September 29, 2017

VIA EDGAR TRANSMISSION

Office of Mergers and Acquisitions

United States Securities and Exchange Commission

Division of Corporation Finance

100 F Street, N.E.

Washington, D.C. 20549

Attention: Tiffany Posil, Special Counsel

Bernard Nolan, Attorney-Adviser

| | Re: | Automatic Data Processing, Inc. (“ADP” or the “Company”) |

Revised Definitive Proxy Statement on Schedule 14A

Filed September 14, 2017 by William A. Ackman et al. (“Pershing Square”)

FileNo. 001-05397

Dear Ms. Posil:

We are writing on behalf of Pershing Square, in response to the comment of the staff (the “Staff”) of the Office of Mergers and Acquisitions of the Securities and Exchange Commission (the “Commission”) set forth in the letter dated September 20, 2017 (the “Comment Letter”), with respect to Pershing Square’s solicitation of proxies from the stockholders of the Company to elect three (3) nominees to the board of directors of the Company.

The comment of the Staff is set forth below, followed by the corresponding response.

| 1. | In the definitive proxy statement filed prior to the record date, disclosure indicates that Pershing Square intends to vote all of the shares of common stock that it beneficially owns at the record date. In the supplement to the definitive proxy statement filed on September 14, 2017, disclosure indicates that the shares of common stock beneficially owned by the Pershing Square Funds constitute approximately 8.3% of the outstanding shares of common stock of Automatic Data Processing, Inc. With a view towards revised disclosure, please confirm whether the Pershing Square Funds had the power to vote or direct the voting of all of the shares of common stock that the Pershing Square Funds beneficially owned at the record date. |

We acknowledge the Staff’s comment and respectfully advise the Staff that as of the September 8 record date:

| | • | | the Pershing Square Funds owned 8,798,442 shares of ADP common stock. Pershing Square had the power to vote or direct the voting of all of such shares as of the record date; and |

| | • | | the Pershing Square Funds owned American-style options to purchase 28,005,233 shares of ADP common stock. The options were not exercised as of the record date and accordingly Pershing Square did not have as of the record date the power to vote or direct the voting of any of the shares of common stock underlying such options. |

We acknowledge that the first sentence to which the Staff refers in its comment could have been more precise had it indicated that Pershing Square intended to vote all of the shares that it beneficially owned at the record dateand which were then capable of being voted. However, in the context of Pershing Square’s entire disclosure package, including in the definitive proxy statement filed September 5, 2017 (the “September 5 Definitive Proxy Statement”), the Supplement to Proxy Statement filed September 14, 2017 (the “September 14 Proxy Supplement”) and other filings, we believe the nature of its ownership and its voting power has been fully and clearly disclosed. To the extent there is any confusion among stockholders on this subject, it is a result of the Company’s statements that have sought to mislead stockholders regarding the size of Pershing Square’s economic interest in the Company. Pershing Square’s disclosures on this subject include the following:

| | • | | Pershing Square provided detailed information regarding the breakdown of shares beneficially owned by each Pershing Square Fund in the September 5 Definitive Proxy Statement (page 31) and the September 14 Proxy Supplement (page 3), in each case identifying, as of the date of such filing, the number of shares held by each Pershing Square Fund (i) of record, (ii) in “street name” and (iii) underlying American-style call options. As a result, we believe stockholders have been fully informed that a majority of Pershing Square’s position in ADP is in the form of options.1 |

| | • | | On page 32 of the September 5 Definitive Proxy Statement, Pershing Square unequivocally stated that “[n]one of the [American-style call] options give Pershing Square direct or indirect voting, investment or dispositive control over any securities of the Company or requires the counterparty thereto to acquire, hold, vote or dispose of any securities of the Company.” As a result, we believe stockholders were fully informed that holding American-style call options did not give the holder thereof the ability to vote the shares underlying the American-style call options. |

| 1 | In addition to Pershing Square’s explicit disclosures, Pershing Square notes that it does not believe that stockholders do not understand the difference between owning (i) shares of common stock and (ii) options to purchase common stock, which do not represent ownership of the underlying common stock and accordingly do not have voting rights. We believe this is a basic distinction that is commonly understood by market participants of nearly all levels of sophistication. |

