SCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934

Filed by the Registrant x |

Filed by a Party other than the Registrant o |

| Check the appropriate box: |

| o | Preliminary Proxy Statement |

| o | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| x | Definitive Proxy Statement |

| o | Definitive Additional Materials |

| o | Soliciting Material Under Rule 14a-12 |

AMERICAN TELECOM SERVICES, INC. |

| (Name of Registrant as Specified in Its Charter) |

| |

| (Name of Person(s) Filing Proxy Statement, if Other Than the Registrant) |

| | | |

| Payment of Filing Fee (check the appropriate box): |

| x | No fee required. |

| o | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | (1) | Title of each class of securities to which transaction applies: |

| | (2) | Aggregate number of securities to which transaction applies: |

| | (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11: |

| | (4) | Proposed maximum aggregate value of transaction: |

| | (5) | Total fee paid: |

| o | Fee paid previously with preliminary materials: |

| o | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | (1) | Amount Previously Paid: |

| | (2) | Form, Schedule or Registration Statement No.: |

| | (3) | Filing Party: |

| | (4) | Date Filed: |

| | | |

Copies of all communications to: Ira Roxland, Esq. Sonnenschein Nath & Rosenthal LLP 1221 Avenue of the Americas New York, New York 10020 (212) 768-6700 |

| | | |

AMERICAN TELECOM SERVICES, INC.

______________________

Notice of 2006 Annual Meeting of Stockholders

To be Held on December 14, 2006

______________________

To the Stockholders of American Telecom Services, Inc.

The 2006 Annual Meeting of Stockholders of American Telecom Services, Inc. will be held at the offices of Sonnenschein Nath & Rosenthal LLP, 1221 Avenue of the Americas, 25th Floor, New York, New York, on Thursday, December 14, 2006 at 10:00 a.m., local time, for the following purposes:

1. To elect six directors to serve for a term of one year.

2. To ratify the appointment of BDO Seidman, LLP as our independent auditors for the fiscal year ending June 30, 2007; and

3. To transact such other business as may properly come before the annual meeting.

The record date for determining stockholders entitled to vote at the annual meeting is the close of business on November 20, 2006. Whether or not you plan to attend the annual meeting, please sign and date the enclosed proxy and promptly return it in the pre-addressed envelope provided for that purpose. Any stockholder may revoke his or her proxy at any time before the annual meeting by giving written notice to such effect, by submitting a subsequently dated proxy or by attending the annual meeting and voting in person.

New York, New York

November 20, 2006

AMERICAN TELECOM SERVICES, INC.

2466 Peck Road

City of Industry, California 90601

______________________

PROXY STATEMENT

______________________

Questions and Answers Regarding This Proxy Statement

When is the annual meeting and where will it be located? The meeting will take place on Thursday, December 14, 2006, at 10:00 a.m., local time, at the offices of Sonnenschein Nath & Rosenthal LLP, 1221 Avenue of the Americas, 25th Floor, New York, New York.

Who is soliciting your proxy? The proxy solicitation is being made by the Board of Directors of American Telecom Services, Inc. Proxies may also be solicited by our officers and employees, but such persons will not be specifically compensated for such services.

When was the proxy statement mailed to stockholders? This proxy statement will first be mailed to stockholders on or about November 22, 2006.

Who may attend the annual meeting? All stockholders of record as of the close of business on November 20, 2006 may attend. If your shares are held through a broker and you would like to attend, please bring a copy of your brokerage account statement reflecting your ownership of our shares on the record date or an omnibus proxy (which you can get from your broker) and we will permit you to attend the annual meeting.

Who is paying for the solicitation of proxies? We will pay all expenses of preparing and soliciting proxies. We have also arranged for reimbursement of brokerage houses, nominees, custodians and fiduciaries for the forwarding of proxy materials to the beneficial owners of shares held of record.

Who may vote at the annual meeting? If you are a holder of common stock as of the close of business on November 20, 2006, you will have one vote for each share of common stock that you hold on each matter that is presented for action at the annual meeting. If you have common stock that is registered in the name of a broker, your broker will forward your proxy materials and will vote your shares as you indicate. You may receive more than one proxy card if your shares are registered in different names or are held in more than one account.

How do you vote? Sign and date each proxy card you receive and return it in the prepaid envelope. Stockholders who hold their shares through a bank or broker can also vote via the Internet if this option is offered by the bank or broker. Any stockholder may revoke his or her proxy, whether he or she votes by mail or the Internet, at any time before the annual meeting by written notice to such effect received by us at the address set forth above, attn: corporate secretary, by delivery of a subsequently dated proxy or by attending the annual meeting and voting in person.

How will your shares be voted? All properly completed and unrevoked proxies that are received prior to the close of voting at the annual meeting will be voted in accordance with the instructions made. If a properly executed, unrevoked written proxy card does not specifically direct the voting of shares covered, the proxy will be voted in favor of the proposals set forth in the notice attached to this proxy statement.

Abstentions will be counted in tabulations of the votes cast on each of the proposals presented at the meeting and will have the same effect as a vote AGAINST each of such proposals. “Broker non-votes” are proxies received from brokers who, in the absence of specific voting instructions from beneficial owners of shares held in brokerage name, have declined to vote such shares in those instances where discretionary voting by brokers is permitted. A broker non-vote will have no effect on the outcome of any of the proposals.

Is your vote confidential? Proxy cards, ballots and voting tabulations that identify individual stockholders are mailed or returned directly to the transfer agent and are handled in a manner that protects your voting privacy. Your vote will not be disclosed except as needed to permit the transfer agent to tabulate and certify the vote and as required by law. Additionally, all comments written on the proxy card or elsewhere will be forwarded to management. Your identity will be kept confidential, unless you ask that your name be disclosed.

What is the record date and what constitutes a quorum? Our board of directors has selected the close of business on November 20, 2006, as the record date for determining the stockholders of record who are entitled to vote at the annual meeting. This means that all stockholders of record at the close of business on November 20, 2006 may vote their shares of common stock at the annual meeting. As of November 20, 2006, 6,502,740 shares of common stock were issued and outstanding. The common stock is our only class of securities entitled to vote, each share being entitled to one non-cumulative vote. The presence at the annual meeting, in person or by proxy, of holders of a majority of the issued and outstanding shares of common stock as of the record date is considered a quorum for the transaction of business. If you submit a properly completed proxy or if you appear at the annual meeting to vote in person, your shares of common stock will be considered part of the quorum. Directions to withhold authority to vote for any director, abstentions, and broker non-votes will be counted as present to determine if a quorum for the transaction of business is present. Once a quorum is present, voting on specific proposals may proceed. In the absence of a quorum, the annual meeting shall be adjourned.

How many votes are needed to approve each proposal? Directors will be elected by a plurality of the votes cast at the meeting. The approval of the proposal to ratify the appointment of BDO Seidman, LLP as our independent auditors requires the affirmative vote of the holders of a majority of the voting power of our common stock that are present in person or by proxy at the meeting.

PROPOSAL ONE

ELECTION OF DIRECTORS

At the annual meeting, you will elect six individuals to our board of directors. Each director will hold office until the next annual meeting and until his respective successor is elected and qualified. In the event that any nominee for director withdraws or for any reason is not able to serve as a director, we will vote your proxy for the remainder of those nominated for director (except as otherwise indicated in your proxy) and for any replacement nominee designated by our board of directors. Each nominee is currently a member of our board of directors.

