UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

Amendment No. 2

to

SCHEDULE 14C

(RULE 14c-101)

SCHEDULE 14C INFORMATION

Information Statement Pursuant to Section 14(c) of the Securities Exchange Act of 1934

Check the appropriate box:

| ¨ | Preliminary information statement. |

| ¨ | Confidential, for use of the Commission only (as permitted by Rule 14c-5(d)(2)) d |

| x | Definitive information statement. |

CHINA ENERGY CORPORATION

(Name of Registrant as Specified in its Charter)

Payment of filing fee (check the appropriate box):

| ¨ | Fee computed on table below per Exchange Act Rules 14c-5((g) and 0-1 I. |

Title of each class of securities to which transaction applies:

Aggregate number of securities to which transaction applies:

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it is determined):

Proposed maximum aggregate value of transaction:

Total fee paid:

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the form or schedule and the date of' its filing. |

Amount previously paid:

Form, schedule or registration statement no.:

Filing party:

Date filed:

CHINA ENERGY CORPORATION

No. 57 Xinhua East Street

Hohhot, Inner Mongolia, P.R. China

Telephone Number: 86-471-466-8870

INFORMATION STATEMENT

WE ARE NOT ASKING YOU FOR A PROXY AND

YOU ARE REQUESTED NOT TO SEND US A PROXY.

The board of directors of China Energy Corporation, a Nevada corporation (the “Company,” “we” and/or “our”), is furnishing this Information Statement to all holders of record of the issued and outstanding shares of the Company’s common stock, par value $0.001 per share, as of the close of business on May 3, 2013 (the “Approval Record Date”), in connection with a transaction that will result in the termination of the registration of our common stock under the federal securities laws. This will eliminate the significant expense required to comply with the reporting and related requirements under these laws. Often referred to as a “going-private transaction,” the transaction is a reverse split of our common stock whereby each Twelve Million (12,000,000)shares of our common stock will be converted to one share of our common stock. The reverse stock split will be accomplished pursuant to an amendment to our Articles of Incorporation (the “Amendment”), a copy of which is attached hereto as Appendix A and is incorporated herein by this reference. Holders of less than one whole share after completion of the reverse stock split will receive cash in lieu of fractional interests in an amount equal to $0.14 for each pre-split share that becomes a fractional interest. As a result, stockholders owning fewer than 12,000,000 shares of our common stock prior to the reverse stock split at the close of business on the effective date of the reverse stock split will no longer be stockholders of the Company. Stockholders owning 12,000,000 or more shares of our common stock on a pre-split basis on the effective date of the reverse stock split will not be entitled to receive cash in lieu of whole or fractional shares of our common stock resulting from the reverse stock split. Our only stockholder owning 12,000,000 or more shares of our common stock on a pre-split basis at the effective time of the reverse stock split is Fortune Place Holdings Limited (“Fortune Place”), a corporation organized under the laws of the British Virgin Islands. Accordingly, as a result of the reverse stock split, Fortune Place will become our sole stockholder. Wenxiang Ding, our President, Chief Executive Officer and Director, is the beneficial owner of 100% of the equity interests of Fortune Place. The $0.14 per share price to be paid for fractional shares represents the fair value for a share of our common stock as determined by a special committee (the “Special Committee”) of our board of directors. The board of directors established the Special Committee, consisting of the sole independent member of our board of directors, to evaluate and review the going-private transaction. The Special Committee based its determination of fair value upon, among other things, the valuation report of Loveman-Curtiss, Inc., our financial advisor.

We are not asking you for a proxy and you are requested not to send us a proxy. Wenxiang Ding, our President, Chief Executive Officer and Director, Yi Ding, Hangzhou Dayuan Group Co. Ltd., Zhiyong Guo, Zhimin Li, and Xinghe County Haifu Coal, who collectively beneficially own approximately 63.9% of the votes entitled to be cast at a meeting of the Company’s stockholders (together, the “Approving Group”), previously consented in writing to the proposed reverse stock split and going-private transaction described in this Information Statement. The elimination of the need for a special meeting of the stockholders to approve the reverse stock split is authorized by Section 78.320 of the Nevada Revised Statutes. That Section provides that the written consent of the holders of outstanding shares of voting capital stock, having not less than the minimum number of votes which would be necessary to authorize or take action at a meeting at which all shares entitled to vote on the matter were present and voted, may be substituted for the special meeting.

The Company is engaging in the reverse stock split in order to reduce its number of stockholders of record to fewer than 300 and subsequently terminate the registration of its common stock under the Securities Exchange Act of 1934, as amended (the “Exchange Act”), after which the Company will no longer be subject to the public reporting obligations under federal securities laws, thereby “going private.” The Company and Mr. Ding are filing a Rule 13e-3 Transaction Statement on Schedule 13E-3 with the Securities and Exchange Commission simultaneously with the filing of this Information Statement since this reverse stock split is considered a “going private” transaction, as defined in Rule 13e-3 under the Exchange Act. As soon as practicable after the filing of the Amendment, the Company will terminate (i) its periodic reporting obligations under Sections 13 and 15 (d) of the Exchange Act; (ii) the registration of its common stock under Section 12(g) of the Exchange Act; and (iii) the quotation of its common stock on the OTC Bulletin Board.

We are pleased to take advantage of the Securities and Exchange Commission rule that allows companies to furnish proxy materials to their stockholders over the Internet. As a result, we are mailing to most of our stockholders a two-page Notice of Availability of Information Statement instead of a printed copy of this Information Statement. The Notice of Availability of Information Statement you have received provides instructions on how to access and review this Information Statement and also instructs you on how to request a printed copy of this Information Statement. We believe this process of sending a two-page notice reduces the environmental impact of printing and distributing hard copy materials and lowers the costs of such printing and distribution. The Company will pay the expenses of furnishing this Information Statement, including the cost of preparing and assembling this Information Statement and mailing the Notice of Availability of Information Statement. The Company anticipates that the Notice of Availability of Information Statement will be sent or given on or about May 10, 2013 to the record holders of common stock as of the close of business on the Approval Record Date, and that the amendment will be filed with the Nevada Secretary of State and become effective no earlier than the 20th day after this Information Statement is sent or given to those holders of common stock.

Under Nevada law, stockholders are entitled to dissenters’ rights of appraisal in connection with this type of going-private transaction. The accompanying Information Statement contains details on the transactions described in this letter, including important information concerning the reverse stock split and the de-registration of our common stock, as well as the dissenters’ rights of appraisal. We urge you to read it very carefully.

neither the securities and exchange commission nor any state securities commission has approved or disapproved the transaction described herein, passed upon the merits or fairness of the proposed transaction or passed upon the adequacy or accuracy of the disclosure in this document. any representation to the contrary is unlawful and a criminal offense. no person is authorized to give any information or to make any representation not contained in this document or related schedule 13E-3, and if given or made, such information or representation should not be relied upon as having been authorized by us.

