Registration No. 333-128608

|

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

|

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933

| China Energy Corporation |

| (Name of small business issuer in its charter) |

| |

| Nevada | 1400 | |

| (State or jurisdiction of incorporation | (Primary Standard Industrial Classification Code | (I.R.S. Employer Identification |

| or organization) | Number) | Number) |

6130 Elton Avenue, Las Vegas, Nevada 89107 Tel: 1-702- 216-0472

(Address and telephone number of principal executive offices)

No.57, Xinhua East Street, Hohhot City, Inner Mongolia

(Address of principal place of business or intended principal place of business)

Magnum Equities Group Inc.

#610-1112 West Pender Street, Vancouver, BC V6E2S1 Canada Tel: 1-604-697-8899 Fax: 1-604-697-8898

(Name, address and telephone number of agent for service)

K. Turner, Resident Agent

#200-245 East Liberty Street, Reno, Nevada 89501 Tel: 1-775-786-1788 Fax: 1-775-786-6755

Approximate date of proposed sale to the public:As soon as practicable after this Registration Statement becomes effective.

If this Form is filed to register additional securities for an offering pursuant to rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. [ ]

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. [ ]

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. [ ]

If delivery of the prospectus is expected to be made pursuant to Rule 434, check the following box. [ ]

- 1 -

| | CALCULATION OF REGISTRATION FEE | |

Title of each class of

securities to be

registered | Number of Shares to be

registered | Proposed maximum

offering price per

unit | Proposed maximum

aggregate offering price | Amount of

registration fee |

|

|

|

|

| Common Stock | 32,495,217 | $0.19 | $6,174,091.23 | $726.69 |

| (1) | The offering price has been estimated solely for the purpose of computing the amount of the registration fee in accordance with Rule 457(c). Our common stock is not traded on any national exchange and in accordance with Rule 457, the offering price was determined by the deemed price shares were issued to our shareholders in a Regulation S offering. The price of $0.19 is a fixed price at which the selling security holders may sell their shares until our common stock is quoted on the OTC Bulletin Board at which time the shares may be sold at prevailing market prices or privately negotiated prices. |

| |

The information in this preliminary prospectus (“Prospectus”) is not complete and may be changed. We may not sell these securities nor may offers to buy be accepted prior to the time the registration statement filed with the Securities and Exchange Commission becomes effective. This Prospectus is not an offer to sell nor does it seek an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

THE REGISTRANT HEREBY AMENDS THIS REGISTRATION STATEMENT ON THE DATE OR DATES AS MAY BE NECESSARY TO DELAY ITS EFFECTIVE DATE UNTIL THE REGISTRANT SHALL FILE A FURTHER AMENDMENT WHICH SPECIFICALLY STATES THAT THIS REGISTRATION STATEMENT SHALL THEREAFTER BECOME EFFECTIVE IN ACCORDANCE WITH SECTION 8(A) OF THE SECURITIES ACT OR UNTIL THE REGISTRATION STATEMENT SHALL BECOME EFFECTIVE ON THE DATE AS THE COMMISSION, ACTING PURSUANT TO SAID SECTION 8(A), MAY DETERMINE.

Subject to Completion, Dated ______________, 2006

|

All of the shares being offered, when sold, will be sold by the Selling Shareholders as listed in this prospectus. The selling shareholders are offering:

32,495,217shares of common stock

|

The shares were acquired by the selling shareholders directly from us in a private offering that was exempt from registration under the United States securities laws. We will bear all expenses related to the offering.

Our common stock is presently not traded on any market or securities exchange. It is our intention to have a market maker apply for trading for our common stock on the Over the Counter Bulletin Board following the effectiveness of this registration statement. The 32,495,217 shares of our common stock will be sold by selling security holders at a fixed price of $ 0.19 share until our shares are quoted on the OTC Bulletin Board and thereafter at prevailing market prices or privately negotiated prices. Please note that these shares may be illiquid. Selling security holders will receive proceeds upon sale of our shares.

The Selling Shareholders may sell the shares as detailed in the section entitled “Plan of Distribution”.

- 2 -

The purchase of the securities offered through this prospectus involves a high degree of risk. SEE SECTION TITLED "RISK FACTORS" ON PAGE 11.

**************

NEITHER THE SEC NOR ANY STATE SECURITIES COMMISSION HAS APPROVED OR DISAPPROVED OF THESE SECURITIES OR DETERMINED WHETHER THIS PROSPECTUS IS TRUTHFUL OR COMPLETE. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

**************

Dealer Prospectus Delivery Obligation

Until _____________, all dealers that effect transactions in these securities, whether or not participating in this offering, may be required to deliver a prospectus. This is in addition to the dealers' obligation to deliver a prospectus when acting as underwriters and with respect to their unsold allotments or subscriptions.

- 3 -

| TABLE OF CONTENTS | |

| | Page |

| Prospectus Summary | 5 |

| Risk Factors | 11 |

| Use of Proceeds | 17 |

| Determination of Offering Price | 17 |

| Dilution | 17 |

| Selling Security Holders | 18 |

| Plan of Distribution | 20 |

| Legal Proceedings | 23 |

| Directors, Executive Officers, Promoters and Control Persons | 23 |

| Security Ownership of Certain Beneficial Owners and Management | 25 |

| Description of Securities | 28 |

| Interests of Named Experts and Counsel | 29 |

| Disclosure of Commission Position of Indemnification for Securities Act Liabilities | 29 |

| Description of Business | 37 |

| Management’s Discussion and Analysis and Plan of Operation | 67 |

| Description of Property | 82 |

| Certain Relationships and Related Transactions | 86 |

| Market for Common Equity and Related Stockholder Matters | 87 |

| Executive Compensation | 88 |

| Financial Statements | 90 |

| Changes In and Disagreements with Accountants on Accounting and Financial Disclosure | 119 |

| Indemnification of Directors and Officers | 119 |

| Other Expenses of Issuance and Distribution | 120 |

| Recent Sales of Unregistered Securities | 120 |

| Exhibits | 121 |

| Undertakings | 124 |

| Signatures | 126 |

- 4 -

We, China Energy Corporation (“CEC”), produce coal through our subsidiary Inner Mongolia Tehong Coal Group Co, Ltd. (“Coal Group”) and supply heating requirements throughout the XueJiaWan district through our subsidiary Inner Mongolia Zhunger Heat Power Co., Ltd. (“Heat Power”). We acquired our subsidiaries on November 30, 2004.

Inner Mongolia Tehong Coal Group Co., Ltd. (“Coal Group”)

