- MFG Dashboard

- Financials

- Filings

- Holdings

- Transcripts

- ETFs

-

Insider

- Institutional

- Shorts

-

6-K Filing

Mizuho Financial (MFG) 6-KCurrent report (foreign)

Filed: 22 May 19, 8:15am

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE13a-16 OR15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of May 2019

Commission File Number001-33098

Mizuho Financial Group, Inc.

(Translation of registrant’s name into English)

5-5, Otemachi1-chome

Chiyoda-ku, Tokyo100-8176

Japan

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form20-F or Form40-F.Form 20-F ☒ Form 40-F ☐

Indicate by check mark if the registrant is submitting the Form6-K in paper as permitted by RegulationS-T Rule 101(b)(1): ☐

Indicate by check mark if the registrant is submitting the Form6-K in paper as permitted by RegulationS-T Rule 101(b)(7): ☐

Indicate by check mark whether the registrant by furnishing the information contained in this Form is also thereby furnishing the information to the Commission pursuant to Rule12g3-2(b) under the Securities Exchange Act of 1934. Yes ☐ No ☒

If “Yes” is marked, indicate below the file number assigned to the registrant in connection with Rule12g3-2(b):82- .

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| Date: May 22, 2019 | ||

| Mizuho Financial Group, Inc. | ||

| By: | /s/ Makoto Umemiya | |

| Name: | Makoto Umemiya | |

| Title: | Managing Executive Officer / Group CFO | |

By making progress on transitioning to the next generation of financial services through the implementation of our new business plan, we strive to respond to the trust placed in us by our shareholders

Results of operations and dividend payouts

|

|

We resolved structural issues ahead of schedule and maintained an adequate level of capital

| p. 7 | |||||

An annual dividend of JPY 7.50 per share of common stock for fiscal year 2018 was paid as initially estimated at the beginning of this fiscal year

| p. 10 | |||||||

| ||||||||

Strategy to create new Mizuho |

|

Mizuho’s efforts in the past year We have implemented changes to the structure and foundations of our business, further integrated the “customer first” principle into everything we do, and fundamentally increased productivity

| p. 14 | |||||

Mizuho in the future We have launched the5-Year Business Plan – Transitioning to the Next Generation of Financial Services as our new business plan

| p.16 | |||||||

To bring fruitfulness to each customer and the economies, industries and the societies in which we operate, over the next 10 years and beyond

| p. 18 | |||||||

|

2

Governance system to support our sustainable growth

|

|

We have established our characteristic governance system in order to pursue increased effectiveness

| p. 22 | |||||

Executive compensation system revised in order to ensure an attitude towards improvement of corporate value shared with shareholders

| p. 26 | |||||||

| ||||||||

External recognition

|

|

Our initiatives have been recognized highly by various external institutions

| p. 28 | |||||

| ||||||||

Toward further improvement of trust

|

|

We respond sincerely to the voices of our shareholders

| p. 29 |

3

4

Compatibility table for Corporate Governance Code

Code No.

| Contents of code

| Reference page

| ||||

1.3

| Basic strategy for capital policy

| p. 11~13

| ||||

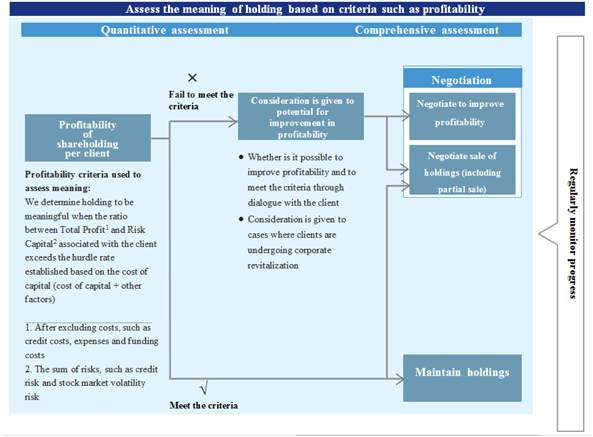

1.4

| Cross-shareholdings

| p. 152~153

| ||||

2.1, 3.1 i)

| Disclosure of business principles, business strategies and business plan

| p. 16~21, 66~78

| ||||

2.3, 2.3.1

| Sustainability issues, including social and environmental matters

| p. 18~21, 71

| ||||

2.4

| Ensuring diversity, including active participation of women

| p. 21

| ||||

3.1 ii)

| Basic view on corporate governance

| p. 22

| ||||

3.1 iii)

| Policies and procedures for determining compensation for directors and executive officers

| p. 26, 103~107

| ||||

3.1 v)

| Reasons for appointment as a director and an executive officer

| p. 37~51, 99~102

| ||||

4.1.2

| State of achievement ofmid-term business plan and analysis thereof

| p. 7~9, 64~65

| ||||

4.2, 4.2.1

| Sound incentive in the compensation for directors and executive officers

| p. 26, 103~107

| ||||

4.7

| Roles and responsibilities of independent outside directors

| p. 22~25

| ||||

4.8, 4.8.1

| Effective use of independent outside directors

| p. 22~25

| ||||

4.9

| Independence standards and qualification for independent outside directors

| p. 54

| ||||

4.11, 4.11.1

| Views on the composition, diversity and expertise of directors for securing the effectiveness of the Board of Directors

| p. 35~36

| ||||

4.11.2

| Number of directors with concurrent offices

| p. 37~51, 93~95

| ||||

4.11, 4.11.3

| Analysis and evaluation of the effectiveness of the Board of Directors

| p. 22~23

| ||||

Note: The above table shows policy excerpts from the Corporate Governance Code which are described in this convocation notice of the ordinary general meeting of shareholders.

5

Forward-looking Statements

This material contains statements that constitute forward-looking statements within the meaning of the United States Private Securities Litigation Reform Act of 1995, including estimates, forecasts, targets and plans. Such forward-looking statements do not represent any guarantee by management of future performance.

In many cases, but not all, we use such words as “aim,” “anticipate,” “believe,” “endeavor,” “estimate,” “expect,” “intend,” “may,” “plan,” “probability,” “project,” “risk,” “seek,” “should,” “strive,” “target” and similar expressions in relation to us or our management to identify forward-looking statements. You can also identify forward-looking statements by discussions of strategy, plans or intentions. These statements reflect our current views with respect to future events and are subject to risks, uncertainties and assumptions.

We may not be successful in implementing our business strategies, and management may fail to achieve its targets, for a wide range of possible reasons, including, without limitation: incurrence of significant credit-related costs; declines in the value of our securities portfolio; changes in interest rates; foreign currency fluctuations; decrease in the market liquidity of our assets; revised assumptions or other changes related to our pension plans; a decline in our deferred tax assets; the effect of financial transactions entered into for hedging and other similar purposes; failure to maintain required capital adequacy ratio levels; downgrades in our credit ratings; our ability to avoid reputational harm; our ability to implement our Medium-term Business Plan, realize the synergy effects of “One MIZUHO,” and implement other strategic initiatives and measures effectively; the effectiveness of our operational, legal and other risk management policies; the effect of changes in general economic conditions in Japan and elsewhere; and changes to applicable laws and regulations.

Further information regarding factors that could affect our financial condition and results of operations is included in “Item 3.D. Key Information—Risk Factors” and “Item 5. Operating and Financial Review and Prospects” in our most recent Form20-F filed with the U.S. Securities and Exchange Commission (“SEC”) and our report on Form6-K furnished to the SEC on December 26, 2018, both of which are available in the Financial Information section of our web page atwww.mizuho-fg.com/index.html and also at the SEC’s web site atwww.sec.gov.

We do not intend to update our forward-looking statements. We are under no obligation, and disclaim any obligation, to update or alter our forward-looking statements, whether as a result of new information, future events or otherwise, except as may be required by the rules of the Tokyo Stock Exchange.

6

We resolved structural issues ahead of schedule and maintained an adequate level of capital

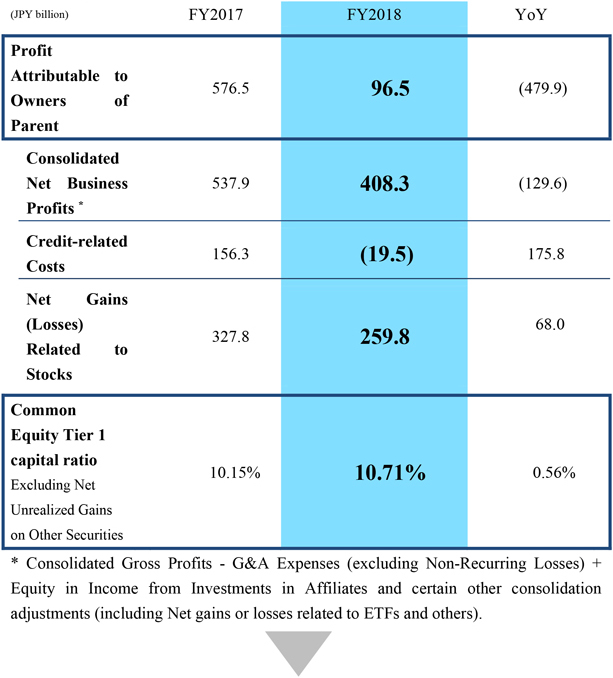

∎ Highlight of financial results (consolidated)

Profit Attributable to Owners of Parent decreased significantly on ayear-on-year basis due primarily to losses recorded in light of the structural reforms. Profit Attributable to Owners of Parent excluding disposal ofone-time losses of JPY 695.4 billion, was JPY 581.8 billion, which was an increase on ayear-on-year basis. |

Regarding Consolidated Net Business Profits, while customer divisions showed increases worldwide, the markets division decreased primarily due to our efforts to ensure the soundness of our bond portfolio, includingnon-Japanese bonds. |

Exceeded the target of the previous medium-term business plan. |

7

∎ Previous medium-term business plan (financial targets)

