Exhibit 10.9

DEBT CONVERSION AGREEMENT

This Debt Conversion Agreement (the "Agreement") dated May 14, 2009, is by and between, Epazz, Inc., an Illinois corporation (the "Company") and Vivienne Passley, an individual (the "Creditor").

WHEREAS, the Company owes $8926.88 to the Creditor in consideration for $6000 loaned to the Company in July 31, 2006, evidenced by the promissory note, attached hereto as Exhibit A. which loan was to bear interest at the rate of 15% per annum and was due and payable on August 1, 2010 (the "Loan");

WHEREAS, the Company desires to convert the Loan into shares of newly issued restricted Series A common stock of the Company, $0.01 par value per share at a rate of three hundred (300) shares of Series A common stock for every $1 of the Loan (the "Common Stock" and the "Conversion Rate;

WHEREAS, the Creditor agrees to convert the Loan into Common Stock at the Conversion Rate and to forgive any accrued and unpaid interest on the Loan ("Accrued Interest"); and

WHEREAS, the Company and the Creditor desire to set forth in writing the terms and conditions of their agreement and understanding concerning conversion of the Loan.

NOW, THEREFORE, in consideration of the premises and the mutual covenants, agreements, and considerations herein contained, the parties hereto agree as follows:

| 1. | Consideration. In consideration and in satisfaction of the forgiveness of the entire $8926.88 owed pursuant to and in connection with the Loan, which amount is owed to the Creditor, the Company agrees to issue the Creditor an aggregate of 2,679,064 shares of Common Stock (three hundred shares for every $1.00 of the Loan converted into shares of common stock)(the "Shares"). 2,500,000 shares of the 2,679,064 will be issue on May 14, 2009. The remainder amount (179,064) will be issue on July 15, 2009. |

In consideration for the issuance of me Shares, the Creditor agrees to forgive the Loan and to waive and forgive any accrued and unpaid interest payable there under.

| 2. | Restricted Shares. The Creditor agrees and understands that the Shares of the Company to be issued to the Creditor have not been registered under the Securities Act of 1933, as amended (the "1933 Act"), nor registered under any state securities law, and will be "restricted securities" as that term is defined in Rule 144 under the 1933 Act. As such, the Shares may not be offered for sale, sold or otherwise transferred except pursuant to an effective registration statement under the 1933 Act, or pursuant to an exemption from registration, under the 1933 Act. The shares to be issued to the Creditor will bear an appropriate restrictive legend. |

The Creditor understands that the Company has not registered the Shares under the 1933 Act or the applicable securities laws of any state in reliance on exemptions from registration, and farther understands that such exemptions depend upon the Creditor's investment intent at the time be acquires the Shares. The Creditor therefore represents and warrants she is receiving the Shares for her own account for investment and not with a view to distribution, assignment, resale or other transfer of the Shares. Because the Shares are not registered, the Creditor is aware that she must hold them indefinitely unless they are registered under the 1933 Act and any applicable state securities laws or she must obtain exemptions from such registration. Creditor acknowledges that me Company is under no duty to comply -with any exemption in the connection, with the Creditor's sale, transfer or other disposition under applicable rules and regulations. Creditor understands mat in the event she desires to sell, assign, transfer, hypothecate or in any way alienate or encumber the Shares in the future, the Company can require that the Creditor provide, at Creditor's own expense, an opinion of counsel satisfactory to the Company to the effect that such action will not result in a violation of applicable federal or state securities laws and regulations or other applicable federal or state laws and regulations.

| 3. | Full Satisfaction. Creditor agrees that she is accepting the Shares in full satisfaction of the Loan which is being converted into Common Stock and that as such Creditor will no longer have any rights of repayment against the Company as to the $8926.88 previously outstanding under the Loan which is being converted into Shares pursuant to this Agreement (or any accrued or unpaid interest which is being waived by Creditor as described above), at such time as the Shares have been issued to Creditor. |

