- MFG Dashboard

- Financials

- Filings

- Holdings

- Transcripts

- ETFs

-

Insider

- Institutional

- Shorts

-

6-K Filing

Mizuho Financial (MFG) 6-KCurrent report (foreign)

Filed: 14 Nov 22, 6:12am

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of November 2022

Commission File Number 001-33098

Mizuho Financial Group, Inc.

(Translation of registrant’s name into English)

5-5, Otemachi 1-chome

Chiyoda-ku, Tokyo 100-8176

Japan

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F. Form 20-F ☒ Form 40-F ☐

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): ☐

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): ☐

Indicate by check mark whether the registrant by furnishing the information contained in this Form is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934. Yes ☐ No ☒

If “Yes” is marked, indicate below the file number assigned to the registrant in connection with Rule 12g3-2(b):82- .

THIS REPORT ON FORM 6-K SHALL BE DEEMED TO BE INCORPORATED BY REFERENCE INTO THE PROSPECTUS FORMING A PART OF MIZUHO FINANCIAL GROUP, INC.’S REGISTRATION STATEMENT ON FORM F-3 (FILE NO. 333-266555) AND TO BE A PART OF SUCH PROSPECTUS FROM THE DATE ON WHICH THIS REPORT IS FURNISHED, TO THE EXTENT NOT SUPERSEDED BY DOCUMENTS OR REPORTS SUBSEQUENTLY FILED OR FURNISHED.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| Date: | November 14, 2022 | |

| Mizuho Financial Group, Inc. | ||

| By: | /s/ Makoto Umemiya | |

| Name: | Makoto Umemiya | |

| Title: | Deputy President & Senior Executive Officer / Group CFO | |

For Immediate Release:

Consolidated Financial Statements for the Second Quarter of Fiscal 2022 (Six months ended September 30, 2022) (Under Japanese GAAP) |  |

| Company Name: | Mizuho Financial Group, Inc. (“MHFG”) | November 14, 2022 |

| Stock Code Number (Japan): | 8411 | |||||||

| Stock Exchange Listings: | Tokyo Stock Exchange (Prime Market), New York Stock Exchange | |||||||

| URL: | https://www.mizuhogroup.com | |||||||

| Representative: | Masahiro Kihara | President & Group CEO | ||||||

| For Inquiry: | Yasutoshi Tanaka | General Manager of Accounting | Phone: | +81-3-6838-6101 | ||||

| Filing of Shihanki Hokokusho (scheduled): | November 29, 2022 | Trading Accounts: | Established | |||||

| Commencement of Dividend Payment (scheduled): | December 6, 2022 | |||||||

| Supplementary Materials on Quarterly Results: | Attached | |||||||

| IR Conference on Quarterly Results: | Scheduled | |||||||

Amounts less than one million yen are rounded down.

1. Financial Highlights for the Second Quarter (First Half) of Fiscal 2022 (for the six months ended September 30, 2022)

(1) Consolidated Results of Operations

| (%: Changes from the previous first half) |

| |||||||||||||||||||||||

| Ordinary Income | Ordinary Profits | Profit Attributable to Owners of Parent | ||||||||||||||||||||||

| ¥ million | % | ¥ million | % | ¥ million | % | |||||||||||||||||||

1H F2022 | 2,944,948 | 86.4 | 439,282 | 10.0 | 333,964 | (13.4 | ) | |||||||||||||||||

1H F2021 | 1,579,249 | 0.1 | 399,340 | 49.2 | 385,657 | 78.9 | ||||||||||||||||||

| Note: | Comprehensive Income: 1H F2022: ¥(51,438) million, —%; 1H F2021: ¥382,910 million, 1.7%; |

| Net Income per Share of Common Stock | Diluted Net Income per Share of Common Stock | |||||||

| ¥ | ¥ | |||||||

1H F2022 | 131.77 | 131.77 | ||||||

1H F2021 | 152.12 | 152.12 | ||||||

(2) Consolidated Financial Conditions

| Total Assets | Total Net Assets | Own Capital Ratio | ||||||||||

| ¥ million | ¥ million | % | ||||||||||

1H F2022 | 256,127,425 | 8,996,055 | 3.4 | |||||||||

Fiscal 2021 | 237,066,142 | 9,201,031 | 3.8 | |||||||||

| Reference: | Own Capital: As of September 30, 2022: ¥8,923,275 million; As of March 31, 2022: ¥9,077,382 million | |||||||||||

| Note: | Own Capital Ratio is calculated as follows: (Total Net Assets - Stock Acquisition Rights - Non-controlling Interests) / Total Assets × 100 Own Capital Ratio stated above is not calculated based on the public notice of Own Capital Ratio. |

2. Cash Dividends for Shareholders of Common Stock

| Annual Cash Dividends per Share | ||||||||||||||||||||

| First Quarter-end | Second Quarter-end | Third Quarter-end | Fiscal Year-end | Total | ||||||||||||||||

| ¥ | ¥ | ¥ | ¥ | ¥ | ||||||||||||||||

Fiscal 2021 | — | 40.00 | — | 40.00 | 80.00 | |||||||||||||||

Fiscal 2022 | — | 42.50 | ||||||||||||||||||

Fiscal 2022 (estimate) | — | 42.50 | 85.00 | |||||||||||||||||

Note: Revision of the latest announced estimates for cash dividends for shareholders of common stock: Yes

3. Consolidated Earnings Estimates for Fiscal 2022 (for the fiscal year ending March 31, 2023)

| (%: Changes from the previous fiscal year) | ||||||||||||||||||||

| Profit Attributable to Owners of Parent | Net Income per Share of Common Stock | |||||||||||||||||||

| ¥ million | % | ¥ | ||||||||||||||||||

Fiscal 2022 | 540,000 | 1.7 | 213.05 | |||||||||||||||||

| Notes: | 1. | Revision of the latest announced earnings estimates for Fiscal 2022: No | ||||||||

| 2. | The number of shares of common stock used in the above per share information is based on the weighted average of the average number of outstanding shares during 1H and the number of outstanding shares as of September 30, 2022 (which is used as a proxy for the average number of outstanding shares during the remainder of the relevant period). | |||||||||

Notes

(1) Changes in Significant Subsidiaries during the Period (changes in specified subsidiaries accompanying changes in the scope of consolidation): No

(2) Changes in Accounting Policies and Accounting Estimates / Restatements

i. Changes in accounting policies due to revisions of accounting standards: Yes

ii. Changes in accounting policies other than i above: No

iii. Changes in accounting estimates: No

iv. Restatements: No

Note: For more information, please refer to “1.(1) Changes in Accounting Policies and Accounting Estimates / Restatements” on page 1-2 of the attachment.

(3) Issued Shares of Common Stock

i. Period-end issued shares (including treasury stock): | As of September 30, 2022 | 2,539,249,894 shares | As of March 31, 2022 | 2,539,249,894 shares | ||||

ii. Period-end treasury stock: | As of September 30, 2022 | 4,930,963 shares | As of March 31, 2022 | 4,659,024 shares | ||||

iii. Average outstanding shares: | 1st Half Fiscal 2022 | 2,534,305,855 shares | 1st Half Fiscal 2021 | 2,535,113,784 shares |

This immediate release is outside the scope of semi-annual audit by certified public accountants or audit firms.

This immediate release contains statements that constitute forward-looking statements within the meaning of the United States Private Securities Litigation Reform Act of 1995, including estimates, forecasts, targets and plans. Such forward-looking statements do not represent any guarantee by management of future performance. In many cases, but not all, we use such words as “aim,” “anticipate,” “believe,” “endeavor,” “estimate,” “expect,” “intend,” “may,” “plan,” “probability,” “project,” “risk,” “seek,” “should,” “strive,” “target” and similar expressions in relation to us or our management to identify forward-looking statements. You can also identify forward-looking statements by discussions of strategy, plans or intentions. These statements reflect our current views with respect to future events and are subject to risks, uncertainties and assumptions. We may not be successful in implementing our business strategies, and management may fail to achieve its targets, for a wide range of possible reasons, including, without limitation: impact of geopolitical disruptions and the corona virus pandemic; intensification of competition in the market for financial services; incurrence of significant credit-related costs; declines in the value of our securities portfolio; changes in interest rates; foreign currency fluctuations; decrease in the market liquidity of our assets; revised assumptions or other changes related to our pension plans; a decline in our deferred tax assets; impairment of the carrying value of our long-lived assets; problems related to our information technology systems, including as a result of cyber attacks; the effect of financial transactions entered into for hedging and other similar purposes; failure to maintain required capital adequacy ratio levels and meet other financial regulatory requirements; downgrades in our credit ratings; our ability to avoid reputational harm; our ability to implement our 5-Year Business Plan and implement other strategic initiatives and measures effectively; the effectiveness of our operational, legal and other risk management policies; the effect of changes in general economic conditions in Japan and elsewhere; and changes to applicable laws and regulations. Further information regarding factors that could affect our financial condition and results of operations is included in “Item 3. D. Key Information-Risk Factors” and “Item 5. Operating and Financial Review and Prospects” in our most recent Form 20-F filed with the U.S. Securities and Exchange Commission (“SEC”), which is available in the Financial Information section of our web page at www.mizuhogroup.com and also at the SEC’s web site at www.sec.gov. We do not intend to update our forward-looking statements. We are under no obligation, and disclaim any obligation, to update or alter our forward-looking statements, whether as a result of new information, future events or otherwise, except as may be required by the rules of the Tokyo Stock Exchange. MHFG is a specified business company under “Cabinet Office Ordinance on Disclosure of Corporate Information, etc.” Article 17-15 clause 2 and prepares the interim consolidated financial statements in the second quarter.

|

Mizuho Financial Group, Inc.

m Contents of Attachment

| 1. Matters Related to Summary Information (Notes) | p.1-2 | |||

(1) Changes in Accounting Policies and Accounting Estimates / Restatements | p.1-2 | |||

| 2. Interim Consolidated Financial Statements and Others | p.1-3 | |||

(1) Consolidated Balance Sheets | p.1-3 | |||

(2) Consolidated Statements of Income and Consolidated Statements of Comprehensive Income | p.1-5 | |||

(3) Consolidated Statements of Changes in Net Assets | p.1-7 | |||

(4) Note for Assumption of Going Concern | p.1-8 | |||

øSELECTED FINANCIAL INFORMATION For the Second Quarter (First Half) of Fiscal 2022 | ||||

Note to XBRL

Please note that the names of the English accounts contained in XBRL data, which are available through EDINET and TDNet, may be different from those of the English accounts in our financial statements.

An MHFG IR conference for institutional investors and analysts is scheduled for Thursday, November 17, 2022. The IR conference presentation materials and audio archive will be available for use by individual investors in the IR Information section of the Mizuho Financial Group website immediately after the conference.

1-1

Mizuho Financial Group, Inc.

1. Matters Related to Summary Information (Notes)

(1) Changes in Accounting Policies and Accounting Estimates / Restatements

(Changes in Accounting Policies)

(Implementation Guidance on Accounting Standard for Fair Value Measurement)

MHFG has applied “Implementation Guidance on Accounting Standard for Fair Value Measurement” (ASBJ Guidance No.31, June 17, 2021 (referred to as “Fair Value Accounting Standard Implementation Guidance”)) from the beginning of the interim ended September 30, 2022. In accordance with the transitional treatment set out in Article 27-2 of “Fair Value Accounting Standard Implementation Guidance”, MHFG applies the new accounting policy set forth in “Fair Value Accounting Standard Implementation Guidance” prospectively. As a result, some Investment trusts and others are calculated using net asset value, etc., as of the calculation date of the fair value.

1-2

Mizuho Financial Group, Inc.

2. Interim Consolidated Financial Statements and Others

(1) Consolidated Balance Sheets

| Millions of yen | ||||||||

| As of March 31, 2022 | As of September 30, 2022 | |||||||

Assets | ||||||||

Cash and Due from Banks | ¥ | 51,359,301 | ¥ | 54,458,168 | ||||

Call Loans and Bills Purchased | 940,008 | 1,231,117 | ||||||

Receivables under Resale Agreements | 12,750,363 | 14,870,926 | ||||||

Guarantee Deposits Paid under Securities Borrowing Transactions | 2,340,089 | 2,357,494 | ||||||

Other Debt Purchased | 3,476,021 | 3,856,777 | ||||||

Trading Assets | 13,221,415 | 19,649,112 | ||||||

Money Held in Trust | 591,183 | 560,762 | ||||||

Securities | 44,641,060 | 38,412,009 | ||||||

Loans and Bills Discounted | 84,736,280 | 92,119,481 | ||||||

Foreign Exchange Assets | 2,627,492 | 3,251,206 | ||||||

Derivatives other than for Trading Assets | 2,277,160 | 4,192,965 | ||||||

Other Assets | 7,797,796 | 9,147,569 | ||||||

Tangible Fixed Assets | 1,095,977 | 1,115,671 | ||||||

Intangible Fixed Assets | 601,292 | 610,368 | ||||||

Net Defined Benefit Asset | 863,217 | 847,771 | ||||||

Deferred Tax Assets | 184,594 | 413,040 | ||||||

Customers’ Liabilities for Acceptances and Guarantees | 8,346,878 | 9,733,515 | ||||||

Reserves for Possible Losses on Loans | (783,886 | ) | (700,532 | ) | ||||

Reserve for Possible Losses on Investments | (107 | ) | (1 | ) | ||||

|

|

|

| |||||

Total Assets | ¥ | 237,066,142 | ¥ | 256,127,425 | ||||

|

|

|

| |||||

1-3

Mizuho Financial Group, Inc.

| Millions of yen | ||||||||

| As of March 31, 2022 | As of September 30, 2022 | |||||||

Liabilities | ||||||||

Deposits | ¥ | 138,830,872 | ¥ | 142,447,797 | ||||

Negotiable Certificates of Deposit | 16,868,931 | 21,823,004 | ||||||

Call Money and Bills Sold | 1,278,050 | 1,572,353 | ||||||

Payables under Repurchase Agreements | 20,068,779 | 23,766,031 | ||||||

Guarantee Deposits Received under Securities Lending Transactions | 1,172,248 | 1,228,757 | ||||||

Commercial Paper | 1,775,859 | 1,574,288 | ||||||

Trading Liabilities | 9,608,976 | 14,822,746 | ||||||

Borrowed Money | 6,590,527 | 2,990,638 | ||||||

Foreign Exchange Liabilities | 1,508,453 | 675,373 | ||||||

Short-term Bonds | 537,167 | 498,772 | ||||||

Bonds and Notes | 10,714,004 | 11,628,828 | ||||||

Due to Trust Accounts | 1,167,284 | 1,138,586 | ||||||

Derivatives other than for Trading Liabilities | 2,770,852 | 4,995,676 | ||||||

Other Liabilities | 6,301,484 | 7,965,234 | ||||||

Reserve for Bonus Payments | 120,052 | 69,600 | ||||||

Reserve for Variable Compensation | 2,278 | 1,186 | ||||||

Net Defined Benefit Liability | 71,774 | 71,418 | ||||||

Reserve for Director and Corporate Auditor Retirement Benefits | 557 | 472 | ||||||

Reserve for Possible Losses on Sales of Loans | 1,309 | 8,068 | ||||||

Reserve for Contingencies | 6,622 | 10,369 | ||||||

Reserve for Reimbursement of Deposits | 17,620 | 15,650 | ||||||

Reserve for Reimbursement of Debentures | 10,504 | 8,965 | ||||||

Reserves under Special Laws | 3,132 | 3,131 | ||||||

Deferred Tax Liabilities | 30,923 | 21,198 | ||||||

Deferred Tax Liabilities for Revaluation Reserve for Land | 59,962 | 59,704 | ||||||

Acceptances and Guarantees | 8,346,878 | 9,733,515 | ||||||

|

|

|

| |||||

Total Liabilities | ¥ | 227,865,110 | ¥ | 247,131,369 | ||||

|

|

|

| |||||

Net Assets | ||||||||

Common Stock | ¥ | 2,256,767 | ¥ | 2,256,767 | ||||

Capital Surplus | 1,125,324 | 1,129,388 | ||||||

Retained Earnings | 4,756,435 | 4,989,307 | ||||||

Treasury Stock | (8,342 | ) | (8,552 | ) | ||||

|

|

|

| |||||

Total Shareholders’ Equity | 8,130,185 | 8,366,911 | ||||||

|

|

|

| |||||

Net Unrealized Gains (Losses) on Other Securities | 719,822 | 118,757 | ||||||

Deferred Gains or Losses on Hedges | (76,757 | ) | (96,220 | ) | ||||

Revaluation Reserve for Land | 132,156 | 131,572 | ||||||

Foreign Currency Translation Adjustments | 2,346 | 256,338 | ||||||

Remeasurements of Defined Benefit Plans | 169,652 | 145,929 | ||||||

Own Credit Risk Adjustments, Net of Tax | (23 | ) | (13 | ) | ||||

|

|

|

| |||||

Total Accumulated Other Comprehensive Income | 947,197 | 556,363 | ||||||

|

|

|

| |||||

Stock Acquisition Rights | 94 | 5 | ||||||

Non-Controlling Interests | 123,555 | 72,774 | ||||||

|

|

|

| |||||

Total Net Assets | 9,201,031 | 8,996,055 | ||||||

|

|

|

| |||||

Total Liabilities and Net Assets | ¥ | 237,066,142 | ¥ | 256,127,425 | ||||

|

|

|

| |||||

1-4

Mizuho Financial Group, Inc.

(2) Consolidated Statements of Income and Consolidated Statements of Comprehensive Income

Consolidated Statements of Income

| Millions of yen | ||||||||

| For the six months ended September 30, 2021 | For the six months ended September 30, 2022 | |||||||

Ordinary Income | ¥ | 1,579,249 | ¥ | 2,944,948 | ||||

Interest Income | 615,622 | 1,169,193 | ||||||

Interest on Loans and Bills Discounted | 422,172 | 686,794 | ||||||

Interest and Dividends on Securities | 119,583 | 178,938 | ||||||

Fiduciary Income | 29,728 | 29,313 | ||||||

Fee and Commission Income | 416,769 | 418,579 | ||||||

Trading Income | 226,614 | 919,840 | ||||||

Other Operating Income | 142,799 | 323,050 | ||||||

Other Ordinary Income | 147,714 | 84,971 | ||||||

Ordinary Expenses | 1,179,909 | 2,505,666 | ||||||

Interest Expenses | 141,461 | 657,161 | ||||||

Interest on Deposits | 28,002 | 226,344 | ||||||

Fee and Commission Expenses | 86,326 | 85,407 | ||||||

Trading Expenses | 35,301 | 864,053 | ||||||

Other Operating Expenses | 59,622 | 99,571 | ||||||

General and Administrative Expenses | 667,594 | 706,446 | ||||||

Other Ordinary Expenses | 189,602 | 93,026 | ||||||

|

|

|

| |||||

Ordinary Profits | 399,340 | 439,282 | ||||||

|

|

|

| |||||

Extraordinary Gains | 51,553 | 12,703 | ||||||

Extraordinary Losses | 4,271 | 6,929 | ||||||

|

|

|

| |||||

Income before Income Taxes | 446,622 | 445,057 | ||||||

|

|

|

| |||||

Income Taxes: | ||||||||

Current | 65,604 | 61,866 | ||||||

Deferred | (10,941 | ) | 45,446 | |||||

|

|

|

| |||||

Total Income Taxes | 54,663 | 107,313 | ||||||

|

|

|

| |||||

Profit | 391,958 | 337,743 | ||||||

|

|

|

| |||||

Profit Attributable to Non-controlling Interests | 6,301 | 3,779 | ||||||

|

|

|

| |||||

Profit Attributable to Owners of Parent | ¥ | 385,657 | ¥ | 333,964 | ||||

|

|

|

| |||||

1-5

Mizuho Financial Group, Inc.

Consolidated Statements of Comprehensive Income

| Millions of yen | ||||||||

| For the six months ended September 30, 2021 | For the six months ended September 30, 2022 | |||||||

Profit | ¥ | 391,958 | ¥ | 337,743 | ||||

Other Comprehensive Income | (9,048 | ) | (389,182 | ) | ||||

Net Unrealized Gains (Losses) on Other Securities | 23,805 | (603,190 | ) | |||||

Deferred Gains or Losses on Hedges | (32,261 | ) | (19,095 | ) | ||||

Foreign Currency Translation Adjustments | 50,061 | 232,335 | ||||||

Remeasurements of Defined Benefit Plans | (58,390 | ) | (23,596 | ) | ||||

Own Credit Risk Adjustments, Net of Tax | — | 9 | ||||||

Share of Other Comprehensive Income of Associates Accounted for Using Equity Method | 7,736 | 24,355 | ||||||

|

|

|

| |||||

Comprehensive Income | 382,910 | (51,438 | ) | |||||

|

|

|

| |||||

(Breakdown) | ||||||||

Comprehensive Income Attributable to Owners of Parent | 375,995 | (56,285 | ) | |||||

Comprehensive Income Attributable to Non-controlling Interests | 6,914 | 4,846 | ||||||

1-6

Mizuho Financial Group, Inc.

(3) Consolidated Statements of Changes in Net Assets

For the six months ended September 30, 2021

| Millions of yen | ||||||||||||||||||||

| Shareholders’ Equity | ||||||||||||||||||||

| Common Stock | Capital Surplus | Retained Earnings | Treasury Stock | Total Shareholders’ Equity | ||||||||||||||||

Balance as of the beginning of the period | 2,256,767 | 1,135,940 | 4,421,655 | (7,124 | ) | 7,807,239 | ||||||||||||||

Cumulative Effects of Changes in Accounting Policies | (724 | ) | (724 | ) | ||||||||||||||||

Balance as of the beginning of the period reflecting Changes in Accounting Policies | 2,256,767 | 1,135,940 | 4,420,931 | (7,124 | ) | 7,806,515 | ||||||||||||||

Changes during the period | ||||||||||||||||||||

Cash Dividends | (95,201 | ) | (95,201 | ) | ||||||||||||||||

Profit Attributable to Owners of Parent | 385,657 | 385,657 | ||||||||||||||||||

Repurchase of Treasury Stock | (2,646 | ) | (2,646 | ) | ||||||||||||||||

Disposition of Treasury Stock | (51 | ) | 1,606 | 1,554 | ||||||||||||||||

Transfer from Revaluation Reserve for Land | 1,086 | 1,086 | ||||||||||||||||||

Change in Treasury Shares of Parent Arising from Transactions with Non-controlling Shareholders | (10,616 | ) | (10,616 | ) | ||||||||||||||||

Transfer from Retained Earnings to Capital Surplus | 51 | (51 | ) | — | ||||||||||||||||

Net Changes in Items other than Shareholders’ Equity | ||||||||||||||||||||

|

|

|

|

|

|

|

|

|

| |||||||||||

Total Changes during the period | — | (10,616 | ) | 291,490 | (1,040 | ) | 279,833 | |||||||||||||

|

|

|

|

|

|

|

|

|

| |||||||||||

Balance as of the end of the period | 2,256,767 | 1,125,324 | 4,712,422 | (8,164 | ) | 8,086,349 | ||||||||||||||

|

|

|

|

|

|

|

|

|

| |||||||||||

| Accumulated Other Comprehensive Income | Stock Acquisition Rights | Non- Controlling Interests | Total Net Assets | |||||||||||||||||||||||||||||||||||||

| Net Unrealized Gains (Losses) on Other Securities | Deferred Gains or Losses on Hedges | Revaluation Reserve for Land | Foreign Currency Translation Adjustments | Remeasurements of Defined Benefit Plans | Own Credit Risk Adjustments, Net of Tax | Total Accumulated Other Comprehensive Income | ||||||||||||||||||||||||||||||||||

Balance as of the beginning of the period | 1,132,460 | 31,618 | 136,384 | (139,514 | ) | 288,088 | — | 1,449,035 | 134 | 105,797 | 9,362,207 | |||||||||||||||||||||||||||||

Cumulative Effects of Changes in Accounting Policies | — | (724 | ) | |||||||||||||||||||||||||||||||||||||

Balance as of the beginning of the period reflecting Changes in Accounting Policies | 1,132,460 | 31,618 | 136,384 | (139,514 | ) | 288,088 | — | 1,449,035 | 134 | 105,797 | 9,361,483 | |||||||||||||||||||||||||||||

Changes during the period | ||||||||||||||||||||||||||||||||||||||||

Cash Dividends | (95,201 | ) | ||||||||||||||||||||||||||||||||||||||

Profit Attributable to Owners of Parent | 385,657 | |||||||||||||||||||||||||||||||||||||||

Repurchase of Treasury Stock | (2,646 | ) | ||||||||||||||||||||||||||||||||||||||

Disposition of Treasury Stock | 1,554 | |||||||||||||||||||||||||||||||||||||||

Transfer from Revaluation Reserve for Land | 1,086 | |||||||||||||||||||||||||||||||||||||||

Change in Treasury Shares of Parent Arising from Transactions with Non-controlling Shareholders | (10,616 | ) | ||||||||||||||||||||||||||||||||||||||

Transfer from Retained Earnings to Capital Surplus | — | |||||||||||||||||||||||||||||||||||||||

Net Changes in Items other than Shareholders’ Equity | 22,295 | (32,361 | ) | (1,086 | ) | 58,546 | (58,950 | ) | — | (11,555 | ) | (39 | ) | 11,161 | (433 | ) | ||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||||||||||

Total Changes during the period | 22,295 | (32,361 | ) | (1,086 | ) | 58,546 | (58,950 | ) | — | (11,555 | ) | (39 | ) | 11,161 | 279,400 | |||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||||||||||

Balance as of the end of the period | 1,154,756 | (743 | ) | 135,297 | (80,968 | ) | 229,137 | — | 1,437,480 | 95 | 116,959 | 9,640,884 | ||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||||||||||

1-7

Mizuho Financial Group, Inc.

For the six months ended September 30, 2022

| Millions of yen | ||||||||||||||||||||

| Shareholders’ Equity | ||||||||||||||||||||

| Common Stock | Capital Surplus | Retained Earnings | Treasury Stock | Total Shareholders’ Equity | ||||||||||||||||

Balance as of the beginning of the period | 2,256,767 | 1,125,324 | 4,756,435 | (8,342 | ) | 8,130,185 | ||||||||||||||

Changes during the period | ||||||||||||||||||||

Cash Dividends | (101,542 | ) | (101,542 | ) | ||||||||||||||||

Profit Attributable to Owners of Parent | 333,964 | 333,964 | ||||||||||||||||||

Repurchase of Treasury Stock | (1,940 | ) | (1,940 | ) | ||||||||||||||||

Disposition of Treasury Stock | (133 | ) | 1,730 | 1,597 | ||||||||||||||||

Transfer from Revaluation Reserve for Land | 584 | 584 | ||||||||||||||||||

Change in Treasury Shares of Parent Arising from Transactions with Non-controlling Shareholders | 4,064 | 4,064 | ||||||||||||||||||

Transfer from Retained Earnings to Capital Surplus | 133 | (133 | ) | — | ||||||||||||||||

Net Changes in Items other than Shareholders’ Equity | ||||||||||||||||||||

|

|

|

|

|

|

|

|

|

| |||||||||||

Total Changes during the period | — | 4,064 | 232,872 | (209 | ) | 236,726 | ||||||||||||||

|

|

|

|

|

|

|

|

|

| |||||||||||

Balance as of the end of the period | 2,256,767 | 1,129,388 | 4,989,307 | (8,552 | ) | 8,366,911 | ||||||||||||||

|

|

|

|

|

|

|

|

|

| |||||||||||

| Accumulated Other Comprehensive Income | Stock Acquisition Rights | Non- Controlling Interests | Total Net Assets | |||||||||||||||||||||||||||||||||||||

| Net Unrealized Gains (Losses) on Other Securities | Deferred Gains or Losses on Hedges | Revaluation Reserve for Land | Foreign Currency Translation Adjustments | Remeasurements of Defined Benefit Plans | Own Credit Risk Adjustments, Net of Tax | Total Accumulated Other Comprehensive Income | ||||||||||||||||||||||||||||||||||

Balance as of the beginning of the period | 719,822 | (76,757 | ) | 132,156 | 2,346 | 169,652 | (23 | ) | 947,197 | 94 | 123,555 | 9,201,031 | ||||||||||||||||||||||||||||

Changes during the period | ||||||||||||||||||||||||||||||||||||||||

Cash Dividends | (101,542 | ) | ||||||||||||||||||||||||||||||||||||||

Profit Attributable to Owners of Parent | 333,964 | |||||||||||||||||||||||||||||||||||||||

Repurchase of Treasury Stock | (1,940 | ) | ||||||||||||||||||||||||||||||||||||||

Disposition of Treasury Stock | 1,597 | |||||||||||||||||||||||||||||||||||||||

Transfer from Revaluation Reserve for Land | 584 | |||||||||||||||||||||||||||||||||||||||

Change in Treasury Shares of Parent Arising from Transactions with Non-controlling Shareholders | 4,064 | |||||||||||||||||||||||||||||||||||||||

Transfer from Retained Earnings to Capital Surplus | — | |||||||||||||||||||||||||||||||||||||||

Net Changes in Items other than Shareholders’ Equity | (601,064 | ) | (19,462 | ) | (584 | ) | 253,991 | (23,722 | ) | 9 | (390,833 | ) | (88 | ) | (50,781 | ) | (441,703 | ) | ||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||||||||||

Total Changes during the period | (601,064 | ) | (19,462 | ) | (584 | ) | 253,991 | (23,722 | ) | 9 | (390,833 | ) | (88 | ) | (50,781 | ) | (204,976 | ) | ||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||||||||||

Balance as of the end of the period | 118,757 | (96,220 | ) | 131,572 | 256,338 | 145,929 | (13 | ) | 556,363 | 5 | 72,774 | 8,996,055 | ||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||||||||||

(4) Note for Assumption of Going Concern

There is no applicable information.

1-8

SELECTED FINANCIAL INFORMATION

For the Second Quarter (First Half) of Fiscal 2022

(Six months ended September 30, 2022)

(Under Japanese GAAP)

Mizuho Financial Group, Inc.

C O N T E N T S

Notes:

“CON”: Consolidated figures for Mizuho Financial Group, Inc. (“MHFG”)

“NON”: Non-consolidated figures for Mizuho Financial Group, Inc., Mizuho Bank, Ltd. (“MHBK”) and Mizuho Trust & Banking Co., Ltd. (“MHTB”)

I. FINANCIAL DATA FOR THE FIRST HALF OF FISCAL 2022 | See above Notes | Page | ||||||||||

1. Income Analysis | CON | NON | 2-1 | |||||||||

2. Interest Margins (Domestic Operations) | NON | 2-5 | ||||||||||

3. Use and Source of Funds | NON | 2-6 | ||||||||||

4. Net Gains/Losses on Securities | CON | NON | 2-8 | |||||||||

5. Unrealized Gains/Losses on Securities | CON | NON | 2-10 | |||||||||

6. Projected Redemption Amounts for Securities | NON | 2-12 | ||||||||||

7. Overview of Derivative Transactions Qualifying for Hedge Accounting | NON | 2-13 | ||||||||||

8. Employee Retirement Benefits | NON | CON | 2-14 | |||||||||

9. Capital Ratio | CON | NON | 2-17 | |||||||||

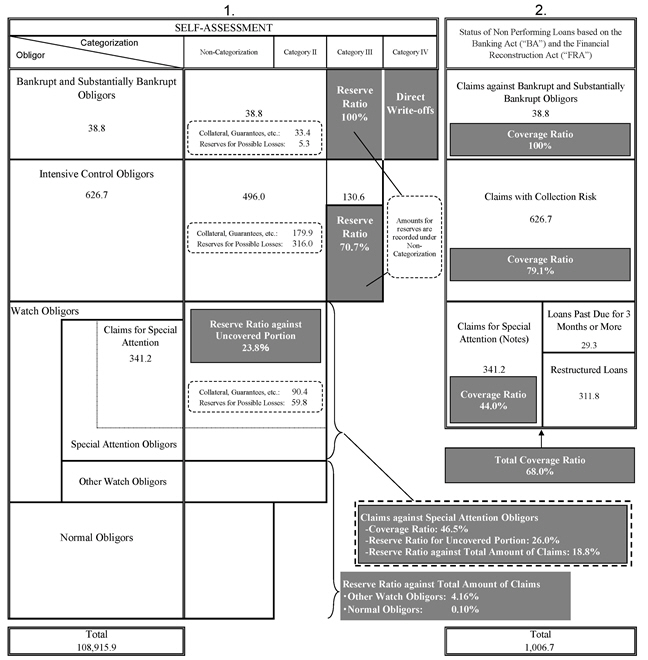

II. REVIEW OF CREDITS | See above Notes | Page | ||||||||||

1. Status of Non Performing Loans based on the Banking Act (“BA”) and the Financial Reconstruction Act (“FRA”) | CON | NON | 2-18 | |||||||||

2. Status of Reserves for Possible Losses on Loans | CON | NON | 2-22 | |||||||||

3. Reserve Ratios for Non Performing Loans based on the BA and the FRA | CON | NON | 2-23 | |||||||||

4. Coverage on Non Performing Loans based on the BA and the FRA | NON | 2-24 | ||||||||||

5. Overview of Non-Performing Loans(“NPLs”) | NON | 2-27 | ||||||||||

6. Results of Removal of NPLs from the Balance Sheet | NON | 2-28 | ||||||||||

7. Status of Loans by Industry | ||||||||||||

(1) Outstanding Balances by Industry | NON | 2-29 | ||||||||||

(2) Non Performing Loans based on the BA and the FRA and Coverage Ratio by Industry | NON | 2-31 | ||||||||||

8. Housing and Consumer Loans & Loans to Small and Medium-Sized Enterprises | ||||||||||||

(“SMEs”) and Individual Customers | ||||||||||||

(1) Balance of Housing and Consumer Loans | NON | 2-32 | ||||||||||

(2) Loans to SMEs and Individual Customers | NON | 2-32 | ||||||||||

9. Status of Loans by Region | ||||||||||||

(1) Outstanding Balances by Region | NON | 2-33 | ||||||||||

(2) Non Performing Loans based on the BA and the FRA by Region | NON | 2-34 | ||||||||||

III. DEFERRED TAXES | See above Notes | Page | ||||||||||

1. Estimation for Calculating Deferred Tax Assets | NON | 2-35 | ||||||||||

IV. OTHERS | See above Notes | Page | ||||||||||

1. Breakdown of Deposits (Domestic Offices) | NON | 2-37 | ||||||||||

2. Number of Directors and Employees | 2-38 | |||||||||||

3. Number of Offices | 2-38 | |||||||||||

4. Earnings Plan for Fiscal 2022 | CON | NON | 2-39 | |||||||||

Attachments | Page | |||||||

Mizuho Bank, Ltd. | ||||||||

Comparison of Non-Consolidated Balance Sheets (selected items) | 2-40 | |||||||

Comparison of Non-Consolidated Statements of Income (selected items) | 2-41 | |||||||

Mizuho Trust & Banking Co., Ltd. | ||||||||

Comparison of Non-Consolidated Balance Sheets (selected items) | 2-42 | |||||||

Comparison of Non-Consolidated Statements of Income (selected items) | 2-43 | |||||||

Statement of Trust Assets and Liabilities | 2-44 | |||||||

Comparison of Balances of Principal Items | 2-45 | |||||||

Mizuho Securities Co., Ltd. | ||||||||

Comparison of Non-Consolidated Balance Sheets (selected items) | 2-46 | |||||||

Comparison of Non-Consolidated Statements of Income (selected items) | 2-47 | |||||||

This immediate release contains statements that constitute forward-looking statements within the meaning of the United States Private Securities Litigation Reform Act of 1995, including estimates, forecasts, targets and plans. Such forward-looking statements do not represent any guarantee by management of future performance.

In many cases, but not all, we use such words as “aim,” “anticipate,” “believe,” “endeavor,” “estimate,” “expect,” “intend,” “may,” “plan,” “probability,” “project,” “risk,” “seek,” “should,” “strive,” “target” and similar expressions in relation to us or our management to identify forward-looking statements. You can also identify forward-looking statements by discussions of strategy, plans or intentions. These statements reflect our current views with respect to future events and are subject to risks, uncertainties and assumptions.

We may not be successful in implementing our business strategies, and management may fail to achieve its targets, for a wide range of possible reasons, including, without limitation: impact of geopolitical disruptions and the corona virus pandemic; intensification of competition in the market for financial services; incurrence of significant credit-related costs; declines in the value of our securities portfolio; changes in interest rates; foreign currency fluctuations; decrease in the market liquidity of our assets; revised assumptions or other changes related to our pension plans; a decline in our deferred tax assets; impairment of the carrying value of our long-lived assets; problems related to our information technology systems, including as a result of cyber attacks; the effect of financial transactions entered into for hedging and other similar purposes; failure to maintain required capital adequacy ratio levels and meet other financial regulatory requirements; downgrades in our credit ratings; our ability to avoid reputational harm; our ability to implement our 5-Year Business Plan and implement other strategic initiatives and measures effectively; the effectiveness of our operational, legal and other risk management policies; the effect of changes in general economic conditions in Japan and elsewhere; and changes to applicable laws and regulations.

Further information regarding factors that could affect our financial condition and results of operations is included in “Item 3.D. Key Information-Risk Factors” and “Item 5. Operating and Financial Review and Prospects” in our most recent Form 20-F filed with the U.S. Securities and Exchange Commission (“SEC”), which is available in the Financial Information section of our web page at www.mizuho-fg.com/index.html and also at the SEC’s web site at www.sec.gov.

We do not intend to update our forward-looking statements. We are under no obligation, and disclaim any obligation, to update or alter our forward-looking statements, whether as a result of new information, future events or otherwise, except as may be required by the rules of the Tokyo Stock Exchange.

MHFG is a specified business company under “Cabinet Office Ordinance on Disclosure of Corporate Information, etc.” Article 17-15 clause 2 and prepares the interim consolidated financial statements in the second quarter.

Mizuho Financial Group, Inc.

I. FINANCIAL DATA FOR THE FIRST HALF OF FISCAL 2022

1. Income Analysis

Consolidated

| (Millions of yen) | ||||||||||||||||

| First Half of Fiscal 2022 | First Half of Fiscal 2021 | |||||||||||||||

| Change | ||||||||||||||||

Consolidated Gross Profits | 1 | 1,153,784 | 44,962 | 1,108,822 | ||||||||||||

Net Interest Income | 2 | 512,032 | 37,871 | 474,160 | ||||||||||||

Fiduciary Income | 3 | 29,313 | (415 | ) | 29,728 | |||||||||||

Credit Costs for Trust Accounts | 4 | — | — | — | ||||||||||||

Net Fee and Commission Income | 5 | 333,172 | 2,729 | 330,443 | ||||||||||||

Net Trading Income | 6 | 55,787 | (135,525 | ) | 191,312 | |||||||||||

Net Other Operating Income | 7 | 223,479 | 140,301 | 83,177 | ||||||||||||

General and Administrative Expenses | 8 | (706,446 | ) | (38,851 | ) | (667,594 | ) | |||||||||

Expenses related to Portfolio Problems (including Reversal of (Provision for) General Reserve for Losses on Loans) | 9 | (55,360 | ) | 4,495 | (59,856 | ) | ||||||||||

Losses on Write-offs of Loans | 10 | (4,865 | ) | 2,158 | (7,023 | ) | ||||||||||

Gains on Reversal of Reserves for Possible Losses on Loans, and others | 11 | 4,921 | (5,303 | ) | 10,225 | |||||||||||

Net Gains (Losses) related to Stocks | 12 | 38,439 | 23,508 | 14,931 | ||||||||||||

Equity in Income from Investments in Affiliates | 13 | 14,491 | (2,028 | ) | 16,519 | |||||||||||

Other | 14 | (10,548 | ) | 13,159 | (23,707 | ) | ||||||||||

|

|

|

|

|

| |||||||||||

Ordinary Profits | 15 | 439,282 | 39,942 | 399,340 | ||||||||||||

|

|

|

|

|

| |||||||||||

Net Extraordinary Gains (Losses) | 16 | 5,774 | (41,507 | ) | 47,281 | |||||||||||

Income before Income Taxes | 17 | 445,057 | (1,565 | ) | 446,622 | |||||||||||

Income Taxes - Current | 18 | (61,866 | ) | 3,738 | (65,604 | ) | ||||||||||

- Deferred | 19 | (45,446 | ) | (56,387 | ) | 10,941 | ||||||||||

Profit | 20 | 337,743 | (54,214 | ) | 391,958 | |||||||||||

Profit Attributable to Non-controlling Interests | 21 | (3,779 | ) | 2,522 | (6,301 | ) | ||||||||||

|

|

|

|

|

| |||||||||||

Profit Attributable to Owners of Parent | 22 | 333,964 | (51,692 | ) | 385,657 | |||||||||||

|

|

|

|

|

| |||||||||||

Credit-related Costs (including Credit Costs for Trust Accounts) | 23 | (50,439 | ) | (807 | ) | (49,631 | ) | |||||||||

Credit-related Costs [23] = Expenses related to Portfolio Problems (including Reversal of (Provision for) General Reserve for Losses on Loans) [9] + Gains on Reversal of Reserves for Possible Losses on Loans, and others [11] + Credit Costs for Trust Accounts [4] |

| |||||||||||||||

Reference: | ||||||||||||||||

Consolidated Net Business Profits | 24 | 440,775 | 2,200 | 438,574 | ||||||||||||

Consolidated Net Business Profits [24] = Consolidated Gross Profits [1] - General and Administrative Expenses (excluding Non-Recurring Losses) + Equity in Income from Investments in Affiliates and certain other consolidation adjustments |

| |||||||||||||||

Number of consolidated subsidiaries | 25 | 174 | 14 | 160 | ||||||||||||

Number of affiliates under the equity method | 26 | 25 | (4 | ) | 29 | |||||||||||

2-1

Mizuho Financial Group, Inc.

Aggregate Figures for the 2 Banks

Non-Consolidated

| (Millions of yen) | ||||||||||||||||||||||||

| First Half of Fiscal 2022 | First Half of Fiscal 2021 | |||||||||||||||||||||||

| MHBK | MHTB | Aggregate Figures | Change | |||||||||||||||||||||

Gross Profits | 1 | 697,816 | 47,619 | 745,435 | 21,062 | 724,373 | ||||||||||||||||||

Domestic Gross Profits | 2 | 413,154 | 47,567 | 460,721 | 65,272 | 395,449 | ||||||||||||||||||

Net Interest Income | 3 | 227,575 | 9,642 | 237,218 | 2,446 | 234,772 | ||||||||||||||||||

Fiduciary Income | 4 | 29,515 | 29,515 | (543 | ) | 30,058 | ||||||||||||||||||

Trust Fees for Jointly Operated Designated Money Trust | 5 | 2,000 | 2,000 | 24 | 1,975 | |||||||||||||||||||

Credit Costs for Trust Accounts (1) | 6 | — | — | — | — | |||||||||||||||||||

Net Fee and Commission Income | 7 | 109,532 | 8,573 | 118,106 | (12,970 | ) | 131,076 | |||||||||||||||||

Net Trading Income | 8 | 58,350 | — | 58,350 | 66,770 | (8,419 | ) | |||||||||||||||||

Net Other Operating Income | 9 | 17,694 | (164 | ) | 17,530 | 9,569 | 7,961 | |||||||||||||||||

International Gross Profits | 10 | 284,662 | 51 | 284,713 | (44,210 | ) | 328,924 | |||||||||||||||||

Net Interest Income | 11 | 233,102 | 127 | 233,229 | 42,930 | 190,299 | ||||||||||||||||||

Net Fee and Commission Income | 12 | 69,466 | (90 | ) | 69,375 | 5,917 | 63,457 | |||||||||||||||||

Net Trading Income | 13 | (138,978 | ) | — | (138,978 | ) | (186,752 | ) | 47,774 | |||||||||||||||

Net Other Operating Income | 14 | 121,071 | 14 | 121,086 | 93,693 | 27,392 | ||||||||||||||||||

General and Administrative Expenses (excluding Non-Recurring Losses) | 15 | (379,683 | ) | (38,835 | ) | (418,519 | ) | 4,340 | (422,859 | ) | ||||||||||||||

Expense Ratio | 16 | 54.4 | % | 81.5 | % | 56.1 | % | (2.2 | %) | 58.3 | % | |||||||||||||

Personnel Expenses | 17 | (147,817 | ) | (18,818 | ) | (166,635 | ) | 1,208 | (167,844 | ) | ||||||||||||||

Non-Personnel Expenses | 18 | (209,597 | ) | (18,270 | ) | (227,868 | ) | 2,737 | (230,605 | ) | ||||||||||||||

Premium for Deposit Insurance | 19 | (7,919 | ) | (249 | ) | (8,168 | ) | 8,619 | (16,787 | ) | ||||||||||||||

Miscellaneous Taxes | 20 | (22,268 | ) | (1,746 | ) | (24,015 | ) | 394 | (24,409 | ) | ||||||||||||||

|

|

|

|

|

|

|

|

|

| |||||||||||||||

Net Business Profits (before Reversal of (Provision for) General Reserve for Losses on Loans) | 21 | 318,132 | 8,784 | 326,916 | 25,402 | 301,513 | ||||||||||||||||||

Net Business Profits (before Reversal of (Provision for) General Reserve for Losses on Loans) from core business areas (2) | 22 | 333,782 | 8,789 | 342,571 | 64,347 | 278,223 | ||||||||||||||||||

Excluding Net Gains (Losses) from redemption of Investment Trusts | 23 | 315,330 | 8,789 | 324,119 | 52,652 | 271,467 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

| |||||||||||||||

Reversal of (Provision for) General Reserve for Losses on Loans | 24 | (41,277 | ) | — | (41,277 | ) | 27,672 | (68,950 | ) | |||||||||||||||

|

|

|

|

|

|

|

|

|

| |||||||||||||||

Net Business Profits | 25 | 276,854 | 8,784 | 285,638 | 53,075 | 232,563 | ||||||||||||||||||

Net Gains (Losses) related to Bonds | 26 | (15,650 | ) | (5 | ) | (15,655 | ) | (38,945 | ) | 23,290 | ||||||||||||||

|

|

|

|

|

|

|

|

|

| |||||||||||||||

Net Non-Recurring Gains (Losses) | 27 | 45,158 | 5,193 | 50,352 | 19,105 | 31,246 | ||||||||||||||||||

Net Gains (Losses) related to Stocks | 28 | 34,024 | 2,437 | 36,462 | 25,700 | 10,761 | ||||||||||||||||||

Expenses related to Portfolio Problems | 29 | (3,751 | ) | — | (3,751 | ) | (14,180 | ) | 10,429 | |||||||||||||||

Gains on Reversal of Reserves for Possible Losses on Loans, and others | 30 | 4,433 | 104 | 4,538 | (4,664 | ) | 9,202 | |||||||||||||||||

Other | 31 | 10,452 | 2,650 | 13,102 | 12,249 | 853 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

| |||||||||||||||

Ordinary Profits | 32 | 322,013 | 13,977 | 335,991 | 72,181 | 263,810 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

| |||||||||||||||

Net Extraordinary Gains (Losses) | 33 | 6,542 | 2,601 | 9,144 | (38,436 | ) | 47,581 | |||||||||||||||||

Net Gains (Losses) on Disposition of Fixed Assets | 34 | (3,110 | ) | (212 | ) | (3,322 | ) | (2,387 | ) | (934 | ) | |||||||||||||

Losses on Impairment of Fixed Assets | 35 | (2,216 | ) | (665 | ) | (2,881 | ) | (303 | ) | (2,577 | ) | |||||||||||||

Gains on Cancellation of Employee Retirement Benefit Trust | 36 | 11,868 | 188 | 12,057 | (39,036 | ) | 51,093 | |||||||||||||||||

Income before Income Taxes | 37 | 328,556 | 16,579 | 345,135 | 33,744 | 311,391 | ||||||||||||||||||

Income Taxes - Current | 38 | (42,233 | ) | (2,186 | ) | (44,420 | ) | 50,494 | (94,914 | ) | ||||||||||||||

- Deferred | 39 | (48,505 | ) | (1,938 | ) | (50,444 | ) | (21,856 | ) | (28,587 | ) | |||||||||||||

|

|

|

|

|

|

|

|

|

| |||||||||||||||

Net Income | 40 | 237,817 | 12,453 | 250,271 | 62,382 | 187,888 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

| |||||||||||||||

(1) Net Business Profits (before Reversal of (Provision for) General Reserve for Losses on Loans) for MHTB excludes the amounts of “Credit Costs for Trust Accounts” [6]. |

| |||||||||||||||||||||||

(2) Net Business Profits (before Reversal of (Provision for) General Reserve for Losses on Loans) from core business areas[22] |

| |||||||||||||||||||||||

=Net Business Profits(before Reversal of (Provision for) General Reserve for Losses on Loans)[21]-Net Gains (Losses) related to Bonds[26] |

| |||||||||||||||||||||||

Credit-related Costs | 41 | (40,594 | ) | 104 | (40,490 | ) | 8,827 | (49,317 | ) | |||||||||||||||

Credit-related Costs [41] = Expenses related to Portfolio Problems [29] + Reversal of (Provision for) General Reserve for Losses on Loans [24] + Gains on Reversal of Reserves for Possible Losses on Loans, and others [30] + Credit Costs for Trust Accounts [6] |

| |||||||||||||||||||||||

Reference: Breakdown of Credit-related Costs | ||||||||||||||||||||||||

Credit Costs for Trust Accounts | 42 | — | — | — | — | |||||||||||||||||||

Reversal of (Provision for) General Reserve for Losses on Loans | 43 | (41,277 | ) | 96 | (41,180 | ) | 27,769 | (68,950 | ) | |||||||||||||||

Losses on Write-offs of Loans | 44 | (303 | ) | 1 | (302 | ) | (3,218 | ) | 2,916 | |||||||||||||||

Reversal of (Provision for) Specific Reserve for Possible Losses on Loans | 45 | (2,176 | ) | 7 | (2,169 | ) | (18,704 | ) | 16,534 | |||||||||||||||

Reversal of (Provision for) Reserve for Possible Losses on Loans to Restructuring Countries | 46 | 6,404 | — | 6,404 | 6,297 | 106 | ||||||||||||||||||

Reversal of (Provision for) Reserve for Contingencies | 47 | (1,351 | ) | — | (1,351 | ) | (1,658 | ) | 306 | |||||||||||||||

Other (including Losses on Sales of Loans) | 48 | (1,889 | ) | — | (1,889 | ) | (1,657 | ) | (232 | ) | ||||||||||||||

Total | 49 | (40,594 | ) | 104 | (40,490 | ) | 8,827 | (49,317 | ) | |||||||||||||||

2-2

Mizuho Financial Group, Inc.

Mizuho Bank

Non-Consolidated

| (Millions of yen) | ||||||||||||||||

| First Half of Fiscal 2022 | First Half of Fiscal 2021 | |||||||||||||||

| Change | ||||||||||||||||

Gross Profits | 1 | 697,816 | 31,215 | 666,600 | ||||||||||||

Domestic Gross Profits | 2 | 413,154 | 75,382 | 337,771 | ||||||||||||

Net Interest Income | 3 | 227,575 | 1,909 | 225,666 | ||||||||||||

Net Fee and Commission Income | 4 | 109,532 | (2,589 | ) | 112,122 | |||||||||||

Net Trading Income | 5 | 58,350 | 66,141 | (7,790 | ) | |||||||||||

Net Other Operating Income | 6 | 17,694 | 9,921 | 7,773 | ||||||||||||

International Gross Profits | 7 | 284,662 | (44,167 | ) | 328,829 | |||||||||||

Net Interest Income | 8 | 233,102 | 43,077 | 190,025 | ||||||||||||

Net Fee and Commission Income | 9 | 69,466 | 5,835 | 63,630 | ||||||||||||

Net Trading Income | 10 | (138,978 | ) | (186,763 | ) | 47,785 | ||||||||||

Net Other Operating Income | 11 | 121,071 | 93,683 | 27,388 | ||||||||||||

General and Administrative Expenses (excluding Non-Recurring Losses) | 12 | (379,683 | ) | 3,045 | (382,729 | ) | ||||||||||

Expense Ratio | 13 | 54.4 | % | (3.0 | %) | 57.4 | % | |||||||||

Personnel Expenses | 14 | (147,817 | ) | 1,213 | (149,030 | ) | ||||||||||

Non-Personnel Expenses | 15 | (209,597 | ) | 1,560 | (211,158 | ) | ||||||||||

Premium for Deposit Insurance | 16 | (7,919 | ) | 8,308 | (16,227 | ) | ||||||||||

Miscellaneous Taxes | 17 | (22,268 | ) | 271 | (22,540 | ) | ||||||||||

|

|

|

|

|

| |||||||||||

Net Business Profits (before Reversal of (Provision for) General Reserve for Losses on Loans) | 18 | 318,132 | 34,260 | 283,871 | ||||||||||||

Net Business Profits (before Reversal of (Provision for) General Reserve for Losses on Loans) from core business areas * | 19 | 333,782 | 73,190 | 260,591 | ||||||||||||

Excluding Net Gains (Losses) from redemption of Investment Trusts | 20 | 315,330 | 61,494 | 253,835 | ||||||||||||

|

|

|

|

|

| |||||||||||

Reversal of (Provision for) General Reserve for Losses on Loans | 21 | (41,277 | ) | 26,863 | (68,140 | ) | ||||||||||

|

|

|

|

|

| |||||||||||

Net Business Profits | 22 | 276,854 | 61,123 | 215,731 | ||||||||||||

Net Gains (Losses) related to Bonds | 23 | (15,650 | ) | (38,930 | ) | 23,279 | ||||||||||

|

|

|

|

|

| |||||||||||

Net Non-Recurring Gains (Losses) | 24 | 45,158 | 16,029 | 29,129 | ||||||||||||

Net Gains (Losses) related to Stocks | 25 | 34,024 | 23,663 | 10,360 | ||||||||||||

Expenses related to Portfolio Problems | 26 | (3,751 | ) | (14,269 | ) | 10,517 | ||||||||||

Gains on Reversal of Reserves for Possible Losses on Loans, and others | 27 | 4,433 | (4,768 | ) | 9,202 | |||||||||||

Other | 28 | 10,452 | 11,403 | (951 | ) | |||||||||||

|

|

|

|

|

| |||||||||||

Ordinary Profits | 29 | 322,013 | 77,152 | 244,860 | ||||||||||||

|

|

|

|

|

| |||||||||||

Net Extraordinary Gains (Losses) | 30 | 6,542 | (33,706 | ) | 40,249 | |||||||||||

Net Gains (Losses) on Disposition of Fixed Assets | 31 | (3,110 | ) | (2,288 | ) | (821 | ) | |||||||||

Losses on Impairment of Fixed Assets | 32 | (2,216 | ) | 323 | (2,539 | ) | ||||||||||

Gains on Cancellation of Employee Retirement Benefit Trust | 33 | 11,868 | (31,741 | ) | 43,610 | |||||||||||

Income before Income Taxes | 34 | 328,556 | 43,446 | 285,110 | ||||||||||||

Income Taxes - Current | 35 | (42,233 | ) | 48,121 | (90,355 | ) | ||||||||||

- Deferred | 36 | (48,505 | ) | (23,172 | ) | (25,332 | ) | |||||||||

|

|

|

|

|

| |||||||||||

Net Income | 37 | 237,817 | 68,395 | 169,422 | ||||||||||||

|

|

|

|

|

| |||||||||||

* Net Business Profits (before Reversal of (Provision for) General Reserve for Losses on Loans) from core business areas[19] =Net Business Profits(before Reversal of (Provision for) General Reserve for Losses on Loans)[18]-Net Gains (Losses) related to Bonds[23] |

| |||||||||||||||

Credit-related Costs | 38 | (40,594 | ) | 7,825 | (48,420 | ) | ||||||||||

Credit-related Costs [38] = Expenses related to Portfolio Problems [26] + Reversal of (Provision for) General Reserve for Losses on Loans [21] + Gains on Reversal of Reserves for Possible Losses on Loans, and others [27] |

| |||||||||||||||

Reference: Breakdown of Credit-related Costs | ||||||||||||||||

Reversal of (Provision for) General Reserve for Losses on Loans | 39 | (41,277 | ) | 26,863 | (68,140 | ) | ||||||||||

Losses on Write-offs of Loans | 40 | (303 | ) | (3,293 | ) | 2,990 | ||||||||||

Reversal of (Provision for) Specific Reserve for Possible Losses on Loans | 41 | (2,176 | ) | (18,726 | ) | 16,549 | ||||||||||

Reversal of (Provision for) Reserve for Possible Losses on Loans to Restructuring Countries | 42 | 6,404 | 6,297 | 106 | ||||||||||||

Reversal of (Provision for) Reserve for Contingencies | 43 | (1,351 | ) | (1,658 | ) | 306 | ||||||||||

Other (including Losses on Sales of Loans) | 44 | (1,889 | ) | (1,657 | ) | (232 | ) | |||||||||

Total | 45 | (40,594 | ) | 7,825 | (48,420 | ) | ||||||||||

2-3

Mizuho Financial Group, Inc.

Mizuho Trust & Banking

Non-Consolidated

| (Millions of yen) | ||||||||||||||||

| First Half of Fiscal 2022 | First Half of Fiscal 2021 | |||||||||||||||

| Change | ||||||||||||||||

Gross Profits | 1 | 47,619 | (10,153 | ) | 57,772 | |||||||||||

Domestic Gross Profits | 2 | 47,567 | (10,109 | ) | 57,677 | |||||||||||

Net Interest Income | 3 | 9,642 | 537 | 9,105 | ||||||||||||

Fiduciary Income | 4 | 29,515 | (543 | ) | 30,058 | |||||||||||

Trust Fees for Jointly Operated Designated Money Trust | 5 | 2,000 | 24 | 1,975 | ||||||||||||

Credit Costs for Trust Accounts (1) | 6 | — | — | — | ||||||||||||

Net Fee and Commission Income | 7 | 8,573 | (10,381 | ) | 18,954 | |||||||||||

Net Trading Income | 8 | — | 629 | (629 | ) | |||||||||||

Net Other Operating Income | 9 | (164 | ) | (352 | ) | 188 | ||||||||||

International Gross Profits | 10 | 51 | (43 | ) | 94 | |||||||||||

Net Interest Income | 11 | 127 | (146 | ) | 274 | |||||||||||

Net Fee and Commission Income | 12 | (90 | ) | 82 | (172 | ) | ||||||||||

Net Trading Income | 13 | — | 11 | (11 | ) | |||||||||||

Net Other Operating Income | 14 | 14 | 10 | 4 | ||||||||||||

General and Administrative Expenses (excluding Non-Recurring Losses) | 15 | (38,835 | ) | 1,294 | (40,130 | ) | ||||||||||

Expense Ratio | 16 | 81.5 | % | 12.0 | % | 69.4 | % | |||||||||

Personnel Expenses | 17 | (18,818 | ) | (4 | ) | (18,813 | ) | |||||||||

Non-Personnel Expenses | 18 | (18,270 | ) | 1,176 | (19,447 | ) | ||||||||||

Premium for Deposit Insurance | 19 | (249 | ) | 310 | (559 | ) | ||||||||||

Miscellaneous Taxes | 20 | (1,746 | ) | 123 | (1,869 | ) | ||||||||||

|

|

|

|

|

| |||||||||||

Net Business Profits (before Reversal of (Provision for) General Reserve for Losses on Loans) | 21 | 8,784 | (8,858 | ) | 17,642 | |||||||||||

Net Business Profits (before Reversal of (Provision for) General Reserve for Losses on Loans) from core business areas (2) | 22 | 8,789 | (8,842 | ) | 17,631 | |||||||||||

Excluding Net Gains (Losses) from redemption of Investment Trusts | 23 | 8,789 | (8,842 | ) | 17,631 | |||||||||||

|

|

|

|

|

| |||||||||||

Reversal of (Provision for) General Reserve for Losses on Loans | 24 | — | 809 | (809 | ) | |||||||||||

|

|

|

|

|

| |||||||||||

Net Business Profits | 25 | 8,784 | (8,048 | ) | 16,832 | |||||||||||

Net Gains (Losses) related to Bonds | 26 | (5 | ) | (15 | ) | 10 | ||||||||||

|

|

|

|

|

| |||||||||||

Net Non-Recurring Gains (Losses) | 27 | 5,193 | 3,076 | 2,116 | ||||||||||||

Net Gains (Losses) related to Stocks | 28 | 2,437 | 2,037 | 400 | ||||||||||||

Expenses related to Portfolio Problems | 29 | — | 88 | (88 | ) | |||||||||||

Gains on Reversal of Reserves for Possible Losses on Loans, and others | 30 | 104 | 104 | 0 | ||||||||||||

Other | 31 | 2,650 | 846 | 1,804 | ||||||||||||

|

|

|

|

|

| |||||||||||

Ordinary Profits | 32 | 13,977 | (4,971 | ) | 18,949 | |||||||||||

|

|

|

|

|

| |||||||||||

Net Extraordinary Gains (Losses) | 33 | 2,601 | (4,730 | ) | 7,331 | |||||||||||

Net Gains (Losses) on Disposition of Fixed Assets | 34 | (212 | ) | (99 | ) | (113 | ) | |||||||||

Losses on Impairment of Fixed Assets | 35 | (665 | ) | (627 | ) | (38 | ) | |||||||||

Gains on Cancellation of Employee Retirement Benefit Trust | 36 | 188 | (7,295 | ) | 7,483 | |||||||||||

Income before Income Taxes | 37 | 16,579 | (9,702 | ) | 26,281 | |||||||||||

Income Taxes - Current | 38 | (2,186 | ) | 2,372 | (4,559 | ) | ||||||||||

- Deferred | 39 | (1,938 | ) | 1,316 | (3,255 | ) | ||||||||||

|

|

|

|

|

| |||||||||||

Net Income | 40 | 12,453 | (6,012 | ) | 18,466 | |||||||||||

|

|

|

|

|

| |||||||||||

(1) Net Business Profits (before Reversal of (Provision for) General Reserve for Losses on Loans) excludes the amounts of “Credit Costs for Trust Accounts” [6]. |

| |||||||||||||||

(2) Net Business Profits (before Reversal of (Provision for) General Reserve for Losses on Loans) from core business areas[22] |

| |||||||||||||||

=Net Business Profits(before Reversal of (Provision for) General Reserve for Losses on Loans)[21]-Net Gains (Losses) related to Bonds[26] |

| |||||||||||||||

Credit-related Costs | 41 | 104 | 1,002 | (897 | ) | |||||||||||

Credit-related Costs [41] = Expenses related to Portfolio Problems [29] + Reversal of (Provision for) General Reserve for Losses on Loans [24] + Gains on Reversal of Reserves for Possible Losses on Loans, and others [30] + Credit Costs for Trust Accounts [6] |

| |||||||||||||||

Reference: Breakdown of Credit-related Costs | ||||||||||||||||

Credit Costs for Trust Accounts | 42 | — | — | — | ||||||||||||

Reversal of (Provision for) General Reserve for Losses on Loans | 43 | 96 | 905 | (809 | ) | |||||||||||

Losses on Write-offs of Loans | 44 | 1 | 75 | (73 | ) | |||||||||||

Reversal of (Provision for) Specific Reserve for Possible Losses on Loans | 45 | 7 | 21 | (14 | ) | |||||||||||

Reversal of (Provision for) Reserve for Possible Losses on Loans to Restructuring Countries | 46 | — | — | — | ||||||||||||

Reversal of (Provision for) Reserve for Contingencies | 47 | — | — | — | ||||||||||||

Other (including Losses on Sales of Loans) | 48 | — | — | — | ||||||||||||

Total | 49 | 104 | 1,002 | (897 | ) | |||||||||||

2-4

Mizuho Financial Group, Inc.

2. Interest Margins (Domestic Operations)

Non-Consolidated

| (%) | ||||||||||||||||

| First Half of Fiscal 2022 | First Half of Fiscal 2021 | |||||||||||||||

| Mizuho Bank | Change | |||||||||||||||

Return on Interest-Earning Assets | 1 | 0.42 | 0.03 | 0.39 | ||||||||||||

Return on Loans and Bills Discounted (1) | 2 | 0.76 | 0.02 | 0.74 | ||||||||||||

Return on Securities | 3 | 0.31 | 0.01 | 0.30 | ||||||||||||

Cost of Funding (including Expenses) | 4 | 0.48 | (0.02 | ) | 0.51 | |||||||||||

Cost of Deposits (including Expenses) | 5 | 0.49 | (0.03 | ) | 0.52 | |||||||||||

Cost of Deposits (2) | 6 | 0.00 | (0.00 | ) | 0.00 | |||||||||||

Cost of Other External Liabilities | 7 | 0.23 | (0.06 | ) | 0.30 | |||||||||||

|

|

|

|

|

| |||||||||||

Net Interest Margin | (1)-(4) | 8 | (0.06 | ) | 0.05 | (0.12 | ) | |||||||||

Loan and Deposit Rate Margin (including Expenses) | (2)-(5) | 9 | 0.27 | 0.05 | 0.22 | |||||||||||

Loan and Deposit Rate Margin | (2)-(6) | 10 | 0.76 | 0.02 | 0.74 | |||||||||||

|

|

|

|

|

| |||||||||||

(1) Return on Loans and Bills Discounted excludes loans to financial institutions (including MHFG). |

| |||||||||||||||

(2) Deposits include Negotiable Certificates of Deposit (“NCDs”). |

| |||||||||||||||

| Reference: After excluding loans to the Japanese government and others |

| |||||||||||||||

Return on Loans and Bills Discounted | 11 | 0.78 | 0.01 | 0.76 | ||||||||||||

Loan and Deposit Rate Margin (including Expenses) | (11)-(5) | 12 | 0.28 | 0.05 | 0.23 | |||||||||||

Loan and Deposit Rate Margin | (11)-(6) | 13 | 0.78 | 0.01 | 0.76 | |||||||||||

| (%) | ||||||||||||||||

| First Half of Fiscal 2022 | First Half of Fiscal 2021 | |||||||||||||||

| Mizuho Trust & Banking | Change | |||||||||||||||

Return on Interest-Earning Assets | 14 | 0.49 | 0.01 | 0.47 | ||||||||||||

Return on Loans and Bills Discounted (1) | 15 | 0.60 | 0.01 | 0.59 | ||||||||||||

Return on Securities | 16 | 2.26 | 0.51 | 1.74 | ||||||||||||

Cost of Funding | 17 | 0.12 | (0.01 | ) | 0.13 | |||||||||||

Cost of Deposits (2) | 18 | 0.00 | (0.00 | ) | 0.01 | |||||||||||

|

|

|

|

|

| |||||||||||

Net Interest Margin | (14)-(17) | 19 | 0.37 | 0.02 | 0.34 | |||||||||||

Loan and Deposit Rate Margin | (15)-(18) | 20 | 0.59 | 0.01 | 0.58 | |||||||||||

|

|

|

|

|

| |||||||||||

(1) Return on Loans and Bills Discounted excludes loans to financial institutions (including MHFG). |

| |||||||||||||||

(2) Deposits include NCDs. |

| |||||||||||||||

Reference: After excluding loans to the Japanese government and others |

| |||||||||||||||

Return on Loans and Bills Discounted | 21 | 0.60 | 0.00 | 0.60 | ||||||||||||

Loan and Deposit Rate Margin | (21)-(18) | 22 | 0.59 | 0.00 | 0.59 | |||||||||||

| Reference | (%) | |||||||||||||||

| First Half of Fiscal 2022 | First Half of Fiscal 2021 | |||||||||||||||

| Aggregate Figures for the 2 Banks | Change | |||||||||||||||

Return on Loans and Bills Discounted (1) | 23 | 0.75 | 0.01 | 0.73 | ||||||||||||

Cost of Deposits (2) | 24 | 0.00 | (0.00 | ) | 0.00 | |||||||||||

|

|

|

|

|

| |||||||||||

Loan and Deposit Rate Margin | (23)-(24) | 25 | 0.75 | 0.02 | 0.73 | |||||||||||

|

|

|

|

|

| |||||||||||

(1) Return on Loans and Bills Discounted excludes loans to financial institutions (including MHFG). |

| |||||||||||||||

(2) Deposits include NCDs. |

| |||||||||||||||

Reference: After excluding loans to the Japanese government and others |

| |||||||||||||||

Return on Loans and Bills Discounted | 26 | 0.77 | 0.01 | 0.75 | ||||||||||||

Loan and Deposit Rate Margin | (26)-(24) | 27 | 0.77 | 0.01 | 0.75 | |||||||||||

2-5

Mizuho Financial Group, Inc.

3. Use and Source of Funds

Non-Consolidated

Mizuho Bank

| (Millions of yen, %) | ||||||||||||||||||||||||

| First Half of Fiscal 2022 | First Half of Fiscal 2021 | |||||||||||||||||||||||

| Change | ||||||||||||||||||||||||

| Average Balance | Rate | Average Balance | Rate | Average Balance | Rate | |||||||||||||||||||

Total | ||||||||||||||||||||||||

Use of Funds | 186,674,068 | 1.04 | 2,007,226 | 0.47 | 184,666,842 | 0.57 | ||||||||||||||||||

Loans and Bills Discounted | 87,764,939 | 1.40 | 6,899,931 | 0.49 | 80,865,008 | 0.91 | ||||||||||||||||||

Securities | 43,237,585 | 0.77 | (1,772,347 | ) | 0.28 | 45,009,933 | 0.49 | |||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||

Source of Funds | 196,762,214 | 0.52 | 12,937,670 | 0.39 | 183,824,544 | 0.12 | ||||||||||||||||||

Deposits | 136,814,341 | 0.30 | 8,767,946 | 0.27 | 128,046,394 | 0.02 | ||||||||||||||||||

NCDs | 20,718,661 | 0.45 | 841,254 | 0.40 | 19,877,406 | 0.05 | ||||||||||||||||||

| Domestic Operations | ||||||||||||||||||||||||

Use of Funds | 119,679,302 | 0.42 | (8,163,978 | ) | 0.03 | 127,843,280 | 0.39 | |||||||||||||||||

Loans and Bills Discounted | 52,001,518 | 0.75 | (800,862 | ) | 0.01 | 52,802,381 | 0.73 | |||||||||||||||||

Securities | 29,260,628 | 0.31 | (322,803 | ) | 0.01 | 29,583,431 | 0.30 | |||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||

Source of Funds | 127,532,403 | 0.03 | 1,136,593 | 0.00 | 126,395,809 | 0.03 | ||||||||||||||||||

Deposits | 101,527,932 | 0.00 | 848,233 | (0.00 | ) | 100,679,698 | 0.00 | |||||||||||||||||

NCDs | 14,131,252 | 0.00 | 403,078 | (0.00 | ) | 13,728,174 | 0.00 | |||||||||||||||||

| International Operations | ||||||||||||||||||||||||

Use of Funds | 73,235,247 | 1.96 | 13,721,002 | 1.02 | 59,514,244 | 0.94 | ||||||||||||||||||

Loans and Bills Discounted | 35,763,420 | 2.36 | 7,700,793 | 1.10 | 28,062,627 | 1.26 | ||||||||||||||||||

Securities | 13,976,957 | 1.74 | (1,449,544 | ) | 0.87 | 15,426,502 | 0.86 | |||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||

Source of Funds | 75,470,291 | 1.29 | 15,350,874 | 0.98 | 60,119,416 | 0.30 | ||||||||||||||||||

Deposits | 35,286,408 | 1.17 | 7,919,712 | 1.06 | 27,366,695 | 0.10 | ||||||||||||||||||

NCDs | 6,587,408 | 1.43 | 438,176 | 1.27 | 6,149,232 | 0.15 | ||||||||||||||||||

2-6

Mizuho Financial Group, Inc.

Mizuho Trust & Banking (Banking Account)

| (Millions of yen, %) | ||||||||||||||||||||||||

| First Half of Fiscal 2022 | First Half of Fiscal 2021 | |||||||||||||||||||||||

| Change | ||||||||||||||||||||||||

| Average Balance | Rate | Average Balance | Rate | Average Balance | Rate | |||||||||||||||||||

Total | ||||||||||||||||||||||||

Use of Funds | 5,195,543 | 0.50 | (109,214 | ) | 0.01 | 5,304,757 | 0.48 | |||||||||||||||||

Loans and Bills Discounted | 3,186,148 | 0.61 | (82,363 | ) | 0.00 | 3,268,511 | 0.60 | |||||||||||||||||

Securities | 214,772 | 2.18 | (38,953 | ) | 0.49 | 253,726 | 1.69 | |||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||

Source of Funds | 5,336,283 | 0.12 | (40,954 | ) | (0.00 | ) | 5,377,237 | 0.13 | ||||||||||||||||

Deposits | 2,661,021 | 0.00 | (219,343 | ) | (0.00 | ) | 2,880,365 | 0.01 | ||||||||||||||||

NCDs | 728,555 | 0.00 | 82,601 | (0.00 | ) | 645,954 | 0.00 | |||||||||||||||||

| Domestic Operations | ||||||||||||||||||||||||

Use of Funds | 5,174,709 | 0.49 | (89,549 | ) | 0.01 | 5,264,259 | 0.47 | |||||||||||||||||

Loans and Bills Discounted | 3,156,345 | 0.60 | (67,330 | ) | 0.01 | 3,223,676 | 0.59 | |||||||||||||||||

Securities | 206,484 | 2.26 | (38,992 | ) | 0.51 | 245,476 | 1.74 | |||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||

Source of Funds | 5,315,547 | 0.12 | (20,814 | ) | (0.01 | ) | 5,336,361 | 0.13 | ||||||||||||||||

Deposits | 2,657,698 | 0.00 | (218,685 | ) | (0.00 | ) | 2,876,384 | 0.01 | ||||||||||||||||

NCDs | 728,555 | 0.00 | 82,601 | (0.00 | ) | 645,954 | 0.00 | |||||||||||||||||

| International Operations | ||||||||||||||||||||||||

Use of Funds | 44,280 | 1.08 | (23,704 | ) | 0.05 | 67,984 | 1.02 | |||||||||||||||||

Loans and Bills Discounted | 29,802 | 1.45 | (15,032 | ) | (0.02 | ) | 44,835 | 1.47 | ||||||||||||||||

Securities | 8,287 | 0.37 | 38 | 0.07 | 8,249 | 0.29 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||

Source of Funds | 44,181 | 0.51 | (24,180 | ) | 0.29 | 68,362 | 0.21 | |||||||||||||||||

Deposits | 3,323 | 0.00 | (658 | ) | (0.01 | ) | 3,981 | 0.01 | ||||||||||||||||

NCDs | — | — | — | — | — | — | ||||||||||||||||||

2-7

Mizuho Financial Group, Inc.

4. Net Gains/Losses on Securities

Consolidated

| (Millions of yen) | ||||||||||||

| First Half of Fiscal 2022 | First Half of Fiscal 2021 | |||||||||||

| Change | ||||||||||||

Net Gains (Losses) related to Bonds | (16,496 | ) | (37,674 | ) | 21,178 | |||||||

Gains on Sales and Others | 54,309 | 4,386 | 49,923 | |||||||||

Losses on Sales and Others | (72,501 | ) | (45,281 | ) | (27,219 | ) | ||||||

Impairment (Devaluation) | (1,012 | ) | 283 | (1,296 | ) | |||||||

Reversal of (Provision for) Reserve for Possible Losses on Investments | (0 | ) | 0 | (0 | ) | |||||||

Gains (Losses) on Derivatives other than for Trading | 2,708 | 2,936 | (228 | ) | ||||||||

| First Half of Fiscal 2022 | First Half of Fiscal 2021 | |||||||||||

| Change | ||||||||||||

Net Gains (Losses) related to Stocks | 38,439 | 23,508 | 14,931 | |||||||||

Gains on Sales | 54,377 | (62,082 | ) | 116,459 | ||||||||

Losses on Sales | (18,529 | ) | 62,402 | (80,931 | ) | |||||||

Impairment (Devaluation) | (1,033 | ) | 873 | (1,906 | ) | |||||||

Reversal of (Provision for) Reserve for Possible Losses on Investments | — | — | — | |||||||||

Gains (Losses) on Derivatives other than for Trading | 3,625 | 22,315 | (18,690 | ) | ||||||||

Non-Consolidated

Aggregate Figures for the 2 Banks |

| |||||||||||

| (Millions of yen) | ||||||||||||

| First Half of Fiscal 2022 | First Half of Fiscal 2021 | |||||||||||

| Change | ||||||||||||

Net Gains (Losses) related to Bonds | (15,655 | ) | (38,945 | ) | 23,290 | |||||||

Gains on Sales and Others | 55,231 | 3,084 | 52,146 | |||||||||

Losses on Sales and Others | (72,582 | ) | (45,250 | ) | (27,332 | ) | ||||||

Impairment (Devaluation) | (1,012 | ) | 283 | (1,296 | ) | |||||||

Reversal of (Provision for) Reserve for Possible Losses on Investments | — | — | — | |||||||||

Gains (Losses) on Derivatives other than for Trading | 2,708 | 2,936 | (228 | ) | ||||||||

| First Half of Fiscal 2022 | First Half of Fiscal 2021 | |||||||||||

| Change | ||||||||||||

Net Gains (Losses) related to Stocks | 36,462 | 25,700 | 10,761 | |||||||||

Gains on Sales | 50,917 | (58,204 | ) | 109,122 | ||||||||

Losses on Sales | (17,481 | ) | 60,795 | (78,276 | ) | |||||||

Impairment (Devaluation) | (599 | ) | 795 | (1,394 | ) | |||||||

Reversal of (Provision for) Reserve for Possible Losses on Investments | — | — | — | |||||||||

Gains (Losses) on Derivatives other than for Trading | 3,625 | 22,315 | (18,690 | ) | ||||||||

2-8

Mizuho Financial Group, Inc.

| Mizuho Bank |

| |||||||||||

| (Millions of yen) | ||||||||||||

| First Half of Fiscal 2022 | First Half of Fiscal 2021 | |||||||||||

| Change | ||||||||||||

Net Gains (Losses) related to Bonds | (15,650 | ) | (38,930 | ) | 23,279 | |||||||

Gains on Sales and Others | 55,231 | 3,096 | 52,135 | |||||||||

Losses on Sales and Others | (72,577 | ) | (45,246 | ) | (27,330 | ) | ||||||

Impairment (Devaluation) | (1,012 | ) | 283 | (1,296 | ) | |||||||

Reversal of (Provision for) Reserve for Possible Losses on Investments | — | — | — | |||||||||

Gains (Losses) on Derivatives other than for Trading | 2,708 | 2,936 | (228 | ) | ||||||||

| First Half of Fiscal 2022 | First Half of Fiscal 2021 | |||||||||||

| Change | ||||||||||||

Net Gains (Losses) related to Stocks | 34,024 | 23,663 | 10,360 | |||||||||

Gains on Sales | 46,969 | (61,671 | ) | 108,640 | ||||||||

Losses on Sales | (16,021 | ) | 62,211 | (78,233 | ) | |||||||

Impairment (Devaluation) | (548 | ) | 807 | (1,356 | ) | |||||||

Reversal of (Provision for) Reserve for Possible Losses on Investments | — | — | — | |||||||||

Gains (Losses) on Derivatives other than for Trading | 3,625 | 22,315 | (18,690 | ) | ||||||||

| Mizuho Trust & Banking |

| |||||||||||

| (Millions of yen) | ||||||||||||

| First Half of Fiscal 2022 | First Half of Fiscal 2021 | |||||||||||

| Change | ||||||||||||

Net Gains (Losses) related to Bonds | (5 | ) | (15 | ) | 10 | |||||||

Gains on Sales and Others | — | (11 | ) | 11 | ||||||||

Losses on Sales and Others | (5 | ) | (4 | ) | (1 | ) | ||||||

Impairment (Devaluation) | — | — | — | |||||||||

Reversal of (Provision for) Reserve for Possible Losses on Investments | — | — | — | |||||||||

Gains (Losses) on Derivatives other than for Trading | — | — | — | |||||||||

| First Half of Fiscal 2022 | First Half of Fiscal 2021 | |||||||||||

| Change | ||||||||||||

Net Gains (Losses) related to Stocks | 2,437 | 2,037 | 400 | |||||||||

Gains on Sales | 3,948 | 3,466 | 482 | |||||||||

Losses on Sales | (1,460 | ) | (1,416 | ) | (43 | ) | ||||||

Impairment (Devaluation) | (50 | ) | (12 | ) | (38 | ) | ||||||

Reversal of (Provision for) Reserve for Possible Losses on Investments | — | — | — | |||||||||

Gains (Losses) on Derivatives other than for Trading | — | — | — | |||||||||

2-9

Mizuho Financial Group, Inc.

5. Unrealized Gains/Losses on Securities

| • | Stocks and others without a quoted market price and Investments in Partnerships are excluded. |

Consolidated

(1) Other Securities

| (Millions of yen) | ||||||||||||||||||||||||||||||||

| As of September 30, 2022 | As of March 31, 2022 | |||||||||||||||||||||||||||||||

| Book Value | Unrealized Gains/Losses | Book Value | Unrealized Gains/Losses | |||||||||||||||||||||||||||||

| (= Fair Value) | Gains | Losses | (= Fair Value) | Gains | Losses | |||||||||||||||||||||||||||

Other Securities | 35,384,404 | 129,885 | 1,474,624 | 1,344,739 | 42,065,723 | 990,184 | 1,593,785 | 603,600 | ||||||||||||||||||||||||

Japanese Stocks | 2,443,398 | 1,390,547 | 1,422,894 | 32,347 | 2,577,310 | 1,499,915 | 1,538,391 | 38,475 | ||||||||||||||||||||||||

Japanese Bonds | 20,775,446 | (54,609 | ) | 19,967 | 74,577 | 28,620,413 | (52,186 | ) | 19,799 | 71,986 | ||||||||||||||||||||||

Japanese Government Bonds | 17,103,302 | (28,940 | ) | 9,437 | 38,377 | 25,158,730 | (30,543 | ) | 7,495 | 38,039 | ||||||||||||||||||||||

Other | 12,165,559 | (1,206,051 | ) | 31,762 | 1,237,814 | 10,867,999 | (457,544 | ) | 35,593 | 493,138 | ||||||||||||||||||||||

Foreign Bonds | 10,332,422 | (1,081,706 | ) | 1,628 | 1,083,335 | 8,937,594 | (414,292 | ) | 2,316 | 416,609 | ||||||||||||||||||||||

| ||||||||||||||||||||||||||||||||

* In addition to “Securities” on the consolidated balance sheets, NCDs in “Cash and Due from Banks,” certain items in “Other Debt Purchased” and certain items in “Other Assets” are also included. * The book values of Other Securities which have readily determinable fair value are stated at fair value, so Unrealized Gains/Losses indicate the difference between book values on the consolidated balance sheets and the acquisition costs. * Unrealized Gains/Losses include ¥20,910 million and ¥27,448 million, which were recognized in the statement of income for September 30, 2022 and March 31, 2022, respectively, by applying the fair-value hedge accounting. As a result, the base amounts to be recorded directly to Net Assets after necessary consolidation adjustments as of September 30, 2022 and March 31, 2022 are ¥108,974 million and ¥962,735 million, respectively. * Other Securities mainly including Foreign Bonds are hedged by using derivative instruments, which apply the deferred method of hedge accounting. Deferred Hedge Gains/Losses before tax adjustment as of September 30, 2022 and March 31, 2022 are ¥458,060 million (Foreign Bonds ¥475,460 million and Japanese Government Bonds ¥(4,323) million) and ¥126,280 million (Foreign Bonds ¥135,310 million and Japanese Government Bonds ¥—million), respectively. Unrealized Gains/Losses applying deferred hedging accounting among hedging instruments as of September 30, 2022 and March 31, 2022 are ¥587,945 million (Foreign Bonds ¥(606,246) million and Japanese Government Bonds ¥(33,263) million) and ¥1,116,464 million (Foreign Bonds ¥(278,982) million and Japanese Government Bonds ¥(30,543) million), respectively. * Unrealized Gains/Losses on Other Securities, net of Taxes (recorded directly to Net Assets after tax and consolidation adjustments, excluding the amount recognized in the statement of income by applying the fair-value hedge accounting, including translation differences and others regarding stocks and others without a quoted market price and Investments in Partnerships) as of September 30, 2022 and March 31, 2022 are ¥118,757 million and ¥719,822 million, respectively.

(2) Bonds Held to Maturity

|

| |||||||||||||||||||||||||||||||

| (Millions of yen) | ||||||||||||||||||||||||||||||||

| As of September 30, 2022 | As of March 31, 2022 | |||||||||||||||||||||||||||||||

| Book Value | Unrealized Gains/Losses | Book Value | Unrealized Gains/Losses | |||||||||||||||||||||||||||||