8

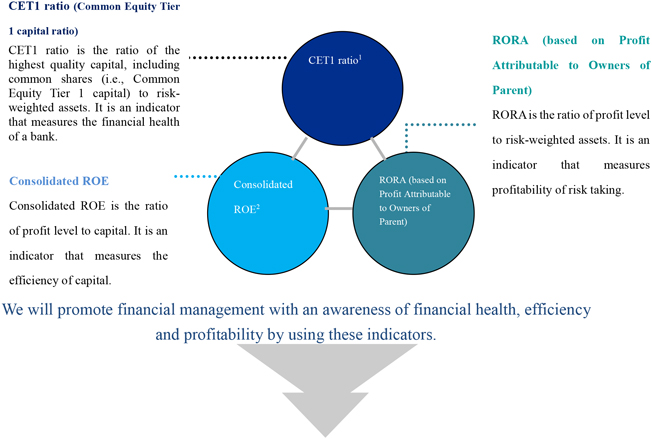

| Previous medium-term business plan FY2018 target | FY2018 (results) | FY2018 (results) (before disposal of | ||||

CET1 ratio1 | Approx. 10% | 10.71% | - | |||

Consolidated ROE2 | Approx. 8% | 1.2% | 7.4% | |||

RORA (based on Profit Attributable to Owners of Parent) | Approx. 0.9% | 0.1% | 1.0% | |||

Proportion ofnon-interest income3 | Approx. 60% | 56% | - | |||

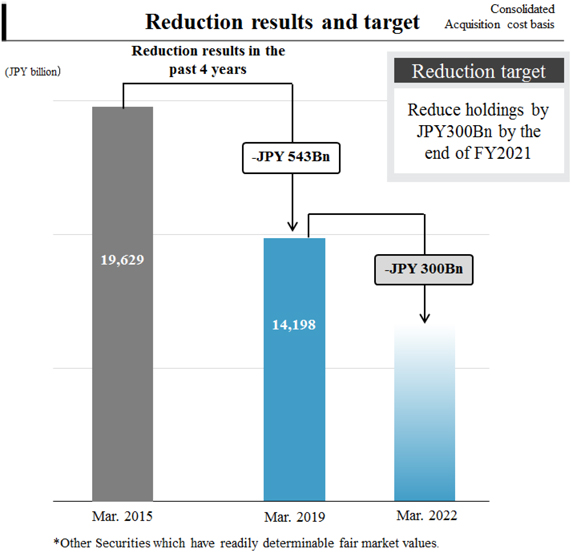

Cross-shareholding disposal4 | JPY 550 billion reduction | JPY 543 billion reduction (approx. JPY | - | |||

Expense ratio5 | Approx. 60% | 78.8% | 71.1% | |||

| 1. | Basel III fully-effective basis (based on current regulations), excluding Net Unrealized Gains on Other Securities. |

| 2. | Excluding Net Unrealized Gains on Other Securities. |

| 3. | The range of management account companies has changed since FY 2017 (the FY2015 result was unchanged). |

| 4. | Shares listed on the Japanese stock markets, acquisition cost basis, cumulative amount from FY2015 to FY2018. |

| 5. | Group aggregated. |

(Reference) Details of losses in light of structural reform

| ||

Losses on Impairment of Fixed Assets

| JPY 500.7 billion

| |

Losses pertaining to the restructuring of securities portfolio and others

| JPY 194.7 billion

| |

Total

|

JPY 695.4 billion

| |

9

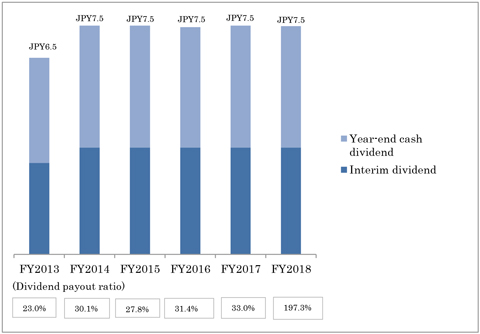

An annual dividend of JPY 7.50 per share of common stock for fiscal year 2018 was paid as initially estimated at the beginning of this fiscal year

∎Year-end cash dividend for fiscal year 2018

| Annual cash dividend on common stock for fiscal year 2018: JPY 7.50 per share of common stock |

Cash dividend for FY2018 (annual dividend) | Amount of fiscal year-end cash dividend out of annual cash dividend

| |||||||

Cash dividend per share of common stock

| JPY 7.50

| JPY 3.75

| ||||||

Total cash dividend

| JPY 190.3 billion

| JPY 95.1 billion

| ||||||

Profit Attributable to Owners of Parent

| JPY 96.5 billion

| |||||||

10

∎ As for our policy to return profits to shareholders for fiscal year 2018, we have implemented a steady dividend payout policy setting a dividend payout ratio on a consolidated basis of approximately 30% as a guide for our consideration.

∎ Our Board of Directors has considered thoroughly and decided to maintain the dividend for fiscal year 2018 at JPY 7.50 per share of common stock, although our net income declined significantly to JPY 96.5 billion in fiscal year 2018 as a result of recording losses in light of structural reform. To make such decision, our Board of Directors has considered that our Common Equity Tier 1 capital ratio, which is the foundation of fulfilling stable financial functions, exceeded the target of the previous medium-term business plan, i.e. 10% as of March 31, 2019, and that we aim to implement a steady dividend payout policy, and has taken into account our business environment comprehensively such as future earnings forecasts, profit base, status of capital adequacy, and domestic and international regulatory trends such as the Basel framework.

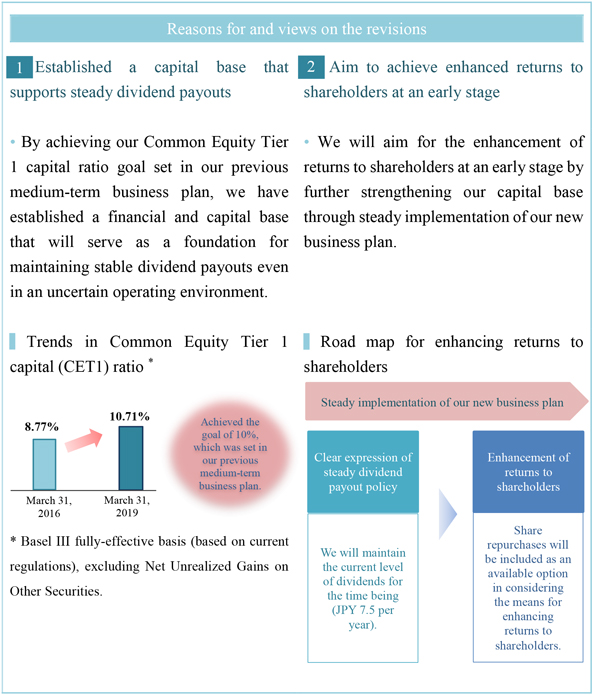

New policy to return profits to shareholders

We have been implementing disciplined capital management policy by pursuing the optimum balance between strengthening of stable capital base and steady returns to shareholders.

We revised our policy to return profits to shareholders based on our new business plan on this occasion.

11

(New) policy to return profits to shareholders

|

We are maintaining the current level of dividends for the time being while aiming to strengthen our capital base We will comprehensively consider the business environment such as Mizuho Financial Group’s business results, profit base, status of capital adequacy, and domestic and international regulatory trends such as the Basel framework in determining the returns to shareholders for each term.

|

Points of revision

|

· The steady dividend payout policy, which we previously adopted and have pursued, is clearly expressed more than ever before.

· To aim for the enhancement of returns to shareholders in the future is clearly set forth in our policy.

- Share repurchaseswill be included as an available option in considering the means for enhancing returns to shareholders, according to the status of our capital and earnings.

12

The recent revisions to our policy to return profits to shareholders were determined by our Board of Directors after thorough consideration of various factors such as evaluation of our returns to shareholders in the past and the appropriateness of such revisions in light ofour new business plan.

All of the directors will endeavor to engage in the management of Mizuho Financial Group, Inc. by fully understanding the significant responsibility that they bear as a result of having received the mandate of our shareholders, as well as by continuing to be keenly aware that they must make optimal decisions with respect to returns to shareholders from the perspective of the medium- to long-term interests of our shareholders.

13

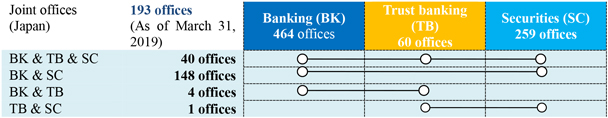

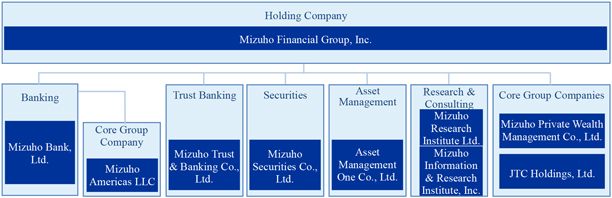

Result of collaboration among banking, trust banking and securities functions

Joint offices (Japan)

15

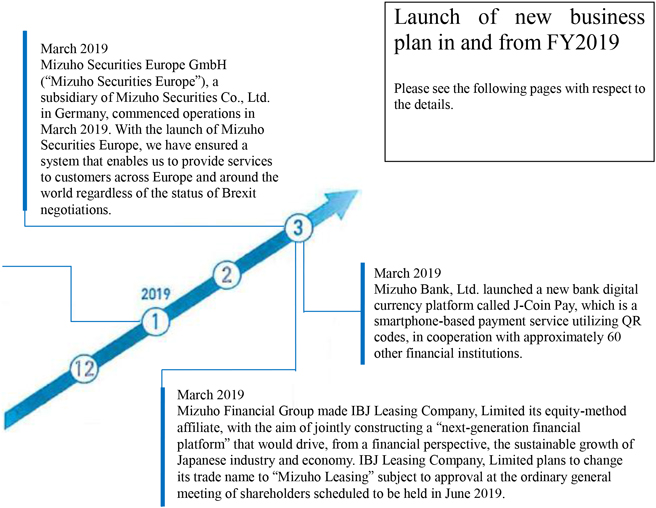

Mizuho in the future

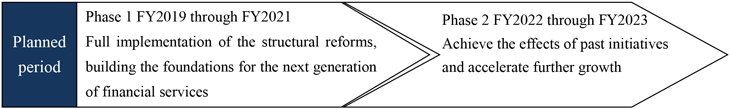

We have launched the5-Year Business Plan – Transitioning to the Next Generation of Financial Services as our new business plan