TABLE OF CONTENTS

| SUMMARY TERM SHEET | | | 1 | |

| CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS | | | 4 | |

| SPECIAL FACTORS | | | 5 | |

| Background of the Transaction | | | 5 | |

| Purpose and Reasons for the Reverse Stock Split | | | 7 | |

| Fairness of the Reverse Stock Split | | | 8 | |

| Alternatives to the Reverse Stock Split | | | 10 | |

| Effects of the Reverse Stock Split | | | 10 | |

| Reports, Opinions or Appraisals | | | 12 | |

| Board of Directors and Stockholder Approval | | | 14 | |

| Dissenters’ Rights | | | 14 | |

| Access Rights | | | 15 | |

| Source and Amount of Funds | | | 16 | |

| BACKGROUND | | | 17 | |

| The Filing Persons | | | 17 | |

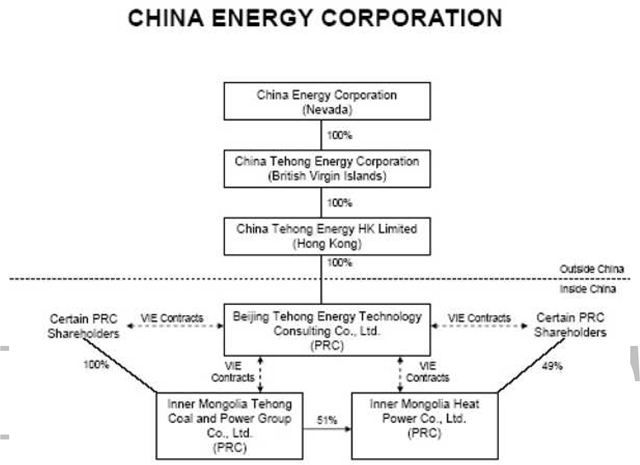

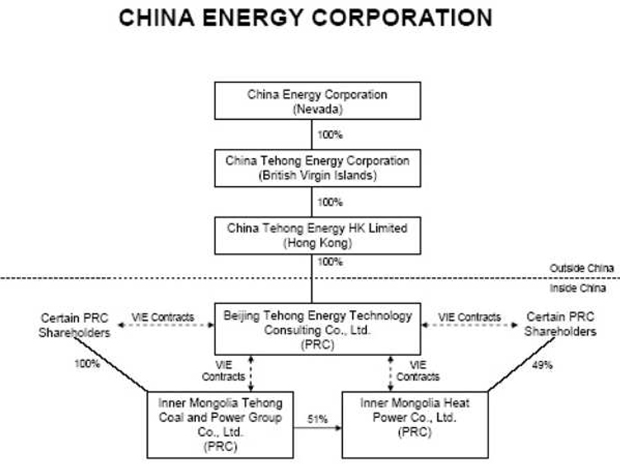

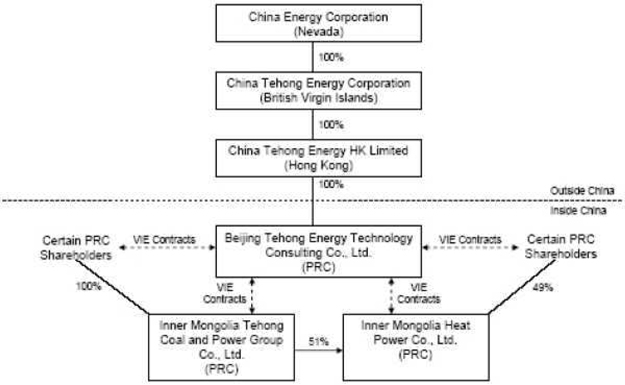

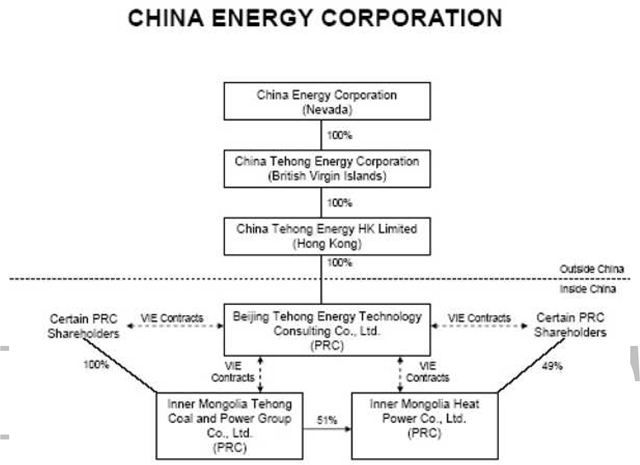

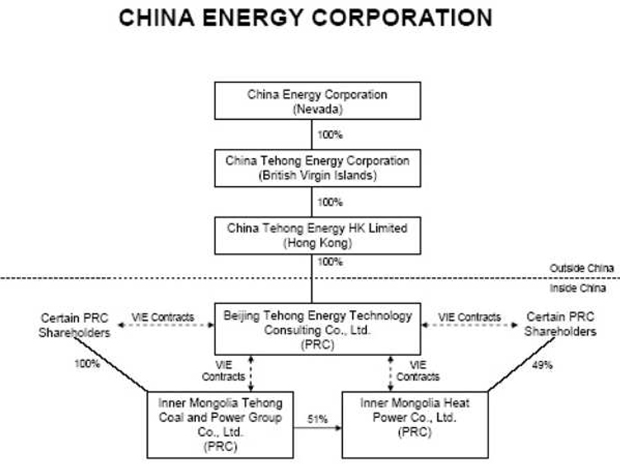

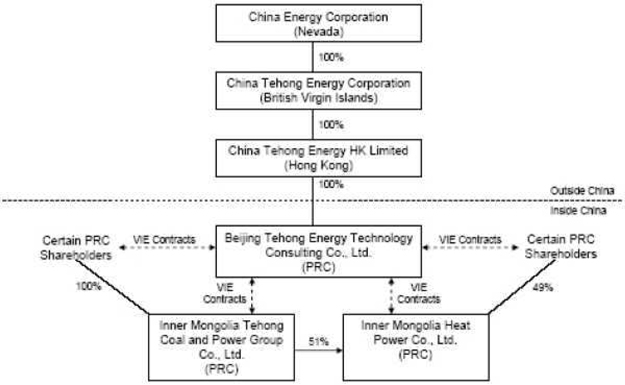

| Structure of the Transaction | | | 17 | |

| The Company’s Securities | | | 18 | |

| Security Ownership of Certain Beneficial Owners and Management | | | 18 | |

| Related Party Transactions | | | 18 | |

| Management | | | 19 | |

| Certain Legal Matters | | | 19 | |

| Reservation of Right to Abandon the Reverse Stock Split | | | 19 | |

| FEDERAL INCOME TAX CONSEQUENCES OF THE REVERSE STOCK SPLIT | | | 19 | |

| Tax Consequences to the Company | | | 19 | |

| Tax Consequences to Stockholders Who Do Not Receive Cash for Fractional Shares | | | 19 | |

| Tax Consequences to Stockholders Whose Entire Interest in Our Common Stock, Both Directly and Indirectly, is Terminated | | | 19 | |

| Tax Consequences to Stockholders Whose Entire Interest in Our Common Stock, Directly but Not Indirectly, is Terminated | | | 20 | |

| FINANCIAL INFORMATION | | | 21 | |

| Historical Financial Information and Management’s Discussion and Analysis of Financial Condition and Results of Operations | | | 21 | |

| Pro Forma Consolidated Financial Statements (Unaudited) | | | 21 | |

| Pro Forma Condensed Consolidated Nine Months Statement of Operations (Unaudited) | | | 22 | |

| Pro Forma Condensed Consolidated Year-End Statement of Operations (Unaudited) | | | 22 | |

| Ratio of Earnings to Fixed Charges | | | 22 | |

| Book Value Per Share | | | 22 | |

| Income Per Share for Continuing Operations | | | 22 | |

| Changes and Disagreements with Accountants on Accounting and Financial Disclosure | | | 22 | |

| INCORPORATION OF CERTAIN DOCUMENTS BY REFERENCE | | | 23 | |

| WHERE YOU CAN FIND ADDITIONAL INFORMATION | | | 23 | |

| APPENDIX A - Form of Certificate of Amendment to the Articles of Incorporation of China Energy Corporation | | | | |

| APPENDIX B - Text of Statutory Provisions Governing Rights of Dissenting Stockholders | | | | |

| APPENDIX C - Form of Demand for Payment of Fair Value | | | | |

| APPENDIX D - Form of Transmittal Letter from Stockholders | | | | |

| APPENDIX E - Annual Savings Chart | | | | |

| APPENDIX F - Draft Valuation Report dated October 23, 2012, prepared by Loveman-Curtiss, Inc. | | | | |

| APPENDIX G - Final Valuation Report dated November 28, 2012, prepared by Loveman-Curtiss, Inc. | | | | |

| APPENDIX H - Fairness Opinion Letter dated November 28, 2012, prepared by Loveman-Curtiss, Inc. | | | | |

| APPENDIX I – Internet Availability Notice | | | | |

| APPENDIX J – Company’s Annual Report on Form 10-K for the year ended November 30, 2012 | | | | |

SUMMARY TERM SHEET

This summary term sheet highlights selected information from this Information Statement. This summary term sheet, however, may not contain all of the information that is important to you. For a more complete description of the reverse stock split, you should carefully read the entire Information Statement and all of its appendixes. For your convenience, we have directed your attention to the location in this Information Statement where you can find a more complete discussion of each item listed below.

As used in this Information Statement, the “Company,” “we,” “our” and “us” refer to China Energy Corporation.

