-0522950 |

| (State or other jurisdiction of incorporation or organization) | (IRS Employer Identification No.) |

| | |

No. 57 Xinhua East Street Hohhot, Inner Mongolia, People’s Republic of China | 010010 |

| | |

| (Address of principal executive offices) | (Zip Code) |

| | |

Registrant’s telephone number, including area code | 1-888-597-8899 | |

| Securities registered under Section 12(b) of the Exchange Act: | |

| | |

| Common Stock, $0.001 par value Common | OTCBB |

| (Title of class) | (Name of exchange on which registered) |

| Securities registered pursuant to section 12(g) of the Act: | |

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes £ No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes £ No x

Check whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Exchange Act during the past 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Yes T No £

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes £ No x

Indicate by check mark ifdisclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, , and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this form 10-K. £

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer £ | Accelerated filer £ |

Non-accelerated filer £ (Do not check if a smaller reporting company) | Smaller reporting company ý |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act. £ Yes T No

State the aggregate market value of the voting and non-voting common equity held by non-affiliates computed by reference to the price at which the common equity was last sold, or the average bid and asked price of such common equity, as of the last business day of the registrant’s most recently completed second fiscal quarter.

Indicate the number of shares outstanding of each of the registrant’s classes of common stock, as of the latest practicable date, 45,000,000 as of September 30, 2009.

DOCUMENTS INCORPORATED BY REFERENCE: None

TABLE OF CONTENTS

PART I

| ITEM 1. | BUSINESS | 3 |

| | | |

| ITEM 1A. | RISK FACTORS | 18 |

| | | |

| ITEM 1B. | UNRESOLVED STAFF COMMENTS | 23 |

| | | |

| ITEM 2. | PROPERTIES | 23 |

| | | |

| ITEM 3. | LEGAL PROCEEDINGS | 26 |

| | | |

| ITEM 4. | SUBMISSION OF MATTERS TO A VOTE OF SECURITY HOLDERS | 26 |

PART II

| ITEM 5. | MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES | 27 |

| | | |

| ITEM 6. | SELECTED FINANCIAL DATA | 29 |

| | | |

| ITEM 7. | MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS | 29 |

| | | |

| ITEM 7A. | QUANTITATIVE AND QUALITATIVE DISCLOSURE ABOUT MARKET RISK | 44 |

PART I

This report contains forward-looking statements within the meaning of Section 21E of the Securities Exchange Act of 1934 (the “Exchange Act”). We have based these forward-looking statements largely on our current expectations and projections about future events and financial trends affecting the financial condition of our business. These forward-looking statements are subject to a number of risks, uncertainties and assumptions, including, among other things:

| · | general economic and business conditions, both nationally and in our markets, |

| · | our expectations and estimates concerning future financial performance, financing plans and the impact of competition, |

| · | our ability to implement our growth strategy, |

| · | anticipated trends in our business, |

| · | advances in technologies, and |

| · | other risk factors set forth herein. |

In addition, in this report, we use words such as “anticipates,” “believes,” “plans,” “expects,” “future,” “intends,” and similar expressions to identify forward-looking statements.

China Energy Corporation (“CEC” or the “Company”) undertakes no obligation to update publicly or revise any forward-looking statements, whether as a result of new information, future events or otherwise after the date of this prospectus. In light of these risks and uncertainties, the forward-looking events and circumstances discussed in this prospectus may not occur and actual results could differ materially from those anticipated or implied in the forward-looking statements.

ITEM 1. BUSINESS

We, China Energy Corporation (“CEC”), produce coal through our operating company located in the People’s Republic of China (“PRC”), Inner Mongolia Tehong Coal Group Co, Ltd. (“Coal Group”) and we supply heating and electricity requirements throughout the XueJiaWan district through our other operating company located in the PRC, Inner Mongolia Zhunger Heat Power Co., Ltd. (“Heat Power”). We acquired control over these operating companies on November 30, 2004.

Inner Mongolia Tehong Coal Group Co., Ltd. (“Coal Group”)

Coal Group produces coal from the LaiYeGou coal mine located in Erdos City, Inner Mongolia, PRC. Coal Group was organized in China on August 8, 2000 as Inner Mongolia Zhunger Tehong Coal Co., Ltd. The name was changed in December 2003 to Inner Mongolia Zhunger Heat Power Co. Ltd. Coal Group operates a coal mine in the Inner Mongolia District from which it produces coal. It also buys, sells, and transports coal, serving the Inner Mongolia District. Coal Group has the capacity to produce approximately up to 800,000 metric tons per year subject to enhancement of productions lines in the next two years. The principal customer of the coal mine is a nearby coking factory. The Company does not view this concentration as a significant risk.

Coal Group’s operations consist of production and processing of raw coal for domestic heating, electrical generation and coking purposes for subsequent steel production. The principal sources of revenue are generated from local heating power industry.

The raw coal produced is non caking coal and has a high ash melting point with high thermal value used almost exclusively as fuel for steam-electric power generation. It has low sulphur and low chemical emission which satisfies government environmental protection standards with heating capability of 6,800 -7,000 Kilocalories (“Kcal”).

The following consists of tonnage of coal produced and purchased from external sources in the past 5 years:

| Year | | Produced | | | External Sources | |

| 2004 | | | 506,913 | | | | 34,295 | |

| 2005 | | | 612,739 | | | | 100,358 | |

| 2006 | | | 549,970 | | | | 3,572 | |

| 2007 | | | 459,055 | | | | 132,764 | |

| 2008 | | | 264,098 | | | | 50,000 | |

Production levels dropped in 2008 as a result of the mine being shut down for 3 months as a result of expansion efforts and also for a further 2 months as a result of the mandatory shut down as required by the PRC government during the summer Olympics.

Inner Mongolia Zhunger Heat Power Co., Ltd. (“Heat Power”)

Heat Power has two distinct operations servicing customers throughout the XueJiaWan district in Ordos City, Inner Mongolia: it supplies steam heating directly to end users and it also supplies electricity to end users through a government controlled intermediary, Inner Mongolia Electric Power Group Co., Ltd. (“Electric Power Group”).

In 2003, Heat Power was granted a license to supply heating to the entire XueJiaWan district in Ordos City, Inner Mongolia. To provide for this requirement, construction began in 2004 on a thermoelectric plant, which was completed in September 2006. In conjunction with the thermoelectric plant, Heat Power also owns 21 heat transfer stations.

Heat Power is a regulated utility company meeting current regulatory requirements applicable to such companies Electric Power Group is also subject to regulated utility company rules and regulations consisting of compliance with safety and environmental standards and pricing structures set by the Inner Mongolia government. Revenues generated are a function of government regulation as the prices charged are approved by the government. The government reviews the pricing of heating from time to time as market conditions change. Also, the cost of coal, Heat Power’s raw material for the production of heat, is also regulated by the government. We purchase coal from suppliers at market price. The incentive for suppliers to provide coal at such prices is the government’s guarantee and arrangement of transportation routes, thereby saving transportation costs on part of the suppliers. Such savings outweigh the reduction in the selling price for the suppliers.

In the XueJiaWan area, hardly anyone owns a domestic heating boiler. Instead, Heat Power supplies heat to end users through a closed pipeline system. Water is first heated in the Company’s thermoelectric plant using boilers and then piped directly to homes and public buildings, including private dwellings, factories, as well as municipal facilities. Lastly, the water is piped back to the thermoelectric plant with the process repeating again.

Heat Power obtains its supply of powdered coal required to generate heat production principally from Zhunger County Guanbanwusu Coalmine (“Guanbanwusu”), an unrelated, unassociated third party. It also obtains its supply through various other coal mines in the area. We do not supply Heat Power with coal for fuel. The Company does not believe this concentration on certain suppliers constitutes a significant risk.