∎ Our ideas embodied in the plan

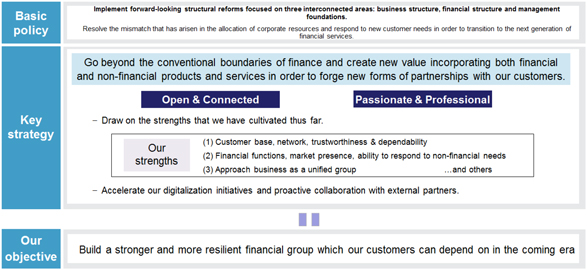

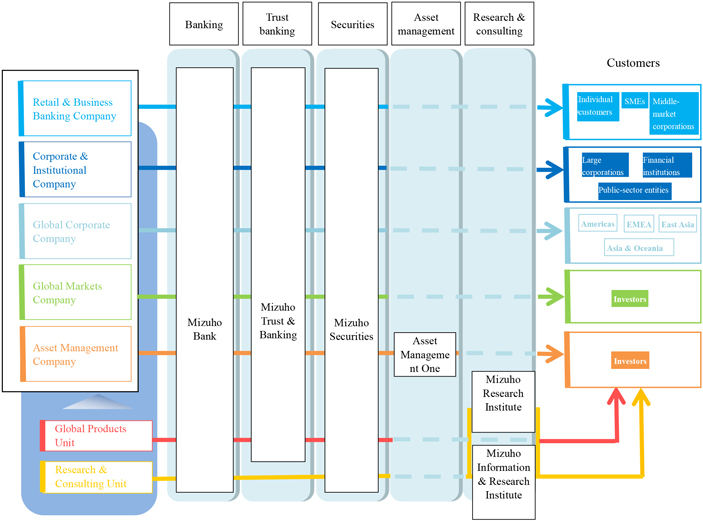

Under the new business plan, we will promote forward-looking structural reforms focused on three interconnected areas: business structures, finance structures and corporate foundations in order to transition to the next generation of financial services by resolving the mismatch that have arisen in the allocation of corporate resources, such as branches and human resources, and respond to new customer needs.

To this end, we will combine the strengths that we have cultivated thus far using digitalization initiatives and the like in order to create new value incorporating both financial andnon-financial products and services and enables us to forge new forms of partnerships with our customers.

Through these initiatives, we will build a stronger and more resilient financial group that our customers can depend on in the coming era.

∎ Framework of the new business plan

16

∎ Five years to make the transition to the next generation of financial services

Digitalization initiatives to make the transition to the next generation of financial services

We are carrying out our digitalization initiatives to make the transition to the next generation of financial services by collaborating with companies outside the group and those in other industries.

Launch ofJ-Coin Pay, a smartphone payment service

We launched a new bank digital currency platform calledJ-Coin Pay, a smartphone payment service using QR codes, in cooperation with approximately 60 other financial institutions.

J-Coin Pay allows customers to make payments, send and receive transfers, and perform other financial transactions all on their smartphones. Customers are also able to use theJ-Coin Pay smartphone app to move funds between theirJ-Coin Pay accounts and their deposit accounts at their financial institutions for free, anytime and anywhere. More financial institutions, users and affiliate merchants are to take part in the future.

AI-based solution for automating data processing

In terms of processing hand-written documents andnon-standard forms, we successfully conductedproof-of-concept testing on a solution for the highly accurate digitization of character information using artificial intelligence (AI), optical character recognition (OCR) and robotic process automation (RPA) technology. Based on the results of theproof-of-concept testing on requests for direct debits from accounts, manual data-entry was reduced by approximately 80%.

With the aim to improve the operational efficiency of the entire financial industry, we started collaborating with regional financial institutions that utilize this solution.

17

To bring fruitfulness to each customer and the economies, industries and the societies in which we operate, over the next 10 years and beyond

∎ Values to be brought to our stakeholders

Through the initiatives under the new business plan, we will create new value for our stakeholders.

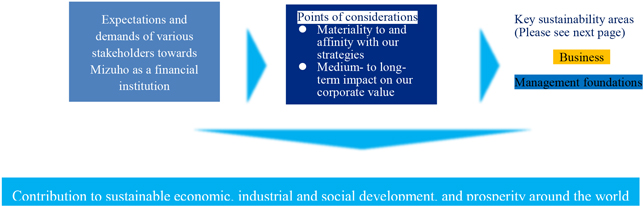

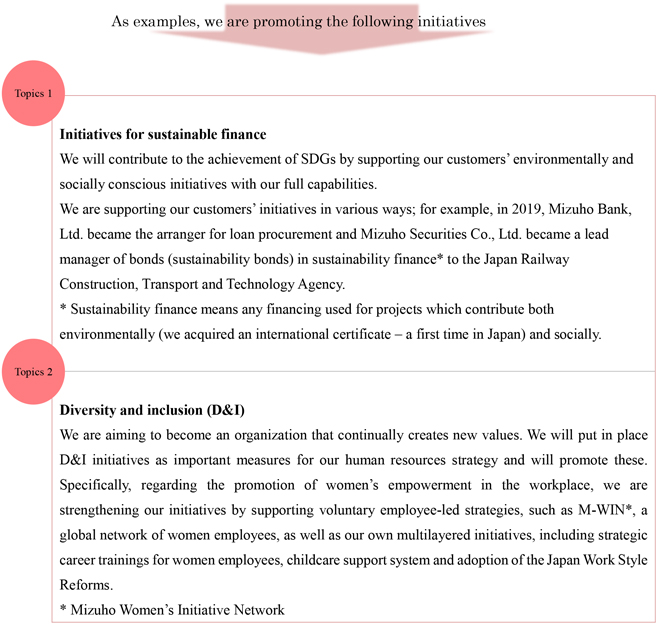

∎ Sustainability for Mizuho Financial Group

From the standpoint of creating economic, industrial and social value through sustainable and stable growth, we will select our key sustainability areas and take proactive approaches to achieving the SDGs (Sustainable Development Goals).

Sustainability for Mizuho Financial Group

| Achieving sustainable and stable growth for the group, and through this growth, contributing to the sustainable development and prosperity of the economy, industry, and society around the world

| |

Process for selecting key sustainability areas

What are SDGs?

The SDGs (Sustainable Development Goals) are a collection of 17 goals, adopted at the United Nations Sustainable Development Summit in September 2015, which aim at creating a sustainable society by 2030. In Japan, initiatives to achieve the SDGs are being promoted not only by the Japanese government, but also by many companies and other organizations.

18

Key sustainability areas

| Business | Declining birthrate and aging of the and lengthening | • Asset formation for the future

• Expansion of our services in response to the declining birthrate and aging of the population

• Greater convenience in response to diversification of lifestyles

| Creating diverse range of stakeholders | |||||

Industrial development and | • Supporting smooth business succession

• Responding to changes in industrial structures

• Making further progress in innovation

• Activating economic communities in Asian economies

• Building resilient infrastructure

| |||||||

Sound economic growth | • Strengthening the function of global financial and capital markets

• Shifting to a cashless society

• Creating social systems based on environmental changes

| |||||||

Environmental

| • Ensuring a stable energy supply and responding to climate change

| |||||||

19

| Business foundations | Governance | • Enhancement of corporate governance

• Risk management, improvement of our IT systems and compliance

• Disclosure of information in a fair, timely and appropriate manner in conjunction with dialogue with our stakeholders

| ||||

Personnel

| • Talent development and creation of a rewarding workplace environment

| |||||

Environment and | • Respecting human rights and being conscious of the environment in investment and financing.

• Responding to climate change

• Promoting financial and economic education and social and local contribution activities

| |||||

20

21

We have established our characteristic governance system in order to pursue increased effectiveness

Governance system

Directors who have received the mandate of the shareholders of Mizuho Financial Group have established our characteristic governance system with distinct features.

∎ Principal features of our governance system

• A Company with Three Committees structure has been adopted. | ||

- Capable of providing the most effective performance of the functions of the Board of Directors, the three legally-required committees and executive officers as defined in the Companies Act. | ||

• Separation of supervision and execution | ||

Structure | - Making supervision of the management the primary focus of the Board of Directors and delegating decisions on business execution to executive officers as defined in the Companies Act, to the maximum extent possible. | |

• The Chairman of the Board of Directors shall be an outside director. | ||

- The core members of the Board of Directors are outside directors. | ||

• The members of the Nominating and Compensation Committees shall all be outside directors. | ||

| Fairness and transparency | • The Chairmen of the Nominating, Compensation and Audit Committees shall all be outside directors.

| |

- Decision making with respect to matters such as appointment and dismissal of the management and the compensation therefor, will be conducted mainly by outside directors. | ||

• Appropriate disclosure based on the Corporate Governance Code. | ||

Efforts toward improvement in effectiveness of the Board of Directors

We make efforts to carry out high-quality discussions at the Board of Directors meetings by means of conducting Outside Director Sessions and offsite meetings regarding business operations and holding other opportunities for discussion.

