Exhibit 99.2

Growth Perspectives Oil and Gas Investment Symposium April 2008 New York, NY

Forward Looking Statements

The statements contained in this presentation that are not historical are “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), including statements, without limitation, regarding the Company’s expectations, beliefs, intentions or strategies regarding the future. Such forward-looking statements relate to, among other things: (1) the Company’s proposed exploration and drilling operations on its various properties, (2) the expected production and revenue from its various properties, and(3) estimates regarding the reserve potential of its various properties. These statements are qualified by important factors that could cause the Company’s actual results to differ materially from those reflected by the forward-looking statements. Such factors include but are not limited to: (1) the Company’s ability to finance the continued exploration and drilling operations on its various properties, (2) positive confirmation of the reserves, production and operating expenses associated with its various properties; and (3) the general risks associated with oil and gas exploration and development, including those risks and factors described from time to time in the Company’s reports and registration statements filed with the Securities and Exchange Commission, including but not limited to the Company’s Annual Report on Form 10-K for the year ended December 31, 2007 filed on March 31, 2008. The Company cautions readers not to place undue reliance on any forward-looking statements. The Company does not undertake, and specifically disclaims any obligation, to update or revise such statements to reflect new circumstances or unanticipated events as they occur.

PRC Overview Microcap E&P Company focused on developing domestic oil and natural gas reserves through: Secondary recovery efforts in producing oil fields Exploration and development of prospect areas with long Exploration and development of prospect areas with long life reserves and multi-year development programs Diversified portfolio to broaden upside potential and minimize downside risk

PRC Management Wayne P. Hall – CEO & Chairman of the Board —26 years exploration industry experience —Co-founder and President, Hall-Houston Oil Company (1983) Don Kirkendall–President —26 years in E&P, gas marketing and natural gas pipeline industry —Co-founded and managed a successful E&P Company and a gas marketing company Jim Denny–Chief Operating Officer —Petroleum Engineer and Certified Geologist —35 years technical energy industry experience —Former President & CEO of Gulf Energy Management Company Harry Lee Stout–CFO & General Counsel —29 years exploration and energy industry experience —Former President of KCS Energy Services, Inc. Allen McGee–Chief Accounting Officer—35 years energy industry accounting experience —Former Controller for Williams Exploration Company

Company Overview Overview Objectives Reserve Summary 2008 CAPEX

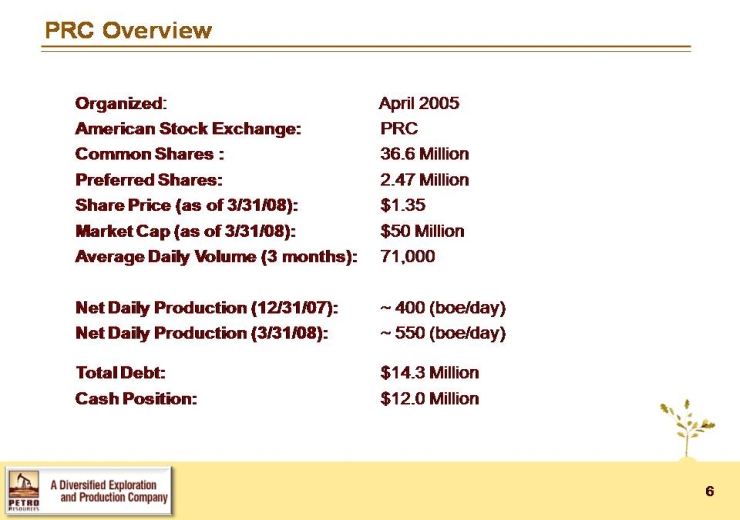

PRC Overview Organized: April 2005American Stock Exchange:PRC Common Shares :36.6 Million Preferred Shares: 2.47 Million Share Price (as of 3/31/08): $1.35 Market Cap (as of 3/31/08): $50 MillionAverage Daily Volume (3 months):71,000 Net Daily Production (12/31/07):~ 400 (boe/day)Net Daily Production (3/31/08):~ 550 (boe/day) Cash Position: $12.0 Million Total Dbt: $14.3 Million