Pacific Projects Inc. (“PPI”)

On December 30, 2007, CEC acquired PPI, a Nevada company with no assets, liabilities, or equity. CEC holds 100% of the issued and outstanding shares of PPI, or 5,000 common shares with a par value of $ 0.001.

On December 31, 2007, PPI entered into a Trust Agreement with all the registered shareholders of Coal Group and Heat Power, pursuant to which all of the shareholders agreed to hold their interests in Coal Group and Heat Power (represented by their registered paid up capital contributions to date) in trust for PPI for an 8 year term, extendable for another 5 more years. Coal Group is a wholly owned subsidiary of CEC and Heat Power is 51% owned by Coal Group and 49% owned by registered shareholders in the PRC in trust for CEC.

Under the plan contemplated by the Trust Agreement, PPI planned to raise adequate funding to convert Coal Group and Heat Power to Foreign Invested Enterprise (hereinafter referred to as “FIE”) eligible businesses pursuant to which a FIE business license would be issued. This new procedure was adopted as result of change in laws in the People’s Republic of China (hereinafter referred to as the “PRC”) wherein all foreign companies incorporated outside the PRC having an interest in PRC domestic companies were required to purchase FIE business licenses for their wholly owned or controlled subsidiaries in the PRC.

On September 8, 2006, new regulations came into effect concerning the merger and acquisition of domestic PRC companies by foreign investors (herein referred to as the “New Regulations”) promulgated by the Ministry of Commerce and other regulatory departments.

At such time, CEC determined that, under the New Regulations, CEC was required to undergo an application process to convert Coal Group and Heat Power from domestic PRC companies to FIEs pursuant to which a FIE business license would be obtained. In doing so, the acquisition of both the companies by CEC under the New Regulations would be classified under a type of acquisition called “Equity Acquisition” pursuant to which CEC, being the foreign investor, would invest cash equity interest into both companies with the acquisition price to be determined by an asset valuation of both companies prepared by a PRC asset valuation company as approved by the Ministry of Commerce of the PRC. The asset valuation would be based on PRC generally accounting standards and not based on US Generally Accepted Accounting Principles. The acquisition price and hence asset valuation would not exceed certain guidelines as described below.

The registered paid up capital of Coal Group as of November 30, 2008 is RMB 60 million or approximately $ 8.5 million and 2.5 times this amount is $ 21.25 million. The 49% registered paid up capital of Heat Power (CEC’s total interest in Heat Power) as of November 30, 2008 is RMB 24.5 million or approximately $3.4 million and 2 times this amount is $ 6.8 million. The total acquisition price per company for FIE conversion would be capped per the following guidelines provided by the Ministry of Commerce:

Registered paid up capital | Total Investment |

| Less that $ 2.1 million | Cannot exceed 1.43 times the amount of registered paid up capital |

| $ 2.1 to $ 5 million | Cannot exceed 2 times the amount of registered paid up capital |

| $ 5 million to $ 12 million | Cannot exceed 2.5 times the amount of registered paid up capital |

| More than $ 12 million | Cannot exceed 3 times the amount of registered paid up capital |

Coal Group’s registered paid up capital is between $5 and $ 12 million and therefore the acquisition price under the New Regulations would not exceed 2.5 times the registered paid up capital amount. Accordingly, upon granting of the FIE license, CEC would be liable for no more than approximately $ 21.25 million given that no further capital contributions are made to Coal Group. Heat Power’s total registered paid up capital is approximately $ 7 million and therefore the acquisition prices cannot exceed 2 times the registered paid up capital amount. CEC’s interest in Heat Power is 49% and therefore the maximum acquisition price would be approximately $ 6.8 million ($ 7 million * 49% * 2).

PPI intended to fund the acquisition price by funds raised pursuant to the Share Trust Agreements entered into on January 3, 2008 with Georgia Pacific Investments Inc. (hereinafter referred to as “GPI”) and Axim Holdings Ltd (hereinafter referred to “Axim”) wherein proceeds from the sale of the CEC’s shares held by Axim and GPI were to be allocated to purchase the FIE business license at the deemed acquisition price.

As of December 31, 2008, GPI held 20,589,107 shares and Axim held 10,000,000 shares, totaling 30,589,107 shares. These shares were obtained from control group shareholders of CEC, who transferred their shares to those entities to be held in trust with the view that those entities would sell those shares in the open market in order to fund the plan to convert Coal Group and Heat Power into FIEs. We deemed the 30,589,107 shares held by GPI and Axim to comprise a portion of the 45,000,000 issued and outstanding shares of CEC.

From the sale of the 30,589,107 shares, all the net proceeds (gross proceeds less $0.20 per share that accrued to the beneficiaries of the Axim and GPI trust beneficiaries in proportion to their shares originally deposited in Axim or GPI, less the brokerage commissions and expenses relating directly to the sale of the shares) were planned to be remitted to PPI to be used for funding of the acquisition price of the FIE business licenses mentioned above under the terms set out in the Trust Agreement. No sale of CEC shares, however, has been made under this arrangement among PPI, GPI and Axim. Please refer to Exhibit 10.2 and 10.3.

History and results of operations

CEC was incorporated in the state of Nevada on October 11, 2002 for the purpose of producing coal to meet the increasing demand in power and heating industries and also to provide heat and electricity to networks in rural developments. CEC was considered a shell company until it entered into the Share Exchange Agreement (the “Exchange Agreement”) to acquire its operating companies, Coal Group and Heat Power, on November 30, 2004 (the “Share Exchange”).

Although CEC is the legal survivor of this acquisition and is the registrant with the Securities and Exchange Commission, under accounting principles generally accepted in the United States, the transaction was accounted for as a reverse merger, whereby Coal Group is considered the “acquirer” of CEC for financial reporting purposes as its shareholders control a majority of the post transaction combined company. Among other matters, this requires CEC to present in all financial statements and other public information filings, prior historical and other information of Coal Group, and requires a retroactive restatement of Coal Group historical shareholder investment for the equivalent number of shares of common stock received in the merger. Accordingly, our financial statements present the results of operations of Coal Group and Heat Power that reflect the acquisition of November 30, 2004 under the purchase method of accounting. Subsequent to November 30, 2004, the operations of the Company reflect the combined operations of CEC, Coal Group and Heat Power.

Since the inception of Coal Group in 2000, its trade consists of production and processing of raw coal for both domestic heating and electrical generation purposes and acting as a brokerage in facilitating coal trade buyers and sellers. Our brokerage activities to date have been limited as our focus is on direct supply of raw coal.

Through Heat Power, we operate a thermoelectric plant and 21 heat transfer stations located in XueJiaWan, Ordos City pursuant to a license granted to us by the Inner Mongolia government.

For the years ended November 30, 2008 and 2007, we generated net income of $ 3,890,712 and $ 2,973,838, respectively.

Our principal business office is located at No.57, Xinhua East Street, Hohhot City, Inner Mongolia.