22

Outside Director Sessions

Fiscal

| Number of meetings

| Details | ||||

2018 | 2 meetings | Exchanged opinions concerning the manner of operation of the Board of Directors, how to proceed with evaluation of the effectiveness of the Board of Directors and formulation of the new business plan, and discussed other issues.

| ||||

Offsite meetings regarding business operations

Fiscal

| Number of meetings

| Details | ||

2018 | 21 meetings | Discussed the new business plan, major management issues, major issues at each company and other topics.

| ||

∎ Outline of each structure and operation status in FY 2018 of the Board of Directors and the three legally-required committees

Board of Directors

|

| |

|

| |

The Board of Directors makes decisions on business execution such as the basic management policy and supervises directors and executive officers as defined in the Companies Act. | ||

Operational status

The Board of Directors held 14 meetings in the fiscal year 2018 and had high-quality discussions regarding issues in relation to the formulation of the new business plan and other subjects. In addition, the Board of Directors received reports on such topics as the status of risk governance, risk management, compliance and internal audit. | ||

Areas of expertise of outside directors

Management Law Finance / accounting Economic and fiscal policy

| ||

23

Nominating Committee

|

|

The Nominating Committee, among other things, makes decisions onthe content of proposals regarding the appointment and dismissal of directors that are submitted to general meetings of shareholders. | ||

Operational status

The Committee held 8 meetings in the fiscal year 2018 and, aside from conducting other matters, decided on the candidates for directors of Mizuho Financial Group and approved the selection of directors of the Three Core Companies. In addition, the Committee received reports on the status of formulation and operation of the succession plan and asked for advice thereon.

Areas of expertise of outside directors

Management Law Economic and fiscal policy | ||

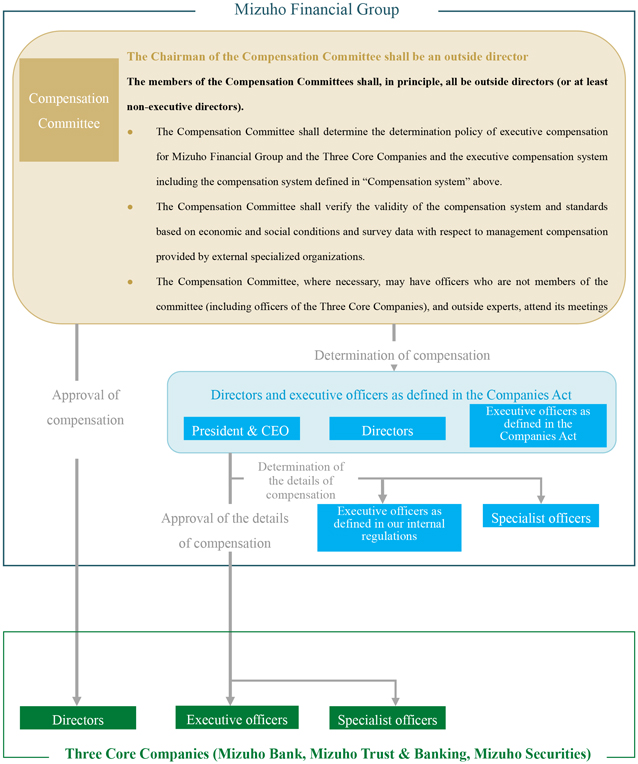

Compensation Committee

|

|

The Compensation Committee determines the policy for determination of executive compensation and the compensation for each individual director and executive officer (as defined in the Companies Act) of Mizuho Financial Group and conducts other matters. | ||

Operational status

The Committee held 11 meetings in the fiscal year 2018 and identified issues regarding the executive compensation system for Mizuho Financial Group and the Three Core Companies and revised it accordingly. Aside from conducting other matters, the Committee also decided on the compensation of individual directors and executive officers as defined in the Companies Act of Mizuho Financial Group and approved the compensation of individual directors of the Three Core Companies.

Areas of expertise of outside directors

Management Law Finance / accounting | ||

24

Audit Committe

|

|

The Audit Committee audits the legality and appropriateness of the execution of duties by directors and executive officers as defined in the Companies Act. | ||

Operational status

The Committee held 17 meetings in the fiscal year 2018 and received reports on such matters as the circumstances regarding the execution of duties by directors and executive officers as defined in the Companies Act, including the management administration for the group companies. Receiving the reports, the Committee principally confirmed the effectiveness of the Structure for Ensuring Appropriate Conduct of Operations (internal control system) and provided opinions in a timely manner. | ||

Areas of expertise of outside directors

Management Law Finance / accounting | ||

25

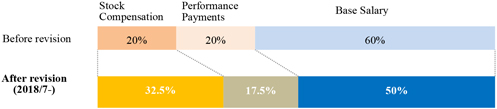

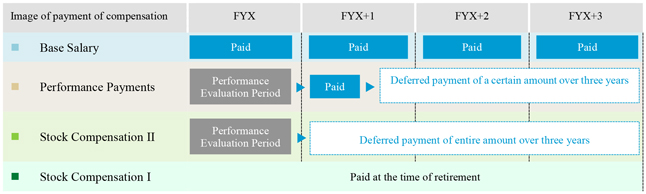

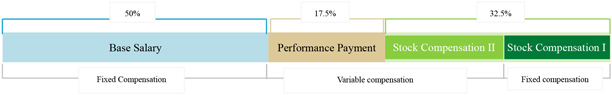

Executive compensation system revised in order to ensure an attitude towards improvement of corporate value shared with shareholders

∎ Compensation system for executives responsible for business execution

Mainly intending to increase the incentive for each officer to fulfill their designated function to the fullest for the purpose of improving corporate value, we revised the compensation system in July 2018, as follows:

Please see pages 104~105 for details of the compensation system.

Compensation system

|

• Designed so that Performance Payments and part of Stock Compensation are linked to the consolidated net business profits and other bases in order to function as an incentive for improving corporate value. |

• The percentage of Stock Compensation is set to be over 30%.

|

<Compensation system for executives responsible for business execution (image)>

Compensation determination process taken by outside directors

The Compensation Committee, comprised exclusively of outside directors all of whom are sufficiently independent from the management of the group, is deeply involved in the process of determining executive compensation and ensuring both the objectivity and transparency of that process.

26

Members of the Compensation Committee (all of which are outside directors)

Chairman | ||||||

Tatsuo Kainaka | Tetsuo Seki | Takashi Kawamura | Hirotake Abe | |||

Major personal history | Major personal history | Major personal history | Major personal history | |||

∎ Superintending Prosecutor of the Tokyo High Public Prosecutors Office ∎ Justice of the Supreme Court ∎Attorney-at-law (current) | ∎ Director, Representative Director and Executive Vice President of Nippon Steel Corporation ∎ President (Representative Director) of the Shoko Chukin Bank, Ltd. | ∎ Representative Executive Officer, Chairman, President and Chief Executive Officer and Director of Hitachi, Ltd. | ∎ CEO of Tohmatsu & Co. ∎ Certified public accountant (current) | |||

<Process to determine Executive compensation and the Compensation Committee’s involvement therein (image)>

* Directors and executive officers as defined in the Companies Act of the Company and the Three Core Companies (Mizuho Bank, Ltd., Mizuho Trust & Banking Co., Ltd. and Mizuho Securities Co., Ltd.) are eligible.

27

Our initiatives have been recognized highly by various external institutions

Customer first principle |

In the R&I Customer-oriented Investment Trust Sales Company Rating by Rating and Investment Information, Inc., which examines how financial enterprises operate their customer-oriented business operations, all four companies – Mizuho Financial Group, Inc., Mizuho Bank, Ltd., Mizuho Trust & Banking Co., Ltd. and Mizuho Securities Co., Ltd. – earned a rating of S, which is the highest rating among the companies examined in 2018. |

Financial innovation | ||||

We were selected as a Competitive IT Strategy Company Stock for the third consecutive year by the Ministry of Economy, Trade and Industry and the Tokyo Stock Exchange. We were recognized for our active efforts to strengthen our competitiveness and create new value through technological innovation. | Our initiatives regarding cybersecurity and the like earned the IT Promotion Award in the 36th IT Awards competition held by the Japan Institute of Information Technology. | |||

Encouraging the active participation of our workforce | ||||

We were selected under the 2019 Health & Productivity Stock Selection, which is jointly administered by the Ministry of Economy, Trade and Industry and the Tokyo Stock Exchange. We were recognized for our approach to employee health and well being by putting into practice strategic workforce health management initiatives. | We were recognized as being actively engaged in promoting the participation of our female employees, and received Nadeshiko Brand designation, conferred jointly by Japan’s Ministry of Economy, Trade and Industry, and the Tokyo Stock Exchange. | |||

Our initiatives to create a more inclusive environment for LGBT and other sexual minorities earned, for the third consecutive year, a top rating of gold in the Pride Index by work with Pride, a voluntary Japanese organization that supports the establishment and promotion of LGBT-related diversity management. | ||||

Disclosures |

We received various awards in recognition of our proactive and advanced online disclosure practices. Our website was recognized for containingin-depth information and being easy to use and understand. |

28

We respond sincerely to the voices of our shareholders

We are actively working to enhancetwo-way communication with our shareholders by utilizing the general meetings of shareholders, publication of booklets and other means. In this section, we will report on the most recent general meeting of shareholders and the valuable comments we have received from our shareholders.

∎ The 16th ordinary general meeting of shareholders (held on June 22, 2018)

· Outline of general meeting of shareholders | ||||

Place | Tokyo International Forum | |||

Number of shareholders present | 279,780 | |||

Number of shareholders attended | 2,246 | |||

Number of shareholders who asked questions or made comments | 10 |

· Principal questions involved:

| • | Approach to improving stock prices |

| • | Differentiation strategy in the technology field |

| • | Rationale of the Nominating Committee for selection of the Group CEO |

· Questionnaire results

We obtained answers from 1,324 shareholders at the venue.

We sincerely appreciate the cooperation of our shareholders. The following is a selection of results from this questionnaire:

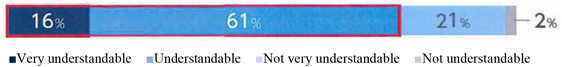

Understandability of the explanations provided

· Was the business report understandable? (Here, we show the result regarding the understandability of the report by the President):

29

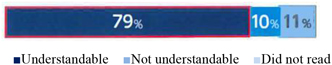

· Were the officers’ answers to questions understandable?