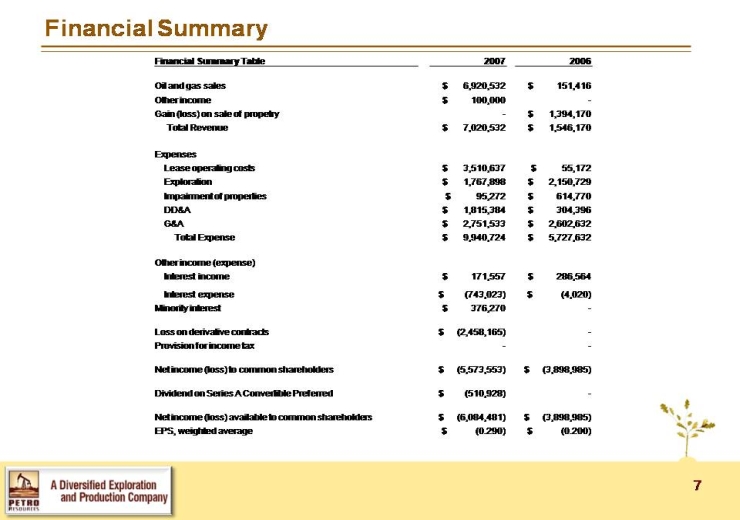

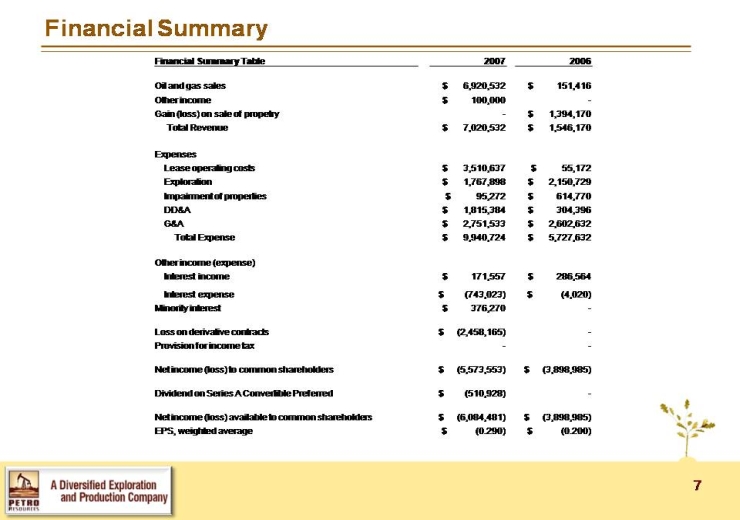

Financial Summary Financial Summary Table 20072006 Oil and gas sales$ 6,920,532 $ 151,416 Other income$ 100,000 -Gain (loss) on sale of propetry -$ 1,394,170 Total Revenue$ 7,020,532 $ 1,546,170 ExpensesLease operating costs$ 3,510,637 $ 55,172 Exploration$ 1,767,898 $ 2,150,729 Impairment of properties$ 95,272 $ 614,770 DD&A$ 1,815,384 $ 304,396 G&A$ 2,751,533 $ 2,602,632 Total Expense$ 9,940,724 $ 5,727,632 Other income (expense)Interest income$ 171,557 $ 286,564 Minority interest$ 376,270 -Loss on derivative contracts$ (2,458,165)-Provision for income tax—interest expense $(743,023) (4,020) Dividend on Series A Convertible Preferred$ (510,928)-Net income (loss) available to common shareholders $ (6,084,481)$ (3,898,985)EPS, weighted average$ (0.290)$ (0.200)

Net income (loss) available to common shareholders $ (6,084,481) $(3,898,985)

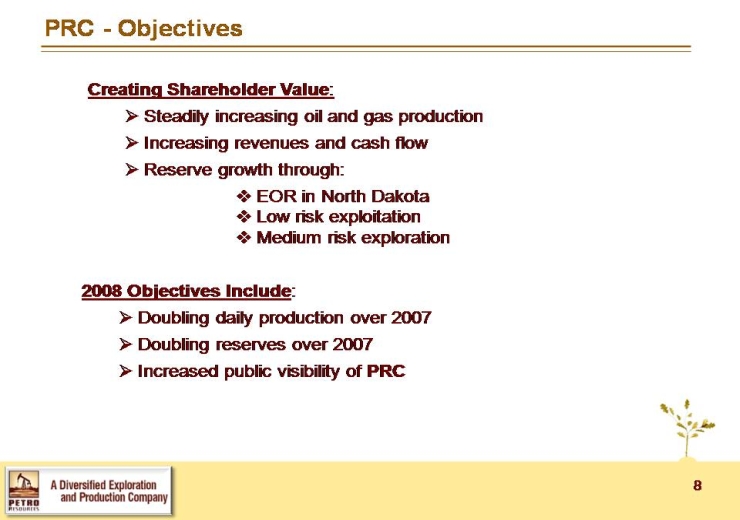

PRC –Objectives Creating Shareholder Value: Steadily increasing oil and gas production Increasing revenues and cash flow Reserve growth through: EOR in North Dakota Low risk exploitation Medium risk exploration Doubling daily production over 2007 Doubling reserves over 2007 2008 Objectives Include: Increased public visibility of PRC

