UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 20-F

[ ] REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR 12(g) OF THE SECURITIES EXCHANGE ACT OF 1934

OR

[ X ] ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year endedDecember 31, 2016

OR

[ ] TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from ____________to ____________

OR

[ ] SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

Date of event requiring this shell company report _____________

Commission file number000-52326

HARD CREEK NICKEL CORPORATION

(Exact name of Registrant as specified in its charter)

Not Applicable

(Translation of Registrant’s name into English)

British Columbia, Canada

(Jurisdiction of incorporation or organization)

203– 700 West Pender Street Vancouver, British Columbia V6C 1G8 Canada

(Address of principal executive offices)

Copy of communications to:

Bernard Pinsky, Esq.

1

Clark Wilson LLP

Barristers and Solicitors

Suite 800 – 885 West Georgia Street

Vancouver, British Columbia, Canada V6C 3H1

Telephone: 604-687-5700 Facsimile: 604-687-6314

Securities registered or to be registered pursuant to Section 12(b) of the Act.

| Title of Class | Name of each exchange on which registered |

| Not Applicable | Not Applicable |

Securities registered or to be registered pursuant to Section 12(g) of the Act.

Common Shares Without Par Value

(Title of Class)

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act.

Not Applicable

(Title of Class)

Indicate the number of outstanding shares of each of the issuer’s classes of capital or common stock as of the close of the period covered by the annual report.

43,074,696 Common Shares without par value issued and outstanding as at December 31, 2016.

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

YES [ ] NO [X]

If this report is an annual or transition report, indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934.

[ ] YES [X] NO

Note – Checking the box above will not relieve any registrant required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 from their obligations under those Sections.

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

[X] YES [ ] NO

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

[ ] YES [ ] NO

2

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer. See definition of “accelerated filer and large accelerated filer” in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer [ ] | Accelerated filer [ ] | Non-accelerated filer [X] |

Indicate by check mark which basis of accounting the registrant has used to prepare the financial statements included in this filing:

| U.S. GAAP [ ] | International Financial Reporting Standards as issued by the International

Accounting Standards Board [X] | Other [ ] |

If “Other” has been checked in response to the previous question, indicate by check mark which financial statement item the registrant has elected to follow.

[ ] ITEM 17 [X] ITEM 18

If this is an annual report, indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

[ ] YES [X] NO

3

TABLE OF CONTENTS

4

FORWARD-LOOKING STATEMENTS

Except for the statements of historical fact contained herein, some information presented in this annual report constitutes forward-looking statements. When used in this annual report, the words “estimate”, “project”, “believe”, “anticipate”, “intend”, “expect”, “predict”, “may”, “should”, the negative thereof or other variations thereon or comparable terminology are intended to identify forward-looking statements. Such forward-looking statements involve known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of our company to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements. Such factors include, among others, changes in project parameters as plans continue to be refined, future prices of nickel, as well as those factors discussed in the section entitled “Risk Factors” on page 8. Although our company has attempted to identify important factors that could cause actual results to differ materially, there may be other factors that cause actual results not to be as anticipated, estimated or intended. There can be no assurance that such statements will prove to be accurate as actual results and future events could differ materially from those anticipated in such statements. Accordingly, prospective investors should not place undue reliance on forward-looking statements. The forward-looking statements in this annual report speak only as to the date hereof. Our company does not undertake any obligation to release publicly any revisions to these forward-looking statements to reflect events or circumstances after the date hereof or to reflect the occurrence of unanticipated events.

Although we believe that the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee future results, levels of activity, performance or achievements. Except as required by applicable law, including the securities laws of the United States, we do not intend to update any of the forward-looking statements to conform these statements to actual results.

As used in this annual report, the terms “we”, “us”, “our” and “Hard Creek” mean Hard Creek Nickel Corporation, unless otherwise indicated.

5

CAUTIONARY NOTE TO UNITED STATES INVESTORS

Unless otherwise indicated, all mineral resource estimates included in this Annual Report on Form 20-F have been prepared in accordance with Canadian National Instrument 43-101 –Standards of Disclosure for Mineral Projects (“NI 43-101”), and the Canadian Institute of Mining, Metallurgy and Petroleum Definition Standards for Mineral Resources and Mineral Reserves (“CIM Definition Standards”). NI 43-101 is a rule developed by the Canadian Securities Administrators which establishes standards for public disclosure an issuer makes of scientific and technical information concerning mineral projects. NI 43-101 permits the disclosure of a historical estimate made prior to the adoption of NI 43-101 that does not comply with NI 43-101 using the historical terminology if the disclosure: (a) identifies the source and date of the historical estimate; (b) comments on the relevance and reliability of the historical estimate; (c) states whether the historical estimate uses categories other than those prescribed by NI 43-101 and, if so, includes an explanation of the differences; and (d) includes any more recent estimates or data available.

Canadian standards, including NI 43-101, differ significantly from the requirements of the Securities and Exchange Commission (the “SEC”), and reserve and resource information contained in this Annual Report on Form 20-F may not be comparable to similar information disclosed by U.S. companies. In particular, and without limiting the generality of the foregoing, the term “resource” does not equate to the term “reserves”. Under U.S. standards, mineralization may not be classified as a “reserve” unless the determination has been made that the mineralization could be economically and legally produced or extracted at the time the reserve determination is made. The SEC’s disclosure standards normally do not permit the inclusion of information concerning “measured mineral resources”, “indicated mineral resources” or “inferred mineral resources” or other descriptions of the amount of mineralization in mineral deposits that do not constitute “reserves” by U.S. standards in documents filed with the SEC. U.S. investors should also understand that “inferred mineral resources” have a great amount of uncertainty as to their existence and great uncertainty as to their economic and legal feasibility. It cannot be assumed that all or any part of an “inferred mineral resource” will ever be upgraded to a higher category. Under Canadian rules, estimated “inferred mineral resources” may not form the basis of feasibility or pre-feasibility studies except in rare cases. Investors are cautioned not to assume that all or any part of an “inferred mineral resource” exists or is economically or legally mineable. Disclosure of “contained ounces” in a resource is permitted disclosure under Canadian regulations; however, the SEC normally only permits issuers to report mineralization that does not constitute “reserves” by SEC standards as in-place tonnage and grade without reference to unit measures. The requirements of NI 43-101 for identification of “reserves” are also not the same as those of the SEC, and reserves reported by our company in compliance with NI 43-101 may not qualify as “reserves” under SEC standards. Accordingly, information concerning mineral deposits set forth herein may not be comparable with information made public by companies that report in accordance with U.S. standards.

PART I

FINANCIAL INFORMATION AND ACCOUNTING PRINCIPLES

The financial statements and summaries of financial information contained in this document are reported in Canadian dollars (“$”) unless otherwise stated. A “tonne” is one metric ton or 2,204.6 pounds.

FIRST TIME APPLICATION OF INTERNATIONAL FINANCIAL REPORTING STANDARDS

Effective from January 1, 2010, the Company adopted International Financial Reporting Standards (“IFRS”), as issued by the International Accounting Standards Board. Unless otherwise stated, all information presented herein has been prepared in accordance with IFRS and all prior period amounts have been reclassified to conform with IFRS. Please note that our prior annual financial statements were prepared in accordance with Canadian generally accepted accounting principles, which may not be comparable to IFRS.

6

| Item 1 | Identity of Directors, Senior Management and Advisers |

Not required.

| Item 2 | Offer Statistics and Expected Timetable |

Not required.

| A. | Selected Financial Data |

The following financial data summarizes selected financial data for our company prepared in accordance with International Financial Reporting Standards (“IFRS”) as issued by the International Accounting Standards Board (“IASB”) for the three fiscal years ended December 31, 2016, 2015 and 2014. The information presented below for the three year period ended December 31, 2016, 2015 and 2014 is derived from our financial statements which were examined by our independent auditors. The information set forth below should be read in conjunction with our audited annual financial statements and related notes thereto included in this annual report, and with the information appearing under the heading “Item 5 – Operating and Financial Review and Prospects”.