Subsequent Event

Upon subsequent review of the FIE business license plan contemplated by the Trust Agreement and the Share Trust Agreements, the Company determined that it could instead adequately reduce any PRC regulatory risk by using an alternative structure involving the use of “variable interest entities” or VIEs. Pursuant to this approach, the Company would forgo any right to registered ownership of the Coal Group and Heat Power (each an “Operating Company” and collectively, the “Operating Companies”) contemplated by the Share Exchange, and would instead permit registered ownership of the Operating Companies to continue to be held by all or certain of the PRC Shareholders (the “VIE Shareholders”). The plan requires the Company to establish a new indirect subsidiary of the Company incorporated in the PRC (“CEC China”) which would enter into a series of contractual arrangements with the VIE Shareholders so that the control and the economic benefits and costs of ownership of the Operating Companies would flow directly to CEC China through a series of management and business cooperation agreements. CEC China would also have the option to purchase the equity interests in the Operating Companies held by the VIE Shareholders. The VIE Shareholders would pledge their equity interests in the Operating Companies as security for their agreement to comply with provisions of the management and cooperation agreements and would provide CEC China with a power of attorney to exercise all their shareholder rights in the Operating Company. The contractual arrangements under the VIE structure are intended to comply with, and be enforceable under, applicable PRC law, and would adequately reduce any PRC regulatory risk without the capital contributions necessary under the FIE plan initially proposed by the Company. In connection with the planned VIE restructuring, the Company and the PRC Shareholders have entered into a Framework Contract in July 2009 pursuant to which the Company has agreed to form CEC China within three months of the execution of the Framework Contract, and the Company and the PRC Shareholders have agreed to enter into the aforementioned agreements.

Pending the consummation of the VIE restructuring, the Company still continues to control the Operating Companies. The evidence of the Company’s ownership of the Operating Companies is reflected by the continued memorialization of the intent of the original shareholders of the Operating Companies to transfer the business of the Operating Companies to the Company, the actions of the original shareholders consistent with this view, and the validity and enforceability of the Framework Contract under PRC law.

Notwithstanding the foregoing, prior to the consummation of the VIE restructuring, the enforceability of the Company’s legal ownership under PRC law could be subject to risk or challenge. We believe that the likelihood of the Company’s claim to legal ownership being at risk or challenged is low. In our view, there is a hypothetical risk that a challenge could arise from an action initiated by either one or more of the original shareholders of the Operating Companies, or by a third-party claiming that it received shares of the Operating Companies from one or more of the original shareholders following the date of the Share Exchange, in each case in violation of the intent of the Exchange Agreement. Given the contractual agreements and representations of the original shareholders under the Exchange Agreement, the PPI Trust Agreement and the Framework Contract, we do not believe this to be a material risk. Furthermore, to the best of our knowledge, the actions of the original shareholders of the Operating Companies have been consistent with this view. Given the foregoing, we plan and expect to maintain control over the Operating Companies pending the VIE restructuring. We do not believe that there is any reasonably possible liability associated with past operations that would arise as a result of our current ownership status over our Operating Companies. We do not believe that our current ownership over our Operating Companies materially adversely affects our Operating Companies’ ability to obtain licenses, permits, or other authorizations that are necessary to conduct business operations and commerce.

Principal Products, Services and Their Markets

Coal Group

Acquisition of LaiYeGou Mine and Mining Right

The LaiYeGou mine was acquired in June 1999. Property acquisition in China is through 50 or 70 year lease and this is the only type of ownership permitted in China. Coal Group has leased the land surrounding the mine and the mine itself for a period of 50 years. The Company has all permits and governmental approvals necessary to mine the reserves in the LaiYeGou mine. Since acquisition of LaiYeGou in 1999, Coal Group’s activities has been coal production for the purpose of supplying raw materials to heating and power industries, retail customers and coking factories for steel production.

All land in China belongs to the PRC government. To extract resources from land, Coal Group is required to obtain a mining right. The regulatory body responsible for issuing such rights is the Provincial Bureau of National Land and Resource, a division of the PRC government. In December 2005, Coal Group’s mining right was assessed to be approximately $ 3.7 million for a period of 14 years commencing November 2005. This mining right is regarded as an intangible asset to be amortized over a period of 14 years. As of November 30, 2008, we have fulfilled our obligations and have made full payment for the right.

The LaiYeGou coal mine is an underground operation capable of producing 800,000 metric tons of coal per year after undergoing expansion efforts. Occupying an area of 230.3 hectares (approximately 569 acres) at Dongsheng Coalfield near Dongsheng City, LaiYe Gou has established proven and probable reserves of 27.09 million metric tons. The product mined is high quality, non-caking coal that has low sulphur, low phosphorus and low ash content which does not fuse together or cake when heated but burns freely and is used mainly for heating and electric power generation.

With such minimal harmful chemical content, it meets the stringent environmental standards set by the Central government of China. It is ideal for general heating applications as well as for power generation, with a heat rating of 6,800–7,000 kcal.

Coal Reserves

The following definitions apply to our mining operations as per Industry Guide 7 of the Securities Act Industry Guides:

| · | Reserve. That part of a mineral deposit which could be economically and legally extracted or produced at the time of the reserve determination. |

Note: Reserves are customarily stated in terms of “ore” when dealing with metalliferous minerals; when other materials such as coal, oil, shale, tar, sands, limestone, etc. are involved, an appropriate term such as “recoverable coal” may be substituted.

| · | Proven (Measured) Reserves. Reserves for which (a) quantity is computed from dimensions revealed in outcrops, trenches, workings or drill holes; grade and/or quality are computed from the results of detailed sampling and (b) the sites for inspection, sampling and measurement are spaced so closely and the geologic character is so well defined that size, shape, depth and mineral content of reserves are well-established. |

| · | Probable (Indicated) Reserves. Reserves for which quantity and grade and/or quality are computed from information similar to that used for proven (measure) reserves, but the sites for inspection, sampling, and measurement are farther apart or are otherwise less adequately spaced. The degree of assurance, although lower than that for proven (measured) reserves, is high enough to assume continuity between points of observation. |

Our survey of reserves was performed by No. 153 Exploration Team of Inner Mongolia Coalfield Geological Bureau, surveying the district of Hongjingta area consisting of 7,800 hectares (approximately 19,266 acres). LaiYeGou is included in Hongjingta and is 230.3 hectares (approximately 569 acres) or 3% of the total survey area. The survey consists of 3,454 samples including 184 outcrops (a body of rock exposed at the surface of the Earth), 140 trenches and 32 drilling samples. The distance between each sample is 4,428 hectares (approximately 10,937 acres). The recoverable reserves in the mine decrease gradually and as of the fiscal year end, the recoverable reserves equaled approximately 11,720,000 metric tons. The sulfur content of the reserves is 0.5 pounds per million BTU or (St,d): 0.19%. The heat value is 25 million Btu/ton (29 MJ/kg).

All reported reserves will be mined out within the period of the existing permit. The Company’s permit is for 50 years and it covers the land and allows the Company to use the storage facility, office and “dormitory” for such period. The reserves will be mined out over a period of 14 years which may not occur over a consecutive 14 year period.

Accuracy and Risks

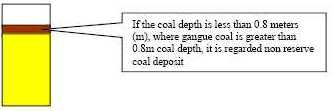

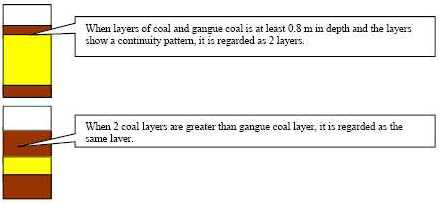

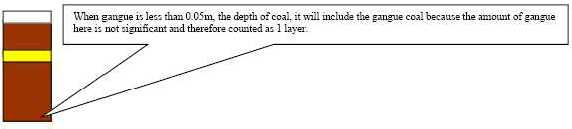

The accuracy and risks associated with Proven Reserves are less than of Probable Reserves due to the assumption of continuity of coal layers between sample points. The following consists of the classifications of the types of coal layers which are determined to be continuous:

(Gangue Coal: Commercially valueless rock material containing minimal amounts of coal)

Non Reserve Coal:

Non reserve coal also consists of coal bearing body in trenches, outcrops, drilling and other underground workings that have been sampled which require further exploration work.

