Exhibit 99.2

Petro Resources Gwowth Perspectives Prichard Capital Partners LLC "Energize 2008" San Francisco, CA

Forward Looking Statements The statements contained in this presentation that are not historical are “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), including statements, without limitation, regarding the Company’s expectations, beliefsintentionsorstrategiesregardingthefutureSuchforwardlookingstatementsrelatetobeliefs, intentions or strategies regarding the future. Such forward-looking statements relate to, among other things: (1) the Company’s proposed exploration and drilling operations on its various properties, (2) the expected production and revenue from its various properties, and(3) estimates regarding the reserve potential of its various properties. These statements are qualified by important factors that could cause the Company’s actual results to differ materially fromthosereflectedbytheforward-lookingstatementsSuchfactorsincludebutarenotlimitedfrom those reflected by the forward-looking statements. Such factors include but are not limited to: (1) the Company’s ability to finance the continued exploration and drilling operations on its various properties, (2) positive confirmation of the reserves, production and operating expenses associated with its various properties; and (3) the general risks associated with oil and gas exploration and development, including those risks and factors described from time to time in the Company’s reports and registration statements filed with the Securities and Exchange Companys reports and registration statements filed with the Securities and Exchange Commission, including but not limited to the Company’s definitive prospectus dated October 30, 2007 filed with the Securities and Exchange Commission on October 31, 2007 and the Quarterly Report on Form 10-QSB for the three months ended September 30, 2007. The Company cautions readers not to place undue reliance on any forward-looking statements. The Company does not undertake, and specifically disclaims any obligation, to update or revise such ,pyyg,p statements to reflect new circumstances or unanticipated events as they occur.

PRC Management Wayne P. Hall–CEO & Chairman of the Board—26 years exploration industry experience —Co-founder and President, Hall-Houston Oil Company (1983)py()Donald L. Kirkendall–President—26 years E&P, natural gas marketing and pipeline experience—Co-founded gas marketing company and Texas Gulf Coast E&P company Harry Lee Stout–CFO & General Counsel —29 years exploration and energy industry experience —Former President of KCS Energy Services, Inc. Allen McGee Chief Accounting Officer —35 years energy industry experience —Former Controller for Williams Exploration Company

Company Overview PRC Overview Reserve Base Business Strategy Partners in Growth

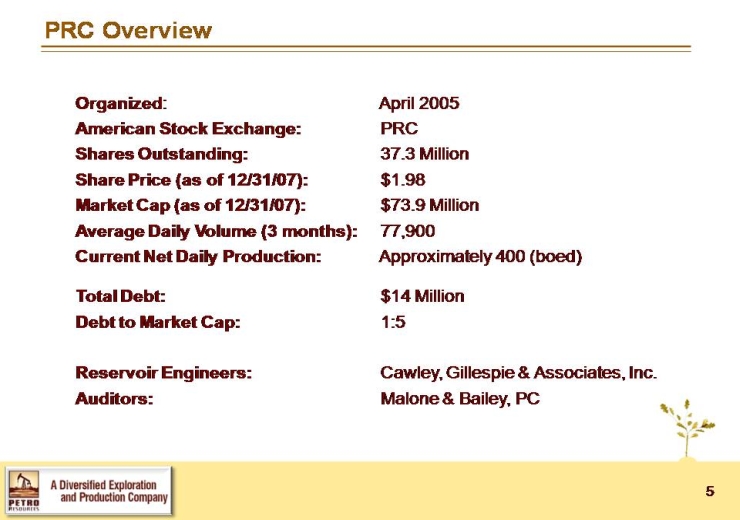

PRC Overview Organized: April 2005 American Stock Exchange: PRC Shares Outstanding: 37.3 Million Share Price (as of 12/31/07): $1.98 Market Cap (as of 12/31/07): $73.9 Million Average Daily Volume (3 months): 77,900 Current Net Daily Production: Approximately 400 (boed) Total Debt: $14 Million Debt to Market Cap 1:5 Reservoir Engineers: Cawley, Gillespie & Associates, Inc. Auditors: Malone & Bailey, PC