The reverse stock split is considered a “going private” transaction as defined in Rule 13e-3 promulgated under the Exchange Act because it is intended to, and, if completed, will enable us to terminate the registration of our common stock under Section 15(d) of the Exchange Act and terminate our duty to file periodic reports with the Securities and Exchange Commission (“SEC”). In connection with the reverse stock split, we have filed with the SEC a Rule 13e-3 Transaction Statement on Schedule 13E-3.

| · | Reverse Stock Split: We will effect a share combination or “reverse stock split” of our common stock whereby each 12,000,000 outstanding shares of our common stock will be converted into one whole share, and in lieu of our issuing fractional shares to stockholders owning less than one whole share of common stock after effectiveness of the share combination, we will pay cash equal to $0.14 multiplied by the number of pre-split shares held by a stockholder who owns fewer than 12,000,000 shares immediately prior to the split. Stockholders with fewer than 12,000,000 shares immediately prior to the reverse stock split will have no further equity interest in the Company and will become entitled only to a cash payment equal to $0.14 times the number of pre-split shares. See “Background - Structure of the Transaction” starting on page 17. |

| · | Approval of Stockholders: Consummation of the reverse stock split requires the affirmative vote or written consent of the holders of a majority of the issued and outstanding shares of the Company’s common stock as of the Approval Record Date. The members of the Approving Group, who hold approximately 63.9%, of the issued and outstanding shares of the Company, approved the reverse stock split by written consent. See “Special Factors – Board of Directors and Stockholder Approval” starting on page 14. |

| · | Timing: The Company intends to effect the reverse stock split as soon as practicable after all filing requirements have been satisfied. The Company proposes to consummate the reverse stock split no earlier than the 20th day after the date on which we first mail the Notice of Internet Availability of Information Statement to our stockholders. The effective date of the reverse stock split will be the date the Company files a Certificate of Amendment to its Articles of Incorporation with the Nevada Secretary of State (the “Effective Date”). |

| · | Purpose of Transaction: The primary purpose of the reverse stock split is to reduce the number of our stockholders of record to less than 300, thereby allowing us to “go private.” We would do so by promptly filing a Certificate of Termination of Registration (SEC Form 15) with the Securities and Exchange Commission under Section 15(d) of the Exchange Act as soon as possible after consummation of the reverse stock split so that we would no longer be required to file annual, quarterly or current reports. See “Special Factors - Purpose and Reasons for the Reverse Stock Split” starting on page 7, and “Background - Structure of the Transaction” starting on page 17. |

| · | Reasons for Transaction: Based on our relatively small size and limited financial resources, the Company does not believe that the costs and burdens of maintaining its status as a public company is justified given the high cost (in terms of both human capital and actual cash outlays) of remaining a public company, in the absence of interest from institutional investors and securities research analysts, and our inability to access the capital markets. Also, as a privately held company, the Company’s management may have greater flexibility to focus on improving the Company’s financial performance without the constraints caused by the public equity market’s valuation of the Company and emphasis on period-to-period performance. As a publicly traded company, the Company faces pressure from public shareholders and investment analysts to make decisions that might produce better short-term results, but over the long term lead to a reduction in the value of the Company’s equity. Furthermore, as an SEC-reporting company, the Company is required to disclose a considerable amount of business information to the public, some of which would be considered proprietary and would not be disclosed by a non-reporting company. As a result, our actual or potential competitors, customers, lenders and vendors all have ready access to this information which potentially may help them compete against us, make it more difficult for us to negotiate favorable terms with them, or facilitate legal claims against us as the case may be. |

| · | Approval of Special Committee: Our board of directors appointed the Special Committee, composed of our sole independent director, to evaluate, review and approve, if appropriate, various strategic alternatives to take the Company private. The Special Committee also retained the firm of Loveman-Curtiss, Inc., an independent business appraisal firm, to render a valuation report to the Special Committee, as to the fairness, from a financial point of view, of the price to be paid for fractional shares in a going private transaction involving a reverse stock split. After careful consideration, the Special Committee has determined that the reverse stock split is procedurally and substantively fair to and in the best interest of all of our unaffiliated stockholders. See “Special Factors – Fairness of the Reverse Stock Split” starting on page 8 and “Special Factors - Reports, Opinions or Appraisals” starting on page 12. |

| · | Fairness Determination by Board of Directors: The board of directors of the Company reasonably believes that the reverse stock split is substantively and procedurally fair to the stockholders of the Company. In making this determination, the board of directors considered many factors, including the valuation report of Loveman-Curtiss, Inc. that the price being offered for fractional shares is fair. See “Special Factors - Fairness of the Reverse Stock Split” starting on page 8. |

| · | Fairness Determination of Mr. Ding: Mr. Ding has adopted the findings of our Special Committee and board of directors regarding the reverse stock split. Mr. Ding reasonably believes that the reverse stock split is substantively and procedurally fair to the stockholders of the Company. See “Special Factors - Fairness of the Reverse Stock Split” starting on page 8. |

| · | Dissenters’ Rights: Upon effectiveness of the reverse stock split, any stockholder who believes that the $0.14 per share price is unfairly low will have the right to object and have a court in Nevada determine the value of such stockholder’s shares, and to be paid the appraised value determined by the court, which could be more than the $0.14 per share. A dissenters’ rights notice will be mailed to stockholders promptly after the Effective Date of the reverse stock split. See “Special Factors - Dissenters’ Rights” starting on page 14. |

| · | Effect of Transaction: Following consummation of the reverse stock split, there will only be one remaining stockholder. We do not anticipate any changes in our board or management following the reverse stock split. The Company has no present intention of changing the Company’s business operations as a result of the reverse stock split or to engage in any extraordinary transactions, such as a merger or sale of assets. See “Special Factors - Effects of the Reverse Stock Split” starting on page 10. |

| · | Source and Amount of Funds: The total amount of funds necessary to make the cash payments to stockholders in connection with the reverse stock split is estimated to be approximately $2,530,000. The Company expects that all of the funds necessary to carry out the reverse stock split will come from our currently available cash. See “Special Factors - Effects of the Reverse Stock Split” starting on page 10. |

| · | Certificates: Stockholders should not send stock certificates to the Company at this time. After the reverse stock split is effected, stockholders will be notified about forwarding certificates and receiving payment, and, if applicable, replacement certificates. |

| · | Tax Consequences: A stockholder who receives no cash payment as a result of the reverse stock split will not recognize any gain or loss for United States federal income tax purposes. A stockholder who receives a cash payment for a fractional share of our common stock as a result of the reverse stock split will recognize capital gain or loss for United States federal income tax purposes equal to the difference between the cash received for the common stock and the aggregate adjusted tax basis in such stock. See “Federal Income Tax Consequences of the Reverse Stock Split” starting on page 19. |

| · | Stockholder Rights: The reverse stock split has been approved through the written consent delivered by the holders of a majority of the voting shares of the Company. No further stockholder action is required to approve the reverse stock split. Stockholders will have dissenters’ rights, or so-called appraisal rights, under Nevada law. See “Special Factors – Board of Directors and Stockholder Approval” starting on page 14 and “Special Factors - Dissenters’ Rights” starting on page 14. |

| · | Reservation of Right to Terminate or Change the Terms of the Reverse Stock Split: The Company retains the right to terminate or modify the terms of the reverse stock split if it determines that the reverse stock split is not in the best interest of the Company and its stockholders. If we determine to cancel the reverse stock split, we may pursue other strategies which will result in our going private, including a change in the ratio of our reverse stock split. |

| · | Payment and Exchange of Shares: As soon as practicable after the Effective Date, we will cause to be sent to each stockholder owning fewer than 12,000,000 pre-reverse stock split shares an instruction letter describing the procedure for surrendering stock certificates in exchange for the cash payment. Upon receipt of properly completed documentation and stock certificates (if applicable), each such stockholder will be entitled to receive the cash payment. See “Special Factors - Effects of the Reverse Stock Split” starting on page 10. |

| · | Continuing Stockholder: The single stockholder owning more than 12,000,000 shares of our common stock on the Effective Date will continue to be a stockholder after the reverse stock split becomes effective. Such stockholder will not receive any cash payment for its whole or fractional shares. See “Special Factors - Effects of the Reverse Stock Split” starting on page 10. |

| · | Stockholders with Shares Held in Street Name: If your shares are held in a stock brokerage account or by a bank or other nominee, you are considered the beneficial owner of shares held in “street name” with respect to those shares, and this Information Statement is being forwarded to you by your broker or other nominee. Your broker or other nominee is considered, with respect to those shares, the stockholder of record. Although the reverse stock split is designed to reduce the number of stockholders of record, we will treat stockholders holding common stock in street name in substantially the same manner as stockholders whose shares are registered in their names for purposes of the reverse stock split. However, banks, brokers or other nominees may have different procedures, and stockholders holding common stock in street name should contact their bank, broker or nominee regarding the treatment of their shares. |

