Exhibit 99.1

Magnum Hunter Announces Mid-Year

2010 Total Proved Oil & Gas Reserves

Quantities Up 91% From Year-End 2009

Present Value Up 164% From Year-End 2009

FOR IMMEDIATE RELEASE - Houston, TX– (Market Wire) – August 5, 2010 – Magnum Hunter Resources Corporation (NYSE Amex: “MHR” and “MHR-PC”) (“Magnum Hunter”, or the “Company") announced today a significant increase in the quantity of the Company’s estimated proved reserves at mid-year 2010, up 91% versus year-end 2009. The present value of estimated future cash flows before income taxes of our estimated proved reserves as of June 30, 2010, discounted at 10% (“PV-10”), also increased 164% as compared to year-end 2009.

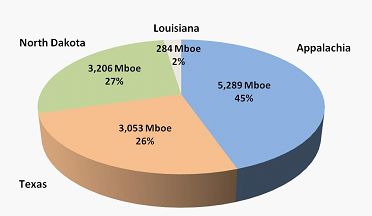

Magnum Hunter’s total proved reserves increased 5.6 million barrels of oil equivalent (Boe) to 11.8 million Boe (69% crude oil & ngl; 53% proved developed producing) as of June 30, 2010 as compared to 6.2 million Boe (74% crude oil & ngl; 43% proved developed producing) at year-end 2009. The Company’s reserve life (R/P ratio) increased from approximately 14 years at December 31, 2009 to approximately 21 years as of June 30, 2010.

Mid-Year 2010 Proved Reserves (SEC Case) 11.8 Million Barrels Equivalent |

|

(PV-10 is a non-GAAP financial measure and should not be considered as an alternative to the standardized measure of discounted future net cash flows as defined under GAAP; see “Non-GAAP Measures; Reconciliation to Standardized Measure” below for our definition of PV-10 and a reconciliation to the standardized measure).

The Company’s June 30, 2010 PV-10 increased by $108 million or 164% to $173.0 million from the December 31, 2009 PV-10 value of $65.6 million. Under new SEC guidelines, the commodity prices used in the June 30, 2010 and December 31, 2009 PV-10 estimates were based on the 12-month unweighted arithmetic average of the first-day-of-the-month price for the periods July 1, 2009 through June 30, 2010 and January 1, 2009 through December 31, 2009, respectively, adjusted by lease for transportation fees and regional price differentials. For crude oil and ngl volumes, this average West Texas Intermediate posted price of $75.76 per barrel at June 30, 2010, was up 24% from the average price of $61.18 per barrel at December 31, 2009. For gas volumes, the average price of the Henry Hub spot price of $4.10 per million British t hermal units (“MMBTU”) at June 30, 2010 was up 6% from the average price of $3.87 per MMBTU at December 31, 2009. All prices were held constant throughout the estimated life of the properties.

The Company’s June 30, 2010 proved reserves of 11.8 million Boe reflect an organic 4% increase over the Company’s pro forma proved reserves of 11.3 million Boe as of December 31, 2009, when including the reserves related to the Company’s acquisition of the assets of Triad Energy Corporation which occurred in February 2010.

The estimates of the Company’s total proved reserves as of December 31, 2009 and as of June 30, 2010 were prepared by our third party engineering consultants, Cawley, Gillespie & Associates, Inc. and DeGolyer and McNaughton.

Management Comments

Mr. Gary C. Evans, Chairman of the Board and Chief Executive Officer of the Company, commented, “Our significant reserve growth during the first half of fiscal year 2010 is primarily due to the mid February acquisition of Triad Energy out of the U.S. Bankruptcy Court. It is important to note that no proved reserves have yet to be booked in our emerging horizontal shale plays. With the aggressive drilling program underway at Magnum Hunter, which will continue for the remainder of this year and into 2011, significant reserve additions associated with both our Eagle Ford Shale play of Central and South Texas and our Marcellus Shale play of Northwestern West Virginia should allow us to continue the creation of increased value for our shareholders from just our existing asset base, excluding any additional p otential acquisitions.”

About Magnum Hunter Resources Corporation

Magnum Hunter Resources Corporation and subsidiaries are a Houston, Texas based independent exploration and production company engaged in the acquisition of exploratory leases and producing properties, secondary enhanced oil recovery projects, exploratory drilling, and production of oil and natural gas in the United States. The Company is presently active in three of the “big four” emerging shale plays in the United States.

Non-GAAP Measures; Reconciliation to Standardized Measure

This release contains certain financial measures that are non-GAAP measures. We have provided reconciliations within this release of the non-GAAP financial measures to the most directly comparable GAAP financial measures. These non-GAAP financial measures should be considered in addition to, but not as a substitute for, measures for financial performance prepared in accordance with GAAP that are presented in this release.