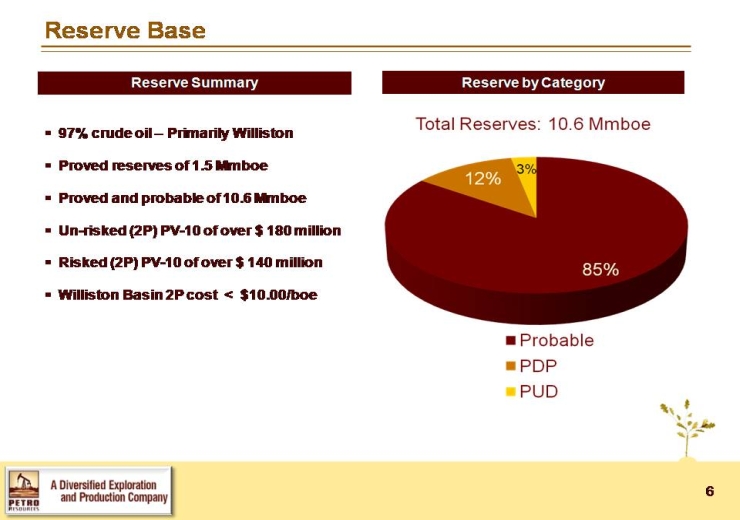

Reserve Base Reserve Summary97% crude oil –Primarily Williston Reserve by Category 97% crude oil –Primarily Williston Proved reserves of 1.5 Mmboe Proved and probable of 10.6 MmboeProb Un-risked (2P) PV-10 of over $ 180 millionRisked (2P) PV-10 of over $ 140 millionWillistonBasin2Pcost<$1000/boe

Business Strategy Growth of reserves and production by:–Drilling of low risk prospects balanced with potential “impact” wells –Secondary recovery projects in North Dakota Secondary recovery projects in North Dakota Strategic alliances with companies having significant competitive advantages Geologic and geographic diversification; onshore and offshoreSmall staff, low G&A, maximize capital available for growth Continue quest for prospects and projects with development potential

Eagle Operating, Inc. (Kenmare, ND) Approach Resources, Inc. (Fort Worth, TX) Hall-Houston Exploration (Houston, TX)

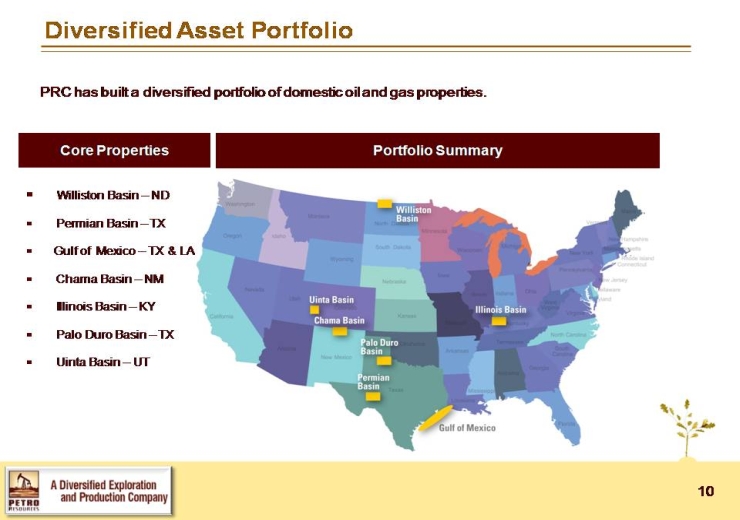

Properties Producing Properties –Williston Basin: North Dakota –Permian Basin: Texas–Gulf of Mexico Drilling Prospects –Chama Basin: New Mexico –Illinois Basin: Kentucky Palo Duro Basin: Texas –Unita Basin: Utah

Diversified Asset Portfolio PRC has built a diversified portfolio of domestic oil and gas properties. Core Properties Portfolio Summary Williston Basin –ND PermianBasinTX Gulf of Mexico –TX & LAChama Basin –NM Illinois Basin –KY Palo Duro Basin –TX Uinta Basin –UT

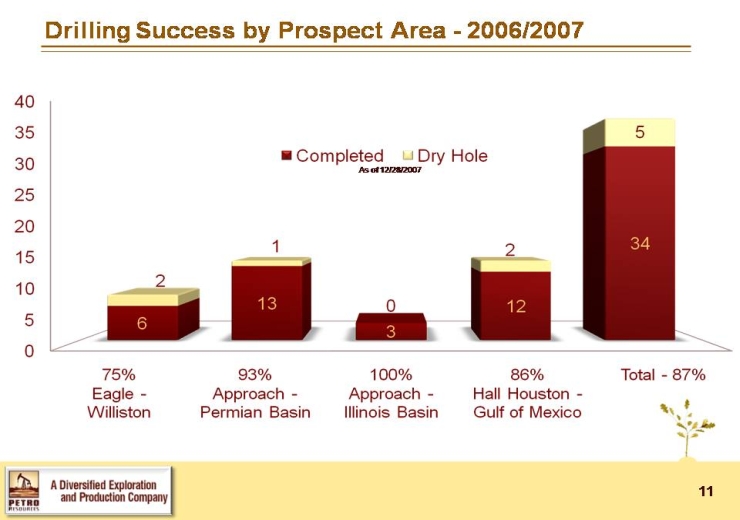

Drilling Success by Prospect Area -2006/2007 40 35 30 25 20 15 10 5 0 75% 93% 100% 85% Total – 87% Eagle – Williston Approach – Permian Basin Approach – Illinois Basin Hal Houston-Gulf of Mexico