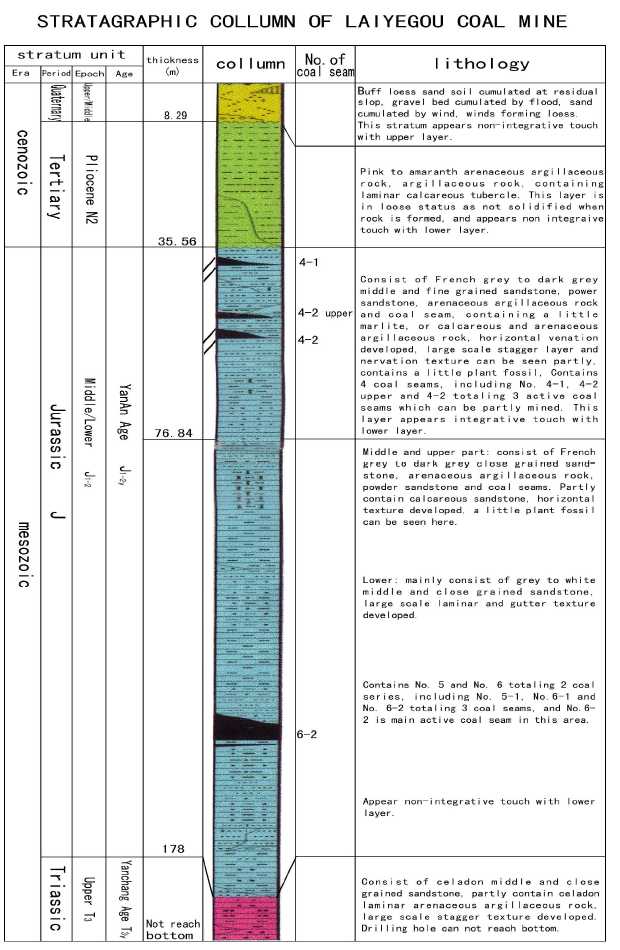

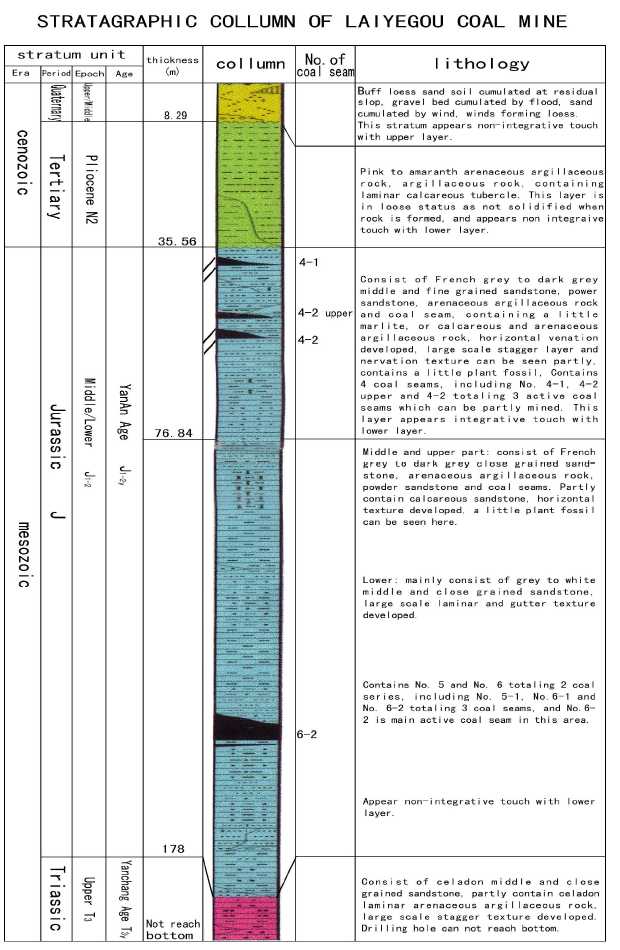

Coal Group produces coal from the LaiYeGou coal mine located in Erdos City, Inner Mongolia, People’s Republic of China. Its trade consists of production and processing of raw coal for domestic heating, electrical generation and coking purposes for subsequent steel production. The principal sources of revenue are generated from local heating power industry.

Coal Group produces approximately 500,000 tons of coal per year based on current levels of input and has the capacity of producing approximately up to 1,200,000 tons subject to enhancement of productions lines in the next 2 years. Coal Group is in the planning stages for increasing capacity to 600,000 tons of coal per year.

The raw coal produced is non caking coal and has a high ash melting point with high thermal value used almost exclusively as fuel for steam-electric power generation. It has low sulphur and low chemical emission which satisfies government environmental protection standards with heating capability of 6,800 -7,000 Kilocalories (“Kcal”).

The following consists of tonnage of coal produced and purchased from external sources in the past 3 years:

| Year | Produced | External Sources |

| 2003 | 235,322 | 20,936 |

| 2004 | 506,913 | 34,295 |

| 2005 | 612,739 * | 100,358 |

* 2005 production exceeded capacity of 500,000 tons produced per year as mentioned above as a result of increasing the levels of input and production capacity from 56 hour to 70 hour average work week.

- 5 -

Inner Mongolia Zhunger Heat Power Co., Ltd. (“Heat Power”)

Heat Power currently supplies heating requirements throughout 120 hectares of the XueJiaWan district in XueJiaWan Town, Zhunger County with its newly constructed thermoelectric plant (“XueJiaWan Expansion”) and 2 heating plants previously used exclusively for heating supply operations. These plants are operated by Heat Power employees. The Autonomous Region Planning & Reform Committee appointed Heat Power in 2003 to establish a thermoelectric plant providing heating and electricity capable of expanding coverage in the area serving a larger population base.

Heat Power supplies heating to users directly and supplies electricity through a government controlled intermediary, Inner Mongolia Electric Power Group Co., Ltd. (“Electric Power Group”). We will, therefore, be operating two processes, one for heating and one for co-generation of electricity supply.

Heat Power is not a regulated utility company and therefore such regulations are only applicable to the entity providing service to the end users. Electric Power Group is subject to these applicable rules and regulations consisting of compliance to safety and environmental standards and pricing structures set by the Inner Mongolia Government.

Heat Power does not supply steam or hot water. Only heating is supplied. Water is heated in the plant using boilers, and then transmitted by pipeline to warm radiators where it is circulated to provide the desired heat. These users include private dwellings, factories as well as municipal facilities. Our customer requirements for this area of coverage are limited to heating.

Heat Power obtains its supply of powdered coal required to generate heat production from Zhunger County Guanbanwusu Coalmine (“Guanbanwusu”), an unrelated, unassociated 3rd party. It also obtains its supply through various other coal mines in the area.

Differing Legal Systems

The Chinese market in which we operate is governed under the laws of the People’s Republic of China (“PRC”), a different legal system than that of North American laws. By laws, we mean encompassing laws which govern the environment, employment and corporate activities.

The following are some of the PRC laws that differ from North American laws that have a material effect on our operations and should be known by investors:

1. Enforcement of civil action against persons in China may be difficult:

Our shareholders, officers and directors are residents of China and as a result, it may be difficult to effect service of process within the United States upon these persons. In addition, there is uncertainty as to whether the courts of China would recognize or enforce judgments of United States courts obtained against us or such persons predicated upon the civil liability provisions of the securities laws of the United States or any state thereof, or be competent to hear original actions brought in these countries against us or such persons predicated upon the securities laws of the United States or any state thereof.

- 6 -

Legal systems are readily revised, and new laws put into effect among different sectors of government and such laws may be contradictory and therefore may not be enforceable. The legal system in China is currently in its development stages.

| 2. | Interpretation of agreements and other documentation translated to English may be difficult. |

| |

Most of the agreements we enter into and documentation we provide in the attached Exhibits were originally prepared in Chinese. Although every attempt is made to translate these documents to plain English to the best of our ability, the language used may not be similar to North American standards.

We are offering 32,495,217 shares of our common stock at a price of $0.19 per share under Rule 415 of the Securities Act of 1933. The offering pertains ONLY to shares which are to be offered or sold solely by or on behalf of a person or persons other than the Company, our subsidiaries or a person of which the registrant is our subsidiaries.

Our selling shareholders (all of which hold less than 10% of outstanding shares and are not officers, directors or shareholders related to any officer or director. 59% own greater than 5% and 13% own less than 5%) own an aggregate of 72% of our outstanding shares and will exercise control over matters requiring stockholder approval and will be able to elect all of our directors. Such control, which may have the effect of delaying, deferring or preventing a change of control, is likely to continue for the foreseeable future and significantly diminishes control and influence which future stockholders may have in the Company. Our officers and directors hold 18% of the outstanding shares and one principal shareholder holds 10% of the outstanding shares, consisting of the remaining 28% ownership of the Company aside from the 72% selling shareholders of which own less than 10% of the Company.

Assuming shares held by the selling shareholders will be sold, the percentage ownership of the officers, directors and principal shareholders is not expected to change.

Our shares are currently not traded on any market or exchange and as a result may be illiquid until we are quoted on an exchange.

- 7 -

History and result of operations

|

CEC was incorporated in the state of Nevada on October 11, 2002 for the purpose of producing coal to meet the increasing demand in power and heating industries and also to expand thermoelectric plants and networks in rural developments. CEC was a shell company until it entered into the Share Exchange Agreement to acquire its subsidiaries, Coal Group and Heat Power, on November 30, 2004.

Although CEC is the legal survivor of this acquisition and is the registrant with the Securities and Exchange Commission, under accounting principles generally accepted in the United States, the transaction was accounted for as a reverse merger, whereby Coal Group is considered the “acquirer” of CEC for financial reporting purposes as its shareholders control a majority of the post transaction combined company. Among other matters, this requires CEC to present in all financial statements and other public information filings, prior historical and other information of Coal Group, and requires a retroactive restatement of Coal Group historical shareholder investment for the equivalent number of shares of common stock received in the merger. Accordingly, our financial statements present the results of operations of Coal Group for the year ended November 30, 2004 and reflect the acquisition of November 30, 2004 under the purchase method of accounting. Subsequent to November 30, 2004, the operations of the Company reflect the combined operations of CEC and Coal Group.

Since the inception of Coal Group in 2000, its trade consists of production and processing of raw coal for both domestic heating and electrical generation purposes and acting as a brokerage in facilitating coal trade buyers and sellers. Our brokerage activities during 2005 and 2006 have been limited as our focus is on direct supply of raw coal.

Through Heat Power, we operate a thermoelectric plant and 2 heating plants located in the XueJiaWan district in which we have a monopoly granted to us by the Inner Mongolia government.