2

| | • | | InAnnex A to the September 5 Definitive Proxy Statement, Pershing Square disclosed every transaction in the Company’s securities affected by the participants in the solicitation in the preceding two years, including the type of security (in other words, whether a transaction was a purchase of common stock or the purchase of an American-style call option) and the “trade amount” (in other words, the dollar amount of the transaction). As a result of this disclosure, we believe stockholders have a full and complete understanding of the size, form and cost of Pershing Square’s investment in ADP. |

| | • | | On both September 7, 2017 (one day before the record date) and September 15, 2017 (seven days after the record date), Pershing Square filed amendments to its Schedule 13D, each of which was required to disclose all of the transactions in ADP’s common stock or derivatives relating to the common stock that were effected by Pershing Square in the previous 60 days prior to such filing. Because no such transactions subsequent to August 30, 2017 were reported, we believe stockholders were fully informed as of the day prior to the record date, and subsequent to the record date, that Pershing Square had not exercised as of the record date the American-style call options it had disclosed in the September 5 Definitive Proxy Statement. |

| | • | | On page 19 of the September 5 Definitive Proxy Statement, Pershing Square stated that “Stockholders who sell their shares before the Record Date (or acquire them after the Record Date) may not vote such shares.” As a result, we believe stockholders were fully informed that exercises of American-style call options after the September 8 record date would not give the holder of the shares received upon exercise the ability to vote those shares at ADP’s 2017 annual meeting. |