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

This document contains certain statements of a non-historical nature constituting “forward-looking statements”. Such forward-looking statements may be identified by the use of terminology such as “may”, “will”, “expect”, “anticipate”, “estimate”, “should”, “or “continue” or the negative thereof or other variations thereof or comparable terminology. Those statements may include statements regarding the intent , belief or current expectations of the Company or its officers with respect to: (i) the Company’s plans and ability to complete the reverse stock split and subsequent deregistration of its common stock, (ii) the expenses associated with the reverse stock split and the subsequent deregistration, (iii) the number of stockholders following the reverse stock split, and (iv) the Company’s financial condition, operating results and capital resources following the reverse stock split. Such forward-looking statements are subject to certain risks and uncertainties that could cause actual results to differ materially from those results currently anticipated or projected. Although the Company believes that the assumptions on which the forward-looking statements contained herein are reasonable, any of the assumptions could prove to be inaccurate given the inherent uncertainties as to the occurrence or nonoccurrence of future events. There can be no assurance that the forward-looking statements contained in this document will prove to be accurate. We undertake no obligation to release publicly the result of any revisions to these forward-looking statements, except as required by law. The “safe harbor” provisions of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, however, do not apply to going-private transactions.

SPECIAL FACTORS

Background of the Transaction

In recent years, we have derived minimal benefits from being a reporting company. Our common stock has failed to attract institutional investors or market research attention which could have created a more active and liquid market for our common stock. Relatively low trading volume and low market capitalization have reduced the liquidity benefits to our stockholders.

Our board of directors does not presently intend to raise capital through sales of securities in a public offering or to acquire other business entities using stock as consideration. Accordingly, we are not likely to make use of the advantages (for raising capital, effecting acquisitions or other purposes) that our status as a reporting company may offer. For a more detailed discussion of the ways in which we have not enjoyed the benefits typically afforded by public company status, please see “Special Factors - Reasons for the Transaction” below.

We incur direct and indirect costs associated with compliance with the Exchange Act’s filing and reporting requirements imposed on public companies, including those imposed upon public companies by the provisions of the Sarbanes-Oxley Act of 2002 (“Sarbanes-Oxley”). The direct and indirect cost of complying with the Exchange Act’s reporting and control requirements is unduly burdensome and costly considering our size. We also incur substantial indirect costs as a result of, among other things, the executive time expended to prepare and review our public filings. As we have relatively few executive personnel, these indirect costs can be substantial.

In light of these considerations, beginning in the summer of 2012, members of our board of directors began discussing among themselves the relative advantages and disadvantages of being a publicly-reporting company. When those advantages were considered in light of the administrative burden, cost and competitive disadvantages associated with filing public reports with the SEC and otherwise complying with the requirements imposed under the Exchange Act, our board of directors began investigating the various alternative methods by which we could deregister.

On September 21, 2012, our board of directors held a telephonic board meeting at which time it appointed Ms. Shiwen Zhou (“Ms. Zhou”) to serve as a non-employee independent director on the board of directors to fill the vacancy created by the resignation of Tieming Ge on July 16, 2012.

On September 24, 2012, our board of directors held a telephonic board meeting, at which time the matter of “going private” and SEC-deregistration was formally introduced. At the request of our President, the Company’s U.S. legal counsel, with the advice and assistance of the Company’s People’s Republic of China (“PRC”) legal counsel, provided the board of directors with a summary of the process relating to deregistration of our common stock and the various alternatives methods, including a reverse stock split, to achieve such deregistration. Our U.S. legal counsel summarized the amount of time and expenses generally associated with the going private process and several examples of previous going-private transactions. The board of directors then discussed the advisability of forming a Special Committee for the purpose of evaluating the advisability and feasibility of going private and considering the fairness of any such transaction on the Company’s non-affiliated stockholders. After discussion, the board of directors approved a resolution directing the board to establish a Special Committee, the sole member of which would be Ms. Zhou, the Company’s sole independent director, to (i) consider the advisability and feasibility of going private, (ii) explore the alternative methods to going private and (iii) engage in discussions with professional advisors relating to its responsibilities, including an appraisal firm or investment bank with regards to delivering a fairness opinion relative to any cash consideration to be paid to stockholders in connection with such a transaction.

On September 29, 2012, the Special Committee met with representatives of the Company’s U.S. legal counsel and PRC legal counsel to discuss the objectives and responsibilities of the Special Committee. The Special Committee discussed the advantages and disadvantages of going private, the various alternative methods of going private, and the factors relevant in determining the fairness of a going private transaction on (i) the stockholders being cashed out and (ii) the stockholders who would remain after the transaction. The Special Committee and representatives of the Company’s U.S. legal counsel and PRC legal counsel also discussed the advisability of involving professional advisors in the transaction, including an independent appraisal firm or investment bank to provide a fairness opinion in connection with any such transaction. The Special Committee decided that it would be appropriate to retain the services of an outside firm to provide a fairness opinion in connection with any such transaction.

On October 3, 2012, the Special Committee held a meeting to review a fairness opinion proposal from Loveman-Curtiss, Inc. (“Loveman-Curtiss”), an independent valuation firm. At the meeting, Rand M. Curtiss, President of Loveman-Curtiss, described the firm’s professional expertise and prior experience providing fairness opinions in connection with going private and similar transactions. Mr. Curtiss also provided a summary of the process and timeline generally followed by Loveman-Curtiss in preparing a fairness opinion. The Special Committee, after consultation with the Company’s U.S. legal counsel and PRC legal counsel, concluded that it was in the best interests of the Company and its stockholders to retain Loveman-Curtiss to provide a fairness opinion regarding the consideration paid to stockholders being cashed out in connection with any going-private transaction that might ultimately be approved.

Prior to the meeting of the Special Committee on October 3, 2012, Ms. Zhou, acting as the Special Committee and with the assistance of the Company’s U.S. and PRC legal counsel, considered various alternatives “going private” methods, including those that had initially been presented to the board of directors at its meeting on September 24, 2012. The Special Committee also reviewed certain internal financial information with respect to the costs being incurred by the Company arising from its SEC-reporting status. At the meeting held on October 3, 2012, the Special Committee, based upon its discussion with legal counsel and an analysis of the financial information and various alternative “going private” methods presented to it, determined that it was in the best interests of the Company and its stockholders to go private through a reverse stock split which would reduce the number of stockholders of the Company to less than 300 and thereby terminate the Company’s SEC-reporting and filing requirements. Ms. Zhou identified those matters considered in connection with her determination, including the significant cost savings to be realized by the Company and the absence of meaningful benefits to the Company in being an SEC-reporting company. Ms. Zhou also summarized the Special Committee’s analysis of the alternative going-private methods considered by the Special Committee, and the reasons that the Special Committee recommended using the reverse stock split. At the conclusion of the meeting, the Special Committee instructed Loveman-Curtiss to provide an opinion as to the fairness, from a financial perspective, of the consideration to be paid to the unaffiliated stockholders whose shares would be purchased in a reverse stock split.

On November 2, 2012, the Special Committee met with Rand M. Curtiss, President of Loveman-Curtiss, and representatives of the Company’s U.S. legal counsel and PRC legal counsel to discuss, among other things, the draft valuation report of Loveman-Curtiss, dated October 23, 2012 (“Draft Valuation Report”) which had previously been provided to the Special Committee on November 1, 2012. The Draft Valuation Report is attached as Appendix F. Mr. Curtiss described the various factors and approaches used by his firm as set forth in the Draft Valuation Report. After discussing the relative importance of these factors and the major elements of each approach, Mr. Curtiss advised the Special Committee that it was his opinion that the fairest and most accurate valuation would be derived from utilizing a combination of the Income and Market approaches as set forth in the Draft Valuation Report. Since both approaches resulted in the same valuation of $0.17 per share, the Draft Valuation Report concluded that $0.17 was the fair value of each share. Mr. Curtiss noted, however, that this was only a preliminary conclusion and that the firm would consider any additional relevant information prior to providing its final valuation report. The Special Committee asked Mr. Curtiss several questions regarding his firm’s analysis, and the assumptions and calculations contained in the Draft Valuation Report. At the conclusion of Mr. Curtiss’ presentation, the Special Committee stated that it would further consider the Draft Valuation Report and the additional information provided by Mr. Curtiss at the meeting, and requested that Loveman-Curtiss review the Company’s internally-generated fiscal 2012 third quarter financial information (which had not been previously made available to Loveman-Curtiss) prior to the preparation of its final valuation report. Mr. Curtiss stated that he would review this additional financial information and any other publicly available information about the Company prior to providing the final valuation report.