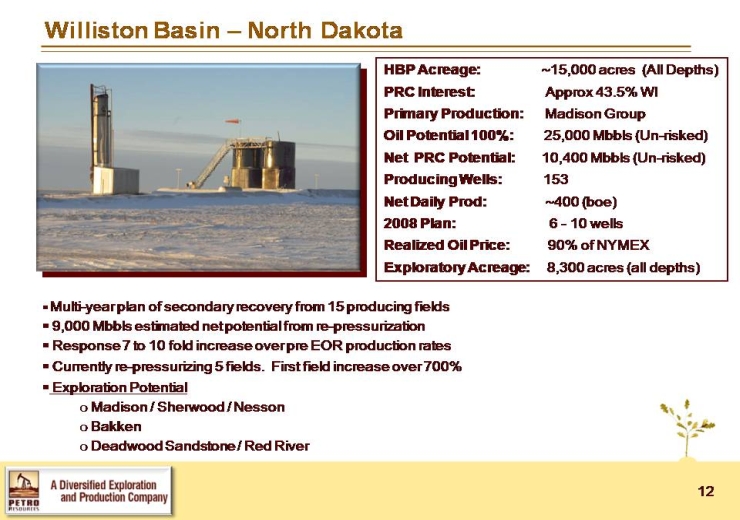

Williston Basin –North Dakota HBP Acreage: 15,000 acres (All Depths) PRC Interest: Approx 43.5% WIPrimary Production: Madison Group Oil Potential 100%: 25,000 Mbbls (Un-risked) Net PRC Potential: 10,400 Mbbls (Un-risked)Producing Wells: 153 Net Daily Prod: ~400 (boe) 2008Plan:610wells Realized Oil Price: 90% of NYMEXExploratory Acreage: 8,300 acres (all depths) Multi-year plan of secondary recovery from 15 producing fields9,000 Mbbls estimated net potential from re-pressurizationResponse 7 to 10 fold increase over pre EOR production rates Currently re-pressurizing 5 fields. First field increase over 700%Cueyepessug5edssedceaseoe00% Exploration Potential Madison / Sherwood / Nesson oBakkenoDeadwoodSandstone/RedRiver