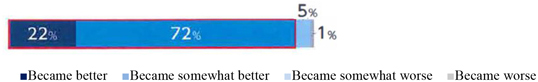

How did your impression of Mizuho Financial Group change after this general meeting of shareholders?

In addition to the above, we received valuable comments from approximately 620 shareholders regarding matters such as the meeting proceedings, answers to questions, and procedures and guidance given at the reception desk.

While we received praise from many shareholders, such as “easy to understand” and “satisfactory,” we also received comments that requested we make an effort to further enhance the general meetings of shareholders. We will continue to strive to conduct the general meeting of shareholders in a more understandable manner and to encourage our shareholders to support us. |

∎ Shareholders’ newsletter (the 17th interim period report to our shareholders issued in December 2018)

We truly appreciate the valuable comments we received from 4,787 shareholders. We will incorporate them in our future publications and IR activities.

Was the newsletter understandable?

30

How did your impression of Mizuho Financial Group change after reading the newsletter?

Additional comments (from approximately 1,350 shareholders)

The comments were primarily related to the following issues:

· Content and layout of the shareholder’s newsletter

· Fintech

· Dividend and stock prices

· Messages of encouragement to Mizuho Financial Group

As our effort to improve understandability by increasing usage of charts and commentaries, increasing the font size and utilizing other methods was well received, we have worked to make this convocation notice more understandable based on such response from our shareholders. |

31

This document has been translated from the Japanese original for reference purposes only. In the event of any discrepancy between this translated document and the Japanese original, the original shall prevail.

(Securities code: 8411)

June 3, 2019

To our shareholders

THE 17TH ORDINARY GENERAL MEETING OF SHAREHOLDERS

Please be advised that the 17th Ordinary General Meeting of Shareholders of Mizuho Financial Group, Inc. will be held as set forth below. You are cordially invited to attend the meeting.

If you are not able to attend the meeting, please exercise your voting rights by mail or via the Internet after examining the reference materials for the ordinary general meeting of shareholders set forth below (pages 35 through 57).

Tatsufumi Sakai

Member of the Board of Directors

President & Group CEO

Mizuho Financial Group, Inc.

5-5, Otemachi1-chome,

Chiyoda–ku, Tokyo

32

| Details | ||||||

| 1. | Date and time: | 10:00 a.m. on Friday, June 21, 2019 (doors open at 9:00 a.m.) | ||||

| 2. | Venue: | Tokyo International Forum (Hall A) | ||||

5-1, Marunouchi3-chome, Chiyoda-ku, Tokyo | ||||||

| 3. | Purpose of the Meeting: | |||||

| Matters to be reported: | Report on the Business Report for the 17th fiscal year (from April 1, 2018 to March 31, 2019), on the consolidated financial statements, on the financial statements and on the Results of Audit of the Consolidated Financial Statements by the Independent Auditors and the Audit Committee | |||||

| Matters to be resolved: | ||||||

| Company’s Proposal (Proposal 1) | ||||||

| Proposal made by the Nominating Committee | ||||||

| Proposal 1: | Appointment of fourteen (14) directors | |||||

| Shareholders’ Proposal (Proposal 2) | ||||||

| Proposal made by a certain shareholder | ||||||

| Proposal 2: | Partial amendment to the Articles of Incorporation (renouncement of the qualification of JGB Market Special Participant) | |||||

| The Board of Directors opposes this proposal. | ||||||

-End of notice-

| ∎ | Any corrections made to the reference materials for the ordinary general meeting of shareholders, the business report, the consolidated financial statements and thenon-consolidated financial statements shall be announced on our website. |

Our website:https://www.mizuho-fg.com/

(or enter “Mizuho FG” into a search engine)

33

Notes:

| · | If you exercise your voting rights twice, in writing and via the Internet, we will only accept the exercise of your voting rights via the Internet as effective. |

| · | If you exercise your voting rights more than once via the Internet, we will only accept the last exercise of your voting rights as effective. |

Information regarding the general meeting of shareholders

| ∎ | In the case of attendance by proxy, please appoint as a proxy one of the shareholders holding voting rights at this general meeting of shareholders, and submit the document certifying the authority of such proxy. |

| ∎ | No gifts to shareholders will be given on the meeting day. |

We appreciate your cooperation to conduct the general meeting of shareholders as smoothly as possible. As the reception at the entrance to the venue is expected to be crowded just prior to the start of the meeting, we encourage you to arrive early in order to mitigate congestion.

34

[Translation]

Reference materials for the General Meeting of Shareholders

Proposal 1: Appointment of fourteen (14) directors

Of the fourteen (14) directors appointed at the 16th Ordinary General Meeting of Shareholders, Messrs. Takanori Nishiyama and Yasuyuki Shibata resigned as directors as of April 1, 2019, and the term of office of the other twelve (12) directors will expire at the closing of this ordinary general meeting of shareholders. Therefore, we propose the appointment of fourteen (14) directors in accordance with the determination by the Nominating Committee.

Among the fourteen (14) candidates for directors, twelve (12) candidates are male and two (2) candidates are female (percentage of female candidates is 14%).

Candidate No. |

| Name | Year of | Chair of | Current title and assignment at Mizuho Financial Group | |||||

1 | Reappointment | Tatsufumi Sakai | 2018 | — | President & Group CEO (Representative Executive Officer ) Member of the Board of Directors | |||||

2 | New appointment | Satoshi Ishii | — | Senior Managing Executive Officer Chief Digital Innovation Officer / CDIO Head of IT & Systems Group / Group CIO Head of Operations Group / Group COO | ||||||

3 | Reappointment | Makoto Umemiya | 2017 | — | Managing Executive Officer Head of Financial Control & Accounting Group / Group CFO Member of the Board of Directors | |||||

4 | New appointment | Motonori Wakabayashi | — | Managing Executive Officer Head of Research & Consulting Unit Head of Risk Management Group / Group CRO | ||||||

5 | New appointment | Hiroaki Ehara | — | Managing Executive Officer Head of Human Resources Group / Group CHRO | ||||||

6 | Reappointment / Internal Non- Executive Director | Yasuhiro Sato | 2009 | — | Member of the Board of Directors, Chairman (Kaicho) (Note) | |||||

7 | New appointment / Internal Non- Executive Director | Hisaaki Hirama | — | Advisor to Audit Committee | ||||||

8 | New appointment / Internal Non- Executive Director | Masahiro Kosugi | — | Advisor to Audit Committee | ||||||

Note: Chairman (Kaicho) Sato engages in our external activities, but does not chair the Board meetings. The Board meetings are chaired by the independent director chair Ota.

35

All six (6) outside directors satisfy the Independence Standards of Outside Directors of Mizuho Financial Group established by Mizuho Financial Group. (For an overview of the independence standards above, please see page 54.)

Candidate No. | Name | Year of | Chair of the Board | Current title and assignment at Mizuho Financial Group | Area of expertise which we expect candidates for | |||||||||||||||||||||||||

Committee Membership | Corporate ment | Law | Finance and Accounting | Economic Policy | Finance | Tech- nology | ||||||||||||||||||||||||

|

| Nominating | Compensation | Audit | Risk | |||||||||||||||||||||||||

9 | Reappointment / Independent Outside Director | Tetsuo Seki | 2015 | — | Member of the Board of Directors | Member | Member | Chair |  |  |  | |||||||||||||||||||

10 | Reappointment / Independent Outside Director | Tatsuo Kainaka | 2014 | — | Member of the Board of Directors | Member | Chair | Member |  | |||||||||||||||||||||

11 | Reappointment / Independent Outside Director | Hirotake Abe | 2015 | — | Member of the Board of Directors | Member | Member |  | ||||||||||||||||||||||

12 | New appointment / Independent Outside Director | Masami Yamamoto | — |  |  | |||||||||||||||||||||||||

13 | Reappointment / Independent Outside Director | Hiroko Ota | 2014 | Chair | Member of the Board of Directors | Member |  | |||||||||||||||||||||||

14 | Reappointment / Independent Outside Director | Izumi Kobayashi | 2017 | — | Member of the Board of Directors | Member | Member |  |  | |||||||||||||||||||||

| * | The above list is not exhaustive and does not show all areas of expertise for which candidates for director have. |

36

| Candidate No. 1 | Tatsufumi Sakai | Reappointment | ||

| Date of birth | August 27, 1959 (Age 59) | |||

| Current title and assignment at Mizuho Financial Group | President & Group CEO (Representative Executive Officer) Member of the Board of Directors | |||

| Number of Mizuho Financial Group shares held1 | Number of shares of Mizuho Financial Group’s common stock currently held: 337,217 shares Potential number of additional shares of common stock to be held: 183,684 shares | |||

Attendance at meetings of the Board of Directors and committees (Fiscal year 2018)2 | The Board of Directors: 12/12 meetings (100%) | |||

| Term in office as a director | 1 year (as of the closing of this ordinary general meeting of shareholders) | |||

Reason for selection as a candidate for director:

He is well-acquainted with the overall business, and has abundant business experience, having been engaged in corporate planning, investment banking business planning, international business planning and other matters as a member of the group since 1984. Moreover, he has abundant management experience as the Group CEO and the President & CEO of Mizuho Securities Co., Ltd. We have selected him as a candidate for director based on the role delegated to him as the head of business execution and because the utilization, as a member of the Board of Directors, of his experience and expert knowledge is expected to strengthen the effectiveness of both the decision-making and supervisory functions of the Board of Directors.

