Exhibit 99.1

Company Perspective and Overview “Energize 2007: New Year, New Realities”

Forward Looking Statements The statements contained in this presentation that are not historical are “forward-looking statements”within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), including statements, without limitation, regarding our expectations, beliefs, intentions or strategies regarding the future. Such forward-looking statements relate to, among other things: (1) expected revenue and earnings growth; (2) estimates regarding the size of pre-drill reserve potential; (3) estimates regarding the size of post-drill reserve potential; (4) regulation of the Company’s industries and markets, (5) the Company's acquisition of the 50% interest in the wells and acreage located in the Williston Basin in North Dakota; (6) the expected production and revenue from the Williston properties; and (7) estimates regarding the increase in reserve potential of the Williston properties.These statements are qualified by important factors that could cause the Company’s actual results to differ materially from those reflected by the forward-looking statements. Such factors include but are not limited to:(1) the Company’s ability to locate and acquire suitable interests in oil and gas properties on terms acceptable to the Company, (2) the Company’s ability to obtain working capital as and when needed , (3) theCompany's ability to acquire the $60 million of financing required to acquire the Williston Basin properties; (4) the Company's ability to negotiate and execute mutually agreeable definitive agreements for its acquisition of the Williston Basin properties; (5 ) positive confirmation of the reserves, production and operating expenses associated with its various properties, including the Williston Basin properties and (6) the risks and factors described from time to time in the Company’s reports and registration statements filed with the Securities and Exchange Commission, including but not limited to the Company’s Pre-Effective Amendment No.2 to its Registration Statement on Form SB-2 Form filed on July 14, 2006. The Company cautions readers not to place undue reliance on any forward-looking statements. The Company does not undertake, and specifically disclaims any obligation, to update or revise such statements to reflect new circumstances or unanticipated events as they occur.

Capital Structure Shares Outstanding:19.7 million Warrants:7.7 million Preferred Stock:None Debt:None AMEX Symbol:“PRC” Daily Volume:10,906 shares Market Cap: $55 million

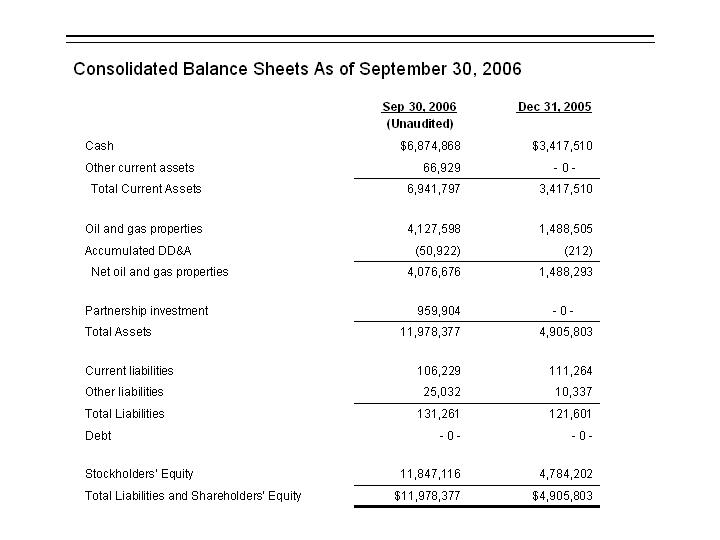

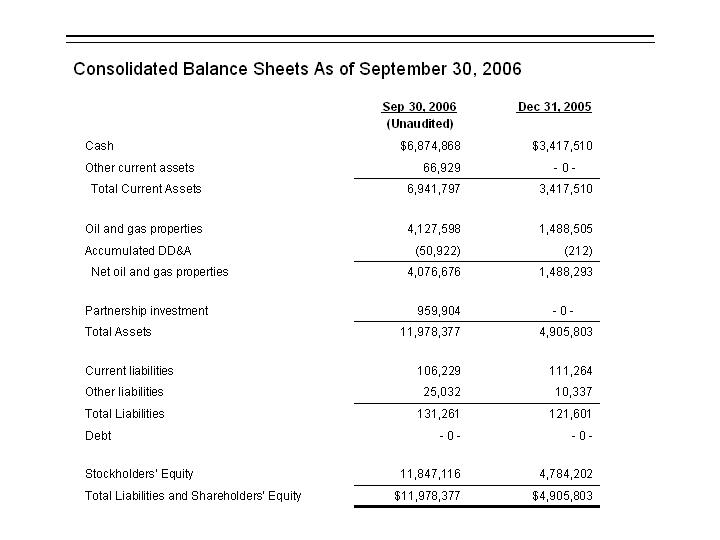

Consolidated Balance Sheets As of September 30, 2006 Consolidated Balance Sheets As of September 30, 2006 Sep 30, 2006(Unaudited) Dec 31, 2005 Cash $6,874,868 $3,417,510 Other current assets 66,929 - 0 - Total Current Assets 6,941,797 3,417,510 Oil and gas properties 4,127,598 1,488,505 Accumulated DD&A (50,922) (212) Net oil and gas properties 4,076,676 1,488,293 Partnership investment 959,904 - 0 - Total Assets 11,978,377 4,905,803 Current liabilities 106,229 111,264 Other liabilities 25,032 10,337 Total Liabilities 131,261 121,601 Debt - 0 - - 0 - Stockholders’ Equity 11,847,116 4,784,202 Total Liabilities and Shareholders’ Equity $11,978,377 $4,905,803