Hard Creek Nickel Corporation

Selected Financial Data in accordance with IFRS for the years 2016, 2015 and 2014:

(Expressed in Canadian Dollars)

| | 2016 | | | 2015 | | | 2014 | |

Net operating revenues | $ | 0 | | | 0 | | | 0 | |

| | | | | | | | | |

Loss from continued operations | $ | 0 | | | 0 | | | 0 | |

Income from discontinued operations | $ | N/a | | | N/a | | | N/a | |

Net loss | $ | (224,112 | ) | | (10,230,524 | ) | | (22,803,513 | ) |

Comprehensive loss | $ | (224,112 | ) | | (10,230,524 | ) | | (22,803,513 | ) |

| | | | | | | | | |

Loss per share from continued operations | $ | (0.00 | ) | | (0.00 | ) | | (0.00 | ) |

Income per share from discontinued operations | $ | N/a | | | N/a | | | N/a | |

Income per share after discontinued operations | $ | N/a | | | N/a | | | N/a | |

| | | | | | | | | |

Share capital | $ | 48,887,797 | | | 48,642,413 | | | 48,642,413 | |

Common shares issued | | 43,074,696 | | | 18,074,696 | | | 90,373,493 | |

Weighted average shares outstanding | | 36,694,422 | | | 18,074,696 | | | 90,373,493 | |

| | | | | | | | | |

Total assets | $ | 302,889 | | | 239,665 | | | 10,480,933 | |

| | | | | | | | | |

Net assets (liabilities) | $ | 287,919 | | | 223,816 | | | 10,454,340 | |

| | | | | | | | | |

Convertible debentures (current and long term portions) | $ | N/a | | | N/a | | | N/a | |

| | | | | | | | | |

Cash dividends declared per common share | $ | 0 | | | 0 | | | 0 | |

Exchange rates (CDN$ to US$) period average | $ | 1.3248 | | | 1.2787 | | | 1.1045 | |

7

Exchange rates (CDN$ to US$) for most recent six months | | | | | | |

| | Period High | | | Period Low | |

October 2016 | $ | 1.3411 | | | 1.3110 | |

November 2016 | $ | 1.3551 | | | 1.3305 | |

December 2016 | $ | 1.3555 | | | 1.3133 | |

January 2017 | $ | 1.3433 | | | 1.3012 | |

February 2017 | $ | 1.3281 | | | 1.3020 | |

March 2017 | $ | 1.3508 | | | 1.3299 | |

Exchange rate (CDN$ to US$) April 28, 2017 | $ | 1.3565 | | | 1.3273 | |

| B. | Capitalization and Indebtedness |

On July 14, 2015, the Company consolidated its common shares on a basis of one (1) new common share for five (5) old common shares held.

| C. | Reasons for the Offer and Use of Proceeds |

Not required.

This Annual Report contains forward-looking statements which relate to future events or our future performance, including our future financial performance. In some cases, you can identify forward-looking statements by terminology such as “may”, “should”, “expects”, “plans”, “anticipates”, “believes”, “estimates”, “predicts”, or “potential” or the negative of these terms or other comparable terminology. These statements are only predictions and involve known and unknown risks, uncertainties and other factors, including the risks in enumerated in this section entitled “Risk Factors”, that may cause our company’s or our industry’s actual results, levels of activity, performance or achievements to be materially different from any future results, levels of activity, performance or achievements expressed or implied by these forward-looking statements.

While these forward-looking statements, and any assumptions upon which they are based, are made in good faith and reflect our current judgment regarding the direction of our business, actual results will almost always vary, sometimes materially, from any estimates, predictions, projections, assumptions or other future performance suggested in this Annual Report. Except as required by applicable law, including the securities laws of the United States, we do not intend to update any of the forward-looking statements to conform these statements to actual results.

An investment in our common stock involves a number of very significant risks. You should carefully consider the following risks and uncertainties in addition to other information in this annual report in evaluating our company and our business before purchasing shares of our company’s common stock. Our business, operating results and financial condition could be seriously harmed due to any of the following risks. You could lose all or part of your investment due to any of these risks.

Risks Associated with Mining

The Company is engaged in the business of acquiring and exploring mineral properties in the expectation of locating mineral reserves. The Company’s property interests are in the exploration stageonly and are without a known body of commercial ore. Accordingly, there is little likelihood that the Company will realize any profits in the short to medium term. Any profitability in the future from theCompany’s business will be dependent upon locating mineral reserves, which itself is subject tonumerous risk factors. If we do not discover any mineral resource in a commercially exploitable quantity, our business will fail and investors may lose all of their investment in our company.

8

The business of exploring for minerals and mining involves a high degree of risk. Few properties that are explored are ultimately developed into producing, profitable mines. In developing its mineral deposits, the Company will be subjected to an array of complex economic factors and accordingly there is no assurance that a positive feasibility study or any projected results contained in a feasibility study of a mineral deposit will be attained. Additional potential problems that may prevent us from discovering any reserves of minerals on our property include, but are not limited to, unanticipated problems relating to exploration and additional costs and expenses that may exceed current estimates. Most of these factors are beyond our control, and any of them could increase costs and make extraction of any identified mineral resource unprofitable.

If we are unable to establish the presence of commercially exploitable reserves of minerals on our property, our ability to fund future exploration activities will be impeded, we will not be able to operate profitably and investors may lose all of their investment in our company.

We face intense competition in the mineral exploration and exploitation industry and we compete with our competitors for financing, for new mineral resource properties and for qualified managerial and technical employees. If we are unable to obtain the financing, new mineral properties or qualified personnel that we require, then we will likely have to cease operations and investors will lose all of their investment in our company.

Our competition includes large established mining companies with substantial capabilities and with greater financial and technical resources than we have. As a result of this competition, we may have to compete for financing and we may be unable to acquire financing on terms we consider acceptable. Our competition could adversely affect our ability to acquire suitable prospects for exploration in the future. We may also have to compete with the other mining companies in the recruitment and retention of qualified managerial and technical employees. If we are unable to successfully compete for financing, mineral properties or qualified employees, we will likely have to cease operations. If we are unable to successfully compete for the acquisition of suitable prospects or interest for exploration in the future, we will not acquire any interest in additional mineral resource properties and have no further chance of discovering minerals. The occurrence of any of these things would likely cause us to cease operations and investors would lose their entire investment in our company.

Because of the inherent dangers involved in mineral exploration and exploitation, there is a risk that we may incur liability or damages as we conduct our business. If we are liable to pay for any damages resulting from the conduct of our business, our financial position could be adversely affected and we may have to slow down or cease operations and investors could lose their investment in our company.

The search for valuable minerals involves numerous hazards. As a result, we may become subject to liability for such hazards, including pollution, cave-ins and other hazards against which we cannot insure against or which we may elect not to insure. At the present time we have no coverage to insure against these hazards. The payment of such liabilities may have a material adverse effect on our financial position. If so, we may have to slow down or cease operations and investors could lose their investment in our company.

Mineral operations are subject to government regulations which could have the effect of preventing us from exploiting any possible mineral reserves on our properties. If this occurs, we may have to cease operations and investors could lose their investment in our company.

Exploration activities are subject to national and local laws and regulations governing prospects, taxes, labor standards, occupational health, land use, environmental protection, mine safety and others which may in the future have a substantial adverse impact on our company’s prospects. In order to comply with applicable laws, we may be required to make capital expenditures until a particular problem is remedied. Existing and possible future environmental legislation, regulation and action could cause additional expense, capital expenditure, restriction and delay in the activities of our company, the extent of which cannot be reasonably predicted. If we violate any applicable law or regulation, we could be forced to stop work and we could be fined. If we are forced to suspend our activities or if we are required to pay a large fine for a violation of these applicable laws and regulations, our business could be adversely affected and investors could lose their investment in our company.

9

Our operations are subject to environmental regulations, which require us to obtain permits and pay bonds and may result in the imposition of fines and penalties. If we are unable to obtain the permits or pay the bonds that we require in the future, we will have to cease the exploration activity in question. Ceasing such exploration activities could reduce our chances of ever discovering mineral resources on our properties. Environmental fines or liability could cause expenses for us, reducing the funds we have for our exploration program and potentially causing us to cease operations. If this happens, investors may lose their entire investment in our company.