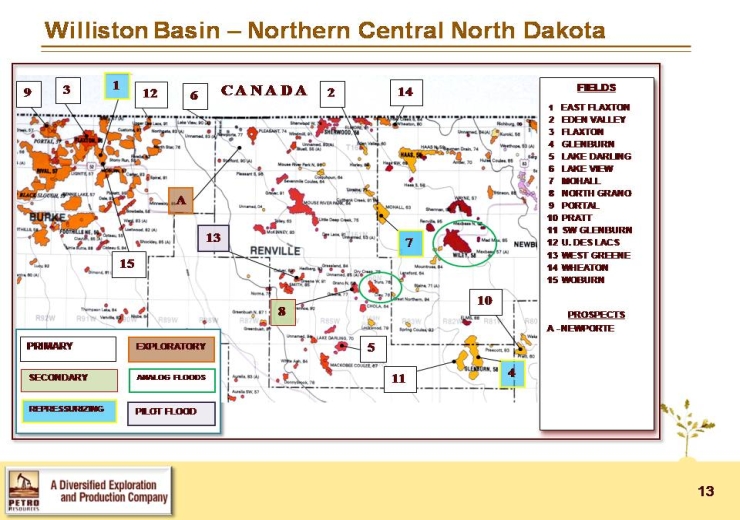

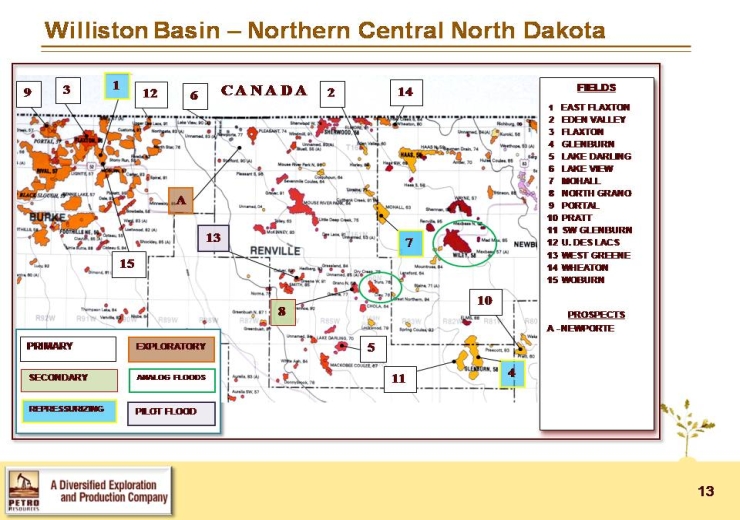

Williston Basin –Northern Central North Dakota FIELDS EAST FLAXTON2 EDEN VALLEY3 FLAXTON4 GLENBURN 5 LAKE DARLING6 LAKE VIEW7 MOHALL8 NORTH GRANO9 PORTAL10 PRATT 11 SW GLENBURN12 U. DES LACS13 WEST GREENE14 WHEATON15 WOBURN PROSPECTS A-NEWPORTE primary secondary repressurizing exploratory analog floods pilot flood

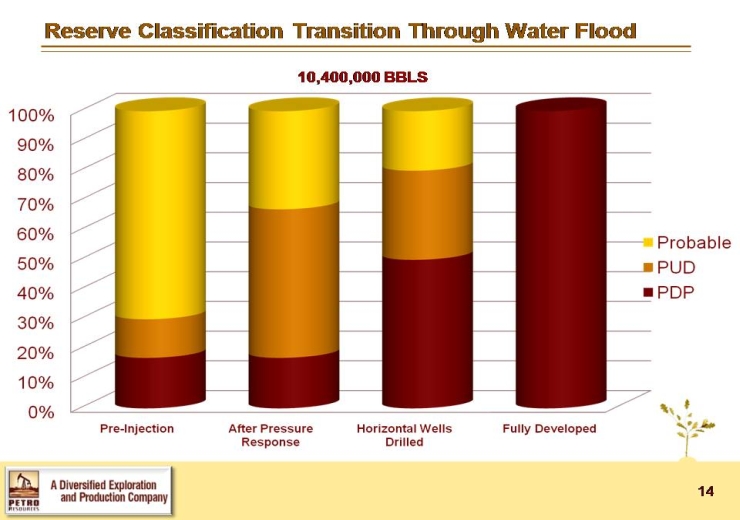

Reserve Classification Transition Through Water Flood 10400000BBLS 100% 90% 80% 70% 60% 50% 40% 30% 20% 10% 0% Pre-Injection After Pressure Response Horizontal Wells Drilled Fully Developed Probable PUD PDP

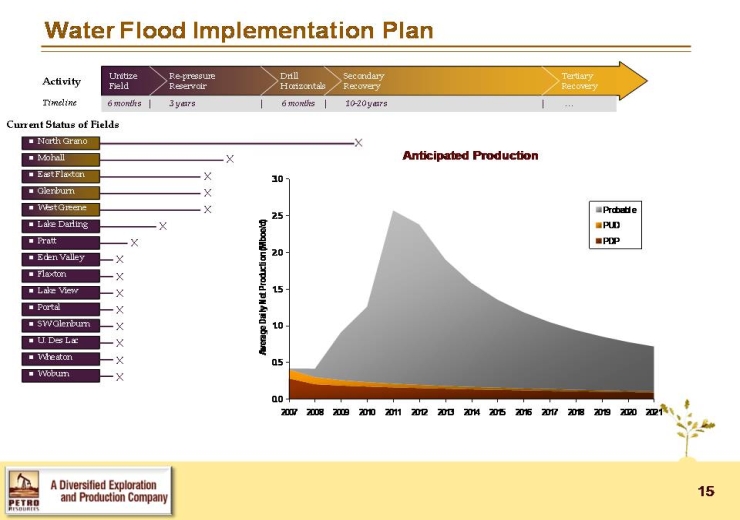

Water Flood Implementation Plan ActivityTimelineCurrent Status of Fields Utilize Field 6 months Re-pressure Reservoir 3 years Drill Horizontals 6 months Secondary Recovery 10-20 years Teriary Recovery … North Grano Mohall East Flaxton Glenburn West Greene Lake Darling Pratt Eden Valley Flaxton Lake View Portal SW Glenburn U. Des Lac Wheaton Woburn Anticipated Production 3.002.502.01.501.000.500.0 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 23018 2-19 2020 2021 Probable PUD PDP