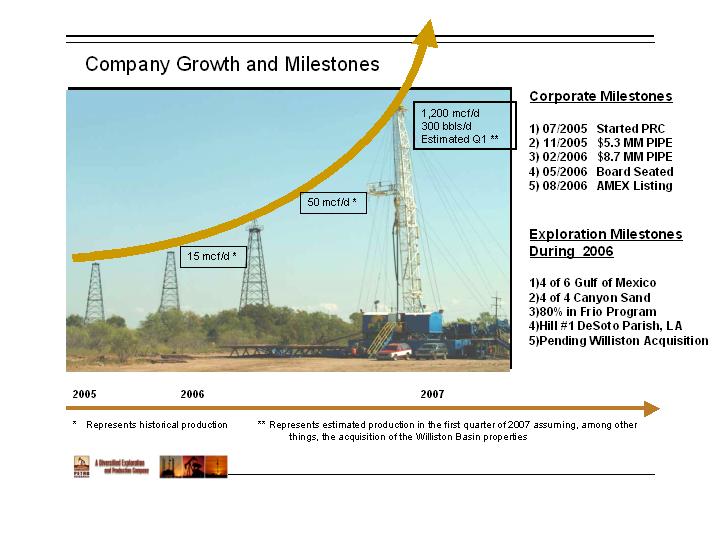

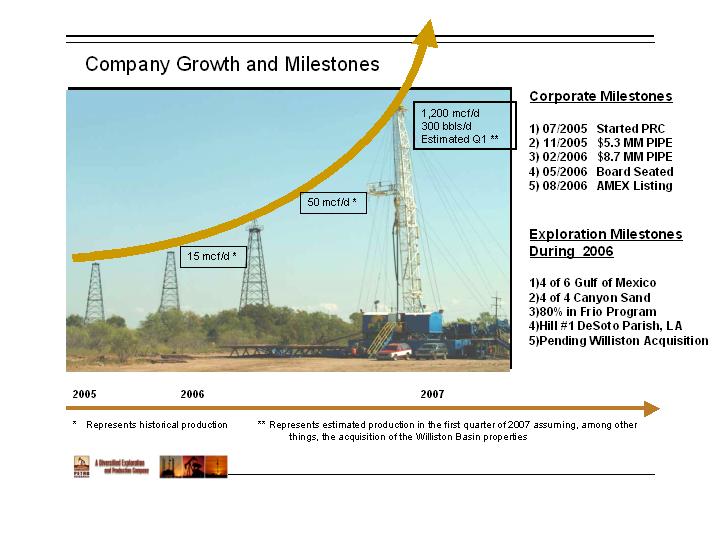

2005 2006 * Represents historical production ** Represents estimated production in the first quarter of 2007 assuming, among other things, the acquisition of the Williston Basin properties Company Growth and Milestones Company Growth and Milestones Corporate Milestones1)07/2005 Started PRC2)11/2005 $5.3 MM PIPE3)02/2006 $8.7 MM PIPE4)05/2006 Board Seated5)08/2006 AMEX Listing Exploration Milestones During 20061)4 of 6 Gulf of Mexico2)4 of 4 Canyon Sand3)80% in Frio Program4)Hill #1DeSotoParish, LA5)Pending Williston Acquisition200715mcf/d *50mcf/d *1,200mcf/d 300bbls/d Estimated Q1 **

Company Overview Petro Resources Corporation is a young, independent exploration and production company focused on cost-effective growth. Business strategy based on: -Strategic alliances with highly qualified operating partners -Production and reserves growth through drilling of under-exploited plays-Expand company potential via disciplined acquisitions with key operators -Control overhead costs by minimizing staff and limiting extraneous costs Growth to date has been organic and proves business model can be successful : -Seated a well qualified Board of Directors -Assembled comprehensive prospect portfolio in 6 states and GOM -Drilling programs starting to gain momentum and showing results-Daily production increasing: Q1 2007 Estimate 1200mcf/d and 300bbls/d with pending Williston acquisition and successful wells being connected

Business Model and Prospect Portfolio Business Model and Prospect Portfolio Advantages of “Non-operator” Business Model: •Greater ease in creation of a highly diversified prospect portfolio •Allows PRC access to leverage “area-specific” expertise of qualified operators •Easily scaled up by simply taking larger working interest positions •Allows for low overhead to allocate more capital to drilling and development •Fewer administrative “headaches” associated with larger number of employees Prospect Portfolio: •Geologically diversified. More than 220,000 gross acres •Geographical diversification has PRC in prospects in 6 states and GOM •Portfolio is good mix of low risk prospects with higher potential programs •Prospect areas are large enough for future development programs •Prospect such as this would have been impossible to create if PRC operated all

Overview Overview - Management and Board of Directors Management and Board of Directors Donald L. Kirkendall-President -26 years exploration and energy industry experience -Co-founded and managed successful natural gas marketing company -Co-founded independent exploration company drilling 100+ wells (Texas Gulf Coast and southern Texas)Strong Management Team and Board of Directors: Over 200 years of diverse experience in exploration and energy related fields. Wayne P. Hall -CEO, Chairman of the Board-25 years exploration industry experience -Co-founder and President, Hall-Houston Oil Company (1983)-Drilled 300+ exploratory wells in Gulf of Mexico-Success rate better than 81%-Discovered 2.2Tcfnatural gas reserves