On December 5, 2012, the Special Committee again met with Mr. Curtiss, as well as with representatives of the Company’s U.S. legal counsel and PRC legal counsel, at which time the Special Committee reviewed the final valuation report from Loveman-Curtiss dated November 28, 2012 (the “Final Valuation Report”), which had been previously provided to the Special Committee. A copy of the Final Valuation report is attached as Appendix G. Mr. Curtiss noted that the Final Valuation Report, similar to the Draft Valuation Report, references several different types of valuation approaches, including the Market and Income valuation approaches. While the valuation based on the Income approach used in the Final Valuation Report was substantially higher than the per share fair value resulting from the Market approach, Mr. Curtiss noted that this difference was virtually eliminated by the discount applied by Loveman-Curtiss to the Income approach valuation as a result of assumptions by Loveman-Curtiss made regarding the likely duration of currency controls by the Chinese government which would significantly impact the ability of the Company’s shareholders to realize value from their investment in the Company’s shares. The Special Committee, after considering the Final Valuation Report and the report of Mr. Curtiss at the meeting, agreed to accept $0.12 as the fair value of the Company’s shares for purposes of considering the going private transaction.

The Special Committee then considered whether it would be appropriate for the Company to pay a premium over fair value for shares redeemed by the Company in connection with the reverse stock split. After discussions with the Company’s U.S. legal counsel and PRC legal counsel, the Special Committee decided that it would be fair and reasonable to add a premium of $0.02 per share. Upon considering the various factors and conclusions set forth in the Final Valuation Report and based upon in its previous deliberations and discussions, the Special Committee determined that it was fair and in the best interests of the Company and its unaffiliated stockholders to go private through a reverse stock split and to cash out all post-split fractional shares based on a pre-split share value of $0.14.

The Special Committee then instructed the Company’s PRC legal counsel to discuss the proposed reverse stock split and going private transaction with the Company’s controlling stockholder, Mr. Ding, our CEO and President, who beneficially owns approximately 60% of the Company’s common shares and whose approval would be required in order to consummate any reverse stock split. Mr. Ding indicated that he would support the transaction recommended by the Special Committee and would consent to the filing of the necessary amendments to the Company’s Articles of Incorporation permitting the reverse stock split, provided that after such reverse stock split, he would be the sole remaining stockholder of the Company. The Company’s PRC legal counsel agreed to advise the Special Committee of Mr. Ding’s position.

After receiving the report of the Company’s PRC legal counsel’s discussion with Mr. Ding, the Special Committee considered the merits of engaging in a going private transaction whereby Mr. Ding, would be the sole remaining stockholder. The Special Committee considered the fact that a reverse stock split consummated in that manner would provide all of the Company’s stockholders (other than for Mr. Ding) with an efficient method to cash out their investment in the Company since there is a limited trading market in the Company’s shares. The Special Committee also took note of the fact a reverse stock split structured in that manner would permit all stockholders (other than for Mr. Ding) to receive the cash fair value of their shares rather than obligating them to remain as minority stockholders in a privately-held company. The Special Committee also took note that the Company would pay all of the transaction costs in connection with the reverse stock split and cash-out of post-split fractional shares saving stockholders the brokerage expenses that they would otherwise incur in cashing out of their investment.

Based upon these considerations, the Special Committee, at a meeting held on December 5, 2012, approved the filing of an amendment to the Company’s Articles of Incorporation to combine and reclassify the number of shares of Common Stock of the Company to give effect to a 12,000,000:1 reverse stock split which would then permit the Company to deregister its shares with the SEC and cause Mr. Ding to be the sole remaining beneficial stockholder. The Special Committee instructed the Company’s U.S. legal counsel to prepare and file as necessary all required documentation and stockholder disclosure documents with the SEC and to take such further legal action as necessary to consummate the reverse stock split. The Special Committee requested that Loveman-Curtiss deliver a fairness opinion based upon its Final Valuation Report to be attached to such SEC filings and stockholder communications as may be required.

On December 11, 2012, the Special Committee met with the entire board of directors and representatives of the Company’s U.S. legal counsel and PRC legal counsel. At this meeting, Ms. Zhou, on behalf of the Special Committee, advised the board of directors that she had determined that it was in the best interest of the Company and its stockholders to go private, and the preferred method to accomplish this was through a 12,000,000:1 reverse stock split that would reduce the number of stockholders to one and thereby enable the Company to terminate its SEC-reporting and filing requirements.

On December 28, 2012, Mr. Ding held a conference call with five (5) other stockholders of the Company: (i) Yi Ding, Mr. Ding’s son; (ii) Zhimin Li, Mr. Ding’s brother-in-law; (iii) Zhiyoung Guo, a close personal friend of Mr. Ding; (vi) Weijun Li, a former business partner of Mr. Ding (representing Hangzhou Dayuan Group Co. Ltd.); and (v) Liguo Zhang, a former business partner of Mr. Ding (representing Xinghe County Haifu Coal). During this conference call, Mr. Ding advised these individuals of his discussions with the representative of the Special Committee whereupon each stockholder also independently decided to execute a written stockholder consent dated December 28, 2012 in support of the transaction.

Purpose and Reasons for the Reverse Stock Split

The purpose of the reverse stock split is to reduce the number of record holders of our common stock to fewer than 300 so that we will be eligible to terminate the public registration of our common stock under the Exchange Act. Provided that the reverse stock split has the intended effect, we will file to deregister our common stock, the effect of which will be to terminate the eligibility of our common stock for quotation on the Over-The-Counter Bulletin Board (“OTCBB”). The Company anticipates that the registration of its common stock will terminate approximately 90 days after the Effective Date.

The Company has derived only minimal benefits from being an SEC-reporting company. Our common stock has failed to attract institutional investors or market research attention, and we do not expect these conditions to improve in the foreseeable future. This lack of investor and analyst interest has resulted in a very low trading volume for our shares which, in turn, has limited the liquidity benefit to our stockholders. Additionally, we are not currently contemplating a capital raise or other significant transaction through issuance of equity. Our management does not believe that we can prudently pay the expenses of complying with these legal requirements in light of the fact that we have realized so few of the benefits normally presumed to result from being a publicly traded company (such as the development or existence of an active trading market for our common stock, an enhanced corporate image, and the ability to use our common stock to attract, retain and grant incentives to employees.)

The legal requirements and compliance responsibilities of public companies, including those imposed by the Sarbanes-Oxley Act of 2002, create large administrative and financial burdens for any public company. If we cease to be subject to the reporting requirements under the Exchange Act, we estimate that our savings will be approximately $750,000 per year, including savings in legal, accounting and printing fees, and director and officer liability insurance premiums attributable to complying with such reporting requirements. A chart forecasting the cost-savings that would result from a termination of our SEC registration (the “Annual Savings Chart”) is attached as Appendix E. We would also expect reductions in other administrative costs associated with being a public company, including investor relations expenses. By eliminating the time and resources devoted to complying with SEC financial reporting requirements and managing stockholder relations, our management and employees will be able to devote more time and effort to improving our operations.

In light of these factors, the Company’s board of directors and Mr. Ding reasonably believe that the Company should go private through the reverse stock split. The Company and Mr. Ding believe that, by going private, the Company will reduce its expenses since the Company will no longer incur the costs required to comply with the SEC’s reporting requirements. Moreover, the reverse stock split will assure the Company of a permanent reduction in the number of its record shareholders to below 300, and provide all stockholders (except for Mr. Ding) with an efficient method of cashing out their investment because (i) there is a very limited trading market in the Company’s shares and by providing all stockholders (other than Mr. Ding) with the opportunity to receive the cash fair value of their shares, none of our unaffiliated stockholders would be required to remain as minority stockholders in a privately-held company and (ii) the Company would pay all of the transaction costs in connection with the reverse stock split and cash-out of post-split fractional shares, thus saving stockholders the brokerage expenses that they would otherwise incur in cashing out of their investment.