For the years ended November 30, 2005 and 2004, we generated net income of$ 3,382,777 and$ 1,156,309, respectively.

Not including funds required for expansion of our facilities, we estimate our cash requirements for the next 12 months will be approximately $ 12,529,250 in order to cover our working capital needs as follows:

| | Coal Group | Heat Power | Total |

| Materials | 4,743,750 | 2,406,250 | 7,150,000 |

| Labor | 163,750 | 1,093,750 | 1,257,500 |

| Overhead | 1,092,500 | 437,500 | 1,530,000 |

| Selling expense | 1,310,000 | 205,000 | 1,515,000 |

| Administrative expense | 808,000 | 268,750 | 1,076,750 |

| Total | $ 8,118,000 | $ 4,411,250 | $ 12,529,250 |

We currently are able to sustain our working capital needs through profits we generate and shareholder loans.

- 8 -

Our principal business office is located at No.57, Xinhua East Street, Hohhot City, Inner Mongolia. Our administrative branch office for North American investor relations and U.S. regulatory reporting is located at 6130 Elton Ave., Las Vegas, Nevada 89107.

We are in the process of constructing our website and expect it to be fully operational in the next 5 months.

This prospectus covers up to 32,495,217 shares of our common stock to be sold by selling stockholders identified in this prospectus.

| Shares offered by the selling security holders: | 32,495,217 shares of common stock, $0.001 par value per share |

| Offering price: | $0.19 per share |

| Common stock outstanding as of December 22, 2006 | 45,000,000 shares |

| Common stock outstanding assuming the maximum number of shares are sold | 45,000,000 shares |

| pursuant to this offering: | |

| Number of shares owned by the selling shareholders after the offering: | 0 shares. (1) |

| Use of proceeds: | We will not receive any of the proceeds of the shares offered by the selling shareholders. |

| Dividend policy: | We currently intend to retain any future earnings to fund the development and |

| | growth of our business. Therefore, we do not currently anticipate paying cash dividends. |

| | See “Dividend Policy.” |

| OTC/BB symbol | Not available |

| (1) | This number assumes that each selling shareholder will sell all of its shares available for sale during the effectiveness of the registration statement that includes this prospectus. Selling shareholders are not required to sell their shares. See "Plan of Distribution." |

| |

- 9 -

Summary Financial Information

|

| | | November 30, |

| Balance Sheet Data:(Consolidated) | August 31, 2006 | 2005 |

| | (Unaudited) | (Audited) |

| Cash | $ 1,372,738 | $ 1,931,249 |

| Total Assets | 34,534,116 | 22,050,684 |

| Liabilities | 21,934,352 | 11,415,842 |

| Total Stockholders' Equity | 12,599,764 | 10,634,842 |

| Total Liabilities and Stockholder's Equity | $34,534,116 | $22,050,684 |

| | Nine month | Year ended, |

| | period ended | November 30, |

| Statement of Operations(Consolidated) | August 31, 2006 | 2005 |

| | (Unaudited) | (Audited) |

| Sales | 10,107,351 | $ 13,052,620 |

| Gross Profit from Operations | 5,680,188 | 7,027,621 |

| Selling and Administrative Expenses | 1,772,039 | 1,605,511 |

| Operating Income | 3,908,149 | 5,151,402 |

| Net Income | $2,197,685 | $ 3,382,777 |

| Net Income Per Share | $ 0.05 | $ 0.08 |

| Weighted Average Number of Common | | |

| Shares Outstanding | 45,000,000 | 45,000,000 |

- 10 -

***You should read the following risk factors carefully before purchasing our common stock. ***

RISKS RELATING TO OUR BUSINESS

|

Our management lacks technical training with operating a mine and as a result may cause the Company to suffer irreparable harm due management’s lack of training.

The lack of technical training of our management requires us to rely on professional engineers as an integral part of our operations. As a result of management’s lack of training, we may not take into account standard engineering or managerial approaches other mineral explorations companies commonly use. Consequently without the technical expertise of either retained staff or contracted 3rd parties, we could suffer irreparable harm in our operations, earnings and ultimate financial success.

Compliance and enforcement of environmental laws and regulations may cause us to incur significant expenditures and resources of which we may not have.

Extensive national, regional and local environmental laws and regulations in China affect our operations. These laws and regulations set various standards regulating certain aspects of health and environmental quality, which provide for user fees, penalties and other liabilities for the violation of these standards. We believe we are currently in compliance with all existing China environmental laws and regulations. However, as new environmental laws and legislation are enacted and the old laws are repealed, interpretation, application and enforcement of the laws may become inconsistent. Compliance in the future could require significant expenditures, which may adversely effect our operations. The enactment of any such laws, rules or regulations in the future may have a negative impact on our projected growth, which could in turn decrease our projected revenues or increase our cost of doing business.

The potential liability for violation of environmental standards consists of loss of our business licenses causing irreparable damage to our reputation and payment of penalties which range depending on the nature of the violation and history of previous violations made. There is currently no fixed amount set by the Government and penalties are determined on a case by case basis. In addition, the project which we undertake will be ceased until compliance with environmental standards is adhered to.

- 11 -

We are required to renew our business license every 10 years where if we are in violation of any environmental or company act laws, our business may be suspended until such violations are remedied.

If our business license is not granted renewal, our operations will be suspended causing not only loss in profits but loss of existing and potential customer base, damage to our reputation, and related costs incurred for business interruption.

Heat Power may be entitled to tax concessions in areas described as “West Region Development Plan” for a set period of time however may lose this benefit at anytime as determined by the Government.

Tax concessions are granted by the Provincial Government to encourage development in rural areas in XueJiaWan. Heat Power is currently under application for these tax concessions. Income taxes are exempt for 5 years upon initial operation and subject to a 50% lower rate until 2010. The Government may at its discretion terminate such tax concessions at any time and we may not have the resources to cover our income taxes as they become due as our budgets are based upon granting of these tax concessions.

We are dependent on a few key personnel, being our officers and directors

We are substantially dependent upon the efforts and skills of our executive officers, WenXiang Ding, YanHua Li and WuSheng Liu. The loss of the services of any of the executive officers could have a material adverse effect on our business.

Our shareholders may not be able to enforce U.S. civil liabilities claims.

Our assets are located outside the United States and are held through a wholly-owned subsidiary incorporated under the laws of Nevada. Our current operations are conducted in China. In addition, our directors and officers are residents of countries other than the United States. All or a substantial portion of the assets of these persons are located outside the United States. As a result, it may be difficult for you to effect service of process within the United States upon these persons. In addition, there is uncertainty as to whether the courts of China would recognize or enforce judgments of United States courts obtained against us or such persons predicated upon the civil liability provisions of the securities laws of the United States or any state thereof, or be competent to hear original actions brought in these countries against us or such persons predicated upon the securities laws of the United States or any state thereof.

We carry no insurance policies and are at risk of incurring personal injury claims for our subcontractors, and incurring loss of business due to theft, accidents or natural disasters.

We currently carry no policies of insurance to cover any type of risk for our contractors. It is common practice in China not to carry such insurance. Should any of such events occur, we are liable for all costs incurred to replace, repair any damage and or compensate for incidences. The costs incurred may adversely affect our operations and we may not have the necessary capital to sustain minimum working capital needs. Social insurance may mitigate such costs however may not be sufficient to cover the full cost or compensation depending on the severity of the incident.

- 12 -

We require the approval from the Inner Mongolia Government for all of our expansion projects and, as a result, could face delays for an indefinite period of time should the Government determine that such expansion project is not in accordance with the rate of economic growth projected over a certain period of time.

All approvals are made under the National Planning and Reform Committee of the Inner Mongolian Government.

The approval process varies depending on size of expansion plans and on average takes approximately 2.5 months.

The prices we charge to supply heating in Zhunger County is determined by the Inner Mongolia Zhunger Pricing Bureau (“the Bureau”) and we may not be able to recoup increases in the cost of raw materials or expenses for an undetermined period of time until application to increase prices is approved.

We are under application to increase the pricing structures of heat supply with Bureau as a result of increases in the cost of coal. Should our application be rejected, this may effect the commencement or completion of new and existing expansion projects and we may require capital from other sources such as shareholder or bank loans which may not be available to us.

In recent years, the price of raw materials has increased leading to increases in cost of heat supply. To increase the price charged to supply heating we must receive approval from the Bureau. The approval process begins with preparation of cost analysis and thereon a hearing will be arranged determining whether the increase is justified.

During this time, the Bureau may grant us a subsidy when the price of raw material increase is more than 10% of the heat supply price. We are under no circumstances permitted to increase heat supply prices in order to recoup raw material costs.