Information Concerning Nominees

Name | Age | Director Since | Principal Occupation and Business Experience |

Lawrence Burstein | 64 | 2005 | Mr. Burstein has been our Chairman of the Board since June 2005. Mr. Burstein has many years’ experience managing and financing public and private companies. Since March 1996, Mr. Burstein has been President and a principal securityholder of Unity Venture Capital Associates Ltd., a private investment company. For approximately ten years prior to 1996, Mr. Burstein was the President, a member of the board of directors and principal securityholder of Trinity Capital Corporation (“TCC”), a private investment company. TCC ceased operations prior to the formation of Unity Venture in 1996. Mr. Burstein is also a member of the board of directors of I.D. Systems, Inc., a Nasdaq National Market-listed designer, developer and producer of a wireless monitoring and tracking system that uses radio frequency technology; THQ, Inc., a Nasdaq National Market-listed developer and publisher of interactive entertainment software for the major hardware platforms in the home video industry; Traffix, Inc., a Nasdaq National Market-listed developer and operator of Internet-based marketing programs as well as direct marketing programs; CAS Medical Systems, Inc., an OTC Bulletin Board-listed manufacturer and marketer of blood pressure monitors and other disposable products principally for the neonatal market; and Millennium India Acquisition Company Inc., an American Stock Exchange-listed blank check company that is seeking to effectuate a business combination with an attractive target business that has operations primarily in India. Mr. Burstein received a BA from the University of Wisconsin and an LLB from Columbia Law School. |

| | | | |

Bruce Hahn | 57 | 2003 | Mr. Hahn is our founder and has been our Chief Executive Officer since our inception in June 2003. Mr. Hahn has more than twenty-five years’ experience in leading consumer product companies in the development and expansion of their product offerings and related distribution channels. From November 1999 to June 2005, Mr. Hahn served as President of SMMI, a management consulting company, where he worked |

| | | with leading communications and consumer products companies in securing and expanding distribution channels for their phones. From 1991 to 1999, he served as Chief Executive Officer of USCI, a cellular carrier which he built into the first consumer-focused, national one-rate cellular carrier in the United States using retail accounts such as Radio Shack and Wal-Mart. From 1985 to 1991, he served as Chief Executive Officer of International Consumer Brands (“ICB”), a consumer product development and distribution company and a leader in the rechargeable tool and kitchen aid industries. His efforts with ICB included building and diversifying that company’s product offerings, developing a personal care appliances company in partnership with Candies, Inc., a leading footwear and apparel provider, and launching a rechargeable power tools division, for which he secured distribution channels through major retail outlets, such as Home Depot. From 1984 to 1985, he served as an Executive Vice President of Cosmo Communications, a manufacturer of diversified products, including telecommunications hardware. From 1980 to 1984, he was Senior Vice President and General Manager at Conair Corporation, a manufacturer and distributor of diversified products, and one of the first companies to introduce phones into the marketplace following the divestiture of AT&T. At Conair, Mr. Hahn managed and directed their telecommunications, personal care appliances and healthcare phones businesses. Mr. Hahn received a BA from the University of Tennessee. |

| | | | |

Robert F. Doherty | 42 | 2006 | Mr. Doherty has served as a member of our board of directors since February 2006. Since April 2006, he has been a partner in Redwood Capital Group, an investment banking firm. From May 2005 to April 2006, he was a financial consultant and President of Great Blue Consulting LLC, a corporate finance consulting firm he founded in October 2002. From February 2004 to May 2005, Mr. Doherty served as a Managing Director in the Investment Banking Division of Jefferies & Company. From October 2002 to February 2004, he was a financial consultant and President of Great Blue Consulting. From March 2002 to September 2002, he was Executive Vice President and Chief Financial Officer of Abovenet, Inc. (formerly Metromedia Fiber Network, Inc.), a provider of fiber connectivity solutions for businesses, having been hired as a financial restructuring expert. In May 2002, Metromedia Fiber Network initiated a voluntary insolvency proceeding under Chapter 11 of the Federal Bankruptcy Code. Mr. Doherty previously served as a Managing Director in the Investment Banking Division of Salomon Smith Barney Inc. from October 1996 to January 2002, and as a Vice President in the Investment Banking Division of PaineWebber Incorporated from March 1989 to October 1996. Mr. Doherty received a BA from the University of Pennsylvania and an MBA from the Stern School |

| | | | |

| | | | of Business of New York University. |

| | | | |

Elliott J. Kerbis | 54 | 2006 | Mr. Kerbis has served as a member of our board of directors since February 2006. Since June 2004, Mr. Kerbis has served as an independent retail consultant. From January 2002 to June 2004, Mr. Kerbis was President and Chief Merchandising Officer for The Sports Authority, a New York Stock Exchange-listed operator of sporting goods retail stores. He joined The Sports Authority in October 2000 as Executive Vice President-Merchandising and Sales Promotion and was promoted to President and Chief Merchandising Officer in January 2002. He previously served as Senior Vice President of Merchandise at Filene’s, a department store owned by The May Department Store Company, from May 1999 to August 2000, and as Executive Vice President of Merchandise for Hardlines of The Caldor Corporation, a discount retailer, from 1987 to 1999. Prior to joining The Caldor Corporation, Mr. Kerbis served in various capacities with R.H. Macy & Co. from 1977 to 1987. Mr. Kerbis received a BS from Baruch College. |

| | | | |

Donald G. Norris | 68 | 2006 | Mr. Norris has served as a member of our board of directors since February 2006. Since November 2003, Mr. Norris has served as President of Norrismen Sales and Marketing and has been a partner of Corporate Identity Network, Inc., each a marketing consulting firm. From January 2000 to November 2003, Mr. Norris was Director of OEM Sales for Earthlink, Inc., a Nasdaq National Market-listed Internet service provider. He previously served as President of Norris and Associates, a consulting firm, from January 1993 to January 2000, and as Director of Subscriber Marketing for Prodigy Services Company, an Internet service provider that was the first consumer online service, from July 1984 to January 1993. Mr. Norris received a BS from Oklahoma State University. |

| | | | |

Robert S. Picow | 51 | 2006 | Mr. Picow has served as a member of our board of directors since May 2006. Mr. Picow has served as Chairman of Cenuco Inc., a publicly traded company engaged in wireless application development and software solutions, since April 2004, and as a Director of Cenuco since July 2003. Mr. Picow has served as a Director of InfoSonics Corporation, a distributor of wireless handsets and accessories in the United States and Latin America, since December 2003, as a Director of Streicher Mobile Fueling, a fuel distribution company, since March 2001 and as a Director of Fundamental Management Corporation, a private fund management company, since May 2001. Mr. Picow served as Vice Chairman and a director of BrightPoint from 1996 until 1997. Subsequent to his last position with BrightPoint in 1997, Mr. Picow was not employed until accepting the directorship in Fundamental Management Corporation in 2001. Mr. Picow was Chief |

| | | | |

| | | | Executive Officer of Allied Communications, a cellular telephone and accessory distribution company, from its formation in 1986 until it merged with BrightPoint in 1996. |

| | | | |

Our board of directors unanimously recommends that you vote FOR the election of the nominees listed above.