Fairness of the Reverse Stock Split

In the course of reaching its decision to approve the reverse stock split, the Special Committee considered various factors that would affect both the sole stockholder who would retains its shares of our common stock and those unaffiliated stockholders who would be cashed-out.

The Special Committee considered the following factors in determining that the transaction is fair to our unaffiliated stockholders:

| • | the opinion of Loveman-Curtiss that, as of November 28, 2012, the date of its fairness opinion, the consideration to be paid to cashed-out stockholders in the reverse stock split is fair, from a financial point of view, to such stockholders; |

| • | that, as of the date of the fairness opinion of Loveman-Curtiss, the 50-day average trading price of the Company’s stock was $0.115 per share, 18% lower than the $0.14 being paid to the cashed-out stockholders in the reverse stock split; |

| • | the opinion of Loveman-Curtiss that the value of the Company’s shares using the Income approach (which consists of a discounted equity cash flow value and non-operating asset value) should be significantly discounted due to the effects of the Chinese government’s foreign currency controls limiting the ability of the Company to pay dividends and of foreign investors to otherwise receive that value; |

| · | the opinion of Loveman-Curtiss that the Company’s liquidation value should not be considered by the Special Committee since the Company is a going concern, and minority stockholders cannot force a liquidation; |

| • | the net book value of the Company was not considered by the Special Committee since Loveman-Curtiss did not consider it an appropriate valuation approach. |

| • | the going concern value of the Company was not considered by the Special Committee because, based on the Company’s recent uneven earnings results and uncertain future business prospects, it was not considered a reliable indication of value. |

| • | that a premium of $0.02 per pre-split share, 16.7% of the fair value as determined by Loveman-Curtiss, would be added to the final per share price to be paid to the cashed-out stockholders; |

| • | the ability of stockholders to receive cash for their shares irrespective of the limited trading market for shares and without being burdened by disproportionately high service fees or brokerage commissions; and |

| • | the fact that neither the Company nor Mr. Ding has purchased any shares of our common stock in the past two years. |

The most weight was given to the recent historical trading performance of our shares on the OTCBB and the fairness opinion of Loveman-Curtiss. Approximate equal weighting was given to the other factors.

The Special Committee considered the following factors in determining that the transaction is fair to our sole stockholder who would continue to hold our shares after the reverse stock split:

| • | the anticipated reduction in Company expenses required to comply with the reporting and internal controls requirements of U.S. securities laws and the associated commitment of management time and attention; |

| • | the anticipated difficulty of recruiting and retaining officers and directors necessary for our continued growth and profitability due to onerous regulatory requirements and potential individual personal exposure, exacerbated by the Special Committee’s belief that the higher cost of meaningful insurance coverage to mitigate this exposure was not justified in view of the Company’s other financial obligations; |

| • | the disproportionate current and expected future increased cost of regulatory compliance and other necessary public company expenses relative to the Company’s current size, and its expected negative impact on our competitiveness and potential long-term success; and |

| · | the diminishing likelihood that the Company would (i) raise capital in the U.S. through sales of securities in a public offering or (ii) acquire other business entities using stock as consideration. |

The Special Committee also considered the following potential adverse factors in connection with the transaction:

| • | following the reverse stock split, all minority stockholders will cease to hold any equity interest in the Company and will lose their ability to participate in our future growth, if any, or benefit from increases, if any, in the value of our common stock; |

| • | under Nevada law, consummation of the reverse stock split would not require the approval of any of the Company’s unaffiliated stockholders since the Company’s controlling stockholder holds a sufficient number of shares to approve the transaction on his own; |

| • | the board of directors did not select an independent representative to act solely on behalf of the unaffiliated stockholders. This, coupled with the lack of a vote by the unaffiliated stockholders, gave unaffiliated stockholders no say in negotiating the terms of the reverse stock split; and |

| • | the cash payment for fractional shares is a taxable transaction for stockholders. |

After taking into account all of the above-referenced factors, the Special Committee determined that the reverse stock split was fair to our unaffiliated stockholders. The Special Committee noted that no firm offers were made by any non-affiliate during the past two years related to (i) a merger or consolidation of the Company, (ii) the purchase of all or a substantial portion of the Company’s assets, or (iii) the purchase of securities in the Company such that the party would exercise control over the Company.

The Company’s board of directors, on behalf of the Company, and Mr. Ding have adopted the analysis and conclusions of the Special Committee in reaching their mutual decision to approve the reverse stock split and both the Company and Mr. Ding believe that the reverse stock split is substantively and procedurally fair to the security holders of the Company, including the Company’s unaffiliated stockholders. No director of the Company dissented to or abstained from voting on the reverse stock split or the going private transaction described herein.

The reverse stock split is being effected without the procedural safeguards set forth in Item 1014(c) and (d) of SEC Regulation M-A, which include approval of the reverse stock split by the unaffiliated stockholders of the Company and the majority of directors who are not employees of the Company retaining an unaffiliated representative to act solely on behalf of the unaffiliated stockholders. Since the reverse stock split has the approval of the Approving Group, which holds approximately 63.9% of the votes entitled to be cast at a stockholders’ meeting, the board of directors decided not to seek the approval of the Company’s unaffiliated stockholders or retain an unaffiliated representative to act on behalf of the unaffiliated stockholders because such actions would not effect the approval of the Approving Group and such actions would merely lead to additional expenses and delay the consummation of the reverse stock split and resulting termination of the Company’s SEC reporting status. However, in an effort to ensure procedural fairness to the unaffiliated stockholders, the board of directors appointed Ms. Zhou, the sole independent director on the Company’s board of directors, to constitute the Special Committee with the responsibility to review and evaluate the going-private transaction and determine a fair price to be paid to the stockholders to be cashed out should the Company complete a going-private transaction. Ms. Zhou is an “independent” director under NASDAQ listing standards and has no stock ownership in the Company. The board of directors placed no restrictions on the authority of the Special Committee to consider and approve or disapprove a going-private transaction.

The fairness opinion of Loveman-Curtiss is attached hereto as Appendix H and is incorporated herein by reference. We will also send a copy of the opinion by regular, first-class mail or e-mail to any interested stockholder or representative of such stockholder who has been so designated in writing upon written request and at our expense.

Alternatives to the Reverse Stock Split

The Special Committee considered several alternatives to the reverse stock split. The Special Committee considered carrying out the going-private transaction through an issuer tender offer. This alternative was rejected on the grounds that it could not provide adequate assurance of achieving the desired objective, i.e., termination of the Company’s SEC-reporting status. The Special Committee also considered carrying out a long-form merger with, or asset sale to, a third party, but determined that it would not be practical to pursue this course since it would require the approval of Mr. Ding, the majority stockholder of the Company, who indicated that he was not willing to enter into any such transaction. The Special Committee concluded that the reverse stock split was the most viable vehicle for terminating the Company’s SEC-reporting status and that there were no presently available alternative means that would provide the Company adequate assurance of permanently reducing the number of record holders of the Company below the necessary threshold of 300 so that the Company could terminate its SEC-reporting status.

Effects of the Reverse Stock Split

Effects on the Company. After consummation of the reverse stock split, we will terminate the registration of our common stock under the Exchange Act. We expect our underlying business and operations to continue, for the most part, in the manner in which they are presently conducted. The executive officers and directors of the Company will not change due to the reverse stock split. Neither the Company nor Mr. Ding has any current plans or proposals to do any of the following: effect any extraordinary corporate transaction (such as a merger, reorganization, liquidation, or sale or transfer of a material amount of assets); sell or transfer any material amount of the Company’s assets; change the composition of the Board or management of the Company or the number or terms of directors or to fill any existing vacancies on the board of directors; change materially the Company’s indebtedness or capitalization; or otherwise effect any material change in the Company’s corporate present dividend policy, structure or business.

Effects on our Stockholders. Based on information currently available to us, we estimate that the reverse stock split will reduce the total number of record stockholders of our common stock from approximately 317 to one. The permanent reduction in the number of our record stockholders below 300 will enable us to terminate the registration of our common stock under the Exchange Act and will substantially reduce the information required to be furnished by us to the public, including our stockholders.