Our operations are subject to environmental regulations promulgated by government agencies. Environmental legislation provides for restrictions and prohibitions on spills, releases or emissions of various substances produced in association with certain mining industry operations, such as seepage from tailings disposal areas, which would result in environmental pollution. A breach of such legislation may result in the imposition of fines and penalties. Environmental legislation is evolving in a manner which means stricter standards, and enforcement; fines and penalties for non-compliance may become more stringent. Environmental assessments of proposed projects carry a heightened degree of responsibility for companies and directors, officers and employees. Prior to conducting exploration involving surface disturbance in British Columbia, we are required to obtain a Work Permit from the Ministry of Energy, Mines and Petroleum Resources. Where significant surface disturbance through road building and drill site preparation is planned, the Ministry requires a Reclamation Bond to cover the estimated reclamation costs if we fail to complete the reclamation. The cost of compliance with governmental regulations, permits and bond requirements has the potential to reduce the profitability of operations by curtailing our exploration activities.

We are not aware of any existing environmental liability associated with any of our exploration properties but if such liability should arise, we may incur costs, which would reduce the amount of money we have available to spend on exploration and could cause our company to suspend operations. Our potential exposure to liability for environmental damage is high and we have no reserves established to pay for such liability. If we are found to be liable for a large amount of environmental damage, we are likely to cease operations. If that happens, investors are likely to lose all of their investment in our company.

Please see the section entitled “Governmental Regulations” on page 17 of this annual report for more information.

Risks Related To Our Company

We have a limited operating history and have not generated any operating revenues since our incorporation. This raises substantial doubt about our ability to continue as a going concern anddoes not provide a meaningful basis for an evaluation of our prospects. If we are unable to generate revenue from our business, we may be forced to delay, scale back, or cease our exploration activities. If any of these actions were to become necessary, we may not be able to continue to explore our properties or operate our business and there is a substantial risk our business would fail, causing investors to lose all of their investment in our company.

We have not generated any operating revenues since our incorporation and we will, in all likelihood, continue to incur operating expenses without revenues until our mining properties are fully developed and in commercial production, which may never happen. We had cash in the amount of $85,758 and receivables of $10,504 as of December 31, 2016. We estimate our average monthly operating expenses to be approximately $15,000. We cannot provide assurances that we will be able to successfully explore and develop our mining properties or assure that viable mineral reserves exist on our properties for extraction. It is unlikely that we will generate any funds internally unless we discover commercially viable quantities of ore. If we are unable to generate revenue from our business during the fiscal year 2017, we may be forced to delay, scale back, or eliminate our exploration activities. If any of these actions were to become necessary, we may not be able to continue to explore our properties or operate our business and if either of those events happen, then there is a substantial risk our business would fail and investors would lose their investment in our company.

10

We have not generated any revenue from our business and we will need to raise additional funds in the near future. If we are not able to obtain future financing when required, we might be forced to discontinue our business.

Because we have not generated any revenue from our business and we cannot anticipate when we will be able to generate revenue from our business, we will need to raise additional funds for the further exploration and future development of our mining claims and to respond to unanticipated requirements or expenses. We anticipate that we do not have sufficient funds to cover administrative expenses for the 12 month period ending December 31, 2017 or for continued exploration. The Company is currently looking for a partner to take the Turnagain project to the feasibility level as well as raising additional working capital through the issuance of shares and or debt. We have also identified a PGE exploration program on the Turnagain property that will require the Company to seek additional financing or a joint venture partnership. We do not currently have any arrangements for financing or joint venture partnerships and may not be able to find such if required. Although we have been successful in the past in obtaining financing through the sale of equity securities, it is possible that we will not be able to obtain adequate financing in the future or that the terms of such financing will be unfavorable and unacceptable to us. Failure to obtain such additional financing is likely to result in a delay or indefinite postponement of further exploration and development of our projects and possible loss of our properties, in which case our company’s securities would never increase in value and investors would lose their entire investment.

Our Articles of Incorporation indemnify our officers and directors against all costs, charges and expenses incurred by them, which may discourage suits against directors or officers for breaches of fiduciary duties even though such suits, if successful, could benefit our company and our shareholders.

Our Articles of Incorporation contain provisions limiting the liability of our officers and directors for their acts, receipts, neglects or defaults and for any other loss, damage or expense incurred by our company which occurs in the execution of the duties of such officers or directors, unless the officers or directors did not act honestly and in good faith with a view to the best interests of our company. Such limitations on liability may reduce the likelihood of derivative litigation against our officers and directors and may discourage or deter our shareholders from suing our officers and directors based upon breaches of their duties to our company, though such an action, if successful, might otherwise benefit our company and our shareholders.

Risks Relating to our Securities

Trading in our common shares on the Toronto Stock Venture Exchange is limited and sporadic, making it difficult for our shareholders to sell their shares or liquidate their investments.

Our common shares are currently listed on the TSX Venture Exchange under the symbol ‘HNC’. The trading price of our common shares has been and may continue to be subject to wide fluctuations. Trading prices of our common shares may fluctuate in response to a number of factors, many of which are beyond our control. In addition, the stock market in general, and the market for base metal exploration companies, including companies exploring for nickel in particular, has experienced extreme price and volume fluctuations that have often been unrelated or disproportionate to the operating performance of such companies. These broad market and industry factors may adversely affect the market price of our shares, regardless of our operating performance. If you invest in our common shares, you could lose some or all of your investment.

11

In the past, following periods of volatility in the market price of a company’s securities, securities class-action litigation has often been instituted. Such litigation, if instituted, could result in substantial costs and a diversion of management’s attention and resources.

Investors will suffer dilution in their net book value per share if we issue additional shares, raise funds through the sale of equity securities or issue employee/director or consultant options.

We are currently without a source of revenue and will most likely be required to issue additional shares to finance our operations and, depending on the outcome of our exploration programs, may issue additional shares to finance additional exploration programs of any or all of our projects or to acquire additional properties or through the exercise of options by our employees, directors and consultants. If we are required to issue additional shares to raise funds, our current shareholders’ interests in our company will be diluted and our current shareholders may suffer dilution in their net book value per share depending on the price at which such securities are sold. As at April 26, 2017, there were outstanding an aggregate number of common share purchase warrants and share purchase options as, upon exercise, would result in the issue of an additional 30,168,293 of our common shares which, if exercised, would represent approximately 41 % of our issued and outstanding common shares. If all of these share purchase warrants and share purchase options are exercised and these common shares are issued, such issuance also will cause a reduction in the proportionate ownership and voting power of all other shareholders. The dilution may result in a decline in the market price of our common shares.

We do not expect to declare or pay any dividends for the foreseeable future, so investors will realize a return on their investment only if the price of shares of our stock increases. There are no guarantees that this will ever happen and investors may lose their entire investment in our company.

We have not declared or paid any dividends on our Common Shares since our inception, and we do not anticipate paying any such dividends for the foreseeable future. Therefore, investors will only realize a return on their investment if the price of our stock increases. There are no guarantees that will ever happen and investors may never realize a return on their investment in our company and may lose their entire investment.

All of our directors, officers and control persons live outside of the U.S. and. investors may not be able to enforce their civil liabilities against us, our directors officers or control persons. Therefore, investors may be discouraged from bringing suits against our directors and officers or may be unsuccessful even if they bring such suits. Suits against directors or officers for breaches of fiduciary duties may be discouraged, even though such suits, if successful, could benefit our company and our shareholders.

It may be difficult to bring and enforce suits against us or our directors, officers and control persons. We were incorporated under theCompany Act (British Columbia) and transitioned under theBusiness Corporations Act (British Columbia) in June of 2004. All of our directors and officers are residents of countries other than the United States and all of our assets are located outside of the United States. Consequently, there is a risk that Canadian courts may not enforce the judgments of U.S. courts or enforce, in an original action, liabilities predicated on the U.S. federal laws directly.Therefore, investors may be discouraged from bringing suits or may be unsuccessful even if they do try.