The capital which we require if we do not receive approval to increase our heat supply prices is approximately $ 250,000 based on 2004 increases and 50,000 tons of coal used. During this year the price of coal increased by 40%.

Our rate of profit is capped by government regulations as prices for heat supply are determined by the Bureau and we may not be able recoup our costs or cover our working capital needs.

Our level of profit is capped by the Bureau as determined from time to time upon review of economic circumstances such as the price of raw materials in comparison with the price point of heat usage charges. The level of profit will not exceed the amount the Bureau determines to be the price charged.

We are operating under conditions where political and legal uncertainties exist whereby changes in the political climate may cause us to incur costs to rectify any changes either local, provincial or central governments may impose on us at any time.

Chinese government policy is volatile as property rights are insecure and the rule of law is still in its infancy. We are subject to unpublished regulations from local, provincial, and national

- 13 -

governments, which often have different and sometimes conflicting agendas and demands. This may affect our operations in all aspects from the price we charge for coal, heat, hot water, electricity supply and the approval process of new expansion projects. The price we charge may be lower than desired and new expansion projects may be delayed indefinitely as a result of conflict with various levels of government.

As a member of the Local Coal Sales Association the minimum price at which we sell coal in any area in China is determined by the Local Coal Sales Association and if there is any decrease in demand for a particular type of coal, we cannot lower our prices beyond the minimum set price to adjust for a decrease in demand without loss of our membership.

If the demand for a particular type of coal decreases, we are not able to decrease our prices in order to generate cash flow when needed until the Local Coal Sales Association determines that such a decrease is warranted. We may not be able to sell coal at such minimum prices and as a result may not be able to meet working capital needs and expansion projects may be delayed indefinitely.

The following are minimum price at which we are required to sell coal:

The price for mass coal (large, middle, and powdered individually sold) must be at least $13.30 per ton and the prices for mixed coal (assortment of mass coal) must be at least $11.50 per ton. Prices set by the Coal Sales Association are reviewed periodically as market conditions change. Enforcement of these price points are also governed under this authority.

We may not be able to expand our production capabilities of the LaiYeGou mine by 20% due to capital constraints and therefore may not meet demand resulting in lost profits.

The expansion of LaiYeGou requires an investment of approximately $ 10,353,195 of which we will require such funds to be raised either through shareholder loans or through the public. There is no guarantee that we will be able to raise such funds.

Collection of accounts receivables of Coal Group and Heat Power averages to 2 years and 6 months respectively, resulting in cash flow problems in meeting our working capital needs.

It is common in the industry to have the age of our accounts receivable to be of this term and cash flow problems may persist. We will require shareholder loans and or bank loans to cover working capital needs and we may exhaust such loans at any time.

- 14 -

RISKS RELATING TO THE OFFERING

|

There is no public market for our common stock and therefore the stock you purchase may be illiquid for an indefinite period of time.

There is no public market for the common stock. Although we intend to apply for quotation of our common stock on the OTC Bulletin Board, there can be no assurance that, even if our common stock is approved for quotation, an active trading market for our common stock will develop or be sustained.

Broker-dealers may be discouraged from effecting transactions in our shares because they are considered penny stocks and are subject to the penny stock rules.

Rules 15g-1 through 15g-9 promulgated under theSecurities Exchange Act of 1934 (the “Securities Exchange Act”) impose sales practice and disclosure requirements on NASD broker-dealers who make a market in "penny stocks". A penny stock generally includes any non-NASDAQ equity security that has a market price of less than $5.00 per share.

Under the penny stock regulations, a broker-dealer selling penny stock to anyone other than an established customer or "accredited investor" (generally, an individual with net worth in excess of $1,000,000 or an annual income exceeding $200,000, or $300,000 together with his or her spouse) must make a special suitability determination for the purchaser and must receive the purchaser's written consent to the transaction prior to sale, unless the broker-dealer or the transaction is otherwise exempt.

In addition, the penny stock regulations require the broker-dealer to deliver, prior to any transaction involving a penny stock, a disclosure schedule prepared by the SEC relating to the penny stock market, unless the broker-dealer or the transaction is otherwise exempt. A broker-dealer is also required to disclose commissions payable to the broker-dealer and the registered representative and current quotations for the securities. Finally, a broker-dealer is required to send monthly statements disclosing recent price information with respect to the penny stock held in a customer's account and information with respect to the limited market in penny stocks.

Our stock is controlled by directors, officers and principal shareholders for the foreseeable future and as a result, will be able to control our overall direction.

Our insiders, being the directors, officers own 18% and together with 5% shareholders own an aggregate of 92% of our outstanding shares. As a result, the insiders could conceivably control the outcome of matters requiring stockholder approval and could be able to elect all of our directors. Such control, which may have the effect of delaying, deferring or preventing a change of control, is likely to continue for the foreseeable future and significantly diminishes control and influence which future stockholders may have in the Company. See "Principal Stockholders."

- 15 -

The initial offering price of $0.19 per share is arbitrarily determined and bears no relation to market value. The market value may be lower than $0.19 per share.

The initial offering price was arbitrarily determined by us based upon the price shares were last sold by us in our most recent Regulation S offering, pursuant to which we entered into an Asset and Share Exchange Agreement (the “Agreement") (Exhibit 10.1) on November 30, 2004 with Coal Group and Heat Power, both Chinese corporations whereby we acquired all of the issued and outstanding stock of Coal Group and 49% of the issued and outstanding stock of Heat Power in consideration of 45,000,000 of our common stock at a deemed price of $0.19 per share. The Agreement was made in a non-arms length transaction and the value of our shares may be less than the initial offering price of $0.19.

We may issue more shares for public offerings and this will dilute the value of the shares held by existing shareholders.

Our shareholders are offering 32,495,217 shares with 12,504,783 remaining, totalling 45,000,000 total shares issued. We may issue more shares to raise funds in the public and this will dilute the value of the value of the shares currently outstanding as the price per share will decrease proportionately by the increase in number of shares outstanding; with market conditions held constant. Our need to issue more shares will depend on the amount of shareholder or bank loans which are granted to us from time to time.

FORWARD LOOKING STATEMENTS

|

This Form SB-2 includes forward-looking statements which include words such as "anticipates", "believes", "expects", "intends", "forecasts", "plans", "future", "strategy" or words of similar meaning. Various factors could cause actual results to differ materially from those expressed in the forward looking statements, including those described in "Risk Factors" in this Form SB-2. We urge you to be cautious of these forward-looking statements. Except as required by applicable law, including the securities laws of the United States, we do not intend to update any of the forward-looking statements to conform these statements to actual results.

Currency Exchange Between Chinese Renminbi and United States Dollars

While our consolidated financial statements are reported in United States dollars, a significant portion of our business operations are conducted in the Chinese currency Renminbi (“RMB”). In order to provide you with a better understanding of these operations as discussed in-depth in the section titled "Description of Business", we provide the following summary regarding historical exchange rates between these currencies:

China previously did not allow it's currency to float on the open market. Rather, the currency was tied to the U.S. dollar. This means the RMB exchange rate versus the U.S. dollar was changed very infrequently. When it was changed, it tends to be very significant. During a period of high inflation, a country with a fixed exchange rate such as China will use foreign currency reserves to hold their rate steady until those reserves are exhausted. In this instance the exchange rate change will tend to be significant.

On July 21, 2005, China changed it policy and no longer values its RMB in terms of US dollars. With this change, the Renminbi is expected to increase.

The common shares offered are being registered for the Selling Shareholders as specified herein. The Selling Shareholders will receive all proceeds from the sale of common stock.

DETERMINATION OF THE OFFERING PRICE

The offering price was arbitrarily determined by us based upon the price shares were last sold in our most recent Regulation S offering. Regulation S provides an exemption from registration to United States incorporated companies that sell their securities to individuals who are resident outside of the United States, provided that:

| 1. | the purchaser certifies that he or she is not a U.S. person and is not acquiring the securities for the account or benefit of any U.S. person; |

| |

| 2. | the purchaser agrees to resell such securities only in accordance with the provisions of Regulation S, pursuant to registration under theSecurities Act of 1933(the “Securities Act”) or pursuant to an available exemption from registration; |

| |

| 3. | the purchaser agrees not to engage in hedging transactions with regard to securities purchased; and |

| |

| 4. | the company is required to refuse to register any transfer of the securities not made in accordance with the provisions of Regulation S, pursuant to registration under the Act or pursuant to an available exemption from registration. |

| |

The common stock to be sold by the selling stockholders is common stock that is currently issued and outstanding. Accordingly, there will be no dilution to our existing stockholders.