We intend to apply for termination of registration of our common stock under the Exchange Act as soon as practicable following completion of the reverse stock split. However, the board of directors reserves the right, in its discretion, to abandon the reverse stock split or to change the ratio of our reverse stock split prior to the proposed Effective Date if it determines that abandoning or modifying the terms of the reverse stock split is in our best interests and the best interests of our stockholders. The board of directors believes that it is prudent to recognize that circumstances might change prior to the Effective Date such that it would not be appropriate or desirable to effect the reverse stock split at that time or on the terms currently proposed. Among other things, the board of directors may abandon or modify the terms of the reverse stock split if any of the following occur:

| · | a change in the nature of our shareholdings that (a) would prevent us from reducing the number of record holders below 300 as a result of the reverse stock split, or (b) would provide sufficient assurance that the number of our record holders would remain below 300 for the foreseeable future without effecting the reverse stock split; or |

| | �� | |

| · | any material adverse change in our financial condition or litigation that would render the reverse stock split inadvisable. |

In any such event, the board of directors will consider whether to abandon or modify the terms of the reverse stock split. We will disclose and announce any abandonment or modification of the reverse stock split by issuing a press release, filing a Current Report on Form 8-K with the Securities and Exchange Commission, posting a notice of such abandonment on our website at www.chinaenergycorp.cn/en/ and by mailing a notice of such abandonment or modification to the stockholders to whom we distributed this Information Statement.

When the reverse stock split is consummated, stockholders owning fewer than 12,000,000 shares of common stock will no longer have any equity interest in the Company and will not participate in our future earnings or any increases in the value of our assets or operations. Thus, only our executive officers, directors and the continuing stockholder will benefit from any future increase in our earnings.

Stockholders owning fewer than 12,000,000 shares of common stock immediately prior to the reverse stock split will, following the reverse stock split, have their pre-reverse stock split shares cancelled and converted into the right to receive cash payment. As soon as practicable after the Effective Date of the reverse stock split, we will send these stockholders a letter of transmittal with instructions as to how such stockholders will be paid the cash payment. A copy of the Transmittal Letter is attached as Appendix D. The letter of transmittal will include instructions on how to surrender stock certificates to our stock transfer agent. The stockholder owning 12,000,000 or more shares of common stock immediately prior to the reverse stock split will not receive any cash payment for its whole or fractional shares of common stock resulting from the reverse stock split.

If your shares are held in a stock brokerage account or by a bank or other nominee, you are considered the beneficial owner of shares held in “street name” with respect to those shares, and this Information Statement is being forwarded to you by your broker or other nominee. Your broker or other nominee is considered, with respect to those shares, the stockholder of record. Although the transaction is designed to reduce the number of stockholders of record, we will treat stockholders holding common stock in street name in substantially the same manner as stockholders whose shares are registered in their names for purposes of the reverse stock split. However, banks, brokers or other nominees may have different procedures, and stockholders holding common stock in street name should contact their bank, broker or nominee regarding the treatment of their shares.

Potential Disadvantages of the Transaction to Stockholders. While we believe that the reverse stock split will result in the benefits described above, several disadvantages should also be noted:

| • | after the reverse stock split, our common stock will not be eligible for trading on the OTCBB, and our remaining stockholder will experience reduced liquidity for its shares of common stock; |

| • | we will no longer engage independent accountants to audit the Company (although we may engage them to conduct a review of our financial statements); |

| • | there will be a reduction in our working capital and assets in order to fund the purchase of fractional shares and to pay for the transaction costs of the reverse stock split; |

| • | the stockholders owning fewer than 12,000,000 shares of common stock on the Effective Date will, after giving effect to the reverse stock split, no longer have any equity interest in the Company and, therefore, will not participate in our future earnings or growth, if any; |

| • | the going private transaction will require stockholders who own fewer than 12,000,000 shares of common stock on the Effective Date to involuntarily surrender their shares in exchange for cash, rather than choosing their own time and price for disposing of their common stock; |

| • | as a result of the termination of our reporting obligations under the Exchange Act, we will not have the ability to raise capital in the U.S. public capital markets; and |

| • | we may have less flexibility in attracting and retaining executives and employees since equity-based incentives (such as stock options) tend not to be as attractive in a privately-held company. |

Effects on Affiliated and Unaffiliated Security Holders. The following chart sets forth the effects on affiliates as well as unaffiliated security holders, including the effect the reverse stock split will have upon each affiliate’s interest in the net book value and net earnings of the Company in both dollar amounts and percentages:

| | | | Before Reverse

Stock Split | | | After Reverse Stock

Split | | | Change | |

| Wenxiang Ding (through his 100% ownership of Fortune Place Holdings Limited) | | | | | | | | | | | | | | |

| | | Number of Shares | | | 26,989,107 | | | | 2.249 | | | | 26,989,104.751 | |

| | | % Ownership | | | 59.9 | % | | | 100 | % | | | 40.1 | % |

| | | Earnings($)1 | | $ | 8,690,999 | | | $ | 14,509,180 | | | $ | 5,818,181 | |

| | | Net Book Value($)2 | | $ | 59,029,587 | | | $ | 98,546,889 | | | | 39,517,302 | |

| All Unaffiliated Stockholders3 | | | | | | | | | | | | | | |

| | | Number of Shares | | | 18,070,893 | | | | 0 | | | | 18,070,893 | |

| | | % Ownership | | | 40.1 | % | | | 0 | | | | 40.1 | % |

| | | Earnings($) | | $ | 5,818,181 | | | | 0 | | | $ | 5,818,181 | |

| | | Net Book Value($) | | | 39,517,302 | | | | 0 | | | | 39,517,302 | |

1The Company’s total earnings can be found in the Company’s Form 10-K for the year ending November 30, 2012.

2The Company’s total net book value can be found in the Company’s Form 10-K for the year ending November 30, 2012.

3Includes all of the Company’s stockholders except Mr. Wenxiang Ding who beneficially owns his shares of the Company through Fortune Place Holdings Limited, a British Virgin Island company.

Financial Effect of the Transaction. Completion of the reverse stock split will require us to spend approximately $2,850,000, which includes legal, printing and other fees and costs related to the reverse stock split, including the fees paid to Loveman-Curtiss for its valuation services. This estimate includes the cost of the aggregate cash payment to stockholders holding fewer than 12,000,000 shares of common stock prior to the reverse stock split, which we estimate will be approximately $2,530,000. As a result, we may have decreased working capital following the reverse stock split and this could have a material adverse effect on our liquidity, results of operations and cash flow. These costs will be partially offset by the costs we would otherwise incur to comply with SEC reporting requirements, which we estimate to be approximately $750,000 per year. It is anticipated that the affiliated security holder who will be the sole stockholder upon completion of the reverse stock split will be the beneficiary of these savings on a recurring basis.

The estimated transaction expenses are as follows:

| | • | | | Legal expenses | | $ | 250,000 | | |

| | • | | | Accounting expenses | | $ | 15,000 | | |

| | • | | | Postage and printing expenses | | $ | 35,000 | | |

| | • | | | Appraisal Firm fees | | $ | 9,500 | | |

| | • | | | Miscellaneous expenses | | $ | 10,500 | | |

Reports, Opinions or Appraisals

Valuation Report of Loveman-Curtiss.In connection with the proposed transaction, the Special Committee engaged Loveman-Curtiss to provide a valuation report as to the fair value of each pre-split share and to render an opinion as to the fairness of the consideration, from a financial point of view, to be received by stockholders whose shares we would acquire in the reverse stock split. Loveman-Curtiss was selected by the Special Committee based on its expertise and prior experience in the valuation of the shares of publicly-held companies engaged in going-private transactions, including Chinese-based companies.

On December 5, 2012, the Special Committee reviewed the Final Valuation Report of Loveman-Curtiss that, as of November 28, 2012, the fair market value of each pre-split share was $0.12. The Final Valuation Report, and accompanying fairness opinion, are attached hereto as Appendices G and H, respectively, and are incorporated herein by reference. Loveman-Curtiss has consented to the Company’s use of the fairness opinion in the Company’s filings with the Securities and Exchange Commission and to the Company making the fairness opinion available for use by its stockholders in conjunction with the going-private transaction.