PV-10 is the present value of the estimated future cash flows from estimated proved reserves after deducting estimated production and ad valorem taxes, future capital costs and operating expenses, but before deducting any estimates of future income taxes. The estimated future cash flows are discounted at an annual rate of 10% to determine their “present value.” We believe PV-10 to be an important measure for evaluating the relative significance of our oil and gas properties and that the presentation of the non-GAAP financial measure of PV-10 provides useful information to investors because it is widely used by professional analysts and investors in evaluating oil and gas companies. Because there are many unique factors that can impact an individual company when estimating the amount of future income taxes to be paid, we believe the use of a pre-tax measure is valuable for evaluating the Company. We believe that PV-10 is a financial measure routinely used and calculated similarly by other companies in the oil and gas industry. However, PV-10 should not be considered as an alternative to the standardized measure as computed under GAAP.

The standardized measure of discounted future net cash flows relating to our proved oil and gas reserves is as follows (in thousands):

| | | (Unaudited) As of June 30, | |

| | | 2010 | |

| | | | |

| Future cash inflows | | $ | 648,230 | |

| Future production costs | | | 221,292 | |

| Future development costs | | | 55,649 | |

| Future income tax expense | | | 78,849 | |

| Future net cash flows | | | 292,440 | |

10% annual discount for estimated timing of cash flows | | | 162,110 | |

Standardized measure of discounted future net cash flows related to proved reserves | | $ | 130,330 | |

| | | | | |

| Reconciliation of Non-GAAP Measure | | | | |

| PV-10 | | $ | 173,305 | |

| Less: Income taxes | | | | |

| Undiscounted future income taxes | | | (78,849 | ) |

| 10% discount factor | | | 35,874 | |

| Future discounted income taxes | | | (42,975 | ) |

| | | | | |

| Standardized measure of discounted future net cash flows | | $ | 130,330 | |

For more information, please view our website at www.magnumhunterresources.com

Forward-Looking Statements

The statements and information contained in this press release that are not statements of historical fact, including all estimates and assumptions contained herein, are “forward looking statements” as defined in Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. These forward looking statements include, among others, statements, estimates and assumptions relating to our business and growth strategies, our oil and gas reserve estimates, our ability to successfully and economically explore for and develop oil and gas resources, our exploration and development prospects, future inventories, projects and programs, expectations relating to availability and costs of drilling rigs and field services, anticipated trends in our business or industry, our future results of operations, our liquidity and ability to finance our exploration and development activities, market conditions in the oil and gas industry and the impact of environmental and other governmental regulation. Forward-looking statement generally can be identified by the use of forward-looking terminology such as “may”, “will”, “could”, “should”, “expect”, “intend”, “estimate”, “anticipate”, “believe”, “project”, “pursue”, “plan” or “continue” or the negative thereof or variations thereon or similar terminology. These forward-looking statements are subject to numerous assumption, risks, and uncertainties. Factors that may cause our actual results, performance, or achievements to be materially different from those anticipated in forward-looking statements include, among others, the following: adverse economic con ditions in the United States and globally; difficult and adverse conditions in the domestic and global capital and credit markets; changes in domestic and global demand for oil and natural gas; volatility in the prices we receive for our oil and natural gas; the effects of government regulation, permitting, and other legal requirements; future developments with respect to the quality of our properties, including, among other things, the existence of reserves in economic quantities; uncertainties about the estimates of our oil and natural gas reserves; our ability to increase our production and oil and natural gas income through exploration and development; our ability to successfully apply horizontal drilling techniques and tertiary recovery methods; the number of well locations to be drilled, the cost to drill, and the time frame within which they will be drilled; drilling and operating risks; the availability of equipment, such as drilling rigs and transportation pipelines; changes in our drilling plans an d related budgets; and the adequacy of our capital resources and liquidity including, but not limited to, access to additional borrowing capacity. These factors are in addition to the risks described in our public filings made from time to time with the Securities and Exchange Commission. Most of these factors are difficult to anticipate and beyond our control. Because forward-looking statements are subject to risks and uncertainties, actual results made differ materially from those expressed or implied by such statements. Readers are cautioned not to place undue reliance on forward-looking statements, contained herein, which speak only as of the date of this document. Other unknown or unpredictable factors may cause actual results to differ materially from those projected by the forward-looking statements. Unless otherwise required by law, we undertake no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events, or otherwise. We urge readers to review and consider disclosures we make in our public filings made from time to time with the Securities and Exchange Commission that discuss factors germane to our business, including our Annual Report on Form 10-K for the year ended December 31, 2009 and our Quarterly Report on Form 10-Q for the quarter ended March 31, 2010. All forward-looking statements attributable to us are expressly qualified in their entirety by these cautionary statements.

####

| | Contact | M. Bradley Davis Senior Vice President of Capital Markets bdavis@magnumhunterresources.com (832) 203-4545 |

4