Two Key Industry Relationships •Gulf of Mexico Experts •Success > 81% Over 25 years •2.2Tcfof Discoveries •Great Prospect Base Approach Resources, Inc.(Fort Worth)Hall-Houston Exploration(Houston) PRC•“Tight Rock Experts • NE Ozona Field -TX• New Albany Shale -KY• Success Rate 95% (+)

PRC PRC’s Prospect Portfolio Prospect Portfolio [Approximately 220,000 Gross Acres] Gul Williston Basin (Proposed Acquisition) Uinta Basin Piceance Basin Illinois Basin New Albany Shale Williston Basin (Proposed Acquisition)Hill #1 -DeSoto Parish Palo Duro Basin Gulf of Mexico South Texas Texas Permian Basin

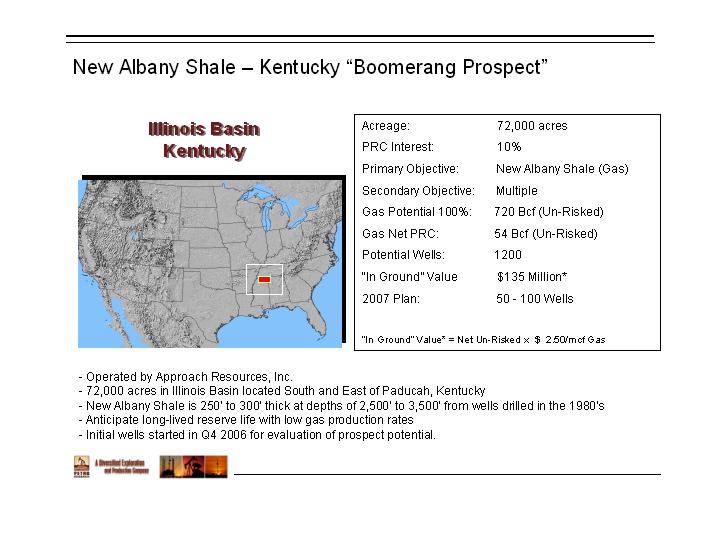

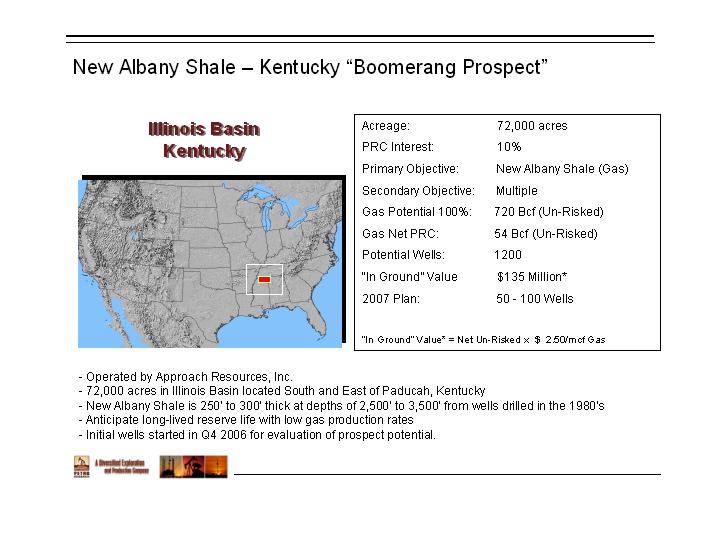

New Albany Shale - Kentucky Kentucky “Boomerang Prospect Boomerang Prospect” Acreage: 72,000 acres PRC Interest: 10% Primary Objective: New Albany Shale (Gas) Secondary Objective: Multiple Gas Potential 100%: 720Bcf(Un-Risked) Gas Net PRC: 54Bcf(Un-Risked) Potential Wells: 1200 “In Ground” Value $135 Million* 2007 Plan: 50 -100 Wells “In Ground” Value* = Net Un-Risked x $ 2.50/mcfGas -Operated by Approach Resources, Inc. -72,000 acres in Illinois Basin located South and East of Paducah, Kentucky -New Albany Shale is 250’to 300’thick at depths of 2,500’to 3,500’from wells drilled in the 1980’s -Anticipate long-lived reserve life with low gas production rates -Initial wells started in Q4 2006 for evaluation of prospect potential. Illinois Basin Kentucky Illinois Basin Kentucky

Permian Basin Permian Basin - Texas Texas “Ozona Prospect Ozona Prospect” -Operated by Approach Resources, Inc. -Analog field is 11 miles east with 99% success rate. In excess of 200 wells drilled and producing -4 Wells drilled and producing. No dry holes to date. Potential for repeatable low-risk, high-return drilling -20 wells possible in 2007Permian Basin Crockett County, Texas Permian Basin Crockett County, Texas Acreage: 18,000 acres PRC Interest: 10%Primary Objective: Canyon Sands (Gas)Secondary Objective: Ellenberger (Oil)Gas Potential 100%: 315Bcf(Un-Risked)Gas Net PRC: 23.6Bcf(Un-Risked)Oil Potential: 5,000MbblsOil Net: 375MbblsPotential Wells: 450 “In Ground” Value $54.8 Million*2007 Plan: 20 Wells “In Ground” Value* = Net Un-Risked x $ 2.50/mcfGas“In Ground” Value* = Net Un-Risked x $ 15.00/Bbl Oil