The preparation of a valuation report is a complex process and is not necessarily susceptible to partial analysis or summary description. Nevertheless, the following is a brief summary of Loveman-Curtiss’s Final Valuation Report addressed to the Special Committee on December 5, 2012 that, subject to the assumptions, qualifications and limitations set forth in that report, the cash consideration of $0.12 per pre-split share to be paid by us to our stockholders who will receive cash in the proposed going-private transaction is fair from a financial point of view. Our stockholders are urged to, and should, read the Final Valuation Report carefully in its entirety for a complete statement of the considerations and procedures followed, factors considered, findings, assumptions and qualifications made, the bases for and methods of arriving at such findings, limitations on the review undertaken in connection with the valuation report, and judgments made or conclusions undertaken by Loveman-Curtiss in reaching its valuation. The Final Valuation Report was furnished for the use and benefit of the Special Committee in connection with its consideration of the proposed going-private transaction. Loveman-Curtiss believes, and so advised the Special Committee, that its analysis must be considered as a whole and that selecting portions of its analysis and the factors considered by it, without considering all factors and analysis, could create an incomplete view of the process underlying the Final Valuation Report.

Loveman-Curtiss’s Final Valuation Report addresses only the fairness, from a financial point of view, of the cash consideration to be paid in the going-private transaction to our stockholders. Loveman-Curtiss was not requested to opine as to, and its report does not address:

| • | the underlying business decision of the Special Committee or the board of directors or any other party to proceed with or effect the proposed going-private transaction; |

| • | the fairness of any portion or aspect of the proposed going-private transaction not expressly addressed in its valuation report; |

| • | the fairness of any portion of the proposed going-private transaction to the holders of any class of our securities, our creditors or to our other constituencies or any other party, other than those set forth in its valuation report; |

| • | the relative merits of the proposed going-private transaction as compared to any alternative business strategies that might exist or the effect of any other transaction in which we might engage; |

| • | the tax or legal consequences of the proposed going-private transaction to us, our security holders, or any other party; and |

| • | the fairness of any portion or aspect of the proposed going-private transaction to any class or group of our security holders compared to any other class or group of our other security holders. |

Furthermore, no opinion, counsel or interpretation was intended with respect to matters that require legal, regulatory, accounting, insurance, tax or other similar professional advice. In connection with its report, Loveman-Curtiss made such reviews, analyses and inquiries as it deemed necessary and appropriate under the circumstances. Among other things, Loveman-Curtiss:

| • | reviewed and analyzed certain publicly available financial and other data of ours; |

| • | reviewed and analyzed the Company’s internally-generated financial information for the nine months ended August 31, 2012; |

| • | reviewed the historical prices and trading activity for our common stock and analyzed its implied valuation multiples; |

| • | reviewed certain publicly available financial data for going private transactions; |

| • | reviewed the asset values of the Company as reflected in its public reports; and |

| • | performed such other analyses and considered such other factors as they deemed appropriate. |

In rendering its opinion, Loveman-Curtiss relied upon and assumed, without independent verification, the accuracy and completeness of the financial statements and other information provided by us or otherwise made available to it and has not assumed responsibility independently to verify such information. Loveman-Curtiss further relied upon the assurances made by us that the information provided has been prepared on a reasonable basis in accordance with industry practice, and that we are not aware of any information or facts that would make the information provided to Loveman-Curtiss incomplete or misleading. Loveman-Curtiss expressed no opinion regarding our forecasts of future business activities or the assumptions on which they were based.

Loveman-Curtiss’s Final Valuation Report was necessarily based upon the information available to it and facts and circumstances as they existed as of the date of the report and is subject to evaluation as of such date; events occurring after the date of the Final Valuation Report could materially affect the assumptions used by Loveman-Curtiss in preparing its fairness opinion.

Loveman-Curtiss expressed no opinion with respect to the prices at which shares of our common stock have traded or may trade following announcement or consummation of the reverse stock split or at any future time. Loveman-Curtiss also did not consider any benefits that may inure to any of our stockholders as a result of the reverse stock split or any related transaction other than in such party’s capacity as a stockholder who receives cash in the reverse stock split. Loveman-Curtiss did not recommend to the Special Committee any specific transaction consideration or advise the Special Committee that any specific amount of consideration constituted the only appropriate amount of consideration for the reverse stock split. The Special Committee, on behalf of the Company, determined the amount of consideration to be paid to cashed-out stockholders in the reverse stock split.

The following is a summary of the material analyses and other information that Loveman-Curtiss prepared or relied on in delivering its valuation report to the Special Committee.

Market Approach to Valuation. Loveman-Curtiss reviewed and analyzed recent and historical trading in our common stock, noting that in the 52 weeks ending November 28, 2012 (the date of their report), the OTCBB-reported closing price of the Company’s shares trended downwards from $0.49/sh. to $0.09/sh., and had closed at $0.12/sh. on the date of its report. Loveman-Curtiss noted that the 50-day average historical trading date average closing price was $0.115 and that the average daily trading volume during that period was 10,905 shares, approximately 0.0002% of the Company’s total issued and outstanding shares. Loveman-Curtiss did not consider the market valuations of comparable companies because it did not believe that any of the candidates were sufficiently comparable to the Company in terms of size, business or markets or there was not sufficient publicly available information on which to base a valuation. Based on its analysis of this market information, Loveman-Curtiss concluded that the fair value of each pre-split share under the Market approach is $0.12.

Income Approach to Valuation.Loveman-Curtiss analyzed the expected discounted equity cash flow from the Company in order to value the Company’s shares under the Income approach. Loveman-Curtiss first calculated the equity cash flow from the business and then applied certain risk factors to the Company’s projections of future equity cash flow. Based on its analyses of these factors, Loveman-Curtiss determined that it would be appropriate to use a discount rate of 25%. Loveman-Curtiss then took into consideration the Company’s non-operating assets and after adding their value to the discounted equity cash flow value per share, Loveman-Curtiss arrived at an initial fair value. This valuation approach assumes that the equity cash flow can ultimately be distributed. Loveman-Curtiss concluded that due to the foreign currency controls imposed by the Chinese government restricting foreign investors’ ability to receive the return of their investment from China and the Company’s stated intent not to pay dividends, Loveman-Curtiss applied a 97% discount on the initial fair value resulting from use of the Income approach.

Asset Approach. Loveman-Curtiss analyzed the liquidation value of the Company in connection with valuing the Company’s shares under the Asset Approach. The Asset Approach values a business by viewing it as a set of assets and liabilities and then assumes the liquidation of those assets. Using this approach, Loveman-Curtiss calculated the fair value of a share of our common stock to be $2.29. However, since the Company is a going concern and the Company’s stockholders could not force the liquidation of the Company without the approval of the Company’s controlling shareholder, Loveman-Curtiss did not consider the valuation obtained using this approach as relevant and gave it no consideration in arriving at its opinion of fair value.

Relative Weighting of the Market and Income Approaches to Valuation. Loveman-Curtiss advised the Special Committee that it was its opinion that the Income approach would significantly overstate the fair value of a share of the Company’s common stock if it did not take into account of the effect of Chinese currency controls restricting foreign investors from receiving the indicated value under the Income approach. By applying a Quantitative Marketability Discount Model, Loveman-Curtiss concluded in its Final Valuation Report that the value indicated by the Income approach should be discounted by approximately 97%, resulting in the same pre-split share value ($0.12) indicated by the Market approach. Loveman-Curtiss therefore concluded the fair value of the Company’s stock was $0.12 per share as of November 28, 2012.

Other. Loveman-Curtiss, as a customary part of its valuation and appraisal business, is engaged in the valuation of businesses and their securities in connection with mergers and acquisitions, underwritings and secondary distributions of securities, private placements and valuations for estate, corporate and other purposes. Loveman-Curtiss has not previously provided us with any services or products and we do not contemplate seeking any such services or products from them in the future.

We have agreed to pay Loveman-Curtiss a fee of $9,500 (plus reimbursement for its out-of-pocket expenses) in connection with the services provided by it under an engagement agreement.That payment became due to Loveman-Curtiss upon delivery of its fairness opinion to the Special Committee. No portion of Loveman-Curtiss’s fee is contingent upon consummation of the reverse stock split or the conclusion reached by Loveman-Curtiss in its fairness opinion.

Board of Directors and Stockholder Approval