Some of our directors and officers are employed elsewhere and their time and efforts will not be devoted to our company full-time.

Some of our directors and officers are employed in other positions with other companies. They will manage our company on a part-time basis. Because of this fact, the management of our company may suffer and our company could under-perform or fail. Mark Jarvis, our CEO, President and director, will devote approximately 25% of his working hours to the management of the Company, Brian Fiddler, our Controller and Chief Financial Officer, will devote approximately 10 hours per week, which is approximately 25% of his working hours, to the management of our company. Lyle Davis, a director of our company, will devote approximately 4 hours per week, which is approximately 10% of his working hours, to the management of our company. Tom Milner a director of our company, will devote approximately 4 hours per week, which is approximately 10% of his working hours, to the management of our company. Leslie Young, the Corporate Secretary of our company, will devote approximately 10 hours per week, which is approximately 25% of her working hours, to the management of our company.

12

Trading of our stock may be restricted by the SEC's penny stock regulations, which may limit a shareholder's ability to buy and sell our stock.

The Securities and Exchange Commission has adopted regulations which generally define "penny stock" to be any equity security that has a market price (as defined) less than $5.00 per share or an exercise price of less than $5.00 per share, subject to certain exceptions. Our securities are covered by the penny stock rules, which impose additional sales practice requirements on brokers or dealers who sell to persons other than established customers and "accredited investors". The term "accredited investor" refers generally to institutions with assets in excess of $5,000,000 or individuals with a net worth in excess of $1,000,000 or annual income exceeding $200,000 or $300,000 jointly with their spouse. The penny stock rules require a broker or dealer, prior to a transaction in a penny stock not otherwise exempt from the rules, to deliver a standardized risk disclosure document in a form prepared by the SEC, which provides information about penny stocks and the nature and level of risks in the penny stock market. The broker or dealer also must provide the customer with current bid and offer quotations for the penny stock, the compensation of the broker or dealer and its salesperson in the transaction and monthly account statements showing the market value of each penny stock held in the customer's account. The bid and offer quotations, and the broker or dealer and salesperson compensation information, must be given to the customer orally or in writing prior to effecting the transaction and must be given to the customer in writing before or with the customer's confirmation. In addition, the penny stock rules require that prior to a transaction in a penny stock not otherwise exempt from these rules, the broker or dealer must make a special written determination that the penny stock is a suitable investment for the purchaser and receive the purchaser's written agreement to the transaction. These disclosure requirements may have the effect of reducing the level of trading activity in the secondary market for the stock that is subject to these penny stock rules. Consequently, these penny stock rules may affect the ability of brokers or dealers to trade our securities. We believe that the penny stock rules discourage investor interest in and limit the marketability of our common stock. This may limit your ability to buy and sell our stock and cause the price of the shares to decline

NASD sales practice requirements may also limit a shareholder's ability to buy and sell our stock.

In addition to the "penny stock" rules described above, the National Association of Securities Dealers (NASD) has adopted rules that require that in recommending an investment to a customer, a broker or dealer must have reasonable grounds for believing that the investment is suitable for that customer. Prior to recommending speculative low priced securities to their non-institutional customers, brokers or dealers must make reasonable efforts to obtain information about the customer's financial status, tax status, investment objectives and other information. Under interpretations of these rules, the NASD believes that there is a high probability that speculative low priced securities will not be suitable for at least some customers. The NASD requirements make it more difficult for brokers or dealers to recommend that their customers buy our common stock, which may prevent you from reselling your shares and may cause the price of the shares to decline.

U.S. investors could suffer adverse tax consequences if we are characterized as a passive foreign investment company.

We may be treated as a passive foreign investment company, or PFIC, for United States federal income tax purposes during the 2003 tax year or in subsequent years. We may be deemed a PFIC because previous financings combined with proceeds of future financings may produce, or be deemed to be held to produce, passive income. Additionally, U.S. citizens should review the section entitled “Taxation-U.S. Federal Income Taxation - Passive Foreign Investment Companies” contained in this Annual Report for a more detailed description of the PFIC rules and how those rules may affect their ownership of our capital shares.

13

If we are or become a PFIC, our U.S. shareholders may be subject to the following adverse tax consequences:

| • | they will be taxed at the highest ordinary income tax rates in effect during their holding period on certain distributions on our capital shares, and gains from the sale or other disposition of our capital shares; |

| | • | they will be required to pay interest on taxes allocable to prior periods; and |

| • | the tax basis of our capital shares will not be increased to fair market value at the date of their date. |

| Item 4 | Information on our Company |

| A. | History and Development of our Company |

We were originally incorporated in British Columbia Canada under theCompany Act (British Columbia) on January 17, 1983, under the name “Bren-Mar Resources Limited”, with an authorized capital of50,000,000 Common Shares without par value. On March 15, 2000, we changed our name to “Bren-Mar Minerals Ltd.” to reflect our change in business to strictly exploration mining and consolidated our then issued and outstanding common shares on the basis of 1 post-consolidation common share for 5 pre-consolidation common shares, and we increased our post-consolidation authorized capital to 50,000,000 common shares. There were no changes in our directors or management. On November 22, 2000, we changed our name to “Canadian Metals Exploration Ltd.” to reflect the Company’s focus on mineral exploration in Canada, there were no changes in directors or management.

TheBusiness Corporations Act (British Columbia) came into force on March 29, 2004, repealing theCompany Act(British Columbia.) Our company now operates under theBusiness Corporations Act (British Columbia). On June 25, 2004, we changed our name to “Hard Creek Nickel Corporation” to reflect the primary type of mineral exploration the Company is engaged in, altered our authorized capital to comprise an unlimited number of common shares and an unlimited number of Class A preferred shares, and adopted our current Articles of Incorporation, which are attached as an exhibit to this form. The previous directors and management were replaced by Mark Jarvis as CEO, President and Director , Brian Fiddler as CFO, Leslie Young as Corporate Secretary, George Sookochoff as Director, Tom Milner as Director and Lyle Davis as Director.

We have our head office and principal place of business at Suite 203 – 700 West Pender Street, Vancouver, British Columbia V6C 1G8 Canada (Telephone: 604.681.2300) . We do not have an agent in the United States.

Our common shares are listed on the TSX Venture Exchange under the symbol “HNC”.

Since inception, we have been engaged in natural resource exploration and development primarily in British Columbia and, since 1996, have focused on the Turnagain Property in the Liard Mining Division of northern British Columbia. We first acquired the mineral claims on the Turnagain Property in 1996 under an option agreement with John Schussler and Ernie Hatzl. The original option agreement gave us the right to earn a 100% interest in the mineral claims on the Turnagain Property in exchange for the issuance of 200,000 of our common shares and the expenditure of CAN$1,000,000 on exploration of the property within 5 years of acquisition. We have now earned the 100% interest and it is subject to a 4% net smelter royalty on possible future production from claim 511330. We have the right to pay out the net smelter royalty by paying CAN$1,000,000 for each 1% of the royalty. To pay out the entire 4% royalty, we would be required to pay CAN$4,000,000.

On November 28, 2002, we entered into an agreement with John Schussler and Ernie Hatzl to acquire an additional 34 mineral claims, adjacent to the Turnagain Property, Laird Mining Division, British Columbia, in exchange for an aggregate total of 100,000 common shares.

14

Between November, 2003 and March, 2005 we staked additional claims, enlarging the Turnagain property from 3,700 hectares to approximately 27,500 hectares. With claim conversions in April 2005 and November 2007, and additional staking in 2009, the Turnagain property now covers 33,220 hectares.

Present Operations of Our Company

Turnagain Property Project

Our current mineral exploration activities on the Turnagain Property include core drilling, geological mapping, geochemical surveying, airborne geophysical survey, downhole geophysical surveying, baseline environmental and engineering studies, and metallurgical testing. From 2001 to December 31, 2016, we have drilled 273 core holes for a total depth of 76,367m (250,548 feet). Approximate total exploration expenditures from January 1, 2014 to December 31, 2016 was CDN$191,000.