Identification of Executive Officers

(Excludes executive officers who are also directors)

Name | Age | Principal Occupation and Business Experience |

Bruce Layman | 45 | Mr. Layman has been our Chief Operating Officer since September 2005. Mr. Layman, who also served as our Chief Financial Officer from September 2005 through mid-November 2006, has more than 15 years’ experience leading the operating and financial functions of communications and technology firms, including building and managing the systems and infrastructure to support operations including billing, customer service, carrier operations and inventory management. From March 2005 to September 2005, Mr. Layman was Vice-President of Account Management for Raptor Communications, Inc., a supplier of VoIP hardware. From January 2000 through February 2005, Mr. Layman served as Chief Financial Officer of Navigauge Inc., a telematics and radio ratings company. Mr. Layman served as Chief Operating Officer of USCI from 1998 to 1999, and as that company’s Director of Corporate Development from 1996 to 1998. Mr. Layman served as Controller of Communications Central Inc., one of the country’s largest prison-phone and payphone operators from 1992 to 1996 and as that company’s Director of Corporate Development from 1990 to 1992. Mr. Layman received a BBA from the University of Georgia. |

| | | |

Adam Somer | 34 | Mr. Somer has been our President of Communications Services since June 2003. Mr. Somer has approximately ten years’ experience in the development, deployment and management of communications and technology products and services. From March 2001 to June 2005, Mr. Somer was the Chief Executive Officer of Madison Strategic Partners, LLC, a consulting firm that assists established and new communications and technology companies, including providers of VoIP and other communications services, in developing strategies for their business growth. Mr. Somer continues as a member of Madison Strategic Partners. From November 1997 to March 2001, he was at deltathree, Inc. (“deltathree”), a Nasdaq Capital Market-listed pioneer in VoIP and hosted broadband services and a provider of private label VoIP services to Verizon, SBC and other telecommunications companies. Mr. Somer’s final position at deltathree was Director of Strategic Development, in which capacity he oversaw the deployment of consumer VoIP services. From 1996 to 1997, Mr. Somer was at Net2Phone, a division of IDT Corporation, Inc., a New York Stock Exchange-listed communications company, where he developed and managed an operational support system for dealing with resellers and consumers for that company’s VoIP services. His final position at Net2Phone was Director of Operations. IDT’s VoIP division |

| | | |

Name | Age | Principal Occupation and Business Experience |

| | | was taken public as Net2Phone in 1999 and is listed on the Nasdaq National Market. Mr. Somer received a BA from Yeshiva University. |

| | | |

Yu Wen Ching | 53 | Mr. Ching has been our President of Manufacturing and Sourcing since June 2003. He has more than 25 years’ experience in the areas of product development, manufacturing and sourcing in Asia. From January 2003 until June 2003, Mr. Ching was involved in the development of our company. From 1999 to December 2002, he was the Managing Director of Yu’s Electronics, a manufacturer of satellite transceiver boxes for European communications companies. From 1995 to June 2001, he was the Managing Director of Yu’s Trading, a manufacturer of motorbikes for markets in Germany and Ireland. From 1993 to 1999, he was the Executive Vice President of Mobile Power of Taiwan, a manufacturer of cellular phone power accessories, including batteries and rechargers. In 1990, Mr. Ching founded Aztec Cellular (“Aztec”) and served as its Chief Executive Officer from 1990 until its sale in 1995. Aztec developed, manufactured and distributed cellular phones in China. From 1973 to 1990, he was the Chief Executive Officer of Yu’s Coop, a textile group that manufactured raw materials and finished goods for the apparel industry and distributed its products to leading brand manufacturers, including Healthtex and Gerber. From 1980 to 1989, he was the Chief Executive Officer of Yu’s Tool, a subsidiary of Yu’s Coop. Yu’s Tool developed and manufactured nickel cadmium-based rechargeable tools and other products distributed through Home Depot, Wal-Mart, Lowes and other major retailers. |

| | | |

Edward R. James | 35 | Mr. James was appointed our Chief Financial Officer in mid-November 2006. Prior thereto and from September 2001, Mr. James was employed by Carter’s Inc, a branded marketer of baby and young children’s apparel, where he served in a number of financial capacities of increasing responsibility, culminating as Director of Finance for its wholesale and mass distribution channels. From 1992 through September 2001, he was employed by United Parcel Service in varied positions, mostly related to accounting operations and project finance management. Mr. James received a BA from Mississippi College and an MBA from Cumberland University. |

| | | |

Board of Directors and Committees of the Board of Directors

Our business is managed under the direction of our board of directors. The board consists of a single class of directors who are elected for a term of one year, such term beginning and ending at each annual meeting of stockholders.

The Board of Directors currently has an Audit Committee and a Compensation Committee.

The Audit Committee currently consists of Robert F. Doherty (Chair), Donald G. Norris and Robert S. Picow. The Board of Directors has determined that each member of the Audit Committee meets the American Stock Exchange definition of “independent” for audit committee purposes. The Board of Directors has also determined that Mr. Doherty meets the SEC definition of an “audit committee financial

expert.” The committee operates under a written charter, which is attached to this proxy statement as Annex A. As more fully described in its charter, the functions of the audit committee include the following:

| · | appointment of independent auditors, determination of their compensation and oversight of their work; |

| · | review the arrangements for and scope of the audit by independent auditors; |

| · | review the independence of the independent auditors; |

| · | consider the adequacy and effectiveness of the internal controls over financial reporting; |

| · | pre-approve audit and non-audit services; |

| · | establish procedures regarding complaints relating to accounting, internal accounting controls, or auditing matters; |

| · | review and approve any related party transactions; and |

| · | discuss with management and the independent auditors our draft quarterly interim and annual financial statements and key accounting and reporting matters. |

The Compensation Committee currently consists of Robert F. Doherty, Elliot J. Kerbis and Donald G. Norris. The Board of Directors has determined that each member of the Compensation Committee meets the American Stock Exchange definition of “independent” for compensation committee purposes. The Compensation Committee is responsible for approving the compensation for the Company’s chief executive officer and, in consultation with the Company’s chief executive officer, approving the compensation of other executive officers. See “Report of the Compensation Committee” below. The Compensation Committee also administers the Company’s 2005 Stock Incentive Plan.

Each committee has the power to engage independent legal, financial or other advisors, as it may deem necessary, without consulting or obtaining the approval of the Board of Directors or any officer of the Company.

Meetings of the Board of Directors and Committees

During our fiscal year ended June 30, 2006, our board of directors held two meetings, our audit committee held one meeting and our compensation committee held no meetings. Each director attended all of the meetings of our board of directors and all of the meetings held by committees on which such director served.

Independence of Majority of Board of Directors

Our board of directors has determined that each of our non-employee directors (Messrs. Norris, Doherty, Kerbis and Picow), who collectively constitute a majority of our board of directors, meets the general independence criteria set forth in the rules of the American Stock Exchange.

Director Nominations and Qualifications

Our board of directors has determined that director nominees should be selected, or recommended for our board’s selection, by a majority of independent directors voting alone. As such, the board has no

nominating committee. The board does not currently have a charter with regard to the nomination process.

Historically, we have not received recommendations from our stockholders and the costs of establishing and maintaining procedures for the consideration of stockholder nominations would be unduly burdensome. Consequently, at this time, we do not have a formal policy with regard to the consideration of any director nominees recommended by our stockholders. However, any recommendations received from stockholders will be evaluated in the same manner that potential nominees recommended by board members, management or other parties are evaluated. Any stockholder nominations proposed for consideration should include the nominee’s name and qualifications for board membership and should be addressed to: Mr. Lawrence Burstein, Chairman, American Telecom Services, Inc., 2466 Peck Road, City of Industry, California 90601. We do not intend to treat stockholder recommendations in any manner different from other recommendations.