4. Mutual Representations. Covenants and Warranties.

| | (a) | The parties have all requisite power and authority, corporate or otherwise, to execute and deliver this Agreement and to consummate the transactions contemplated hereby and thereby. The parties have duly and validly executed and delivered this Agreement and will, on or prior to the consummation of the transactions contemplated herein, execute, such other documents as may be required hereunder and, assuming the due authorization, execution and delivery of this Agreement by the parties hereto and thereto, this Agreement constitutes, the legal, valid and binding obligation of the parties enforceable against each party in accordance with its terms, except as such enforcement may be limited by applicable bankruptcy, insolvency, reorganization, moratorium or similar laws affecting creditors' rights generally and general equitable principles. |

| | (b) | The execution and delivery by the parties of this Agreement and the consummation of the transactions contemplated hereby and thereby do not and shall not, by the lapse of time, the giving of notice or otherwise: (a) constitute a violation of arty law; or (b) constitute a breach or violation of any provision contained in the Articles of Incorporation or Bylaws, or such other documents) regarding organization and/or management of the parties, if applicable; or (c) constitute a breach of any provision contained in, or a default under, any governmental approval, any writ, injunction, order, judgment or decree of any governmental authority or any contract to which either the Company or the Creditor is a party or by which either the Company or the Creditor is bound or affected. |

| 5. | Creditor Representations and Warranties. The Creditor represents and warrants to the Company that the Creditor has such knowledge and experience in financial and business matters that the Creditor is capable of evaluating the merits and risks of an investment in the Shares and that the Creditor is an "accredited investor" as such term is defined under the 1933 Act The Creditor represents that she is familiar with the Company's business objectives and the financial arrangements in connection therewith and she believes that the Shares are the kind of securities that she wishes to hold for investment and that the nature and amount of the Shares are consistent with her investment program. The Creditor has been advised and is folly aware that investing in securities such as the Shares is a speculative and uncertain undertaking whose advantages and benefits are generally limited to a certain class of investors who understand the nature of the proposed operations of the Company and for whom the investment is suitable. The Creditor recognizes that an investment in the hares involves certain risks and she has taken full cognizance of and understands all of the risk factors related to the business objectives of the Company and the Shares. |

| | (a) | Assignment. All of the terms, provisions and conditions of this Agreement shall be binding upon and shall inure to the benefit of and be enforceable by the parties hereto and their respective successors and permitted assigns. |

| | (b) | Applicable law. This Agreement shall be construed in accordance with and governed by the laws of the State of Illinois, excluding any provision which would require the use of the laws of any other jurisdiction. |

| | (c) | Entire Agreement. Amendments and Waivers. This Agreement constitutes the entire agreement of the parties regarding the subject matter of the Agreement and expressly supersedes all prior and contemporaneous understandings and commitments, whether written or oral, -with respect to the subject matter hereof. No variations, modifications, changes or extensions of this Agreement or any other terms hereof shall be binding upon any party hereto unless set forth in a document duly executed by such party or an authorized agent or such party. |

| | (d) | Section headings. Section headings are for convenience only and shall not define or limit the provisions of this Agreement. |

| | (e) | Effect of Facsimile and Photocopied Signatures. This Agreement may be executed in several counterparts, each of which is an original. It shall not be necessary in making proof of this Agreement or any counterpart hereof to produce or account for any of the other counterparts. A copy of this Agreement signed by one party and faxed to another party shall be deemed to have been executed and delivered by the signing party as though an original. A photocopy of this Agreement shall be effective as an original for all purposes. |

| | [Remainder of page left intentionally blank. Signature pages follows.] |

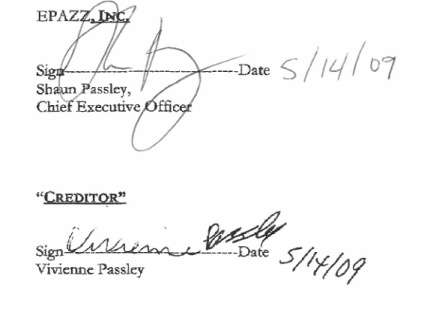

IN WITNESS WHEREOF, the parties hereto have executed this Agreement as of the day and year first written above.