As of December 31, 2016, we had approximately $89,698 in working capital, which is not sufficient to cover our operating costs for the next twelve months at $15,000 per month. To make up the shortfall, the Company will have to raise additional funds by issuing shares or debt. If the Company is to carry out a 2017 exploration program, we will be required to obtain additional equity funding or secure a joint venture partner to provide funding to cover 100% of the anticipated costs.

Nature of Operations and Principal Activities

We are in the mineral resource business. This business generally consists of three stages: exploration, development and production. We are a mineral resource company in the exploration stage because we have not yet found mineral resources in commercially exploitable quantities, and are engaged in exploring land in an effort to discover them. Mineral resource companies that have located a mineral resource in commercially exploitable quantities and are preparing to extract that resource are in the development stage, while those engaged in the extraction of a known mineral resource are in the production stage.

Mineral resource exploration can consist of several stages. The earliest stage usually consists of the identification of a potential prospect through either the discovery of a mineralized showing on that property or as the result of a property being in proximity to another property on which exploitable resources have been identified, whether or not they are or have in the past been extracted.

After the identification of a property as a potential prospect, the next stage would usually be the acquisition of a right to explore the area for mineral resources. This can consist of the outright acquisition of the land or the acquisition of specific, but limited, rights to the land (e.g., a license, lease or concession). After acquisition, exploration would probably begin with a surface examination by a prospector or professional geologist with the aim of identifying areas of potential mineralization, followed by detailed geological sampling and mapping of this showing with possible geophysical and geochemical grid surveys to establish whether a known trend of mineralization continues underground, possibly trenching in these covered areas to allow sampling of the underlying rock. Exploration also commonly includes systematic regularly spaced drilling in order to determine the extent and grade of the mineralized system at depth and over a given area, as well as gaining underground access by ramping or shafting in order to obtain bulk samples that would allow one to determine the ability to recover various commodities from the rock. If minerals are found, exploration might culminate in a feasibility study to ascertain if the mining of the minerals would be economic. A feasibility study is a study that reaches a conclusion with respect to the economics of bringing a mineral resource to the production stage.

Our primary natural resource property is the Turnagain Property, located in the Liard Mining Division of northern British Columbia. We have not identified the existence of any commercially viable mineral deposits at any of our mineral properties.

15

It is unlikely that a commercially viable mineral deposit exists on any of our properties, and further exploration is required before we can evaluate whether any exist and, if so, whether it would be economically and legally feasible to develop or exploit those resources. Even if we complete our current exploration program and we are successful in identifying a mineral deposit, we would be required to spend substantial funds on further drilling and engineering studies before we could know whether that mineral deposit will constitute a reserve (a reserve is a commercially viable mineral deposit). Please refer to the section entitled “Risk Factors”, beginning on page 10 of this annual report for additional information about the risks of mineral exploration.

Revenues

To date we have not generated any revenues from any of our properties.

Principal Market

We do not currently have any market, as we have not yet identified any mineral resource on any of our properties that is of a commercially exploitable quantity. If we succeed in identifying a mineral resource in commercially exploitable quantities, our principal markets would consist of metals refineries and base metal traders and dealers.

Seasonality of our Business

Our mineral exploration activities are subject to seasonal variation due to the winter season in northern British Columbia. Field work is best carried out between mid-May and late-November when day time temperatures average 10 to 15 degrees Celsius. Our other operations, such as metallurgical review and analysis of geochemical survey results, can be carried out all year round.

Sources and Availability of Raw Materials

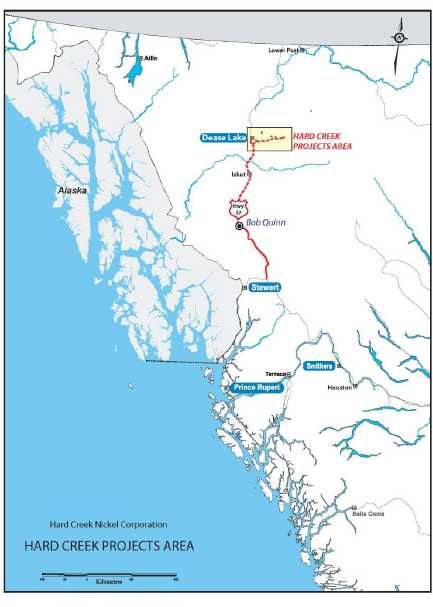

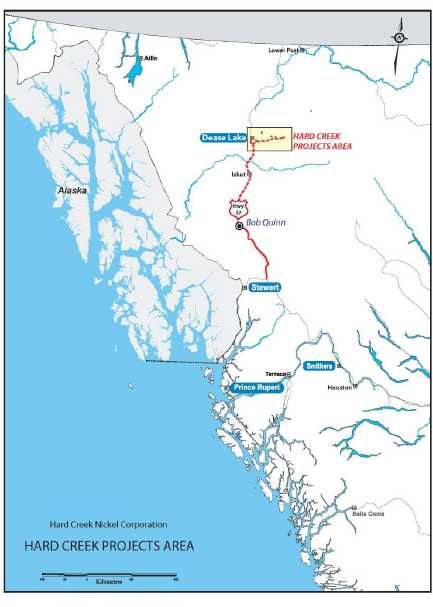

Other than a paved highway and the small community of Dease Lake, located 70km west of the Turnagain property, there is no infrastructure close to the Turnagain property. A small amount of hydroelectric power is generated near Dease Lake, to supply the town, but there is little excess capacity. The closest suitable source of hydroelectric power for mine development is the completed Northwest Transmission Line at Bob Quinn Lake, 207km south along the highway. If a mineral resource is found on our Turnagain property, power generation would be required.

Patents and Licenses; Industrial, Commercial and Financial Contracts; and New Manufacturing Processes

In conducting our business operations, we are not dependent on any patented or license processes, technology, industrial, commercial or financial contract or new manufacturing processes.

Competitive Conditions

The mineral exploration industry is highly competitive. We compete with other mining companies, some of which have greater financial resources and technical facilities, for the acquisition of mineral interests, as well as for the recruitment and retention of qualified employees. We compete for qualified employees with Vancouver based companies, including Hunter Dickenson Inc., Equity Engineering and Ivanhoe Mines, and international mining companies, including Billiton-BHP, Rio Tinto and Anglo American, among others.

16

Governmental Regulations

Mining operations are subject to a wide range of national and provincial government regulations such as restrictions on production, price controls, tax increases, expropriation of property, environmental protection, and protection of agricultural territory or changes in conditions under which minerals may be marketed. Mining operations may also be affected by claims of native peoples, any of which could have the effect of reducing or preventing us from exploiting any of our properties.

Mineral claims in British Columbia are of two types. Cell mineral claims are established by electronically selecting the desired land on government claim maps, where the available land is displayed as a grid pattern of open cells, each of approximately 450-500 hectares. Payment of the required recording fees is also conducted electronically. This process for claim staking has been in effect since January, 2005, and is now the only way to stake claims in British Columbia. Prior to January, 2005, legacy claims were staked by walking the perimeter of the desired ground and erecting and marking posts at prescribed intervals. Legacy claims, staked before January, 2005, remain valid and may be converted into cell claims.

Cell mineral claims may be kept in good standing by incurring assessment work or by paying cash-in-lieu of assessment work. Assessment work requirements are CAN$5.00 per hectare per year during the first 2 years following the location of the mineral claims, increasing to CAN$10.00 per hectare in the third and fourth years, CAN$15.00 per hectare in the fifth and sixth years and CAN$20.00 per hectare for all succeeding years. Cash-in-lieu of exploration and development work is double the value of the corresponding assessment work requirement.

We will be required to comply with all regulations, rules and directives of governmental authorities and agencies applicable to the exploration of minerals in the Province of British Columbia and in Canada generally. Under these laws, prior to production, we have the right to explore the property. We are required to file a “Notice of Work and Reclamation” with the British Columbia Ministry of Energy and Mines to conduct exploration works on mineral properties in British Columbia. To obtain a work permit, a company may be required to post a bond. In addition, the production of minerals in the Province of British Columbia requires prior regulatory approval.