When considering a potential candidate, our independent directors will take into consideration such factors as it deems appropriate, including the following:

| · | the appropriate size of the board, |

| · | the needs of our company with respect to the particular talents and experience of our directors, |

| · | the knowledge, skills and experience of nominees, including experience at the policy-making level in technology, business, finance, administration or public service, in light of prevailing business conditions, the knowledge, skills and experience already possessed by other members of our board and the highest professional and personal ethics and values, |

| · | minimum individual qualifications, including strength of character, mature judgment, familiarity with the business and industry of our company, independence of thought and an ability to work collegially, |

| · | experience with accounting rules and practices, |

| · | principles of diversity, |

| · | appreciation of the relationship of our business to the changing needs of society, and |

| · | the desire to balance the considerable benefit of continuity with the periodic injection of the fresh perspective provided by new members. |

We do not currently employ an executive search firm, or pay a fee to any other third party, to locate qualified candidates for director positions.

Code of Ethics

Our board of directors unanimously adopted a Code of Ethics applicable to our principal executive officer, principal financial officer, principal accounting officer and our other employees and employees of our subsidiaries. The Code of Ethics is available on the SEC’s website at www.sec.gov.

Stockholder Communication with Board Members

We maintain contact information for stockholders, both telephone and email, on our website under the heading “Our Company¾Contact Us.” By following the “Contact Us” link, a stockholder will be given access to our telephone number and mailing address, as well as links for providing email correspondence both to us and to our investor relations group. Communications specifically marked as a communication for our board of directors will be forwarded to the board or specific members of the board as directed in the stockholder communication. In addition, communications sent directly to us via telephone, facsimile or email for our board of directors will be forwarded to the board by an officer.

Board Member Attendance at Annual Meetings

Our board of directors does not have a formal policy regarding attendance of directors at our annual stockholder meetings. This annual meeting of stockholders will be our first annual meeting as a public company.

REPORT OF THE AUDIT COMMITTEE

The committee has adopted a written charter that has been approved by the Company’s board of directors. A copy of the charter is attached to this proxy statement as Annex A.

Management has the primary responsibility for the financial statements, for maintaining effective internal control over financial reporting and for assessing the effectiveness of internal control over financial reporting. The independent auditors are responsible for auditing those financial statements in accordance with standards of the Public Company Accounting Oversight Board (United States) and to issue a report thereon. The committee’s responsibility is to oversee the financial reporting process on behalf of the board of directors and to report the result of their activities to the board of directors.

The committee has implemented procedures to ensure that during the course of each fiscal year it devotes the attention that it deems necessary or appropriate to each of the matters assigned to it under the committee’s charter. To carry out its responsibilities, the committee met one time during our fiscal year ended June 30, 2006.

In overseeing the preparation of the Company’s financial statements, the committee met with both the Company’s management and its independent registered public accounting firm to review and discuss its audited financial statements prior to their issuance and to discuss significant accounting issues, including its judgments as to the quality, not just the acceptability, of the Company’s accounting principles. The Company’s management advised the committee that all financial statements were prepared in accordance with generally accepted accounting principles, and the committee discussed the statements with both management and independent auditors. The committee’s review included discussion with the independent auditors of matters required to be discussed pursuant to Statement on Auditing Standards No. 61, as amended (Communication with Audit Committees), other standards of the Public Company Accounting Oversight Board (United States), rules of the Securities and Exchange Commission, and other applicable regulations.

The committee also reviewed management’s report on its assessment of the effectiveness of the Company’s internal control over financial reporting and the independent auditors’ report on management’s assessment and the effectiveness of the Company’s internal control over financial reporting.

With respect to the Company’s independent registered public accounting firm, the committee, among other things, discussed with BDO Seidman, LLP, matters relating to its independence, including the disclosures made to the committee as required by the Independence Standards Board Standard No. 1 (Discussions with Audit Committee) and considered the compatibility of non-audit services with the independent registered public accounting firm’s independence.

On the basis of these reviews and discussions, the committee recommended to the Company’s board of directors, and the board has approved, the Company’s audited financial statements and management’s assessment of the effectiveness of the Company’s internal control over financial reporting be included in its Annual Report on Form 10-K for the fiscal year ended June 30, 2006 for filing with the Securities and Exchange Commission.

| November 20, 2006 | Audit Committee of the Board of Directors Robert F. Doherty, Chairman Donald G. NorrisRobert S. Picow |

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL

OWNERS AND MANAGEMENT

The following table sets forth certain information, as of November 20, 2006, with respect to the beneficial ownership of shares of our common stock held by: (i) each director; (ii) each person known by us to beneficially own 5% or more of our common stock; (iii) each named executive officer; and (iv) all directors and executive officers as a group. Unless otherwise indicated, the address for each securityholder is c/o American Telecom Services Inc., 2466 Peck Road, City of Industry, California 90601.

Name and Address of Beneficial Owner | Number of Shares of Common Stock Beneficially Owned (1) | Percent of Class |

Lawrence Burstein 245 Fifth Avenue Suite 1600 New York, New York 10016 | 206,565(2) | 3.1% |

| | | |

| Bruce Hahn | 797,900(3) | 12.3% |

| | | |

| Adam Somer | 220,000(4) | 3.4% |

| | | |

| Yu Wen Ching | 674,000(5) | 10.4% |

| | | |

| Robert F. Doherty | 10,000(6) | * |

| | | |

| Elliott J. Kerbis | 10,000(6) | * |

| | | |

| Donald G. Norris | 10,000(6) | * |

| | | |

| Robert S. Picow | 26,000(7) | * |

| | | |

I NET Financial Management, Ltd. No. 17-1, Alley 3, Lane 217 Chung Hsiao E. Road Sec. 3, Taipei, Taiwan, R.O.C. | 674,000(8) | 10.4% |

| | | |

Jack Silver 660 Madison Avenue New York, New York 10021 | 580,000(9) | 8.5% |

| | | |

The Future, LLC 417 Lucy Street Henderson, Nevada 89015 | 361,000(10) | 5.6% |

| | | |

| All current executive officers, directors as a group (9 persons) | 1,280,465(11) | 19.1% |

| | |

* Less than 1%.

| (1) | As used in this table, beneficial ownership means the sole or shared power to vote, or direct the voting of, a security, or the sole or shared power to invest or dispose, or direct the investment or disposition, of a security. Except as otherwise indicated, based on information provided by the named individuals, all persons named herein have sole voting power and investment power with respect to their respective shares of our common stock, except to the extent that authority is shared by spouses under applicable law, and record and beneficial ownership with respect to their respective shares of our common stock. With respect to each securityholder, any shares issuable upon exercise of options and warrants held by such securityholder that are currently exercisable or will become exercisable within 60 days of November 20, |

| | 2006 are deemed outstanding for computing the percentage of the person holding such options, but are not deemed outstanding for computing the percentage of any other person. |

| (2) | Includes 38,000 shares of common stock owned by Unity Venture Capital Associates Ltd., of which Mr. Burstein is President. Also includes 58,333 shares of common stock issuable upon exercise of warrants. Does not include 25,000 shares of common stock issuable upon exercise of options and 50,000 shares of common stock that are the subject of PARS, which options and common stock will not vest within 60 days of November 20, 2006. |

| (3) | Includes 674,000 shares of common stock owned by I NET Financial Management, Ltd., which is 51% owned by Mr. Ching and 49% owned by Mr. Hahn. Each disclaims beneficial ownership of the other’s interest. Also includes 120,000 shares held by BLA Opportunities LLC, which is controlled by Bruce Hahn’s wife for the benefit of Mr. Hahn’s adult and minor children. Mr. Hahn disclaims any beneficial ownership in these shares. Does not include 25,000 shares of common stock issuable upon exercise of options and 75,000 shares of common stock that are the subject of PARS, which options and common stock will not vest within 60 days of November 20, 2006. |