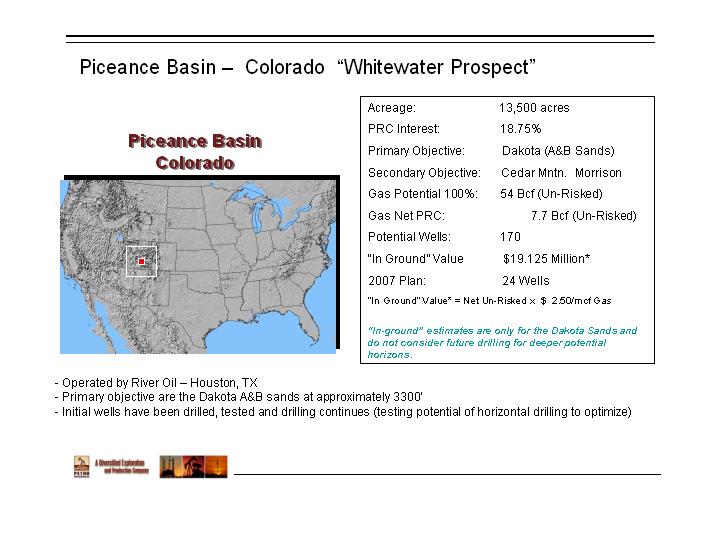

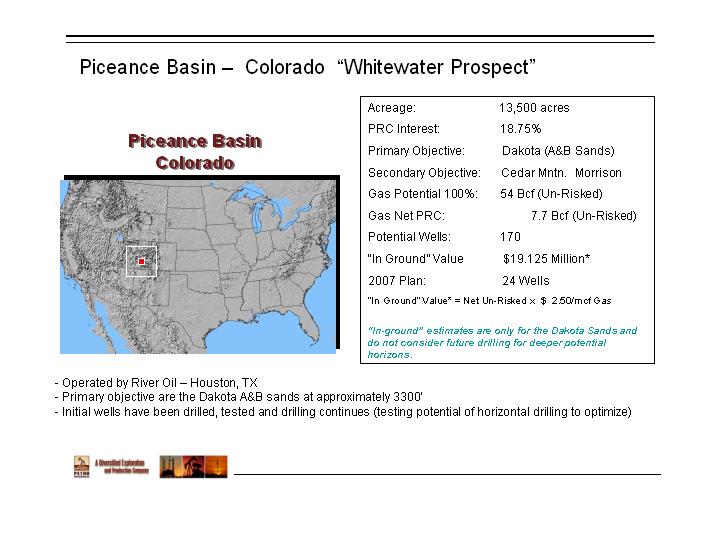

Piceance Basin- Colorado “Whitewater Prospect Whitewater Prospect” Acreage: 13,500 acres PRC Interest: 18.75% Primary Objective: Dakota (A&B Sands) Secondary Objective: Cedar Mntn. Morrison Gas Potential 100%: 54Bcf(Un-Risked) Gas Net PRC: 7.7Bcf(Un-Risked) Potential Wells: 170 “In Ground” Value $19.125 Million* 2007 Plan: 24 Wells “In Ground” Value* = Net Un-Risked x $ 2.50/mcfGas “In-ground” estimates are only for the Dakota Sands and do not consider future drilling for deeper potential horizons. -Operated by River Oil -Houston, TX -Primary objective are the Dakota A&B sands at approximately 3300’ -Initial wells have been drilled, tested and drilling continues (testing potential of horizontal drilling to optimize) Piceance Basin Colorado

Gulf of Mexico Gulf of Mexico -Operated by Hall-Houston with previous GOM success (81% success ratio in 300+ wells, 2.2Tcfnatural gas) -High initial production rates and resulting cash flow (short reserve life) -Success to date is four discoveries out of six prospects drilled -Initial production is expected in Q1 of 2007Gulf of Mexico Shallow Water -Texas and La.Gulf of Mexico Shallow Water -Texas and La .Acreage: 65,000 (+) acres PRC Interest: 5.3% of HHE position Primary Objective: Varies by prospect Secondary Objective: Most have multiple targets Gas Potential: 5 -50Bcfper prospect Gas Net PRC: 4Bcf“In Ground” Value $10 million2007 Plan: 6 -10 wells “In Ground” Value* = Net Un-Risked x $ 2.50/mcfGas