- 17 -

The Selling Shareholders below are offering 32,495,217 shares of common stock offered through this prospectus. A total of 45,000,000 shares of common stock were issued on November 30, 2004 when entered into a Share Exchange Agreement, attached in Exhibit 10.1, with Coal Group and Heat Power whereby we acquired all of the issued and outstanding stock of Coal Group and 49% of the issued and outstanding stock of Heat Power for consideration of 45,000,000 of our common stock. The remaining 51% of Heat Power is owned by Coal Group. These shares were exempt from registration under Regulation S of the Securities Act as they were made to off-shore, non US residents. We currently have not engaged any promoters. Our selling shareholders have no relationship with any promoters to date.

The following table provides as of December 22, 2006 information regarding the beneficial ownership of our common stock held by each of the selling stockholders.

Name of Selling

Shareholder | Beneficial Ownership

Before Offering | # Shares

Offered | Beneficial Ownership

After Offering(1) |

|

| | | # Shares | Percent(2) | | # Shares | Percent(2) |

| SanHu | An | 400 | * | 400 | 0 | 0% |

| QingZe | Bai (3) | 3,564,967 | 8% | 3,564,967 | 0 | 0% |

| Qun | Ding (4) | 4,197,200 | 9% | 4,197,200 | 0 | 0% |

| WenHua | Ding (5) | 2,886,571 | 6% | 2,886,571 | 0 | 0% |

| PuiPui | Fong | 591,700 | 1% | 591,700 | 0 | 0% |

| Wang | Guo | 400 | * | 400 | 0 | 0% |

| ZhiYong | Guo | 384,619 | * | 384,619 | 0 | 0% |

| JiaWen | Han | 100 | * | 100 | 0 | 0% |

| ShengLi | Hao | 500 | * | 500 | 0 | 0% |

| PeiZen | Hu | 152,575 | * | 152,575 | 0 | 0% |

| Yee | King (6) | 2,400,000 | 5% | 2,400,000 | 0 | 0% |

| JianGuang | Li | 42,227 | * | 42,227 | 0 | 0% |

| Junhua | Li (7) | 3,456,644 | 8% | 3,456,644 | 0 | 0% |

| JunYan | Li | 724,366 | 2% | 724,366 | 0 | 0% |

| Zhimin | Li (8) | 3,500,200 | 8% | 3,500,200 | 0 | 0% |

| MeiYu | Liu | 400,000 | 1% | 400,000 | 0 | 0% |

| YuhHsin | Liu (9) | 3,200,000 | 7% | 3,200,000 | 0 | 0% |

| LiangMei | Qin | 400 | * | 400 | 0 | 0% |

| PuYi | Qu | 215,531 | * | 215,531 | 0 | 0% |

| Yun | Wang | 35,189 | * | 35,189 | 0 | 0% |

| BoRenBaTu | Yang | 187,559 | * | 187,559 | 0 | 0% |

| ShengJie | Yang | 215,531 | * | 215,531 | 0 | 0% |

| LiHua | Zhang | 215,531 | * | 215,531 | 0 | 0% |

| YongFu | Zhang | 500 | * | 500 | 0 | 0% |

| Hangzhou Dayuan | | | | | | |

| Group Co., Ltd | (10) | 3,323,742 | 7% | 3,323,742 | 0 | 0% |

| Xinghe County | | | | | | |

| Haifu Coal | | | | | | |

| Transportation & | | | | | | |

| Sale Co., Ltd | (11) | 2,798,765 | 6% | 2,798,765 | 0 | 0% |

| Total | | 32,495,217 | 72% | 32,495,217 | 0 | 0% |

- 18 -

| * | Less than 1% |

| |

| | (1) | This table assumes that each shareholder will sell all of its shares available for sale during the effectiveness of the registration statement that includes this prospectus. Shareholders are not required to sell their shares. |

| |

| | (2) | The percentage is based on 45,000,000 common shares outstanding as of December 22, 2006. |

| |

The following are the address of 5% shareholders:

(3) QingZe Bai: No.3-10, Building23,HuLunBer North Road, XinCheng District, Hohhot City, Inner Mongolia, China 010050.

| | (4) | Qun Ding: No.2-1-3,N0.3 Jianshe North Street, Xincheng District , Hohhot City, Inner Mongolia 010010. |

| |

| (5) | WenHua Ding: No.22-2, First Housing, Wendur Road, Dongsheng City, Inner Mongolia, China, 017000. |

| WenHua Ding is the brother of Wenxiang Ding. |

| | |

| | (6) | Yee King: Room 2005, Ping Hei House, Tai Ping Estate, Sheung Shui, N.T. Hong Kong |

| |

| (7) | Junhua Li: No. 27 Bungalow, Provincial No. 3 Printery Housing, Dongfeng East Road, ChangAn District, |

| Shijiazhuang City, Hebei Province, 050000. |

| | |

| (8) | Zhimin Li: Xichiyang Village, Donghoufang Town, Wuji County, Hebei Province, 052400. |

| | |

| (9) | YuhHsin Liu: Room 1308, Wan De Mansion, No.1019 Shen Nan Zhong Lu, Shenzhen, China 518046. |

| | |

| | (10) | Hangzhou Dayuan Group Co., Ltd: No. 198 GongKang, Hangzhou City, Xhejiang Province, China 310015. |

| |

| (11) | Xinghe County Haifu Coal Transportation & Sale Co., Ltd: Overseas Apartment, Zhunguan Street, Xincheng |

| District, Hohhot City, Inner Mongolia 010010. |

The named parties beneficially own and have sole voting and investment power over all shares or rights to these shares. The numbers in this table assume that none of the selling shareholders sells shares of common stock not being offered in this prospectus or purchases additional shares of common stock, and assumes that all shares offered are sold.

It is possible that the selling shareholders may not sell all of the securities being offered.

None of the selling shareholders are a broker-dealer or an affiliate of a broker-dealer. To date, the selling shareholders have no agreements, understandings or arrangements with any parties directly or indirectly to dispose of the securities offered.

None of the selling stockholders has had a material relationship with us other than as a stockholder at any time within the past three years; or has ever been one of our officers or directors except as noted above family relationships with our President, Wenxiang Ding.

Please refer to “Risks Relating to Our Business- Our shareholders may not be able to enforce U.S. civil liabilities claims.”

- 19 -

We are registering the common stock on behalf of the selling shareholders. The 32,495,217 shares of our common stock can be sold by selling security holders at a fixed price of $0.19 per share until our shares are quoted on the OTC Bulletin Board and thereafter at prevailing market prices or privately negotiated prices. Please note that these shares may be illiquid as these shares are not traded on a market or exchange.

To be quoted on the OTC Bulletin Board, we must engage a market maker to file an application for a trading symbol on our behalf to the National Association of Securities Dealers. The market maker will make a market for our shares to be traded on the open market. This process typically takes between 3 and 6 months.

The selling shareholders may sell some or all of their common stock in one or more transactions, including block transactions:

| 1. | on such public markets or exchanges as the common stock may from time to time be trading; |

| |

| 2. | in privately negotiated transactions; |

| |

| 3. | through the writing of options on the common stock; |

| |

| 4. | in short sales; or |

| |

| 5. | in any combination of these methods of distribution. |

| |

The sale price to the public may be:

|

| 1. | the market price prevailing at the time of sale; |

| |

| 2. | a price related to such prevailing market price; or |

| |

| 3. | such other price as the selling shareholders determine from time to time. |

| |

The shares may also be sold in compliance with Rule 144 of the Securities Act. In general, under Rule 144, a person who has beneficially owned shares of a company's common stock for at least one year is entitled to sell within any three-month period a number of shares that does not exceed the greater of:

| 1. | 1% of the number of shares of the company's common stock then outstanding; or |

| |

| 2. | the average weekly trading volume of the company's common stock during the four calendar weeks preceding the filing of a notice on Form 144 with respect to the sale. |

| |

Sales under Rule 144 are also subject to manner of sale provisions and notice requirements and to the availability of current public information about the company.

Under Rule 144(k), a person who is not one of the company's affiliates at any time during the three months preceding a sale, and who has beneficially owned the shares proposed to be sold for at

least two years, is entitled to sell shares without complying with the manner of sale, public information, volume limitation or notice provisions of Rule 144.