| (4) | Does not include 25,000 shares of common stock issuable upon exercise of options and 50,000 shares of common stock that are the subject of PARS, which options and common stock will not vest within 60 days of November 20, 2006. |

| (5) | Includes 674,000 shares of common stock owned by I NET Financial Management, Ltd., which is 51% owned by Mr. Ching and 49% owned by Mr. Hahn. Each disclaims beneficial ownership of the other’s interest. Does not include 25,000 shares of common stock issuable upon exercise of options and 50,000 shares of common stock that are the subject of PARS, which options and common stock will not vest within 60 days of November 20, 2006. |

| (6) | Reflects 10,000 shares of common stock issuable upon exercise of options. Does not include 15,000 shares of common stock issuable upon exercise of options, which will not vest within 60 days of November 20, 2006. |

| (7) | Includes 10,000 shares of common stock issuable upon exercise of options and 8,000 shares of common stock issuable upon exercise of warrants. Does not include 15,000 shares of common stock issuable upon exercise of options, which will not vest within 60 days of November 20, 2006. |

| (8) | I NET Financial Management, Ltd. is 51% owned by Yu Wen Ching, our President of Manufacturing and Sourcing, and 49% owned by Bruce Hahn, our Chief Executive Officer. Each disclaims beneficial ownership of the other’s interest. |

| (9) | Based on information contained in a Schedule 13G filed by Jack Silver on February 10, 2006, such shares of common stock include (i) 290,000 shares held by Sherleigh Associates Inc. Defined Benefit Pension Plan, a trust of which Mr. Silver is the trustee, and (ii) warrants to purchase 290,000 shares held by Sherleigh. The Schedule 13G states that Mr. Silver has the sole voting and dispositive power with respect to all 580,000 shares. |

| (10) | Does not include 25,000 shares of common stock issuable upon exercise of options and 50,000 shares of common stock that are the subject of PARS, which options and common stock will not vest within 60 days of November 20, 2006. The Future, LLC is wholly-owned by Tonda Mullis. |

| (11) | Includes 40,000 shares of common stock issuable upon exercise of options and 66,333 shares of common stock issuable upon exercise of warrants. Does not include 215,000 shares of common stock issuable upon exercise of options and 300,000 shares of common stock that are the subject of PARS, which options and common stock will not vest within 60 days of November 20, 2006. |

EXECUTIVE COMPENSATION

Report of the Compensation Committee

Compensation Philosophy

We believe that executive compensation should:

| · | provide motivation to achieve strategic goals by tying executive compensation to our performance, as well as affording recognition to individual performance; |

| · | provide compensation reasonably comparable to that offered by other technology development companies and communications hardware and services companies; and |

| · | align the interests of executive officers with the long-term interests of our stockholders through the award of equity purchase opportunities. |

Our compensation philosophy is designed to encourage and balance the attainment of short-term compensation goals, as well as the implementation and realization of long-term strategic initiatives. As greater responsibilities are assumed by an executive officer, a larger portion of compensation is “at risk.” This philosophy is intended to apply to all management.

Compensation Program

Compensation for our executive officers is determined in accordance with such officer’s respective employment agreement and based on each individual’s sustained performance, the achievement of our research and development milestones, production program and commercialization goals and our then-projected capital requirements for the year. These employment agreements were entered into upon consummation of our initial public offering on February 6, 2006.

Our executive compensation program is determined, or is recommended for our board’s determination, by our compensation committee, which was formed on February 6, 2006. This program has three major components: base salary, short-term incentive bonus payments and long-term equity incentives.

Individual compensation reviews for all executive officers, including our Chief Executive Officer, are conducted from time to time, depending on the expiration or renewal dates of employment or consulting agreements with our executive officers. We do not assign specific weighting factors when measuring performance; rather, subjective judgment and discretion are exercised in light of our overall compensation philosophy.

Base salary and compensation, as well as short-term incentive bonus payments, are determined by evaluating individual responsibility levels and individual performance.

Our board of directors believes that executive officers, including our Chief Executive Officer, who are in a position to make a substantial contribution to our long-term success and to build stockholder value should have a significant equity stake in our ongoing success. Accordingly, one of our principal motivational methods has been the award of stock options and performance accelerated restricted stock (PARS) which vests only if certain net sales and net profits are achieved. In addition to financial benefits to executive officers, if the price of our common stock during the term of any such option increases beyond such option’s exercise price, the program also creates an incentive to remain with us since options generally vest and become exercisable at least one year after the date of grant.

Our compensation committee and our board of directors as a whole will continue to review our compensation programs to assure such programs are consistent with the objective of increasing stockholder value.

| November 20, 2006 | Compensation Committee of the Board of Directors Robert F. Doherty Elliott J. Kerbis Donald G. Norris |

Summary Compensation

No cash compensation was paid, or accrued to or for the benefit of, our executive officers prior to June 1, 2005. Accruals for compensation of our executive officers began on June 1, 2005.

The following table sets forth information for the fiscal year ended June 30, 2006 concerning compensation we paid to our Chief Executive Officer and our other executive officers whose total annual salary and bonus exceeded $100,000 for the year ended June 30, 2006.

| | | | | Annual Compensation | | Long-Term Compensation Awards | | | | | |

| Name and Principal Position | | Fiscal Year | | Salary($) | | Bonus($) | | Other Annual Compen- sation($) | | Restricted Stock Awards ($)(a) | | Number of Shares Underlying Options(#) | | LTIP Payouts ($)(a) | | All Other Compen- sation($) | |

| Bruce Hahn | | 2006 | | $ | 170,830 | | $ | — | | $ | 26,464 | | $ | — | | | 25,000 | | $ | — | | $ | — | |

| Chief Executive Officer | | 2005 | | $ | — | | $ | — | | $ | — | | $ | — | | | — | | $ | — | | $ | — | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Bruce Layman | | 2006 | | $ | 100,655 | | $ | — | | $ | 4,900 | | $ | — | | | 25,000 | | $ | — | | $ | — | |

| Chief Operating Officer and Chief Financial Officer | | 2005 | | $ | — | | $ | — | | $ | — | | $ | — | | | — | | $ | — | | $ | — | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Adam Somer | | 2006 | | $ | 116,246 | | $ | — | | $ | 6,000 | | $ | — | | | 25,000 | | $ | — | | $ | — | |

| President of Communications Services | | 2005 | | $ | — | | $ | — | | $ | — | | $ | — | | | — | | $ | — | | $ | — | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Yu Wen Ching | | 2006 | | $ | 130,000 | | $ | — | | $ | — | | $ | — | | | 25,000 | | $ | — | | $ | — | |

| President of Manufacturing and Sourcing | | 2005 | | $ | — | | $ | — | | $ | — | | $ | — | | | — | | $ | — | | $ | — | |

| _____________________ | | | | | | | | | | | | | | | | | | | | | | | | |

| (a) | As of June 30, 2006 an aggregate of 225,000 shares of performance based accelerate stock (“PARS”) were outstanding to the executive officers included herein. The aggregate value of such awards was $1,057,000 as of the date of grant and $753,750 as of June 30, 2006. The PARS will vest upon the achievement, if ever, of certain performance targets. |

Option Grants in Last Fiscal Year

The following table shows the stock option grants made to the executive officers named in the Summary Compensation Table during the fiscal year ended June 30, 2006:

Name | | Number of Shares of Common Stock Underlying Options Granted | | Percent of Total Options Granted to Employees In Fiscal Year | | Exercise Price (1) | | Expiration Date |

| Bruce Hahn | | 25,000 | | 18.5% | | $5.05 | | 2/6/11 |

| Bruce Layman | | 25,000 | | 18.5% | | $5.05 | | 2/6/11 |

| Adam Somer | | 25,000 | | 18.5% | | $5.05 | | 2/6/11 |

| Yu Wen Ching | | 25,000 | | 18.5% | | $5.05 | | 2/6/11 |

| (1) | Options were granted at an exercise price equal to the fair market value of our common stock, as determined by the closing sales price. |

Fiscal Year End Option Values

The following table shows information with respect to unexercised stock options held by the executive officers named in the Summary Compensation Table as of June 30, 2006. No options held by such individuals were exercised during the fiscal year ended June 30, 2006.

| | | Number of Securities Underlying Unexercised Options at Fiscal Year-End | | Value of Unexercised In-The-Money Options at Fiscal Year-End | |

Name | | | Exercisable | | | Unexercisable | | | Exercisable | | | Unexercisable | |

| Bruce Hahn | | | — | | | 25,000 | | $ | — | | $ | — | |

| Bruce Layman | | | — | | | 25,000 | | $ | — | | $ | — | |

| Adam Somer | | | — | | | 25,000 | | $ | — | | $ | — | |

| Yu Wen Ching | | | — | | | 25,000 | | $ | — | | $ | — | |

Equity Compensation Plan Information

The following table provides information as of June 30, 2006 about our common stock that may be issued upon exercise of options, warrants and rights under all of our existing equity compensation plans.

Plan Category | | Number of Shares of Common Stock to be Issued upon Exercise Of Outstanding Options, Warrants and Rights | | Weighted-Average Exercise Price of Outstanding Options, Warrants and Rights | | Number of Shares of Common Stock Remaining Available for Future Issuance under Equity Compensation Plans (Excluding Common Stock Reflected in First Numerical Column) | |

| Equity compensation plans approved by security holders: | | | | | | | |

| 2005 Stock Option Plan | | | 565,000* | | | 4.79 | | | 35,000 | |

| Equity compensation plans not approved by security holders: | | | — | | | — | | | — | |

| Total: | | | 565,000 | | | 4.79 | | | 35,000 | |

_______________

| * | Represents (i) options to purchase 240,000 shares of common stock and (ii) 325,000 unvested performance accelerated restricted stock. |

Employment Agreements

We have entered into employment agreements with each of Messrs. Hahn, Layman, Somer and Ching, each of which expires on December 31, 2007. We have also entered into an employment agreement with Edward James which expires on December 31, 2008. Messrs. Hahn, Layman, Somer, Ching and James are paid monthly on the basis of the following annualized base salaries:

| Bruce Hahn | | $ | 230,000 | |

| Bruce Layman | | $ | 137,500 | |

| Adam Somer | | $ | 137,500 | |

| Yu Wen Ching | | $ | 158,400 | |

| Edward James | | $ | 135,000 | |

| | | | | |

Messrs. Hahn, Layman, Somer and Ching are entitled to the following bonuses based on our net sales (defined as our revenues collected during a period less allowances granted to retailers, markdowns, discounts, commissions, reserves for service outages, customer hold backs and expenses):

| · | one percent of the amount by which our net sales for our fiscal year ending June 30, 2007 exceeds our net sales during our fiscal year ended June 30, 2006; and |

| · | one percent of the amount by which our net sales for our six-month fiscal period ending December 31, 2007 exceeds our net sales during our six-month fiscal period ended June 30, 2007. |

Mr. James will be entitled to the following bonuses based on our net sales:

| · | one percent of the amount by which our net sales for each of our fiscal years ending June 30, 2007 and June 30, 2008 exceeds our net sales during our fiscal years ended June 30, 2006 and ending June 30, 2007, respectively; and |

| · | one percent of the amount by which our net sales for our six-month fiscal period ending December 31, 2008 exceeds our net sales during our six-month fiscal period ending December 31, 2007. |

The bonuses described above will be limited to an amount no greater than 75% of each recipient’s then current annual base salary or, in the case of the six-month period ending December 31, 2007, the base salary during such period.

Messrs. Hahn, Layman, Somer and Ching will also be entitled to the following bonuses based on our net profits (defined as our net income, after taxes, as determined in accordance with GAAP):

| · | one percent of our net profits for our fiscal year ending June 30, 2007; and |

| · | one percent of our net profits for the six-month period ended December 31, 2007. |

Mr. James will be entitled to the following bonuses based on our net profits:

| · | one percent of our net profits for each of our fiscal years ending June 30, 2007 and June 30, 2008, respectively; and |

| · | one percent of our net profits for our six-month fiscal period ending December 31, 2008. |

These employment agreements further provide that Mr. Hahn’s aggregate bonuses from net sales and net profits for any bonus period will in no event exceed 150% of his base salary during such period, each of Messrs. Layman, Somer and Ching’s aggregate bonuses from net sales and net profits for any bonus period will in no event exceed 112% of his base salary during such period, and Mr. James’ aggregate bonuses from net sales and net profits for any bonus period will in no event exceed 75% of his base salary during such period, respectively.

No bonuses were earned by any of our executive officers during or related to our operating results during our fiscal year ended June 30, 2006.

Directors’ Compensation

Mr. Burstein is paid $80,000 per year in his capacity as chairman of the board of directors.

Directors who are not employees receive $1,250 (plus reimbursement for travel expenses) for each board of directors meeting attended in person and $500 for each board of directors meeting attended telephonically. Upon the commencement of his term, each non-employee director received a grant of options to purchase 15,000 shares of our common stock at an exercise price equal to not less than the fair market value per share of our common stock at the time of grant. Thereafter, each such director receives quarterly during his term as a director grants of options to purchase 5,000 shares of our common stock at an exercise price per share equal to not less than the fair market value per share of our common stock at the time of grant. All directors’ options vest in their entirety on the first anniversary of their respective grant dates.

Compensation Committee Interlocks and Insider Participation

Robert F. Doherty, Elliott J. Kerbis and Donald G. Norris, all of whom are independent members of our board, comprise the compensation committee of our board of directors. Our compensation committee has responsibility for compensation of our executive officers and directors, including the grant of stock options.

Section 16(a) Beneficial Ownership of Reporting Compliance

Section 16(a) of the Exchange Act requires our directors and executive officers and persons who own beneficially more than 10% of our common stock to file reports of ownership and changes in ownership of such common stock with the SEC, and to file copies of such reports with us.

Based solely upon a review of the copies of such reports filed with us, we believe that during the year ended June 30, 2006 such reporting persons complied with the filing requirements of said Section 16(a), except that each of Bruce Hahn; Bruce Layman; Adam Somer; Yu Wen Ching; Robert F. Doherty; Elliott J. Kerbis; Donald G. Norris; I NET Financial Management, Ltd. and The Future, LLC did not file on a timely basis his or its respective Form 3.

Each of the delinquent Form 3s were subsequently filed with the SEC.