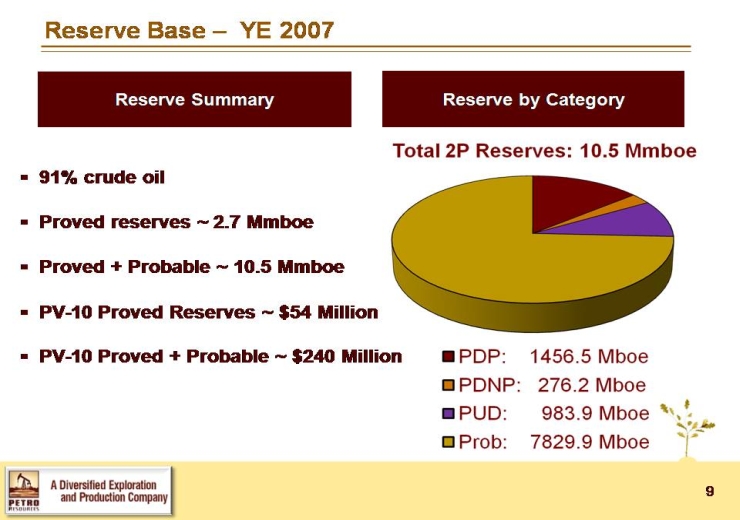

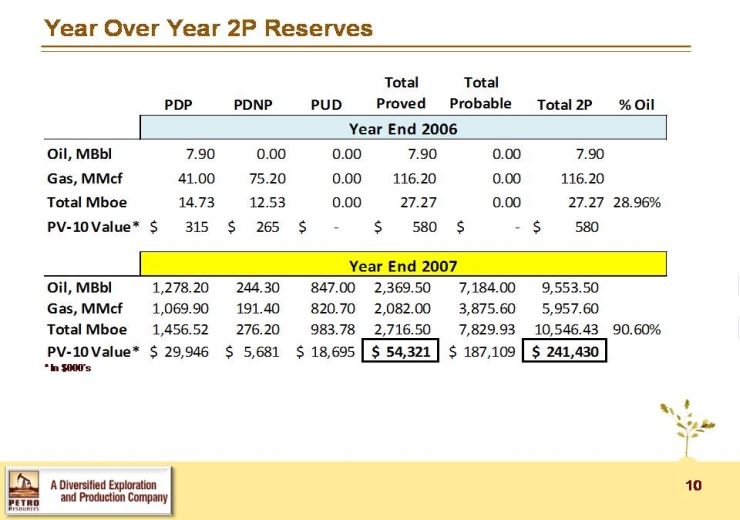

Reserve Base –YE 2007 Reserve Summary Reserve by Category 91% crude oil Proved + Probable ~ 10.5 Mmboe PV-10 Proved Reserves ~ $54 Million PV-10 Proved + Probable ~ $240 Million Proved reserves 2.7 Mmboe Total 2P Reserves: 10.5 Mmboe PDP PDNP PUD Prob 1456.5 276.2 983.9 7829.9 Mboe

Year Over Year 2P Reserves PDPPDNPPUDTotalProvedTotalProbableTotal2P%Oil YearEnd2006 lblOil,MBbl7.900.000.007.900.007.90Gas,MMcf41.0075.200.00116.200.00116.20 TotalMboe14.7312.530.0027.270.0027.2728.96% PV10Vl*315$265$$$580$580$PV10Value*315$265$$$580$580$Oil,MBbl1,278.20244.30847.002,369.507,184.009,553.50YearEnd2007 Gas,MMcf1,069.90191.40820.702,082.003,875.605,957.60TotalMboe1,456.52276.20983.782,716.507,829.9310,546.4390.60%PV10Value*29,946$5,681$18,695$54,321$187,109$241,430$

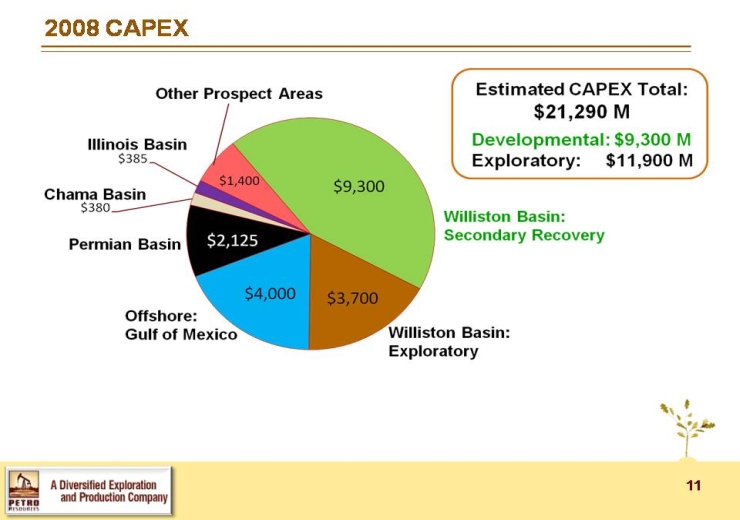

2008 CAPEX Other Prospect Areas Illinois Basis Chama Basis Permian Basis Offshore: Gulf of Mexico Williston Basin: Exploratory Williston Basis: Secondary Recovery $385 $380 $1,400 $2,125 $4,000 $3,700 $9,300 Estimated CAPEX Total: $21,290 M Developmental: $9,300 M Exploratory: $11,9020 M

Properties Producing PropertiesWilliston Basin: North Dakota–Permian Basin: Texas Gulf of Mexico Drilling Prospects–Chama Basin: New Mexico–Illinois Basin: Kentucky

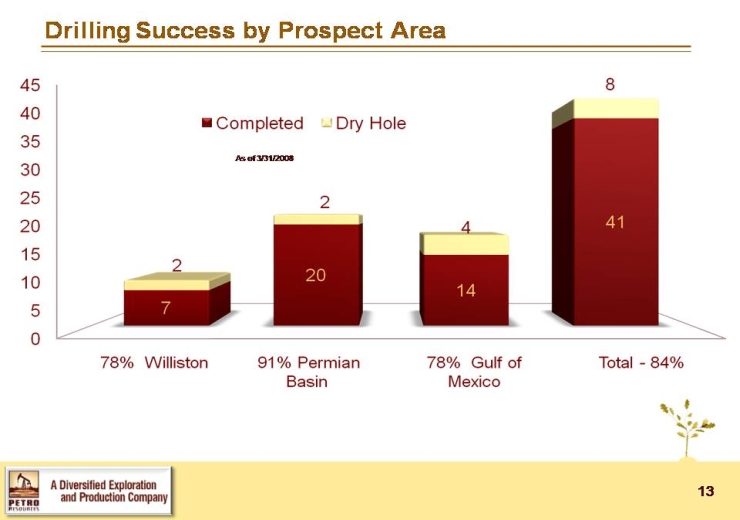

Drilling Success by Prospect Area As of 3/31/2008 45 40 35 30 25 20 15 0105 0 Completed Dry Hole 78% Williston 91% Permian Basis 78% Gulf of Mexico Total – 84%

Williston Basin: North Dakota

Williston Basin Long Life Production Base Secondary Recovery Upside Exploration Prospects 3 Key Attractions:

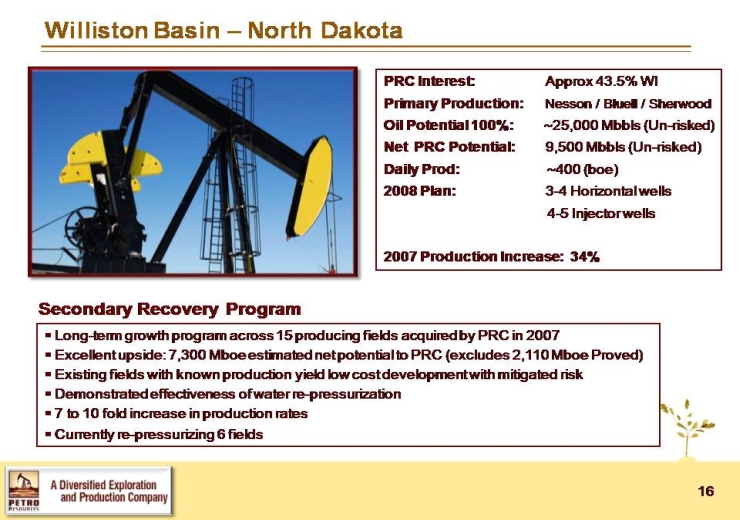

Williston Basin –North Dakota PRC Interest: Approx 43.5% WIPrimary Production: Nesson/ Bluell/ SherwoodOil Potential 100%: ~25,000 Mbbls(Un-risked) Daily Prod: ~400 (boe) 2008 Plan: 3-4 Horizontal wells4-5 Injector wells 2007 Production Increase: 34% Net PRC Potential 9,500 Mbbls (Un-risked) Secondary Recovery Program Long-term growth programacross 15 producing fields acquired by PRC in 2007Excellent upside: 7,300 Mboe estimated net potential to PRC (excludes 2,110 Mboe Proved) Demonstrated effectiveness of water re-pressurization7 to 10 fold increase in production rates Currently re-pressurizing 6 fields Existing fields with know production held low cost development with mitigated risk

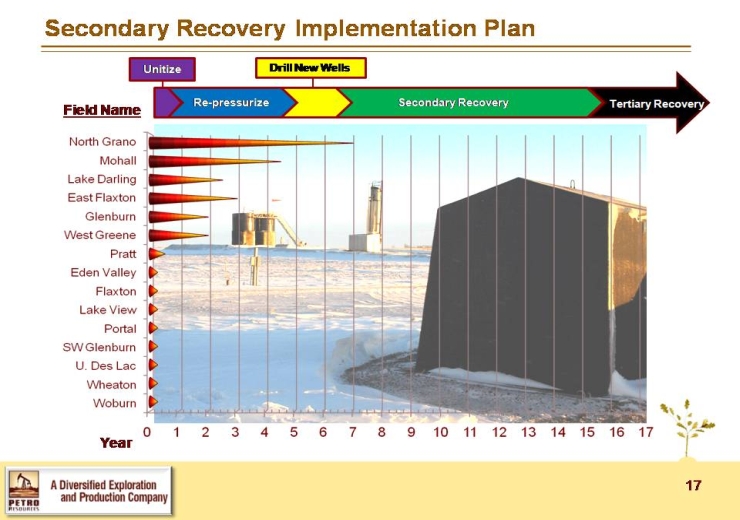

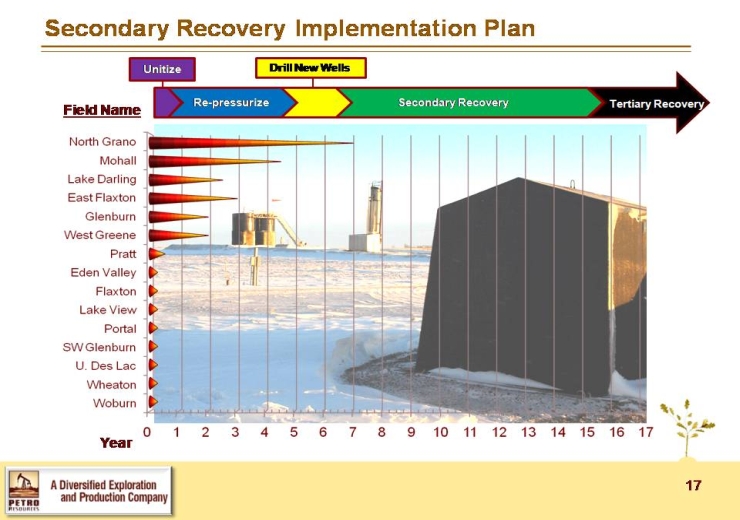

Secondary Recovery Implementation Plan Unitize Drill New Wells Re-pressurize Secondary Recovery Tertiary Recovery Field Name North Grano Mohall Lake Darling East Flason Glenburn West Greene Pratt Eden Valley Flaxton Lake View Portal SW Glenburn U. Des Lac Wheaton Woburn Year 0 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17