The selling shareholders may also sell their shares directly to market makers acting as principals or brokers or dealers, who may act as agent or acquire the common stock as a principal. Selling shareholders may be underwriters for the shares offered for sale. Any broker or dealer participating in such transactions as agent may receive a commission from the selling shareholders, or, if they act as agent for the purchaser of such common stock, from such purchaser. The selling shareholders will likely pay the usual and customary brokerage fees for such services. Brokers or dealers may agree with the selling shareholders to sell a specified number of shares at a stipulated price per share and, to the extent such broker or dealer is unable to do so acting as agent for the selling shareholders, to purchase, as principal, any unsold shares at the price required to fulfill the respective broker's or dealer's commitment to the selling shareholders. Brokers or dealers who acquire shares as principals may thereafter resell such shares from time to time in transactions in a market or on an exchange, in negotiated transactions or otherwise, at market prices prevailing at the time of sale or at negotiated prices, and in connection with such re-sales may pay or receive commissions to or from the purchasers of such shares. These transactions may involve cross and block transactions that may involve sales to and through other brokers or dealers.

If any selling shareholders enter into an agreement, after effectiveness, to sell their shares to a broker-dealer as principal and the broker-dealer is acting as an underwriter, we will file a post-effective amendment to our registration statement identifying the broker-dealer, providing the required information regarding the plan of distribution, revising the disclosure in the registration statement and filing the agreement as an exhibit. Prior to such involvement, a broker-dealer must seek and obtain clearance of the underwriting compensation and arrangements from the NASD Corporate Finance Department.

We are bearing all costs relating to the registration of the common stock. We estimate that the expenses of the offering to be paid by us on behalf of the selling shareholders is $ 95,803.18. The selling shareholders, however, will pay any commissions or other fees payable to brokers or dealers in connection with any sale of the common stock.

The selling shareholders must comply with the requirements of the Securities Act and the Securities Exchange Act in the offer and sale of the common stock. In particular, during such times as the selling shareholders may be deemed to be engaged in a distribution of the common stock, and therefore be considered to be an underwriter, they must comply with applicable law and may among other things:

| 1. | not engage in any stabilization activities in connection with our common stock; |

| |

| 2. | furnish each broker or dealer through which common stock may be offered, such copies of this prospectus, as amended from time to time, as may be required by such broker or dealer; and |

| |

| 3. | not bid for or purchase any of our securities or attempt to induce any person to purchase any of our securities other than as permitted under the Securities Exchange Act. |

| |

The Securities and Exchange Commission (the “SEC”) has also adopted rules that regulate broker-dealer practices in connection with transactions in penny stocks. Penny stocks are generally equity securities with a price of less than $5.00 (other than securities registered on certain national

securities exchanges or quoted on the OTC Bulletin Board system, provided that current price and volume information with respect to transactions in such securities is provided by the exchange or system).

The penny stock rules require a broker-dealer, prior to a transaction in a penny stock not otherwise exempt from those rules, deliver a standardized risk disclosure document prepared by the SEC, which:

| · | contains a description of the nature and level of risk in the market for penny stocks in both public offerings and secondary trading; |

| |

| · | contains a description of the broker's or dealer's duties to the customer and of the rights and remedies available to the customer with respect to a violation to such duties or other requirements; |

| |

| · | contains a brief, clear, narrative description of a dealer market, including "bid" and "ask" prices for penny stocks and the significance of the spread between the bid and ask price; |

| |

| · | contains a toll-free telephone number for inquiries on disciplinary actions; |

| |

| · | defines significant terms in the disclosure document or in the conduct of trading penny stocks; and |

| |

| · | contains such other information and is in such form (including language, type, size, and format) as the SEC shall require by rule or regulation; |

| |

The broker-dealer also must provide, prior to effecting any transaction in a penny stock, the customer:

| · | with bid and offer quotations for the penny stock; |

| |

| · | the compensation of the broker-dealer and its salesperson in the transaction; |

| |

| · | the number of shares to which such bid and ask prices apply, or other comparable information relating to the depth and liquidity of the market for such stock; and |

| |

| · | monthly account statements showing the market value of each penny stock held in the customer's account. |

| |

In addition, the penny stock rules require that prior to a transaction in a penny stock not otherwise exempt from those rules; the broker-dealer must make a special written determination that the penny stock is a suitable investment for the purchaser and receive the purchaser's written acknowledgment of the receipt of a risk disclosure statement, a written agreement to transactions involving penny stocks, and a signed and dated copy of a written suitability statement. These disclosure requirements will have the effect of reducing the trading activity in the secondary market for our stock because it will be subject to these penny stock rules. Therefore, stockholders may have difficulty selling those securities.

- 22 -

We are not aware of any pending or threatened legal proceedings, in which we are involved. In addition, we are not aware of any pending or threatened legal proceedings in which entities affiliated with our officers, directors or beneficial owners are involved with respect to the operations of the company.

DIRECTORS, EXECUTIVE OFFICERS, PROMOTERS AND CONTROL PERSONS

The following information sets forth the names of our officers and directors, their present positions, ages and biographical information within the last 5 years. Also provided is a brief description of the business experience of our directors and executive officers and significant employees during the past five years and an indication of directorships held by the directors in other companies subject to the reporting requirements of the Securities Exchange Act.

| Name | Age | Position | Period Serving | Term(1) |

| WenXiang Ding | 50 | CEO, President,Director, Secretary, Treasurer | December 1, 2006 – November 30, 2007 | 1 year |

| YanHua Li | 48 | Director | December 1, 2006 – November 30, 2007 | 1 year |

| WuSheng Liu | 43 | CFO | December 1, 2006 – November 30, 2007 | 1 year |

| (1) | Directors hold office until the next annual stockholders’ meeting or until a successor or successors are elected and appointed. |

| |

Mr. Ding became our CEO, President, Director, and Treasurer on November 5, 2004. Mr. Ding is responsible for implementing our investment projects, financial budgets and forecasts, overseeing research and development and human resources and marketing.

Mr. Ding is also responsible for our overall direction and various initiatives as needed from time to time in maintaining the health of the Company. Mr. Ding is currently overseeing our marketing and public relations efforts in maintaining current customers and attracting new customers and also initiating contracts with sectors of the Inner Mongolia Government for expansion of electrical and heating networks.

In August, 2000, Mr. Ding became the Executive Director and General Manager of Coal Group where he brought his experience in the coal industry from serving as the Chief Accountant and, Operations Director of Inner Mongolia Coal of the People’s Republic of China General Political Department. Mr. Ding also founded Heat Power in September 2003 where he serves as the General Manager. Mr. Ding’s position as General Manager of Coal Group and Heat Power holds the same responsibilities as his position as our President.

- 23 -

In 1993, Mr. Ding obtained training in coal mine management from the Beijing coal Management Institute. During 2002, he obtained further training in coal mine production and public utility management from the Inner Mongolia Coal Industry Bureau and Erdos City Construction Bureau, respectively.

Mr. Ding works on average 52 hours per week on Company affairs and has an employment contract with the Company. Please refer to Exhibit 10.14 (a).

Ms. YanHua Li

Ms. Li became our Director on November 5, 2004. Her responsibilities include overseeing our finance and human resources departments.

Ms. Li is also the General Manager of Inner Mongolia XiangRong Commercial and Trade Co., Ltd. where she oversees the finance department and responsible for operations management and has been for the past 5 years.

Ms. Li does not have any technical training in her field of finance, human resources and operations management.

Ms. Li works on average 48 hours per week on Company affairs and is the spouse of Wenxiang Ding.

Ms. Li has an employment contract with the Company. Please refer to Exhibit 10.14(b) .

Mr. Liu became our CFO on November 5, 2004 and oversees our financial department, and works closely with Mr. Ding in implementing our investment projects, financial budgets and forecasts.Mr. Liu previously held the position of Chief Financial Officer at Sinopetro Hohhot Petro Co., Ltd., an oil refinery commencing from 2003 to 2005. This company is unrelated and unassociated with Coal Group, Heat Power and the Company. Mr. Liu’s is responsible for management of financial reporting.

Mr. Liu brings his experience in financial management and internal audit from his work with Petro China Hohhot Oil & Chemical Branch from 1992-2003.

Mr. Liu does not have any technical training in his field.

Mr. Liu has an employment contract with the Company. Please refer to Exhibit 10.14(c) .

Promoters

We were incorporated by Peter Khean, a promoter of our Company wherein he prepared the necessary incorporation documents. Incorporation and related costs amounted to approximately $3,000. Mr. Khean is the President of Magnum Equities Group Inc, our agent for service. We do not have other promoters.

Our significant employees are Mr. Ding, Ms. Li, and Mr. Liu, all of whom provide a significant contribution to our business.

Please refer to “Risks Relating to Our Business- We are dependent on a few key personnel being our officers and directors.”