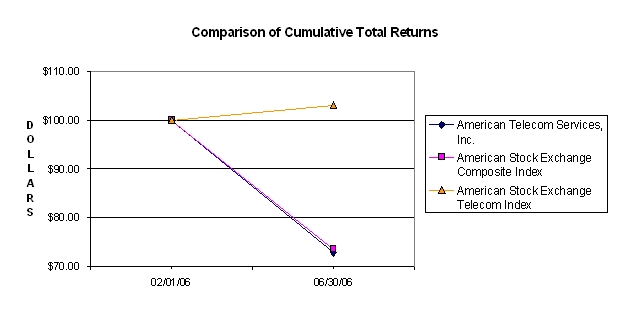

Performance Graph

The graph below compares the annual performance of our common stock with the performance of the American Stock Exchange Composite Index and the American Stock Exchange Telecom Index from February 1, 2006, the date our common stock commenced trading on the American Stock Exchange, through June 30, 2006. The performance graph assumes that an investment of $100 was made in our common stock and in each index on February 1, 2006, and that all dividends, if any, were reinvested.

| | | 2/1/06 | | 6/30/06 | |

| American Telecom Services, Inc. | | $ | 100.00 | | $ | 72.83 | |

American Stock Exchange Composite Index(1) | | $ | 100.00 | | $ | 73.55 | |

| American Stock Exchange Telecom Index | | $ | 100.00 | | $ | 103.07 | |

We believe that the foregoing information provided has only limited relevance to an understanding of our compensation policies during the indicated periods and does not reflect all matters appropriately considered in developing our compensation strategy. In addition, the stock price performance shown on the graph is not necessarily indicative of future price performance.

CERTAIN RELATIONSHIPS

Mr. Burstein, our Chairman of the Board, purchased $25,000 principal amount of our 6% notes and $37,500 principal amount of our 8% notes in our 2005 private placements, and also received an aggregate of 58,333 private warrants in connection with such purchases. Mr. Burstein paid the same purchase price as all other investors in the private placements and received identical registration rights with respect to his securities.

Certain marketing services are being provided to us by Future Marketing, whose sole stockholder is also the sole stockholder of The Future, LLC, which owns 5.6% of our stock. Future Marketing, among other things, assists in the development and execution of our marketing plans, manages our accounts, assists in our product development and handles our back-office vendor functions. As compensation for its services, Future Marketing is paid monthly on the basis of an annualized base of $184,800 through December 31, 2007.

Future Marketing will be entitled to the following supplemental fees based on our net sales (defined as our revenues collected during a period less allowances granted to retailers, markdowns, discounts, commissions, reserves for service outages, customer hold backs and expenses):

| · | one percent of the amount by which our net sales for our fiscal year ending June 30, 2007 exceeds our net sales for our fiscal year ended June 30, 2006; and |

| · | one percent of the amount by which our net sales for our six-month fiscal period ending December 31, 2007 exceeds our net sales during the six-month period ended June 30, 2007. |

The fees described above for any period will be limited to an amount no greater than 75% of Future Marketing’s base fees paid during such period.

Future Marketing will also be entitled to the following supplemental fees based on our net profits (defined as our net income, after taxes, as determined in accordance with GAAP):

| · | one percent of our net profits for our fiscal year ending June 30, 2007; and |

| · | one percent of our net profits for our six-month fiscal period ending December 31, 2007. |

In no event may the aggregate supplemental fees paid to Future Marketing from net sales and net profits during any period described above exceed 112% of the base fees paid during such period.

No supplemental fees were earned by Future Marketing during or related to our operating results for our fiscal year ended June 30, 2006.

Future Marketing has received 25,000 options and 50,000 PARS pursuant to our 2005 stock option plan.

We have entered into a five-year agreement with David Feuerstein, a stockholder of our company, pursuant to which, in consideration for helping to establish our service provider relationship with IDT and, going forward, maintaining and expanding our relationships with each of IDT and SunRocket, we will pay him one quarter of one percent of all net revenues collected by us during each year of the term of the agreement directly attributable to the sale of (i) digital cordless multi-handset phone systems, (ii) multi-handset VOIP telephones and (iii) related telephone hardware components ((i), (ii) and (iii), collectively, “Hardware”), subject to a maximum aggregate amount of $250,000 for such

year. Under our agreement, such net revenues mean our gross amounts of billing on Hardware sold to retailers less (I) sales and other taxes, postage, cost of freight and disbursements included in such bills and (II) allowances granted to such retailers including, without limitation, advertising and promotional allowances, markdowns, discounts, returns and commissions.

We will also pay to Mr. Feuerstein five percent of all net revenues collected by us from IDT Puerto Rico & Co (“IDT”) during each year of the term of and directly attributable to our service agreement dated as of November 25, 2003 with IDT (the “IDT Agreement”), subject to a maximum aggregate amount of $250,000 for such year. Under our agreement, such net revenues mean payments to which we are entitled and collect under the IDT Agreement less service provider deductions provided under our agreement including, without limitation, reserves for service outages, customer hold backs and expenses.

We will also pay to Mr. Feuerstein two percent of all net revenues collected by us from SunRocket during each year of the term of and directly attributable to our June 7, 2005 service agreement with SunRocket, subject to a maximum aggregate amount of $250,000 for such year; provided, however, that any revenues attributable under the SunRocket agreement from the provision of Internet-based communications services relating to “subscriber bounty,” “advertising co-op” and “key-city funds” are excluded in any computation of such net revenues. Under our agreement, such net revenues mean payments to us to which we are entitled from SunRocket less service provider deductions provided under the SunRocket agreement including, without limitation, reserves for service outages, customer hold backs and expenses.

Pursuant to our agreement with Mr. Feuerstein, approximately $4,600 and $0 fees were paid to him during our fiscal years ended June 30, 2006 and 2005, respectively.

Our agreement may be extended for an additional five-year term if we are profitable for three of the first five years of the initial term. If so extended, Mr. Feuerstein will be entitled to a reduced revenue sharing allocation. Our agreement also provides for certain revenue sharing allocation reductions if certain conditions are not satisfied during the initial term.

Messrs. Somer and Feuerstein are each 50% owners of a communications industry consulting firm.

All of the foregoing transactions were negotiated and entered into on an arms-length basis. We believe that the terms of these transactions are fair and reasonable to our company and no less favorable to us than could have been obtained in an arms-length transaction with non-affiliates.

INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

The audit committee of our board of directors has appointed BDO Seidman, LLP, Independent Registered Public Accounting Firm, as our independent auditor for our fiscal year ending June 30, 2007. We expect a representative of our independent auditors to attend the 2006 Annual Meeting of Stockholders. Such representative will have an opportunity to make a statement if he or she desires to do so and will be available to respond to appropriate questions.

Professional Services Fees

Fees for professional services provided by our independent auditors in each of the last two fiscal years, in each of the following categories are as follows:

| | | Year Ended June 30, | |

| | | 2006 | | 2005 | |

| Audit fees | | $ | 247,000 | | $ | 38,000 | |

| Audit-related fees | | | — | | | — | |

| Tax fees | | | — | | | — | |

| All other fees | | | — | | | — | |

| Total | | $ | 247,000 | | $ | 38,000 | |

Audit fees include fees associated with the annual audit, the reviews of our quarterly reports on Form 10-Q, assistance with and review of documents filed with the Securities and Exchange Commission and comfort letters.

The audit committee has adopted a policy that requires advance approval of all audit, audit-related, tax and other services performed by the independent auditor. The policy provides for pre-approval by the audit committee of specifically defined audit and non-audit services. Unless the specific service has been previously pre-approved with respect to that year, the audit committee must approve the permitted service before the independent auditor is engaged to perform it.

ANNUAL REPORT

Our Annual Report on Form 10-K for our fiscal year ended June 30, 2006 is being mailed to stockholders together with this proxy statement. We will provide without charge to each of our stockholders, upon the written request of any such stockholder, a copy of such Annual Report, exclusive of exhibits. Written requests for such Form 10-K should be sent to Mr. Edward James, Chief Financial Officer, American Telecom Services, Inc., 2466 Peck Road, City of Industry, California 90601.