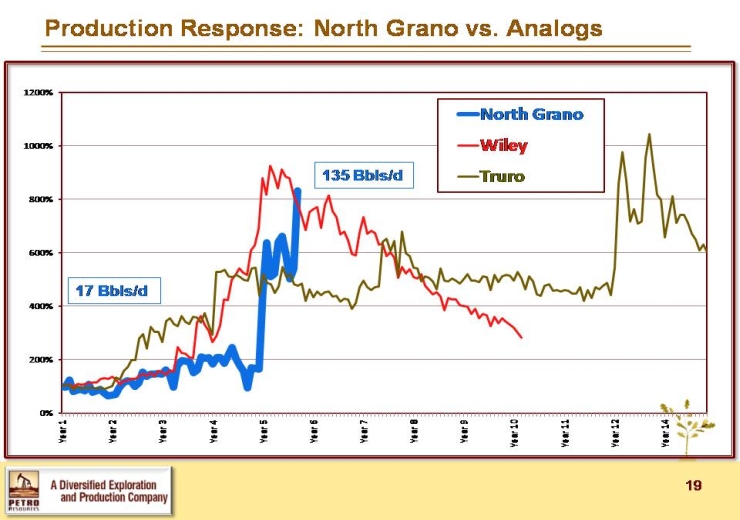

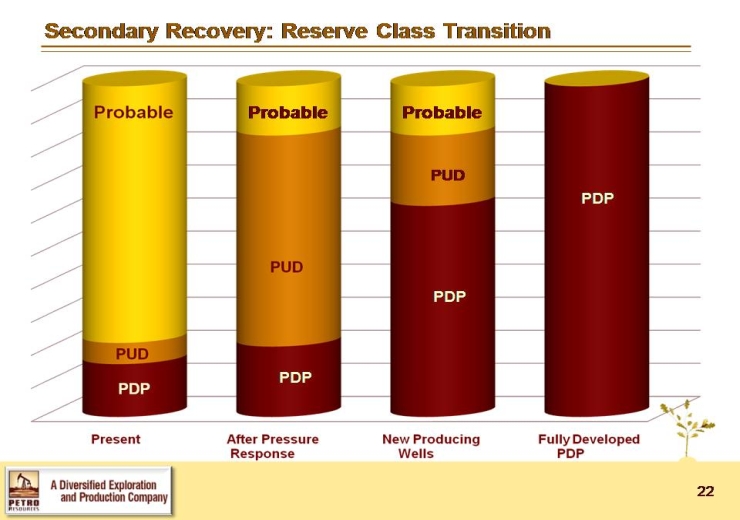

Secondary Recovery Results North GranoUnit fully into secondary recovery Drilled 3 producing wells in 2007 Moved Reserves from PUD to PDP Six fields being re-pressurized Bottom hole pressures are increasing Moved ’07 Reserves from Probable to PUD Increased injection rates are having a positive impact Production per well is improvingThree horizontal wells planned for 2008

Production Response: North Grano vs. Analogs 135 Bbls/d 17 Bbls/d NorthGrano Truro Wiley 0%Year1Year2Year3Year4Year5Year6Year7Year8Year9 Year10Y Year11Y Year12Y Year14Y

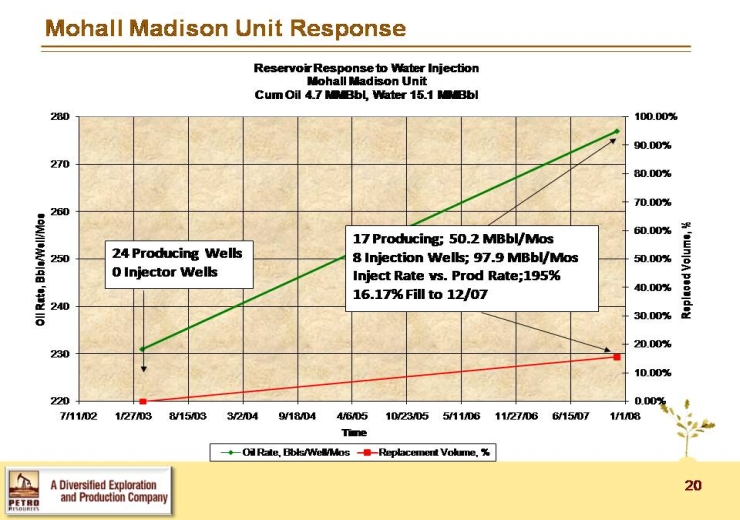

Mohall Madison Unit Response Reservoir Response to Water Injection Mohall Madison Unit Cum Oil 4.7 MMBbl, Water 15.1 MMBbl 70.00%80.00%260270%os40.00%50.00%60.00%250aced Volume, %ate, Bbls/Well/Mo24ProducingWells0InjectorWells17Producing;50.2MBbl/Mos8InjectionWells;97.9MBbl/MosInjectRatevs.ProdRate;195%16.17%Fillto12/0720.00%30.00%230240ReplOil Ra16.17%Fillto12/07 100.00%280 0.00%2207/11/021/27/038/15/033/2/049/18/044/6/0510/23/055/11/0611/27/066/15/071/1/08Time Oil Rate, Bbls/Well/Mos Replacement Volume, %