Brief personal record

April 2011 | Executive Officer, Senior Corporate Officer of Strategic Planning Group of CB | |

April 2012 | Executive Officer, General Manager of Group Planning Division of FG Executive Officer, General Manager of Group Planning Division of BK Executive Officer, General Manager of Group Planning Division of CB | |

April 2013 | Managing Executive Officer, Head of Investment Banking Unit of FG Managing Executive Officer, Head of Investment Banking Unit and in charge of Business Collaboration Division (Securities & Trust Services) of BK Managing Executive Officer, Head of Investment Banking Unit and in charge of Business Collaboration Division (Securities & Trust Services) of CB | |

April 2014 | Managing Executive Officer, Head of International Banking Unit of FG Managing Executive Officer, Head of International Banking Unit of BK | |

April 2016 | President & CEO of SC | |

April 2018 | President & Group CEO of FG (Member of the Board of Directors / President & Group CEO from June 2018) (current) Member of the Board of Directors of BK (current) Member of the Board of Directors of TB (current) Member of the Board of Directors of SC (current) |

37

Definitions: FG: Mizuho Financial Group, Inc. BK: Mizuho Bank, Ltd. CB: Mizuho Corporate Bank, Ltd. TB: Mizuho Trust & Banking Co., Ltd. SC: Mizuho Securities Co., Ltd. | ||

Status of major concurrent offices

Member of the Board of Directors of Mizuho Bank, Ltd.

Member of the Board of Directors of Mizuho Trust & Banking Co., Ltd.

Member of the Board of Directors of Mizuho Securities Co., Ltd.

38

| Candidate No. 2 | Satoshi Ishii | New appointment | ||

| Date of birth | September 1, 1963 (Age 55) | |||

| Current title and assignment at Mizuho Financial Group | Senior Managing Executive Officer Chief Digital Innovation Officer / CDIO Head of IT & Systems Group / Group CIO Head of Operations Group / Group COO | |||

| Number of Mizuho Financial Group shares held1 | Number of shares of Mizuho Financial Group’s common stock currently held: 217,206 shares Potential number of additional shares of common stock to be held: 142,992 shares | |||

Attendance at meetings of the Board of Directors and committees (Fiscal year 2018) | — | |||

| Term in office as a director | — (as of the closing of this ordinary general meeting of shareholders) | |||

Reason for selection as a candidate for director:

He is well-acquainted with the overall business, and has abundant business experience, having been engaged in human resources planning, international business planning, business promotion and other matters as a member of the group since 1986. We have selected him as a candidate for director based on the role delegated to him as Chief Digital Innovation Officer, Head of IT & Systems Group and Head of Operations Group, and because the utilization, as a member of the Board of Directors, of his experience and expert knowledge is expected to strengthen the effectiveness of both the decision-making and supervisory functions of the Board of Directors.

Brief personal record

April 2014 | Executive Officer, General Manager of Corporate Secretariat of FG Executive Officer, General Manager of Corporate Secretariat of BK | |

April 2015 | Managing Executive Officer, Head of Human Resources Group of FG Managing Executive Officer, Head of Human Resources Group of BK | |

April 2017 | Senior Managing Executive Officer, Head of Business Promotion of BK | |

| April 2019 | Senior Managing Executive Officer, Chief Digital Innovation Officer, Head of IT & Systems Group and Head of Operations Group of FG (current) Deputy President & Executive Officer, In charge of Digital Innovation Department, Head of IT & Systems Group and Head of Operations Group of BK (current) | |

Definitions: | ||

FG: Mizuho Financial Group, Inc. | ||

BK: Mizuho Bank, Ltd. | ||

Status of major concurrent office

Deputy President & Executive Officer of Mizuho Bank, Ltd.

39

| Candidate No. 3 | Makoto Umemiya | Reappointment | ||

| Date of birth | December 23, 1964 (Age 54) | |||

| Current title and assignment at Mizuho Financial Group | Managing Executive Officer Head of Financial Control & Accounting Group / Group CFO Member of the Board of Directors | |||

| Number of Mizuho Financial Group shares held1 | Number of shares of Mizuho Financial Group’s common stock currently held: 52,749 shares Potential number of additional shares of common stock to be held: 107,228 shares | |||

Attendance at meetings of the Board of Directors and committees (Fiscal year 2018) | The Board of Directors: 14/14 meetings (100%) | |||

| Term in office as a director | 2 years (as of the closing of this ordinary general meeting of shareholders) | |||

Reason for selection as a candidate for director:

He is well-acquainted with the overall business, and has abundant business experience, having been engaged in financial planning, portfolio management, business promotion and other matters as a member of the group since 1987. We have selected him as a candidate for director based on the role delegated to him as the Head of the Financial Control & Accounting Group and because the utilization, as a member of the Board of Directors, of his experience and expert knowledge is expected to strengthen the effectiveness of both the decision-making and supervisory functions of the Board of Directors.

Brief personal record

April 2012 | General Manager of Osaka Branch of BK | |

| April 2014 | General Manager of Financial Planning Division of FG General Manager of Financial Planning Division of BK | |

April 2015 | Executive Officer, General Manager of Financial Planning Department of FG Executive Officer, General Manager of Financial Planning Department of BK | |

April 2017 | Managing Executive Officer, Head of Financial Control & Accounting Group of FG (Member of the Board of Directors, Managing Executive Officer from June 2017) (current) Executive Managing Director, Head of Financial Control & Accounting Group of BK (Managing Executive Officer from April 2019) (current) | |

Definitions: FG: Mizuho Financial Group, Inc. BK: Mizuho Bank, Ltd. | ||

Status of major concurrent office

Executive Managing Officer of Mizuho Bank, Ltd.

40

| Candidate No. 4 | Motonori Wakabayashi | New appointment | ||

| Date of birth | August 13, 1964 (Age 54) | |||

| Current title and assignment at Mizuho Financial Group | Managing Executive Officer Head of Research & Consulting Unit Head of Risk Management Group / Group CRO | |||

| Number of Mizuho Financial Group shares held1 | Number of shares of Mizuho Financial Group’s common stock currently held: 33,122 shares Potential number of additional shares of common stock to be held: 128,575 shares | |||

Attendance at meetings of the Board of Directors and committees (Fiscal year 2018) | — | |||

| Term in office as a director | — (as of the closing of this ordinary general meeting of shareholders) | |||

Reason for selection as a candidate for director:

He is well-acquainted with the overall business, and has abundant business experience, having been engaged in research & consulting business, business promotion, corporate credit supervision and other matters as a member of the group since 1987. We have selected him as a candidate for director based on the role to be delegated to him as the Head of Research & Consulting Unit and Head of Risk Management Group and because the utilization, as a member of the Board of Directors, of his experience and expert knowledge is expected to strengthen the effectiveness of both the decision-making and supervisory functions of the Board of Directors.

Brief personal record

April 2013 | General Manager of Industry Research Division of BK General Manager of Industry Research Division of CB | |

April 2015 | Executive Officer, General Manager of Industry Research Division of BK | |

April 2016 | Managing Executive Officer, Deputy Head of Research & Consulting Unit of FG Managing Executive Officer, Head of Research & Consulting Unit and In charge of Banking of BK | |

April 2018 | Managing Executive Officer, Head of Research & Consulting Unit of FG Managing Executive Officer, Head of Research & Consulting Unit of BK | |

April 2019 | Managing Executive Officer, Head of Research & Consulting Unit and Head of Risk Management Group of FG (current) Managing Executive Officer, Head of Research & Consulting Unit and Head of Risk Management Group of BK (current) Managing Executive Officer, Head of Risk Management Group of TB (current) | |

Definitions: FG: Mizuho Financial Group, Inc. BK: Mizuho Bank, Ltd. CB: Mizuho Corporate Bank, Ltd. TB: Mizuho Trust & Banking Co., Ltd. | ||

Status of major concurrent office

Managing Executive Officer of Mizuho Bank, Ltd.

Managing Executive Officer of Mizuho Trust & Banking Co., Ltd.

President & CEO of Mizuho Research Institute Ltd. (Mr. Wakabayashi is expected to assume this position in late June 2019)

41

Candidate No. 5 | Hiroaki Ehara | New appointment | ||

Date of birth | February 5, 1965 (Age 54) | |||

| Current title and assignment at Mizuho Financial Group | Managing Executive Officer Head of Human Resources Group / Group CHRO | |||

| Number of Mizuho Financial Group shares held1 | Number of shares of Mizuho Financial Group’s common stock currently held: 60,435 shares Potential number of additional shares of common stock to be held: 111,350 shares | |||

Attendance at meetings of the Board of Directors and committees (Fiscal year 2018) | — | |||

| Term in office as a director | — (as of the closing of this ordinary general meeting of shareholders) | |||

Reason for selection as a candidate for director:

He is well-acquainted with the overall business, and has abundant business experience, having been engaged in human resources planning, operations planning, business promotion, internal audits and other matters as a member of the group since 1987. We have selected him as a candidate for director based on the role to be delegated to him as the Head of the Human Resources Group and because the utilization, as a member of the Board of Directors, of his experience and expert knowledge is expected to strengthen the effectiveness of both the decision-making and supervisory functions of the Board of Directors.

Brief personal record

April 2013 | General Manager of Sapporo Branch of TB | |

April 2015 | Executive Officer, General Manager of Trust Business Department VI of TB | |

April 2016 | Managing Executive Officer, Joint Head of Human Resources Group and Joint Head of Internal Audit Group of FG Executive Managing Director, Head of Human Resources Group and Head of Internal Audit Group of TB | |

| April 2019 | Managing Executive Officer, Head of Human Resources Group of FG (current) Managing Executive Officer, Head of Human Resources Group of BK (current) Managing Executive Officer, Head of Human Resources Group of TB (current) | |

Definitions: FG: Mizuho Financial Group, Inc. BK: Mizuho Bank, Ltd. TB: Mizuho Trust & Banking Co., Ltd. | ||

Status of major concurrent office

Managing Executive Officer of Mizuho Bank, Ltd.

Managing Executive Officer of Mizuho Trust & Banking Co., Ltd.