There are no arrangements or understandings between any of our directors or executive officers, pursuant to which either was selected to be a director or executive officer. Our director YanHua Li and our President WenXiang Ding are husband and wife and there are no other family relationships among any of our directors and officers.

Involvement in Certain Legal Proceedings:

|

Our directors, executive officers and control persons have not been involved in any of the following events during the past five years and which are material to an evaluation of the ability or the integrity of our directors or executive officers:

| 1. | any bankruptcy petition filed by or against any business of which such person was a general partner or executive officer either at the time of the bankruptcy or within two years prior to that time; |

| |

| 2. | any conviction in a criminal proceeding or being subject to a pending criminal proceeding (excluding traffic violations and other minor offences); |

| |

| 3. | being subject to any order, judgment, or decree, not subsequently reversed, suspended or vacated, of any court of competent jurisdiction, permanently or temporarily enjoining, barring, suspending or otherwise limiting his involvement in any type of business, securities or banking activities; and |

| |

| 4. | being found by a court of competent jurisdiction (in a civil action), the SEC or the Commodity Futures Trading Commission to have violated a federal or state securities or commodities law, and the judgment has not been reversed, suspended, or vacated. |

| |

Audit Committee Financial Expert

|

We do not have an audit committee financial expert nor do we have an audit committee established at this time. We expect to establish this committee within the next 12 months.

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth as of December 22, 2006 certain information regarding the beneficial ownership of our common stock by:

| 1. | each person who is known by us to be the beneficial owner of more than 5% of the common stock, |

| |

2. each of our directors and executive officers and

3. all of our directors and executive officers as a group.

The persons or entities listed below have sole voting and investment power with respect to all shares of common stock beneficially owned by them, except to the extent such power may be shared with a spouse. No change in control is currently being contemplated.

As of December 22, 2006, 45,000,000 shares with a par value of $0.001 per share were issued and outstanding. We are authorized to issue 200,000,000 shares with a par value of $0.001 per share.

Title of Class

| Name and Address of Beneficial

Owner | Amount and Nature of

Beneficial Owner | % Class (1)

|

|

| Officers and Directors: | | | |

| Common Stock | WenXiang Ding, President, CEO, | 12,504,583 (2) | 28% |

| | Director, Secretary | | |

| | No.1-3,Building 1,Residential Area, | | |

| | West Street, XinCheng District, | | |

| | Hohhot City, Inner Mongolia, China, | | |

| | 010010 | | |

| Common Stock | YanHua Li, Director | 703,786 (2) | 2% |

| | No.1, Building 7, No.23 Jianshe | | |

| | Street, Xincheng District, Hohhot | | |

| | City, Inner Mongolia, 010010 | | |

| Common Stock | WuSheng Liu, CFO | 200 | * |

| | Xiguanjin Street, Kekeyiligeng | | |

| | Town, Wuchuan County, Inner | | |

| | Mongolia China, 011700 | | |

Officers and Directors

as a Group |

| 12,504,783 | 28% |

|

| 5% Shareholders: | | | |

| Common Stock | QingZe Bai | 3,564,967 | 8% |

| | No.3-10, Building23,HuLunBer | | |

| | North Road, XinCheng District, | | |

| | Hohhot City, Inner Mongolia, China | | |

| | 010050 | | |

| Common Stock | Qun Ding | 4,197,200 | 9% |

| | No.2-1-3,N0.3 Jianshe North Street, | | |

| | Xincheng District, Hohhot City, | | |

| | Inner Mongolia 010010 | | |

| Common Stock | WenHua Ding | 2,886,571 (3) | 6% |

| | No.22-2, First Housing, Wendur | | |

| | Road, Dongsheng City, Inner | | |

| | Mongolia, China 017000 | | |

| Common Stock | Yi Ding | 4,407,572 (2) | 10% |

| | No.21, AnDeLi North Road, | | |

| | DongCheng District, Beijing, China | | |

| | 100000 | | |

| Common Stock | Yee King | 2,400,000 | 5% |

| | Room 2005, Ping Hei House, Tai | | |

| | Ping Estate, Sheung Shui, N.T. Hong | | |

| | Kong | | |

| Common Stock | Junhua Li | 3,456,644 | 8% |

| | No. 27 Bangalow, Provincial No. 3 | | |

| | Printery Housing, Dongfeng East | | |

| | Road, ChangAn District, | | |

| | Shijiazhuang City, Hebei Province, | | |

| | 0500000 | | |

| | | | |

- 26 - -

|

|

| Title of Class | Name and Address of Beneficial

Owner | Amount and Nature of

Beneficial Owner | % Class (1) |

| Common Stock | Yee King | 2,400,000 | 5% |

| | Room 2005, Ping Hei House, Tai | | |

| | Ping Estate, Sheung Shui, N.T. Hong | | |

| | Kong | | |

| Common Stock | Junhua Li | 3,456,644 | 8% |

| | No. 27 Bangalow, Provincial No. 3 | | |

| | Printery Housing, Dongfeng East | | |

| | Road, ChangAn District, | | |

| | Shijiazhuang City, Hebei Province, | | |

| | 0500000 | | |

|

| Common Stock | Zhimin Li | 3,500,200 | 8% |

| | Xichiyang Village, Donghoufang | | |

| | Town, Wuji County, Hebei Province, | | |

| | 052400 | | |

| Common Stock | YuhHsin Liu | 3,200,000 | 7% |

| | Room 1308, Wan De Mansion, | | |

| | No.1019 Shen Nan Zhong Lu, | | |

| | Shenzhen 518046, China | | |

| Common Stock | Hangzhou Dayuan Group Co. Ltd. | 3,323,742 | 7% |

| | (4) | | |

| | No.198 GongKang, Hangzhou City, | | |

| | Zhejiang Province China 310015 | | |

| Common Stock | Xinghe County Haifu Coal | 2,798,765 | 6% |

| | Transportation & Sale Co., Ltd.(5) | | |

| | Overseas Apartment, Zhuguan Street, | | |

| | Xincheng District, Hohhot City, | | |

| | Inner Mongolia 010010 | | |

Officers, Directors and

5% Shareholders as a

Group |

|

41,832,872

|

92%

|

|

|

| | (1) | Based on 45,000,000 shares outstanding as of December 22, 2006. |

| |

| (2) | Wenxiang Ding owns 7,393,225 directly, his spouse, YanHua Li owns 703,786, and his son, Yi Ding owns 4,407,572. The total of these shares is 12,504,583. |

| |

| (3) | Wenhua Ding is the brother of Wenxiang Ding. |

| |

| (4) | Shareholders of Hangzhou Dayuan Group Co., Ltd are Li Weijun, ,Yu Jianping, Wu Weidong, Gao Zhixiang, Ma Zhiming, Lin Xia, Qin Lihong, Jin Lu, Zhang Yong, Chai Meichang, Gao Hualiang and Hangzhou Dayuan Group Co., Ltd Holding Committee**. |

| |

| (5) | Shareholders of Xinghe County Haifu Coal Transportation & Sale Co., Ltd are Zhang Liguo, Zhang Junfa, and Yang Peixiu. |

| |

| ** | Hangzhou Dayuan Group Co., Ltd was originally a Government owned enterprise and was subsequently privatized. During this transition, a separate committee was established so original owners including the Government, former management and employees retain interest in the company. These shareholders are not shareholders in Coal Group, Heat Power or the Company. The privatizing of Government owned companies is a common practice in China. |

| |

- 27 -

DESCRIPTION OF SECURITIES

|

The securities being registered are 32,495,217 shares with a par value of $0.001 per share. Pursuant to our articles of incorporation, the total authorized capital is 200,000,000 shares with a par value of $0.001 per share, of which 45,000,000 shares are issued to 30 shareholders as of December 22, 2006. This public offering consists solely of 32,495,217 shares of common stock being resold by selling shareholders at a price of $0.19 per share; therefore, this offering will not affect the total number of shares of common stock issued and outstanding.

All of our authorized shares are of the same class and, once issued, rank equally as to dividends, voting powers, and participation in assets. Holders of shares are entitled to one vote for each share held of record on all matters to be acted upon by the shareholders. Holders of shares are entitled to receive such dividends as may be declared from time to time by the Board of Directors, in its discretion, out of funds legally available. However, our present intention is not to pay any cash dividends to holders of shares but to reinvest earnings, if any. In the event of our liquidation, dissolution or winding up the holders of shares are entitled to share pro-rata in all assets remaining after payment of liabilities.

Shares have no pre-emptive, conversion or other subscription rights. There are no redemption or sinking fund provisions applicable to the shares.

Our articles and by-laws do not contain any provisions that would delay, defer or prevent our change in control.