Continuous Reserve Coal:

These types of reserve and non reserve coal sampled are extrapolated to be continuous between sampling points of which may not be consistent.

Proven and Probable Reserves

The reserves in the LaiYeGou Coal Mine are as follows as of March 2005 in thousand metric ton units:

| Proven reserves | | | 21,160 | |

| Probable reserves | | | 4,930 | |

| Total reserve*** | | | 26,090 | |

| | | | | |

| | | | | |

| Insitu proven reserve consumed | | | 6,590 | |

| Probable reserves** | | | 4,939 | |

| Reserve developed * | | | 14,570 | |

| Total | | | 26,090 | |

*These reserves were developed during our expansion of LaiYeGou.

** Probable reserves are assigned to existing facilities whereby existing infrastructure and equipment allows these reserves to be mined at current production levels.

*** Reserves are insitu (in the ground)

With the exception of reserves currently developing, all other reserves have been assigned to existing facilities and determined for sorting or for packaging of mixed coal.

The following table shows the in-place reserves, mining reovery and coal production for the mine:

| Year | | In-place Reserves | | | Recovery | | | Coal Produced | |

| 2006 | | | 1,374,927 | | | | 40 | % | | | 549,970 | |

| 2007 | | | 1,147,637 | | | | 40 | % | | | 459,055 | |

| 2008 | | | 330,122 | | | | 80 | % | | | 264,098 | |

Coal Specifications

The British Thermal Unit (“BTU”) per pound is 12,322.98. One BTU is equal to the amount of heat required to raise the temperature of one pound of liquid water by 1 degree Fahrenheit at its maximum density, which occurs at a temperature of 39.1 degrees Fahrenheit. One BTU is equal to approximately 251.9 calories or 1055 joules.

Coal produced from LaiYeGou does not undergo any washing or any other preparation prior to sale to customers as its raw form is satisfactory in meeting the needs and requirements of its customers. As a result, LaiYeGou does not have wash plant facilities nor it is necessary to account for dilution of its products.

The sulphur content is 0.5 pounds per million BTU and deemed to be compliant coal as non compliance coal emits greater than 3.0 pounds of sulphur dioxide per million BTU when burned.

Mining Method

Coal Group currently uses the “Long Wall” production of mining whereby large rectangular blocks of coal are defined during the development stage of the mine and are then extracted in a single continuous operation. Each defined block of coal, known as a panel, is created by driving a set of headings from main or trunk roadways in the mine, some distance into the panel.

The panel or block of coal up to 1,000 feet wide and two or three miles long is completely extracted. The working area is protected by movable hydraulic powered roof supports called shields. The longwall employs a shearer, with two rotating cutting drums, which is dragged mechanically back and forth across the coal face. The coal which is cut falls onto a heavy chain conveyor which delivers it to a belt conveyor system for removal out of the mine. The longwall shields advance with the machine as mining proceeds and provide not only high levels of production but also increased miner safety.

Longwall mining systems employ sensors to detect how much coal remains in the seam being mined as well as robotic controls to enhance efficiency. Microprocessors record seam data as a longwall miner makes its initial pass, subsequent passes then follow the previous route resulting in high efficiencies.

With the use of a longwall system, the amount of coal which is recovered in a given area increases from 50% to as much as 80%. The carefully planned longwall process has a positive influence on minimizing the effects of subsidence. Gradual or occasionally abrupt collapse of rock layers sometimes occurs between an underground mine and the surface. With the longwall operation, such ground movements are completed in a shorter period of time and the settling process occurs in a more uniform and predictable manner helping to minimize surface impacts. Longwall production has increased the largest amount of tonnage among underground mining methods.

Employees

There is approximately 150 staff working in the mine under the supervision of one contractor, Wu Lingwen. Coal Group has an agreement with Wu Lingwen for a period of 3 years commencing March 1, 2006. The agreement was renewed for a further 2 years. Wu Lingwen is responsible for all areas of production and processing.

Screening, Crushing and Loading Facilities

Our screening facilities consist of a filter which divides three types of coal according to customer specifications. We use manual screening method to filter the coal consisting of two screens of different filters and steel frame to support the facility.

We do not have crushing facilities. We also do not have washing facilities and therefore do not incur losses of product from this process.

Our loading facilities consist of equipment leased by the contractor. We require the use of 4 Loaders with the capacity of 1.5 tons each.

Transportation Infrastructure

Currently our customers provide their own transportation of goods from production to their desired location. There are however transportation challenges customers face where routes are inefficient. Where the contract is granted through government appointment, the government guarantees transportation from LaiYeGou coal mine to the final destination. Where contracts are privately arranged, transportation is arranged through hire of third party transporters by customers. In some instances, coal is purchased by third parties close in proximity to train stations where transportation to customer destinations is more efficiently arranged. However, transportation to destinations is limited to where routes are in place. Coal Group does not own any transportation equipment for the purpose of delivering its goods.

Resources and Utilities

The source of water for the mine is from Zhunger Keyuan Water Supply Co., Ltd, a public utility company owned by the government.

The source of power is provided by the Agricultural Power Supply Bureau and the Erdos Power Industry Bureau, public utility companies owned by the government.

Coal Group Markets

Coal Group’s main product is “Raw coal” or “Mixed coal” consisting of large, middle and powdered coal; accounting for more than 90% of our sales. Coal Group does not specifically sell large mass coal, middle mass coal and powdered coal unless it is requested by the customer.

Large Mass Coal

Production of this mass coal fulfills the needs of its retail customers in Hohhot and in BaoTou, the second largest city in Inner Mongolia with a population of 1.96 million. Retail customers purchase large mass coal for individual or commercial resale. Most coal mines in the area do not engage in individual sale and have minimum purchase requirements and therefore deter the type of customers Coal Group attracts to its customer base.

Middle Mass Coal

The price of middle mass coal generally is lower than of large mass or powdered coal and therefore it is not as frequently produced resulting in lower levels of supply.

Powdered Coal

Powdered coal is generally for the use of power stations for electricity and heat generation purposes. Coal Group supplies Zhejiang Fuxing Electric and Fuel Co., Ltd., which services the ZhejiangFuXing & JiangSu region with its electricity and heating generation needs.

Mixed Coal

The composition of mixed coal is classified into three specifications according to mass size. Coal is screened according to clients’ requests. Large mass coal is mainly for civil use, middle mass coal is mostly used in coking industry and powdered coal is mainly used in electricity generating.

The size specifications and price per ton is as follows:

| Type of Coal | | Specification in Centimeters | | | Percentage Coverage | | | Unit Price Per Ton | |

| Large mass coal | | >20 | | | | 30 | % | | $ | 74 | |

| Middle mass coal | | 1-20 | | | | 40 | % | | $ | 57 | |

| Powdered coal | | <1 | | | | 30 | % | | $ | 43 | |

These specifications are similar for coal purchased from other companies.

Pricing

The following are annual production per ton and weighted average prices received in the past five years:

| Year | | Annual Production Per ton | | | Weighted Average Price | |

| 2004 | | | 506,913 | | | $ | 10 | |

| 2005 | | | 612,739 | | | $ | 24 | |

| 2006 | | | 549,970 | | | $ | 24 | |

| 2007 | | | 459,055 | | | $ | 25 | |

| 2008 | | | 264,098 | | | $ | 58 | |

Contracts to be Awarded

Each year, the China Coal Industry Association convenes a supply and sale meeting whereby contracts to supply coal to power stations are awarded to suppliers based on levels of production.

Coal Group is classified as one of the top 20 coal producers and, as a result, will be awarded contracts to service various regions. The meeting attendees included National Planning and Reforming Committee, Railway Ministry Communication Ministry, National Electric Power Corporation, Coal Industry Association, and the Provincial Planning and Reforming Committee.