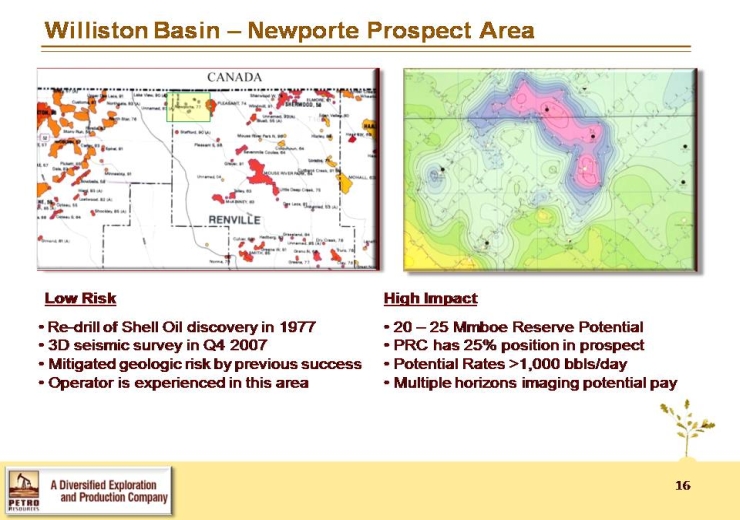

Williston Basin –Newporte Prospect Area LowRisk High Impact Re-drill of Shell Oil discovery in 1977 3D seismic survey in Q4 2007 Mitigated geologic risk by previous success Operator is experienced in this area 20 –25 Mmboe Reserve Potential PRC has 25% position in prospect Potential Rates >1,000 bbls/day Multiple horizons imaging potential pay

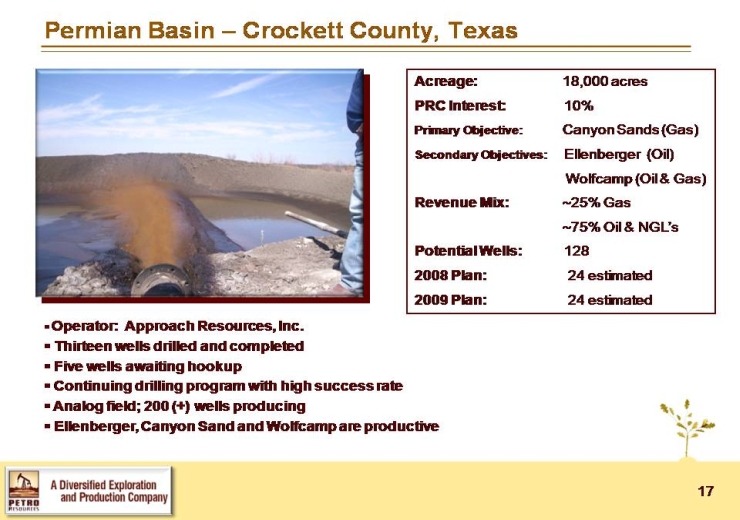

Permian Basin –Crockett County, Texas Acreage: 18,000 acresPRC Interest: 10%Primary Objective:Canyon Sands (Gas) Secondary Objectives: Ellenberger (Oil)Wolfcamp (Oil & Gas)Revenue Mix:~25% Gas ~75% Oil & NGL’sPotential Wells: 128 2008 Plan: 24 estimated 2009Pl24titd Operator: Approach Resources, Inc. Thirteen wells drilled and completedFivewellsawaitinghookup Continuing drilling program with high success rateAnalog field; 200 (+) wells producingEllenberger, Canyon Sand and Wolfcamp are productive

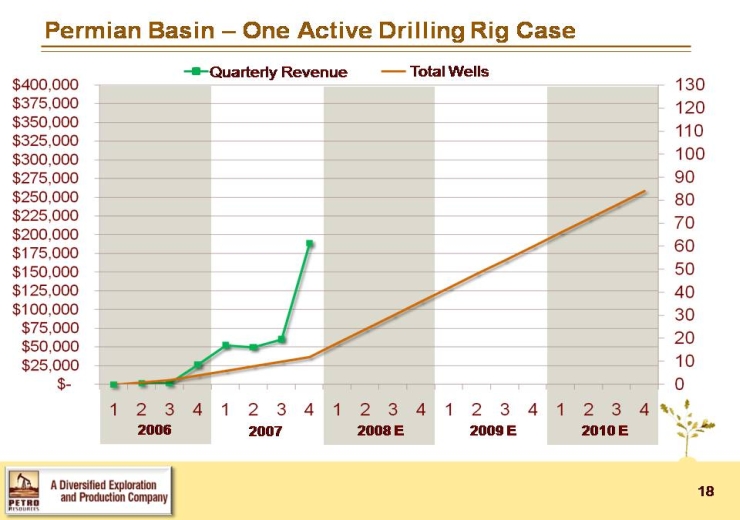

Permian Basin –One Active Drilling Rig Case Quarterly Revenue Total Wells 200620072008E2009E2010E