Our mineral claims entitle our company to continue exploration activities on our properties, subject to our compliance with various Canadian federal and provincial laws governing land use, the protection of the environment and related matters.

If we locate a commercially viable mineral resource on any of our properties, we would be required to conduct extensive community consultations in northern British Columbia with both Aboriginal and non- Aboriginal groups, environmental surveys both on the property and along transportation corridors. We also would be required to develop a mining plan and a mine closure plan. These surveys and plans would be combined into a comprehensive Environmental Impact Statement and submitted to the British Columbia government for review and approval. Any development or exploitation of such a mineral resource would be subject to Canadian federal and provincial laws governing land use, protection of the environment, occupational health, waste disposal, toxic substances, mine safety and other matters. We had no material costs related to compliance and/or permits in recent years, and anticipate no material costs in the next year.

We will have to sustain the cost of reclamation and environmental mediation for all exploration work undertaken. The amount of these costs is not known at this time as we do not know the extent of the exploration program that will be undertaken beyond completion of the recommended work programs. The Company has posted $187,900 in total reclamation bonds towards the reclamation of existing exploration drill sites and access roads on the Turnagain property. Permits and regulations will control all aspects of any production program if the project continues to that stage because of the potential impact on the environment.

17

Our operations are subject to environmental regulations promulgated by various levels of governments and their agencies. Existing environmental legislation provides for restrictions and prohibitions on spills, releases or emissions of various substances produced in association with certain mining industry operations, such as from disposal areas, which would result in environmental pollution. A breach of such legislation may result in the imposition of fines and penalties. Prior to conducting exploration involving surface disturbance in British Columbia, we are required to obtain a Work Permit from the Ministry of Energy, Mines and Petroleum Resources. So far, we have obtained the permits we needed to conduct our exploration program but if we are unable to obtain the permits that we require in the future, we will have to cease the exploration activity in question. Ceasing such exploration activities could reduce our chances of ever discovering mineral resources on our properties.

Where significant surface disturbance through road building and drill site preparation is planned, the Ministry of Energy, Mines and Petroleum Resources require a Reclamation Bond to cover the estimated reclamation costs if we fail to complete the reclamation. From 1996 to present, we have posted $187,900 in total reclamation bonds with the Ministry of Energy, Mines and Petroleum Resources.

We are not aware of any existing environmental liability associated with any of our exploration properties but if such liability should arise, we may incur substantial costs, which would reduce the amount of money we have to spend on exploration and could cause us to cease operations. Our potential exposure to liability for environmental damage is high and we have no reserves established to pay for such liability. If we are found to be liable for a large amount of environmental damage, we are likely to have to cease operations.

| C. | Organizational Structure |

We have one wholly-owned subsidiary, Canadian Metals Exploration Ltd., incorporated under theCanada Business Corporation Act (Canada) on July 14, 2004. This wholly-owned subsidiary is currently inactive.

| D. | Property, Plant and Equipment |

This section summarizes the assets of the company including its executive office in Vancouver, B.C., sample storage warehouse near Vancouver and its most important assets, mineral exploration properties.

The company has 100% interest in a number of mineral exploration properties located in British Columbia, the Turnagain is presently the only material exploration property and is described below.

Our executive office is located at 203 – 700 West Pender Street, Vancouver, British Columbia V6C 1G8, Canada. The Company subleases approximately 1,000 square feet of space for $53,159 per year expiring on March 31, 2019. We sublease 75% of this space resulting in approximately $1,300 per month in office rent. This space accommodates all of our executive and administrative offices. We believe that this existing space is adequate for our current needs. Should we require additional space, we believe that such space can be secured on commercially reasonable terms.

The company has rented a warehouse near Vancouver, British Columbia in which to store drill core samples and to prepare composite samples for metallurgical test-work. We rent this facility for $500 per month on a month to month basis. We own office, vehicle, and exploration equipment with a cost of approximately $15,000 located at our Vancouver Office and our camp at the Turnagain property.

18

Our main mineral property the Turnagain is described more fully below:

The Turnagain Property

This section provides a summary of the geology and exploration activities on the Turnagain Property.

Exploration data collected during the 2003 to 2016 exploration programs was completed under the supervision of Tony Hitchins, M.Sc., an employee of Hard Creek Nickel Corporation.

19

Location and Accessibility

The Turnagain Property consists of 65 neighboring mineral claims situated in the Liard Mining Division of northern British Columbia, 70 km east of Dease Lake and 1,350 km north-northwest of Vancouver. The maps above indicate where the property is located in the province of British Columbia, Canada. The mineral claims collectively cover an area of 33,220 hectares. The Turnagain Property is situated in the Stikine Ranges of the Cassiar Mountains. Elevations range from about 1,000 meters above sea level along the Turnagain River, in the central claim area, to 2,200 meters at an unnamed summit in the north central property area.

The Turnagain Property straddles the Turnagain River near where it joins Hard Creek. The community of Dease Lake, on Highway #37 some 400 km north of the port of Stewart, is 70 km west of the property. Helicopter access from Dease Lake involves a 20 minute flight. A secondary road extending easterly from Dease Lake has been used by large, articulated 4-wheel drive vehicles to convey large jade boulders from the Kutcho Creek area and to supply placer gold operations at Wheaton Creek over the past number of years. A branch of this road network extends into the Turnagain Property with road distance to Dease Lake of about 100 km.

A dirt airstrip, measuring approximately 930 meters long, constructed in the 1960s, and upgraded in early 2007, is situated within the claims on the northwest side of the Turnagain River and can accommodate small fixed wing aircraft. This airstrip is immediately adjacent to our current camp facility and core storage. Previous exploration programs have made use of camp facilities at Wheaton Creek (Boulder), which is about 15 km by road west of the Turnagain Property.

Three times a week, Dease Lake has scheduled airline service and offers some supplies and services. The communities of Terrace and Smithers, both several hundred km south, offer a range of services and supplies which can be trucked to Dease Lake via Highway #37.

The area between Dease Lake and the Turnagain Property features maturely dissected mountains rising to elevations of between 2,000 and 2,425 meters above sea level and separated by wide, drift-filled valleys in which elevations average 1,000 meters. Forest cover, present in valley areas, is replaced by typical alpine flora above 1,500 meters. Bedrock is reasonably well exposed in the areas above tree line and along drainages.

Description of Claims

The Turnagain Property consists of 65 neighboring mineral claims situated in the Liard Mining Division of northern British Columbia, 70 km east of Dease Lake and 1,350 km north-northwest of Vancouver. The mineral claims collectively cover an area of 33,220 hectares. The Turnagain Property is situated in the Stikine Ranges of the Cassiar Mountains. Elevations range from about 1,000 meters above sea level along the Turnagain River, in the central claim area, to 2,200 meters at an unnamed summit in the north central property area. The Turnagain Property straddles the Turnagain River near where it joins Hard Creek. The Company owns a 100% interest in all of these mineral claims subject to a 4% net smelter royalty on possible future production on one mineral claim (Tenure No. 511330) subject to a buyout clause of $4 million. The following table summarizes the claim name, size, and expiry date for the 65 claims in the Turnagain Property as of April 26, 2017

20

The following table shows details relating to Hard Creek Nickel Corporation’s Turnagain claims andthe expiry dates of those claims:

Tenure Number | Claim Name | Area (ha) | Issue Date | Expiry Date |

Legacy Mineral Claim |

407627 | PUP 4 | 500.0 | 2004/Jan/01 | 2021/Jan/01 |

On-Line Cell Mineral Claims |

501131 | Drift 1 | 422.0 | 2005/Jan/12 | 2019/Jan/12 |

501168 | Drift 2 | 421.8 | 2005/Jan/12 | 2019/Jan/12 |

501234 | Drift 3 | 421.7 | 2005/Jan/12 | 2019/Jan/12 |

501298 | Drift 4 | 421.8 | 2005/Jan/12 | 2019/Jan/12 |

508218 | Dinah 1 | 407.2 | 2005/Mar/03 | 2019/Mar/03 |

508219 | Dinah 2 | 407.1 | 2005/Mar/03 | 2019/Mar/03 |

508221 | Dinah 3 | 406.9 | 2005/Mar/03 | 2019/Mar/03 |

508222 | Dinah 4 | 406.7 | 2005/Mar/03 | 2019/Mar/03 |

508223 | Dinah 5 | 407.1 | 2005/Mar/03 | 2019/Mar/03 |

508225 | Dinah 6 | 407.1 | 2005/Mar/03 | 2019/Mar/03 |

508226 | Dinah 7 | 254.6 | 2005/Mar/03 | 2019/Mar/03 |

508227 | Dinah 8 | 407.3 | 2005/Mar/03 | 2019/Mar/03 |

508228 | Dinah 9 | 135.5 | 2005/Mar/03 | 2019/Mar/03 |

508229 | Dinah 10 | 203.4 | 2005/Mar/03 | 2019/Mar/03 |

528780 | T1 | 67.7 | 2006/Feb/23 | 2019/Feb/23 |

528781 | T2 | 203.3 | 2006/Feb/23 | 2019/Feb/23 |

528782 | T3 | 152.6 | 2006/Feb/23 | 2019/Feb/23 |

528784 | T4 | 288.3 | 2006/Feb/23 | 2019/Feb/23 |

528787 | T5 | 169.6 | 2006/Feb/23 | 2019/Feb/23 |

528788 | T6 | 270.2 | 2006/Feb/23 | 2019/Feb/23 |

528789 | T7 | 422.5 | 2006/Feb/23 | 2019/Feb/23 |

528790 | T8 | 253.6 | 2006/Feb/23 | 2019/Feb/23 |

Converted Legacy to On-Line Cell Mineral Claims (April 2005 and November 2007) |

503365 | Hard 2 | 793.3 | 2005/Jan/14 | 2019/Feb/18 |

510889 | Flat 10, 13, 15 | 1627.9 | 2005/Apr/18 | 2019/Apr/07 |

510892 | Flat 2, 6 | 1219.3 | 2005/Apr/18 | 2019/Apr/07 |

510910 | Flat 9, 12, 14 | 1424.3 | 2005/Apr/18 | 2019/Apr/07 |

510911 | Flat 1, 5 | 1066.9 | 2005/Apr/18 | 2019/Apr/07 |

510912 | Flat 8, 11 | 779.9 | 2005/Apr/18 | 2019/Apr/07 |

511214 | Hard 4, 6 | 979.9 | 2005/Apr/20 | 2019/Feb/18 |

511226 | Hill 1, 2 | 1216.1 | 2005/Apr/20 | 2019/Feb/18 |

511227 | Hill 3 | 506.7 | 2005/Apr/20 | 2019/Feb/17 |

511230 | Hill 4, 5 | 760.5 | 2005/Apr/20 | 2019/Feb/17 |

511234 | Hill 6 | 185.9 | 2005/Apr/20 | 2019/Feb/16 |

511244 | Hard 5, 7 | 489.9 | 2005/Apr/20 | 2019/Feb/18 |

511251 | Hard 8 | 473.4 | 2005/Apr/20 | 2019/Feb/17 |

511257 | Hill 9, 10 | 1014.4 | 2005/Apr/20 | 2019/Feb/17 |

511279 | Hard 9, 10 | 896.7 | 2005/Apr/20 | 2019/Feb/17 |

511304 | Hill 7, 8 | 1149.7 | 2005/Apr/21 | 2019/Feb/17 |

511305 | Hound 3 | 271.0 | 2005/Apr/21 | 2019/Sep/27 |

511306 | Turn 2, Flat 7 | 881.2 | 2005/Apr/21 | 2019/Feb/19 |

511329 | Hound 1, 2 | 1015.4 | 2005/Apr/21 | 2019/Sep/27 |

21

511330 | Cub | 592.6 | 2005/Apr/21 | 2021/Dec/01 |

511337 | Cub 10, 18, Pup 1 | 1065.8 | 2005/Apr/21 | 2018/Dec/01 |

511340 | Cub 17 | 253.9 | 2005/Apr/21 | 2018/Dec/01 |

511344 | Turn 1, Bear 2 | 271.0 | 2005/Apr/21 | 2019/Feb/19 |

511347 | Flat 3, 4 | 474.3 | 2005/Apr/21 | 2019/Apr/07 |

511348 | Cub 2 | 389.4 | 2005/Apr/21 | 2021/Dec/01 |

511586 | Pup 2 | 236.9 | 2005/Apr/25 | 2019/Jan/01 |

511593 | Pup 3 | 101.5 | 2005/Apr/25 | 2021/Dec/01 |

511627 | Cub 11 | 592.1 | 2005/Apr/25 | 2018/Dec/01 |

511628 | Hard 1 | 709.0 | 2005/Apr/25 | 2019/Feb/18 |

511629 | Hard 3 | 472.9 | 2005/Apr/25 | 2019/Feb/18 |

570454 | Bear 1 | 456.8 | 2007/Nov/22 | 2019/May/26 |

570455 | Bear 19, Bear 21 to 28 | 237.0 | 2007/Nov/22 | 2019/May/26 |

570456 | Bear 3 to 18 | 220.2 | 2007/Nov/22 | 2019/May/26 |

570457 | Bear 20 | 16.9 | 2007/Nov/22 | 2019/May/26 |

609390 | FLAT 7 | 254.6 | 2009/Jul/21 | 2018/Sep/20 |

609394 | FLAT 6 | 407.4 | 2009/Jul/21 | 2018/Sep/20 |

609396 | FLAT 8 | 203.8 | 2009/Jul/21 | 2018/Sep/20 |

609397 | FLAT 5 | 407.4 | 2009/Jul/21 | 2018/Sep/20 |

609398 | FLAT 4 | 407.4 | 2009/Jul/21 | 2018/Sep/20 |

609403 | FLAT 3 | 407.3 | 2009/Jul/21 | 2018/Sep/20 |

609423 | FLAT 2 | 407.3 | 2009/Jul/21 | 2018/Sep/20 |

609424 | FLAT 1 | 424.2 | 2009/Jul/21 | 2018/Sep/20 |

22

The following figure shows the claims for the Turnagain property listed above.

Exploration History

Nickel and copper sulphides were discovered within the current Turnagain property area in a bedrock exposure along the Turnagain River in 1956. Mineral claims covering the area where these sulphides were found as well as other traces of sulphides were acquired by Falconbridge Nickel Mines Limited in 1966.

Falconbridge Nickel Mines Limited also completed work over the following seven years, including surface and airborne geophysical surveys, geological mapping, geochemical surveys and 2,895 meters of conventional and packsack diamond drilling in 40 widely spaced drill holes.

Our Turnagain Property represents a unique style of sulphide mineralization associated with a zoned, ultramafic complex (a suite of rocks high in iron and magnesium but low in silica.) Iron and nickel sulphides are widespread in dunite (ultramafic rock comprising more than 90% olivine) and wehrlite (ultramafic rock comprising less than 90% olivine and >10% pyroxene) near dunite-wehrlite contacts. Exploration on the Turnagain Property between 1967 and 2002 was sporadic and was concentrated in the Horsetrail area or near other small exposures of net-textured sulphides. We acquired the property in 1996.

23

Work Completed by the Registrant

We acquired the Turnagain River property in 1996 and our exploration work that year included 400 line km of airborne magnetic surveys and 795.5 meters of diamond drilling in 5 holes. Additional diamond drilling completed by our company in 1997 and 1998 amounted to 3,123 meters in 14 holes. Related work included 18 line km of surface magnetic surveys covering two areas of the property, bore hole pulse-electromagnetic surveys in four of the 1997-1998 drill holes and preliminary metallurgical test work on drill core composites.

In 2002, we performed ground magnetic and Induced Polarization geophysical surveys over part of the claim area and completed 1,687 meters of diamond drilling in 7 holes. Exploratory work in 2003 included geological mapping and prospecting with bedrock, stream sediment and limited soil sampling and 8,669 meters of diamond drilling in 22 holes, including the deepening of one hole started in 2002. Preliminary metallurgical test work was conducted on composite 2002-2003 core samples.