Coal Group obtains its contracts by maintaining its current levels of production. It is classified as a mid scale coal mine by the China Coal Industry Association. Production of less than 300 thousand metric tons are classified as small scale mines, 300 thousand to 900 thousand are classified as mid size scale mines and 900 thousand and above are classified as large scale mines. There are currently no other requirements to be awarded such contracts. The level of production required per year for segregation of large, mid or small scale mines is determined upon review of previous data of production of coal and projected requirements with the consideration of growth in various areas.

As new rural areas are developed, there will be the need to supply heating and electricity to new users and thus the requirement of raw coal material. With the increase in demand, the government will award contracts to service these areas as needed.

Government contracts granted to Coal Group not only entitles Coal Group to supply its products but also grants Coal Group a government guarantee of transportation routes. Government granted transportation routes are far more reliable and cost effective compared to the hire of third party contractors to deliver products.

LaiYeGou Expansion

In response to the escalating demand for its coal products, Coal Group has invested in infrastructure improvements necessary for increasing the annual production capability of the LaiYeGou Coal Mine to 800,000 tons per year. Infrastructure improvements commenced in May 2006 and were recently completed. The cost of the expansion was approximately $ 10 million and was financed through shareholder and bank loans. Please see “Sources of Capital”.

Heat Power

Heat Power was founded in September 2003 in XueJiaWan Town, Inner Mongolia. Since its inception, Heat Power operated an existing Heat Power plant in XueJiaWan as part of its agreement with the Zhunger County government to phase out the existing heating plant for development of a more efficient and effective plant with heating and electricity generation capabilities as per the monopoly granted as described below.

Heat Supply License

On July 29, 2003 Heat Power was granted the license and monopoly by the Zhunger County government to provide centralized heating service to the entire XueJiaWan area, including Donghua and Yinze residential area. The monopoly was granted for an undetermined period of time given that Heat Power maintains production capabilities and predetermined prices set by the Zhunger County government.

Thermoelectric Plant

The thermoelectric plant was constructed by December 2005 and put into operation effective September 2006. The thermoelectric plant allows for a centralized heat and electricity supply in the area with 110,400,000 mega joules and 144,000 megawatts, respectively generated per year.

Heat Power will provide electricity to users by merging an electrical network with Electric Power Group, a government owned enterprise. Heat Power has also constructed additional heat transfer stations, totaling 21 to date, to improve the efficiencies and reliability of the thermoelectric plant. Heat Power is also in the process of constructing additional boilers necessary supplement to ensure stable and reliable heat supply.

Heat Power purchased approximately 120,000 metric tons of powdered coal for its current operations under an agreement with Guanbanwusu to supply up to 180,000 metric tons of coal per year.

Supply of Powered Coal

The powdered coal required to generate heating is supplied principally by Guanbanwusu and has a heating capability of 4600-4,900 kcal and is low sulphur, low phosphorus, medium ash, and high ash melting point, which satisfies the government Environmental Protection Standard and is regarded as environmentally friendly coal. The coal must have a minimum heating capacity of 4,600 Kcal or reduction of price per ton is implemented. Guanbanwusu is responsible for transporting coal to the plants.

Heat Power also obtains its supply of powdered coal from other suppliers with which it has no formal agreement. Suppliers are hesitant to enter into agreements for a fixed price as a result of the price of coal fluctuating on an upward trend.

Tax Exemption

The Ministry of Finance and National Tax Administration Bureau has granted Value Added Tax (“VAT”) exemptions for heat supply industries operating in Inner Mongolia where VAT applicable on revenue or expenses will not be required to be remitted or withheld, respectively. The exemption is effective until 2010.

Expenses paid for construction are subject to VAT. Please see below “Taxation Rates”. Tax exemptions were granted mainly as a result of the government encouraging economic development in the area. XueJiaWan, prior to construction of the thermoelectric plant, did not have efficient methods of providing heating and electrical requirements to users, resulting in large amounts of raw material coal being consumed with very low levels of output of heating and electricity. The thermoelectric plant allowed for a more efficient and effective means for distribution with a centralized heat and electricity supply throughout the area.

Heat Power Markets

Heat Power’s marketing efforts are solely devoted to obtaining heat supply monopolies and contracts with monopolized divisions for supply of electricity through the Inner Mongolian government and related city planning authorities. To obtain these monopolies, Heat Power must demonstrate that it can meet the following requirements:

1) Reputation and operating history of the company. The company must have a good reputational, record, including never having been involved in illegal operations or default on payment of taxes.

2) Production capability requirements. No operating history is required, but the company must have the capability to manage the heat supply station and enlarge its production capacity if needed. The PRC government does not specify production capabilities, only that heat supply stations are operational.

3) Reputation of directors and officers. The Company’s directors, supervisor or top management must obey “China Company Act” and the “Controlled Regulation of Artificial Person Registration”.

As per the above, Heat Power and its management meet these requirements. Contracts are awarded through government appointment through evaluating these criteria in submission of contract bids. In addition, these contracts must specify prices charged which may be capped for a certain period as determined and approved by the local price control committee. Competition in obtaining monopolies is largely mitigated by a good review of operating history. To the best of management’s knowledge, there are few entities which have the ability to maintain production and expansion capabilities and have a good operating history.

The monopoly is granted for an undetermined period of time given that production capabilities and prices are maintained. So as long as heat is supplied to the specified area, there are no termination provisions.

Outlook on future demand for coal

Integral to China’s industrial expansion and related energy demand escalation at the present time, the PRC government is encouraging sectors to build more power stations, coking factories, calcium carbide factories and silicon iron factories across the country. As a consequence, the future demand in China for coal remains strong; a key factor underpinning the output of power stations and such factories potentially reaching 1.650 billion metric tons during the present calendar year, 1.820 billion metric tons in 2010 and 2.100 billion metric tons by 2020. However, estimates of supply deficiencies also are sizable at 250 million metric tons and 700 million metric tons in 2010 and 2020, respectively.

Diesel is an alternative competing factor to coal; however, it is generally not used as most energy generation plants and users are only equipped to receive coal as a raw material. The use of diesel is also not cost effective as it is four times higher in price compared to coal products; however, diesel has a higher energy rate per ton compared to coal.

In addition to the excess demand, transporting coal from Shanxi Provice to Hebei Province proves to be a challenge as transportation routes are currently inefficient or non-existent. Currently, the development and improvement of roads and railways cannot keep up with levels of demand. There are plans for city planners to rectify this issue by allocating resources to bettering and building transportation systems; however, to our knowledge, these improvements are not expected to materialize for at least the next five years which could result in lost sales and other opportunities for expansion.

As for Coal Group, methods of circumventing transportation challenges are to receive contracts granted by the government whereby transportation is guaranteed from LaiYeGou coal mine to final destination. When contracts are between private parties only, transportation is arranged through hire of third party transporters or by customers themselves. In some instances, coal is purchased by third parties close in proximity to train stations where transportaiton to customer destinations is more efficiently arranged. However, transportation to destinations is limited to where routes are in place. Coal Group does not own any transportation equipment for the purpose of delivering its goods.

Heat Power’s transportation from Guanbanwusu to its plants is provided by Guanbanwusu.

Heating requirements are supplied throughout the XueJiaWan area through underground pipelines. Existing pipelines are used and in new areas expanded. The PRC government has constructed new networks for this area.

Advertising and marketing strategy

Distribution

Coal Group

Coal Group does not have methods of distribution as sales of its large, middle mass and powdered coal are largely being transported by customers. Coal Group will transport products by truck and by railway for certain customers that request this service.