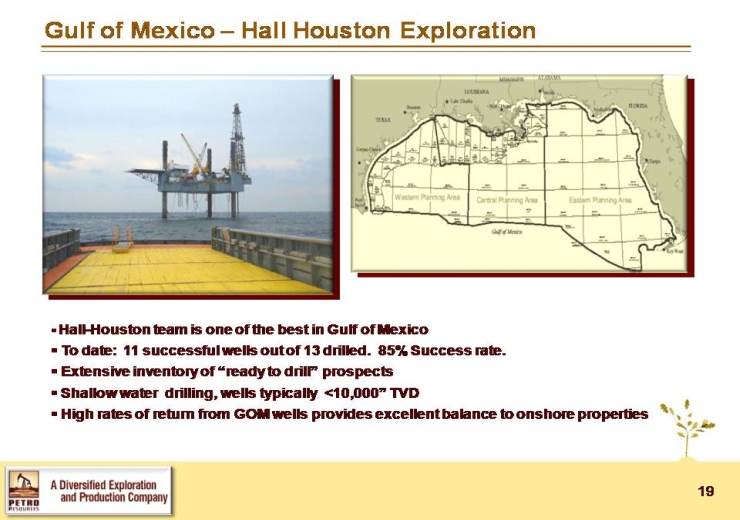

Gulf of Mexico –Hall Houston Exploration Hall-Houston team is one of the best in Gulf of Mexico To date: 11 successful wells out of 13 drilled. 85% Success rate. Extensive inventory of ready to drill prospects Shallow water drilling, wells typically <10,000” TVD High rates of return from GOM wells provides excellent balance to onshore properties

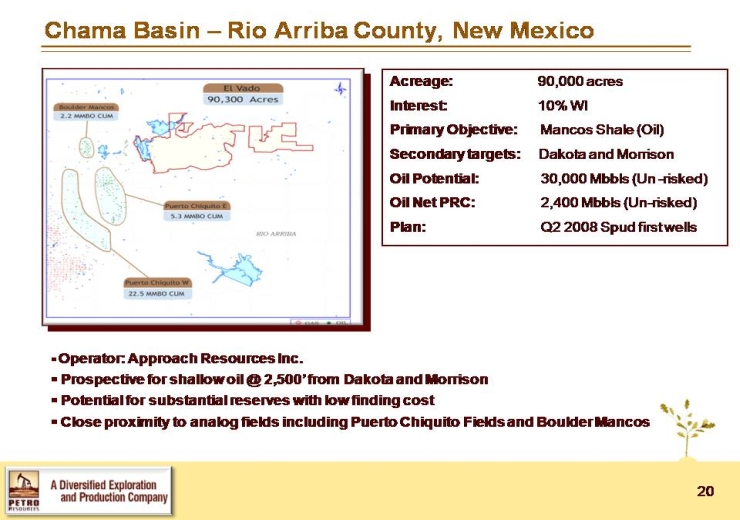

Chama Basin –Rio Arriba County, New Mexico Acreage:90,000 acres Interest:10% WIPrimary Objective: Mancos Shale (Oil) Secondary targets: Dakota and MorrisonOil Potential: 30,000 Mbbls (Un -risked)Oil Net PRC:2,400 Mbbls (Un-risked) Plan: lQ2 2008 Spud first wells Operator: Approach Resources Inc. Prospective for shallow oil @ 2,500’ from Dakota and Morrison Potential for substantial reserves with low finding cost Close proximity to analog fields including Puerto Chiquito Fields and Boulder Mancos