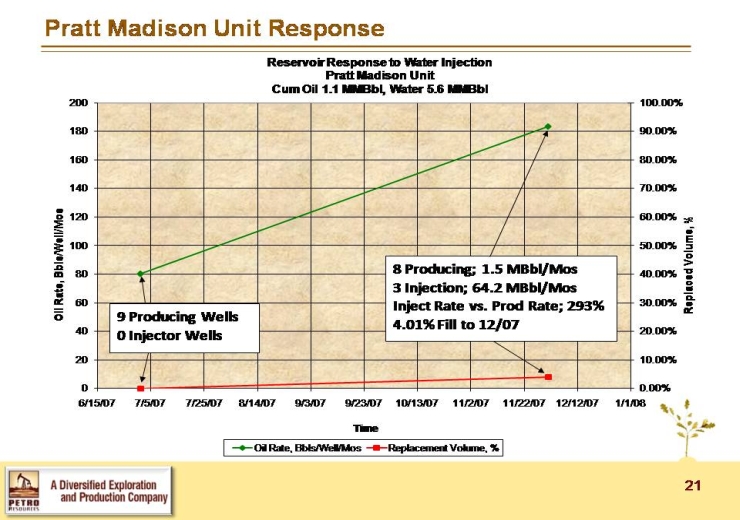

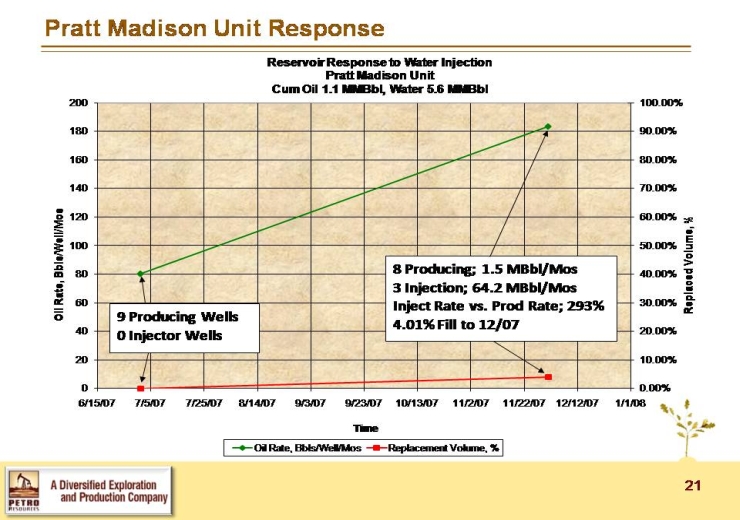

Pratt Madison Unit ResponseReservoir Response to Water InjectionPrattMadisonUnit90.00%100.00%180200Pratt Madison UnitCum Oil 1.1 MMBbl, Water 5.6 MMBbl 60.00%70.00%80.00%120140160 60.00%70.00%80.00%120140160%Mos40.00%50.00%80100placed Volume, %Rate, Bbls/Well/M8Producing;1.5MBbl/Mos3Injection;64.2MBbl/Mos10.00%20.00%30.00%204060RepOil R9ProducingWells0InjectorWellsInjectRatevs.ProdRate;293%4.01%Fillto12/07 0.00%06/15/077/5/077/25/078/14/079/3/079/23/0710/13/0711/2/0711/22/0712/12/071/1/08Time OilRtBbl/Wll/MOil Rate, Bbls/Well/Mos RltVl%Replacement Volume, %

Secondary Recovery: Reserve Class Transition Probably PUD PDP Present After Pressure Response New Producing Wells Fully Developed PDP

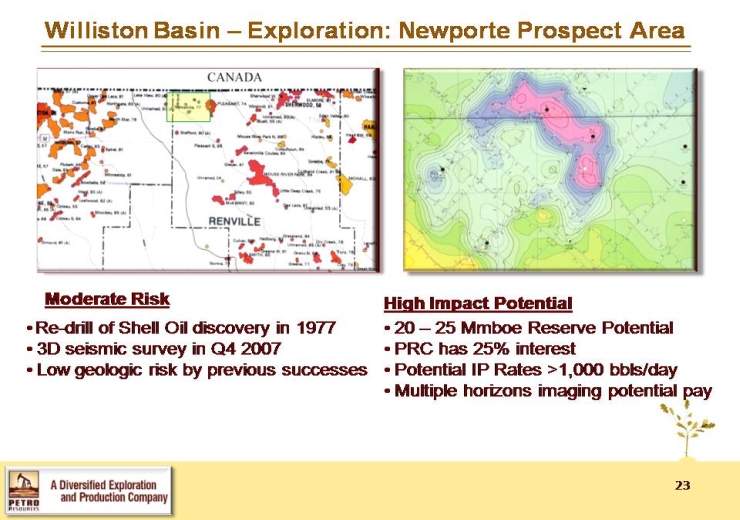

Williston Basin –Exploration: NewporteProspect Area •Re-drill of Shell Oil discovery in 1977•3D seismic survey in Q4 2007 •Low geologic risk by previous successes • Moderate Risk High Impact Potential •20 –25 Mmboe Reserve Potential •PRC has 25% interest•PotentialIPRates>1000bbls/day•Potential IP Rates >1,000 bbls/day•Multiple horizons imaging potential pay

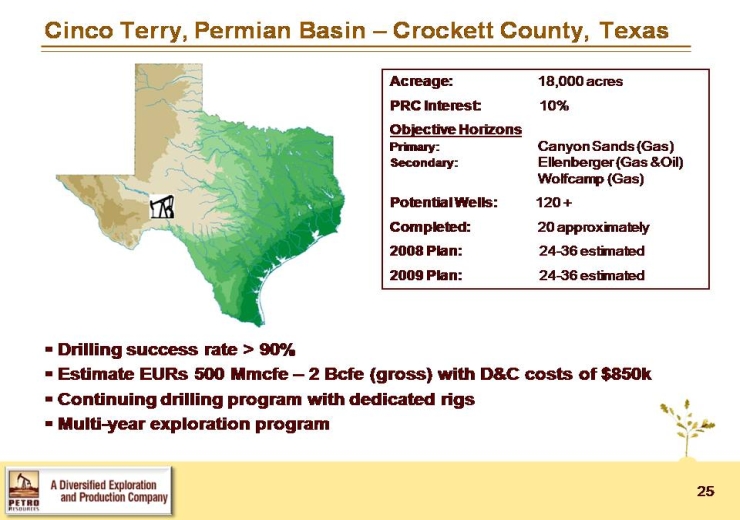

Cinco Terry, Permian Basin –Crockett County, Texas Acreage: 18,000 acresPRC Interest: 10%Objective Horizon Primary:Canyon Sands (Gas)Secondary: Ellenberger (Gas &Oil)Wolfcamp (Gas)Potential Wells: 120 +Completed: 20 approximately2008 Plan: 24-36 estimated2009 Plan: 24-36 estimated Drilling success rate > 90% EstimateEURs500Mmcfe2Bcfe(gross)withD&Ccostsof$850kEstimate EURs 500 Mmcfe –2 Bcfe (gross) with D&C costs of $850k Continuing drilling program with dedicated Multi-year exploration program