2007 STOCKHOLDER PROPOSALS

Stockholders are entitled to submit proposals on matters appropriate for stockholder action consistent with regulations of the Securities and Exchange Commission. In order for stockholder proposals for our 2007 Annual Meeting of Stockholders to be eligible for inclusion in our proxy statement, they must be received by us at our principal executive offices not later than July 25, 2007.

OTHER MATTERS

Our board of directors knows of no other matters to be brought before the meeting. However, if other matters should come before the meeting, it is the intention of each person named in the proxy to vote such proxy in accordance with his or her judgment on such matters.

EXHIBIT A

AMERICAN TELECOM SERVICES, INC.

______________________

Audit Committee Charter

______________________

Organization. This charter governs the operations of the Audit Committee (the “Committee”) of American Telecom Services, Inc. (the “Company”). The Committee shall review and reassess the charter at least annually and recommend any changes to the charter to the full Board of Directors of the Company (the “Board”). The Committee shall be comprised of at least three directors determined by the Board to meet the independence and financial literacy requirements of the American Stock Exchange and applicable federal law. Appointment to the Committee, including the designation of the Chair of the Committee and designation of any Committee members as “audit committee financial experts,” shall be made on an annual basis by the full Board.

Statement of Policy. The Committee’s purpose is to represent and provide assistance to the Board in fulfilling its oversight responsibility to the stockholders, potential stockholders, the investment community and others of the Company’s accounting and financial reporting processes and the audits of the Company’s financial statements. In so doing, it is the responsibility of the Committee to maintain free and open communication between the Committee, the auditors and management of the Company. In discharging its oversight role, the Committee is empowered to investigate any matter brought to its attention with full access to all books, records, facilities and personnel of the Company. The Committee shall have the authority to engage independent legal, accounting and other advisers, as it determines necessary to carry out its duties. The Committee shall have sole authority to approve related fees and retention terms of such advisers.

Responsibilities and Processes. The primary responsibility of the Committee is to oversee the Company’s financial reporting process on behalf of the Board and report the results of its activities to the Board. Management is responsible for preparing the Company’s financial statements, and the independent auditors are responsible for auditing those financial statements. The Committee in carrying out its responsibilities believes its policies and procedures should remain flexible, in order to best react to changing conditions and circumstances. The Committee should take the appropriate actions to set the overall corporate “tone” for quality financial reporting, sound business risk practices, and ethical behavior.

The following shall be the principal recurring processes of the Committee in carrying out its oversight responsibilities. The processes are set forth as a guide with the understanding that the Committee may supplement them as appropriate.

| · | The Committee shall have a clear understanding with management and the independent auditors that the independent auditors are ultimately accountable to the Board and the Committee, as representatives of the Company’s stockholders. |

| · | The Committee shall be directly responsible for the appointment, compensation, retention and oversight of the work of the independent auditors (including resolution of disagreements between management and the independent auditors regarding financial reporting). The independent auditors shall report directly to the Committee. |

| · | The Committee shall ensure receipt from the independent auditors of a formal written statement delineating all relationships between such independent auditors and the Company or any other relationships that may adversely affect their independence, and, based on such review, shall assess their independence consistent with Independence Standards Board Standard No. 1, as may be modified or supplemented. The Committee shall actively engage in a dialogue with the independent auditors with respect to any disclosed relationships or services that may impact their objectivity and independence and take, or recommend that the Board take, appropriate action to oversee the independence of the independent auditors. |

| · | Annually, the Committee will review the experience and qualifications of the key members of the independent auditors and the independent auditors’ quality control procedures. |

| · | The Committee shall review and pre-approve all audit services and all permissible non-audit services. The Committee may delegate the authority to grant pre-approvals to one or more designated members of the Committee with any such pre-approval reported to the Committee at its next regularly scheduled meeting. |

| · | The Committee shall establish procedures for the receipt, retention and treatment of complaints received by the Company regarding accounting, internal accounting controls, or auditing matters, and the confidential, anonymous submission by employees of concerns regarding questionable accounting or auditing matters. |

| · | The Committee shall discuss with the auditors the overall scope and plans for their audits including the adequacy of staffing and compensation. Also, the Committee shall discuss with management and the auditors the adequacy and effectiveness of the accounting and financial controls, including the Company’s system to monitor and manage business risk, and legal and ethical compliance programs. Further, the Committee shall meet separately with the auditors, with and without management present, to discuss the results of their examinations and any report prepared by the auditors and delivered to the Committee. |

| · | The Committee shall review and discuss with management and the independent auditors (a) any material financial or non-financial arrangements of the Company that do not appear on the financial statements of the Company, and (b) any transaction with parties related to the Company. |

| · | The Committee shall review the interim financial statements with management and the independent auditors prior to the filing of the Company’s Quarterly Reports on Form 10-Q. Also, the Committee shall discuss the results of the quarterly review and any other matters required to be communicated to the Committee by the independent auditors under generally accepted auditing standards. The Chair of the Committee may represent the entire Committee for the purposes of this review. |

| · | The Committee shall review with management and the independent auditors the financial statements to be included in the Company’s Annual Report on Form 10-K (or the annual report to stockholders if distributed prior to the filing of the Form 10-K), including their judgment about the quality, not just acceptability, of accounting principles, the reasonableness of significant judgments, and the clarity of the disclosures in the financial statements. Also, the Committee shall discuss the results of the annual audit and any other matters required to be communicated to the Committee by the independent auditors under generally accepted auditing standards. |

AMERICAN TELECOM SERVICES, INC.

2006 ANNUAL MEETING OF STOCKHOLDERS

This Proxy is Solicited on Behalf of American Telecom Services, Inc.

The undersigned hereby appoints Bruce Hahn and Lawrence Burstein as proxies, each with the power to appoint his substitute, and hereby authorizes them, and each of them, to vote all shares of common stock of American Telecom Services, Inc. (the "Company") held of record, as of the close of business on November 20, 2006, by the undersigned at the 2006 Annual Meeting of Stockholders, to be held at the offices of Sonnenschein Nath & Rosenthal LLP, 1221 Avenue of the Americas, 25th Floor, New York, New York, 10020, on Thursday, December 14, 2006 at 10:00 a.m., local time, or any adjournment or postponement thereof.

When properly executed, this proxy will be voted in the manner directed herein by the undersigned stockholder.

IF NO DIRECTION IS GIVEN, THIS PROXY WILL BE VOTED "FOR" EACH OF THE PROPOSALS SET FORTH ON THE REVERSE SIDE.

(Continued and to be Completed on Reverse Side)

| ý | | Please mark your votes as indicated in this example | | |

| | | | | |

| 1. | | Election of Directors | | The nominees for the Board of Directors are: Lawrence Burstein, Bruce Hahn, Robert F. Doherty, Elliott J. Kerbis, Donald G. Norris and Robert S. Picow |

| | | | | |

| | | FOR All Nominees o | | WITHHELD From All Nominees o |

(To withhold authority to vote for any individual nominee, write the nominee's name in the space provided below.)

| 2. | To ratify the appointment of BDO Seidman, LLP as our independent auditors the fiscal year ending June 30, 2007. |

| 3. | To transact such other business as may properly come before the meeting. |

Yes, I plan to attend the 2006 Annual Stockholders Meeting o

Please sign exactly as name appears hereon. Joint owners should each sign. When signing as attorney, executor, administrator, trustee or guardian, please give full title as such. If a corporation, please sign in full corporate name by president or other authorized officer. If a partnership, please sign in partnership name by an authorized person.

Dated:_____________________________, 2006

_________________________________________

Signature

_________________________________________

Signature

PLEASE SIGN, DATE AND RETURN THE PROXY CARD IN THE ENCLOSED ENVELOPE.