Heat Power

Supply of powdered coal is delivered to Heat Power’s plants facilitated by Guanbanwusu. Guanbanwusu makes all necessary arrangements with third party transporters. The distance between the mine and operations is approximately 3 km.

The transportation industry is fairly competitive and Heat Power or Guanbanwusu could retain other transporters should there be a need.

Subcontractors

Coal Group hires contractors to hire staff to work in the LaiYeGou coal mine. There is currently one contractor at the LaiYegou mine which has hired 150 employees.

Competition

Coal Group

Due to existing market conditions as discussed above in the “Outlook on Future Demand of Coal”, we do not have competition in the usual sense of the term. There are approximately 30,000 coal mining companies throughout China; however, since demand currently exceeds supply, competition is not a concern in the operation of our business.

We expect that China’s coal industry will remain a large, growing and chronically under-supplied customer base for the foreseeable future.

There are pressures from the PRC government to use nuclear power instead of coal due to environmental concerns; however, coal reserves in China are abundant and less expensive and a switch to other forms of resources to generate energy is unlikely.

Heat Power does not have competition as it receives a monopoly to supply heating and electricity requirements to serviced areas. Competition in obtaining monopolies is largely mitigated by a good review of operating history by the PRC government.

The monopoly is granted for an undetermined period of time given that production capabilities and prices are maintained. As long as heat is supplied to the specified area, there are no termination provisions.

Patents, Trademarks and Labor Contracts

We do not have any trademarks on our trade name or logo or patents on our products or production processes.

Employees and Principal Business Offices

Coal Group

Coal Group has a total of 30 full time employees, and 150 contracted staff to operate the LaiYeGou coal mine. The 30 employees fill positions in its Administration, Accounting, Sales, Finance & Securities, and Management department.

The Administration department is responsible for human resources, training, and payroll. The department also evaluates all processes to ensure certain levels of efficiency are maintained and provides any support services to other departments should the need arise.

The Accounting department is responsible for compliance with accounting principles and national tax laws, bookkeeping, preparing budgets and analysis of financial reports.

The Sales department is responsible for launching advertising campaigns, market research and customer service.

The Finance and Securities department is responsible for all corporate matters relating to preparation of contracts and maintaining corporate books and records.

The Management department is responsible for overall direction and marketing efforts. This department oversees all other departments.

Heat Power

Heat Power has 250 full time employees filling positions in our Administration, Finance, Heat Station Management and Project Management Departments and also at the thermoelectric plant.

Heat Power’s Administration and Finance departments have similar functions as do their Coal Group counterparts described above.

The Heat Station Management department is responsible for inventory levels, purchasing, transportation, maintenance, safety, and overall management of the efficiency and operation of thermoelectric plant including heat transfer stations and boilers.

The Project Management department is responsible for design and production process specifications of new projects and appointing and managing subcontractors.

Heat Power has over 200 employees working in its heating stations in XueJiaWan consisting of engineers, technicians and management staff overseeing operations.

Administrative Branch Office

As of November 30, 2008, we had three consultants in our Administrative Branch Office. The consultants provided translation and EDGAR filing services. The consultants also had access to legal counsel for the purpose of preparing the necessary reports to comply with regulations applicable to fully reporting companies. Mr. Ding provided this office space rent free.

Subsequent Event

In May 2009, the Company terminated the 3 consultants in our Administrative Branch Office, hired new financial advisors, and closed its Administrative Branch Office.

Management believes that relations with its employees are good.

ITEM 1A. RISK FACTORS

***You should read the following risk factors

carefully before purchasing our common stock. ***

RISKS RELATING TO OUR BUSINESS

Our management lacks technical training with operating a mine and as a result may cause the Company to suffer irreparable harm due management’s lack of training.

The lack of technical training of our management requires us to rely on professional engineers as an integral part of our operations. As a result of management’s lack of training, we may not take into account standard engineering or managerial approaches other mineral explorations companies commonly use. Consequently without the technical expertise of either retained staff or contracted third parties, we could suffer irreparable harm in our operations, earnings and ultimate financial success.

Compliance and enforcement of environmental laws and regulations may cause us to incur significant expenditures and resources which we may not have.

Extensive national, regional and local environmental laws and regulations in the PRC affect our operations. These laws and regulations set various standards regulating certain aspects of health and environmental quality, which provide for user fees, penalties and other liabilities for the violation of these standards. We believe we are currently in compliance with all existing PRC environmental laws and regulations. However, as new environmental laws and legislation are enacted and the old laws are repealed, interpretation, application and enforcement of the laws may become inconsistent. Compliance in the future could require significant expenditures, which may adversely affect our operations. The enactment of any such laws, rules or regulations in the future may have a negative impact on our projected growth, which could in turn decrease our projected revenues or increase our cost of doing business.

The potential liability for violation of environmental standards consists of loss of our business licenses causing irreparable damage to our reputation and payment of penalties which range depending on the nature of the violation and history of previous violations made. There is currently no fixed amount set by the government and penalties are determined on a case by case basis. In addition, the project which we undertake will be ceased until we comply with applicable environmental standards.

We are required to renew our business license every 10 years. If, at the time of renewal, we are in violation of any environmental or company act laws, our operations may be suspended until such violations are remedied.

Suspension in our operations would cause not only loss of profits but loss of existing and potential customer base, damage to our reputation, and related costs incurred for business interruption.

Heat Power may be entitled to tax concessions in areas described as “West Region Development Plan” for a set period of time; however, we may lose this benefit at anytime as determined by the government.

Tax concessions are granted by the Provincial government to encourage development in rural areas in XueJiaWan. Heat Power is currently under application for these tax concessions. The government may at its discretion terminate such tax concessions at any time and we may not have the resources to cover our income taxes as they become due as our budgets are based upon granting of these tax concessions.

We are dependent on a few key personnel, being our officers and directors

We are substantially dependent upon the efforts and skills of our executive officers and directors. The loss of the services of any of the executive officers could have a material adverse effect on our business.

Our shareholders may not be able to enforce U.S. civil liabilities claims.

Our assets are located outside the United States and are held through a wholly-owned subsidiary incorporated under the laws of Nevada. Our current operations are conducted in China. In addition, our directors and officers are residents of countries other than the United States. All or a substantial portion of the assets of these persons are located outside the United States. As a result, it may be difficult for you to effect service of process within the United States upon these persons. In addition, there is uncertainty as to whether the courts of China would recognize or enforce judgments of United States courts obtained against us or such persons predicated upon the civil liability provisions of the securities laws of the United States or any state thereof, or be competent to hear original actions brought in these countries against us or such persons predicated upon the securities laws of the United States or any state thereof.

We carry no insurance policies and are at risk of incurring personal injury claims for our subcontractors, and incurring loss of business due to theft, accidents or natural disasters.

We currently carry no policies of insurance to cover any type of risk for our contractors. It is common practice in China not to carry such insurance. Should any of such events occur, we are liable for all costs incurred to replace, repair any damage and or compensate for incidences. The costs incurred may adversely affect our operations and we may not have the necessary capital to sustain minimum working capital needs. Social insurance may mitigate such costs however may not be sufficient to cover the full cost or compensation depending on the severity of the incident.

We require the approval from the Inner Mongolia government for all of our expansion projects and, as a result, could face delays for an indefinite period of time should the government determine that such expansion project is not in accordance with the rate of economic growth projected over a certain period of time.

All approvals are made under the National Planning and Reform Committee of the Inner Mongolian government. The approval process varies depending on size of expansion plans and on average takes approximately 2.5 months.

The prices we charge to supply heating in Zhunger County is determined by the Inner Mongolia Zhunger Pricing Bureau (the “Bureau”) and we may not be able to recoup increases in the cost of raw materials or expenses for an undetermined period of time until application to increase prices is approved.