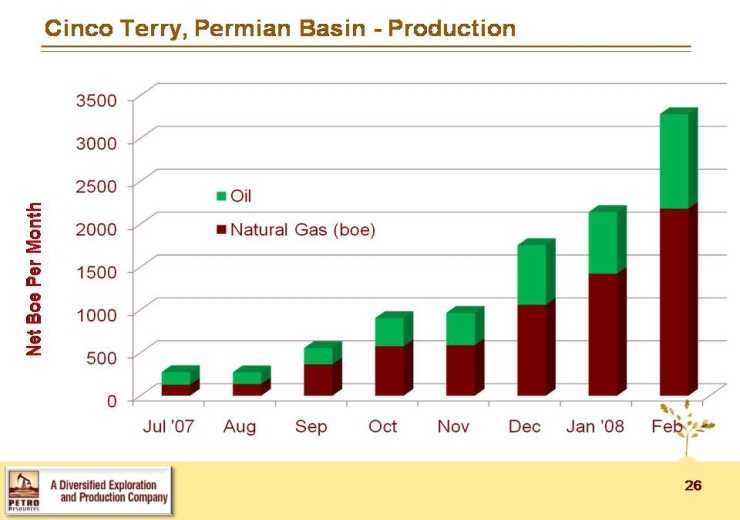

Cinco Terry, Permian Basin -Production Net Boe Per Month Oil Natural Gua (boe) 0 500 1000 1500 2000 2500 3000 3500 Jul ’07 Aug Sep Oct Nov Dec Jan ’08 Feb

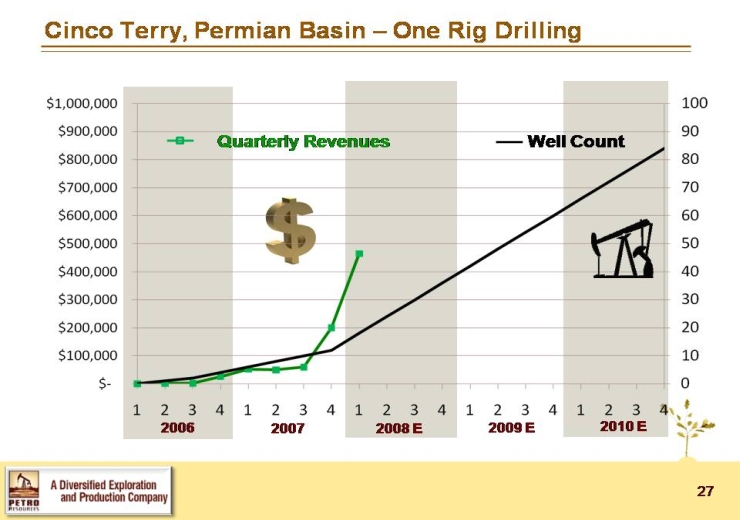

Cinco Terry, Permian Basin –One Rig Drilling Quarterly RevenuesWell Count 200620072008 E2009 E2010 E

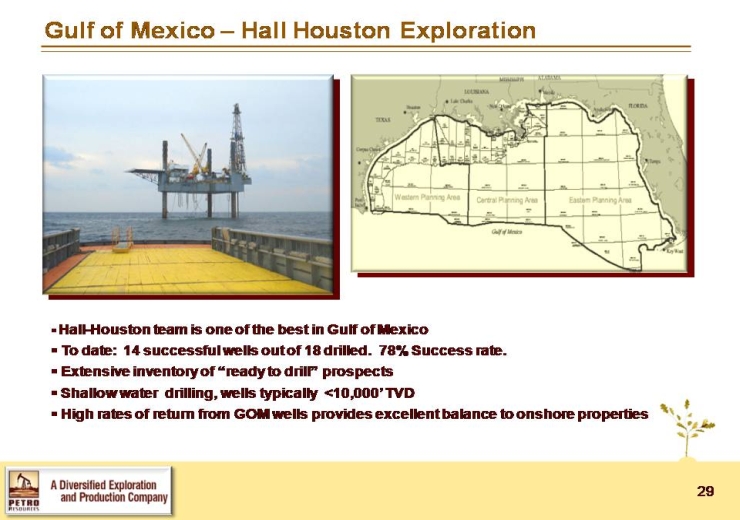

Gulf of Mexico –Hall Houston Exploration Hall-Houston team is one of the best in Gulf of Mexico To date: 14 successful wells out of 18 drilled. 78% Success rate. Extensive inventory of ready to drill prospects Shallow water drilling, wells typically <10,000’ TVD High rates of return from GOM wells provides excellent balance to onshore properties