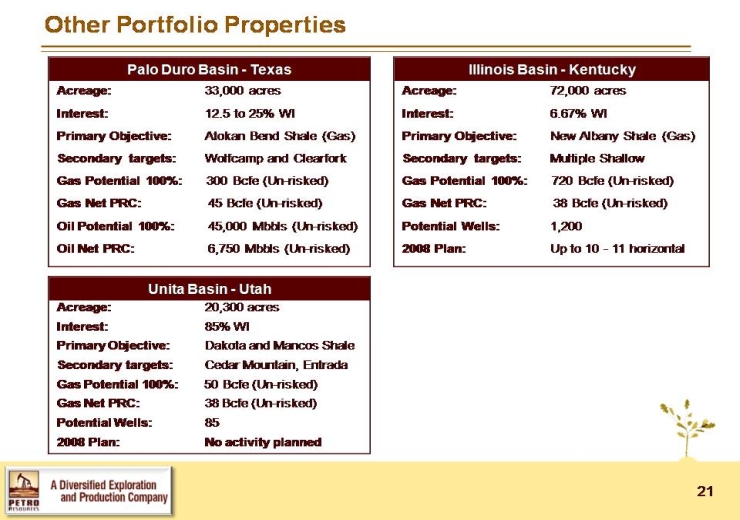

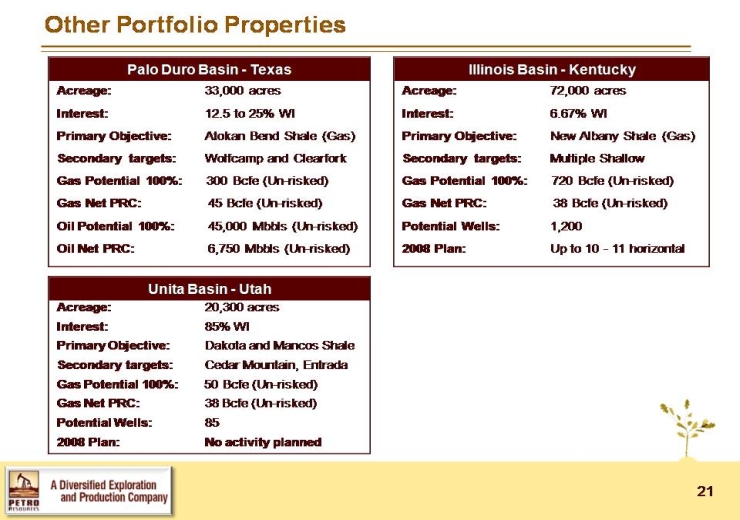

Other Portfolio PropertiesPaLO Duro Basin – Texasd Illinois Basin – Kentucky Unita Basin – Utah Acreage:33,000 acres Interest:12.5 to 25% WIPrimary Objective: Atokan Bend Shale (Gas) Secondary targets: Wolfcamp and ClearforkGas Potential 100%: 300 Bcfe (Un-risked)Gas Net PRC:45 Bcfe (Un-risked) Oil Potential 100%: 45000Mbbl(Uikd) Oil Net PRC:6,750 Mbbls (Un-risked) Acreage:72,000 acres Interest:6.67% WIPrimary Objective: New Albany Shale (Gas) Secondary targets: Multiple ShallowGas Potential 100%: 720 Bcfe (Un-risked)Gas Net PRC:38 Bcfe (Un-risked) Potential Wells:1,200 2008 Plan:Up to 10 -11 horizontal Acreage:20,300 acres Interest:85% WIPrimary Objective: Dakota and Mancos Shale Secondary targets: Cedar Mountain, Entrada Gas Potential 100%: 50 Bcfe (Un-risked)Gas Net PRC:38 Bcfe (Un-risked)Potential Wells:852008 Plan: No activity planned

Summary Growth Highlights Financial Summary Contact Information

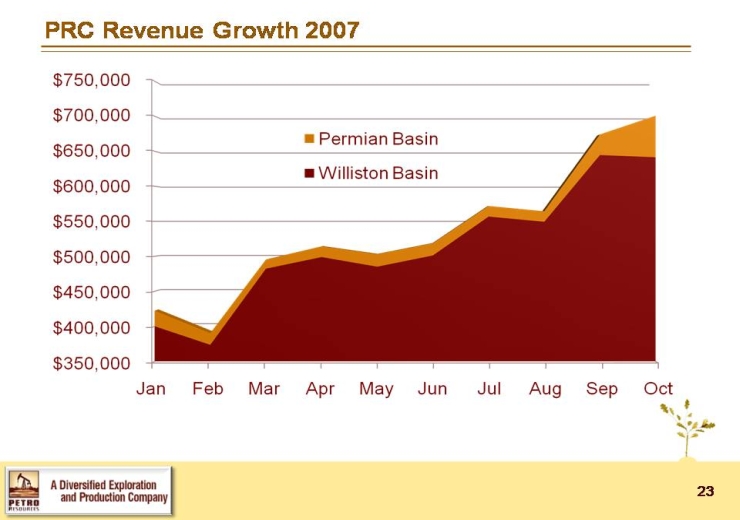

PRC Revenue Growth 2007 Jan Feb Mar Apr May Jun Jul Aug Sep Oct Permian Basin Williston Basin $350,000 $400,000 $450,000 $500,000 $550,000 $600,000 $650,000 $700,000 $750,000