We are under application to increase the pricing structures of heat supply with the Bureau as a result of increases in the cost of coal. Should our application be rejected, this may affect our ability to meet our working capital needs and we may require capital from other sources such as shareholder or bank loans which may not be available to us.

In recent years, the price of raw materials has increased leading to increases in cost of heat supply. To increase the price charged to supply heating, we must receive approval from the Bureau. The approval process begins with preparation of cost analysis and then a hearing is arranged to determine whether the increase is justified.

During this time, the Bureau may grant us a subsidy when the increase in the price of raw material is more than 10% of the heat supply price. We are not permitted under any circumstances to unilaterally increase heat supply prices in order to recoup raw material costs.

Our rate of profit is capped by government regulations as prices for heat supply are determined by the Bureau and we may not be able recoup our costs or cover our working capital needs.

Our level of profit is capped by the Bureau as determined from time to time upon review of economic circumstances such as the price of raw materials in comparison with the price point of heat usage charges. The level of profit will not exceed the amount the Bureau determines to be the price charged.

We are operating under conditions where political and legal uncertainties exist whereby changes in the political climate may cause us to incur costs to rectify any changes either local, provincial or central governments may impose on us at any time.

Chinese government policy is volatile as property rights are insecure and the rule of law is still in its infancy. We are subject to unpublished regulations from local, provincial, and national governments, which often have different and sometimes conflicting agendas and demands. This may affect our operations in all aspects from the price we charge for coal, heat, hot water, electricity supply and the approval process of new expansion projects. The price we charge may be lower than desired and new expansion projects may be delayed indefinitely as a result of conflict with various levels of government.

As a member of the Local Coal Sales Association, the minimum price at which we sell coal in any area in China is determined by the Local Coal Sales Association and, if there is any decrease in demand for a particular type of coal, we cannot lower our prices beyond the minimum set price to adjust for a decrease in demand without loss of our membership.

If the demand for a particular type of coal decreases, we are not able to decrease our prices in order to generate cash flow when needed until the Local Coal Sales Association determines that such a decrease is warranted. We may not be able to sell coal at such minimum prices and as a result may not be able to meet working capital needs and expansion projects may be delayed indefinitely.

The following are minimum prices at which we are required to sell coal:

The price for mass coal (large, middle, and powdered individually sold) must be at least $13.30 per ton and the prices for mixed coal (assortment of mass coal) must be at least $11.50 per ton. Prices set by the Coal Sales Association are reviewed periodically as market conditions change. Enforcement of these price points are also governed under this authority.

RISKS RELATING TO OUR STRUCTURE

We control our subsidiaries through a series of contractual arrangements as opposed to through direct record ownership, and the enforceability of our claim to legal ownership of Coal Group and Heat Power (each, an “Operating Company” and collectively, the “Operating Companies”) under such contractual arrangements may be subject to risk under PRC law.

On November 30, 2004, the Company entered into a share exchange agreement (the “Exchange Agreement”) pursuant to which the shareholders of 100% of the equity interests in Coal Group and the shareholders of 49% of the equity interests in Heat Power (collectively, the “PRC Shareholders”) acquired shares of the Company’s common stock in consideration for their exchange (the “Share Exchange”) of 100% of their equity interests in the Operating Companies. Due to certain changes in applicable PRC law, the Share Exchange, however, was not effected in such a way that would permit the share registration of the Operating Companies held by the PRC Shareholders to be perfected by the recordation with applicable Chinese regulatory authorities of the transfer of ownership of the Operating Companies to the name of China Energy Corporation. In response to this change in law, the Company commenced a plan to convert the holding structure of the Operating Companies into Foreign Invested Enterprises (“FIEs”) under PRC law. In connection with this plan, the PRC Shareholders and PPI, a subsidiary of the Company, entered into a Trust Agreement with the PRC Shareholders, whereby all the shareholders confirmed their obligation to hold their interests in Coal Group and Heat Power in trust for PPI. Nevertheless, even though the Company and the PRC Shareholders entered into the Share Exchange and the Trust Agreement and the related plan to convert the Operating Companies into FIEs, the enforceability of the Company's claim to legal ownership of the Operating Companies may be subject to risk under applicable PRC law. Specifically, since the Operating Companies and the PRC Shareholders are located in the PRC, any action to enforce or challenge the terms of the Exchange Agreement and the Trust Agreement would ultimately have to be heard in the PRC to realistically be effective. Accordingly, given the issue as to perfection, we cannot predict to what extent a PRC administrative or court authority would determine that the Exchange Agreement or the Trust Agreement or the intent of the parties as memorialized therein created a legal right or claim to ownership of the Operating Companies that would be enforceable under PRC law. In addition, since PRC administrative and court authorities have significant discretion in interpreting and implementing statutory and contractual terms, it may be more difficult to evaluate the outcome of administrative and court proceedings and the level of legal protection that we would enjoy in the PRC as compared with more developed legal systems. It is also unclear as to the level of comity that a PRC court would extend to a contract governed by non-PRC law, or any final judicial determination as to the enforceability of contract made by a non-PRC court. Regardless, we believe that our ownership of the Operating Companies is appropriate because of the continued memorialization of the intent of the original shareholders of the Operating Companies to transfer the business of the Operating Companies to the Company, the actions of the original shareholders consistent with this view, and the validity and enforceability of the Framework Contract under PRC law (see “Business – Subsequent Event” above).

RISKS RELATING TO OUR COMMON SHARES

Broker-dealers may be discouraged from effecting transactions in our shares because they are considered penny stocks and are subject to the penny stock rules.

Rules 15g-1 through 15g-9 promulgated under the Securities Exchange Act of 1934 (the “Securities Exchange Act”) impose sales practice and disclosure requirements on NASD broker-dealers who make a market in “penny stocks”. A penny stock generally includes any non-NASDAQ equity security that has a market price of less than $5.00 per share.

Under the penny stock regulations, a broker-dealer selling penny stock to anyone other than an established customer or “accredited investor” (generally, an individual with net worth in excess of $1,000,000 or an annual income exceeding $200,000, or $300,000 together with his or her spouse) must make a special suitability determination for the purchaser and must receive the purchaser’s written consent to the transaction prior to sale, unless the broker-dealer or the transaction is otherwise exempt.

In addition, the penny stock regulations require the broker-dealer to deliver, prior to any transaction involving a penny stock, a disclosure schedule prepared by the SEC relating to the penny stock market, unless the broker-dealer or the transaction is otherwise exempt. A broker-dealer is also required to disclose commissions payable to the broker-dealer and the registered representative and current quotations for the securities. Finally, a broker-dealer is required to send monthly statements disclosing recent price information with respect to the penny stock held in a customer’s account and information with respect to the limited market in penny stocks.

Our stock is controlled by principal shareholders for the foreseeable future and as a result, will be able to control our overall direction.

Our 5% shareholders own an aggregate of 74% of our outstanding shares. As a result, the insiders could conceivably control the outcome of matters requiring stockholder approval and could be able to elect all of our directors. Such control, which may have the effect of delaying, deferring or preventing a change of control, is likely to continue for the foreseeable future and significantly diminishes control and influence which future stockholders may have in the Company. See “Principal Stockholders.”

FORWARD LOOKING STATEMENTS

This Form 10K includes forward-looking statements which include words such as “anticipates”, “believes”, “expects”, “intends”, “forecasts”, “plans ”, “future”, “strategy” or words of similar meaning. Various factors could cause actual results to differ materially from those expressed in the forward looking statements, including those described in “Risk Factors”. We urge you to be cautious of these forward-looking statements. Except as required by applicable law, including the securities laws of the United States, we do not intend to update any of the forward-looking statements to conform these statements to actual results.