We currently intend to retain future earnings, if any, to finance the expansion of our business. As a result, we do not anticipate paying any cash dividends in the foreseeable future. Should we declare a dividend in the future, such dividend will be paid to shareholders on a pro rata basis in accordance with their shareholdings at such time.

We have not issued and do not have outstanding any warrants to purchase our shares.

We have not issued and do not have outstanding any options to purchase our shares.

We have not issued and do not have outstanding any securities convertible into shares or any rights convertible or exchangeable into shares.

Changes in Control:

There are no arrangements which may result in a change in control.

- 28 -

INTEREST OF NAMED EXPERTS AND COUNSEL

None of the experts named herein was or is a promoter, underwriter, voting trustee, director, officer or employee of the Company.

Our financial statements as of November 30, 2005 and 2004, appearing in this prospectus and registration statement have been audited by Robert G. Jeffrey, Certified Public Accountant, an independent auditor, as set forth in their report thereon, appearing elsewhere in this prospectus and in this registration statement, and are included in reliance upon such reports given upon the authority of said firm as experts in accounting and auditing.

The validity of the Shares offered hereby will be passed upon for us by Lonsdale Avenue Law Centre, a law firm located in Vancouver, British Columbia, Canada.

DISCLOSURE OF COMMISSION POSITION OF INDEMNIFICATION FOR SECURITIES ACT LIABILITIES

Our officers and directors are indemnified as to personal liability as provided by the Nevada Revised Statutes ("NRS") and our bylaws. Section 78.7502 of the NRS provides that a corporation may eliminate personal liability of an officer or director to the corporation or its stockholders for breach of fiduciary duty as an officer or director provided that such indemnification is limited if such party acted in good faith and in a manner which he reasonably believed to be in or not opposed to the best interest of the corporation.

Our articles of incorporation and bylaws allow us to indemnify our officers and directors up to the fullest extent permitted by Nevada law, but such indemnification is not automatic. Our bylaws provide that indemnification may not be made to or on behalf of a director or officer if a final adjudication by a court establishes that the director or officer's acts or omissions involved intentional misconduct, fraud, or a knowing violation of the law and was material to the cause of action.

Unless limited by our articles of incorporation (which is not the case with our articles of incorporation) a corporation must indemnify a director who is wholly successful, on the merits or otherwise, in the defence of any proceeding to which the director was a party because of being a director of the corporation against reasonable expenses incurred by the director in connection with the proceeding.

Insofar as indemnification for liabilities arising under the Securities Act may be permitted to directors, officers and controlling persons of the small business issuer pursuant to the foregoing provisions, or otherwise, the small business issuer has been advised that in the opinion of the SEC such indemnification is against public policy as expressed in the Securities Act and is, therefore, unenforceable.

In the event that a claim for indemnification against these types of liabilities, other than the payment by us of expenses incurred or paid by a director, officer or controlling person in the

- 29 -

successful defence of any action, suitor proceeding, is asserted by a director, officer or controlling person in connection with the securities being registered, we will submit the question of whether indemnification by us is against public policy to an appropriate court and will be governed by the final adjudication of the case.

ORGANIZATION WITHIN THE LAST FIVE YEARS

Business Development

China Energy Corporation-Parent Company

|

We were incorporated in the state of Nevada on October 11, 2002 for the purpose of producing coal to meet the increasing demand in power and heating industries. We also construct improved power and heating facilities in rural developments; expanding such network coverage to users. We also act as a broker to facilitate coal sales. We were formally known as “Omega Project Consultations Inc.” and on November 3, 2004 we changed our name to “China Energy Corporation”. We were incorporated by Peter Khean, a promoter of our Company wherein he prepared the necessary incorporation documents. Incorporation and related costs amounted to approximately $3,000. Mr. Khean is the President of Magnum Equities Group Inc, our agent for service.

On November 30, 2004, we entered into a Share Exchange Agreement, attached in Exhibit 10.1, with Coal Group and Heat Power, both Chinese corporations, whereby we acquired all of the issued and outstanding stock of Coal Group and 49% of the issued and outstanding stock of Heat Power for consideration of 45,000,000 of our common stock. The remaining 51% ownership of Heat Power is owned by Coal Group. Please refer to “Coal Group: Subsidiary”below. These shares were exempt from registration under Regulation S of the Securities Act as they were made to off-shore, non US residents.

The Share Exchange Agreement stipulates that the Company endeavours to raise $10,000,000 for expansion of operations of Coal Group and Heat Power. Current projects such as the XueJiaWan Expansion consisting of construction of thermoelectric plants have been funded solely by shareholder loans. Heat Power will require an additional $ 2.84 million for construction in order to improve its efficiencies and reliability of heating and electricity supply. Heat Power will receive funding through shareholder loans and possibly bank loans of which such option will be examined early 2007. Any funding raised in the public market will be invested in Coal Group’s expansion of the LaiYeGou mine.

Coal Group is in the planning stages of expanding its mining capabilities where funding will be provided by shareholder and bank loans and funds raised in the public market. The cost of the expansion will be approximately $10,000,000. The Company expects to engage the services of a promotion and investor relations group when it receives trading status on the OTC Bulletin Board to assist in raising the necessary funding over a period of time. Currently no agreement has been entered into with any promoters or investor relations groups. There were no fees paid or any type of consideration received by promoters as a result of the Share Exchange Agreement.

- 30 -

Prior to the Share Exchange Agreement, Mr. Ding, our President was also the President and General Manager of Coal Group. Mr. Liu our CFO was also the CFO of Coal Group. Mrs. Li, our director was Supervising Manager of Coal group.

Mr. Ding was also President and General Manager of Heat Power prior to the Share Exchange Agreement. Mrs. Li and Mr. Liu did not hold positions at Heat Power.

The relationship between Coal Group and Heat Power prior to the Share Exchange Agreement remained under the supervision and control of Mr. Ding as he was the President and General Manager and oversaw operations of both companies.

As a result of the Share Exchange Agreement, Coal Group and Heat Power became our wholly-owned subsidiaries. The shareholders of Coal Group and Heat Power unanimously agreed to enter into the Agreement for the purposes of restructuring itself in anticipation of becoming listed on the OTC Bulletin Board. We were formed by shareholders of Coal Group and Heat Power for this purpose and prior to entering into the Agreement; we had no assets, liabilities, equity and had not issued any of our shares. As a result of entering into the Agreement; the shareholders of Coal Group and Heat Power became our shareholders, whereby the 45,000,000 shares were issued. The Agreement therefore was a non-arms length transaction. Mr. Ding, Mrs. Li and Mr. Liu were our CEO, Director and CFO, respectively, when the Agreement was signed.

Business activities of Coal Group and Heat Power did not change as a result of this Agreement.

For the years ended November 30, 2005 and 2004, our net income was$ 3,382,777 and$ 1,156,309, respectively.

Coal Group: Subsidiary

Organization and History of Ownership

|

Coal Group, a China Corporation, was founded in August 2000 in Dongsheng City of Inner Mongolia. Coal Group has a business license granted from the Inner Mongolia Administrative Bureau of Industry and Commerce. The business license is attached in Exhibit 99.1.

When Coal Group was founded, Mr. Ding owned 40%, YanHua Li owned 26.67% and Yi Ding owned 33.33 %. The ownership structure changed in December 2003 whereby Mr. Ding owned 50%, YanHua Li owned 14.67% and Yi Ding ownership remained unchanged at 33.33% . There was no consideration exchanged and this was a non arms length transaction as Mr. Ding is the spouse of Ms. Li and Yi Ding is their son. There was no agreement signed as result of these transactions.

In September 2003, our President and majority shareholder, Mr. Ding, acquired a 70% interest in Heat Power. The remaining 30% was acquired by ZhiYong Guo. The 70% interest was acquired through a contribution of property which is used by Heat Power in its operations. The property was capitalized at its appraised value of in the amount Mr. Ding paid for the assets he contributed. In February, 2004 Mr. Ding transferred this equity interest to Coal Group.

In March 2004, Coal Group sold 15% of its interest to Hangzhou DaYuan Group Co. Ltd.. In August of 2004, a further 4% interest was sold to Xinghe County Haifu Coal Transportation and Sale Co. Ltd; leaving 51% to be owned by Coal Group. The price for each of these transactions

was proportionately equal to the total of the appraised value of the property contributed by Mr. Ding for the 70% equity interest in Heat Power. In the case of each of these sales, the proceeds were loaned to Heat Power. As a result the Share Exchange Agreement, Coal Group and the Company together now own 100% of the outstanding capital stock of Heat Power.