42

| Candidate No. 6 | Yasuhiro Sato | Reappointment Non-Executive Director | ||

| Date of birth | April 15, 1952 (Age 67) | |||

| Current title and assignment at Mizuho Financial Group | Chairman (Kaicho), Member of the Board of Directors* * Chairman (Kaicho) Sato engages in our external activities, but does not chair the Board meetings. The Board meetings are chaired by the independent director chair Ota. | |||

| Number of Mizuho Financial Group shares held1 | Number of shares of Mizuho Financial Group’s common stock currently held: 954,642 shares Potential number of additional shares of common stock to be held: 581,420 shares | |||

Attendance at meetings of the Board of Directors and committees (Fiscal year 2018) | The Board of Directors: 14/14 meetings (100%) | |||

| Term in office as a director | 10 years (as of the closing of this ordinary general meeting of shareholders) | |||

Reason for selection as a candidate for director:

He is well-acquainted with the overall business, and has abundant business experience, having been engaged in corporate planning, international business planning, business promotion and other matters as a member of the group since 1976. Moreover, he has abundant management experience as the Group CEO and President & CEO of Mizuho Bank, Ltd. We have selected him as a candidate for director because the utilization, as a member of the Board of Directors, of his experience and expert knowledge in his position as director who does not concurrently serve as executive officer is expected to strengthen the effectiveness of both the decision-making and supervisory functions of the Board of Directors.

Brief personal record

March 2003 | Executive Officer / Senior Corporate Officer of International Banking Unit of CB | |

April 2004 | Managing Executive Officer in charge of business promotion | |

March 2006 | Executive Managing Director / Head of Corporate Banking Unit | |

April 2007 | Deputy President / Chief Auditor | |

April 2009 | President & CEO (until July 2013) | |

June 2009 | Member of the Board of Directors of FG | |

| June 2011 | Member of the Board of Directors of BK President & Group CEO of FG (until June 2014) | |

July 2013 | President & CEO of BK | |

April 2014 | Member of the Board of Directors (until April 2018) Member of the Board of Directors of TB (until April 2018) Member of the Board of Directors of SC (until April 2018) | |

June 2014 | Member of the Board of Directors, President & Group CEO of FG | |

April 2018 | Chairman, Member of the Board of Directors, Executive Officer (Chairman, Member of the Board of Directors from June 2018) (current) | |

Definitions: FG: Mizuho Financial Group, Inc. BK: Mizuho Bank, Ltd. CB: Mizuho Corporate Bank, Ltd. TB: Mizuho Trust & Banking Co., Ltd. SC: Mizuho Securities Co., Ltd. | ||

Status of major concurrent office

None

43

| Candidate No. 7 | Hisaaki Hirama | New appointment / Internal Non-Executive Director | ||

| Date of birth | December 26, 1962 (Age 56) | |||

| Current title and assignment at Mizuho Financial Group | Advisor to Audit Committee | |||

| Number of Mizuho Financial Group shares held1 | Number of shares of Mizuho Financial Group’s common stock currently held: 130,941 shares Potential number of additional shares of common stock to be held: 78,660 shares | |||

Attendance at meetings of the Board of Directors and committees (Fiscal year 2018) | — | |||

| Term in office as a director | — (as of the closing of this ordinary general meeting of shareholders) | |||

Reason for selection as a candidate for director:

He is well-acquainted with the overall business, and has abundant business experience, having been engaged in accounting, business promotion, internal audits and other matters as a member of the group since 1986. We have selected him as a candidate for director because the utilization, as a member of the Board of Directors, of his experience and expert knowledge in his position, as a director who does not concurrently serve as an executive officer is expected to strengthen the effectiveness of both the decision-making and supervisory functions of the Board of Directors.

He has considerable expert knowledge concerning finance and accounting, which he gained through his experiences and career as General Manager of Accounting Department of Mizuho Financial Group and General Manager of Accounting Department of Mizuho Bank, Ltd.

Brief personal record

| April 2014 | Executive Officer, General Manager of Marunouchi-Chuo Branch Division No.1 of BK | |

| April 2015 | Executive Officer, General Manager of Nagoya Corporate Branch of BK | |

April 2017 | Managing Executive Officer, Deputy Head of Internal Audit Group of FG Managing Executive Officer, Head of Internal Audit Group of BK | |

April 2019 | Advisor to Audit Committee of FG (current) | |

Definitions: FG: Mizuho Financial Group, Inc. BK: Mizuho Bank, Ltd. | ||

Status of major concurrent office

None

44

| Candidate No. 8 | Masahiro Kosugi | New appointment / Internal Non-Executive Director | ||

Date of birth | July 4, 1965 (Age 53) | |||

| Current title and assignment at Mizuho Financial Group | Advisor to Audit Committee | |||

| Number of Mizuho Financial Group shares held1 | Number of shares of Mizuho Financial Group’s common stock currently held: 44,139 shares Potential number of additional shares of common stock to be held: 0 shares | |||

Attendance at meetings of the Board of Directors and committees (Fiscal year 2018) | — | |||

| Term in office as a director | — (as of the closing of this ordinary general meeting of shareholders) | |||

Reason for selection as a candidate for director:

He is well-acquainted with the overall business, and has abundant business experience, having been engaged in accounting, portfolio management and other matters as a member of the group since 1989. We have selected him as a candidate for director because the utilization, as a member of the Board of Directors, of his experience and expert knowledge in his position, as a director who does not concurrently serve as an executive officer is expected to strengthen the effectiveness of both the decision-making and supervisory functions of the Board of Directors.

He has considerable expert knowledge concerning finance and accounting, which he gained through his experiences and career as General Manager of Accounting Department of Mizuho Financial Group Inc. and General Manager of Accounting Department of Mizuho Bank, Ltd.

Brief personal record

April 2014 | General Manager of Portfolio Management Division of FG General Manager of Portfolio Management Division of BK | |

April 2016 | General Manager of Accounting Department of FG General Manager of Accounting Department of BK | |

| April 2018 | Executive Officer, General Manager of Accounting Department of FG Executive Officer, General Manager of Accounting Department of BK | |

April 2019 | Advisor to Audit Committee of Mizuho Financial Group, Inc. (current) | |

Definitions: FG: Mizuho Financial Group, Inc. BK: Mizuho Bank, Ltd. | ||

Status of major concurrent office

None

45

| Candidate No. 9 | Tetsuo Seki | Reappointment / Independent Outside Director | ||

Date of birth | July 29, 1938 (Age 80) | |||

| Current title and assignment at Mizuho Financial Group | Member of the Board of Directors Member of the Nominating Committee Member of the Compensation Committee Chairman of the Audit Committee | |||

| Number of Mizuho Financial Group shares held1 | Number of shares of Mizuho Financial Group’s common stock currently held: 46,500 shares Potential number of additional shares of common stock to be held: 11,200 shares | |||

Attendance at meetings of the Board of Directors and committees (Fiscal year 2018) | The Board of Directors: 14/14 meetings (100%) The Nominating Committee: 8/8 meetings (100%) The Compensation Committee: 11/11 meetings (100%) The Audit Committee: 17/17 meetings (100%) | |||

| Term in office as a director | 4 years (as of the closing of this ordinary general meeting of shareholders) | |||

| Area of expertise expected to have |  Corporate management Corporate management Finance and accounting Finance and accounting Finance Finance | |||

Reason for selection as a candidate for director:

He has served as Representative Director and Executive Vice President of Nippon Steel Corporation; President (Representative Director) of the Shoko Chukin Bank, Ltd.; Chairperson of the Japan Corporate Auditors Association; and Chairperson of the Audit Committee of Japan Post Holdings Co., Ltd. We propose to appoint him as an outside director based on our conclusion that he will be able to significantly contribute to, among other matters, (i) strengthening the effectiveness of both the decision-making and supervisory functions of the Board of Directors, and (ii) our efforts to further enhance internal control systems and group governance, from a perspective independent from that of the management, leveraging his extensive experience and deep insight as a senior executive.

He has considerable expert knowledge concerning finance and accounting which he gained through his experiences and career as CFO of Nippon Steel Corporation, Chairperson of the Japan Corporate Auditors Association and a member of the Audit Committee of Mizuho Financial Group.

Candidate’s independence

He satisfies the Independence Standards of Outside Directors of Mizuho Financial Group established by Mizuho Financial Group.

Activities on the Board of Directors and committees

By leveraging his extensive experience and deep insight as a senior executive, he proactively made suggestions concerning, among other matters, (i) increasing our fundamental earnings power, (ii) appropriate allocation of human resources based on our business strategies, (iii) how effective performance evaluations should be structured and (iv) direction of the new business plan based on our structural reforms.

Brief personal record

April 1963 | Joined Yawata Iron & Steel Co., Ltd. | |

June 1993 | Director of Nippon Steel Corporation | |

| April 1997 | Managing Director | |

April 2000 | Representative Director and Executive Vice President | |

June 2003 | Executive Advisor | |

June 2004 | Senior Corporate Auditor | |

June 2006 | Independent Director of Terumo Corporation (until September 2008) | |

March 2007 | Outside Director of Sapporo Holdings Limited (until September 2008) | |

June 2007 | Outside Director of Tokyo Financial Exchange Inc. (until September 2008) | |

October 2007 | Chairperson of the Japan Corporate Auditors Association (until October 2008) Outside Director of Japan Post Holdings Co., Ltd. (until September 2008) | |

June 2008 | Executive Advisor to Nippon Steel Corporation (until September 2008) | |

October 2008 | President (Representative Director) of the Shoko Chukin Bank, Ltd. | |

June 2013 | General Advisor (current) | |

June 2015 | Member of the Board of Directors (Outside Director) of Mizuho Financial Group (current) | |

March 2016 | Audit & Supervisory Board Member of Sapporo Holdings Limited (current) |

Status of major concurrent office

Audit & Supervisory Board Member of Sapporo Holdings Limited

46

Candidate No. 10 | Tatsuo Kainaka | Reappointment / Independent Outside Director | ||

Date of birth | January 2, 1940 (Age 79) | |||

| Current title and assignment at Mizuho Financial Group | Member of the Board of Directors Member of the Nominating Committee Chairman of the Compensation Committee Member of the Audit Committee | |||

| Number of Mizuho Financial Group shares held1 | Number of shares of Mizuho Financial Group’s common stock currently held: 25,000 shares Potential number of additional shares of common stock to be held: 11,200 shares | |||

Attendance at meetings of the Board of Directors and committees (Fiscal year 2018) | The Board of Directors: 14/14 meetings (100%) The Nominating Committee: 8/8 meetings (100%) The Compensation Committee: 11/11 meetings (100%) The Audit Committee: 17/17 meetings (100%) | |||

| Term in office as a director | 5 years (as of the closing of this ordinary general meeting of shareholders) | |||

| Area of expertise expected to have |  Law Law | |||

Reason for selection as a candidate for director:

He has served in positions such as Superintending Prosecutor of the Tokyo High Public Prosecutors Office and Justice of the Supreme Court, and he is currently active as anattorney-at-law. We propose to appoint him as an outside director based on our conclusion that he will be able to significantly contribute to, among other matters, (i) strengthening the effectiveness of both the decision-making and supervisory functions of the Board of Directors, and (ii) the further enhancement of our corporate governance, compliance and risk management framework, from a perspective independent from that of the management, leveraging his extensive experience, deep insight and high level of expertise.