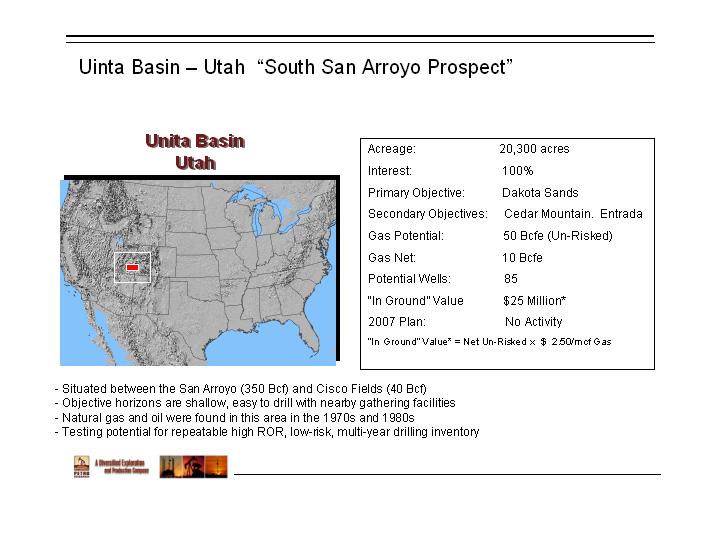

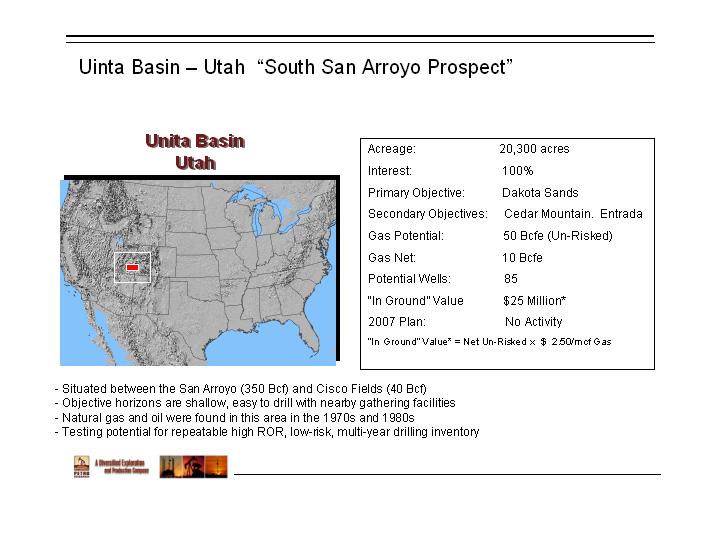

Uinta Basin - Utah “South San Arroyo Prospect South San Arroyo Prospect” Acreage: 20,300 acres Interest: 100% Primary Objective: Dakota Sands Secondary Objectives: Cedar Mountain. Entrada Gas Potential: 50Bcfe(Un-Risked) Gas Net: 10Bcfe Potential Wells: 85 “In Ground” Value $25 Million* 2007 Plan: No Activity “In Ground” Value* = Net Un-Risked x $ 2.50/mcfGas -Situated between the San Arroyo (350Bcf) and Cisco Fields (40Bcf) -Objective horizons are shallow, easy to drill with nearby gathering facilities -Natural gas and oil were found in this area in the 1970s and 1980s -Testing potential for repeatable high ROR, low-risk, multi-year drilling inventory Unita Basin Utah

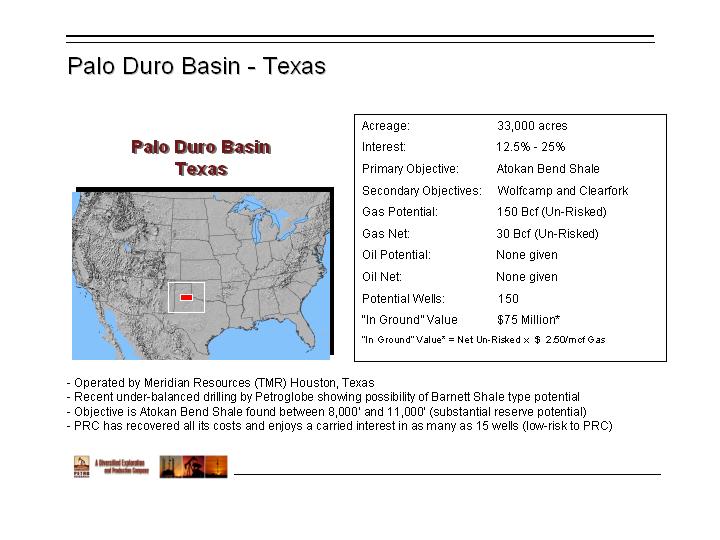

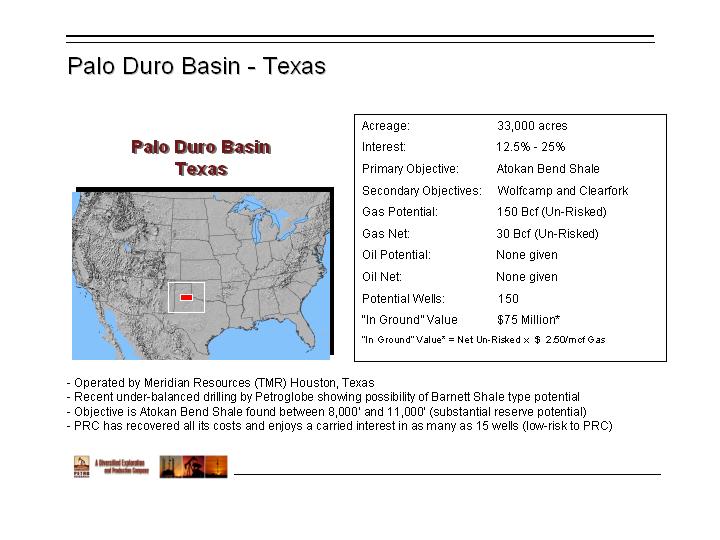

Palo Duro Basin - Texas Acreage: 33,000 acres Interest: 12.5% -25%Primary Objective: Atokan Bend Shale Secondary Objectives: Wolf campand Clearfork Gas Potential: 150Bcf(Un-Risked)Gas Net: 30Bcf(Un-Risked)Oil Potential: None given Oil Net: None given Potential Wells: 150 “In Ground” Value $75 Million*“In Ground” Value* = Net Un-Risked x $ 2.50/mcfGas-Operated by Meridian Resources (TMR) Houston, Texas-Recent under-balanced drilling by Petroglobe showing possibility of Barnett Shale type potential-Objective is Atokan Bend Shale found between 8,000’and 11,000’(substantial reserve potential)-PRC has recovered all its costs and enjoys a carried interest in as many as 15 wells (low-risk to PRC)