In 2004, we conducted a comprehensive exploration program that included a helicopter borne magnetic and electromagnetic survey covering 1,866 line km, 14 km of ground magnetic and electromagnetic surveys, 1:20,000 scale aerial photography of the entire property, the collection of more than 3,000 geochemical soil samples, geological mapping, and 7522 meters of diamond drilling in 49 holes. We analyzed the approximately 4,000 core samples for 30 elements including nickel, copper, cobalt, sulphur and often platinum and palladium. Extensive metallurgical test work has been completed on 2003-2004 composite core samples and also on 2005-2006 composite core samples.

Our 2005 exploration program consisted of geological mapping, bedrock and soil sampling, and 7,143 meters of diamond drilling in 37 holes. We also undertook various mineralogical, environmental baseline surveys, engineering, metallurgical and analytical studies on the property.

Our 2006 exploration program was completed by early November and included 19,111 meters of diamond drilling in 68 holes, surface mapping and sampling in several areas and continuation of fish habitat surveys and water sampling. Metallurgical test-work on composite samples from our 2005 and 2006 drill core was also completed during 2007.

Our 2007 exploration program was completed by early November and included 24,325 meters of diamond drilling in 72 holes, surface mapping and sampling in several areas and continuation of fish habitat surveys and water sampling. Metallurgical test-work was directed towards further definition of the reagent scheme and nickel flotation kinetics for future pilot plant testing.

Our 2008 exploration program was completed by early September and included 4,105 meters of diamond drilling in 15 holes, surface mapping and sampling in several areas and continuation of fish habitat surveys and water sampling. Metallurgical test-work continued towards further definition of the reagent scheme and nickel flotation kinetics for future pilot plant testing.

In 2009 we developed an extensive electronic relational drill hole database, initiated metal leaching tests on site, and continued with baseline water sampling. Metallurgical testwork continued towards further definition of the reagent scheme and nickel flotation kinetics for future pilot plant testing. A small pilot plant test was conducted and a range of concentrates collected to develop potential hydrometallurgical refining processes. These concentrates were used for completion of amenability testing of the Activox® process in Perth Australia and the Outotec Nickel Chloride Leach in Pori Finland.

In 2010 the focus was primarily on the geological and mineralization model refinement and metallurgical test-work rather than the traditional field work exploration programs.

24

In December 2011, the Company received the Turnagain Project Preliminary Economic Assessment (“PEA”) prepared by AMC Mining Consultants (Canada) Ltd. The complete PEA was filed on SEDAR on December 5, 2011, this technical report is also available on the Company's website www.hardcreek.com under the heading "Projects".

During the years ended December 31, 2012 - 2016, the Company focused on finding a partner to take the Turnagain Nickel project to the feasibility level, reviewed possible opportunities for reducing the overall project capital costs and identified a PGE exploration program on the Turnagain property.

| Item 5 | Operating and Financial Review and Prospects |

The following discussion and analysis should be read in conjunction with the consolidated financial statements and notes thereto included herein (see also "Selected Financial Data"). The consolidated financial statements have been prepared in accordance with International Financial Reporting Standards (“IFRS”).

Our results of operations have been, and may continue to be, affected by many factors of a global nature, including economic and market conditions, the availability of capital, the level and volatility of prices and interest rates, currency values, commodities prices and other market indices, technological changes, the availability of credit, inflation and legislative and regulatory developments. Factors of a local nature, which include the political, social, financial and economic stability, the availability of capital, technology, workers, engineers and management, geological factors and weather conditions, also affect our results of operations. See “Key Information – Risk Factors”. As a result of the economic and competitive factors discussed above, our results of operations may vary significantly from period to period.

Year Ended December 31, 2015 Compared to Year Ended December 31, 2016

General and Administrative - During the year ended December 31, 2016 (“2016”), the Company incurred a net loss of $224,112 ($0.01 per share) compared to a net loss of $10,230,524 ($0.57 per share) during the year ending December 31, 2015. The administrative expenses for 2016 were $196,321, up from $178,242 from 2015. Total administrative expenses includes two non-cash expenses, amortization and stock-based compensation, these amounts were $2,968 (2015: $3,876) and $42,831 (2015: $Nil) in 2016, respectively. Excluding amortization, the 2016 administrative expenses were $150,522 down from $174,366 in 2015. Office and general expenses in were $101,804 (2015: $101,559), an increase of $245. Investor relations in 2016 were $12,540 (2015: $15,263), a decrease of $2,723, legal and audit in 2016 were $18,178 (2015: $19,544) a decrease of $1,366. Management fees in 2016 were $18,000, down $20,000 from the $38,000 incurred in 2015. Excluding amortization and stock-based compensation, the total general and administrative expenses for 2016 were approximately $12,550 per month compared to $14,530 per month in 2015.

At December 31, 2016 the Company impaired the Turnagain mineral claims by $29,093 (2015: $10,055,858) to $1 based on the current nickel prices, the global over-supply of nickel held in inventories and the weaker than expected Chinese and European demand. During 2016, the Company earned $1,302 from interest income compared to $3,576 for 2015.

Exploration - During the year ended December 31, 2016, the Company incurred expenditures on exploration and evaluation assets of $29,093 (2015: $69,699). The exploration expenditures for 2016 were approximately $2,425 per month compared to $5,800 per month in 2015. In June 2015, the Company received $150,000 from the return of one of its reclamation deposits.

25

Year Ended December 31, 2014 Compared to Year Ended December 31, 2015

General and Administrative - During the year ended December 31, 2015 (“2015”), the Company incurred a net loss of $10,230,524 ($0.57 per share) compared to a net loss of $22,803,513 ($1.26 per share) during the year ending December 31, 2014. The administrative expenses for 2015 were $178,242, down from $221,709 from 2014. Total administrative expenses includes one non-cash expense, amortization, which charges the cost of equipment against earnings over its useful life, these amounts were $3,876 and $5,082 in 2015 and 2014, respectively. Excluding amortization, the 2015 administrative expenses were $174,366 down from $216,627 in 2014. Office and general expenses in were $101,559 (2014: $125,654), a decrease of $24,095. Investor relations in 2015 were $15,263 (2014: $18,947), a decrease of $3,684, legal and audit in 2015 were $19,544 (2014: $24,026) a decrease of $4,482. Management fees in 2015 were $38,000, down $10,000 from the $48,000 incurred in 2014. Excluding amortization, the total general and administrative expenses for 2015 were approximately $14,550 per month compared to $18,050 per month in 2014. At December 31, 2015 the Company impaired the Turnagain mineral claims by $10,055,858 to $1 based on the current nickel prices, the global over-supply of nickel held in inventories and the weaker than expected Chinese and European demand. During 2015, the Company earned $3,576 from interest income compared to $4,124 for 2014.

At December 31, 2015 the Company impaired the Turnagain mineral claims by $10,055,858 to estimated net realizable value of $1 based on the current nickel prices, the global over- supply of nickel held in inventories and the weaker than expected Chinese and European demand.

Exploration - During the year ended December 31, 2015, the Company incurred exploration and evaluation costs of $69,699 (2014: $91,875).

| B. | Liquidity and Capital Resources |

Since the Company is organized in Canada, the Company’s December 31, 2016 consolidated financial statements have been prepared in accordance with IFRS.

As at December 31, 2016, our company had accumulated losses totaling $54,796,348 and a working capital of $89,698. The Company does not have any source of external liquidity such as bank loans or lines of credit to draw upon and relies on private placement funding and the exercise of share purchase warrants to fund ongoing operations and exploration programs.

As noted, these conditions raise substantial doubt about the Company’s ability to continue as a going concern. The financial statements do not include any adjustment that might arise from this uncertainty. The auditors’ report includes an explanatory paragraph disclosing the substantial doubt regarding the Company's ability to continue as a going concern.

As at December 31, 2016 the Company had cash of $85,758 and working capital of $89,698.

As of April 26, 2017, we had approximately $24,700 in cash, $11,3500 in receivables, and $872 in accounts payable and do not have sufficient working capital to cover our 2017 operating costs or 2017 exploration program and will need to raise additional funds through further equity issuances or loans.