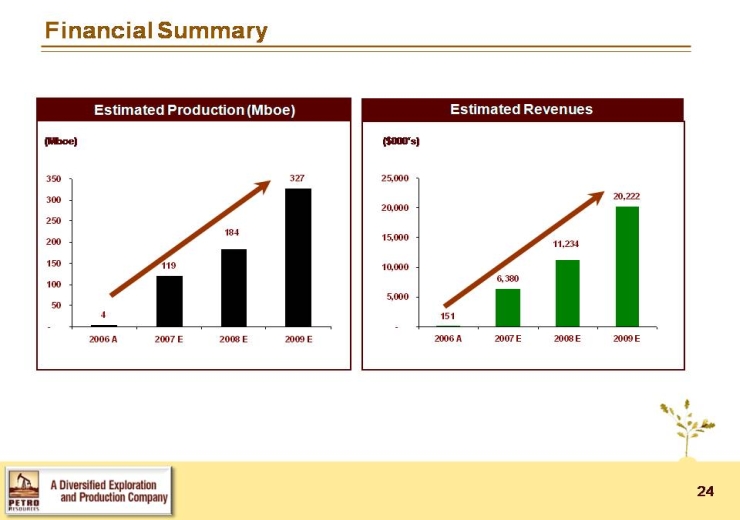

Financial Summary Estimated Production (Mboe) Estimated Revenues 2006 A 2007 E 2008 E 2009 E 2006 A 2007 E 2008 E 2009 E 4 119 184 327 151 6,380 11,234 20,222 50 100 150 200 250 300 350 5,000 10,000 15,000 20,000 25,000 ($000’s)

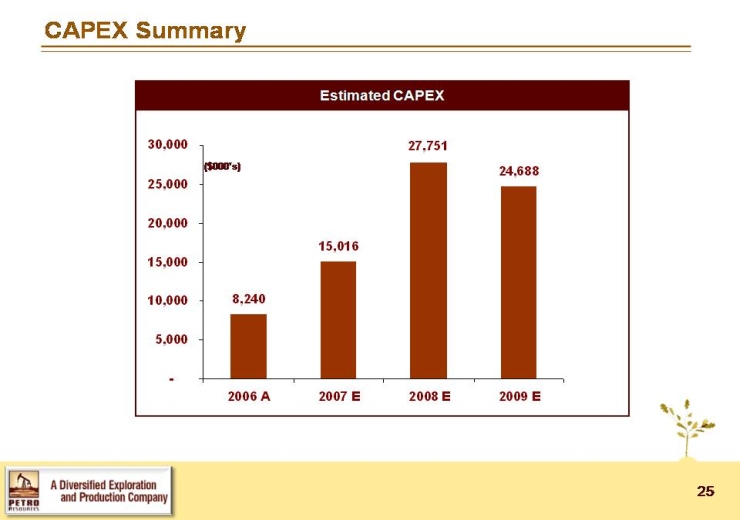

CAPEX Summary 30,000 25,000 20,000 15,000 10,000 5,000 2006 A 2007 E 2008 E 8,240 15,016 27,751 24,688 2009 E

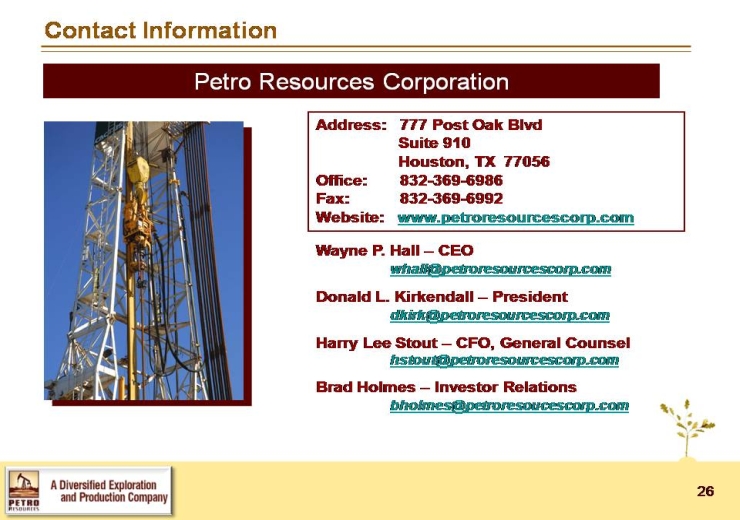

Contact Information Petro Resources Corporation Address: 777 Post Oak BlvdSuite910Suite 910Houston, TX 77056Office: 832-369-6986 Fax: 832-369-6992Website: Wayne P. Hall –CEOwhall@petroresourcescorp.com Donald L. Kirkendall –President dkirk@petroresourcescorp.comwww.petroresourcescorp.com Harry Lee Stout –CFO, General Counselhstout@petroresourcescorp.com Brad Holmes –Investor Relationsbholmes@petroresoucescorp.com