Hill #1 Prospect, DeSoto Parish Louisiana Parish Louisiana Acreage: 640 acres PRC Interest: 10.0% Primary Objectives: James Lime @ 7,250’TVD Secondary Objective: None Gas Potential Gross: 2.0 -4.0Bcf Gas Potential Net: .30Bcf Potential Wells: One well. 3 -5,000’Laterals “In Ground” Value $750,000* “In Ground” Value* = Net Un-Risked x $15.00/bbl oil $2.50/mcfGas-Well successfully drilled and completed with 3 -5,000’laterals -Encountered approximately 19 producing fractures. (Typical well may cut 6 or 7 such fractures) -Well turned to sales January 2, 2007 at initial rate of 3,760mcfdwith anticipated increases Hill #1DeSotoParish, La. Discovery Hill #1DeSotoParish, La. Discovery

Williston Basin - Water Flood Project (Potential Acquisition) Water Flood Project (Potential Acquisition) Acreage: 15,000 acres PRC Interest: Approx 43.5% average WI Primary Objective: Madison Group (Oil) Secondary Objective: Bakken Oil Potential 100%: 25.0MMBo Oil Net Potential: 10.4MMbo Potential Wells: 158 (Drilled and Producing) “In Ground” Value $171 Million* 2007 Plan: Begin secondary recovery *PV 10 Value as determined by Cawley Gillespie @ $60/bbl -Approx 43.5% working interest in 15 producing oil fields (Bottineau, Renville and Burke Counties North Dakota) -Current gross production 500 to 600Bblsper day -Water flooding has commenced in 5 of 15 prospective fields. New horizontals anticipated Q1 2007 -Nearby water flood projects imply secondary recovery of approximately 25MMBbls of oil from existing fields As previously disclosed in its quarterly report filed with the SEC on November 14, 2006, the Company is pursuing the acquisition of 50% of the interest in the Williston Basin wells and acreage currently owned by the seller . The parties expect the transaction to close, assuming satisfaction of certain conditions, including the Company's ability to acquire the $60 million of financing required to acquire and develop the Williston Basin properties, on or before January 31, 2007. Williston Basin North Dakota Williston

Williston Basin -Water Flood Implementation Plan Drill Horizontals Unitize Field Re-pressure Reservoir Secondary Recovery Tertiary Recovery6 months | 3 years | 6 months | 10-20 years | …Activity Timeline Current Status of Fields North Grano West Greene Eden Valley Flaxton Lake Darling Lake View Portal Pratt Mohall Glenburn East Flaxton SW Glenburn U. Des Lac Wheaton Woburn X Drill Horizontals Unitize WoburnXXXXXXXXXXXXXXX0.00.51.01.52.02.53.0200720082009201020112012201320142015201620172018201920202021 Average Daily Net Production (Mboe/d)$0$5$10$15$20$25$30Capital Expenditures ($MM)PROBPUDPDPTotal Capex

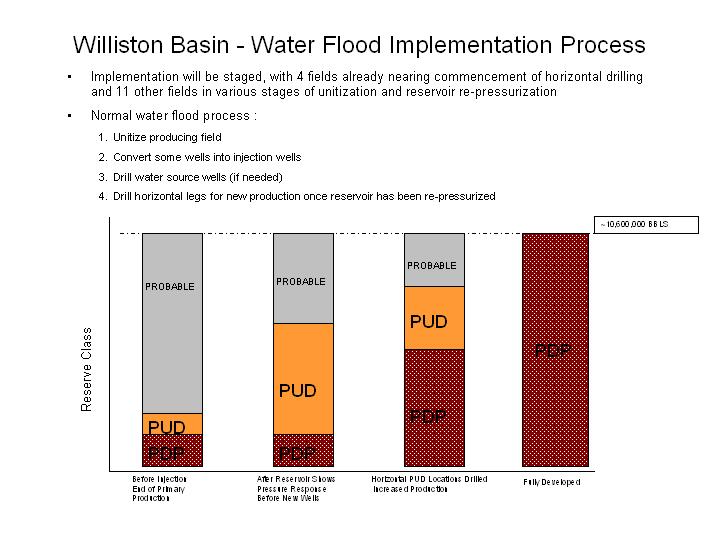

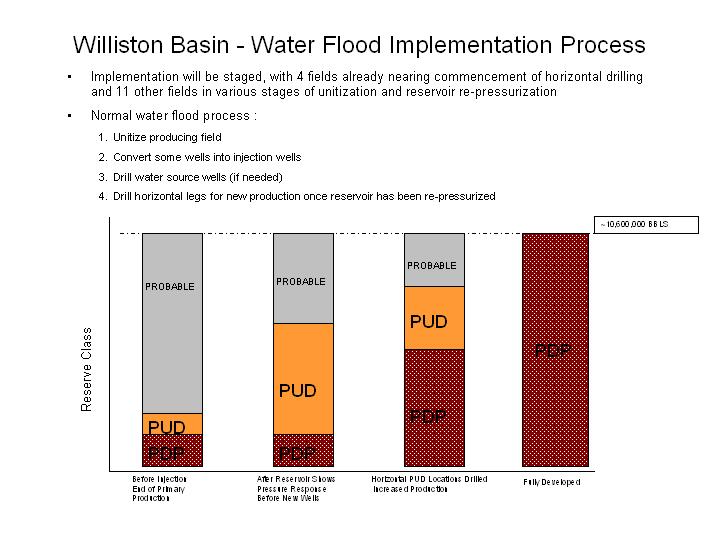

Williston Basin -Water Flood Implementation Process •Implementation will be staged, with 4 fields already nearing commencement of horizontal drilling and 11 other fields in various stages of unitization and reservoir re-pressurization •Normal water flood process : 1. Unitize producing field 2. Convert some wells into injection wells 3. Drill water source wells (if needed) 4. Drill horizontal legs for new production once reservoir has been re-pressurized ~10,600,000 BBLS Before Injection End of Primary Production After Reservoir Shows Pressure Response Before New Wells Horizontal PUD Locations Drilled Increased Production Fully Developed PDP PDPPUDPROBABLEPDPPUDPROBABLEPDPPUDPROBABLE Reserve Class

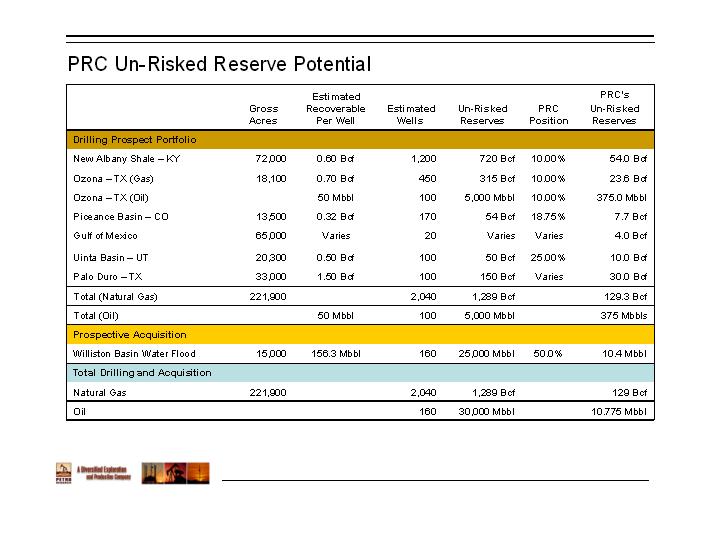

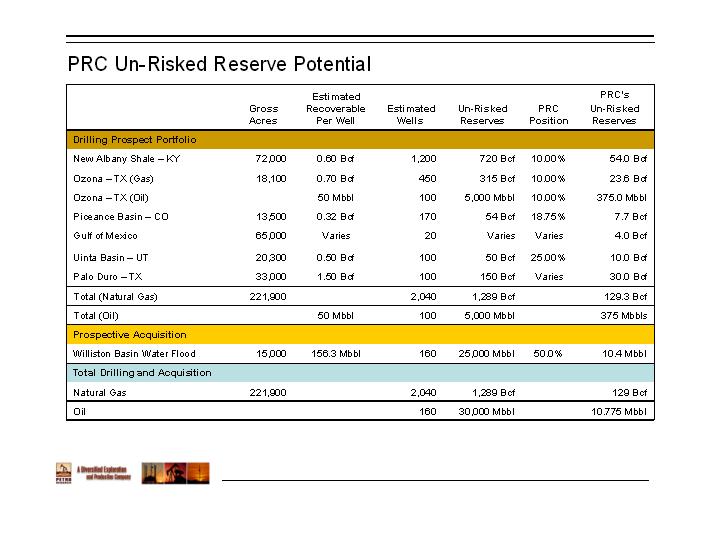

PRC Un PRC Un-Risked Reserve Potential Risked Reserve Potential Gross Acres Estimated Recoverable Per Well Estimated Wells Un-Risked Reserves PRC Position PRC’s Un-Risked Reserves Drilling Prospect Portfolio New Albany Shale - KY 72,000 0.60 Bcf 1,200 720 Bcf 10.00% 54.0 Bcf Ozona - TX (Gas) 18,100 0.70 Bcf 450 315 Bcf 10.00% 23.6 Bcf Ozona - TX (Oil) 50 Mbbl 100 5,000 Mbbl 10.00% 375.0 Mbbl Piceance Basin - CO 13,500 0.32 Bcf 170 54 Bcf 18.75% 7.7 Bcf Gulf of Mexico 65,000 Varies 20 Varies Varies 4.0 Bcf Uinta Basin - UT 20,300 0.50 Bcf 100 50 Bcf 25.00% 10.0 Bcf Palo Duro - TX 33,000 1.50 Bcf 100 150 Bcf Varies 30.0 Bcf Total (Natural Gas) 221,900 2,040 1,289 Bcf 129.3 Bcf Total (Oil) 50 Mbbl 100 5,000 Mbbl 375 Mbbls Prospective Acquisition Williston Basin Water Flood 15,000 156.3 Mbbl 160 25,000 Mbbl 50.0% 10.4 Mbbl Total Drilling and Acquisition Natural Gas 221,900 2,040 1,289 Bcf 129 Bcf Oil 160 30,000 Mbbl 10.775 Mbbl