Although he has not previously been engaged in management of a company other than in his career as an outside director and outside audit & supervisory board member, we believe he will fulfill the duties of an outside director of Mizuho Financial Group appropriately due to the reasons stated above.

Candidate’s independence

He satisfies the Independence Standards of Outside Directors of Mizuho Financial Group established by Mizuho Financial Group.

The relationship between him, asattorney-at-law, and the group does not affect his independence, for reasons including that neither he nor the law office to which he belongs, i.e., Takusyou Sogo Law Office, have received any money or proprietary benefit from the group other than the compensation he receives as an outside director of Mizuho Financial Group.

Activities on the Board of Directors and committees

By leveraging his extensive experience, deep insight and high level of expertise as a Public Prosecutor, judge, andattorney-at-law, he proactively made suggestions concerning, among other matters, (i) proper allocation of human resources responding to the volume of business, (ii) employee satisfaction with regards to working in the group and (iii) improvement plans based on the analysis of causes of crisis.

Brief personal record

April 1966 | Appointed as Public Prosecutor | |

January 2002 | Superintending Prosecutor of the Tokyo High Public Prosecutors Office | |

| October 2002 | Justice of the Supreme Court | |

| March 2010 | Admitted to the Tokyo Bar Association | |

| April 2010 | Joined Takusyou Sogo Law Office (current) | |

| January 2011 | President of the Life Insurance Policyholders Protection Corporation of Japan (current) | |

| November 2013 | Member of the Board of Directors (Outside Director) of BK (until June 2014) | |

June 2014 | Member of the Board of Directors (Outside Director) of FG (current) | |

Definitions: FG: Mizuho Financial Group, Inc. BK: Mizuho Bank, Ltd. | ||

Status of major concurrent offices

Attorney-at-law at Takusyou Sogo Law Office

President of the Life Insurance Policyholders Protection Corporation of Japan

Corporate Auditor (External) of Oriental Land Co., Ltd.

47

Candidate No. 11 | Hirotake Abe | Reappointment / Independent Outside Director | ||

Date of birth | November 13, 1944 (Age 74) | |||

| Current title and assignment at Mizuho Financial Group | Member of the Board of Directors Member of the Compensation Committee Member of the Audit Committee | |||

| Number of Mizuho Financial Group shares held1 | Number of shares of Mizuho Financial Group’s common stock currently held: 46,500 shares Potential number of additional shares of common stock to be held: 11,200 shares | |||

Attendance at meetings of the Board of Directors and committees (Fiscal year 2018) | The Board of Directors: 14/14 meetings (100%) The Compensation Committee: 11/11 meetings (100%) The Audit Committee: 17/17 meetings (100%) | |||

| Term in office as a director | 4 years (as of the closing of this ordinary general meeting of shareholders) | |||

| Area of expertise expected to have |  Finance and accounting Finance and accounting | |||

Reason for selection as a candidate for director:

He has served in positions such as CEO of Tohmatsu & Co., and he is currently active as a certified public accountant. We propose to appoint him as an outside director based on our conclusion that he will be able to significantly contribute to, among other matters, strengthening the effectiveness of both the decision-making and supervisory functions of the Board of Directors, from a perspective independent from that of the management, leveraging his extensive experience, deep insight and high level of expertise.

Although he has not previously been engaged in management of a company other than in his career as an outside director and an outside audit & supervisory board member, we believe he will fulfill the duties of an outside director of Mizuho Financial Group appropriately due to the reasons stated above and his considerable expert knowledge concerning finance and accounting as a certified public accountant.

Candidate’s independence

He satisfies the Independence Standards of Outside Directors of Mizuho Financial Group established by Mizuho Financial Group.

With respect to the relationship between him, as a certified public accountant, and the group, neither he nor the accounting office to which he belongs, i.e., Certified Public Accountant Hirotake Abe Office, have received any money or proprietary benefit from the group other than the compensation he receives as an outside director of Mizuho Financial Group.

Activities on the Board of Directors and committees

By leveraging his extensive experience, deep insight and high level of expertise as a certified public accountant, he proactively made suggestions concerning, among other matters, (i) proper financial reporting, (ii) human resources strategy in response to digitalization and business expansion overseas and (iii) strengthening the function of internal control within the Three Core Companies.

Brief personal record

January 1970 | Joined Tohmatsu Awoki & Co. | |

June 1985 | Temporarily transferred to Deloitte & Touche New York Office (until October 1992) | |

July 1990 | Senior Partner of Tohmatsu & Co. | |

June 2001 | CEO (until May 2007) | |

June 2004 | Executive Member of Deloitte Touche Tohmatsu Limited (until May 2007) | |

June 2007 | Senior Adviser of Deloitte Touche Tohmatsu (until December 2009) | |

January 2010 | Established the Certified Public Accountant Hirotake Abe Office (current) | |

June 2010 | Outside Corporate Auditor of Conexio Corporation (until June 2018) | |

September 2010 | Visiting Professor, Chuo Graduate School of International Accounting (until March 2012) | |

June 2011 | Outside Corporate Auditor of Honda Motor Co., Ltd. (until June 2015) | |

October 2012 | Outside Audit and Supervisory Board Member of Nippon Steel & Sumitomo Metal Corporation (until June 2016) | |

June 2015 | Member of the Board of Directors (Outside Director) of Mizuho Financial Group (current) |

Status of major concurrent offices

Certified Public Accountant Hirotake Abe Office

48

| Candidate No. 12 | Masami Yamamoto | New appointment / Independent Outside Director | ||

| Date of birth | January 11, 1954 (Age 65) | |||

| Current title and assignment at Mizuho Financial Group | — | |||

| Number of Mizuho Financial Group shares held1 | Number of shares of Mizuho Financial Group’s common stock currently held: 0 shares Potential number of additional shares of common stock to be held: 0 shares | |||

Attendance at meetings of the Board of Directors and committees (Fiscal year 2018) | — | |||

| Term in office as a director | — (as of the closing of this ordinary general meeting of shareholders) | |||

| Area of expertise expected to have |

| |||

Reason for selection as a candidate for director:

He served as Representative Director, President of Fujitsu Limited and he is currently active as Representative Director, Chairman of this company. He is also in charge of important posts such as a member of the Council for Promotion of Regulatory Reform. We selected him as a candidate for outside director based on our conclusion that he will be able to significantly contribute to, among other matters, strengthening the effectiveness of both the decision-making and supervisory functions of the Board of Directors, from a perspective independent from that of the management, leveraging his extensive experience as a senior executive of a global corporation and deep insight and expertise in the field of technology.

Candidate’s independence

He satisfies the Independence Standards of Outside Directors of Mizuho Financial Group established by Mizuho Financial Group.

The business relationship between Fujitsu Limited, where he serves as Director, Chairman, and the group does not affect his independence, for reasons including that (i) the percentage of sales gained through the business with the group of the consolidated net sales of Fujitsu Limited, and (ii) the percentage of gross profits gained through the business with group companies of Fujitsu Limited of the consolidated gross profits of Mizuho Financial Group, are less than 1%, respectively.

Brief personal record

| June 2004 | Executive Vice President, Personal Systems Business Group of Fujitsu Limited | |

June 2005 | Corporate Vice President | |

June 2007 | Corporate Senior Vice President | |

January 2010 | Corporate Senior Executive Vice President | |

April 2010 | President | |

June 2010 | Representative Director, President | |

June 2015 | Representative Director, Chairman | |

June 2017 | Director, Chairman (current) Outside Director of JFE Holdings, Inc. (current) | |

Status of major concurrent office

Director, Senior Advisor of Fujitsu Limited (Mr. Yamamoto is expected to assume this position in late June, 2019) Outside Director of JFE Holdings, Inc. | ||

49

Candidate No. 13 | Hiroko Ota | Reappointment / Independent Outside Director | ||

| Date of birth | February 2, 1954 (Age 65) | |||

| Current title and assignment at Mizuho Financial Group | Member of the Board of Directors Chairman of the Board of Directors Member of the Nominating Committee | |||

| Number of Mizuho Financial Group shares held1 | Number of shares of Mizuho Financial Group’s common stock currently held: 5,000 shares Potential number of additional shares of common stock to be held: 11,200 shares | |||

Attendance at meetings of the Board of Directors and committees (Fiscal year 2018) | The Board of Directors: 14/14 meetings (100%) The Nominating Committee: 8/8 meetings (100%) | |||

| Term in office as a director | 5 years (as of the closing of this ordinary general meeting of shareholders) | |||

| Area of expertise expected to have |

| |||

Reason for selection as a candidate for director: