UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 20-F

[ ] REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR (g) OF THE SECURITIES EXCHANGE ACT OF 1934

OR

[ X ] ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2008

OR

[ ] TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from ____________to ____________

OR

[ ] SHELL COMPANY PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

Date of event requiring this shell company report _____________

For the transition period from ____________to ____________

Commission file number000-52326

HARD CREEK NICKEL CORPORATION

(Exact name of Registrant as specified in its charter)

Not Applicable

(Translation of Registrant’s name into English)

British Columbia, Canada

(Jurisdiction of incorporation or organization)

1060 – 1090 West Georgia Street Vancouver, British Columbia V6E 3V7 Canada

(Address of principal executive offices)

1

Copy of communications to:

Bernard Pinsky, Esq.

Clark Wilson LLP Barristers and Solicitors

Suite 800 – 885 West Georgia Street

Vancouver, British Columbia, Canada V6C 3H1

Telephone: 604-687-5700 Facsimile: 604-687-6314

Securities registered or to be registered pursuant to Section 12(b) of the Act.

| Title of Class | Name of each exchange on which registered |

| Not Applicable | Not Applicable |

Securities registered or to be registered pursuant to Section 12(g) of the Act.

Common Shares Without Par Value

(Title of Class)

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act.

Not Applicable

(Title of Class)

Indicate the number of outstanding shares of each of the issuer’s classes of capital or common stock as of the close of the period covered by the annual report.

There were 60,370,592 Common Shares without par value issued and outstanding as at June 17,2009.

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. YES [ ] NO [X]

If this report is an annual or transition report, indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934. [ ] YES [X] NO

Note – Checking the box above will not relieve any registrant required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 from their obligations under those Sections.

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

[ ] YES [X] NO

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

[ ] YES [ ] NO

2

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer. See definition of “accelerated filer and large accelerated filer” in Rule 12b-2 of the Exchange Act. (Check one): Large accelerated filer

[ ] Accelerated filer [ ] Non-accelerated filer [X]

Indicate by check mark which financial statement item the registrant has elected to follow.

[ ] ITEM 17 [X] ITEM 18

If this is an annual report, indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). [ ] YES [X] NO

TABLE OF CONTENTS

3

FORWARD-LOOKING STATEMENTS

Except for the statements of historical fact contained herein, some information presented in this registration statement constitutes forward-looking statements. When used in this registration statement, the words “estimate”, “project”, “believe”, “anticipate”, “intend”, “expect”, “predict”, “may”, “should”, the negative thereof or other variations thereon or comparable terminology are intended to identify forward-looking statements. Such forward-looking statements involve known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of our company to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements. Such factors include, among others, changes in project parameters as plans continue to be refined, future prices of nickel, as well as those factors discussed in the section entitled “Risk Factors” on page 8. Although our company has attempted to identify important factors that could cause actual results to differ materially, there may be other factors that cause actual results not to be as anticipated, estimated or intended. There can be no assurance that such statements will prove to be accurate as actual results and future events could differ materially from those anticipated in such statements. Accordingly, prospective investors should not place undue reliance on forward-looking statements. The forward-looking statements

4

in this registration statement speak only as to the date hereof. Our company does not undertake any obligation to release publicly any revisions to these forward-looking statements to reflect events or circumstances after the date hereof or to reflect the occurrence of unanticipated events.

Although we believe that the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee future results, levels of activity, performance or achievements. Except as required by applicable law, including the securities laws of the United States, we do not intend to update any of the forward-looking statements to conform these statements to actual results.

As used in this prospectus, the terms “we”, “us”, “our” and “Hard Creek” mean Hard Creek Nickel Corporation, unless otherwise indicated.

PART I

FINANCIAL INFORMATION AND ACCOUNTING PRINCIPLES

The financial statements and summaries of financial information contained in this document are reported in Canadian dollars (“$”) unless otherwise stated. A “tonne” is one metric ton or 2204.6 pounds. All such financial statements have been prepared in accordance with United States generally accepted accounting principles.

The financial statements of Hard Creek for the years ended December 31, 2006, 2007 and 2008 have been reported on by Dale Matheson Carr-Hilton LaBonte LLP, Chartered Accountants, Suite 1500 – 1140 West Pender Street, Vancouver, British Columbia, V6E 4G1.

| Item 1 | Identity of Directors, Senior Management and Advisers |

| A. | Directors and Senior Management |

The Directors and the senior management of our company as of June 17, 2009 are as follows:

| Name | Business Address | Function |

Mark Jarvis

| 1060 – 1090 W. Georgia St.

Vancouver, BC V6E 3V7

Canada

| As President, Chief Executive Officer and

director, Mr. Jarvis is responsible for the

development of our strategic direction and

the management and supervision of our

overall business. |

George Sookochoff

| #503-1771 Nelson Street

Vancouver, BC V6M 1M6

Canada | As a non-executive director, Mr.

Sookochoff is responsible for the

corporate governance of our company. |

Tom Milner

| PO Box 10

McLeese Lake, BC V0L 1P0

Canada | As a non-executive director, Mr. Milner is

responsible for the corporate governance

of our company. |

Lyle Davis

| 2838 Carnation Street

North Vancouver, BC V7H 1L8

Canada | As a non-executive director, Mr. Davis is

responsible for the corporate governance

of our company. |

Brian Fiddler

| 408 Shiles Street

New Westminster, BC V3L 3K4

Canada

| As Controller and Chief Financial Officer,

Mr. Fiddler is responsible for the financial

and corporate management and

supervision of the affairs and business of

our company. |

5

Tony Hitchins

| 1060-1090 West Georgia Street

Vancouver, BC V6E 3V7

Canada

| As Chief Operating Officer, Mr. Hitchins

is responsible for the project management,

field management and logging core,

supervision of exploration on the

Turnagain Nickel Project, hiring field

staff and maintaining claims in good

standing. (Mr. Hitchins ceased to be

COO on June 2, 2008.) |

Neil Froc

| 42621 Canyon Road

Lindell Beach, BC V2R 5B8

Canada

| As Executive Vice President, Mr. Froc is

responsible for the management of

engineering and technical studies

including infrastructure and socio-

economic project development. |

Leslie Young

| 5991 Gibbons Drive

Richmond BC V7C 2C6

Canada

| As Corporate Secretary, Ms. Young is

responsible for the internal accounting

and record keeping, general

administration, and making all necessary

filings and financial reporting for our

company. |

Our legal advisers are Clark Wilson LLP, Barristers & Solicitors, with a business address at Suite 800, 885 West Georgia Street, Vancouver, British Columbia, Canada V6C 3H1.

Our auditors are Dale Matheson Carr-Hilton LaBonte LLP, Chartered Accountants (“DMCL LLP”) with a business address at Suite 1500– 1140 West Pender Street, Vancouver, British Columbia, V6E 4G1. DMCL LLP is a member of the Canadian Institute of Chartered Accountants and the Institute of Chartered Accountants of British Columbia. DMCL is also registered with the Canadian Public Accounting Board and the Public Company Accounting Oversight Board (United States).

| Item 2 | Offer Statistics and Expected Timetable |

Not Applicable.

| A. | Selected Financial Data |

The following table summarizes selected financial data for our company for the years ended December 31, 2008, 2007, 2006, 2005, and 2004 respectively. The information in the table was extracted from the detailed financial statements and related notes included in this registration statement and should be read in conjunction with such financial statements and with the information appearing under the heading, “Item 5 –Operating and Financial Review and Prospects”.

Selected Financial Data

(Stated in Canadian Dollars)

Fiscal Years Ended December 31

6

US GAAP | 2008

Audited | 2007

Audited | 2006

Audited | 2005

Audited | 2004

Audited |

Net Sales or

Operating

Revenue | NIL

| NIL

| NIL

| NIL

| NIL

|

| Net Loss | $5,480,641 | $8,960,241 | $5,738,018 | $3,332,394 | $4,648,724 |

Net Loss from

Operations

(January 17,

1983 (inception

to December 31,

2008) | $40,287,926

| $34,807,285

| $25,847,044

| $20,109,026

| $16,776,632

|

| Depreciation | $20,860 | $14,528 | $7,493 | $6,780 | $6,076 |

General and

Administrative

Expenses | $2,072,166

| $1,654,437

| $1,049,305

| $570,745

| $1,104,084

|

Mineral Property

Exploration

Costs | $3,522,375

| $7,182,030

| $5,509,087

| $2,679,212

| $2,987,287

|

| Other Income | $565,874 | $440,586 | $1,660,137 | $237,508 | $249,376 |

Basic and

Diluted Net Loss

per Share | $0.09

| $0.16

| $0.14

| $0.11

| $0.20

|

| Assets | $6,685,512 | $11,767,456 | $2,220,698 | $1,697,951 | $1,303,553 |

| Current Assets | $6,429,027 | $11,529,201 | $1,834,442 | $846,465 | $607,583 |

| Capital Stock | $40,976,100 | $40,847,875 | $23,800,546 | $18,632,327 | $15,059,286 |

Common Stock

(adjusted to

reflect changes

in capital) | 60,370,592

common

shares

| 60,220,592

common

shares

| 49,322,614

| 37,675,494

| 28,310,394

|

Basic and

Diluted Net Loss

per Common

Share | $0.09

| $0.16

| $0.14

| $0.11

| $0.20

|

Cash Dividends

per Common

Share | NIL

| NIL

| NIL

| NIL

| NIL

|

| B. | Capitalization and Indebtedness |

Our authorized capital consists of an unlimited number of Common Shares without par value and an unlimited number of Class A Preference Shares without par value. As of June 17, 2009, we had 60,370,592 Common Shares and no Class A Preference Shares issued and outstanding.

The table below sets forth our total indebtedness in Canadian dollars and capitalization as of December 31, 2008. You should read this table in conjunction with the audited and unaudited financial statements and accompanying notes included in this registration statement.

7

| As at December 31, 2008 | |

| (Stated in Canadian Dollars) | |

| | | | |

| Liabilities | | | |

| Current, unsecured and unguaranteed | $ | 172,741 | |

| Current, secured and guaranteed | | - | |

| | $ | 172,741 | |

| | | | |

| Shareholders’ Equity | | | |

| Common stock | $ | 40,976,100 | |

| Additional paid-in capital | | 5,447,894 | |

| Deficit | | (40,287,926 | ) |

| | $ | 6,136,068 | |

| C. | Reasons for the Offer and Use of Proceeds |

Not applicable.

This Registration Statement contains forward-looking statements which relate to future events or our future performance, including our future financial performance. In some cases, you can identify forward-looking statements by terminology such as “may”, “should”, “expects”, “plans”, “anticipates”, “believes”, “estimates”, “predicts”, or “potential” or the negative of these terms or other comparable terminology. These statements are only predictions and involve known and unknown risks, uncertainties and other factors, including the risks in enumerated in this section entitled “Risk Factors”, that may cause our company’s or our industry’s actual results, levels of activity, performance or achievements to be materially different from any future results, levels of activity, performance or achievements expressed or implied by these forward-looking statements.

While these forward-looking statements, and any assumptions upon which they are based, are made in good faith and reflect our current judgment regarding the direction of our business, actual results will almost always vary, sometimes materially, from any estimates, predictions, projections, assumptions or other future performance suggested in this Registration Statement. Except as required by applicable law, including the securities laws of the United States, we do not intend to update any of the forward-looking statements to conform these statements to actual results.

An investment in our common stock involves a number of very significant risks. You should carefully consider the following risks and uncertainties in addition to other information in this prospectus in evaluating our company and our business before purchasing shares of our company’s common stock. Our business, operating results and financial condition could be seriously harmed due to any of the following risks. You could lose all or part of your investment due to any of these risks.

Risks Associated with Mining

Our company and all of our properties are in the exploration stage. We have no revenues from operations and limited ongoing mining operations. It is unlikely that any of our properties contain any mineral resources in commercially exploitable quantities. The chances of us ever reaching the development stage are extremely remote. If we do not discover any mineral resource in a commercially exploitable quantity, our business will fail and investors may lose all of their investment in our company.

Despite exploration work on our mineral properties, we have not established that any of them contain any commercially exploitable mineral reserves. It is unlikely that we will ever find commercially exploitable

8

mineral reserves. We have no revenues from operations and limited ongoing mining operations. The probability of any of our properties or any individual prospect ever having a commercially exploitable mineral reserve is extremely remote; in all probability our mineral resource properties do not contain any reserves and any funds that we spend on exploration will probably be lost. The chances of us ever reaching the development stage are remote. The search for valuable minerals as a business is extremely risky. It is not likely that additional exploration on our properties will establish that commercially exploitable reserves of minerals exist on our mineral properties. Additional potential problems that may prevent us from discovering any reserves of minerals on our property include, but are not limited to, unanticipated problems relating to exploration and additional costs and expenses that may exceed current estimates. Most of these factors are beyond our control, and any of them could increase costs and make extraction of any identified mineral resource unprofitable.

If we are unable to establish the presence of commercially exploitable reserves of minerals on our property, our ability to fund future exploration activities will be impeded, we will not be able to operate profitably and investors may lose all of their investment in our company.

We face intense competition in the mineral exploration and exploitation industry and we compete with our competitors for financing, for new mineral resource properties and for qualified managerial and technical employees. If we are unable to obtain the financing, new mineral properties or qualified personnel that we require, then we will likely have to cease operations and investors will lose all of their investment in our company.

Our competition includes large established mining companies with substantial capabilities and with greater financial and technical resources than we have. As a result of this competition, we may have to compete for financing and we may be unable to acquire financing on terms we consider acceptable. Our competition could adversely affect our ability to acquire suitable prospects for exploration in the future. We may also have to compete with the other mining companies in the recruitment and retention of qualified managerial and technical employees. If we are unable to successfully compete for financing, mineral properties or qualified employees, we will likely have to cease operations. If we are unable to successfully compete for the acquisition of suitable prospects or interest for exploration in the future, we will not acquire any interest in additional mineral resource properties and have no further chance of discovering minerals. The occurrence of any of these things would likely cause us to cease operations as a company and investors would lose their entire investment in our company.

Because of the inherent dangers involved in mineral exploration and exploitation, there is a risk that we may incur liability or damages as we conduct our business. If we are liable to pay for any damages resulting from the conduct of our business, our financial position could be adversely affected and we may have to slow down or cease operations and investors could lose their investment in our company.

The search for valuable minerals involves numerous hazards. As a result, we may become subject to liability for such hazards, including pollution, cave-ins and other hazards against which we cannot insure or against which we may elect not to insure. At the present time we have no coverage to insure against these hazards. The payment of such liabilities may have a material adverse effect on our financial position. If so, we may have to slow down or cease operations and investors could lose their investment in our company.

Mineral operations are subject to government regulations which could have the effect of preventing us from exploiting any possible mineral reserves on our properties. If this occurs, we may have to cease operations and investors could lose their investment in our company.

Exploration activities are subject to national and local laws and regulations governing prospects, taxes, labor standards, occupational health, land use, environmental protection, mine safety and others which may in the future have a substantial adverse impact on our company’s prospects. In order to comply with applicable laws, we may be required to make capital expenditures until a particular problem is remedied. Existing and possible future environmental legislation, regulation and action could cause additional

9

expense, capital expenditure, restriction and delay in the activities of our company, the extent of which cannot be reasonably predicted. If we violate any applicable law or regulation, we could be forced to stop work and we could be fined. If we are forced to suspend our activities or if we are required to pay a large fine for a violation of these applicable laws and regulations, our business could be adversely affected and investors could lose their investment in our company.

Our operations are subject to environmental regulations, which require us to obtain permits and pay bonds and may result in the imposition of fines and penalties. If we are unable to obtain the permits or pay the bonds that we require in the future, we will have to cease the exploration activity in question. Ceasing such exploration activities could reduce our chances of ever discovering mineral resources on our properties. Environmental fines or liability could cause expenses for us, reducing the funds we have for our exploration program and potentially causing us to cease operations. If this happens, investors may lose their entire investment in our company.

Our operations are subject to environmental regulations promulgated by government agencies. Environmental legislation provides for restrictions and prohibitions on spills, releases or emissions of various substances produced in association with certain mining industry operations, such as seepage from tailings disposal areas, which would result in environmental pollution. A breach of such legislation may result in the imposition of fines and penalties. Environmental legislation is evolving in a manner which means stricter standards, and enforcement; fines and penalties for non-compliance may become more stringent. Environmental assessments of proposed projects carry a heightened degree of responsibility for companies and directors, officers and employees. Prior to conducting exploration involving surface disturbance in British Columbia, we are required to obtain a Work Permit from the Ministry of Energy, Mines and Petroleum Resources. Where significant surface disturbance through road building and drill site preparation is planned, the Ministry requires a Reclamation Bond to cover the estimated reclamation costs if we fail to complete the reclamation. The cost of compliance with governmental regulations, permits and bond requirements has the potential to reduce the profitability of operations by curtailing our exploration activities.

We are not aware of any existing environmental liability associated with any of our exploration properties but if such liability should arise, we may have to pay a lot of money to fix it or pay compensation, which would reduce the amount of money we have to spend on exploration and could possibly cause us to go out of business. Our potential exposure to liability for environmental damage is very high and we have no reserves established to pay for such liability. If we are found to be liable for a large amount of environmental damage, we will likely have to cease operations. If that happens, investors would likely lose all of their investment in our company.

Please see the section entitled “Governmental Regulations” on page 18 for more information.

Risks Related To Our Company

We have a limited operating history and have not generated any operating revenues since our incorporation. This raises substantial doubt about our ability to continue as a going concern and does not provide a meaningful basis for an evaluation of our prospects. If we are unable to generate revenue from our business, we may be forced to delay, scale back, or cease our exploration activities. If any of these actions were to become necessary, we may not be able to continue to explore our properties or operate our business and there is a substantial risk our business would fail, causing investors to lose all of their investment in our company.

We have not generated any operating revenues since our incorporation and we will, in all likelihood, continue to incur operating expenses without revenues until our mining properties are fully developed and in commercial production, which may never happen. We had cash in the amount of $4,125,235, recoverable taxes of $28,286 and mining tax credits of $2,222,020 as of December 31, 2008. We estimate our average monthly operating expenses to be approximately $163,000. As a result, we need to generate

10

significant revenues from our operations or obtain financing. We cannot provide assurances that we will be able to successfully explore and develop our mining properties or assure that viable reserves exist on the properties for extraction. It is unlikely that we will generate any funds internally unless we discover commercially viable quantities of ore. If we are unable to generate revenue from our business during the fiscal year 2009, we may be forced to delay, scale back, or eliminate our exploration activities. If any of these actions were to become necessary, we may not be able to continue to explore our properties or operate our business and if either of those events happen, then there is a substantial risk our business would fail and investors would lose their investment in our company.

We have not generated any revenue from our business and we will need to raise additional funds in the near future. If we are not able to obtain future financing when required, we might be forced to discontinue our business.

Because we have not generated any revenue from our business and we cannot anticipate when we will be able to generate revenue from our business, we will need to raise additional funds for the further exploration and future development of our mining claims and to respond to unanticipated requirements or expenses. We anticipate that we have sufficient funds for the 12 month period ending December 31, 2009, but we will need to raise further capital very soon thereafter in the approximate amount of $20,000,000 to $30,000,000. We do not currently have any arrangements for financing and we may not be able to find such financing if required. We cannot be sure that additional funding will be available to us for further exploration and development of our projects or to fulfill our obligations under any applicable agreements. Although we have been successful in the past in obtaining financing through the sale of equity securities, it is possible that we will not be able to obtain adequate financing in the future or that the terms of such financing will be unfavorable and unacceptable to us. Failure to obtain such additional financing would likely result in a delay or indefinite postponement of further exploration and development of our projects with the possible loss of such properties, our company would never increase in value and investors would never see a return on their investment.

Our Articles of Incorporation indemnify our officers and directors against all costs, charges and expenses incurred by them , which may discourage suits against directors or officers for breaches of fiduciary duties even though such suits, if successful, could benefit our company and our shareholders.

Our Articles of Incorporation contain provisions limiting the liability of our officers and directors for their acts, receipts, neglects or defaults and for any other loss, damage or expense incurred by our company which shall happen in the execution of the duties of such officers or directors, unless the officers or directors did not act honestly and in good faith with a view to the best interests of our company. Such limitations on liability may reduce the likelihood of derivative litigation against our officers and directors and may discourage or deter our shareholders from suing our officers and directors based upon breaches of their duties to our company, though such an action, if successful, might otherwise benefit our company and our shareholders.

Risks Relating to our Securities

Trading in our common shares on the Toronto Stock Exchange is limited and sporadic, making it difficult for our shareholders to sell their shares or liquidate their investments.

Our common shares are currently listed on the Toronto Stock Exchange under the symbol ‘HNC’. The trading price of our common shares has been and may continue to be subject to wide fluctuations. Trading prices of our common shares may fluctuate in response to a number of factors, many of which are beyond our control. In addition, the stock market in general, and the market for base metal exploration companies, including companies exploring for nickel in particular, has experienced extreme price and volume fluctuations that have often been unrelated or disproportionate to the operating performance of such companies. These broad market and industry factors may adversely affect the market price of our shares,

11

regardless of our operating performance. If you invest in our common shares, you could lose some or all of your investment.

In the past, following periods of volatility in the market price of a company’s securities, securities class-action litigation has often been instituted. Such litigation, if instituted, could result in substantial costs and a diversion of management’s attention and resources.

Investors will suffer dilution in their net book value per share if we issue additional shares, raise funds through the sale of equity securities or issue employee/director or consultant options.

We are currently without a source of revenue and will most likely be required to issue additional shares to finance our operations and, depending on the outcome of our exploration programs, may issue additional shares to finance additional exploration programs of any or all of our projects or to acquire additional properties or through the exercise of options by our employees, directors and consultants. If we are required to issue additional shares to raise financing, your interests in our company will be diluted and you may suffer dilution in your net book value per share depending on the price at which such securities are sold. As at June 17, 2009, there were outstanding an aggregate number of common share purchase warrants and share purchase options as, upon exercise, would result in the issue of an additional 8,162,302 of our common shares which, if exercised, would represent approximately 14 % of our issued and outstanding common shares. If all of these share purchase warrants and share purchase options are exercised and these common shares are issued, such issuance also will cause a reduction in the proportionate ownership and voting power of all other shareholders. The dilution may result in a decline in the market price of our common shares.

We do not expect to declare or pay any dividends, so investors will realize a return on their investment only if the price of shares of our stock goes up. There are no guarantees that will ever happen and investors may lose their entire investment in our company.

We have not declared or paid any dividends on our Common Shares since our inception, and we do not anticipate paying any such dividends for the foreseeable future. Therefore, investors will only realize a return on their investment if the price of our stock goes up. There are no guarantees that that will ever happen and investors may never realize a return on their investment in our company.

All of our directors, officers and control persons live outside of the U.S. U.S. investors may not be able to enforce their civil liabilities against us, our directors officers or control persons. Therefore, investors may be discouraged from bringing suits or may be unsuccessful even if they do try. Suits against directors or officers for breaches of fiduciary duties may be discouraged, even though such suits, if successful, could benefit our company and our shareholders.

It may be difficult to bring and enforce suits against us or our directors, officers and control persons. We were incorporated under theCompany Act (British Columbia) and transitioned under theBusiness Corporations Act (British Columbia) in June of 2004. All of our directors and officers are residents of countries other than the United States and all of our assets are located outside of the United States. Consequently, it is a risk that Canadian courts may not enforce the judgments of U.S. courts or enforce, in an original action, liabilities predicated on the U.S. federal laws directly. Therefore, investors may be discouraged from bringing suits or may be unsuccessful even if they do try.

Some of our directors and officers are employed elsewhere and their time and efforts will not be devoted to our company full-time.

Some of our directors and officers are employed in other positions with other companies. They will manage our company on a part-time basis. Because of this fact, the management of our company may suffer and our company could under-perform or fail. Brian Fiddler, our Controller and Chief Financial Officer, will devote approximately 32 hours per week, which is approximately 80% of his working hours, to the

12

management of our company. George Sookochoff, a director of our company, will devote approximately 4 hours per week, which is approximately 10% of his working hours, to the management of our company. Lyle Davis, a director of our company, will devote approximately 4 hours per week, which is approximately 10% of his working hours, to the management of our company. Tom Milner a director of our company, will devote approximately 4 hours per week, which is approximately 10% of his working hours, to the management of our company.

Trading of our stock may be restricted by the SEC's penny stock regulations, which may limit a shareholder's ability to buy and sell our stock.

The Securities and Exchange Commission has adopted regulations which generally define "penny stock" to be any equity security that has a market price (as defined) less than $5.00 per share or an exercise price of less than $5.00 per share, subject to certain exceptions. Our securities are covered by the penny stock rules, which impose additional sales practice requirements on brokers or dealers who sell to persons other than established customers and "accredited investors". The term "accredited investor" refers generally to institutions with assets in excess of $5,000,000 or individuals with a net worth in excess of $1,000,000 or annual income exceeding $200,000 or $300,000 jointly with their spouse. The penny stock rules require a broker or dealer, prior to a transaction in a penny stock not otherwise exempt from the rules, to deliver a standardized risk disclosure document in a form prepared by the SEC, which provides information about penny stocks and the nature and level of risks in the penny stock market. The broker or dealer also must provide the customer with current bid and offer quotations for the penny stock, the compensation of the broker or dealer and its salesperson in the transaction and monthly account statements showing the market value of each penny stock held in the customer's account. The bid and offer quotations, and the broker or dealer and salesperson compensation information, must be given to the customer orally or in writing prior to effecting the transaction and must be given to the customer in writing before or with the customer's confirmation. In addition, the penny stock rules require that prior to a transaction in a penny stock not otherwise exempt from these rules, the broker or dealer must make a special written determination that the penny stock is a suitable investment for the purchaser and receive the purchaser's written agreement to the transaction. These disclosure requirements may have the effect of reducing the level of trading activity in the secondary market for the stock that is subject to these penny stock rules. Consequently, these penny stock rules may affect the ability of brokers or dealers to trade our securities. We believe that the penny stock rules discourage investor interest in and limit the marketability of our common stock. This may limit your ability to buy and sell our stock and cause the price of the shares to decline

NASD sales practice requirements may also limit a shareholder's ability to buy and sell our stock.

In addition to the "penny stock" rules described above, the National Association of Securities Dealers (NASD) has adopted rules that require that in recommending an investment to a customer, a broker or dealer must have reasonable grounds for believing that the investment is suitable for that customer. Prior to recommending speculative low priced securities to their non-institutional customers, brokers or dealers must make reasonable efforts to obtain information about the customer's financial status, tax status, investment objectives and other information. Under interpretations of these rules, the NASD believes that there is a high probability that speculative low priced securities will not be suitable for at least some customers. The NASD requirements make it more difficult for brokers or dealers to recommend that their customers buy our common stock, which may prevent you from reselling your shares and may cause the price of the shares to decline.

U.S. investors could suffer adverse tax consequences if we are characterized as a passive foreign investment company.

We may be treated as a passive foreign investment company, or PFIC, for United States federal income tax purposes during the 2003 tax year or in subsequent years. We may be deemed a PFIC because previous financings combined with proceeds of future financings may produce, or be deemed to be held to produce, passive income. Additionally, U.S. citizens should review the section entitled “Taxation-U.S. Federal Income Taxation - Passive Foreign Investment Companies” contained in this Registration Statement for a

13

more detailed description of the PFIC rules and how those rules may affect their ownership of our capital shares.

If we are or become a PFIC, our U.S. shareholders may be subject to the following adverse tax consequences:

- they will be taxed at the highest ordinary income tax rates in effect during their holding period on certain distributions on our capital shares, and gains from the sale or other disposition of our capital shares;

- they will be required to pay interest on taxes allocable to prior periods; and

- the tax basis of our capital shares will not be increased to fair market value at the date of their date.

| Item 4 | Information on our Company |

| A. | History and Development of our Company |

We were originally incorporated in British Columbia Canada under theCompany Act (British Columbia) on January 17, 1983, under the name “Bren-Mar Resources Limited”, with an authorized capital of 50,000,000 Common Shares without par value. On March 15, 2000, we changed our name to “Bren-Mar Minerals Ltd.” to reflect our change in business to strictly exploration mining and consolidated our then issued and outstanding common shares on the basis of 1 post-consolidation common share for 5 pre-consolidation common shares, and we increased our post-consolidation authorized capital to 50,000,000 common shares. There were no changes in our directors or management. On November 22, 2000, we changed our name to “Canadian Metals Exploration Ltd.” to reflect the Company’s focus on mineral exploration in Canada, there were no changes in directors or management.

TheBusiness Corporations Act (British Columbia) came into force on March 29, 2004, repealing theCompany Act(British Columbia.) Our company now operates under theBusiness Corporations Act (British Columbia). On June 25, 2004, we changed our name to “Hard Creek Nickel Corporation” to reflect the primary type of mineral exploration the Company is engaged in, altered our authorized capital to comprise an unlimited number of common shares and an unlimited number of Class A preferred shares, and adopted our current Articles of Incorporation, which are attached as an exhibit to this form. The previous directors and management were replaced by Mark Jarvis as President and Director , Brian Fiddler as CFO, Leslie Young as Corporate Secretary, George Sookochoff as Director, Tom Milner as Director and Lyle Davis as Director.

We have our head office and principal place of business at Suite 1060 – 1090 West Georgia Street, Vancouver, British Columbia V6E 3V7 Canada (Telephone: 604.681.2300) . We do not have an agent in the United States.

Our common shares are listed on the Toronto Stock Exchange under the symbol “HNC”.

Since inception, we have been engaged in natural resource exploration and development primarily in British Columbia and, since 1996, have focused on the Turnagain Property in the Liard Mining Division of northern British Columbia. We first acquired the mineral claims on the Turnagain Property in 1996 under an option agreement with John Schussler and Ernie Hatzl. The original option agreement gave us the right to earn a 100% interest in the mineral claims on the Turnagain Property in exchange for the issuance of 200,000 of our common shares and the expenditure of CAN$1,000,000 on exploration of the property within 5 years of acquisition. We have now earned the 100% interest and it is subject to a 4% net smelter royalty on possible future production. We have the right to pay out the net smelter royalty for CAN$1,000,000 for each 1% of the royalty. So, to pay out all 4% of the royalty, we would be required to pay CAN$4,000,000.

14

On April 25, 2001, we entered into an agreement with Northwest Petroleum Inc. of Bakersfield, California to acquire rights to two separate oil and gas projects located in the state of California, consisting of the Buttonwillow Oil and Gas Leases in Kern County, California and the Moffat Ranch Gas Field in Madera County, California. We subsequently determined in March of 2002 that the Buttonwillow oil and gas leases and the Moffat Ranch Gas Field gas project were not feasible. Accordingly, the agreement with Northwest Petroleum Inc. was terminated on March 21, 2002 and our investment of $143,717 was written off.

On November 28, 2002, we entered into an agreement with John Schussler and Ernie Hatzl to acquire an additional 34 mineral claims, adjacent to the Turnagain Property, Laird Mining Division, British Columbia, in exchange for an aggregate total of 100,000 common shares.

Between November, 2003 and March, 2005 we staked additional claims, enlarging the Turnagain property from 3,700 hectares to approximately 27,500 hectares. With claim conversions in April 2005 and November 2007 the Turnagain property now covers 30,300 hectares.

In April, 2004, we staked three claim blocks in northern British Columbia. The staked properties varied in size from 1,500 to 5,500 hectares and totaled 9,000 hectares and were located in northern British Columbia, between 20km west and 100km northwest of the Turnagain property. After preliminary site investigations it was decided that all of these properties did not warrant further work and subsequently these claims were allowed to lapse. They are no longer owned by the company.

In January and February, 2005 we acquired, by staking on-line, four additional claim blocks in central and northern British Columbia for a total area of approximately 27,140 hectares. Some reconnaissance prospecting was completed on the claims with no further work warranted. All of the claims were allowed to lapse and are no longer owned by the company.

In September, 2005 we acquired by staking on-line, one additional claim block of approximately 1,906 hectares located approximately 50km north of the Turnagain property. Some reconnaissance prospecting was completed on the claim with no further work warranted. The claim block was allowed to lapse and is no longer owned by the company.

In March, 2006 we acquired by staking on-line, one additional claim block of approximately 4,489 hectares located approximately 130km southeast of the Turnagain property. Some reconnaissance prospecting was completed in the summer of 2006. It was determined that no further work was warranted and the claims were allowed to lapse in 2008. They are no longer owned by the company.

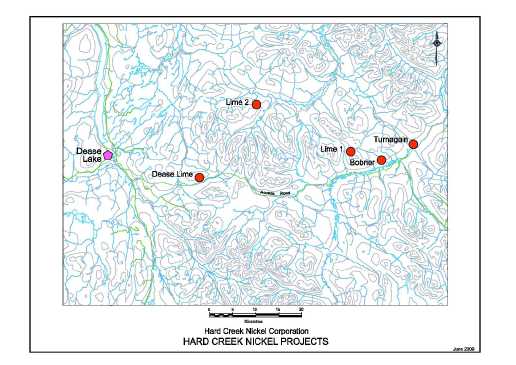

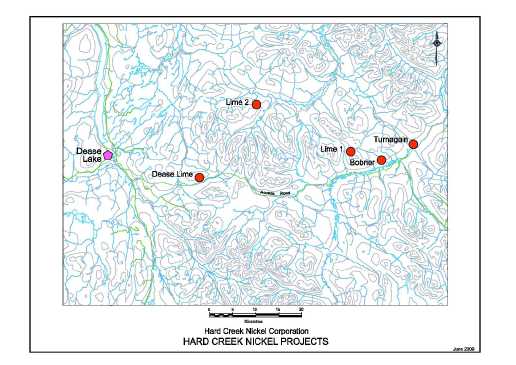

In May, 2006 we acquired by staking on-line, two additional claim blocks which are known as the Lime 1 and Lime 2 properties. They consist of approximately 1,133 hectares and are located approximately 15km and 35km west of the Turnagain property. Some reconnaissance prospecting was completed in the summer of 2006 with additional follow up work completed in 2008. Work was filed on the properties with the expiry date of the properties extended until September 30, 2010.

In July, 2006 we acquired by staking on-line, one additional claim block consisting of approximately 18,050 hectares located on the west side of Vancouver Island approximately 130km west of Campbell River, B.C. Some reconnaissance prospecting was completed in late 2006. It was determined that no further work was warranted and the claims were allowed to lapse in 2008. They are no longer owned by the company.

On October 11, 2006 we acquired by legal action, one additional claim block which is known as the Bobner property. It consists of approximately 150 hectares and is located approximately 8km west of the Turnagain property. Some reconnaissance prospecting was completed in the summer of 2008. An additional area of 305 hectares contiguous to the existing claim area was added by map staking in August 2008. Work was filed on the property with the expiry date of the properties extended until July 5, 2012.

15

On April 16, 2007 we acquired by staking on-line, one additional claim block consisting of approximately 1,971hectares located on the west side of Vancouver Island approximately 45km southwest of Gold River, B.C. Some reconnaissance prospecting was completed on the claim in 2008 with no further work warranted. The claim block was allowed to lapse and is no longer owned by the company.

On August 25, 2008 we acquired by staking on-line, one additional claim block known as the Dease Lime property. It consists of approximately 780 hectares and is located approximately 48km west of the Turnagain property. Some reconnaissance prospecting is scheduled for the summer of 2009.

Present Operations of Our Company

Turnagain Property Project

Our current mineral exploration activities on the Turnagain Property include core drilling, geological mapping, geochemical surveying, downhole geophysical surveying, baseline environmental and engineering studies, and metallurgical testing. From 2001 to December 31, 2008, we have drilled 273 core holes for a total depth of 76,367m (250,548 feet). Approximate total exploration expenditure during this period was CAN$25,400,000.

As of December 31, 2008, we had approximately $6,376,000 in cash or cash equivalents on hand, which is sufficient to cover our operating costs for at least 20 months based on an estimated $163,000 per month plus our anticipated 2009 exploration program of approximately $3,100,000.

Nature of Operations and Principal Activities

We are in the mineral resource business. This business generally consists of three stages: exploration, development and production. We are a mineral resource company in the exploration stage because we have not yet found mineral resources in commercially exploitable quantities, and are engaged in exploring land in an effort to discover them. Mineral resource companies that have located a mineral resource in commercially exploitable quantities and are preparing to extract that resource are in the development stage, while those engaged in the extraction of a known mineral resource are in the production stage.

Mineral resource exploration can consist of several stages. The earliest stage usually consists of the identification of a potential prospect through either the discovery of a mineralized showing on that property or as the result of a property being in proximity to another property on which exploitable resources have been identified, whether or not they are or have in the past been extracted.

After the identification of a property as a potential prospect, the next stage would usually be the acquisition of a right to explore the area for mineral resources. This can consist of the outright acquisition of the land or the acquisition of specific, but limited, rights to the land (e.g., a license, lease or concession). After acquisition, exploration would probably begin with a surface examination by a prospector or professional geologist with the aim of identifying areas of potential mineralization, followed by detailed geological sampling and mapping of this showing with possible geophysical and geochemical grid surveys to establish whether a known trend of mineralization continues underground, possibly trenching in these covered areas to allow sampling of the underlying rock. Exploration also commonly includes systematic regularly spaced drilling in order to determine the extent and grade of the mineralized system at depth and over a given area, as well as gaining underground access by ramping or shafting in order to obtain bulk samples that would allow one to determine the ability to recover various commodities from the rock. If minerals are found, exploration might culminate in a feasibility study to ascertain if the mining of the minerals would be economic. A feasibility study is a study that reaches a conclusion with respect to the economics of bringing a mineral resource to the production stage.

16

Our primary natural resource property is the Turnagain Property, located in the Liard Mining Division of northern British Columbia. We also own four very early stage, mineral properties in British Columbia. We have not identified the existence of any commercially viable mineral deposits at any of our mineral properties. We intend to conduct prospecting and sampling on the Dease Lime property in 2009.

It is unlikely that a commercially viable mineral deposit exists on any of our properties, and further exploration is required before we can evaluate whether any exist and, if so, whether it would be economically and legally feasible to develop or exploit those resources. Even if we complete our current exploration program and we are successful in identifying a mineral deposit, we would be required to spend substantial funds on further drilling and engineering studies before we could know whether that mineral deposit will constitute a reserve (a reserve is a commercially viable mineral deposit). Please refer to the section entitled “Risk Factors”, beginning on page 8 of this registration statement, for additional information about the risks of mineral exploration.

Revenues

To date we have not generated any revenues from any of our properties.

Principal Market

We do not currently have any market, as we have not yet identified any mineral resource on any of our properties that is of a commercially exploitable quantity. If we succeed in identifying a mineral resource in commercially exploitable quantities, our principal markets should consist of metals refineries and base metal traders and dealers.

Seasonality of our Business

Our mineral exploration activities are subject to seasonal variation due to the winter season in northern British Columbia. Field work is best carried out between mid-May and late-November when day time temperatures average 10 to 15 degrees Celsius. Our other operations, such as metallurgical review and analysis of geochemical survey results, can be carried out all year round.

Sources and Availability of Raw Materials

Other than a paved highway and the small community of Dease Lake, located 70km west of the Turnagain property, there is no infrastructure close to the Turnagain property. A small amount of hydroelectric power is generated near Dease Lake, to supply the town, but there is little excess capacity. The closest suitable source of hydroelectric power for mine development is the transmission line at Meziadin Junction, 300km south along the highway. If a mineral resource is found on our Turnagain property, power generation would be required.

Patents and Licenses; Industrial, Commercial and Financial Contracts; and New Manufacturing Processes

In conducting our business operations, we are not dependent on any patented or license processes, technology, industrial, commercial or financial contract or new manufacturing processes.

Competitive Conditions

We compete with other mining companies, some of which have greater financial resources and technical facilities, for the acquisition of mineral interests, as well as for the recruitment and retention of qualified employees. Exploration in British Columbia has experienced a dramatic revival in the past two years and increased activity is forecast for the future. We compete for qualified employees with Vancouver based

17

companies, including Hunter Dickenson Inc., Equity Engineering and Ivanhoe Mines, and international mining companies, including Billiton-BHP, Rio Tinto and Anglo American.

Governmental Regulations

Mining operations are subject to a wide range of national and provincial government regulations such as restrictions on production, price controls, tax increases, expropriation of property, environmental protection, and protection of agricultural territory or changes in conditions under which minerals may be marketed. Mining operations may also be affected by claims of native peoples, any of which could have the effect of reducing or preventing us from exploiting any of our properties.

Mineral claims in British Columbia are of two types. Cell mineral claims are established by electronically selecting the desired land on government claim maps, where the available land is displayed as a grid pattern of open cells, each of approximately 450-500 hectares. Payment of the required recording fees is also conducted electronically. This process for claim staking has been in effect since January, 2005, and is now the only way to stake claims in British Columbia. Prior to January, 2005, legacy claims were staked by walking the perimeter of the desired ground and erecting and marking posts at prescribed intervals. Legacy claims, staked before January, 2005, remain valid and may be converted into cell claims.

Cell mineral claims may be kept in good standing by incurring assessment work or by paying cash-in-lieu of assessment work in the amount of CAN$4.00 per hectare per year during the first 3 years following the location of the mineral claims. This amount is increased to CAN$8.00 per hectare in the fourth and succeeding years.

Legacy mineral claims in British Columbia may be kept in good standing by incurring assessment work or by paying cash-in-lieu of assessment work in the amount of $100 per mineral claim unit per year during the first three years following the location of the mineral claim. This amount increases to $200 per mineral claim unit in the fourth and succeeding years.

We will be required to comply with all regulations, rules and directives of governmental authorities and agencies applicable to the exploration of minerals in the Province of British Columbia and in Canada generally. Under these laws, prior to production, we have the right to explore the property. We are required to file a “Notice of Work and Reclamation” with the British Columbia Ministry of Energy and Mines to conduct exploration works on mineral properties in British Columbia. To obtain a work permit, a company may be required to post a bond. In addition, the production of minerals in the Province of British Columbia requires prior regulatory approval.

Our mineral claims entitle our company to continue exploration activities on our properties, subject to our compliance with various Canadian federal and provincial laws governing land use, the protection of the environment and related matters.

If we locate a commercially viable mineral resource on any of our properties, we would be required to conduct extensive community consultations in northern British Columbia with both Aboriginal and non-Aboriginal groups, environmental surveys both on the property and along transportation corridors. We also would be required to develop a mining plan and a mine closure plan. These surveys and plans would be combined into a comprehensive Environmental Impact Statement and submitted to the British Columbia government for review and approval. Any development or exploitation of such a mineral resource would be subject to Canadian federal and provincial laws governing land use, protection of the environment, occupational health, waste disposal, toxic substances, mine safety and other matters. We had no material costs related to compliance and/or permits in recent years, and anticipate no material costs in the next year.

We will have to sustain the cost of reclamation and environmental mediation for all exploration work undertaken. The amount of these costs is not known at this time as we do not know the extent of the exploration program that will be undertaken beyond completion of the recommended work programs. The

18

Company has posted $187,900 in total reclamation bonds towards the reclamation of existing exploration drill sites and access roads on the Turnagain property. Permits and regulations will control all aspects of any production program if the project continues to that stage because of the potential impact on the environment.

Our operations are subject to environmental regulations promulgated by various levels of governments and their agencies. Existing environmental legislation provides for restrictions and prohibitions on spills, releases or emissions of various substances produced in association with certain mining industry operations, such as from disposal areas, which would result in environmental pollution. A breach of such legislation may result in the imposition of fines and penalties. Prior to conducting exploration involving surface disturbance in British Columbia, we are required to obtain a Work Permit from the Ministry of Energy, Mines and Petroleum Resources. So far, we have obtained the permits we needed to conduct our exploration program but if we are unable to obtain the permits that we require in the future, we will have to cease the exploration activity in question. Ceasing such exploration activities could reduce our chances of ever discovering mineral resources on our properties.

Where significant surface disturbance through road building and drill site preparation is planned, the Ministry of Energy, Mines and Petroleum Resources require a Reclamation Bond to cover the estimated reclamation costs if we fail to complete the reclamation. From 1996 to present, we have posted $187,900 in total reclamation bonds with the Ministry of Energy, Mines and Petroleum Resources.

We are not aware of any existing environmental liability associated with any of our exploration properties but if such liability should arise, we may have to pay a lot of money to fix it or pay compensation, which would reduce the amount of money we have to spend on exploration and could possibly cause us to go out of business. Our potential exposure to liability for environmental damage is very high and we have no reserves established to pay for such liability. If we are found to be liable for a large amount of environmental damage, we will likely have to cease operations.

| C. | Organizational Structure |

We have one wholly-owned subsidiary, Canadian Metals Exploration Ltd., incorporated under theCanada Business Corporation Act (Canada) on July 14, 2004. This wholly-owned subsidiary is currently inactive. The Company is currently looking at other property acquisitions in Canada but outside the Province of British Columbia. Hard Creek Nickel Corporation is incorporated in the Province of British Columbia only and is not registered to do business outside this province. Canadian Metals Exploration Ltd. is incorporated nationally across Canada and is registered to do business in each province. If the Company were to acquire exploration properties outside British Columbia but still in Canada, these properties would be registered in the subsidiary Canadian Metals Exploration Ltd.

| D. | Property, Plant and Equipment |

This section summarizes the assets of the company including its executive office in Vancouver, B.C., sample storage warehouse near Vancouver and its most important assets, mineral exploration properties.

The company has 100% interest in a number of mineral exploration properties located in British Columbia, of which the Turnagain is presently considered the most significant and is described below. The Bobner, Dease Lime, Lime 1 and Lime 2 are believed to contain favorable geology. We intend to conduct prospecting and sampling on the Turnagain and the Dease Lime properties in 2009.

Our executive office is located at 1060 – 1090 West Georgia Street, Vancouver, British Columbia V6E 3V7, Canada. The Company leases the 2,500 square feet of space for $48,880 per year and the lease expires on September 30, 2011. This space accommodates all of our executive and administrative offices. We believe that this existing space is adequate for our current needs. Should we require additional space, we believe that such space can be secured on commercially reasonable terms.

19

The company has recently rented a warehouse near Vancouver in which to store drill core samples and to prepare composite samples for metallurgical testwork. We have also installed a walk-in freezer in this space and are storing samples presently within the freezer to limit the possible oxidation of select samples which may be used in future metallurgical testwork. This facility rents for $1850 per month on a six-month renewable lease. The cost to run the freezer is $105 per month. Additional warehouse space was added to the original rented space in 2007 and more space is still available if required. We own office, vehicle, and exploration equipment with a cost of approximately $88,000 located at our Vancouver Office and the Turnagain camp. We lease a photocopier at the rate of $700 per three months. The company leases a borehole survey tool on occasion at $7,000 per month during the June-November field season. Satellite internet and telephone service at our Turnagain camp costs $250 per month.

Our main mineral property the Turnagain is described more fully below:

20

The Turnagain Property

This section provides a summary of the geology and exploration activities on the Turnagain Property. The technical information regarding the Turnagain Property included in this section is based, in large part, on three technical reports:

1) Report on the 2003 Exploration Program, Turnagain Nickel Property, dated April 21, 2004, prepared by N. C. Carter Ph.D., P.Eng, in compliance with the requirements of National Instrument 43-101 and Form 43-101F1.

2) Preliminary Assessment on the Turnagain Property dated September 25, 2007 prepared by Tony Lipiec, P.Eng., Gerrit Vos, P. Eng. and Greg Kulla, P. Geo. of AMEC Americas Limited in conjunction with Ron Simpson, P.Geo, in compliance with the requirements of National Instrument 43-101 and Form 43-101F1 as adopted by the British Columbia Securities Commission.

3) Technical Report and Mineral Resource Estimate prepared by Ronald G. Simpson, P.Geo, dated March 29, 2007, and prepared in compliance with the requirements of National Instrument 43-101 and Form 43-101F1 as adopted by the British Columbia Securities Commission.

The Technical Reports were used as supporting documentation and were filed with the British Columbia Securities Commission and the TSX Venture Exchange. Dr. Carter, Tony Lipiec, Gerrit Vos, Greg Kulla and Mr. Ronald G. Simpson are “qualified persons” as the term is defined under National Instrument 43-101.

Exploration data collected during the 2003 to 2008 exploration programs was done under the supervision of Neil Froc, P. Eng., and Tony Hitchins, M.Sc., all employees of Hard Creek Nickel Corporation.

Location and Accessibility

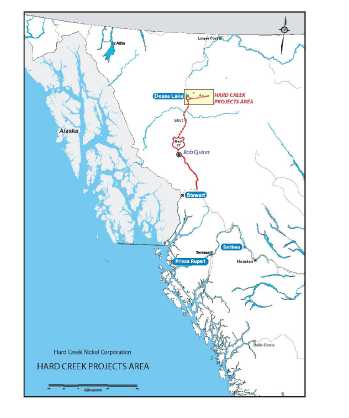

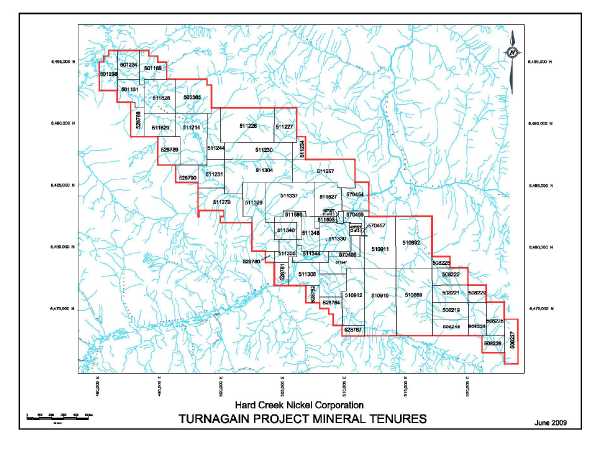

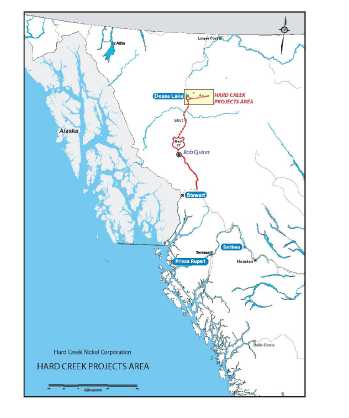

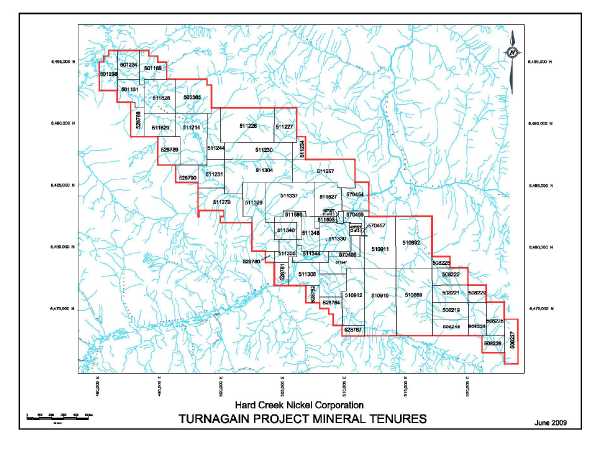

The Turnagain Property consists of 57 neighboring mineral claims situated in the Liard Mining Division of northern British Columbia, 70 km east of Dease Lake and 1350 km north-northwest of Vancouver. Please

21

see the above map to see where the property is located in the province of British Columbia, Canada. The mineral claims collectively cover an area of 30,300 hectares. The Turnagain Property is situated in the Stikine Ranges of the Cassiar Mountains. Elevations range from about 1,000 meters above sea level along the Turnagain River, in the central claim area, to 2,200 meters at an unnamed summit in the north central property area.

The Turnagain Property straddles the Turnagain River near where it joins Hard Creek. The community of Dease Lake, on Highway #37 some 400 km north of the port of Stewart, is 70 km west of the property. Helicopter access from Dease Lake involves a 20 minute flight. A secondary road extending easterly from Dease Lake has been used by large, articulated 4-wheel drive vehicles to convey large jade boulders from the Kutcho Creek area and to supply placer gold operations at Wheaton Creek over the past number of years. A branch of this road network extends into the Turnagain Property with road distance to Dease Lake of about 100 km.

A dirt airstrip, measuring approximately 930 meters long, constructed in the 1960s, and upgraded in early 2007, is situated within the claims on the northwest side of the Turnagain River and can accommodate small fixed wing aircraft. This airstrip is immediately adjacent to our current camp facility and core storage. Previous exploration programs have made use of camp facilities at Wheaton Creek (Boulder), which is about 15 km by road west of the Turnagain Property.

Three times a week, Dease Lake has scheduled airline service and offers some supplies and services. The communities of Terrace and Smithers, both several hundred km south, offer a range of services and supplies which can be trucked to Dease Lake via Highway #37.

The area between Dease Lake and the Turnagain Property features maturely dissected mountains rising to elevations of between 2,000 and 2,425 meters above sea level and separated by wide, drift-filled valleys in which elevations average 1,000 meters. Forest cover, present in valley areas, is replaced by typical alpine flora above 1500 meters. Bedrock is reasonably well exposed in the areas above tree line and along drainages.

Description of Claims

Our Turnagain Property consists of 57 neighboring mineral claims. Hard Creek Nickel Corporation owns a 100% interest in all of these mineral claims subject to a 4% net smelter royalty on possible future production on one mineral claim (Tenure No. 511330 formerly the “Cub” claim). We retain the right to purchase all or part of the net smelter royalty for CAN $1,000,000 per 1%. The following table summarizes the claim name, size, and expiry date for the 57 claims in the Turnagain property as of June 2, 2009.

The following table shows details relating to Hard Creek Nickel Corporation’s Turnagain claims and the expiry dates of those claims:

Tenure Number |

Claim Name | Area

(ha) |

Issue Date |

Expiry Date |

| Legacy Mineral Claim |

| 407627 | PUP 4 | 500.0 | 2004/jan/01 | 2019/jan/01 |

| On-Line Cell Mineral Claims |

| 501131 | Drift 1 | 422.0 | 2005/jan/12 | 2019/jan/12 |

| 501168 | Drift 2 | 421.8 | 2005/jan/12 | 2019/jan/12 |

| 501234 | Drift 3 | 421.7 | 2005/jan/12 | 2019/jan/12 |

| 501298 | Drift 4 | 421.8 | 2005/jan/12 | 2019/jan/12 |

| 508218 | Dinah 1 | 407.2 | 2005/mar/03 | 2019/mar/03 |

| 508219 | Dinah 2 | 407.1 | 2005/mar/03 | 2019/mar/03 |

| 508221 | Dinah 3 | 406.9 | 2005/mar/03 | 2019/mar/03 |

22

| 508222 | Dinah 4 | 406.7 | 2005/mar/03 | 2019/mar/03 |

| 508223 | Dinah 5 | 407.1 | 2005/mar/03 | 2019/mar/03 |

| 508225 | Dinah 6 | 407.1 | 2005/mar/03 | 2019/mar/03 |

| 508226 | Dinah 7 | 254.6 | 2005/mar/03 | 2019/mar/03 |

| 508227 | Dinah 8 | 407.3 | 2005/mar/03 | 2019/mar/03 |

| 508228 | Dinah 9 | 135.5 | 2005/mar/03 | 2019/mar/03 |

| 508229 | Dinah 10 | 203.4 | 2005/mar/03 | 2019/mar/03 |

| 528780 | T1 | 67.7 | 2006/feb/23 | 2019/feb/23 |

| 528781 | T2 | 203.3 | 2006/feb/23 | 2019/feb/23 |

| 528782 | T3 | 152.6 | 2006/feb/23 | 2019/feb/23 |

| 528784 | T4 | 288.3 | 2006/feb/23 | 2019/feb/23 |

| 528787 | T5 | 169.6 | 2006/feb/23 | 2019/feb/23 |

| 528788 | T6 | 270.2 | 2006/feb/23 | 2019/feb/23 |

| 528789 | T7 | 422.5 | 2006/feb/23 | 2019/feb/23 |

| 528790 | T8 | 253.6 | 2006/feb/23 | 2019/feb/23 |

| Converted Legacy to On-Line Cell Mineral Claims (April 2005 and November 2007) |

| 503365 | Hard 2 | 793.3 | 2005/jan/14 | 2019/feb/18 |

| 510889 | Flat 10, 13, 15 | 1627.9 | 2005/apr/18 | 2019/apr/07 |

| 510892 | Flat 2, 6 | 1219.3 | 2005/apr/18 | 2019/apr/07 |

| 510910 | Flat 9, 12, 14 | 1424.3 | 2005/apr/18 | 2019/apr/07 |

| 510911 | Flat 1, 5 | 1066.9 | 2005/apr/18 | 2019/apr/07 |

| 510912 | Flat 8, 11 | 779.9 | 2005/apr/18 | 2019/apr/07 |

| 511214 | Hard 4, 6 | 979.9 | 2005/apr/20 | 2019/feb/18 |

| 511226 | Hill 1, 2 | 1216.1 | 2005/apr/20 | 2019/feb/18 |

| 511227 | Hill 3 | 506.7 | 2005/apr/20 | 2019/feb/17 |

| 511230 | Hill 4, 5 | 760.5 | 2005/apr/20 | 2019/feb/17 |

| 511234 | Hill 6 | 185.9 | 2005/apr/20 | 2019/feb/16 |

| 511244 | Hard 5, 7 | 489.9 | 2005/apr/20 | 2019/feb/18 |

| 511251 | Hard 8 | 473.4 | 2005/apr/20 | 2019/feb/17 |

| 511257 | Hill 9, 10 | 1014.4 | 2005/apr/20 | 2019/feb/17 |

| 511279 | Hard 9, 10 | 896.7 | 2005/apr/20 | 2019/feb/17 |

| 511304 | Hill 7, 8 | 1149.7 | 2005/apr/21 | 2019/feb/17 |

| 511305 | Hound 3 | 271.0 | 2005/apr/21 | 2019/sep/27 |

| 511306 | Turn 2, Flat 7 | 881.2 | 2005/apr/21 | 2019/feb/19 |

| 511329 | Hound 1, 2 | 1015.4 | 2005/apr/21 | 2019/sep/27 |

| 511330 | Cub | 592.6 | 2005/apr/21 | 2018/dec/01 |

| 511337 | Cub 10, 18, Pup 1 | 1065.8 | 2005/apr/21 | 2018/dec/01 |

| 511340 | Cub 17 | 253.9 | 2005/apr/21 | 2018/dec/01 |

| 511344 | Turn 1, Bear 2 | 271.0 | 2005/apr/21 | 2019/feb/19 |

| 511347 | Flat 3, 4 | 474.3 | 2005/apr/21 | 2019/apr/07 |

| 511348 | Cub 2 | 389.4 | 2005/apr/21 | 2018/dec/01 |

| 511586 | Pup 2 | 236.9 | 2005/apr/25 | 2019/jan/01 |

| 511593 | Pup 3 | 101.5 | 2005/apr/25 | 2019/jan/01 |

| 511627 | Cub 11 | 592.1 | 2005/apr/25 | 2018/dec/01 |

| 511628 | Hard 1 | 709.0 | 2005/apr/25 | 2019/feb/18 |

| 511629 | Hard 3 | 472.9 | 2005/apr/25 | 2019/feb/18 |

| 570454 | Bear 1 | 456.8 | 2007/nov/22 | 2019/may/26 |

| 570455 | Bear 19, Bear 21 to 28 | 237.0 | 2007/nov/22 | 2019/may/26 |

23

| 570456 | Bear 3 to 18 | 220.2 | 2007/nov/22 | 2019/may/26 |

| 570457 | Bear 20 | 16.9 | 2007/nov/22 | 2019/may/26 |

The last four cell claims in the list with an issue date of November 22, 2007 indicates a group of claims once held in trust by the Supreme Court of British Columbia. In February 2004, we filed an action in the Supreme Court of British Columbia against Mr. Wolf Wiese, a former consultant to our company. The action sought the transfer to our company of claims neighboring the Turnagain property, which were staked in the name of Mr. Wiese. We believe that these claims should have been staked in the name of the Company. On July 10, 2006 the Supreme Court of British Columbia ordered that the claims be transferred to our company. The transfer of ownership was completed on October 11, 2006. Mr. Wiese has subsequently filed a Notice of Appeal of the Order. The appeal was heard and dismissed on April 30, 2007 in the British Columbia Court of Appeals with costs payable to the Company.

The following figure shows the claims for the Turnagain property listed above.

Exploration History

Nickel and copper sulphides were discovered within the current Turnagain property area in a bedrock exposure along the Turnagain River in 1956. Mineral claims covering the area where these sulphides were found as well as other traces of sulphides were acquired by Falconbridge Nickel Mines Limited in 1966.

Falconbridge Nickel Mines Limited also completed work over the following seven years, including surface and airborne geophysical surveys, geological mapping, geochemical surveys and 2895 meters of conventional and packsack diamond drilling in 40 widely spaced drill holes.

24

Our Turnagain Property represents a unique style of sulphide mineralization associated with a zoned, ultramafic complex (a suite of rocks high in iron and magnesium but low in silica.) Iron and nickel sulphides are widespread in dunite (ultramafic rock comprising more than 90% olivine) and wehrlite (ultramafic rock comprising less than 90% olivine and >10% pyroxene) near dunite-wehrlite contacts. Exploration on the Turnagain Property between 1967 and 2002 was sporadic and was concentrated in the Horsetrail area or near other small exposures of net-textured sulphides. We acquired the property in 1996.

Work Completed by the Registrant

We acquired the Turnagain River property in 1996 and our exploration work that year included 400 line km of airborne magnetic surveys and 795.5 meters of diamond drilling in 5 holes. Additional diamond drilling completed by our company in 1997 and 1998 amounted to 3,123 meters in 14 holes. Related work included 18 line km of surface magnetic surveys covering two areas of the property, bore hole pulse-electromagnetic surveys in four of the 1997-1998 drill holes and preliminary metallurgical test work on drill core composites.

In 2002, we performed ground magnetic and Induced Polarization geophysical surveys over part of the claim area and completed 1,687 meters of diamond drilling in 7 holes. Exploratory work in 2003 included geological mapping and prospecting with bedrock, stream sediment and limited soil sampling and 8,669 meters of diamond drilling in 22 holes, including the deepening of one hole started in 2002. Preliminary metallurgical test work was conducted on composite 2002-2003 core samples.

In 2004, we conducted a comprehensive exploration program that included a helicopter borne magnetic and electromagnetic survey covering 1,866 line km, 14 km of ground magnetic and electromagnetic surveys, 1:20,000 scale aerial photography of the entire property, the collection of more than 3,000 geochemical soil samples, geological mapping, and 7522 meters of diamond drilling in 49 holes. We analyzed the approximately 4,000 core samples for 30 elements including nickel, copper, cobalt, sulphur and often platinum and palladium. Extensive metallurgical test work has been completed on 2003-2004 composite core samples and is in progress on 2005-2006 composite core samples.

Our 2005 exploration program consisted of geological mapping, bedrock and soil sampling, and 7,143 meters of diamond drilling in 37 holes. We also undertook various mineralogical, environmental baseline surveys, engineering, metallurgical and analytical studies on the property.

Our 2006 exploration program was completed by early November and included 19,111 meters of diamond drilling in 68 holes, surface mapping and sampling in several areas and continuation of fish habitat surveys and water sampling. Metallurgical testwork on composite samples from our 2005 and 2006 drill core was also completed during 2007.

Our 2007 exploration program was completed by early November and included 24,325 meters of diamond drilling in 72 holes, surface mapping and sampling in several areas and continuation of fish habitat surveys and water sampling. Metallurgical testwork was directed towards further definition of the reagent scheme and nickel flotation kinetics for future pilot plant testing.

Our 2008 exploration program was completed by early September and included 4,105 meters of diamond drilling in 15 holes, surface mapping and sampling in several areas and continuation of fish habitat surveys and water sampling. Metallurgical testwork continued towards further definition of the reagent scheme and nickel flotation kinetics for future pilot plant testing. This testwork is on-going and will continue through 2009. Additional testwork will also be initiated in 2009 to determine the viability of the Activox® Process as the potential hydrometallurgical plant option.

Present Condition of the Property

25

No mining operations have taken place on the property. Diamond drill casings have been left in place and the locations of the bore holes marked with labeled fence posts. There are approximately 32 km of unpaved roads and trails on the property, constructed from the late 1960s to the present. Reclamation work has been and will be performed on disused roads.

A camp, consisting of 17 wall tents, 3 trailers and drill core storage facilities, capable of accommodating approximately 30 people, has been constructed. A 700 meter unpaved air strip is adjacent to the camp. Power is provided by an on-site diesel generator.

The property is without known reserves and our proposed work program is exploratory in nature.

Mineralization