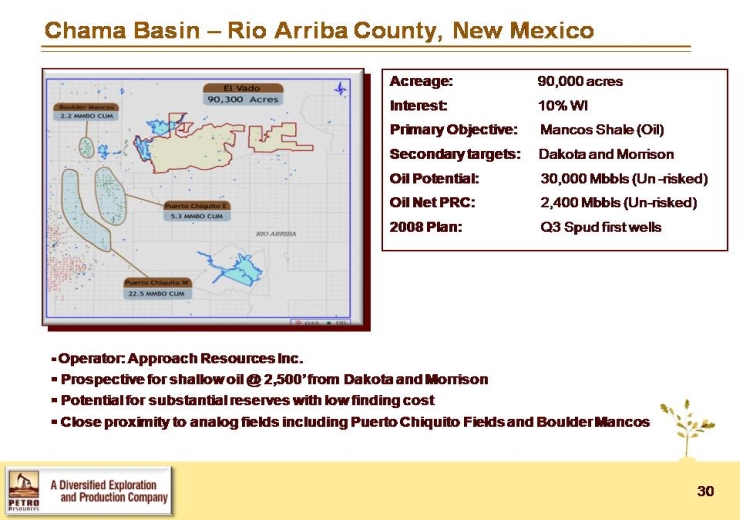

Chama Basin –Rio Arriba County, New Mexico Acreage:90,000 acres Interest:10% WIPrimary Objective: Mancos Shale (Oil) Secondary targets: Dakota and MorrisonOil Potential: 30,000 Mbbls (Un -risked)Oil Net PRC:2,400 Mbbls (Un-risked) 2008 Plan: Q3 Spud first wells Operator: Approach Resources Inc. Prospective for shallow oil @ 2,500’ from Dakota and Morrison Potential for substantial reserves with low finding cost Close proximity to analog fields including Puerto Chiquito Fields and Boulder Mancos

Summary Growth Highlights Contact Information

PRC Production Growth Boe/Qtr Permian Gas Permian Oil Williston Gas Williston Oil 1Q’07 2Q’07 3Q’07 4Q’07 1Q’08E

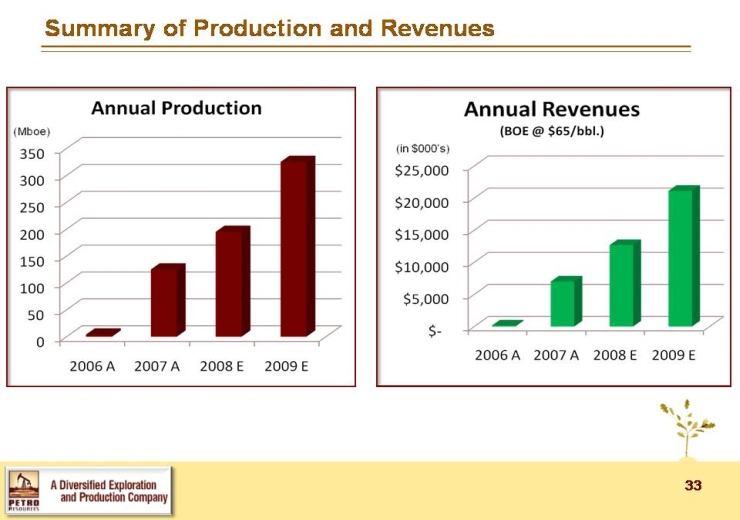

Summary of Production and Revenues Annual Production Annual Revenues (BOE @ $65/bbl.)

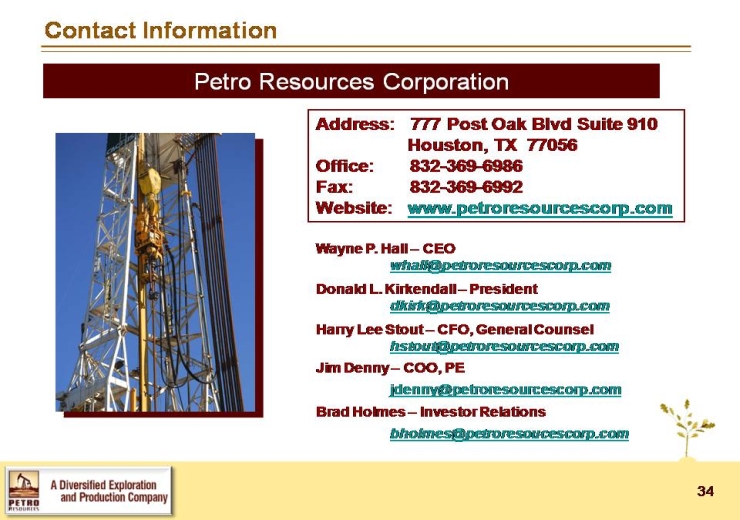

Contact Information Petro Resources Corporation Address: 777 Post Oak Blvd Suite 910 Houston, TX 77056 Office: 832-369-6986 Fax: 832-360-6992 Website: www.petroresourcescorp.com

Wayne P. Hall – CEO Donald L. Kirkendall – President – Harry Lee Stout – CFO General Counsel Jim Denny – COO PE Brad Holmes – investor Relations

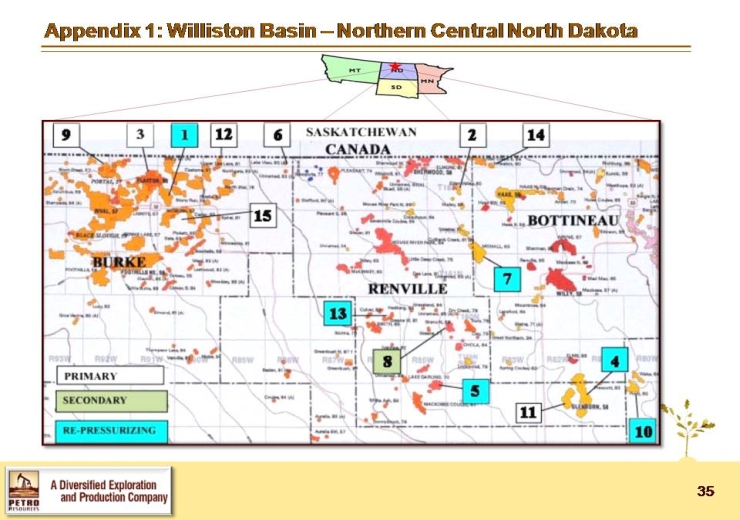

Appendix 1: Williston Basin –Northern Central North Dakota Primary Secondary Re-Pressurizing