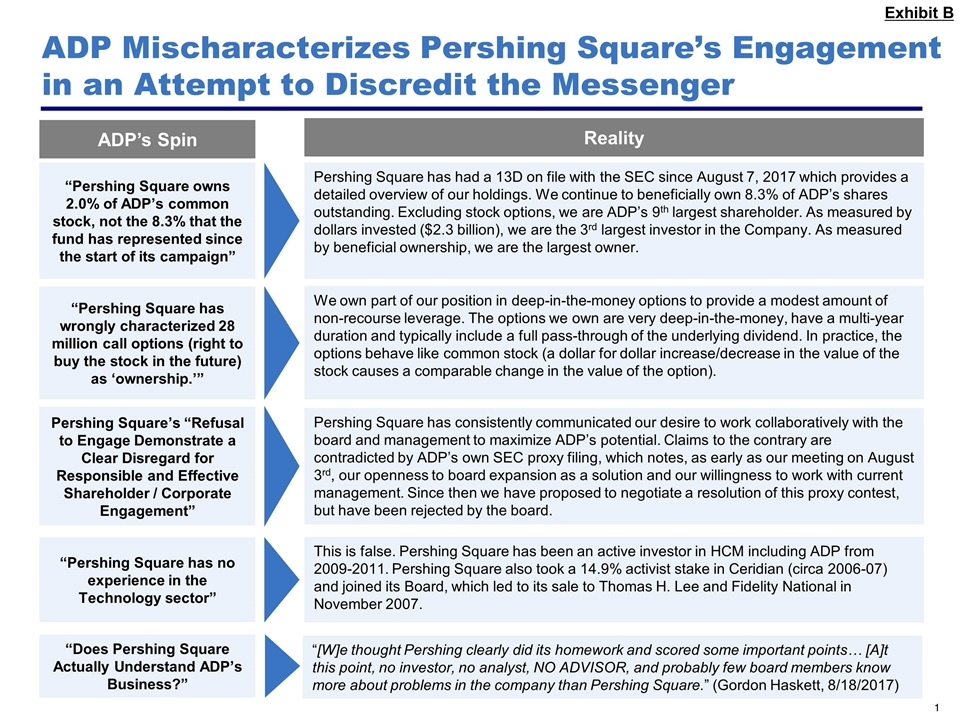

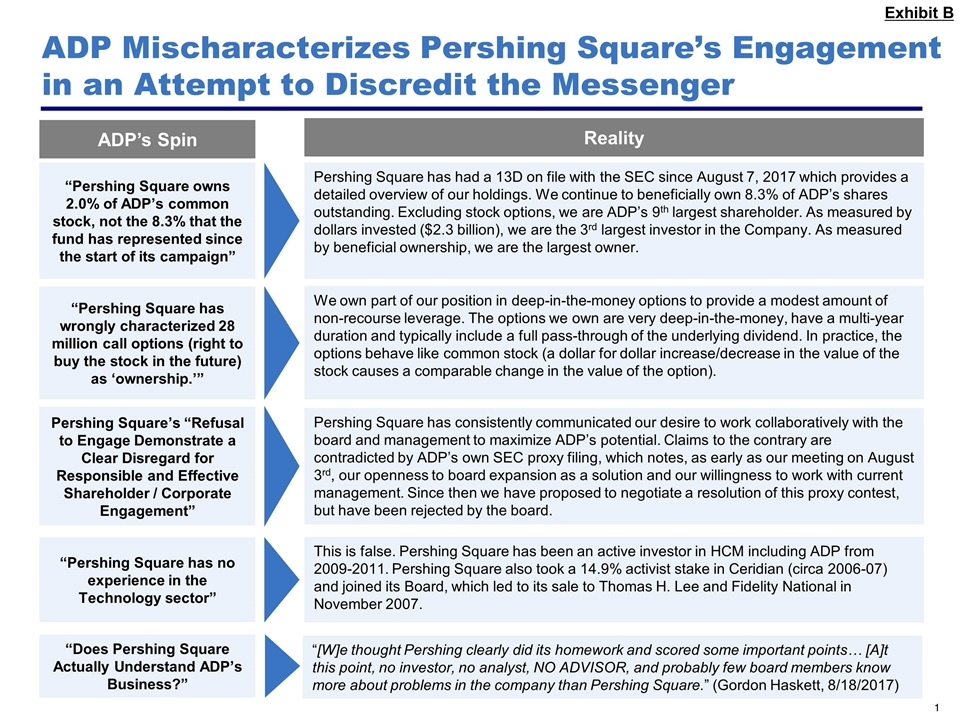

In addition, in a television interview on CNBC on September 20, 2017, Pershing Square publicly and precisely stated that it owned (i) two percent of ADP’s common stock and was able to vote only that two percent at ADP’s 2017 annual meeting and (ii) the remainder of its ADP interest in the form of stock options, which do not carry voting rights and accordingly cannot be voted at the annual meeting. A transcript of the relevant portion of the interview is attached hereto asExhibit A, and the entire transcript has been filed with the Commission as Definitive Additional Materials. Pershing Square also set forth additional clarifying information about the size and nature of its ADP ownership in a presentation filed with the Commission as Definitive Additional Materials on September 25, 2017. The relevant slide is attached hereto asExhibit B.

As a result of the foregoing, Pershing Square does not believe there is any confusion with respect to its ownership in ADP or the number of shares of ADP common stock which Pershing Square has the power to vote at the 2017 annual meeting.

Furthermore, Pershing Square does not believe that its power to vote only the shares it owned in the form of common stock as of the record date, and not the shares underlying American-style call options beneficially owned as of the record date, is material to a stockholder’s decision as to how to vote at the 2017 annual meeting. Pershing Square

3

believes that the information that is material to an individual investor’s voting decision consists largely of (i) Pershing Square’s substantive arguments with respect to its concerns about, and plans for, ADP’s business, as reflected in the “Reasons for the Solicitation” section of the September 5 Definitive Proxy Statement and in the various public presentations made (and to be made) by Pershing Square and filed (and to be filed) with the Commission as Definitive Additional Materials and (ii) the business experience, reputation and overall quality of Pershing Square’s director nominees relative to the Company’s nominees.

Pershing Square acknowledges that information with respect to its ownership of ADP securities may also be material in so far as the size of Pershing Square’s ownership position is arguably indicative of the conviction Pershing Square has in its arguments with respect to ADP and its future prospects. But in this regard, Pershing Square notes that the September 5 Definitive Proxy Statement, as discussed above, contains copious public disclosure with respect to the size, form and cost (approximately $2.3bn) of Pershing Square’s position in ADP securities. Accordingly, both the magnitude of Pershing Square’s dollar investment and the voting profile of the ADP securities Pershing Square owns have been fully and fairly disclosed.

* * *

In connection with this response to the Staff’s comment, each of the filing persons acknowledged to me and I therefore acknowledge on their behalf that:

| | • | | Each filing person is responsible for the adequacy and accuracy of their disclosures, notwithstanding any review, comments, action or absence of action by the Staff; |

| | • | | Staff comments or changes to disclosure in response to the Staff’s comments do not foreclose the Commission from taking any action with respect to the filing; and |

| | • | | None of the filing persons may assert Staff comments as a defense in any proceeding initiated by the Commission or any person under the federal securities laws of the United States. |

Please do not hesitate to contact me at212-504-5757 if there are any comments or questions concerning the foregoing or if I can be of assistance in any way.

Sincerely,

/s/ Richard M. Brand

Richard M. Brand

4

Exhibit A

September 20, 2017 Interview on CNBC’s “Fast Money: Halftime Report” with Scott Wapner

Scott Wapner: So your position’s 8%. Only 2% is in common stock.

Bill Ackman: That’s correct.

Scott Wapner I want to play a soundbite what Rodriguez told Jim Cramer recently.

Bill Ackman: Sure.

Carlos Rodriguez[on videotape]: I’m hoping he’s an 8% stockholder because, as you know, I’m not sure if it’s to conceal what the transactions were, but there were derivatives that were used, stock options and forward contracts, and I’m hoping that at this point, now that he doesn’t need to conceal his position anymore, that he’s converted his ownership into true stock ownership and not just a leveraged position using stock options.

Scott Wapner: How do you respond to that?