Valuation Model of Un- Risked Reserve Potential Risked Reserve Potential Gross Un-Risked (1)PRC’s Un-Risked Revenue is a modeling of future revenue potential illustrated by multiplying PRC’s Un-Risked Reserves by $6.00 per Mcff or gas or $50 per Bbl of oil. This is simply used to illustrate value of Un-Risked Reserve potential as expressed in terms of production using current prices for natural gas and oil production as of the date prepared. This is not intended as a forecast of actual future revenues. (2) In Ground Value (“IGV”) is a calculation designed to place a potential value on the net un-risked reserves of projects or prospects in the ground. The IGV is calculated by multiplying the net un-risked reserves for a product or prospect, expressed in Mcfor Bbl as appropriate (“NUR”) by a recent purchase price for reserves in the ground (“Price”) paid by publicly traded companies. Price assumptions in the above model are $15.00 per BO and $2.50 per Mcf. Therefore, the formula would be represented as IGV = NUR x Price. For example, 1,000,000 BO un-risked reserves in the ground would yield an IGV of $15,000,000 (1,000,000 BO x $15.00/BO = $15,000,000). IGV and Un-Risked Revenue are calculations based on un-risked reserves (usually prior to drilling) and this un-risked value is subject to being reduced by a myriad of risk factors. Some of the risks include, but are not limited to, geological risks, reservoir size, reservoir quality, drilling, completion, engineering, cost overrun, commodity pricing, andgoods and services pricing. Each prospect will have its unique set of risks. Reserves PRC Position PRC’s Un-Risked Reserves PRC’s Un-Risked Revenue($MM)(1) In-Ground Value ($MM)(2) Drilling Prospect Portfolio New Albany Shale - KY 720 Bcf 10.00% 54.0 Bcf $324.00 $135.00 Ozona - TX (Gas) 315 Bcf 10.00% 23.6 Bcf $141.75 $59.06 Ozona - TX (Oil) 5,000 Mbbls 10.00% 375.0 Mbbls $18.75 $5.63 Piceance Basin - CO 54 Bcf 18.75% 7.7 Bcf $45.90 $19.13 Gulf of Mexico Varies Varies 4.0 Bcf $24.00 $10.00 Uinta Basin - UT 50 Bcf 25.00% 10.0 Bcf $60.00 $25.00 Palo Duro - TX 150 Bcf 25.00% 30.0 Bcf $180.00 $75.00 Total (Natural Gas) 1,289 Bcf 129.3 Bcf $775.65 $323.19 Total (Oil) 5,000 Mbbls 375 Mbbls $18.75 $5.63 Prospective Acquisition Williston Basin Water Flood 25,000 Mbbls 50.00% 9,375 Mbbls $468.75 $140.63 Total Natural Gas 1,289Bcf 129 Bcf $775.65 $323.19 Oil 30,000 Mbbls 9,750Mbbls $487.50 $140.63 Grand Total $1,263.15 $463.82

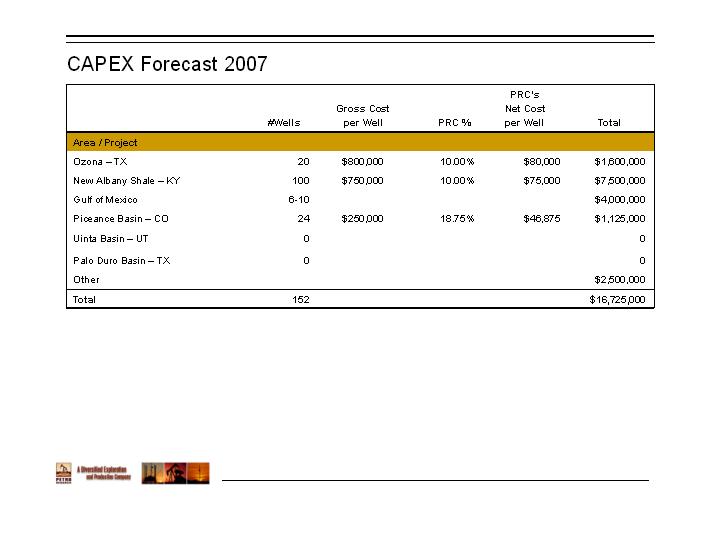

CAPEX Forecast 2007 #Wells Gross Costper Well PRC % PRC’s Net Cost per Well Total Area / Project Ozona -TX 20 $800,000 10.00% $80,000$1,600,000 New Albany Shale -KY 100 $750,000 10.00% $75,000$7,500,000 Gulf of Mexico 6-10 $4,000,000 Piceance Basin -CO 24 $250,000 18.75% $46,875$1,125,000 Uinta Basin -UT 0 0 Palo Duro Basin -TX 0 0 Other $2,500,000 Total 152 $16,725,000

Contact Information 5100 Westheimer, Suite 200 Houston, TX 77056 Office: 713-968-9282 Fax: 713-968-9283 Website: www.petroresourcescorp.com Wayne P. Hall -Chief Executive Officerwhall@petroresourcescorp.com ⑀⍽Donald L. Kirkendall-Presidentdkirk@petroresourcescorp.com Petro Resources Corporation

24