Currency Exchange Between Chinese Renminbi and United States Dollars

While our consolidated financial statements are reported in United States dollars, a significant portion of our business operations are conducted in the Chinese currency Renminbi (“RMB”). In order to provide you with a better understanding of these operations as discussed in-depth in the section titled “Description of Business”, we provide the following summary regarding historical exchange rates between these currencies:

China previously did not allow its currency to float on the open market. Rather, the currency was tied to the U.S. dollar. This means the RMB exchange rate versus the U.S. dollar was changed very infrequently. When it was changed, it tends to be very significant. During a period of high inflation, a country with a fixed exchange rate such as China will use foreign currency reserves to hold their rate steady until those reserves are exhausted. In this instance the exchange rate change will tend to be significant.

The value of the RMB against the U.S. dollar and other currencies may fluctuate and is affected by, among other things, changes in political and economic conditions. On July 21, 2005, the PRC government changed its decade-old policy of pegging the value of the RMB to the U.S. dollar. Under the new policy, the RMB is permitted to fluctuate within a narrow and managed band against a basket of certain foreign currencies. This change in policy has resulted in an approximately 21.2% appreciation of the RMB against the U.S. dollar between July 21, 2005 and June 30, 2009. Provisions on Administration of Foreign Exchange, as amended in August 2008, further changed China’s exchange regime to a managed floating exchange rate regime based on market supply and demand. Since reaching a high against the U.S. dollar in July 2008, however, the Renminbi has traded within a narrow band against the U.S. dollar, remaining within 1% of its July 2008 high but never exceeding it. As a consequence, the Renminbi has fluctuated sharply since July 2008 against other freely-traded currencies, in tandem with the U.S. dollar. It is difficult to predict how long the current situation may continue and when and how it may change again. Substantially all of our revenues and costs are denominated in the RMB, and a significant portion of our financial assets are also denominated in RMB. We principally rely on dividends and other distributions paid to us by our operating companies in China. Any significant revaluation of the RMB may materially and adversely affect our cash flows, revenues, earnings and financial position, and the value of, and any dividends payable on, our common stock in U.S. dollars. Any fluctuations of the exchange rate between the RMB and the U.S. dollar could also result in foreign currency translation losses for financial reporting purposes.

ITEM 1B. UNRESOLVED STAFF COMMENTS

None

ITEM 2. PROPERTIES

Principal Business Office

Coal Group

Principal Business Office

Our principal business office is located at No.57, Xinhua East Street, Hohhot City, Inner Mongolia, where our sales, legal, administration, accounting, finance and management departments are located. The third floor is approximately 5,050 square feet and is kept in good condition.

The office building was purchased by our President, Mr. Ding, in July 1998 on behalf of Coal Group and he subsequently transferred title to Coal Group once it obtained a business license. The full purchase price has been paid and no amounts remain outstanding for this property. The building has 3 floors and is 14,674 square feet.

We occupy the third floor and the first and second floors are occupied by XianGrong Commercial & Trade Co., Ltd where they operate a restaurant. Coal Group provides this space in exchange for property maintenance and catering services. Catering services and various banquets held throughout the year for promotion purposes cost approximately $25,000. Only expenses exceeding $25,000 are paid.

The land on which the office building is situated is leased from the PRC government or previous holders of the lease for a period of 50 years, expiring in 2048. A lease from the PRC government grants use of land by obtaining a State Owned Land Usage Certificate and a lease obtained through previous lease holders grants use of land by obtaining a Collective Land Usage Certificate. Land in China cannot be owned and the only form of ownership is by way of lease for a period of up to 50 years. A regulation Coal Group must comply with in order to keep the lease is the use of the land as specified in the business license. Any changes in use must be approved by the PRC government.

Investment

In August 2005, Coal Group entered into an agreement with Deheng Assets Management Co., Ltd. (“Deheng Assets”) to purchase two office buildings located at Building 3 in Hongqi Street in Hohhot City (Property Certificate No. 2003001090) and Building 8 in Hongqi Street in Hohhot City (Property Certificate No. 2003002197). Coal Group intends to hold this property as an investment and currently has no plans for improvements to this property. Coal Group plans to lease the units for commercial use.

The two buildings are currently vacant with the exception of 3 floors which were previously occupied by 1 tenant. The space is rented on a month to month basis. Coal Group may consider renovation plans in the next fiscal year.

LaiYeGou Mine

Location & Access

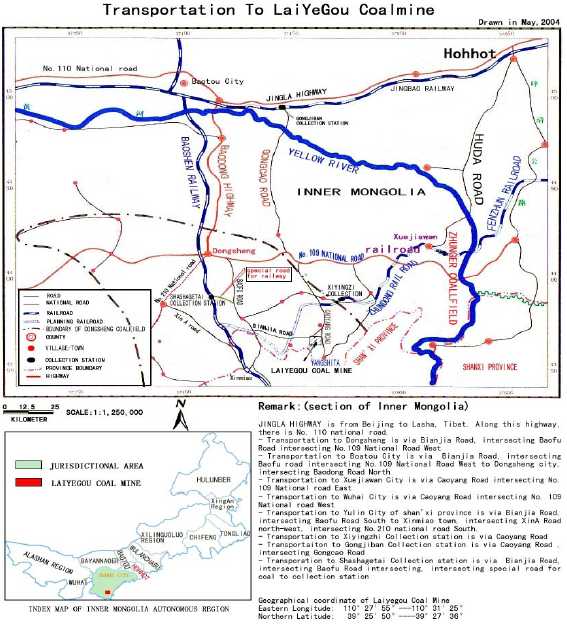

The location of the LaiYeGou mine is south-east of Bianjia Road and is approximately 230 hectares as shown on the below map:

. The location is central as it intersects with national highways making access to the mine central to regional areas through No. 210 National Highway. The distance from LaiYeGou to each location is as follows:

| · | Yulin City, Shang’xi Province - 215 km |

There are other transportation routes. BaoShen Railway crosses Dongsheng where Dongsheng Coalfield and Shenfu Coalfield are located. These mines are 35 km away from a railway collection station and therefore a convenient location where Coal Group is able to purchase raw materials and transport it to customers.

Access to the property is monitored strictly by mine managers. Prior to entering the premises, mine managers assess condition and safety reports from the previous day and determine location and safety parameters for employees. Condition and safety reports are prepared on a daily basis and serves as a basis for permitting entry to the mine and locations where employees are assigned to work.

Ownership & Previous Operations

The LaiYeGou mine was acquired in June 1999. The land in which the mine is located is leased for a period of 50 years from the PRC government. As mentioned previously, land in China cannot be owned and the only form of ownership is by way of lease for a period of up to 50 years. A regulation we must comply with in order to keep the lease is the use of the land as specified in the business license. Any changes in use must be approved by the PRC government.

Since acquisition of LaiYeGou, Coal Group’s activities have been coal exploration for the purpose of supplying raw materials mostly to heating and power industries and retail customers.

In order to maintain our business license, we are required to pass random periodic safety inspections which check for gas and water seepage, ventilation, communication methods between in and outside of mine, any breach of environmental laws and certifications of employees who work in the mine. Mine managers and staff must be trained and have mine management qualification certificates obtained through the Coal Safety Production Bureau. To date, we have not breached any of the rules and regulations rendering our mine unsafe. Mine managers on site perform daily safety inspections.

Current Conditions

The LaiYeGou coal mine is an underground operation with a capacity of 800,000 metric tons per year. Since acquisition, we have made enhancements such as reconstruction of wider laneways for access to the mine and from mine to coal field, construction of 7 work stations and emergency exits, and improvements to the draught system.

Equipment Used