Bill Ackman: Sure, so number one, here’s our position, very simple. We own 2% of the company in common stock. If you throw out the rest of our investment, we’re the ninth largest stockholder of the company, so we’ve got a billion dollars or so invested in the common stock of the company. We own verydeep-in-the-money stock options that have a term that goes out into late 2020 and early 2021 and those options areover-the-counter. They are extendable. They are unusual in that we actually receive a pass-through of the dividends on the meaningful percentage of the options that we own. And what that does, is it’s the economics— these are not speculative options. They’re struck at $55, $50 a share versus a stock that’s $107. These are options that give, in effect, it’s the equivalent of buying a stock with a 30% margin loan. But I don’t like margin loans because margin loans can force you out of a position. So it just gives us— now, by the way, the stock goes up a dollar, those options go up a dollar. The stock goes down a dollar, those options go down a dollar. We own the economics of 8.3% of the company, meaning if the company goes from being worth $50 billion to being worth $100 billion, we’re gonna make $8 billion. So it’s a big commitment to the company, and it makes us—

The other thing I point out is the vast majority, Carlos sold a bunch of stock in therun-up on our, the bounce on the rumor of our involvement. Most of his, almost the entire amount of his investment is in the form of stock options. Those options, he did not buy, he received them, of course. And they were struck at the money when he received them. He owns a levered position of the company, which is a lot more levered than the one that we have. So the notion that the CEO would criticize us for the $2.3 billion we committed to the company, it doesn’t make a lot of sense. By the way, stockholders don’t care. What stockholders care about is, one, we’ve got a meaningful stake in the business and we intend to own that stake for a long period of time; two, the only way we’re gonna make money here is if the stock does well. This is not a liquid position. We’re planning to own this thing for four, five, six years. So it’s really not so much only about this proxy contest. We’re gonna be here for a long time.

A-1

Scott Wapner: But beyond the money, doesn’t this hurt you in a proxy vote? You can only vote 2%—

Bill Ackman: That’s correct. We can only vote 2%. And this is I think another important part.

Scott Wapner: It hurts you, doesn’t it?

Bill Ackman: No, on the margin you can say it does but, at the end of the day, we’re gonna end up on the board of the company if a majority of the stockholders support us. In some sense, the fact that we are, we’re not forcing ourselves onto the board by buying so much of the stock that we’re guaranteed to win, right? We’re putting ourselves in the hands of stockholders and we’re saying, look, we own 2% of the stock, in common stock, we don’t have the right to vote more than our position than that, and we want you to decide whether you want a major stockholder on the board, whether you want two independent directors with great business track records, a lot of board experience, recent and relevant experience about business transformation. One of our candidates is on the board of Symantec, he’s chair of the audit committee. He was on a committee of that board where they did precisely this. They went and took a look at, what is the opportunity to improve the efficiency of our business. They hired outside consultants and, with board oversight, management executed the plan. Paul is one of those members of the committee, and they extracted $600 million worth of costs out of Symantec to the benefit of those stockholders. We want to do precisely the same thing here. We felt the fact that Paul just came from a process like that would be very helpful in working with the board here.

A-2

ADP Mischaracterizes Pershing Square’s Engagement in an Attempt to Discredit the Messenger Pershing Square has had a 13D on file with the SEC since August 7, 2017 which provides a detailed overview of our holdings. We continue to beneficially own 8.3% of ADP’s shares outstanding. Excluding stock options, we are ADP’s 9th largest shareholder. As measured by dollars invested ($2.3 billion), we are the 3rd largest investor in the Company. As measured by beneficial ownership, we are the largest owner. “Pershing Square owns 2.0% of ADP’s common stock, not the 8.3% that the fund has represented since the start of its campaign” Pershing Square’s “Refusal to Engage Demonstrate a Clear Disregard for Responsible and Effective Shareholder / Corporate Engagement” “Pershing Square has no experience in the Technology sector” “Does Pershing Square Actually Understand ADP’s Business?” ADP’s Spin Reality “Pershing Square has wrongly characterized 28 million call options (right to buy the stock in the future) as ‘ownership.’” We own part of our position in deep-in-the-money options to provide a modest amount of non-recourse leverage. The options we own are very deep-in-the-money, have a multi-year duration and typically include a full pass-through of the underlying dividend. In practice, the options behave like common stock (a dollar for dollar increase/decrease in the value of the stock causes a comparable change in the value of the option). Pershing Square has consistently communicated our desire to work collaboratively with the board and management to maximize ADP’s potential. Claims to the contrary are contradicted by ADP’s own SEC proxy filing, which notes, as early as our meeting on August 3rd, our openness to board expansion as a solution and our willingness to work with current management. Since then we have proposed to negotiate a resolution of this proxy contest, but have been rejected by the board. This is false. Pershing Square has been an active investor in HCM including ADP from 2009-2011. Pershing Square also took a 14.9% activist stake in Ceridian (circa 2006-07) and joined its Board, which led to its sale to Thomas H. Lee and Fidelity National in November 2007. “[W]e thought Pershing clearly did its homework and scored some important points… [A]t this point, no investor, no analyst, NO ADVISOR, and probably few board members know more about problems in the company than Pershing Square.” (Gordon Haskett, 8/18/2017) Exhibit B